SOUTHWEST US

Engaging in the global critical minerals market means fac ing up to the huge challenge presented by China, says Neo Per formance Materials’ (TSX: NEO) CEO and president Constantine Karayannopoulos.

Speaking during an exclusive Q&A session at the Critical Minerals Summit 2022, held at the National Club in downtown Toronto on Nov. 9, Karayannopoulos outlined the task ahead for Western countries and companies.

“We should do a session just on that alone,” the CEO told moder ator and summit organizer Tracy Weslosky, who is also the CEO of InvestorIntel.

China poorly understood While the CEO said that Neo has four plants, including two rare earth refineries in China, many West erners have failed to understand the how and why of the east Asian country’s industrial development.

“For the last 20 years there has been a very rational, deliberate industrial strategy that would have been very easy to predict today if you had been following how each successive five-year plan plays into that industrial strategy,” he said.

“They’re absolutely determined to dominate the electric vehicle market [and] 34% of all EVs are made and sold in China…in order to achieve that they need raw mate rial security.”

For China to achieve its decar bonization and electrification tar gets will require trillions of dollars of investment, as it will for the rest of the world, Karayannopoulos explained.

“That’s mind boggling. There’s a massive task ahead of us and I don’t think governments around the world really appreciate how complex this is. I consider myself an environmentalist. [But] you can’t have your cake and eat it too. If you want to decarbonize…we need more factories to take what ever comes out of the mines and make them into the products that will allow us to decarbonize.”

But such enormous industrial development in the West will have to be done by skilled profession als, and Weslosky asked Karayan nopoulos where they would come from.

“It has taken two decades for the supply chains to migrate from North America to Asia,” he said. “It will take at least as long for them to come back. And it starts with edu cation. China graduates more engi neers than in North America we’re graduating graduates!”

Diversify supply, but wisely

The Neo president also touched on where critical minerals might be mined in the coming years, and gave the example of his company’s efforts to source rare earths from Greenland.

In August, it announced it had secured a licence from Hudson Resources (TSXV: HUD) for its Sarfartoq Carbonatite Complex to explore for neodymium and pra seodymium at relatively high ratios of 25%-40% total rare earth oxides, according to a 2011 preliminary economic assessment.

He acknowledged that the largely undeveloped country guards its resources closely, and permits no oil and gas development and no uranium mining.

But he added that Neo took the time to consult properly with the Greenlandic government.

“We really need to understand the lay of the land, to make sure that you’ve done all the right things. Don’t walk into people’s geography and expect to be in business just like that,” he said.

Karayannopoulos spoke at the summit just hours after it was announced that his company was awarded a grant of up to €18.7 mil lion ($25.3 million) from the Esto

nian government under Europe’s Just Transition Fund for its rare earth permanent magnet manu facturing plant in the Baltic state. It was reportedly the first ever grant given out to a critical minerals company in the European Union.

Both that facility and its Green land project are part of the Toron to-based company’s aim to diversify rare earth sources and expand sup ply chains.

Karayannopoulos’ talk was among several presentations and panel discussions held at the sum mit where the subject of China was prominent.

Beijing’s top-down advantage

Of the many ways by which China has climbed to the top of the crit ical minerals market, its political system — unburdened by electoral mandates — is a major factor.

“[China] has a longer term out look than we do in the U.S. and we teeter totter more than China because of the political structure,” said Jacob Koelsch, a research asso ciate at government relations firm J.A. Green, on a panel about gov ernment investment in critical minerals.

“We can’t match their continu ity of planning and development,” he said.

And China’s massive criti cal minerals development can be organized through longer plan ning periods than in democratic countries, explained Alastair Neill, director of the Critical Minerals

At the most recent Mining Legends Speaker Series event at the Fairmont Pacific Rim in Vancouver, guest speaker Andrée St-Germain, CFO of Integra Resources (TSXV: ITR; NYSE-AM: ITRG) and the 2018 recipient of the Young Mining Professionals’ Eira Thomas Award, spoke candidly about her career pivot from investment banking into mining and why it was the ‘scariest decision’ of her life.

Organized by The Northern Miner, the Canadian Mining Hall of Fame and Young Mining Professionals, the Mining Leg ends Speaker Series pairs CMHF inductees (in this case Bob Quar termain) with accomplished young talent and gives the audi ence a chance to ask questions to bridge the knowledge gap in the industry and discuss the oppor tunities and challenges inherent to the future of mining.

St-Germain holds an MBA in Finance from York University and began her career in invest ment banking at Dundee Capi tal markets, working with mining companies on M&A advisory and financing. In 2013 she joined Golden Queen Mining as CFO, and then moved to Integra Gold as CFO in early 2017 and helped oversee its sale to Eldorado Gold that same year for $590 million. She is also a director of Osisko Metals (TSXV: OM) and an advi sor at Wyloo Metals, which took over Ontario-focused Noront

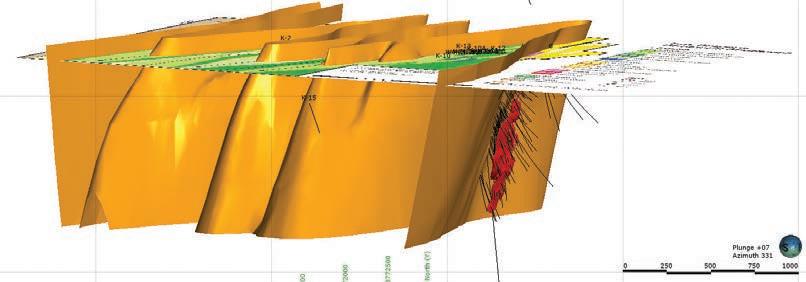

Metal Energy Corp. (TSXV: MERG; US-OTC: MEEEF) a Toronto-based battery metal exploration company, is actively expanding high-grade nickel sulphide mineralization at the pastproducing Manibridge mine in the world-class Thompson Nickel Belt of northern Manitoba.

The company is expecting to complete a 10,000-metre diamond drill program in December at Manibridge, a former Falconbridge operation that produced 1.3 million tonnes at 2.55% nickel and 0.27% copper from 1971 to 1977.

Metal Energy completed its first drill program on the project last winter. Highlights include hole No. 4, which intercepted 0.92% nickel over 33 metres starting at a depth of 150.5 metres, including 1.24% nickel over 11.5 metres. Hole No. 3 cut 0.81% nickel over 13.5 metres starting at 337.5 metres; and hole No. 6 yielded 1.13% nickel over 9 metres starting at 700 metres, including 1.62% nickel over 5 metres.

Pleased with the winter results, the company completed 5,331 metres of drilling in 19 holes this summer from June to July. Sixteen holes reached bedrock, each intersecting nickel-copper-cobalt sulphide mineralization verified by X-ray fluorescence. Sulphide-rich zones range from 1 metre to 55 metres thick, the company says, with an average thickness exceeding 15 metres at depths between 150 metres and 300 metres. The zones may be amenable to open pit mining, said James Sykes, CEO of Metal Energy. All of these assay results are pending.

“Combined with the six drill holes from our winter program, we have a 100% nickel-sulphide intersection success rate in all of our completed drill holes at Manibridge,” he said. “We’ve drilled wide and tight-spaced holes across a kilometre strike length as deep as 700 metres. Mineralization is robust and open in all directions, especially at depth beyond the current scope of drilling, which has identified structurally-controlled highgrade mineralization potential.”

The company benefits from extensive exploration data at Manibridge, in addition to its mining history. The mine, 32 km southwest of the community of Wabowden, last operated in the 1990s in a lower nickel price environment, said Sykes, adding the company is one to two years from having calculated resources.

“The logistics are all here,” he said. “It has easy access. We didn’t have to prep the ground for anything. We can drive up right to where we want to go and that’s exactly where we are drilling. It’s been super simplistic that way.”

The company’s recent option agreement with Mistango River Resources (CSE: MIS) provides a unique opportunity to continue exploration with minimal dilution, greater insider ownership aligning with shareholders, and capital preservation, said Sykes.

Mistango can spend $1.5 million to earn 15% of the 43.7-sq.-km Manibridge project. Metal Energy holds a 70% interest, while CanAlaska Uranium (TSXV: CVV) holds the remaining share. The company can buy back the Mistango interest for $2.25 million with a 2024 deadline.

“We are excited to renew our Phase 2 drill program and complete the remaining 4,669 metres as we progress southwest along this fertile

Of the holes drilled to date, surface coordinates were within 300 metres to 600 metres of the Manibridge mine, said Sykes. The remaining holes are moving to within 150 metres to 300 metres of the workings to depths between 225 metres to 400 metres.

“Really, having the drill density from historic drill holes hasn’t provided us with too much information because they didn’t sample as much,” he said. “We sample more than they used to, and we’re showing there are more nickel sulphides in the ground than were originally recognized.”

Despite a lack of geochemical data in some cases, historic drilling is guiding exploration at Manibridge, said Sykes. Historic intercepts include 8.7 metres of 4.5% nickel at a depth of 203 metres, 24.08 metres of 2.93 % nickel at 186 metres, and 16.77 metres of 2.67% nickel at 245 metres. The company has also stepped out and drilled sulphide intercepts in areas with no previous drilling.

“This is following a particular trend

that goes for at least three kilometres, and everywhere along this trend is continuously mineralized,” said Sykes. “To the northeast of the trend, near the end of the three kilometres, is another high-grade nickel discovery that occurs near surface.”

Previous operator drill results have returned intercepts upwards of 12% nickel, he added. “It’s a zone that remains quite open and we’re putting more effort into understanding the geology of this area.”

Geology at Manibridge is a metamorphosed ultramafic package, said Sykes. Sulphide deposits are stratiform or controlled by folds and shear systems.

“It’s predominantly nickel,” he said. “There’s a little bit of copper. It’s enriched in chromium of all things. So, that tells me it’s a very hot system with more primordial metal elements. It’s highly enriched in magnesium. As we drill, we drill through into this magnesium-rich ultramafic package that includes a considerable number of nickel-sulphide zones. A lot of these new discoveries are outside of what was previously defined.”

Sykes wants to find ore clusters and substantial grades over substantial widths.

“That’s always objective number one,” he said. “Any sniff of higher grades requires more attention because they may be offshoots of something much larger. Number two, we stick to the geology because we know it’s tried, tested, and proven.”

Exploration in northern Manitoba, a region replete with overburden, means relying on geophysics and diamond drilling, said Sykes, although geophysics doesn’t answer every question.

“We are progressing towards the old mine workings, and the idea behind that is hopefully the mineralization gets better as we go that way,” he said. “But as we head in that direction, we learn more about the structural controls of the system. We do think there is a depth component to this whole system — plunging downwards that nobody has ever explored.”

Using tighter drill-hole spacing means Metal Energy may be able to build tonnage while at the same time exploring for high-grade zones connected to the Manibridge mine, said Sykes.

Northern Manitoba is a minefriendly jurisdiction with excellent infrastructure and an experienced workforce, said Sykes, adding the government of Manitoba supports exploration and development.

“They have accommodated some of our requests, and they’ve also been very strict and thorough too,” he said. “They have travelled out and completed site visits. It’s not like they’re just rubber-stamping things.”

The Thompson Nickel Belt hosts multiple nickel deposits with estimated production of 5 billion lb. of nickel since the early ‘60s, said Sykes.

Regional exploration began in 1946 with a 10-year geophysical

and geological exploration program culminating in the discovery of the Thompson deposit in 1956 by Inco, according to the Manitoba Geological Survey.

A historical resource for Vale’s mining operations in the Thompson region is listed by the Manitoba Geological Survey as 150 million tonnes grading 2.32% nickel and 0.16% copper. Total reserves for the Thompson operation as of 2017 were 27.5 million tonnes at 1.75% nickel.

“The Thompson Nickel Belt is still vastly underexplored,” said Sykes.

“In the right nickel price environment, the region has a heck of a lot of potential. The demand for nickel is at all time world highs. So, we need to incentivize lower-scale operations where grades of approximately 1% nickel or higher are lucrative and economic. That opens up the Thompson Nickel Belt dramatically.”

In November, Metal Energy began trading on the OTCQB Venture market with the symbol MEEEF in the United States, in addition to its TSX Venture Exchange listing.

“It was a big day for the company, expanding our investor outreach and developing a broader shareholder base within the United States,” said Sykes in a November news release.

Demand for Nickel and other battery metals should remain strong due to growing demand for electric vehicles and renewable energy storage technology, said Sykes.

“We continue advancing our flagship Manibridge project as we believe it has the size and scope to be recognized by the American investment community during this commodity supercycle,” he added.

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Metal Energy Corp. and produced in co-operation with The Northern Miner. Visit www.metalenergy.ca for more information.

GLOBAL

www.northernminer.com

There’s got to be a sense of schadenfreude in some circles of the mining business watching the implosion of FTX this month.

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Alisha Hiyate, BA (Poli Sci, Hist) ahiyate@northernminer.com

MULTIMEDIA SPECIALIST: Henry Lazenby hlazenby@northernminer.com

STAFF WRITER: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PHOTO EDITOR AND PODCAST HOST: Adrian Pocobelli, MA (ENGL) apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/

CAREER ADS George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 moliveira@northernminer.com

ADDRESS: Toronto Head Office 225 Duncan Mill Road, Suite 320 Toronto, ON, M3B 3K9 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES: Canada: C$130.00 one year; 5% G.S.T. to CDN orders. 7% P.S.T. to BC orders 13% H.S.T. to ON, NL orders 14% H.S.T. to PEI orders 15% H.S.T. to NB, NS orders U.S.A.: C$172.00 one year Foreign: C$222.00 one year GST Registration # 809744071RT001 (ISSN 0029-3164)

CANADA POST: Return undeliverable Canadian addresses to Circulation Dept. c/o The Northern Miner 225 Duncan Mill Road, Suite 320 Toronto, ON M3B 3K9 Publication Mail Agreement #40069240 Periodicals Postage Rates paid at Niagara Falls, NY, 14304. U.S. office of publication 2424 Niagara Falls Blvd, Niagara Falls, N.Y.

COLUMN

BY DR CHRIS HINDE Special to The Northern Miner

Somehow, cryptocurrencies have competed with the mining sector as both a speculative investment — squeezing out speculative money that might oth erwise be directed to junior miners — and as a store of wealth and inflation hedge, competing with pre cious metals.

BY ALISHA HIYATEWhile some have called crypto “digital gold,” the limits of that analogy became clear this month.

The first two weeks of November saw the sudden and dramatic collapse of the cryptocurrency exchange only five years after it was founded by 30-year-old wunderkind Sam Bankman-Fried.

Concerns about FTX’s balance sheet were first raised in early Novem ber. Those concerns were validated when a competitor, Binance, came in to buy the company, then cancelled the deal.

“As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investiga tions, we have decided that we will not pursue the potential acquisition of FTX.com,” Binance said on Nov. 9.

Investors pulled their money out and regulators in the Bahamas — where FTX and Bankman-Fried are based — moved to freeze the compa ny’s assets.

FTX, which was worth US$32 billion in February, filed for bankruptcy protection on Nov. 11. Reports have emerged that FTX transferred at least US$1 billion in clients’ funds (without their knowledge and through a “back door” software program to keep the manoeuvre on the down low) to Alameda Research, a company controlled by Bankman-Fried.

In response to the FTX scandal, total market cap in the crypto sector declined by 11.3% in the first 24 hours to $848 billion, according to Canac cord. Bitcoin, which peaked at US$68,000 in November 2021, was already having a terrible year before the FTX news, dipping below US$19,000 in late September. At press time it was at about US$16,000.

While exactly just what happened with FTX is still being investigated and no charges have yet been laid, analysts at Canaccord Genuity described it in a Nov. 10 report as the “digital currency equivalent of a run on a bank.”

It’s also reminiscent of the biggest black eye to date in mining – the Bre-X Minerals fraud of the 1990s.

While Bre-X was just one company, investors worldwide lost some $3 billion in the scam. It also destroyed confidence in the mining sector and led both regulators and the industry to cooperate on creating new stan dards to protect investors.

The crypto space is subject to fraud and theft: the U.S. Federal Trade Commission estimates that U.S. investors lost US$1B in crypto scams last year.

It’s safe to say that the FTX fiasco is likely to bring more regulation –finally — to the crypto space.

‘Hands-off’

Before its fall, FTX was considered a leading exchange in the crypto indus try — and above-board enough to attract risk-averse funds such as the Ontario Teachers Pension Plan, which has now written off its $95 million investment in FTX. (Notably, in August, Caisse de depot et placement du Quebec wrote off a US$150-million investment in Celsius Network — a cryptocurrency lending company that filed for bankruptcy protection in July.)

In a Nov. 17 video titled “Cryptos are not precious — gold and silver are,” Jeffrey Christian, managing director of New York-based commodi ties research and consulting firm CMP Group, predicted further trouble for crypto investors.

“Private cryptocurrencies are likely to disappear, and they’re going to likely disappear in ugly fashion that’s going to cost investors a lot of money,” he said.

Christian noted that regulators have mostly taken a “hands-off” approach to crypto since it first emerged in 2009.

While they believed there would be big losses in this unregulated mar ket, they didn’t want to be the catalyst for such a collapse by stepping in to regulate.

However, that’s starting to change now with fears of financial contagion becoming a real concern as the crypto market has grown to around US$3 trillion from US$500 billion over the past few years.

In the meantime, Christian predicts that the FTX mess could spark a bit of a revival for precious metals, which have mostly languished this year as central banks continue to jack up interest rates.

“In the long run, our view is that cryptocurrencies will implode — there’ll be bigger issues, there’ll be more thefts… Larger investors will lose more money and that will refocus investors’ attention on the values of owning some gold and silver – real tangible assets that are the antithesis of cryptocurrencies.” TNM

One-hundred years ago a five-year search culminat ed in arguably the world’s greatest ever exploration suc cess. No, not a mineral deposit (although lots of gold was found), rather the almost intact tomb of an Egyptian pharaoh.

The ancient burial site in the Valley of the Kings outside Luxor (formerly Thebes) had been widely assumed to be fully explored, and it was only the persistence of a 48-year-old British archaeologist, Howard Carter (1874-1939), that exposed the entrance to the val ley’s 62nd royal tomb.

The burial site was, of course, that of Tutankhamun (1341-1323 BC). Although the first step lead ing to his tomb’s entrance portal was found on Nov. 4, the outer door was only breached 20 days later (awaiting the arrival from Great Britain of the explora tion sponsor Lord Carnarvon). Famously, after a further two days, Carter made a small hole in the inner, tomb door (on Nov. 26, 1922) and, on being asked what he saw, said “wonderful things.”

These wonderful things were fashioned from local gold, with Egypt being a major producer of precious metals for over 2,000 years. In addition to vast mineral resources in the Eastern Desert, the pharaohs had access to the riches of Nubia (a region stretching south from Aswan in Egypt to the conflu ence of the Blue and White Niles at Khartoum in Sudan).

Gold mining (initially from alluvial deposits) on these Pre cambrian rocks of the Arabi an-Nubian shield dates back to almost 2500 BC, and some 250 ancient gold mines have been identified (including sites at Abu Marawat, Abu Zawal, Barramiya, Sir Bakis and Wadi Hammamat in the Eastern Desert). Current gold mines in the area include the Sukari open-pit operation.

The 100th anniversary of the discovery of Tutankhamun’s tomb reminds us of the need in explora tion for finance, expertise and per severance, and of the significant rewards for success.

The need for success in min eral exploration was high lighted recently by analysis from S&P Global Market Intelligence (SPGMI), as reported in The North ern Miner. The report, ‘The Big Pic ture: Metals and Mining, notes that global efforts to decarbonize are driving the rollout of metals-inten sive technologies, bringing about near-term challenges in the com

modities sector. SPGMI analysts say that increasing consumption will “outstrip the mining industry’s ability to ramp up supply, result ing in commodity deficits as early as 2024.”

SPGMI also expects deteriorat ing global macroeconomic con ditions to persist into early 2023, representing a downside risk to the metals and mining sector. Producers will be hit by “narrow ing margins,” while “exploration activity next year will slow amid tighter financing conditions.”

While SPGMI sees a bumpy road ahead, the International Energy Agency reports that to meet the goals of the Paris Agreement, sectors contributing to the green energy transition will be responsi ble for over 45% of the total copper demand, 61% of the nickel demand, 69% of the cobalt demand, and a staggering 92% of lithium demand by 2040. This dramatic increase in consumption poses a massive chal lenge for miners. Although explo ration expenditure is expected to decline next year, SPGMI has reported that commercial explora tion budgets for non-ferrous met als are 16% higher this year than in 2021, at US$13 billion. This is based on SPGMI’s survey of 2,200 companies with a published explo ration budget of over US$100,000 and follows a 35% exploration hike last year.

Gold accounts for over 53% of this year’s exploration spending, with copper accounting for nearly 22%. Regionally, Canada (21%), Australia (18%) and the U.S. (12%) account for the lion’s share, with Latin America attracting 25% and Africa only 10%.

The total is still well short of the almost US$21 billion spent on exploration in 2012, and there are 300 fewer companies with significant exploration bud gets. Worryingly, the industry is also increasingly risk averse, with grassroots exploration account ing for only 25% of the total, com pared with a 50% share at the turn of the millennium. In contrast, the spending proportion for mine site exploration remains near an alltime high of 38%, compared with a share of barely 20% only 22 years ago.

Carter’s search was focussed on a single brownfield site, but the Pharaohs explored across the Arabian-Nubian shield. Modern explorers could do worse than emulate their ancient efforts. TNM

—Dr. Chris Hinde is a mining engineer and the director of Pick and Pen Ltd., a U.K.-based consulting firm. He previously worked for S&P Global Market Intelligence’s Metals and Mining division.

| Exploration lessons from the pharaohs

Canadian battery mineral miners and explorers are sniffing around hundreds of millions of dollars in potential funding from the United States military, but there are no firm deals yet to take advantage of an alliance dating back to the Second World War.

The concept of the U.S. funding projects in Canada to help side step China’s control over lithium and rare earth element (REE) pro cessing broke into the open this month at a conference in Wash ington, D.C. However, some com panies say they’ve been aware of the initiative for years.

“Canada is a resource-based economy, whereas the U.S. is a manufacturing-based economy,” Christopher Grove, president of Commerce Resources (TSXV: CCE), which operates the Ashram REE project in northern Quebec, said by email. “This should be a perfect marriage.”

There appears to be a new urgency under the Biden admin istration as it says it faces loom ing national security threats from China due to the geopolitical lever age Beijing has in its control of most global critical minerals mar kets. Those minerals are needed for green energy and the wider econ omy. In March, the administration used the 1950 Defense Produc tion Act (DPA) Title III to give the Department of Defense increased powers to help miners and explor ers secure supplies of battery min erals such as lithium, nickel, cobalt, graphite and manganese. They’re also seeking REEs used in much modern technology, from weap ons to mobile phones.

The DPA has US$750 million to fund projects after measures approved in a law passed in August for tax breaks on electric vehi cles made in North America, and from a provision in a Ukraine aid package in May, Lieutenant-Com mander Tim Gorman, a spokes man for the Secretary of Defense, said in an email on Nov. 16.

The Ukraine assistance ties into the concerns about Russian control over resources like natu ral gas supplies for Europe, and how China supplies up to 80% of critical metals to the global mar ket, according to analysts’ esti mates. They forecast the demand for critical minerals needed for the global transition to clean energy will expand massively. The cost is

measured in trillions of dollars.

Canada’s federal Natural Resources ministry gave the DPA a list of 70 projects in Canada that might be suitable for fund ing. Ontario added several projects to the list, including Ring of Fire Metals’ (TSXV: ROF) Eagle’s Nest project, located 540 km northeast of Thunder Bay, a spokesperson for the provincial mines ministry said.

Luca Giacovazzi, chief execu tive officer of Ring of Fire parent Wyloo Metals, says it has had ini tial talks with the U.S. Department of Defense, but not about dollar amounts.

Eagle’s Nest is the “best undevel oped high-grade nickel project in Canada,” Giacovazzi said by email.

“We’re already studying options to build Ontario’s only battery nickel sulphate plant,” Giacovazzi said. “Our chrome projects are also very interesting as the only source in the Western Hemisphere that’s large scale and very high quality.”

Still, Canadian resources in bat tery and critical minerals are low by global comparisons. Canada has less than 3% of world cobalt reserves while the Democratic Republic of the Congo has nearly half; Canada has 2.5% of man ganese reserves compared with South Africa’s 43%, according to the U.S. Geological Survey.

Commerce Resources applied for funding under the DPA Title III program a few years ago, but has “seen little so far stemming from it of any substance,” Grove said.

The DPA hasn’t awarded any funds yet, but could fast-track some projects to decisions in a month if they meet an “urgent and compelling need” after filing a detailed submission, Lt.-Cmdr. Gorman said. Unfortunately, only 1% of filings so far come close to meeting criteria, he said.

The criteria concern how the project expands the industrial base and output of critical mate rials for emerging technologies and national defence; a techni cal description of the proposed work; bios of key personnel; and rough cost estimates, Gor man said. The program may ask some companies to submit tech nical and cost reports in a process that takes six to nine months for approval, he said.

Ottawa took steps this month to protect its critical minerals indus try from Chinese control, barring foreign companies from investing

in three Canadian projects. They involve lithium, cesium and tan talum.

Canada announced a nearly $3.8-billion critical minerals strat egy in April to develop the indus try. In June, the U.S. and Canada joined with other major Western economies in a Minerals Security Partnership to catalyze industry investment.

But cross-border funding of mining projects in Canada stretch es back decades to defence coop eration agreements during World War II. They helped develop Que bec’s aluminum industry and com panies such as Alcan.

After the war, the U.S. deemed Canada and other Western allies such as the United Kingdom and Australia as part of its National Technology and Industrial Base for defence and commercial indus try development. The designation opens projects in those countries to funding from the U.S. Depart ment of Defense.

Matthew Zolnowski, a portfo lio manager for DPA, told a Nov. 10 conference in Washington the current program is in its early stages but that it’s engaging Cana dian companies.

Commerce’s Grove says he’s known Zolnowski for a decade and been aware of the DPA pro gram for years.

“This specific initiative has had a lot of life breathed into it by the current administration,” Grove said. “We are very familiar with the process to apply for this capital.”

A spokesperson for Natu ral Resources Canada said staff couldn’t immediately reply to requests for comment.

The Ontario projects on the Natural Resources list to the U.S. are Rock Tech Lithium’s (TSXV: RCK) Georgia Lake, Ava lon Advanced Materials’ (TSX: AVL) Separation Rapids, Fron tier Lithium’s (TSXV: FL) PAK, Zentek’s (TSXV: ZEN; NASDAQ: ZTEK) Albany, Northern Graph ite’s (TSXV: NGC) Bissett Creek, Canada Nickel’s (TSXV: CNC) Crawford and Electra Battery Materials’ (TSXV: ELBM) First Cobalt refinery.

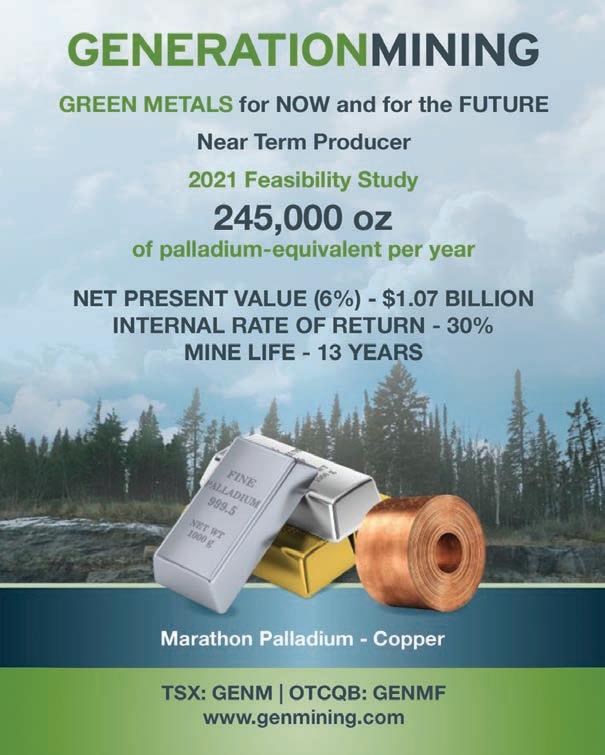

Ontario added Wyloo’s Eagles Nest, Generation Mining’s (TSX: GENM) Marathon, Clean Air Metals’ (TSXV: AIR) Thunder Bay North, Magna Mining’s (TSXV: NICU) Shakespeare, KGHM Inter national’s Victoria, and Green Technology Metals’ (ASX: GT1) Seymour. TNM

QUEBEC | Junior has completed nearly 40,000 metres of drilling in 2022 at past-producer

BY COLIN MCCLELLANDDoré Copper Mining (TSXV: DCMC; US-OTC: DRCMF) has finished drilling almost 40,000 metres this year at its Corner Bay copper project in Quebec, work that will help it expand the resource as it aims to complete a feasibility study in 2024.

The Corner Bay project is located about 500 km northwest of Quebec City.

Drilling highlights from the last dozen holes included 5.1 metres of 5.68% copper, 0.32 gram gold and 18.3 grams silver per tonne, and 510 parts per million molybde num in drill hole CB-22-86; and 2.6 metres of 3.69% copper, 10.3 grams silver per tonne and 414 parts per million molybdenum in drill hole CB-22-83.

“The results confirm the conti nuity of the copper mineralization in the deposit,” Ernest Mast, Doré Copper president and chief exec utive officer, said in the release. “We have also identified a num ber of holes from 2004 with highgrade copper mineralization in the upper portion of the deposit that were not incorporated in the min eral resource.”

The company intends to continue infill drilling at the site in 2023 fol lowing exploration drilling at the nearby Doré Ramp and Joe Mann projects, Mast said. There is also about 2,000 metres in infill drilling planned at the Devlin project in next year’s first quarter. Completing the feasibility study in 2024 depends on improved market conditions and additional funding, he said.

Doré wants to be Quebec’s next copper producer. Prices were at record highs earlier this year, but demand for copper is expected to be sustained for years during the global transition to green energy to fight climate change.

After reviewing drilling required for the feasibility study, Doré iden tified nine holes from 2004 that were excluded from the current mineral resource estimate. All holes intersected copper mineralization at a shallow depth in the two sub parallel veins above the dyke, the company said.

Significant high-grade inter cepts from those holes included 7.1 metres grading 10.09% copper and 0.61 gram gold per tonne in hole CB-04-13; and 13 metres grading 3.23% copper and 0.38 gram gold per tonne in hole CB-04-15.

The company envisions the Cor ner Bay project as a hub-and-spoke operation, with Corner Bay as the main feed for Doré’s centralized Copper Rand mill, supplemented by the Devlin and Joe Mann deposits.

Corner Bay, located on the south flank of the Lac Doré Com plex, was discovered in the early 1980s. A ramp running 115 metres underground was built in 2008 by Campbell Resources, but there was no production besides a devel opment sample of 36,000 tonnes. Doré began drilling in 2017 and has expanded the deposit along strike and down plunge, it said.

The site holds an indicated resource of 2.7 million tonnes grad ing 2.66% copper and 0.26 gram gold per tonne for contained metal of 157 million lb. copper and 22,000 oz. gold, according to a preliminary economic assessment released in May.

The inferred resource from the same study showed 5.9 million tonnes grading 3.43% copper and 0.27 gram gold per tonne for con tained metal of 443 million lb. cop per and 51,000 oz. gold, based on a cut-off grade of 1.3% copper and a copper price of US$3.75 per pound.

While the drilling results con firm continuity of copper mineral ization for the site’s Main Vein that straddles a dyke, they also defined the presence and continuity of a second vein located 50 metres east of the Main Vein above the dyke, the company said in a news release on Nov. 22. Mineralization in this area appears to be parallel and con trolled by mafic dykes, interpreted as originating from the Chibou gamau Pluton, Doré said. The Cor ner Bay camp is about 40 km by road from Chibougamau, Que.

Second vein intercepts included 2 metres grading 3.34% copper, 0.56 gram gold and 15.6 grams sil ver per tonne in hole CB-21-53; and 0.6 metre grading 0.9% copper in hole CB-21-58.

TNM

RESHORING

Cross-border funding of mining projects dates back to Second World WarCommerce Resources’ Ashram rare earths exploration camp in northern Quebec. COMMERCE RESOURCES

Increasing consumption will out strip the mining industry’s ability to ramp up supply, resulting in commodity deficits as early as 2024, a new analysis by S&P Global has found.

The report, ‘The big picture: Metals and Mining,’ says that global efforts to decarbonize are driving the rollout of metals-inten sive technologies, bringing about near-term challenges in the com modities sector.

On the battery metals side, gov ernment incentives and policy mandates will boost sales of pas senger plug-in electric vehicles by a 28.1% CAGR (compound annual growth rate) from 2021 through 2026. Battery component supply pipelines will struggle to keep up with such a sharp rise in demand.

“Our assessment of develop ing lithium assets foretells healthy growth in 2023, but a failure to meet demand expectations as early as 2024,” Mark Ferguson, S&P direc tor, wrote in the report released on Nov. 9.

According to Ferguson, cobalt faces similar challenges. Although output is forecast to rise into 2024, mainly from the Democratic Republic of the Congo, the metal is forecast to slip into a deficit start ing in 2025. Similarly, the antici pated growth in Indonesian pri mary nickel supply into 2025 will postpone a deficit until 2026, when battery-related demand for nickel is forecast to hit 17.6% of all nickel demand — up from 7.1% in 2021.

S&P expects deteriorating global macroeconomic conditions to per sist into early 2023, representing a downside risk to the metals and mining sector as many commod ity prices slide and equity markets weaken. Producers will be hit by narrowing margins, while explora tion activity will slow amid tighter financing conditions.

As the year progresses, analysts expect improving conditions once central banks gain the upper hand on inflation.

According to S&P, lower activ ity levels in the second half of 2022 and through 2023 will reinforce the metals and mining industry’s importance in the global energy transition.

Supply constraints across com modities deemed critical to the

effort are forecast to emerge as early as 2024, with demand expanding markedly on rising EV sales, the shift towards renewable energy technologies, and related transmis sion and distribution requirements.

As government policies increas ingly focus on meeting critical mate rials requirements through domes tic and regional supply chains, the mining sector should see additional support for developing projects in the near-to-medium term. Prices are expected to remain relatively high through 2026 compared with pre-pandemic levels.

Near-term headwinds

Macroeconomic events have dom inated commodities markets for most of 2022. With the increasing threat of a global recession, they

Endeavour Mining (TSX: EDV; LSE: EDV) said on Nov. 21 it had made a major greenfield gold discovery in Côte d’Ivoire, which has the poten tial to become a new flagship asset for the company.

The miner, which has several gold operations and projects in West Africa, has outlined a hefty initial resource at the Assafou target on its 100%-owned Tanda-Iguela property.

Indicated resources for Assafou sit at 14.9 million tonnes, at 2.33 grams gold per tonne for 1.1 million ounces. A further 32.9 million inferred tonnes grad ing 1.8 grams gold for 1.9 million oz. of gold.

“It ranks as one of the most significant discoveries made in West Africa over the last decade and shows potential to be another flagship asset for the com pany,” chief executive Sébastien de Montessus said in

a news release.

The site has a low discovery cost of less than US$10 for every indicated ounce of gold discovered and pre liminary tests show high gold recovery rates exceed ing 95%, he noted.

The company said the new discovery and explo ration success across its portfolio helps it to stay on track to achieve a discovering target of between 15 to 20 million oz. for the five-year period ending in 2025.

The announcement comes only a month after it announced the beginning of construction at its 2.7-mil lion-oz. Lafigué project, also in Côte d’Ivoire.

Endeavour has a large footprint in Burkina Faso, where it has been subject to a number of terrorist attacks in the past three years.

This year, the company expects to churn out between 1.3 million and 1.4 million oz. of gold at all-in sustaining costs of US$880 to US$930 per ounce.

are likely to weigh on fundamentals again in 2023, says associate analyst Aude Marjolin in the report.

In addition to the challenges of multi decade-high inflation driven by supply chain issues arising from the Covid-19 pandemic, the major economies have been grappling with other concerns that are not expected to ease into 2023.

Electric vehicle production has recently been one of the affected industries, tempering demand for battery metals such as nickel, cobalt and lithium despite the global push for electrification of the mobility sector.

“Governments have nevertheless been deploying efforts to secure local supply chains for these crit ical materials through legislation, although the resulting supply and demand trends will not materi alize in the short term,” Marjolin notes. “Instead, macroeconomic headwinds from energy inflation, raw material costs and parts short ages are expected to impact auto production and battery metals demand.”

Meanwhile, disrupted property markets have hampered copper and iron ore demand. Real estate data for the U.S. shows a downward trend in new construction and the potential for a general downturn in the hous ing market. In China, despite vari ous infrastructure grants from the government and a resumption of projects by developer China Ever grande, a lacklustre peak construc tion season, along with the ongo ing zero-Covid policy, is expected to limit any uptick in demand and prices in the first half of 2023.

With capital costs increasing, even renewable energy resource buildouts will be affected, further impacting steel and copper con sumption.

Despite muted demand in 2023, inflation is expected to pressure the metals markets. “We forecast 2023 prices to average lower than 2022 across the industrial commodities, with a year-over-year drop ranging from 7% for copper to 33% for lith ium,” Marjolin wrote.

The analyst also sees muted mergers and acquisitions activity in 2023. “The souring macroeco nomic environment and result ing market volatility will likely make for cautious buyers in 2023, although these same factors may expand the pool of assets available for purchase.”

Further, governments have begun implementing sourcing requirements, especially for bat tery metals, against the geopoliti cal backdrop of the Russia-Ukraine conflict, which has exposed supply chain issues and dependence on foreign sources of critical minerals. This may spur a different trend in M&A activity, focused on domestic industry consolidation and compa nies buying out small operations to

enter the playing field and capital ize on demand.

Meanwhile, data points to access to capital becoming even more constrained in 2023. S&P principal analyst Kevin Murphy points out financing raised by junior and inter mediate explorers totalled US$8.4 billion through August, down sig nificantly from the US$14.6 billion raised in 2021.

“Should this trend continue through the remainder of 2022 and into the first few months of 2023, we expect a 10-20% decrease in the global exploration budget for 2023,” Murphy said.

The decrease will not be felt evenly, however. Gold budgets should decrease more than energy transition metals copper, nickel and lithium.

While S&P sees a bumpy road ahead, the International Energy Agency data shows that to meet the goals of the Paris Agreement, sectors contributing to the green energy transition will be responsi ble for over 45% of the total copper demand, 61% of the nickel demand, 69% of the cobalt demand, and a staggering 92% of lithium demand by 2040.

Such a dramatic increase from 8-29% at the end of the last decade poses a massive challenge for the market’s supply side.

The IEA predicts that between 2020 and 2040, global demand for all energy transition minerals will need to quadruple from 7.1 mil lion tonnes to 27.4 million tonnes to meet the Paris Agreement goals. Under a more ambitious scenario of reaching net zero by 2050, demand for all energy transition minerals would increase sixfold to 43.1 mil lion tonnes by 2030 — including lithium, cobalt, nickel, manganese and graphite, which are crucial for widely used high-performance lith ium-ion batteries.

S&P estimates that, on average, it takes 17 years to progress a cop per mine from discovery to the first production — a timeframe that will most likely increase in the com ing years due to mounting project development barriers.

These include historically poor capital allocation and increasingly stringent ESG requirements, accord ing to Wood Mackenzie, which present challenges to the growth of copper mine projects. At the same time, it is currently estimated that the world would require an addi tional 500,000 tonnes of new copper supply annually for 20 years. This is roughly equivalent to building a new Escondida — the world’s larg est copper mine — every two years. By 2030, electric vehicles alone will require 1.6 million tonnes of copper, according to the IEA.

Meanwhile, signs are apparent that copper supplies are getting thin. At present, visible exchange inventories, including Shang hai bonded copper stocks, have recently slumped to the lowest level on record as of the end of Octo ber. Inventories are down by nearly 50% from a year ago and currently stand at less than a third of the average level observed in the pre ceding five years.

Imported copper cathode premi ums to China hit all-time highs last month. Year-to-date copper mine production in Chile, the world’s largest producer, is down by 7% year-on-year — on track for its fourth consecutive year of contrac tion. TNM

“OUR ASSESSMENT OF DEVELOPING LITHIUM ASSETS FORETELLS HEALTHY GROWTH IN 2023, BUT A FAILURE TO MEET DEMAND EXPECTATIONS AS EARLY AS 2024.”

MARK FERGUSON S&P GLOBAL DIRECTOR

BY COLIN MCCLELLAND

BY COLIN MCCLELLAND

Our TNM Drill Down features highlights of the top gold assays of the past week. Drill holes are ranked by gold grade x width, as identified by our sister company Mining Intelligence (www.miningintelligence.com).

Results over the length of the Americas led the week. Wes dome Gold Mines (TSX: WDO), at its Kiena mine com plex in Quebec, scored the high est –width x grade result, followed by New Pacific Metals (TSX: NUAG) at its Carangas project in Bolivia and i-80 Gold (TSX: IAU; US-OTC: IAUCF) at Ruby Hill in Nevada.

Drill hole N103-6839W4 at Kiena near Val d’Or, Que., cut 1 metre grading 4,140 grams gold per tonne starting from 260.9 metres deep for a grade x width of 4,140. Hole 6796W6 also returned strong grades over a longer interval with 50.7 metres grading 92.11 grams gold starting from 94 metres.

Hole 6752W10 cut 83.2 metres grading 13.94 grams gold from 748.9 metres deep, showing new mineralization 100 metres below the known limit of the A zone resource, the company said. It also made a discovery in the south limb of the A zone, a lateral expansion of mineralization identified by multi ple intercepts.

“Discovering additional gold ounces near planned infrastruc ture in our view is a strong way to leverage the exploration potential at Kiena,” BMO

The project has proven and probable reserves of 1.8 million tonnes grading 11.1 grams gold per tonne for 651,000 oz. of contained gold. Based on a prefeasibility study completed in 2021, the project is expected to produce an average of 84,000 oz. gold annually over a mine life of seven years at an all-in sustaining cost of $894 per ounce.

The Kiena mine complex restarted production in May 2021 after declining gold prices and lack of developed reserves forced Wes dome to suspend operations in 2013. From 1981 until that time,

it had produced almost 1.8 million oz. gold.

In second place this week, New Pacific Metals reported 591.85 metres grading 1.03 grams gold per tonne from 176.3 metres in hole DCAr0049 for a grade x width of 609.61 at its Carangas project in the western Bolivian department of Oruro.

The diamond drill hole included higher grade intervals of 14.6 metres grading 2.16 grams gold from 412.1 metres; and 29.1 metres grading 2.76 grams gold from 446.63 metres.

The site is part of an area in the Andes which has seen large cop per-gold

ean side, but little exploration in Bolivia. New Pacific says it wants to publish its first resource estimate for Carangas by the middle of next year. The Canadian company is drilling in the project’s Central Val ley area under a silver zone, Alex Zhang, vice president of explora tion, told The Northern Miner on a recent site visit.

“Once we started drilling, we couldn’t stop because every hole hit a very long intercept of mineraliza tion,” Zhang said.

In third place this week is i-80 Gold, which intercepted 10 metres grading 60.2 grams gold per tonne from 199.4 metres in hole 1RH2255 for a grade x width of 602 at its Ruby Hill project in northern Nevada.

Another Ruby Hill hole cut 18.3 metres grading 1.9 grams gold and 631.3 grams silver per tonne, 33% lead and 7.4% zinc.

The site, part of a gold mining area dating to the 1860s, has indi cated mineral resources for an open pit operation of 220.8 million tonnes grading 0.54 gram gold per tonne for 3.7 million oz. contained gold. TNM

BY ALISHA HIYATE IN BARTICA, GUYANA

BY ALISHA HIYATE IN BARTICA, GUYANA

On a 35-minute helicopter ride from Guyana’s capital of Georgetown to Reunion Gold’s (TSXV: RGD) Oko West proj ect in the Cuyuni mining district, it’s easy to see where the South Amer ican country got its nickname — the land of many waters. We fly over the Demerara River and the mighty Essequibo River which leads down to Bartica — a town of 20,000 that’s also a gold mining gateway and lies at the confluence of three rivers — Essequibo, Mazaruni and Cuyuni.

The bird’s-eye view also makes it easy to see that Reunion is in the right place to look for gold. As we get closer to the project, 95 km southwest of Georgetown, past and current artisanal mining operations come into view through the dense forest canopy.

Reunion has a long history exploring the 400,000sq.-km Gui ana Shield in Guyana and neigh bouring Suriname and French Guiana dating back to 2012. Its executive chairman David Fen nell has an even longer history in the region going back to the early 1980s. Fennell, a mining vet eran and founder of Golden Star Resources, which built and oper ated the Omai gold mine in Guyana with Cambior in the early 1990s, was also key in the discovery and development of the Gross Rosebel mine in Suriname (recently sold by Iamgold (TSX IMG; NYSE: IAG) to Zijin Mining).

Optioned in 2018, the Oko West claims are newer to Reunion’s port folio. But it didn’t take long before it made a promising discovery that it’s now quickly advancing towards a first resource.

Despite the artisanal workings in the area, the company’s big find at Oko West – the Kairuni zone — was not discovered by small scale miners (although there is evidence of them throughout the concession), but through geochemical testing.

Soil sampling in early 2020 at the project, which is on strike with and adjacent to G2 Goldfields’ (TSXV: GTWO) separate Oko project to the north, outlined a 6-km goldin-soil anomaly while following up on a 2019 airborne magnetic geophysical survey. The discovery was confirmed by trenching in late 2020 that returned highlights of 69 metres of 5.98 grams gold per tonne and 34.5 metres of 5.5 grams gold.

The very first drill hole at the project, part of a preliminary, 1,000-metre drill program in early 2021, cut 9.1 metres of 1.74 grams gold per tonne from surface, fol lowed by 20.1 metres of 1.54 grams gold from 50 metres downhole.

Now, the company’s completing a 28,000-metre-plus diamond drill program, slated to be completed in early 2023, when Reunion plans to release an initial resource for the project. Drilling has so far out lined the Kairuni zone – the north ern 2.5 km of strike of a 6-km shear zone — across up to 100 metres in width and 600 metres depth. Drill ing has returned such positive results, Reunion announced in Sep tember that it would delay the initial resource from the third quarter as originally planned, since it would be “premature.”

At press time on Nov. 21, Reunion revealed that a new, high-profile president and CEO will take over from interim CEO Carlos Bertoni, who is retiring. Rick Howes, former chief execu

tive of Dundee Precious Metals, will join the company as of Jan. 1, 2023. Howes is a mining engineer with nearly 40 years of experience and a track record of overseeing on-schedule and on-budget capital projects and leading mining inno vation.

‘Rapidly evolving’

During the site visit in early Novem ber, Reunion Gold’s vice-president of exploration, Justin van der Toorn noted that the project has evolved at rapid pace since the start of the first major drill campaign in June 2021. The camp, which has grown from about 20 people in early 2020 to regularly accommodating up to 90, reflects the ramp-up in activity.

At the time of the visit, the com pany was in the midst of commis sioning a new fuel storage facil ity, building a new workshop, and planning to expand capacity fur ther to 120 people next year.

“It’s a very rapidly evolving camp, and it’s been quite an excit ing period to see the project go from those initial couple of holes to what we now have and the poten tial that we have here,” van der Toorn said.

Reunion had three core rigs turning at the time, with another two just-arrived rigs about to be put to work. Van der Toorn said

the five diamond drill rigs will give the exploration team capacity of about 7,000 metres per month. Having raised $36.8 million in June and $11.5 million in February, the company has around $50 million in its treasury — enough to fund work at that pace through the end of next year.

The company also recently con verted its option agreement with a local permit holder to a prospect ing licence, which is the first step to tenure for a foreign company. (Now that Reunion has the per mit, the last remaining small-scale miner on the concession was just packing up to leave in November.)

The first major drill program at Oko West began in June 2021, with early results that included 43.5 metres of 2.92 grams gold per tonne start ing from surface (hole 13) and 61 metres of 2.54 grams gold from sur face (hole 14).

“We started out looking at more of a shallow system, trying to develop the potential here within the saprolite,” van der Toorn said.

The saprolite layer extends to about 80 to 100 metres, and was untouched by artisanal miners — locally known as pork-knockers.

“We’ve got the entire saprolite profile preserved, which is obvi ously the easy win as a starter pit on these kinds of projects,” van der

Toorn noted.

More recent results reported in September included 52.5 metres of 5.19 grams gold from 4.5 metres depth in hole 135 and 49.8 metres of 4.12 grams gold from 221.7 metres in hole 124.

Though the strongest results have come from the Block 4 area of the Kairuni zone, Reunion has also hit nice grades and widths out side that block, including 37 metres of 2.99 grams gold in RC hole 205 in Block 6 to the south, and 67.6 metres of 1.21 grams gold in dia mond drill hole 166B in Block 1 to the north.

High-grade heart Mineralization at Oko West is hosted in a combination of volca nics and sediments in a north-south shear zone, along at a volcano/sed imentary-granitoid contact. The bulk of the mineralization in the orogenic gold system is in sedimen tary rock rather than granitoids, and shows excellent continuity from top to bottom.

“We do see a strong associa tion with quartz veining,” van der Toorn said. “That said, the majority of our mineralization (is in) brec cias, there’s sheared sediments with fractures well developed across them, and then foliation parallel quartz veins that also host gold,”

he said, adding that the system is complex.

“It’s not like one vein that’s sometimes quite typical in oro genic gold systems, but it’s really a well-developed deformation zone within which you’re then precipi tating gold through various mech anisms.”

The 2.5-km-long Kairuni zone has seen the bulk of drilling, with a 6,000-metre reverse-circulation drill program under way at the 3.5-km-long southern half of the system, dubbed the Takutu zone. There’s also further potential on the 44-sq.-km property in the Carol zone, a potential zone parallel to Kairuni, and the Bryan zone further west, which the company believes could be the hard rock source of downstream alluvial workings.

“Block four (part of the Kairuni zone) has really delivered the heart of the high-grade mineralization, the very thick grades that we’re see ing in that package of sediments,” van der Toorn said.

“We are still trying to under stand more of the geology here. Obviously, the drilling has gone very well and what that leads to is that you generally don’t actually spend much time thinking about the details of why and how it fits

BY COLIN MCCLELLAND

BY COLIN MCCLELLAND

MATAGAMI, QUE. —

Maple Gold Mines (TSXV: MGM; US-OTC: MGMLF) is in “advanced and detailed” talks with three poten tial acquisitions as it seeks to nearly double its contained gold resources, chief executive officer Matthew Hornor says.

The Vancouver-based explorer wants to lift its total indicated and inferred contained metal resource to more than 5 million oz. gold from about 3 million oz., Hornor said in November at the camp for Maple’s adjacent Douay and Joutel projects, about 700 km northwest of Montreal. All of Douay and more than half of the Joutel property are a 50:50 venture with Agnico Eagle Mines (TSX: AEM; NYSE: AEM) in Quebec’s Abitibi gold belt.

Maple seeks to buy companies in the same region, which spans the Ontario-Quebec border south of James Bay and holds some of Cana da’s largest gold producers, Hornor said in an interview. He declined to name the companies involved in talks because of rules about stock price-moving news.

“It’s got to be something we get at a discount because we have a joint venture partnership and cash,” said Hornor, who used to work for bil lionaire entrepreneur Robert Fried land, the founder of Ivanhoe Mines (TSX: IVN), among other compa nies. “We’re opportunistic in find ing companies who would benefit from aligning with us.”

Maple wants the advantages of a larger resource base and a re-rating of its stock to secure better financ ing for development as it pro gresses through an agreement with Agnico that increases Maple’s share of expenses. It is also keen to buy companies while stock market val uations are relatively low and gold prices are generally high historically.

The Abitibi belt, known for the Canadian Malartic open pit mine run jointly by Agnico Eagle and Yamana Gold (TSX: YRI; NYSE: AUY; LSE: AUY), and Kirkland Lake Gold’s (TSX: KL; NYSE: KL; ASX: KLA) Detour Lake mine, also

hosts many smaller projects that show resources and potential, but would benefit from consolidation, Hornor said. Some may lack fund ing or others may be in a distressed situation, he added.

“Given the challenges in the cap ital markets, talented geologists are often frustrated with the lack of budget to execute projects,” he said. “Our interest is in projects with smart people attached to them so we wouldn’t dilute the focus of our team here.”

Maple has $15.3 million in cash. Its shares were trading at 16¢ apiece in Toronto at press time, valuing the company at $54 million. Ana lysts said the company would likely use some cash and sell shares to pay for the acquisitions.

The explorer’s potential acqui sitions are part of a dual-track strategy to dramatically expand its resources by January 2025. The other track is drilling. The company is adding two rigs this month for a total of five engaged at Douay and drilling as much as 1,800 metres underneath and beside former mines at Eagle and Telbel, which form the Joutel project.

“The fastest way to increase resources is this acquisition plan,” Mark Reichman, an analyst based in St. Louis for Noble Capital Mar kets, who covers Maple and vis ited the site this month, said in an interview. “If they were picking

resources from a company trad ing at a lower enterprise value to resources ratio, it could be positive. But longer term, the real value is going to be determined by the deep drilling program.”

Current indicated resources at Douay and Joutel are 10 million tonnes grading 1.59 grams gold per tonne for 511,000 oz. contained metal, according to an update in March. The inferred total is 76.7 mil lion tonnes grading 1.02 grams gold per tonne for 2.5 million ounces.

This year, Maple bought the underground Eagle mine, Agnico’s first mine which ran from 1974 to 1986, from Globex Mining Enter prises (TSX: GMX) for $2.4 mil lion. It is part of the Joutel project, but not in the joint venture with Agnico.

The rest of Joutel is mostly the Telbel property, which Agnico mined from 1983 to 1993. Telbel and Eagle together produced 1.1 million oz. of gold.

But getting the former mines at Eagle and Telbel into work ing order would require various preparations, such as draining their shafts and tunnels of water which has seeped in over the past 30 years. The company needs to con duct a prefeasibility study to see if the “expensive” process is worth it, CEO Hornor said.

Analysts also said the Harricana River’s proximity to Joutel means

restarting operations will need a water treatment plant that could easily cost tens of millions of dollars.

The 400-sq.-km Douay and Joutel properties straddle strikes along the Casa Berardi and Harricana/Jou tel deformation zones that formed about 2.7 billion years ago. Mul tiple events over succeeding eras, including volcanic activity, intru sions and shearing pushed gold closer to the surface.

Douay has the same sort of scale and geological formations found at Canadian Malartic and Detour, Fred Speidel, vice-president of exploration, said. The 2018 East Gouldie discovery at Canadian Malartic, which extends from 700 metres to 1,900 metres below sur face, is especially interesting, Spe idel said in an interview.

“The importance of that discov ery has had a huge influence on our thinking, in terms of our will ingness to pursue higher risk, but also potentially higher reward deep drilling,” Speidel said.

For winter 2022-23, Maple is seeking new discoveries in areas that haven’t been drilled before in 10,000 metres of drilling at Douay and 6,000 metres at Telbel. At Douay, the leading targets are below 1,000 metres where there has been almost no drilling deeper than 700 metres, he said.

At Joutel, targets are being drilled at depths of 1,400 to 1,800 metres, well below the deepest mine work ings at about 1,200 metres. At Eagle, where both lateral and depth exten sions are being tested, targets are continuing to be drilled at depths of between 200 and 1,300 metres. Eagle mine workings are between 65 and 800 metres deep, he said.

Even if Speidel’s drilling hits discoveries ballooning Maple’s resources, Hornor says his pur chasing plans won’t shrink.

“The acquisitions get even eas ier when we have more ounces because people will be more inter ested in doing a transaction with us because the platform will be stron ger,” the CEO said. “Consolidation in Abitibi should be done and we’re trying to make it happen.”

The next resource update for Douay and Joutel may come in 2024 after the current drilling pro gram, barring a large discovery that can significantly alter the resources total on its own, Speidel said.

Highlights so far this year include Eagle mine hole EM-22-005 which cut 7.5 metres grading 4 grams gold per tonne, including 3 metres of 6.4 grams. Hole EM-22-009 returned 3 metres of 11.4 grams gold, includ ing 1 metre at 24.4 grams.

In the 531 zone at Douay last year, drill hole DO-21-316 inter sected 32.2 metres of 1.54 grams gold per tonne from 430 metres downhole, including 6.7 metres of 4.63 grams gold.

Pierre Vaillancourt, a Toron to-based mining analyst with Hay wood Securities who doesn’t cover the company but visited the site, says the joint venture with Agnico shows the major’s confidence in Maple’s team and the potential for new drilling discoveries.

“There’s still a lot of work to be done to pull it all together into a cohesive system, but in the time they’ve been there they’ve made good progress,” Vaillancourt said. “It’s been 30 years since Eagle and Telbel closed, so the timing is right for them to come in and take a fresh approach, especially with a higher gold price. What’s old is new again.”

“CONSOLIDATION IN ABITIBI SHOULD BE DONE AND WE’RE TRYING TO MAKE IT HAPPEN.”

MATTHEW HORNOR, CEO OF MAPLE GOLDThe head frame at Maple Gold Mines’ Douay project. COLIN MCCLELLAND

BY COLIN MCCLELLAND IN CARROLLS CORNER, NS

BY COLIN MCCLELLAND IN CARROLLS CORNER, NS

Secretariat won the Triple Crown that year, NASA launched Sky lab and Watergate intensified. It was 1973, the same year Esso Minerals and Cuvier Mines began developing the Gays River under ground zinc and lead project in Nova Scotia, 60 km northeast of Halifax.

The Gays River mill began pro cessing 900 tonnes per day in 1979 before underground flooding ham pered mining for the joint venture and subsequent owners. West ern Mining stopped operations in 1991, and Acadian Mining’s 2007 restart with open-pit operations ended two years later.

Now, EDM Resources (TSXV: EDM) wants to restart open pit mining once again, aiming for the end of next year. To get there, it will need to increase mill capacity to 2,700 from 2,500 tonnes per day at an estimated cost of $30.6 million, according to a November 2021 updated prefeasibility study (PFS). It calls the project Scotia mine.

“When you have this huge mill that’s been built, you have to take advantage of it,” EDM chief exec utive officer Mark Haywood said on a recent tour after running through modernizing plans. “If you line up those things then we can create enormous value for the stakeholders.”

The prefeasibility study outlined a 14.3-year mine life producing a total of about 445 million lb. zinc and 288 million lb. lead in concen trates, or 35 million lb. zinc and and 15 million lb. zinc in concen trate per year. All-in sustaining costs are projected at US52¢ per lb. zinc-equivalent. Total operating costs were forecast to run to $52.56 per tonne milled.

The study used base case metal prices of US$1.22 per lb. zinc and US$1.04 per lb. lead, and estimated the project would deliver an aftertax net present value of $128 mil lion at a discount rate of 8% and an internal rate of return of 65%.

Haywood, a veteran mining engineer who has worked at BHP’s (NYSE: BHP; LSE: BHP; ASX: BHP) Morinbah North coal mine, and for Gold Fields (NYSE: GFI) in Ghana and Iamgold (TSX: IMG; NYSE: IAG) in Burkina Faso, said he’s trying to counter inflationary pressures in diesel, reagents and wages by securing better deals on equipment in the mill and the pit.

Haywood’s reopening plan includes

more ore crushing outside the mill building to achieve proper ore size with less waste material and dust entering the mill. He plans to replace a re-grinder with a second ball mill, improve the conventional flotation circuit with automation and replace a kiln dewatering process with a fil ter press method. EDM will stream line the loading of zinc and lead into sealed shipping containers instead of open dump trucks.

The plant needs a new trans former and 4-megawatt natural gas backup generators, and the com pany is considering the installa tion of solar and wind power on the 6.6-sq.-km site, Haywood said.

The project has proven and prob able reserves of 13.7 million tonnes grading 2.03% zinc and 1.1% lead for 35 million lb. of contained zinc and 15 million lb. of contained lead.

Taylor Combaluzier, an analyst

with Toronto-based Red Cloud Securities, doesn’t cover the com pany, but has it on his watchlist after visiting the site in October.

“The recently completed and significantly improved mineral resource estimate and updated PFS, the large amount of infrastructure already in place and resultant mod est capex requirements, along with its recent debt financing to get the Scotia Mine into production should warrant attention from investors,” Combaluzier said in an email.

“With several zinc-lead mines coming offline and meager mine supply growth projected in the coming years, the restart of the Scotia Mine could potentially help meet the demand for those com modities.”

EDM updated the resource in December 2019, increasing the measured and indicated ton nage by 105% and the inferred by 7%. The measured and indicated resource now stands at 25.5 mil lion tonnes grading 1.89% zinc and 0.99% lead (2.84% zinc-equivalent) and the inferred resource at 5 mil lion tonnes grading 1.5% zinc and 0.66% lead (2.13% zinc-equivalent).

In March 2021, the company updated the resource estimate to include a gypsum resource for the first time of 5.2 million measured and indicated tonnes grading 91.8% gypsum and 790,000 inferred tonnes grading 91.2% gypsum.

In June, Geneva-based metals trader IXM, a unit of China’s CMOC Group, signed agreements to loan US$24 million to EDM for the proj ect and to buy all the project’s zinc and lead production for the first 10 years.

Other investors include Fan Camp Exploration (TSXV: FNC), an explorer with projects across Ontario and Quebec, which holds about 14% of EDM. Board mem bers and management hold some 30%, according to the company.

EDM is betting its zinc price forecast of as much as US$1.40 per lb. in the next two years and limited costs to restart the past producing mine will mean wide margins. (At press time zinc was US$1.38 per lb. and lead US$1 per pound.)

At the site, Jason Baker, who joined EDM in 2019 as mine man ager, stood overlooking the open pit filled with about 50 metres of water and described how stripping back the overburden will start by the third quarter of 2023 after the delivery of heavy earth-moving machinery. The company is await ing a final permit for sediment and erosion control, which Baker expects to receive within a month.

“There was always the stigma of flooding here with the under ground mine,” said Baker, a local who started his career more than 20 years ago in the coal mines of Penn

sylvania. “Open pit mining is less of a challenge with water.”

EDM plans to install perimeter wells to monitor and drain water from the pit — if needed — where there were none before. They’ll be inside the ring of birch trees around the property that contains the Mis sissippi Valley-type lead-zinc deposit. The orebody is in dolo mitized limestone that developed on an irregular pre-Carboniferous basement topographic high where coral reefs grew 300 million years ago. The strike runs some 4 km and the deposit extends to about 120 metres depth.

However, Acadian’s open-pit oper ation suffered a combination of problems before it was put on care and maintenance in 2009, said Baker, who worked for the now-de funct company at the time.

The financial crisis knocked met als prices lower while inadequate power supplies and poor crushing jammed the mill and raised operat ing costs, he said. The company also over-handled the ore and product with multiple dumping and haul ing steps instead of a more seamless process, he said.

“Acadian was trying to push too much ore — like 3,000 tonnes a day — through the mill,” Baker said. “They wanted to increase produc tion because the zinc price was fall ing but they didn’t have the power and the proper crushing so there were a lot of outages.”

Selwyn Resources bought the project in 2011 for $10 million, minus $2.5 million for an environ mental bond. Then Selwyn changed its management and name in 2019 to EDM Resources.

EDM shares had fallen 4% this month to 48¢ per share in Toronto at press time within a 52-week trad ing range of 75¢ and 44¢, valuing the company at $9.6 million.

“We’re trading at 10% of our net asset value, which is a significant opportunity for investors,” Hay wood said.

The year the project first began on the site, 1973, was also when the Montreal Canadiens defeated the Chicago Blackhawks for the Stan ley Cup. Haywood, a transplanted Australian, is a Canadiens fan.

“The Habs will be trying hard for the Stanley Cup in 2023,” he said. “EDM will also be pushing the game-changing start of commercial production

the Scotia mine.”

Vancouver-based Cypress Development (TSXV: CYP) says it has successfully tested the world’s first hydrochloric acid process to extract battery-grade lith ium carbonate from clay at its halfa-billion-dollar project in Nevada.

The Clayton Valley lithium proj ect, about 270 km northwest of Las Vegas is producing lithium car bonate at a 99.94% purity level, Cypress chief executive officer Bill Willoughby said in an interview in October. That purity exceeds bat tery grade which is 99.5%.

“What we want to do with clay is go all the way from ore in the ground to the finished product at the site and not have to look to any post-processing or refining to be able to finish it,” Willoughby said by phone from Twin Falls, ID. “That’s why the press release on the purity is important. It shows we can get to battery-grade on site at the mine.”

Mining companies are scram bling to meet demand for minerals such as lithium, cobalt, nickel and graphite used in electric vehicle batteries as fossil fuels are retired in transportation and for other power uses in favour of renewable energy.

Governments in various jurisdic tions are offering tax incentives to switch while ramping up laws to cut greenhouse gas emissions affecting the climate.

Traditionally, lithium carbon ate has been extracted from evap oration ponds after being pumped from brine reservoirs under salt flats, or mined from ore such as spodumene. Mining clay was con sidered too expensive, but miners have cut costs by using leaching, which is markedly faster than the brine evaporation route that can take months or years.

Hydrochloric acid is com monly used in mining operations such as tungsten, uranium, zirco nium, potash and rare earth ores for extraction, separation, purifica tion and water treatment, Cypress noted. Its process will apply acid leaching to lithium clay in a con ventional agitated tank followed by the production of lithium car bonate from concentrated lithium chloride solution.

There are several other projects in Nevada aiming to extract lith ium from clay for electric vehicle batteries.

Lithium Americas (TSX: LAC; NYSE: LAC) has secured most of its permits and is preparing a fea sibility study for its Thacker Pass project. Ioneer (ASX: INR) is advancing the Rhyolite Ridge proj ect, Noram Lithium (TSXV: NRM) is working on the Zeus lithium project and Spearmint Resources (CSE: SPMT) has the Green Clay and McGee Lithium Clay projects.

Hydrochloric acid vs sulphuric acid

But only Cypress is choosing the hydrochloric acid leaching process instead of the generally less expen sive sulphuric acid method. Koch Industries, which posted 2020 rev

enues of US$115 billion, in June bought the process Cypress is using from Pickering, Ont.-based Che mionex.

“We wanted to steer away from the sulphate side and go more to chlorides because it was more com patible with the environment of Clayton Valley,” Willoughby said. “We just felt there were fewer trans portation issues, fewer material han dling issues.”

The operation will mine the clay deposits like running ore through a conventional mill, the CEO said.

“You end up with a dry stack tailings facility and you’re conserv ing as much water as you can and you’re recycling that water through the process. There are environmen tal benefits that way if you don’t have to inject it or evaporate great quantities of it.”

Rob Bowell, a geochemistry expert for Cardiff, Wales-based SRK Consulting, said hydrochlo ric acid leaching will only become more widespread in the lithium industry if the cost drops.

“Hydrochloric acid will likely mobilize lithium from clays as it is aggressive and hence the desired use by Cypress, but I would imag ine the process has a focus on recovering unspent acid and recy cling as much as possible to avoid excessive costs,” Bowell said by

email. “It is more challenging to use safely as well.”

The Cypress extraction testing is part of a feasibility study due in the first quarter of 2023. It is using a pilot plant at Amargosa, NV, about

halfway to Las Vegas from the pro posed mine, where processing is being done by Saltworks Technol ogies, Willoughby said.

Cypress’s prefeasibility study for the Clayton Valley project forecast US$493 million in capital costs for an after-tax net present value of just over US$1 billion at an 8% discount rate.

The study estimated a process ing rate of 15,000 tonnes per day for annual production of 27,400 tonnes of lithium carbonate equiv alent over a 40-year mine life. It is derived from a probable mineral reserve of 213 million tonnes aver aging 1,129 parts per million (ppm) lithium (1.3 million tonnes lithium

carbonate equivalent) based on a cut-off grade of 900 ppm lithium, the company said.

Cypress hasn’t opted for off-take agreements because even though a large brand name might create some excitement, it is too early to commit to one company when there might be more competitive offers down the road, Willoughby said.

“It feels an awful lot like a futures contract, and I’ve never seen a futures contract come out nice for a metals company at an early stage. In fact, I’ve seen a couple compa nies go under because the futures contracts they had in place wound up torpedoing their finances.”

The project lies on some 27 sq. km near an outcrop of Paleozoic car bonates jutting up through lakebed sediments and next to North Amer ica’s only lithium brine operation, Albemarle’s (NYSE: ALB) Silver Peak mine, Cypress said.