SILVER AND PGMS

One of the most exciting gold exploration stories in recent years has been Great Bear Resources and its Dixie gold project near Red Lake, Ont. The company was acquired by Kinross Gold (TSX: K; NYSE: KGC) in February — even before it had a chance to compile an ini tial resource for the high-grade, large-scale project. In September, Royal Gold (NASDAQ: RGLD) bought Great Bear Resources — a spinout of Great Bear whose only asset was a 2% net smelter return royalty on Dixie — for $200 mil lion, bringing the total value of Great Bear’s assets to $2 billion.

Faso-focused miners say operations have not been affected following a second coup d’état on Sept. 30 that saw the country’s president Lt.-Col. Paul Henri Sandaogo Damiba over thrown after only nine months in power.

While local mining operators face growing security, logistical and financing issues, they appear to remain bullish on the jurisdiction, with no announcements emerging of reduced exploration and mine development budgets to date.

Burkina Faso is Africa’s fourth-largest gold producer, and gold makes up a significant part of its GDP and national exports.

The change of leadership appears to have its roots in a disagreement within the Burkina Faso military on security issues in the north and east of the country, areas which have been hard-hit by Islamic-associ ated terrorist insurgencies in recent years.

The nation’s new military leader, Captain Ibrahim Traoré, said on Oct. 2 that the country was facing an emergency in every sector, “from security to defence, to health, to social action, to infrastructure,” and it was time for the government to “abandon the unnecessary red tape.”

An analyst with global risk con

sultancy Control Risks says that, at first glance, the development is unlikely to directly impact the min ing sector from a regulatory per spective. The current leadership has gone so far as to say no additional constraints will be placed on the mining sector, given its economic importance.

“The succession of coups in Burkina Faso, and more broadly persistent discontent in the armed forces, is driven by worsening mil itancy and repeated failure of suc cessive governments to improve security,” said analyst Tristan Gue ret in response to emailed questions.

Since 2015 Islamist militants have made significant gains across the country, expanding their influ ence in rural areas and carrying out frequent and deadly attacks against civilians and security forces.

According to Gueret, the Burki nabe security apparatus has long suffered from capacity issues,

including manpower, air sup port, intelligence, and personal equipment. Such challenges were also made worse by divisions and rivalry between different branches of the security forces.

“Deteriorating militancy, high casualty rates among troops, capac ity issues, and grievances in the rank-and-file, both against the political class and senior officers who are seen as out of touch and disconnected from the day-to-day realities of the counterinsurgency, have been the main drivers of dis content,” Gueret said.

Before the coup against Presi

Great Bear Resources’ former president and CEO Chris Taylor joined The Northern Miner’s Q3 Global Mining Symposium on Sept. 29 to discuss the company’s success, and what other explora tion companies can learn from it. Taylor was previously named The Northern Miner‘s 2021 Person of the Year.

Great Bear’s story is a classic one of an exploration discov ery, entailing years of hard work and personal sacrifice to reach the prize. Taylor, a structural and economic geologist, financed the project personally in the early days when investors were skep tical and it was difficult to raise money. He racked up $300,000 worth of personal debt on his line of credit, because he believed in the project.

“If you have a story you really believe in, you have to be able to stick with your guns,” he said. For him and his family, that meant many years of “paying more into the company than you ever take out of it.”

While the slumps in the indus try are difficult, they are great times to pick up projects, he noted.

“The Dixie acquisition, now the Great Bear project, was about a $200,000 total acquisition that ended up with a $2 billion total valuation only seven years later. This is the kind of thing that can happen in a bad market. So stick with it… (and) look for those opportunities.”

While Red Lake is a historic gold mining camp, Great Bear’s dis covery was in an area that wasn’t thought to be prospective and in host rocks that weren’t supposed to carry gold.

“In the Red Lake camp, you’re not going to be looking for a major gold system in the area that

“SUCCESSIVE COUPS, ALONGSIDE DETERIORATING SECURITY, ARE LIKELY TO CONTINUE DAMPENING INVESTOR CONFIDENCE IN BURKINA FASO.” TRISTAN GUERET, ANALYST WITH CONTROL RISKSEndeavour

Investment Management adopted a strict voting policy against industry directors who have served for two or more years but have invested less than two years of director’s fees into the un derlying equity, it took a stand for shareholder value rarely seen in the junior space.

The New York-based hedge fund, with over US$700 million in total assets under management — more than half of that in gold and silver junior miners — announced its new investment stewardship policy toward directors of public companies last month.

It sets “a clear, lower-bound for director share ownership,” accord ing to chief investment officer Sean Fieler.

He said Equinox Partners intends to push back on the growing indif ference of boards to non-executive director stock ownership and the decision of some companies to pro hibit non-executive directors from owning stock altogether.

“We have seen a troubling de-emphasis of financial alignment among international mining com panies,” Fieler said in an interview.

The executive underlined that the company was not acting as an activist investor, but looking out

for its interests as a long-term value investor.

Equinox has put in a rigid policy of not voting for nonaligned direc tors, even if they’re running in an uncontested election.

“If those directors don’t own at least a very lower bound of stock, which we determined to be two years of their board compensation

if they served for two years or more, and we feel like that’s an incredibly generous, probably too low, lower bound, they have really a different view of the role of a director than we do,” he said.

“The policy gets that 10% of the very worst actors.”

By elevating individuals who do not own stock and are unlikely to

acquire a significant financial inter est in the company they oversee, the board is adding colleagues who will tend to prioritize “collegiality” and “reputation” over its compa ny’s financial interests, particularly in the junior gold space, the execu tive argues.

‘Clubby’ boardrooms

Fieler said he had witnessed declin ing levels of insider ownership across a swath of gold mining com panies in the last seven years.

“You see a meaningful drop in insider ownership, and we really see a growing number of boards treating a director posi tion as really a slot to fill rather than a technically competent per son that’s going to be aligned with shareholders, and we think that’s problematic,” he said.

Fieler points to Gold Fields’ (NYSE: GFI; JSE: GFI) proposed acquisition of Yamana Gold (TSX: YRI; NYSE: AUY) as a “particularly interesting wrinkle on this whole problem.”

The context of the Yamana deal is an excellent example of how when one works through the list of reasons to pursue a merger, the valuation is not amongst them, he argued.

And if one has a majority on the board that has no alignment with shareholders, it spells trouble for investors.

Since the Johannesburg-based miner approached its target, share holders have criticized the pro posed all-stock merger, arguing the friendly approach does not guaran tee growth and profitability.

Fieler noted Gold Fields’ case as being peculiar in its policy as it states non-executive directors shouldn’t have alignment with shareholders so they can better rep resent all stakeholders.

“It’s very much not a random thing that is happening in that case — it’s kind of a natural outcome of a potential policy to disentan gle the company’s owners from the board. It’s more so than has usually been done in the ‘clubby’ nature of boardrooms,” Fieler said.

While pointing out there is no law against having a ‘clubby’ a boardroom, Fieler said boards and their chairs don’t want dissidents in the boardrooms as it makes it harder to govern those companies.

“But as a general rule, in the junior mining space, we don’t see an effort on the part of insid ers to invite shareholders onto the board,” he said.

“That’s not the norm. And because of that, you can really get divergent interests between the shareholders, even substantial shareholders and insiders at these companies. And then that leads to various unattractive behaviours from a shareholder perspective.”

TNM

BY NORTHERN MINER STAFF

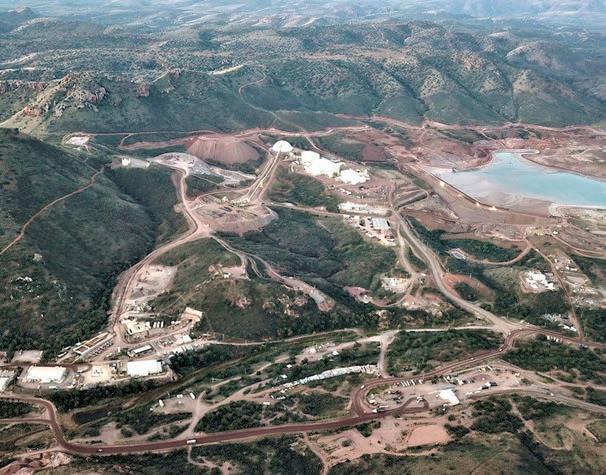

Element 29 Resources (TSXV: ECU)

BY NORTHERN MINER STAFF

Element 29 Resources (TSXV: ECU)

a Vancouver-based copper explorer with projects in Peru, has released its first resource estimates for the Elida project in the Andean nation, with an initial resource soon to follow from its Flor de Cobre project.

Both properties were previously drilled and returned intercepts of potentially economic grades with low observed levels of deleterious elements like arsenic.

“I think this is a very significant initial copper resource estimate that we’ve delivered,” said CEO Steve Stakiw, a geologist who joined the company in April. “The potential to grow this is great. Also, the molybdenum is almost double global average moly grades in copper-porphyry systems and has the potential to enhance the economics of the deposit.”

The initial estimate at Elida, located 250 km north of Lima, outlines 321.7 million inferred tonnes grading 0.32% copper, 0.03% molybdenum and 2.6 grams silver per tonne with a low modeled 0.74:1 strip ratio on the Zone 1 porphyry, one of five porphyry centres on the project. Stakiw said that resource growth potential on Zone 1 remains open.

Element 29 is also initiating its next phase of drilling on the project to test the other porphyry zones at Elida. Stakiw noted that additional metallurgical studies are planned.

A near-surface higher-grade subset of the resource consisting of 34.1 million tonnes inferred at 0.55%

copper, 0.037% molybdenum and 4.4 grams silver per tonne at a cutoff grade of 0.45% copper has the potential to be mined with minimal stripping in the initial years of mining at Elida, said Stakiw.

“For me, it’s the ability to take this from an exploration stage project to what I think is a very material copper resource,” he said. “In terms of pounds in the ground we’re at about 2.2 billion contained pounds of copper in just a portion of one of five porphyries.”

E29 is also planning to deliver a resource estimate in late 2022 on the Candelaria zone at Flor de Cobre, which is 250 km northwest of the Chilean border near Arequipa in the Southern Peru Copper Belt.

There is a historical copper resource at Candelaria of 57.4 million

tonnes of 0.67% copper that was outlined by Rio Amarillo and Phelps Dodge – now Freeport-McMoRan (NYSE: FCX) in the 1990s. E29 will be updating that resource with data from a recently completed drill program, said Stakiw.

The Southern Peru Copper Belt is a portion of the Andean magmatic arc that hosts numerous economic copper-gold porphyry and skarn deposits.

The Flor de Cobre project also hosts the large Atravesado porphyry target, supported by coincident outcrop geology, surface geochemistry and geophysical responses. Atravesado is located approximately 2 km northwest of Candelaria and is a 1.5-km by 1.6-km circular zone characterized by outcropping copper oxide

mineralization in association with quartz vein stockworks and potassic alteration, said Stakiw.

As a junior that’s moving from early exploration to defined resources at its projects, he notes that this transition usually benefits a company’s stock price.

“You look at the opportunity for the company to get that re-rating out there, because as you transition from an explorer to a company with delineated or proven resources, then you’re moving down the development pathway,” he said. “That’s when you ideally start to get better valuations in the market.”

Both E29 projects are at compara tively low altitudes, making explo ration and potential development easier, said Stakiw. Some mines in the region are at 4,500 to 5,000 metres elevation. Also, Elida and Flor de Cobre are close to paved regional highways and other infrastructure in pro-development jurisdictions of Peru, he said.

“There are mines and a skilled workforce around us,” Stakiw said. “So, it checks all those boxes. Both our projects have that luxury. For us, that de-risks the development pathway. It’s one thing exploring and finding stuff, but if it’s at high altitude in a remote area that’s anti-mining we know how that ends.”

E29 is in regular dialogue with adjacent communities, maintaining relationships that are open and transparent, said Stakiw, noting some other Peruvian mining projects can be fraught with challenges.

“There are projects like the Las

Bambas mine, which is a big copper operation in Peru, it’s near the Southern Peru Copper Belt, but it’s inland a bit, so you’re getting into the agricultural and tourist areas near Cusco and into those areas where it’s much more challenging. The communities can be tougher to negotiate with as there is increased competition for land use.”

Added scrutiny of mining projects around the world is a good thing, said Stakiw, noting responsible companies have an opportunity to set an example. Taking shortcuts isn’t something he’s interested in.

“We do like Peru,” he said.

“Obviously, we are biased because that’s where we operate. It’s a great place to be doing business, especially for a copper explorer, because it’s the number two copper producer in the world and has strong exploration and discovery potential given its metal endowment.”

Out of the world’s top 10 largest copper mines, three or four are in Peru, Stakiw said. Most of the rest, he explained, are in Chile, which is the world’s number one copper producer.

“We are in the same belt and just over 20 km on trend from the large Cerro Verde mine,” he said. “I think that’s the number five copper producer in the world, so we’re in a great neighbourhood.”

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by ELEMENT 29 RESOURCES and produced in co-operation with The Northern Miner. Visit www.e29copper.com for more information.

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Alisha Hiyate, BA (Poli Sci, Hist) ahiyate@northernminer.com

MULTIMEDIA SPECIALIST: Henry Lazenby hlazenby@northernminer.com

STAFF WRITER: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PHOTO EDITOR AND PODCAST HOST: Adrian Pocobelli, MA (ENGL) apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/ CAREER ADS George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 moliveira@northernminer.com

ADDRESS: Toronto Head Office 225 Duncan Mill Road, Suite 320 Toronto, ON, M3B 3K9 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES:

BY ALISHA HIYATE BY DR CHRIS HINDE Special to The Northern Miner

prices continue to hold near historic highs, even in the face of an anticipated global recession. Spot prices for both lithium carbonate and hydroxide are now hovering around US$70,000 per tonne, and prices are expected to remain high through 2024 or longer.

In an early October report, Bank of America analysts forecast demand for the energy metal will grow by 20% on a compound annual basis between 2021 and 2030, from 700,000 tonnes of lithium carbonate equivalent (LCE) last year to 2.7 mil lion tonnes in 2030. That level of growth will require 50 new mines pro ducing an average of 40,000 tonnes of LCE, BofA estimates.

But there’s a problem. Ironically, while it is climate concerns that are driving demand for lithium higher through the EV revolution, environ mental issues are also limiting supplies.

Lithium production simply can’t be scaled up to meet the level of expected future demand without new technology that reduces its environ mental impact.

Permitting delays and long development timelines are already big bar riers to new supply — but growing opposition to projects is compounding the problem.

In an August report, Fitch Solutions analysts noted a “sharp uptick” in community opposition to brine-based lithium projects in Latin America.

Much of global lithium production comes from brine operations, which concentrate the critical mineral by relying on evaporation of water from brine pumped to surface. In spite of their large footprint (brine produc tion occupies over 3,100 sq. metres of land per tonne of lithium hydrox ide produced vs. hard rock operations at 464 sq. metres per tonne) only about 50% of the precious white metal is typically recovered from brines. (On the other hand, hard rock operations emit three times the greenhouse gases of brines.)

Opposition to brine operations is linked largely to competition for water. Chile, the world’s number two lithium producer, has endured 13 years of drought, putting lithium companies SQM and Albemarle on a colli sion course with other water users. Their operations, located in salt flats in the Atacama Desert, have come under increasing scrutiny for their use of scarce groundwater.

SQM got into trouble in 2016 for pumping more brine than its permits allowed and has had to redraft its environmental compliance plans. Since then, the company has committed to using less fresh water and building a desalination plant so it can use seawater, and to reducing the amount of brine it pumps by 50% (compared with 2019 levels) by 2030. SQM, which wants to be recognized as a “green” company by 2030, is spending US$1.5 billion to reduce its water use.

But it’s not just brine projects that have proven contentious. Thacker Pass, an open pit clay lithium project in Nevada, also faces stiff opposition on environmental grounds, including for its planned use of groundwater. A coalition of Native American tribes, environmental groups, and a local rancher, have challenged the project’s approval by for mer president Donald Trump. The appeal is scheduled to be heard by a federal court early next year.

And Rio Tinto’s Jadar project in Serbia — despite being an under ground mine rather than a brine or open pit operation — also attracted protests. As a result, the government revoked Jadar’s permits in January this year. If developed, the US$2.4-billion project would produce close to 60,000 tonnes LCE annually over a 40-year mine life.

As the green credentials of lithium projects are crucial to end users and the viability of the growing EV market, the mining sector is finding allies to help make lithium production more sustainable. Automakers, bat tery makers and governments are just as motivated to find solutions — undoubtedly a requirement for the world’s decarbonization efforts — to lithium’s environmental footprint.

For example, in 2021, SQM and partners in the battery and auto sec tors established the Responsible Lithium Partnership to invest in studies to quantify the impact of lithium mining on groundwater in the Atacama.

Analysts are looking to direct lithium extraction (DLE) — which has also attracted support from governments and end users in the battery chain — as a potential gamechanger. The technology, which has the poten tial for 90% recoveries, is already being used commercially in combination with evaporation at Livent’s Fenix operation in Argentina, as well as sev eral projects in China, according to a recent report by Red Cloud Securi ties. It also is being tested for use in geothermal brine projects in California and Europe, and by E3 Lithium at its petrobrine project in Alberta; and Rio Tinto’s recently acquired Rincon brine project in Argentina.

DLE from geothermal brines has raised hopes for their potential for extremely low-impact lithium production, although Berkshire Hathaway has reportedly encountered technical obstacles in its efforts to produce lithium from one such project as part of its geothermal energy infrastruc ture in California’s Salton Sea.

While BofA analysts note that DLE is not a new technology, they acknowledge it is still in its “relative infancy.”

“No two brines are the same, and brine composition can even vary across a specific resource. This creates complications in DLE technology selection and deployment, often overcome by significant process flow tin kering and demonstration production hours,” they wrote in an October report.

Despite the challenges, the near-term should be very exciting as the innovative solutions that will square the circle of sustainable lithium emerge.

TNM

Theworld’s first, and still larg est, broadcaster is 100 years old. The British Broadcast ing Company (BBC) was formed on Oct.18, 1922, by a group of leading wireless manufacturers, including the Italian inventor and electrical engineer Guglielmo Mar coni (1874-1937). The company became a corporation when it was nationalized in 1927.

Marconi had been building transmitting devices since 1894, and moved to Wales in 1896 at the instigation of his mentor, Caernar fon-born Sir William Preece (the General Post Office’s chief engi neer). Marconi sent the world’s first wireless transmission (from Flat Holm island in the Bristol Channel to Lavernock Point near Cardiff) on May 13, 1897, and transmitted the first transatlantic radio signal in December 1901.

Marconi went on to deliver Britain’s first live public trans mission in 1920, and began daily radio broadcasts, for the BBC, from his London studio (2LO on the Strand) on Nov.14, 1922.

Television (literally ‘far off sight’) wasn’t broadcast by the BBC for another 14 years (Novem ber 1936), but Scottish electrical engineer John Baird (1888-1946) had conducted the world’s first demonstration of transmitting images to multiple sites (albeit only silhouettes) in March 1925 from Selfridge’s department store in London. Baird was a prolific inventor, including attempts in his 20s to create diamonds by heating graphite. His first ‘proper’ broadcast (of human faces) was on Jan. 26, 1926 to scientists at the Royal Institution.

During its founding years, in the aftermath of WWI, the BBC was guided by the Victorian pater nalism of its first director-general, the imposing Scottish mechanical engineer John Reith (1889-1971).

A strict Presbyterian, Reith stood almost two metres tall (6 foot 6 inches) and had a pronounced scar on his cheek from a sniper’s bullet.

Reith helped establish the state broadcaster’s enduring reputa tion for clarity and impartiality. He summarized the BBC’s pur pose in three words: inform, edu cate and entertain (which remain part of the organization’s mission statement).

The first two of Reith’s simple corporate instructions, to inform and to educate, are useful guide lines for business communica tions today. They are also invoked in a book published in February by marketing expert Kevin Dun can. In his ‘Bullshit-Free Book’, Duncan argues that we need to reclaim our language by commu nicating clearly.

The book starts with an exam

ination of why we use so much jargon and non-sensical phrases (for example “reaching out,” and any percentages over 100%), and then lists and analyzes 100 exam ples of bullshit. The book ends with a manifesto to help anyone achieve clear communications.

Corporate ‘guff’ is certainly not a new concept. In the mid-1990s, for example, Financial Times col umnist Lucy Kellaway was mock ing business jargon, and exposing the hidden meanings behind cor porate press releases.

The English language is full of ambiguities, especially when used by the British. For example, when we say “with all due respect,” it means nothing of the sort, we actually mean “I think you are wrong.” Similarly, “that is an orig inal idea” means not that you are a genius, rather you’re daft. For some reason we are often misun derstood by foreigners.

An article by Gillian Tett in the Financial Times earlier this year applauded Duncan’s crusade, and discussed the need for clar ity. Tett noted that many linguis tic characteristics are cultural (the English dislike giving offence) but can cause confusion and misinter pretation. Most people who use English as a foreign language are much more direct than the British in their translation, they speak/ write what they see.

Hollywood and the internet have facilitated global communica tion, and English (or is that Amer ican) has become the lingua franca for large parts of the business world. This penetration is mon itored annually by Miami-based Education First in its English Pro ficiency Index (most recently pub lished in December 2021), which ranks 112 countries and regions by their levels of English usage and comprehension.

There are some 7,000 languages in the world, yet more than half of the population speak just 23 of them. Of these languages, English is the most understood (followed closely by Mandarin), with 18% of the global population able to communicate in it. English is spo ken by some 400 million people as a native language (it is an offi cial language in 67 countries), and spoken by a further 1 billion as a foreign language.

In business communication, we need to avoid corporate confus cation, jargon and the vernacular of local speech, and learn to speak and write like fluent foreigners; clearly and to the point. Unlike the BBC, mining companies don’t need to entertain, but they do need to inform and educate; Reith would surely approve.

Chris Hinde is a mining engineer and the director of Pick and Pen Ltd., a U.K.-based consulting firm. He previously worked for S&P Global Market Intelligence’s Metals and Mining division.

right

Mining’s problems are now the world’s problems, as lithium scale-up issues show

Jeff Swinoga has come from away, leaving high-crime Mexico for the warm-hearted community of Gander, NL.

After helping raise US$400 mil lion as chief financial officer of Torex Gold Resources’ (TSX: TXG) El Limon Guajes mine in Guerrero state and stints at First Mining (TSX: FF) and consul tantcy EY Canada, his new proj ect is developing stakes near the heart of Newfoundland’s multi-bil lion-dollar gold rush that saw Exploits stock surge by more than a third last week to 23¢ a share.

It was after the company pounced on a claim it’s calling Block H for now, right beside New Found Gold’s (TSXV: NFG) Queensway project, which hit 92.86 grams per tonne gold over 19 metres in its 2020 discovery hole and is now in the midst of a 400,000-metre drill program. New Found owns about 11% of Exploits. Also next door is Labrador Gold (CVE: LAB) with its Golden Glove and Big Vein sites reporting 6.22 grams per tonne gold over 4 metres and 44.08 grams gold over 4.28 metres, respectively.

“We’re thrilled to acquire this property, it’s one of the best claims in the province,” Swinoga, 55, said during an interview en route to the site just outside Gander, the small community known for hosting thousands of temporary 9-11 trans plants as recounted in the musical Come From Away. “We just can’t wait to get at it.”

The stake adds to the more than 2,000 sq. km controlled by Exploits in central Newfoundland, stretch ing from the island’s north coast to near its southern shore and hold ing nine projects. The zone is sliced by fault lines — the Valentine, Dog Bay, Appleton and the Gander River Ultramafic Belt or GRUB — all formed about 480 million years ago during the closing of the Iapetus Ocean that allowed gold to migrate up from the earth’s mantle.

After Marathon Gold (TSX: MOZ) posted measured and indi cated resources (inclusive of reserves) of 64.6 million tonnes grading 1.9 grams gold per tonne for 4 million oz. contained gold at its almost $500-million Valentine open pit project near Grand Falls, N.L, geologists consider the prov ince’s central region one of the top gold zones in Canada. It ben efits from Gander’s mining infra structure, power supplies and access through a network of for estry roads. The region could rank after the Abitibi area straddling the Ontario — Quebec border, north west Ontario around Red Lake and the golden triangle in northwest British Columbia. Analysts forecast first gold from Valentine in early 2025.

Still, Exploits hasn’t made a big find yet, and the five drilling tar gets across three projects last year “didn’t offer meaningful gold val ues,” Swinoga said. The CEO was measured but not tight-lipped, affable but not boisterous, as he told how the stock rose to a high of $1.54 in July last year on the back of additional backing from lead inves tor Eric Sprott, who holds 18% as well as the 6% held by Sprott Asset Management. Investors were riding a wave of optimism that Exploits would surely soon announce another opportunity like

“Then our stock slid as froth came off the market and labs were backed up six to eight months for our assay results,” said Swinoga, who replaced company co-founder and CEO Michael Collins a year ago.

After the region’s initial mon ey-raising frenzy, large discoveries remain rare and some of the lus tre of piling into the area may have worn off, Red Cloud Securities ana lyst Koby Kushner said in a phone interview.

“Area plays, very rarely are they successful,” Kushner said. “Closeology doesn’t mean prospectivity.”

Exploits senior geologist Mark Richardson cautioned how pin pointing finds in the region requires extensive analysis of the orogenic structures of thrusting, folding and cross-shearing along faults when the two ancient continents of Gan deria and Laurentia collided hun dreds of millions of years ago.

“The gold can be nuggety and

difficult to trace,” Richardson said beside Angie’s Vein (named after a favourite local restaurant), a quartz outcropping on the North Gazee bow project. “That’s why drilling is easy to miss it, and why some companies around here space their holes just 25 metres apart.”

Exploits, with $10 million in cash and no debt, adopted a new meth odology this year with a 10-point checklist to pinpoint targets before drilling. Swinoga cut back the amount of drilling, frustrating some investors eager for a big dis covery, to concentrate on research. Measure twice, cut once, as the say ing goes.

“We believe our probability of a gold discovery has significantly increased with our new meth odology and our newly acquired claims,” the CEO said.

Round-the-clock diamond drill ing started in August at the Titan site, 42 km north of the Keats proj ect held by New Found Gold. Drill

results could be released in two months, depending on the findings, Swinoga said.

“We are confident that we should intersect gold at Titan because it has been found historically, which is very encouraging,” the CEO said. “We’ll just need to wait for the assay results to see how much.”

Part of the confidence comes from Swinoga’s belief in his team. It has a tech startup feel with young people who have also come from

away. Exploration manager Nick Ryan, 35, returned to St. John’s after several years at the Coffee gold project in the Yukon; geologist Nate Costello, 6’4” tall and growing a beard to rival ZZ Top, has worked in Greenland, Peru and Nevada at just 29; and low-key geologist Brad Smith, 30, brings experience from offshore oil rigs. Geologist Kasey Stone, 26, joined just two months ago from New Found Gold after she worked at national educational charity Mining Matters.

The team’s youth is tempered by veteran guidance from Swinoga, who started with seven years at Barrick Gold (TSX: ABX; NYSE: GOLD) where he helped raise $200 million for the Bulyanhulu mine in Tanzania among other projects before spells at Hudbay Miner als (TSX: HBM), where the stock rocketed from $2 to $28, Mag Industries, North American Palla dium (TSX: PDL) and Golden Star Resources.

There are also Ken Tylee, 64, vice-president of exploration, with experience at McEwen Mining (TSX: MUX; NYSE: MUX), Kinross Gold (TSX: K; NYSE: KGC), and the former Goldcorp; Doug Cater, 65, who conducted due diligence on Kirkland Lake Gold’s $1-bil lion acquisition of Newmarket Gold in 2016, and advice from David Groves, 80, a Perth, Australia-based industry-leading expert in geology.

The crew is analyzing some 10,000 soil samples across the Appleton North, Duder Lake and Titan South areas and intends to release a “heat map” of mineral ization in a month or so showing a “smoke trail” back to a gold source, Swinoga said.

The billowing where there’s fire image evokes the time Swinoga and a nervous Torex lawyer scuttled across the dusty Mexican desert in a decrepit red sedan, seemingly under the radar of armed thugs backing union unrest, but really in their sights all along.

If analysts often assign a 5% dis count rate on the stock of opera

tors in riskier mining areas, what’s the premium for operating in the land of Come From Away? Swinoga laughed then pondered.

“I joined Exploits because New foundland is a great province with great people, we’ve got talented exploration staff and we’re wellfunded,” he said. “Having a big brother like New Found Gold was a great opportunity to be on the front lines of a potential billion-dollar company.”

Ecuador-focused Australian miner SolGold (TSX: SOLG; LSE: SOLG) is merging with Canadian junior Cornerstone Capital Resources (TSXV: CGP) to secure a 100% ownership of the Cascabel copper-gold project in the South American country.

The friendly deal, SolGold’s third official attempt to take over the Ottawa-headquartered junior, val ues it at £96.7 million (US$107.9 million).

Under the terms of the agree ment, Cornerstone shares will be exchanged for SolGold’s on the basis of 15 SolGold shares for every Cornerstone share. SolGold has the option to pay up to 20% of the deal in cash. If it chooses not to do so, its shareholders will hold 80% of the new enlarged firm.

The firm noted the 80/20 split is consistent with the current effec tive exposure both companies have to the Cascabel project.

Cornerstone’s shares skyrock eted on the news, climbing as much as 35% in Toronto to $3.69 each on Oct. 7. SolGold’s shares closed down 1.37% in London on the same day at 17.22 pence (26¢), but were almost 17% higher in Toronto on the news, leaving the company with market capitalization of almost £388 million (US$431 million).

SolGold said the merger will consolidate ownership of Casca bel, in which it currently holds an 85% stake, along with a strong portfolio of other projects.

The miner also said it is under taking a strategic review which

may include evaluating financing alternatives and a spinout of assets other than the Cascabel project.

“This merger transaction makes sense for both sets of shareholders. The merger allows our sharehold ers to maintain exposure to the world class Cascabel project and is a step towards maximizing value,” Cornerstone president and CEO, Brooke Macdonald, added.

SolGold had tried and failed to take over Cornerstone in 2017 and 2018. And in 2019, it made its first disclosed attempt, which was fol lowed by another offer in 2020.

The parties ended the two-year standoff that cost SolGold’s chief executive his post in June last year, agreeing to jointly advance the copper-gold project in Ecuador.

In August, the miner announced

a round of management changes, which included newly appointed chief financial officer Ayten Sari das stepping down after only six weeks in the job, after an unsuc cessful equity rise.

In top 20 copper mines

The Cascabel project, located in the Imbabura province of north west Ecuador, is one of the most

ambitious mining projects in a country that is keen to develop mineral resources to spur its slug gish economy.

According to the pre-feasibility study published in April, annual production will average 132,000 tonnes of copper, 358,000 oz. of gold and 1 million oz. of silver during Cascabel’s 55-year mine life.

That means the asset has the potential to become one of the 20 largest copper-gold mines in South America.

Alpala, the largest deposit found at Cascabel so far, has measured and indicated resources of 2.7 bil lion tonnes grading 0.53% cop per-equivalent (0.37% copper, 0.25 gram gold per tonne, and 1.08 parts per million silver) for 9.9 million tonnes of contained cop per, 21.7 million oz. gold and 92.2 million oz. of silver.

During the first 25 years of min ing, Cascabel is expected to have an average annual production of 207,000 tonnes of copper, 438,000 oz. of gold and 1.4 million oz. of silver.

Over the last two years, Ecua dor has attracted a flurry of inter est from big miners looking to increase their exposure to cop per. The highly conductive metal is in demand for use in renewable energy and electric vehicles, but big, new deposits are rare.

It is estimated that the global copper industry needs to spend more than $100 billion to build mines able to close what could be an annual supply deficit of 4.7 mil lion tonnes by 2030.

BURKINA FASO from 1dent Roch Marc Christian Kabore in January 2022, there had been several incidents of mutinies by disgruntled troops. The January 2022 coup came after more than 50 gendarmes were killed in Inata in November 2021, and reports later emerged that the authorities had abandoned them.

Similarly, the intervention on Sept. 30 occurred after at least 27 soldiers were killed during an ambush on a convoy on Sept. 26.

“Successive coups, alongside deteriorating security, are likely to continue dampening investor con fidence in Burkina Faso. This is particularly pertinent for the min ing sector, which has been under considerable pressure over the past 18 months, with mining operators facing growing security, logistical and financing issues,” Gueret said.

Even so, the analyst does not expect authorities to place addi tional constraints on the mining sec tor, given its economic importance.

“There are also no signs that ECOWAS would be willing to impose sanctions on the country that would cause further financial or logistical challenges for min ing operators. That said, security remains the main challenge for the sector, and unless there are signif icant measures taken to enhance security around mining assets, it is unclear how long some mining sites will be able to continue oper ating, particularly in the north and east of the country,” Gueret said.

Meanwhile, he adds that uncer tainty and insecurity will continue to depress investment in explo ration, weakening the pipeline of future projects in the longer term.

The latest Burkina Faso coup saw many younger people waving Rus sian flags in the capital’s streets, Ouagadougou.

Although relatively small in number, it has prompted specula tion that there may have been some Russian involvement in the events that saw Traoré seize power in a nation beset by growing jihadist violence.

Yevgeny Prigozhin, an oligarch close to Russian President Vlad imir Putin and the founder of the

Wagner Group, a shadowy merce nary organization active in several African countries, congratulated the young junta leader, describing him as “a truly worthy and coura geous son of his motherland.”

“The people of Burkina Faso were under the yoke of the colo nialists, who robbed the people and played their vile games, trained, supported gangs of bandits and caused much grief to the local pop ulation.”

According to local media reports, he was referring to former colo

nial power France, and those wel coming the coup not only waved Russian flags but attacked French institutions, including the embassy.

The violence sent shockwaves across the region, demonstrating the strength of anti-French resent ment in many of France’s former African colonies.

Burkina Faso has been desta bilized by a decade-long Islamist insurgency that leaders have failed to suppress.

More than 40% of the country, a former French colony, is currently

outside government control. Thou sands have been killed, and about 2 million people have been displaced by fighting since 2015, when an insurgency that began in Mali in 2012 spread to Burkina Faso and other countries in the Sahel region, south of the Sahara Desert.

Operations unaffected Soon after the turbulent events of the first weekend of October, min ers and explorers were quick to publish statements saying busi ness was more or less continuing unhindered.

West African Resources (ASX: WAF), an Australian gold miner that gets all its revenue from Burkina Faso, saw its shares dive 10% on the news to A95¢ per share in the immediate aftermath. That’s the lowest the stock has closed at this year.

The company said the new mil itary leadership had released a statement urging the people of Burkina Faso to “go about their business in peace.” It added it remained on track to meet 2022 production guidance of 220,000240,000 oz. gold.

Endeavour Mining (TSX: EDV; LSE: EDV) also said its mines were unaffected. The company is Burkina Faso’s top miner with four operations — Houndé, Mana, Boungou and Wahgnion – and two exploration projects.

Canada’s Iamgold (TSX: IMG; NYSE: IAG), which owns the Essakane mine, said that all employees and contractors were safe. Essakane, located about 330 km northeast of the country’s capital, Ouagadougou, is Iamgold’s biggest operating mine.

Our TNM Drill Down feature highlights the top gold assays of the past week.

Drill holes are ranked by gold grade x width, as identified by our sister company Mining Intelligence (www.miningintelligence.com).

This week’s top three assays take us around the world, to Alaska, Morocco and Fiji, with projects by Nova Minerals (ASX: NVA), Stellar AfricaGold (TSXV: SPX) and Lion One Met als (TSXV: LIO), respectively.

The top hole came from Nova’s Estelle Gold project 150 km north west of Anchorage, AK. Diamond drill hole RPM-022 hit 67 metres of 10.4 grams gold per tonne start ing from 112 metres depth for a grade x width of 696.8. The hole returned an overall average grade of 3.9 grams gold over 193 metres.

The hole was drilled in the RPM North zone to complete explora tion there while “a large number” of holes from RPM North and RPM South have yet to be reported because of laboratory backlogs, the company said. Infill drilling con tinues at the site’s Cathedral and Korbel zones.

“I am pleased to report more shallow high‐grade broad min eralization from our drilling at RPM,” Nova chief executive officer Christopher Gerteisen said. “This program is part of a targeted pro gram designed to allow for further increases to potential measured and indicated resources.”

Nova’s Estelle project has 21 prospects in a 35 km-long area in Alaska’s Tintina Gold Belt, which is known for Victoria Gold’s (TSX: VGCX) Eagle Mine and

RANK

DRILL

(m) (m) (G/T

1 Estelle United States Nova Minerals (ASX: NVA) RPM-022 112 67.0 10.40 697

Tichka Est Morocco Stellar Africagold (TSXV: SPX) TB2022P01 75 155.7 3.50 545

Tuvatu Fiji Lion One Metals (LIO) TUDDM-001 81.8 24.0 14.96 359

Lamaque Canada Eldorado Gold (TSX: ELD) LS-21-086 413.4 22.1 16.14

Treaty Creek Canada Tudor Gold (TSXV: TUD) GS-22-151-W1 744.0 300.0 0.95

Sunday Creek Australia Souther n Cross Gold (ASX: SGX) SDDSC046 183.6 21.5 12.20

Cakmaktepe Turkey SSR Mining (TSX: SSRM; ASX: SSR) AR461 138.0 28.3 8.23

Colorado V Ecuador Challenger Exploration (ASX: CEL) CVDD-22-010

Goldwedge United States

Gold (TSXV: SGN)

Alice River Australia Pacgold Ltd. (ASX:

Kinross Gold’s (TSX: K) Fort Knox Gold Mine. The RPM North zone has an inferred resource of 23 million tonnes at 2 grams gold per tonne for 1.5 million oz. with a cut-off of 0.3 gram gold per tonne.

A phase two scoping study and resource updates for Korbel and RPM are due in the near term, the company said.

Stellar AfricaGold came second for the week after its diamond drill hole TB2022P01 at the Tichka Est project intersected 165 metres of 3.5 grams gold per tonne starting from 75 metres depth for a grade x width of 545.

Stellar completed 13 of 20 planned drill holes at zone B of the Tichka Est project in Moroc co’s Atlas Mountains, about 80 km southwest of Marrakech. The com pany adjusted the targeting as it

became clear results were poor in a sub-vertical sheared structure and better near the surface in the upper part of a diorite sill. Crews dug a 240-metre trench which assayed an average of 3.5 grams gold per tonne over 155.7 metres, the com pany said.

Five holes hit gold mineraliza tion, including intersections of 3.71 grams gold per tonne over 9 metres, 3.03 grams gold per tonne over 6 metres and 3.3 grams gold over 4 metres, the company said.

“While the initial drill program did not support our first theory of the source of the gold at Zone B, it did provide us with fresh insight into the Zone B’s complex geol ogy,” vice-president of exploration Maurice Giroux said in a news release. “We do consider the over all program to be encouraging and

DATA |

BY STAFF WRITER773.9

41.2 3.89

14.9

are looking forward to continuing the exploration at Tichka Est at Zone B with now the new geolog ical model factored in and also at Zones A and C which also include diorite intrusives.”

Stellar is in the midst of a US$2.1-million exploration pro gram across the three zones at Tichka Est after signing an agree ment with the Moroccan gov ernment in August 2020. The company also has the Namarana gold project in Mali.

Lion One Metals scored third this week with its Tuvatu alkaline gold project on the island of Viti Levu in Fiji. The diamond drill hole TUDDM-001 hit 14.96 grams gold per tonne over 24 metres from a depth of 81.8 metres for a grade x width of 359.04.

The hole was one of six drilled

during June, July and August in the URW1, Murau and SKL lodes, part of the Navilawa Caldera, a 7-km diameter alkaline gold sys tem, the company said. An indi cated resource from 2018 estimates 1 million tonnes of 8.5 grams gold per tonne with a cut-off grade of 3 grams gold per tonne for 274,600 oz. gold. A resource update is planned for the first quarter of next year, the company said.

“These latest results underscore the continuous, high-grade nature of the mineralization at Tuvatu,” Lion One chief executive officer Walter Berukoff said in a news release. “Each batch of drill results adds enormous value to the proj ect in both addition of ounces to the total metal budget as well as clarification of important upside potential.”

TNM

The

Geological Sur vey (USGS) and NASA are teaming up to map portions of California, Colorado, Nevada, Arizona, New Mexico and Utah for critical mineral potential.

US$16-million, five-year, government-funded project will employ NASA’s Airborne Visible/ Infrared Imaging Spectrometer high-altitude earth remote sensing platform and MODIS/ASTER Air borne Simulator to collect hyper spectral data over large regions in the arid and semi-arid western United States.

Hyperspectral data are reflec tions of light from surfaces, mea sured across hundreds of frequency bands. These measurements cap ture not only light visible to our eyes, but also bands of light beyond the visible, into the infrared.

According to the USGS and NASA, the data collected can be very useful in studying sur face rock formations because each mineral in rocks has its own

unique reflection characteristics across the various bands of light. Thus, looking for these patterns or ‘spectral signatures’ can help iden tify locations with high potential for mineral resources.

The research will also include evaluating critical mineral poten tial in mine waste.

“Mine waste is receiving increas ing attention for its potential to contain critical mineral resources, particularly those that are most often produced as by-products, while also offering an opportu nity for remediation of contami nated sites,” the agencies said in a media statement. “For instance, the USGS recently analyzed mine tailings from historical iron pro duction in the Adirondacks of New York for rare earth element potential.”

The Geological Survey has also used hyperspectral data in the past to analyze mineral potential in Alaska and has found these data useful for understanding a variety of other earth science and biolog ical issues including geologic acid

mine drainage, debris flows, agri culture, wildfires and biodiversity.

“This exciting scientific effort is made possible through President Biden’s Bipartisan Infrastructure Law’s investments and will enable NASA and the USGS to leverage our unique capabilities toward a common goal,” USGS Director David Applegate said in a news release. “The data we’re collecting will be foundational for not only critical minerals research but also for a wide range of other scientific applications, from natural haz ards mitigation to ecosystem res toration.”

The US$16 million allocated to this project is part of a larger, US$510.7-million investment pro vided by the Bipartisan Infrastruc ture Law for the USGS to support integrated mapping and interpre tation of mineral resources data, the preservation of data from geo chemical samples from the Earth Mapping Resource Initiative, and the construction of a USGS energy and minerals research center in Golden, Colo. TNM

TAKE NOTICE THAT on October 4, 2022, GPR commenced proceedings under the CCAA (the “CCAA Proceedings”) in the Supreme Court of British Columbia (the “Court”) and was granted an order (the “Initial Order”) protecting GPR from its creditors.

The Initial Order, among other things, stays all proceedings against the creditors of GPR. Pursuant to the Initial Order, Alvarez & Marsal Canada Inc. was appointed Monitor (the “Monitor”) of the business and financial affairs of the GPR.

A copy of the Initial Order has been posted on the Monitor’s website at: www.alvarezandmarsal.com/GPR

The Monitor will post additional relevant information and

the CCAA Proceedings

parties

the Monitor’s

contact the

related

they become available.

further

Alvarez & Marsal Canada Inc.

Cathedral Place Building 925 West Georgia Street, Suite 902 Vancouver, BC V6C 3L2 Telephone: (+1) 604-639-0852

Facsimile: (+1) 604-638-7441 Email: gpr@alvarezandmarsal.com

at:

The future of environmen tal, social and governance (ESG) issues in the mining industry will see Indigenous com munities commonly hold equity stakes in projects while companies become fully transparent about all operations, not just information to meet laws. These were just a couple of points to come out of a six-per son thought-leadership panel on ESG presented by SLR Consulting at The Northern Miner’s Q3 Global Mining Symposium on Sept. 28-29.

Mining companies are spend ing billions on ESG as movements such as Black Lives Matter, climate change activism and Indigenous rights gather momentum through social media and a generational shift in attitudes towards corporate responsibility. And the federal gov ernment is offering tax credits for adopting net-zero technologies and carbon capture concepts, as well as $600 million for a renewables and electrification program as part of the up to $3.8 billion announced this year to boost critical minerals mining.

“The needle is moving and now faster than ever before,” Kevin D’Souza, chief sustainability officer with Resource Capital Fund, said during the 45-minute session. “The themes that we won’t have seen really on our radars up until a few years ago, you know, diversity and equity inclusion is one that’s really come full speed.”

Panelists in the session, moder ated by SLR managing principal Stephan Theben, said the indus try has been proactive in ESG for

decades although the goalposts have moved on many issues as wider society becomes more aware and demanding. They cautioned that there was no going back to transgres sive times and that mining compa nies must fully adopt ESG measures in their culture to avoid accusations of greenwashing, when companies follow fake or misleading ESG pol icies for the sake of image.

Stephen Crozier, vice-presi dent sustainability at Ring of Fire Metals, told the session there’s an industry-wide tension concern ing how much information about operations companies should share with the public. The public won’t settle just for disclosures to meet laws, so companies had better pre pare, he said.

“We are set up for a collision here, which doesn’t have to be, you know, a destructive collision,” Cro zier said. “But there is still a big ten sion here, and the reluctance to be more specific and more transpar ent at sites is currently not helping. The sooner it is addressed, the bet ter because it’s inevitable that it will have to be addressed.”

Diversity and inclusion have become buzzwords in recent years amid the upheaval following the death of George Floyd at the hands of police in the United States, the revelations of unmarked graves at former residential schools for Indigenous children in Canada, and the wider acknowledgement of trans people, among other LGTBQ issues. That inclusion is now broad ening to more calls for mining companies to give local commu nities, especially Indigenous com munities, equity stakes in projects, Resource Capital’s D’Souza said.

“In the near future, I really do expect to see community and Indig enous community equity in mining projects,” he said. “That’s true part nership going forward. And that’s where this new ESG approach is fundamentally seen as creating that sustainable culture, not just finan cial.”

Issues such as gender parity are gaining traction, yet Pierre Grat ton, president and chief executive officer of the Mining Association of Canada, noted how skilled trade schools channel fewer women than

men into the mining work force.

“We do need to work with the schools to try to convince many more people and visible minori ties as well,” Gratton said. “A lot of immigrants come to Canada, they never think of working in the min ing sector, tend often to congregate primarily in urban areas, and our jobs are, many of them are not in urban areas.”

Part of the transformation required among mining compa nies is to move away from lingo like “social licence” and toward concepts such as creating value for communities.

“A social licence is solely about benefit to a company and the desire to secure this acceptance to oper ate,” D’Souza said. “In my entire thirty-year career, I’ve never ever once heard a community request a social licence or celebrate its exis tence, whereas creating social value is about that equity benefit sharing, maximizing procurement, employ ment and being that true partner in a community.”

Another point in a sounder approach to ESG is to become less

beholden to achieving measurable goals and more aware of meaning ful contributions that often can’t be quantified.

“There is a temptation within the ESG space to kind of reduce the effort across these really increas ingly complex domains into digest ible data points,” Crozier said. “The challenge is that in some of these areas, they’re not easily reducible to very simplified data points, or mile stones.”

Climate change remains another big ESG issue and the industry needs to embrace more electrifica tion, Jean-Marie Clouet, director of investor relations at Agnico Eagle Mines (TSX: AEM; NYSE: AEM) in Canada, said.

“If it’s an underground mine, when you have diesel equipment, you need to push a lot of air, it’s a lot of energy, you can actually reduce costs, but there’s a transi tion to be done,” he said. “There’s a lot of work that needs to be done, not just with the industry, but really with all the partners, including gov ernment, that needs to happen on a societal level.”

The panel dismissed examples of recent pushback from some inves tors on whether ESG is absolutely necessary, as coming from relics who will soon fade away.

“It’s political shenanigans,” D’Souza said, referring to com ments in the United States. “It’s making ESG politicized, which is a shame. But I think we’re just going to see it dwindle out, because these are the same people who are going to be fighting when their parts of the world are going to be suffering from climate change.”

Canadians may be a modest bunch, but when it comes to our importance in the glob al mining industry, we have a lot to be proud of.

At The Northern Miner’s Q3 Global Mining Symposium in late September, Douglas Silver pre sented data showing Canada leads the world in exploration spend ing (US$800 million per year vs. US$530 million for runner-up Australia); in capital spending on mining (accounting for 35% of the total compared to 13% for Austra lia); and the number of listed min eral companies (more than 1,400 compared with 661 for Australia).

The figures all show the “massive role” Canadians play in global min ing, said Silver, a U.S.-based geolo gist and executive who founded the Denver Gold Group. “They over shadow all the other nationalities when it comes to capital spending.”

Silver noted that Canada’s TMX Group, which operates three of the country’s five stock exchanges, and regulators such as the Ontario Securities Commission have a lot to do with our strength in mining.

“In the corporate world, money is the food that allows companies

to operate and grow. And having had the privilege of interacting with both of these groups, I can say with great conviction that their corporate cultures are one of help ing and not hindering. Their rules have been tested by time and make sense — and I can’t say that about some of the other exchanges, par ticularly ones near my home.”

The result, said Silver, is that combined, the companies listed on the TSX and TSX Venture Exchange have grown more than 160% in cumulative listed market

capitalization over the last 10 years — despite market downturns and the Covid-19 pandemic.

“The TSX and Venture exchanges complete more than 1,300 financ ings each year for mineral compa nies and this leads to literally billions of dollars in capital raised, which is what we need to go and discover, develop and operate mines,” said the 40-year mining veteran.

Silver, who started his career as an exploration geologist, has also been an executive in mining royalty and private equity firms, including Red Kite Management and its spinout company Orion Resource Partners – both major players in mine finance. Silver also founded the Denver Gold Group, and was inducted into the U.S. National Mining Hall of Fame in 2018.

Globally, Canadian companies own more than 6,100 projects in 97 countries, with the vast major ity of these projects located in North America.

Through their leadership in global mineral activity, Canadian companies have also become lead ers in creating global mining stan dards, Silver said.

“When Canadian companies operate in foreign jurisdictions,

they also take these standards with them and share them. And this elevates the world in mining practices, which is, with the cur rent emphasis on ESG, very, very important.”

During a Q&A session, moderator and Northern Miner Group pres ident Anthony Vaccaro asked Sil ver what he believes is the biggest threat to Canada’s dominance of the mining sector.

“I think the biggest threat to Canadian mining is the internet,” he replied. “Because what it allows is people that are anti-mining have an easier way to get together and fundraise.”

Silver is currently studying the root causes behind the surge in opposition to mining projects — which is coming at the same time as the EV transition, and global elec trification requires more metals.

“It sounds like a great idea,” he said of global electrification. “But there’s simply not enough deposits in the world and permitting is tak ing longer and longer to put them into production.

Governments of the world are “absolutely ignorant” on the whole subject of copper, Silver said.

“Take Resolution or Rosemont (both copper projects) in Arizona where they’re pushing 20 years since they started permitting. The governments can’t have it both ways. They can’t demand that we develop more copper mines, and then not allow us to develop them.

“So this supply delay will con tinue. And as long as the anti-min ing forces have the microphone, they will continue to delay, stall, cheat whatever it takes to prevent new mines from being built.”

Both governments and the public have important choices to make, he noted.

“Governments are going to have to decide whether they want to serve the people and upgrade their infrastructure, or whether they want to simply sit on social issues, and not have these privileges.”

Silver added: “I think the world has to decide what that balance is, between what society needs to evolve and be more innovative, and how we get those metals.”

Ultimately, Silver said that proj ect delays will just mean higher prices. “If the demand is higher than the supply, the price is going up. So what a wonderful time to be 40 years old and having a big career in the mining business!”

investment attractiveness.

BY HENRY LAZENBYThe Quebec government has formed specialized units to help mineral explorers and mine developers navigate the prov ince’s regulatory system from the discovery stage through produc tion and closure, The Northern Miner’s recent Q3 Global Mining Symposium heard.

A thought leadership panel fea turing four Quebec government representatives underlined the vast exploration potential in the province.

According to Jonathan Lafon taine, mining exploration activity monitor with the Ministry of Energy and Natural Resources, there cur rently are more than 220,000 active claims in Quebec, yet they only cover about 6% of the province.

“There’s still lots of room and an incredibly vast space to explore,” he said.

According to government data, in 2021, exploration and development spending totalled about $964 mil lion in Quebec, placing it among the top Canadian destinations for mining investment.

Quebec has one of the most diverse commodity bases in the world, from precious metals, including gold, to bulks like highgrade iron ore and critical metals such as nickel, copper, and lithium. The province used to be a lithium producer and is now regaining that role. The panel also singled out the rare earth niobium as a high-poten

tial commodity in the context of the energy revolution.

Quebec currently has about 22 mines in operation, three in care and maintenance and 33 min ing projects. They include projects owned by major players such as Rio Tinto (NYSE: RIO; LSE: RIO), Glencore (LSE: GLEN), Arcelor Mittal, Newmont (TSX: NGT; NYSE: NEM), Agnico Eagle Mines (TSX: AEM; NYSE: AEM), and BHP (NYSE: BHP; LSE: BHP).

James Moorhead, the province’s resident geologist, said Quebec has one of the best geoscientific data bases globally.

“The province’s large explora tion potential is expressed yearly through the discoveries that keep

coming,” he said.

Moorhead said gold attracts the lion’s share of exploration budgets, with about 70% of expenditures directed at finding and mining the yellow metal.

The panel stressed how all this activity is made possible by the government’s proactive approach in making free high-quality geo logical survey datasets available to explorers

“We receive about $12 to $16 million per year to send out geo logical survey teams of geologists to update our maps and to keep our data present,” Moorhead said.

Lafontaine said the government

was eager to interact with compa nies to find a collaborative and suc cessful outcome for the proponent.

“The idea is that we want to dis tribute this information as much as possible as easily as possible to various exploration groups. Explo ration done on fundamental prin ciples needs good data, and that’s what we strive to provide,” he said.

Vincent Fréchette, a mining engi neer with the Ministry of Energy and Natural Resources, said Quebec has a well-developed and transpar ent regulatory and administrative system designed to assist miners in all phases, from exploration through development, operation and mine closure. It has helped the province earn a top 10 position in the Fraser Institute’s annual survey of mining

Aside from government vehicles designed to benefit from the mineral exploration and mining business, such as Investissement Québec and Soquem, Fréchette explained that the provincial government created a Coordination Office three years ago to fast-track the mineral permitting process in Quebec.

“Through this office, we aim at ensuring a better management of timelines in issuing permits and optimize the exchange of infor mation between proponents and departments,” he said.

The office currently has four proj ects in progress. One of the cases is establishing interdepartmental tables that make it possible to offer mining proponents a personalized level of support adapted to regional realities, explained Fréchette.

He also explained how, in Que bec, the management of mining titles is computerized and easily accessible online.

The Gestion des titres miniers (GESTIM) website offers, through a geomatics application, instant access to updated data from the Register of Mining, Real and Immovable Rights of Quebec.

GESTIM can help users reduce the cost of acquiring and moni toring mining titles; consult and download data from the public register of mining rights by select ing the desired parameters; gener ate mining title maps adapted to one’s specific needs; view mining title maps and download them for free in PDF format; and to request a claim designation, among other functions.

Are ESG ratings for min ers clear enough? Are ESG principles clearly under stood by most people? What role can digital transformation play in mining?

Theo Yameogo, sector leader for EY Americas & EY Canada Min ing & Metals joined a conversation centred on the evolution of ESG and digital transformation at The Northern Miner’s Q3 Global Min ing Symposium on Sept. 29.

The current ESG landscape in Canada is characterized by a broad set of principles adopted by indus try organizations like the Mining Association of Canada, Yameogo explained.

He pointed to the TSM (Towards Sustainable Mining) and Copper Mark principles as examples, though he noted there isn’t yet consensus on which ESG standards are better than others.

EY is working with other com panies to “see if there’s some sort of a framework that actually makes it simple,” targeting listed compa

nies in North America, Yameogo said.

One benefit of a framework and more clarity around ESG prin ciples is connecting better with investors, many of whom lose interest in mining when they learn it can take 10 to 15 years until a mine starts production.

“We need to get a new set of investors that we haven’t originally tapped into,” Yameogo said. “But at this point, it’s still tough to raise money. That’s how I see us as an industry dealing with ESG imper atives, because they’re not really defined. We need to help define them. And we need to communi

cate. People don’t understand the essential role of mining and met als. We need to think about it as a sector and we need to tell the story.”

While Yameogo acknowledged that ESG is facing pushback in some quarters, mainly from CFOs towards rating agencies and “gre enwashing,” he believes the momentum of ESG is heading in the right direction.

“Many companies have been aware of ESG way before we cre ated ESG. Health and safety, [the] environment, community [health]

have always been around. We used to call them EHS [Environment, Health and Safety]…all sorts of names.

“But today, ESG is basically a formula. It is the formulation of all of this under some sort of report ing structure.”

Turning to the issue of digi tal transformation in mining, Yameogo said his approach has three steps: replicate home prac tices at work, focus on the digital purpose and structure data in a way that is meaningful for regular people.

One example that mining could replicate is from banking. While years ago when people had to wait until the end of the month to see paper statements from their banks, or go to the bank in person to see the statements, today customers can log on to an app and see their information instantly.

“Why is it that in mining, we still have month-end reports?” he asked in contrast. “These are the little steps that people should think about because this resonates with people. Why am I walking

around with paper? I don’t really use paper in my house.”

In terms of digital purpose, companies need to define what they want to be known for and lay out a roadmap instead of “run ning to every conference and buy ing the next big thing and testing this and running that,” he said. “It confuses the hell out of the work force because they don’t know the objective. What’s the purpose of the transformation? That’s usually what we talk to clients about.”

And when it comes to structur ing data, Yameogo said it’s useful to consider how exploration com panies present a project to com munities.

“How do you structure that data? How do you make it mean ingful for others? How do you… think about all your environmen tal footprint mapping?”

He gave the example of a com pany in South Africa that mod els mines in a three-dimensional, virtual reality format, giving peo ple goggles to view the model in a more engaging way.

“It’s like VR of your mine, rather than [going through] a bunch of slides.”

Educational data from the last several years reveals that young people in Canada are choosing careers other than min ing. Forecasts from the industry show that demand for mining-re lated labour will only increase this decade. It all makes for an indus try-wide dilemma and raises ques tions of how Canada can reach its potential, especially as the “EV rev olution” gathers momentum.

George Hemingway, managing partner and Innovation Practice lead at Stratalis Group joined The Northern Miner’s Q3 Global Mining Symposium on Sept. 28 to discuss job trends in mining, cultivating a sense of purpose in employees and diversity and inclusion.

The issue of sectors lacking suffi cient workforces isn’t unique to mining. Hemingway stated that in his research more broadly, 40% of the workforce was “looking to leave” their jobs in 2023, another quarter plan to leave in the next five years and others would completely change their industry.

But he noted that even though companies might be making more money than before, labour issues can’t be solved only with money.

“I think that people need a rea son to wake up in the morning, they need a reason to work, they need a reason that is more than a pay

cheque,” Hemingway said. “They need to know not just what they do, but they need to understand why they do what they do. The truth is that a lot of folks, given the choice in the work that they have today, are relatively discontent.”

The challenge of disinterest or labour shortages will continue in various sectors — including min ing — until the industries can effec tively communicate the value of the work and connect that with the needs of younger generations, Hemingway explained.

But he offered another way of looking at data showing declining interest in mining careers, and sug gested that a narrow focus on spe

cific occupations misses the bigger picture.

Miners seeking to be on the cut ting edge of technology might be recruiting tech wizards, but Hem ingway questions if more isn’t needed to tackle problems in a col laborative way.

“I think that what’s going to hap pen is we’re actually going to need less of the people that we think we need in the jobs that we think we need them in. The real challenge… will be even if you have the right people, even if you have the right technology, are you actually going to be able to transform with those people?”

As an example, he cited tailings management, a complicated pro cess that requires examining the mining process, downstream activ

ities, closure and long-term assets.

“The kind of collaborative mind set that’s needed isn’t necessarily the kind of collaborative mindset we’ve hired for,” he said. “We hire people not to be Renaissance think ers, but to be experts at what they do. It’s that white collar collabora tive thinking and that mindset of hiring people with that mold, that is going to become one of the chal lenges as well.”

Despite some efforts by miners to address public concerns that the industry wrecks the environment, Hemingway said they don’t do enough to “move the needle” and help people trust the industry.

It just doesn’t help align its pur pose enough with the values of the public.

“I think that the way that the public perception can be changed for the mining industry, is by tak ing the focus — ironically — off of mining,” he said.

He gave the example of an energy analyst working for a mining com pany in greenhouse gas reductions monitoring.

“[If] you ask them, what’s the good they do for society? Why did they do it? Well, someone that is reducing GHGs is protecting the planet. [Or] someone who is work ing in tailings isn’t just monitoring for static liquefaction or piezome ters. They are protecting communi

ties. I don’t think we do a good job at all of helping people bring that message out.”

Before the discussion closed, Hem ingway turned to the issue of diversity and inclusion, and asked whether mining companies really want to deliver on that.

“Do you really? And why? So, if the answer is, ‘well, because every body says so. And that’s what the world looks like. And if we don’t do it, we’re going to get in trou ble.’ It’s a bit of a challenge, because you don’t actually understand the value of diversity, you don’t actu ally understand the value of differ ent thinking.”

Hemingway said that diversity initiatives should focus also on diversity-of-thought.

“First having that understanding that people with diverse thoughts, different thinking, different points of view, can actually add value to how you work, and how you improve, and the kind of company you are and actually codifying what the heck that actually means. And bringing that to life is something that most companies don’t do.

“You’ve got to be able to attract that more diverse group that is com ing up through the ranks by giving them a reason why your industry is an industry that appeals to them deeply. And then… you have to make it safe to be diverse.”TNM

Canada is a global hydrogen leader, yet there is ample potential to reduce, or even eliminate, the lightest element’s carbon emissions-heavy current production methods, says Erin Bobicki, a minerals processing and microwave researcher with the University of Alberta.

Bobicki is also a founding direc tor of Aurora Hydrogen, a start-up developing technology for emis sion-free hydrogen production, which aims to fill a perceived lowcost distributed hydrogen market gap.

Bobicki explained during The Northern Miner’s recent Global Mining Symposium that the global hydrogen market entails around 90 million tonnes per year, split between about 45% to upgrade heavy oil and petroleum produc tion, and another 45% to make ammonia and the balance for other industrial uses.

As the world looks to quickly decarbonize transportation and industry, hydrogen demand is expected to increase dramatically, from US$130 billion worth today to US$2.5 trillion in 2025, accord

ing to the Hydrogen Council.

Bobicki stressed that there is an urgent need to develop new lowcost and low-carbon technologies for hydrogen production.

“There’s a lot of hydrogen con sumed today, and decarboniz ing those processes and producing clean hydrogen is important for many industries as they navigate along the path to achieving netzero emissions targets,” Bobicki said.

The researcher notes that hydro gen has become an accepted pil lar on that path since it’s a cleaner alternative to fossil-fuelled technol ogies and for applications where electricity is not suitable. Its appli cations are multiplying rapidly.

“Where a chemical fuel is desir able, hydrogen fits the bill in many respects. In applications like longhaul transportation, when you need assets available 24/7, you don’t have time to stop and charge for a period when you want to be hauling goods instead of waiting. So, batteries are hefty to lug around if we look at the long haul, trucking, trains and shipping applications.

“And so, hydrogen has been identified as a better fit for the decarbonization of those indus tries, compared to electric vehi cles,” she said.

Even household applications stand to benefit from hydrogen, such as for space heating in a cold climate like Canada’s. She suggests

blending hydrogen with natural gas is a crucial way to decarbonize many industries.

Importantly, Bobicki also pointed out that when it comes to transportation applications, hydro gen is not beholden for use only in platinum-heavy fuel cells in a vehi cle since it can be blended with diesel and used in the regular oper ation of an internal combustion engine.

“Those engines are commercial. You can buy those,” Bobicki said. “In addition, you can blend up to 5% hydrogen into natural gas with out much of an issue and use it in most home appliances available today.”