5 minute read

finances

Another Source of Income in

RETIREMENT I by John Keeton – Covenant Interest rates are near all-time lows, social security likely will not get a cost of living dividends may help supplement income adjustment this year, and pensions are becoming a thing of the past. The bottom line is that needs. retirement income is becoming harder and harder to generate. In addition to interest rates falling to all

Investing in stocks with dividends may be an option that fits nicely within a retiree’s time lows, social security is another income overall financial needs and plan. While dividends can be a key piece of the retirement source that is a challenge for retirees. With income puzzle, there are a few things to be mindful of when focusing on dividends for inflation very low due to the economic overall income needs. crisis of 2020, there’s a high probability

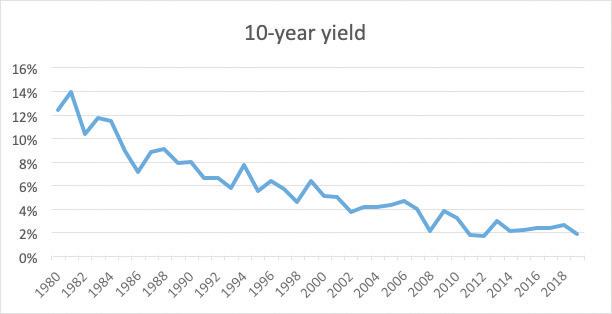

The charts below illustrate the stark contrast in income between U.S. treasury bonds that social security recipients will receive and dividends from the S&P 500 since 1980. While rates have essentially gone to zero, no adjustment to their social security checks dividends on the S&P 500 have gone up over 900% during the same timeframe! This has made this year. This is the true definition of “fixed dividend stocks more competitive than bonds from an income standpoint and a great vehicle income”. Lastly, pensions are becoming a to combat inflation. This drop in rates is making it harder to get income and this is where thing of the past replaced by 401(k) plans. This has put more of the burden of saving for retirement on the employee rather than the employer providing an income to the retiree for their entire life.

For all these reasons, retirees are living on their savings more and more. That’s where dividends come into play. Below are some common considerations for dividend investors.

1. DIVIDENDS ARE NOT BONDS. THEY ARE SUBJECT TO CHANGE.

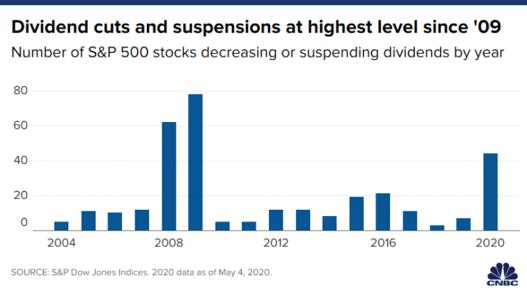

While bonds have a stated rate, dividends are declared by the company each quarter. They can be lowered, kept the same, or increased. In 2020, there have been close to 50 companies within the S&P 500 Source: Bloomberg that have cut or suspended their dividends. This can drastically affect your income.

The key takeaway is to do your research before investing in a dividend stock or fund. Research the business and the future ability of the company to continue the dividend.

2. DON’T ALWAYS BUY THE STOCKS WITH THE HIGHEST DIVIDENDS

It’s tempting to look for only stocks that have a very high dividend yield. Keep in mind that when a company has a high dividend yield, it could be because the dividend remained constant, but the price of the stock fell for various reasons. This could eventually lead to the company cutting their dividend. Besides just focusing on high dividends, look for companies that have had the ability to not only sustain their dividends, but consistently raise their dividends over the years.

3. DIVIDENDS ARE NOT ALWAYS

20 Boerne Business Monthly Source: Bloomberg | June 2020 MORE TAX EFFICIENT

Dividends can be taxed either two ways:

Qualified or Ordinary. • Ordinary dividends are taxed as ordinary income (taxed at same rate as your overall income tax rate) • Qualified dividends are taxed at a lower rate (maximum rate is 20% in 2020)

Generally, most income generated within a portfolio outside of dividends will be considered ordinary unless you are investing in tax exempt municipal bonds. If you are in a higher tax bracket, consider having qualified dividends to effectively generate higher yields after tax within your portfolio.

Dividends have been around for literally hundreds of years. While they are a great income source, they are just one part of a comprehensive retirement income plan. Income sources, taxes, legacy goals, and risk are just

a few elements every retiree needs to be thinking about in order to put a comprehensive income plan together. A financial advisor who is part of an advisory firm that is a fiduciary can take all the retiree’s information and craft a plan that works for the retiree. Income planning in 2020 is more of an art than a science. Having the right tools to put the plan together is critical. BBM

The contents of this article are provided for informational purposes only. It is not an exhaustive list and is not intended to provide any legal or tax advice. Please consult your respective legal, tax and financial advisor before taking any action.

John Keeton is a senior wealth advisor at Covenant. In this advisory role, John applies the firm’s proprietary process, Lifestyle. Legacy. Philanthropy.®, to help clients develop and implement prudent strategies to achieve their lifetime goals. John assists families with their investment, income tax, wealth transfer planning, and philanthropic strategies and leads Covenant’s internal team meeting, identifying how we are best utilizing and implementing the above services for our clients.

PERFECTLY TENDER GUARANTEED DELICIOUS &

GET THE GRILLER’S BUNDLE INTRODUCTORY PRICE : $ 79 99

+ 4 MORE BURGERS FREE

4 (5 oz.) Butcher’s Cut Filet Mignon 4 (4 oz.) Boneless Pork Chops 4 (4 oz.) Omaha Steaks Burgers 4 (3 oz.) Gourmet Jumbo Franks 4 (2.8 oz.) Potatoes au Gratin 4 (4 oz.) Caramel Apple Tartlets Omaha Steaks Seasoning Packet $224.91* separately

20 MAIN COURSES + SIDES & DESSERT

*Savings shown over aggregated single item base price. Limit 2 pkgs. Free gifts must ship with #63281 Standard S&H will be added. Expires 10/31/20. ©2020 Omaha Steaks, Inc.

COWBOY SLEEPWEAR!

Now Available! Luxury Cloth Face Masks for $8.00 Each

Locally Owned and Operated

Cowboy Sleepwear for All Ages Vintage Western Premium Fabrics Domestic & International Shipping

• Matching Sets • Original Pants • Low Rise Pants • Boxer Shorts • Nightshirts • T-shirts • Cow Kids Wear

INFANTS, YOUTH & ADULT SIZES NEW PLUS SIZES! NOW AVAILABLE IN 2X & 3X! www.cowboypajamas.com