GOLD IN CANADA

> B2Gold arrives in Nunavut

> Current state of gold mining in Nova Scotia

REBALANCING RESOURCES AND SUPPLY CHAINS

OVERHAULING HAUL ROAD

MAINTENANCE

> B2Gold arrives in Nunavut

> Current state of gold mining in Nova Scotia

REBALANCING RESOURCES AND SUPPLY CHAINS

OVERHAULING HAUL ROAD

MAINTENANCE

Kappes, Cassiday & Associates (KCA) now has four carbon converters successfully operating at mines in Armenia, Argentina, Mexico and Nevada. These units take carbon fines and dirty, wet waste carbon at gold leach plants, thoroughly ash it and remove all mercury. Recovery of gold and silver into bullion is typically 99%. For waste carbon loaded to 200 grams gold per tonne, operating cost is $6.00 per gram, or 11% of the value of the recovered gold. Often waste carbons are loaded much higher - the cost per gram drops accordingly.

Mines with the Carbon Converter can recover their gold quickly without the Chain-of-Custody problems of shipping carbon to outside processors. Shipping mercury-contaminated wastes off-site incurs large risks of environmental contamination, and the Carbon Converter eliminates this risk.

Having the Carbon Converter on site allows the operation to explore various process optimization techniques. For example, carbon fines below 30 mesh are usually lost to tailings in CIL plants, because such fines cannot be recovered cleanly. These losses can account for 1% of the gold fed to the plant. The Carbon Converter can process them. Another opportunity exists where process facilities periodically discard a portion of their coarse carbon in order to maintain optimum carbon activity. With the Carbon Converter, this carbon can be consumed on site and the contained gold recovered economically.

The installed cost of the Carbon Converter is about US$1 million including site services, a building, and infrastructure. For mines which generate at least 50 tonnes/ year of carbon wastes and fines, payback is typically less than one year.

775-972-7575

www.carbonconverter.com

GOLD IN CANADA

12 New technologies are a golden opportunity for Côté Gold.

14 Atlantic Canada: Current state of gold mining in Nova Scotia.

16 Greenstone mine nears finish line.

18 B2Gold arrives in Nunavut: Canada’s newest mining friendly territory.

21 Four new gold pits underway.

TECHNOLOGY

24 Addressing the critical issue of catalytic converter thefts and unrecycled precious metals.

28 Innovating the smelting process: IGBT induction furnaces at the forefront.

SUPPLY CHAIN

26 Rebalancing resources and supply chains for greater resilience.

SCREENS AND HAULING

30 Four time-tested tips to increase screening uptime.

31 Overhauling haul road maintenance.

4 EDITORIAL | He who has the gold makes the rules.

6 FAST NEWS | Updates from across the mining ecosystem.

8 LAW | Protecting innovation and AI in mining.

9 MIN(E)D YOUR BUSINESS | Mining resilience: Leveraging insurance for incident recovery.

10 ESG | Sustainably and fast tracking critical minerals to market.

33 ON THE MOVE | Tracking executive, management, and board changes in Canada’s mining sector.

www.canadianminingjournal.com

Coming in October 2023

Canadian Mining Journal’s October issue will discuss ESG related matters, as we focus on innovations that will lower carbon output and reduce environmental footprint, with a feature report on mining in Quebec.

Please visit www.canadianminingjournal.com for regular updates on what’s happening with Canadian mining companies and their personnel both here and abroad. A digital version of the magazine is also available at https://www.canadianminingjournal.com/digital-edition/

Front cover image: The Back River gold district, which is now part of B2Gold’s portfolio, requires building 160 km of ice roads every year to bring in materials CREDIT: B2GOLDIt is time for us to reflect on gold mining in Canada this year. The latest report by the World Gold Council (WGC) suggests that, if the risk of recession persists, gold could see more positive potential due to increased demand for high-quality assets. However, the strong first half for gold in 2023 is likely to give way to a more neutral second half. The report concluded that “Given the inherent uncertainty in predicting the global macroeconomic outcome, we believe that gold’s positive asymmetrical performance can be a valuable component to investors’ asset allocation toolkit.”

SEPTEMBER 2023 Vol. 144 – No . 07

225 Duncan Mill Rd. Suite 320, Toronto, Ontario M3B 3K9

Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief

Dr. Tamer Elbokl TElbokl@CanadianMiningJournal.com

News Editors

Marilyn Scales mscales@canadianminingjournal.com

Walter Strong wstrong@canadianminingjournal.com

Production Manager

Jessica Jubb jjubb@northernminer.com

Advisory Board

David Brown (Golder Associates)

Michael Fox (Indigenous Community Engagement)

Scott Hayne (Redpath Canada)

Gary Poxleitner (SRK)

Manager of Product Distribution

Allison Mein 416-510-6789 ext 3 amein@glacierrig.com

Publisher & Sales

Robert Seagraves

416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada

George Agelopoulos

416-510-5104 gagelopoulos@northernminer.com

According to our sister site, Mining.com, gold was positive in the first half of 2023, rising 4.93% and outperforming most other major assets, supported by a stable U.S. dollar and continued demand from central banks. The yellow metal was also sought by investors as a portfolio diversifier, particularly during the mini-banking crisis in March. It is worth noting that lithium also increased by 10.81%, making it the best-performing commodity and one of only two that recorded a positive return, but we will discuss lithium in October issue.

On the other hand, most commodities lost ground during the first half of 2023, as global manufacturing activity receded, and China’s economy delivered a disappointing rebound after the Covid-19 pandemic.

In this issue, we feature several articles that provide updates on the current major gold projects in Canada on pages 12 to 23, including a feature on the current state of gold in Nova Scotia on page 14. The issue also includes feature articles on technology, ESG, supply chain, screens, and hauling, in addition to our regular “Law” and “Min(e)d your business” departments.

Canadian Mining Journal’s October issue will discuss ESG related matters, as we focus on innovations that will lower carbon output and reduce environmental footprint. We will also have a feature report on mining in Quebec. Relevant editorial contributions can be sent directly to the Editor in Chief no later than September 7, 2023. CMJ

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group

Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published 10 times a year by Glacier Resource Innovation Group (GRIG). GRIG is located at 225 Duncan Mill Rd., Ste. 320, Toronto, ON, M3B 3K9 Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891. Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods:

Phone: 1-888-502-3456 ext 3; E-mail: amein@glacierrig.com

Mail to: Allison Mein,

225 Duncan Mill Rd., Ste 320, Toronto, ON M3B 3K9

We acknowledge the financial support of the Government of Canada.

“

When paper money systems begin to crack at the seams, the run to gold could be explosive.”

— HARRY BROWNE, AN AMERICAN WRITER, POLITICIAN, AND INVESTMENT ADVISOR.

He who has the gold makes the rulesCanadian Mining Journal’s Editor in Chief, Dr. Tamer Elbokl, happily holding a freshly poured gold bar from the second pour at Séguéla mine during his visit in July 2023.

– Fitted with Liebherr Mining’s most advanced innovations

– Designed to support greenhouse gas emission reduction targets: Liebherr Power Efficiency comes as standard to reduce fuel consumption, diesel engine is Tier 4/Stage V compliant, electric-drive powertrain already in development

– Strong parts commonality with existing excavator portfolio to reduce lifecycle costs and to simplify maintenance

– New attachment design reduces overall machine weight resulting in faster cycle times and increased Approved Rated Suspended Load (ARSL)

Introducing the latest cabin generation: enhanced ergonomics, large touch screens, and a new and improved control panel design

Move more material using less fuel thanks to state-of-the-art Liebherr technologies.

Lucara Diamond pulled a 1,080 carat diamond from its Karowe diamond mine in Botswana. It’s the company’s fourth thousand-plus carat diamond from the mine since 2015.

The diamond, measuring 82.2 x 42.8 x 34.2 mm, is described as a type IIa topwhite gem of high-quality, and was recovered from direct milling of ore sourced from the M/PK(S) unit of the south lobe.

The other three notable recoveries since 2015 include the 1,758 carat Sewelô (2019), a 1,174-carat stone in 2021, and the 1,109 carat Lesedi La Rona (2015).

Lucara CEO Eira Thomas said this fourth large diamond might not be the last. “As we progress mining deeper in the open pit and transition to underground mining, exclusively in the south lobe, the preponderance of large, high-

value stones is increasing,” she said. Thomas added that the discovery “underpins the strong economic rationale for investing in the underground expansion that will extend the mine life out to at least 2040.” CMJ

Snowline Gold (TSXV: SGD; OTCQB: SNWGF) has announced additional analytical results from its ongoing drill program at the Valley target on its Rogue project in the Yukon.

Holes V-23-039 and V-23-037 returned the two strongest gold intersections from the project to date, demonstrating the presence of a high-grade, near-surface core to the gold system at Valley. Hole V-23-039 averaged 2.47 g/t gold over 553.8 metres from bedrock surface, including two distinct zones with multiple-gram-per-tonne gold mineralization.

Analytical results for an additional 19 holes (7,116 metres) at Valley are pending, with drilling at Valley and other Rogue project targets ongoing. Company CEO Scott Berdahl said, “Drill hole V-23-039 is the best drill hole reported at the Rogue project’s Valley target to date and ranks among the best drill holes ever drilled for gold in the Yukon. The grades are exceptional for a reduced intrusion-related gold system, where resource grades for most known deposits are well below 1.0 g/t gold.”

According to the company, high gold recoveries from non-refractory metallurgy and the deposit’s location in a favourable mining jurisdiction, mean the Valley target is emerging as one of the top recent gold discoveries on a global scale. Drilling is ongoing at Valley and on other potentially similar gold targets elsewhere on Snowline’s 100%-owned, 94,000 hectare Rogue project. CMJ

In a move to revamp its mining operations, Torex Gold’s Mexican subsidiary Minera Media Luna has partnered with industry leaders Norcat and AMI Personnel to launch a comprehensive training initiative. The collaboration aims to equip the workforce with the necessary skills and expertise for Torex Gold’s transition from surface mining to underground operations at the Media Luna copper-gold project.

Torex must recruit and train a diverse workforce spanning various essential roles in underground operations. These roles include driller assistants, construction miners, and jumbo operators, among others. Norcat and AMI are collaboratively crafting a robust curriculum that outlines the training prerequisites, objectives, timelines, and resources required to ensure that incoming workers acquire the indispensable skills and knowledge vital for their respective roles.

Trina Hayden, Norcat’s chief advisory officer, said that “The partnership between Norcat and AMI exemplifies the importance of working together across borders to drive meaningful and sustainable impact within the mining industry.”

AMI and Norcat will collaborate on the design, development, and delivery of 16 specialized courses. These courses comprise two introductory programs laying a strong foundation of knowledge, followed by 14 role-specific courses catering to diverse organizational positions.

The training program is set to begin in August. AMI and Norcat aim to have approximately 231 workers successfully complete their training by December 2025. CMJ

Equinox Gold (TSX: EQX; NYSE: EQX) says the construction at the Greenstone gold project near Geraldton, Ont., is on time and on budget. The project, 60% owned by Equinox and 40% by Orion Mine Finance, will be one of Canada’s largest gold projects, producing more than 5.0 million oz. of gold over its initial 14-year mine life.

The first gold will be poured in the first half of next year.

The total pre-production capex is $1.23 billion. At the half-way point of 2023, $937 million of the budget (on a 100% basis) had been spent. Equinox expects to contribute about $170 million more as its share to fund the project to completion.

Many of the facilities have been completed and the operating team has assumed responsibility for the water treatment plant, truck shop, warehouse, sewage treatment plant, potable water plant, pit and plant site fuel station, reagent storage, and onsite explosives plant. The new provincial Ministry of Transportation patrol yard is complete and the old one has been dismantled. Finally, the natural gas pipeline to the site is operational.

Mechanical installations are 75% complete, and the electrical and piping work are both 67% complete. The power plant is being commissioned. Relocation of Hwy 11 is substantially complete and ahead of schedule with handover planned for the third quarter this year. Yet to be completed are the mill and tailings management facility.

Equinox president and CEO Greg Smith

Grounded Lithium reports its preliminary economic assessment (PEA) for the Kindersley lithium project demonstrates a strong economic case for producing battery-grade lithium hydroxide monohydrate (LHM), with potential for future phases.

Phase one of the project in Saskatchewan includes an after-tax internal rate of return of 48.5% and an after-tax net present value of US$1.0 billion at an 8% discount rate. The initial capital investment for the project is estimated at US$335 million, with a payback period of 3.7 years.

The company says Kindersley stands out with a lower capital intensity compared to other North American brinebased lithium projects, with an initial capital intensity of US$30,500 per tonne of LHM. The projected all-in operating costs are US$3,899 per tonne of LHM, amounting to an annual expenditure of US$42.9 million.

said in a recent press release, “The Greenstone project continues to advance on budget and on schedule. With most ancillary facilities complete and transferred to the operations team and construction activities 83% complete, our focus is shifting toward commissioning and operational readiness as we advance to construction completion and first gold pour in the first half of 2024, and then achiev

ing commercial production.” CMJ

The PEA is based on an annual production of 11,000 tonnes of LHM and assumes a sales price of US$25,000 per tonne.

Grounded Lithium president and CEO Gregg Smith said, “The independent economic results of phase one of the KLP compare favourably within the lithium mining industry from a capex and opex perspective and we believe the results of the PEA bode well for critical future steps.” CMJ

• GOLD | Equinox calls Greenstone gold 85% complete, first pour in

The mining world is embracing innovation like never before to keep pace with the demand for minerals from the automobile sector, telecommunications and electronics manufacturers, and many modern industries.

Innovation is rapidly being adopted in a variety of forms across the mining supply chain from digitization of key data, resource extraction, and generative artificial intelligence (AI) to innovation that promotes sustainable practices. So far, the year 2023 has seen a flurry of announcements from global investors and companies in generative AI and machine learning in mining. AI exploration projects are currently underway in Quebec and Ontario, and Canadian technology startups are attracting new international funding.

New innovations and AI in the mining sector

AI-enabled innovation around data analysis is one option for identifying and assisting in more efficient extraction of mineral deposits while minimizing environmental damage. Successful efforts to utilize artificial intelligence for discovering and rediscovering mineral deposits appear only to be limited by available data and the need to digitize historical information. AI is increasingly being used to map more exploration data and streamline the process of discovery.

Additionally, AI-enabled mining innovation for other aspects of the mining supply chain continues to move forward.

Extraction innovation is focusing on remote tunnel monitoring systems which allow monitoring of mining tunnel integrity. This typically relies on the use of sensors to assess the soundness of tunnels, which reduces the risk to human life. Remote monitoring system technology uses AI to determine the viability of digging the tunnels deeper to access additional mineral deposits. These technologies can help propel mining into the future by maximizing the extraction of resources and safety in old and new mines.

Mining innovation is also being fueled by the quest for the zero-carbon mine. This goal can be achieved with the adoption of sustainable innovation that includes improved operational efficiencies, use of sustainable fuels and drivetrains, utilization of green electricity, and the engagement and use sustainable sourcing along the mining supply chain.

The global mining industry is embracing the need to protect these proprietary innovative technological tools and successes, such as AI-enabled extraction detection for locating vital resources. Depending on the innovation, there are a number of ways to protect these relevant core business assets through

identifying and protecting them as intellectual property. Intellectual properties, such as patents, trade secrets, trademarks, industrial designs, and copyright protection can all be used to develop and enrich a mining company’s asset pool.

Patenting has been embraced by the mining industry, as it can provide robust protection and the basis for revenue streams through commercialization. Global mining giants have robust global patent portfolios, which has been reflected in the steady increase of patent filings globally since 2005. While global economic uncertainty has slowed the number of patent filings in 2023 to date, AI-enabled mining technologies like remote tunnel monitoring systems, which can significantly improve the global mining industry, are still a focus for the industry.

Trade secrets protection is another option that can provide an economical and viable way to protect AI modeling and systems and processing methodologies. Like other forms of intellectual property, trade secrets can be monetized by licensing or being bought and sold. While a successful trade secret strategy can keep the innovation proprietary indefinitely, it requires robust agreement terms and meticulous security protocols to ensure the trade secret remains secret. Once the trade secret is disclosed to the public, it becomes part of the public domain and is no longer proprietary.

Both industrial design and copyright protection can be used to ensure that software enabled inventions are monetized in a relevant manner, and trademark protection can ensure that a company’s goodwill is not diluted.

All companies need to keep in mind that AI’s regulatory landscape in Canada and around the world is still in its infancy and will continue to change as AI technology and public perception develops.

A curated intellectual property strategy can provide a mining company with a wide variety of assets that can be the foundation for increased revenue, financing, and success. The accelerated adoption of innovation in and by the mining industry will encourage greater investment to maintain the supply for the surging demand for metals and minerals. CMJ

Cyberattacks, fires, floods, earthquakes, and thefts. Operating a business entails certain unpredictable risks. A single event can wreak havoc. Though mining organizations may appear unlikely targets for cyberattacks due to their physical nature, this assumption is far from accurate. As their use of, and dependence on, technology expands, so does the vulnerability of their operations, widening the potential opportunities for attack.

For example, an attacker may target the automated machinery control system within a mine, causing it to malfunction or shut down entirely. Without the machinery’s functionality, the mine’s productivity could drastically decline. This business interruption, in combination with the costs to restore technology and networks, could result in significant financial losses and/or extra expense loss.

Understanding how cyber insurance can respond to the impact of these attacks is becoming increasingly important. The complexities of the insurance programs regarding instances of ransomware and cyberattacks are unique and challenging. These insurance contracts often include several policies that address business interruption, property damage, kidnap and ransom, and crime and fidelity. In addition, in the event of a claim, there could be numerous insurers and several insurance adjusters working on one related incident.

What can cause a cyber or network security insurance

While the answer is continuing to evolve, it is not yet universal. Most cyber insurance claims are the result of employee mistakes and human error. Equally, most external cyberattacks, such as distributed denial of service attacks, phishing, and ransomware/malware campaigns, are more costly to those affected. Some scenarios that include cyber crime and/or triggers for a cyber insurance claim may include the following:

> Extortion payments made by the company in the event of a ransomware attack.

> Funds transfer fraud attacks and business email compromises (BEC); a company is tricked into making a payment into an attacker-controlled account.

> Distributed denial of service attacks where a company’s servers crash due to the high volume of traffic directed to it by cyber criminals.

> Email hacks or other unauthorized actions (phishing, shoulder surfing, etc.).

> Juice jacking: compromise of devices like phones and computers that use similar data cables (charging/data transfer/USB) to install malware on the device.

> Document manipulation or destruction.

> Access to sensitive business data being shared unlawfully by a company employee.

> Sophisticated equipment breached, impacting efficiency and resulting in decreased or lost production.

> The high cost (financial and reputational) of communicating to customers that their sensitive information has been exposed.

Most insurance policies mandate adequate security standards to help prevent and even mitigate any potential damages caused by ransomware and cyberattacks. Some policies may exclude certain incurred costs depending on the insured’s business practices, the occurrence of the cyberattack, and the policy overall. Although cyber insurance policies vary, some may provide coverage for the following:

> Lost profits from a cyber attack that interrupts day-to-day operations and services.

> Regulatory fines for data breaches.

> Legal defense fees resulting from data breaches.

> Costs to hire cybersecurity professionals to determine and repair any impacts of cyber breach found in current systems.

> Credit monitoring service costs for parties impacted by a data breach or cyber attack.

> Ransoms paid to recover systems.

> Professional fees incurred to measure, document, and prepare the insurance claim.

Cyber threats are growing at an exponential rate globally, with 71% of mining participants in EY’s most recent global information security survey having seen an increase in the number of disruptive attacks over the past 12 months, and 55% are worried about their ability to manage a cyber threat. Understanding how your insurance interacts with your operations is critical to allow you to restore your business and recover what was lost. CMJ

Building the infrastructure to meet the world’s energy transition goals will require more minerals than we have right now. We need minerals and metals for every component of our modern world, as well as the world we are building. Mined materials are used to create batteries, solar panels, wind turbines, and the associated infrastructure for clean energy projects. The demand is here – and it is growing along with these technologies.

So, we – the world – are facing an incredible challenge. Not only do we need to meet the demand for minerals and metals, but we must also mine in a responsible and sustainable way. Now, in addition to prioritizing safety and maximum throughput, miners must consider their environmental footprint, community

acceptance, and workforce inclusion. It is clear the world needs minerals and metals to enable modern life. But with long permitting timelines for new mines, how can we get the minerals we need? For new mines, it can take 10 years or more to get from initial exploration to operation. For existing operations, we are faced with targeting deeper mineral deposits with higher rock stress zones and hot temperatures – all these challenges can lead to reduced productivity and depleted returns. So, we are looking for other solutions that take less time and can supplement the mineral supply chain.

Mine and then re-mine Residual minerals are often present in waste piles and tailings. Reprocessing tailings is a viable option to access critical

minerals more quickly. It is attractive because mining companies can forgo the full permitting process required for new mines. Reprocessing tailings is also a form of asset transformation, taking a liability (tailings impoundment) and repurposing it as an asset (ore).

For example, we recently developed a client’s initial design brief into a commissioned pilot plant that could improve gold recovery from tailings waste. The plant tested back-end recovery of a new flotation tailings stream through the existing gold plant. The client wanted to understand whether the existing carbon-in-leach circuit had the additional capacity to accept flotation material and recover sufficient gold. The pilot plant was successful, and now our client can replicate this tailings waste recov-

ery solution – improving gold collection efficiency.

Improve productivity in existing operations

It sounds like the obvious answer: We will get more critical minerals to market faster if we increase recovery rates and reduce waste. What kind of processes can we automate to reduce downtime? Where can we reduce bottlenecks in the workflow?

Although iron is not typically deemed “critical,” in this debottlenecking example, BHP was able to process an additional 2 million tonnes per year through their plant in Pilbara, Western Australia. The total capital was A$3 million to adjust chutes, add screens, replace motors, and replace other minor equipment within the plant.

Again, one of the bigger challenges with this solution is potential changes to production schedule. Mine operators must do their due diligence and conduct thorough analysis when choosing to implement a modern technology or change current workflow.

With so many technology providers and innovative start-ups, it can be overwhelming for a mining company to take on vetting providers, selecting the best option, and creating a collaboration agreement. Consultants can bridge that gap and bring an intimate understanding of emerging and best available technologies. This is key for meeting increasingly challenging social and environmental obligations.

For example, our mining, minerals, and metals group leverages many non-agnostic original equipment manufacturer and technology provider collaborations, and this service can be offered to clients. Because of the huge value this offers, I expect the technology partnership/collaboration business model will grow in popularity and be more of the “norm” for many consulting companies moving forward.

The world needs minerals and metals to enable modern life. And we need mines that produce those resources responsibly. No matter how much we reprocess tailings and improve recovery, we will also still need new mines to keep up with the demands of the energy transition. This is

Trusted. Independent. Committed.

where we need strong collaboration between mining companies, Indigenous and non-Indigenous communities, government agencies, and investment communities to produce positive outcomes. The ideal situation is to decrease the permitting time while still taking great care to operate sustainably and in a way that benefits people.

There are great plans in place that show state and federal governments realize the importance of mining. For example, the Canadian Critical Minerals Strategy of 2023 is a great starting point, identifying 31 minerals deemed necessary for Canada’s economy and security. The United States Critical Minerals Strategy was created in 2022 and identifies 50 mineral commodities that are also deemed integral to the prosperity and growth of the U.S. economy. In June 2023, Australia released theirs, outlining six focus areas for growth in the Critical Minerals Market.

We, as the mining industry, need to work more closely with state and federal governments to act on these plans and support critical minerals strategies. We must be more sustainable, and that includes re-mining materials. We must be efficient and examine our production, and partner with technology providers. This will help us to meet the critical mineral needs of today and for future generations. CMJ

Brian Mashford is senior vice-president, mining, minerals, and metals at Stantec

Our fit-for-purpose solutions encompass the skills of qualified geologists, geostaticians, analytical chemists, mineralogists, metallurgists, process engineers and mining engineers brought together to provide accurate and timely mineral and process evaluation services across the mining life cycle.

Ihave been writing monthly about technology development and adoption in the mining sector for the better part of a year. Often, I like to highlight interesting examples of technologies that have been adopted to solve specific business challenges at mining operations. Very seldom have I had the chance to cover widescale adoption of transformative solutions and that is why I am excited to be talking about the technologies that are being deployed at a mining project just north of Sudbury, Ont., at Côté Gold.

Recently, I had a chance to speak to the Côté Gold operations department to ask them about the technologies they have planned for the site, the drivers behind the adoption, and some of the knock-on effects of deploying new systems.

It is widely known that the Côté Gold operation is going to be using autonomous equipment. Mining companies are not traditionally known as risk takers when it comes to technology adoption. So,

while understanding the factors that went into making the decision to go autonomous is interesting, it is also important to highlight which factors were the real tipping point on making the decision viable.

Other industries understand well that the world is changing and that they need to adopt new technologies. For Côté Gold operations, it was decided early on to use certain new technologies. There were trends in the labour market and other downstream benefits that made the decision to implement autonomous equipment into the operational plan worthwhile. The group assessed a solution offered by Caterpillar that made sense and fit their needs. The consensus was that CAT auatonomous haulage system (AHS) haul truck is a dependable and secure choice for the mining sector. In 2018, Caterpillar mining trucks, operating under MineStar Command for hauling, achieved a significant milestone of transporting one billion tonnes. During

this period, the autonomous trucks traveled nearly 35 million kilometers without any lost time injuries, which is paramount for Côté Gold. The team also selected autonomous drills from Epiroc to automate the drilling cycle as well.

Some very tangible factors went into weighing the decision to execute on the autonomous plan. Primarily, the technology makes their site safer, more reliable, and predictable and is also beneficial for talent attraction. In Côté’s specific context, the AHS is safer than human-conducted operations. This is a bold statement, but the system, with all the protection layers, is incredibly safe. Large mobile equipment incidents are still very prevalent in today’s industry, but autonomy allows the mines to remove workers from a lot of interactions and potential incidents involving large mobile equipment.

In addition, the AHS is also an extremely reliable and predictable system. By removing the human error, engineers can

precisely predict production and productivity factors. Everything can then be calculated from “first principles.” From the operations management perspective and for mine planning and predictability purposes, Côté Gold sees this as the “Holy Grail.” Autonomy does not allow a truck to necessarily operate faster or harder, but it does allow the ability to run in hours when a staffed operation cannot run (during shift change, during some weather conditions, etc.). Additionally, the team expects better reliability from the trucks as they are equipped with data capture capabilities. The machines can diagnose small issues before they become large breakdowns.

Finally, in an industry that sometimes struggles to advertise its high-tech nature, the AHS waves a clear flag to prospective employees that Côté Gold is a leader in advanced technology and, therefore, an attractive place to work. AHS offers something exciting for the new workforce. The company knew they could use AHS as a talent attraction tool and recognized that they want employees with an open mind, eager to learn, and willing to do things differently, and these technology-forward approaches ensure they attract candidates with this mindset.

One of the key considerations for mining companies when it comes to large-scale changes in approaches is the knock-on impact on processes. While the Côté Gold team understands they have an advantage in this, as they are working with a new mining project, some changes to mine design and mine planning had to be considered at the outset of this journey.

Engineers, for example, had to design the mine to separate the autonomous and non-autonomous operating zones. The site has the mine haul roads, the pit itself and any areas that run the autonomous equipment is part of the autonomous operations zone (AOZ). All other equipment, deliveries, personnel, and others are operating on their own roads and areas outside and physically separated from the AOZ. From a planning perspective, the equipment need space particularly in dump and load areas. This needed to be planned before operations to have all workspaces prepared for the machines prior to being deployed.

Additionally, the team spent significant effort in designing the communications infrastructure to support the auton-

omous operations. The site required full coverage of the operating areas, full redundancy, and significant flexibility with permanent, semi-permanent, and mobile communications hardware to enable the equipment to run on a network separated from the administrative network. These types of comms networks are innovative as high-speed private LTE and 5G are still nascent technologies in open-pit mining.

In the end, adopting this technology requires well-conceived integration. The operations team designed a specific control room to accommodate mine haulage, drilling, and eventually an integrated production control room with space for both mine and process plant control. The

well. These opportunities really show how the decision to go with autonomous systems opens doors for even more technology downstream.

AHS enables a much more integrated, data-rich approach to operations that will lead to better situational awareness and critical controls.

As a mining technology junkie, my thoughts jumped to what other technology adoption might the AHS lead to. Since the AOS is so restricted, several other technologies come into play to support autonomous operations. The private LTE backbone the system runs on is a powerful new technology and it allows for a host of new technologies due to its reliability and low latency. Additionally, since crews cannot access the areas as readily as in other mines, remote-operated technologies are used as much as possible. For example, the site will employ a fleet of fixed wing and quadcopter drones, remote sensors, and loggers, and they will be incorporating survey capabilities on most of the light vehicles on site. For future consideration, the team is also looking at advanced dig face scanning and fragmentation solutions as

If you adopt advanced technology, how does this impact the profile of the talent you need to operate and maintain the systems? For the team at Côté Gold, finding key talent is a top priority, not only in traditional roles but also in roles they did not know existed. Autonomous has challenged their HR teams to be more adaptive and creative when it comes to filling these roles as opposed to traditional mining roles. Pit technicians, for example, need to understand mining equipment, survey systems, telemetry, hardware as well as traditional mining processes. Mine engineers need to understand reporting workflows, dashboards, programming, data analytics, and so on. As such, being open to potential employees with diverse backgrounds and experiences that have worked in dynamic team settings is critical. From a technical training perspective, the Côté Gold team stressed that they are well-supported by their partners in autonomous technologies (CAT and Epiroc) to provide the right training for their haulage control team and autonomous drilling team. They admitted that while this may take time upfront, it also provides the team with new challenges and new experiences that they can use either at Côté Gold or when they move on to future roles.

A unifying theme in speaking with the Côté Gold team was a refreshing sense of comfort and excitement about new technologies. The team believes that these autonomous technologies are more technologies of today and not of the future. In their view, it would have been a disservice to a major new development such as Côté Gold to not deploy the technologies they have at their disposal. In all, the Côté Gold operations department conveyed to me that they are “very proud to implement these solutions successfully to date at Côté Gold mine and to show others that this is not just an aspiration but a reality that can be implemented at other mines and in this part of the world.” If we can take anything away from the Côté Gold experience, it is that mining innovation is moving in the right direction.

CMJNova Scotia has a rich history of gold mining dating back to the mid-1800s. Long before the Klondike gold rush of 1897, Nova Scotia experienced its first gold rush in the Mooseland area in 1860. In the following few years, a large area, now called the gold district of Nova Scotia, witnessed many gold discoveries. The area covers most of the shoreline of the province along the Atlantic Ocean including the counties of Guysborough, Halifax, Lunenburg, and Queens.

Nova Scotia’s natural formations of gold are the result of millions of years of geological processes, including metamorphism, erosion, and chemical reactions. These formations include quartz veins, placer deposits, and sulphide-associated gold deposits. New exploration techniques, such as geochemical and geophysical surveys, are helping to identify new gold deposits

in the province. As these techniques evolve, more natural formations of gold will be discovered in Nova Scotia, providing new opportunities for the province’s mining industry.

Currently, Northern Shield Resources is exploring between New Glasgow and Antigonish, Transition Metals is targeting areas in the Cape Breton Highlands, Osprey Gold is exploring in several areas including the historic Goldenville site, MegumaGold is hoping to find gold in various areas surrounding other companies’ claims, and SLAM Exploration is planning to drill in Mount Uniacke.

The mining and quarrying industries employ more than 5,000 Nova Scotians, with average annual wages of $55,000, according to the Mining Association of Nova Scotia.

So, what is the current state of gold mining in Nova Scotia?

Currently, the province has one operating gold mine: The Touquoy mine in Moose River, near Middle Musquodoboit, which opened in 2017. According to the company, the mine produced 50,567 oz. of gold in 2022, Table 2 lists the Atlantic opera-

The Touquoy mine is located about 80 km northeast of Halifax, N.S. When it is mined out, three additional deposits: Beaver Dam, Fifteen Mile Stream, and Cochrane Hill could have a combined mine life to 2030. For those projects be developed, the logical place to create a new tailings management area is within the mined-out pit. The company is also exploring in the Moose River corridor and elsewhere in the province.

tion annual production since 2017. Australian miner St Barbara acquired the mine in 2019 for $722 million.

Four other gold mines are in the environmental assessment stage, including three proposed by St Barbara subsidiary, Atlantic Mining Nova Scotia: Beaver Dam, Cochrane Hill, and Fifteen Mile Stream, and the fourth is Anaconda Mining’s proposed Goldboro mine.

St Barbara is currently exploring prospects along the Moose River Corridor and the south-west region of Nova Scotia, with the aim of extending existing planned pits and potential satellite pits. St Barbara has 21 exploration projects in Nova Scotia and more than 1,900 km2 of exploration. Key exploration targets are near existing deposits, with a focus on targets along strike between Touquoy and Fifteen Mile Stream.

The Fifteen Mile Stream project is located approximately 40 km east-northeast of the Touquoy mine, while the company’s Beaver Dam project is mid-way between the Fifteen Mile Stream project and the Touquoy mine. St Barbara recently updated it Fifteen Mile Stream project. The project redesign now includes a standalone 1.7 million to 1.8 million t/y processing facility, with the Touquoy processing plant being relocated to Fifteen Mile Stream. An update of the project to prefeasibility study level is due in November 2023.

The project targets a 10-year mine life and an average gold production of 60,000 oz. per year. The company now says the relocation of the bulk of the Touquoy processing plant to Fifteen

Mile Stream is the preferred development pathway for the next phase of its Atlantic operations.

St Barbara managing director and CEO, Andrew Strelein, said, “This new design for Fifteen Mile Stream is an excellent alternative pathway to development with improved recoveries and with lower overall capital cost and execution risk. It is time to move on from the earlier design with integration with Touquoy given the delays in approvals to our in-pit tailings proposal.” Strelein added that the project redesign represents a simple solution for bringing Fifteen Mile Stream into production.

The Touquoy processing plant, finished in 2017, has a throughput rate of 2.0 million tonnes per year. Although Fifteen Mile Stream ores are expected to be harder and require finer product size compared to the ore from Touquoy mine, the company says the processing plant can handle it. Consequently, reusing Touquoy plant equipment will make the project less expensive.

In December 2021, St Barbara and the Mooseland and Area Community Association (MACA) signed a community partnership agreement (CPA) that formalizes the company’s commitment to the local community near its Touquoy gold mine.

The agreement aims to help Mooseland members thrive and achieve sustainable benefits and outcomes. It pledged an initial financial contribution of $75,000 plus an annual contribution of $25,000 to the MACA. The agreement runs for three years and any additional years that St Barbara uses Mooseland road for mining operations. The funding was to be used by MACA for community health, environmental management, economic development, and youth education. Subsequently, St Barbara has also signed CPAs with the food bank and family resource centre closest to the Touquoy Mine.

In 2020, more than 300 people were employed full-time at the Touquoy gold mine in addition to the full-time contractors.

As of 31 December 2022, total ore reserves at St Barbara’s Atlantic operations were estimated at 46.0 million tonnes at 1.0 g/t Au for 1.5 million oz. of contained

resources were estimated at 57.0 million tonnes at 1.1 g/t Au for 1.9

The company said its operation at Touquoy and exploration work at other sites in the province have generated a total of about 350 jobs. According to the province, the company has also spent $25.5 million on local supplies and $10 million on local contractors.

The Touquoy operations have been processing solely from stockpiles since early February; however, the inability to obtain permits for in-pit tailings deposition within a reasonable time will result in the operations moving to care and maintenance by the end of September 2023. Approximately 150 employees who are in roles that will not be required in care and maintenance have been notified and will be provided with appropriate assistance with this transition. CMJ

majorcanada@majordriling.com

There is a new gold mine coming to Ontario. The Greenstone mine, located 275 km northeast of Thunder Bay near Geraldton, is being developed in partnership by Equinox Gold Corp. (60%) and Orion Mine Finance Group (40%). Construction is on track to pour gold in the first half of 2024.

Greenstone is going to be among the largest open pit gold mines in Canada, with production averaging 400,000 oz. of gold per year for the first five years and more than 360,000 oz. per year over the initial 14-year mine life.

First a short history: Gold was discovered on the property about 1916-18. Between 1938 and 1970, the Hardrock mine produced more than 2.0 million oz. as an underground mine. Premier Gold Mines acquired the project in 2008 and two years later, after completing additional exploration drilling, produced a resource estimate. Premier Gold continued to advance the project, completing a preliminary economic assess-

ment in 2014, a 50:50 joint venture with Centerra Gold in 2015 and a feasibility study in 2016. Premier Gold also advanced permitting and engineering, and by 2019 the project was fully permitted and shovel ready.

In December 2020, Orion bought

By Marilyn ScalesCenterra’s 50% interest and Equinox Gold announced plans to acquire Premier Gold. The acquisition was finalized in April 2021, Equinox Gold bought an additional 10% from Orion to hold a 60% controlling interest, and the new partners kicked the newly named Greenstone project into high gear.

The construction groundbreaking ceremony in October 2021 was commemorated with speeches by the local mayor, the Ontario Minister of Mines and the project’s Indigenous partners. Long-term benefit agreements are in place with five local Indigenous communities. The project is located on the traditional territories of four First Nations – Animbiigoo Zaagi’igan Anishinaabek, Aroland First Nation, Ginoogaming First Nation, and Long Lake #58 First Nation. It is also home to the citizens of the Métis Nation of Ontario.

With 5.5 million oz. of gold reserves at

the project, anyone would be encouraged to develop a new gold mine. This time around, the Greenstone mine is to be a conventional truck and hydraulic shovel open pit operation.

At the end of July, construction at Greenstone was about 85% complete and the project remains on budget, with US$937 million of the US$1.23 billion construction budget spent at June 30. The build has been accomplished with an integrated team of both owner’s personnel and contractors seconded from G Mining Services.

At the helm is general manager Eric Lamontagne with 25 years of experience. He was manager of project development for Premier Gold, and before that worked for Agnico Eagle Mines at the Meadowbank mine and as project manager for the Meliadine gold mine.

“The majority of the Greenstone team have been working on the project since the beginning, which I think has been integral to the success of this build,” said

Lamontagne. “We have strong relationships within the team, within the community and with the project’s Indigenous partners, and we are all committed to the success of this project. We have also had very strong support from Equinox Gold and Orion. This mine is going to transform the region, bringing meaningful employment, new business opportunities and benefits to all stakeholders, and we’re all looking forward to pouring first gold next year.”

Mining will begin in a starter pit and proceed in five main phases. The final dimensions of the open pit will be 1.8 km long, 1.0 km wide, and 600 metres deep. Blasthole drilling will proceed in 10-metre benches, and the holes loaded with bulk emulsion. The average life of mine strip ratio will be 5.1:1, and five waste dumps will be established.

The deposit will be mined for 13 years, following pre-production. When the ore is depleted, the mill will process lowgrade stockpiled material for nine

months. In addition, an underground extension and the near-mine Brookbank, Kailey, and Key Lake open pit deposits host nearly 5.0 million oz. of gold resources and could provide ore to extend the mine life beyond the initial 14 years contemplated today.

The processing plant has the capacity for daily throughput of 27,000 tonnes. It will include a crushing circuit (gyratory and cone), a grinding circuit (high-pressure grinding rolls and ball mills), preleach thickening and cyanide leaching, a carbon-in-pulp (CIP) circuit, carbon elution and regeneration, electrowinning and gold refining, cyanide destruction and a tailings management facility.

Other infrastructure includes water management facilities, a power plant powered by natural gas, site access and haul roads, explosives and reagent storage facilities, fuel storage and distribution, a recycling facility, and site security.

When in production, Greenstone will be Equinox Gold’s largest mine, and its only mine in Canada. Equinox Gold expects to produce around 590,000 oz. in 2023 from seven other mines in the U.S., Mexico and Brazil. With another approximately 240,000 oz. per year from Greenstone (Equinox Gold’s 60% share), plus production growth from expansion plans at three other mines, it’s easy to see a company with huge growth potential. CMJ

Mineral resource development is an important economic driver in Nunavut. The development of mining projects in the West Kitikmeot region impacts the government and residents of the territory. Nunavut has a well-established and sophisticated environmental review process, allowing all parties to participate in open and transparent review processes.

Recently, I discussed B2Gold’s recent move to buy Sabina Gold & Silver Corp. in an all-stock deal worth $1.1 billion (US$824 million) with B2Gold’s president and CEO, Clive Johnson. In this article, Johnson answers questions from the Canadian Mining Journal to give an update on the transaction that resulted in B2Gold owning the Back River gold district in Nunavut, which holds multiple high-potential mineralized zones poised to boost the Vancouver-based gold giant’s reserves and production. The Back River gold district consists of five mineral claims blocks along an 80-km belt. The most advanced project in the district, Goose, is fully permitted, construction stage, and has been de-risked with significant infrastructure currently in place. The Goose project has an estimated two-year con-

struction period, which is expected to be completed and first gold poured in the first quarter of 2025.

B2Gold’s management team has strong northern construction expertise and experience to deliver the fully permitted Goose

project and the financial resources to develop the significant gold resource endowment at the Back River gold district into a large, long life mining complex.

“The closing of the acquisition of Sabina and the Back River gold district represents

“As we continue with the construction of the Goose project and move toward commencement of production in 2025, our exploration program will also start immediately. We aim to further define the Back River gold district’s untapped potential and unlock the significant value we see and opportunities for growth.”

— CLIVE JOHNSON, PRESIDENT AND CEO OF B2GOLD.

B2Gold is a low-cost international senior gold producer headquartered in Vancouver, B.C. Founded in 2007, today, B2Gold has operating gold mines in Mali, Namibia, and the Philippines. Additionally, the company has numerous exploration and development projects in various countries including Canada, Mali, Finland, and Uzbekistan. B2Gold forecasts total consolidated gold production of between 1,000,000 and 1,080,000 oz. in 2023.

Following the acquisition of Sabina Gold & Silver Corp. in April 2023, B2Gold acquired Sabina’s 100% owned Back River gold district located in Nunavut, Canada.

a milestone for B2Gold, as we continue to build a low-cost responsible senior gold mining company. We are excited to add such a high-quality, high-grade gold project in a top mining jurisdiction to our global portfolio, and we are thrilled to

welcome the exceptional Sabina team into B2Gold. We also look forward to working with the Kitikmeot Inuit Association and local communities as we advance the construction of the Goose project and our development strategy,” said Mr. Johnson.

Under the terms of the transaction, Sabina shareholders received 0.3867 B2Gold common shares per Sabina common share. In aggregate, B2Gold issued approximately 216 million B2Gold shares as consideration under the transaction.

QB2Gold acquired fellow precious metals miner Sabina Gold & Silver in an all-stock deal worth $1.1 billion (US$824 million). Can you please talk to us about this acquisition and how important it is for B2Gold and the Canadian mining sector?

AWe are very excited to be coming home to Canada, building B2Gold’s first mine in Canada after decades of successful mine construction and operation around the world, including in Africa, Asia, Russia, and South America. The Goose project, which is part of the Back River gold district, adds a high-quality, construction stage, high-grade gold project in a top mining jurisdiction to our global portfolio.

Once the Goose project construction is complete, we expect it will produce over 300,000 oz. of gold per year with an attractive cost profile. The Goose project remains on schedule for mill completion and first gold pour in the first quarter of 2025.

The Back River gold district is a multi-generational district with five claim blocks (including Goose) along an 80-km belt, all with significant exploration potential. B2Gold has several organic growth opportunities with the ongoing construction of the Goose project, and a potential expansion of our operation in Mali.

QB2Gold is known as a low-cost international senior gold producer. Is this acquisition going to affect this reputation?

ANo, it is not. We are a million oz. gold producer and have seen continued annual growth in gold production for more than a decade. The Goose project will support the continued growth with a very attractive cost profile.

QB2Gold has projects and explorations internationally, with only the head office located in Vancouver, Canada. The acquisition of Sabina hands B2Gold the Back River gold district property in Nunavut, which holds multiple high-

potential mineralized zones poised to boost B2Gold’s gold reserves. This would be your first property in Canada. Does this mean a change in the strategy of B2Gold?

AThe Back River gold district is B2Gold’s first Canadian operation. The acquisition is a great fit for B2Gold as we can leverage our construction expertise and cold-weather operating experience (from Kupol in Russia with Bema Gold, B2Gold’s predecessor company) to create value for B2Gold shareholders.

B2Gold’s management team has strong northern construction expertise and experience to deliver the fully permitted Goose project, the most advanced project in the district. We also have the financial resources to develop the significant gold resource endowment at the Back River gold district into a large, long-life mining complex that will benefit the Inuit people of Nunavut and their government. B2Gold recognizes that respect and collaboration with the Kitikmeot Inuit Association is central to the license to operate in the Back River gold district and will continue to prioritize developing the project in a manner that recognizes Indigenous input and concerns and brings longterm socio-economic benefits to the area.

The acquisition does not signal a change in strategy. B2Gold has always been a geologically focused, not geographically focused, international gold producer. Elsewhere in Canada, we are moving forward with a strategy to make strategic investments in Canadian junior mining companies where qualified management teams are conducting exploration that demonstrates good mineral potential. This includes providing financial backing and technical expertise, and gives us access to some potentially large discoveries, such as Snowline’s exploration project in Yukon, and Matador’s exploration project in Newfoundland and Labrador.

B2Gold is also a company built on and committed to exploration. Currently, with an annual exploration budget of $88 million, we have major exploration projects underway around our existing mines and development projects, as well as in Finland, Cote d’Ivoire, and Uzbekistan. CMJ

It has been decades since the Canadian mining sector has seen multiple open pits under construction. Four new gold open pits are coming onstream in the next six months, setting the stage for heightened commissioning activity. The new operations will contribute over 1.3 million oz. of annualized gold production when fully commissioned. If all goes as planned, in 2024, Canadian gold production should exceed 8 million oz. of gold and set the stage to surpass the national gold production record set in 2021.

All these projects are far from “cookie cutter” and are adapting to the jurisdictions they are operating in. Both Magino and Greenstone will have on-site natural

gas generated power due to the lack of available capacity from the grid, while Côté Gold made significant design changes through the incorporation of a high-pressure grinding roll (HPGR) and vertical grinding technology to maximize the utilization of available grid power. The Blackwater project is constructing a 135 km 230 kV transmission line to provide power to the site and utilize threestage crushing to initially keep power consumption low.

All the sites have sized the material handling equipment for later expansion opportunities. Utilizing 140- to 231-tonne haul trucks delivers lower operating costs, without the need for elaborate maintenance equipment. Three sites have incorporated gyratory crusher for primary crushing stages – to enable later expansion phases. The Magino site will utilize a jaw crusher, with the provision of a secondary cone crusher stage to provide optimal feed to the SAG mill. It is more common practice to utilize two stages of crushing ahead of any downstream option – SAG or HPGR, since the operational characteristics improve dramatically when controlling the top size to any mill circuit.

targets below the pit shell. An optimization and expansion review of the mill will also take place in Q3 – with the goal of increasing production beyond current levels. With the high-grade Alamos Gold Island gold mine immediately adjacent to Magino, it will be exciting to see the exploration results from the next phase of exploration.

Artemis is actively planning to achieve carbon neutrality at the Blackwater site by 2029. An option agreement with Caterpillar to supply zero-emission vehicles with a targeted order date of 2025 is in place. All electrified equipment should be on-site for 2029. The site will benefit from receiving B.C. Hydro’s low cost and reliable grid power to meet this goal.

The Magino mine start up has been event free, with 3,295 oz. produced as of June 30, 2023. The company has incurred $730 million of the $755 million budgeted to complete the project. Commercial production is on track for Q3 2023. The team will be quite active converting in-pit resources into reserves, along with testing structures to the west and high-grade

Artemis is seeing considerable progress at the Blackwater site – with an estimated 27% of the project completed. The mill building is set to be erected and enclosed by the end of 2023, which is an important step forward and reflects the hard work and expertise of the entire team. Another exciting development is the upcoming delivery of the first 240-tonne Cat 793 haul truck by the third quarter of 2023. The haulage fleet will be a combination of Cat 785 and Cat 795NG haul trucks and complemented with 22 to 34 m3 hydraulic excavators. The truck delivery marks a crucial moment and will pave the way for increased pit development.

Despite forest fire restrictions, construction progress remains on schedule for the second half of 2024. All construction activities were suspended due to the extensive wildfire activity in central B.C. during July 2023. The team’s careful planning and ability to secure staffing from recently completed construction projects have ensured timelines are met despite unforeseen events. An important milestone has been achieved with 160,000 hours of operations without a lost time injury frequency rate (LTIFR), highlighting the project’s commitment adherence to protocols and employee well-being.

The Greenstone Gold project is rapidly advancing towards construction completion with crews shifting focus to operational readiness and commissioning. The project had the unusual complexity of rerouting a major highway and building a 65 MW natural gas-powered generating plant – both of which are substantially completed, with the power plant being commissioned soon.

The equipment requirements of this site are unique owing to the strip ratio and layout of the deposit. Two of the six Epiroc Pit Viper 235s are operational for 10 metre bench drilling. One of the 29 m3 Komatsu PC5500 shovels is operational with the remaining units operational in the coming months. Eight of the Cat 793s out of the fleet are running and preparing for the startup.

The final dimensions of the open pit will be 1.8 km long, 1.0 km wide, and 600 metres deep. The mine design is unique in that the open pit will be dealing with intersecting historic underground workings as mining advances. Underground voids will be filled with sand or rock fill as needed.

Mining of the Greenstone open pit will occur in five main phases preceded by a starter pit. Waste rock will be placed in five distinct waste dumps with four located around the pit and one further to the south. The open pit will generate 690 million tonnes of overburden and waste rock over the life of mine

(LOM) for an average LOM strip ratio of 5.1:1. Reserves equal 135 million tonnes of ore at 1.27 g/t Au.

Côté Gold mine (Majority owned by a 60-40 joint venture between Iamgold and Sumitomo Metal and operated by Iamgold): Production starts first half of 2024

electric shovels and Cat 793F haul trucks. Three Cat 994s will also be on-site for loading and stockpiling. Remarkable accomplishments in training are evidenced by owner mining teams managing over one million tonnes in Q1 of 2023.

will provide 56 MW of power required for this plant. By incorporating an efficient crushing design, HPGR, and Vertimills, the project team mitigated risk by designing a plant with available grid power.

Finally, the Côté Gold mine will start commissioning in Q4 of 2023. Operating at a planned throughput of 37,200 t/d –this site will churn out close to 500,000 oz. of gold yearly – with significant resource potential to grow further.

A conscious effort to maintain a safe work environment is front and centre at this mine. In early 2023, the mine surpassed 10 million project hours with a lost time injury frequency rate (LTIFR) at 0.02, which is clear evidence of a workforce that embraces a Zero Harm attitude. The construction team recently added an additional 264 beds to the camp to ensure sufficient accommodation for up to 1,900 workers on-site in June.

The site completed the extensive tailings management facility raise just before the spring freshet and created sufficient water storage capacity for commissioning activities. All civil works and structural steel are in place, with the high-pressure grinding roll positioned in place and quickly advancing to commissioning in Q4 of 2023. The installation of crucial components like CIP tanks, Vertimill mechanical works, and associated structural steel, as well as cyclone installations, has reached an advanced stage.

A unique feature of this site is the implementation of an autonomous mining fleet. Ten autonomous vehicles have been commissioned thus far, including Atlas Copco Pit Viper 231s (to drill 12 m benches) and a combination of Cat 6060

The installation of a Weir Minerals 2.4 by 2.4 metre HPGR will mark the largest scale installation of an HPGR in Canada. This single HPGR will utilize 7,800 kW of power to crush up to 1,596 t/h into an 80% passing 2.4 mm product for the ball and Vertimill circuits. Pilot stage grindability test work indicated the Côté Lake deposit material is very competent and resistant to SAG milling. A typical SAG mill configuration, even with high ball loads, would not be energy efficient. Test work conducted at COREM using HPGR technology confirmed metallurgical and economic advantages over SAG milling in a more traditional flowsheet. The HPGR provides metallurgical benefits by inducing micro cracking in the ore which improves the cyanide leach kinetics that would not be possible if a conventional flow sheet were utilized.

Grid connection to the provincial hydro grid will be completed soon and

The most interesting facet about the Côté Gold project is the potential upscale of the reserve base. With the recent inclusion of the Gosselin zone into the resource category, measured and indicated resources now exceed 490.4 million tonnes at 0.9 g/t equating to 13.56 million oz. of gold. A 15,500 metre drill program slated for this year is positioned to expand the Gosselin zone, as it is still open at depth and on strike to the west.

To observe four open pit projects come online with unique solutions for their operating challenges is quite interesting to anyone in the business. The ramp up of these mines will undoubtedly improve how we build and operate other mines that are in the later stages of development. CMJ

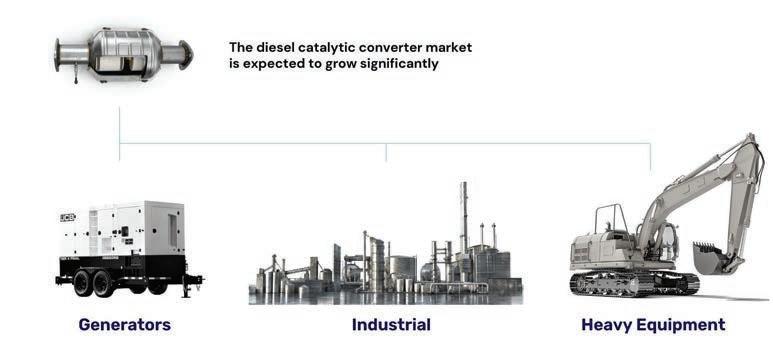

The alarming rise of catalytic converter theft has been making headlines as of late and for good reason. According to the Allstate Insurance Company of Canada, catalytic converter theft has increased by 60% over the past year and shows no signs of slowing down.

Meanwhile, in the U.S., catalytic converter theft has taken a shape of its own with the formation (and thankfully, the recent collapse after a year-long search) of a multi-million dollar catalytic converter theft ring that stole and then sold roughly 27,300 converters for approximately US$300 per unit over the course of a three-year period.

There are a multitude of reasons. First and foremost, catalytic converters are used to filter out and burn harmful emissions from the exhaust gases in automobiles, trucks, and commercial vehicles while improving the vehicle’s efficiency. Without them attached to our vehicles where they belong, those harmful emissions are now contributing to existing environmental pollutants.

This need creates a high demand for catalytic converters. In fact, the catalytic converter market continues to grow and is forecasted to reach a whopping US$73.1 billion by 2025. You may wonder where this growth is coming from, given electric vehicles are also growing in demand. While that is certainly true, electric vehi-

cles will not replace non-road heavy equipment and yellow iron equipment, which also use catalytic converters.

But the main reason has to do with the precious metals that are found in those catalytic converters. Each year, an alarming US$21.2 billion worth of precious metals from diesel catalytic converters are left unrecycled in landfills, compounded by the fact that these resources are already scarce as it is.

There is, perhaps, an even bigger issue at large: smelting is the dominant commercial method to recovering precious metals today, namely palladium (Pd) and palladium (Pt), from used catalytic converters – but a significant contributor to harmful environmental pollutants, including greenhouse gases (GHGs) and toxic byproducts that contaminate the air and water, not to mention human health.

These are the issues Regenx Tech is working to solve, the first-to-market, non-smelter company that is revolutionizing the precious metal recovery industry. The company’s mission is to reshape the future of clean technology by tackling these pressing challenges at their core through the introduction of a new environmentally friendly and commercially viable method for recovering platinum group metals from diesel catalytic converters.

As the first and only method to recover platinum group metals in an environmentally friendly and commercially via-

ble manner, Regenx’s clean tech solution has marked a significant milestone in the niche but vital mining and precious metal recovery industry for the following reasons:

1 The ability to extract precious metals more by doing less

Currently, 27 million auto catalytic converters become available for scrap each year, yet only 30% of the palladium is recovered. In this new process, Regenx recovers 90% of precious metals in an environmentally safe sustainable manner.

This process creates groundbreaking efficiencies compared to the cost-intensive and time-consuming nature of the current process.

Perhaps the biggest benefit of all is the method’s positive impact on climate change. As mentioned earlier, smelting has dominated the precious metal recovery industry and at the time, for good reason: it was the only commercially viable method until now. However, the excess release of carbon dioxide and byproduct toxins involved in the heating and melting processes of smelting creates serious environmental implications that are damaging to the health of the population and the planet at large. The rate at which smelting occurs makes this process all the more terrifying.

critical

In addition, US$21.2 billion per year worth of precious metals from diesel catalytic converters is being wasted and left in landfills and scrap yards because many smelter companies are no longer accepting diesel catalytic converters. One reason for this is that catalytic converters create processing issues and operational inefficiencies. In addition, most smelter companies have capped their carbon emissions footprint, and current industrial smelters are operating at close to 100% capacity. Because of this, no new smelters are being built, leaving no alternative solution to recovering the precious metals so urgently needed by a growing market.

Meanwhile, sustainability is the primary focus of the new process. The new clean technology emits far less carbon dioxide into the atmosphere and is less energy-intensive compared to traditional mining and recycling by smelters. Additionally, it recovers and recycles over 90% of the precious metals found in diesel catalytic converters.

Mining, as we know, produces a finite resource, and continual replacement of the resource is not sustainable. That is why our process is designed so that just one plant with four modules will recover 170,000 oz. of platinum and palladium annually.

This marks a major breakthrough in clean technology and the precious metal recovery industry.

Recycling precious metals from diesel catalytic converters is a largely untapped market. In fact, 85% of the world’s annual supply of the precious metal palladium is used in catalytic converters, and in North America alone, a whop-

Here is a closer look at our clean-tech four-step process:

STEP 1: Input materials. The core materials are separated from the metal containers and ground into fine powder.

STEP 2: Extraction. Platinum and palladium are extracted from the ground materials and placed into a solution through chemical processing.

STEP 3: Recovery. Platinum and palladium are recovered as a concentrate from the solution using a proprietary process.

STEP 4: Refining. The concentrate is then sent to a refinery for upgrading and sale.

ping 2,110,000 oz. of palladium was used in the production of catalytic converters just in the year 2021. Yet, as a reminder, there is US$21.2 billion per year worth of precious metals in retired catalytic converters that go to waste with no solution to be found until now.

On the other end, world platinum production is decreasing. In 2017, 8 million oz. of platinum were produced, and in 2019, it was 6 million oz. This is because traditional mining for palladium and platinum is not only difficult but expensive, not to mention further compromised due to geopolitical matters. For example, two-thirds of the global platinum production is in South Africa, and Russia falls right behind.

However, while the initial and primary focus will be on diesel catalytic converters, there is currently a wide cross-section of markets using platinum and palladium in everyday products, including hydrogen

fuel cells, medical devices, electronic glass, hard disc drives (cloud data storage), fertilizers, physical investment (coins), safety products, jewelry, dental devices, pharmaceutical equipment, transportation, and much more.

This makes the new solution all the more commercially viable compounded by a surging diesel catalytic converter market, which is expected to grow from US$24.7 billion in 2017 to US$39.3 billion in 2025. In other words, each four-module plant has the ability to produce US$100 million in revenue alone when it is scaled to full capacity.

In addition, because the clean tech system reduces our carbon footprint and does not require as much energy as traditional mining and recycling methods, it creates the ability to accrue carbon credits as a secondary revenue source, offering an even greater opportunity to scale.

Figuring out how to recover 90% of precious metals from catalytic converters in an environmentally safe and sustainable manner has not been easy, but it has certainly been worth it.

The plant is constructed in modular stages with each module having a capacity of 2.5 tonnes. The first module will begin extracting precious metals in August, and then increase its extraction amount up to its capacity of 2.5 tonnes each day within an approximate 30-day period. The plant will then fabricate and assemble the second, third, and fourth modules in the process, allowing for the extraction of up to 10 tonnes of precious metals each day and 3,120 tonnes annually.

Overall, the critical issue of catalytic converter thefts and unrecycled precious metals demands innovative solutions. The new process will not only address the urgent need for a new method, but also offers a cleaner, more sustainable outlook to protect the environment, conserve valuable resources, and build a brighter future for generations to come. The crucial need to support and adopt transformative clean tech mining solutions that are both efficient and sustainable is important now more than ever.

CMJGreg Pendura has been the CEO of Regenx since 2009. He has an impressive background of over 35 years in founding, financing, and advising emerging private and public companies.

How do we balance supply chains and finite resources to mitigate the effects of the next big shock to our energy systems?

This article dives into one of the key findings outlined in GHD’s SHOCKED report, one of the largest global opinion research studies that interviewed 450 senior decision makers in the energy sector regarding the ongoing energy crisis.