Stuart ‘Tookie’ Angus remembered as a ‘rainmaker,’ mentor, and ‘brilliant’ lawyer

OBITUARY | ‘He became. . . not merely one of our lawyers, but rather one of us’

Glencore sweetens offer for Teck

TECK.A/TECK.B;

The revised proposal, announced on Apr. 11, gives Teck’s shareholders the option to receive cash instead of exposure to the companies’ combined coal portfolio, plus a 24% stake of the combined metals-focused business.

The Swiss miner and commodities trader’s original all-stock deal was to acquire Teck and then separate itself into two companies, with one unit holding assets in thermal and metallurgical coal, as well as oil, and the other containing its base metals portfolio.

Teck’s chief executive Jonathan Price, who took the company’s top job in September, said on Apr. 10 that Glencore’s original proposal was structurally flawed and “a complete non-starter.”

Our

Price added that an acquisition by Glencore would destroy value for the company’s shareholders as it would reduce their exposure to copper and expose them to “significant jurisdictional, ESG [environmental, social and corporate governance] and execution risks.”

But with its fresh offer, Glencore said it would effectively buy Teck’s shareholders out of their coal exposure. It acknowledged that certain investors may prefer a full coal exit while others may just want to cut their thermal coal exposure.

Glencore CEO Gary Nagle said Teck should review the sweetened deal and delay the vote on its own plans to split the business, which is scheduled for Apr. 26.

“We believe that it is in your shareholders’ interests to engage with Glencore and we see no valid reason not to delay your shareholders meeting,” Nagle said in a statement.

See TECK / 5

The Howe Street investment community is grieving the loss of industry veteran Stuart ‘Tookie’ Angus.

Angus, who leaves a deep mark after a 50-year career in the industry, peacefully passed surrounded by loved ones on Mar. 24 at the age of 74.

Those who knew Angus say his empathy for other people, deep understanding of finance and mining, and exceptional work ethic made him indispensable in the tightly knit Vancouver mineral exploration and mining industry.

“Tookie put people together, he mentored and advised a whole generation of geologists and promoters on how to make good deals, and he was integrally involved in mergers valued at over $8 billion,” says industry heavyweight Ross Beaty, who first met Angus in 1978 and says he was ultimately involved in more than 5,000 transactions.

“He got deals completed, something few lawyers know how to do. He was a vibrant, dynamic and brilliant business lawyer who was an integral part of the Vancouver and Canadian mining scene for decades.”

Beaty, who counted Angus as a close friend as well as a business colleague, credits Angus, who was a director of his first company, with helping him sell it to a U.S. mining firm in 1994.

Angus integrated himself into the industry because he was interested in it, Beaty says. “He voraciously read mining publications

The Northern Miner, got to know the dealmakers, and was smart and enjoyable to work with,” he says.

Angus had an extensive legal and mining background, starting with his graduation from the University of British Columbia with a Bachelor of Law degree. During his career, he founded Fasken’s Global Mining Group, leading the practice for five years before moving to Endeavour Financial where he and served as managing director of mergers and acquisitions. He was also a retired member of the Law Society of British Colum-

bia, and served as a director or advisor to countless juniors over the years.

Beaty especially liked Angus’s enthusiasm for deals and for people

See ANGUS / 7

PM40069240

EXCERPT FROM VIRGINIA HEFFERNAN’S NEW BOOK ON THE RING OF FIRE / 8 905 841 5004 | geotech.ca VTEM™ | ZTEM™ | Gravity | Magnetics Geotech_Earlug_2016_Alt2.pdf 1 2016-06-24 4:27:20 PM WWW.SGS.COM/MINING MINERALS@SGS.COM DELIVERING QUALITY EXPERTISE GLOBALLY ACROSS THE ENTIRE MINING LIFE CYCLE expert advice from exploration to closure .com SPECIAL FOCUS BATTERY METALS Companies searching for lithium, graphite, nickel and more / P10-16 APRIL 17 — 30, 2023 / VOL. 109 ISSUE 8 / GLOBAL MINING NEWS • SINCE 1915 / $5.25 / WWW.NORTHERNMINER.COM

HIGHLIGHTS FROM THE FEDERAL BUDGET’S $21B CLEAN TECH PUSH / 2

You, your project, and the nancier are on different continents…

We’re your common ground.

global experience gives you expert integrated solutions at every phase of your mining project

NYSE: TECK) by adding a US$8.2-billion cash component to its original US$23-billion bid for Canada’s largest diversified miner.

Teck Resources’ Highland Valley Copper mine in B.C. TECK RESOURCES

Stuart ‘Tookie’ Angus

Robertson GeoConsultants (RGC) and SRK Global today announced the passing of Andy Robertson on March 29. Andy was a founder of both companies. He was 79.

Andy was born in Pretoria, South Africa, and moved to Vancouver, Canada, in 1977.

Our hearts are with his family, as we share in their loss. A celebration of life will be held within the next few months.

We invite you to read about his life and history with SRK and RGC below.

Dr. Andrew (Andy) MacGregor Robertson was born in 1943 in Pretoria, South Africa, where he was exposed to mining from a very young age. In 1966, he graduated with a BSc in Civil Engineering from the University of Witwatersrand in Johannesburg, South Africa, and completed his PhD there in 1977.

Over the next 50+ years, Andy’s remarkable consulting career developed serving the mining industry with a strong focus on improving mine waste management practices to reduce the environmental footprint of mining. During this time, he cofounded two very successful mining consulting firms, a mine planning software company, and a mining technology company.

In February 2014, Andy was inducted into the International Mining Technology Hall of Fame for his work in environmental management and stewardship.

Well before that honor, in 1974 when Andy was just 30 years old, he, Oskar Steffen, and Hendrik Kirsten formed Steffen, Robertson & Kirsten in Johannesburg, South Africa. At the time, SRK was the only consulting firm in Africa to specialize in mining geotechnics.

Four years later in 1977, Andy moved to Canada to start the first international branch of what became SRK Consulting. Several offices in the US were formed under his guidance. In these early formative years of the company, he provided strong guidance and mentorship to many young engineers and geoscientists. Many went on to develop distinguished careers within SRK as well as other consulting or mining companies. Today, SRK has over 1600 employees worldwide in 40+ offices.

In addition to SRK, Andy developed several other companies that serve the mining industry. He supported the development of Gemcom in 1981, the mining industry’s first PC-based exploration database as well as ore deposit modelling, and open pit mine planning software system. In 2012, Gemcom was sold to Dassault Systèmes, owner of GEOVIA.

In 1989, Andy launched InfoMine, with the vision of making mining information more widely available. He spearheaded the digital strategy that became the cornerstone of the company and under his leadership, InfoMine expanded to include EduMine.com (training), CareerMine (recruitment), and Mining.com (news).

In 1995, Andy founded Robertson GeoConsultants, a specialised, international mining consultancy based in Vancouver, BC. His consulting practice included serving on several peer-review panels and independent review boards for some of the highest and most challenging tailing dams in the world.

From the 1980s to 2000, Andy worked on foundational research for the testing, prediction, and control of acid rock drainage (ARD). He was a contributing member of the British Columbia ARD Task Force from 1985 to 1990, which published some of the industry’s first ARD guidelines. Andy wrote or contributed to industry technical guides on mine waste management, uranium mill waste disposal, and guidelines for the rehabilitation of mines. These guidelines established the foundation for environmental best practices in the industry.

Andy’s interest in raising industry standards was a pervasive theme through his work. He was instrumental in pioneering the use of failure mode and effects analysis (FMEA)—one of the first systematic techniques for failure analysis—and multiple accounts analysis (MAA) for engineered solutions in the mining industry. In the late 1990s, he published several papers on the use of FMEA and MAA that are still commonly referenced today in the mining industry.

During his career, Andy worked tirelessly to protect the environment, communities, water quality, and water supplies. He leveraged his background in rock mechanics, geotechnical engineering, and geochemistry to raise the bar for environmental stewardship within the industry and for the work products he delivered.

Andy was passionate about improving the design, construction, operation, and closure of tailings dams. To make tailings dams safer, he advocated for improving the technology used for the design, construction, and long-term stability of tailing dams; for fiscal responsibility in the construction and operation of these dams; and for governance so today’s designs account for the needs of future generations and changes in societal expectations.

Beside Andy’s brilliant mind, business acumen, and ability to spot talent, he was also admired for his humility, kindness, and generosity. Andy was always willing to share his knowledge through publications, courses, and countless meetings and discussions. His legacy will live on in all the engineers and scientists he has mentored over his remarkably long and successful career. Truly a great man!

Federal budget gives clean tech and critical minerals a $21B push

OTTAWA | Includes a 30% tax credit for clean tech, promises to quicken mining approvals

BY COLIN MCCLELLAND

Ottawa plans to spend $21 billion over five years on clean technology in one of the main platforms affecting the mining industry contained in this year’s annual federal budget.

Finance Minister Chrystia Freeland said the amount, including a 30% investment tax credit to boost clean-tech manufacturing, especially in the electric vehicle (EV) supply chain, could expand to $80 billion by 2034.

“We are going to make Canada a reliable supplier of clean energy to the world,” Freeland said in Parliament on Mar. 28. “And, from critical minerals to electric vehicles, we are going to ensure that Canadian workers mine, and process, and build, and sell the goods and the resources that our allies need.”

The tax credit for capital investments in manufacturing equipment will apply to purchases of equipment used to extract and process critical minerals used in EVs and to purchase equipment used in manufacturing along the entire EV supply chain, including for batteries.

Pierre Gratton, president and CEO of the Canadian Mining Association, welcomed the budget initiatives.

“I am optimistic that with these new measures Canada will be able to attract new private sector investment

into Canada’s mining, smelting and refining industry, creating well-paid jobs for Indigenous and non-Indigenous Canadians across the country,” Gratton said in a statement.

Freeland had promised to boost Canada’s green energy stimulus after the United States approved the Inflation Reduction Act last year. It provides nearly US$370 billion in incentives for investing in clean technology.

Tied to minerals strategy

Last year, Canada approved nearly $3.8 billion for spending until 2030 in its critical minerals strategy. It included $1.5 billion for infrastructure, roads and power lines, the same amount for projects, as well as money for research and development, such as geoscience.

The clean technology subsidies announced in this year’s budget are to be based on the wages earned by workers in the companies applying for aid; the higher the wages, the more financial help they would qualify for, according to the budget.

The budget also contains a 15% refundable tax credit for eligible investments in non-emitting electricity generation systems. These also include abated natural gas electricity-fired electricity generation, stationary electricity storage systems, and equipment for the transmission of electricity between provinces and territories.

There’s also a commitment to improve the efficiency of the impact assessment and permitting processes for major projects by the end of 2023.

The budget formalizes amounts contained in last year’s critical minerals strategy, such as re-allocating $1.5 billion within the Strategic Innovation Fund to support projects in sectors including clean technologies, critical minerals and industrial transformation. It also marks $1.5 billion of the critical minerals infrastructure fund to help pay for energy and transportation projects associated with critical minerals.

The Liberal government also said it would support loans to Indigenous communities to help them purchase equity stakes in major projects through the Canada Infrastructure Bank.

Regarding the total amount of spending, Canada’s budget deficit will expand to $40.1 billion next year instead of shrinking to a balanced budget by 2028, as put forward in the fall economic statement last year, because of greater chances of a recession and higher debt servicing costs.

The country recorded a deficit of $6.44 billion in the first 10 months of the 2022-2023 fiscal year, compared with a deficit of $75.29 billion during the same period in the last fiscal year, the finance ministry said. TNM

‘There will be no Ring of Fire’ chant First Nation leaders in Ontario legislature

INDIGENOUS RIGHTS | Three connecting roads proposed for RoF

BY HENRY LAZENBY

Two ranking leaders of an Ontario First Nation were forced to leave the provincial legislature on Mar. 29 after rowdily accusing the Doug Ford government of failing to consult them about mining development in northern Ontario’s Ring of Fire region.

The leaders of Neskantaga and four other First Nations, including about 80 community members, travelled to Queen’s Park from northern Ontario and appealed to the Ford government to halt mining development until the Indigenous communities have been consulted.

“There will not be a Ring of Fire. [There has been] no free and prior informed consent,” Christopher Moonias, inbound chief of Neskantaga, shouted at a steel-faced Premier Ford from the legislature gallery on Mar. 29. “Doug Ford, you come and meet me.”

Moonias was shortly after escorted out of the room. Wayne Moonias, the current chief of Neskantaga, who joined Christopher in a chant against the Ring of Fire, was also escorted out.

Responding to allegations of a lack of consultations about the Ring of Fire during the session, Ontario’s Minister of Indigenous Affairs, Greg Rickford, told the legislature that the Ford government is focused on “consensus and rela-

tionship building.”

At least six provincial and federal environmental studies are underway to build the first road into the emerging Ring of Fire mining camp. It would connect the regional highway network to the development — but could cost at least $2 billion. Ford’s government has pledged $1 billion and repeatedly asked the federal government to match its commitment.

The Marten Falls and Webequie First Nations are the proponents for the road, which is proposed to be developed in three segments and are leading consultation processes with at least nine other First Nations communities. They are also leading an environmental assessment process for the 200-km Marten Falls access road, a 107-km road between Webequie

and the Ring of Fire, and the 155km Northern Link road to connect the two roads.

Several other First Nations whose traditional territories edge the Ring of Fire, 540 km northeast of Thunder Bay, Ont., are fervently opposed and argue they have not been adequately consulted in the development process.

Ring of Fire Metals’ Eagle’s Nest is the area’s most advanced project. According to a 2012 feasibility study, it has proven and probable reserves of 11.1 million tonnes grading 1.68% nickel, 0.87% copper, 0.87 gram platinum per tonne, 3.09 grams palladium and 0.18 gram gold.

Ring of Fire acquired the assets via a takeover of Noront

2 APRIL 17 — 30, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

See PROTEST / 6

Christopher Moonias, inbound chief of Neskantaga First Nation, confronts Ontario Premier Doug Ford in the Legislature on Mar. 29. ALAN S HALE/TWITTER

THANK YOU TO OUR VALUED SPONSORS

DIAMOND SPONSOR

PLATINUM SPONSORS

MINING COUNTRY SPONSORS

PATRON SPONSORS

®

PREMIER SPONSORS

Celebrating 20 Years

GOLD PLUS SPONSORS

GLOBAL MINING NEWS THE NORTHERN MINER / APRIL 17 — 30, 2023 3

SAVE THE DATE: MARCH 3–6, 2024 | pdac.ca/convention

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

Mining’s brand needs to catch up with its importance to humanity

Any public figure knows that they must brand themselves early — or risk being branded in an unflattering light that could well stick. Ask any of the victims of former U.S. president Donald Trump — a master of branding and image, if, debatably, little else.

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF:

Alisha Hiyate, BA (Poli Sci, Hist) ahiyate@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

SENIOR STAFF WRITER: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PODCAST HOST: Adrian Pocobelli, MA (Engl) apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/

CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE:

(416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 moliveira@northernminer.com

ADDRESS: Toronto Head Office 225 Duncan Mill Road, Suite 320 Toronto, ON, M3B 3K9 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES: Canada: C$130.00 one year;

G.S.T. to CDN orders. 7% P.S.T. to BC orders 13% H.S.T. to ON, NL orders 14% H.S.T. to PEI orders 15% H.S.T. to NB, NS orders

U.S.A.:

COMMENTARY

What the EU’s Critical Raw Materials Act means to miners

New act’s ambitious goals lack legal force

BY ROBERT BRADSHAW Special to The Northern Miner

BY ALISHA HIYATE

The mining industry has a well-established brand, but it could use a spit shine. Although the sector has made tremendous advances in lowering its environmental impact and creating more positive social impacts, it’s still seen by many as dangerous, polluting, exclusionary and a technological laggard.

This may be starting to change. Awareness of the importance of critical minerals to the technology that people know and love has grown, aided by Tesla CEO Elon Musk’s pleas for miners to “mine more nickel” and his musings that the EV manufacturer could get into lithium mining itself.

A public opinion survey commissioned by the Mining Association of Canada (MAC) and conducted by Abacus Data in 2022 found that, at least in Canada, the mining sector has finally moved to being seen as a contributor to climate change solutions rather than just a contributor to climate change.

Within Canada, the recognition that the industry creates well-paying jobs and contributes to the economy also seems to engender support, with 80% of respondents saying they have a positive impression of metals and minerals producers in the country. MAC noted that support for new mining projects in Canada rose to 67% of respondents in the survey, up from 61% the previous year, and that rose further to 83% support if respondents knew the projects would have a plan to reduce greenhouse gas emissions.

But the lack of interest among younger talent in joining the sector shows there’s still a long way to go to win the public over. Even though Gen Z, who are just entering the workforce now, seek work that offers purpose and a chance to make a difference and also feel existential anxiety about climate change, they are not inspired by a career in mining, despite its central role in the energy transition.

Failure to attract — and keep — talent

In a February 2023 post entitled: “Has mining lost its luster? Why talent is moving elsewhere and how to bring them back,” consulting firm McKinsey & Co. noted that enrolment in mining engineering programs has dropped by a staggering 63% since 2014 in Australia, while mining program graduations in the United States have fallen by 39% since 2016.

“Mining is not currently an aspirational industry for young technical talent to join,” the report’s authors wrote.

“Recent public failures of the industry relating to safety, destruction of Indigenous cultural sites, and workplace culture have also adversely affected the mining sector’s ability to attract talent. Accordingly, we expect that the mining industry will be asked to make significant progress in coming years around increased accountability for ESG issues, scaling of renewables on-site, automation, and a changing associated workforce.”

Neither is the mining sector able to retain the talent it already has. According to McKinsey, mining job vacancies in Australia have more than doubled since February 2020.

“The employee value proposition in mining has started to deteriorate and this is showing up in industry data, with demand outstripping the supply of mining talent,” wrote the authors.

Now that the push for a secure Western supply of critical minerals and manufacturing is truly on, it’s past time for the mining sector to step up its engagement with society. The billions in commitments from the Canadian government in their 2022 and 2023 budgets (see page 2) and hundreds of billions of dollars from the U.S. government for the energy transition (see last week’s editorial), represent a level of support from Western governments that hasn’t been seen in generations — and that many have compared to a war-time like effort. There’s a risk that this investment could get ahead of public support for mining, as well as the mining sector’s ability to attract talent.

A couple of current trends could make a big difference.

The recent willingness of automakers such as Stellantis and General Motors to invest in mining companies could provide a golden opportunity for miners, who don’t sell anything to consumers directly, to connect with the public.

And with mining companies now able to measure their Scope 1 and 2 emissions, their water intensity, and other impacts, and making headway on Scope 3 emissions (which are indirect emissions created offsite), they are closer than ever before to being able to demonstrate that mining can be a positive for the environment, for communities, and for society. TNM

The EU published its proposed Critical Raw Materials Act (CRMA) on Mar. 16, with the ambitious goal of “establishing a framework for ensuring a secure and sustainable supply of critical raw materials.” While the proposal contains much to be celebrated, the question remains whether the proposed legal framework goes far enough to make the EU’s goals a reality.

The European Commission has set out the EU’s critical raw materials problem in stark terms. The EU is heavily reliant on imports of minerals like lithium, cobalt, copper and rare earth elements that are critical to strategic sectors of the economy and the energy transition. Many of those imports come from a handful of countries or even a single country: the EU sources 98% of its rare earths and 97% of its magnesium from China. EU members are concerned that supplies could face disruption, price hikes or be used as a geopolitical tool (as seen with Russian oil and gas). Supply chain risks are compounded by ballooning demand from the renewable energy and tech sectors, with EU demand for rare earths set to grow five times, and lithium twelve times, by 2030.

What the CRMA says…

As announced last September, the proposed CRMA intends to break this “quasi-monopoly” with a two-fold approach.

First, the CRMA aims to reduce reliance on imports by promoting extraction, processing and recycling of critical raw materials within the EU. This means investing in Europe’s untapped resources, including rare earths in Sweden; lithium in France, Germany, Spain and Portugal; and magnesium and graphite in Romania. The CRMA will oblige EU member states to draw up national exploration programs and to designate a national authority as a “one-stop shop” for permitting critical raw material projects. Mining projects designated by the European Commission as “strategic projects” will benefit from a streamlined permitting process lasting a maximum of two years, as well as EU support in facilitating financing and offtake agreements.

Second, the CRMA envisages that “strategic partnerships” with non-EU states will diversify imports, making supply chains more resilient. To date, the EU has concluded partnerships with Canada, Ukraine, Kazakhstan and Namibia to foster cooperation on trade and investment in critical raw materials. Talks between the EU and U.S. are underway on a similar partnership. The EU also plans to improve bargaining power by creating a club of authorities and businesses to jointly purchase the most vital critical raw materials, so-called “strategic raw materials” like boron, copper, cobalt, lithium and platinum.

Accompanying these reforms are ambitious targets. By 2030, the

EU aims to extract 10% and process 40% of its strategic raw material needs domestically. No single country should account for more than 65% of the EU’s annual consumption of any one strategic raw material.

… and what it doesn’t

The CRMA sends the right messages and has been welcomed by the industry, even though it will have to pass through the European Parliament and Council before it can become law, something that will take some time. But while the EU may talk the talk, there is doubt over whether the CRMA contains enough detail and legal force to support its ambitions. The EU’s targets are aspirational, with no legal mechanism to enforce them. Similarly, its vaunted strategic partnerships, as the proposed CRMA acknowledges, are established only in “non-binding” instruments.

Given that it champions more non-binding partnerships with resource-rich nations, it is perhaps surprising that the CRMA does not mention existing binding instruments – namely, treaties for the promotion and protection of investments, in particular bilateral investment treaties (BITs). Those treaties play a key role in protecting mining investments and resolving disputes.

Explorers, developers and producers in critical raw materials, like other mining companies, must reckon with the risk of disputes with host governments. In the past year alone, legal claims have been threatened or launched against the Democratic Republic of the Congo (DRC), Chile, Panama and Denmark over the authorities’ alleged unfair treatment of critical raw material projects. Issues with host governments – ranging from disagreements over royalties to blockades of mines – can bring supply chains grinding to a halt. The risk is particularly acute for critical raw materials given their strategic importance, which is only likely to grow. Political risk, whether in the form of nationalization, bans on ore exports or other measures, may make shareholders and financiers think twice before sinking the billions needed into exploring and extracting new resources.

Where disputes arise, one of the first questions investors ask is, “what are my rights?” – which is where BITs come in. BITs provide investors with safeguards against hostile government action, such as expropriation or discriminatory treatment, and often provide a neutral forum to resolve disputes with the host government as an alternative to the local courts. The EU has begun to include investment protection chapters, covering many of the same protections as BITs, into free trade agreements like those with Canada and Singapore.

In its communication accompanying the CRMA, the European Commission notes the role of the EU’s trade and investment agreements in creating an “investor friendly, predictable and stable” business environment. It points

4 APRIL 17 — 30, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

5%

C$172.00 one year Foreign: C$222.00 one year GST Registration # 809744071RT001 (ISSN 0029-3164) CANADA POST: Return undeliverable Canadian addresses to Circulation Dept. c/o The Northern Miner 225 Duncan Mill Road, Suite 320 Toronto, ON M3B 3K9 Publication Mail Agreement #40069240 Periodicals Postage Rates paid at Niagara Falls, NY, 14304. U.S. office of publication 2424 Niagara Falls Blvd, Niagara Falls, N.Y. 14304. U.S. POSTMASTER: send address corrections to: Northern Miner Box 1118 Niagara Falls, N.Y. 14304.-7118 THE NORTHERN MINER is published biweekly by Glacier Resource Innovation Group, a division of Glacier Media Inc., a leading Canadian media company with interests in business-to-business information services. From time to time we make our subscription list available to select companies and organizations whose products or services may interest you. If you do not wish your contact information to be made available, please contact us by one of the following methods: Phone: 1-888-502-3456; Fax: (416) 447-7658; Mail to: Privacy Officer, The Northern Miner, 225 Duncan Mill Road, Suite 320, Toronto, ON M3B 3K9.

EDITORIAL

DEPARTMENTS Special Section: Battery Metals 10 Professional Directory 17 Market News 18 Metal, Mining and Money 20 Stock Tables 20-23 COMPANY INDEX Albemarle 12 Allkem 12 Arras Minerals 5 Barrick Gold 6, 7 Brunswick Exploration 14 Canada Silver Cobalt Works 14 Cannindah Resources 5 Challenger Exploration 5 FE Battery Metals 14 First Quantum Minerals 7 FPX Nickel 16 Frontier Lithium 14 Glencore 1, 16 Graphite One 14 Infinitum Copper 10 Livent Corp 12 Midland Exploration 7 Mineral Resources 12 Nevada King Gold 5 New Found Gold 5 New Pacific Metals 5 NGEx Minerals 13 NOA Lithium Brines 15 Osisko Mining 5 PalladiumOne Mining 16 Piedmont Lithium 12 Pilbara Minerals 12 Power Nickel 15 Prismo Metals 10 Probe Gold 5 Rio Tinto 7 Santana Minerals 5 Sayona Mining 12 SQM 12 Standard Lithium 15 Teck Resources 1 Taseko Mines 6 Vizsla Copper 5 Vizsla Silver 10 Winsome Resources 13 See EU / 5

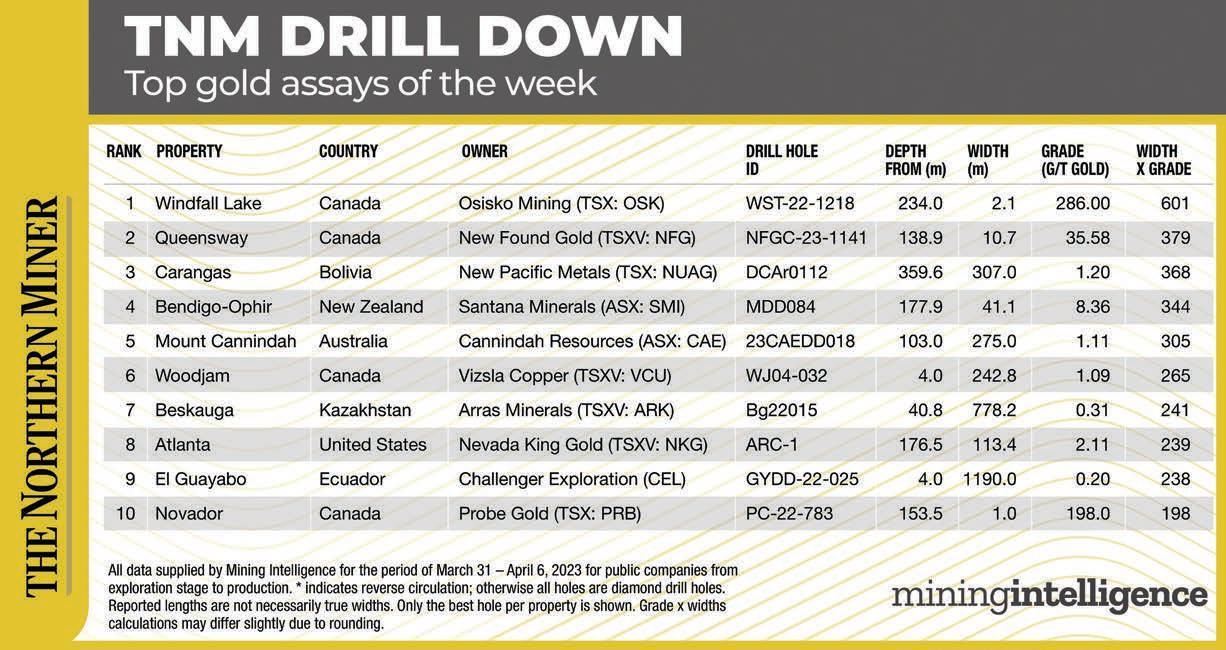

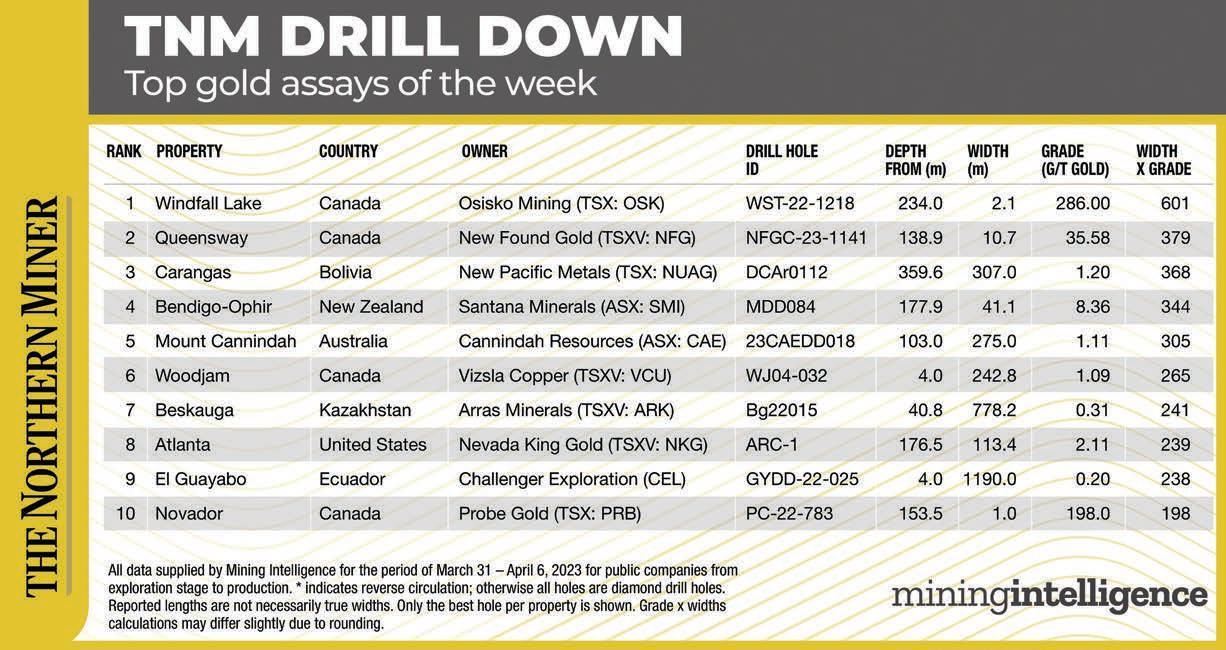

Osisko Mining leads week’s gold assays at Windfall in Quebec

BY BLAIR MCBRIDE

Our TNM Drill Down features highlights of the top gold assays of the past week. Drill holes are ranked by gold grade x width, as identified by our sister company Mining Intelligence.

The top gold assays for the week Mar. 31-Apr. 6 come from projects in the Americas — specifically, Canada and Bolivia. Osisko Mining (TSX: OSK) leads the rankings for the week with its Windfall project in Quebec. On Apr. 5, the company reported that hole WST-22-1218 returned 2.1 metres grading 286 grams gold per tonne from 234 metres depth, for a grade x width value of 601. WST-22-1218 was drilled as part of a targeted feasibility study surface drill campaign that was completed in September at Windfall, in the Abitibi greenstone belt in the Eeyou Istchee James Bay region.

Over the past six months, Osisko has drilled more than 55,000 metres across 45 holes that have targeted expansion and infill work at the Lynx segment of Windfall. The holes are aimed at upgrading inferred resources to measured or

to the EU’s trade deal with Chile agreed in December 2022, which includes an investment protection chapter covering EU investors in Chile and vice versa. Chile, notably, accounts for more than 60% of the EU’s lithium imports. The European Commission intends to expand the EU’s network of trade and investment agreements, which it describes as “complementary” to the strategic partnerships on critical raw materials.

It’s a promising move but there is a long way to go before new trade and investment treaties can enter into force. Even once the ink is dry on the EU-Chile agreement, it must be ratified by all 27 EU member states (a process which has lasted almost nine years in the case of the EU-Canada Comprehensive Economic and Trade Agreement). In

TECK from 1

Copper booty

Experts had anticipated that Teck’s decision to split the business in two would make it a takeover target. The company owns four copper mines in South America and Canada, which produced 270,000 tonnes combined last year.

Teck also expects to double copper output after the second phase of its Quebrada Blanca (QB) project in Chile ramps up to full capacity by the end of 2023.

Glencore believes that operating Quebrada Blanca jointly with the nearby Collahuasi mine, in which the Swiss multinational holds a 44% stake, would add at least US$1 billion of value to its coffers.

Top miners are hungry for copper assets as demand for the metal accelerates and a global shortfall looms. BHP, Rio Tinto and Glencore itself have disclosed that they are actively looking to grow their copper exposure.

indicated. According to a feasibility study published in November, the project has probable reserves of 12.1 million tonnes grading 8.1 grams gold for 3.2 million oz. of contained metal. Measured resources total 811,000 tonnes grading 11.4 grams grams gold for 297,000 oz., indicated resources come to 10.2 million tonnes grading 11.4 grams

the meantime, investors in many resource-rich countries may be left without treaty protection. The DRC, for example, produces around 70% of the world’s cobalt but has BITs in force with only two EU members, France and Germany.

Where does this leave miners? If passed, the CRMA should make the EU a more attractive investment destination for critical raw materials projects. But, for both miners investing in the EU and those investing in other countries who are planning to supply the EU’s critical raw material demand, it is important to regard the legal framework beyond just the CRMA. That includes structuring investments — or reviewing existing investments — to optimize their protection under existing BITs or other investment treaties. When planning a project as a foreign investor, it is arguably as important to con-

For Glencore, acquiring Teck would be its biggest acquisition since buying Xstrata in 2012 and it would “unlock approximately US$4.25 billion — US$5.25 billion of post-tax synergy value,” according to the company.

Teck’s controlling shareholder, Norman Keevil, has said he would not sell to a foreign company at any price.

He already has the support of key stakeholders, including gold magnate Pierre Lassonde, who told The Globe and Mail he’s planning to buy a stake in Teck’s spinoff coal company to protect it from a foreign takeover.

Top Teck investor backs its separation plan Egerton Capital UK, the seventh-largest holder of Teck’s class B shares, has also said it will back the miner’s restructuring plans.

Teddy Molson, a partner with Egerton, told Bloomberg News he believes that splitting Teck into two

gold for 3.7 million oz.; and inferred resources total 12.2 million tonnes grading 8.4 grams gold for 3.3 million ounces.

The second-best gold assay of the week came from New Found Gold’s (TSXV: NFG) Iceberg discovery at its Queensway project in Newfoundland. On Apr. 4, the company

sider investment treaties as it is to consider the tax treaties in force. Waiting until a dispute is on the horizon often proves to be too late. Rather, taking advice at an early stage is essential, especially as political risk is one barrier to investment that the CRMA does not address.

reported that hole NFGC-231141 returned 10.6 metres grading 35.6 grams gold, for a grade x width value of 377. That hole was a 50-metre step-down from hole NFGC-23-1120, which cut 29.8 metres of 49.7 grams gold and 3.8 metres of 14.6 grams gold, as reported in March. Iceberg is a high-grade zone located northeast of the Keats Main area, along the prospective Appleton Fault Zone.

part of the wider 500,000-metre program at Queensway.

So let’s hear two cheers for the CRMA. The EU is taking the problem of critical raw material supplies seriously and has set itself the worthy ambition of promoting investment in mining. But to secure supplies and satisfy the explosion in demand, it will take more than just voluntary targets and partnerships — investment protection needs to be part of the solution too.

Robert Bradshaw is an international disputes lawyer at LALIVE practicing in the mining and energy sectors. The opinions expressed in this article are his own.

Mineralization at Iceberg starts at surface and drilling has traced it along more than 50 metres of strike and more than 80 metres down-dip. It remains open along strike and to depth. Drilling continues inside the projection of the prospective Keats-Baseline Fault Zone in search of more near-surface high-grade gold mineralization,

TNM

autonomous companies is “much more attractive” to prospective buyers.

The firm owns 2.25% of Teck’s class B shares, which makes it the seventh-largest holder of the stock.

Teck operates under dual-class structure in which the family of octogenarian mining mogul Norman Keevil owns the majority of class A “supervoting” shares, each worth 100 votes. The class B shares are worth one vote each.

The business split requires twothirds support from both class A and class B shares, meaning that investors with a small percentage of the total voting rights could have the power to sink the company’s vision.

The Vancouver-based miner is urging investors to back the proposed restructuring while fending off Glencore’s bid.

If Glencore ends up acquiring Teck, the deal would go down in history as one of the world’s biggest-ever mining takeovers. TNM

The third-best drill assay for the week comes from New Pacific Metals’ (TSX: NUAG) Carangas project in western Bolivia. Hole DCAr0112 returned 306.9 metres from 359.5 metres depth grading 1.2 grams gold per tonne, for a grade x width value of 368. On Apr. 6, the company reported assay results of the last 29 holes from its 2022 program, 10 of which are deep holes drilled in locations towards the Central Valley anomaly that overlays the gold mineralization system at Carangas. New Pacific’s 15,000 metre drill program for 2023 is almost finished, and its results, as well as results from previous two years, will be used in an initial resource expected in the second quarter of 2023. TNM

GLOBAL MINING NEWS THE NORTHERN MINER / APRIL 17 — 30, 2023 5

TNM DRILL DOWN:

EU from 4

Barrick Gold, PNG ink new deal

to restart Porgera mine

Taseko beefs up economics for Florence ISR copper project

ARIZONA | Florence retains strong economics despite capital creep

BY HENRY LAZENBY

Taseko Mines (TSX: TKO; NYSE-AM: TGB; LSE: TKO) says operating its Florence Copper production test facility in Arizona over the past 18 months has increased its confidence in the in-situ recovery (ISR) project, and it’s ready to begin construction as soon as its permits come through.

BY CECILIA JAMASMIE

BY CECILIA JAMASMIE

The Porgera gold mine in Papua New Guinea (PNG), halted since 2020, is closer to resuming operations with a new deal signed by the country’s government, Barrick Gold’s (TSX: ABX; NYSE: GOLD) local subsidiary and New Porgera.

Under an agreement inked on Mar. 30, all parties have committed to push forward Porgera’s reopening, starting by filing for a special mining lease.

“It’s been a long journey but in the process we have secured the buy-in of all the stakeholders,”

Barrick CEO Mark Bristow said.

“The reopening of the mine would represent another victory for our host-country partnership model which has been so successful in Tanzania and has now also been adopted for the new Reko Diq copper-gold project in Pakistan.”

Barrick and its partner, China’s Zijin Mining, became embroiled in a dispute with the government and locals in 2020 over benefits sharing while attempting to renew the mine’s licence.

The standoff was resolved in April 2021 through two deals which gave the PNG government a majority stake in Porgera. Barrick and Zijin agreed to halve their stakes.

New Porgera, as the mine is now called, is 51% owned by PNG stakeholders, including local landowners and the Enga provincial government.

Economic benefits will be shared 53% by the PNG stakeholders and 47% by Barrick Niugini Limited, the mine operator.

The vast gold mine is an open pit and underground operation in PNG’s central Enga province, about 600 km northwest of Port Moresby.

It hosts an orebody with measured and indicated resources of 10 million oz. and inferred resources of 3.4 million oz. of gold.

It produced about 600,000 oz. of gold in 2019, before being put on care and maintenance.

After initial ramp up and optimization of the Wangima pit, Porgera is forecast to produce an average of 700,000 oz. per year. TNM

JENNIFER PELL REST IN PEACE

The Vancouver, B.C.-based base metals miner released updated economics for the project at the end of March in a new technical report. The new figures show an after-tax net present value (NPV) using an 8% discount of US$930 million and an after-tax internal rate of return (IRR) of 47%. Payback is expected relatively quickly at 2.6 years. The company’s previous 2017 technical report put Florence Copper’s after-tax NPV at US$680 million at a copper price of $3 per lb., and its IRR at 37%.

Overall, the operation is forecast to produce 85 million lb. of metal yearly over a 22-year mine life.

Taseko is still waiting for the U.S. Environmental Protection Agency to issue an underground injection control permit. At least one analyst suggests the permit could come as early as July. The project is expected to cost US$232 million over 18 months to reach commercial scale from the completed test stage.

Taseko in January secured US$25 million in additional financing to pay for the solvent extraction and electrowinning (SX/EW) plant with Bank of America Leasing & Capital. That follows an initial investment of US$50 million made recently by Japan’s Mitsui for construction of the project.

Taseko’s president and CEO, Stuart McDonald, said in a statement that despite the high inflation the

On March 27, 2023, after a tough battle with cancer, we lost Dr. Jennifer Pell, dear friend and highly accomplished professional geologist. She was passionate about all things related to geology and diamonds. She loved her big black dog Zac and living on False Creek in Vancouver and enjoyed photography, music, foreign films, art gallery crawls and caring for orchids. She took great pleasure in travelling globally and engaging in lively conversation with friends and colleagues. Jennifer was born in 1956 in Ottawa and received a Bachelor’s degree in geology from the University of Ottawa. She went on to earn a Ph.D in structural geology from the University of Calgary in 1984 and until 1987 did postdoctoral work focused on kimberlites, carbonatites and related rocks at the University of British Columbia.

Jennifer’s post-doc and subsequent consulting work was supported by the British Columbia Geological Survey. Based on this work, she authored BC Geological Survey Bulletin 88, “carbonatities, nepheline syenites and related rocks in British Columbia” which was published in 1994. Her background was ideal preparation for her next position starting in 1992, as District Geologist for the federal government in the NWT, based in Yellowknife. She was in charge of monitoring diamond exploration developments in the Slave craton region and found herself in the middle of the biggest diamond rush ever. She made many friends in Yellowknife and it was there that she met her partner, Toby Hughes. She left Yellowknife in 1997 and went on to work on diamond exploration projects in Tanzania, West Africa and Brazil. In 2002 she joined Dunsmuir Ventures Ltd. as Vice President Exploration and managed diamond exploration programs in Quebec, Manitoba, Nunavut, the NWT and the USA. From 2005 to 2018, Jennifer was Chief Geoscientist for Peregrine Diamonds who evaluated the DO-27 kimberlite in the NWT and discovered the Chidliak diamond district in Nunavut in 2008. Over 70 kimberlites were discovered at Chidliak in less than four years. Jennifer was responsible for overseeing diamond recovery and valuations and logging of Chidliak drill core which established the foundation for kimberlite geologic models. She spent many months in the field and the quality and meticulous nature of her work was second to none. In 2018 De Beers hired Jennifer as a Petrologist after purchasing Peregrine Diamonds.

Jennifer was a director of the Association of Mineral Exploration, British Columbia and the NWT and Nunavut Chamber of Mines, the co-chairperson of the annual PDAC diamond session in Toronto and past President of the Vancouver Orchid Society. She touched many lives, is sorely missed and leaves behind a great legacy of geologic work and many friendships. She is survived by her partner Toby Hughes, two sisters Wendy and Nancy, and a brother David.

industry has recently endured, Florence economics stands out as one of the world’s lowest capital intensity copper development projects.

“With procurement of long-lead items well advanced, we are ready to commence construction of the commercial facility following the issuance of the final UIC permit in the coming months,” McDonald said.

Inflation has marginally increased projected operating costs to US$1.11 per lb. from US$1.10 per lb. Previously.

In a note to clients, BMO Capital Markets mining analyst Rene Cartier noted that Taseko has made efforts to curb the effects of inflation by ordering long-lead items well in advance.

“Taseko indicated the primary driver of cost increases related to construction labour and wellfield drilling costs, which impact both initial and sustaining capital costs. Sustaining capital was a bit higher than our estimates,” the analyst said.

“We still see the operating cost profile of Florence as competitive, which could provide Taseko additional optionality, if required. For instance, we estimate an additional 2% net smelter return royalty on the project would only add about US$0.07 per lb. to costs,” the analyst said.

“Overall, TKO has de-risked the project, and was able to incorporate learnings from the test work that’s been undertaken, thereby leading to a higher degree of confidence at Florence.”

The Florence ISR process works by injecting a weak sulphuric acid solution, called raffinate, through targeted portions of the mineral deposit using an array of injection wells. The raffinate passes through natural fractures and voids in the deposit, dissolving the copper mineralization.

The copper-laden solution, known as pregnant leach solution, is then collected in recovery wells, and pumped to the surface for processing. The copper is extracted using solvent extraction and electrowinning techniques producing a copper cathode product.

Leaching of the production test wellfield began in December 2018. It continued under commercial operating conditions until June 2020, after the leaching phase was ramped down and concluded with the shutdown of the process plant that October.

Taseko says the test demonstrated that copper could be produced profitably and that the hydraulic control of process solutions in the well field could be established and maintained to protect underground drinking water aquafers.

Florence Copper has proven and probable reserves of 320 million tons grading 0.36% copper for 2.3 billion lb. of contained metal, using a US$3.05 per lb. copper price.

At $2.26, Teseko shares are down 19% over the 12 months, having tested $1.15 and $3. The company has a market capitalization of $663.9 million. TNM

Resources last year, which picked up the package of assets from U.S.based Cleveland-Cliffs (NYSE: CLF) after its abrupt departure from Canada in 2013 despite having sunk half a billion dollars to advance Eagle’s Nest and the neighbouring chromite deposits.

Open access

The March protest follows the formation in early February of a First Nations alliance to protect their lands and waters. The Grassy Narrows, Wapekeka, Neskantaga and Big Trout Lake First Nations have little appetite for unregulated activity on their lands, considering the mercury pollution left behind by legacy industry.

Yet mining prospectors have staked thousands of new claims on their territories over the past few years.

Grassy Narrows First Nation, located about 100 km northeast of Kenora, Ont., said in a Jan. 31 statement it had seen about 4,000 mining claims staked on its lands since 2018. The Ontario government

then allowed any licenced prospector to register a mining claim online for a fee.

The province’s online staking system does not tell prospectors whether the land is part of Indigenous territory before they stake a claim. Likewise, Ontario does not require prospectors to give any notice to First Nations until after the claims have been registered and are in force.

The four First Nations that have come together said they want to meet with Ford to discuss their concerns.

In 2021, Grassy Narrows First Nation launched legal action against the Ontario government for issuing nine exploration permits to mining companies to start drilling and exploring for gold on its territory. Ontario issued the permits between 2018 and 2021.

Grassy Narrows said that was done without consultation on lands declared as an Indigenous Sovereignty and Protected Area under Grassy Narrows law in 2018. In 2007, the First Nation called for a moratorium on any industrial activity on its territory. TNM

6 APRIL 17 — 30, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

PROTEST from 2

Barrick Gold CEO Mark Bristow in Papua New Guinea. BARRICK GOLD

Taseko Mines’ Florence copper project in Arizona. TASEKO MINES

GOLD | Government now has majority stake in project

ANGUS from 1 in the mining industry, recalling that he loved telling stories about his travels, helping people make deals, and talking about the colourful characters in the industry. “He was fun to be with and never shy about telling people his thoughts. I really loved spending time with Tookie and will miss him tremendously,” Beaty says.

Seattle-based investment guru and exploration speculator Rick Rule says Angus was a rare bridge between the finance and mining communities. He often acted as the mediator between quarrelling parties and resolved situations bound for arbitration or worse.

“He was, more often than many people realize, the mechanism for settlement for disputes between the tribes in the mining industry,” he tells The Northern Miner. “Otherwise, those issues would have found themselves at least in arbitration, if not in court. Tookie had the ability because he was trusted and liked by all sides,” Rule says.

Rule says Angus was deeply interested in mining, which meant that he learned the topic with exceptional depth.

“He became, in his own way, not merely one of our lawyers, but rather one of us,” Rule says. “I don’t think Tookie ever really worked a day in his life because he was so involved in what he was doing,” he adds.

“And don’t get me wrong, he had a black belt in billing – he got paid. But there was an empathy and an enthusiasm there that let you know that, while he wouldn’t have done it for free, he wasn’t just there for the money.”

In fact, Angus was often so enthusiastic that he tried to do too many things at once. “Tookie had a distressing habit of saying ‘yes.’ And very often, he said, yes in ways that exceeded anybody’s human capacity,” Rule says.

A family man for the deal

Angus was born in 1949 in Santo Domingo in the Dominican Republic. When he was four, the family moved to Nova Scotia and settled in Lethbridge on a sugar beet plantation. The nickname ‘Tookie’ was a baby name given to Angus by his mother, Mary — a throwback to the family’s Scottish heritage.

Angus’s son Hamish says that as a young boy watching his dad in front of the mirror preparing for the endless multitude of promoters, dealers, corporate executives, and explorers visiting his family home, he knew he wanted to be like his dad one day. Somebody who in his eyes always knew the truth, was respected in business circles and had an exceptional way of communicating with everyone.

“His passion was to do deals. He absolutely was committed to finding the maximum value for share-

First Quantum to earn 55% of Rio Tinto’s Granja copper project

JV | Copper miner to fund up to US$546M in costs for Peru project

BY AMANDA STUTT

First Quantum Minerals (TSE: FM) has agreed to partner with Rio Tinto (NYSE: RIO; ASX: RIO) to develop the La Granja project in Peru, forming a joint venture that will give it a majority stake in one of the largest undeveloped copper deposits in the world.

Under the deal, First Quantum will acquire 55% of the project for US$105 million, and commit to fund up to US$546 million in capital and operational costs to take the project through a feasibility study. First Quantum will become the project operator. The transaction is expected to complete by the end of the third quarter.

Rio Tinto acquired La Granja from the government of Peru in 2006 and has since carried out an extensive drilling program that expanded the resource and understanding of the orebody, and established partnerships with host communities, local and national governments.

La Granja currently ranks as the fourth largest copper project in the world, and Peru is the world’s second biggest copper producer.

“La Granja is an exciting but complex project that has the potential to be a significant new source of the copper that is needed for the energy transition,” Rio Tinto Copper chief executive Bold Baatar said

in a statement. “We are pleased to enter into this agreement with First Quantum, that will bring our combined development capabilities and deep knowledge of La Granja to progress the project.”

Baatar added that developing La Granja would also further strengthen Rio Tinto’s copper portfolio following its acquisition of Turquoise Hill Resources to consolidate a direct 66% interest in the Oyu Tolgoi mine in Mongolia.

“Rio Tinto’s work on La Granja has been extensive to date and we share our partner’s view that the project has the potential to be a Tier 1 copper mine,” First Quantum CEO Tristan Pascall said. “We look forward to working together to build on this foundation, leveraging First Quantum’s core strengths in mine design, project development and community engagement to progress La Granja to the next stage.”

La Granja is located at high altitude in Cajamara, northern Peru

and has an inferred resource of 4.3 billion tonnes grading 0.51% copper.

The companies have also entered into a memorandum of understanding to cooperate in exploration and development of copper and other base metals projects globally, and will share knowledge around bestin-class mining, processing, and decarbonization practices.

The investment in Peru comes despite political turmoil earlier this year in the country that saw protesters invade mine sites and block roads following the removal of former president Pedro Castillo in December after attempting to dissolve Congress.

First Quantum recently resolved a dispute with the Panamanian government over royalties that temporarily shut its giant Cobre Panama mine in February. After reaching an agreement that guarantees a minimum annual income of US$375 million to the Central American government, the mine resumed operations in March. TNM

holders, no matter how dire the situation,” Hamish says.

At home, Angus was an avid angler and family man who enjoyed spending time outdoors, kicking rocks. Hamish remembers when he and his dad reeled in a 135 lb. prize sailfish on Christmas Eve, a proud accomplishment of providing enough food to feed a festive family gathering.

Hamish says Angus succumbed to complications associated with a complex heart surgery and fought for his life for 64 days in the intensive care unit. “Since he first encountered some heart issues three years ago, Tookie developed a strong spiritual component to his character to which I attribute his several miraculous recoveries since then,” he said. “He accomplished everything he wanted to in life.”

Hamish tipped his hat to the late stock promoter Murray Pezim, who he says played an integral part in his dad’s early days.

Most recently, as the chairman of K92 Mining (TSX: KNT) since its inception, Angus helped it acquire the transformational Kainantu project in Papua New Guinea in 2014.

“Considered a giant of the mining industry for over 40 years, Tookie brought a tremendous passion to everything he did, including structuring, financing and advising on many significant business ventures,” K92 said in a Mar. 27 statement.

In addition to chairing the K92 board, Angus was chairman of Sun Summit Minerals (CSE: SMN) and Kenadyr Mining (TSXV: KEN), and Nevsun Resources, and was a strategic advisor to Falcon Resources (TSXV: FG). During his career he served as a director of companies that included First Quantum Minerals (TSX: FM), Canico Resource, Bema Gold, Ventana Gold and Plutonic Power Corp. He also served as chairman of the Board of B.C. Sugar Refinery.

A celebration of life ceremony will be held in Angus’s honour on May 3 in Vancouver. TNM

Investing in the Canadian Resource Sector at Reduced Cost of Captial

PearTree is a Canadian Securities Dealer and Investment Fund Manager advancing over (CAD) $500 million annually for resource exploration and mine development in a uniquely Canadian structure which results in as much as $2.00 of capital deployed for every $1.00 invested by global institutions and family offices.

Averaging $500M deployed through PearTree in 2021 and 2022 for the mineral exploration & development sector

Watch our video in English, Français, Deutsch and Español on our website

peartreecanada.com

GLOBAL MINING NEWS THE NORTHERN MINER / APRIL 17 — 30, 2023 7

Expanding the universe of exploration capital.

Copper mine in Peru. ADOBE STOCK/JOSE LUIS STEPHENS

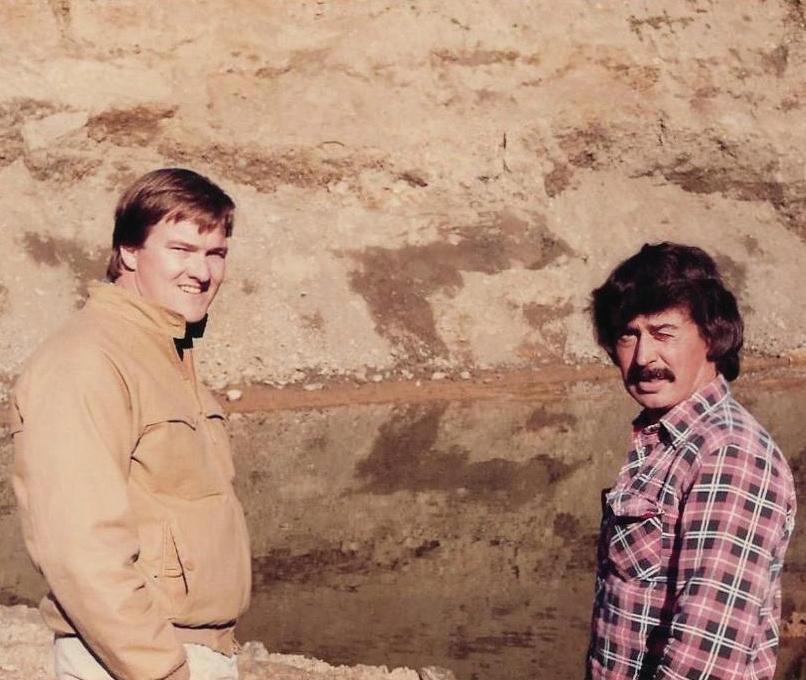

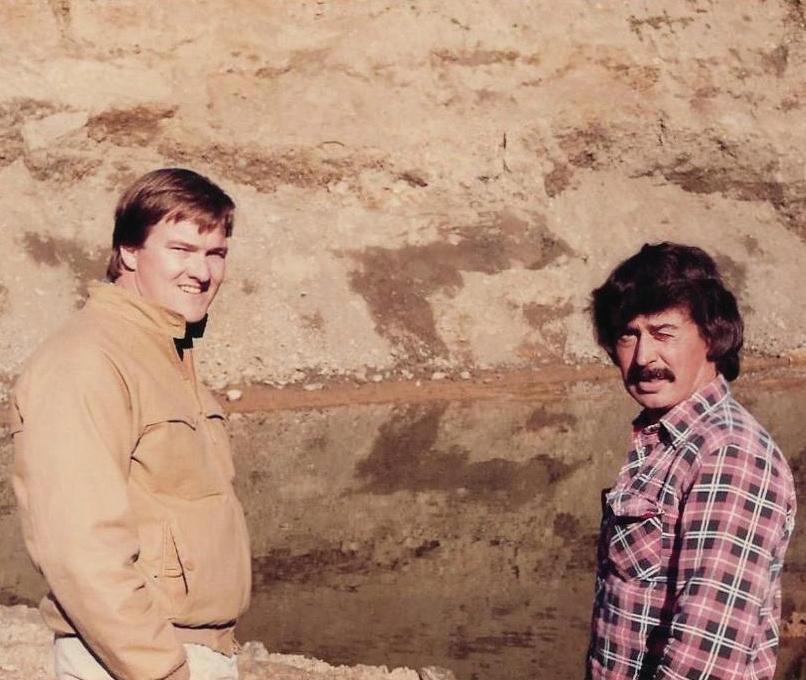

Tookie Angus (L) on one of his early conquests in the Yukon with long-time promoter and best friend Larry Barr. ANGUS FAMILY

Tookie Angus. ANGUS FAMILY

Book excerpt: From backrooms to bulldozers

RING OF FIRE | A clash between Indigenous rights, Ontario’s Mining Act and hapless politicians sets the stage for conflict

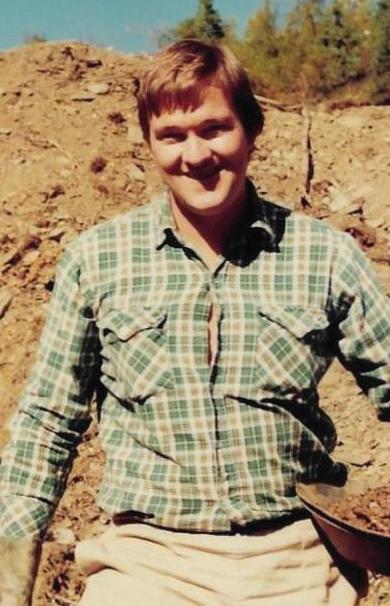

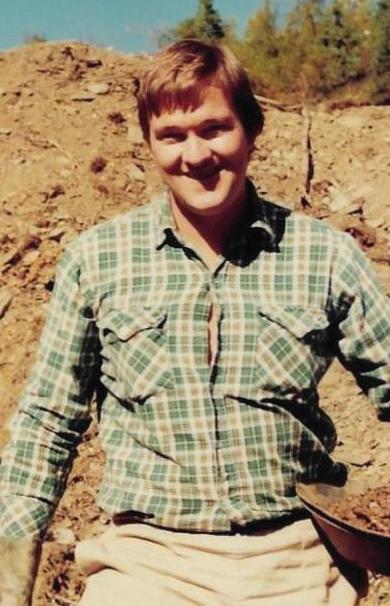

The following is an excerpt from the book “Ring of Fire: High Stakes Mining in a Lowlands Wilderness” by Virginia Heffernan and published by ECW Press (www.ecwpress.com).

Dalton McGuinty was Ontario premier in 2007 when the Ring of Fire was discovered. At the time, the courts were starting to consistently side with First Nations across Canada over the right to be consulted about development on their traditional lands. The province was clumsily playing catch-up.

Ontario’s inability to manage disputes between resource developers and First Nations asserting their legal right to consultation — which often involves coordination among several different ministries — culminated in 2008 when Justice Patrick Smith imprisoned Chief Donny Morris and five other members of the Kitchenuhmaykoosib Inninuwug (KI) First Nation for contempt of court. Morris and other community members had been fighting for a decade to stop Platinex Resources from drilling for platinum on KI’s traditional lands 600 km north of Thunder Bay, just northwest of the Ring of Fire. Platinex fought back, suing the KI First Nation and the Ontario government for disrupting exploration on claims it had legitimately staked and explored under the Ontario Mining Act.

The case went to the Ontario Court of Appeal, which ruled that the six-month jail sentences meted out by Justice Smith were too harsh. The appeal court reduced them to the ten weeks of time served. Ontario then settled with Platinex, paying $5 million for losses the company incurred.

McGuinty’s Liberals withdrew the disputed lands from staking and reformed the Mining Act to include a new vehicle for dispute resolution.

After the verdict, Vernon Morris, chief of the Oji-Cree Muskrat Dam First Nation, stated: “The government’s view of duty to consult is that there will be basis for discussions to begin for planning and development.

Our interpretation of the duty to consult is that we have a right to say ‘No’ when the actions for development will have a harmful effect or no benefit to our First Nation.”

It was a watershed case in

Ontario, whose provincial leaders would be wary of shirking their duty to consult in the future.

But Dalton McGuinty didn’t have much to say about what was happening on the ground in the Ring of Fire until 2010, when Cleveland-based Cliffs Natural Resources started pouring millions of dollars into the area in the hopes of accessing a chromite source to complement its well-established iron ore and steel business. The premier was encouraged by Cliffs’ investment and saw the Ring of Fire as an opportunity for Ontario to recover from the 2008–09 global financial crisis. He leaned on the federal government to help build the infrastructure required to get the mines built as quickly as possible.

Up until then, a lot of the Ring of Fire exploration and infrastructure planning had been proceeding without Indigenous consultation, contrary to the growing tendency for the Supreme Court of Canada to rule on the side of First Nations in battles with provinces over resource development.

Though most Ontarians were oblivious to the transgressions, the exploration activity did not go unnoticed by Indigenous communities.

Predictably enough, in early 2010, band members of Marten Falls, 100 kilometres southeast of the Ring of Fire, erected a blockade to prevent companies from landing their bush planes on frozen airstrips on Koper Lake and McFaulds Lake, within the community’s traditional lands.

Without access to the lakes, Noront, Cliffs, and other companies would be unable to fly in supplies and personnel to conduct what they considered vital winter exploration in the region.

Led by Chief Elias Moonias, Marten Falls established the blockades not necessarily because the community members wanted to prevent further exploration, but because they wanted the companies to use their airstrip and their winter road instead of the frozen lakes.

“We are not against mining and want to do business, but we want to do it together,” Chief Moonias told the Canadian Press.

To calm the waters, McGuinty sent Northern Development and Mines Minister Michael Gravelle to Marten Falls to find out how to appease community members. Minister Gravelle met with Chief Moonias, hammered out an agreement, then dined on moose stew with the rest of the community before hopping on a puddle jumper to fly to Webequie, west of the potential mine sites.

Under the agreement, Marten Falls agreed to lift the blockades in exchange for the Ontario government hearing out the demands of Moonias and Webequie Chief Cornelius Wabasse. If the chiefs were not satisfied with the negotiations over demands for a revamped airport, environmental impact reviews, training and job guarantees, an extended road network, and a better memorandum of understanding with the government, they would resume the blockade. But resolving the conflict was never going to be that easy. While Gravelle feasted on stew and exchanged gifts with Moonias, some of the community’s youth stood silently on the fringes of the gathering with placards reading “This land is our land.”

In 2011 the province stepped up its commitment to the process by

creating a Ring of Fire Secretariat, essentially a new government department to encourage development of the chromite and other deposits while taking into account environmental impacts and the economic needs of the First Nations communities.

At a Ring of Fire infrastructure conference held in Thunder Bay in mid-2011, Gravelle outlined the extraordinary, once-in-a-century opportunity the Ring of Fire represented. “We need to get it right, that is why we have set up a Ring of Fire coordinator, why we are setting up a Ring of Fire Secretariat, and why we are working so hard with all the partners, the First Nations and the companies, to make sure we move forward together,” he said. “That is crucially important.” But the next year, McGuinty — the first Liberal premier to secure three consecutive terms in office since the nineteenth century — was forced to step down amid indignation over what was considered a scandalous decision to cancel gas-powered electrical plants in NIMBY Liberal ridings at a cost to taxpayers of $1 billion.

Kathleen Wynne succeeded McGuinty. She too considered the Ring of Fire a unique opportunity to satisfy northern constituents, advance Indigenous reconciliation, and fill government coffers. Her

approach was more conciliatory.

She set up a meeting with the Matawa Tribal Council of nine First Nations, the first the council had had with a sitting premier since 1975. By the time they parted ways, Wynne and the council had established the basic pillars of a framework agreement for development of the Ring of Fire: employment and training opportunities; effective land management that respects environmental protection; resource revenue sharing; and infrastructure where there was none.

The new premier moved quickly to set the negotiations in motion. She appointed retired Supreme Court justice Frank Iacobucci to serve as chief negotiator for the province. Bob Rae stepped in as chief negotiator on behalf of the Matawa Tribal Council. Optimism was in the air.

“My job arose out of the First Nations’ desire to engage with the provincial and federal governments in a more collective way because Cliffs’ proposed mine was a huge development that would have a wide impact,” said Rae. “We did have the attention of the premier and she met openly with us. The chiefs didn’t like everything they heard because she was telling it as she saw it as first minister. But she really paid attention.”

Still, the legacy of distrust established over the decades the Crown had repeatedly failed to meet its treaty obligations to First Nations remained a dark cloud over the negotiations. And Cliffs, beginning to suffer financially, was growing impatient with the endless meetings between government, Indigenous groups, and industry in Toronto and Thunder Bay that never seemed to resolve anything.

“If a company shows up with a bag of money, surely you find a way to help them spend it,” said David Anthony, former VP and senior project director for Cliffs, who quit the project in frustration in 2012. “I think if you go to fifteen different meetings and no progress is made, you come to the conclusion that [development] is never going to happen.”

Exacerbating the dysfunction was an assumption that all nine of the First Nations of the Matawa Tribal Council would speak with a common voice. The council’s slogan is “The Power of Unity. The

By Alisha Hiyate

When geologist and writer Virginia

Heffernan was looking for a topic for her first book, it didn’t take long for her to settle on Ontario’s Ring of Fire. Like many people who follow Canada’s mining sector closely, Heffernan, who had enrolled in a creative non-fiction writing program at University of King’s College to earn her MFA, had recognized the importance of Noront Resources’ 2007 discovery of the Eagle’s Nest nickel-copper-PGM deposit in the region.

“It was always in the back of my head,” said Heffernan, a one-time staff writer with The Northern Miner. “All the promotion around it was also kind of fascinating with [Noront founder] Richard Nemis — he was such an interesting character.”

In March, Heffernan released Ring of Fire: High-Stakes Mining in a Lowlands Wilderness, published by ECW Press.

The book takes a broad view of the topic, giving the reader needed context about geology, the scrappy world of junior mining, the evolution of Indigenous consultation requirements and Indigenous participation

in mining, the potential environmental impacts of mining in the Ring of Fire, and of course, the politics.

Written during the pandemic, Heffernan’s original plan to visit First Nations communities in the Ring of Fire to hear the viewpoints beyond the leadership proved impossible because of Covid-19 lockdowns.

Some communities, namely Marten Falls and Webequie are supportive of development, while others such as Neskantaga and the James Bay coastal community of Attawapiskat, are adamantly opposed.

However, she was able take an eight-day canoe trip on the Missanaibi River to Moose River, which spills into James Bay, fighting

“ferocious winds” coming off of James Bay as well as unrelenting deer flies, black flies and mosquitoes. Ending at Moose Factory, several hundred kilometres southeast of the Ring of Fire, Heffernan says the journey familiarized her with the bog and fen peatlands ecosystem in the James Bay lowlands and the challenges of building a road.

While Heffernan’s book traces the origin of past and current conflicts that potential development of the region has spawned — from the Indian Act to the political miscalculations of Ontario politicians — she ultimately is optimistic that development in the region will move forward. But it will have to be in an environmentally responsible way that Indigenous communities will benefit from and have a hand in monitoring.

“We need to see some sort of partnership with the First Nations up there. If they have a percentage of the project or projects, that’s going to make all the difference. Then once you get that revenue streaming into the communities, it would mean more self-governance, more control over their lives, health care and schooling.”

8 APRIL 17 — 30, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

The first book on Ontario’s Ring of Fire sees a happy ending for contentious development

Virginia Heffernan’s canoe trip into Ontario’s James Bay Lowlands. CINDY ANDREW

Virginia Heffernan. DAHLIA KATZ

Dignity of Difference.” While the communities are united in their belief that they have jurisdiction over their traditional lands, the Ring of Fire discussions only served to emphasize their differences. Four of the communities (Aroland, Constance Lake, Ginoogaming, and Long Lake #58) have access to all-season roads; the other five (Eabametoong, Nibinamik, Neskantaga, Marten Falls, and Webequie) are only accessible by air or winter road, so their priorities regarding infrastructure are different.

Marten Falls, Webequie, Neskantaga, and Nibinamik are the closest communities to the proposed development and have the most to gain from jobs and training programs, but Neskantaga also lies on the shores of Attawapiskat Lake,an important and relatively pristine source of fish that could be disrupted by mining activity or road building.

And nothing about the formation and evolution of the nine communities had been organic. “The political structures and how they express themselves are a consequence of the Indian Act,” said Rae. “When people say, ‘Why can’t you just agree?’ they respond, ‘Well, why did you create nine communities to represent a few thousand people?’ The communities are different because a lot of things have happened historically to create different dynamics,” including abuse suffered at the hands of priests visiting the communities to convert their members to Christianity.

The resulting trauma, and disagreements about how to respond to the church, divided clans and families. The Nations found it difficult to reach consensus on all the issues that confronted them.

Meanwhile, shaken by lower commodity prices and an erosion of shareholder confidence, Cliffs was getting cold feet as the negotiations dragged on. Finally, after spending about $550 million in the region over four years, the company announced it was pulling out of the project in late 2013. Its new CEO, Lourenco Goncalves, who was parachuted in to revive the American company’s flagging fortunes, went so far as to say the Ring of Fire was beyond the point of no return.

Cliffs’ departure was unsurprising given the company’s internal turmoil coupled with the uncertainty surrounding the Ring of Fire, and with Cliffs went the urgency to

strike a deal with the First Nations. All that was left in the Ring of Fire was a handful of junior companies without the financial resources to achieve much more than a little grassroots exploration. It seemed like a death knell for the ambitious development project.

“I did not once hear the Ontario government say [they were] ready to fund a road. It was always: let’s get together for lunch, we’ll pay a bunch of people to come to the meeting, we’ll go over the same stuff we’ve gone over a hundred times before. And at the end of the meeting, there will not be a single resolution or any indication that we actually plan to do something,”

David Anthony told me. “If [they] had said they would build a road and toll it back to us, or at least start a dialogue about how a road could get built,there might be a whole chromite industry in Canada right now.”

But the province was undeterred.

In mid-2014, Premier Wynne announced that her minority government was prepared to contribute $1 billion to build a road to the Ring of Fire. Minister Gravelle implored the federal government to match the infrastructure funds, calling the Ring of Fire a “project of national significance.” He wrote to his counterpart in Ottawa, Greg Rickford, requesting a meeting “at your earliest convenience to discuss the [Ring of Fire] and the importance of a strong federal role in ensuring this development can proceed and its economic benefits for Ontario, First Nations and Canada can be realized.”

But the feds, then led by Conservative prime minister Stephen

Harper,were mostly silent on the file. They said they would need a detailed plan from Ontario, including fully costed infrastructure proposals, before they would be willing to step into the fray. Part of the challenge was that Indigenous affairs are handled federally, while mining falls under provincial jurisdiction. Rarely do the two levels of government confer on those two areas of interest. It’s a convenient means to dodge the issue.

At a meeting in Timmins in March 2015, federal Treasury Board President Tony Clement reiterated that the Ring of Fire needed two things before the federal government would take a sustained interest: a worthwhile return on investment and a good working relationship between the province and the First Nations. In his opinion, the proposed development lacked both.

The dismissal by the federal government was frustrating not only for the province but also for the First Nations involved. Canada has certain obligations to Indigenous peoples recognized and affirmed in section 35of the Constitution Act, 1982, interpreted to include a wide of range of cultural, economic, and political rights. The Matawa Tribal Council rightly expected, at the very least, to have discussions with representatives in Ottawa, not just be left at the mercy of the province.

Eventually, Wynne herself grew impatient with the impasse. She sent a letter to the Council Chiefs in May 2017, demanding that they come together on decisions or she would scrap the regional framework and deal with the communities on an individual basis. In her

letter, Wynne told the chiefs they “should not squander” her 2014 commitment to spend $1 billion to help build a road to the deposits in the Ring of Fire.

“We have not achieved much of the progress on road and infrastructure development that we had hoped for under the RFA [regional framework agreement] over the past three years,” Wynne wrote in the letter. “While I continue to hope progress can be made, I am prepared to continue to advance discussions with those First Nations that would like to pursue transportation infrastructure through our bilateral process.”

After many months at the negotiating table, Rae was equally discouraged. “Frustrating is not a strong enough word. There was a moment in time when we had a framework worked out and signed and the provincial government was willing to make some investment in the communities and their well-being,” he said. “But there was not enough trust on the table for[the communities] to move ahead.”

Neskantaga was particularly wary. While Chief Wayne Moonias believed Wynne’s heart was in the right place and she understood the suffering the First Nation had endured under Treaty 9, he said it was “disingenuous” of her to expect Indigenous peoples to cooperate with resource permits on their land while their own jurisdictional claims went unaddressed.

Tensions escalated when the province signed agreements with Webequie and Marten Falls to make them proponents on the environmental assessments to build roads into their communi-

ties (from the Ring of Fire in Webequie’s case and from a forestry road that leads to the town of Nakina in Marten Falls’ case).

The neighbouring communities of Neskantaga and Eabametoong viewed the decision as favouritism and accused the Wynne government of acting in bad faith by not adhering to the regional framework agreement.

They considered the agreements an attempt to “divide and conquer” the First Nations within the Matawa Tribal Council.

“The approach the Wynne government is taking to roads in the Ring of Fire is a scandal and could be a nail in the coffin for our Aboriginal rights and way of life,” the two communities said in a joint media release issued in May 2018.

A month later, Wynne was voted out of office and replaced as premier by Conservative Doug Ford. At least Wynne was the devil they knew.