MASTERING INVESTMENT PROPERTY TO INCREASE YOUR NET WORTH

4 Types of Residential Real Estate Investments

Purchasing a property to have as a long term rental that offers monthly cash flow for retirement and good to fair appreciation.

Purchasing a property for short term or long term rental that offers residual income but has low appreciation.

Purchasing a home with excellent appreciation, but no monthly cash flow or less that $200 per month.

Purchasing a property that is a “fixer upper” for immediate resale or to keep as a rental.

Selection details ...

TYPE 1 This property is suggested for someone who wants to keep their day job and retire with security. It is important that you look for a property that has an average to above average appreciation rate of return. This property will normally have a cash flow of $100-$200 per month, but increase in value 4% to 5% per year. The ideal property is a SFR (single family residence).

TYPE 2 This property is all cash-flow focused- multi unit is great as well as SFR that has good monthly cashflow. Focus of appreciation is not the main idea, all monthly cashflow. This allows you to prepay the mortgage with the excess rent and gain equity position from prepaying more than appreciation. This is the best one to start with as it helps with qualifying for the next property easier in most cases.

TYPE 3 This type of property is only suggested for someone with substantial savings because the mortgage payment is typically high ranging from $900 and up. Remember this property will take longer to rent but the quality of tenants will be impeccable. This is suggested for short ternn holding for approximately 5 years.

TYPE 4 Many homes are found at a “deal” price because of the quality in which the [Previous homeowner left it. If these properties interest you, the first suggestion is to start and complete your first one without attempting a second, stay focused! The most important thing to look for is the “when done” value. Have an appraisal completed during the first 10 days of the purchase agreement, submit your written plans of improvements to the appraiser or lender and request the appraiser to complete a when done appraisal or subject to your repairs appraised value. To be an effective project the minimum net to you as the seller should be of 15-25% with the work completed within 6-8 weeks. When this home is completed it will fit into TYPE 1 or TYPE 2 property or sell for a profit.

WHAT KIND SHOULD I GET?

We have all heard that it is never a great idea to have all your eggs in one basket right? That is the same case in real estate. If you think about it, if you ask a financial advisor, “where should I invest,” the response is “let’s look into a few funds.” So the best plan is to get a mix of all types of property into your portfolio for a balance of appreciation and cash flow.

Invest in type two first by purchasing one or two, then move to type one for two to three more purchases. Starting with type two and type one at the beginning will establish a strong foundation to your new business. Now you have about five properties that some have good cash flow and some have low cash to decent cash flow but are increasing in value for a potential sale in the future.

At this point, you can implement the system of “the snowball effect” and can achieve success by having your first home paid in full in the first five years. Now we grow into type 3 and 4 the more expensive rentals and rehab properties. Some look into upgrading their primary residence and turning it into a type 3 as well, or begin to search for the perfect “fixer upper” (type 4).

PURCHASE MONEY

Most lenders and brokers will require you as a non-owner purchaser to invest 10% down payment for each home. If you are capable or are just getting started, your first purchase could hopefully be owner occupied to capture a lower down payment requirement and a lower interest rate.

Maximize your cash; have a clear plan of action from the beginning. The Mortgage Planner consultant will walk you through your 15-year plan to maximize your cash flow by customizing the home loan programs to meet your goals. Don’t just accept a 30-year fixed as other options may accelerate your plan differently. At The Mortgage Planner each loan is customized, even if we decide on a 30-year fixed, but knowing the program advantages is half the battle.

BEFORE YOU BEGIN, KNOW YOUR SURVIVAL NUMBER!

This is such a vital key to any businesses success. You are a business owner! You must know what it costs your family to survive per month and include your rental mortgage payments in that figure.

For example, if you take into account all of your personal debt like your house payment, car, phone, credit cards, gas, electric, cable etc. and don’t forget your rental mortgage payments that you must pay. The minimum payment totals multiplied by three, will give you your SURVIVAL NUMBER. This does not include speeding tickets, vacations or other once in awhile expenses.

Let’s say your survival number is $3,000 per month including spending money, then your survival account (money market suggested) should have $9,000 in it. Remember the rule of thumb is 3 X’s your monthly survival should be backing your rental business for vacancies and repairs.

Many investors don’t take the time or the discipline to save the cash flow from their investments nor commit to the system. When your debt is paid in full and you have 3 times your monthly survival in a money market for reserve or that next great deal, life becomes much easier to profit and play the game of life by implementing structure to your rental property business.

As the snowball effect pays your properties off one at a time in an accelerated fashion, your net worth rises and your cash flow becomes passive income that plans your retirement for you.

Maintaining a survival account is the first step to starting the snowball process, it makes it easy to purchase the next “great deal” when it comes. It also prevents any glitches in the snowball effect system when a tenet moves or you need to complete repairs.

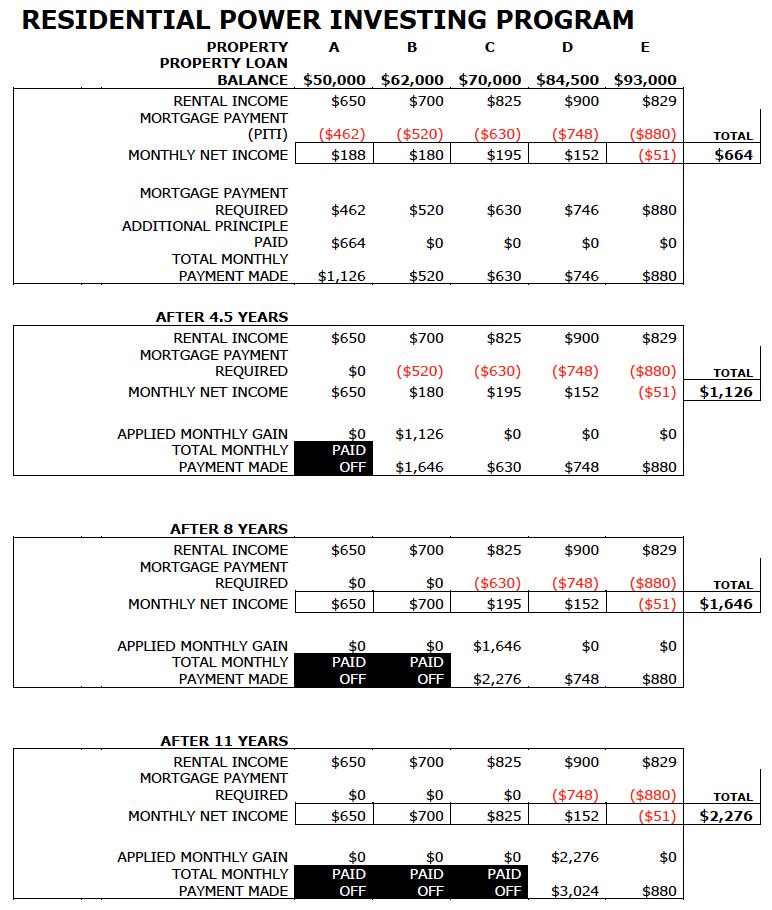

CREATING THE “SNOWBALL EFFECT”

It all starts with one! Use other people’s money to grow your portfolio! The plan is simple but yet many people can’t stick to it. It takes discipline and goals you really want. Start with one and your goal must be to pay it off. On the snowball analysis you will see that by purchasing 3-5 rental properties with ‘average’ rent you can have your first 30-year home loan paid off in less than 5 years! From there it’s all down hill getting the rest paid in full so that you and your family retire with a high net worth and passive income of over $45,000 per year, while the average American last year retired on less than $10,000 per year.

The rental figures used in the snowball effect example are based on estimated non-owner occupied taxes and insurance escrowed in the monthly payment. However, it does not take into account any vacancy factors or repairs figured in the equation to any property.

The figures used are based on a SFR (single family residence) homes. We have found that purchasing multi-units and/or occupying a unit in the beginning can reduce the years estimated significantly.

The Mortgage Planner will schedule your investment plan at an investing consultation and can prepare accurate figures for your real estate investments knowing exactly how soon you need to create passive income to retire on.

We can also recommend a licensed real estate agent to assist you in the search for homes.

For additional information or planning your real estate investment strategies please visit www. TheMortgagePlanner.net or call (704) 728-0191. Serving the Carolinas.

RESIDENTIAL POWER INVESTING PROGRAM

RESIDENTIAL POWER INVESTING PROGRAM

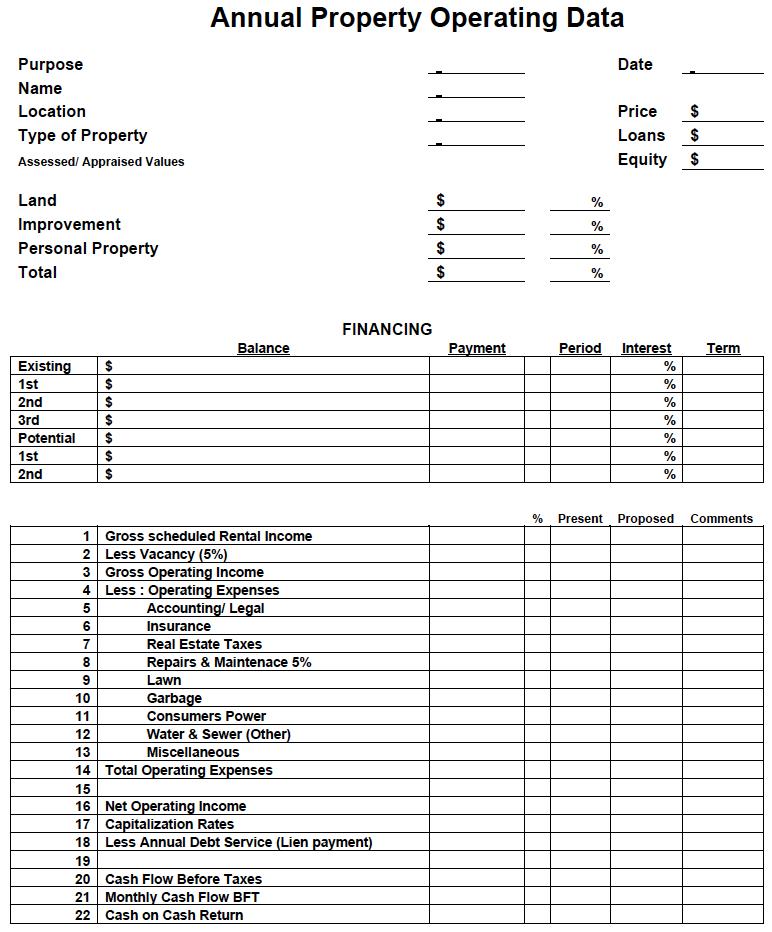

IMPROVEMENT (REHAB) PROPERTIES

IMPROVEMENT (REHAB) PROPERTIES TEMPLATE