Critical Minerals Strategy to streamline permitting, build remote infrastructure

BY BLAIR MCBRIDE

The federal government unveiled on Dec. 8 the details of its Critical Minerals Strategy, a plan first introduced in the April budget that earmarks almost $3.8 billion over eight years to further develop Canada’s place in the global critical minerals industry.

A significant portion of the total funding — $1.5 billion — is allocated over seven years for constructing infrastructure for critical minerals projects in remote areas, such as the Ring of Fire in northern Ontario. And $40 million is set aside to support northern regulatory processes in reviewing and permitting projects.

Officially announced in Vancouver by Natural Resources Minister Jonathan Wilkinson, the 52-page document outlines the government’s plan for Canada “to become a global supplier of choice for critical minerals” and the digital technologies they enable.

“There is no energy transition without critical minerals,” Wilkinson said at the Pinnacle Hotel Harbourfront. “The sun provides the raw energy but electricity flows through copper, nuclear power requires uranium, [and] electric vehicles require batteries made with lithium and cobalt.”

Out of a list of 31 critical minerals in Canada, the strategy prioritizes six for their economic growth potential and status as inputs for supply chains: lithium, graphite, nickel, cobalt, copper, and rare earth elements.

It also focuses on five segments in the critical mineral value chain: geoscience and exploration; mineral extraction; intermediate processing; advanced manufacturing; and recycling.

Wilkinson said the focus of the strategy is to expand the critical

mineral sector while doing things in the right way.

“It can’t take us twelve to fifteen years to open a mine in this country if we want to accomplish our climate goals,” he said, adding that the government plans to accelerate processes and timelines while respecting the environment and Indigenous peoples, who “must see benefits through mining projects.”

The document doesn’t identify any new funding streams that weren’t already set out in Budget 2022.

Areas of focus

The strategy is guided by six areas of focus: driving research, innovation, and exploration; accelerating project development; building sustainable infrastructure; advancing reconciliation with Indigenous peoples; growing a diverse workforce and prosperous communities; and strengthening global leadership and security.

In seeking to drive innovation and exploration, $79.2 million will

be earmarked for public geoscience and exploration to help identify and assess mineral deposits. Under this focus, the new 30% Critical Mineral Exploration Tax Credit for targeted critical minerals will be introduced, and $47.7 million allocated for upstream critical mineral research and development through research labs. Another $144.4 million is set for further R&D, and the use of technologies to support critical mineral development for upstream and midstream segments of the value chain.

Wilkinson said that more investment in geological mapping across more areas of the country will benefit exploration companies.

“[And] there’s $1.5 billion in the funding for infrastructure that can include roads or transmission lines in the North that can actually help mines,” he said.

‘One project, one assessment’ To accelerate project develop-

Glencore and

copper mines ride out unrest as Peru promises early polls

BY COLIN MCCLELLAND

The worst protests to hit Peru in years are shaking investor confidence in the world’s second-largest copper producer as strikes and blockades threaten output from mines run by Glencore (LSE: GLEN) and China-controlled MMG.

The unrest has left at least 20 people dead this month and was continuing even after new President Dina Boluarte declared a state of emergency and promised elections more than two years early in late 2023.

Boluarte announced the initiatives following the Dec. 7 sacking of former President Pedro Castillo on charges of corruption and attempts to undermine the constitution. The state of emergency allows armed forces greater leeway to restore order.

Glencore’s Antapaccay and MMG’s Las Bambas mines are key operations in the South American country where hundreds of thousands of demonstrators took to the streets this month.

Police at times used deadly

force as buildings burned, some national highways and regional roads were blocked, and airports closed. Protesters backed by some large unions who called local and national strikes want Boluarte to

INSIGHTS ON COSTING AND INFLATION FROM THE CANADIAN MINING SYMPOSIUM / 2 905 841 5004 | geotech.ca VTEM™ | ZTEM™ | Gravity | Magnetics Geotech_Earlug_2016_Alt2.pdf 1 2016-06-24 4:27:20 PM WWW.SGS.COM/MINING MINERALS@SGS.COM DELIVERING QUALITY EXPERTISE GLOBALLY ACROSS THE ENTIRE MINING LIFE CYCLE expert advice from exploration to closure .com DECEMBER 26, 2022 — JANUARY 15, 2023 / VOL. 108 ISSUE 26 / GLOBAL MINING NEWS • SINCE 1915 / $5.25 / WWW.NORTHERNMINER.COM

MMG

ESG | State of emergency fails to quell protests in Andean nation PM40069240 SITE VISIT: G2 GOLDFIELDS HOPES TO ADD TO DISCOVERY COUNT IN GUYANA / 8

POLICY | Natural Resources minister endorses ‘one project, one assessment’ principle

See STRATEGY / 7

See PERU / 16 SPECIAL FOCUS OUTLOOK 2023 A look at what’s ahead for commodities | 12-15

Thousands of protesters took to the streets in Peru in December amid the state of emergency declared by new president Dina Boluarte. PIXABAY

OUR FUTURE January 23 – 26, 2023 Vancouver Convention Centre East roundup.amebc.ca Register Today

Natural Resources Minister Jonathan Wilkinson speaks in Vancouver on Dec. 9. NATURAL RESOURCES CANADA

Inflation hits miners: ‘It has never been more expensive to build or operate a mine in the US’

BY NICHOLAS LEPAN

It has never been more expensive to operate or build a mine, according to new research from CostMine, although not all costs are rising equally.

In late November, Michael Sinden, vice-president of data with The Northern Miner Group, presented inflation data at the Canadian Mining Symposium in London, showing that mining operational and capital expenditures are reaching 20-year highs.

rials, reagents, grinding media, and liners. The bulk of costs come from fuel, explosives, chemicals, and electricity, or as Sinden puts it: “Anything hydrocarbon related is inflating costs at a mine.”

based mines is only rising at a 2.8% to 3.5% compound CAGR and salaries are growing at a 2.9 to 3.9% CAGR.

All this is coming at a time when metal demand is accelerating due to a mineral

sity of British Columbia, Canadian Research Chair in Advanced Mine Energy Systems, the mining industry is still using fossil fuels because it is “comfortable” with them.

“Fuels have been the most techno-economically feasible choice and should we not take into account the environmental costs associated with consuming them, there is a good chance that fossil fuels will stay the most ‘comfortable’ energy source in at least the near future.”

He notes that fossil fuels are still relatively cheap, abundant, and flexible enough to power remote mining sites. In addition, different mining operations have different energy demands due to the variability of operating conditions such as climate, location, level of access to energy grid, deposit type, mining technique, and mineral processes.

Mill and underground capital expenditures are a serious source of inflation as deeper mines and expensive milling equipment are driving up costs. Since 2015, costs have risen 7% on a compound annual growth rate (CAGR) basis or 60% compounded over this period.

When it comes to labour, costs aren’t the problem, at least not yet, CostMine data shows. The hourly rate for labour at U.S.-

and metal intensive energy transition and increased scrutiny of the mining industry’s own carbon footprint.

Mitigate or eliminate carbon costs? Renewable energy is increasingly becoming cost competitive with fossil fuels. Decarbonizing the mining industry appears to be a solution, but it is not so simple.

According to Ali Madiseh of the Univer-

However, Madiseh cautions that this could change with incoming carbon tax policies around the world. Miners should consider at what point their reliance on fossil fuels becomes too expensive, or could result in the loss of their licence to operate.

“Unfortunately, there is no silver bullet to mine decarbonization,” Madiseh adds. The process is rather step-by-step. People need to devise a strategic plan and start with the low-hanging fruits which are technologically more mature and economically less costly to implement.”

Sinden pointed out that this data is not a big surprise given the current economic climate but there is more to the story. “There’s no question mine costs are increasing and will continue to do so, but the ability to pinpoint where inflation is coming from and the ability to mitigate it is critical.”

Mill and surface operations expenditures experienced the biggest uptick due to exposure to fuel and electricity costs, raw mate-

Mining operations that depend on a hydro-powered electrical grid may have a relatively low carbon footprint while some remote operations may rely solely on fossil fuel-generated power, greatly increasing their carbon footprint.

The global transition towards a green economy can only be accomplished with renewable power, electric vehicles and energy storage technologies, but this places pressure on the mining industry to produce minerals and metals.

The need for mines has never been greater, but at what cost? TNM

Demand for diamonds has ‘never been better’

BY ADAM DICKIE

The post-pandemic period represents “the best diamond market in the better part of a decade,” Lucara Diamonds’ (TSX: LUC) president and CEO Eira Thomas told delegates at The Northern Miner’s recent Canadian Mining Symposium in London, U.K.

In an interview with The Northern Miner podcast host Adrian Pocobelli, Thomas explained the rationale of investing in a space that gives exposure to both mined commodities and consumer-marketed products.

“Demand for luxury products and diamonds has never been better,” Thomas said. “If you have an outlook that the world is going to continue to grow, albeit even now at a slower pace, then you have a positive view on the commodity.”

Lucara operates one of the highest-margin diamond mines in the world — Karowe, in Botswana, where an average of 300,000 carats are produced per year. In guidance released on Nov. 28, the company said it expects to generate between US$200 to US$230 million next year, thanks in part to the firm’s innovative sales channels.

“It’s a challenging commodity — every diamond is unique, and they all have unique price points,” she said. “How do you take that pro-

duction and sell it regularly for repeatable income?”

Previously, Thomas noted, diamond sellers solved that problem by building up inventory into different ‘buckets’ based on categories including size, colour, and shape. “We would force our customers to buy an entire bucket — if you only wanted ten stones, too bad, you’d have to take all 32,” she said.

In 2020, Lucara introduced a digital twist to traditional diamond marketplaces with Clara, its 100%owned web sales platform for rough stones. Buyers can submit queries to the Clara store requesting specific stone characteristics, and an algorithm matches available rough diamond inventory in quantities down to a single stone.

Thomas noted that having a digital market helps buyers achieve better margins by avoiding unnecessary travel costs and bucket-style pricing.

“We have technology today to make this much easier,” she said. “People can place orders without leaving their office. Normally they’d have to get on a plane and come to Botswana.”

Vote of confidence

While Thomas predicts the Clara platform will start delivering cash flow in 2023, smaller stones represent a minority of her company’s sales (only diamonds between

1 and 10 carats are sold through Clara). Instead, the Karowe mine is famous for its abundance of large, high-value diamonds greater than 10.8 carats that generate about 70% of Lucara’s annual revenue.

On Nov. 16, Lucara announced it had reached a 10-year extension of a sales agreement it has with HB Group, a Belgium-based diamond manufacturer. Under that agreement, Lucara’s 10.8+ carat diamonds are sold at the estimated polished outcome determined through scanning and planning technology. The final payments are

based on actual sale prices minus costs and fees.

“All of our large diamonds are now being manufactured and sold as polished diamonds,” said Thomas, “so we have complete control of where our diamonds are going.”

One target for Lucara’s diamonds is the luxury conglomerate Moët Hennessy Louis Vuitton (LVMH). In 2019, Lucara partnered with LVMH to curate and manufacture its massive, 1,758carat Sewelô diamond in return for an upfront payment and a 50% stake in derived stones.

“Louis Vuitton bought Tiffany two years ago in the middle of COVID,” said Thomas. “They can see the tremendous opportunity to bring diamond jewelry along in this journey of luxury good consumption. That gives us a lot of confidence as a producer.”

Lucara is investing its boosted revenue stream back into Karowe, announcing in August the beginning of a shaft sinking phase that will eventually convert the openpit operation into an underground mine. The plan, first announced in 2019, promises to generate over $5 billion in revenue for the firm with estimated capital costs of $547 million.

“It’s really about execution on the underground,” Thomas said. “We’re pleased with the ground

conditions — we just have to continue to ramp up and push hard.”

Diamonds on the blockchain Thomas noted that with supply chain pressure brought on by the Ukraine-Russia conflict, diamond provenance is emerging as a prime concern for buyers large and small. Her firm’s successes in Botswana, including having the country’s first female managing mine director, make Lucara’s story easy to sell.

“Big brands won’t buy a diamond unless they know where it came from,” said Thomas, who pointed out that purchasers of Lucara gems can follow their diamonds through the value chain using Blockchain technology. “We guarantee the provenance of all of those big stones.”

As for future headwinds, Thomas drew attention to the underperformance of diamond stocks even after sharp increases in sales and revenue after 2020. Part of the problem, she noted, is the historic opacity that is associated with the diamond sphere.

“We’ve had to really look hard in the mirror and find a way to bring transparency to the industry,” she said. “But now we’re opening Clara up to the entire world, and we have other producers and sellers of secondary diamonds also selling their diamonds through this unique digital marketplace.”

2 DECEMBER 26, 2022—JANUARY 15, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

Lucara Diamonds CEO Eira Thomas speaks at the Canadian Mining Symposium in London, U.K. in November. NORTHERN MINER

CMS 2022 | Opex and capex nearing 20-year highs, CostMine data shows

CMS 2022 | Digital sales, blockchain tracing cement Lucara’s place in diamond market

TNM

80 140 160 220 280 Surface Mine Capex Surface Mine Opex U/G Capex U/G Opex Mill Capex Mill Opex Labor, 43% Drill bits/Steel, 2% Drills, 2% Trucks, 2% Excavators, Loaders, Dozers, 3% Tires, 7% Explosives, 18% Lubricants, 3% Fuel, 20%

Mill Labor, 24 Grinding Media, 21.5 Concentration, 1.6 Crushing & Grinding, 3.8 Electricity, 17.3 Reagents, 24.5 Lubricants, 3.9 Fuel, 3.4 0 5 10 15 20 25 30 35 Laborer — Surface Mill Equipment Operator Production truck driver Heavy Equipment Operator — Surface Hourly Wage (US$/hr) 2000 2010 2021 US Mine Cost Inflation by Theme (Index, 2000 = 100) Surface Mine Opex Breakdown Mill Opex Breakdown 132,000 59,200 71,000 155,700 93,600 108,100 213,100 118,200 129,200 50,000 100,000 150,000 200,000 250,000 General Manager Chief Geologist Mine Superintendent Salary (US$/year) Select US Employee Hourly Wages (US$/hr) Select US Employee Salaries (US$/hr)

Hecla steps up to meet growing silver demand

CMS 2022 | Company will soon account for 60% of US silver production

BY HENRY LAZENBY

North America’s oldest silver miner, Hecla Mining (NYSE: HL), is on track to solidify its position as the continent’s primary silver leader with a plan to increase its U.S. output by 20% and to become the most prominent Canadian silver producer by year-end.

The 130-year-old company’s CEO, Phil Baker, told The Northern Miner’s recent Canadian Mining Symposium in London that the 1.2 billion oz. silver market is growing at about 200 million oz. per year. That demand growth is coming most notably from the photovoltaic (PV) market, which Baker expects to grow at about 12% annually, or about 200 million ounces.

While the photographic demand for silver had passed, growing demand from industrial applications had expanded beyond electronics to the energy industry itself, “which has brought us to a new place for silver,” Baker said.

Coupled with rising industrial applications, massive demand from India for silver jewelry has reached pre-pandemic levels after causing “some concern,” according to the executive, since demand had fallen off dramatically during the pandemic years.

“And it’s that Indian demand for silverware and things that are really the strongest ever,” said Baker.

The CEO estimates the primary silver market comprises about 800 million oz., with another 200 million oz. sourced on the second-

ary recycled market. “That deficit, of course, is coming out of aboveground stocks. Unlike other metals, you’ll never run out of silver. But it’s got to be extracted from people, which maybe is harder than extracting it from the ground when you have a robust market,” said Baker.

He added Hecla takes the long view on silver given the metal’s solid fundamentals and its habit of mimicking gold price movements in potentially exponential terms.

“It doesn’t matter when it’s going to happen, but we know that when it does, our share price will move dramatically along with the silver price,” he said.

Growth trajectory

Currently, Hecla accounts for about 40% of U.S. silver output. That figure is set to jump to about 60% as

soon as the miner ramps up production at the Greens Creek mine in southeast Alaska and hits its stride with a new mining technique at the Lucky Friday mine in Idaho.

Greens Creek has since 1987 produced 330 million oz. of silver, where continuous exploration success has allowed for several 10-year extensions of the mine plan.

“Today, we’ve got about another decade left,” said Baker.

The mine produces about 10 million oz. per year. It’s also the reason Hecla is the third-largest producer of zinc in the U.S., with another 50,000 oz. of gold a year as a by-product credit.

“One analyst told me years back, that Greens Creek, besides uranium, is the highest-valued rock on the planet because of the four metals it produces. It’s a gift that keeps giving.”

Since Hecla became the sole operator in 2008 (taking over from Rio Tinto), the mine has generated about US$1.2 billion of free cash flow.

At the Lucky Friday mine, Baker said the company is finally coming to grips with the difficulty of dealing with an 80-year-old mine more than 3 km deep.

Since the start, the mine produced, on average, about 2.5 to 3 million oz. a year. But because of the depth, it is seismically active, which has presented the company with significant operating headaches.

Baker explained that blasting energizes the surrounding unstable rocks, causing earthquakes and mine instability.

Over the past decade the company has tried several mining techniques, even looking at mechanically mining the rock. “Well, in that process, we discovered another way of doing it, which is a big blast, where we’re blasting 10,000 times the amount of material, which creates a huge amount of energy,” he explained.

“And that huge amount of energy gets released simultaneously with the blast. And so, as a result, this mine is going from a very highgrade 800 tons a day operation to 1,200 tons, and I suspect we’ll eventually get to 1,600 tons,” said Baker.

“As we go deeper, the grade goes up. And with our new mining method, the production is going up.”

Canadian angle Hecla is also bullish on Canada. It

CANICKEL MINING LIMITED BUCKO LAKE MINE, WABOWDEN, MANITOBA

CaNickel Mining Limited (“CaNickel”) owns the Bucko Lake Mine in Wabowden, Manitoba. Since 2012, the Bucko Lake Mine has been in care and maintenance and the mine discharges mine water effluent into Bucko Lake on a continual basis as part of normal operations.

Bucko Lake is a lake in the Grass River System of Northern Manitoba. The lake does not have any cottages or inhabitants close by and is understood to be an area of little interest to the local populace. However, the lake is considered “water frequented by fish” for the purposes of legislation as it contains populations of at least two fish species. Mining companies must not permit the deposit of an effluent that contains a deleterious substance in excess of authorized limits in water frequented by fish.

Since March 2008, the Bucko Lake Mine has exceeded an effluent flow rate of 50 m3 per day and has been depositing effluent that contains “deleterious substances” into Bucko Lake. CaNickel acknowledges that it had, and continues to have, the responsibility to ensure that the quality of the effluent discharged from the legacy tailings area into the environment adheres to the Metal and Diamond Mining Effluent Regulations (MDMER), formerly the Metal Mining Effluent Regulations (MMER), and the Fisheries Act.

Legislation also contains certain requirements to ensure the regular collection of samples from final discharge points to conduct acute lethality tests. An effluent at 100% concentration which kills more than 50% of the rainbow trout subjected to such effluent over a 96-hour period is considered acutely lethal.

In 2016 and 2022, CaNickel plead guilty to charges of certain contraventions of the MDMER. As part of its sentence respecting the 2022 conviction, CaNickel agreed to take out this paid article to explain the facts of the incidents, articulate the importance of complying with the MDMER and to explain the possible environmental risk associated with non-compliance.

THE INCIDENTS

In May 2014, CaNickel’s testing determined that the effluent it was discharging into Bucko Lake had exceeded the limit for radium and self-reported these results to Environment Canada.

At the direction of Environment Canada, CaNickel increased dosing of barium chloride to reduce the radium levels. After the results of these efforts were received, it was determined that more barium chloride was required. However, this determination was not made for 13 days as the only employee trained to review the results was out of the country.

It was determined that CaNickel should have had policies and procedures in place with respect to dosing and that another person should have been present to perform the same procedures and adjust the levels immediately. A further contributing factor to this incident was confusion regarding weekly sample limits of 1.11 Bq/L and the monthly mean limit of 0.37 Bq/L. While the company collected weekly samples which were compliant, it failed to take into account the much lower mean monthly sample limit.

Then in October 2014, employees were performing clean up and hosing in the Bucko Lake mill facility when some nickel concentrate spillage (approx. 18% nickel) was inadvertently directed to a sump feeding the water treatment plant and released to the environment. Environment Canada demonstrated nickel contamination after conducting tests which determined that 100% of the rainbow trout died in a 100% concentrate (and that 10% died in a 50% concentrate). This incident highlights the requirement for ensuring employees carry out plans properly and in accordance with legislation.

As a result of the above, CaNickel pled guilty to having discharged effluent exceeding the limits for radium and nickel in 2016.

In July 2017, CaNickel had recognized that radium lev-

operates the Casa Berardi mine in Quebec.

“It’s a gold mine, which we like because we need the diversification from silver. If you look at the silver price, compared to the gold price, it’s been depressed. And you can tell that the gold-silver ratio works in our favour. We’re getting more revenue, more cash flow from gold on a relative basis than to silver.”

The mine is also the company’s only operation that produces mixed metal doré bars, meaning it gets to sidestep dealing with the smelters.

Meanwhile, at its Keno Hill silver mine in Canada’s Yukon — which it acquired through an all-share takeover of Alexco Resource this year — the focus is on the development and drilling of the Bermingham and Flame & Moth deposits to bring the mine into full and consistent production by the end of 2023. According to Baker, the operation will make Hecla Canada’s biggest silver miner once at full tilt.

With expanding North American mines, Hecla raised its fiscal 2022 guidance to 13.6-14.1 million oz. for silver and 169,000-180,000 oz. gold in October.

Earlier this year, Hecla said that its global proven and probable reserves of the precious metal grew in 2021 to the second highest level in the company’s history — to 200 million ounces.

The company’s New York-listed shares are up more than 12% over the past 12 months at US$5.34, which gives it a market cap of US$3.2 billion. TNM

els were increasing in its effluent discharge. The company made changes to the treatment chemistry in hopes of reducing radium levels but was ultimately unsuccessful. In hindsight, CaNickel should have halted the discharge to evaluate the cause of the rising radium levels.

Around the same time, CaNickel failed to formally select a date for sampling to conduct acute lethality tests at least 30 days in advance of the sampling date, in contravention of legislation. By failing to do so, the samples were not taken at the frequency required by the legislation.

As a result, CaNickel pled guilty in 2022 to one count of having discharged effluent exceeding the limits for radium and one count of failing to collect the acute lethality sample on the selected day.

THE IMPORTANCE OF COMPLIANCE

Radium has adverse biological effects and is a known human carcinogen. Nickel is toxic to the environment and to all fish species. Given the risks involved with high levels of such substances, compliance with the MDMER is critical to ensure that testing is performed at regular intervals to identify quality issues.

When quality issues are identified, companies must take all reasonable steps to correct the issues as soon as possible. Failure to do so may have a negative impact on the surrounding environment and result in charges being levied against the company. In CaNickel’s case, substantial financial penalties were levied and its reputation impacted.

CaNickel would like to use this advertisement to impress upon all mining companies that compliance with the MDMER is vital to safeguard the environmental and human health. CaNickel has now taken all reasonable steps to ensure that it will remain in compliance with the legislation going forward.

GLOBAL MINING NEWS THE NORTHERN MINER / DECEMBER 26, 2022—JANUARY 15, 2023 3

Hecla Mining CEO Phil Baker. NORTHERN MINER

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Alisha Hiyate, BA (Poli Sci, Hist) ahiyate@northernminer.com

MULTIMEDIA SPECIALIST: Henry Lazenby hlazenby@northernminer.com

STAFF WRITER: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PHOTO EDITOR AND PODCAST HOST: Adrian Pocobelli, MA (ENGL) apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/

CAREER ADS George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 moliveira@northernminer.com

ADDRESS: Toronto Head Office 225 Duncan Mill Road, Suite 320 Toronto, ON, M3B 3K9 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES: Canada: C$130.00 one year; 5% G.S.T. to CDN orders. 7% P.S.T. to BC orders 13% H.S.T. to ON, NL orders 14% H.S.T. to PEI orders 15% H.S.T. to NB, NS orders U.S.A.: C$172.00 one year Foreign: C$222.00 one year GST Registration # 809744071RT001 (ISSN 0029-3164)

CANADA POST: Return undeliverable Canadian addresses to Circulation Dept. c/o The Northern Miner 225 Duncan Mill Road, Suite 320 Toronto, ON M3B 3K9

Publication Mail Agreement #40069240

Periodicals Postage Rates paid at

The Northern Miner’s most clicked stories of 2022

As we end off 2022, The Northern Miner takes a look at the top 10 most-clicked stories on our website from Jan. 1 to Dec. 15.

No. 1: Canada’s Top Ten precious metals juniors

THE VIEW FROM ENGLAND:

COLUMN | Coal mine approval a seasonal gift from UK government

BY DR CHRIS HINDE Special to The Northern Miner

decision by early July (a promise eventually compromised by Boris Johnson’s resignation as Prime Minister).

BY ALISHA HIYATE

By Northern Miner Staff (Jul. 7, 2022)

Our most-read story of the year ranked the Top Ten Canadian-headquartered precious metals juniors according to market capitalization as of Jun. 7, 2022. The list of companies with projects that are not yet in production was compiled by Mining Intelligence and included: NovaGold Resources, Seabridge Gold, Osisko Mining, New Found Gold, Rupert Resources, Artemis Gold, Skeena Resources, Sabina Gold & Silver, New Pacific Metals, and Discovery Silver.

No. 2: Union at Saskatchewan Mosaic potash plant seeks mediation for higher wages

By Colin McClelland (Nov. 18, 2022)

A union representing workers at Mosaic’s potash mine in Esterhazy, Sask. says it has filed for provincial mediation after negotiations for higher wages broke down.

Some 750 workers at the site about 230 km east of Regina have been without a contract since Feb. 1, Dan Bailey, union representative with Unifor Local 892, said by phone from Regina.

“Cost of living is a concern,” Bailey said. “The employer is certainly in a situation, if you just review recent quarterly reports, that they should be able to work with its employees and assist in dealing with the increases to the cost of living.”

No. 3: New Found’s Queensway drilling lifts explorer back into billion-dollar territory

Colin McClelland (Nov. 29, 2022)

New Found Gold’s high-grade Queensway project in central Newfoundland may be fundamentally altered after surprising drilling results from a zone it nearly dismissed.

This week the Vancouver-based company reported diamond drill hole NFGC-22-960 at the Keats West area intersected 42.6 grams gold per tonne over 32 metres. That followed last week’s 18.6 grams gold per tonne over 15.95 metres in hole NFGC-22-773, located 200 metres up-plunge.

No. 4: New drill results from Kerkasha project in Eritrea suggest large gold discovery, says Alpha

By Naimul Karim (May 25, 2022)

Alpha Exploration has reported drill results from its first campaign on the Aburna gold prospect, part of the company’s Kerkasha project in Eritrea, based on which it expects is “a large gold discovery” in the property.

Highlights from the latest results of the 19-hole program that ended in March included 22 metres grading 4.5 grams gold per tonne starting from 47 metres depth in drill hole ABR-018 and 5 metres grading 1.94 grams gold starting from 71 metres in hole ABR-017.

“These results… continue to support the view that Alpha has found what could be a large gold discovery at Aburna with widespread gold mineralization,” the company’s CEO Michael Hopley said in a press release.

No. 5: RANKED: World’s biggest nickel projects — 2022

By Amanda Stutt (Mar. 30, 2022)

Nickel is used mainly in the steelmaking process, but also in production of batteries for electric vehicles, and it is the metal that has grabbed the most headlines so far this year.

With the nickel price spiking 250% to a high of US$101,365 a tonne earlier in the year, driven in large part by a short squeeze centred on Chinese tycoon Xiang Guangda, who had amassed a big wager that nickel prices would fall through his company Tsingshan Holding Group Co., this article identifies the top 10 largest nickel deposits based on contained nickel resources that could form part of the global supply landscape in the future.

No. 6:

Shelby Yee and Alex Dorsch named Young Mining Professionals of the Year

By Carl Williams (Apr. 21, 2022)

The Young Mining Professionals (YMP) awards, presented in association with The Northern Miner, recognize two mining professionals under 40 who have demonstrated exceptional leadership skills and innovative thinking, and provided value to their companies and shareholders.

Shelby Yee, the CEO and co-founder of RockMass Technologies, a Toronto-headquartered mining and geosciences technology start-up, has won the 2022 Eira Thomas award. Alex Dorsch, managing director

Gifts have been exchanged in England during December since before the building of Stonehenge 5,000 years ago. Back then our Neolithic ancestors were celebrating the midwinter solstice (Dec. 21) with feasts and offerings.

The parties became more formal following the landing of Roman legions in AD43, with their festival of Saturnalia (Dec. 17-23) and its tradition of banquets and the giving of gifts. In the first half of the 4th century, Emperor Constantine amalgamated the Empire’s various mid-winter festivals into a celebration of the birth of Christ (choosing Dec. 25 as it corresponded with the winter solstice in the Roman calendar).

Christianity on these islands didn’t properly emerge until after the arrival in 597 of the Pope-sanctioned mission of Saint Augustine (who became the first archbishop of Canterbury). Indeed, in the Early Middle Ages (5th to 11th centuries) we held onto our pagan celebrations of the Anglo-Saxon Mōdraniht (Night of the Mothers) and the Germanic Yuletide. The latter was a mid-winter festival connected with the god Odin, who may have influenced the association with a white-bearded figure and reindeer.

The first recorded celebration in England of Christ’s birth and the name Christmas (Christ’s Mass) was not until 1038. Even then, presents were still mainly associated with the 4th century gift-giving saint, Nicholas of Myra (Santa Claus is a phonetic derivation of ‘Sinterklaas,’ a Dutch figure based on Saint Nicholas). Christ didn’t become the focus of these presents until Martin Luther’s dogmatic instructions in the early 16th century.

With such a rich history, it is wonderful that the U.K. government has given the local mining industry a seasonal gift. On Dec. 7, the Secretary of State for Communities, Michael Gove, approved our first new underground coal mine for 30 years (as predicted in my column of end of June).

The £160 million ($265 million) Woodhouse mine, near Whitehaven in Cumbria, will replace imports of metallurgical coal and will create much needed jobs (500 directly). Critics argue, however, that the decision to award planning permission until 2049 undermines the U.K.’s climate-change credentials.

The project, owned by West Cumbria Mining, was first unveiled in 2014 and approved (for the third time) by Cumbria County Council two years ago. Progress was suspended in February 2021, however, after the government’s Climate Change Committee (CCC) expressed concern, and the then Communities Secretary, Robert Jenrick, ‘called in’ the planning application for review. The subsequent public inquiry closed in October 2021, with the government saying it would make a final planning

Jenrick’s replacement, Gove, has faced a tough decision. Coal mining is deeply unpopular, and goes against the government’s own CO2 commitments. Nevertheless, boosting raw material security and reducing the country’s dependence on Russia is crucial, and Cumbria is crying out for skilled, long-term, well-paid private-sector jobs.

Gove claims the coal mine would “to some extent, support the transition to a low-carbon future.” The CCC chair Lord Deben, however, has called the proposal “indefensible,” and warned that the approval will damage the U.K.’s leadership on climate change, and “create another example of Britain saying one thing and doing another.”

Although there are currently no operating mines on the West Cumberland Coalfield, more than 70 pits were sunk during the past 300 years. The first reference to coal extraction in the area is to an operation at Arrowthwaite in the 13th century. Small scale, near surface, coal leases were granted in the 16th century, with the Lowther family developing the region’s mines from the mid17th to early 20th centuries. The first undersea mine in England, Saltom, was sunk in 1729 on the shore near Whitehaven (this mine closed in 1848 but the winding engine house and mine shaft remain).

The Whitehaven mines were notorious for firedamp (coalbed methane), and over 500 people died in gas explosions. As a result they were the first collieries to use the locally invented ‘Steel Mill’ for lighting (a hand-cranked device using flint), designed by the mining engineer Carlisle Spedding in the mid-18th century. These were used until the introduction in 1819 of Sir Humphrey Davy’s new safety lamp, which he tested in the Whitehaven collieries (because, as he explained, they had the “severest possible conditions”).

Nevertheless, firedamp explosions continued to cause a devastating loss of life in the Whitehaven mines (including that of Spedding himself in 1755). Accidents in the 20th century included the death of 136 miners at Wellington Pit in May 1910, 79 in three explosions in the 1920s at Haig Pit, and 116 in two explosions at William Pit in the 1940s.

Mark Jenkinson, the Member of Parliament for nearby Workington, said the announcement was “fantastic news,” and a “great day for West Cumbria.” He might have added it was a timely present for U.K. mining generally, and that a new, safer, mine will be a fitting tribute to the men, women and children who have died on this coalfield.

TNM

—Dr. Chris Hinde is a mining engineer and the director of Pick and Pen Ltd., a U.K.-based consulting firm. He previously worked for S&P Global Market Intelligence’s Metals and Mining division.

4 DECEMBER 26, 2022—JANUARY 15, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

Niagara Falls, NY, 14304. U.S. office of publication 2424 Niagara Falls Blvd, Niagara Falls, N.Y. 14304. U.S. POSTMASTER: send address corrections to: Northern Miner Box 1118 Niagara Falls, N.Y. 14304.-7118

NORTHERN MINER is published biweekly by Glacier Resource Innovation Group, a division of Glacier Media Inc., a leading Canadian media company with interests in business-to-business information services. From time to time we make our subscription list available to select companies and organizations whose products or services may interest you. If you do

THE

not wish your contact information to be made available, please contact us by one of the following methods: Phone: 1-888-502-3456; Fax: (416) 447-7658; Mail to: Privacy Officer, The Northern Miner, 225 Duncan Mill Road, Suite 320, Toronto, ON M3B 3K9.

EDITORIAL

DEPARTMENTS Special Focus 11 Professional Directory 17 Market News 18 Metal, Mining and Money 19 Stock Tables 20-23 American Creek Resources 10 Ascot Resources 9 B2Gold 10 Barrick Gold 6 BHP 6, 11 Emmerson Resources 10 First Quantum Minerals 16 Flynn Gold 10 G2 Goldfields 8 Gascoyne Resources 10 Glencore 1 Greenland Minerals............................................11 Hecla Mining 3

See MOST CLICKED / 16 COMPANY INDEX Horizon Gold.......................................................10 Ivanhoe Electric 6, 11 Ivanhoe Mines 6 Lucara Diamonds ...............................................2 Midland Exploration 10 Nova Minerals 9 OceanaGold 10 Ora Gold 10 Probe Metals 10 Rio Tinto 11 Snow Lake Resources 9 SSR Mining 10 West African Resources 10

GLOBAL MINING NEWS Mining Corporates and Organisations 150+ Attendees 6000+ Global Industry Speakers 200+ Participating Countries 100+ REASONS TO ATTEND THE FUTURE MINERALS FORUM 2023 Learn regional and international mineral development strategies Engage with senior Government officials from the region Explore emerging markets parterships and investment opportunities Contribute to conversations around the creation of minerals and metals value chain Define the pillars of future responsible mineral development Register Online ENABLING THE CREATION OF RESILIENT AND RESPONSIBLE MINERALS AND METALS VALUE CHAIN 2023 11-12 January Forum and Exhibition 10 January Ministerial Roundtable Riyadh, Saudi Arabia, King Abdul Aziz International Center Mining Corporates and Organisations 150+ Attendees 6000+ Global Industry Speakers 200+ Participating Countries 100+ REASONS TO ATTEND THE FUTURE MINERALS FORUM 2023 Learn regional and international mineral development strategies Engage with senior Government officials from the region Explore emerging markets parterships and investment opportunities Contribute to conversations around the creation of minerals and metals value chain Define the pillars of future responsible mineral development Register Online ENABLING THE CREATION OF RESILIENT AND RESPONSIBLE MINERALS AND METALS VALUE CHAIN 2023 11-12 January Forum and Exhibition 10 January Ministerial Roundtable Riyadh, Saudi Arabia, King Abdul Aziz International Center Mining Corporates and Organisations 150+ Attendees 6000+ Global Industry Speakers 200+ Participating Countries 100+ REASONS TO ATTEND THE FUTURE MINERALS FORUM 2023 Learn regional and international mineral development strategies Engage with senior Government officials from the region Explore emerging markets parterships and investment opportunities Contribute to conversations around the creation of minerals and metals value chain Define the pillars of future responsible mineral development Register Online ENABLING THE CREATION OF RESILIENT AND RESPONSIBLE MINERALS AND METALS VALUE CHAIN 2023 11-12 January Forum and Exhibition 10 January Ministerial Roundtable Riyadh, Saudi Arabia, King Abdul Aziz International Center

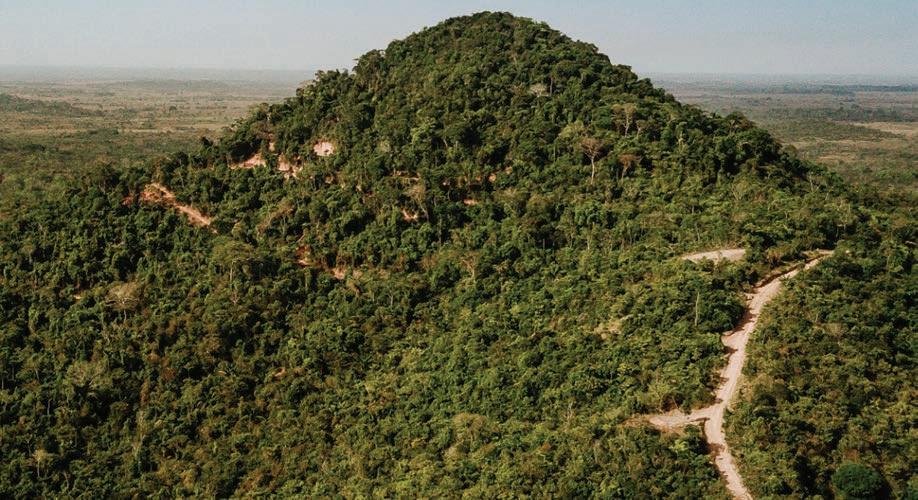

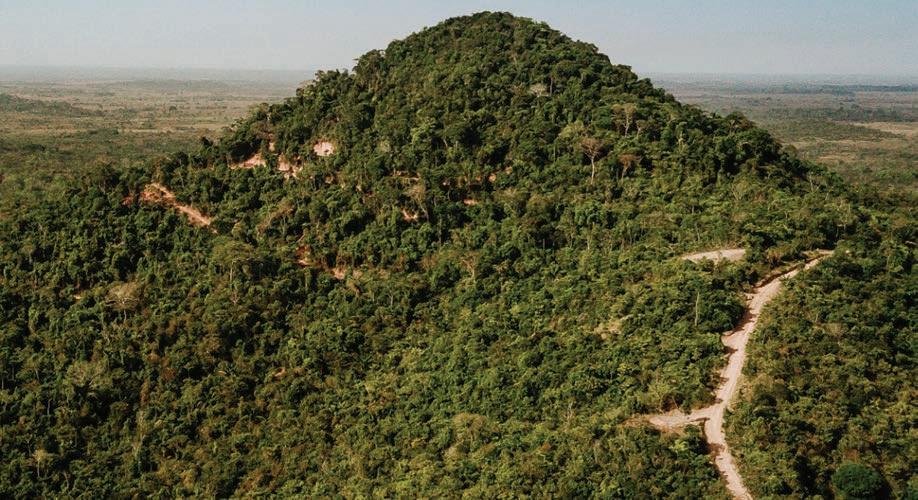

How Brazil is becoming a global leader in the production of green metals

BY DAVID STRANG

For years, Brazil was overlooked as a favourable mining jurisdiction within South America. But what’s recently become apparent is that times are changing. The countries that were once deemed as go-to options are now experiencing civil unrest and political instability. While these countries no longer attract the investment dollars they once did, Brazil is emerging as a mining destination of choice. This is further supported by strong consumer preference, and in some cases government mandates, to source low-carbon inputs for applications ranging from electric vehicles to regional power infrastructure. Second only to Norway in its share of power generated by renewable sources, Brazil is able to produce some of the cleanest battery metals in the world.

From a geological perspective, Brazil has vast and largely untapped mineral wealth. The country has historically been the world’s largest producer of iron ore and a significant producer of gold. Brazil is now also gaining recognition for its potential as a major supplier of the metals desperately needed for the greening of the global economy, such as copper, nickel and lithium.

Brazil recently elected Luiz Inacio Lula da Silva, better known as Lula, as the country’s 39th president, putting the country’s political dynamic directly in the global spotlight. While left-leaning Lula — who was also president between 2003 and 2010 — holds very different views from his right-leaning predecessor Jair Bolsonaro, he has returned to power with promises of attracting foreign investment, reducing rising poverty rates and advancing Brazil’s environmental agenda.

Despite changes in ruling parties over the years, there has been a consistent understanding of Brazil’s potential to be a leader in pro-

ducing metals necessary to support global decarbonization targets, and to produce those metals at the lowest emissions levels in the world.

Blessed by its government’s foresights in the 1960s and 1970s to develop renewable energy sources as the way forward to powering its economy, Brazil today produces over 85% of its electricity from these sources including hydro, solar and wind generation, a remarkable statistic by any measure and especially so given it is the seventh most populous country in the world.

Recognizing that it has the unique opportunity to be a global

leader in the production of battery metals, Brazil has also taken significant steps to improve the mining regulatory framework, the most substantive changes the country has seen over the past 60 years. In 2018, Brazil launched the National Mining Agency (ANM), to help improve the mining sector’s performance across the country. The advancement of the mining industry achieves two equally significant goals for Brazil. First, from a global standpoint, Brazil recognizes the role mining plays in enabling the transition to sustainable energy sources, for which much more metal is required to generate and transmit clean power. To that end, Brazil recently established its Strategic Minerals Policy in March 2021. The policy aims to prioritize the advancement of mining projects deemed strategic to the country and to global decarbonization efforts. Between the Strategic Minerals Policy and the NMA, mining companies have an estab-

lished framework and licence to operate in the country.

Closer to home and the second main reason why Brazil is interested in maintaining and growing mining activity is the role the industry plays for its growing middle-class population. As South America’s largest country with one of the fastest growing populations in the world, Brazil has a pressing need to increase the standard of living for the majority of its citizens. And one of the fastest ways to do that is through mining, both from a wealth creation standpoint and as a means of increasing employment. Brazil’s mining industry generated estimated revenues of $89 billion in 2021 and directly employs over 200,000 people – including many in some lower-income states where mines are located.

Despite all of Brazil’s advancements around mining, business and green energy, the world’s view of Brazil is still associated with antiquated stereotypes that are not

reflective of what the country is today and where it is headed. Nor is it reflective of Ero Copper’s experience, either.

While my company, Ero Copper, has been active in Brazil for only six years, our Caraíba Operations have been working since the late 1970s and form part of the fabric of Bahia State. We are proud to operate in Brazil and excited to see all the support from its government and people toward our industry. We have witnessed first-hand the progress the country has made in building a sustainable, healthy, efficient and transparent mining industry. Brazil is our home and we plan on staying for a while. Last month, we announced an extension of mine life for our Caraíba Operations in Bahia to 20 years, and earlier this year, we began construction of a new copper mine, Tucumã, located in the Carajás region of Para state. Across our portfolio, we have and continue to invest heavily in exploration as we recognize the potential of Brazil’s untapped and underappreciated mineral wealth, particularly when it comes to battery metals.

As we look forward to the next four years under President Lula’s leadership, we see a Brazil poised to take its position as a major producer of the metals needed to help fight climate change, and to produce those metals with the lowest carbon footprint in the world. All within an updated regulatory framework that enhances the protection of the environment and its citizens. TNM

Future Minerals Forum returns to Saudi Arabia in 2023

BY BLAIR MCBRIDE

The Kingdom of Saudi Arabia is gearing up for the 2023 edition of the Future Minerals Forum (FMF), one year after the inaugural conference was held.

The forum, scheduled for Jan. 10-12 in the capital Riyadh, aims to further discussions among industry players on the growing demand for critical minerals as the world seeks solutions to climate change. It also seeks to accelerate the exploration and production of critical minerals and metals in the Middle East, Africa and Central Asia.

Organizers expect more than 6,000 people to attend the conference, including more than 150 representatives of mining majors and companies, more than 200 global industry speakers, and more than 50 government ministers and officials.

Prominent speakers on the agenda include Bandar Khorayef Saudi Arabia’s Minister of Industry and Mineral Resources; Mark Bristow, CEO of Barrick Gold (TSX: ABX; NYSE: GOLD); Mike Henry, CEO of BHP (NYSE: BHP;

LSE: BHP; ASX: BHP) ; and Robert Friedland, CEO of Ivanhoe Mines (TSX: IVN).

Barrick operates the Jabal Sayid copper mine in the country in a 50-50 joint venture with Saudi state-owned miner Ma’aden, while Friedland’s Ivanhoe Electric (TSX: IE; NYSE-AM: IE) is competing to secure a large zinc-copper exploration licence 175 km west of Riyadh

Despite its position as the world’s number one exporter of oil, Saudi Arabia has committed to a low carbon economy. Its Vision 2030 plan seeks to build up its mining sector by attracting US$170 billion in investment by the end of the decade.

The return of FMF comes as construction of the zero-carbon footprint, green energy-powered city of Neom continues in the kingdom’s northwest. Saudi Arabia has set aside US$500 billion for the project.

Financing for a planned US$5-billion green hydrogen plant in Neom, said to be one of the world’s largest, is set to be completed in the coming months, with construction expected to finish in 2026, Bloomberg reported in November.

At the 2023 FMF, keynote speeches, fireside chats and panel discussions will fall under five broad themes: critical mineral development in the world today, the context of Saudi Arabia and the wider region, decarbonizing supply chains, digital & new technology, and communities and the future workforce.

One keynote address covers a five to 10-year outlook on the kingdom’s role “as a global leader in renewable energy.”

It will consider what is required for large-scale solar and hydrogen production using renewable energy to become economic, what type of projects should be supported and the connections between renewable energy sources and technology.

At last year’s FMF, Khalid Al-Mudaifer, vice-minister for mining affairs at the Saudi Ministry of Industry and Mineral Resources touted the kingdom’s establishment of its Minerals Investment Law in 2021 as a major achievement of Vision 2030. The government also opened online access to its National Geographic Database, a portal of geological, geophysical, and geochemical information with 10,000 detailed reports on mining targets and prospects that goes back 80 years.

Several panels and discussion sessions will focus on the place of Saudi Arabia and regional countries in the critical minerals supply and demand gap, outlining mineral hot spots in the region, permitting procedures, and the skills needed for transitioning away from oil and gas.

In a sign of social changes in the

Middle East, one panel will look at women in mining and how economic trends will affect women in the sector.

In the lead-up to the FMF, the Development Partner Institute (DPI) and strategic consulting firm

Clareo Partners published a joint paper stressing the need for standardized environmental, social and governance (ESG) principles in reducing greenhouse gas emissions and building economies free of fossil fuels.

The two U.S.-based organizations point to the role that Saudi Arabia can play in helping with the creation of universally-adopted principles that support the adequate, affordable, secure and responsible sourcing of minerals.

With the kingdom positioned to build a “triangle of trust” between government, communities and mining companies, the organizations identify three areas where Saudi Arabia can make the biggest impact: it’s already serving as a forum for open dialogue at FMF;

6 DECEMBER 26, 2022—JANUARY 15, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM See FORUM / 16

EVENTS | Kingdom accelerating pivot from oil to critical minerals

COMMENTARY | Ero Copper CEO says perceptions about South American nation are outdated

—David Strang is Chief Executive Officer of Ero Copper Corp.

Above: Ero Copper’s Tucumã project (formerly Boa Esperanca) in Brazil. ERO COPPER

Left: An Ero Copper employee shows a rock sample with copper mineralization.

ERO COPPER/

Robert Friedland, speaking at the 2022 Future Minerals Forum in Riyadh, Saudi Arabia. FUTURE MINERALS FORUM

ment, the strategy identifies the need to streamline project assessments and permits, as well as for investment to unlock potential in mineral-rich regions.

To that end, funding is available through three initiatives identified in the 2021 and 2022 federal budgets: the $1.5-billion critical minerals envelope under the Strategic Innovation Fund (SIF) to support advanced manufacturing, processing and recycling; $40 million to support northern regulatory processes in project reviewing and permitting; and $21.5 million for a Critical Minerals Centre of Excellence to develop policies to assist project developers in navigating regulatory processes.

The SIF will be among the “most significant” of the direct funding avenues, the strategy notes. The fund is aimed at helping to build critical mineral value chains where prefabrication and manufacturing activities are done domestically, while supporting projects that decrease reliance on foreign critical mineral inputs. SIF funding will begin in 2024-2025 and last for six years.

While the strategy says the government is exploring regulatory harmonization with U.S. partners, Wilkinson said Canada isn’t going to wait for the U.S. to formulate its own permit approach and will go ahead with its own.

The minister also said that with permitting rules differing by province and territory, the “common theme” is they have to be expedited but must not “cut corners environmentally and they must respect Indigenous peoples.”

Federal and provincial permitting processes at times don’t work very well, Wilkinson acknowledged, and could be better advanced concurrently.

“We need to be aligning projects with the provinces so that there’s one project, one assessment. That’s the model we need to be using going forward. There’s no reason why the federal government and the provinces need to be conducting independent assessments,” he said.

Building new infrastructure

The focus on building sustainable infrastructure aims to address the challenges of developing critical mineral projects in remote or underdeveloped areas. The strategy states that the costs of building infrastructure in those areas discourage investment and “hinder the socio-economic development” of communities open to mineral development. And in northern regions, underdeveloped infrastructure poses challenges for industrial development and access to Canadian and international markets. A total of $1.5 billion will be allocated over seven years starting in 20232024 for such infrastructure development, particularly for priority deposits.

In addition, the strategy says that since off-grid mining operations in remote areas depend heavily on GHG emitting power sources, strategic investments in green energy infrastructure would improve the environmental performance and sustainability of critical mineral projects by integrating them into the value chain. Such investments could spur competitiveness and cut energy costs.

“I met with both the Yukon and N.W.T. governments earlier this week [and] they’re hearing from mining companies who want to develop these deposits for access to clean energy,” Wilkinson said. “There’s a huge push for the government to think about infrastructure that is going to actually facilitate the development of some of these areas where there is a cluster of minerals.”

The strategy doesn’t specify how the infrastructure funds would be disbursed or accessed.

Indigenous participation

In seeking to advance reconciliation, the strategy acknowledges that Indigenous peoples are the rights holders and in some cases the title holders to lands where mineral resources are located. The government hopes to spur Indigenous participation in projects while respecting Aboriginal and treaty rights, advancing economic reconciliation and supporting safe communities throughout the critical mineral project lifecycle.

At least $25 million will be allocated for Indigenous participation and early engagement in the strategy, out of $103.4 million over five years starting in 2022-2023 through the Indigenous Natural Resource Partnerships Program. That program is accessible to communities, businesses and organizations.

Actions under the strategy will comply with the Canadian’s government’s implementation of the United Nations Declaration on the Rights of Indigenous Peoples Act, the document states.

Chief Sharleen Gale of Fort Nelson First Nation in northern B.C, who is also chair of the First Nations Major Projects Coalition, told the audience at the Pinnacle Hotel that she encourages the government to go even further in developing the strategy.

“Ensure proponents of battery mineral projects approach First Nations as early as possible and ensure we’re part of development on our lands,” she said. “The key to success in this sector is free, prior and informed consent.”

The fifth focus of growing a diverse workforce and prosperous communities recognizes that up to 113,000 new workers will be needed in the mining sector by 2030 to meet demand and replace workers leaving the industry. And as the critical minerals industry further develops, demand will ramp up for a diverse set of skills needed for geoscience, AI, computer technology and automotive assembly.

Several federal training initiatives will help build up those skills, including through the Sectoral Workforce Solutions Program, the Indigenous Skills and Employment Training Program, the Skills and Partnership Fund and the Youth Employment and Skills Strategy.

Diversity and inclusion will be given priority in those efforts, with the federal government supporting the training and retention of women, youth, Indigenous peoples and other groups.

International partnerships

The sixth and final focus seeks to ensure international engagement on critical minerals aligns with the federal government’s strategic objectives and its Indo-Pacific Strategy.

It will also further integrate the government’s Responsible Busi-

ness Conduct Strategy, launched in April 2022 with multilateral agreements; and leverage initiatives like the Mining Association of Canada’s Towards Sustainable Mining program to encourage environmentally friendly mining practices and international collaboration to prevent products from conflict, child labour and “environmentally poor” operations from entering supply chains.

Budget 2022 allocates $70 million over eight years starting in 2022-2023 for international partnerships to promote Canadian

mining leadership, including promoting ESG standards and supporting multilateral critical mineral commitments.

Asked what would stop a mining company in Canada from selling its lithium to China, Wilkinson responded that the government has a “carrot and stick” approach.

“With the carrot, we’re interested in fostering development of processing industries... and we set aside money in the critical minerals strategy as well as in the Strategic Investment Fund to ensure those developments are happening in

Canada. But part of the strategy is about geopolitics. It’s about ensuring that not just Canada but democratic countries around the world have access to the resources they require, in a manner that doesn’t make them vulnerable. In the same way we saw Germany become vulnerable to pressures from Russia,” he said.

Wilkinson mentioned the divestments that Canada undertook in early November, forcing some Chinese companies to divest their holdings in critical minerals firms.

“There is a broader review of investments in this country. We need to be consistent in how we do this. But we welcome investments from other countries in a way that promotes economic opportunities for Canada,” he said.

Mining Association of Canada (MAC) president Pierre Gratton said in a release that the association supports the strategy, calling it clear, focused and action-oriented and possibly the most significant industrial strategy the country has seen in decades.

“MAC looks forward to working with the government of Canada to help deliver on the strategy’s promise. Speed matters, as Canada is not alone in vying to capitalize on the critical minerals opportunity,” Gratton said. “Greater still, fighting climate change can’t wait, and without the minerals and metals necessary to fight it, we will fail. The challenge before us is big, but this strategy squarely puts us on the path to success.” TNM

New Sustainable Critical Minerals Alliance to push ‘naturepositive’ mining

BY BLAIR MCBRIDE

Canada has joined the launch of the new Sustainable Critical Minerals Alliance that seeks to pursue environmentally sound and responsible mining, Natural Resources Minister Jonathan Wilkinson announced on Dec. 12.

Speaking at the United Nations Biodiversity Conference (COP15) in Montreal, Wilkinson said Alliance members will commit to developing and sourcing critical minerals through a “nature-positive” approach by collaborating with industry on practices that respect biodiversity and local and Indigenous communities.

Other Alliance members include the United States and United Kingdom, Australia, France, Germany and Japan.

“The Sustainable Critical Minerals Alliance is a historic step forward for Canada and our international partners in our collective efforts to secure the responsibly sourced critical minerals we need to power the clean energy transition,” Wilkinson said. “[Members] will put human rights, sustainability and the highest environmental, social and governance standards at the heart of our critical mineral supply chains, helping to build the prosperous, low-carbon economy of the future.”

Among its goals, the Alliance harmonizes with the G7 2030 Nature Compact, inked in 2021 which pledges signatories to halt and reverse biodiversity loss by 2030.

Under the Alliance, members also agree to respect the rights of local and Indigenous communities through engagement and including such communities in the economic benefits of mining; fight climate change by reducing greenhouse gas emissions and push mining, processing and recycling processes that advance sustainability; and building a circular economy by promoting the reuse and recycling of critical minerals, which could reduce the number of new mines needed for supplying minerals.

Governments in the partnership will also act through institutions such as the United Nations Environment Assembly, the International Energy Agency, the World Bank, and the Organization for Economic Co-operation and Development to support sustainable mining, participate in multi-stakeholder and industry initiatives that promote high standards in mining to promote diversity and inclusion in the resource and energy sectors, such as the Equal by 30 Campaign.

Natural Resources Canada (NRCan) said in a news release that dialogue on deeper collaboration on sustainable critical minerals is anticipated at the International Mines Ministers Summit at PDAC in March 2023.

The formation of the international critical minerals body came just three days after NRCan released details of its Critical Minerals Strategy, an almost $3.8 billion plan to develop Canada’s critical minerals industry by accelerating permitting, ramping up infrastructure construction in remote areas and partnering with Indigenous communities.

GLOBAL MINING NEWS THE NORTHERN MINER / DECEMBER 26, 2022—JANUARY 15, 2023 7 STRATEGY from 1

TNM

COP15 | Partners pledge to put human rights, sustainability at heart of supply chains

“We need to be aligning projects with the provinces so that there’s one project, one assessment,” said Wilkinson about plans to streamline the permitting process.

NATURAL RESOURCES CANADA

Natural Resources Minister Jonathan Wilkinson speaks about Canada’s entry into the Critical Minerals Alliance at the United Nations Biodiversity Conference (COP15) in Montreal on Dec. 12. NATURAL RESOURCES CANADA

G2 Goldfields hopes to add to discovery count at Oko project in Guyana

BY ALISHA HIYATE IN BARTICA, GUYANA

When Dan Noone first visited Guyana in 2004, the capital Georgetown was a “sleepy place,” says the geologist and CEO of G2 Goldfields (TSXV: GTWO). “There weren’t many cars on the road.”

As recently as 2010, Guyana was ranked the second-poorest nation in the Caribbean, after Haiti. Now, after a string of oil discoveries off Guyana’s coast by Exxon Mobil over the last seven years, Georgetown is a “bustling” city, and the South American country of less than 1 million people is on pace to be the fastest growing economy in the world this year, with expected GDP growth of 48%, according to the International Monetary Fund.

Guyana’s reputation as a gold miner has also been on the ascent. At the time of Noone’s first visit, he was CEO of Absolut Resources. Four years later he would join Guyana Goldfields — the company that discovered, built and put Guyana’s largest gold mine, Aurora, into production under the leadership of founder and mining entrepreneur Patrick Sheridan — as a director, later becoming VP Exploration in 2010. Guyana Goldfields was bought by China’s Zijin Mining in 2020 for US$238 million.

Under Noone and Sheridan as executive chairman, G2 Goldfields — the name refers to the second take of Guyana Goldfields — hopes to be even more successful in advancing its high-grade Oko main gold project in the Cuyuni mining district, 60 km west of Bartica.

The company is off to a promising start at Oko, with an initial resource for the Oko Main deposit released in April this year outlining 793,000 indicated tonnes grading 8.63 grams gold per tonne for 220,000 contained oz. and 3.3 million inferred tonnes grading 9.25 grams gold for 974,000 gold ounces.

But this time around, G2 isn’t looking to build a mine. Now that Guyana’s gold potential is attracting more interest, Noone says the company won’t likely have to go that far to get an attractive takeover bid.

“Guyana was a different place 18 years ago. There weren’t really any major companies in there exploring the country, we didn’t have the oil discoveries,” he recalls. “So every time we brought someone down to try and get them to come and buy [Aurora], we had to take them through the whole history and meet the government and hold their hand.”

Noone says that also applies to the majors — Barrick Gold and Newmont — who didn’t know much about the country at the time. Barrick is now actively exploring in Guyana, and Newmont operates the Merian mine in Suriname, which produced more than 450,000 oz. gold last year.

“This time around Guyana’s very much a place that the majors want to be. I think it’ll be a lot easier when it comes to exiting or trying to transact with another company on the project. There’ll be a lot more suitors here this time, maybe a lot more competitive.”

With that in mind, G2 is aiming to make the resource “as big as possible as quickly as possible,” Noone says.

Doubling deposit’s depth So far, Oko Main is around 900 metres long, 250 metres wide, and

at the time of the resource, at least 350 metres deep. But the G2 team believes the deposit, which starts from surface, will extend much deeper.

“It’s a classic narrow high-grade reef-style system and we are certain that there will be deeper roots to the discovery,” VP Exploration Boaz Wade told guests during a November site visit to the project.

“A big part of our drilling focus will be on that within the next year or so — extending the high-grade shear zones of vein structures that we’ve discovered to certain vertical depths.”

The company’s looking to double the deposit’s current depth of 350 metres, and is now drilling at depths of more than 450 metres.

Gold mineralization at the orogenic deposit is hosted in three main shear zones that are between 1.5 and 14 metres wide, with about 50 metres between shears.

Wade also noted the team explicitly targeted high-grade ounces in the initial Oko Main resource, which incorporated 98 holes, with the cutoff grade set at 4 grams gold per tonne.

In mid-November, the company reported deeper holes, with hole OKD-130 cutting 3.8 metres of 70 grams gold per tonne from 442 metres; while hole OKD-126A

returned 3 metres of 27.8 grams gold starting from 496 metres depth. (True widths are estimated at 65-85% of reported widths.)

Highly prospective Oko Oko Main is only the first of many discoveries the company expects to make at Oko, which is located in the Cuyuni greenstone belt and accessible from Georgetown by a combination of boat and truck. Overall, the company holds options on 77.7 sq. km of ground, controlling 17 km of prospective strike length of the prospective 23-km-long Aremu-Oko Trend. Through soil sampling and mapping of historical and current artisanal mining operations, G2 has identified five discrete, multi-kilometre-long zones of gold mineralization.

In addition to growing Oko Main, G2 plans to follow up on “a multitude” of near-surface targets over the next six to 12 months, says Wade. The team is looking for another high-grade discovery or a combination of a high grade discovery and of a more bulk style system with open pittable economic potential.

Its prime target is the 1.2-km Ghanie/Shear 1 zone on the property, which lies on the main Oko shear, just south of Oko Main and just north of and along strike of

Reunion Gold’s Oko West deposit next door. When G2 releases an updated resource for Oko Main — expected at the end of the first quarter of 2023 — it also plans to release a first resource for Ghanie.

While Oko Main (and most of the other targets at the Oko project) host high-grade veins hosted in carbonaceous sediments, the Ghanie zone hosts a magnetite replacement style of mineralization that Noone says is similar to that found at Reunion’s Oko West.

Noone describes Ghanie, which saw a 12-hole, 1,356-metre diamond drill program this fall, as a “gamechanger” for G2. While the zone had seen previous drilling in 2020 and 2021, the company says the holes were collared too far to the west, missing the main shear and drilling the intrusion instead. The company released assays from the first four holes at the end of November, including an “exceptional” intercept of 50 metres grading 1.71 grams gold per tonne from 21 metres down hole in GDD-04.

“The mineralization is hosted in magnetite-rich metamorphic rocks and is disseminated over wider zones that are tens of metres as opposed to metres, and generally lower grade — 1.5 to 2 grams gold as opposed to over 10 grams gold,” Noone said.

“The significance of the Ghanie zone is the potential to host broad, near-surface volumes of gold mineralization that can be mined in an open pit. This opens up the scale of operation that can be built and the rate at which ounces can be mined.”

While Noone says Ghanie is a great second discovery at Oko, he believes there are more to find along the Aremu-Oko Trend. Targets include Oko North, Oko North West, Sands, Aremu Mine, Herod’s Vein and Shepherd’s Vein.

Historical production and 2019 discovery

The Guiana Shield which underlies Guyana as well as neighbouring Suriname, French Guiana and parts of Venezuela and Brazil, is highly prospective for gold. But the craton is underexplored because it’s covered by dense tropical forest with limited outcropping rock.

The Aremu-Oko district saw its first alluvial gold rush in the 1870s. Despite hosting the historic Aremu mine, which yielded close to 6,500 oz. at an average grade of 15.6 grams gold per tonne over a five-year period in the early 20th century — as well as small-scale mining since then, the Oko property had never been drilled or subjected to a modern exploration program before G2 began work in 2019.

At Oko there are still some medium-scale miners, who are all operating legally as sub-contractors under agreements with the underlying Guyanese concession holder. G2 has made all option payments to the local licence holder except for one — a $1-million payment it will need to complete within two years in order to transfer the claims to it under a prospecting licence. Under Guyana’s system, that’s the first step to ownership of concessions by a foreign company. Once it acquires a prospecting licence, G2 will have five years to complete a feasibility study. The payment will leave the local vendor with a 2.5% NSR royalty, which G2 can purchase for $4 million.

The November 2019 discovery of Oko Main was aided by small-scale mining on the concession.

“We started a soil sampling program that went from Aremu down to Oko over about a six-month period and when we got to October, we realized we needed to get down and drill Oko because we had an option payment due in November,” Noone recalls. The team went to an area of the property just south of the camp where medium-scale miners had an active mine shaft and drilled underneath it.

“We were drawn to where they were mining. There was some surface geological information in that pit, but it was pretty minimal, so it was fairly hard to figure out exactly what was going on,” he says.

“The first four holes I think we drilled in different directions just to make sure that we had the right orientation. We weren’t sure that it was going to be a planar body because it could have been a series of shoots — which would have been easier to miss if you’re not drilling in the right direction.”

Luckily, the very first hole hit with 27 metres of 5.2 grams gold per tonne from 63 metres depth.

With about $10 million in the treasury, Noone says the company has enough cash to keep the drill turning for another year. G2 has drilled about 35,000 metres to date on the property, with three drill rigs currently at work.

“There’s definitely a lot of other targets to get on with,” Noone says, adding each has its own “unique nature.” In terms of next targets, the company will be investigating Oko North, Bird Cage, Sands, Oko Northwest, Aremu East and Shepherd Vein.

G2 Goldfields traded at 69¢ at press time in a 52-week range of 38¢ and 83¢.

The company has 164.7 million shares outstanding for a market capitalization of $113 million.

8 DECEMBER 26, 2022—JANUARY 15, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

SITE VISIT | Guyana Goldfields team working to grow high-grade Oko Main

TNM

Top left: G2 Goldfields CEO Dan Noone (centre with ballcap) at the core shack at Oko. ALISHA HIYATE

Top right: VP Exploration Boaz Wade at the Oko gold project. ALISHA HIYATE

Left: Drilling at G2 Goldfields’ Oko project in Guyana. G2 GOLDFIELDS

Snow Lake investor battle brings raw energy to Manitoba lithium project

GOVERNANCE | Shareholder group wants to oust management over executive pay

BY COLIN MCCLELLAND

Ashareholder rift over millions of dollars in executive pay at Snow Lake Resources (NASDAQ: LITM) is rattling the explorer’s plans to develop a lithium project in northwest Manitoba.

Management postponed a Dec. 15 shareholder’s meeting until January after an investors’ group that controls 42% of the company said it would try to vote out chief executive officer Philip Gross, chief operating officer Derek Knight and chief financial officer Mario Miranda.

Shorecrest Group, a Toronto-based advisor representing the Concerned Shareholders of Snow Lake, accuses Gross and the board of directors of enriching themselves with more than $6 million for just seven months of service, according to company documents. The board tried to raise millions more in cash through a proposed stock sale in September that would have diluted shares by 55%, but the financing was blocked by a provincial court injunction on Sept. 29.

“The existing collaborating directors have continued to burn through millions of dollars of the company’s money to keep their jobs,” Shorecrest wrote in a proxy circular for the aborted meeting.

“They have hired multiple expensive law firms and proxy advisory firms to purposefully delay this meeting for over four months, to entrench themselves and try to stop shareholders from having a fair and

democratic say in imposing proper governance and making management accountable.”

At stake is a project for what may be the world’s hottest commodity. Demand for lithium to make batteries for electric vehicles and other modern technologies is forecast to accelerate for decades. End users like Tesla, GM and other automakers are scrambling for supplies and Snow Lake already has an offtake agreement with LG Energy Solution of South Korea. However, the site’s remote location about 700 km north of Winnipeg may be a stumbling block for development.

Snow Lake defended the meeting postponement by saying the shareholders group dissidents are engaged in a potentially illegal proxy vote gathering, making potentially

Nominations open for 2023 Peter Munk and Eira Thomas Awards

February