Mexico’s ‘shock’ new mining law hurts juniors most

BY HENRY LAZENBY

Canadian juniors in Mexico were blindsided by a new mining regime on Apr. 29, after the Mexican Senate rushed through a contentious bill that experts say will deter investment.

Under the new mining law, companies will have to deal with an increased burden of pre-consultation, impact studies and water concessions, among other regulations. The new law also requires financial commitments (bonding) that will be difficult to meet for junior explorers. It also allows authorities to cancel exploration concessions after two years if no work is completed on them.

The “aggressive” move by the government is “extremely damaging” to Mexico’s mining industry, says mining entrepreneur Ross Beaty, who’s made a career of investing in high-risk jurisdictions across Latin America, including Mexico. “It’s a very significant negative to Mexico’s previously good investment climate for mining.”

It comes just a month after Mexico nationalized its lithium sector, although the country doesn’t have any producing mines.

The Senate unanimously and with little debate approved two constitutional reforms and a new mining law which the Mexican mining chamber and the Canadian federal government had rebuked as recently as Apr. 26.

Reuters reported at the end of April that Senators approved the laws in an accelerated process without opposition legislators present. Morena party legislators convened outside the chamber’s usual voting location after the opposition occupied the chamber trying to prevent the session.

Mexico’s federal government is led by the Morena party under President Andrés Manuel López Obrador (AMLO), a charismatic populist elected in a landslide victory in 2018. Since then, no new mining concessions have been issued in Mexico.

Investments ‘at risk’

The reforms appear to be most damaging to junior explorers as they make it harder to obtain a new concession, says Joe Mazumdar, an analyst with the junior mining newsletter Exploration Insights. “Therefore, those not currently working in Mexico may think twice before entering this jurisdiction.”

Chief among the concerns regarding the mining reforms is a shortened tenure of mining concessions, reducing the duration from 50 years to 30 years, with only a one-time 15-year renewal possible.

Applications for new concessions filed up to Apr. 20 will be rejected without further action, while Mazumdar believes that those with granted applications will be grandfathered in.

Beaty argues that future investments are at risk. He explains that due to investment capital being mobile, he can’t see any Mexican or international companies wanting to invest new risk capital in the jurisdiction’s exploration and mining industries because of these new laws.

“They are hostile to the industry and utterly uncompetitive with other mining jurisdictions,” Beaty said. “It’s a real shock.”

He says that responsible mining by Mexican and foreign mining companies has been a massive boon to many communities in Mexico that rely on the jobs, demand for services and community benefits

mining provides. “These will dry up because the new rules are so draconian and hostile to new investment,” he says.

He questions the motivation of the Morena party for the move, which in his view, will spell the end of mining investment in Mexico until the laws are modified to make them more competitive with other mining countries.

Mazumdar expects mining companies to argue the unconstitutionality of these reforms, given the nature of their rollout to the public. “I don’t think this will be a quick process but note that AMLO’s presidency is limited to one term, which ends in September 2024.”

The new law also tightens water extraction permits and requires some mining profits to be returned to local communities, among other modifications.

Another key change means mineral concessions will now be granted through public auction, and not via a first applicant priority process.

Jobs impacted

Under the new rules, juniors will be required to present more studies and work along with funds upfront to be held as bonds before obtaining the concessions amid the uncertainty of getting them due to the public auctions. This, says Mexico’s national mining chamber, Camimex, could cost the country some US$9 billion in investments and up to 420,000 jobs.

“As far as I can tell, within 12 months, concession holders will have to provide financial assurances for the potential environmental impacts of the mining project, without knowing what kind of mining project it would be as the See MEXICO / 2

BY COLIN MCCLELLAND

David Austin has already sold what may be the largest undeveloped metallurgical coal land package in western Canada for several billion dollars.

Now, in a strange twist of fate, he’s planning to sell some of the same properties again for billions more after a record year for the steel-making commodity.

Colonial Coal International (TSX: CAD), founded by Austin, has about 700 million tonnes of measured, indicated and inferred metallurgical coal across its Huguenot and Flatbed properties in northeast British Columbia, according to respective preliminary economic assessments in 2020 and 2018.

For the past year, 16 of the world’s largest steelmakers, miners and met coal brokers — mostly from Japan, India and China — have been under non-disclosure agreements to pick through Colonial’s books and development plans. Colonial is riding on the enhanced publicity of Glencore’s (LSE: GLEN) pursuit of Teck Resources’ (TSX: TECK.A/ TECK.B; NYSE: TECK), which has four met coal mines in B.C. producing about 27 million tonnes a year.

“Teck has basically put a magnifying glass on coal assets in British Columbia,” Austin said by phone from Vancouver. “And that’s really helped us because it’s allowed a lot of companies who haven’t really paid much attention now saying ‘hey, there’s an opportunity there.’”

The prospective buyers for Asia’s steel plants want to secure supplies of metallurgical coal, also known as coking coal, the world’s best performing commodity by value last year when it nearly quadrupled in price to US$660 per tonne. Prices have fallen to See COAL / 10

CHILE’S NEW LITHIUM POLICY: HALF-BAKED OR READY TO SERVE? / 2-3 905 841 5004 | geotech.ca VTEM™ | ZTEM™ | Gravity | Magnetics Geotech_Earlug_2016_Alt2.pdf 1 2016-06-24 4:27:20 PM WWW.SGS.COM/MINING MINERALS@SGS.COM DELIVERING QUALITY EXPERTISE GLOBALLY ACROSS THE ENTIRE MINING LIFE CYCLE expert advice from exploration to closure .com SPECIAL FOCUS TOP NEW PROJECTS BY MINE LIFE Ranking top projects in construction globally / P11-16 MAY 15 — 28, 2023 / VOL. 109 ISSUE 10 / GLOBAL MINING NEWS • SINCE 1915 / $5.25 / WWW.NORTHERNMINER.COM

LEGISLATION | Reforms follow nationalization of lithium sector in April

GOLD FIELDS FINDS ITS ENTRY INTO CANADA WITH OSISKO’S WINDFALL / 5

PM40069240

Mexican President Andrés Manuel López Obrador (centre) with senators on Apr. 28. LOPEZ OBRADOR/TWITTER

Colonial Coal is hoping to sell two metallurgical coal projects in northeastern British Columbia. COLONIAL COAL INT’L

Colonial boss scores two kicks at same coal can for billions in B.C.

M&A | Met coal projects attracting interest

Chile’s lithium policy could be a boon to other producers

CRITICAL MINERALS | There’s disagreement about whether policy counts as ‘nationalization’, but move still rattles investors

BY CECILIA JAMASMIE

Adecision by the world’s No. 2 lithium producer Chile to tighten control over its key battery metal sector has left many in the industry wondering what the state-led public-private model will look like and who, if anyone, will benefit from it.

The lack of specifics on how much ownership the government will demand from companies and the difficulties President Gabriel Boric will face when trying to create a national lithium company, add to the uncertainties Chile’s new lithium policy has created.

While Boric’s announcement has been branded as “nationalization,” Shawn Doyle, a lawyer and business advisor at Canada’s McCarthy Tétrault, believes it’s actually a positive development for private capital keen to invest in the battery metal.

“In his speech, Boric indeed invoked expropriations that occurred in Chile’s copper industry in 1971. However, it must be remembered that, as a result of policy paralysis, Chile has been effectively closed to new private investment in lithium for decades,” he wrote in a note to clients.

Doyle added that, as a result of the policy status quo, Chile has only two private producers — Albemarle (NYSE: ALB) and SQM (NYSE: SQM) — holding longstanding leases, while all other would-be players “have been left waiting,” he said.

Albemarle chief executive, Kent Masters, also sees the new policy as an opportunity to tap into new lithium reserves, beyond the mines it already has.

“I don’t fear about Albemarle’s future in Chile,” he told CNBC. “Boric’s government wants to bring more Chilean lithium supply to the market by partnering with companies interested in the business, which know how to operate those mines,” Masters said.

Nicolás Saldías, senior analyst at the Economist Intelligence Unit for Latin America and the Caribbean, said that phrasing Chile’s move as nationalization is “too strong.”

“It’s a quasi-nationalization in that the playing field will now be levelled in favour of the state,” he said.

Others are not so sure. Bernardo Fontaine, Chilean economist and academic, believes that private capital will hesitate before letting the state own the majority of their business, particularly if the same state competes with their other operations for buyers.

“It’s an optimistic and enthusiastic bet to ask investors to choose partnering with a state company, via minority stake, risking capital and technology as opposed to simply doing it alone,” Fontaine said in an interview.

Boric’s announcements seem more focused on the nationalization of production than on development and the maximization of tax revenue, he said. “Let’s hope the government proves otherwise,” Fontaine added.

For Joe Lowry, known in mining circles as “Mr. Lithium” due to his decades of experience in the sector, says that the ambiguity in Chile’s policy could be a boon to other producing countries, with Canada being in a particularly advantageous place.

According to Mining Intelligence, Canada currently has nearly 40 lithium projects in different stages of development, but only two operating mines, Sayona Mining’s (ASX: SYA) North American Lithium (NAL) in Quebec (owned 25% by Piedmont Lithium

[NASDAQ: PLL]) and Sinomine Resource Group’s Tanco mine, in Manitoba.

In its critical minerals strategy released in December, Ottawa listed lithium as one of the top six critical minerals due to its importance in the clean technology sector.

“I believe that Canada, with its vast hard rock lithium assets, will become the Australia of North America in terms of lithium supply,” Lowry says. “But the more capital that lands in North America’s lithium industry, the worse it is for Chile.”

Best cost-structure

Lowry, who is also President of Global Lithium LLC, believes Chile has the best cost-structure in the world for producing lithium.

“[It] not only has giant reserves with high concentrations of lithium, but it also has a geographical advantage — the driest desert in the world, where evaporation ponds work best,” he says.

The problem, he notes, is that the strategy unveiled last week could slow the development of the country’s local industry.

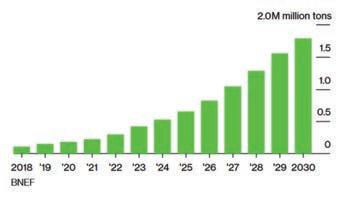

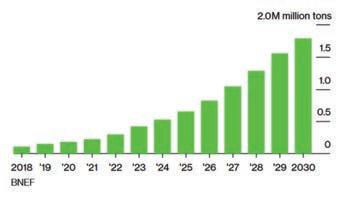

The expert, who has seen the global lithium sector grow from a US$200 million market when he entered the game in 1990 to US$1 billion by 2015 and over US$40 billion today, expects supply will continue to disappoint even as governments and automakers in the U.S. and Europe are investing heavily in the sector.

“[This is why] Chile is in a great position and it can remain there for at least two decades, but it needs to calm investors by providing details of how the new model will work,” he says.

The forecast shows how the power dynamics of the lithium industry are changing rapidly. “The top six lithium producers can sell all of their production today, without having to sell Tesla a gram. That wasn’t true six years ago,” Lowry says.

The North Carolina-based consultant believes Chile could easily recover its world leader position in the lithium market, lost to Australia in 2018, with the right policies.

“If you go back to early 2016, Australia had only one lithium mine in operation, while Chile was the dominant world producer. All of that has turned around in the last five to seven years and it’s a shame. It didn’t have to happen,” Lowry said.

Boric’s move places Chile closer to fellow Latin American countries

Bolivia and Mexico, which have discouraged investors by imposing greater state control, though Chinese groups may still be keen to fill the gap. “But is that what Chile wants?” Lowry wonders.

Investors have shown panic. Since Boric’s announcement, the value of the two lithium miners operating in Chile — U.S.-based Albemarle (NYSE: ALB) and Chile’s SQM (NYSE: SQM)— has dropped by a combined US$8.5 billion.

The world’s two top producers are set to operate in a different landscape once their current contracts expire.

Both companies have recently announced plans to expand operations elsewhere and experts say

they wouldn’t be surprised if they announce further geographical diversification. Albemarle is in pursuit of Australia’s Liontown Resources (ASX: LTR), while SQM is advancing the US$1.4 billion Mt Holland hard-rock project, also in Australia, with local lithium conglomerate Wesfarmers (ASX: WES).

In a recent commentary, German Mineral Resources Agency’s senior analyst Michael Schmidt wrote that regulatory uncertainties in Chile, Bolivia and Mexico will mean that about 63% of global lithium supply will come from rocks and not from brines by 2030.

Analysts from Fastmarkets believe that, if Chile fails to capital-

ize on the lithium boom, it would fall from the world’s second-largest lithium producer last year to fourth in 2030 after China, Australia and Argentina. They forecast the country’s share of production would shrink from almost a third to 12%.

While Boric needs approval from Congress for the creation of a national lithium company, he has the power to enact other elements of the policy. This is why he has enlisted two other state-owned companies, Codelco, the world’s largest copper producer, and state miner Enami, to determine how the private-public partnerships will operate.

Codelco will initially be in charge of negotiating a stake for the state in Albemarle’s and SQM’s operations. Enami will sign up partners for new contracts. Their roles will then be undertaken by the dedicated national lithium company, with a mandate to develop the industry into a pillar for Chile’s economy while protecting its environment.

Previous efforts to bring more actors into the country’s lithium sector have failed, with the most recent case being the one of Chinese automaker ByD Co, whose 80,000-tonne lithium contract was revoked following objections from a local governor.

Together with the lack of details in Chile’s lithium policy, expanding lithium mining in the Atacama desert is set to evoke environmental concerns. This, analysts agree, could make the process of awarding contracts more difficult and lengthier.

Asked about what he would say to Boric if he asked him for advice, Lowry does not hesitate: “I would tell him to put [the lithium policy announcement] back in the oven and finish the baking job.” TNM

project would still be in the early exploration stages. Within 90 days, the concession holders may also have to change their water access via the National Water Commission from industrial use to mining use,” Mazumdar says.

Mexican business conglomerate Grupo Mexico’s mining division on Apr. 27 indicated the change would not affect its operations, and Mazumdar assumes that the adjustment’s impact on producers will be minimal.

Toronto-based miner Torex Gold Resources (TSX: TXG), which has operations in Guerrero

state, says that while it was still reviewing the full impact of the amendments, it had not yet seen any indications they would be applied retroactively.

“As such, given that the tenure of Torex concessions has been granted on a 40- and 50-year basis, we see minimal impact to our operations in Mexico,” a spokesperson said in a statement sent to The Northern Miner “We are confident that discussions between industry and government will be ongoing as the government drafts the by-laws and directives, which will provide clarity on the operating parameters associated with the amendments,”

said the mid-tier company.

As recently as the week before the reforms passed, Canada’s Minister of International Trade, Mary Ng, expressed concerned that they could affect Canadian investment in Mexico’s mining sector, as well as North America’s supply chain resiliency and competitiveness.

Canadian mining companies, mainly listed on the TSX, represent the largest group of foreign investors in Mexico’s mining sector. According to government data, Canadian direct investment in Mexico was valued at $25 billion in 2021, making it Canada’s ninth-largest direct investment destination. TNM

2 MAY 15 — 28, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

SQM’s Soquimich lithium brine project in the Atacama salt flat in Chile. SQM

Torex Gold’s El Limón Guajes (ELG) Mine complex in Mexico’s Guerrero state. TOREX GOLD

MEXICO from 1

Juniors see glass half full in Chile’s new lithium plan

SOUTH AMERICA | Investors skeptical the policy will unlock new development

BY TOM AZZOPARDI

Plans by the Chilean government to strengthen control over the country’s lithium have sent shockwaves through the industry and markets.

As headlines warned of resource nationalism, shares in SQM (NYSE: SQM), Chile’s biggest producer, fell as much as 20% as investors digested the prospect of ceding control of its lucrative lithium business to the state.

However, companies on the ground are hopeful that the lithium strategy announced Apr. 20 by leftwing President Gabriel Boric could finally unlock Chile’s huge reserves of lithium after years of stasis.

“President Boric has had the courage to break the deadlock regarding government policy on lithium in Chile,” says Henk van Alphen, CEO of Wealth Minerals (TSXV: WML).

Under regulations dating back to the Cold War, Chile classifies lithium as a strategic mineral (due to its possible use in nuclear weapons), reserving its production for the state.

As a result, despite Chile hosting an estimated 40% of global reserves, only two companies have been able to produce lithium in the country, from tenements on the giant Atacama salt flat that they rent from economic development agency CORFO.

Under Boric’s plan, Chile’s state copper giant Codelco will negotiate with Albemarle (NYSE: ALB) and SQM to take majority control once their contracts expire (in 2030 and 2043, respectively).

But while the Salar de Atacama hosts the bulk of Chile’s lithium riches, its northern highlands host dozens of smaller saltflats which could boost production in the medium term.

Previous administrations have sought to bolster production by granting special licences to produce a limited volume of lithium over a set period of time.

But these efforts have fallen flat.

In 2012, SQM was stripped of such a contract after it was found to have breached the tender rules (and to have been paying a stipend to the government official in charge of the auction).

Last year, a court blocked similar contracts awarded to Chinese electric vehicle maker BYD and mining company Servicios y Operaciones

Mineras del Norte S.A., after Indigenous communities living near salt flats complained that they had not been properly consulted.

Under the government’s new plans, the state will seek to partner with private investors to explore,

produce and process lithium into value-added products. Until a new national lithium company is set up (which requires Congressional approval), Boric has ordered Codelco and state mining firm Enami to begin engaging with potential partners.

Government cooperation over control

Rather than scaring off investment, prospective lithium producers in Chile say the proposal could pave the way for new projects to advance towards construction.

“These proposals create a greater degree of certainty for the lithium

industry in Chile and therefore an improved climate for investment,” said Aldo Boitano, chief executive of CleanTech Lithium (AIM: CLT), which is working on a prefeasibility study at its Laguna Verde project, after releasing a positive scoping study in January.

With more clarity about how Chile plans to develop its lithium industry, multinationals are more likely to move in, firms argue.

“No doubt, this announcement will be noticed by multiple lithium consumers globally, who have been reluctant to enter Chile until this moment,” said Van Alphen of Wealth, which owns claims on two

salares.

Although President Boric’s initial announcement suggested that the government would seek control over all the aspects, this message was subsequently toned down.

Speaking to Chilean television on Apr. 23, Finance Minister Mario Marcel said that the majority state participation would only apply to assets considered of strategic importance, such as the giant Salar de Atacama. At smaller salt flats, the state could hold a minority stake, he said.

According to Clean Tech, the company has already received reassurances that its projects would not be subject to state control.

A major test for Chile’s new lithium policy will come at the Salar de Maricunga, where several firms are vying to develop the country’s second largest lithium reserves.

Australia-listed Lithium Power

International (ASX: LPI) and Singapore-backed Simco are both advancing projects using minerals claims that predate the restriction on lithium production. With environmental and export permits in hand, LPI is already in financing talks to begin construction later this year.

But Codelco has been exploring its own claims over the Salar with exploration work to measure a resource at the site close to completion. Speaking at its annual shareholders meeting on May 2, chairman Maximo Pacheco said that the company aimed to define a business model for its lithium project on the salar by the end of 2023, including estimates for investment and production.

“It’s a very attractive project,” he said. Moreover, Codelco is the only company to have been granted a licence to produce lithium by the government, covering almost the whole of the Salar, and expressed skepticism that the salt-flat can support multiple operations.

Responding to the new policy, LPI said it remains committed to developing the first stage of the project (based on grandfathered claims) alone but is exploring an alliance with the government to develop a further expansion based on newer claims, “in what could be the first example of a public-private alliance under the new parameters established by the new policy.”

Despite enthusiasm among corporate managers, investors remain skeptical about Chile’s new policy. LPI’s share price has fallen almost a quarter since the policy was unveiled. Clean Tech and Wealth have suffered similar declines.

The coming months could be crucial for Chile’s lithium industry as companies assess whether it can strike a workable deal with Codelco and other state entities or would be better off under the more laissez faire regimes in Australia and Argentina. TNM

GLOBAL MINING NEWS THE NORTHERN MINER / MAY 15 — 28, 2023 3

Lithium Power International’s Maricunga project in northern Chile.

LITHIUM POWER INTERNATIONAL

Wealth Minerals’ Atacama project on the namesake salar in Chile. WEALTH MINERALS

CleanTech Lithium’s Francisco Basin project in Chile. CLEAN TECH LITHIUM

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

Work to sideline Russia on nuclear fuel begins in earnest

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Alisha Hiyate, BA (Poli Sci, Hist) ahiyate@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

SENIOR STAFF WRITER: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PODCAST HOST: Adrian Pocobelli, MA (Engl) apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/

CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 moliveira@northernminer.com

ADDRESS:

510-6789 tnm@northernminer.com SUBSCRIPTION

Canadian miners are missing out on R&D tax incentives

Tax credit system rewards innovation

BY ALISHA HIYATE

BY ALISHA HIYATE

Cameco CEO Tim Gitzel first joined the company’s executive team in 2007 – the year that the uranium price peaked at a high of US$136 per lb., rising from less than US$10 per lb. In 2001. And although the current price of uranium oxide, at US$53.50 per lb. is nowhere near those bubbly (and it must be said, unsustainable) levels, Gitzel sounded downright giddy on the uranium miner’s first-quarter conference call at the end of April.

There are many things that are going for Cameco, one of the world’s top uranium suppliers, including increasing prices, and rising demand and contracting by utilities. But what they all boil down to is the realignment of energy markets post Russia’s invasion of Ukraine last year.

On the call, Gitzel described attending the dinner between Prime Minister Justin Trudeau and U.S. President Joe Biden in Ottawa in late March. During the event, he said the two leaders talked about the critical role of nuclear energy and the importance of nuclear collaboration between Canada and the U.S.

“It was almost hard to believe — like a dream come true,” Gitzel, who’ss been Cameco’s CEO since 2011, told analysts. “Nuclear energy would NEVER have made top billing at a meeting between our countries even a few years ago.”

The same day as the event, the two nations released a joint statement pledging more cooperation on nuclear energy and technology as a way to fight both climate change and Western dependence on Russia.

The “really positive” joint statement between the U.S. Department of Energy (DOE) and Canada’s Ministry of Natural Resources is “the kind of signal from government that our industry has been waiting for for a long time,” Gitzel said.

This signal extends beyond North America. In mid-April, five G-7 countries including Canada, the U.S., France, Japan and the U.K. signed a cooperation agreement on nuclear fuel, proclaiming their intent to “reduce reliance on civil nuclear and related goods from Russia, including working to assist countries seeking to diversify their nuclear fuel supply chains,” and to work together to establish a global commercial nuclear fuel market and support their “collective climate, energy security, and economic resilience objectives.”

In a separate statement, U.K. Energy Security Secretary Grant Shapps zeroed in on how Russia’s actions under President Vladimir Putin have spurred this new global geopolitical realignment.

“The U.K. has been at the very heart of global efforts to support Ukraine, defeat Putin and ensure neither him nor anyone like him can ever think they can hold the world to ransom over their energy again,” he said. “This is the next vital step, uniting with other countries to show Putin that Russia isn’t welcome anymore, and in shoring up our global energy security by using a reliable international supply of nuclear fuel from safe, secure sources.”

Shapps’ pointed words draw attention to just how little progress has been made on weaning off Russian supply since the war started last February, despite Western nations’ desire to punish Russia for its ongoing assault of Ukraine. While Russia is not a huge supplier of uranium (about 6%), it does control around 27% of global uranium conversion capacity, and nearly 40% of global enrichment capacity, according to Sprott, which has several uranium-centred investment products. Realizing the damage it would do to their own nuclear sectors, Western leaders have mostly opted not to impose sanctions on Russian supplies. In a mid-April report, U.K.-based defence and security think tank Royal United Services Institute (RUSI) noted that together, the U.S. and France imported close to US$1 billion worth of enriched uranium from Russia last year.

Even so, prices in the enriched fuel and conversion markets have been climbing as Western utilities have sought alternatives to Russian supply.

That’s helped Cameco break into new markets in Eastern Europe, including signing a 10-year contract with Westinghouse Electric to supply UF6 (converted uranium suitable for enrichment) to Bulgaria.

“Our recent contracting success to supply new markets in Eastern Europe clearly demonstrates the desire of our customers to diversify. These are markets where we were previously unable to compete,” the company said in its first-quarter results press release.

Price rise to come

While uranium prices have risen, enrichment and conversion prices have seen the greatest boom so far. In its most recent quarter, Cameco’s average realized price only ticked up 4% to US$45.14 per lb. of uranium oxide (U₃O₈) from US$43.24 per lb. in the same period last year.

But Cameco execs believe that’s still to come.

“We haven’t seen that kind of demand that’s gone through those two parts of the fuel cycle fully hit the uranium side yet, so we’re obviously pretty excited about it — it’s why we want to remain leveraged in both our portfolio and our pipeline,” said Grant Isaac, Cameco’s CFO and executive vice-president on the conference call.

In the meantime, the “positive fundamentals” Cameco has been pointing to for over a decade are finally starting to show up in the company’s financial results.

In the first quarter, Cameco’s revenue was up 73% to $687 million, while its net earnings and production both more than doubled. Cameco produced 4.5 million lb. U₃O₈ in the first quarter (up from 1.9 million lb. in the same period last year), and as it continues to ramp up the McArthur River mine and Key Lake mill, which it restarted last fall after a four-year suspension, it expects that mine alone to produce 15 million lb. this year and 18 million lb. next year.

The real test to what many see as a new uranium bull market will be whether the improving picture for nuclear power translates into new mines. From that perspective, a slow and steady rise in uranium will help junior miners hoping to develop new mines in Saskatchewan’s Athabasca Basin — including NexGen Energy, Fission Uranium (see page 10) and Denison Mines — a lot more than a return to sky-high prices. TNM

As mining companies across Canada face budget cuts and more pressure to make sound investments, it has never been more important to make the most of every cent available. Canada has one of the most generous tax credit programs in the world, yet many in the industry are either not aware it exists, or wrongly assume it does not apply to them.

The main tax incentive for research and development in the mining industry is the Scientific Research and Experimental Development (SR&ED) program, awarded by the Canada Revenue Agency (CRA). The name conjures up images of scientists in lab coats — a far cry from the world of drilling and mining, which may be another reason it is often overlooked.

In fact, industries related to natural resources typically have some of the lowest claim rates. While different rules govern how SR&ED is awarded in the case of mining, successful claims can potentially contribute thousands of dollars to a project, so it is worth a closer look.

SR&ED legislation specifically excludes claiming for activities related to ‘prospecting, exploring or drilling for, or producing, minerals, petroleum or natural gas.’ This is all considered field work carried out as part of business operations in the resources sector.

This wording can be a stumbling block for Canadian mining companies, and the headline exclusion of prospecting for minerals may deter many companies from exploring a claim for SR&ED Investment Tax Credits. What many financial officers overlook is that the regulation does not disregard supporting activities. As innovation is found in virtually every aspect of the mining industry, millions of dollars may be missed by this simple misunderstanding.

There are some key areas of the industry that are more likely to be eligible for tax credits, including:

• The design and engineering of new systems or components used in the extraction and processing of materials;

• The development of components for the industry where the work experiences technological uncertainty; and

• Technology that can be used to maintain equipment used by mining companies in Canada.

What does qualifying activity look like?

It can be difficult to predict exactly what the CRA will deem to be qualifying activity, so it’s worth going into the claims process with a solid understanding of the kind of innovation and R&D they will be looking for.

Some aspects of labour may qualify, including the personnel employed by the company, as well as any subcontractors. Any work that is directly related to the SR&ED activity could be eligible — outside of operations aspects such as marketing, sales and customer service. The CRA recognizes that a significant aspect of any R&D involves the time spent by personnel in successfully completing the project. One caveat: all employees and subcontractors must be Canadian-taxable suppliers. The development of new technology used by miners, as well as investment in capital equipment could also be eligible. You may even be able to secure funding from the payments made to third party researchers to conduct the necessary R&D on your behalf.

The CRA looks particularly favourably on mining companies’ efforts to improve processes in line with environmental concerns. This could include anything from reducing greenhouse gas emissions from machinery to mine reclamation. The regulation does not specifically exclude mineral processing technology either, so any investment into ore feed changes or reducing energy consumption could be eligible for SR&ED. Investment in new mineral exploration technology and methods, software and equipment that makes finding deposits easier and reduces environmental impacts could also be eligible.

How much are these tax credits worth?

Once all the qualifying activity has been taken into account, companies can expect the funding to be awarded in two different credits. This all depends on the corporate structure of the company, as well as the province in which it is based. Companies can claim a refundable Federal Investment Tax Credit of 35% on activity directly attributed to innovation. Alongside this, the Provincial Refundable Investment Tax Credit rate varies, so for example, the metal and coal mining companies of British Columbia would be able to claim a further 10% in refundable credits, as that is what the provincial program offers.

Canada’s mining sector is investing heavily in new technology and practices to keep up with global challenges around the use of natural resources. So long as mining companies can come to grips with federal tax credit rules on what might be eligible, they can tap funding that will help them continue to invest in innovation. TNM

—Richard Hoy, president of specialist tax consultancy Catax Canada can be reached at Richard.Hoy@catax.com.

COMPANY INDEX

4 MAY 15 — 28, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

Canada: C$130.00 one year; 5% G.S.T. to CDN orders. 7% P.S.T. to BC orders 13% H.S.T. to ON, NL orders 14% H.S.T. to PEI orders 15% H.S.T. to NB, NS orders U.S.A.: C$172.00 one year Foreign: C$222.00 one year GST Registration # 809744071RT001 (ISSN 0029-3164) CANADA POST: Return undeliverable Canadian addresses to Circulation Dept. c/o The Northern Miner 225 Duncan Mill Road, Suite 320 Toronto, ON M3B 3K9 Publication Mail Agreement #40069240 Periodicals Postage Rates paid at Niagara Falls, NY, 14304. U.S. office of publication 2424 Niagara Falls Blvd, Niagara Falls, N.Y. 14304. U.S. POSTMASTER: send address corrections to: Northern Miner Box 1118 Niagara Falls, N.Y. 14304.-7118 THE NORTHERN MINER is published biweekly by Glacier Resource Innovation Group, a division of Glacier Media Inc., a leading Canadian media company with interests in business-to-business information services. From time to time we make our subscription list available to select companies and organizations whose products or services may interest you. If you do not wish your contact information to be made available, please contact us by one of the following methods: Phone: 1-888-502-3456; Fax: (416) 447-7658; Mail to: Privacy Officer, The Northern Miner, 225 Duncan Mill Road, Suite 320, Toronto, ON M3B 3K9. EDITORIAL

Toronto Head Office 225 Duncan Mill Road, Suite 320 Toronto, ON, M3B 3K9 (416)

RATES:

Aclara Resources 9 Alara Resources 14 Allkem 16 Alto Metals 6 Artemis Gold 11 Atlas Lithium 7 Aura Minerals....................................................12 B2Gold 11 Bellevue Gold 6 CleanTech Lithium 3 Colonial Coal International 1 Eldorado Gold 14 Emerita Resources 6 Fission Uranium 10 Fresnillo...............................................................11 Gascoyne Resources 6 Generation Mining............................................5 Glencore 8, 15 Gold Fields 5 Horizonte Minerals 15 Iamgold 12 IGO 16 Ioneer 7 Ivanhoe Mines 8, 11, 14 Lithium Americas 16 Lithium Power International 3 Lundin Gold 6 MAG Silver 11 Mayfair Gold 6 MetalsTech..........................................................6 Nevada King Gold 6 NexGen Energy 10 NextSource Materials 16 Nighthawk Gold 5 Northern Dynasty Minerals 7 Northern Star Resources 6 Nouveau Monde Graphite.............................16 Osisko Mining 5 Peak Rare Earths 9 Pensana 9 Rio Tinto 12 Sandfire Resources 14 Santana Minerals 6 SQM 3, 16 Teck Resources 7, 8 Tirupati Graphite 16 Triton Minerals 16 Walkabout Resources.....................................16 Wealth Minerals 3 West African Resources 11 COMMENTARY

Gold Fields to share in Windfall by buying half of Osisko gold project

M&A | Deal gives South Africa-based miner its entry to Canada after failed Yamana bid

BY COLIN MCCLELLAND

Gold Fields (NYSE: GFI; JSE: GFI), the eighth-largest miner by market value, has joined with Osisko Mining (TSX: OSK) to back the Windfall gold project in Quebec, one of Canada’s largest proposed precious metal developments.

Gold Fields said on May 2 it agreed to pay $600 million for half of the project in the Abitibi belt about 700 km northwest of Montreal. The funds are payable in two equal tranches, one now and one after the province approves construction.

The Gold Fields investment gives the Johannesburg-based miner the entry to Canada it missed last year when it was outbid for Yamana Gold. It also provides Windfall with more than enough cash for the estimated $789 million in construction costs and protects Osisko from a hostile takeover like it underwent with the Canadian Malartic mine it developed more than a decade ago.

“Windfall is the starter point for Gold Fields and ourselves in terms of having a mine come into production in about two and a half year’s time,” Osisko CEO John Burzynski said in a May 4 phone interview with The Northern Miner. “We also have about 2,400 sq. km of district scale property, an anchor in Quebec, and you know, there’s plenty of exploration to be done.”

The equal partnership may tweak plans to increase first-year production by a third, Burzynski said. It would extend the underground project’s ramp currently planned to run 630 metres deep to 800 metres instead, accessing ore grading about 9.1 grams gold per tonne rather than 8.1 grams, which could lift annual output to 400,000 oz. in contrast to 306,000 oz. in last year’s feasibility study, the CEO said.

“It’s in the interest of both Gold Fields and ourselves to look at scheduling some of the higher-grade material earlier,” Burzynski said. “They won’t require any changes to the mill design, so it won’t interfere with permitting.”

Funding secured

BMO Capital Markets analyst Andrew Mikitchook said the investment secures Windfall’s development.

“There is clearly a significant buffer over Osisko’s share of capex,” Mikitchook said in a note on May 2. “We view the large investment from Gold Fields as an endorsement of Windfall’s quality.”

Burzynski said it may take 18 months to get permits for the project, followed by a year of construction.

Gold Fields will also pay $75 million a

Nighthawk soars on NWT gold project’s

two-year

payback

GOLD | PEA sees output of 290,000 oz. a year at Colomac

Drilling at Nighthawk Gold’s Colomac site in the Northwest Territories. NIGHTHAWK GOLD

BY COLIN MCCLELLAND

Shares in Nighthawk Gold (TSX: NHK; US-OTC: MIMZF) jumped more than 20% after the company said its Colomac project in the Northwest Territories could pay for itself in about two years.

The open-pit project 200 km north of Yellowknife could produce 290,000 oz. of gold annually selling for US$1,600 each to generate US$464 million a year compared with estimated capital costs of $654 million, according to a preliminary economic assessment released on Apr. 26. The after-tax payback period is pegged at 2.1 years.

The study envisions a phased open-pit development starting with a central hub of the Colomac main, Grizzly Bear and Goldcrest deposits followed by satellite deposits 11 to 28 km away. Of these, Cass, Kim and Damoti are to be open pit and underground mined, while Treasure Island is only underground.

year in regional exploration costs. Bringing Windfall into production and exploring in the area is expected to cost the company $1.2 billion.

“What really excites us with the work that John and the Osisko team have done is the upside potential at both Windfall but then also at the Quévillon and Urban Barry prospecting areas,” Gold Fields interim CEO Martin Preece told BNN Bloomberg TV on May 4. “Canada is the cold version of Australia. It’s a great mining destination.”

Windfall has probable reserves of 12.2 million tonnes grading 8.06 grams gold per tonne for 3.2 million oz. gold. The feasibility study envisions a 10-year mine life.

Shares in Gold Fields in Johannesburg closed recently at 297.99 rand ($21.71) apiece, within a 52-week range of 126.62 rand and 319.17 rand, valuing the company at 262.5 billion rand ($19.1 billion). They were at 282.75 rand before the deal.

Osisko shares traded at $3.87 apiece at press time in Toronto, within a 52-week range of $2.36 and $4.53, valuing the company at $1.4 billion. They were at $3.77 before the deal. TNM

“The Colomac gold project has the potential to be a phenomenal asset,” Nighthawk president and CEO Keyvan Salehi said in a statement accompanying the study.“Only a handful of gold projects in the world that are owned by junior gold companies have similar favourable economics.”

Shares in Nighthawk rose 21% on Apr. 26 in Toronto to 58¢ apiece before setting a new one-year high at 72¢ at press time, valuing the company at $89.1 million. The stock previously traded in a 52-week range of 26¢ to 64¢.

Colomac would have an after-tax net present value of $1.2 billion at a 5% discount rate with an internal rate of return of 35% at the US$1,600 per oz. gold price, the study showed. The corresponding figures would increase to $2 billion at a 5% discount rate and 56%, based on a US$2,000 per oz. gold price. The payback period would shrink to 1.5 years.

Toronto-based Nighthawk’s plan would see a 11.2-year mine life with peak production of 340,000 oz. gold in the second year. Other forecasts include annual sustaining capital costs of $59 million, total annual cash costs of US$673 per oz. and all-in sustaining cash costs per year of US$828 per ounce.

Open pit extraction would focus on grades higher than 1.5 grams gold per tonne. Developing Colomac should take two years, the company said. Processing would be through a conventional milling, gravity and leaching circuit with gold recovery estimated at 96.3%. The company plans to spend $103 million to install wind turbines and solar panels to generate 60% of the site’s power. The rest would be provided by diesel generators.

A resource update in February showed the combined open-pit and underground indicated resource rose to 70.4 million tonnes grading 1.5 grams gold for contained metal of 3.4 million oz., a 26% jump from 2.7 million oz. in last year’s estimate. The corresponding inferred figures are 24.3 million tonnes grading 2.2 grams gold for 1.7 million oz., a 27% gain from last year’s estimate of 1.3 million ounces.

Nighthawk said it is preparing a prefeasibility study for the project and evaluating pit sequencing, equipment sizing, camp configuration, an airstrip extension and infill drilling to upgrade inferred resources.

The deposits are open along strike and at depth, while the 930-sq.-km property has 27 historical gold “occurrences” that warrant exploration, CEO Salehi said.

“We are expecting assay results from the highly prospective Leta Arm zone,” he said. “We are also planning to further drill the Cass, 24/7 and Damoti deposits, which we believe have the potential to expand mineralization beyond what has been outlined.” TNM

Generation Mining in US$400M debt deal for Marathon

ONTARIO | Updated feasibility for Marathon palladium-copper project pegs capex at $1.1B

BY MARILYN SCALES

With a new US$400-million debt financing expected to close in the third quarter, Generation Mining (TSX: GENM; US-OTC: GENMF) will have $740 million of the $1.1 billion needed to build its Marathon palladium-copper project in northern Ontario.

The company announced in early May that it has signed a non-binding term sheet for a senior finance facility of up to US$400 million ($540 million) with a syndicate

including Export Development Canada (EDC), ING Capital, and Societe Generale.

The debt facility adds to a $200-million streaming arrangement with Wheaton Precious Metals (TSX: WPM.CA; NYSE: WPM) signed in late 2021. Generation has also secured federal and provincial approvals for its environmental assessment.

“The interest of EDC, ING, Societe Generale, and Wheaton Precious Metals further validates the Marathon project’s status as an economic, sustainable, environmen-

tally sensitive, low-cost producer of critical metals that are needed to support emissions controls and the transition to a greener economy,” said Generation president and CEO Jamie Levy.

Generation updated its feasibility study for Marathon at the end of March, replacing a previous study published in 2021. It pegged capital costs at $1.1 billion ($898 million net of equipment financing and pre-commercial production revenue), with a payback period of 2.3 years. The project has a net present value (using a 6% discount rate) of

$1.2 billion and an internal rate of return of 25.8%.

The feasibility outlines an openpit mine and process plant with a mine life of 12.5 years, producing a total of 2.1 million oz. palladium and 517 million lb. copper. Payable metals over the mine life include 485,000 oz. platinum, 158,000 oz. gold and 3.2 million oz. silver.

In late March, Generation finalized an offtake agreement with Glencore (LSE: GLEN), which will buy 50% of the concentrates produced at Marathon.

The project is located 300 km east

of Thunder Bay and just north of Lake Superior.

Marathon hosts open pit proven and probable reserves of 127.6 million tonnes at 0.65 grams per tonne and 0.21% copper for 2.3 million oz. palladium and 530 million lb. copper. It also contains 285,000 oz. gold at 0.07 grams per tonne, 806,000 oz. platinum at 0.2 grams and 6.8 million oz. silver at 1.6 grams.

Generation shares traded at 52¢ in Toronto at press time, for a market capitalization of $94.3 million.

The stock has traded in a 52-week window of 51¢ and 95¢. TNM

GLOBAL MINING NEWS THE NORTHERN MINER / MAY 15 — 28, 2023 5

The pumping station at Osisko Mining’s Windfall project in Quebec. OSISKO MINING

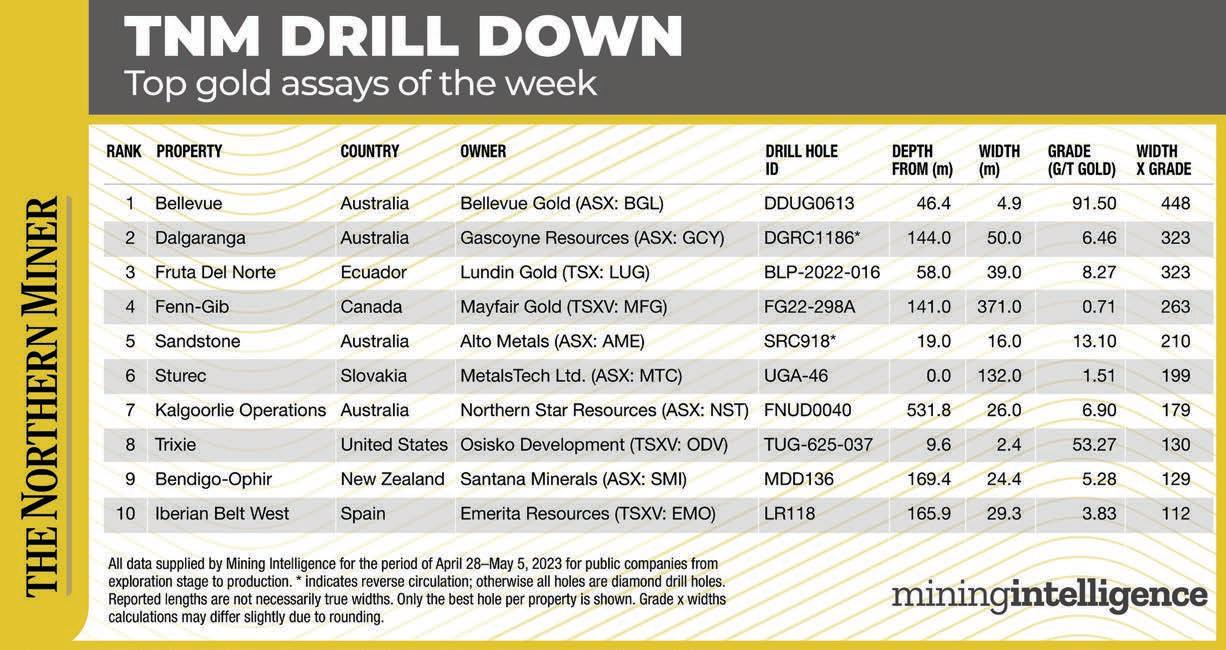

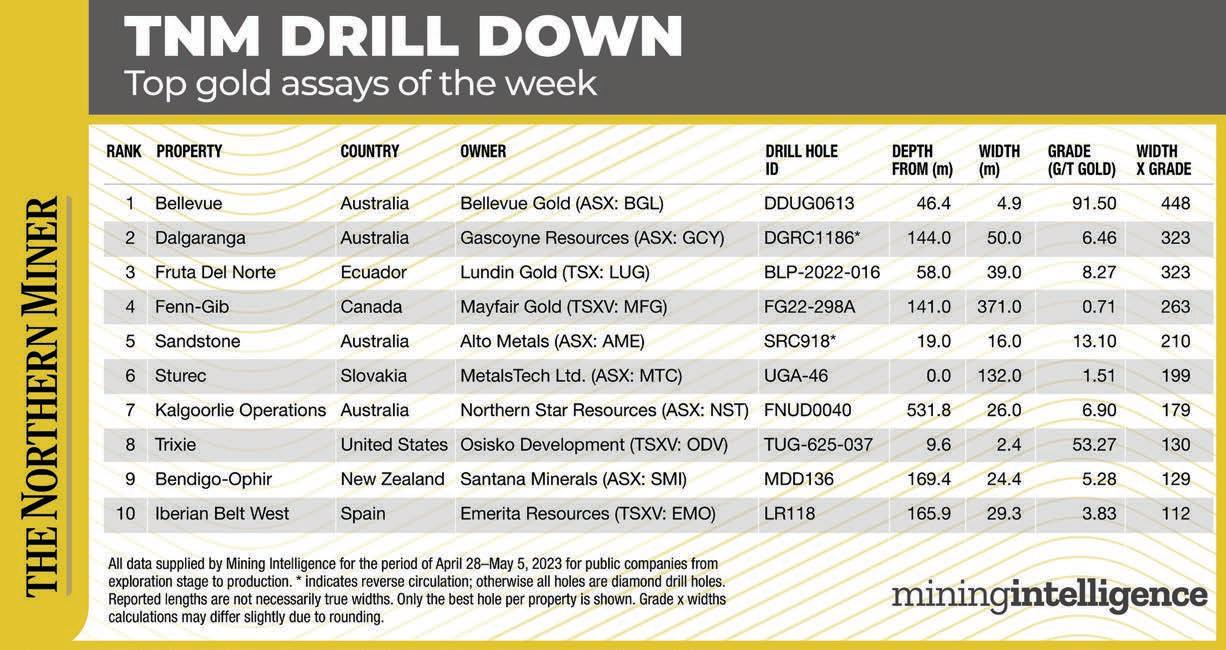

TNM DRILL DOWN:

Bellevue Gold project in Australia tops week’s gold assays

BY BLAIR MCBRIDE

Our TNM Drill Down features highlights of the top gold assays of the week (Apr. 28-May 5). Drill holes are ranked by gold grade x width, as identified by data provider Mining Intelligence (www. miningintelligence.com).

Last week’s top gold assays come from Australia and Ecuador. Bellevue Gold (ASX: BGL) leads the rankings with its namesake project in Western Australia. On May 1, the Perthbased company reported that hole DDUG0613 returned 4.9 metres grading 91.5 grams gold per tonne from 46.4 metres depth for a grade x width value of 448.35. The assays from the highlight hole were among results from more than 50 grade control drill holes in the Armand Upper Lode at Bellevue. Along with the Marceline and Bellevue South lodes, the area has returned highgrade results from underground drilling. “These exceptional results are important because they demonstrate the extremely robust nature of the resource model and therefore the strength of the production forecasts,” said managing director Darren Stralow in a release. While exploration drilling continues, first gold pour at the underground mine is expected in the second half of 2023, with an initial mine life of 10 years. Bellevue hosts probable reserves of 6.8 million tonnes grading 6.1 grams gold for 1.3 million oz. of gold.

The second best assay of the week came from Gascoyne Resources’ (ASX: GCY) Dalgaranga project in Western Australia. On May 2, the company reported that hole DGRC1186, cut 50 metres grading 6.46 grams gold from 144 metres depth for a grade x width value of 323. That reverse-circulation hole, from the Never Never deposit, also cut 10 metres at 23.7 grams gold. It also represents the fifth best intercept found so far at Never Never, said Gascoyne CEO and managing director Simon Lawson. “These standout results, provide further validation that Never Never is one of the most exciting new gold dis-

coveries in Australia, with hightenor, high-grade mineralisation now defined over a significant strike and dip extent just north of the existing mine,” he said. An updated resource for Never Never, released in January, shows it hosts underground and open pit indicated resources of 157,300 oz. gold in 1.3 million tonnes grading 3.69 grams gold. Another 145,800 oz. are in 710,000 inferred tonnes grading 6.43 grams gold. The company expects to release another resource update in the second half of the year. Dalgaranga was a producing gold mine until it was put on care and maintenance last November.

Gascoyne’s exploration program at the site began in February 2022.

The third best assay of the week came from Lundin Gold’s (TSX: LUN) producing Fruta Del Norte project in southeast Ecuador. On May 4, the miner reported diamond drill hole BLP-2022-016 cut 39 metres grading 8.27 grams gold from 97 metres depth, for a grade x width value of 322.53. The hole, in the Bonza Sur target, also returned 1 metre grading 277 grams gold from 70 metres depth hosted in a wide hydrothermal alteration zone. Bonza Sur is a new mineralized target discovered in near-mine drilling at the beginning of the year while

testing a 1.2-km-long geochemical soil anomaly along the south extension of the East Fault, located 1 km south of the main Fruta Del Norte deposit. Additional drilling confirmed the mineralization continues along strike to the south and at depth. “These results demonstrate the significant exploration potential of our land package that we have just started to test,” said CEO Ron Hochstein. Lundin plans to drill up to 23,000 metres in the near-mine program this year at an estimated cost of $24.6 million. The company has already completed 4,110 metres across eight holes since mid-April TNM

Nevada King Gold drills decades-high gold assay at old Atlanta project

EXPLORATION | Junior mulls

resource update next year at past producing gold-silver project

BY COLIN MCCLELLAND

Nevada King Gold (TSXV: NKG; US-OTC: NKGFF) says assay results show the highest-grade intercept in almost 50 years at the past-producing Atlanta mine in southeast Nevada.

Reverse-circulation drill hole AT23WS-022 cut 42.8 metres grading 5.64 grams gold per tonne and 6.7 grams silver from 288 metres downhole, including 7.6 metres at 28.5 grams gold, the company said in a release on Apr. 27.

This hole, located 290 metres northeast of the Atlanta pit “represents the highest-grade gold intercept exceeding 1.52 metres in length on the entire Atlanta property going back to the 1970s,” exploration manager Cal Herron said in the release. “How many more high-grade structures will we find at Atlanta that no one knew about?”

The Atlanta mine in the state’s Battle Mountain Trend, 264 km northeast of Las Vegas, produced 110,000 oz. of gold and 800,000 oz. of silver between 1975 and 1985. A 2020 estimate pegged measured and indicated resources at 11 million tonnes grading 1.3 grams gold per tonne for 460,000 ounces. Inferred resources add 5.3 million

tonnes grading 0.83 gram gold for 142,000 ounces.

Vancouver-based Nevada King drilled nearly 14,000 metres last year at the project and plans to hit a total of 30,000 metres by June on the 51.6-sq.-km site. More than 40,000 metres were drilled by Gold Fields (NYSE: GFI), Kinross Gold (TSX: K; NYSE: KGC) and Meadow Bay Gold starting in the early 1990s.

“With metallurgical test work well underway and our drilling progressing nicely, a second-quarter 2024 resource update could be in the cards,” Nevada King founder

and CEO Collin Kettell said in an emailed reply to questions. “It will incorporate quite a bit more drilling and we may push it back if zones continue to remain open.”

Historic drilling comparison

The release of assays on Apr. 27 was from holes drilled north of the Atlanta pit to test the grade and thickness of mineralized blocks in the Atlanta Mine Fault zone and the West Atlanta Graben moving northward toward the North Extension Target zone. Drill hole AT23WS-020 cut 61.1 metres grad-

ing 3.04 grams gold and 21.4 grams silver including 4.6 metres at 15.84 grams gold and 19.8 grams silver.

“This suggests that historic drill intercepts within the West Atlanta Graben failed to accurately reflect true thickness and grade,” Herron said. “This comparison illustrates the need for tightly spaced holes that thoroughly penetrate the mineralized zones, and also highlights the differences in grade and thickness being encountered by Nevada King compared to many holes reported by prior operators.

“We continue to see good conti-

nuity of mineralization over an area approximately 360 metres long in a north-south direction and at least 150 metres wide within the portion of the West Atlanta Graben drilled so far. Several historical holes suggest this mineralization extends further to the west and north from the area drilled to date.”

Nevada King began acquiring properties along the Battle Mountain Trend in 2016 and now holds 10,315 claims over 834.9 sq. km, making it the third largest mineral hard rock claim holder in Nevada behind Kinross and Nevada Gold Mines, a joint venture of Barrick Gold (TSX: ABX; NYSE: GOLD) and Newmont Gold (TSX: NGT; NYSE: NEM).

Nevada King’s holdings include the Lewis property beside Nevada Gold Mines’ Hilltop deposit, the Horse Mountain-Mill Creek project adjoining a Nevada Gold Mines exploration project, and the Iron Point property where the Battle Mountain-Cortez and GetchellTwin Creeks gold trends intersect. Shares in Nevada King rose 3.5% on the news to 44¢ apiece before hitting 47¢ at press time, valuing the company at about $131 million. The stock has traded within a 52-week range of 26¢ and 50¢. TNM

6 MAY 15 — 28, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

Nevada King Gold’s Atlanta property in southeastern Nevada. NEVADA KING GOLD

U.S. Army gives glimmer of hope for Pebble copper-gold project in Alaska

COPPER | Northern Dynasty says engineers could undermine stance of EPA, which has blocked the project

BY COLIN MCCLELLAND

The United States Army is improving the slim odds for the Northern Dynasty Minerals (TSX: NDM; NYSE: NAK) Pebble project in southwest Alaska which has already been blocked by environmental authorities.

The U.S. Army Corps of Engineers, which has its own approvals process for what would be North America’s largest mine with a 600-metre-deep pit, said Apr. 25 it will take another look at its refusal in 2020 to approve the project after Northern Dynasty successfully appealed the decision. The corps has to report back in 45 days.

“We have been saying that the record of decision process was not fairly conducted since 2020 and are pleased to see that the review officer has raised similar concerns,” Ron Thiessen, president and CEO of Northern Dynasty, said in a news release on May 1. “This remand decision is a strong win for the project because it brings these issues to light and directs the district to address them, potentially setting the stage for a much different outcome.”

BMO Capital Markets agreed in a May 1 note about items Northern Dynasty appealed when the corps ruled against the gold, copper and molybdenum project 380 km southwest of Anchorage.

“These include possible inconsistencies in the evaluation of a compensatory mitigation plan and

possible inconsistencies in weighing the benefits vs. detriments of developing Pebble,” mining analyst Andrew Mikitchook wrote. “Correcting the remanded issues could have a meaningful impact on the overall permitting decision.”

At issue this time in the decadeslong struggle to develop the project forecast to generate US$1.7 billion in annual revenue is whether Northern Dynasty was allowed to adjust its comprehensive mitigation plan with public feedback, and if the corps ruled wrongly on the project’s tailings storage.

Thiessen argues the company wasn’t given proper instruction, feedback or time to change its mit-

igation plan to meet requirements, which in turn could potentially prompt the U.S. Environmental Protection Agency’s to reverse its decision to reject the project. That refusal was based on concerns the project would breach the Clean Water Act and hurt the world’s largest sockeye salmon fishery at Bristol Bay.

He also noted the corps’ review said it had been wrong to consider potential catastrophic impacts of a tailings storage facility failure as a reason for its permit denial after the final environmental impact study had found the tailings storage design didn’t present any reasonably foreseeable failure risks.

Atlas Lithium lands US$20M royalty deal for Neves project

CRITICAL MINERALS | 40,000-metre drill program under way on battery minerals project now fully funded

BY JACKSON CHEN

Atlas Lithium (NASDAQ: ATLX) saw its share price explode on May 2 after securing US$20 million in funding for its flagship hard-rock lithium project in the Lithium Valley area of Minas Gerais state, Brazil.

By late morning, the stock surged 12.4% to US$43.70 apiece, having hit a 52-week high of US$45 in the earlier hours of trading.

Atlas sold a 3% gross overriding revenue (GOR) royalty on the Das Neves project to Canada’s Lithium Royalty Corp. (TSX: LIRC) for US$20 million in cash. The firm said it was the largest lithium royalty deal in Brazil so far. Das Neves covers four of Atlas’ 64 mining claims.

Lithium Royalty recently completed an initial public offering of $150 million. It holds a 1% royalty on all claims owned by new producer Sigma Lithium (TSXV: SGML; NASDAQ: SGML), which began production at its Grota do Cirilo mine in Minas Gerais in April.

With the royalty transaction, Atlas is now fully funded to complete its 40,000-metre drilling program at Das Neves, where it has 10 drills working towards delineating an initial resource. The property comprises over 304 sq. km.

So far, the company has outlined an important discovery at Anitta, which has a strike length of at least 1.1 km, a width of around 20 metres, and is open along strike and at depth. Recently, Atlas reported that a drill hole at Anitta hit a 25.4-metre spodumene intersect with a high reading of 4.4% lithium oxide, which is one of the highest grades reported at a spodumene deposit in the Lithium Valley.

According to Atlas, drilling at Anitta has yielded multiple instances of fresh, high-grade spodumene intersections located near the surface, and amenable to open pit mining.

“The Das Neves project exhibits highgrade coarse-grain spodumene ore that should lend itself to simple processing. Brazil is quickly developing into an important and environmentally friendly lithium jurisdiction, and we are excited to support Atlas Lithium on its accelerated path to production,” commented LRC president and CEO Ernie Ortiz in a news release.

Atlas shares traded at US$29 at press time, valuing the company at US$202.8 million. TNM

Northern Dynasty says it is considering how to challenge the EPA’s ruling in court. The Army Engineers review could give it ammunition. It marks another zigzag in the project that began as a discovery in the late 1980s by what now is Teck Resources (TSX: TECK.A/ TECK.B; NYSE: TECK).

There have been a series of studies, permits, refusals and appeals for the project since Northern Dynasty took control in 2001. The company even appealed successfully against the EPA more than a decade ago. This year’s EPA ruling barred the project from depositing waste material within the local

watershed, effectively cancelling it. But if the tailings storage design is indeed sound, that could undermine the EPA’s stance.

“The EPA in its final determination specifically refers to the risk of tailings failure to justify its decision, despite the (environmental impact study) saying that this is not reasonably foreseeable,” Thiessen said. “This contradiction will need to be explained.”

However, President Joe Biden has called Bristol Bay, which is home to a US$2.2-billion-a-year salmon fishery, “no place for a mine.” His administration has blocked other mines, such as the Antofagasta (LSE: ANTO) Twin Metals project in Minnesota, despite the loud cry for more critical minerals projects to challenge Chinese dominance and promote the country’s transformation to green energy to fight climate change.

Pebble has measured and indicated resources of 6.5 billion tonnes grading 0.4% copper, 0.34 gram gold per tonne, 240 parts per million (ppm) molybdenum, 1.7 grams silver per tonne and 0.41 ppm rhenium, for 57 billion lb. of copper, 70.6 million oz. gold, 3.4 billion lb. molybdenum and 345 million oz. of silver.

Shares in Northern Dynasty gained 3.5% on the news to 30¢ each, within a 52-week range of 28¢ to 46¢, valuing the company at $158.6 million. TNM

Ioneer’s Rhyolite Ridge lithiumboron resource soars by 168%

NEVADA | Mine would quadruple lithium output in US

BY BLAIR MCBRIDE

BY BLAIR MCBRIDE

Aleap in the estimated resources at ioneer’s (NASDAQ: IONR; ASX: INR) Rhyolite Ridge lithium-boron project in Nevada means the site could eventually produce enough lithium to charge more than 50 million EVs. The company is eyeing first production in 2026.

An updated estimate, released on Apr. 26, puts global resources at the project’s South Basin deposit at 360.2 million tonnes at 1,750 parts per million (ppm) lithium and 6,850 ppm boron for about 3.4 million tonnes of lithium carbonate equivalent (LCE) and 14 million tonnes of boric acid equivalent (BAE). The resource includes 60 million tonnes of proven and probable reserves at 1,800 ppm lithium and 15,400 ppm boron, as outlined in a 2020 feasibility study.

That study pegged the global resource at Rhyolite at 146.5 million tonnes of LCE and 11.9 tonnes of BAE in a 3 sq. km area.

“We are extremely pleased with the significant increase in the South Basin Mineral Resource estimate,” said ioneer executive chairman James Calaway. “It highlights Rhyolite Ridge’s optionality and multi-generational scale potential to provide a secure, sustainable and reliable domestic source of lithium for the growing electric vehicle battery supply chain.”

About 80% of the updated resource is classified as measured and indicated. Inferred resources total 65.7 million tonnes for 630,000 tonnes LCE at 3,550 ppm and 1.8 million tonnes BAE at 14,600 ppm.

Cut-off grades of 1,090 ppm lithium and 5,000 ppm boron, remain unchanged.

The increased resource takes into account drilling and assays from all four stratigraphic layers underneath the lake-bed sedimentary rocks of the Cave Spring Formation in

Nevada. The 2020 resource analyzed just two layers. All four layers remain open to the north, south and east, with further potential for resource growth.

The Sydney, Australia-headquartered company expects that once the project is permitted and construction is complete, Rhyolite Ridge will quadruple current lithium chemical output in the U.S.

The project is currently in the final phase of permitting and ioneer anticipates starting construction in 2024 for a 2026 production start.

Rhyolite Ridge is located about 60 km southwest of Tonopah, in southwestern Nevada. It is the only known lithium-boron deposit in North America and one of only two known such deposits in the world.

Ioneer shares traded at A31¢ (28¢) at press time, giving the company a market cap of A$650.5 million. The stock has traded in a 52-week window of A26¢ and A74¢. TNM

GLOBAL MINING NEWS THE NORTHERN MINER / MAY 15 — 28, 2023 7

Exploration at Atlas Lithium’s Das Neves property in Brazil. ATLAS LITHIUM

Zigzags

A drill rig at Northern Dynasty Minerals’ Pebble project in southwest Alaska. NORTHERN DYNASTY MINERALS

The South Basin deposit at Ioneer’s Rhyolite Ridge project in Nevada. IONEER

Ivanhoe taps Glencore for US$250M to start world-beating Kipushi early

AFRICA | Highest grade zinc project to begin production in January

Glencore says takeover bid for Teck stands after spinoff fails

M&A | Swiss firm says it will take its offer to shareholders if board refuses to engage

BY COLIN MCCLELLAND

Ivanhoe Mines (TSX: IVN; USOTC: IVPAF) says it has signed off-take and financing agreements with Glencore (LSE: GLEN) to restart the world’s highest-grade zinc mine at Kipushi in the Democratic Republic of Congo (DRC) next year.

Glencore, the Switzerland-based miner and commodity trader, will take all of the mine’s zinc concentrate for five years and fund the operation with a US$250 million loan to be repaid by 2028, Ivanhoe said in a news release on Apr. 28. The mine, located near the Zambian border in DRC’s far southern Haut-Katanga province has US$380 million in capital costs remaining, it said.

“When Ivanhoe Mines acquired its interest in Kipushi almost 12 years ago, the mine was flooded and in a dilapidated state,” company executive co-chair Robert Friedland said in the release. “We are proud to see new, state-of-theart mining equipment, operated by our Congolese employees, underground for the first time in three decades.”

Kipushi, 68% owned by Ivanhoe and the rest held by stateowned Gécamines, plans to mine a world-leading 36% zinc over the first five years of production.

The site, which produced from 1925 to 1993, is expected to yield 10.8 million tonnes of ore at an average head grade of 31.9% zinc over a 14-year mine life, generating 3.3 million tonnes of zinc metal in concentrate, according to a feasibility study last year.

Andrew Mikitchook, a mining analyst for BMO Capital Markets, noted the agreements with Glencore matched previous statements from Ivanhoe and the project is ahead of schedule.

“Detailed engineering is complete and procurement is 79% complete with all medium- and long-lead items ordered,” Mikitchook said in a note on Apr. 28. “Underground mining is also ahead

of schedule, with first equipment deliveries achieved and horizontal development of 682 metres (30% above plan) in the first quarter.”

Mining the Big Zinc deposit is planned to start in January, followed by the first concentrate deliveries in the third quarter, Ivanhoe said. The concentrator is to process 800,000 tonnes of ore a year for 437,000 tonnes of zinc concentrate annually at an average grade of 55% zinc.

Operations so far have been funded by a US$661 million Kipushi shareholder loan. The company is also considering interim bank financing of up to US$80 million, it said.

Vancouver-based Ivanhoe is working with Haut-Katanga to develop a dedicated commercial border crossing into Zambia at Kipushi to avoid shipping costs and congestion at Kasumbalesa

and Sakania, 110 km and 230 km, respectively, by road to the southeast. A new portal would also help Ivanhoe’s Kamoa-Kakula copper mine about 350 km to the northwest and provincial capital Lubumbashi less than 20 km away.

“We will also endeavour, with our partner Gécamines, to continue exploring Kipushi, including copper-rich and silver-rich zones,” Ivanhoe President Marna Cloete said in the release. “Kipushi soon will join Kamoa-Kakula as another tier-one production asset in our portfolio, and mark the next step as we execute our plan to emerge as the world’s newest diversified major mining company.”

Ivanhoe shares traded at $11.79 at press time in Toronto, giving the company a market capitalization of $14.3 billion. Its stock has traded in a 52-week window of $6.41 and $13.05. TNM

BY CECILIA JAMASMIE

Glencore (LSE: GLEN) is far from giving up on its plan to take over Teck Resources (TSX: TECK.A/TECK.B; NYSE: TECK) as it confirmed on Apr. 27 that its bid for Canada’s largest diversified miner still stands.

The mining giant and commodities trader, which does not typically take “no” for an answer, implied that Teck’s decision to withdraw its proposal to split up into two companies backed its own plans.

The Vancouver-based miner scrapped its plan to split into two just ahead of a key shareholder vote on Apr. 26, as Glencore circled with a US$23-billion offer made in March and the promise of a sweeter one.

Teck, which could not convince the majority of its investors to back the plan to separate its copper and coal businesses, said its board will work on providing a “simpler and more direct separation plan.”

While chief executive Jonathan Price said that the company received “very strong support” from shareholders for the goal of separation, it also gathered feedback suggesting that a more direct approach to dividing up the business was preferred.

“In the interim, Teck is poised for value creation; we are ramping up our flagship QB2 copper project to full production, advancing our industry-leading pipeline of copper growth projects, and safely and responsibly optimizing production at our existing operations,” Price said.

The executive noted that Glen-

core’s rejected proposals remained a non-starter and said the board will work on providing a “simpler and more direct separation plan.”

The move is considered as a key win for Glencore, which had been campaigning to persuade Teck’s shareholders to vote against the split, and instead accept its unsolicited bid, which includes a US$8.2-billion cash sweetener.

Glencore has framed the failed vote as a mandate to begin talks on its offer, noting on May 4 that its own proposal provided Teck shareholders with a “clean separation” for its coal business, while also creating significant additional value for its shareholders.

Its offer would have given Teck’s shareholders who did not want to own shares in the combined coal operation the option to receive cash plus 24% of the combined metals-focused business.

The Swiss firm added that it was willing to engage with Teck’s board to improve its proposal structure, but would still make an offer directly to shareholders if there was no response.

Glencore, which plans to acquire Teck and then split itself into two companies — metals and coal — appealed to the Canadian public by saying that its own metals unit would have “significant critical minerals and recycling operations in Canada, managed from Canada.”

The country’s deputy prime minister, Chrystia Freeland, said on May 1 that Teck should remain headquartered in Canada, providing the clearest indication to date that the federal government was closely watching the takeover battle unfold. TNM

8 MAY 15 — 28, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

A conveyor belt carries ore at Ivanhoe Mines’ Kipushi zinc mine in the Democratic Republic of Congo. IVANHOE MINES

Teck’s Highland Valley Copper project in south-central British Columbia. TECK RESOURCES

Teck’s Elkview steelmaking coal operations in B.C. TECK RESOURCES

Ivanhoe Mines’ Kipushi zinc mine in the DRC. IVANHOE MINES

Aclara Resources says revamped EIA for rare earths project reduces impacts

CHILE | Feasibility for Penco Module slated for 2024

BY BLAIR MCBRIDE

Aclara Resources’ (TSX: ARA) Environmental Impact Assessment (EIA) submission for its Penco Module rare earths project has been admitted by the Chilean Environmental Assessment Service following a preliminary review, as the company targets a feasibility study for 2024.

The new assessment document makes several improvements on the previous filing that Aclara withdrew in March of last year after it was unable to satisfy requirements related to the environment and local flora and fauna, the company said in a release on Apr. 28.

“Today we feel proud, not only because we have addressed these technical aspects through a rigorous scientific investigation, but because the new EIA now includes world class environmental attributes that enhance the value proposition of the new project,” said Aclara CEO Ramón Barúa. “In doing so, we have strengthened our relationship with the host community by demonstrating that we want to co-develop the project, that we have listened to their concerns and that we are now presenting a new project that is stronger and better in all aspects.”

The Penco Module project hosts heavy rare earth elements in ionic clay deposits across a 6-sq.-km property located near the coastal city of Concepcion and about 500 km south of Santiago.

Aclara said that starting last April, it launched several studies aimed at assessing how the project can avoid adversely affecting the local environment, particularly the Queule and Pitao native tree species.

The new EIA includes plans to use only recycled water for all of Penco’s water needs; the revegetation of more than 2 sq. km of land with native species that will be donated to a Chilean foundation for the benefit of local communities, construction of a reproduction centre for the Pudu deer and a recreational park for the Penco community.

Aclara added that the project’s extraction process won’t involve the use of explosives, crushing or milling and a fertilizer will be used as its main reagent, which will also be recycled with 99% efficiency. Penco won’t require a tailings storage facility as no solid or liquid residues will be produced. The new assessment also includes details of a prefeasibility engineering study of Penco.

Construction and production at Penco would create more than 2,000 direct and indirect jobs, Aclara says, with priority on hiring workers from the local region.

The Chile-based company expects the new EIA will be subject to an evaluation period of about 18 months.

Pensana taps major UK investor to fund rare earths project in Angola

RARE EARTHS | M&G backs electric vehicle metals refinery in UK

BY COLIN MCCLELLAND

London-based Pensana (LSE: PRE) is being backed by one of the United Kingdom’s largest asset managers and the Angolan sovereign wealth fund to build a rare earths refinery in England and a mine in the African country.

M&G Investment Management, which has £342 billion ($583 billion) under management, and the roughly US$3 billion Angolan fund (FSDEA) are investing a further US$10 million to increase their respective stakes in Pensana to 13% and 23%, the company said in a news release on April 29.

In March, Aclara said it had awarded a contract for the feasibility study to Chilean engineering firm Pares & Alvarez. The study is due out in the first half of 2024.

Aclara expects to begin construction of the plant in the second half of 2024.

Last October, the company posted an updated resource estimate for Penco, following its preliminary economic assessment (PEA) in 2021.

The PEA estimates initial and sustaining costs at Penco of US$148 million and operating costs of US$23.6 million over a 12-year mine life. Using a price assumption of US$96 per kg of rare earth oxide (REO), Penco’s after-tax net present value would be US$78 million based on a 5% discount rate, and its internal rate of return 23%, with a post-tax payback period of 4.7 years.

In terms of production, the PEA gives a base case of about 774 tonnes of REO per year, with peak production of 1,156 tonnes of REO in the third year, for 8,901 tonnes over the mine life.

Average EBITDA over the mine life is estimated at US$539 million.