ENERGY METALS

BY HENRY LAZENBY

The opening day of the Association of Mineral Exploration (AME) Roundup conference in Vancouver saw some political sparks fly as federal Natural Resources Minister Jonathan Wilkinson and Conservative Party firebrand Pierre Poilievre delivered remarks.

The opposition leader said that the limelight-loving Liberal leader, Prime Minister Justin Trudeau, has squandered the opportunity over the past eight years to build an alternative supply chain able to service the emerging electric vehicle market and so-called energy revolution.

“Instead, miners today face permitting delays ranging from five to 25 years, according to official gov-

undermined by stifling policy.

“We have the sixth biggest natural gas resources globally; 1,300 trillion cubic feet of natural gas are

right beneath our feet. We cannot export a single solitary cubic foot of that gas overseas because we do not have liquefaction facilities.”

Poilievre suggested the lack of liquefaction facilities was not to blame on the industry.

“When Trudeau took office, fifteen proposals for natural gas liquefaction were on his desk — zero have been built, not one. Meanwhile, the Americans have built six; the Qataris are selling more liquefied gas than ever. The Germans built an import facility for natural gas in 194 days, and Canada has been unable to build a single export facility in the past eight years.”

Poilievre continued his criticism of Canada’s mineral policy, saying

See POILIEVRE / 5

RISK | Industry survey flags inflation, geopolitics as top concerns ahead of ESG

BY HENRY LAZENBY

BY HENRY LAZENBY

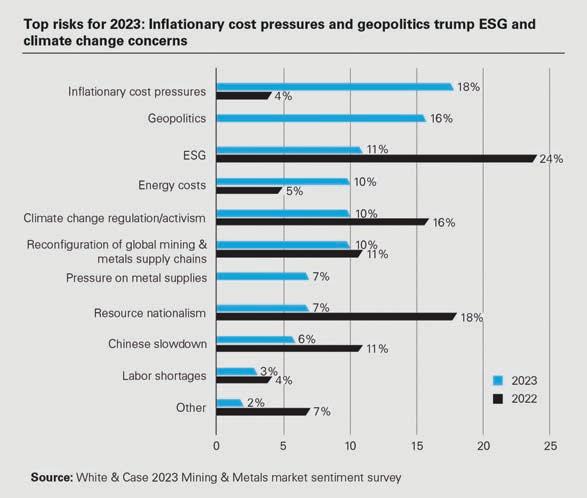

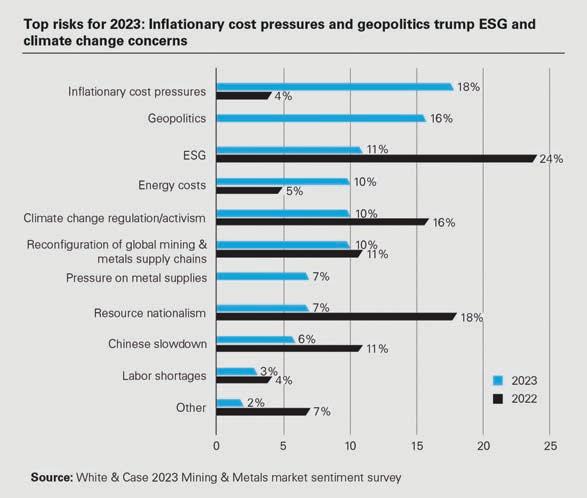

Inflation and geopolitics have overtaken ESG as the biggest concerns for 2023, while energy costs, shifting supply chains, and climate-related regulation and activism still worry firms.

Despite shared concerns, there is surprisingly little agreement on the economic outlook, how market players will respond, or what will be the pervasive theme for the year ahead.

These are chief among the conclusions of the seventh annual

and the risk of supply deficits are stark.

The report’s author, White & Case partner Rebecca Campbell, who leads the firm’s Global Mining & Metals Industry Group, noted the prominence of EV supply chain concerns in the survey responses. Copper and lithium ranked materially higher as the likely big winners in 2023, with battery minerals and base metals as probable areas for consolidation.

“It seems that everything EV-linked is perceived to be where the opportunities are for 2023,” Campbell wrote.

When it comes to the development of energy transition metals, end-users are expected to play a far bigger role in financing the development of energy transition minerals in 2023, with 41% of respondents citing end

GM TO INVEST US$650M IN LITHIUM AMERICAS FOR THACKER PASS DEVELOPMENT / 3 905 841 5004 | geotech.ca VTEM™ | ZTEM™ | Gravity | Magnetics Geotech_Earlug_2016_Alt2.pdf 1 2016-06-24 4:27:20 PM WWW.SGS.COM/MINING MINERALS@SGS.COM DELIVERING QUALITY EXPERTISE GLOBALLY ACROSS THE ENTIRE MINING LIFE CYCLE expert advice from exploration to closure .com FEBRUARY 6—19, 2023 / VOL. 109 ISSUE 3 / GLOBAL MINING NEWS • SINCE 1915 / $5.25 / WWW.NORTHERNMINER.COM

ROUNDUP | Opposition leader lays out his alternative resource strategy CANACCORD REVEALS TOP GOLD PICKS: ENDEAVOUR, KINROSS AND PROBE / 2

‘Trudeau-pian’ policy drives mining investment away, says Poilievre

2023 is ‘likely to surprise’ as much as 2022, finds White & Case

.com

Conservative Party leader Pierre Poilievre at Roundup. HENRY LAZENBY

45 offices worldwide and a global network of af liates. No matter where you are in the world, chances are we’ve got your project covered.

SPECIAL FOCUS / 9-16

Canaccord bullish on gold price, Endeavour, Kinross and Probe

GOLD | Bank assesses macroeconomic factors, company performance

BY COLIN MCCLELLAND

Investment bank Canaccord

Genuity is upbeat on the gold price and production margins as recession looms and the United States dollar retreats. It also picks Endeavour Mining (TSX: EDV; LSE: EDV), Kinross Gold (TSX: K; NYSE: KGC) and Probe Gold (TSX: PRB), which changed its name from Probe Metals and graduated to the TSX in late January, among its top Canadian equity performers this year.

The gold price may hit an average of US$1,862 per oz. this year, up from its record average of US$1,802 an oz. in 2022 but down from its current spot price around US$1,925 per oz., analysts with the Vancouver-based company said in a forecast released Jan. 19.

“We’re bullish,” Canaccord said as it considered how efforts to curtail decades-high inflation are expected to slow the economy while the U.S. dollar has fallen 10% from a 20-year high in September, both factors that typically drive gold prices higher.

U.S. inflation slowed to 6.5% in December from 9.1% in June and the market expects the U.S. Federal Reserve to prevent its benchmark interest rate rising above 5% this year after measures of employment and manufacturing declined.

“These headwinds look to have largely run their course with inflation and the economy slowing,” the bank said. “Gold and gold equities have more room to run ahead of a potential Fed pause and with a non-trivial chance of a recession emerging.”

The bank projected average all-in sustaining costs (AISC) for miners to fall 2% to US$1,265 an oz. after supply costs hit their highest in last year’s third quarter and oil prices have fallen 14% from an average of US$95 per barrel in 2022.

“Most producers indicate that input cost inflation appears to have peaked,” Canaccord said. “We forecast AISC margins improving 17% to US$597 an oz. in 2023.”

Canaccord also projected silver rising to US$24.38 an oz. this year and platinum advancing to

US$1,084 per ounce. It increased its long-term gold price estimate to US$2,048 per oz. in 2026 versus US$1,922 per oz. previously. It raised its long-term silver price to US$26.97 per oz. in 2026 from US$23 an ounce.

Endeavour ticks boxes

Canaccord chose Endeavour Mining as a top stock pick among senior producers because it “ticks all the boxes” with strong execution, balance sheet and capital return. It has also fully funded growth and has an inexpensive valuation of 0.6 times net asset value versus a peer average of 0.74 times. Endeavour’s Lafigué project under construction in Côte d’Ivoire should increase company output to as much as 1.6 million oz. by 2025 from 1.3 million oz. last year, the bank said.

Kinross Gold is another leading pick among senior producers due to its steady annual production of about 2 million oz., reduced risk

Focused on Discovery

after leaving Russia last year, the potential of 500,000 oz. a year in output from its recently acquired Great Bear project in Ontario by 2028 and a valuation of 0.49 times net asset value, the analysts said. In the intermediate space, Canaccord likes SSR Mining (TSX: SSRM; NASDAQ: SSRM; ASX: SSR) as a defensive stock and For-

tuna Silver Mines (TSX: FVI; NYSE: FVI) as an offensive choice. It chose Orezone Gold (TSX: ORE; US-OTC: ORZCF) as its top junior, upgrading its rating to buy from spec buy because it moved to producer status in December with the declaration of commercial production at its Bomboré gold mine in Burkina Faso, 85 km east of the capital of Ouagadougou.

“We like SSRM for its operating prowess, emerging value at each of the assets, strong balance sheet and capital return program, capable management team, and attractive relative valuation,” Canaccord said. “Orezone has done an admirable job advancing Bomboré into commercial production on time and on budget.”

Probe triples resources

The bank ranks Probe Gold, with its Novador project near Val-d’Or, Que. as the best gold explorer. The company’s proposed open-pit and underground operation may produce more than 200,000 oz. a year with a 33% internal rate of return assuming a gold price of US$1,500 an oz., according to a 2021 preliminary economic assessment. Probe recently tripled resources from Novador’s Monique deposit, one of three on the site.

“Management strength is another key to our thesis, with CEO David Palmer, winner of PDAC’s 2015 Bill Dennis Award and the Northern Miner’s 2014 Mining Person of the Year, and chairman Jamie Sokalsky, former Barrick CEO, leading much of the same

team involved in their success with Probe Mines, which was acquired by Goldcorp for $526 million at a significant premium back in 2015.”

Among streaming and royalty companies, Canaccord recommends Wheaton Precious Metals (TSX: WPM; NYSE: WPM) and intermediate Osisko Gold Royalties (TSX: OR; NYSE: OR). Wheaton should surpass rival Franco-Nevada (TSX: FNV; NYSE: FNV) in gold-equivalent output by 2025 and has a strong balance sheet of US$500 million, no debt and access to US$2 billion in credit, the bank said. It expects Osisko to grow production by 37% during 2022-27 as output starts or increases at the San Antonio, Cariboo and Windfall projects.

Canaccord lowered its rating on Newmont (TSX: NGT; NYSE: NEM) and Alamos Gold (TSX: AGI; NYSE: AGI) to hold from buy on valuation. It upgraded Coeur Mining (NYSE: CDE) to hold from sell.

Investors, who had to cope last year with inflation at 40-year highs, the most hawkish Fed in more than a decade, a surging American dollar and the conflict in Ukraine, now must consider the balance of interest rates and a potential recession, Canaccord said.

“One of the biggest questions among investors for 2023 is whether the Fed can pull off a soft landing or whether a recession ensues,” the bank said.

“A potential recession scenario would likely force the Fed to cut rates sooner given the intensity of hikes to date which we would also view as positive for gold.” TNM

Glencore halts operations in Peru due to violent protests

AMERICA | Worker housing set fire at Antapaccay mine

BY NORTHERN MINER STAFF

Following an attack on Jan. 20 in which a worker housing area was torched, Glencore (LSE: GLEN) announced that it halted operations at the Antapaccay copper mine in southern Peru. In a statement, the company said that the incidents endangered the safety of its employees and that the authorities should start taking action to protect people and private property rights.

According to the Swiss miner, a group of citizens from Espinar province, where Antapaccay is located, arrived at the site at noon on Jan. 20 and demanded that operations be stopped and that the firm issue a communiqué asking for the resignation of Peruvian President Dina Boluarte.

Then, some of the people forced their entry into different mine facilities, stole workers’ belongings, and set the housing area on fire. Two and a half hours later, the protesters left the site.

“The emergency and security teams are working to guarantee the safety of the employees that remain in the operation, as well as to extinguish the fires. So far no injuries have been reported,” the press release stated.

Prior to this incident, Glencore’s mine, one of the country’s largest, was operating only with 38%

of its workforce as a result of the protests. Earlier in January, activists broke into Antapaccay’s water plant and set the facility on fire. The plant provides drinking water to over 6,000 people in nearby communities.

Given the number of incidents — including roadblocks — that took place in the first half of January, the company halted the shipping of copper concentrate. MMG’s Las Bambas, which shares with Antapaccay the same highway access to ports, followed suit. At press time in late January, MMG

said it would also have to suspend production at Las Bambas. Unrest has rattled Peru since the ouster and arrest of former president Pedro Castillo late last year. Protest leaders are demanding a general election.

According to Bloomberg, the disruption is threatening to choke off access to almost US$4 billion worth of copper. The unrest comes at a particularly precarious moment for copper markets as inventories stand at historically low levels as demand is rising due to electrification of vehicles. TNM

2 FEBRUARY 6 —19, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

Haul trucks drive through the property at the Antapaccay copper mine in Peru, located near the city of Espinar. GLENCORE

LATIN

Pouring gold at Alamos Gold’s Island gold mine, near Dubreuilville, in northern Ontario. ALAMOS GOLD

CSE: SIG | OTCQB: SITKF | FRE: 1RF www.sitkagoldcorp.com • Initial 1.34 million ounce gold resource at RC Gold Project, Yukon • Located in the Tombstone Gold Belt • District scale road accessible, 376 square kilometre property • Carlin-type mineralization discovered in drilling at Alpha Gold, Nevada

GM, Lithium Americas to jointly develop Thacker Pass mine

NEVADA | Automaker to invest US$650M in two tranches to advance largest lithium resource in U.S.

BY CECILIA JAMASMIE

Shares of Lithium Americas (TSX: LAC; NYSE: LAC) soared on Jan. 31 after it announced that General Motors (NYSE: GM) will invest US$650 million in the company to help it develop the Thacker Pass lithium mine in northern Nevada.

The Canadian miner’s stock was up by more than 12% in trading in New York after it unveiled GM’s investment, which the companies say represents the largest-ever investment by an automaker to produce battery raw materials.

Lithium carbonate from Thacker Pass, the largest known lithium source in the U.S., will be used in GM’s proprietary Ultium battery cell.

“Direct sourcing critical EV raw materials and components from suppliers in North America and free-trade-agreement countries helps make our supply chain more secure, helps us manage cell costs, and creates jobs,” GM CEO Mary Barra said in a statement.

“The agreement with GM is a major milestone in moving Thacker Pass toward production, while setting a foundation for the separation of our U.S. and Argentine businesses,” Lithium Americas president and CEO Jonathan Evans noted.

The investment will be split into two tranches. Funds for the first

tranche will be held in escrow until certain conditions are met, including the outcome of the Record of Decision ruling currently pending in the U.S. District Court, GM said in a news release. The tranche entails GM purchasing 15 million shares of Lithium Americas at a price of $21.34 per share, representing a $320-million investment and 9.999% ownership, Lithium said. If the conditions are met, the funds are expected to be released

European Metals soars as Czech lithium project labelled ‘strategic’

BATTERY METALS | Project qualifies for support from EU’s ‘Just Transition Fund’

BY CECILIA JAMASMIE

Shares in European Metals Holdings (LSE: EMH; ASX: EMH) jumped on Jan. 30 in both Sydney and London after it said its Cinovec lithium project had been classified as strategic for the Czech Republic’s Usti region.

The nomination means the project will be given priority for grant funding from the Just Transition Fund (JTF), which supports European Union regions relying on fossil fuels and high-emission industries in their green transition.

Applications for grants through the JTF opened on Nov. 14, 2022 and will close on Dec, 31, 2023.

The stock rose almost 18% on the news in Australia to close 9.7% higher at A74¢, before levelling off to A70¢ at press time in Toronto In London it climbed 17.3% to 44 pence, but dropped later in the day to 39 pence — still 4% higher than the closing price on Jan. 27 — and rose slightly to 40 pence at press time.

The mining company said it is confident it will receive a significant portion of the funds applied for ahead of many other projects that have been submitted. The maximum amount the JTF could allocate to European Metals’ Cinovec project is 1.2 billion Czech koruna (US$54.8 million), it said.

The designation provides “further evidence of strong sup-

port from the Czech government and the European Union and the Europe-wide recognition of the critical part which the Cinovec project will play in enabling the EU to reach its stated goals of lithium self-sufficiency by 2030,” chairperson Keith Coughlan said in the statement.

The funding could accelerate the project’s development and reduce the time until the first ore is produced, Coughlan noted.

European Metals controls the exploration licences to the Cinovec lithium/tin project in the Czech Republic, which it describes as Europe’s largest hard rock lithium deposit and the world’s fourth-largest non-brine deposit.

Czech utility CEZ, in which the state holds a 70% interest, has a 51% indirect stake in the project through European Metals 100%owned local subsidiary Geomet.

The project sits some 100 km northwest of Prague in the Czech Republic on the border with Germany. It lies on the Krusne hory/ Erzgebirge metallogenic province at the northern border of the Bohemian Massif, one of the major metamorphic crystalline complexes of the European Variscan Belt.

Once in operations, the Cinovec mine will churn out 29,386 tonnes of lithium hydroxide a year over its 25-year productive life, according to a pre-feasibility study update, published in early January. TNM

by the end of 2023 and GM will become a shareholder in Lithium Americas.

The second tranche investment of $330 million is expected to be made into Lithium Americas’ U.S.-focused lithium business after the separation of its U.S. and Argentina businesses and depends on similar conditions, including Lithium Americas securing enough capital to fund development costs to support Thacker Pass.

“This investment is evidence of the thrust the IRA (Inflation Reduction Act) has provided to the U.S. EV value chain,” Jordan Roberts, an analyst at Fastmarkets NewGen said in an emailed statement. “We expect Thacker Pass to represent almost 20% of North America’s processed production in 2032, giving GM a massive share of potential U.S. lithium production.”

The announcement follows comments from a U.S. judge indi-

cating she would rule “in the next couple of months” on whether former president Donald Trump erred in 2021 when he approved the lithium project.

The Vancouver-based miner, which has received all necessary permits to begin construction, had expected a ruling by last September.

The mine has the capacity to produce lithium for up to 1 million electric vehicles (EV) a year and is expected to create 1,000 jobs during construction and 500 permanent positions.

Lithium Americas is planning for the open-pit project’s production capacity to reach 60,000 tonnes a year of battery-grade lithium carbonate over a 46-year mine life, according to a 2018 prefeasibility study.

Measured and indicated resources at Thacker Pass total 385 million tonnes averaging 2,917 parts per million (ppm) lithium for 6 million tonnes of lithium carbonate equivalent (LCE). Inferred resources are 147 million tonnes averaging 2,932 ppm for 2.3 million tonnes of LCE.

While the world needs more lithium, investment in new supply has not kept pace with rising demand, which is expected to hit more than 1 million tonnes of lithium carbonate equivalent by 2025.

GM shares rose about 5.4% to $38.24 on the news as well as betterthan-expected fourth-quarter earnings and guidance for 2023. TNM

Investing in the Canadian Resource Sector at Reduced Cost of Captial

PearTree structures and funds Canadian resource exploration and development activities accessing Canada’s unique flow-through share tax incentives. Global investors purchase shares stripped of tax value at discounts to market.

Averaging $500M

deployed through

PearTree in 2021 and 2022 for the mineral exploration & development sector

Watch our video in English, Français, Deutsch and Español on our website

GLOBAL MINING NEWS THE NORTHERN MINER / FEBRUARY 6 —19, 2023 3

the universe of exploration capital.

peartreecanada.com Expanding

Lithium Americas’ Thacker Pass project, located in northern Nevada. LITHIUM AMERICAS

• SINCE 1915 www.northernminer.com

Peru’s political crisis puts mining in the crosshairs

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF:

Alisha Hiyate, BA (Poli Sci, Hist) ahiyate@northernminer.com

MULTIMEDIA SPECIALIST: Henry Lazenby hlazenby@northernminer.com

STAFF WRITER: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PHOTO EDITOR AND PODCAST HOST: Adrian Pocobelli, MA (ENGL) apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/

CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 moliveira@northernminer.com

ADDRESS:

Head Office

Duncan Mill Road, Suite 320 Toronto, ON, M3B 3K9 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES:

GST Registration

THE VIEW FROM ENGLAND: COLUMN | Unfortunate alliances by mining leaders

BY DR CHRIS HINDE Special to The Northern Miner

BY ALISHA HIYATE

Peru’s ongoing political crisis spells more trouble for miners in the world’s No. 2 copper producing nation, following two years marked by increasingly frequent protests targeting the industry. The country was thrown into turmoil on Dec. 7, when former president Pedro Castillo was removed from office after less than a year and half on the job, after trying to dissolve Congress. The leftist Castillo, who made the move hours before he was set to face a third impeachment vote by the divided Congress, was impeached anyway, and has been arrested and charged with rebellion and conspiracy.

Castillo, Peru’s first Indigenous president, has widespread support among Peru’s rural Indigenous population — even after failing to make progress on a socialist agenda encapsulated in his slogan: ‘no más pobres en un país rico’ (no more poor in a rich country) and being dogged by allegations of corruption. (He also proposed holding a referendum on redrawing the country’s 30-year-old constitution that was blocked by Congress.)

Since his removal and arrest, protests and road blockades in support of Castillo have been unrelenting, damaging the country’s mining, tourism and agriculture industries. (In a Jan. 30 report, The Wall Street Journal put the count of road blockades at 65, while the government estimated the economic cost at US$1.3 billion in infrastructure and lost production.)

Protesters have demanded either Castillo’s reinstatement or new elections.

The jailed former leader has also garnered support from the leftist governments of Mexico, Argentina, Colombia, Venezuela, Cuba, Honduras and Nicaragua.

The protests have turned violent, with 58 protesters dead as well as one police officer, who was burned alive by a mob, as of late January, and accusations that security forces have used unjustified force in response to the unrest.

New President (former vice-president) Dina Boluarte, while blaming radicals connected with drug trafficking, illegal mining and smuggling for the protests, has attempted to placate demonstrators by moving up elections to 2024 from 2026. However, she was unable to garner enough support for the proposal in a dysfunctional and divided Congress. (As an indication of the country’s fractured politics, Boluarte is the country’s sixth president in five years.)

Mining accounts for nearly 60% of Peru’s exports and the upheaval has put at risk a sector that accounts for nearly 10% of GDP. While mining operations have frequently been targeted by protesters in the past, the current crisis has reached a frightening level.

“I haven’t seen this level of violence, the coordinated nature of action, seeking to affect mining and energy, during the time I have been working in the sector,” Magaly Bardales of the industry group Sociedad Nacional de Mineria Petroleo y Energia (SNMPE) told Bloomberg news in late January.

Footage posted on social media from Glencore’s Antapaccay copper mine in southern Peru, which suspended operations on Jan. 20 after the third attack on the site in a month, shows invaders entering the site, setting fires and stealing workers’ belongings. In a statement, the company said operations had been difficult to maintain since Jan. 4 when a road blockade was set up, preventing the free movement of supplies and workers.

“On January 12 and 13, we were the object of criminal acts and unjustified attacks, putting the life and health of our workers at risk,” including that of an employee from Espinar who was inside a building as it was being set on fire, the company said in a statement after one of the attacks. It said it also saw serious damage to facilities that included the pump house that provides water to communities in the area.

Like Antapaccay, most of the mining operations that have been targeted are in southern Peru’s highlands, where the protests have been most intense – although Nexa’s Atacocha zinc mine in central Peru was also shut by protests for a week in early January.

The reasons behind the crisis are complex. There’s no doubt that Indigenous Peruvians’ justified anger over entrenched discrimination, racism and inequality plays a part.

In addition, with regards to mining’s role, rural Indigenous populations don’t see much of the benefits from the country’s vast mineral wealth, despite reforms passed in the early 2000s that were meant to share that wealth more equally, sending back about half of mining revenues to local governments. Even though mining and natural resources generate a lot of money for the regions, these local governments have not effectively used the funds to improve rural populations’ quality of life, says Fernando Pickmann, a Lima-based lawyer and a senior partner at Dentons who leads the company’s Canadian and Latin American mining practice.

“The central government has been sending millions of dollars to regions that host the mines that has been administrated by the regions,” he told The Northern Miner in late January. “The problem has been corruption or a misunderstanding of what to do with that money.”

He also believes (as Boluarte has also alluded to) that a relatively small number of people are funding the protests and fuelling the violence for their own ends. These include leftist groups from other Latin American nations (Bolivia’s former president Evo Morales was banned from entering Peru in early January by the Boluarte administration), socialist leaders from inside the country, and informal miners and drug traffickers that operate in southern Peru.

“They are isolated groups,” Pickmann says. “We believe that they are not more than say 50,000 or 60,000 that are generating chaos in Peru out of a population of 33 million.”

Pickmann, who sits on the board of several juniors and one senior company and is president of Regulus Resources, says miners should take comfort in the strength of the country’s institutions during the crisis.

“Peru is a country that is living a hard moment fighting against these violent groups but everything is under the control of our government and the rules of our constitution,” he said. “Not even one article of our constitution has been violated in this process and that’s very important because the legal structure of the country has been respected.”

He believes that normalcy will eventually return.

“Of course mining investment has been paused until everything is clarified... but we are not at civil war,” he says, adding that the social unrest is no different than the protests against inequality that swept Chile in 2019 and the Black Lives Matter movement in the U.S.

Just brilliant! The mining industry is in urgent need of redemption but, at conferences in January, mining executives have aligned themselves with the Kingdom of Saudi Arabia (KSA) and an elitist club operating from a Swiss ski resort. The general public is hardly likely to be won over by our partnering with right-wing royalty in Riyadh and the World Economic Forum (WEF).

In the past, miners have been accused of being so focused on their own operating performance and corporate development that they failed to notice what was important for the whole industry; of not seeing the forest (or ‘wood’ in the U.K.) for the trees. I suspect that now, however, the pendulum has swung too far towards postulating about the far future, and we are losing sight of the trees. The industry needs to attend to more immediate woes, in particular the collapse in public support — from which flows, indirectly, the very serious issues of skills shortages, delays in planning approval and insufficient funding.

Mining requires a ground-up, practical, initiative and the forest-trees idiom gives a clue to the solution. We must rebuild plank by plank, and copy what the Welsh are doing for a 15th century ship found buried in a river bank near Newport.

The 35-metre-long wine-trading vessel sank in 1469 after breaking its moorings on the river Usk. Discovered in 2002, the ship would have weighed some 400 tonnes fully laden but the surviving structure weighs only 25 tonnes. Over the past 20 years the individual timbers have been removed and £8 million (US$10 million) spent preserving and restoring the wood. This has included freeze-drying at the Mary Rose museum in Portsmouth (Mary Rose was Henry VIII’s flagship naval vessel that sank in 1545 and was recovered in 1982).

The timber was also checked against the U.K.’s dendrochronology database, which utilizes radiocarbon dating and the unique grain patterns in wood. Timber can be dated as far back as 12000 BC, and the database can even pinpoint where the original trees were growing. It seems that the

trees for the Newport ship’s wood were felled during 1449 in northern Spain (although the wine came from France).

It was announced in mid-January that the restoration process is complete. After spending over 530 years buried in Welsh mud, the planks are properly dried out and will be put on display. The reassembly can now begin, and with almost 2,500 pieces (and no flatpack instructions) it has been called the world’s largest 3-D puzzle.

The Newport vessel dates from the dawn of European maritime exploration and it sank 23 years before Christopher Columbus ‘discovered’ America.

Discovery of new lands, and the prospect of traded riches, reminds us that the mineral prospectivity of the Arabian-Nubian Shield is not in doubt, and Saudi Arabia offers a potentially lucrative hub for the region. This should not disguise the fact that the country is hardly an ideal partner to improve the immediate standing of the global mining industry.

At the recent Future Minerals Forum in Riyadh, corporate leaders from BHP (Mike Henry), Rio Tinto (Dominic Barton), Barrick Gold (Mark Bristow) and Ivanhoe Mines (Robert Friedland), in particular, queued up to trumpet KSA’s role in providing guidance to the mining industry. The Arabian-Nubian Shield might be a profitable way forwards for individual mining companies, but the region’s leaders are a bad fit for our industry.

Similarly, if mining leaders think the annual meeting in Davos is likely to offer a solution to the industry’s short-term travails they are sadly mistaken. Instead, we need to empower our own trade organizations to drive the industry forwards. The Prospectors & Developers Association of Canada and the International Council on Mining and Metals spring to mind, but they need to find a greater resolve, and grow teeth.

Certainly, Klaus Schwab’s organization isn’t the answer; the WEF can’t see the individual trees blocking our way because of its focus on the whole forest. We will be cut down long before Schwab’s vision for us comes to pass. TNM —Dr. Chris Hinde is a mining engineer and the director of Pick and Pen Ltd., a U.K.-based consulting firm. He previously worked for S&P Global Market Intelligence’s Metals and Mining division.

COMPANY INDEX

“My advice to investors and to mining companies will be keep their positions there,” Pickmann says. “Don’t lose the opportunity because the resource is there and Peru continues under constitutional rule providing the legal guarantee and security the country has always provided investors and companies.” That may be the case, however, miners would do well to think long and hard about their ESG strategies as they wait for the crisis to subside. In Peru — as elsewhere — they’re going to have to get better at making allies when, in a polarized world, there is no shortage of adversaries. TNM

4 FEBRUARY 6 —19, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

GLOBAL MINING NEWS

Toronto

225

C$130.00

5% G.S.T.

7% P.S.T. to BC

13% H.S.T. to ON, NL orders 14% H.S.T. to PEI orders 15% H.S.T. to NB, NS orders U.S.A.: C$172.00

Foreign:

Canada:

one year;

to CDN orders.

orders

one year

C$222.00 one year

# 809744071RT001 (ISSN 0029-3164) CANADA POST: Return undeliverable Canadian addresses to Circulation Dept. c/o The Northern Miner 225 Duncan Mill Road, Suite 320 Toronto, ON M3B 3K9 Publication Mail Agreement #40069240 Periodicals Postage Rates paid at Niagara Falls, NY, 14304. U.S. office of publication 2424 Niagara Falls Blvd, Niagara Falls, N.Y. 14304. U.S. POSTMASTER: send address corrections to: Northern Miner Box 1118 Niagara Falls, N.Y. 14304.-7118 THE NORTHERN MINER is published biweekly by Glacier Resource Innovation Group, a division of Glacier Media Inc., a leading Canadian media company with interests in business-to-business information services. From time to time we make our subscription list available to select companies and organizations whose products or services may interest you. If you do not wish your contact information to be made available, please contact us by one of the following methods: Phone: 1-888-502-3456; Fax: (416) 447-7658; Mail to: Privacy Officer, The Northern Miner, 225 Duncan Mill Road, Suite 320, Toronto, ON M3B 3K9.

EDITORIAL

Amex Exploration 6 AngloGold Ashanti 7 Antofagasta 6 Arras Minerals 6 Ascot Resources 6 Barrick Gold 7 Baselode Energy 14 Calibre Mining 6 Cameco 10 Canada Nickel 14 Endeavour Mining 2 European Metals Holdings 8 Fission Uranium 10 Fortuna Silver Mines 2 Franco-Nevada 2 Freegold Ventures 6 General Motors 3 Geopacific Resources 6 Glencore 2 GoGold Resources 6 Granite Creek Copper 8 Green Technology Metals 15 Grounded Lithium ...........................................15

Kinross Gold.......................................................2 Li-FT Power 9 Lithium Americas 3 Lithium One Metals 15 Marimaca Copper 15 Montagne Gold 6 New Pacific Metals 6 NexGen Energy 16 NGEx Minerals 6 Orezone Gold 2 Osisko Gold Royalties 2 Patriot Battery Metals 8, 15 Probe Gold 2 Rock Tech Lithium 15 Sitka Gold 8 South Star Battery Metals 16 SSR Mining 2 Surge Battery Metals 16 Teck Resources 5 Uranium Energy 10 Western Uranium & Vanadium 8 Wheaton Precious Metals 2 Zinc8 Energy Solutions 11

BC Premier Eby touts exploration spending, pledges to speed up permitting

ROUNDUP | Provincial critical minerals strategy in the works

BY HENRY LAZENBY

British Columbia-focused mineral explorers set a new spending record in 2022, hitting $740.4 million, Premier David Eby announced on Jan. 23 during an industry event in Vancouver.

The figure surpasses the previous record a decade ago of $681 million, and the $660 million spent in 2021.

The rise was underpinned by an 84% increase in copper exploration budgets, with the province’s so-called Golden Triangle in the northwest capturing the bulk of the attention.

The final figures for B.C.’s mining production are also expected to be a record $18.2 billion, Eby said during the opening of the Association of Mineral Exploration (AME) Roundup conference. That’s a $4.3 billion increase over 2021.

Director of the B.C. Geological Survey’s development office Gordon Clark attributed the increase in value over 2021 to soaring metallurgical coal prices that achieved a high of US$670 per tonne last year and has remained relatively high at close to US$300 per tonne as of December.

During a regional overview session, he said that B.C. currently has seven operating metallurgical coal mines. The province is also Canada’s largest producer of copper and gold and the country’s only producer of molybdenum.

Copper is among the 31 critical minerals identified in Canada’s new federal Critical Minerals Strategy as key to both the digital economy and the energy transition, and it’s one mineral B.C. has in relative abundance.

The estimated global demand for copper will grow by 4.7 million tonnes by 2030, thanks to the increased demand from the energy transition and greater urbanization, said Teck Resources’ (TSX:

TECK.A/TECK.B; NYSE: TECK)

recently appointed CEO, Jonathan Price. The company operates the large-scale Highland Valley Copper mine, 330 km east of Vancouver.

“To put that into perspective, Teck’s Highland Valley Copper mine here in B.C. is Canada’s largest copper mine,” Price said. “Four-point-seven million tonnes would be the equivalent of building another 35 Highland Valley Copper mines in just seven years.” The time factor in getting new metal to market is of great concern to exhibitors on the Roundup display floor, especially concerning permitting new projects. It can take a decade or two to bring a discovery into production.

To this end, Eby has, as part of his government’s efforts to address the housing crisis, committed to speed up permitting for housing, which is expected to quicken the pace for the resource industries.

POILIEVRE from 1

the seeming inability to provide better-quality metal and energy products to energy-hungry Asian markets means more coal is being burned to power their electrical grids. It could be powered by clean Canadian natural gas, he said.

Capital flight

Poilievre stressed that money flows to where the biggest returns are possible. “Why would you add the risk that you might wait around 25 years for a permitting ‘maybe’? Or a ‘no,’ when you can go to other countries where you can get an answer within 18 months? Well, the answer is you wouldn’t and that’s why increasingly, our money is leaving our country,” he said.

“Ten years ago, we had $22 billion of annual mining investment. Last year, we had $14 billion and that does not even account for inflation. Canadians invest $800 billion more in the rest of the world than the world invests in us because the money goes where it can get a return on investment.”

He lambasted Bill C-69 for having driven investment away by, for example, opening the door to identity politics when it comes to mine

“For decades, our province has had a slow and complicated permitting process system. It bogged down our province’s growth,” Eby said. “We announced two weeks ago a new major investment in addressing permitting in our province. New staff are coming on to expedite permits through the approvals process, and staff to assist us in reworking our permit system so it’s more efficient and faster.”

Eby also said he had asked his

new energy and mines minister, Josie Osborne, to expedite a provincial critical minerals strategy.

Mineral Tenure Act challenge Eby underlined that the success of explorers and miners in B.C. hinges on early engagement with First Nations.

Currently, the B.C. Mineral Tenure Act is facing a “very serious legal challenge” from the Gitxaala and Ehattesaht First Nations,

www.northernminer.com

staff gender-based analysis. “So hard-working blue-collar men are the problem and that’s why companies need to make sure there are not too many men going to towns when mines open up.

“Can you imagine an investor looking at that criteria trying to figure out how to properly fill out the application to get it approved when you introduce that kind of woke nonsense and political discretion into the process,” Poilievre said.

Should Poilievre get an opportunity to form a government, he pledged to immediately repeal C-69 and replace it with a new law, “which consults First Nations, protects the environment, but gets things done in this country,” adding: “We have to stop stopping and start starting in this country as we have to speed things up.”

Poilievre proposed a three-point plan to get the industry moving again. It hinges on strong exploration tax incentives, removing the carbon tax and replacing it with more focused incentives and doubling down on nuclear generation to produce low-carbon impact metals.

Canada’s advantage

Speaking via a pre-recorded video, Minister Wilkinson framed Can-

ada as well-positioned to take advantage of the emerging economic opportunities the energy transition brings.

“A key element of our plan is identifying and seizing the opportunities that will be enabled as we move towards a lower carbon future,” Wilkinson said. “Successful strategies leverage comparative advantages and make no mistake, Canada has a lot going for it to help us win on a global scale. Canada has educated and highly trained people in place and significant deposits of natural resources that are increasingly in demand, including critical minerals and hydrogen,” he said, adding that the country is a global leader in ESG standards and practices.

“[We’re a] nation with abundant resources is eager to enhance our production of critical minerals and to build value chains in processing, refining and product manufacturing,” said the minister.

Late last year, the federal government launched Canada’s Critical Minerals Strategy, which outlines nearly $4 billion to support economic growth and competitiveness while promoting climate action and strong environmental management. TNM

and he expects more challenges to come.

First Nations pressing for changes to the act want to be notified when anyone files a mineral claim in their traditional territory. That has created some concerns for prospectors who consider mineral claims a form of intellectual property and therefore like to keep claims secret.

“I want to assure you that our government is committed to finding a way forward to address this issue,” Eby said. “We will be engaging with you as an industry to make sure that the regime works for you. But we will also do it in partnership with First Nations in our province.”

On Jan. 18, the provincial government struck agreements with Blueberry River First Nations that essentially make them co-regulators. The first consent-based decision-making framework was signed last year with the Tahltan First Nation.

Minister Osborne reiterated the government’s commitment to co-develop a modernized Mineral Tenure Act. “I am confident that by working closely with First Nations, First Nations organizations, industry and communities, we can modernize the act in a way that balances our commitment to reconciliation with a thriving mineral exploration and mining sector,” she said in a statement.

Eby urged prospectors and exploration companies to work with First Nations to gain their consent when exploring and prospecting in their traditional territories.

“The very first contact that nations have around economic development or a particular proposal in their community is your industry,” Eby said. “You set the tone. So, if it’s a constructive and collaborative tone at the beginning, that leads to greater success down the road with mine development.” TNM

users as the stakeholder most likely to invest in them, increasing by a third from 2022.

Climate change also remains high among industry priorities. The climate change response will continue to be an issue for mining companies, as will supply chain management — both factors continue to dominate as the main priorities for the second year running — cited by 28% and 21% of respondents, respectively.

M&A landscape

The survey suggests mining majors are entering 2023 in a much stronger position than in previous downturns. Respondents were divided over whether majors will increase their M&A activity.

Campbell points out that 2014 instilled discipline among mining majors, punishing those who’d overleveraged and neglected costcutting.

“The largest mining companies

GLOBAL MINING NEWS THE NORTHERN MINER / FEBRUARY 6 —19, 2023 5

Above: At Roundup 2023 in Vancouver.

Right: Teck Resources CEO Jonathan Price speaks at Roundup. HENRY LAZENBY

See SURVEY / 8

Caterpillar mining equipment. CATERPILLAR

Jonathan Price, CEO of Teck Resources

SURVEY from 1

TNM DRILL DOWN:

Freegold Ventures reports top gold assay for Jan. 20-27

BY BLAIR MCBRIDE

Our TNM Drill Down features highlights of the top gold assays of the past week. Drill holes are ranked by gold grade x width, as identified by our sister company Mining Intelligence. (www.miningintelligence.com).

The Americas produced this week’s top drill assays, and Vancouver-headquartered Freegold Ventures (TSX: FVL) took the lead with its Golden Summit project in central Alaska. The junior reported 90.8 metres grading 3.83 grams gold per tonne from 363 metres depth, for a width x grade value of 731 in hole GS2232. The hole was one of seven drilled into the Dolphin deposit that returned high grades or expanded mineralization. Hole GS2215 returned 370.1 metres grading 1.71 grams gold from 189.3 metres depth, including 3 metres of 119 grams gold near the central part of Dolphin. Hole GS2226, drilled to the north and on the western side of the Tolovana Vein expanded mineralization to the north in an area of limited drilling. GS2236, drilled in the same direction as GS2226 returned 175.3 metres grading 1.93 grams gold from 53 metres depth and 42.1 metres grading 5.5 grams gold, and demonstrates expansion potential to the west. According to a preliminary economic assessment of the project, published in 2016, it has an indicated resource of 61.4 million tonnes grading 0.7 grams

TNM DRILL DOWN Top gold assays of the week

gold for 1.3 million oz. of contained metal, and an inferred resource of 71.5 million tonnes grading 0.69 grams gold for 1.5 million oz. of contained metal.

The second best assay of the week comes from New Pacific Metals’ (TSX: NUAG) Carangas silver-gold project in Bolivia. Hole DCAr0094 returned 504.6 metres grading 1.22 grams gold per tonne from 228.5 metres depth, for a width x grade value of 616. That hole was among four deep stepout holes drilled south of the previous gold intercepts, and included DCAr0067 that cut 513.6 metres

grading 0.72 gram gold from 171.34 metres, and a 112.11-metre interval of 1.82 grams gold from 450.42 metres, with the hole ending in gold mineralization at 688 metres depth due to drill hole problems. Hole DCAr0078 cut 668.7 metres grading 0.48 gram gold from 179.3 metres, which was collared in the southern portion of the Central Valley, between the so-called East and West Dome hills of the Carangas area. Hole DCAr0081 cut 404.25 metres grading 0.42 grams gold from 141.5 metres depth. An inaugural resource estimate for Carangas is planned for the second

quarter of this year.

The third best assay of the week comes from Calibre Mining’s (TSX: CXB) Golden Eagle project in northwestern Washington State. Hole GEC22-003 returned 195.1 metres grading 2.9 grams gold per tonne from 105.8 metres depth for a grade x width of 566. The results are from three holes of the Vancouver-based miner’s first phase diamond drill program at the 100%-owned project. Calibre also reported that Hole GEC22-001 returned 4.3 grams gold over 92.42 metres from 96.7 metres depth, as well as 7.8 grams

gold over 17.3 metres from 154.8 metres. Hole GEC22-006 returned 2.38 grams gold over 114.3 metres from 42.7 metres; 2.66 grams gold over 19.8 from 19.8 metres and 2.65 grams gold over 25.7 metres from 160 metres. “Results from Golden Eagle reinforce the potential for this project to provide significant value to Calibre shareholders,” said Calibre CEO Darren Hall, in a Jan 24. news release. “I look forward to results from the second phase of drilling as well as the commencement of a comprehensive metallurgical program to fully assess this strategic asset’s potential.” TNM

Industry scolds US for mining ban in Minnesota wilderness area

ENVIRONMENT | Biden administration move comes while promoting critical minerals

BY COLIN MCCLELLAND

The mining industry is criticizing a United States government decision to remove a large swath of northeastern Minnesota from development for 20 years even as the administration promotes critical minerals projects for national security.

The U.S. Department of the Interior on Jan. 26 extended a temporary ban from last year on copper, nickel and other hard rock mining across about 900 sq. km of the federal Boundary Waters Canoe Area Wilderness along the Canadian border by the north shore of Lake Superior. Former president Donald Trump had tried to approve mining in the area.

“It’s difficult to square the announcement of this significant land withdrawal with the Biden administration’s stated goals on electrification, the energy transition and supply chain security,” Rich Nolan, president and CEO of the U.S. National Mining Association said in a news release.

“At a time when demand for minerals such as copper, nickel and cobalt are skyrocketing for use in electric vehicles and solar and wind infrastructure, the administration is withdrawing hundreds of thousands of acres of land that could provide U.S. manufactur-

ers with plentiful sources of these same minerals. It’s nonsensical.”

The administration’s move follows the allocation of billions of dollars in funding for the mining industry and the forming of an alliance among Western nations to take on China as the predominant source of critical minerals, which are needed for modern technology to fight climate change and in defence.

Competing interests

However, the White House has promised to conserve 30% of the

U.S. landmass by 2030, including a contested 1,800 sq. km of tribal lands in Nevada and this month’s protection of the Tongass National Forest in Alaska.

“The Department of the Interior takes seriously our obligations to steward public lands and waters on behalf of all Americans,” Interior Secretary Deb Haaland said in a statement. “Protecting a place like Boundary Waters is key to supporting the health of the watershed and its surrounding wildlife, upholding our Tribal trust and treaty responsibilities, and boost-

ing the local recreation economy.”

The area in Minnesota includes Antofagasta’s (LSE: ANTO) Twin Metals underground project to mine copper, nickel, cobalt and platinum group metals. Washington cancelled the Chilean miner’s leases there last year. The company didn’t respond to an e-mail seeking comment.

The project proposed processing 18,000 tonnes of ore per day mined from 122 metres to 1,375 metres depth. It said processing would remove most of the sulphide minerals, producing tailings without

acid rock drainage. Up to half the tailings would be used as backfill in the underground mine and the rest would be dry-stacked on the surface, Antofagasta said.

U.S. government agencies say mining operations as far away as 160 km threaten acid pollution of the area’s waterways which attract the most visitors of any wilderness area in the U.S., some 150,000 people a year.

“Even small amounts of this pollution is detrimental to public health,” Christine R. Goepfert, a campaign director for the U.S. National Parks Conservation Association, said in a statement on Jan. 26. “Banning mining activities in the region’s prized Boundary Waters will protect the broader park ecosystem now and for years to come.”

The American Exploration & Mining Association said it had joined with local Congressman Pete Stauber in September to urge the Biden administration to keep the Boundary lands open to projects.

“Today’s decision ignores the comprehensive environmental laws and regulations under which modern mines are designed and operated,” association executive director Mark Compton said. “It is just another sad chapter illustrating the way this administration sabotages itself.” TNM

6 FEBRUARY 6 —19, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

The region of northeastern Minnesota now off limits to mining comprises about 900 sq. km of the federal Boundary Water Canoe Area Wilderness along the north shore of Lake Superior. PIXABAY IMAGE

RANK PROPERTY COUNTRY OWNER DRILL HOLE DEPTH WIDTH GRADE WIDTH ID FROM (m) (m) (G/T GOLD) X GRADE 1 Golden Summit United States Freegold Ventures (TSX: FVL) GS2232 363.0 190.8 3.83 731 2 Carangas Bolivia New Pacific Metals (TSX: NUAG) DCAr0094 228.5 504.6 1.22 616 3 Golden Eagle United States Calibre Mining (TSX: CXB) GEC22-003 105.8 195.1 2.90 566 4 Los Ricos Mexico GoGold Resources (TSX: GGD) LRGAG-22-118 95.6 55.0 7.80 429 5 Perron Canada Amex Exploration (TSXV: AMX) PE-22-535 841.8 4.9 75.81 368 6 Woodlark Island Papua New Guinea Geopacific Resources (ASX: GPR) BSSTG001* 40.0 91.0 2.64 240 7 Beskauga Kazakhstan Arras Minerals (TSXV: ARK) Bg22012 41.0 1,050.0 0.21 221 8 Los Helkados Chile NGEx Minerals (TSXV: NGEX) LHDH079 148.0 1,215.2 0.18 219 9 Premier Canada Ascot Resources (TSX: AOT) P22-2459 42.5 8.0 26.56 212 10 Kone Ivory Coast Montage Gold (TSXV: MAU) GBRC026* 0.0 78.0 2.70 211

All data supplied by Mining Intelligence for the period of Jan. 20—27, 2023 for public companies from exploration stage to production. * indicates reverse circulation; otherwise all holes are diamond drill holes. Reported lengths are not necessarily true widths. Only the best hole per property is shown.

Push tech jobs to attract women to industry, forum panel says

ESG | Mentorships are key, women tell Saudi conference

BY COLIN MCCLELLAND

The industry needs to encourage mentors, adjust mindsets and offer technology jobs to boost the level of women from just 8% of the global mining workforce, according to a panel at the Future Minerals Forum in Saudi Arabia.

New technologies allow women to sidestep the image of a soot-covered coal miner headed underground with a pickaxe and choose careers such as geo-chemistry, finance and artificial intelligence, Emily King, chief innovation officer of Mexico-focused Analog Gold, told the conference in Riyadh on Jan. 12.

“The more we can integrate technology into all the different ways the sector works,” King said, “the more attractive it will be to young people in general and women specifically.”

Companies are facing increasing pressure to increase the number of women as the industry and its watchdogs push environmental, social and governance (ESG) priorities.

The second edition of the two-day conference focused on the oil superpower’s efforts to continue as an energy leader — in battery metals — after the world transitions away from fossil fuels. But it also allowed state-owned miner Ma’aden to declare women hold 20% of its positions, and Saudi energy minister Prince Adulaziz bin Salman Al Saud to say more than half his team is female. They’re following reforms led by Crown Prince Mohammed bin Salman that have also allowed women drivers and reined in the religious police.

Remote work

It’s important for the industry’s ESG

goals to engage women in remote jobs so they can work without disrupting the traditional roles they hold as caregivers, Sheila Khama, former chief executive officer of De Beers Botswana, told the forum.

“We should consider how can we use remote and digital technologies to enable women to work without having to make a choice as to whether they contribute to mining or leave children unattended,” Khama said. “The problem that happens to women is not a women’s problem, it is society’s issue and it’s one we should tackle collectively.”

Christine Gibbs-Stewart, CEO of Sydney-based Austmine, a mining equipment association, said Australia’s relatively well-developed industry needs more leaders and mentors to raise female participa-

tion from just 16%.

“We need the best and brightest to join the mining industry,” Gibbs-Stewart said. “Leaders need to make sure people are treated fairly, to call out bad behaviour, to encourage and promote women and most importantly they need to listen for what is needed to really foster and grow women into the mining industry.”

Systemic biases

Mashael Al-Omair, a metallurgical engineer at Ma’aden, said the industry needs to address systemic biases that creep into areas such as personal protective equipment (PPE) that isn’t suitable for women, or awkward on-site rapport between the sexes.

“It’s a bit of a challenge to get your work done or get your point

across but in the end they’re mostly well-intentioned,” Al-Omair said. “It’s just getting over that barrier providing PPE for women, having the sensitivity training, amenities on site that are fit for women. Being in Saudi, which has started having women in mining, it’s not a question of if, it’s when and how much.”

Amanda Van Dyke, a fund manager at Africa-focused private equity firm Arch Emerging Partners, said she was impressed with the Saudi energy minister’s staffing and cited Barrick Gold (TSX: ABX; NYSE: GOLD) CEO Mark Bristow as another industry leader promoting women.

“He was hiring junior geologists and engineers 30 years ago and those women are now senior in his organization,” Van Dyke said. “It is from that leadership that recog-

nizes talent and encourages women to come to the top that you will get there.”

Small business support Wendy Tyrrell, executive director of the Chicago-based Development Partner Institute, an ESG consultancy, said inclusive-minded education from grade school onwards and support for small businesses would help more women enter the industry.

“This opportunity for education must go all the way to senior executives and board level,” Tyrrell said. “There are fantastic opportunities to broaden the space for women through education, mentorship and sponsorship.”

Panel moderator Dina Alnahdy, a member of the Saudi National Mining Board, conducted an informal poll and found only about half of the audience of maybe 100 mostly men would hire a woman even to a junior-level post.

“How can we adjust this mindset?” she asked.

Al-Omair replied that leaders must become aware of unconscious biases while King said men must get beyond fearing to say the wrong thing in front of women, perhaps by learning from diversification mentors.

Khama, who has also worked for the World Bank and AngloGold Ashanti (JSE: ANG), said she benefited from the confidence gained by being raised like a boy in her Botswana village because she was an only child.

“It isn’t that I’m more intelligent than anyone, it’s that I had an attitude and a belief that I was as good as a man,” she said. “I worked so hard that if I wasn’t in the room the men knew something was missing. There’s no substitute for that.” TNM

Eurasian Resources expands search for EV minerals in Saudi Arabia

FUTURE MINERALS FORUM | CEO says ‘future elephants’ will be outside established mining regions

BY COLIN MCCLELLAND IN RIYADH, SAUDI ARABIA

Eurasian Resources Group has signed deals to explore in Saudi Arabia with a Mars rover-like sampler as it helps prepare a passport for electric vehicles showing their battery mineral sources.

The Luxembourg-based company, which is 40%-owned by the Kazakhstan government, has agreed with Saudi state-owned miner Ma’aden to search for copper, nickel, lead, zinc and rare earths, chief executive officer Benedikt Sobotka said in an exclusive interview with The Northern Miner on the sidelines of the Future Minerals Forum in Riyadh on Jan. 12.

“This region has been underexplored and of course geologically this is elephant country in the same area as the Nubian shield,” Sobotka said. “For the first time we’re going to use a remote-operated vehicle, which is very exciting because it will save a tremendous amount of time.”

The unlisted company, with 2021 revenue of US$8.5 billion, will deploy the sampler called Nomad to survey, analyze soils on the spot

and transmit results to handlers. Its round-the-clock operation will cover some six belts of opportunity initially mapped by Saudi Arabia.

Sobotka, chairman of the Global Battery Alliance, a network of governments, industries and watchdogs promoting corporate social responsibility (CSR) in mineral sourcing, announced a new vehicle passport to that effect at the World Economic Forum in Davos, Switzerland, following the Future Minerals Forum. Tesla and Volkswagen also joined the passport system,

which is intended to check off greenhouse gas emissions, human rights records and environmental protections, he said.

“It will help trace materials for the end consumer that go into the electric vehicle,” the chairman said.

“It’s a combination of provenance and CSR rating which will make the composition of the battery transparent.” Saudi Arabia itself plans to develop enough renewable capacity by 2035 to power about 17 million homes as the Middle East begins to embrace the clean energy transition.

Following the convention, Eurasian announced plans to invest US$50 million in the country, focused on early stage, technology-enabled exploration for large deposits.

Double cobalt output Eurasian, which has about 70,000 employees across 20 countries, also mines battery metals in Kazakhstan and a slew of African nations. It produced 1.54 million tonnes of ferroalloys and 20,700 tonnes of cobalt in 2021, according to a company sustainability report.

The miner is starting construction within a year to double its

cobalt production in the Democratic Republic of the Congo by 2027 while it further explores its 2,000-sq.-km holding in the country’s southern Katanga province, Sobotka said.

“It will be required, because just in cobalt the industry will have to build 30 to 40 mines in the next 10 years,” the CEO said. “The energy transition for the minerals and metal industry is the biggest purchase order in history because of the sheer amount of volume that’s going to be required.”

The global mining industry spends less than US$100 billion a year on capital projects compared with the oil and gas sector’s US$2.2 trillion annually, according to S&P Global. Achieving clean energy goals is going to require fundamental shifts in investing not just in dollar terms, but in attitudes to mining and the talent needed, Sobotka said.

“We’re talking about high-grade nickel, manganese and cobalt, materials that are not easy to mine and process. And they tend to be in jurisdictions that are not easy to work in,” Sobotka said.

“The future elephants are all going to be outside the established

jurisdictions and we’re very comfortable working in these regions,” he said. “We as an industry have to be much more bold when it comes to making commitments to new countries.”

Indonesia on deck Kazakhstan itself has had its share of turmoil. President KassymZhomart Tokayev invited Russian-led troops a year ago to quell riots that stemmed from fuel price hikes before spreading.

The largely undeveloped DRC has been notoriously difficult to govern, with thousands of artisanal miners in the country’s east controlled by rival militia groups, some sponsored by neighbouring countries.

Now, Eurasian is considering Indonesia, which has a fifth of global reserves of nickel, but has restricted the export of raw materials to force companies to build factories in the sprawling, thirdmost populous country. There are also concerns about who will succeed President Joko Widodo next year and if nearby China will exert undue influence in the new cold war for critical minerals. TNM

GLOBAL MINING NEWS THE NORTHERN MINER / FEBRUARY 6 —19, 2023 7

Eurasian Minerals CEO Benedikt Sobotka. THE NORTHERN MINER

At the 2023 Future Minerals Forum in Riyadh. FUTURE MINERALS FORUM

Carmacks PEA lifts Granite Creek Copper shares

YUKON | Early-stage study shows 9-year life for 7,000 tpd project

BY HENRY LAZENBY

Yukon-focused explorer Granite Creek Copper’s (TSXV: GCX; US-OTC: GCXXF) Toronto-quoted equity closed in positive territory on Jan. 19 after it released strong initial economics for the Carmacks copper-gold-silver project.

Located in the Minto Copper District within the traditional territories of Little Salmon/Carmacks

First Nation and Selkirk First Nation, Granite’s preliminary economic assessment (PEA) shows it can turn a good profit with solid leverage to rising copper prices. The PEA also demonstrates plenty of resource upside providing mine life expansion potential.

Using base-case metal price assumptions of US$3.75 per lb. copper, US$1,800 per oz. gold and US$22 per oz. silver, the PEA calculates a post-tax net present value (NPV), at a 5% discount, of $230 million, with an internal rate of return (IRR) of 29%. Should metal

prices rise to US$4.25 per lb. copper, US$2,000 per oz. gold and US$25 per oz. silver, the NPV jumps to $330 million, with an attractive IRR of 38%.

The head grade is expected to average 1.1% copper-equivalent, comprising 0.9% copper, 0.3 gram gold and 3.5 grams silver per tonne. The operation is expected to produce copper-equivalent metal at an all-in sustaining cost of US$2.57 per lb.

The mine plan is based on a resource of 21.3 million tonnes grading 1.1% copper-equivalent for 33.9 million lb. of metal in concentrate per year.

The project is estimated to cost $220 million to build, requiring a further $130 million over the mine life as sustaining capital. The model provides for a two-year payback.

Carmacks would operate for nine years at 7,000 tonnes per day.

Granite is positioning the project as a potential low-carbon source of copper. The project will be powered by the Yukon’s electrical grid,

which primarily uses renewable electricity.

The open pit sulphide and oxide project is expected to benefit from resource expansion and secondary processing of oxide material to improve oxide recoveries further.

“The inclusion of sulphide alongside oxide ore, either as a blend or a straight sulphide feed, has resulted in significant upside on the proj-

Sitka Gold posts first resource for RC project in Yukon

BY NORTHERN MINER STAFF

Vancouver-based Sitka Gold (CSE: SIG; US-OTC: SITKF) has outlined an inferred resource of 1.3 million oz. gold at its Blackjack and Eiger deposits, part of the RC project in central Yukon.

The inferred resource for those deposits combined comes to 61.1 million tonnes grading 0.68 gram gold per tonne, based on a cut-off grade of 0.25 gram gold.

The resource starts at surface and the two deposits remain open in all directions. It was based on 11,630 metres of drilling across 34 holes.

“The production of an initial resource of over 1.3 million ounces of gold with only 34 diamond drill holes marks a major milestone for our flagship project in the Yukon,” Sitka’s CEO Cor Coe noted in a press release.

“Beginning in 2020 with the initial four diamond drill holes that

Sitka drilled in the Blackjack-Saddle-Eiger corridor, our team knew we had discovered an area with high potential to produce a discovery of an intrusion related gold deposit.”

The company is planning to drill 10,000 metres at the project this year. The drill program will be focused on Blackjack and Eiger as well as on the Saddle Zone. Saddle is located midway between Blackjack and Eiger and was not included in the resource estimate.

Sitka believes the Saddle Zone contains “significant mineralization” and has reported intercepts there of 0.52 gram gold over 84.8 metres from surface in drill hole DDRCCC-20-01 and 0.59 gram gold over 48 metres from a depth of 48 metres.

The Blackjack discovery was made in the company’s last drill hole of 2021 (DDRCCC-21-021), which intersected 220.1 metres of 1.17

grams gold from surface, including 50.5 metres of 2.08 grams gold.

The drill hole was the westernmost hole in the Saddle-Eiger trend and was drilled beneath a greater than 500 parts per billion (ppb) gold-in-soil anomaly previously identified at surface. Sitka says that soil anomaly is part of a larger 2 km by 500 metre gold-in-soil anomaly that is open in all directions and spans the Saddle and Eiger zones.

The 376-sq.-km RC project is situated in the Yukon’s Tombstone Gold Belt and is positioned between Victoria Gold’s (TSX: VGCX) Eagle gold mine and Sabre Gold Mines’ (TSX: SGLD; US-OTC: SGLDF) Brewery Creek gold mine.

Sitka has an option to acquire 100% of the project.

At press time in Toronto, Sitka shares were trading at 10¢, in a 52-week window of 6¢ and 21¢. The junior explorer has a market cap of roughly $19.8 million. TNM

ect, with further opportunities recognized in both processing and exploration,” notes CEO Timothy Johnson in the release.

The exploration team is tracing priority targets near the proposed open pits “with clear exploration potential to extend mine life with four target areas within 1 km of the current resource,” according to Granite’s news release.

Strong geophysical signatures are giving it high confidence the upcoming drill program will intersect more economical mineralization.

Shares closed 6.25% higher on Jan 19.at 8.5¢ apiece before levelling off to 7¢ at press time in Toronto having tested 5¢ and 17.5¢ in the past 12 months. Granite has a market cap of $10.5 million. TNM

SURVEY from 5

have since shied away from developing their own projects, instead allowing junior miners to do so until they’re ripe for M&A activity. That approach comes with considerable risks, particularly as junior miners have good reason to consolidate among themselves, seek out joint ventures with downstream consumers, or otherwise explore alternative financing arrangements to pursue growth more aggressively than majors do,” says Campbell.

Since few projects are developed by majors and firms have generally struggled to finance via capital markets in 2022, junior miners, end-users and traders have turned to joint ventures, direct financing, and long-term offtake agreements to secure supply. Junior miners may be better placed for growth despite financial conditions if majors don’t shell out.

“Our respondents expect that end-users, governments, export credit agencies and development finance institutions will lead the way, financing critical minerals projects for these reasons, with conflicting views on whether majors are willing to spend,” Campbell said.

The report also flags several other noteworthy perspectives, including that increased taxation is expected to be the most likely manifestation of resource nationalism in 2023. The

survey found 68% of respondents expect resource nationalism to increase in 2023. According to Campbell, respondents offered diverging views about the themes that will dominate 2023. Some cited high prices and good supply/ demand fundamentals; others cited policy support from local governments, inflation and cost pressures, or a deepened focus on climate resilience. None confidently predicted growth or recession.

Deal types, the structure of financing and risks for mining are all rapidly evolving without a clear picture of what’s to come. Shifts in U.S. trade policy against the WTO, the passage of the Inflation Reduction Act, and the EU’s recently agreed carbon border adjustment mechanism (CBAM) create new risks of disputes and commercial litigation for metals firms and opportunities to invest.

Campbell says that the growing overlap between ESG concerns and structural market trends is driving relatively novel approaches to vertical integration and the shortening of supply chains. She adds that these changes will likely push more firms to look at carbon credits and trading schemes or seek to minimize risks from their assets of future trade disputes, where possible, while preparing for them in the event they arise.

“2023 is likely to surprise us as much as 2022 did,” Campbell concludes. TNM

PRECIOUS METALS | 1.3 M oz. inferred resource sits in two main deposits

8 JANUARY 16—22, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

Drilling at Sitka Gold’s RC gold project in the Yukon. SITKA GOLD

Examining drill core from Granite Creek Copper’s Carmacks copper-gold-silver project in the Yukon. GRANITE CREEK COPPER

Li-FT Power eyes Yellowknife for continent’s next big lithium resource

LITHIUM | Explorer has raised $17M for exploration for project acquired in November 2022

BY BLAIR MCBRIDE

Yellowknife was founded on gold mining, and now lithium holds the potential to open a new chapter for the Far North’s second largest city.

Just a short drive east of Yellowknife and off the paved, all-season highway the Ingraham Trail, Vancouver-based explorer Li-FT Power (CSE: LIFT) is preparing to turn its drills on 13 targets it calls the Yellowknife Lithium project.

“When you talk about the potential, it’s just really easy to see because the pegmatites stick out of the ground and you can fly over them, they go for 1.8 km, and you just see almost 100% exposure,” Francis MacDonald, CEO Li-FT said in an interview with The Northern Miner

“It’s very easy to see the size potential and imagine that this really could be one of the largest hard rock lithium resources in North America,” said MacDonald, an exploration geologist who co-founded North America-focused explorer Kenorland Minerals (TSXV: KLD) in 2016.

Two sets of targets, the Nite and Big East and Big West pegmatites are located about 25 km east of Yellowknife. Sampling of the pegmatites have returned grades ranging from 1.45% to 1.53% lithium oxide (Li2O). The Big pegmatites consist of dyke swarms of more than 150 metres width and extend between 900 and 1,000 metres in length.

Nite, a linear dyke of 4 to 10 metres in width, extends for 900 metres.

Those pegmatites were trenched and sampled by Canadian Superior Exploration from 1975 to 1979, according to the project’s technical report, published on Dec. 30, 2022.

About 30 km further down the highway, another cluster of targets, the Fi, Ki and Shorty pegmatites sit north of the Ingraham Trail and just east of Hidden Lake Territorial Park. Ki and Shorty are within a 3-km radius, MacDonald said.

Fi Main extends 1,800 metres — composed mostly of a linear dyke about 15 metres wide — and channel sampling from 1956 and 1979 returned grades of 1.2% Li2O. The 12-metre-wide Ki runs 600 metres and grades 1.4% Li2O, based on spodumene crystal counts, Li-FT says. And Shorty, a linear dyke, runs 400 metres at about 25 metres width (up to 40 metres wide in places) grading at 1.07% Li2O.

“[These have] been off everybody’s radar, and there’s really been no work done on [them] since the 1980s,” MacDonald said. “So, it’s kind of a diamond in the rough. And it’s just been sitting there. So, I think it’s quite exciting from that standpoint, in that it’s not an old project that’s been kicked around.

In terms of grade, the explorer’s Thor target has returned the highest, at 1.59% Li2O. It was drilled and sampled between the late 1950s and 1970s by Down North Minerals and Canadian Superior.

“There’s massive spodumene crystals there, up to 80 cm long,” MacDonald said. “Big crystals are

important for lithium deposits because you can run a DMS circuit which makes it simpler for the processing.”

But Thor is among the most remote of Li-FT’s targets, and sits 120 km east of Yellowknife and 20 km northwest of Great Slave Lake, with no road access. Thor is also located north of the Nechalacho project, where Vital Metals’ (ASX: VML) Canadian subsidiary Cheetah Resources is developing Canada’s only rare earths mine. MacDonald said the Thor target is about 50 km away from Nechalacho.

Li-Ft acquired the 13 targets from private company 1361516 B.C. Ltd. in December. Its outstanding shares were exchanged for 0.60 of a common share of Li-FT and as a result 18 million Li-FT shares were issued at a price of $8.59 apiece.

Li-FT has raised about $17 million including from flow-through financing for the exploration projects, MacDonald said.

Winter drilling plans

After filing a technical report for the projects in January, the company’s next big step is starting its drill program this winter to compile an inferred resource.

It has received its land use and water permits from the Mackenzie Valley Land and Water Board

(MVLWB), and plans to set up two drill programs: one at the Nite and Big East and West pegmatites; and one near an old mine site by Hidden Lake to drill Fi, Ki and Shorty. Four to six rigs will be deployed.

MacDonald said the company has an agreement with the federal government — which remediated

NATURAL RESOURCES

Trusted. Independent. Committed.

the site after previous gold mining activity in the 1960s — to start a 49-person camp there.

While the CEO hopes drills can begin turning in a few weeks, the MVLWB said Li-FT needs to undertake more engagement with local Indigenous groups and cabin owners before it can start drilling.

MacDonald said company representatives met with the chiefs and councils of the Yellowknives Dene First Nation in mid-January and shared information about the projects. More meetings with Indigenous community members are planned for February.

“We’ll continue to engage with them until the MVLWB are satisfied with our engagement,” he said.

Beyond eventually opening a lithium mine in the Northwest Territories, and producing spodumene concentrate, Li-FT’s ultimate goal is to bring the project to the point where a lithium converter facility can be built in western Canada.

“You need a big enough resource to justify building a converter,” MacDonald said. “We might look at doing it ourselves if we bring in…an established lithium producer. Then Li-FT could be a partner in a lithium chemical production business.”

But looking at the nearer term, he sees lithium exploration and mining in the Yellowknife region as an opportunity to revive its historic mining prominence.