3 minute read

The Economics of Marijuana Taxation

By Siddharth Gundapaneni

As of November 2021, recreational marijuana is now legal in 19 states, along with Washington D.C. While this as a start may seem great, it hasn’t been half as effective as it should have been. Although marijuana usage on its own can not kill a person, there has been an uptick in fatal cases of marijuana laced with synthetic opioids. This is largely due to the majority of cannabis users still purchasing their products from illegal markets. Such outcomes were not originally expected in the fight for legalization, and reform is needed to incentivize consumers to buy from safer, legal dispensaries. to marijuana, is in fact an inelastic good, meaning that even if the price of cigarettes is changed, demand for it should remain unchanged. This is likely due to the fact that about 85% of cigarette smokers are addicted to nicotine. Cigarette smokers that are addicted tend to continue purchasing cigarettes regardless of how expensive they are. This does not hold true for marijuana smokers as marijuana is known to have very little, if any, physically addicting properties. Therefore, when marijuana users see high prices in markets due to burdensome taxes, they are more likely to be deterred from dispensaries subject to said taxes, and instead purchase from an unauthorized source.

Advertisement

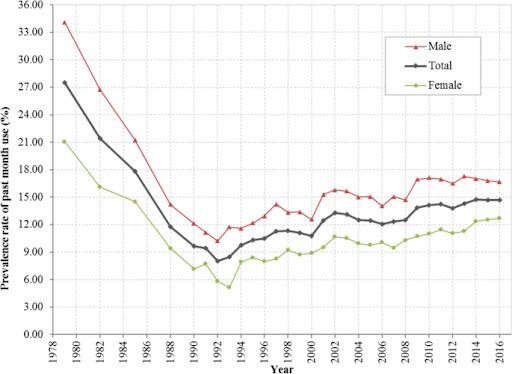

The extent of some states’ taxes are so overbearing that it is even cheaper to import marijuana from other states. For example, Washington state has a 37% excise tax on the sale of marijuana, in addition to the 6.5% state sales tax, and another 3.6% in sales tax for Seattle residents. The miniscule increase in marijuana usage over the last two decades can be attributed to states that legalized weed and did not apply excessively high taxes. If economists were correct in saying that marijuana has inelastic demand, we would’ve seen significantly more increases in usage rates nationwide. Seeing the lack of increase in usage along with the introduction of legal markets, we can conclude that marijuana is an elastic good. We can also then assume that, without such onerous taxes, demand for legal marijuana will increase. This allows us to see all the positive effects of legalization in action.

Consumers will undoubtedly prefer a FDA-regulated product in place of an illegal good. When comparing states with cumbersome excise taxes like California, and states with less burdensome policy like Colorado, the results are quite telling. 78% of all marijuana sold in California was not legal, while that number dwindles to the low 30s in Colorado. California’s excessive regulations make legal dispensaries unable to compete with illegal markets, and that is much less so the case in Colorado. Moreover, an increase in consumers purchasing marijuana legally will categorically prevent fatalities from marijuana laced with fentanyl from untrusted drug dealers. State governments must forgo some tax revenue in exchange for the safety of its constituents.

The transition of marijuana purchases from illegal dealers to legal dispensaries is a goal that state governments should strive to meet. An increase in the legal consumption of marijuana will lead to the gradual diminution of black markets in the industry. This will also prevent the purchase of marijuana for many under the legal consumption age, as dispensaries tend to be quite strict when asking to see identification, whereas a street dealer has no incentive to check for identification. Legal marijuana consumption must be propelled ahead of illegal markets in every state, and that is best done through less regulatory policies in one of America’s up and coming industries.

Throughout the 1990s and early 2000s, many economists theorized that marijuana usage would increase upon legalization. The Brookings Institution went so far as to say, “The belief that legalization would lead to an instant and dramatic increase in drug use is considered to be so self-evident as to warrant no further study.” All that being said, after more and more states began legalizing recreational use of marijuana, use rates just barely increased, as shown in the graph below—so how could so many experts have been so wrong? The issue arises with the false assumption that marijuana is an inelastic good.

Cigarettes, a product that is often on shelves next