Manganese batteries market may face deficit in 2024

BY BRUNO VENDITTI

The high-purity manganese market may face tight supply as early as 2024, according to industry experts.

An essential component of the steel-making process, manganese has played an increasingly significant role in the battery market. The metal sulphate is an important stabilizing ingredient in the cathodes of batteries widely used in electric vehicles and electronics.

Volkswagen, Mercedes, Tesla, and GM are among the companies that have announced intentions to use high-purity manganese in their cars. A Chevy Bolt, for example, can contain over 24 kg of manganese.

“The reason nobody is talking about manganese is that it’s very cheap, and it’s taken for granted,” says Andrew Zemek, special adviser at CPM Group.

While the lithium price has skyrocketed over the last couple of years, passing US$80,000 per tonne and other metals like cobalt and copper reached over US$8,000 per tonne, manganese sulphate costs less than US$1,000 per tonne in China.

But rising demand from the EV industry and the subsequent deficit of high-purity manganese might impact the metal price in 18 or 24 months, according to Euro Manganese CEO Matt James.

“There’s been a build-out of manganese sulphate capacity in China and that has been enough to feed the current demands of the battery industry,” James said in an interview. “But going forward, we’re going to see significant growth in both the European and North American battery industry. Both of those will require their own supply chains.”

“As the market looks to source locally, in North America because of the Inflation Reduction Act (IRA) or Europe because of geopolitics, when they start to look at the high-purity capacity in both of

those regions, it is very, very small,” James said.

“The Chinese price does not reflect a western price. The price today in Europe and North America commands a significant premium,” he said .

People in the industry estimate the price will hit US$3,300 per tonne by 2027 — growing to US$4,000 by 2031 for Europe and North America, considering the cost of freight from China and costs with green credentials.

Reliance on China

Over 92% of high-purity manganese sulphate conversion capacity is in China. Currently, only two plants outside of China are in production, one in Japan and the other in Belgium.

Nippon Denko in Japan, uses imported ore, as does Vibrantz Technologies in Belgium, which produces high-purity manganese sourced from South Africa, Gabon, and Brazil.

Combined, those two facilities produce around 5% of the global high-purity manganese sulphate.

“I don’t see a risk of shortage in

the short term because so much capacity is being built in China,” said Aloys d’Harambure, executive director of the International Manganese Institute.

However, the market might have to adjust as the United States and Europe moves to build their own supply chain of battery materials.

“The environmental, social, and governance procedures in China are sometimes not as strict as in... European and North American and some African countries. The cost of high manganese sulphate that you see from China is not realistic from the rest of the industry,” d’Harambure said.

According to Sam Jaffe, vice-president of battery storage solutions for E Source, China can always “blow out” the North American and European competitors if it chooses to do so.

But that dynamic is changing.

“As we move to intra-continental supply chains, China remains a huge factor in the high-purity manganese market, but it’s not the single determinant of where those

BC mining and exploration off to a strong start after tumultuous 2022

ROUNDUP 2023 | Sector seeing strongest ever government support, says AME CEO

BY HENRY LAZENBY

High interest rates, high inflation and reduced access to finance made 2022 a challenging year for the mineral exploration sector.

But unofficial financial numbers point to a solid start in 2023 for exploration activity in British Columbia, says Kendra Johnston, the Association for Mineral Exploration B.C.’s president and CEO ahead of the organization’s annual Roundup event in Vancouver on Jan. 23-26.

“Our numbers are going to be quite strong this year,” she said in a recent interview. “Last year, we hit an almost-high of $660 million spent in the field, which was $8 million behind our previous high.”

Johnston notes that 2022 was marked by numerous financings for exploration before the market began to dry up.

During 2022, rampant inflation raised the cost of running exploration projects. “We look at the price of fuel and the war that’s happening overseas, there’s political upheaval in Peru, and most recently, it seems like there’s constant political upheaval to some degree in the United States. There’s just a lot going on in the world right now,” Johnston said.

“And it’s all overlaid by this conversation of the energy transition and the green future and the need for critical minerals that creates a push-pull dynamic of being able to get out into the field and explore for the critical minerals.”

Although the costs of exploration, including drilling and helicopter costs, were up this year, and financing was hard to capture, Johnston noted that the indus-

try has never before had all levels of government aligned on the importance of minerals and metals for the energy transition, and with that, public support for the

PIEDMONT LITHIUM LOOKS TO QUEBEC MINE TO SUPPLY TESLA / 3 905 841 5004 | geotech.ca VTEM™ | ZTEM™ | Gravity | Magnetics Geotech_Earlug_2016_Alt2.pdf 1 2016-06-24 4:27:20 PM WWW.SGS.COM/MINING MINERALS@SGS.COM DELIVERING QUALITY EXPERTISE GLOBALLY ACROSS THE ENTIRE MINING LIFE CYCLE expert advice from exploration to closure .com JANUARY 16—22, 2023 / VOL. 109 ISSUE 1 / GLOBAL MINING NEWS • SINCE 1915 / $5.25 / WWW.NORTHERNMINER.COM

RESHORING | Local supply needed to feed North American EV supply chain PM40069240 TNM SCHOLARSHIP WINNER MUSES ON MINING AND THE METAVERSE / 5

See ROUNDUP / 5

See MANGANESE / 9 SPECIAL FOCUS / 10-15

AME BC CEO Kendra Johnston AME BC

An electric vehicle battery. AdobeStock

OUR FUTURE January 23 – 26, 2023 Vancouver Convention Centre East roundup.amebc.ca Register Today MINING IN BC, YUKON & NWT

2 JANUARY 16—22, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM REPLACE OR REDESIGN? RETHINK TH550B by Sandvik is a fully battery powered truck and the only battery powered truck for underground mining with a 50 tonne capacity. The truck combines Sandvik’s 50 years of experience in developing loaders and trucks with Artisan’s innovative electric drivelines and battery packs. Learn more about the Sandvik TH550B along with the self-swapping battery system. Explore our website ROCKTECHNOLOGY.SANDVIK

Piedmont Lithium, Tesla ink new deal pivoting from delayed Carolina project

BY COLIN MCCLELLAND

Piedmont Lithium (NASDAQ: PLL; ASX: PLL) and automaker Tesla agreed to cut their supply agreement by tonnage and time while shifting the source away from a proposed mine stymied by the approvals process.

Piedmont is to send 125,000 tonnes of spodumene concentrate to Tesla over three years (about 41,600 tonnes a year) starting in the second half of this year, according to the agreement announced in a Jan. 3 news release. There’s an option to extend it for another three years.

It replaces the September 2020 agreement that would have seen Piedmont supply about 53,300 tonnes a year of spodumene concentrate to the automaker for five years if deliveries started in the 12 months following last July.

The new agreement changes the source to a past-producing Quebec project called North America Lithium, which Piedmont bought into in 2021, instead of the US$840-million Carolina open pit project in North Carolina that has yet to secure permits.

“The electric vehicle and critical battery materials landscape

has changed significantly since 2020 and this agreement reflects the importance of — and growing demand for — a North American lithium supply chain,” Piedmont Lithium president and chief executive officer Keith Phillips said in the release.

Automakers and other technol-

ogy companies are scrambling to gather supplies of lithium to make batteries for their electric vehicles and gadgets like mobile phones. Tesla chief Elon Musk has mused more than once on the possibility of buying the company’s own lithium mining operations. The light metal is also important for his

New Pacific’s Silver Sand PEA outlines robust 14-year mine

BOLIVIA | Study pegs capex at US$308M capex for operation producing 12M oz silver per year

BY HENRY LAZENBY

New Pacific Metals (TSXV: UAG) has delivered a strong preliminary economic assessment for its Silver Sand project in Potosi department, Bolivia.

The PEA results, released on Jan. 9 confirm the potential to develop a low capital intensity conventional open pit and tank leach operation at Silver Sand. The project would produce about 12 million oz. of silver in doré bars per year over a 14-year mine life and generate solid financial metrics.

Under the base case scenario and at a 5% discount rate, the project has an estimated pre-tax net present value (NPV) of US$1.1 billion and an internal rate of return (IRR) of 52%. On an after-tax basis, the project generates a US$726 million NPV and an IRR of 39%.

The study assumed a base case silver price of US$22.50 per ounce.

Observers say the upfront capital cost of US$308 million, which includes a US$52-million contingency component, is reasonable.

The operation is expected to produce 171 million oz. of silver at an average life-of-mine cost of US$8.45 per ounce.

Under the current mine plan, the mine will produce more than 15 million oz. between years one through four, with life-of-mine (LOM) average annual payable metal production exceeding 12 million oz. silver.

Company founder and CEO Rui Feng suggests the study is a testament to the world-class nature of the deposit that could be developed into one of the world’s largest sil-

ver mines with long life and robust economics.

“We are very pleased with the results of this PEA. Given the robust economic parameters of the project, there is room to accommodate inflation pressure in capital or operating costs,” he said in a press release.

In a note to clients, BMO Capital Markets Research mining analyst Ryan Thompson said the PEA was encouraging. “In our view, the project has the potential to be a meaningful primary silver asset,” he said.

The analyst said incorporating the new data into his model held up well as expected. Using the longterm BMO price deck of US$20 per oz. silver, BMO had previously estimated the NPV of the project at US$630 million and assumed slightly lower upfront capital but higher sustaining capital.

“We had previously assumed

lower processing costs/recoveries (with a heap leach), but the PEA is now assuming a conventional processing plant, driving higher recoveries and processing costs. We are now also incorporating the updated resource estimate, which assumes more ounces over the LOM at modestly lower grades,” the analyst said.

“Our revised NPV of $621 million is broadly unchanged compared to our previous assumptions.”

Measured and indicated resources at Silver Sand are 54.3 million tonnes grading 116 grams silver per tonne for 201.8 million oz. Inferred resources add 4.6 million tonnes at 88 grams silver for 13 million oz.

The stock was trading at $3.42 at press time in Toronto, having traded between $2.55 and $5.58 over the past 12 months. The company has a market capitalization of $536 million.

TNM

rocket company, SpaceX.

But U.S. production of lithium hydroxide used in batteries is sparse at about 15,000 tonnes a year, Piedmont says. Lithium reserves across North America’s three countries total just 2.6 million tonnes compared with 9.2 million tonnes in China alone, according to a May 2022 report from McKinsey & Co.

Production start

Piedmont says it expects spodumene concentrate production to restart at its quarter-owned North American Lithium project by June, with first commercial shipments slated to follow in the summer.

The North Carolina-based company said it plans to deliver spodumene concentrate to Tesla from the Quebec project under Piedmont’s agreement with Sayona Mining (ASX: SYA), which owns three-quarters of it. The deal allows Piedmont to buy 113,000 tonnes

per year or half of the project’s spodumene concentrate production, whichever is greater.

The spodumene concentrate shipments to Tesla will be priced according to average market prices for lithium hydroxide monohydrate at the time of each delivery, Piedmont said.

The new agreement with Tesla helps keep the Quebec project’s output in North America, the miner said. It also supports efforts by the Biden administration to boost the supply of critical minerals like lithium, copper, nickel and cobalt needed for the clean energy economy, such as through the funding earmarked last year in the U.S. Inflation Reduction Act.

Piedmont was among 20 companies awarded US$2.8 billion in U.S. government funding last year to help the critical minerals industry meet electric vehicle and other green energy targets. Washington is trying to loosen Beijing’s hold on the global supply of critical minerals. Experts say it controls some 80% of the market.

Piedmont Lithium said it plans to use the US$141.7 million from the program to build a US$600-million processing plant in Tennessee for material mined in Quebec and in Ghana. It is partnered in the West Africa country with Atlantic Lithium (AIM: ALL; ASX: A11).

Shares in Piedmont Lithium traded at US$48.43 in New York at press time, up 14% in the first week of January, giving the company a market cap of US$872 million. The stock has traded within a 52-week range of US$32.08 and US$79.99.

Shares in Sayona Mining in Australia rose A5¢ in the first week of the month to A22¢, within a 52-week range of A11¢ and A39¢, valuing the company at A$1.8 billion. TNM

GLOBAL MINING NEWS THE NORTHERN MINER / JANUARY 16—22, 2023 3

.com

Preventable.Prevented.

BATTERY METALS | Quebec project tapped to supply automaker

The North American Lithium spodumene concentrator in Quebec. PIEDMONT LITHIUM/TWITTER

The Silver Sand project is located in Bolivia’s mineral-rich southwestern Potosi department. NEW PACIFIC METALS.

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Alisha Hiyate, BA (Poli Sci, Hist) ahiyate@northernminer.com

MULTIMEDIA SPECIALIST: Henry Lazenby hlazenby@northernminer.com

STAFF WRITER: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PHOTO EDITOR AND PODCAST HOST: Adrian Pocobelli, MA (ENGL) apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/ CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 moliveira@northernminer.com

ADDRESS: Toronto Head Office 225 Duncan Mill Road, Suite 320 Toronto, ON, M3B 3K9 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES: Canada: C$130.00 one year; 5% G.S.T. to CDN orders. 7% P.S.T. to BC orders 13% H.S.T. to ON, NL orders 14% H.S.T. to PEI orders 15% H.S.T. to NB, NS orders U.S.A.: C$172.00 one year Foreign: C$222.00 one year GST Registration # 809744071RT001 (ISSN 0029-3164)

CANADA POST:

EDITORIAL

Five trends that defined 2022

We’ve put together a list of five trends we believe encapsulate the drama of 2022.

1 Geopolitical ‘curveballs’

THE VIEW FROM ENGLAND: COLUMN | When copper production was dominated by the Welsh

BY DR CHRIS HINDE Special to The Northern Miner

mine in the world. The operation slowly became uneconomic, however, and closed in 1904.

Russia’s invasion of Ukraine was certainly the biggest geopolitical shock of 2022 — and one that continues to disrupt commodities markets and feed an energy crisis in Europe. While miners have benefitted from higher prices, it’s come at the cost of great uncertainty and volatility.

BY ALISHA HIYATE

Even so, the war wasn’t the only big shock of 2022. By one analyst’s count, there were at least six major events that made last year a rocky one, throwing “a geopolitical curveball” to investors every two months.

In a Jan. 6 note, Zoltan Pozsar, the global head of short-term interest rate strategy at Credit Suisse said the events all represent “fronts” in a global struggle for power as the world fragments into a multipolar order. They ranged from the G7’s “financial blockade” of Russia to China’s naval blockade of Taiwan and its challenge to the petrodollar by pushing for yuan-priced oil contracts. Underlining how different this environment really is from the previous status quo, Pozsar notes that investors haven’t had to consider geopolitical risk for generations because of the “cocoon” of a “unipolar world order, under the cover of Pax Americana.”

No wonder UBS analysts called 2022 “one of the most challenging years in history for investors,” in its 2023 outlook.

The geopolitical tensions are giving rise to resource nationalism and as UBS analysts wrote in their “Year Ahead 2023” note, a strong emphasis on security.

“We believe we are at the beginning of an era of security, in which energy security, food security, and technological security will be increasingly prioritized by governments and businesses, even if they come at the cost of efficiency,” they wrote.

The ‘silver’ lining?

“We expect the era of security to drive commodity prices higher over the long term. A focus on sourcing supplies from allied nations, structural underinvestment, efforts to achieve net-zero emissions, and a need to meet growing emerging market demand should all help support prices.”

2 Cost crunch

Miners saw intense cost inflation in 2022, both in operating costs and in capital costs at new developments and mine expansions.

Probably the most dramatic increase has been at the Côté gold joint venture in Ontario, where Iamgold revealed in May that the total price tag had reached US$3 billion, up from around US$1.3 billion in 2020. Argonaut Gold’s Magino, Teck Resources’ QB2 in Chile, and Rio Tinto’s Oyu Tolgoi expansion in Mongolia, and others have also experienced rising capital costs.

On the operations side, gold miners saw average all-in sustaining costs (AISC) climb to an all-time high of US$1,289 per oz. in the third quarter of 2022, according to the World Gold Council. That’s up 14% from the third quarter of 2021, and 32% higher than the same quarter two years ago, thanks to rising labour and input costs — including fuel, wrote Adam Webb, WGC’s director of mine supply, metals focus, in a mid-December post. In the third quarter, more than 9% of gold was produced at an AISC that was greater than the gold price.

Although costs may remain high this year, they only rose 1% in the most recent quarter, indicating a cool down in the trend. Prices are not expected to see the same steep rises this year, and could see a “modest contraction” in the second half, assuming a pullback of oil and gas prices, Webb wrote.

3 CEO turnover

In such a difficult environment, it’s no surprise that some CEOs lost their jobs last year. Agnico Eagle Mines, Gold Fields, Newcrest Mining, Iamgold, and Centerra Gold were just some of the companies that saw a change in leadership.

In some cases the changeout was due to underperformance, in others it was a reported culture clash (Agnico’s CEO Tony Makuch, who resigned less than two weeks after taking on the CEO role in early 2022) and in Gold Fields’ case, the failure of its planned merger with Yamana Gold.

4 Onshoring/reshoring

Not all of 2022’s trends were negative. With the Canadian and U.S. governments both getting serious about critical minerals policy and security last year, it was hard to keep up with the announcements for new investments by global companies in electric vehicle plants, EV battery manufacturing, and in critical minerals projects and companies — about two dozen in all amounting to more than $11 billion. The announcements also strengthened cooperation between Canadian and American, Japanese, Korean and German governments and industry, while the U.S. Inflation Reduction Act was a boon for investment, making EVs produced in Canada and with Canadian minerals eligible for U.S. EV incentives.

5 Selective M&A

The hunt for quality assets in a subdued market drove M&A in gold, copper, lithium — and even uranium in 2022.

The biggest deals were Agnico Eagle Mines and Pan American Silver’s US$4.8-billion bid for Yamana Gold (following Agnico’s US$10-billion takeover of Kirkland Lake Gold, which closed in early 2022) and Rio Tinto’s US$3.3-billion takeover of Turquoise Hill Resources.

While the dollar amounts were lower, there was notable consolidation in the royalty sector, which offers coveted protection from cost pressures, execution risk and diversification of geopolitical risk. Deals included Sandstorm Gold’s $646.4-million acquisition of Nomad Royalty; Triple Flag Precious Metals’ $606-million purchase of Maverix Metals, an all-share merger of Elemental Resources and Altus Strategies; and Royal Gold’s buyout of Great Bear Royalties for $200 million. TNM

The U.K. no longer springs to mind as a mining giant, but we used to have a dominant role in the global industry. The extraction of non-ferrous metals on these islands, particularly copper and tin, dates back to before 2000 BC, and surface workings for coal and iron ore were widespread after the beginning of the Iron Age around 750 BC. This mineral wealth was one of the things that attracted the attention of Rome.

The nation’s mining history comes to mind with the recent news (courtesy of the ‘North Wales Live’ website) that after 37 years of clearance work, volunteers are nearing their goal of breaking through to an unexplored section of Llandudno’s Ty Gwyn copper mine. Although worked for just 18 years in the mid-19th century, this mine was briefly thought to be the most profitable copper operation in the world.

Dating from only 1835, Ty Gwyn (meaning ‘white house’ in Welsh) started much later than the other two mines on the Gt Orme peninsula (the ‘Old’ and ‘New’ Great Orme operations) and was geographically separate.

Great Orme (Norse for sea serpent) is a carboniferous limestone hill immediately to the west of the seaside town of Llandudno. Mining of Great Orme’s dolomite-hosted malachite was extensive 3,500 years ago (circa 1700-1400 BC) and the main site was worked again from 1690 to 1860. The original Bronze Age tunnels (over 8 km of them) were only discovered in 1987, and the prehistoric site was opened to the public in 1991.

The Great Orme mines were part of a group of operations in Caernarfonshire (the others being in Snowdonia) but the estimated total output of 3,000 tonnes of copper metal was dwarfed by production at Parys Mountain on the nearby Welsh island of Anglesey.

Evidence of copper mining on this hill (it has an elevation of only 150 metres) dates back nearly 4,000 years. Originally called Mynydd Trysglwyn (a tree-topped hill) the ‘mountain’ was renamed in 1406 after Robert Parys, who had received the land from Henry IV (1367-1413) as a reward for collecting taxes and fines from inhabitants who had supported the Welsh rebellion of Owain Glyndwr.

Evidence of the earlier Bronze Age workings was found in 1761, but the site didn’t become economic until a rich copper seam was discovered in 1768. At its peak, Parys Mountain employed 1,500 people and was the largest copper

Parys Mountain was controlled in the 18th century by a local lawyer, Thomas Williams (1737-1802) of Llanidan, who also owned mines in Cornwall and operated copper smelters. Known as the Copper King, Williams was the richest man in Wales when he died, and at a Parliamentary monopoly investigation in 1800 admitted that half of the U.K.’s copper industry was in his hands.

Williams was instrumental in promoting the technique of covering ships hulls with copper sheets to protect them against molluscs and weeds. Williams sold to the navies of both England and her enemies, and the term ‘copper bottomed’ came to signify a sound investment.

The shareholders of Anglesey Mining Plc., which is the current owner of Parys Mountain, will be hoping the site is a copper-bottomed investment.

At the end of November, the company described Parys Mountain’s Northern Copper zone (NCZ) as “an exciting opportunity.” This deposit was discovered in 1962, and an estimate in 2012 gave the zone an inferred resource of 9.4 million tonnes at 1.27% copper, 0.38% zinc, 0.24% lead, as well as 5 grams silver per tonne and 0.1gram gold (net smelter return cut-off of US$48 per tonne). A preliminary economic assessment in January 2021 boosted 5.2 million tonnes of ore into the indicated category, with a further 11.7 inferred million tonnes at a grade of over 2% copper equivalent. Work in 2023 will include drilling into the NCZ to confirm historic grades and continuity and to seek further zones of high-grade mineralization.

In November 2022, Anglesey Mining’s CEO, Jo Battershill, spoke at the Mines and Money conference in London. He described Parys Mountain as having “world-class infrastructure, a supportive local community and, in terms of its geology, a lot of unfinished business.”

A geologist with over 25 years of experience in the industry, Battershill was appointed in August 2021 to lead Anglesey Mining’s investigation of the Parys Mountain deposit. There have been a number of failed attempts to restart the iconic mine over the past century; if Anglesey Mining succeeds, Battershill will join a long list of celebrated copper miners in North Wales. TNM

—Dr. Chris Hinde is a mining engineer and the director of Pick and Pen Ltd., a U.K.-based consulting firm. He previously worked for S&P Global Market Intelligence’s Metals and Mining division.

4 JANUARY 16—22, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

Return undeliverable Canadian addresses to Circulation Dept. c/o The Northern Miner 225 Duncan Mill Road, Suite 320 Toronto, ON M3B 3K9 Publication Mail Agreement #40069240 Periodicals Postage Rates paid at Niagara Falls, NY, 14304. U.S. office of publication 2424 Niagara Falls Blvd, Niagara Falls, N.Y. 14304. U.S. POSTMASTER: send address corrections to: Northern Miner Box 1118 Niagara Falls, N.Y. 14304.-7118

media company with interests in business-to-business information services. From time to time we make our subscription list available to select companies and organizations whose products or services may interest you. If you do not wish your contact information to be made available, please contact us by one of the following methods: Phone: 1-888-502-3456; Fax: (416) 447-7658; Mail to: Privacy Officer, The Northern Miner, 225 Duncan Mill Road, Suite 320,

ON M3B 3K9.

THE NORTHERN MINER is published biweekly by Glacier Resource Innovation Group, a division of Glacier Media Inc., a leading Canadian

Toronto,

DEPARTMENTS Special Focus 10 Professional Directory 21 Market News 22 Metal, Mining and Money 23 Stock Tables 24-27 Agnico Eagle Mines 11 Amarc Resources 13 Artemis Gold 16 ATAC Resources 13 Avalon Advanced Materials 11 B2Gold 8 Big Ridge Gold 6 Black Cat Syndicate 6 Brixton Metals 6, 13 Copper Mountain Mining 9 Dolly Varden Silver 12 Electra Battery Materials 8 Euro Manganese 9 Fireweed Metals 14 Foran Mining 7 FPX Nickel 5 Franco-Nevada 16 Fury Gold Mines 12 Glencore 3, 8 Goliath Resources 14 Grizzly Discoveries 6

COMPANY INDEX Hecla Mining 12 Kinross Gold......................................................11 Minsud Resources 6 New Pacific Metals 3 Osisko Development 16 Osisko Metals 14 Panoro Minerals 6 Pantoro 6 Piedmont Lithium 3 Premium Nickel Resources 7 Sayona Mining 3 Scottie Resources 6 Silver Hammer Mining 6 Skeena Resources 16 Snowline Gold 15 South32...............................................................9 South Star Battery Metals 6 Vital Metals 11 Westhaven Gold 15 White Gold.....................................................6, 11

sector is starting to emerge.

This year’s theme at AME BC is ‘Critical to Our Future,’ referring to not only critical minerals but also exploration’s importance to the B.C. economy, to reconciliation, to the energy transition and to future skills development as what has been seen as a ‘sunset industry’ becomes a ‘sunrise industry’, Johnston says.

Among the event highlights are Stephen D’Esposito from Regeneration; Cassie Boggs, Hecla Mining chair and director; and B.C. premier David Eby, who will address the AME’s opening ceremony.

Separately, AME BC has partnered with the B.C. Cancer Foundation on a fundraising event on Jan. 23, which will feature Canadian astronaut Chris Hadfield. The conference will be held at the Vancouver Convention Centre East.

Critical impetus

The energy transition is the driving force in getting all levels of government on the same page with mineral exploration and development.

Johnston says critical conversations are taking place at the federal level, and country to country, with critical minerals and partnership and trade deals being ironed out that will change the global mineral landscape.

“To get to that place, we need to have the expansions (and) the new projects approved, to get through the permitting process to be able to pull that material out of the ground and get it into the hands of the officials who are talking about trading it,” Johnston said. “That process is

not short. And then, of course, how we replace that material from the exploration perspective, the discoveries that need to be made, the dollars that need to be spent on the ground, on the 10,000 projects it takes to find the one that’s going to be advanced.”

Despite recognition of the need for the minerals and metals today, Johnston says there’s a lack of understanding of the time constraints and permitting hurdles that stand in the way of new production. “I think there’s a catch-22 on both the timing side of it and the financial side of it,” she said.

While B.C. is best known for its copper-gold porphyry deposits, Johnston quickly points out that copper is on Canada’s critical minerals list and on allied countries’ lists (other than the U.S.).

Mining’s biggest future challenges: meeting sustainability expectations — and adapting to the metaverse

AWARDS | Winner of the 2022 YMP Northern Miner Scholarship outlines emerging

pressures on the sector

BY JONATHAN UMBSAAR

We present the winner of the 2022 Northern Miner Scholarship, part of the Young Mining Professionals Scholarship Fund. Entrants were asked to write an essay outlining the mining industry’s biggest challenges over the next 10 years. For a list of all the 2022 YMP Scholarship winners, visit www.ympscholarships.com/2022winners.

Asocietal shift is happening — specifically in the mindset of first-world, capitalist countries: we are beginning to recognize that unsustainable practices are coming back to haunt us. Companies and consumers alike are transitioning towards products with lifetime guarantees, and products that limit waste and eliminate inefficiency. If the Covid-19 pandemic has proven anything, it is that a stay-at-home lifestyle is not only practical, but is often preferable for much of the population.

As a university student in the first year of my PhD program in economic geology, I believe that within my lifetime, there will be a global transition towards online workplaces and recreation that

is facilitated by VR technology within a metaverse. Physical products and services will be progressively replaced by virtualized NFTs (non-fungible tokens), which will be marketed as an environmentally friendly, inimitable, and unbreakable alternative to physically produced goods, and manufactured with minimal carbon emissions. I believe that the demand for physical goods will see an inverse correlation with adoption of metaverse technology, with a subsequent decline in the

“The conversation around electric vehicles and the technology upgrades that are required for everything that we want going forward all involve copper, and EVs just happen to be the poster child of that conversation,” Johnston said.

But B.C. also has substantial volumes of silver in the ground, which is crucial to industrial applications such as electronic circuitry.

Also adding to B.C.’s potential for critical minerals is its emerging nickel potential, as demonstrated by the rapid advances achieved by FPX Nickel (TSXV: FPX) at its largescale Decar district in central B.C.

Registration to attend the AME BC’s Roundup event is open, and more information is available here (https://roundup.amebc.ca/ register/). TNM

First Nations challenge to free-entry system headed to court

While B.C.’s evolving legislative environment that helps the province rank consistently among the top mining jurisdictions globally, one of the key issues currently under discussion is the Mineral Tenure Act, which allows claim staking using the free entry model.

Simple prospecting rights do not require proponents to engage and consult with Aboriginal host communities — or notify communities before staking a mineral claim, explains the Association for Mineral Exploration B.C.’s president and CEO, Kendra Johnston.

This is something that First Nations have challenged in court, arguing that it conflicts with the principle of free, prior and informed consent embedded in B.C.’s Declaration on the Rights of Indigenous Peoples Act (DRIPA).

Last year, the Gitxaala First Nation filed a judicial review over mineral claims in its traditional territory on Banks Island. In June this year, the Ehattesaht First Nation also filed a similar judicial review challenging mineral claims in its traditional territory. The two First Nations have agreed to have both reviews tried simultaneously.

The case is scheduled to be heard in April 2023. The B.C. government is contesting the judicial review.

The Union of B.C. Indian Chiefs called the Mineral Tenure Act “a relic of colonization.”

According to Johnston, the critical points in the First Nations’ case are very specific to individual tenure holders and an individual project. Still, the two that are more widespread relate to the need to modernize the mineral tenure grant and the timing of consultation.

“They want to see consultation before claim staking. We’re certainly in favour of opening up the Mineral Tenure Act and looking at it and talking about modernization, what that might look like. The act is old. There’s lots of stuff in there that could be modernized,” she said.

However, consultation before staking is a little more contentious, as that would remove the free entry system, Johnston notes.

“Free entry is not a lovely term — that’s maybe a good point to talk about in the modernization process. But the consultation prior to staking at that point means a proponent would be forced to share their ideas (intellectual property) gathered from mostly desktop studies with third parties before being able to test their theories in the field,” she said.

“Consulting before claim staking gives your knowledge out when you don’t have anything to protect it. It raises regulatory compliance issues relating to disclosure.”

AME BC’s popular Indigenous program, the Gathering Place, will host speakers on Jan. 24 and 25, tackling issues such as nation-tonation collaboration, the B.C. Regional Mining Alliance’s work to foster economic development through exploration and mining, incorporating Indigenous knowledge in project studies and highlighting career opportunities.

GLOBAL MINING NEWS THE NORTHERN MINER / JANUARY 16—22, 2023 5 • 2022 43-101 Inferred Resource Calculation of 861,400 Oz Gold • More than $25m spent on drilling with the Resource only covering ~7% of the main anomaly • Fully permitted for exploration drilling and workable year round • Exceptional capital structure with less than 22m shares outstanding having just raised more than $2m • Fully financed for Phase 1 Diamond Drilling commencing January 2023 carlylecommodities.com CARLYLE COMMODITIES - COULD THIS BE THE NEXT MAJOR DISTRICT SCALE GOLD DISCOVERY IN BC? CSE:CCC | FSE:BJ4 | OTC:DLRYF ROUNDUP from 1

See

METAVERSE / 9

Jonathan Umbsaar, winner of the YMP Scholarship Fund’s 2022 Northern Miner scholarship.

FPX Nickel’s Decar project in central British Columbia. FPX NICKEL

BY HENRY LAZENBY

Our TNM Drill Down features highlights of the top gold assays of the past week.

Drill holes are ranked by gold grade x width, as identified by our sister company Mining Intelligence. (www.miningintelligence.com).

This period’s top drill assays come from Canada, Peru and Australia. Scottie Resources (TSXV: SCOTT) reported the best assay in hole SR22-156, which intersected 2.4 metres, grading 194 grams gold per tonne from 148 metres depth for a width x grade value of 466 at its namesake gold project in British Columbia. According to the company, the intersection was the best recorded across all targets on the property to date. Its location significantly expands the bonanza grade zone at the north end of the Blueberry contact structure. Scottie is still waiting on additional assays down plunge from this sizeable gold hit.

The grades at depth reinforce that the junior is exploring a robust system with substantial upside. The Blueberry Contact zone is 2 km north-northeast of the company’s past-producing high-grade Scottie mine, 35 km north of Stewart, B.C.

Top Gold assays for Dec. 22-Jan. 6

TNM DRILL DOWN

Top gold assays of the week

1 Scottie

2 Cotabambas

Resources (TSXV: SCOTT) SR22-156 148.0 2.4 194.0 466.00

(TSXV: PML) CB-206 3.8 341.6 0.4 137.00

3 Nicolsons/Halls Creek Australia Pantoro (ASX: PNR) WNG22017* 45.42 3.58 28.63 103.00

4 Destiny Canada Big Ridge Gold (TSXV: BRAU) DES21-179 366.5 16.3 3.80 62.00

5 White Gold Canada White Gold (TSXV: WGO) WHTRS22D029 266.5 10.9 5.34 58.00

6 Thor n Canada Brixton Metals (TSX: BBB) THN22-213 534.0 709.0 0.06 43.00

7 Greenwood Canada Grizzly Discoveries (TSXV: GZD) 22DA-016 7.0 180.0 0.20 36.00

8 Chita Valley Argentina Minsud Resources (TSXV: MSR) CHDH22-57 484.0 354.0 0.10 35.00

9 Silver Strand United States Silver Hammer Mining (CSE: HAMR) SS22-017 29.7 8.4 2.90 24.00

10 Paulsens Australia Black Cat Syndicate (ASX: BC8) 22PGRD010 48.0 1.92 9.30 18.00

The second-best assay comes from Panoro Minerals’ (TSXV: PML) Cotabambas project in Peru, where hole CB-206 returned 341.6 metres grading 0.4 gram gold per tonne from 3.8 metres depth for a width x grade value of 137. Panoro says the drill hole delineated an extension of the high-grade zone to near surface at the west side of the North pit, intersecting 341.7 metres of primary copper sulphi-

des averaging 0.6% copper, 0.4 gram gold and 2.75 grams silver (0.91% copper equivalent). The drill hole is thought to relate to multiple porphyry dykes, including 115.6 metres averaging 2% copper equivalent and 68.6 metres grading 2.9% copper equivalent.

The results show potential to increase the size of the high-grade zone at both the North and South Pit, and indicates continuity at

depth below the pit shells’ limits. At the same time, local structure controls and correlation to geophysics results are considered excellent tools to trace the mineralization along strike.

The third-best drill assay comes from Australia-based Pantoro (ASX: PNR) and its Nicholsons/ Halls Creek project in Western Australia. The company released the results from hole WNG22017,

which returned 3.6 metres grading 28.6 grams gold per tonne from 45.4 metres depth for a width x grade value of 103. Pantoro notes the Wagtail South ore reserve at Halls Creek remains unmined, with development completed on two levels below the JORC-compliant reserve. Further, the Rowdies orebody, which is currently only partially developed, continues to return high-grade drill results at depth. TNM

South Star targets late 2023 start for Brazil graphite mine

BATTERY METALS | Permits in place for US$8M first phase

BY COLIN MCCLELLAND

South Star Battery Metals

(TSXV: STS; OTCQB: STSBF)

says its Santa Cruz graphite project in eastern Brazil is on track to complete construction and commissioning by December this year.

Most large machinery has been contracted and the initial offices are to be completed in January at

company said last month.

Production is to begin in an US$8-million first phase at a rate of 5,000 tonnes of concentrate per year from an open pit. South Star then plans to complete US$27 million in upgrades to produce 25,000 tonnes a year. Phase one permits and licences are in place.

The Vancouver-based company wants to submit plans to Brazil’s

tonnes a year in a third phase, and file requests for environmental permits for phases two and three to municipal authorities, it said.

“Phase one commercial production is planned for December 2023,” chief executive Richard Pearce said in the release. “We are confident in delivering on our promise to be the first new graphite production in the Americas since 1996.”

South Star is developing what may be the largest industrial plant in the country, which is second only to China in graphite production. It’s seeking to tap into the surging demand for materi-

als to make electric vehicle batteries and other green technologies. South Star also has an early-stage graphite development project at a past-producing mine dating from World War II about 100 km north of Montgomery, AL.

The company says it expects permits and licences for Santa Cruz’s phases two and three to be approved late this year around when phase one operations are to start.

Including both the initial phase and the expansion, the Santa Cruz project has an after-tax net present value of US$81.2 million with a 5% discount rate for an annual

after-tax internal rate of return of 35%, according to a 2020 prefeasibility study. South Star calculated average operating costs for the 12-year life of the mine at US$396 per tonne of concentrate and used a price of US$1,287 per tonne of concentrate.

The project has proven and probable reserves of 12.3 million tonnes grading 2.4% graphitic carbon for 295,400 tonnes in-situ graphite.

South Star shares gained 1¢ to 54¢ apiece in Toronto at press time, valuing the company at $15 million. Its shares have traded in a 52-week window of 37¢ and $1.65. TNM

Space rock yields mysterious minerals

GEOLOGY | University of Alberta researchers ID minerals ‘new to science’ in 15-tonne meteorite discovered in Somalia

BY NORTHERN MINER STAFF

Ateam of researchers has discovered at least two minerals never before seen on earth in a 15-tonne meteorite discovered in Somalia — the ninth-largest meteorite ever found.

The two minerals, with a potential third mineral under consideration, came from a single 70-gram piece that was sent to the University of Alberta for classification.

“Whenever you find a new mineral, it means that the geological conditions, the chemistry of the rock, was different than what’s been found before,” Chris Herd, curator of the University of Alberta’s Meteorite Collection, said in a media statement.

“That’s what makes this exciting. In this particular meteorite, you have two officially described minerals that are new to science.”

The new minerals — named elaliite and elkinstantonite — were quickly identified by Andrew Locock, head of the university’s Electron Microprobe Laboratory, because each had been synthetically created before. Elaliite is named after the meteorite itself, dubbed the El Ali meteorite for its discovery near El Ali, about 270 km north of Mogadishu, the capital of Somalia. Herd named the second mineral after distinguished NASA scientist Lindy Elkins-Tanton, for her studies on the cores of planets.

The research, conducted jointly with UCLA and the California

Institute of Technology, suggests that more minerals may be found if scientists can obtain more samples.

The problem is the future of the meteorite is uncertain. Researchers say it appears to have been moved to China, so it remains to be seen whether additional samples will be available for scientific purposes.

For now, the team continues to examine the minerals to determine what they can share about the conditions in the meteorite when it formed. Herd also noted that any new mineral discoveries could yield exciting new uses down the line.

“Whenever there’s a new material that’s known, material scientists are interested too because of the potential uses in a wide range of things in society,” he said. TNM

6 JANUARY 16—22, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

majordrilling.com GLOBAL LEADER IN SPECIALIZED DRILLING SURFACE & UNDERGROUND TNM DRILL

DOWN:

All data supplied by Mining Intelligence for the period of Dec. 22, 2022 – Jan. 6, 2023 for public companies from exploration stage to production. * indicates reverse circulation; otherwise all holes are diamond drill holes. Reported lengths are not necessarily true widths. Only the best hole per property is shown.

RANK PROPERTY COUNTRY OWNER

DRILL HOLE DEPTH WIDTH GRADE WIDTH ID FROM (m) (m) (G/T GOLD) X GRADE

Canada Scottie

Peru Panoro Minerals

Foran’s

BY COLIN MCCLELLAND

Foran Mining (TSXV: FOM; US-OTC: FMCXF) says it will use a US$150 million loan from Sprott Resource Lending to help construct its McIlvenna Bay copper project in Saskatchewan.

The funding from Toronto-based Sprott joins $200 million proposed by the Ontario Teachers’ Pension Plan, which was announced in August and should be approved “in due course,” Foran said in a news release on Dec. 21.

The financing will almost cover the estimated $368 million cost to build the project about 330 km northeast of Prince Albert, Sask., according to a feasibility study released last February. It also forecasted $481 million in sustaining capital for the 18-year initial phase of the mine.

“We have been meticulously evaluating various financing proposals from numerous lenders to support the development,” Dan Myerson, Foran’s executive chairman and chief executive officer, said in the release. “This agreement maximizes risk-adjusted value per share for existing shareholders.”

The McIlvenna Bay project has probable reserves of 25.7 million tonnes grading 1.23% copper, 2.39% zinc, 0.47 gram gold per tonne and 15.3 grams silver. According to the study, an underground mine at McIlvenna Bay would produce 38.8 million lb. copper, 63.6 million lb. zinc, 20,000 oz. gold and 486,000 oz. silver annually over its first 15 years.

The study estimated the project will have an after-tax net present value of $1.1 billion at a 7% discount rate, and an internal rate of return of 54%. It used base case prices of US$3.50 per lb. copper, US$1.20 per lb. lead and US$1,600 per oz. gold.

Vancouver-based Foran said it has received an initial advance of US$29.5 million from the Sprott loan. Principal repayments are to start in mid-2026 and the loan accrues annual interest of at least 8.95%, the company said.

Active project region

Foran is developing the project in east-central Saskatchewan in a three-pronged strategy with its Bigstone copper-zinc project 25 km west of McIlvenna Bay and eight other targets the explorer is probing in the same area. Foran is planning to build a centralized mill and says the operation will be carbon neutral through the use of electric vehicles and hydro-electric power. In the bigger picture of green technology development, the project ticks off a few boxes, with copper and zinc included on the federal

government’s list of critical minerals considered essential. The age of electric vehicles and modern technologies depends on copper wiring, and there’s the push to reduce greenhouse gas emissions blamed for global warming.

“We look forward to partnering with Foran on its destination to become a premier critical metals producer,” Narinder Nagra, managing partner of Sprott, said in the same release. “Our financing of Foran is consistent with our strategy to provide innovative and flexible capital to maximize the value of exceptional projects.”

BMO Capital Markets said last month that Foran has so far kept its costs for the copper project in line with the feasibility study while planning to expand drilling on neighbouring targets to 35,000 metres next year after exploration at the Tesla site returned positive results this year.

“Foran continues to consolidate claims in proximity to McIlvenna Bay, providing the company an extensive land package,” mining analyst Rene Cartier wrote in a Nov. 30 note. “The proximity of Tesla offers the strong potential of additional resource growth.”

Shares in Foran traded at $2.97 apiece at press time in Toronto within a 52-week range of $1.93 and $3.25. The company has a market capitalization of about $678 million. TNM

Premium Nickel aims to re-open Selebi mine in Botswana

CRITICAL MINERALS | Past-producing deposits may be linked

BY COLIN MCCLELLAND

Premium Nickel Resources (TSXV: PNRL) says drill results from its Selebi nickelcopper-cobalt project in Botswana advance the concept that two past-producing deposits there are connected at depth.

The Toronto-based company acquired the project, 400 km north of the capital of Gaborone, a year ago and is aiming to find links between the Selebi north and south deposits, which are separated by about 3 km, the company said in a late December news release.

Highlights include diamond drill hole SMD-22-006a-W2, which cut 9.8 metres grading 0.97% nickel, 1.74% copper and 0.03% cobalt for 1.56% nickel equivalent from 1,581.5 metres down-hole. It included 6.8 metres of 1.28% nickel, 2.35% copper and 0.04% cobalt for 2.06% nickel equivalent.

The same hole also returned 4.7 metres grading 1.1% nickel, 1.24% copper and 0.04% cobalt for 1.55% nickel equivalent from 1,639.8 metres depth. It’s the first time Premium has found significant widths and grades in this deeper interval.

The drilling so far hasn’t fully defined the plunge direction or dip extent of the ore body’s thickening, Premium said. But borehole electromagnetic data is being analyzed to refine the location of the controlling structures for more precise drilling this year with additional rigs.

“Selebi mine could be a single continuous mineralized system,” chief executive officer Keith Morrison said in the release. “The borehole geophysics have been very successful in imaging highly conductive metallic mineralization along the down-dip structure possibly joining the two deposits.”

Past-producing focus

The surge in demand for nickel and copper to build electric vehicle batteries and other modern technologies is pushing some developers to consider past-producing mines. New projects can modernize operations to use less water and power while gaining more metal from the ore. Africa also benefits

from abundant solar energy and inexpensive labour.

The latest assays follow other drill results released in September and August. Drilling downdip to the west intercepted thicker intervals of mineralization than reported in 2016 by previous owners, Premium said.

The past-producing Selebi mine had two shafts — Selebi and Selebi North — situated about 6 km apart. Mining started in 1980 and ended in 2016, when the operations were placed on care and maintenance due to a failure in the offsite Phikwe processing facility, the company says.

Premium wants to reopen the Selebi mine as well as its past-producing Selkirk mine about 75 km to the north. Botswana parastatal company BCL ran Selebi and acquired Selkirk, which had been run by Russia’s Norilisk Nickel, shortly before BCL failed in 2016.

The Selebi south deposit has a resource of 11.3 million tonnes grading 0.98% nickel and 1.9% copper, according to a 2016 study that followed South African Mineral Resource Committee guidelines, but wasn’t compliant with NI 43-101. It also showed the Selebi

north deposit with 4.6 million tonnes grading 1.06% nickel and 0.96% copper.

Selkirk has 6 million indicated tonnes grading 1.06% nickel and 0.36% copper at a cut-off grade of 0.75% nickel, according to a 2007 NI 43-101 resource estimate.

Premium says its preparation of a preliminary economic assessment this year targets resources of 23 million tonnes at Selebi south, 10 million tonnes at Selebi north and 55 million tonnes at Selkirk.

Premium’s Selkirk would be an open pit operation. Anglo American (LSE: AAL) mined 1 million tonnes at Selkirk grading 2.6% nickel and 1.5% copper between 1989 and 2002 when the massive sulphide material was exhausted.

Premium also holds the Maniitsoq nickel-copper-cobalt project on the west coast of Greenland, the Post Creek/Halcyon property in Sudbury, Ont. and five exploration permits in Morocco.

Shares in Premium Nickel Resources rose more than 6% in the first week of January, reaching $1.74 at press time, within a 52-week range of $1.18 and $2.60, valuing the company at $202.7 million. TNM

GLOBAL MINING NEWS THE NORTHERN MINER / JANUARY 16—22, 2023 7

Workers examine rock samples at the Selebi site, a past-producing nickel-cobaltcopper mine in eastern Botswana. PREMIUM NICKEL RESOURCES

!"#$%&'()$*+,,+-.$*/$010& EPICENTER OF LITHIUM EXPLORATION & DEVELOPMENT with multiple projects in known regions of lithium production, EXPANDED DRILL PROGRAMS expected to commence Q4 2022 in Nevada and Manitoba. WELL FUNDED WITH STRATEGIC INVESTORS to complete drill programs and acquire new projects in the lithium sector. EXPERIENCED MANAGEMENT TEAM has built & financed resource companies around the world. Li POWERING THE ENERGY REVOLUTION For more information or to subscribe to corporate news, please contact: info@acmelithium.com 1-604-564-9045 CSE: ACME | US OTCQX: ACLHF www.acmelithium.com Manitoba, Canada and Nevada, U.S.

US$150M

cover

FINANCING | Saskatchewan copper project to be carbon neutral

loan helps nearly

McIlvenna Bay cost

The camp at Foran Mining’s McIlvenna Bay polymetallic project in east-central Saskatchewan. FORAN MINING

Electra Battery Materials readies black mass recycling plant

BY MOOSA IMRAN

Electra Battery Materials

(TSX-V: ELBM; NASDAQ: ELBM) says a battery materials recycling demonstration plant it launched in late December should be completed in the first quarter, and could pave the way for a 5,000-tonne-per-year commercial facility.

The demonstration plant at Temiskaming Shores, about 480 km north of Toronto is designed to recover and recycle high-value elements found in lithium-ion batteries, including nickel, cobalt, lithium, copper and graphite.

The black mass recycling plant is part of an integrated battery materials complex Electra is developing in northern Ontario.

Electra says it will process up to 75 tonnes of black mass material in batch mode using its proprietary hydrometallurgical process. Commissioning of the plant started in mid-October.

Once the demonstration plant is completed and operating, Electra says it will assess whether to continue processing black mass throughout 2023 with material

supplied by its business partners or from third parties.

“With the outlook for electric vehicle adoption in North America becoming increasingly bullish as a result of the recent passage of the U.S. Inflation Reduction Act and the considerable investments made by automotive companies to electrify their fleet, the need for a domestic supply of battery-grade materials supply whether through primary

refining or recycling processes becomes critical,” Trent Mell, Electra’s CEO, stated in a news release.

The company noted that its battery recycling strategy is the second of a phased development plan for its integrated battery materials park near the Sudbury nickel basin that will recycle lithium batteries, produce cobalt, nickel and manganese sulphates from primary feeds and supply the battery grade material to

third-party cathode precursor manufacturers.

The company says that in 2023 it will commission North America’s only cobalt sulphate refinery at the same location with an initial production capacity of 5,000 tonnes of cobalt per year.

In September, Electra signed a three-year agreement to supply battery grade cobalt to LG Energy Solution, a global manufacturer of

lithium-ion batteries for electric vehicles. Under the deal, Electra will supply 1,000 tonnes of cobalt contained in a cobalt sulphate product in 2023 and a further 3,000 tonnes in each of 2024 and 2025.

Exploration projects

In December, Electra also optioned a 5.3-sq.-km cobalt property adjacent to its Iron Creek project in Idaho. The property includes an outcropping mesothermal quartz vein swarm with cobalt and gold mineralization, and historic drilling returned 6.25 metres grading 0.51% cobalt starting from 77.5 metres down hole.

The company also announced in early January that it will dispose of its non-core Canadian assets while retaining royalty interests in the properties.

Under a 2021 share purchase and option agreement, junior Kuya Silver (TSXV: KUYA) already had the right to earn up to 70% of Electra’s Silver Kings joint venture properties, which cover 166 sq. km in Ontario’s cobalt-silver district. Now, Kuya can earn up to 100% by making a $1 million payment in cash or shares by Jan. 31 this year. TNM

Colombians demand smooth transition after Glencore exits

Two B2Gold workers dead after robbery in Mali

WEST AFRICA | Fekola mine operations unaffected, company says

BY NORTHERN MINER STAFF

Two employees of B2Gold (TSX: BTO) in Mali were killed on Dec. 29 when their bus was attacked in an armed robbery, the miner says.

The incident occurred when the bus under police escort was transporting workers from the Fekola gold mine to Bamako, the capital of the west African country. They came upon a robbery in progress about 75 km west of the city, the company said in a statement.

“Security forces accompanying the bus transport supported the safety of B2Gold personnel but, unfortunately, the incident resulted in the death of two employees,” B2Gold said. “Initial reports indicate all other employees on the bus have been safely accounted for and are being transported to Bamako for assistance.”

The miner said operations at the gold mine weren’t affected and the incident wasn’t linked to terrorism.

Mali is one of several west African countries impacted by an influx of Islamic militants in recent years. France has pulled out many of its troops who used to patrol this Sahel region including several of its former colonies, such as Mali. The country has been in turmoil for at least a decade since a military coup allowed a jihadist insurgency to flourish. The Malian government has also deployed Russian mercenaries in an attempt to restore order.

Earlier in December, attackers in the northern city of Timbuktu killed two United Nations peacekeepers from Nigeria and wounded four others. TNM

BY NORTHERN MINER STAFF

Mayors of five municipalities in northern Colombia’s Cesar mining corridor want the government of President Gustavo Petro to phase out mining operations with a smooth transition into other industries instead of an abrupt halt.

About 90% of the corridor’s economy is based on mining and related activities.

The mayors expressed concern regarding Petro’s stance on mining, according to local media, particularly since little has been done after Glencore subsidiary Prodeco handed its coal mining concessions back to the Colombian state.

The move, which Glencore took in 2021 after the country’s National Mines Agency declined its request to keep its Calenturitas and La Jagua mines on care and maintenance, left almost 5,000 people unemployed. They’re surviving by working on nearby farms or by starting small business ventures. Local leaders say some municipalities are losing about $4 million in taxes and royalties because the mining industry is stagnant.

The process of finding a new owner for the mines has been suspended until Prodeco fulfills technical, environmental, labour and financial obligations, according to a report by Caracol, a local private television network. TNM

•

•

For further information, please contact: Qu Bo Liu at qubo.liu@dehua.ca

Electra Battery Materials’ cobalt refinery project in Temiskaming Shores, Ont. ELECTRA BATTERY MATERIALS

New Memoir by Raymond J. Mongeau The Man Who Licks Rocks

Amazing Canadian Geological & Exploration Journeys, leading to his deliberations on climate change, the global population and pandemics.

Electra Battery Materials’ cobalt refinery project in Temiskaming Shores, Ont. ELECTRA BATTERY MATERIALS

New Memoir by Raymond J. Mongeau The Man Who Licks Rocks

Amazing Canadian Geological & Exploration Journeys, leading to his deliberations on climate change, the global population and pandemics.

Get your copy now at: www.themanwholickedrocks.com

Canadian Dehua International Mines Group is Soliciting Offers for the coking coal mine projects in Northeastern BC

Canadian Dehua International Mines Group (“CDI”) is soliciting offers for the acquisition of CDI’s interest in the:

Murray River Project; or

Bullmoose Project.

8 JANUARY 16—22, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

or Hailey Liu at hailey.liu@fticonsulting.com.

RECYCLING | Northern Ontario demonstration plant to be completed in Q1

COAL | Quick end of operations leaves thousands jobless

Haul trucks near B2Gold’s

Fekola gold mine in Mali. B2GOLD

Prodeco railway cars transport coal in Colombia. PRODECO A Prodeco coal train in Colombia. PRODECO

demand for hydrocarbons.

What does this mean for the mining industry? Mining will be increasingly focused on electronic components, and hydro, wind, solar, and battery powered machines.

As evidenced by their recent price surges since 2020, metals such as lithium, cobalt, nickel, and even manganese will become incredibly valuable, as electric (and ideally selfdriven) automobiles take over the trucking and delivery-based industries, whereas some more common and traditionally mined materials will likely depreciate in value. Materials such as concrete, asphalt, and iron could become much less valuable, as public buildings see less use, resulting in cities that are less motivated to engage in publicly owned projects and spaces, as people become entrenched in private spaces and opt for the increasingly convenient and comfortable lifestyle of staying at home.

The mining industry’s biggest challenge will be to adapt to these changes, and to meet the demands of a highly sophisticated, and virtualized society. I believe the mining industry will increasingly “mine” old technology and infrastructure while opening and operating fewer traditional mines. With the transition to working from home, and an adoption of virtual lifestyles, we can already see that office spaces, town halls, libraries, universities, medical facilities, places of worship, grocery stores, and restaurants have all experienced a significant decline in foot traffic, and it may not be long before some of these institutions forego in-person activities altogether. Some may transition to a strictly online/delivery-based service in order to streamline efficiency and cut unnecessary costs amidst rapid inflation. Many of these old buildings could become obsolete, and could be demolished. Many common building components such as copper and iron will be salvaged from these buildings prior to demolition, further depreciating the value of some base metal deposits. I believe the mining industry is poised to take advantage of this societal shift to a virtual takeover, but many mining companies will likely fail to make the transition. Mining companies will need to adapt to survive, as society ventures into truly unexplored territory.

Seafloor Mining

Demand for materials involved in battery power will continue to increase, which may in turn lead to seafloor expeditions, specifically in search of manganese nodules, which are also a source of cobalt and nickel — metals that are invaluable for battery-powered technology. How-

ever, extracting these materials from the seafloor comes with several different challenges, specifically the environmental impacts, permitting regimes, and its potential to inflame political disputes over territory. The world’s oceans do not belong to any one country, so who has the authority to determine who gets to mine what, and where, and define what is a reasonable degree of environmental disturbance? Unless ore deposits can be found within a country’s exclusive economic zone, mining corporations must appeal to globalized institutions such as the International Seabed Authority, which has thus far granted 19 exploration licences within the Pacific Ocean’s Clarion Clipperton Zone — an area renowned for its abundance of polymetallic manganese nodules. These discussions open the door beyond manganese nodules to the mining of other seafloor deposits such as seafloor massive sulphides, which host especially unique and fragile faunal abundances that are restricted to these hydrothermal settings.

With the rise of seafloor mining, the mining industry may be challenged by even greater political interference, as governments may choose to create public mining corporations that are perceived as acting in the public interest, rather than allowing private companies to access seafloor mining opportunities. This will present huge challenges for the mining industry, as companies may be forced to compete with government-owned mining corporations.

The ongoing virtualization of work and recreation demonstrates challenges for the mining industry. These societal shifts have repercussions for the demands of metals, specifically for those involved in battery-powered technology. These metals tend to be particularly abundant in seafloor deposits such as manganese nodules, but the logistics surrounding seafloor mining remain uncertain.

The future of the mining industry is closely intertwined with political, social, and environmental concerns, all of which are prone to unpredictable fluctuations in public sentiment. Only one thing is certain: mining is here to stay, but the concerns and demands of this sector will always be in flux, as rising sustainability expectations, environmental concerns, and social restructuring will all directly impact the demand for resources in the coming decades.

— Jonathan Umbsaar is a firstyear PhD student at the University of Toronto, researching the critical metal distributions of seafloor massive sulphides and how these deposits compare to the ancient analogues that we mine on land.

Copper Mountain reopens mine after ransomware attack

CYBERSECURITY | Operation intact, but unclear if demands were met

BY COLIN MCCLELLAND

Copper Mountain Mining (TSX: CMMC; ASX: C6C) said it reopened its mine in southern British Columbia within days of a Dec. 27 ransomware attack that left deliveries unaffected.

The Vancouver-based company restarted the primary crusher on Jan. 1 at its mine near Princeton, about 300 km east of Vancouver, and resumed operations at the mill “shortly thereafter,” Copper Mountain said in a Jan. 6 news release.

“On Jan. 4, the mill was at full production and the operation is currently being stabilized as the remaining business systems are fully restored,” the company said.

“Throughout this downtime, which resulted from the attack on its IT systems, the company has been shipping copper concentrate to the port of Vancouver from mine inventory and has maintained its planned shipping schedule.”

Manganese pipeline

By 2031, North America is expected to require over 200,000 tonnes of high-purity manganese annually.

The continent, however, has no current high-purity manganese processing capacity to supply a large number of battery gigafactories and cathode plants under development.

South32 (LSE: S32; ASX: S32) is developing the first new U.S. manganese mine in decades. The company has allocated $55 million of capital expenditure to work on the Hermosa project in Arizona for the current fiscal year and expects to begin a pre-feasibility study before mid-2023.

In Europe, Euro Manganese (TSXV: EMN; ASX: EMN) is developing its Chvaletice project in the Czech Republic, the only sizeable, classified resource of manganese in the European Union.

The project entails re-processing manganese deposits contained in waste (tailings) from a decommissioned mine that operated between 1951 and 1975.

The company plans to convert the carbonate to high-purity manganese metal and sulphate and send it to Euro Manganese’s planned processing facility in Quebec where it will be converted into a liquid sulphate. The site is adjacent to two proposed cathode plants allowing the liquid sulphate to be piped directly into the cathode production processes.

“Going forward, we’re going to see a European battery industry and a North American battery industry,” said Jaffe. “Both of those are growing at a tremendous pace and are going to require their own supply chains, including a supply chain for manganese. And when you think about moving forward, I would talk about 10 years from now or over the next five years.” TNM

The shutdown was a preventative measure as Copper Mountain assessed the extent of the attack on its systems at the mine and its corporate offices, the company said. Copper Mine’s Jan. 6 update didn’t mention any damage, the identity of the attackers, dollar amounts they may have sought or any amounts paid to the hackers. A spokesperson for the company didn’t reply to emailed questions by press time.

All the mine’s environmental management systems operated during the outage and there were no incidents or injuries to personnel, the company said. Its information technology teams and cybersecurity consultants are setting up safeguards against further risks, it said.

The company said at the time of the attack it isolated operations, switched to manual processes where possible and contacted authorities.

Copper Mountain owns three-quarters of the open-pit mine operation, which produces an average of about 100 million lbs. of copper equivalent a year. Japan’s Mitsubishi Materials owns

the remaining quarter.

There are plans to expand the mill to 65,000 tonnes per day from 45,000 tonnes and increase average annual production to 138 million lbs. of copper equivalent.

The mine has proven and probable reserves of 650 million tonnes grading 0.25% copper, 0.11 gram gold per tonne, and 0.73 gram silver for 3.6 million lbs. contained copper, 2.2 million oz. gold and 15.2 million oz. silver.

Shares in Copper Mountain erased losses suffered from the attack. They had gained more than 12% by press time in Toronto to $2.14 each, within a 52-week range of $1.23 and $4.38, valuing the company at $409 million. TNM

GLOBAL MINING NEWS THE NORTHERN MINER / JANUARY 16—22, 2023 9 METAVERSE from / 5

MANGANESE from 1 markets will move,” Jaffe said.

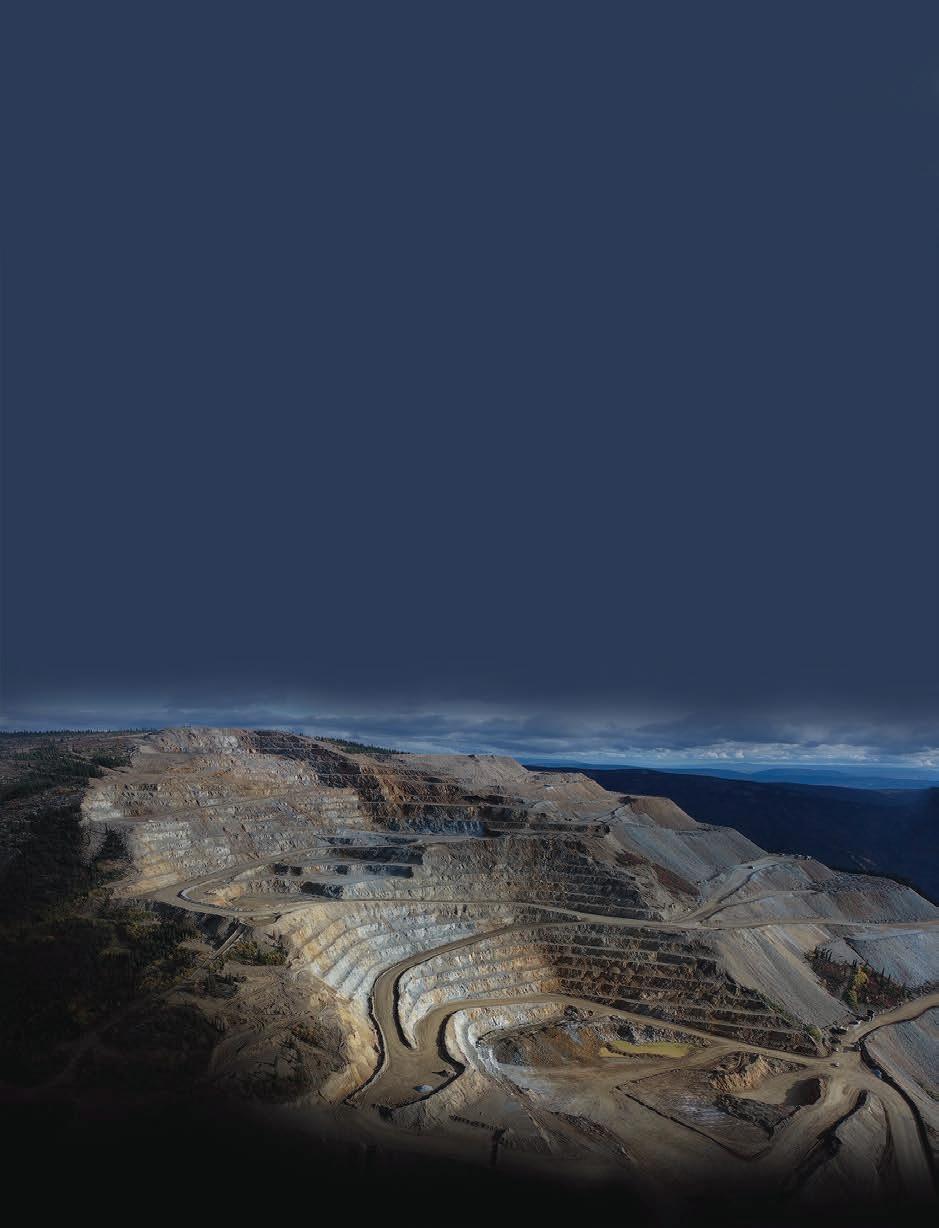

An electric haul truck at Copper Mountain Mining’s open pit mine in B.C.

COPPER MOUNTAIN MINING

Copper Mountain Mining’s operation is located about 300 km east of Vancouver near Princeton, B.C.

COPPER MOUNTAIN MINING

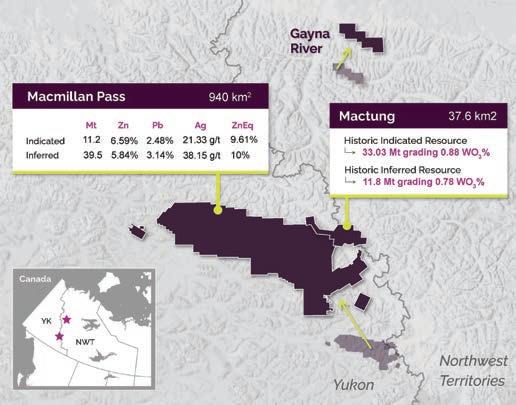

MINING IN BC, YUKON & NWT

BY COLIN MCCLELLAND

BY COLIN MCCLELLAND

Arctic Canadian Diamond, operator of the Ekati mine in the Northwest Territories, is on track to expand revenue by more than half as it aims to be the only miner using a remote underwater vehicle with a cutting drum.

The Calgary-based unlisted company will likely record 2022 income of about $500 million, an increase of more than 60% from the previous year’s 11 months of operations, because of higher output and market prices plus a month more of business, chief executive officer Rory Moore said in a December interview with The Northern Miner

“For the first time in a long time we’re making money,” Moore said by phone from Vancouver, although the miner says it has been in the black since it formed in early 2021 from the ashes of former owner Dominion Diamonds.

The first part of an underwater remote mining system to process 600 tonnes an hour and slash ore volume by up to 20% is due to arrive next month at Ekati, about 300 km northeast of Yellowknife. Built by Rotterdam-based IHC Mining, it will be the first underwater system to burrow into the walls of flooded open pits to mine kimberlite, not just suck gemstone-bearing sediment off the ocean floor like the operations off Namibia’s coast held by the Namdeb joint venture between De Beers and Namibia.

The potential for strong 2022 financial results and the prospect of underwater technology to cut costs marks a turning point for Ekati after the demise of former owner Dominion almost two years ago. As a private operator, disclosures are very limited, but Arctic Canadian appears to be performing well even though Covid-19 reduced labour, raised costs and hindered production. Almost 25 years after Ekati started as Canada’s first diamond mine, Moore wants to exploit

Below: The remote operated underwater mining crawler excavates with a drum cutter in small layers and eliminates the need for blasting explosives.

deposits with lower margins and extend its life by a decade or more.

Even though one of Ekati’s main deposits, Sable, wasn’t mined for a third of the year, the mine’s output may miss its 2022 target of 5 million carats by just 14%, Moore said. Waste rock had built up in the mine during Dominion’s ownership when it only targeted the gem-bearing kimberlite for removal, the CEO said.

“This last year there’s been a lot of focus on stripping waste at Sable, which meant that for four months we didn’t mine ore at Sable,” he said. “We just took the pain.”

Debt payments

Now, Arctic is using its success to pay down its debt. The first lien debt to banks of about $85 million has been paid off, the highest priority debt that came out of the creditor restructuring process after Dominion failed, Moore said.

The next debt to be repaid is capital invested by new owners DDJ Capital, Brigade Capital, and Western Asset Management. Arctic is also starting to collateralize an environmental surety of several hundred million dollars with cash, he said.

Still, diamond markets are notoriously volatile and some of the latest curve balls include sanctions against Russia — the world’s largest producer — as well as decades-high inflation and forecasts of widespread recession this year. And then there’s what happens after the war with Ukraine ends and gems may flood the market.

“The hardship that’s going on in the world at the moment is not conducive to luxury goods,” Moore said. “Everyone’s got their safety belts on and it’s unpredictable at the moment because of the Ukraine-Russia conflict.”

Diamond prices fell a moderate 4% last year, buoyed in part

by trading restrictions on Russian gems, after prices rose by 30% in 2021 to a record high in January 2022, according to diamond analyst Paul Zimnisky.

“Global natural diamond supply is forecast to remain around multi-decade lows for at least the next five years, which should be somewhat supportive of prices,” Zimnisky said by email.

Arctic is focusing on mining out Sable, developing the Point Lake open-pit project, testing the underwater remote mining system and extending the life at Ekati’s Misery underground mine, Moore said.

A 71.26-carat yellow stone from Misery, the site’s highest-revenue ore source, was sold at auction on Dec. 15 in Antwerp for an undisclosed amount that exceeded expectations, Arctic said. Industry experts said it’s probably the largest fancy vivid yellow gemstone discovered in Canada.

Underwater mining

The deposits of Sable Deep, Fox Deep and Point Lake Deep are the company’s three targets for underwater remote mining. The Point Lake project, about 33 km south of Ekati’s processing plant, has all its permits. Although a water draining operation hit an environmental limit in September, the project won’t be delayed, Moore said.

“We’ll start work on Point Lake this summer which doesn’t affect the overall timeline for the project because we’re a little bit behind at Sable, which will go a little bit longer,” he said. “Point Lake and Sable will share equipment, so the delay at Sable actually works great for Point Lake.”

The Jay deposit is permitted for open pit mining, but is being shelved for now because it may cost US$600 million to develop conventionally by constructing dykes to hold back the water and access the orebody, Moore said. Underwater mining would lower costs significantly, he said.

Arctic plans to test the system at the depleted Lynx deposit in 2024. In February, the surface platform is expected to arrive at Ekati. It will launch and recover a bulldozer-sized crawler with teeth on a drum that cuts about a foot of kimberlite on each pass into fist-sized chunks and pumps them to the surface. The ore slurry is then sent to a dewatering plant.

Of course, the industry routinely

uses remote mining machines on land. Arctic even used one at its Fox deposit for two years. The new IHC Mining technology uses environmentally safe hydraulic fluids, but there are other challenges, such as managing a water recirculation process to keep the slurry out of local pristine lakes, and just working a submersible by remote-control.