finances

I

Another Source of Income in

RETIREMENT by John Keeton – Covenant

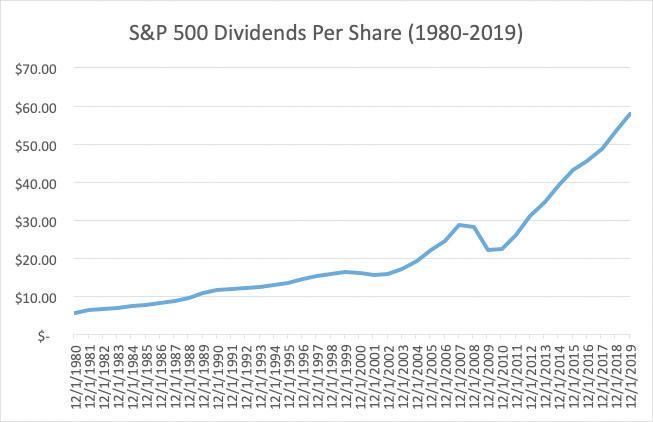

Interest rates are near all-time lows, social security likely will not get a cost of living adjustment this year, and pensions are becoming a thing of the past. The bottom line is that retirement income is becoming harder and harder to generate. Investing in stocks with dividends may be an option that fits nicely within a retiree’s overall financial needs and plan. While dividends can be a key piece of the retirement income puzzle, there are a few things to be mindful of when focusing on dividends for overall income needs. The charts below illustrate the stark contrast in income between U.S. treasury bonds and dividends from the S&P 500 since 1980. While rates have essentially gone to zero, dividends on the S&P 500 have gone up over 900% during the same timeframe! This has made dividend stocks more competitive than bonds from an income standpoint and a great vehicle to combat inflation. This drop in rates is making it harder to get income and this is where

Source: Bloomberg

Source: Bloomberg

20

B oerne B usiness M onthly | June 2020

dividends may help supplement income needs. In addition to interest rates falling to alltime lows, social security is another income source that is a challenge for retirees. With inflation very low due to the economic crisis of 2020, there’s a high probability that social security recipients will receive no adjustment to their social security checks this year. This is the true definition of “fixed income”. Lastly, pensions are becoming a thing of the past replaced by 401(k) plans. This has put more of the burden of saving for retirement on the employee rather than the employer providing an income to the retiree for their entire life. For all these reasons, retirees are living on their savings more and more. That’s where dividends come into play. Below are some common considerations for dividend investors. 1. DIVIDENDS ARE NOT BONDS. THEY ARE SUBJECT TO CHANGE. While bonds have a stated rate, dividends are declared by the company each quarter. They can be lowered, kept the same, or increased. In 2020, there have been close to 50 companies within the S&P 500 that have cut or suspended their dividends. This can drastically affect your income. The key takeaway is to do your research before investing in a dividend stock or fund. Research the business and the future ability of the company to continue the dividend. 2. DON’T ALWAYS BUY THE STOCKS WITH THE HIGHEST DIVIDENDS It’s tempting to look for only stocks that have a very high dividend yield. Keep in mind that when a company has a high dividend yield, it could be because the dividend remained constant, but the price of the stock fell for various reasons. This could eventually lead to the company cutting their dividend. Besides just focusing on high dividends, look for companies that have had the ability to not only sustain their dividends, but consistently raise their dividends over the years. 3. DIVIDENDS ARE NOT ALWAYS MORE TAX EFFICIENT Dividends can be taxed either two ways: