According to a recent draft discussion paper on Canada’s Critical Minerals Strategy, the strategy will address five core objectives: support economic growth and competitiveness, promote climate action and environmental pro tection, enhance global security and partnerships with allies, advance Indigenous reconciliation, and foster diverse and inclusive workforces and communities.

The value chain for critical minerals includes five segments: exploration, min ing, processing, manufacturing and advanced manufacturing, and recycling, and there is an opportunity for investors in every stage of that value chain. Therefore, the Canadian government has committed $4 billion in Budget 2022 to address the entire critical minerals value chain.

“Simply put, there is no energy transition without critical minerals, and this is why critical mineral supply chain resilience is an increasing priority for advanced economies,” Jonathan Wilkinson, Minister of Natural Resources.

Additionally, Deputy Prime Minister Chrystia Freeland signaled in a speech this week in Washington, D.C. that the federal government is prepared to address reg ulatory hurdles to economic development in Canada’s natural resource sector.

In this issue’s ESG column, Carolyn Burns reflects on critical minerals strategy, and how we can accelerate project development and advance reconciliation. Benedikt Sobotka argues on pages 42-43 that with battery demand set to explode over the coming decade, businesses, governments, and NGOs must renew their efforts to ensure the value chain is scaled up in a responsible, circular, and sustain able manner.

Also in this issue, we continue examining recent technologies that could maxi mize the production of critical minerals such as lithium on pages 32-35.

This issue also features several articles on underground construction, ventila tion, and communication, with a notable contribution from Cambrian College’s Centre for Smart Mining on pages 30-31, along with lawyers’ advice on invest ments in mining in case you are having trouble with international investments in foreign countries.

Our virtual symposium: “Reimagine Mining,” on Oct. 12, was an immense suc cess with almost 1,200 delegates registered. In case you missed it, we will have detailed coverage of the water management sessions in our January 2023 issue, including the answers to almost 40 questions that Dr. Chris Kennedy, Teck Resources’ water director, was asked by the audience.

On a personal note, I enjoyed my first visit to an underground mine during the “Mining Transformed 2022,” the world’s first technology exhibition in an under ground operating mine at the end of September. The NORCAT Underground Centre is a state-of-the-art operating mine. Mining Transformed 2022 provided a unique opportunity for more than 40 exhibitors and the visitors to connect underground amongst live demonstrations of emerging technologies that are poised to trans form the global mining industry. Kudos to Don Duval, CEO of NORCAT, and his team for organizing such a successful event. CMJ

NOVEMBER 2022 Vol. 143 – No . 9

225 Duncan Mill Rd. Suite 320, Toronto, Ontario M3B 3K9

Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Dr. Tamer Elbokl

TElbokl@CanadianMiningJournal.com

Marilyn Scales

mscales@canadianminingjournal.com editor@canadianaminingjournal.com

Jessica Jubb

jjubb@glacierbizinfo.com

David Brown (Golder Associates)

Michael Fox (Indigenous Community Engagement)

Scott Hayne (Redpath Canada)

Gary Poxleitner (SRK)

Allison Mein

403-209-3515 amein@glacierrig.com

Publisher & Sales Robert Seagraves 416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada

George Agelopoulos 416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published 10 times a year by Glacier Resource Innovation Group (GRIG). GRIG is located at 225 Duncan Mill Rd., Ste. 320, Toronto, ON, M3B 3K9 Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891.

Subscriptions – Canada: $51.95 per year; $81.50 for two years.

USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary.

HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods: Phone: 1-888-502-3456 ext 3; E-mail: amein@glacierrig.com

Mail to: Allison Mein, 225 Duncan Mill Rd., Ste 320, Toronto, ON M3B 3K9

We acknowledge the financial support of the Government of Canada.

Within underground mines, the primary horizontal trans portation openings are provided by drifts. A significant portion of overall development costs often account for their construction, and production costs may be noticeably affected by these excavations. To offer insight into the expense of excavating drifts and ramps, Costmine has designed an array of typical configurations and estimated the associated costs. These costs were estimated with the help of a software appli cation from Costmine’s suite of engineering-based mining cost estimating applications, Sherpa Underground. The following table summarizes the results of these estimates in U.S. dollars (2021) per metre of advance:

The assumed rock characteristics upon which the cost estimates are based.

Drift excavation Compressive Rock quality scenario strength (kpa)

Unsupported 190,000

Rock bolts 155,000

Shotcrete 130,000

In our designed configurations, blast holes for openings with face areas of less than 9.28 m2 are provided by airleg drills. Jumbos equipped with drifters drill the blastholes for the larger faces. In both the ramps and the untracked drifts, development muck is collected and transported using scoop trams. In tracked drifts, muck is collected and loaded into rail cars by overshot muckers. Diesel locomotives transport the cars away from the active face to the dump point. The costs of operating the neces sary ancillary machinery (such air compressors, auxiliary fans, and pumps) are also included in the estimates.

In our designs, high strength emulsion-based explosives are used for all blasting. Powder factors are tied to the face area of the opening and to the quality of the rock and vary from a low of 0.53 kg/t to a high of 1.67 kg/t. Under appropriate conditions, less expensive blasting agents (such as Anfo) can be used, which in most cases would result in a reduction in the costs of the blasting supplies. However, the use of bulk explosives is often accompanied by an increase in the required powder fac tor. Blasts are initiated with non-electric millisecond delay caps. Where rockbolts are used for support, our designs assume that

the bolts are placed 1.2 metres on center and one steel mat is used for every three bolts.

Rock bolts (1.2 to 2.4 metre long) $11.10 to $17.00/bolt Rock bolt mats $23.5 to $32.50/mat Shotcrete $512.72/cubic metre

Finally, the drift development cost estimates are summarized below in units of U.S. dollars per metre of advance.

Face dimensions (width x height in metres)

Unsupported Rock bolts Shotcrete

1.8 x 2.4 1,404 1,273 1,219 2.4 x 2.7 1,420 1,290 1,255 3.7 x 3.0 1,523 1,265 1,349

x 3.7 1,883 1,684 1,645

x 4.6 2,878 2,517 2,385

Costs are not included for items such as move-in and set-up, yard preparation, support equipment installation, camp facili ties, design and engineering, or contractor profit.

For all the drift excavation scenarios investigated, expenditures for labour far exceed those for any other cost category. Labour’s contribution fell within the range of 50% to 60% of the overall cost estimates, with supplies accounting for about 15% to 20% depending upon the drift excavation scenario.

The estimated development costs may strike some readers for lower-than-expected distribution of costs between support methods. This may be the result of decrease in quality rock characteristics that would require stronger rock support meth ods, which was accounted for in the reported estimates. As the quality of the rock decreases, the consumption rates for drilling and blasting supplies fall. The associated reduction in costs is offset, to a degree, by an increase in rock support costs. This bal ance is the primary influence on the cost distribution among the excavation scenarios described above. CMJ

Sam Blakely is asenior mining engineer with Costmine, a Division of The Northern Miner Group.

RIO TINTO is investing up to $515 million over the next eight years to decarbonize its Fer et Titane (RTFT) operations in Sorel-Tracy, Que. and to help diversify its critical minerals portfolio, while the federal government will contribute up to $222 million to the initiatives.

The partnership, worth up to $737 million will support innovations to reduce by up to 70% the greenhouse gas emis sions from RTFT’s titanium dioxide, steel and metal powders business.

The partnership will also support Rio Tinto’s BlueSmelting project, an ilmenite smelting technology for making highgrade titanium dioxide feedstock, steel and metal powders that could cut 95% of greenhouse gas emissions compared to RTFT’s current reduction processes.

A demonstration plant is under construction at RTFT to test the BlueSmelting technology and it is expected to be completed in the first half of 2023. Once operational, Rio Tinto said it could potentially reduce up to 70% of RTFT’s overall greenhouse gas emissions, or the equivalent of 670,000 tonnes of CO2.

Also enabled by the partnership will be an increase in the

production of the critical mineral scandium, of which Rio Tinto said it became the first North American producer in April this year at its Element North 21 demonstration plant.

The company plans to quadruple production capacity to reach up to 12 tonnes of scandium oxide per year, up from current capacity of 3.0 tonnes, by adding new modules to the existing plant that extracts high purity scandium oxide from the waste streams of titanium dioxide production.

The $30-35 million project is slated to begin producing scan dium oxide in 2024.

In addition, Rio Tinto will add titanium to its output portfo lio by joining with other titanium industry producers to advance a new process for extracting and refining titanium.

Rio Tinto will build a pilot plant at the RTFT metallurgical complex to validate the process which it said requires no harmful chemicals and doesn’t generate direct greenhouse gas emissions. The plant is expected to be completed by the end of 2023. CMJ

EMERGING AUSTRALIAN lithium miner Sayona Mining is closer to the re start of production at its North Ameri can Lithium (NAL) project in La Corne, Que., as it awarded a four-year, $200-mil lion contract to Quebec company L. Fournier et Fils for mining operations.

This is one of the largest such contracts ever signed in Quebec, and it is expected to create 120 new jobs to be

filled from the region of AbitibiTemiscamingue, Que., including the Pikogan and Lac Simon First Nations communities.

Fournier will be responsible for the supervision of all stripping and drilling, blasting, loading, and transportation of ore and waste rock. The contractor will also maintain the site roads and all other services. Drilling and blasting will

be conducted by another Quebec com pany, Dynamitage Castonguay.

Work is to begin this month with a fleet that includes 10 trucks of 100tonne capacity and two excavators.

First lithium production from NAL is to begin in the first quarter of 2023. The project will produce an estimated 115,000 tonnes of 6% lithium oxide in a spodu mene concentrate annually for 27 years.

AZIMUT EXPLORATION has won the Discovery of the Year award from the Mineral Exploration Association of Quebec (AEMQ) for the discovery of the Patwon gold zone on the com pany’s 100%-owned Elmer property.

The award is granted to highlight the importance of a new discovery that has a ripple effect on exploration activities both on the property and in the surrounding area. The Azimut team is understandably very honoured by this recognition.

Discovered in 2020, the Patwon zone has been delineated by 115 holes (48,381 metres). The zone is continuous from sur face to at least 800 metres, and it remains open at depth – and probably along strike, says Azimut. The strike length extends nearly 600 metres with an estimated true width of 35 metres. Drilling continues to expand and optimize a potential open pit.

Azimut’s wholly owned Elmer property is a gold-silver-cop per-zinc project located in the Eeyou-Istchee James Bay region of Quebec, about 5 km west of the James Bay Road and 100 km

from Newmont’s Eleonore gold mine. The property is also 60 km from the Cree community of Eastmain. CMJ

TECK RESOURCES is teaming up with SAAM Towage to deploy electric-pow ered tugboats at Neptune Terminal in Vancouver. These will be the first electric tugs operating in Canada, and their deployment supports Teck’s climate goals.

SAAM will supply two ElectRA 2300 SX tugs that will begin operation in the sec ond half of 2023. Their use will eliminate over 2,400 tonnes of greenhouse gas emissions each year. The electric tugs are much quieter than diesel-powered boats, a benefit for marine life in the harbour.

The ElectRA tugboats are designed by Vancouver-based Robert Allan Ltd. And will be built at Sanmar Shipyards in Tür kiye (Turkey).

Teck previously announced an agree ment with Oldendorff Carriers to employ energy efficient bulk carriers for ship ments of Teck steelmaking coal from the Port of Vancouver, reducing 45,000 tonnes of carbon dioxide per year, equiv

alent to removing nearly 10,000 passen ger vehicles from the road. Teck has also announced a pilot of a fully electric on-highway transport truck to haul cop

The deployment of electric tugs will remove 2,400 tonnes of GHG from the air each year and reduce noise.

CREDIT: TECK RESOURCES

CREDIT: TECK RESOURCES

per concentrate between the Highland Valley copper operations in south-central B.C. and a rail loading facility in Ashcroft, B.C. CMJ

Miners love to talk about “the markets,” but increasingly at industry conferences it is the carbon markets, and not just the stock markets, that has everyone’s attention. Pres sure is mounting on mining industry participants to make their operations “carbon neutral” or “net-zero.” But what does this mean, and what are the strategic and legal considerations that companies should be evaluating?

In response to the 2015 United Nations Paris Agreement, which formalized targets for lowering greenhouse gas (GHG) emis sions, countries and businesses alike have increased their pub lic commitments to reduce global emissions, with many coun tries announcing aggressive GHG emission reduction goals and pledging to be carbon-neutral or net-zero by 2050.

In Canada, building off regimes put in place by early adopt ing provinces like Alberta, the federal government has finalized the Canadian Greenhouse Gas Offset Credit System Regulations facilitating a national compliance carbon market. In the United Kingdom, the government has launched a comprehensive review of net-zero delivery by 2050 to ensure legally binding climate goals are pro-growth and pro-business, and that invest ment continues to boost economic growth. Similarly, securities regulators in Canada and the United States are actively examin ing expansive new disclosure regimes that will require detailed climate change related disclosures.

Carbon credits act as a complementary tool that can be used alongside broader decarbonization efforts. For example, car bon credits can compensate for unabated GHG emissions while a company pursues an emissions mitigation strategy in order to reach a balance between GHG emissions and removals (netzero).

The terms “carbon credit,” “carbon offset” or “carbon allow ance” are often used interchangeably but can mean different things depending on the particular carbon market in which they are deployed. Generally though, they refer to a transfer able instrument that represents one tonne of carbon dioxide (tCO2) or the carbon dioxide equivalent (tCO2e) of another GHG. Carbon credits are derived from activities that either avoid or reduce the release of GHGs into the atmosphere (such as the creation of biodiversity reserves), or that remove and use and/ or sequester GHGs from the atmosphere (such as carbon cap ture use and storage (CCUS) projects).

Carbon credits trade within carbon markets, of which there are generally two types: compliance and voluntary.

Compliance markets are created where governments pre scribe GHG emission reduction requirements within their juris dictions. Regulated entities within compliance markets either create or acquire compliance carbon credits as a means of com plying with legislatively prescribed GHG emissions reduction requirements.

Voluntary markets function outside of the compliance mar kets and allow participants to acquire carbon credits that may not satisfy the requirements of legislatively prescribed compli ance markets, but which demonstrate a participant’s efforts to satisfy GHG reduction required by an array of stakeholders. This includes customers, shareholders, and financing entities.

There are significant opportunities presented by the growth in the carbon markets where mining companies can take proactive steps and demonstrate leadership. These actions could include:

> creating market differentiation through voluntary enhanced corporate disclosure (for example, including discussion of Scope 1, 2 and 3 emissions) and preparation of focused sustain ability reports outlining corporate climate change vision;

> engaging consultants to determine the “carbon footprint” of business and associated activities;

> evaluating the purchase of voluntary carbon credits as a means of publicly positioning the company as “carbon neutral;”

> evaluating the possibility for adoption of “green” power sources, technology and equipment as part of exploration, development and mining planning and operations for both existing and future projects (and including detailed analysis as part of any NI 43-101 technical reports);

> setting sustainability targets or requirements for project partners and third-party service providers or suppliers; or

> evaluating the potential feasibility of any carbon credit gen erating projects on existing mineral lands or properties as an additional revenue source.

Investors are increasingly focusing investment decision-mak ing on a company’s carbon neutral or net-zero commitments. Unsurprisingly, the world’s largest mining companies already devote extensive disclosure to their voluntary climate change commitments, and even exploration and junior mining compa nies are now seeking to differentiate themselves from their peers through public commitment to net-zero.

CMJ

STEVAN D. BENNETT and THOMAS W. MCINERNEY are partners and co-heads of Climate Change, Power and Renewable Energy Practices at Bennett Jones LLP.

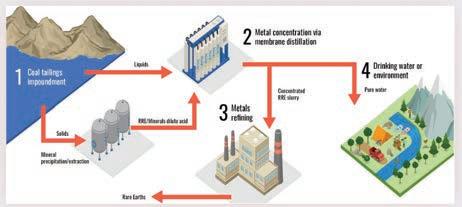

If we are going to transition to a low-carbon economy, we need to increase the production and use of critical minerals (e.g., cobalt, graphite, lithium, nickel, copper, and rare earth elements) by an alarming rate. Earlier this year, the Govern ment of Canada launched Canada’s Critical Minerals Strategy.

The objective of the strategy is to “… boost the supply of criti cal minerals to grow domestic and global value chains for the green and digital economy … and position Canada as a global leader in the responsible, inclusive, and sustainable produc tion of critical minerals and secure value chains from mines to manufacturing.” (Critical Minerals Center of Excellence, 2022) You can find the strategy on the Critical Minerals Center of Excellence website.

Two main pillars of the strategy are accelerating project development (i.e., streamlining and speeding up the permitting process) and advancing Indigenous reconciliation. On the sur face, these two objectives may seem to be at odds. But that does not have to be the case. Land use planning and Indigenous-led processes for consultation and consent can be the foundation of an accelerated permitting process that does not compromise reconciliation, and Indigenous rights.

As part of the government’s strategy implementation plan, there was a public consultation period this summer. Below are the excerpts from our submission to the Government of Canada that present some ways we can accelerate project development as well as advance reconciliation. To streamline permitting while advancing reconciliation and recognizing Indigenous rights, we can (i) incentivize and support Indigenous land use planning and (ii) support Indigenous-led consultation and con sent processes and decisions related to mineral development.

Land use planning can help Indigenous governments as well as regional and federal stake holders accelerate the responsible development and identification of preferred zones for critical minerals, cultural and social use, remining of waste, resto ration, and nature-based climate solutions. There are several useful benefits of effective local land use plans:

> They offer useful information to provincial and federal agen cies in their planning and permitting processes.

> They are an invaluable tool for private sector proponents –supporting early rightsholder and stakeholder engagement, consultation, and mineral development planning.

> They are more likely to consider cumulative impacts and could be a driver for community-led impact assessments on a regional scale.

Indigenous leadership in land use planning is essential to

uphold rights, Indigenous methods for land use, and reconcili ation. Local land use planning could take place within the con text of broader land use mapping efforts, and there are some excellent examples of community-led mapping that includes historical cultural and environmental information.

But to achieve this, there needs to be funding and resources available to Indigenous governments, municipal governments (or municipal coalitions), NGOs, land, and water organizations for voluntary land and natural resource use planning. This can take the form of grants, training workshops, and sharing skills and lessons learned with communities who have used land use planning to inform natural resource development. Land use plans must also be recognized in the decisions related to critical minerals, and where there are Indigenous rights to land use deci sions they must be protected. This means that local priorities for biodiversity, social, and cultural use and other economic oppor tunities may supersede critical mineral development.

Consultation and consent processes should be designed and led by Indigenous communities and governments. The process and outcome are more likely to be supported by the community, address community needs, and build off land use history, com munity mapping, nature-based assets, and critical minerals.

Support for Indigenous led consultation and consent pro cesses could be used to

> create opportunities to discuss and define expectations related to community protocols with a focus on critical minerals;

> develop Indigenous/community protocols that are aligned with regional, provincial, and federal permitting systems;

> increase training opportunities for government-band level land use managers, and funding opportunities to build the depth of Indigenous land use departments with a specific focus on research and data related to critical minerals and naturebased assets;

> create opportunities to learn from each other and share expe riences, including with international Indigenous groups; and

> create opportunities to co-design and participate in land scape-level programs designed to manage cumulative impacts (e.g., community safety specifically as it relates to gender based violence, changes to water quality and quantity, and biodiversity) and benefits (e.g., employment and procurement opportunities).

CMJ

CAROLYN BURNS is the director of sustainable resources at Resolve. Resolve is an NGO that forges sustainable solutions to critical social, health, and environmental challenges by creating innovative partnerships where they are least likely and most needed.

The mining sector is making progress.

The last year has seen many compa nies prioritize environment, social, and governance (ESG) factors, weav ing them into corporate strategies, deci sion-making and reporting, as the issues become a priority for all stakeholders and shareholders. With ESG now firmly integrated within business models, min ing companies must now consider how these issues will evolve and broaden their capabilities to manage them effec tively going forward.

This needs to be articulated through transparent, outcome-based measure ment and assurance. In fact, more rigor ous reporting will become critical if com panies are to meet growing expectations and avoid accusations of “greenwash ing.” Companies that go beyond policy and have a holistic approach to ESG can get an edge on competitors in many ways from accessing capital to securing licence to operate and attracting talent.

The EY Top 10 business risks and opportunities for mining and metals in 2023 report outlines some of the top ESG issues the sector expects to face the most scrutiny on and how to respond.

76% of survey respondents cited water stewardship as their top ESG risk, as climate change and water scarcity concerns esca late. As this will continue to be a critical issue for years to come, coordination between organizations and governments needs to be a priority.

The sector’s current trend of setting blanket targets around water usage often fails to acknowledge trade-offs, for example, water-saving technologies can be energy-intensive. Transpar ency around the water and energy nexus and a lifecycle ap proach can help companies assess and limit impact.

Improving diversity, equity and inclusion (DE&I)

DE&I remains a critical challenge for the sector. Unless mining companies can address these issues, they face significant risks in attracting the current next generations of talent, and in sustain ing their businesses into the future. Key DE&I issues include:

> Increasing participation of women: Companies still strug gle to attract, retain and promote women, depriving them of a huge talent pool as well as the proven benefits of a more gender diverse workforce. Rethinking traditional recruitment tactics, creating equitable career paths, and breaking down barriers on-site and in corporate headquarters are examples to help accelerate change.

> Safety and support on-site: Companies need to change how mining sites are built, operated and constructed to improve

safety and support for all workers. For example, on-site child care could attract more people while making a positive contri bution to the community.

> Building a purpose-led brand: Companies must do more to build a brand aligned with the purpose and values of the next generation of talent.

Increasing credibility of disclosures through data and communication

Around the world, regulation of carbon emissions, sustainabil ity and social governance is increasing, with companies subject to different regulatory and reporting frameworks across juris dictions. The new International Sustainability Standards Board (ISSB) aims to help meet the demand for high-quality, transpar ent, reliable and comparable reporting by companies on ESG, including climate data. Complying with new standards and expectations will require mining companies to improve the availability, rigor and reliability of data.

Accessing capital increasingly depends on meeting ESG tar gets, with investors expecting comprehensive, accurate non financial value included in company disclosures. Policymakers and companies need to work together to ensure the availability of better climate and other ESG data to create transparency and assurance of company actions or plans.

The circular economy offers opportunities for companies to take ownership of their products throughout their lifecycle, finding ways to unlock new value. For example, a company that mines battery minerals can also play a role in ensuring they are

retained and reused at the end of the battery’s life, opening up the opportunity of new commercial models for battery disposal.

Stewardship of minerals throughout their lifecycle can be an excellent differentiator for companies, particularly while recy cling continues to develop. While nearly 60% of survey respon dents said engaging in circular economy strategies is a differen tiator, only half of them plan to do so.

Developing long-term strategic vision for mine closure Mine closures impact a wide range of stakeholders, and expec tations are increasing around how miners mitigate these impacts, including the socioeconomic effects on communities.

A proactive approach to mine closure begins when a mine is first planned. Designing with closure in mind allows for effec tive ongoing engagement with traditional owners and commu nities, creates opportunities for progressive closure activities and ensures that decisions throughout the life of the mine con sider the impact of closure options. When companies take this strategic approach – while engaging with communities and supporting their socioeconomic longevity – they can leave a positive legacy long after mines have closed.

As we head toward 2023, new business models offer oppor tunities for mining companies to reposition for a changing future, with many considering the benefits of strategies to ratio nalize, grow and transform. Companies that scrutinize and shift business models now can get an edge on competitors as demand and expectations change. CMJ

THEO YAMENGO is EY Americas and Canada mining and metals leader. For more information visit http://www.ey.com/en_ca/mining-metals .

The alignment of global mining safety and CR’s Zero Harm values make us passionate about keeping people and the environment safe while using our innovative products. That’s why we’re always working with sustainability and safety experts to design solutions that are ready to meet the challenges of a modern mine. Mine smarter with CR.

Mine operators face mounting pres sure to produce and process ore at a lower cost per tonne and remain profitable in an increasingly compet itive landscape; all that while operat ing in some of the most complex and ever-changing industrial environments on the planet. A major task that these operators must overcome is successfully deploying a reliable and unfailing net work connectivity to all corners of the mine, especially the working face.

Underground mines and tunnels are some of the most challenging environ ments to deploy network systems. The corkscrew design of ramps, varying sized stopes, numerous crosscuts, and increas ing mine depths can severely limit the reach of wireless signals. In a setting with extensive connectivity and throughput demands, operators must consider all available options. The use of technology underground has increased drastically as operators seek enhanced productivity, semi and fully autonomous control, video feeds, energy cost savings, and improved employee safety.

Operators can achieve significant pro ductivity gains by unlocking full auton omy and mobility with a portable wire less infrastructure that voice-only leaky feeder cannot. However, many wireless networking options fall short of mining requirements due to their lack of

dynamic and fully mobile vehicle-to-ve hicle and vehicle to fixed node or worker communication.

Underground mines are mission-critical environments. They present a unique myriad of hurdles to deploying network systems. Connectivity and throughput demands are high, and mine layouts can limit how far wireless signals can travel.

The mining industry continues to invest in various technologies, like semiand fully autonomous scoops and trucks, remote fan and gas monitoring and con trol, video in the shafts and working areas, remote blasting over existing net works, decreasing post blast re-entry times, remote surveying with drones, real time telemetry from mobile and fixed equipment, and all call radio and phone communications during drills and emergencies.

The industrial internet of things (IIoT) is playing a significant role in reducing min ing accidents and downtime. The whole environment transforms when machin ery, equipment, and people are constantly interconnected. Onboard and fixed sen sors can monitor temperature and air quality to ensure adequate ventilation, while cameras can stream video in real time. Wearable devices in combination

with sensors can alert workers when entering an unsafe area and track their progression. They can also be used to alert operators to warnings from the numerous screens in today’s operator cabs.

New technology requires reliable net work connectivity that not only keeps operations running smoothly but seam lessly ensures staff, equipment, and applications remain functioning 24/7, 365 days a year. A solution that allows underground mines to quickly intercon nect existing infrastructures, introduce new technology, relocate, or remove network infrastructure all without caus ing network downtime is needed. As more and more devices get intercon nected, the transmitted data volume grows exponentially.

Underground mines are looking to lever age autonomy to meet increasingly strin gent safety and productivity mandates. The challenge is that autonomous appli cations are not only bandwidth-inten sive, but most require continuous, unin terrupted communication from surface to underground and vice versa.

Operators are utilizing remote technol ogy to help eliminate danger when per forming industrial tasks. Beginning at the working face of the mine and moving

outward, automated equipment enhanc es safety by keeping human personnel out of hazardous locations and streaming live data to enable real-time situational awareness. However, automation plat forms also require continuous connectiv ity to function effectively. If communica tions encounter interference, it may cause bandwidth-intensive autonomous applications to cease operating.

Many mines depend on fiber to achieve reliable underground communications. But installing fiber in active haulage drifts and ramps is challenging and can create operational and maintenance nightmares. In addition, development areas can rarely support any fiber infra structure. It is not uncommon for trucks to accidentally catch and rip down sec tions of fiber. When that happens, con nectivity across the entire underground mine can be lost. Therefore, operators must look towards a wireless solution that can limit the possibilities of down time and the risks it brings with it.

Another important cost factor is to use the existing fiber infrastructure up to a non-production area such as the station or an electrical substation and then go wireless from there.

However, traditional wireless net works cannot provide the unfailing con nectivity that is necessary underground. They depend on fixed transmission points, so they cannot be easily reconfig ured and expanded. In Wi-Fi, point-topulti-point (P2MP), or LTE network, a sin gle point of failure presents a real threat that is not tolerable in mines.

The ability to transmit dynamic video is also a prime requirement for mining as remote-controlled equipment and cameras provide visibility into under ground locations, so high bandwidth and multi-frequencies are a must. The ability to do remote mucking from sur face and continue to skip between shifts can lead to a large production gain.

As more and more devices are con nected, the need for bandwidth increases, so the network must be able to expand easily without interruption. Having a wireless infrastructure in key areas elimi nates the need for additional fiber runs from the surface. Underground, the net work must overcome uneven surfaces, numerous corners, changing back heights, vent tubing, air and water pipes, and power cables as well as be impervious to changing temperatures, depths, and dusty environments; all of which present vari

ous propagation challenges.

In a true wireless mesh network, there is no single point of failure, as each node acts independently, forming connections to other nodes. If one node becomes tem porarily unavailable or goes down, it should have no impact on the network.

The type of mesh required for mining should be self-healing, so that if one node

becomes unavailable, the next node self-optimizes to find another efficient path to transmit data. Uninterrupted, continuous routing is a must. Real min ing wireless mesh networks should be versatile, rugged, and flexible, moving with the mine, as new locations are opened to ensure uninterrupted cover age.

CMJ

Darrell Gillis is Rajant’s sales director in Canada.

Global demand for aggregates and mining materials is on the rise with the industry facing an expected growth of 4.2 bil lion tonnes over the next 15 years. That is a lot of material, which means producers need efficient equipment to meet spec ifications and turn a meaningful profit.

Every tonne of material must go over at least one vibrating screen, so ensuring the equipment’s efficiency is critical to an operation’s success. The good news is that there are technolo gies available today that can help increase or improve screen ing productivity. Integrating cutting-edge systems like eccentric screening technology, state-of-the-art screen media, and diag nostic tools can prevent blinding, pegging, carry-over, or con tamination, thus improving screening performance, productiv ity, and profits.

Vibrating screens that are engineered with a double eccen tric shaft assembly create a constant stroke to maintain g-force during material surging. The double eccentric shaft design forces the screen body to follow the movement of the shaft. While the shaft travels up, the counterbalance weights move in the opposite direction and create a force equal to what is gen erated by the body. As a result, the forces cancel each other out and maintain a consistent positive stroke that handles material volume spikes without losing momentum.

One producer in western Canada quickly saw the benefits of switching to double eccentric screening technology when they replaced two horizontal vibrating screens with one double eccentrically driven, four-bearing inclined vibrating screen. Changing their equipment helped to eliminate surging, blinding, pegging, and material contamination challenges while increas ing their production by 25%.

A vibrating screen’s operation can have a significant impact on a machine’s surroundings. The metal springs on a traditional concentric vibrating screen, for example, can be noisy to oper ate. This metal-to-metal, up-and-down or side-to-side move ment can cause excessive noise and vibration. To resolve this problem, double eccentric technology makes use of shear rub ber mounts that are strategically designed to minimize lateral movement. The rubber mounts reduce noise while maintaining smoother operation, even in extreme circumstances such as overloading, surging, and starting or stopping under load.

The use of eccentric technology virtually eliminates vibration in the structure – or chassis when used with portable equip ment – which protects the integrity of the machine. This means producers can potentially use multiple eccentric vibrating screens in one structure, boosting productivity. Attempting to operate multiple concentric machines in a structure, however, could create vibrations damaging enough to not only cause a negative effect on the quality of production but open the door to safety risks and downtime.

A leading phosphate producer in North America – producing 8.0 million tonnes per year – increased screening area by 60% by transitioning to double eccentric equipment. The mine incorporates a six-story screening plant to house multiple vibrating screens that run 24/7. Multi-storey screen houses are common in industry but can pose structural concerns due to the vibrating screens’ size, capacity, and force. Opting for dou ble eccentric technology eliminated those concerns.

Integrating eccentric screening technology, state-of-the-art screen media, and diagnostic tools.

Combining the use of advanced eccentric screening technology with the best screen media for the application is a recipe for success. Specifically, polyurethane screen media can be a bene ficial asset to any operation seeking to prevent blinding and pegging while improving material stratification and increasing wear life.

Polyurethane media offers the best combination of open area and wear life for both wet and dry applications. Polyurethane screen media that is poured open cast can result in 1.5 to 2 times longer wear life than injection-molded products. Opencast polyurethane permanently hardens when cured to main tain its chemical properties and improve wear life. Alternatively, injection-molded screen media can soften when temperatures rise, resulting in shorter wear life. Polyurethane screen media also features tapered openings to reduce the risk of blinding and pegging.

The solution to improving material stratification lies in find ing the ideal mix of screen media types to ensure all phases of screening work correctly. A screen media company that offers a variety of screen media types can help evaluate how material moves through the three phases of screening – from layered to basic to sharp – to give recommendations on the best screen media for an application. Producers can customize the screen deck by choosing screen media that maximizes productivity for each phase by blending the best combination of open area and wear life.

A vibrating screen needs regular checkups to run optimally. Vibration analysis and diagnostic systems designed specifically for vibrating screens by OEMs (original equipment manufac turers) are reliable tools for maintaining continued efficiency and longevity of screening machines. To ensure the best pro ductivity, operations can partner with an OEM that specializes not only in manufacturing equipment, but also offers addi tional diagnostic tools, product-specific knowledge, and years of engineering experience.

Utilizing vibration analysis software, for example, allows mining and aggregates operations to monitor a vibrating screen’s performance in real-time by detecting problems before they lead to diminished performance, decreased effi ciency, and increased operating costs. The most robust sys tems incorporate eight wireless sensors that magnetically fas ten to key areas of a vibrating screen and measure orbit, accel eration, deviations, and other important data points that indicate the condition of the machine. The sensors send realtime information wirelessly to be analyzed, ideally by an OEM-certified service technician who can provide a detailed summary and recommendations.

Some manufacturers use vibration analysis technology to offer impact testing – or a bump test – which ensures proper machine calibration and promotes efficient operation. Impact testing involves striking the machine at key points with a dead blow hammer while the machine is off. Vibration analysis sen sors are placed at key locations on the vibrating screen while a technician tests the natural frequency of a machine. Based on the results, engineers can adjust machine parameters to avoid operating in resonance, which can diminish productivity, dam age vibrating screens and pose safety risks. Natural frequency can shift over time as components are repaired or replaced, so the impact test should be conducted regularly. By incorporating impact testing into an operation’s regular maintenance routine,

producers can ensure optimum screening performance and equipment reliability.

Another advanced diagnostic tool is condition monitoring, which is designed to monitor the health of vibrating screens using modern algorithms and artificial intelligence. The system utilizes permanent sensors that monitor the equipment 24/7 to capture real-time information and provide alerts via e-mail immediately upon the first sign of a potential problem. By con stantly monitoring the accelerations of the vibrating screen, certain systems can even forecast the equipment’s dynamic condition in regular intervals of 48 hours, five days, and four weeks. With consistent use, condition monitoring software will accurately point out and predict critical issues and advise when to schedule maintenance, along with what to focus on during that planned downtime.

By using diagnostic programs to conduct regular analysis, and by engaging in predictive and preventative maintenance, operations will see minimized downtime through faster prob lem-solving, lower repair costs, and increased peace of mind.

The development of the double eccentric screen and other screening technology provides operations with innovative and cost-effective ways to increase their profits and efficiency. By integrating the right equipment, screen media, and vibration analysis systems, producers can see more uptime, higher qual ity results, increased productivity, and greater profits.

CMJ

Duncan High is the processing equipment technology manager at Haver & Boecker Niagara.

Ventilation is the greatest energy consuming system in most underground mines. Traditional operations, especially older ones, run their ventilation fans 24/7 to provide fresh air and to remove noxious gases and particulate matter.

It doesn’t have to be that way. Advances in ventilation on demand (VOD) offer real savings.

In the case of Newmont’s Éléonore gold mine, estimated energy savings thanks to VOD amounted to 43% on propane to heat underground air, 56% on electric power consumed by fans, and 73% on surface electric power demand.

The project is located in Eeyou Istchee or James Bay region of Quebec. The mine is 100%-owned by Newmont, and the 2022 guidance is 275,000 oz. of gold.

The Éléonore gold mine has a fresh air capacity of more than 425 m3/s. The principal ventilation system consists of two Howden Alphair 12300-AMF-6600 exhaust axial fans with a nom

inal power of 1,471 kWh each, configured in parallel. There is also an exploration shaft that has two Howden Alphair 11200AMF-6600 main intake fans with a nominal power of 551.6 kWh, again configured in parallel. The mine also has over 140 auxil iary and booster fans operated in conjunction with seven damp ers and air regulators, and a heating system fuelled by propane.

Newmont invited Howden to design and implement a venti lation control system that would optimize the supply of fresh air to underground workers while reducing energy consump tion and operating costs – all of which translated into the reduc tion of greenhouse gases.

Howden set out to create an automated system covering all the ventilation equipment in the Éléonore mine, including the main fans, underground auxiliary fans and airflow regulators. Thirty ventilation monitoring stations (VMS) were installed to determine the quantity and quality of fresh air at various

February

963

871

852

886

886

2,552,577

2,049,635

2,854,524

2,205,882

2,666,228

2,214,275

2,694,978

1,256,929

1,271,459

1,290,602

732,193

1,749,888 787,243

1,729,800 564,951

1,674,000 440,029

2,684,352 466,616

594,039

2,684,352 809,630

2,684,352 516,953

1,298,836

2,527,250 452,823

points underground. Each VMS includes one flow sensor and three gas sensors to detect carbon monoxide, nitrous oxides and propane. These VSM stations are an integral part of Howden’s Ventsim Control system.

The system communicates with all the hardware and instru mentation in the mine without the need of programming on the surface. The system automatically adjusts airflow according to real-time needs in the mine and allows easy point-and-click manual control as desired.

The Ventsim Control installation included a mine-wide track ing system to detect the presence of vehicles and personnel underground. Each of the 144 vehicles was fitted with a radio frequency identification (RFID) tag that indicates its position in the mine and whether the engine is operating. Everyone work ing underground was also given a unique RFID tag that con nects to one of 254 zone-based access points. As mine condi tions change, the system automatically recalculates and adjusts using the latest information.

The tracking data is transmitted from these access points to the control room on the surface through a hybrid fiber optic network. There is currently between 60% and 70% Wi-Fi cover age in the mine, with plans for 100% coverage during full pro duction. The data from the RFID tags provides enhanced safety and management of the movement of vehicles and personnel, as well as ventilation on demand.

The data from the tracking system allows ventilation require ments for each zone to be calculated by the VOD logic software. This information is then used to automatically modify the speed of each of 140 underground auxiliary fans, to ensure that

each zone of the mine receives enough fresh air.

The control system in the Éléonore mine can be easily expanded as the mine grows in size to maintain adequate, safe ventilation in every part of the workings as new areas and lev els are opened up.

The installation of the Ventsim Control system, with its mon itoring stations and automation of all ventilation equipment, means that the supply of fresh air to individual work zones is maintained with complete safety, ensuring all underground personnel have a comfortable working environment. At the same time, the waste associated with continual ventilation of the whole mine has been eliminated.

The results were verified by an energy audit caried out by Howden. The project could save almost 3.0 million litres of pro pane, 31 million kWh of underground electricity, and 19 mil lion kWh of surface electricity.

The Éléonore mine benefited from reduced air waste because Ventsim Control calibrates in real-time to actual air flow needs where people and machinery are active. This increased production because blast gases were cleared quickly, reducing downtime up to three hours per production blast. Safety is improved because personnel do not control the fans manually. Contaminants gases are monitored and reduced to comply with regulations. The strategic deployment of variable frequency drives reduces power use by 50% to 60%. And the system is expandable.

Newmont chose Howden’s VOD system for its promised ben efits in production, sustainability and safety – all of which were realized. CMJ

O P T I M I Z E Y O U R P R O J E C T SOPTIMIZE YOUR PROJECTS W I T H T H E M O S T E F F I C I E N TWITH THE MOST EFFICIENT V E N T I L A T I O N S Y S T E M

N T H E I N D U S T

ENERGY-SAVING SOLUTION

Capital-intensive projects in foreign countries and long-term agreements in the mining industry can be sub ject to political risk and change that can impact investment. The protections avail able through investment treaties and the importance of structuring investments at the outset can help mitigate risk and pro tect international interests.

One of the key tools available to those involved in international mining opera tions is investment structuring to seek protection (and rights) under interna tional investment treaties. Not only can investment structuring provide certain

protections, but it can result in a com pany being able to pursue its rights with assistance from disputes funders or to utilize disputes funding so that the dis pute is de-risked for subsequent corpo rate transactions.

Recently, CMJ met with a panel of three lawyers from Dentons to discuss invest ment protection of capital-intensive proj ects in foreign countries, and long-term agreements in the mining industry.

Dentons’ expertise and experience in mining and natural resources goes beyond the law and extends to a deep understanding of the industry and how

that should translate into legal matters. This article summarizes the key take aways from that discussion. A detailed version of the discussion is available through a podcast on the Northern Miner website.

What is investment protection? And what do investment treaties protect?

Investment protections are protections and benefits to foreign investors under international investment agreements. They are usually multilateral or bilateral investment treaties or free-trade agree ments that contain investment protec tions. The first investment treaties date back to the mid-fifties, but they became much more common in the 1980s.

RACHEL HOWIE is a partner at Dentons and the co-lead of the Litigation and Dispute Resolution group in Canada. She also co-leads the firm’s Canadian Alternative Dispute Resolution and Arbitration group. Her practice focuses on international and domestic arbitration and litigation, primarily in the energy, mining, and natural resources industries.

JAMES LANGLEY is a partner at Dentons in London, U.K. He focuses on international arbitration, including both commercial arbitration and investor state arbitration, as well as commercial litigation and alternative dispute resolution. He works within the natural resources, energy and infrastructure, retail, telecoms, shipping, and sports sectors.

JOHN HAY is a partner at Dentons and the head of the U.S. International Dispute Resolution group. He has more than 35 years of experience representing domestic and international clients in complex commercial and investment treaty disputes. He has arbitrated disputes in a wide variety of areas, including construction, energy and mining, joint ventures, financial services, real estate, and investments in foreign countries.

They are intended to attract private investment in developing countries. They provide fundamental protection for investments as an alternative to local law that is inadequate to protect the investor, and they provide rules for arbitration under the treaty as an alternative to local courts.

To put it in context, there are probably over 2,300 different investment treaties in force today in the world. In addition to the procedural protection of an arbitra tion clause, they also have some substan

tive protections, such as most favoured nation treatment and national treatment, which prevents discrimination in favour of local entities when a foreign investor is making an investment. Other key pro tections include an obligation to provide fair and equitable treatment and a guar antee against expropriation without compensation.

Freedom to transfer funds and capital into and out of the country is also an important aspect of these treaties. The treaties also provide full protection and security against possible actions by the government. They cover investments by an investor from one country in the terri tory of another country. The investment is usually generally defined to include virtually any asset.

Investment protection protects the inves tor against the risk of state interference with investments. This can be a concern in mining because mining projects are long-term. They could span multiple gov ernments and multiple elections in any given region. And even in states that are considered safer for investment, a gov ernment change because of an election or another regulatory shift that could see perhaps a new denial of a license for a

and political risk and change.

If those investment agreements give the right to arbitrate disputes, they ensure that the investor is not necessar ily required to act against the state in local courts where the outcome may be unpredictable or where the outcome might be political or where the courts might not be thought of as independent. Another important aspect is that these protections are additive to what can be obtained through political risk insurance from private providers or in contracts from governments or from the multilat eral investment guarantee agency. The protections and benefits are outside of national laws, which mean it is very diffi cult, if not impossible for one state to uni laterally change the law to deny them.

Investment protections also provide foreign investors with more expansive protections if they must pursue a claim for a loss; the amount that they could claim and could be entitled to under an investment arbitration could be far higher.

Unlike private insurance that might have premiums to be paid, there is no cost to these protections.

That is a relatively new thing and of course a massive advantage for an inves tor in mining, for example. Local courts do not necessarily have an expertise in mining, but arbitration tribunals do.

To allow negotiations that oftentimes come up with a resolution, investment agreements are structured where the party bringing the claim must give a notice, and then there is usually a cooling off period before the claim proceeds. The benefit of this structure is that it might be enough to bring the parties to the table to really get a commercially fair deal.

In most cases, you seek the benefit of those agreements in countries where the regimes are not democratic to protect your investment. So how do those gov ernments get into those agreements?

It is not an in an agreement between the individual company and the state, although that sometimes happens. It is a situation where one country has a treaty with another country where both coun tries are consenting to arbitration, and under that treaty, they agree that the investors from one of the countries into the other will have certain rights.

For example, Canada and Colombia

There are plenty of issues that can come up and motivate a government to change its policy.

have an investment treaty under which if a Canadian mining company invests in Colombia and the Colombian government does something that adversely impacts that investment, that investor has a right to bring an arbitration against Colombia. So, Colombia is bound to arbitrate.

These are bilateral investment treaties, but usually called investment protection and promotion agreements. States enter these treaties to incentivize investment from the other state. Despite exposing themselves potentially to claims from investors, they are also doing that in exchange for investment in the first place. Something that will be factored into the negotiations between the states is what protections one is prepared to offer to the other. The system can sud denly change, and one country might ter minate a treaty (as was the case during NAFTA renegotiations), but eventually they may reach another agreement that satisfies all parties.

Why is this particularly relevant to the mining industry?

There is an exponential demand for criti cal minerals and rare earth elements that is expected to quadruple by 2030 because of EV and other green technologies. These are still capital-intensive endeavors, and they still require substantial investment at the outset. They have high production

costs, they are long-term, and the investor might not see a profit for years after start ing a new operation. Also, at that intersec tion of competing regulatory and political issues for governments are things like water and land use plans, taxation, royal ties, mining permits, emissions targets, environmental areas of protection, and government interest and strategic and critical domestic supply. All of that could create a perfect storm where projects, in jurisdictions that might be politically unstable or even subject to just regular change through elections and change in government perspective, would be sub ject to impacts in a way that are detrimen tal to the investment.

Because miners doing business now need to make decisions on projects to meet demand in 2030 and beyond, it is difficult to predict where that political and regulatory perspective might be at that point in time. So, doing an invest ment agreement analysis and seeing what protections are or could be in place can help to protect them in the future.

You can expect all sorts of ways in which governments will seek to take a greater share of that investment. As an investor, you should never wait until something goes wrong to your invest ment to check whether you have treaty protection; you need to make sure you have that at the outset to avoid having to

restructure your investment to take advantage of a treaty, which you gener ally cannot do after a dispute has arisen.

There are plenty of issues that can come up and motivate a government to change its policy. If a mining company is investing in a country that does not pro vide a great deal of protection through treaties, they can at the early stages of the project partner with another com pany, that would be the actual investor, from a country that has a better invest ment treaty with the host state.

ESG has a more advanced regulatory regime in the more developed parts of the world. We are seeing provisions around ESG being introduced in trea ties. It is quite a new thing. ESG in the context of mining has several different strands. One of the obvious things would be the environmental impact of the min ing process itself. Then, the human rights related issues and the impact on local communities.

The G in ESG manifested itself in issues around corruption: we are seeing an increase in integrated companies operat ing projects out of subsidiaries or group companies. The parent company is a listed company in a jurisdiction where it is eas ier to bring claims. Also, when a country offers favourable benefits for investments in the renewable energy sector and then removes those or significantly reduces the benefits, the result can be a whole wave of claims against the state.

A relatively new phenomenon is the possibility that the treaty wording allows the state to bring a counterclaim against the investor in case of environmental issues for example.

So, there may be a situation where an investor has been successful in the pri mary claim against the state, but there is a counter claim that neutralizes the value of that. It is a growing area and will become more prominent as we see new treaties where it is easier to bring counterclaims. CMJ

In October 2022 issue, the title of the article on pages 16-17 should be “Updates on gold producers in the Maritimes and Atlantic Canada.”

Also, “and Atlantic Canada” should be added at the end of the first sentence.

As a leading provider of mining solutions, Hitachi offers high-performing equipment and services that help bolster your operational performance and overall productivity. From fleet management systems that render real-time visibility and establish control over mine operations, to highly engineered excavators and haul trucks, Hitachi is here to protect your operators, your site team and your bottom line.

> By Stephan Theben and Charlie Ursell

> By Stephan Theben and Charlie Ursell

New mining projects can positively transform the social, economic, and technological landscape of a region. But closure of a mining project often unin tentionally creates a stereotypical “boom and bust” cycle, creating economic, envi ronmental, and social challenges for stakeholders. Like many major drivers of economic growth, mining projects have the potential to mold multigenerational social architecture at the same time as modifying the surrounding environment, communities, and region to have a posi tive outcome.

With the increasing demand for criti cal minerals and the advancement of “green” technologies to slow the advance of climate change, mining operations will continue to be more prominent and widespread. Even with increased effort in recycling and reuse of metals, there is simply not enough material in circula tion to avoid a ramp up in the number of mining projects globally. This will chal lenge the industry to find solutions for a greater number of communities and regions. Local communities will face the challenge of departing human capital as mine cycles end, with trained, skilled workers leaving communities as mining operations wind down to find the next opportunity.

The wave of departing workers has real impacts on communities facing shrinking social benefits afforded by the influx creating economic activity and human capital. So, with briefer lifecycles, and more remote host communities, a more drastic effect is likely.

Despite these new or emerging para digms, planned reclamation and closure

is still one of the lowest priorities in min ing decision-making frameworks. Included in the Paris 2050 Agreement and UNDRIP, there is an ever-shifting regulatory landscape and new investor and consumer environmental, social –and governance (ESG) pressures. Yet a recent study from the Arabian Journal of Geoscience surveyed 60 mining experts on ranking what criteria is important to begin underground mining operations. The researchers found reclamation ranked as having the lowest importance in decision-making.

A study in early 2022, involving researchers from several Brazilian uni versities, found that mine closure in their country represented one of the top five greatest operational risks, and recom mended that planning for closure could help improve operational performance while lowering environmental, socioeco nomic, health, and safety impacts.

Likewise, inaccurate approaches to mine closure cost estimating carries sig nificant risk. An Australian study pre sented in the International Conference on Mine Closure found that rigorous clo sure estimates could be as high as double the initial budget in the Australian min ing space. This is further confirmed by a guide from the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development, where “mine closure costs have been underestimated, partly due to a lack of understanding of the complexity of the task.”

Many international, national and com pany standards addressing mine closure and reclamation exist, providing exten sive resources that often exceed regula tory requirements. Best practices for

mine closure include Canada’s own Towards Sustainable Mining (TSM) mine closure framework which is frequently being adopted in other nations.

Resulting closure plans and strategies aim to mitigate socio-economic impacts and return mine sites to viable and diverse ecosystems that will serve the needs of post-mining use of the land. The principal objective has been to bring ‘planning for closure’ into the design phase, with progressive reclamation as the project progresses.

There has been progress to celebrate within the Canadian context. We can com pare the closure plans and approaches of the mines of today with those of the 1940s, the Giant mine in the Northwest Territories, and other “historic sites.”

Modern closure and remediation pro cesses take significant steps to ensure there is long-term chemical and physical stability to a closed mine site.

The Hollinger legacy project in Timmins is one example of community reclamation – a way to use the excava tion from gold mining to create recre ational value for the host community. The agreement between industry and community was signed before opera tions ended; an example of why good stakeholder engagement and putting a plan for closure in place long before it arrives can lead to positive outcomes.

The Hollinger legacy project demon strates both the risk of poor closure plan ning as well as how proper prioritization from industry and community can build a better future for mine sites.

Georgina Pearman’s 101 Things to Do with a Hole in the Ground lists popular examples from around the world where old mines have been converted into opportunities for socioeconomic develop

ment and growth. Examples include cre ating spaces for recreation, science, tech nology, medicine, and energy generation.

Despite having abundant available best practices and resources, why are the notable international examples not yet the new standard?

For all mining projects, exploration leads to evaluation which, in some cases, leads to development, construction, produc tion and then closure.

The trend for greater collaboration and stakeholder engagement when plan ning mine closure is a part of our new paradigm – as a report from CSA Group in 2020 highlights greater expectation around mine closure having social and economic benefit. This will necessitate greater multi-stakeholder engagement, earlier and better-informed consultation, and stronger collaboration between par ties in planning for the future.

One needs to consider the question: Is optimizing the current process alone going to solve the closure challenge for us and our stakeholders?

Some examples of key questions that lead to a different way of thinking about the closure challenge with more sustain able outcomes include:

1 To what extent have we gone past con sultation processes and co-designed a vision for the future that mining can enable with our host communities?

Impact benefit agreements are set up for those whose lives will be affected in all the stages of the mining process. If impacts of mining extend beyond this process, then how can we engage communities early to ensure we understand their visions for a future that a post-extraction use of the land and assets can enable?

2 To what extent are we being good neighbors during the project vs. being good citizens who are designing with the end in mind?

Because human, social, intellectual, and cultural capital extends far beyond the fence line of a site, why does closure focus on the impacts of mining in a region through a site-specific lens? Mining proj ects aren’t confined to development of a mine site, mining operations can impact the development of an entire region. If mine sites can be collaborative with local, regional, or national government agen das, mining can enable more economic and social possibilities. This can even be more effective through the inclusion and prioritization of Indigenous governments and voices of Indigenous leadership.

3 To what extent are we embracing the circular economy that many of our min erals and metals are increasingly becom ing a part of?

Cradle to cradle thinking reprioritizes our design for a circular economy – we should be designing for what the mine sites and assets become after extraction is complete. For example, how can mod ular units on sites be designed to build homes and facilities in local communi ties? How can mine sites be used to sup port new infrastructure projects to deliver lasting benefits for the region even after all the miners have left?

Some say, “the only certainty in min ing is closure.” A closed site is the legacy left behind for future generations. Looking at closure through the life-of-as set lens when designing and planning, as opposed to only the life-of-mine, mining companies have the potential to make good otherwise lost value for not just all their current stakeholders but for future generations.

CMJ Stephan Theben is managing principal and mining sector leader, SLR Consulting, Canada and Charlie Ursell is a consultant and managing partner at Coeuraj Consulting.

US AT

Demolition robots excel at under ground mining due to compact, emission-free power, and remote-op eration. Designed for demanding demoli tion applications, these machines easily stand up to the heat and pressure of ultradeep mining.

Demolition robots are used for a variety of tasks, including scaling, drilling, blasting, bolting, breaking, shaft maintenance, and stope retrievals. After a rock fall, for example, a demolition robot can be used to retrieve equipment like a loader. They tend to travel the uneven ground more quickly than traditional retrieval equip ment, and they can break up oversize and other obstacles to make extraction easier.

There are also models that are set on a pedestal rather than tracks. These sta tionary breaker boom systems are used for primary breaking tasks that feed mobile crushers, jaw crushers, gyratory crushers, and grizzlies. The power source and arm are integrated for a compact

breaking solution that has just a single power cable.

What are the main features of a demolition robot?

Demolition robots offer exceptional pow er-to-weight ratios – often on par with machines three times their size – and sig nificantly outclass even the most advanced jackleg drills. An advanced three-part arm provides unrivaled range of motion for drilling, scaling, breaking, and bolting in any direction. The use of hydraulics also eliminates the need for supplying compressed air, which in turn, minimizes the utility requirement at the face, while electric running guarantees zero-emission operation.

SmartConcept is a set of technological fea tures, developed by Brokk, that offer im provements in power management, reli ability, maintainability, and ergonomics.

The SmartConcept technology is split into three parts: SmartPower, SmartDesign, and SmartRemote.

How do SmartPower and SmartDesign technologies apply in the case of demolition robots?

The revolutionary SmartPower system was designed to withstand extremely tough day-to-day demolition forces. It helps the operator start the robot on a poor power supply while, at the same time, protecting it from harmful faulty power. The system senses when the power supply is poor or faulty and com pensates as much as possible to protect internal components. The technology has unparalleled reliability.

SmartDesign extends machine life and provides unprecedented ease of mainte nance. With 70% fewer cables and the addition of hardened exterior compo nents, Brokk robots are better equipped to withstand the rigors of machine vibra tions and heat generated during opera tion. The line features several elements to ease maintenance, including strategic, easy-to-access grease points and hydrau lic hoses; LED headlights with built-in protections; and steel machine covers. Through the technology, operators not

only get 360° rotation abilities, but they can operate “over the back,” which offers heightened flexibility in confined spaces.

What are the main reasons to choose underground demolition robot technology in the mining industry?

Everyone is aware of the dangers of un derground mining, so safety is a major reason to choose a robot. With remote-op eration, workers can strategically posi tion themselves to avoid the most dan gerous situations. We know that 80% of underground mining accidents and fatal ities occur at the face, so allowing work ers to perform drilling, blasting, bolting, and breaking remotely can make a huge difference.

Versatility and efficiency are other rea sons. With the right attachment, opera tors can move from scaling to drilling for bolting and then drilling for blasting with one tool change – that includes cleaning the lifters with a spade tool in the ham mer. These machines can also handle much larger attachments than similar

Opposite: Demolition robots are used for a variety of tasks, including scaling, drilling, blasting, bolting, breaking, shaft maintenance and stope retrievals

Right: The Brokk Pedestal Boom is a stationary breaker boom system used for primary breaking tasks that feed mobile crushers, jaw crushers, gyratory crushers and grizzlies.

sized equipment, allowing mines to bring powerful tools to new applications with out increasing tunnel size. It even opens the possibility of 100% remote drilling and bolting since there are several com pact demolition robots with ample power to operate carousel attachments. While the operator stands a safe distance away, the robot can drill, load a rock bolt, then torque it without any wasted movement for fast, efficient, safe bolting of the back.

Are the demolition robots batterypowered?

Currently, demolition robots are offered in electric and diesel models. The first re

mote-controlled demolition machine, in troduced in 1976, was electric, and the technology has continued to evolve ever since. The electric models feature zero emissions, which means they are ideal for underground mining. The Smart Power design ensures that faulty electric ity or power surges will not damage the machine while preserving unparalleled power consistency. Brokk (the demoli tion robot manufacturer) continues to monitor the development of battery-pow ered machines as technology continues to advance. It is conceivable that bat tery-powered models will be available in the future.

CMJ

Rajant

Industrial

> By John Moon and Steve Gravel

> By John Moon and Steve Gravel

Wireless communication got off to a slow start after James C. Maxwell, consolidating the work of others, created a theoretical description of electromagnetic waves in 1865. His elegant set of equations languished for over two decades until Heinrich R. Hertz developed hardware in 1887 capable of verifying Maxwell’s predic tions. These electromagnetic waves then remained a lab oratory curiosity for more than another decade until Guglielmo Marconi improved equipment to the point where by 1902 telegraphic messages could be sent over distances of more than 3,000 km.