8 minute read

Investment entity nuances

SMSF investments in unit trusts or companies must be approached with caution to avoid breaches of some specific superannuation system rules, writes Knowledge Shop technical superannuation adviser Jason Hurst.

There are different ways an SMSF might consider owning its assets. When entering into arrangements with other parties, it is common to have an SMSF invest in a private trust or company. These arrangements often involve purchasing or building property where the trust or company owns the underlying property and the super fund and other investors own the shares/units. Although the rules apply similarly to companies and trusts, it is more common that an SMSF invests through a unit trust rather than a company due to the flow-through tax treatment.

This can create opportunities for SMSFs and other investors to enter arrangements they may not have otherwise been able to on their own due to having insufficient capital to do so. However, the rules relating to investing via these structures are complex and different parts of superannuation and taxation legislation need to be carefully considered. Getting things wrong can have significant impacts as breaches in this area could result in investments needing to be removed from an SMSF and in some cases liquidated all together.

The superannuation rules need to be considered at both implementation and on an ongoing basis. We regularly come across scenarios where trustees who don’t seek advice are getting things wrong. In some cases it involves entering into transactions they may regularly implement in their other personal or business structures without considering the retirement savings landscape. After considering the sole purpose test and the fund’s investment strategy, a key next step when entering an arrangement is to take into account the parties involved, their level of control over the entity and any relationships between the parties.

When is an entity a related party?

It is important to consider whether an entity in which an SMSF plans to invest is a related party. This can impact the allowable level of investment, whether a fund can acquire existing shares or units and whether other parts of the Superannuation Industry (Supervision) (SIS) Act 1993 and SIS Regulations 1994 need to be considered.

A company or trust would be considered a related party of an SMSF if the fund members together with any of their related parties control the entity. Some cases are more obvious than others, but an important starting point can be to consider who might be a related party of the fund’s members.

Who is a related party of an individual?

The following people/entities can be a related party of a super fund:

• members of the SMSF,

• a standard employer sponsor, and

• part 8 associates (individuals, companies and trusts).

Standard employer sponsor

In our experience this is not common and would only apply if an employer contributes to the SMSF under an arrangement with the trustee. In most cases when an employer is contributing to a fund, it will be due to an arrangement with a member.

Part 8 associates

Part 8 associates of an individual are contained in section 70B of the SIS Act and include:

• a relative, being a parent, grandparent, sibling, aunt or uncle, nephew or niece, lineal descendants and adopted children of an individual or their spouse,

• the spouse of any of the above people,

• other members and trustees/directors of the SMSF,

• a partner in a partnership,

• a trustee of a trust where the individual and/ or other part 8 associates control the trust, and

• a company that is sufficiently influenced by or the majority voting interest is held by members and/or related parties.

When will a company or trust be a related party?

The definitions of control of a trust or company are specified in section 70E of the SIS Act Broadly, individuals must look at whether the SMSF members and any of their related parties as a ‘group’ can control the entity either formally or informally.

Control of a trust

A trust will be considered controlled by an SMSF if any of the following occurs:

• a group including the SMSF members and any part 8 associates has a fixed entitlement to more than 50 per cent of the income or capital,

• this group can appoint or remove trustees, or

• the trustee or majority of trustees, either formally or informally, might be expected to act in accordance with the instructions of this group.

Company – sufficient influence

A company will be controlled or ‘sufficiently influenced’ by an SMSF if any of the following occurs:

• a group including the SMSF members and any part 8 associates are in the position to cast more than 50 per cent of the maximum number of votes that might be cast at a general meeting of the company, and

• a majority of the company directors are under an obligation to act in accordance with the wishes of this group. This could include influence through interposed entities.

Generally speaking, the 50 per cent in both of the above definitions will relate to shareholding or unitholding, however, that may not always be the case.

Other elements to consider

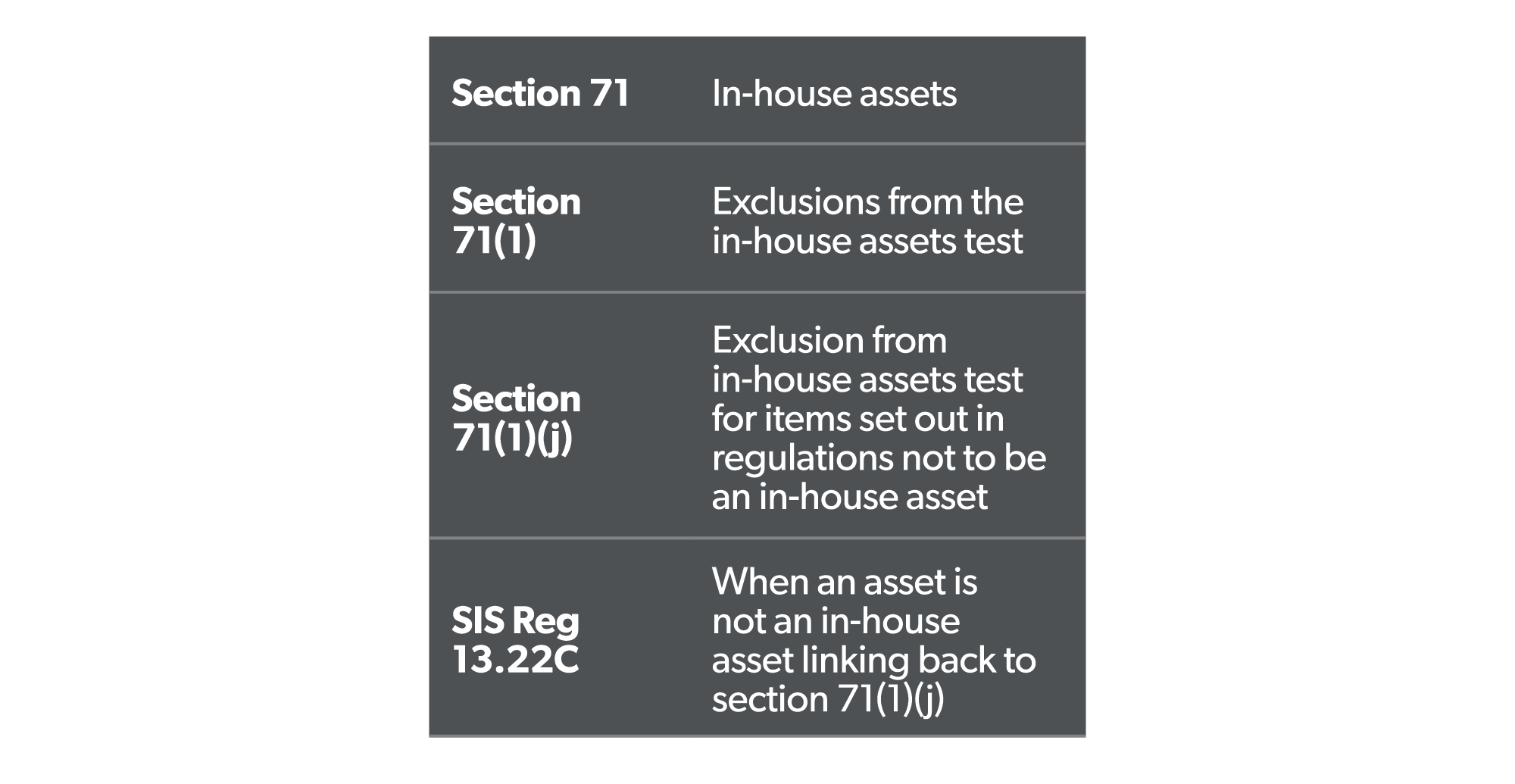

Where an SMSF invests in a related trust/ company, the starting point should be section 71 of the SIS Act to determine if any in-house assets are involved.

Generally, an SMSF can only have in-house assets that are valued at up to 5 per cent of the market value of fund assets, however, there are exemptions to this rule.

These include the following:

Although pre-11 August 1999 investments are not a focus of this article, it is important to consider when any existing units or shares were originally purchased by the SMSF. These investments are exempt from the in-house asset rules and have greater scope to maintain borrowings or be involved in other activities that may no longer be allowable to unit trusts or companies where an SMSF has invested after this date.

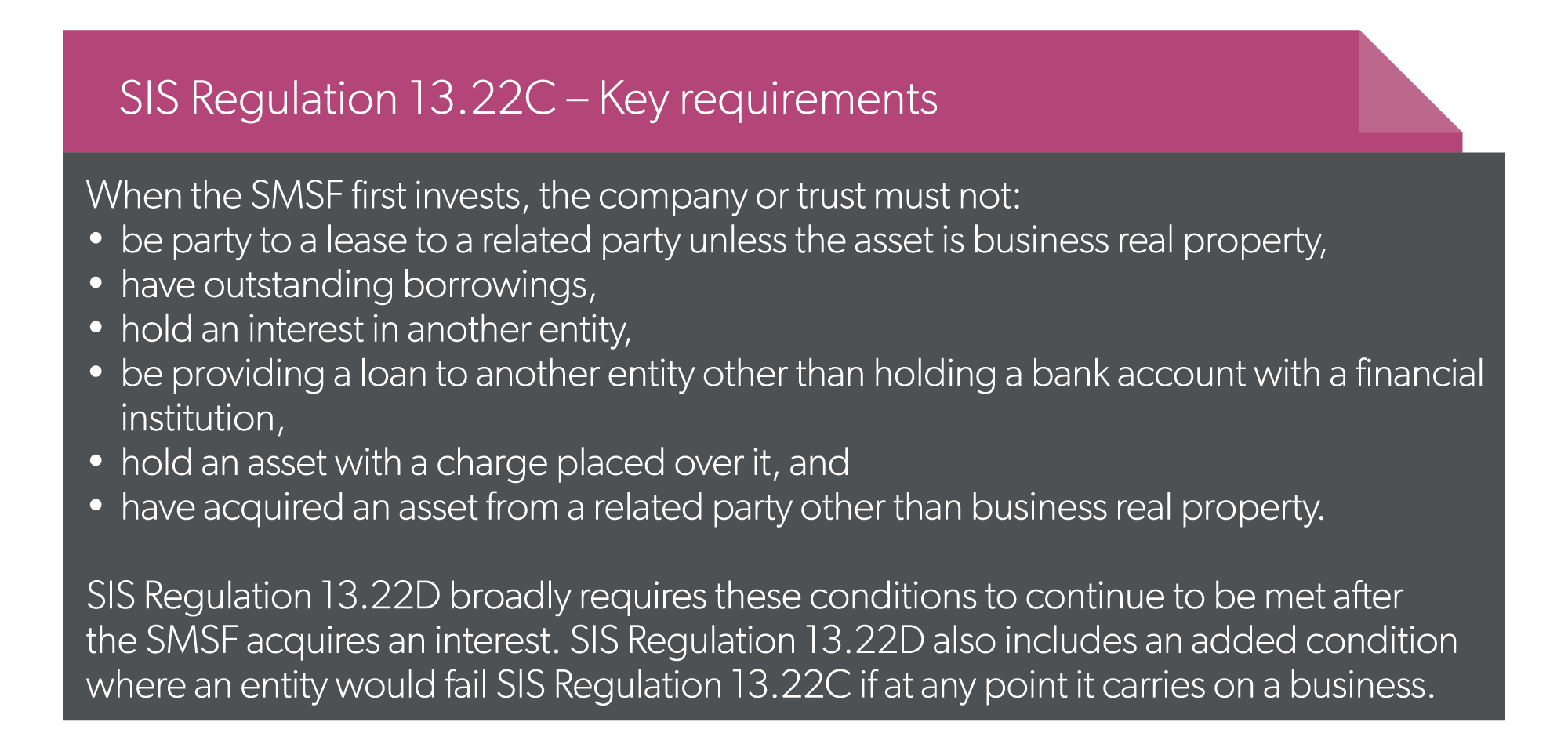

SIS Regulations Division 13.3A and Regulation 13.22C

Division 13.3A of the SIS Regulations provides an exemption from the in-house asset limits if a company or trust meets certain conditions. For this exemption, the entity must meet the requirements in SIS Regulation 13.22C upon acquisition by the SMSF. SIS Regulation 13.22D also contains provisions. Certain similar aspects of this regulation need to be met in continuity to ensure the exemption continues to apply.

The exemption is available by following the legislative pathway below.

Although not in the context of an SMSF, the Administrative Appeals Tribunal case of McCarthy and Commissioner of Taxation dealt with the issue of whether a relatively small development was considered carrying on a business.

Should trustees wish to ‘develop’ property in a related trust or company while relying on SIS Regulation 13.22C, it is recommended they seek specialised legal advice.

As soon as the exemption available under SIS Regulation13.22C is lost due to a Regulation 13.22D event occurring, then the exemption from the in-house assets test is lost forever, even if the event causing the breach is rectified.

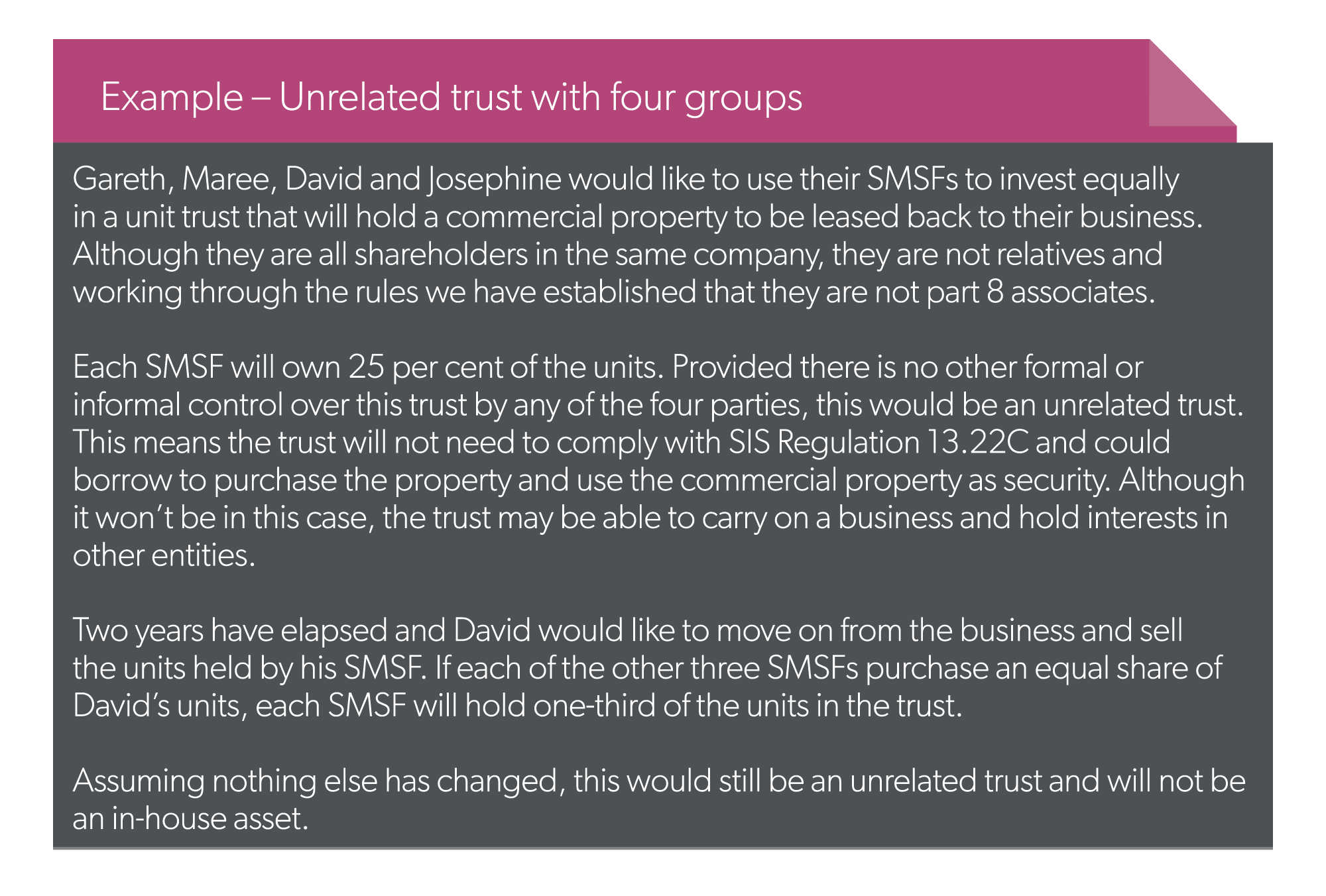

Investing in an unrelated trust or company (see example)

If a trust or company is not controlled by the SMSF members and/or any related parties, it will not be an in-house asset. This means SIS Regulation 13.22C does not need to be met and it is possible an SMSF can invest in an unrelated entity where the entity is borrowing, has a charge over assets or is carrying on a business.

Trustees should always consider the lack of control they may have when investing in an unrelated entity.

Succession planning should also be considered carefully before proceeding.

An entity with as little as two unrelated groups can be an unrelated entity if each group does not hold more than 50 per cent of the units or voting rights and cannot control the entity in any other way. While this can work in practice, succession planning needs to be even more carefully considered. Having two parties with neither having control can lead to stalemates and if one party wanted to exit the arrangement, the remaining SMSF may end up with an investment in a related trust/company unless the exiting party can find another unrelated person or group to sell its interest to.

Where an unrelated entity that has borrowed becomes a related entity, it would not comply with SIS Regulation 13.22C and would be subject to the 5 per cent in-house asset limits. Unless the value of the SMSFs investment is less than 5 per cent of the fund assets, selling shares or units, or transferring them outside of the fund may be necessary.

Conclusion

Investing through unlisted entities can provide substantial opportunities for SMSF trustees to boost the retirement wealth of their members, however, the rules are complex, and it is easy to run into trouble without expert advice both at implementation and on an ongoing basis.

SMSF practitioners should encourage their trustee clients to always seek advice before considering any opportunities and also when other stakeholders in the entity, particularly nonSMSF investors, propose any changes to these arrangements.