MINING IN THE DIGITAL AGE

Artificial intelligence is making the unseen seen

DEEP SEA MINING AND THE GREEN TRANSITION

GRASSY MOUNTAIN COAL PROJECT IN ALBERTA

CRITICAL MINING IN BRITISH COLUMBIA

FEATURES

MINING IN THE DIGITAL AGE

8 Meeting the metals mining shortfall.

16 The role of mine electrification in a digital era.

18 Environmental technologies can help mining companies navigate the new GRI sustainability standard.

20 Making the unseen seen: Artificial intelligence provides real-time visual insights into mining operations.

24 Precision beyond the noise: Preparing for solar-triggered signal disruptions.

27 Embracing technology fusion and quantum sensing can accelerate mineral discovery.

31 Autonomous tire inspections and artificial intelligence can improve safety, uptime, and compliance.

33 Lack of tech talent holds mining innovation back.

MINING IN CANADA

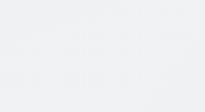

35 Deep sea mining can provide metals for the green transition.

39 Benefits of the Grassy Mountain coal project in Alberta.

41 Critical mining in British Columbia: $36 Billion in critical minerals investment at stake.

INTERNATIONAL MINING

44 Argentina’s abundant copper and lithium.

MAINTENANCE AND AUTOMATION

46 Using automation to correct conveyor belt mis-tracking.

MINING WORKFORCE

49 What is the correlation between transformational leadership and the profitability of Arizona copper mining companies?

HISTORY OF MINING

51 Fire and the mining frontier.

DEPARTMENTS

4EDITORIAL | Artificial intelligence will revolutionize the mining industry.

6FAST NEWS | Updates from across the mining ecosystem.

10COSTMINE | Are rail transport costs really four times higher?

13MIN(E)D YOUR BUSINESS | Sustainable mining finances: Exploring costs and liabilities.

53ON THE MOVE | Tracking executive, management, and board changes in Canada’s mining sector.

www.canadianminingjournal.com

Coming in June/July 2024

Canadian Mining Journal’s June/July issue will report on water management, and we look at methods to improve the planning and results of mine closure, including a detailed look at tailings, with a special feature on pumps.

Tamer Elbokl, PhD

Tamer Elbokl, PhD

PArtificial intelligence will revolutionize the mining industry

rime Minister Trudeau announced earlier in the month of April that the federal government would be setting aside $2.4 billion in Budget 2024 to position the country in the forefront of artificial intelligent (AI) and secure Canada’s AI advantage. This announcement is important for the mining industry, especially with all the great work being done on AI in the technology sector in Canada and how that work is finding applications in mining. However, it is not yet clear whether or how the mining sector can directly benefit from this announcement.

According to a recent survey by Gartner, 80% of executives think automation can be applied to any business decision. The survey revealed how organizations are evolving their use of AIas part of their automation strategies.

In recent years, the adoption of AI has emerged as a gamechanger for mining, allowing for more efficient mineral exploration, maximizing extraction by improving drilling and blasting technologies, taking automation to new levels, and dramatically improving safety and environmental monitoring. Additionally, AI can also help in mining by optimizing predictive maintenance, processes, supply chain, and operational performance.

In this issue, we cover several topics related to “Mining in the Digital Age” on pages 8 and 16-34, with a special focus on AI. For example, on page 16, the article discusses the role of mine electrification in a digital era. On page 18, Rachel MadorHouse explains how new environmental technologies can help mining companies. Additionally, AI is making the unseen seen in the mining industry: alwaysAI is using AI to provide real-time visual insights into mining operations (see page 20). One of our regular contributors, Danny Parys, argues that the lack of tech talent holds mining innovation back on page 33.

In our “Mining in Canada” section, an interview with Craig Shesky, CFO of The Metals Company, sheds some light on how deep sea mining can provide metals for the green transition (see page 35). Flip to the interview on page 41 in which I discuss critical mining in British Columbia and how a recent independent study concluded that $36 billion in critical minerals investment could be at stake with Michael Goehring, president and CEO of the Mining Association of British Columbia (MABC).

If you are planning to be in Vancouver, B.C. between May 12 and 15, 2024, to attend CIM CONNECT 2024, please remember to collect a copy of this issue and visit The Northern Miner Group’s booth 707.

Finally, our June-July 2024 issue will report on water management, and we look at methods to improve the planning and results of mine closure, including a detailed look at tailings, with a special feature on pumps. CMJ

MAY 2024

Vol. 145 – No . 3

69 Yonge St., Ste. 200, Toronto, ON M5E 1K3 Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief Dr. Tamer Elbokl telbokl@canadianminingjournal.com

News Editor Marilyn Scales mscales@canadianminingjournal.com

Production Manager Jessica Jubb jjubb@northernminer.com

Advisory Board

David Brown (Golder Associates) Michael Fox (Indigenous Community Engagement) Scott Hayne (Redpath Canada) Gary Poxleitner (SRK)

Manager of Product Distribution Allison Mein 416-510-6789 ext 3 amein@northernminergroup.com

Publisher & Sales Robert Seagraves 416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada George Agelopoulos 416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published nine times a year by The Northern Miner Group. TNM is located at 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3. Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891.

Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods: Phone: 1-888-502-3456 ext 3; E-mail: amein@northernminergroup.com

Mail to: Allison Mein, 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3 We acknowledge the financial support of the Government of Canada.

• MINE DEVELOPMENT | Canada Nickel starts work on Crawford FEED, eyes 2027 production

Canada Nickel Company has kicked off front end engineering design (FEED) at its flagship Crawford nickel project in northern Ontario, which it expects to bring into production in 2027.

Ausenco Engineering Canada, the engineering partner, will lead this development phase, which is to be finished by August. Data collected during the 2024 winter geotechnical program, which is nearing completion, will support FEED activities, Canada Nickel said.

“As we continue to successfully advance Crawford financing and permitting activities, we are confidently moving into this next phase of project development,” chief executive Mark Selby said, adding that the company is aiming for a mine construction decision by mid-2025,

with first production by the end of 2027.

The proposed operation will consist of two open pits complemented by an on-site mill, to be completed in two phases to allow for throughput ramp-up. Total capital cost for the two phases is

• NEW MINE | Ascot begins milling at its Premier gold project in BC

Ascot Resources has begun ore processing at the Premier gold project 25 km from Stewart, B.C. Rock was introduced to the grinding circuit on March 31, and the first ore was fed on April 5, 2024.

The project is located on Nisga’a Nation Treaty Lands in the prolific Golden Triangle of northwestern British Columbia.

Commissioning activities continue on the gravity and leaching circuits, the carbon regenerations circuit, the elution circuit, cyanide destruction facility, and the gold room.

The tailings storage facility, new water treatment plant, tailings thickener, and pipeline systems are all ready for operation.

Currently, mining has begun from the Silver Coin and Big Missouri deposits to feed a refurbished 2,500 t/d

processing plant. Mining of the Red Mountain deposit will begin in year three, and then from the Premier deposit. Low-cost longhole stoping is planned for most of the mines, and ore will be trucked to the mill and waste will be returned underground as rockfill and cemented rockfill.

The refurbished processing plant uses conventional crushing, grinding, and gravity circuits followed by a standard carbon-in-leach (CIL) process to produce doré bar. An energy-efficient fine grinding ball mill and an additional preleach thickener to facilitate a finer grind of the hard ore. The tailings dam was also raised to increase capacity.

Total gold production from the Premier project will be 1.1 million oz. of gold and 3 million oz. of silver. CMJ

Make sure to send your press releases to: editor@canadianminingjournal.com

estimated at US$3.5 billion.

Over a 41-year project life, total metal production is calculated at 3.54 billion lb. of nickel, 52.9 million lb. of cobalt, 490,000 oz. of palladium and platinum, 58 million tonnes of iron, and 6.2 million lb. of chromium. First production is targeted for 2027.

Peak production at Crawford nickel mine is expected in year 11, when autonomous trucks and remotely operated shovels are fully integrated into the operation. Canada Nickel counts with the backing of top players in the mining and batteries market. The Toronto-based miner attracted the interest of Agnico Eagle Mines, Canada’s largest gold producer, which now owns 12% of Canada Nickel. CMJ

• TOLL MILLING | Talisker signs deal to toll Bralorne gold

ore a Nicola’s Merritt mill

Nicola Mining and Talisker Resources have signed an agreement to toll ore from Talisker’s Bralorne gold project at Nicola’s Merritt mill, near the British Columbia town of the same name.

Nicola’s mill is the only processing plant permitted to accept third party gold and silver feed from throughout the province.

In February this year, Talisker drilled 86.5 g/t gold over 1.5 metres within a 9.6-metre section at 14.31 g/t at Bralorne project, where mining is to begin at the Mustang gold mine before the end of June.

Nicola’s flagship project is New Craigmont, a project including the former Craigmont copper mine adjacent to the mill. The mine ceased operation in 1979 and was dismantled in 1982. The property was consolidated, and Nicola gained 100% ownership in November 2015. Additional work is planned this year to increase both tonnage and grade at New Craigmont. CMJ

Greenstone

Equinox Gold says it is on track to produce first gold at the $1.2 billion Greenstone project in northern Ontario next month after starting ore processing this week.

The project, located 275 km northeast of Thunder Bay, Ont., is a 60:40 partnership with New York-based Orion Mine Finance Group. It aims to produce 400,000 oz. of gold per year and more than 5 million oz. over a 14-year mine life.

Equinox has stockpiled more than 1.5 million tonnes of ore at Greenstone and pre-crushed 70,000 tonnes of low-grade ore for early commissioning feed, it said. Progressively higher-grade ore is to be fed into the mill as production ramps up towards a planned throughput of 27,000 tonnes per day. Commercial production is targeted for this year’s third quarter.

• LITHIUM PLANT | Winsome reveals plan to repurpose Renard diamond plant for lithium

Perth-based Winsome Resources plans to buy the Renard diamond mine in Quebec and transform the plant to process lithium.

The company has paid $4 million for an option to buy the assets, which could help hasten development of its Adina lithium discovery in the Eeyou Istchee James Bay region.

Renard, developed and formerly operated by Stornoway Diamonds from 2016 until December last year, contains a permitted processing plant. Winsome says it may be possible to repurpose the plant to treat lithium ore.

The company can choose to exercise its option to acquire Renard any time after it is approved by the Quebec Court and before Sept. 30 for $52 million in cash or scrip. Extensions to the timeline are possible. Winsome would be bound to a specific payment schedule if it does exercise the option. CMJ

• MINE RESCUE | Norcat and partners unleash 5G underground with SafeSight’s winning technology

The Mining Technology Innovation Challenge, a collaboration betweenNorcat,Rogers,Dell Technologies, theOntario Vehicle Innovation Network(OVIN), and theMining Innovation Commercialization Accelerator(MICA), announced the successful conclusion of the Mining Technology Innovation Challenge, powered by Rogers 5G.

The challenge encouraged innovative start-ups and entrepreneurs from across Canada to develop underground mining technologies that utilize the capabilities of the Rogers 5G wireless private network at the Rogers Technology Centre of Excellence at the Norcat Underground Centre in Onaping, Ont. The solutions focused on underground safety, productivity, energy efficiency, and environmental impact and leveraged the ultra-low latency on the Rogers 5G network. SafeSight Exploration emerged as the challenge winner on May 30, 2024.

SafeSight’s 5G-enabled underground emergency response and mine rescue tool kit, DeepTraxx-5G and SafeScanner-5G, are illuminating a path towards a safer future for the entire industry. The winning technology received $100,000 worth of support, including $25,000 in funding for proof-of-concept development and testing at the Rogers Technology Centre of Excellence.

The integration of 5G technology in the mining sector holds great promise, offering high-speed connectivity and low-latency capabilities that can significantly enhance safety, communication, productivity, and operational efficiency in underground mines across the globe. CMJ

Meeting the metals mining shortfall

Moving away from fossil fuels to meet essential global carbon reduction targets means mining for metals and minerals will need to increase significantly over the coming years. Electric vehicles, wind turbines, solar panels, and overall electrification are all areas of increased demand, meaning metals like copper, iron, and zinc will be continuously required.

How the need for more metals will be met with our current infrastructure is uncertain. Taking copper as an example, production is predicted to reach a crisis point by 2030 with an annual deficit of five million tonnes. Stemming from a surge in demand driven by the exponential growth in electric vehicles and a myriad of other electrification applications, surpassing current production capacity, this is an alarming prognosis that would ultimately impede global sustainability goals.

Demand for refined copper to meet global decarbonization efforts is poised to nearly triple by 2050, compared to the 2020 production levels. This means the world is challenged with sustaining an annual increase in copper production of between 20% to 30% within the next seven years ― that is a capacity on par with the current outputs of major producers Chile and Peru combined.

Canada is viewed by the world as a frontrunner when it comes to the adoption of technologies for the energy transition. It has a healthy copper market, particularly in its province of British Columbia, highlighted by major projects, including one in which ABB provided electrification technologies and expertise with Copper Mountain Mining. The country regularly produces more than 500,000 tonnes of copper per year ― around 3% of the world’s production ― and its exports of the material are valued at approximately $10 billion per year.

Infrastructure investment: A ticking clock

New mining operations are an increasingly urgent necessity, and there are several industry projects awaiting decisions,

yet many investors are waiting until the price is right. With highly specialist equipment required and only a small number of industry players, the risk with this approach is a major bottleneck on the horizon.

On top of the challenge of timely investment, mining companies are processing ore grades that are increasingly low, with one tonne of copper in every 100 tonnes of rock at best. They typically do this with advanced and scalable grinding technology solutions. The industry workhorse for driving mills has been the gearless mill drive (GMD), which facilitates the extraction of copper from raw materials through grinding processes in the most efficient way.

ABB is the market leader of GMDs in the world and building these very large units takes time. This equipment challenge becomes two-fold when considering the forecasts of future ore grades being even lower than present, so much so that double the ore will need to be processed for the same amount of copper.

Increasing extraction and decreasing emissions

The integration of technology, alongside investments in new mining ventures, will be pivotal in ensuring that the world secures the essential metals required for the energy transition while maintaining cost-effectiveness and limiting the environmental impact of extraction.

The need to extract and process additional metals, while mitigating the already precarious and prominent issues associated with global warming this presents, is a formidable challenge for the sector. Mining currently contributes around 7% of total greenhouse gas (GHG) emissions globally, with diesel combustion in machinery alone responsible for half of this substantial environmental footprint.

Efforts by mining enterprises to reduce carbon encompass multiple initiatives to shift machinery from diesel to electric wherever feasible. Additionally, they are actively engaged in designing machinery fueled by alternative energy sources like

hydrogen and ammonia. This concerted endeavor aims to significantly curtail, if not eliminate, the reliance on fossil fuels in mining equipment such as trucks, loaders, and excavators.

Unlocking value with artificial intelligence (AI) and digital technology

The digital transformation of equipment, systems, and procedures, with the primary objective of optimizing operational efficiency within mining operations, is another crucial imperative for the sector. For instance, within the domain of GMDs, numerous predictive analysis systems have already been implemented to monitor equipment. These advanced systems enable companies to proactively address maintenance requirements, ensuring peak availability and efficiency for their machinery.

Artificial intelligence (AI) is ushering in a new era of innovation in mining equipment, empowering advanced performance and operational analyses. This transformative technology provides a more comprehensive range of insights, particularly in machine operation. This enables proactive measures to prevent issues and, importantly, facilitates indepth assessments of processed ore quality.

The shift towards digitalizing operations is imperative because of the heightened demand, prompting mining companies to prioritize maintenance procedures and preemptive failure mitigation. In this environment, even the slightest efficiency improvement holds significant value.

Embracing digital transformation becomes not just a necessity but a strategic advantage, enabling mining entities to proactively address challenges, optimize processes, and ultimately enhance overall operational performance. It is this evolution, alongside investments in novel mining ventures, that will help the world secure the essential metals required for the energy transition. CMJ

Wilson Monteiro is global business line manager for gearless mill drive at ABB.

ARE RAIL TRANSPORT COSTS REALLY FOUR TIMES HIGHER?

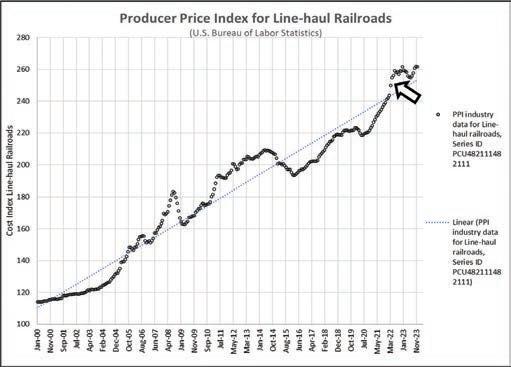

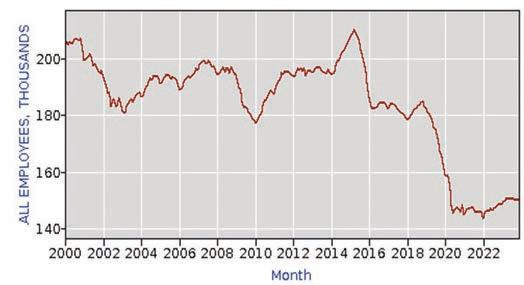

Our analyst’s review for rail transport over the past decades notes the abnormally large increase in the cost to move rail freight continues and new rates now persist for a third year. The new cost regime in transportation appears a more permanent fixture since the initial impact of Covid-19 continues unchanged. What is happening or what might be a cause of the much-steepened upward increase in cost seen since 2020? Figure 1 (and accompanying table) compares rail transport cost for distances of 800 km and 1,600 km (in dollars per ton/mile) for the initial period 2004 to 2020, which then bends upward to 2023 in the recent period.

Initial period. From 2004 to 2020, the rise has been along a well-defined trend. The black curve for the 1,600-km distance helps to explain the rising trend. The average rate for 1,600-km cost trend from 2004 up to the time of Covid-19 rises at a smooth annual rate of US$0.0043 per tonne/mile each year (black dotted line depicts). Many unusual events coincided with Covid-19: schools and businesses shut down, and ocean freight was backlogged. The return to normal required about a year or two, but the rise in rail transport cost did not normalize, though it seems more permanent.

Recent period. After 2020, the initial trend no longer applies as the curve departs to a much steeper annual per tonnetonne/mile trend. What is unusual is the much steeper rise in the cost for each of the green and black curves after 2020 (black arrow), with cost climbing from US$0.107 per tonne/mile in 2020 to US$0.160 per tonne/mile in 2023. The year-over-year costs are increasing at a much faster rate per year in the recent period, with increases more than four times larger than the initial 2004-20 period because the year-over-year price trend climbed from US$0.0043 (the slope

of a best-fit dotted line) pre-2020 to US$0.0178 in the post-2020 period. This means the cost of transporting a tonne of freight by rail for a 1,600-km distance climbed from US$98 per tonne in 2018 to US$160 per tonne in 2023. Overall, this means that costs may double every two to three years rather than doubling each 10 to 15 years.

The rise in year-over-year trend is much larger for the shorter 800-km distance when comparing the recent period to the initial period. The annual rate of increase for the initial period was US$0.126 per tonne/mile in 2020 compared to US$0.196 per tonne/mile in 2023. This is a more than 5X year-over-year increase to move freight for the 800-km distance with costs rising from US$57 per tonne in 2018 to US$98 per tonne.

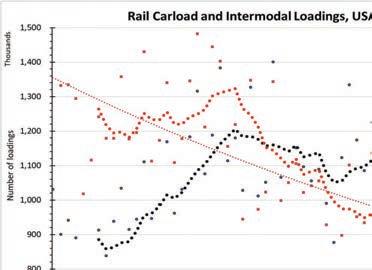

What factors might explain the sudden upward cost trajectory? Is other information available to support, deny or verify the increases in cost? The following four charts explore related data to find an explanation.

Data for line-haul railroads from U.S. Bureau of Labor Statistics below (Fig. 2) also confirms a change is underway as seen in observations discussed. The BLS producer price index for line-haul Railroads rises above the trend line after 2021 (black arrow) following the dip below trend during 2020-021. The pro-

The largest railroad companies earn revenue margins of 15%, and returns on capital invested are in the order of 12% to 14%.

ducer price index indicates that business intensity has increased, by either price or volume but is not more specific as to a cause. Either one or both of these two explanations are possible; noticeable as first, an increase in volumes of business or second, an increase of rates per unit shipped. More detail is revealed from the examination of the monthly rate of

economic recovery underway in the recent period. This analysis also shows that business intensity in the 2020 postCovid recovery exceeded rates following the 2008-09 recession. Rail business accelerated at remarkably high rates from the beginning in June 2020 to a peak in January 2023 before returning to

Canada, and Mexico for rail by carloads and intermodal units. Loading data in Fig. 3 shows monthly loadings averaged by quarter year of rail cars and intermodal units (in thousands) at U.S. and Canadian railroads (Assoc. of American Railroads, by permission). The curves show the number of carload (bold red

Figure 3. Rail carload and intermodal loadings, 2007-2023. Sourced from Association of American Railroads by permission.

Figure 2. Producer price index for line-haul railroads.

Figure 4. Rail transportation employees 2000-2023. Sourced from Bureau of Labor Statistics.

Figure 3. Rail carload and intermodal loadings, 2007-2023. Sourced from Association of American Railroads by permission.

Figure 2. Producer price index for line-haul railroads.

Figure 4. Rail transportation employees 2000-2023. Sourced from Bureau of Labor Statistics.

with the downward trend more pronounced from 2015 to 2023. The thin red dotted curve is a best-fit trend of rail loadings from 2007-23 to show loadings have decreased by 24.6% from an average of 1.3 million carloads per month in 2008 to an average in 2023 of 995,000 carloads per month, with the January 2024 count at 1.0 million carloads. Business volume has clearly decreased. A nearly

identical but subdued downward trend in railcar loadings is also underway in Canada with a decrease in volume of 12.5% from 2015 to 2022.

An explanation for the initial question of the sudden upward cost trajectory now favors rate or price increases as the cause for sharp increases in cost, as loading data show shipper volumes are eliminated as a cause.

Other factors in rising rail costs

OF DOLLARS

Is there more to the saga of high and increasing costs in railroading? The largest railroad companies earn revenue margins of 15%, and returns on capital invested are in the order of 12% to 14%. Data was not available on earnings of railroad employees, although employment in the industry (Fig. 4) has fallen from about 190,000 before 2016 to about 145,000 today. Class 1 railroad employment (not including warehousing) was 122,343 in December 2023. Freightwaves. com says the cost to build railcars has risen from US$50,000 in the past to US$150,000 today with about 100,000 more rail cars in service today at 1.6 million compared to 1.5 million in 2009. About 17% or 339,000 railcars remained in storage (not used or idled) of the total of nearly 2.0 million railcars (AAR Oct 2021). Perhaps the most significant factor is that railroads now must operate under the rule of precision scheduled railroading (PSR) to protect against high speed and to reduce accidents and increase profits or operating ratios. Costs of implementing PSR are borne by each railroad. Operating ratios have been sub-60% during the years-long period to implement PSR. Railroads continue to report that PSR provokes disruption at the six major U.S. and two major Canadian railroads and negatively affects service. To reach sub-25% ORs, chair Martin J. Oberman of the Surface Transportation Board says railroads must cut employment. This seems to be underway (Fig. 4), but the result translates to higher costs borne by rail shipping customers.

The reason for the upward trend to explain higher cost is complex and no one reason can be identified as a single cause, so the cause involves multiple factors. It is clear that increases in cost or rates best explain and translates to the much higher costs charged by railroads today.

More information to address the question of or to explain high cost is available for the 2023-24 period entitled 2023-2024 Update – Rail Industry and Freight Rates is provided in Appendix B-Transportation (TR) a chapter in Mining Cost Service of CostMine.com. CMJ

Dave Boleneus is a seasoned analyst with over 45 years of professional experience in major mining companies, oil corporations, and esteemed consulting organizations globally.

Sustainable mining finances: Exploring costs and liabilities

When done correctly, sustainable mining should save money and reduce emissions

The mining industry is changing, and mining professionals can spur progress on sustainability goals. After all, engineers play a vital role in achieving a sustainable vision. In addition to designing for safety and reliability, they can also include environmental, social, and governance (ESG) considerations. In doing so, engineers can integrate sustainable design elements into their daily work.

Focusing on sustainability gives companies a leg up on their competition. How? Sustainable decisions help a company meet its environmental goals, they comply with regulations, and they boost the bottom line thanks to cost savings from operational efficiencies. All this results in increased production. This is vital to meet the demand for critical minerals in clean energy technology.

Corporate leadership teams must drive goals focused on sustainability. It all starts with a future vision. Then, it builds with interim milestones and projects that will move the needle. But the goals must be supported with the investment and people to make it happen. Let us explore the finances behind sustainable mining below.

What is a carbon credit?

By

amount of emission reductions. The credits are then recorded and can be traded on the carbon markets.

We often refer to green credits as carbon credits or environmental certificates. They represent a reduction or removal of greenhouse gas (GHG) emissions. Mining companies can earn green credits by reducing carbon emissions. They can also earn them by sequestering carbon. Both actions contribute to sustainability.

Here is how carbon credits typically work:

1 | Emission reduction projects: Mining companies can invest in projects that reduce or offset their carbon footprint. This could mean using energy-efficient technologies. It could mean supporting reforestation projects. It could also mean capturing and storing methane emissions.

2 | Verification and certification: Next, the project undergoes a verification process. This helps confirm that the claimed emission reductions are valid. Independent third parties often certify these projects; they provide credibility to the achieved reductions.

3 | Issuance of credits: Once verified, the mining company receives carbon credits. The number of credits links to the

4 | Trading and compliance: Other entities looking to offset their own emissions can purchase the credits. In some cases, it is required that companies offset a portion of their emissions so they can use credits for compliance. Because of this, carbon credits can be sold in either the voluntary or compliance carbon market.

For a mining company, embracing green credit programs contributes to environmental sustainability, and it can also generate revenue. So, the company can make money from its decarbonization efforts. Then, it can invest in more sustainable mining practices. This financial incentive aligns with broader trends in corporate responsibility and sustainable development.

What about financial green premiums and brown penalties?

Green premiums and brown penalties are financial terms tied to environmental stewardship. Green premiums are incentives for environmentally friendly practices. Brown penalties are costs or fines associated with harmful practices. Green premiums and brown penalties both exist in the mining industry. Green premiums are a clear financial advantage. They benefit companies that adopt sustainable practices. This can include

Mine

water management is a good opportunity for mining companies to showcase sustainable efforts and earn green premiums. For example, many sites are recycling or treating the water, showing water stewardship. CREDIT: ADOBE STOCK

using cleaner technologies, reducing carbon emissions, or applying eco-friendly processes. For example, mining companies that adopt sustainable practices might receive higher prices for their products. They could gain preferential access to markets, and they could attract environmentally conscious investors. These premiums reflect a market willingness to reward responsible actions.

Brown penalties are the costs that companies face if they engage in environmentally harmful practices. Think pollution, deforestation, or poor tailings management. Mining companies facing brown penalties might experience increased regulatory scrutiny or legal challenges. It could also lead to fines or less access to certain markets. Investors and consumers may shy away from companies with poor environmental records. This leads to a financial disadvantage.

Green premiums and brown penalties are economic outcomes, and they are linked to the practices of mining companies. It is key for miners to put positive practices in place; it is also important to limit harmful ones. These financial incentives reflect a broader shift towards responsible resource extraction.

Cost savings through recruitment and retention

It has been said before, but it bears repeating; Employees want to work for companies that are responsible. This is especially true when it comes to the environment. According to Gallup, Gen Z and millennials now make up nearly half (46%) of the full-time workforce in the U.S. These new generations care more about climate change and social equity than the workforce before them. Meaning? Companies that champion environmental and social efforts are more attractive to potential employees. They are more likely to get the top talent.

A culture of sustainability can also increase employee retention. This saves money and maintains a company’s intellectual capital. An employer of choice must prove how they are improving lives today and for generations to come. ESG-focused values are appealing for many employees — especially millennials —

who want their work connected to a higher purpose.

This is the ideal time for mining companies to tap into the new generation of workers. It is also a great time to further the ESG initiatives and achievements. This also means fostering a fresh view of the mining industry within society. Mining is changing its way of working. That is, being responsible and sustainable. It is an industry that is sourcing the critical minerals we need for green technologies, embraces workforce diversity, and engages with community. Mining is an industry that puts people first.

Making the cultural shift

One of the biggest obstacles to sustainability is a classic culprit: Money. Many people recognize the financial benefits of sustainability, but some still view it as an expensive undertaking or just a box-ticking exercise. Some may also think that these practices increase risk through downtime or less output.

However, it is important to measure the long-term view of the business, and to consider the liabilities from not operating sustainably. One example is increased costs for mine closure, or it could be something harder to measure, such as reputational damage or increased risks in the business.

Responsible miners have strong relationships with communities, their workforces, customers, suppliers, and governments. This yields a smoother business operation. Thus, it is a financial benefit as much as it is a social one.

An effective way to start a cultural shift is helping both leaders and employees recognize the financial and social upsides to sustainability. When done right, sustainable designs drive operational costs down. They also improve recovery rates. For example, a copper mine in Arizona completed a debottlenecking study to review their operation. During this exercise, they realized they could save energy costs by modifying their grinding and crushing circuit. How? The modifications helped reduce energy use while also increasing their recovery. Sharing success stories like this can teach others that sustainable solutions bring cost benefits to the business.

Everyone has a role to play in decarbonizing mining

Engineers can lead the charge by using innovative and sustainable solutions in their projects. The result is operations that deliver on environmental protection, decarbonization, safety, and the returns to stakeholders. The message is not hollow. The outcomes prove it.

Sustainability is not a target buried within an annual report. It is a moral obligation. It is a business imperative for corporations. It is the foundation of commitments, strategies, and metrics that are tracked and reported annually, and it is achievable, but only when supported with the funding and the people to make it happen. CMJ

Samantha Espley has over 30 years of experience, with a range of expertise encompassing mining operations, capital projects, mining, and mineral processing technical services. She serves on the Stantec mining leadership team as a senior advisor.

Lauren Meyer is a geotechnical engineer based out of Stantec’s Fort Collins office. She is passionate about including sustainability in her everyday work and is committed to enhancing her clients’ ESG goals.

UNLOCKING BUSINESS POTENTIAL

By Jason Clifton and Karen D’Andrea

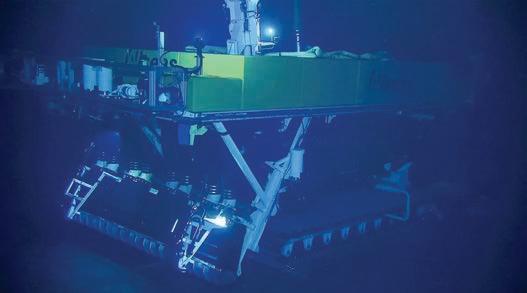

THE ROLE OF MINE ELECTRIFICATION IN A DIGITAL ERA

In envisioning the mines of the future, electrification emerges as a transformative cornerstone, heralding a paradigm shift in the mining industry’s operational landscape. Gone are the days when diesel-powered machinery dominated the extraction process. Instead, a new era of sustainability and efficiency is dawning, powered by electric technologies at the core. North American surface mines started testing out heavyduty electric equipment — mainly haul trucks attached to electric trolley lines — in the 1990s. Additionally, Canada was one of the first countries to introduce battery-powered electric vehicles (EVs) to underground mining in 2012.

Electrification promises not only to revolutionize the operational dynamics within mines but also to redefine their environmental footprint, aligning with global efforts towards decarbonization and sustainability. It is clear that electrification will serve as a primary component of the mines of tomorrow, signalling a new era of innovation, efficiency, and environmental stewardship by leveraging synergies between other technologies, connecting business and operational key performance indicators (KPIs) and aligning talent and capital.

Synergizing electrification with mining tech

When thoughtful electrification programs are combined with those addressing analytics, autonomous mining, software, and IoT, there is synergy driving needed disruption in today’s mining industry. Rather than addressing electrification in a vacuum, a holistic view of the entire ecosystem of technologies

being considered for use in current and future mine planning and operations scenarios is necessary to understand how the benefits of each can be optimized and accelerated. Assessing and planning for an electric mobile fleet transition without an outlook on the automation roadmap, or preparing for fleet management data and analytics software, is doing a disservice to the potential of your ultimate fleet.

Recognizing that the current vision of the fleet and its role in future mining operations will evolve over the next five years can provide planners with reassurance, understanding that market readiness may not always match their business readiness. In an industry traditionally reliant on proven technologies, adopting a mindset focused on progress rather than perfection is crucial for achieving tangible advancements.

By strategically integrating the technical and commercial dimensions of electrification with cutting-edge technologies and a firm commitment to meaningful impact, we can propel future outcomes, drive bottom-line growth, and foster genuine sustainability.

Connecting electrified operation KPIs to business metrics

The KPIs of electrified fleets and, in turn, operations hold significant relevance to overall business KPIs. For instance, understanding the energy consumption patterns during different phases of production can reveal opportunities for optimization. Aligning energy (i.e., vehicle usage) with production schedules is inherent to minimizing waste and reducing costs in any oper-

ation. Moreover, identifying areas of high energy consumption relative to production output can highlight inefficiencies that may require attention, such as vehicle malfunctions or suboptimal procedures.

However, beyond this, there is a notable gap in comprehending the full business value of an electrified fleet. There is great opportunity to translate conventional electric vehicle KPIs into pertinent metrics for the mining sector. This understanding underscores the necessity to adapt methodologies and operational approaches to maximize the value extraction in mining operations.

Decarbonization, talent, and capital alignment in electrified mines

Genuinely integrating environmental, social, and governance (ESG) principles into any business strategy is crucial. Companies with a clear sense of purpose are three times more likely to retain employees and outperform the S&P by ten times. However, merely having a purpose is not sufficient; it must be communicated effectively both internally and externally.

Incorporating actions that generate genuine long-term value and focusing on ESG factors like electrification into your talent narrative is essential. Engage your employees by offering opportunities to contribute to the discussions and innovate alongside leadership with appropriate change management and employee readiness programs. Foster a culture that actively promotes and celebrates open innovation daily, going beyond simply welcoming bottom-up ideas.

Expanding on the importance of people, we are navigating a landscape where consumers are increasingly thoughtful and

conscientious. Their preferences significantly influence the capital accessible to mines of every scale. As outlined in this year’s EY’s Top 10 Risks and Opportunities in Mining and Metals, capital rose to the number 2 spot as the mining sector grapples to fund the expansions required to meet increasing demand for minerals crucial to the energy transition. However, miners will need to balance continued economic returns with more investment in digital, decarbonization, and of course ESG.

In today’s rapidly evolving mining landscape, electrification emerges as a transformative force, synergizing with cutting-edge technologies to drive disruption. Yet, addressing electrification in isolation risks missing out on its full potential. A holistic approach, integrating electrification with analytics, autonomous mining, software, and IoT, is imperative for optimizing benefits across mining operations. This integration demands a forward-looking mindset, recognizing that the role of electrified fleets is evolving, necessitating alignment with both short term and long-term market and business readiness.

As electrification becomes increasingly central to mining operations, connecting electrified operations KPIs to broader business metrics becomes essential. Aligning electrification-enabled decarbonization efforts with talent retention and access to capital becomes critical for driving growth and fostering genuine sustainability for the industry and for future generations.

CMJEY Canada’s consulting practice includes Jason Clifton as a partner and Karen D’Andrea as a manager. To learn more about main electrification, visit: https://www.ey.com/en_ca/mining-metals

ENVIRONMENTAL TECHNOLOGIES CAN HELP MINING COMPANIES

NAVIGATE THE NEW GRI SUSTAINABILITY STANDARD

As we move towards net-zero, the vital role of the mining industry is becoming increasingly apparent. The sector must simultaneously increase production of minerals to sustain decarbonization and reduce its environmental impacts. Despite this difficult position, new biodiversity monitoring technologies are proving to be useful tools to tackle this challenge.

Mining plays a key role in the transition to net-zero because its products are central to the production of clean energy and technology. The International Energy Agency (IEA) has suggested that mineral inputs must increase by fourfold to meet the goals of the Paris Agreement. But the time from discovery to commercial extraction will still take some companies 16 years. Closing this gap will be vital to meet decarbonization goals.

Historically, some mining operations have contributed to environmental degradation through issues like contamination and pollution of local ecosystems. This is especially relevant given that 20% of existing mines are biodiversity hotspots, as tracked by the MSCI ACWI Investable Market Index (IMI). As a result, an accurate assessment of the impact of existing and future mines on the environment is crucial.

The Earth’s biodiversity remains our greatest asset, not only acting as “our strongest natural defence against climate change,” according to the U.N., but as a fundamental means to our global economy. More than 50% of global GDP is moderately or highly dependent on nature as estimated by the World Economic Forum. Thus, adopting sustainable practices is not only sensible for businesses from an environmental perspective, but also necessary from a profitability standpoint. Today, risking nature poses an economic risk, with four of the top five threats to business in the next 10 years being environment related.

In Canada, where half of the world’s publicly listed mining companies are based, the minerals and metals sector represents 4% of the country’s gross domestic product (GDP) with a value of $91 billion in 2021. Protecting this GDP from nature-related risk is vital, and initiatives led by the Canadian government such as the 2022 Critical Minerals Strategy reflect this need.

New standards within mining

Beyond governmental initiatives that aim to regulate the mining industry, there are other independent bodies that influence the sector. In early Feb. 2024, the Global Reporting Initiative (GRI) launched its landmark “Sustainability Standard for the Mining and Extractives Sectors.” This standard aims to guide mining organisations through their difficult positions of providing essential minerals for modern society while actively working to lessen the impact of their activities on the environ-

ment and local communities.

This is a pivotal moment for the industry and a welcome development for many stakeholders, offering a robust framework for reporting on ESG impacts that will elevate accountability and transparency practices. Successful navigation of the standards will aid companies in managing stakeholder relationships and building trust to make the industry more resilient to nature-related risk. As Carol Adams, chair of the GRI’s Global Sustainability Standards Board (GSSB), has said, “From a sustainability standpoint, the position of mining is complex, in that it is both part of the solution and the problem.”

The new GRI standard provides reporting guidance for the transparent sharing of certain material topics such as preserving biodiversity and engaging communities. However, to implement the sustainability reporting that the GRI standardizes, companies must establish a baseline for natural capital at a site level. Through this assessment, nature can be brought into the value chain, allowing mining companies to assess the impact of activity and ultimately limit nature-related risks.

However, because of the variety of nature data that can be collected and analyzed, it can be unclear which measurements are best placed to give an accurate picture of the state of biodiversity. The GRI standards aim to provide guidance and metrics to aid in the ability of mining companies to have a comprehensive understanding of reporting needs. Importantly, the GRI emphasizes the need for data to be reliable and reproducible if possible and provides examples to further support the industry.

In January, Rohitesh Dhawan, president and CEO of the International Council on Mining and Metals (ICMM) announced adherence to the biodiversity-preserving commitments set by

the Taskforce on Nature-related Financial Disclosures (TNFD) at a Nature Positive Initiative event in Davos. In this context, the announcement of the Global Sustainability Standards for the mining sector has not come as a surprise. It has simply reinforced the difficult position the mining industry is in to maintain regular activity whilst adhering to the latest biodiversity regulations required to halt and reverse nature loss by 2030.

Nature-based solutions

Currently, companies are held back by the lack of specialist knowledge, scalable solutions, and the data-gap in biodiversity monitoring. Fortunately, technologies, such as environmental DNA (eDNA) have enabled companies to measure nature in an accurate, cost-efficient manner, and on a large scale. While the technology is cutting edge in terms of its transformational impact on biodiversity monitoring, it has been used for over a decade, and is well-established and thoroughly vetted. In the GRI 101: Biodiversity 2024 guidance document, eDNA is listed as a primary data method for reporting on biodiversity.

Small traces of DNA left behind by living organisms can be captured from environmental samples and used to survey single species or whole communities. Surveyance of eDNA allows mining companies to identify at-risk, invasive, or protected species, along wider biological groups in the site of interest. These analyses of eDNA can also be utilized to set a baseline from which they can monitor nature restoration progress over time.

The simplicity of eDNA methodology is highlighted in one way by the ease of sample collection, which is frequently done as a citizen science project and aids in community engagement. This adheres to the new GRI standard that emphasizes community engagement as part of reporting. In many projects, com-

munity members or students in local schools can get involved, so this technology enables community engagement, one of the new requirements mining companies should take part in as per the latest GRI standard. This enables companies to not only contextualize biodiversity data to report back to stakeholders, but also to actively involve local communities, granting social licence to operate.

The combination of this eDNA technology and other nature intelligence technologies aimed at capturing nature’s complexity, such as geographic information systems (GIS), bioacoustics, and drones, is enabling businesses to gain a clear picture of biodiversity at any given time and location. Many companies, including Anglo American, Sínese, and Rio Tinto have already used these technologies to support their drive to nature-positivity through an understanding of the biological risks of their business’ activities.

It is hugely promising to see how these technological innovations can help the mining industry further its sustainability and nature goals. The adoption of the GRI Sustainability Standards will help the mining industry fulfill the environmental reporting valued by regulators, stakeholders, and the public. The rapid scaling and deployment of technologies such as eDNA will be the key to improve due diligence, producing transparent environmental assessments, and enable mining companies to engage with local communities, easing the pressure of regulators and the public on the sector. CMJ

Rachel Mador-House is an environmental geneticist with over 15 years of experience. She now utilizes her extensive molecular genetics knowledge to further biodiversity monitoring at NatureMetrics as the Head of Scientific Affairs for North America.

Making the seen

Artificial intelligence provides real-time visual insights into mining operations unseen

For the mining industry, continuous innovation is required to optimize production, lower costs, and improve the safety of workers. Artificial intelligence (AI) and machine learning (ML) technologies can help mining companies adapt to a changing landscape of unpredictable events. AI has many benefits for the industry; however, it is still very new and there is a lot of work that needs to be done while applying it, which requires a robust foundation of planning, research, communication, and change management.

In a previous article last year, we discussed how AI-enabled data analysis can assist in more efficient extraction of mineral deposits while minimizing environmental damage. AI is

increasingly being used to map more exploration data and streamline the process of discovery.

Additionally, AI-enabled mining innovation for other aspects of the mining supply chain continues to move forward. Eventually, AI will revolutionize the mining industry.

Moreover, extraction innovation is focusing on remote tunnel monitoring systems which allow monitoring of mining tunnel integrity. Remote monitoring system technology uses AI to determine the viability of digging the tunnels deeper to access additional mineral deposits. These technologies can help propel mining into the future by maximizing both the extraction of resources and safety in old and new mines.

A few examples of the various ways AI can help the mining industry include the following:

• Mineral exploration: Analyzing large datasets, including geological and geophysical data, to identify potential mineral deposits and expedite exploration efforts.

• Predictive maintenance: AI-powered sensors and ML algorithms can detect potential equipment failures, thus reducing downtime and increasing overall efficiency.

• Autonomous vehicles: Autonomous vehicles (powered by AI) can improve safety and efficiency in transportation and hauling operations.

• Process optimization: Optimizing mining processes, such as crushing and grinding, to reduce energy consumption and improve yields.

• Safety monitoring: Sensors and cameras can monitor mines for safety hazards and alert operators to potential risks.

• Environmental monitoring: Monitoring and mitigating environmental impacts, such as water pollution and land degradation.

• Supply chain optimization: Optimizing supply chain operations, including logistics and inventory management.

• Geomechanical analysis: Analyzing and predicting rock behavior to help reduce the risk of rockfalls and other geological hazards.

• Drilling and blasting: Improving accuracy and reducing waste by optimizing drilling and blasting operations.

• Data analytics: Providing insights and improving decisionmaking by analyzing large datasets.

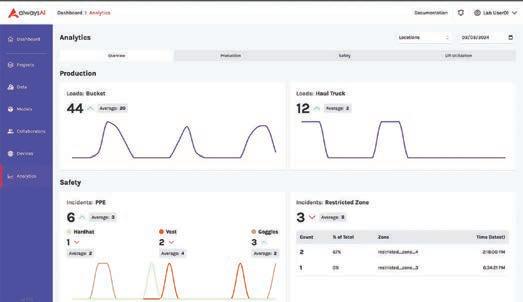

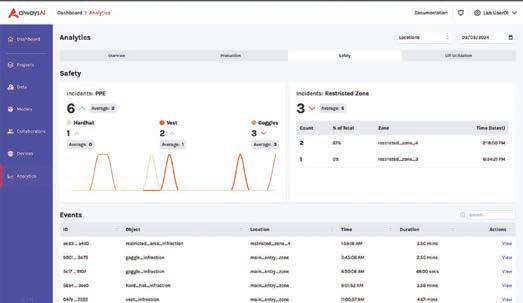

During PDAC 2024, I caught up with Marty Beard, co-founder and CEO, and Justin Rich, director of cloud engineering and IT at alwaysAI, to discuss how mines can minimize downtime, maximize productivity, and enhance safety to improve top and bottom lines using computer vision to provide a detailed view of the entire mining lifecycle. This article is based on the conversation that took place during PDAC 2024.

The alwaysAI platform

The company employs computer vision for practical AI solutions across various sectors, from mining and manufacturing to retail and beyond, enhancing operational efficiencies while addressing privacy concerns.

The software (computer vision platform) is an extraordinary end-to-end vision AI platform, which means that they offer a comprehensive set of tools ― like advanced APIs, user-friendly dataset and model management, and convenient remote deployment ― that can eliminate the complexity of computer vision without sacrificing functionality, thus allowing companies to build computer vision applications, and there is a lot involved in that process. So, businesses can easily extract the data they need from existing cameras in real-time. The platform provides an end-to-end capability to build computer vision apps, run those apps 24/7 out in the real world, and then get all that data that people need to help them make better business decisions.

Computer vision enables existing cameras to quickly identify and interpret objects in the physical world allowing the realtime monitoring of everything happening in the mine, thus making more sustainable, safe, and profitable mining possible using practical artificial intelligence (AI) solutions.

A game-changer for the computer vision industry

During the last quarter of 2023, alwaysAI announced the release of enhanced machine learning operations (MLOps) features to its comprehensive computer vision platform. These integrated capabilities solidify alwaysAI as a premier MLOps computer vision provider with a suite of powerful features and tools to streamline the entire computer vision lifecycle.

The release also complements alwaysAI’s existing Dataset Management and Remote Deployment features, making it easier for developers to create, deploy, and manage enterprise-grade computer vision models and applications.

“We are always enhancing our tools and functionality to provide practical AI solutions that can dramatically streamline operations and drive more revenue,” says Marty Beard. “These advanced model evaluation and management features are the latest upgrades to our comprehensive, end-to-end computer vision platform,” he added.

Key features of alwaysAI’s MLOps include the following:

> Enhanced user interface to streamline the model configuration process.

> Multiple GPU options for greater control of model training speeds.

> Forecasted model training duration based on your specific parameters for ultimate flexibility.

> Real-time session performance including metrics such as mAp, recall, and validation loss.

> Model evaluation with alwaysAI’s exclusive modelIQ tool that measures precision, recall, and F1 score, to facilitate successful model refinement.

The alwaysAI platform also features a comprehensive analytics dashboard to easily view operational insights and receive immediate alerts about potential issues or concerns. For mining operators, this could include PPE usage, movement in restricted zones, machine downtime, as well as precise data about the number of bucket loads and dumps.

Various ways for alwaysAI to help the mining industry

Computer vision provides a detailed view of the entire mining lifecycle to minimize downtime, maximize productivity, and enhance safety to improve top and bottom lines. Computer vision enables existing cameras to quickly identify and interpret objects in the physical world allowing miners to monitor everything happening in the mine in real-time. More sustainable, safe, and profitable mining is made possible with Vision AI.

“Vision AI can help in every critical mining process from extraction to processing, inventory management and transportation, and delivery. AI technology like alwaysAI Smart Mining solutions enable operators to quickly deploy computer vision applications onto cameras to accurately measure and count ore extraction, monitor cage and large machine utilization, detect PPE, and address a wide variety of other applications that will have a dramatic impact on profitability,” said Marty Beard.

When asked about examples of how the alwaysAI can help solve different problems in mining, Marty and Justin presented the following examples of problems and solutions offeredby the computer vision platform:

1. Collar and cage analytics

MINING

Problem: Lack of visibility in mines often leads to unplanned downtime and delays that can cost thousands of dollars a day. Solution: Monitoring and tracking all activities, including people, materials, and equipment in collar and cage feature with real-time visual data to improve efficiency and maximize tonnage production.

Problem: Inaccurate, outdated, or incomplete data about critical muck car and muck bucket activity makes improving processes difficult.

Solution: Use the feature for monitoring and tracking critical muck bucket and muck car activities to ensure debris is cleared efficiently to streamline processes and better manage resources.

3. Maximizing safety; PPE detection

Problem: Because of the inherent dangers in mining operations, minimizing safety risks is essential. However, without visual insights into operations, injuries and accidents are inevitable.

Solution: Identify and track PPE usage including head, eye, ear, foot, and hand protection, and visibility apparel to ensure safety compliance, limit injuries and costly infractions, and prevent site downtime.

4. Labour productivity

Problem: Mining requires hundreds of workers in small spaces that are challenging to monitor, thus making shift variances difficult to reconcile.

Solution: Real-time visual data about movement and dwell time throughout the mine will help to better manage human resources and maximize consistent productivity. For worker privacy, all data can be blurred and anonymized.

The future of AI in mining

“I think it is going to have a very powerful impact on improving productivity, safety, and the environment. So, it is going to become best practice. I think right now it is very early to start seeing that potential impact,” said Beard. He added, “I think companies like alwaysAI are starting to make the technology accessible. And once that happens and people see the actual impact of this technology, it will automatically become a best practice.”

“We are currently more focused on the operational part, but there are several companies that are using big data and starting to use AI to advance the exploration and make it a more efficient process. Ultimately, AI is perfectly positioned to help get more productivity out of the existing assets,” Marty Beard concluded. CMJ

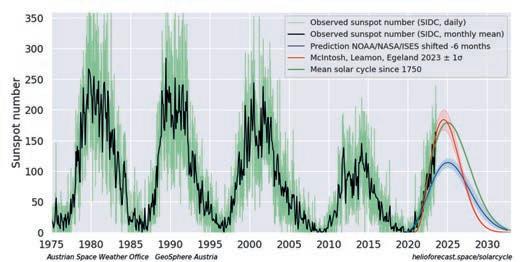

PRECISION BEYOND THE NOISE

Preparing for solar-triggered signal disruptions

Automated and autonomous operations are essential and expanding parts of mine operations worldwide. Technology is built into nearly every task — with a large majority dependent on global navigation satellite systems (GNSS) for precise positioning, safe navigation, and productivity gains. Mine sites include equipment that ranges from remote-controlled and robotic drilling machines to driverless haul trucks.

The Research and Market’s Global Mining Automation Market report recently noted that mining automation is on the rise, driven by technologies including robotics, machine learning and data analytics, which enable mining companies to automate processes, cut costs and improve safety. The report anticipates the global mining automation market size will grow from US$3.6 billion in 2024 to US$5.1 billion by 2029. And, nearly all these machines and workflows are reliant on accurate positioning delivered via GNSS satellites to hardware and software that processes these signals.

What happens when those GNSS signals go down, or perhaps even worse, deliver inaccurate data?

It is a very real challenge, particularly in high latitudes, such as in Canada, as the influences of Solar Cycle 25 grow. The current 11-year solar cycle began in 2019 and is anticipated to peak between 2024 and 2026, a time when ionospheric scintillation (signal noise) will be at its high-

est level — and GNSS signal reliability is

A measure of significance

Ionospheric scintillation is the rapid modification of radio waves in the ionosphere. It extends from about 80 to 966 km above earth’s surface. Severe scintillation conditions can prevent a GNSS receiver from locking on to the signal and make it very difficult to calculate a position.

By how much is dependent on several factors — though several metres of error are not uncommon. A 2014 study in Brazil evaluated the impact of scintillation on real-time kinematic (RTK) positioning using ionospheric scintillation data collected in the country during the

solar maximum year 2014. The report noted significant positioning errors when dynamic RTK processing strategies were used during strong scintillation events. In this case, the study found the maximum positioning deviations in the east, north and upper directions reaching 2.29 metres, 1.84 metres, and 1.37 metres, respectively.

Similar GNSS position deviations have been noted during the past three solar cycle peaks dating back to the early 1990s by mining customers in Canada, particularly in northern regions like Alberta.

For mine operators who have invested in autonomous machines as well as remote-controlled and automated precision applications, scintillation is already a concern. As occurrences increase in

frequency and severity as the solar maximum approaches, owners might see more downtime and shutdowns for mines that rely on precision GNSS applications. For instance, the level of positioning error noted above (e.g., 2.29 metres) can result in long-haul road truck accidents (with another truck or into a berm).

Perhaps the most challenging problem of scintillation is that loss of accuracy may not be immediately apparent. Autonomous vehicles could continue operating with inaccurate data, potentially leading them to wrong locations, causing productivity losses or even accidents. Automated systems are also at risk. For instance, GNSS position deviations could trigger false alarms or miss slope movement in slope stability monitored areas.

To make matters more challenging for owners and operators, the random and intermittent nature of scintillation events makes it difficult to predict and plan for this upcoming solar cycle peak. Scientists might estimate that ionospheric activity will occur at midday or dusk, for instance, but that will not always be the case. The disturbance can be random. As the solar cycle peak draws closer, the frequency will increase and the number of times where precision GNSS powered machines are not going to work predictably will rise.

The solar fix

Scintillation is not a new issue in the GNSS space, and leading manufacturers continue to improve receiver tracking and processing algorithms to minimize the disruption of signals during future cycles. Ionospheric mitigation features have been added and improved upon in GNSS receivers over the past three solar cycles, with frequency independence just one such adjustment. During ionospheric storms, there can be significant frequency-dependent differences in the phase and carrier delay through the ionosphere. Ensure your receivers are not dependent on any one frequency for operation.

To prepare for the current and future solar maximums, Trimble leveraged comprehensive data collection exercises to develop IonoGuard technology. This technology is designed to mitigate cycle slips and improve signal tracking of disrupted GNSS signals. It is an additional layer of protection that makes precise GNSS measurements possible under the most challenging atmospheric conditions, increasing the likelihood of unin-

terrupted and robust positioning data around the clock. During recent solar storm events in Brazil, Peru, and northern Sweden, the improvement in both horizontal and vertical positional accuracy using IonoGuard was significant. Bottom line, there are solutions available to minimize the risk of impact caused by scintillation in the coming years, but those strategies must be put in place in the near term.

One of the main challenges to resolv-

ing scintillation in mines is the lengthy validation process required for implementing new technology solutions — often taking six months or longer. While developing solutions to issues like GNSS signal losses, simply coming up with a hypothetical fix is not sufficient. That fix then needs to be thoroughly tested and validated to ensure it will work properly and safely without disrupting mine operations or other systems.

Martin® Manufactured

Liner has the backbone to stand strong while absorbing the impact and abrasion of punishing bulk handling environments. This proprietary design features impact-resistant urethane molded directly around a supporting steel plate. The rugged construction prevents the the urethane from separating from the plate which can subsequently damage belts and enclosures. Our canoe liners shield the sealing system and chute walls better, control more dust and spillage, and improve overall safety. All benefits contributing to reduced cost of operation.

PROcheck is our signature, expert analysis beginning with our diagnostic

Pulse Vibration Analysis examines the health of any brand of vibrating screen, while our Pulse Impact Test prevents your screen from operating in resonance.

An NOAA model predicting the maximum magnitude of the solar cycle in 2025 would be similar to the previous 11-year cycle. However, new models and measurements indicate a cycle more like the cycle which peaked around 2002.

The intensive validation process for new technology involves testing in labs, with system integrators and on actual mine sites. The length of this validation means mines need to work with technology partners that already have identified problems and have solutions in place well in advance of when peak issues are set to occur.

Moving forward

There is no question that scintillation will directly affect the positioning accuracy of GNSS-enabled mine solutions in the future, but every owner can minimize those effects with the following steps to success:

> A mitigation strategy is essential, so be aware the peak season for GNSS issues in 2024 will be toward the end of the year, so strategies should be developed as an integral part of risk management plans and in place by then if not sooner.

> Work closely with a technology partner that has experience developing solutions to GNSS accuracy issues and can help validate and deploy solutions quickly before problems become critical. That technology partner should already have solutions that have been validated in real-world conditions. When evaluating solutions, consider automation that can detect errors in real-time and adapt accordingly to minimize downtime from accuracy losses and look for features like real-time ionospheric correction.

> Make sure to validate any new technology thoroughly by testing to avoid unintended disruptions, as validation takes significant time but is important for safety and productivity.

In equatorial and high latitude regions, like Canada, Brazil, and Chile, ionospheric disturbances are common, and will only intensify in the coming years. With Solar Cycle 25 on track to peak over the next two years, the time is now to implement a solution. CMJ

Kevin Andrews is director of land product at Trimble Applanix. Giri Baleri is director of product management and strategic marketing for Trimble OEM GNSS. Riley Smith is a marketing director for Trimble Geospatial.

QUANTUM TECHNOLOGIES IN MINING EXPLORATION

Embracing technology fusion and quantum sensing can accelerate mineral discovery

Mining has been a key industry across much of the world for centuries and has evolved a great deal over time. Now, as many of the world’s wealthiest economies begin to pivot away from fossil fuels and seek greener, more efficient sources of energy, the mining industry has taken on even more strategic importance than ever before. Control of key resources has become a vital geopolitical issue. Finding sufficient supplies of these minerals therefore not only determines who gets to extract them, but in some ways may also help to determine who will build the advanced economies of tomorrow first.

The ongoing transition toward electrification of multiple industries, along with the adoption of renewable sources of energy instead of fossil fuels, has created a massive gap between the supply and demand for many kinds of metals and critical minerals. An EY report in 2022 highlighted that demand estimates for the following year indicated a global deficit of 700,000 tonnes of lithium and 4.7 million tonnes of copper at that time. And many expect these numbers to trend upwards. Efficiency and increasing exploration along with high conversion rates from greenfield exploration to operating mines are therefore key to bridging this gap, both from a supply and a cost per unit perspective.

The good news is, there may be solutions available which can help address this problem. The use of multiple types of advanced sensors in combination to cross-correlate different sources of geophysical data can accelerate the identification of drilling targets. Conventional airborne methods such as gravimetry and magnetometry are combined with land-based electromagnetic methods, geological soil sampling methods, and others. Processing and correlating these huge datasets are a key challenge, and we can learn from other industries which have successfully adopted artificial intelligence (AI) and machine learning on a large scale to process the data. However, in most cases these approaches leverage historical datasets, in which data resolution and quality can vary drastically. Access to high-quality, high-resolution data is crucial for high depth dis-

coveries, particularly in the context where large, shallow deposits have already been found and developed.

Over the last decade, the advent of drone sensing technologies has provided high-speed, high-resolution data collection in a very efficient timeframe, turning weeks of ground surveys into days. Low altitude drone surveys also help exploration by revealing key data points which could not previously be identified in historical surveys.

As a next step towards this “data fusion” and accelerated exploration, SBQuantum is building a platform to deploy sensors measuring magnetics and gravity from a drone, accelerating the generation of these datasets while significantly improving cost efficiency. Conventional total magnetic field surveys are currently the industry benchmark, providing a single data quantity from which to infer the resource body from inversions. SBQuantum leverages the room-temperature, quantum-based vector readings using its diamond magnetometer technology to perform full tensor magnetic gradiometry, generating eight times more maps which can be fed into inversion or AI software. Combined with gravimetry, these juxtaposed airborne datasets will streamline both the collection of data and its interpretations.

A key consideration when inverting geophysical data is setting appropriate constraints for the inversion to reduce the possible degeneration of the potential solutions. By jointly inverting the gravity and full tensor magnetics data, solutions of this kind will provide enhanced 3D descriptions of the ore bodies, with greater resolution and confidence.

To demonstrate the readiness of our full tensor system, SBQuantum has built and deployed a backpack sized device over nickel ultrafamafic structures. By correlating the tensor magnetic maps, high resolution geologies were revealed and the dipping of the body could be inferred using only tensor data, in a way that cannot be done solely with total magnetic field data. Access to all tensor components also provides a means to highlight additional geologies. Ultimately, combining

SANDVIK SAVES ON DRILLER TRAINING

Learn anywhere, anytime with with cutting-edge simulators

Sandvik Mining and Rock Solutions leads the charge in revolutionizing operator training through the use of cutting-edge simulator technology.

This revolutionary tool, available for training purposes at Sandvik facilities and customer sites throughout Canada, aims to enhance the skills of operators and maintenance teams across a range of iSeries surface and underground equipment. With its advanced controls including automation capabilities, Sandvik’s operator training tools promise to revolutionize.

The simulators offer a comprehensive and realistic learning experience. Trainees familiarize themselves with equipment functions and operations before they encounter the actual machinery. In addition to enhancing operator skills, a Sandvik’s surface or underground simulator also contributes to improved environmental, health, and safety (EHS) practices.

By minimizing the risk of accidents and equipment damage, the simulator promotes a safer working environment for all personnel involved in mining operations. And an operator with better training will reap productivity gains as well.

“The introduction of the DS412i bolter and DL432i longhole drill training simulators at Sandvik’s facility in Sudbury, Ont., as well as the Seabee mine site has been a game-changer for our mining operations,” says Greg Scammell, mine manager for SSR Mining. “With the ability to practice in a safe environment alongside dedicated operator trainers before encountering new equipment, our operators have gained confidence and proficiency, leading to improved productivity and safety outcomes.

“Sandvik’s commitment to innovation has truly revolutionized our training

practices and elevated our operational performance, even before the newly purchased underground equipment was commissioned to site,” Scammell added.

By providing hands-on training in a controlled setting, Sandvik simulators significantly reduce the drill start-up period and improve overall equipment utilization. Trainees can practice various scenarios and learn to manage different operating conditions, optimizing productivity and minimizing downtime.

“Sandvik’s simulator training and tooling presentations have proven to be worth their weight in gold. Whether it was an operator’s introduction to Sandvik equipment, or just a refresher, Sandvik’s simulator training was an exceptional experience for our operators,” says Spencer Andriashek, project manager for Otokiak Corp. at B2Gold’s Goose project.

“The simulator provided a safe environment for a hands-on learning experience, enabling our indigenous