9 minute read

A twist in the transfer tail

A revised UK tax position could likely result in a change to the process followed when retirement savings amounts are transferred from this jurisdiction, writes Cooper Partners director and head of SMSF succession Jemma Sanderson.

As outlined in previous articles in this publication, one of the strategies often employed to transfer United Kingdom pension accounts to Australia is relocating the increase in value since residency to an Australian Recognised Overseas Pension Scheme (ROPS), whereby the Australian ROPS fund pays the tax at 15 per cent on this component, with the balance being paid to the individual directly as two lump sum payments with no further tax to pay in either jurisdiction.

The above was achievable from a UK perspective as His Majesty’s Revenue and Customs (HMRC) was satisfied, under the Double Taxation Agreement (DTA) between Australia and the UK, that Australia had the right to tax lump sum payments where there was more than one payment. Through a UK tax adviser, we obtained confirmation from HMRC on this treatment.

An update

In December 2023 we received information from both HMRC and the ATO that impacts the taxation treatment of UK and foreign pension transfers.

Proposed HMRC changes

In late December 2023, we received intelligence that HMRC was reconsidering its application of the DTA. A summary of the previous view and proposed changes are as in Table 1.

It is important to note Table 1 is based only on draft intelligence at the time of writing. However, in our discussions with a UK tax adviser, who also has been involved in discussions with HMRC officials with respect to this view, they are not recommending any individuals make any substantial payments from their UK scheme to themselves personally at this time even with a UK nil tax code in place.

Relevantly, a nil tax code only results in the UK scheme not withholding tax on a payment and doesn’t mean HMRC won’t assess the individual personally on the lump sum payment after the end of the relevant UK tax year in the tax return lodgement process undertaken by HMRC.

Although this is not an absolute final view, for now it is advised that, given this UK tax position, one-off flexible access drawdown (FAD) or uncrystallised fund pension lump sum (UFPLS) payments should not be initiated.

ATO interpretative position

In addition to the above UK position, we had discussions with the ATO just before Christmas with regard to their interpretation of the formula to calculate the taxable amount under the Australian provisions of any transfer from an overseas pension scheme. This amount, referred to as applicable fund earnings (AFE), is generally the increase in value since residency.

This is relevant where a partial amount of any UK scheme is transferred to Australia, whether to a super fund or to the individual directly.

This interpretation is as follows with respect to the calculation of the AFE on any foreign pension transfer/payment:

1. Where a benefit is transferred from one foreign pension scheme to another while the individual is an Australian tax resident, the ATO considers a certain section of the Income Tax Assessment Act 1997 (ITAA) applies to the transactions than what is generally applied.

2. Where a partial transfer occurs, whether to the individual directly or to an Australian ROPS via a new UK account after residency that is often a self-invested personal pension (SIPP), this section would result in any partial transfer being taxable to the extent of the balance remaining after the partial transfer.

3. This would mean where a partial transfer was made, the payment may be fully taxable in Australia.

4. However, under an alternative section of the ITAA, widely applied across the industry and which has an alternative interpretation of the application of the provisions, it would not be taxable.

5. The application of this method to the transfer of any benefit as a small interim and final UFPLS payment is not tax prohibitive on the payment itself. Rather, it would result in there being a small amount of tax payable on the interim payment with no tax amount on the final payment, with the exception of any increase in value between those two payments, or there being any leftover previous earnings that had already accrued.

Example 1:

An individual transferred the previously calculated AFE component of their UK scheme (SIPP1) to an Australian ROPS via a new UK pension scheme (SIPP2). This was calculated to be £300,000 of a balance of £800,000.

The balance remaining in SIPP1 is £500,000 after the above action and is comprised of the value of their account in UK pension schemes at their date of residency.

Subsequent to the initial transfer, the individual shifts another £300,000, whether to an Australian superannuation fund or to them personally, where the tax position would be as per Table 2, using an exchange rate of 1GBP:1.929AUD.

As there is a balance of £200,000 remaining (E), that is the taxable amount of the £300,000 transfer, with a balance of £100,000 (K) being tax-free.

Where the above transfer was transferred to:

i. the individual directly, then the individual would pay tax on £200,000 at their marginal tax rate,

ii. an Australian ROPS directly, the individual would pay tax on the AFE at their marginal rate, as there remained a balance in this SIPP after the transfer, and the entire payment would be a non-concessional contribution (NCC), or

iii. another SIPP to then flow to an Australian ROPS where there was no interest remaining after the transfer, the fund would pay tax at 15 per cent and the balance would be treated as an NCC.

This interpretation and the application of this particular section of the ITAA is new and contrary to previous guidance and an alternative reading.

The ATO has acknowledged this interpretation does not align with the legislative intentions. Notwithstanding this, our discussions with the ATO suggest this will be its interpretation and application of the provisions to UK and other foreign super fund transfers where the circumstances are relevant.

In the absence of legislative change, given it is the ATO position, it is important to follow this approach so as not to end up with any adverse taxation implications.

Example 2:

Using the same circumstances as the example above, where the remaining benefit is transferred in full to a ROPS or to an individual directly, the calculation would be as in Table 3, noting this position remains unchanged from the prior view.

As there is no balance remaining, there is no amount that is AFE and the entire transfer is non-taxable and classified as an NCC if paid directly to superannuation that is a ROPS in Australia.

Interestingly, the lower the amount remaining, the lower the AFE. However, we then need to be alive to the NCC component.

NCC component

Where the amount is an NCC in excess of the individual’s available limit, it needs to be released from superannuation in order to mitigate 47 per cent tax on the excess (under the Australian tax provisions). The mechanism works as follows:

a. The ATO will consider the contributions made to superannuation for a relevant financial year once the relevant super fund has lodged its annual return for the relevant year.

b. This could be for a contribution made in the 2024, say January 2025.

c. The ATO will attribute an earnings rate (called associated earnings (AE)) to that excess amount, which is the general interest charge (GIC) rate for the year. In the 2024 financial year as an example, the rate is 11.19 per cent.

d. That AE accrues from 1 July of the year of the excess (for a 2023/24 contribution this would be from 1 July 2023) until the ATO data matches and it issues a notice to the taxpayer regarding the excess (after the lodgement of the superannuation fund’s annual tax return and the individual’s personal tax return).

e. Then an amount is ultimately released from superannuation that is equal to the excess, plus 85 per cent of the AE amount to factor in the fact earnings in super are taxed at 15 per cent.

f. The AE is taxable at the individual’s marginal tax rate, less a 15 per cent offset given the above regarding the 15 per cent tax rate already in superannuation.

g. The relevant fund then pays this amount, the excess and 85 per cent of the AE in cash to the ATO, which deducts any tax payable on the AE and then pays the balance to the taxpayer in cash.

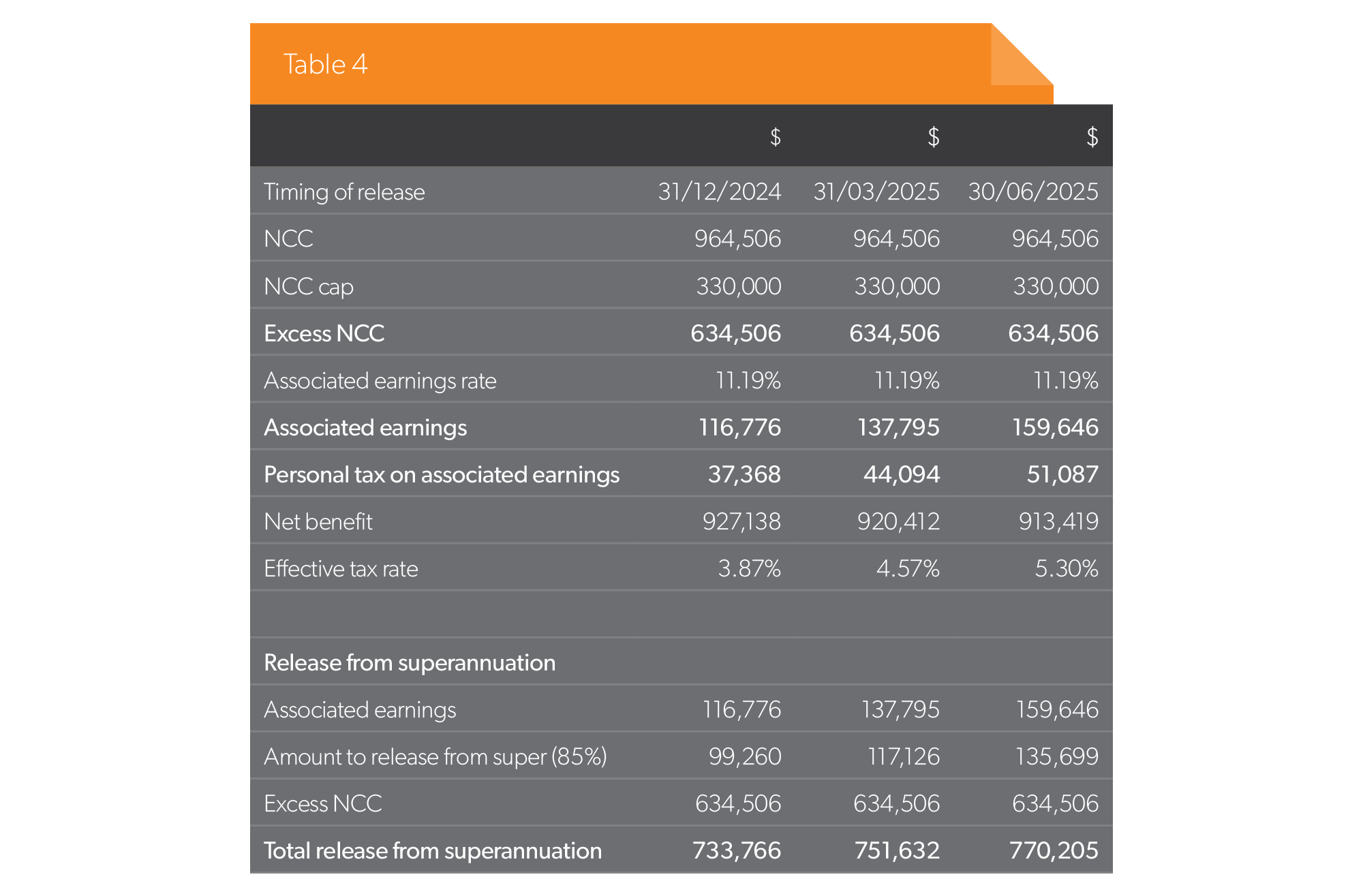

h. Based on the above scenario, the calculations would be approximately as in Table 4 where the individual has their full NCC limit available, with the AE dependent upon when the amount is released.

i. Based on the above, the sooner the fund can lodge its return, the sooner the excess will be released and the cash then released. Under the three different scenarios, all dependent on when the amount is released, the personal tax would range from $37,368 to $51,087, and the total amount to be released from superannuation would range from $733,766 to $770,205.

The release of any excess contribution can be facilitated as follows:

a. from other superannuation benefits in Australia (that is, not the receiving ROPS fund), or

b. from the receiving ROPS fund, however, that requires the correct reporting to be undertaken to ensure no adverse HMRC implications.

Next steps

The above may be disappointing for some as the HMRC position means payments can no longer be made to individuals directly without the risk of UK tax, with even FAD payments considered irregular being potentially caught. Accordingly, it is now more so than ever important to consider how best to manage any transfer so that an individual's UK pension can be transferred to Australia tax effectively.

There remian three possible courses of action:

1. Transferring the benefit to an Australian superannuation fund in full or in part, with consideration for the application of the Australian tax provisions.

2. Waiting for HMRC to release its view publicly and hope it is contrary to the above. As noted above, the intelligence in this regard is draft only and not legislation or a final view with an effective date of application.

3. Leaving the scheme in the UK and considering withdrawing as a pension or other payments.

We recommend transfers that are in progress or intended to occur in the 2024/25 without consideration of the above provisions be revisited to ensure they remain appropriate and won’t give rise to adverse tax outcomes.