SPECIAL FOCUS GLOBAL GOLD

LITHIUM | Junior says the ‘self-interested’ shareholders want to acquire stakes in some of its claims

BATTERY METALS | Regional OPEC-like cartel could control 70% of world’s reserves

BY CECILIA JAMASMIEBolivia’s government is calling its lithium-producing neighbours to forge ahead with the idea of setting a Latin America-wide policy on the exploitation of the coveted battery metal.

The idea, part of a broader initiative involving Argentina, Bolivia, Brazil and Chile to form an OPEClike cartel, seeks to collectively boost the bargaining power of these countries, President Luis Are said in a speech in La Paz.

BY HENRY LAZENBYTwo activist shareholders with ‘substantial’ holdings in Azimut Exploration (TSXV: AZM) have accused the junior of “squatting” on some of Quebec’s most prospective lithium lands.

On Mar. 14, Coloured Ties Capital (TSXV: TIE) and privately held Bullrun Capital issued a second open letter to Azimut’s founder, president and CEO Jean-Marc Lulin, accusing the geologist of refusing to acknowledge or engage with them about its detailed exploration plans for its James Bay lithium portfolio.

The activists are turning up the heat on Lulin and Azimut after Patriot Battery Metals’ (TSXV: PMET; ASX: PMT) promising Corvette lithium discovery as well as Winsome Resources’ (ASX: WR1) Adina discovery. Patriot aims to publish the first resource on Corvette this summer.

The concerned shareholders say they are active investors in Quebec’s critical mineral exploration projects via investments in junior explorers.

“These companies have made discoveries that have made James Bay the lithium exploration capital of the world and provided amazing shareholder returns to all investors in the James Bay region,” they said in a Tuesday press release.

For example, Patriot enjoyed a more than 2,200% run-up in its stock price through January.

In contrast, Azimut holds what

the activists believe is the best and most prospective critical minerals ground in the region, but has chosen not to advance its lithium potential. Recently, Azimut went on a staking frenzy to stake additional ground.

The activists argue Azimut’s stock price has a discounted valuation compared with its peers that reflects the market’s frustration with Azimut’s refusal to explore its vast critical mineral land holdings instead focusing solely on gold.

“This practice to acquire vast critical mineral land holdings in Quebec and then squat on these

highly prospective lands is in direct contrast to others from outside Quebec and Canada who may ‘know the land less’ but have established critical minerals deposits on ground adjoining or surrounding Azimut ground in the last three years,” the activists charged.

They’re advocating for a revamp of Azimut’s business practices. They insist the company establish a critical minerals division and engage a qualified critical minerals exploration executive team to run it.

They want Azimut to engage in business practices that are respectful of all shareholders, adjoining property junior exploration companies and all other stakeholders, including Canada’s current mandate to develop critical minerals assets in Quebec.

In a response, Azimut characterized the activists’ assertions as containing “numerous inaccuracies, mischaracterizations, and false statements.”

“The recent re-election of all company’s directors at the annual general shareholders’ meeting, with support ranging between 92.5% and 99.9% of the shares voted at the meeting, demonstrates that shareholders endorse the company’s current leadership and business strategy,” Lulin said in the Mar. 16 statement.

The company said it had demonstrated an openness to the activ-

“We must be united in the market, in a sovereign manner, with prices that benefit our economies, and one of the ways, already proposed by (Mexico’s) President Andres Manuel Lopez Obrador, is to think of a kind of lithium OPEC,” Arce said according to local paper La Razon.

Bolivia holds the world’s largest lithium resources at 21 million tonnes, according to the U.S. Geological Survey. The area of sprawling salt flats known as the “lithium triangle,” which includes northern Chile and Argentina, has about 65% of the globe’s known resources of the white metal.

If Peruvian, Mexican and Brazilian potential reserves were added, the region would hold nearly 70% of the world’s lithium reserves. This would translate into a restructuring of the world economic scenario around the energy transition and a provide a new, sound source of income for Latin American economies, according to the Latin American Strategy Centre for Geopolitics (CELAG).

Bolivia, which has almost no industrial production or commercially viable reserves, inked in January a deal with a consortium that includes Chinese battery giant CAT to jointly extract lithium from its Uyuni and Oruro salt flats.

The partnership would give the group of companies, which also includes mining giant CMOC, rights to develop two lithium plants.

Arce, who wants to industrialize Bolivia’s lithium before the end of his term in 2025, expressed concern about foreign meddling in the lithium business, particularly from the United States.

“We don’t want our lithium to

be in the Southern Command’s crosshairs, nor do we want it to be a reason for destabilizing democratically elected governments or foreign harassment,” he said.

Chile, Argentina and Bolivia have been talking about creating a lithium cartel since July last year. They now seek to integrate other Latin American nations with an incipient lithium industry, including Brazil and Mexico.

Analysts, including Geopolitical Monitor’s Arman Sidhu, believe that bringing the idea to fruition is likely to spark opposition from environmentalists and Indigenous groups that contributed to left-wing victories in Chile, Argentina, and Brazil.

He also warned of additional obstacles, including China’s monopolist position in the industry, investors’ fears and the longterm political viability of such an idea. TNM

PM40069240

THE ACTIVISTS ARGUE AZIMUT’S STOCK PRICE HAS A DISCOUNTED VALUATION THAT REFLECTS THE MARKET’S FRUSTRATION WITH ITS REFUSAL TO EXPLORE ITS VAST CRITICAL MINERAL LAND HOLDINGS, INSTEAD FOCUSING SOLELY ON GOLD.Companies searching near and far for the yellow metal | 9-16

E3 Lithium (TSXV: ETL; US-OTC: EEMMF) says its latest resource upgrade could make Alberta’s Bashaw district, Canada’s largest lithium brine project, a contender among the world’s biggest battery metal suppliers.

Its sprawling Bashaw district between Calgary and Edmonton now hosts 6.6 million measured tonnes of lithium carbonate equivalent (LCE) and 9.4 million indicated tonnes of LCE for a total of 16 million tonnes.

“This resource upgrade is the largest of its kind in Canada and is significant on a global scale,” Chris Doornbos, president and CEO of E3 Lithium, said in a news release on Mar. 21. “The amount of data and geological work required to upgrade resources of this magnitude is significant and further increases our understanding of the Leduc aquifer and as a result, our technical confidence in our commercialization plans.”

The upgraded Bashaw is one of the world’s largest direct lithium extraction brine projects, featuring investment by the country’s sec-

ond-largest integrated oil company, Imperial Oil, and support from the federal government. The new resource dwarfs Canada’s estimated 3.2 million tonnes of measured and indicated lithium oxide resources in hard rock deposits, according to Natural Resources Canada.

Calgary-based E3’s upgrade used

data and core sample analysis from its 2022 drill program. It also developed a geological model of the Bashaw district showing details of reservoir properties.

A breakdown of the resources shows the project’s Clearwater area has measured and indicated resources of 11.1 billion cubic

Chile’s government said it is open to further amend a controversial mining royalty bill expected to enter into force early next year, following mounting criticism of its impact on the industry’s competitiveness.

Finance Minister Mario Marcel said after the bill’s approval in January by the mining commission of the Senate, miners have requested certain modifications that do not alter the proposed law, but which could be included during the legislative stage.

As it stands, the proposed royalty has a hybrid nature as it combines an ad valorem component that would be applied to annual sales of copper and a variable element linked to the mining operating margin.

Amid several potential adjustments, Marcel highlighted one that would set a limit to the potential tax burden for the combination of various taxes. This, he noted in a statement, would give “greater security or predictability to collection.”

REBUILT GARDNER

DENVER DRILLS!

Finally selling the rest of my drilling and blasting equipment.

Two Gardner Denver Air drills.

Both rebuilt! #1. 0 hours #2. 22 hours. One converted to a plugger! Conversion kit included. A box of brand new rifle bars seals etc. etc.

Lots of brand new parts. Long & short jacklegs.

One atlas Copco gas drill and one Swedish Pionjar. Hex-steal multiple lengths! Tapered and button bits. lubricator. 1- type 6 Magazine

Selling all together!

Serious inquiries only.

Price is negotiable.

Another adjustment would allow companies to include start-up expenses as a cost for the calculation of the adjusted mining operational taxable income, Marcel said.

Companies with operating losses

metres of brine with a median lithium concentration of 74.5 mg per litre for contained metal of 4.3 million tonnes LCE. The remaining Bashaw district has 29.2 billion cubic metres of brine with the same median concentration for 11.7 million tonnes LCE.

E3 said it expanded the Clear-

water area and that it held 900,000 tonnes of inferred LCE in its Rocky area west of the Bashaw district. Bashaw also includes the Exshaw area.

The project aims to tap lithium-enriched brine from the Leduc aquifer, a dolomitized ancient reef complex that spans hundreds of square kilometres and is more than 200 metres thick.

2020 Clearwater PEA

A 2020 preliminary economic assessment for development of the Clearwater area estimated annual output of 20,000 tonnes of lithium hydroxide. The initial capital cost was pegged at US$602 million. The assessment figured an after-tax net present value of US$820 million with an 8% discount rate producing a 27% internal rate of return.

E3 received $27 million in November from the federal government’s Strategic Innovation Fund. Imperial Oil, a Canadian unit of ExxonMobil, said last June it would invest $6.4 million into exploring the extraction of lithium from below its historic Leduc oil field, one of the first crude oil discoveries in Western Canada. TNM

Contact: Bertrand Lund | Lund9@telus.net

as well as those with very low or close to negative profitability would be exempt from the ad valorem component.

Since President Gabriel Boric first introduced the idea of a new royalty, the mining industry has been up in arms. It argues that, as they stand, the reforms would add uncertainty to investment decisions needed to help fill a global copper supply gap as demand rises in the clean energy transition.

The potential changes, the government says, would protect investments, particularly from small and medium-sized miners, as the royalty would have a fixed ad valorem component of 1% on copper sales.

Between 8% and 26% of the total to pay would depend on the mining company’s operating margin.

Chile, the world’s largest copper producer, hosts major miners including BHP (NYSE: BHP; LSE: BHP; ASX: BHP), Anglo American (LSE: AAL), Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO), Antofagasta (LSE: ANTO), Glencore (LSE: GLEN), and state-run Codelco. TNM

BY CECILIA JAMASMIENewmont (TSX: NGT; NYSE: NEM), the world’s largest gold producer, may be preparing a sweetened takeover offer for Newcrest Mining (TSX: NCM; ASX: NCM), which rejected the miner’s unsolicited bid in mid-February.

Speculation on a potential deal, originally estimated at US$17 billion, comes as Newmont is said to have gained partial access to its Australian rival’s corporate books.

While initial feedback from analysts and shareholders suggested that Newmont will have to improve its bid, they now say Newcrest has no clear alternative choices.

Barrick Gold (TSX:ABX; NYSE: GOLD), the world’s No. 2 bullion producer, has said it doesn’t plan to make a rival offer and Agnico Eagle Mines (TSX: AEM; NYSE: AEM), the third-largest gold miner, is busy wrapping up a deal with Pan American Silver (TSX: PAAS; NASDAQ: PAAS) to jointly acquire Yamana Gold (TSX: YRI; NYSE: AUY; LSE: AUY).

If successful, the NewmontNewcrest tie-up would be one of the biggest in Australian history, as the target company is the country’s No. 1 miner gold producer.

It would also increase Newmont’s footprint in high-demanded copper, which prices have soared recently due to its use in renewable energy and electric vehicles.

Agreeing on a price tag that satisfies both sides could stretch negotiations over several weeks or months, Sprott Asset Management’s Douglas Groh told Bloomberg News on Mar. 22.

“I think a deal is inevitable,” Groh said, adding it’s obvious to the market there’s no leadership at Newcrest. The company’s chief executive officer surprised investors in December by abruptly leaving the post.

Newcrest currently operates the large open-pit and underground Telfer mine in Western Australia’s Pilbara region and is the top gold producer in British Columbia, since the 2019 acquisition of the Red Chris copper and gold mine.

Last year, the company expanded its footprint in Canada with the takeover of Pretium Resources, which handed it the Brucejack gold mine.

The company also owns 50% of the Wafi-Golpu project in Papua New Guinea. The other half is owned by Harmony Gold.

Newmont didn’t respond to requests for comment.

“THIS RESOURCE UPGRADE IS THE LARGEST OF ITS KIND IN CANADA AND IS SIGNIFICANT ON A GLOBAL SCALE.”

CHRIS DOORNBOS PRESIDENT AND CEO OF E3 LITHIUM

Patriot Battery Metals (TSXV: PMET; ASX: PMT) said it has extended the main spodumene deposit on its Corvette project in Quebec by half a kilometre, sending its stock higher.

The Vancouver-based explorer’s 20,000-metre winter drilling campaign at the project about 300 km east of James Bay has lengthened the CV5 deposit strike another 550 metres to 3.15 km, it said on Thursday. Assays from 52 drill holes are pending and five holes are in progress, it said.

“We have been able to meet and already exceed our winter program objectives in terms of meterage drilled and new spodumene pegmatite discovered,” Darren L. Smith, vice-president of exploration, said in a news release. “We are now within approximately 1.5 km of the CV4 pegmatite cluster to the east and have just begun to step-out westwardly towards the CV13 pegmatite cluster.”

AZIMUT from 1 ists’ repeated requests for meetings and communications in the past.

“However, rather than engage constructively, the Bullrun Group has adopted bullying tactics to drive their self-interested agenda forward,” Lulin said.

Azimut said it had engaged in conversations and written exchanges with the group on several occasions regarding their intent to acquire a stake in several of Azimut’s properties.

“Following those exchanges, which have unfortunately escalated to multiple harassing and belligerent messages, the board determined that the propositions of the Bullrun Group were not compelling for Azimut or its shareholders, and the board concluded that it was not in the company’s best interest to further engage with the Bullrun Group at that time.”

It’s not clear how big a stake Bullrun and Coloured Ties own in Azimut, but the explorer’s top shareholders are Agnico-Eagle Mines (TSX: AEM; NYSE: AEM) at 10.1% and pension fund Caisse de dépôt et placement du Québec at 9.3%.

In February, Azimut outlined its key 2023 objectives for its lithium properties.

At the Pikwa and Galinée properties, it said it plans to implement an “aggressive” field program to assess the lithium potential. The properties are directly on strike with the two most important recent lithium discoveries (Corvette and Adina) in the Eeyou Istchee James Bay region.

Azimut holds the assets in a 50-50 joint venture with Quebec-owned

Shares in Patriot Battery Metals closed 5% higher on Mar. 23 at $11.33 each. The shares have traded within a 52-week range of $2.45 to $17.69.

Patriot is exploring along a 4.3km trend of spodumene pegmatite it discovered in 2017 as it prepares an initial resource estimate and prefeasibility study this year. Last month, drill hole CV22-083 returned CV5’s strongest interval to date with 156.9 metres grading 2.12% Li2O, including 25 metres at 5.04% Li2O.

Quebec has become a hard rock lithium hotspot as companies vie to supply the surging electric vehicle market. The federal government approved the James Bay open-pit project by Galaxy Resources, a part of Allkem (TSX: AKE; ASX: AKE), in January. Azimut Exploration (TSXV: AZM) has its own James Bay project and Sayona Mining (ASX: SYA) is planning to restart its North American Lithium operations within days.

Patriot intends to test the CV5 pegmatite along strike at both ends.

Soquem.

The company also holds 100% of the Corvet and Kaanaayaa lithium prospects south of Corvette. It said it has similar plans to assess the lithium potential on these properties through “agressive” field programs.

Lastly, Azimut also holds the James Bay lithium project, one of the largest lithium portfolios in the Eeyou Istchee James Bay region, comprising 16 claim blocks for 2,234 claims. It plans to undertake recon-

Regional magnetic data and spodumene-pegmatite boulders indicate the trend continues, it said. The winter drilling intersected widths of 5-50 metres of continuous pegmatite, mostly spodumene-bearing, it said.

Geological modelling shows CV5’s thickness varies between 25 and 120 metres, although spodumene pegmatite has been intersected as deep as 425 metres and remains open, Patriot said. The location of this deep intersection suggests the presence of additional spodumene-pegmatite lenses south of the main body. These areas are expected to be further drilled over the summer-fall program, it said.

“There remains more than 20 km of geologically favourable trend to be explored for new pegmatite targets and three known spodumene pegmatite clusters yet to be drill tested,” Patriot CEO Blair Way said in the release. “The exploration and development team continues to execute, and the drill bit continues to deliver.” TNM

naissance prospecting supported by remote sensing and advanced geochemical targeting this year.

Shares in Patriot have come down from their 12-month high of $17.69 to currently trade at $11.20, but are still up 1,500% over the last year. The junior has a market cap of about $1 billion. Shares in Azimut are down slightly over the past 12 months at $1.25, after spiking recently to a year high of $1.80. It has a market cap of $92.2 million. TNM

BY NORTHERN MINER STAFFThe European Union has published its Critical Raw Materials Act and added copper, nickel and manganese to its list of critical materials.

The CRMA, unveiled by the Brussels-based European Commission on Mar. 16, outlines that the EU would simplify permitting procedures for critical raw materials projects and that select projects would have support for access to finance and shorter permitting timeframes (24 months for extraction permits and 12 months for processing and recycling permits).

The act indicates that the EU would set up a Critical Raw Materials Club for all “like-minded countries” willing to strengthen global supply chains.

Mining and processing targets were also quantified. By 2030, a minimum of 10% of all critical raw materials consumed in the EU each year must be mined from European mines. In addition, 40% of the EU’s annual consumption must be processed there and at least 15% must come from recycled materials.

Finally, not more than 65% of the EU’s yearly consumption of each strategic raw material at any relevant stage of processing can come from a single third country.

“This Act will bring us closer

to our climate ambitions,” Ursula von der Leyen, the president of the European Commission, stated in a press release. “It will significantly improve the refining, processing and recycling of critical raw materials here in Europe.”

But some analysts say the act was short on details and excluded important raw materials needed for the green energy transition such as zinc, silver, and aluminum.

“The full document is long, unnecessarily complex (different critical and strategic material lists), heavy on targets but light on detail on how to achieve these, and naturally subject to further discussion,” Colin Hamilton of BMO Capital Markets wrote in a research note.

“Compared with the [US] Inflation Reduction Act, which was heavy on providing monetary firepower, the EU version has limited mention of funds but lots of policy rationale.”

Looking ahead, Hamilton noted that some metal trade flows will have to adapt. “At present, Europe gets almost all its magnesium from China, is heavily reliant on nickel and silicon metal imports, and mines next to no titanium, graphite, lithium, cobalt, bauxite, and PGMs,” he said. “These are the areas we expect to see the greatest domestic EU investment focus, many of which overlap with China’s diversification needs.” TNM

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF:

Alisha Hiyate, BA (Poli Sci, Hist) ahiyate@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

SENIOR STAFF WRITER: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PHOTO EDITOR AND PODCAST HOST: Adrian Pocobelli, MA (ENGL) apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/ CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 moliveira@northernminer.com

ADDRESS: Toronto Head Office 225 Duncan Mill Road, Suite 320 Toronto, ON, M3B 3K9 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES: Canada:

one year;

G.S.T. to CDN orders.

P.S.T. to BC orders

H.S.T. to ON, NL orders

H.S.T. to PEI orders

H.S.T. to NB, NS orders U.S.A.: C$172.00 one year Foreign: C$222.00 one year

GST Registration # 809744071RT001 (ISSN 0029-3164)

CANADA POST: Return undeliverable Canadian addresses to Circulation Dept.

“It can be easy to take a partnership between Canada and the United States as a given,” U.S. President Joe Biden told the House of Commons on Mar. 24 on his first official visit to Canada. While he meant this as a positive and went on to describe the peaceful and prosperous relationship is a “marvel,” Canada has been reminded several times in recent years that it can’t — and shouldn’t — expect that U.S. economic policy will automatically favour us, no matter how close and historic the bond.

BY ALISHA HIYATEA few years ago, Biden’s predecessor, former President Donald Trump, made the unexpected and unilateral decision to redraw the carefully crafted North American Free Trade Agreement, resulting in the new U.S.-Mexico-Canada Agreement (USMCA) in 2020.

And just last year, there was a panic over Canada’s initial exclusion from EV incentives in Biden’s landmark Inflation Reduction Act (IRA) — an omission that was only reversed at the last minute after frenzied lobbying by Canada.

But during Biden’s speech and subsequent joint press conference with Prime Minister Justin Trudeau, he offered reassuring words and commitments that the U.S. wants to cooperate with Canada on clean energy, critical minerals security and supply chains, defence, and more.

While at one point, Biden seemed to imply that Canada would get the mining jobs and the U.S. would get manufacturing, most of his speech emphasized that the nations would build the batteries and technologies that go into clean tech like EVs together.

“We each have what the other needs,” he said.

“Our nations are blessed with incredible natural resources. Canada in particular has large quantities of critical minerals that are essential for… the world’s clean energy future,” Biden added.

“I believe we have an incredible opportunity to work together so Canada and the United States can source and supply here in North America everything we need for reliable and resilient supply chains.”

He went on to predict in his joint remarks with Trudeau that in the future, China would be “out of the game, in terms of many of the products they’re producing,” and that the U.S. and Canada would be solidly “economically situated for the future in terms of also bringing back manufacturing jobs.”

During Biden’s visit, the two nations also announced a one-year Energy Transformation Task Force to speed up coordinated efforts to deliver clean energy and integrated supply chains for renewable energy, EVs, critical minerals and more.

And in addition to EV incentives under the IRA, Canadian companies will also be eligible for other U.S. funding under the U.S. Defense Production Act, including a total of US$250 million announced last year toward mining and processing critical minerals (funding recipients will be named in the spring), and a $50-million pool to incentivize investment in the semiconductor sector.

Compete or collaborate?

Biden and Trudeau also disagreed with the perception that the “massive” funding (about US$370 billion over 10 years) the U.S. has earmarked for clean energy spending would hurt Canada.

“The IRA, which is bringing in massive investments and massive opportunities for American workers and companies, is also going to have strong impacts on supply chains and producers and employees in Canada,” Trudeau said in a joint press conference after Biden’s appearance in the House.

Still, the United States’ all-in approach on the energy transition has put pressure on the Trudeau government to beef up its support not just for clean tech, but also for the raw materials needed for the energy transition.

Its $3.8-billion critical minerals strategy announced in its 2022 budget last March looks rather anemic compared to U.S. spending, even on a proportional basis.

“We’re going to have to make sure we’re staying competitive and targeting the areas where we think we can best compete,” Trudeau acknowledged at the joint presser, adding, “we’ll have more to say about that in our budget next week.”

The feds are already supporting investment by auto and battery makers such as Volkswagen, which in March chose St. Thomas, Ont., for its first battery plant outside of Europe, Umicore and its plans for a $1.5-billion cathode materials plant near Kingston, Ont., and Stellantis and LG Energy Solution’s $5-billion battery plant near Windsor (although dollar amounts of incentives have not been revealed). They’ve also announced tax credits for exploration for critical minerals. But that still neglects a crucial part of the supply chain — the part that actually supplies the sought-after raw materials.

The 2023 federal budget was just released at press time on Mar. 28, revealing a few highlights for miners.

In response to the IRA, the government has earmarked $21 billion –mostly in tax credits and subsidies — for clean technology, renewable energy and more over next five years. This could grow to $80 billion by 2034.

This includes a clean tech manufacturing tax credit that will be worth $4.5 billion over five years. The 30% tax credit will be available to companies mining and refining critical minerals to offset the cost of equipment.

The government also seems to recognize that incentives alone are not going to get the results they want. That’s why it’s good to see that the budget also establishes a $1.5-billion Critical Minerals Infrastructure Fund, to be managed by Natural Resources Canada, that should help advance priority mining projects by funding energy and transportation infrastructure.

Equally important, it also contains a commitment to improve the efficiency of the impact assessment and permitting processes for major projects by the end of this year, and commits to advancing loans through the Canada Infrastructure Bank to Indigenous communities so they can purchase equity stakes in major projects. TNM

Politicians everywhere have a tendency to make decisions based on short-term outcomes that might become catastrophic in the long term. There are few better examples of this than legislation in London 250 years ago. In one of the U.K.’s worst ever political decisions (and we’ve had a few), Parliament voted on Apr. 27, 1773, to help the financially troubled East India Co. (EIC) by allowing it to sell tea from China directly to the American colonies.

The Tea Act, which received royal assent in May 1773, also reinforced an existing tax on tea in the American colonies (and so implicitly an acceptance of Parliament’s right to impose taxation). This outraged the good folk of Massachusetts and led to the Boston Tea Party of December 1773. The British government considered the spoiling of a cargo of tea an act of treason and responded harshly. By April 1775 the episode had escalated into a rather unfortunate revolution. EIC survived for another 100 years but our American colony was gone by 1783.

Because they have relatively short-term tenures, many, perhaps most, politicians have a tendency to myopia; they are not able clearly to see objects that are far away (also a weakness, I would argue, of chief executives). Our leaders then overcompensate by stating the blindingly obvious. Witness the Chancellor of the Exchequer, who recently announced “The wind doesn’t always blow, or the sun always shine.” Speaking on the Ides of March, Jeremy Hunt warned Parliament that the U.K. faces a shortfall in reliable energy sources.

Historically, Great Britain has been characterized as an island of coal being buffeted by gale-force winds in a sea of oil and gas. Issues with solar energy hardly come as a surprise, but we should never have become short of energy.

Our politicians have ‘history’ with regard to resource planning. This political ineptitude was described rather well in 1945 by the Welsh labour politician Aneurin ‘Nye’ Bevan (1897-1960). Bevan noted: “This island is made mainly of coal and surrounded by fish. Only an organizing genius could produce a shortage of coal and fish at the same time.”

In his budget speech, Hunt said nuclear power was “vital to meet our net-zero obligations,” and described it as a “critical source of cheap and reliable energy.” Hunt added that he wanted to encourage private investment in new nuclear power by classifying it as ‘environmentally sustainable,’ and would launch a new organization, Great British Nuclear, to help deliver nuclear projects.

In Bevan’s time, the U.K. relied almost exclusively on coal-fired power stations for its electric-

ity. Our electricity is now generated by a mixture of gas, nuclear and increasingly renewables. In a LinkedIn article on Mar. 10, Professor Brian Smart (formerly of the universities of Strathclyde and Heriot-Watt in Scotland) called for “true organizing genius” to secure this energy supply and take the nation forwards.

Professor Smart noted the “rush to renewables,” and away from fossil fuels, because of genuine concerns over greenhouse gas emissions driving global warming. The underlying issue, he warned, is that wind and solar are inherently intermittent in their performance, and, in the absence of sufficient compensatory energy storage, reliance has to be placed on other means of guaranteed generation — gas and nuclear in particular.

While nuclear has high assurance, large reactors have to be operated continually at their design load. It is adjustable gas-powered generation, therefore, that is frequently used to compensate for the day-to-day underperformance of renewables. Since the Russia-Ukraine war, however, operational problems have developed with regard to the security, assurance and affordability of gas-powered electricity.

Professor Smart suggests the solution lies in boosting the capacity of two types of stored energy.

First, the short-term vagaries of renewable energy should be compensated through a program of building battery facilities and hydrogen storage.

Second, the longer-term issues of supply security could be offset by building large strategic resources. Professor Smart suggested that we need to find a new green way of emulating our former coal-fired power stations, which were able to store six months of coal (and operate continuously but variably). Gas-fired generators, coupled with carbon capture and storage, are the only readily scalable source that can do this now. Gas-storage reservoirs could be filled when the price of gas was low, which would help address affordability as well as security.

There are four tenets of a nation’s electricity supply. The aggregate system must be secure (insulated from being weaponized by a foreign power), assured (able to provide an absolute continuity of supply), affordable and compatible with the shift to net zero greenhouse gas emissions.

We are signed up for the fourth of these tenets, but politicians everywhere need to tackle the other three imperatives while recognizing the inherent danger of relying on the wind blowing and the sun shining. TNM

—Dr. Chris Hinde is a mining engineer and the director of Pick and Pen Ltd., a U.K.-based consulting firm. He previously worked for S&P Global Market Intelligence’s Metals and Mining division.

BY COLIN MCCLELLAND

BY COLIN MCCLELLAND

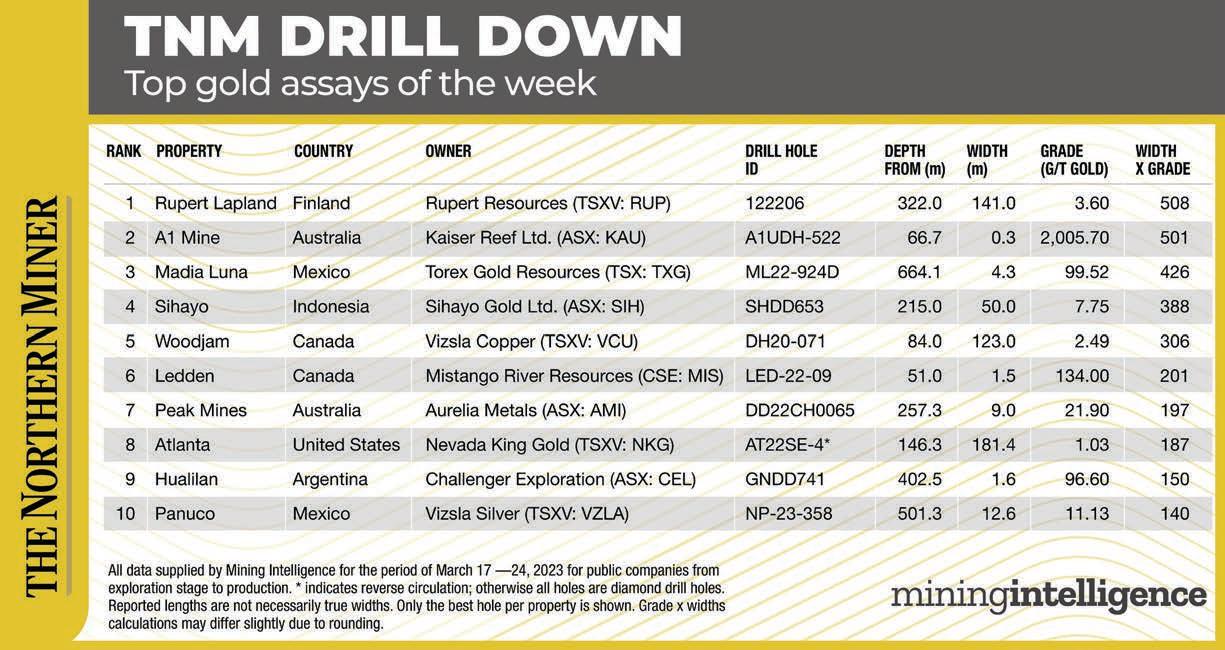

Our TNM Drill Down features highlights of the top gold assays of the past week. Drill holes are ranked by gold grade x width, as identified by our sister company Mining Intelligence.

Results from three corners of the globe led the week of Mar. 17-24. Rupert Resources (TSX: RUP) says new assays may expand its Ikkari gold project in northern Finland. Kaiser Reef (ASX: KAU) plans to expand the A1 mine in Australia dating from 1861. And Torex Gold Resources (TSX: TXG) is drilling at its EPO gold deposit in Mexico.

Rupert drill hole 122206 cut 141 metres grading 3.6 grams gold per tonne from 322 metres depth for a grade x width of 508 in the central portion of the Ikkari deposit.

It’s in Lapland, about 900 km north of Helsinki, where a potential open-pit mine could produce 200,000 oz. of gold a year, according to a November preliminary economic assessment (PEA).

“The intercept extends to 100 metres below the open pit considered by the PEA, confirming the continuity of high-grade mineralization,” Rupert said Mar. 21.

“Initial results confirm the exceptional continuity of the Ikkari resource and the potential for resource expansions in the west and at depth,” Rupert CEO James Withall said in a release.

The company is working on a prefeasibility study for Ikkari and intends to have all its permits by the end of 2025, Withall said in a presentation in March.

Canaccord Genuity mining analyst Michael Fairbairn said in a note on Mar. 21 that the highgrade results increase the potential for incremental growth in the next resource update.

“The ongoing infill and expansion drill programs will help de-risk and optimize the deposit’s economics, which may see the PEA pit shell pushed down to capture more ounces in the open pit,” Fairbairn said.

The latest resource estimate filed in January shows Ikkari holds 46.4 million indicated tonnes grading 2.5 grams gold per tonne for 3.7 million oz. contained metal. The first resource, delivered in 2021, was 49 million inferred tonnes grading 2.5 grams gold for 4 million oz. gold.

Ikkari could be built for US$405 million to operate as an open-pit mine for 11 years, moving underground in the 10th year for 24 years total, the PEA showed. Sustaining capital costs would be US$395 million. After-tax net present value would be US$1.6 billion with a 5% discount to produce an internal rate of return of 46% and payback after two years, assuming a gold price of US$1,650 per ounce.

Kaiser’s A1

Second during the week, Kaiser drill hole A1UDH-522 cut 0.3 metre grading 2,005.7 grams gold per tonne from 66.7 metres depth for a grade x width of 501 at the underground A1 mine. The operation about 150 km northeast of Melbourne produced 620,000 oz. gold from 1861 until 1992.

Kaiser mines the site targeting ore with more than 10 grams

gold per tonne. It wants to expand into mechanized mining after it increases resources and reserves.

The assay is from 1,254 metres of drilling that has extended high-grade mineralization, in particular northerly extensions to Jupiter Reef and beyond the historic mining of Dukes Reef on the 22 Level, Kaiser said in a release on Mar. 21.

“The drill holes from A1 continued to target both near-term mining and new deeper medium-term discoveries,” Kaiser said. Drill holes A1UDH-522 and -523 “show there is potential to go further north than the old workings. This creates a small but potentially rich ore block,” the company said.

Kaiser bought the mine in 2021 as part of Centennial Mining. It also included the Maldon goldfield under care and maintenance and the Maldon processing plant that treats A1 ore.

Torex’s EPO

The third best results came from Torex drill hole ML22-924D at the EPO deposit in Guerrero, Mexico. The hole cut 4.3 metres grading 99.5 grams gold per tonne from 664.1 metres depth for a grade x width of 426.

Drilling at EPO, which lies north of the Media Luna deposit near the Guajes Tunnel and south of the Balsas River on the company’s Morelos Complex 180 km southwest of Mexico City, was focused on upgrading inferred resources to the indicated category, the company said Mar. 23.

“Drilling EPO, with a view to advancing to the mine design stage, is a strategic priority given the potential for EPO to play a key role in supporting our efforts to fill the mill and maintain consistent gold equivalent production beyond 2027,” Jody Kuzenko, president and CEO,

said in the release.

“These drill results continue to demonstrate the underlying resource potential of the Morelos property and reinforce our positive outlook on our ability to complement future production from Media Luna.”

Toronto-based Torex plans to start commercial production at Media Luna late next year. Media Luna’s annual output over an 11.75-year mine life is expected to be 280,000 oz. of gold, 34.8 million lb. of copper and 1.3 million oz. of silver. Torex is estimating its total gold production this year at 470,000 ounces. TNM

In its quest for bonanza returns, high-tech capital is willing to take a bet on mining, an industry not noted for producing steady returns and challenged by its comparatively small size.

This, according to a panel of Silicon Valley capitalists and entrepreneurs at this year’s Prospectors and Developers Association of Canada convention in Toronto on Mar. 7, who are bringing fresh talent into the industry as well as capital.

A wave of US$10-US$15 billion of sophisticated funding has flown towards junior mining and clean energy innovators over the past three years, said David Danielson of Breakthrough Energy Ventures of California., a US$2-billion Bill Gates-backed climate and venture capital investment firm.

Climate tech venture capital has been one of the fastest growing trends in venture capital over the last three years, Danielson said.

While he sees early signs of life in the roughly US$2 billion invested, his fund deploys a high-risk-to-reward strategy.

“If we take 30 companies where we can put US$30 million in each early, we’re winners if two or three of those turn into billion dollar returns for us,” he said.

Danielson is also an adjunct professor at Stanford University, where he teaches courses on energy venture development. He has also served as the assistant secretary for the U.S. Department of Energy’s

Office of Energy Efficiency.

“Although Breakthrough Energy just got involved, there are early signs of life,” he told the panel, adding it takes about 10 years to know whether something’s gotten ‘commercial traction.’

The panel took place just days before the failure of key startup capital lender Silicon Valley Bank in the U.S.

Regarding mining innovation, Breakthrough Energy has a strong interest in accelerating the process from mineral discovery to production.

“We bring a bunch of new technologies together and experts from the industry to increase the hit rate by five times on discoveries to get dramatically more of these metals

online. We aim to find innovative ways to compress that development timescale,” Danielson said.

Meanwhile, BHP Xplor VP Sonia Scarcelli said she had noticed an uptick in talent transferring from Silicon Valley to Toronto’s Bay Street. She administers BHP’s (NYSE: BHP; LSE: BHP; ASX: BHP) junior accelerator program, which looks at companies at any stage along the value curve.

And for all the ostensibly hightech end-uses of mining products, a fresh look by Silicon Valley talent is giving mining research and development a shot in the arm and finding new economic uses for metals.

“We invest in early-stage concepts and ideas to work on the very front end of the value chain of the

resources,” Scarcelli says.

The accelerator program aims to get in early on exploration concepts and ideas globally, partnering with the companies and bringing its in-house know-how and new geological thinking. “We’re investing in commercializing these opportunities, looking at how we can accelerate the exploration phase. We can squeeze that — instead of five to 10 years — down to maybe a couple of years,” Scarcelli said. Scarcelli herself has transferred from the oil and gas industry. “To have disruption, you have to have a disrupting idea, and I see talent from other industries coming to mining.”

Rethinking old problems

Rio Tinto (NYSE: RIO; LSE: RIO;

ASX: RIO) is taking a fresh look at the perennial problem of tailings, Peter Harvey, the major’s managing director for closure and legacy management, said.

He sees the mine closure sector as a real opportunity for profit, both in accessing remaining minerals in tailings and through the ecological and recreational value rehabilitated lands hold.

“We look at what residual value exists in our portfolio, whether that’s minerals or metals, value in the land, in the water, the biodiversity, how do we leverage and access that and part of that residual value,” he said.

Harvey tapped the mining R&D space as being able to “really move the needle forward.”

Meanwhile, Doris Hiam-Galvez, a senior advisor at consulting engineering services firm Hatch, said that applying the concept of ‘designing sustainable prosperity’ is a method that enables the creation of a future sustainable society. It represents a practical and structured process where the key parties collaborate to design their future from the outset, looking beyond mine closure.

“The future is all about change. We must be ready and adapt to that change,” said Hiam-Galvez. “I think we are all aligned in what we must do. We talk so much, but I think it’s time for action. And we will see more action because we have no choice. Adopting new technologies faster will reduce that time to de-risk mining investments.” TNM

PDAC 2023 | Panel discussion sheds light on unexpected challenges of reducing carbon emissions

BY BLAIR MCBRIDE

BY BLAIR MCBRIDE

If the mining industry’s decarbonization journey is envisioned as a race, it’s more akin to a twisting trail race complete with uphill efforts, sharp turns and obstacles en route, than a straight road race.

Argentina, Chile, Bolivia and BAccording to a panel themed “The amazing race to decarbonize” at this year’s Prospectors and Developers Association of Canada conference in March, companies are at different stages of the process, and face complex challenges in their efforts to cut carbon emissions.

One of the most important steps in decarbonizing, if not the first one, is tracking progress with data and aligning it with the plan to reduce emissions.

Cora Devoy, director of sustainability with Lundin Mining (TSX: LUN) told the panel that it could be a “huge” challenge to get reliable data so that the company isn’t accused of presenting a curated picture of its progress, or greenwashing.

“We need the right data. The key is good, reliable data,” she told moderator Keith Russell, director of the Atlanta-based Partners in Performance.

Melanie Miller, chief sustainability officer with Toronto-headquartered explorer Seabridge Gold (TSX: SEA; NYSE: SA), added that data should also be geared towards the proper purpose.

Although Miller said Seabridge is proud of its engagement with local and Indigenous communities, it’s

conscious of who reads its reporting.

“[With] the metrics and the reporting and the alignment, we are working on our baseline and we want to do that with integrity when it comes to Scope 1, Scope 2, and Scope 3 [emissions] reporting,” she said. “But we also want to report what is critical to our stakeholders and what is material to our business — not just what is appeasing to reporting agencies or investors.”

Scale of decarbonization

Sonia Gupta, Dundee Precious Metals’ (TSX: DPM) director of sustainability, noted that Dundee is aware of its place in a wider supply chain and how it works with larger companies.

As a smaller firm in that chain, she knows it isn’t responsible for decarbonizing an entire industry

and can’t “green the power grid” on its own.

“We have a challenge that a lot of our suppliers are very carbon intensive,” she said. “I think what we can do, and what we do benefit from is having more intimate relationships within our supply chain and within our suppliers. To work together to actually try to find those optimization opportunities.”

Dundee, for its part, has had a carbon management plan since 2011 for its operations in Bulgaria, Namibia and Ecuador. It released its first Task Force on Climate-Related Financial Disclosures report in 2020 and its first emissions report last year.

Gupta said Dundee aims to be net-zero by 2050 and cut its emissions by 37% by 2035.

But decarbonization doesn’t look

the same everywhere, as Udloriak Hanson, Baffinland Iron Mines’ vice-president of community and sustainable development, explained to the panel.

At its Mary River iron ore mine, located in the northern region of Baffin Island, Nunavut, the company focuses on diesel use reduction and shifting to biofuels and offsets.

Although Baffinland closely tracks the operation’s energy usage, being so remote from the southern power grid makes it difficult for the mine to transition to net zero.

Remote mines like Mary River show how technical challenges can be magnified in mining decarbonization efforts.

Hanson cited a regulation by the International Maritime Asso-

ciation (IMO) in 2020 that would ban heavy fuel oil in Arctic waters. However, the fuel is often used in shipping in the Far North. The federal government has said it supports the ban.

While the ban would reduce the risk of the fuel polluting northern waters, Hanson noted that many Inuit fear the ban will raise shipping costs in the Arctic.

“Everything is shipped up north, if it’s not shipped, it’s flown,” she said. “If it’s going to cost more to ship, then it’s going to cost more to put food on the table. And no one had demonstrated or provided any assurances that this wasn’t going to hurt the Inuit. There are these issues that you really have to weigh and ask if it’s worth it at this point in time?”

A similar issue occurred when Baffinland was touring Nunavut communities for its proposed Phase 2 expansion of the Mary River mine, which the federal government rejected last November. The company discussed with communities the use of zero-emission wind mills to power the mine site, but many Inuit had concerns.

“It really had everything to do with them being afraid that we were going to affect their food chain, that we were going to affect the migration of animals or birds,” Hanson said. “What we thought might have been a good thing to do at our mine, and I’d argue it is…is considered dangerous for Inuit. They’re not saying don’t do it, but [they asked] where’s the data? Where’s the information to prove that this isn’t going to affect us?” TNM

Anew report by market analyst Wood Mackenzie argues that steel, aluminum, and copper stand to benefit most from an uptick in China’s gross domestic product growth this year.

WoodMac suggests that if China’s economy grows at the expected base case of 5.5% in 2023, the recovery will remain domestically contained with minimal global impact.

However, due to the industry-intensive nature of the high-case scenario laid out in the report, positive ripple effects will be felt across the global economy. The high case scenario of 7% will also see exporters of capital equipment, resources and materials to China witness some considerable upside.

According to Trade Economics, the Chinese economy grew 3% last year, significantly missing the central government’s 2022 target of 5.5%.

China is the largest importer of almost every commodity in the global markets. In its report released on Mar. 23 entitled ‘The Great Reopening,’ WoodMac looks at the expected impact of the Asian powerhouse’s re-emergence from government-orchestrated Covid restrictions.

Global metal markets are inextricably bound to China’s economy. “In our high-growth scenario, where growth is driven by more intensive industrial production and an outperforming property sector, the impact is greatest among the metal market’s heavyweights — steel, aluminum and copper,” WoodMac’s research director for the global mining team, Nick Pickens, said in a statement.

According to WoodMac data, China accounts for almost 900 million tonnes of finished steel consumption, just over half the global total.

Nearly two-thirds goes into the

construction sector. “Our base-case scenario already has Chinese steel demand recovering through the second half of the year, partly supported by an uptick in the property sector,” WoodMac said.

“However, our high-growth scenario boosts consumption by 25 million tonnes.”

In its base case, additional supply over time of steel’s critical raw materials — iron ore and coking coal — leads to a softening of prices. “In our China high-growth case, however, export markets would be unable to adequately respond to a near-term surge in Chinese demand, sustaining higher prices for longer.”

Demand growth

WoodMac suggests the key barometer for copper is Chinese property completions rather than building starts. Consumption, generally in the form of wire, is skewed towards

the later stages of the construction cycle.

Consequently, more supportive housing policies in China this year will spill into higher physical demand by the construction industry for 2024, WoodMac forecasts.

A further impact of its highgrowth scenario is a boost in demand for copper for appliances and machinery, though to a lesser extent than in construction.

“Combined, we estimate an additional 215,000 tonnes of copper demand, or 1.6% of total consumption, over the next two years,” WoodMac said.

China’s construction sector drives about a quarter of global aluminum consumption. Therefore, a stronger property market recovery would support a healthy increase in aluminum demand in 2023 and 2024, adding over 500,000 tonnes, or 1.3%, to primary consumption.

WoodMac’s analysts expect

more robust physical demand should underpin a recovery in metals prices, but levels also hinge on sentiment. Positive signals often trigger a flow of speculative money into the sector, turbocharging prices in the short term.

WoodMac flagged a further twist for metals. Higher energy demand could repeat the power-related supply disruptions experienced across China and Europe over the past two years. These led to production curtailments in zinc, primary aluminum, steel and nickel, which could hold metal price upside.

The report concludes that energy and natural resource markets remain delicately balanced, and while China’s leadership remains cautious on monetary policy and fiscal policy, sharper growth cannot be discounted. China’s reopening could once again turn up the heat on prices across the energy and natural resources spectrum. TNM

First Majestic Silver (TSX: FR; NYSE: AG) is taking action to reduce overall costs by temporarily suspending all mining activities and reducing its workforce at the Jerritt Canyon gold mine in Nevada, effective immediately. The company made the announcement on Mar. 20.

The Jerritt Canyon operation, which comprises a fully permitted processing plant and two producing mines (open pit and underground), was expected to produce between 119,000-133,000 oz. of gold this year.

Over the past 22 months since its acquisition of Jerritt Canyon, the company has been focused on increasing underground mining rates in order to sustainably feed the processing plant at a minimum of 3,000 tonnes per day in order to generate free cash flow.

Despite these efforts, mining rates have remained below this threshold, First Majestic said, and cash costs per ounce have remained higher than anticipated primarily due to ongoing challenges such as contractor inefficiencies and high costs, inflationary cost pressures, lower-than-expected head grades, and multiple extreme weather events affecting northern Nevada, which have compounded conditions and caused material headwinds for the operation.

“The decision to temporarily suspend mining activities at Jerritt Canyon, which represented approximately 21% of the company’s 2022 revenue, was driven by our goal to produce profitable ounces across the company,” Keith Neumeyer, First Majestic’s president and CEO, commented in a news release.

He noted that while mining activities have temporarily stopped, processing of the remaining surface stockpiles will still occur over the next couple of months. During the suspension, the company intends to process approximately 45,000 tonnes of

aboveground stockpiles through the plant at Jerritt Canyon.

In addition, Neumeyer said “the

company will continue exploring both near-mine and prospective regional greenfield targets to

grow Jerritt Canyon’s resources, which we believe will significantly enhance the economics for the

eventual restart of operations.”

Acquired from Sprott Mining in April 2021, the Jerritt Canyon property covers 308.2 sq. km of mining claims in Nevada. The Jerritt Canyon deposit was discovered in 1972, and first gold production occurred from the open pit in 1981, then underground in 1997.

The property contains an estimated 1.6 million oz. of gold in measured and indicated resources (8.6 million tonnes grading 5.84 grams gold per tonne), plus 1.3 million inferred oz. of gold (6.9 million tonnes grading 5.61 grams gold).

Shares of First Majestic fell as much as 25.4% to $5.53 on Mar. 21 on the news. At press time on Mar. 27 its Canadian-listed shares had recovered to $9.13 for a market cap of $2.5 billion. TNM

YUKON | Most recent feasibility study pegged Casino capex at $3.8B

AWARDS | Deadline for submissions is July 20

BY AMANDA STUTTThe Canadian Mining Hall of Fame has issued its 2024 call for Nominations. Each year, the CMHF reaches out through its network in search of outstanding individuals to consider for induction into the Canadian Mining Hall of Fame.

Through their leadership and achievements, individual nominees must have shaped Canada’s global leadership in mining, embodied the important role mining plays in Canadian society, and inspired future generations in mining.

Over 200 industry leaders have already been inducted into the Canadian Mining Hall of Fame since its inception in 1989.

In a release, CMHF chair Janice Zinck noted that Canada’s mining industry is “at the forefront of the world’s energy transition” and the supply of “future-facing” minerals and metals. “This generational opportunity will capitalize on our industry’s past successes. The Canadian Mining Hall of Fame celebrates the leadership that has built the mining sector into what it is today through current Members and future inductees.”

BY JACKSON CHEN Western Copper and Gold (TSX: WRN; NYSE-AM:WRN) announced on Mar. 24 a strategic equity investment by Japan’s Mitsubishi Materials to advance the company’s Casino copper-gold project in Yukon towards development.

Mitsubishi has agreed to acquire about 5% of Western’s outstanding shares at $2.63 per share. The exact number of shares to be issued (and by extension, total proceeds received) will depend on whether Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO) elects to exercise its right to participate in equity financings to maintain its 7.84% ownership.

Assuming Rio Tinto elects to exercise its participation right in full, about 8.1 million shares would be issued to Mitsubishi for gross proceeds of $21.3 million, and around 880,000 shares would be issued to Rio Tinto, bringing in $2.3 million.

Western Copper’s shares gained 0.8% by 12:45 p.m. ET on the investment by Mitsubishi. The Vancouver-based miner has a market capitalization of $362.3 million.

Located 300 km northwest of Whitehorse, the Casino property is host to a porphyry copper-gold-silver deposit containing 2.4 billion tonnes of measured and indicated resources at grades of 0.14% copper, 0.19 gram gold per tonne and 1.5 grams silver, for 7.6 billion lb. copper, 14.5 million oz. gold and 113.5 million oz. silver.

In summer 2022, Western published a feasibility study on the Casino project, which pegged capital costs at a whopping $3.6 billion. The study estimated Casino’s after-tax net present value, at an 8% discount rate, at $2.3 billion and its internal rate of return at 18.1%. Over a 27-year project life (in the case of heap leach, 24 years), annual production would reach 163 million lb. copper, 211,000 oz. gold and 1.3 million oz. silver.

Investor rights agreement

In connection with the investment, Western and Mitsubishi will enter into an investor rights agreement that gives Mitsubishi the right to appoint a member to the Casino project technical and sustainability committee, as well as one or more representatives to Western Cop-

per’s board.

Mitsubishi will also have the right to participate in future equity financings to maintain its ownership level. These rights can be exercised within 24 months of Mitsubishi’s investment, unless its interest falls below 3%.

In a release, Paul West-Sells, CEO of Western Copper, said Mitsubishi’s investment is a “strong endorsement” of the Casino project.

Western will remain the sole owner and operator of the Casino project, which it has been developing since 2008. The project encompasses the construction of a conventional open pit mine along with a mineral processing plant and heap leach facility, for which the environmental and socio-economic impacts are currently being reviewed by the Yukon government.

Last August, Mitsubishi also acquired a 15% stake in a joint venture it formed with another Canadian junior, Giga Metals (TSXV: GIGA). It invested $8 million into the JV, which will advance Giga’s Turnagain nickel-cobalt project in B.C. TNM

www.northernminer.com

Nominations must be submitted through Canadian Mining Hall of Fame member organizations or associate member organizations, which include: Canadian Institute of Mining, Metallurgy and Petro-

leum; Mining Association of Canada; The Northern Miner and the Prospectors and Developers Association of Canada.

Associate member organizations include: the Mining Associations of British Columbia, Ontario, Quebec and Saskatchewan and the Association for Mineral Exploration (AME). Any organization or member of the public is welcome to nominate a candidate, provided their nomination is channeled through one of these organizations.

The 2024 nomination deadlines are May 1 to contact a member or associate member organization about nominating a candidate for induction and May 31 for nomination materials to be delivered to a member or associate member organization for review. Member or associate member organizations must submit their nominations by July 20.

The guidelines, criteria for selection and nomination form are available at www.mininghalloffame.ca.

In November 2023, three new inductees were announced to be inducted into the Canadian Mining Hall of Fame in 2023: Jim Cooney, Alexander John Davidson and Douglas Balfour Silver.

The CMHF will welcome these new members at the annual dinner and induction ceremony on Thursday, May 24, 2023 at The Carlu in Toronto. Reservations can be made through the Hall of Fame website. TNM

Sprott Asset Management LP has announced the launch of Sprott Nickel Miners ETF (NASDAQ: NIKL), the only U.S.-listed exchange-traded fund focused on nickel mining companies.

NIKL represents the latest addition to Sprott’s suite of energy transition-focused ETFs following its launch of four critical minerals ETFs in early February.

“Nickel is a vital component in the rechargeable batteries used for hybrid and electric vehicles [EVs] and clean energy storage,” said John Ciampaglia, CEO of Sprott Asset Management, in a release.

“Automakers have begun adding more nickel to EV batteries to increase their drivable range. Demand for this critical mineral for use in EVs and battery storage may increase nearly 20 times by 2040, relative to 2020. We believe nickel producers are well positioned to benefit from the significant investment required to fund the energy transition.”

https://soundcloud.com/northern-miner http://www.northernminer.com/tag/podcast/

The Sprott Nickel Miners ETF seeks to provide investment results that, before fees and expenses, correspond generally

to the total return performance of the Nasdaq Sprott Nickel Miners Index (NSNIKL). The index is designed to track the performance of a selection of global securities in the nickel industry, including nickel producers, developers and explorers.

This new ETF joins Sprott’s energy transition fund suite, which is focused on the investment opportunity of the critical minerals needed to generate, transmit and store cleaner energy. The suite now comprises a total of seven funds. TNM

Navoi Mining and Metallurgical Co., the world’s fourth-largest gold company by output, plans to start another mine in its Uzbekistani homeland this year while intending to go public eventually with a stock market listing in the West.

Eugene Antonov, deputy CEO and chief transformation officer of the state-owned company, said he met with Canadian banks and TSX officials during Navoi’s first visit to the Prospectors and Developers Association of Canada’s annual conference in Toronto in March.

“It was a great success because we had lots of interest,” Antonov told The Northern Miner in an interview as PDAC wound down on Mar. 8. “They were raising their eyebrows after they found out how big a company we are, when so little is known about us.”

The company produced 2.8 million oz. of the yellow metal in 2021, with earnings of US$4.8 billion, making it the country’s largest earner by revenue. Navoi is headquartered in the namesake city in east-central Uzbekistan.

Now, the miner is undergoing widespread modernization with US$1.2 billion in loans from J.P. Morgan, Citibank, Société Générale and Deutsche Bank while targeting annual output of 3 million oz. gold by 2026. It plans to start mining during the third quarter 100 km northeast of Navoi at the Pistali deposit, discovered four years ago, adding 150,000 oz. a year to production.

Antonov, who used to work for Kinross Gold (TSX: K; NYSE: KGC) and has an MBA from the University of Toronto, couldn’t say exactly where or when Navoi would apply to list publicly, but said the first goal is to raise the company’s profile. Last year, the company visited a mining industry event in London.

Navoi has 12 mostly open-pit mines and nine processing plants across the central Asian country and plans to spend US$17 million this year on exploration. It’s seeking to find and develop another Muruntau open-pit mine, its primary operation producing 1.7 million oz. of gold a year with a potential 40-year mine life. Antonov says Muruntau has 59 million oz. of gold in 2.1 billion indicated tons of 0.88 gram gold per tonne, according to a JORC compliant 2020 estimate, although the figures are not available on Navoi’s website.

Westernizing mining

standards

Uzbekistan, under President Shavkat Mirziyoyev, has started privatizing state-owned enterprises, removed some trade barriers and lifted currency controls to help its economy grow by nearly 6% last year, according to The Economist. The magazine chose Uzbekistan as the world’s most improved country in 2019.

Officials cut its mineral extraction tax to 10% from 25% in 2019 and are updating its mining code by adopting Western claims practices, government land auctions and Aus-

tralian standards for resource estimates, Antonov says. He didn’t say whether that meant Navoi is leaning towards listing on the Australian stock market.

However, Uzbekistan is doubly landlocked; lacking a seaport and surrounded by landlocked and mostly post-Soviet countries. Some in the West may see it as a Russia ally in its war with Ukraine although the government in Tashkent, the capital, has said it respects Ukraine’s territorial integrity. Uzbekistan was ruled for 27 years by post-Soviet dictator Islam Karimov. Now, Mirziyoyev, who started as president in 2016, is keen to change the constitution to extend his term to 2040 when it’s due to end in 2026, The Economist says.

Still, the reforming country has been good for Navoi, which recorded total cash costs of US$623 per oz. and all-in sustaining costs of US$751 per oz. in 2021 as it benefited from bigger mines and lower labour, energy and borrowing costs than most peers, the deputy CEO said.

“Management has worked hard to successfully keep costs low, which are helped by the largescale operations that allow us to achieve that benefit. We also have very low leverage,” he said, referring to a ratio of debt to earnings before interest, tax, depreciation and amortization of 0.6.

As for critics who might suggest Navoi is able to lower costs by operating under lax environmental codes, Antonov disagreed.

“Uzbekistan has very strict min-

ing laws,” he said. “We’re fully cognizant that as we enter international capital markets, we will be held accountable at international standards.”

Navoi annually trains 13,000 employees of its 46,000-member workforce in environmental, social and governance issues, has built four solar power plants and is expanding its economic development programs, the deputy CEO said.

Antonov joined Navoi after

Uzbekistan sought him as a foreign-trained national to help the former Soviet republic transform to a market-based economy where it can benefit from its location at the crossroads of the ancient Silk Road.

“We’re here to meet with banks

Trusted. Independent. Committed.

and investors but we’ve also met with a number of Canadian producers and suppliers of the most technologically advanced exploration and processing systems,” he said. “We operate in a desert so the overburden can be thick and there is huge potential to find another Muruntau mine, so we need to work smarter to find it.” TNM

Our fit-for-purpose solutions encompass the skills of qualified geologists, geostaticians, analytical chemists, mineralogists, metallurgists, process engineers and mining engineers brought together to provide accurate and timely mineral and process evaluation services across the entire mining life cycle.

Above: Navoi Mining and Metallurgical Co. deputy CEO Eugene Antonov at PDAC 2023. E. ANTONOV

Above: Navoi Mining and Metallurgical Co. deputy CEO Eugene Antonov at PDAC 2023. E. ANTONOV

The largest gold producer you’ve never heard of is growing GOLD | Uzbekistan’s biggest miner is looking to the West for a stock listing

“UZBEKISTAN HAS VERY STRICT MINING LAWS. WE’RE FULLY COGNIZANT THAT AS WE ENTER INTERNATIONAL CAPITAL MARKETS, WE WILL BE HELD ACCOUNTABLE AT INTERNATIONAL STANDARDS.”

EUGENE ANTONOV DEPUTY CEO, NAVOI MINING AND METALLURGICAL CO.Dump trucks at Navoi Mining’s Muruntau gold mine. NAVOI MINING AND MELLURGICAL being CEO of former Londonlisted Trans-Siberian Gold, a producer of about 50,000 oz. a year.

In the smothering 35° Celsius dry heat in the shadow of no fewer than 19 active volcanoes, Canadian outfit Calibre Mining (TSX: CXB; US-OTC: CXBMF) is accelerating gold production growth in Nicaragua.

Not only is the Central American country regarded as one of the top coffee, cocoa, and tobacco exporters globally, but the geologically active jurisdiction remains exceptionally prospective for minerals, as Calibre is proving as it moves to expand production.

The mid-tier gold miner acquired a dominant land position in Nicaragua in 2019 after buying the El Limon and La Libertad mines, the Pavon gold project and other mineral concessions from B2Gold (TSX: BTO; NYSE: BTG) for US$100 million in cash and scrip.

Since then, the company has been working feverishly to expand the resource base and implement a hub-and-spoke model to boost economies of scale.

The company comes off a strong 2022 performance, having increased gold output 20% over 2021 and increased its reserve base 33% to 1.4 million oz. gold in February.

While the company has enjoyed success as a first mover, operating in Nicaragua comes with significant risk associated with international criticism of the country’s ruling regime under President Daniel Ortega.

Exploration

Since 2019, with the help of Calibre’s VP for exploration in Nicaragua, Pedro Silva, the company has started to rethink and modernize its approach to exploration in the country. This includes bringing knowledge in house, applying new technologies, and applying a rifle shot approach to targeting.

Silva has had a long and illustrious career spanning nearly three decades, mainly with Newmont (TSX: NGT; NYSE: NEM), Kinross Gold (TSX: K; NYSE: KGC), and Barrick Gold (TSX: ABX; NYSE: GOLD).

Under his stewardship, Calibre has digitized its database and applied various geoscience techniques to help identify new targets. Although these methods are not new to the industry, they are fresh in Nicaragua. Historical exploration was primarily driven by following artisanal mining and relied upon deposits outcropping at the surface.

The introduction of modern techniques has paid off, so far helping to identify a 6-km-long VTEM corridor (a zone of high apparent resistivity) at El Limon dubbed Panteon North.

During a site visit attended by sell-side analysts, the media, and investors, Calibre management was excited to share its latest findings from the Panteon North discovery. Drill results released on Mar. 21 highlight the potential to grow the system with grade.

The Panteon North discovery was announced in May 2022 as a part of Calibre’s aggressive drill program. Calibre has since expanded the dimensions of the discovery significantly, with the central discovery zone recently delivering an initial probable reserve of 244,000 oz. held in 810,000 tonnes grading 9.45 grams gold per tonne.

The discovery holds the potential for the company to use all of its excess processing capacity in Nicaragua, which stood at 1.6 million tonnes milled in 2022 compared with 2.7 million tonnes per year of installed capacity.

This is important, said Haywood Capital Markets mining analyst Geordie Mark in a Mar. 21 note to clients. “Drilling on the VTEM anomaly supports maiden drilling data released in December 2022 and highlights the structural corridor as a target zone for controlling high-grade gold mineralization,” he wrote.

Calibre’s senior VP for growth Tom Gallo said more drilling results over 2023 should add to the continuity of the Panteon North and northwest system, which are essential to augment future production plans beyond 2025. “Drilling on the VTEM corridor provides future leverage to discovery upside of comparable styles of high-grade, low-sulphidation epithermal mineralization,” said Gallo.

But growth opportunities abound at each of the Nicaraguan assets.

Silva points out that other promising targets include Blag and La Luna at the Eastern Borosi project, Veta Azul and Calvario at La Libertad, and Hagie at El Limon.

“In our view, Calibre has already laid the groundwork to continue its impressive track record of increasing reserves and resources and extending mine lives in Nicaragua,” said Canaccord Genuity mining analyst Michael Fairbairn in a Mar. 8 note to clients.

Calibre’s probable reserves have grown 370% since 2019 to 1.4 million oz gold as of Dec. 31, 2022. The Nicaragua reserves are held in 6.3 million tonnes grading 5.37 grams gold per tonne for 1.1 million oz. gold. It also holds 3.3 million oz. silver at 16.25 grams per tonne.

Indicated resources stand at 16.8 million tonnes grading 3.37 grams gold per tonne and 8.9 grams silver per tonne for 1.8 million oz. gold and 4.8 million oz. silver. The com-

pany holds marginal resources elsewhere, including the Pan project in Nevada.

In the near term, Calibre is banking on grade-driven production growth as it transitions from a focus on extending legacy mine lives to a focus on growing free cash flow. The company expects to produce 275,000-300,000 oz. gold by 2024, compared with 2022 production of 222,000 oz., which translates to an increase of about 30% at the midpoint of guidance. Calibre has guided for 2023 production of 250,000-275,000 oz.

The growth is expected to be mainly driven by the recent commissioning of the Pavon Central pit and the Eastern Borosi project (on the Atlantic side of the country), boosting production from the year’s second half.

To achieve continued growth, the company is focused on optimizing its mine plans, an effort led by VP for Nicaragua operations David Hendricks, an industry veteran who held senior positions with Barrick and Kinross and most recently was the general manager at the Tasiast mine in Mauritania.

By focusing on project sequencing, Hendriks believes Calibre can grow or sustain production while investing the growth capital needed to bring new projects online.

Fairbairn anticipates Calibre will generate substantial free cash flow over the next several years as it executes its plan in Nicaragua. Notably, he expects Calibre to generate about 32% free cash flow yield by 2025 and projects it will be trading under cash value by 2026 if the share price does not re-rate.

Infrastructure gains Nicaragua has invested heavily in building out a high-quality road network. Roads are paved with asphalt or interlocking bricks and are exceptionally well maintained by the government. During the site visit, management demonstrated how the

the regime.

The new U.S. sanctions under President Joe Biden expanded a previously signed Donald Trumpera executive order to include specific potential restrictions on trade and investment involving Nicaragua, with a particular reference to the gold industry.

The U.S. Treasury Department also acted in concert with the order to designate sanctions against Nicaragua’s General Directorate of Mines (DGM) and an official of the Nicaraguan government named Cerna, the former head of state security and a confidante to Ortega. These actions come as a continuation of the U.S. government’s efforts to limit the power and resources of the Ortega regime, which has silenced critics and dismantled democratic institutions in the country.

The United Nations also regularly files reports alleging human rights violations by the Ortega regime during the violent 2018 uprisings.

country’s improving infrastructure was helping simplify logistics for Calibre’s hub-and-spoke operation. This enables the company to ship ore from the El Limon operation to fill the extra capacity at its La Libertad mill via road.

Silva explained that Calibre’s busiest trucking route runs between El Limon and La Libertad, where the company ships about 1,000 tonnes daily.

After the site visit, the company announced mining at its Pavon Central open pit mine operation, which started in January, had progressed ahead of schedule and budget and averaged 1,000 tonnes per day shipped to the Libertad mill in February.

In a Mar. 15 statement, the company’s president and CEO Darren Hall (who was unfortunately not with the tour group), noted Pavon Central will be a significant contributor to the company’s production growth starting this year.

Nicaragua’s active geology also lends itself to ample renewable energy generation, and the Ortega regime is hoping to capitalize on the opportunity.

Laureano Ortega — one of President Ortega’s sons and widely tipped to be in line to take over from his father should Ortega’s wife, Rosario Murillo, not accede to lead government — told the tour group during a presentation that renewable energy generation accounted for 75% of the country’s power in 2022 and that the nation is on track for 90% renewable coverage by 2033.

All is not smooth sailing in Nicaragua, given the generally oppressive political regime prompting riskweary investors to sit on the sidelines to see where things are headed under Ortega.