ONE OF A TEAM

DHL Global Forwarding’s Sue Donoghue on Being a True Leader

INSIDE THIS ISSUE

New Era for Nuclear

ITER: Engineering Faults, But Logistics Excellence

Hywind Testbed for Mega Offshore

Wind to Open Floodgates

PLUS: Everything from Breakbulk

Middle East’s Phenomenal Success

INDUSTRIAL

Issue 2 2023

PROJECT CARGO BREAKBULK&

BE AMBITIOUS, BUT BE TRUE TO YOURSELF

DHL’s Sue Donoghue Talks Leadership, People

33 NUCLEAR NEW ERA FOR NUCLEAR Energy Transition, Security Driving New Project Announcements

Mark Your Calendars for Upcoming Breakbulk Events

Breakbulk Europe 6-8 June 2023

Rotterdam Ahoy, Netherlands

Breakbulk Americas 26-28 September 2023

George R. Brown Convention Center, USA

Breakbulk Middle East 12-13 February 2024

Dubai World Trade Centre, UAE

37 BREAKBULK PROJECTS STEPHEN SPOLJARIC, CORPORATE MANAGER OF GLOBAL LOGISTICS, BECHTEL NO EXCUSE FOR EMISSIONS CONFUSION Project Kick-started to Standardize Reporting Parameters

38 SPACE AIMING FOR THE PROJECT STARS Europe’s Space Ambitions Lean on Logistics

44 LOGISTICS ENGINEERING FAULTS, BUT LOGISTICS EXCELLENCE Seminal ITER Project Hit by Delays

48 THOUGHT LEADER TON KLIJN, DIRECTOR, ESTA DON’T LEAVE CRANE OPERATING STANDARDS TO CHANCE

Plea to Back ESTA’s European License

49 THOUGHT LEADER HILDE MOL-LUKKEZEN, MARKETING AND COMMUNICATIONS MANAGER, OMDS PATH TO A DIGITAL FUTURE Simplifying Breakbulk Data Sharing

50 THOUGHT LEADER LEIF ARNE STRØMMEN, PARTNER, PEAK GROUP AS PROJECTS READY FOR LIFT-OFF 2023’s Lull a Springboard for 2024’s Boom

52 OUTLOOK MORE OPPORTUNITIES THAN RISKS AHEAD

Industry Experts Share Breakbulk Sector Outlooks

INSIDE THIS ISSUE

Story 30

Cover

54

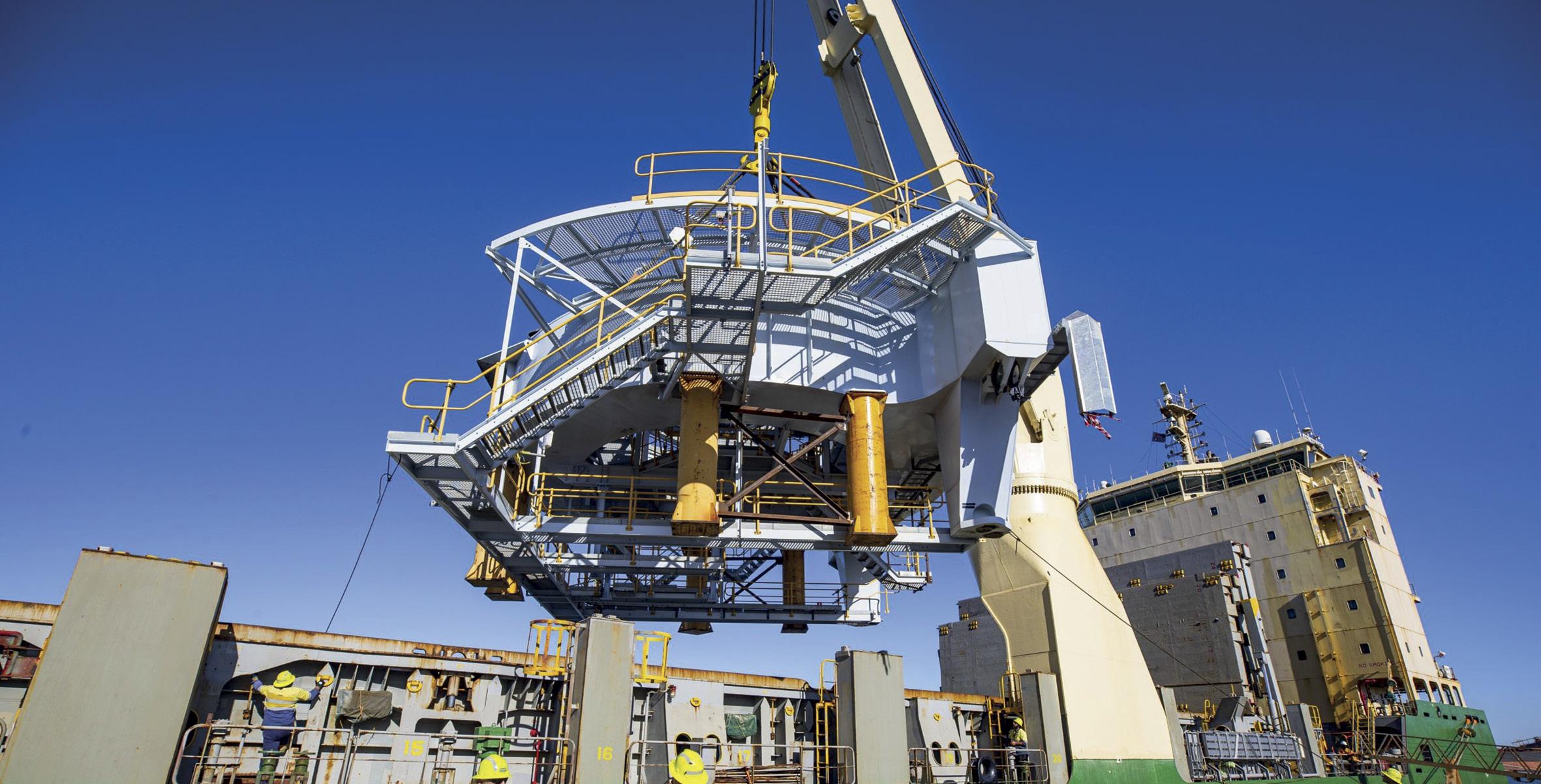

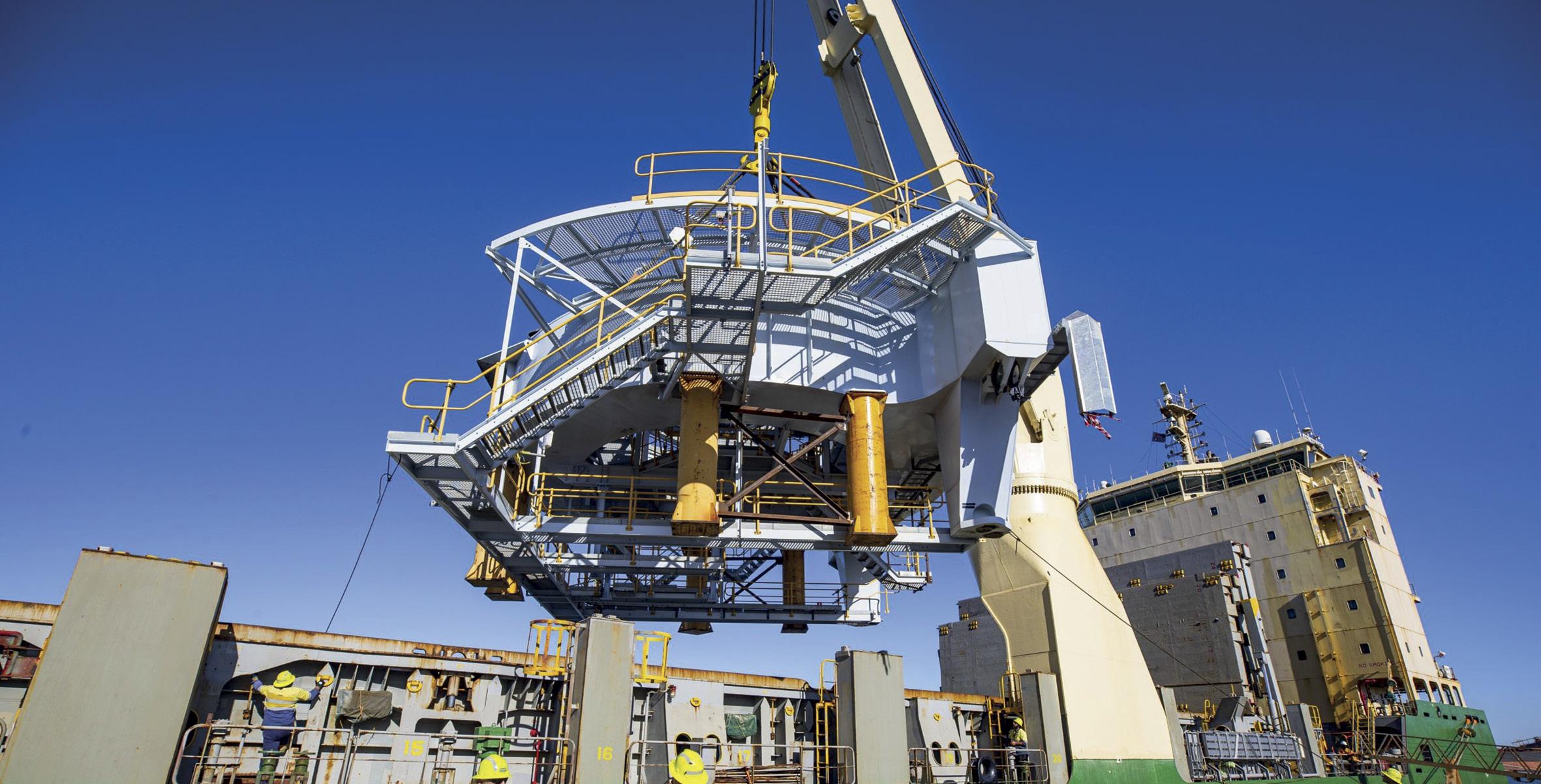

CREDIT: MAMMOET

www.breakbulk.com BREAKBULK MAGAZINE 3

54 RENEWABLES OFFSHORE WINDS BLOW FAVORABLY Testbed for Mega Offshore Wind to Open Floodgates

56 CASE STUDY: BERTLING LOGISTICS OVERCOMING AN AIR DRAFT CHALLENGE Project Calls for Careful Calculations to Ensure Bridge Clearance

60 VEHICLE CARRIERS RECHARGING US ELECTRIC VEHICLE EXPORTS Biting Point for Breakbulk Car Sales

64 MINING SOUTH AMERICA’S WHITE GOLD RUSH Project Potential in Region’s Flourishing Lithium Sector

68 CONFERENCE BREAKBULK MIDDLE EAST REVIEW

A Selection of Stories from Breakbulk Middle East Sessions

72 SAUDI ARABIA SAUDI DIGS DEEP ON MINING AMBITIONS

Political Support Catalyzes Project Cargo Demand

74 CASE STUDY: AAL SHIPPING THREE ENGINEERS’ HEADS BETTER THAN ONE Early Logistics Engagement Pays Dividends for Reclaimer Move

80 BACK PAGE PROJECTS IN THIS ISSUE

INSIDE THIS ISSUE

Also in this issue 06 EDITORIAL 08 GLOBAL SHIPPER NETWORK MEMBERS, EVENT PARTNERS AND EXHIBITORS IN THIS ISSUE 09 UPFRONT 78 BREAKBULK ONE 74 CREDIT: AAL SHIPPING 60 72 CREDIT:

CREDIT:

4 BREAKBULK MAGAZINE www.breakbulk.com ISSUE 2 / 2023

STEVE MORTON, GPA

SWIRE SHIPPING

www.swireprojects.com chartering@swireprojects.com A division of Swire Shipping, a private and wholly owned company of John Swire & Sons. MOVING THE FUTURE Efficient, trusted and flexible shipping solutions for global industrial projects.

NAVIGATING TRANSITIONS TOGETHER

Welcome to the second issue of Breakbulk Magazine for 2023, where we celebrate the success of Breakbulk Middle East and look forward to our flagship event, Breakbulk Europe in June, followed by Breakbulk Americas in September. Moving from one event to the next, our team is in a constant state of transition, similar to what we see throughout the project cargo and breakbulk industry.

Breakbulk magazine looks at hot topics for the industry determined by people like you who work in the field – industry professionals who are members of our advisory boards around the world, who speak on panels, and those we meet at the events themselves, plus a host of experts at large. Most recently, our editorial team attended Breakbulk Middle East in Dubai, an event that saw twice as many attendees compared with previous years. (See the event’s success in numbers on page 10.)

Led by senior reporter Simon West, the team had numerous conversations with industry leaders who contributed their insights into some of the stories you’ll find inside this issue, such as “Saudi Digs Deep on Mining Ambitions” on page 72, and of course, the cover story featuring DHL’s Sue Donoghue on page 30. Sue said she never saw herself becoming a CEO of a Middle East cluster for a global logistics company, but her leadership skills revealed themselves early: as a Brownie (part of Girlguiding for ages 7-10) in the UK, and later as a Scout leader and swim coach. Now that’s a transition worth understanding for leaders, especially female ones, everywhere.

But these conversations not only provided material for region-related issues. With 98 countries represented

at the event, there were plenty of opportunities to speak face-toface with leaders from Europe, the Americas and the rest of the world.

Renewables as part of the energy transition is a hot topic everywhere and one that features prominently in this issue. For an overview of energy investment across the GCC, see Ryan McPherson’s take on page 68. Offshore wind projects often dominate the renewables discussion, and you can read about Hywind Tampen, a testbed for floating wind technology in the North Sea on page 54.

The article, “Offshore Winds Blow Favorably,” sets the stage for a crucial session at Breakbulk Europe called “Managing the Offshore Wind Boom.” The session will host panelists from the 2022 wind session to discuss the impending capacity shortfall for transporting wind components. In preparation for the panel, the panelists formed a workgroup to find solutions to these challenges. We filmed the workgroup in Rotterdam, and you can check out their progress here: https:// youtu.be/lN_lna2gvlA . In the next issue, we will feature the workgroup in detail, and you’ll have a chance to meet them in person at Breakbulk Europe.

Nuclear is having a moment as well, becoming an integral part of the energy transition as you’ll see on page 33. Further off is fusion technology and we look at the progress, delays and logistics triumphs of the ITER project in France on page 42.

There’s so much to absorb in this issue. If you take the time to read it from cover to cover, I promise you’ll come away with information you can apply now in whatever sector of the industry you’re working in. And I hope that this new knowledge will help smooth the transitions you’re facing today.

Best wishes,

Leslie Meredith Editorial Director

EDITORIAL DIRECTOR

Leslie Meredith / +1 (801) 201-5971 Leslie.Meredith@breakbulk.com

NEWS EDITOR

Carly Fields carly.fields@hyve.group

SENIOR REPORTER

Simon West simon.west@hyve.group

DESIGNER Mark Clubb

REPORTERS

Asma Ali Zain

John Bensalhia

Amy McLellan

Iain MacIntyre

Lori Musser

Malcolm Ramsay

Thomas Timlen

Liesl Venter

BREAKBULK EDITORIAL ADVISORY BOARD

John Amos, emeritus

Amos Logistics

Dennis Devlin Maersk

Dharmendra Gangrade

Larsen & Toubro Limited

Margaret Kidd

University of Houston

Anders Maul

Blue Water Shipping

Dennis Mottola, emeritus Global Logistics Consultant

Sarah Schlüter Hapag-Lloyd

Stephen “Spo” Spoljaric Bechtel Corp

Roger Strevens

Wallenius Wilhelmsen

Jake Swanson

DHL Industrial Projects

Ulrich Ulrichs BBC Chartering

Johan-Paul Verschuure

Rebel Group

Grant Wattman Combi Lift Americas

PORTFOLIO DIRECTOR

Jessica Dawnay

Jessica.Dawnay@breakbulk.com

MARKETING & MEDIA DIRECTOR

Leslie Meredith leslie.meredith@hyve.group

To advertise in Breakbulk Media products, visit: http://breakbulk.com/page/advertise

SUBSCRIPTIONS

To subscribe, go to https://breakbulk.com/ page/breakbulk-magazine

A publication of Hyve Group plc. The Studios, 2 Kingdom Street Paddington, London W2 6JG, UK

6 BREAKBULK MAGAZINE www.breakbulk.com ISSUE 2 / 2023

EDITORIAL

Leslie Meredith

Est.2004 Membership Available in Selective Markets! Application: info@gpln.net / www.gpln.net Visit us at Breakbulk Europe Rotterdam, The Netherlands 6-8 June 2023 GPLN Booth No: 1A20 ProudGPLNMemberinGermany Since2019

Global Shipper Network Members

Bechtel: New Era for Nuclear, page 33; No Excuse for Emissions Confusion, page 37

Fluor: New Contracting Methods Needed Post-pandemic, page 69

GE: New Era for Nuclear, page 33

Petrofac: Adaptability Needed to Meet Market Challenges, page 70

Rio Tinto: South America’s White Gold Rush, page 64

Shell: Shell, Technic and Zachary to Engineer Texas CCP Project, page 79

Siemens Gamesa: Offshore Winds Blow Favorably, page 52

SLB: Movers and Shakers, page 20

Technip: Shell, Technic and Zachry to Engineer Texas CCP Project, page 79

thyssenkrupp Industrial Solutions: Three Engineers’ Heads Better Than One, page 74

Westinghouse: New Era for Nuclear, page 33

Zachry: Shell, Technic and Zachry to Engineer Texas CCP Project, page 79

Breakbulk Global Event Partners

(Exhibiting at all three Breakbulk events this year)

AAL Shipping: Movers and Shakers, page 20; Flexibility, Adaptability Needed to Meet Market Challenges, page 70; Job Hunting? ‘Don’t Pigeonhole Yourself’, page 71; Three Engineers’ Heads Better Than One, page 74

DHL Global Forwarding: Be Ambitious, But Be True to Yourself, page 30; Ship Capacity Challenges Coming to a Head, page 18; Adaptability Needed to Meet Market Challenges, page 70

Mammoet: Offshore Winds Blow Favorably, page 54; Don’t Leave Crane Operating Standards to Chance, page 48; Mammoet Installs First Villa at Luxury Resort, page 78

MSC Mediterranean Shipping Company: Adaptability Needed to Meet Market Challenges, page 70

Wilhelmsen group/Wallenius Wilhelmsen: Recharging US Electric Vehicle Exports, page 60; Wilhelmsen Targets DoubleDigit Growth in 2023, page 28

Breakbulk Europe Exhibitors

A.P. Moller-Maersk: Movers and Shakers, page 20

Bertling Logistics: Overcoming an Air Draft Challenge, page 56

Blue Water Shipping: Movers and Shakers, page 20

deugro: New Contracting Methods Needed Post-pandemic, page 69

dship Carriers: Movers and Shakers, page 20

Expeditors: Job Hunting? ‘Don’t Pigeonhole Yourself’, page 71

Harren Group/Jumbo-SAL-Alliance: ITER: Engineering Faults, But Logistics Excellence, page 44

The Heavy Lift Group: South America’s White Gold Rush, page 64

NYK Line: Movers and Shakers, page 20

Port of Rotterdam: Europe Outlook, page 52

Port of Venice: ITER: Engineering Faults, But Logistics

Excellence, page 44

Roll Group: Overcoming an Air Draft Challenge, page 56; Movers and Shakers, page 20

Sallaum Lines: Movers and Shakers, page 20

Swire Shipping: Saudi Digs Deep on Mining Ambitions, page 72; Swire Projects Launches New Australia Route, page 79

United Heavy Lift: New Contracting Methods Needed Postpandemic, page 69

Breakbulk Americas Exhibitors

Bertling Logistics: Overcoming an Air Draft Challenge, page 56

dship Carriers: Movers and Shakers, page 20

NYK Line: Movers and Shakers, page 20

Port of Portland: Recharging US Electric Vehicle Exports, page 60

Sallaum Lines: Movers and Shakers, page 20

Breakbulk Middle East Exhibitors

BBC Chartering: Adaptability Needed to Meet Market Challenges, page 70

Bertling Logistics: Overcoming an Air Draft Challenge, page 56

deugro: New Contracting Methods Needed Post-pandemic, page 69

DSV: Movers and Shakers, page 20

Expeditors: Job Hunting? ‘Don’t Pigeonhole Yourself’, pp 71

IMGS Group: IMGS Group Expands Dubai Operations, page 23

MLB Shipping: New Contracting Methods Needed Postpandemic, page 69

Multimax Shipping: Multimax Looks to Beef Up Fleet, page 22

RAK Ports: Movers and Shakers, page 20

Roll Group: Overcoming an Air Draft Challenge, page 56

SPARK: Saudi Digs Deep on Mining Ambitions, page 72

IN THIS ISSUE 8 BREAKBULK MAGAZINE www.breakbulk.com ISSUE 2 2023

CREDIT: SWIRE SHIPPING

The People and Businesses that Lead This Thriving Industry

UpFront

WHAT’S INSIDE:

From the Sidelines at Breakbulk Middle East Movers & Shakers

Conversations with DHL’s Andy Tite, AAL’s Christophe Grammare, Chapman Freeborn’s Sharon Vaz-Arab, and more New Faces at Breakbulk Europe

Project logistics specialist BDP International moves module for UAE energy project.

CREDIT: BDP

Project logistics specialist BDP International moves module for UAE energy project.

CREDIT: BDP

BREAKBULK MIDDLE EAST REVIEW

Breakbulk Middle East 2023 by the Numbers

10 BREAKBULK MAGAZINE www.breakbulk.com ISSUE 2 2023 UpFront

www.breakbulk.com BREAKBULK MAGAZINE 11

Heard at Breakbulk Middle East 2023 BREAKBULK MIDDLE EAST 2023

“Networking is the backbone of the shipping sector. As companies grow, we become more disparate and we move into different regions, so it’s important that we can engage as close as possible with our audiences. Breakbulk offers AAL the opportunity to do that.”

John Pittalis, Marketing and Communications Director, AAL Shipping and member of the Breakbulk Europe Advisory Board

“This is our first time to be part of this exhibition. We have taken part because we are looking for agents in the region and instead of visiting a number of countries where we operate, we thought that since Dubai is the hub, it is an ideal place to make business connections.”

Baki Ozmen, Head of Logistics, Neoflex

“Breakbulk Middle East has been far more vibrant than ever before, attracting a huge crowd. As exhibitors we have been pleased with the traction we are getting at our stand. The venue is warm and bright and the floorplan well-developed. The Women in Breakbulk event was a highlight – intimate and warm. We look forward to doing this again in Rotterdam.”

Meera Kumar, President and CEO, Diabos Global

“I was here last year and it is a lot busier than last year’s event! At our booth we have seen so many interesting people. Some potentially partners, some potential clients, and some potential suppliers.”

Peter Rondhuis, CEO, Roll Group

Link to video: Roll Group: Alliances Key to UAE Wind Success

12 BREAKBULK MAGAZINE www.breakbulk.com ISSUE 2 2023

UpFront

“It is absolutely fantastic to see such a huge crowd again. It seems like we have everyone in the industry participating, and we have a great international presence.”

Shujjat Alikhan, Vice President, IMGS Group

Link to Video: IMGS Returns to Breakbulk for More Business Success

“Breakbulk Middle East has been one of the best events we have attended. It has allowed us to share our experiences and knowledge with the logistics sector. It is an event we will continue to support.”

Anfal Zahir Al Affani, Market Lead, Oman’s Ministry of Transportation, Communication and IT

“I must admit this is my first time at Breakbulk Middle East. I’ve been to Breakbulk Europe before and I am really happy with the turnout here. It’s very busy and active. You can feel there’s a lot of energy here.”

Nicholas Gallie

Co-Owner,

ConexBird

Link to video: ConexBird Reduces Risk at Ports

“I think it’s great! I remember the first Breakbulk Middle East in Abu Dhabi, if you see the size of the event and how it’s grown over the years, you can certainly see there’s a lot of Middle East interest at the moment.”

Steffen Behrens, President, Middle East, deugro Emirates

Link to video: Working Through Freight Formats with deugro’s Steffen Behrens

“Our ultimate goal is to network at this exhibition, which is the reason for our participation. From the event’s start, we made great connections, learned about other companies’ work and showcase what we have to offer.”

Kadeeja Afreen, Logistics Coordinator, Rajab Express

“It’s our first time exhibiting so we’re really pleased to be here. The amount of people here is impressive. The exhibition’s expanding, it’s getting more traction. There are already commitments for next year and that’s really exciting!”

Andy Tite, Vice President and Global Business Development and Commercial Director of Industrial Projects, DHL Industrial Projects

Link to video: Business Outlook with Andy Tite, DHL IP

www.breakbulk.com BREAKBULK MAGAZINE 13

Q&A with New Exhibitors

Companies Attending Set Out Their Stalls

Cargo Flet Blasant S.L.

Equipment

Spain

Sonia Pinteño, Coordinator/ Assistant of Direction

Visit Cargo Flet Blasant S.L. at stand 1K27

What is the most interesting thing about your business? The challenge is the realization of developing innovative solutions and equipment to meet the constant demand of the heavy lifting market.

What made your company want to exhibit at Breakbulk Europe?

Being able to be present and communicate with one of our company’s target business segments.

What is your company’s view on project opportunities in Europe at the moment?

We are experiencing a unique moment in technical development derived from the urgency demanded by new ways of producing and distributing clean energy.

Existing and future projects in the offshore wind energy sector, the installation of green hydrogen structures, and the construction of new nuclear power plants mean that we look with anticipation and confidence at the business of lifting equipment for heavy and oversized loads.

ÖZNAKLİYAT

Türkiye

Filiz Bozat, Deputy General Manager/CRO

Visit ÖZNAKLİYAT KARA TAŞIMACILIĞI A.Ş. at stand 1F01

What is the most interesting thing about your business? We provide project and heavy road transport within Türkiye, Europe, CIS countries, and Iraq.

What made your company want to exhibit at Breakbulk Europe?

Finding new partners and clients, meeting and selling to current customers, increasing awareness of our brand, product and services, launching a new product and service, entering new markets, maintaining our company image, and learning about our competitor’s products and services!

What is your company’s view on project opportunities in Europe at the moment?

Most of the projects in our area are led by Europe-based global forwarders and EPCs, so we need to make our brand name memorable.

Cordstrap

Equipment

Netherlands

Adrian Costas, Business Development Manager Heavy Duty Securing and Accredited Cargo Surveyor

Visit Cordstrap at stand 2B64-C65

What is the most interesting thing about your business? The passion to protect goods, people, and the environment. Cordstrap has a wealth of experience in creating cutting-edge solutions that have transformed conventional lashing procedures and raised security standards. The CTU Code, CSS Code, and AAR requirements are all respected in the development of each of our solutions.

What made your company want to exhibit at Breakbulk Europe?

Many of our global clients visit this event. It is the ideal setting for showcasing both the benefits of our solutions and our wide range of heavy duty securing experience. We can service our customers globally thanks to our extensive network.

What is your company’s view on project opportunities in Europe at the moment?

More and more project cargo businesses are seeking for fresh approaches to improve their cargo security procedures. In addition to offering such solutions, Cordstrap also offers training on them.

NEW FACES AT BREAKBULK

EUROPE

Road Transport

14 BREAKBULK MAGAZINE www.breakbulk.com ISSUE 2 2023

UpFront

Harlyn Solutions

Industry-related Service

United Kingdom

Paige Taylor, Marketing

Visit Harlyn Solutions Ltd at stand 2J10-K11

What is the most interesting thing about your business?

We are engineers innovating the world of shipping through engineering-led transport solutions. We specialize in moving complex and unique cargo from point A to B. From lifting plans to sourcing vessels, we talk the same language as our clients and understand the intricacies that are involved in these large-scale projects.

What made your company want to exhibit at Breakbulk Europe?

Having celebrated our third birthday at the start of the year, we have come a long way since 2020. We have almost tripled our team in the last twelve months and our projects have become bigger and more complex which is really engaging and rewarding. We want to exhibit our triumphs and capabilities to a wider audience as well as build connections with European companies.

What is your company’s view on project opportunities in Europe at the moment?

We deliver a wide range of projects throughout Europe, working within the civil, marine, and offshore industry and would like to continue building our reputation around the continent.

Olmar

Ports & Terminals

Netherlands

Martijn Snijder, Managing Partner

Visit Olmar at stand 2M35

What is the most interesting thing about your business? Collaborating with our users, we are safety and client focused. Owning circa 50 large warehouses, 14 cranes, deep draft, a great rail connection and a large fleet of forklift trucks, reachstackers, terminal tractors and wheel loaders we experience that only offering storage and handling capacity is not allowing our clients to excel. Thinking together about - for example - throughservices, capital investments, and offering CO2-neutral services really can lead to game changers. A classic win-win!

What made your company want to exhibit at Breakbulk Europe?

After our acquisition of Hacklin operations in Pori and the Port of Pori crane operations in the summer of 2022 we wanted to continue their great legacy of being present at Breakbulk Europe. We are keen to show and discuss our capabilities and ample expansion possibilities for investments and for project cargoes, wind mills, forest products, dry bulk, containers and scrap.

What is your company’s view on project opportunities in Europe at the moment?

The energy transition towards Fit for 55 and carbon-zero in 2050 has triggered an exciting period of growth with projects to support the transition of factories, transport equipment, wind farms, solar, and all the things that are yet to be thought of. We focus on supporting those cargo flows with a natural benefit of going through Pori, supported by our 15.3 meter draft, great rail connection, and largest land size in the area.

Sea Bridge Shipping Management

CO.

Maritime Transport

China

Cathy Li, Assistant General Manager

Visit Sea Bridge at stand 1L25

What is the most interesting thing about your business?

We are passionate about breakbulk shipping and stowage solutions, because there are many different types of breakbulk and each shipment has its own unique loading requirements; we are always taking on different “challenges” to find a solution that meets all the requirements of the shipment, and of course it is these challenges that make us progress.

What made your company want to exhibit at Breakbulk Europe?

Sea Bridge (SBS) has been operating mainly in the U.S. Gulf Coast region, but now we want to try to develop European breakbulk shipping as well. As a fresher, attending Breakbulk Europe is a great opportunity to meet and be mentored by senior members of the industry, and to introduce the European market to Sea Bridge.

What is your company’s view on project opportunities in Europe at the moment?

We are both excited and nervous about project opportunities in Europe as we will be facing new challenges. In terms of the current relationship between Asia and Europe, we believe that there is still a lot of potential for project development in Europe, and we are committed to doing our best in this regard. Certainly we will observe the premise of environmental and ecological sustainability and make our shipping solutions for European projects to our satisfaction.

www.breakbulk.com BREAKBULK MAGAZINE 15

UpFront NEW EXHIBITORS AT BREAKBULK EUROPE

Company name Stand number Sector Country ADVEEZ 1J50 IT France Ahmet Yigit Heavy Transport Ltd. Sti. 2M10 Freight Forwarder Türkiye Alexander Global Logis tic s 2E75 Freight Forwarder Germany Angor a Shipping CO 2M02 Maritime Transport Türkiye Bolloré Africa Logistics 2B51 Freight Forwarder France BOXXPORT Gmbh 2L24-M25 Industry-related Service Germany Car go Flet Blas ant S.L. 1K27 Equipment Spain Casper Group Ltd 2C70 Industry-related Service United Kingdom Cargo Power Network 1A50 Association United States CARRIER53’ 2C60 Maritime Transport Germany CBOX Cont ainer s 1K25 Equipment Netherlands C-Cont ainer Concept s 1E34 Equipment Germany CDN Nether lands B.V. 1H41 Industry-related Service Netherlands CETA Logistics & Projects 1M30 Freight Forwarder Türkiye Cords tr ap 2B64-C65 Equipment Netherlands dship Car r ier s GmbH & Co. KG 1C31-D30 Maritime Transport Germany DB Car go AG 1K31 Rail Transport Germany DCM Containers, India 1J46 Equipment India Denholm Por t Ser vices Limited 1N31 Ports & Terminals United Kingdom Egytrans 2L02 Freight Forwarder Egypt EOS 1A44 IT Singapore ERHARDT PROJECTS, S.L. 1G11-H10 Freight Forwarder Spain Evge Egypt for shipping agenc ies – mar itime af f air s 2H75 Maritime Transport Egypt Frontier Heav y Haul & Suppor t Inc . 2G74 Road Transport United States Gateway Logis tic s Group 2M06 Freight Forwarder United States Get ac Tec hnology Cor por ation 1N33 IT Taiwan (Province of China) Gebrueder Weiss Gmbh 1M36 Freight Forwarder Austria GIO Shipping Co.Ltd 1J35 Maritime Transport China Grimaldi Group 1L40 Maritime Transport Belgium Grindrod Logistics Africa 1M15 Freight Forwarder South Africa Hanson Car r ier s Pte Ltd 2F74 Maritime Transport China Har lyn Solutions Ltd 2J10-K11 Industry-related Service United Kingdom HAROPA PORT 2D31 Ports & Terminals France ICT Innov ative Cont ainer Tec hnologies GmbH 1M24 Equipment Austria IDEA Maroc Shipping & Global Forwarding 2G72 Freight Forwarder Morocco ISS Global For warding Tasimac ilik A.S 2B74 Freight Forwarder Türkiye NEW EXHIBITORS

16 BREAKBULK MAGAZINE www.breakbulk.com ISSUE 2 2023

AT BREAKBULK EUROPE 2023

ITO Fr ank f ur t Hans Ger z ymisc h 2A51 Freight Forwarder Germany Jassper International Pte Ltd., Singapore 1K43 Freight Forwarder Singapore KOMSTAL Mic hal Kowejs z a 1N30 Equipment Poland Logis tic s Plus 1E41 Freight Forwarder Türkiye Maxton Shipping 2M51 Freight Forwarder United States Mes sina Line 1C34-D35 Maritime Transport Spain MOBOTIX AG 1H45 IT Germany MS Spec ial Tr anspor t s & Projec t s SRL 2L01 Road Transport Romania Multimax Shipping DMCC 2K10 Maritime Transport United Arab Emirates MUR Shipping 1K35 Freight Forwarder Netherlands Navigator Tr anspor t 2G55 Road Transport Poland Navis 2J11 IT United States Neoflex 1M31 Equipment Türkiye Network Global Logistics A.ş. 1N20-M21 Freight Forwarder Türkiye Olmar 2M35 Ports & Terminals Netherlands ÖZNAKLİYAT KARA TAŞIMACILIĞI A.Ş. 1F01 Road Transport Türkiye Polish For warding Company 1L21-M20 Freight Forwarder Poland Por t of Lisbon / Por t of Setubal 1K34 Ports & Terminals Portugal Port Rhenan Colmar Neuf-Brisach 1N35 Ports & Terminals France Prolog India Pvt. Ltd. 1G45 Freight Forwarder India Qaranbeesh Group 1A31-B30 Ports & Terminals Saudi Arabia RAM Spreader s 1N23 Equipment Singapore Sai Wan Shipping 1J55 Maritime Transport Hong Kong Sea Br idge 1L25 Maritime Transport China SEDNA Communic ations 1N21 IT United Kingdom SESCO Tr ans for Developed Logis tic s 2J70-K71 Industry-related Service Egypt Shenship Singapore Pte Ltd 1K54 Industry-related Service Singapore Sinogrand Shipping 2M41 Freight Forwarder China SJ Logis tic s Group EMEA 2L11 Freight Forwarder Korea, Republic of SMP Global Pte Ltd 1F50 Industry-related Service Singapore Spec ial Tr anspor t euroExpres s, s.r.o 1A48 Road Transport Slovakia TITAN 1H51 Road Transport Türkiye TPL Projec t Stoc k Company 1D40 Freight Forwarder China Tr ans atlantic Logis tic s Pv t Ltd 2A65 Freight Forwarder India TUNISHIP 1K52 Freight Forwarder Tunisia Williams Shipping 1F02 Maritime Transport United Kingdom Company name Stand number Sector Country www.breakbulk.com BREAKBULK MAGAZINE 17

IN CONVERSATION

Perfect Storm in Reverse to Buoy Outlook

By Carly Fields

The global logistics industry has seen a significant shift in cargo movement, according to Andy Tite, vice president of global business development and commercial director at DHL Industrial Projects. Speaking with Breakbulk, Tite noted that the delays, congestion, and lack of space experienced earlier have given way to a situation where companies are now holding inventory, which has released capacity in the container fleet. This situation has coincided with the release of congestion in China, creating what Tite described as “almost a perfect storm in the opposite direction. With rates crashing as fast as they shot up if not faster.”

From a project perspective, “it’s almost the polar opposite,” he said. Tite noted that there were delays due to construction restrictions, travel restrictions, and investment being put on hold during the pandemic. However, he anticipated that as restrictions are lifted, there will be a surge in project-related activities, with investments in oil and gas leading to double offsets in renewables investment. “Bring all of that together, and I think not just next year and beyond, but the next six months is going to be busy and hopefully a great time for the project for the industry,” he said.

stakeholders in the industry will start planning more proactively, moving towards a more collaborative and considered approach to how, when, and where to move cargo.

At DHL, Tite and his team have a mindset of genuine interest, providing clients with service, information, and expertise. This approach helps clients to ask the right questions when putting together requests for proposals (RFPs) and anticipating potential pain points or areas of concern. Tite emphasized the importance of being realistic and collaborating with subject matter experts who can bring their value to the table.

Regarding capacity, Tite noted that land-based asset owners have been consolidating equipment, making it difficult to look at smaller projects or spot shipments. However, DHL’s chartering team has strong carrier relationships, ensuring that it can provide accurate service provisions and call on support, if necessary, in the ocean freight market.

Tite noted that there will be some reliability in pipeline and expects a bit of a logjam until the industry figures itself out. However, he hoped that shippers and other

One challenge that Tite noted is the disconnect between freight rates and budgets. As project financing needs to be set well in advance of operational activity, managing this challenge can be difficult. However, Tite anticipated that rates will fall eventually, providing shippers with benefits after the hard work of financing has been done. Despite carriers enjoying the last few years, Tite added that no-one sets the market, and it is governed by basic economics based on supply versus demand.

DHL Expert Predicts a Project Boom

18 BREAKBULK MAGAZINE www.breakbulk.com ISSUE 2 2023 UpFront

Andy Tite

“...I think not just next year and beyond, but the next six months is going to be busy and hopefully a great time for the project for the industry.”

– Andy Tite, DHL

IN CONVERSATION

Paving the Way for Future Generations

By Liesl Venter

Women are increasingly taking up leadership roles in the breakbulk and project cargo logistics industry, as the value of their contribution and particular skill sets are being recognized.

Economic empowerment and the reduction of gender inequities in the workplace, however, must remain the priority of every woman in the industry as they pave the way for future generations, said Thelma Williams, Dubai-based auditor and marine surveyor for Bureau Veritas.

Williams, the only woman to occupy such a position in the UAE, said women continue to demonstrate how their involvement in business leads to higher levels of productivity, safety and improved financial returns.

“Women represent an enormous untapped resource in the overall breakbulk talent pool,” Williams said. “Not everyone is made for everything. We all have strengths and weaknesses, but if you are passionate about working in the breakbulk sector then there is no reason to shy away from it just because you are a woman. The sector has proven that there is room for women to show what they are capable of.”

Women, she said, bring particular skills to the table, including patience and pragmatism. While there is no denying that breakbulk and project cargo remains an industry still dominated by men, for Williams, change is happening as more women enter the profession adding value with the skills and characteristics they bring to the job.

“For me, it is not about doing a man’s job like a man, but what I can do as a woman. That goes one step further –doing my job as me. I am my biggest cheerleader.”

A Former Seafarer

Born in Johannesburg and raised in Cape Town, South Africa, Williams is not new to the concept of inequality. As the first South African woman of color to get her captain’s ticket, she spent years at sea often in challenging situations.

“As a seafarer, I realized that women do not need to shy away from roles perceived to be those of men. As women in maritime, and women in breakbulk, we need to remember that we have a place and that before we expect other people to validate us, we need to validate ourselves. I joined the maritime industry about 20 years ago completely clueless about what the future held, but I knew this: I could do whatever was asked of me.”

It is a personal oath that Williams has held dear her entire career.

“I cannot control what men do in this industry. For that matter, it is not about me being comfortable with men or even trying to emulate what they do or fit into their world. I am, first and foremost, a woman working in the maritime sector and doing a job well. As women, we need to be true to our gender. I have never had to change who I am to do my work.”

Williams says women are increasingly being recognized in the breakbulk sector for their contributions. “There are still not enough women in the breakbulk and project cargo logistics sector. As women in the industry, we hold positions of privilege. We need to stand tall as we are paving the way for generations of women still to come.”

According to Williams, women also need to share their stories and experiences no matter how small or insignificant they think they might be.

“It is only through the collective voice that we will be able to affect long-term change. The shipping industry has been around for years, as has women’s involvement in it. We are now starting to step up and move forward as we are capable mariners who add value to the workplace. We must add our voice to the multitude of women’s voices advocating for more women in maritime.”

For Williams, the outlook for women in the breakbulk sector is extremely positive. “Women’s voices are getting louder and the industry can no longer ignore it. Yes, we are still far from reaching a balance, but we are heading in the right direction.”

www.breakbulk.com BREAKBULK MAGAZINE 19

Bureau Veritas was the sponsor of the Women in Breakbulk Breakfast at this year’s Breakbulk Middle East in Dubai.

Thelma Williams, Keynote Speaker at Breakbulk Middle East’s Women in Breakbulk Breakfast, Talked to Breakbulk on International Women’s Day

Thelma Williams

Highlighting Recent Industry Hires, Promotions and Departures MOVERS

A.P. Moller-Maersk

Breakbulk Europe Advisory Board member Tim Killen has joined AP Moller-Maersk as the Danish shipping group’s global head of growth for project logistics. Killen boasts more than 25 years of experience working on capital projects in various senior management capacities. Prior to Maersk, the executive served as deugro’s chief sales officer and executive vice president.

In January, Maersk officially launched Maersk Project Logistics, a new product that would focus on solution design, special cargo transportation and project management services. Killen told Breakbulk : “I am honored to join the global Maersk organization and to be able to play a part in Maersk’s Integrator strategy and the implementation of the new Maersk Project Logistics service offering.”

AAL Shipping

AAL Shipping has promoted Karim Smaili to general manager in the Middle East. AAL is operating at least one scheduled multipurpose heavy-lift cargo sailing through the region each month, with additional tramp sailings to support its clients.

“The region is not only importing project cargo to meet local needs but also exporting steel and locally fabricated project heavy-lift components. With our well-established trade routes connecting all these regions, we can provide the global ocean transport solutions needed,” said Smaili, who has worked in AAL’s Dubai office since its launch in early 2015.

AND SHAKERS

Roll Group

Netherlandsbased Roll Group announced that industry experts Patrick van der Meide and Harmen Tiddens will set up and lead Roll Africa, a new unit focused on heavy transport solutions throughout the continent. Both Van der Meide and Tiddens had previously held various management roles with lifting specialist Mammoet.

“As we strive every day to execute safe operations at the highest industry level, we need experience and solid understanding of this expanding market, and are glad to have Patrick and Harmen on board.” said Peter Rondhuis, CEO of Roll Group.

dship Carriers

Dea Chincuanco has started her new role as vice president of strategy and commercial management at dship Carriers.

Chincuanco, previously served as the company’s assistant vice president – commercial and chartering North America.

Chincuanco is a member of Breakbulk’s Women in Breakbulk networking platform and gave an inspiring speech to more than 120 female professionals at the Women in Breakbulk Breakfast at Breakbulk Americas 2022 in Houston.

SLB

Vinit Pednekar has been promoted to materials manager at oilfield services provider SLB’s distribution center in Houston. Pednekar will take responsibility for the overall running of the complex, which supports SLB’s global operations. The executive has held various roles at SLB since joining the firm in 2007, including global logistics planning manager, product line supply manager and, most recently, supplier manager for well construction.

“Over the last 15-plus years with SLB, I have explored all avenues of supply chain management. The company has given me an opportunity to live and work in different countries, and every experience has been valuable in my career development,” Pednekar told Breakbulk. SLB – formerly Schlumberger – is a member of the Breakbulk Global Shipper Network.

Journal of Commerce

Susan Oatway has taken up a new role as research analyst for multipurpose and project shipping at the Journal of Commerce, part of S&P Global. Susan, a member of the Breakbulk Europe Advisory Board, said she would be working with the editors within S&P’s global intelligence and analytics division.

Prior to the JOC, the analyst spent 25 years as a director – then associate – of London-based Drewry Shipping Consultants. Susan has also been a Fellow of the Institute of Chartered Shipbrokers since 1996, serving as the organization’s first female international chairperson from 2019 to 2021.

Tim Killen

Tim Killen

UpFront

Karim Smaili

20 BREAKBULK MAGAZINE www.breakbulk.com ISSUE 2 2023

Patrick van der Meide

Harmen Tiddens

Dea Chincuanco

Vinit Pednekar

Susan Oatway

Kerry Project Logistics

Having spent the bulk of his career in the Middle East, Alberto Pittaluga recently jumped continents, joining Kerry Project Logistics as the company’s Houston-based regional director for the Americas. Pittaluga’s two decades in the Middle East included eight years at ALE and, most recently, twoand-a-half years as head of Al Faris’s operations in Iraq.

Milan-headquartered KPL, the industrial projects division of Kerry Logistics, is present in 53 countries worldwide, delivering some 310,000 tonnes of airfreight every year. “Being based in Houston makes project management in North, Central and South America much easier,” Pittaluga said to Breakbulk

RAK Ports

RAK Ports in Ras

Al Khaimah, the northernmost emirate of the UAE, has named Roy Cummins as its new CEO. The senior ports executive with more than 30 years’ experience in maritime logistics previously headed the Port of Brisbane in eastern Australia. “Roy is a recognized leader, and a strong team player with a leadership approach that promotes collaboration, fosters innovation and empowers teams,” the company said.

RAK Ports operates at four hubs across Ras Al Khaimah, including Saqr Port, the biggest bulk handling port in the region, and RAK Maritime City, the only free zone in the region to have direct quayside access.

Sallaum Lines

Switzerland-based roll-on, roll-off and breakbulk shipping specialist Sallaum Lines has named Kay Lemcke as its new chief operating officer. The executive, previously managing director of Sallaum Lines Germany, has relocated to the firm’s headquarters in Kägiswil to oversee the company’s continuous operations and processes.

“I am immensely proud having been part of our group over the last 10 years and I am looking forward to developing and executing our global operations in my new role as COO, with the aim to continue delivering excellent service with a strong team, while further progressing our environmental responsibilities,” Lemcke said.

Blue Water Shipping

Blue Water Shipping has named Jørgen Wisborg as its new chairman, taking over from Kurt Skov, who steps down after more than 50 years’ service at the transport and logistics group that he founded in 1972. Wisborg joins Blue Water after almost three decades at Danish energy company OK, where he had served as CEO since 2005.

“Jørgen Wisborg is a very skilled and experienced leader,” Skov said. “As chairman, he will contribute to sustaining and strengthening Blue Water’s strategic development in collaboration with the rest of the board and our executive management. On top of strong business skills, it has been important for us to find a chairman who will safeguard our culture and values. And we have found that with Jørgen.”

DSV

Transport and logistics specialist

DSV has appointed Yasser Alyassin as the company’s new regional director for industrial projects in the MENA region. Alyassin, who will be based in Dubai, was previously director of logistics at UK-based oilfield services provider Petrofac. Prior to that, the executive held various roles in the Middle East for heavy-lift specialist ALE.

Alyassin has appeared as a specialist speaker at Breakbulk events. Last year, the executive was invited to join a thought-provoking main stage panel session at Breakbulk Europe in Rotterdam covering the technology needs of the EPC industry.

NYK Group Europe

Japanese shipping company

Nippon Yusen

Kabushiki Kaisha, or NYK Line, has named Carl-Johan Hagman as new president and CEO of NYK Group Europe. Hagman will replace Svein Steimler, who will step down at the end of March to continue as special advisor to NYK.

Until mid-2022, Hagman had been CEO of Swedish shipping group Stena Line. “NYK is maybe the world’s most well reputed shipping company, and I am very happy to be welcomed as part of the team,” Hagman said. “I promise to do my best to contribute to the company’s continued success in its vital mission of helping cargo owners transition to sustainable, resilient and even more efficient supply chains.”

www.breakbulk.com BREAKBULK MAGAZINE 21

Alberto Pittaluga Kay Lemcke Yasser Alyassin

Carl-Johan Hagman

Jørgen Wisborg

Roy Cummins

By Asma Ali Zain

Multimax Looks to Beef Up Fleet

Singapore-Based Carrier Eyes Expansion to Europe, East Africa

Multimax Shipping is looking to beef up its fleet of multipurpose and bulk carriers, with an executive for the Singapore-based company telling Breakbulk it wanted to acquire “at least five more” vessels.

Multimax currently operates 18 owned and chartered vessels, focused primarily on the transport of bulk cargo such as coal, granites, aggregates, salt, steel, general cargo, specialized and project cargo.

“We are in discussions with various ship owners to get at least five more ships in our fleet,” said Shailendra Singh Chauhan, Multimax’s chartering manager for breakbulk, dry bulk, projects and heavy-lift.

Multimax set up an office in Dubai in 2018. Since then, the company has become a “well-recognized carrier in the region,” Singh said. It has delivered cargoes for major projects in the region’s oil and gas, power and construction sectors.

The Simple Solution to Complex Cargo

According to the executive, the company is planning to use its Dubai office as a launchpad into other markets in the region, such as Saudi Arabia.

“There are several projects coming up in Saudi Arabia, and we are targeting these projects,” Singh said. “One reason why we are increasing our fleet size is that for the past three years, we have seen a lot of demand from Saudi and we want to give them a regular service.”

The company also wants to expand its services and trade routes into Europe and Africa by the end of this year. It currently offers services to the Far East, Australia and Africa.

“As a company that is looking to increase its freight size in the project segment, we are further expanding to the markets in Europe and Africa by the last quarter of 2023,” Singh said. “So far, the service has been only up to East of Suez Canal.”

IN

UpFront

CONVERSATION

When you need that something special, the Port of San Diego knows how to handle specialty cargo. Move your cargo from ship to ground to market much faster. • OPEN SPACE • FLEXIBILITY • EXPERTISE Coming this year ! All-electric cranes with increased maximum lift capacity up to 400 metric tons! Learn more at portofsandiego.org/cargo

Shailendra Singh Chauhan. CREDIT: MULTIMAX

THE SPECIAL A DVAN TAG E

By Simon West

IMGS Group Expands Dubai Operations IN CONVERSATION

Canada-Headquartered Forwarder Eyes Growing Potential in Region

Just months after launching a new multipurpose cargo terminal at Jebel Ali Port in Dubai, IMGS Group has unveiled plans to further expand the facility.

Speaking to Breakbulk on the sidelines of Breakbulk Middle East, IMGS’s vice president, Shujjat Alikhan, said the terminal was operating at full capacity and struggling to keep up with demand that was showing no signs of abating.

“We inaugurated the 40,000-tonne bulk cargo facility in July 2022 and it was immediately off to a flying start,” Alikhan said. “As we speak, we have zero capacity due to the high demand we are seeing. The board has already approved our expansion plans and we have started this process that will see us double our capacity by 2024.”

It was a strategy, Alikhan said, driven by numbers. “Our company has its DNA in Africa, but we are being pushed more and more to look at the Middle East. The volumes, the numbers and the connectivity are driving us to grow our footprint here as it is no longer just our commercial and administrative hub, but is fast becoming our operations champion.”

Where previously the company had been handling 10-15 vessels out of Port Elizabeth in South Africa, the executive said now at least seven of those vessels were permanently catered for in Dubai.

“More and more, the benefit of Jebel Ali Port as a logistics hub is being realized. Rather than sending cargoes to Africa directly where connectivity to the hinterland is oftentimes challenging, the move is to now trans-ship to the Middle East and distribute from here. It is not only far more effective but also very cost efficient, and with the added value of expertise from companies such as ours it is a win-win for the industry.”

According to Alikhan, the safe environment offered by Jebel Ali along with its strong connections to Africa will see the port and region continue to grow as a logistics hub for years to come.

IMGS Group, which this year celebrates its 60th anniversary, will continue to invest in its Middle Eastern operations, he said.

“We have continued to see growth in the past few years. The pandemic did not slow us down as we saw an increase in volumes leading to expansion and massive investment we have already made at Jebel Ali, which is exceptionally well connected, be it via air, sea, road or rail.”

Shujjat Alikhan. CREDIT: IMGS GROUP

Finance Harder to Come By

Asked about challenges, Alikhan said proper access to finance for buyers remains problematic, while new start-ups have affected rates. “We saw a lot of start-ups during Covid that managed to get some big contracts, undercutting on prices without understanding the financial impact. This had a big impact on many of the large logistics companies,” he said.

“The subsequent result was that many of these companies were not able to perform and deliver to the contracts. We are starting to see the business go full circle with companies again opting to use vetted breakbulk service providers rather than new and unknown start-up service providers.”

Alikhan believes there are numerous benefits to using a neutral service provider such as the IMGS Group. “Not only is it the safety and quality of our service but the integrity and confidentiality that we offer makes all the difference.”

The executive also pointed to a joint venture with the Archer-Daniels-Midland Company, or ADM, to handle all their cargo distribution in Pakistan as part of a corporate social responsibility program to deliver food to the country.

The JV, unveiled late last year, will handle grains, oilseeds, feedstuffs, pulses and will sell goods domestically in the territory of Pakistan.

IMGS was a sponsor at Breakbulk Middle East 2023.

www.breakbulk.com BREAKBULK MAGAZINE 23

By Carly Fields

IN

CONVERSATION

Difficulty of Managing Client Expectations

Disrupted Supply Chain Requires Pricing Reset

Managing client expectations is now one of the biggest challenges for global project forwarders as they navigate a complex global supply chain affected by a range of factors including congestion, fluctuating fuel prices and capacity shortages, according to a senior forwarding executive.

Speaking to Breakbulk, Simon Duke, CEO Middle East & Asia Pacific for Trans Global Projects, said: “If you have a contract, trying to maintain lump sum rates is part of our challenge. We can all maintain rates, but it’s also trying to find the equipment or space at those rates. And then obviously, there are the delays - when you’ve got a project with cargo required on site on set dates, you need to maintain those dates.

“It can be a tricky situation when clients expect the performance but at the previous rates which were locked in,” he added.

Duke also highlighted the issue of congestion and equipment shortages in the U.S. and Europe. He said that while things were normalizing, there were still challenges ahead. One of the solutions to these problems, he added, was for clients to book well in advance.

“We have some pipe moving out of India and that was locked in nine months ago at the bunker level at that time. That was a bit of a risk and reward. The solution is locking in early and putting everything in place under milestones to ensure that nothing slips.”

Duke added that while there were different strategies for managing costs, the safest approach for both parties is probably a cost-plus scenario. “We are stakeholders, we are partners, so I see a cost-plus scenario is probably the best way forward in today’s market.”

Outlook is Bright

Meanwhile, the outlook for the global project market is bright, according to Duke. He shared his optimism about the buoyant global project market with Breakbulk, noting that “2022 was a very, very good year for the chartering desk.”

Duke identified the power and renewables sector, particularly projects involving turbines and generators, as the future of Trans Global’s business. He also noted that mining has been on the rise in Australia, and that EPC construction can include upgrades and expansions.

But the most exciting projects are the “NEOMs of the world,” he said. However, he added that it can be challenging to put a pipeline against the projects due to their complexity. Duke said that Saudi Arabia, with Aramco’s $50 billion investment over the next five years, is going to be the next big market for the company. He noted that the company has successfully delivered 7,000 metric tons of pipe into Damman this year, with fabricated equipment expected to move into Saudi Arabia from Jebel Ali in the near future.

Duke also revealed that resource management is one of the biggest challenges for Trans Global Projects, with finding qualified engineers and support staff proving particularly difficult. He highlighted the issue of high expectations among potential employees due to the demand for their skills, resulting in a need to manage costs.

Despite these challenges, Duke expressed his confidence in the future of the global project market and Trans Global Projects’ role in it.

Simon Duke.

24 BREAKBULK MAGAZINE www.breakbulk.com ISSUE 2 2023

CREDIT: TRANS GLOBAL PROJECTS

UpFront

By Carly Fields

Changing Landscape of Project Air Freight IN CONVERSATION

Insights from Chapman Freeborn’s Sharon Vaz-Arab

The Covid-19 pandemic has undoubtedly impacted the air freight industry, with traditional carriers facing airport closures and capacity issues while air charter specialists like Chapman Freeborn experienced a surge in demand. However, as passenger travel slowly resumes and freight demand increases, the industry is witnessing a shift in the types of cargo being transported, leading to a slowdown in charter conversions.

According to Sharon Vaz-Arab, president of Chapman Freeborn IMEA: “There is a certain amount of benchmarking of rates – traditional carriers versus charter operators – but there’s also a shortage of capacity so there’s less availability of what can fly.”

The shortage of capacity is partly due to the ramping up of freight demand, with many shippers now looking to procure their own capacity rather than relying on traditional carriers. “Forwarders have been 80 percent of our business. But because of the pandemic and the lack of capacity, we’re seeing shippers looking to have their own procured capacity. For example, with Maersk and several others,” Vaz-Arab said.

Chapman Freeborn, an asset-light aircraft charter specialist, was acquired by Avia Solutions Group two years ago, which owns 140 aircraft and plans to double that number. “Although we do have capacity within the group, a large amount of CF’s business is procured from the great relationships we maintain in the industry and an access to a wider network of operators,” Vaz-Arab explained. The company is also focusing on expansion and strengthening its footprint in its India, Dubai and Johannesburg offices as well as exploring opportunities in and around the wider region.

However, the pandemic has also highlighted the humanitarian aspect of the air freight industry, with a surge in demand for humanitarian and government aid flying into Syria and Türkiye. Vaz-Arab added: “That’s the need of the hour.

“In addition to that, we’re seeing industrial projects growth development in Saudi Arabia. Africa growth continues with various projects and rebuilding of infrastructure, fast development of LNG projects, energy, oil and gas, and rail expansion. India is another market rebuilding with a strong domestic market that we will focus on.”

Chapman Freeborn prides itself on maintaining transparency with its clients and adhering to regulatory compliant shipping and air freight standards. “We give them various options, the low cost versus the high costs and the pros and cons with both, so that they can pick the options that fit them best,” Vaz-Arab said. The company’s global presence, with 100 offices and service centers worldwide, and a workforce of 10,000 highly skilled employees, is a testament to its commitment to the industry for the long haul.

www.breakbulk.com BREAKBULK MAGAZINE 25

“We’re seeing industrial projects growth development in Saudi Arabia. Africa growth continues with various projects and rebuilding of infrastructure, fast development of LNG projects, energy, oil and gas, and rail expansion. India is another market rebuilding with a strong domestic market that we will focus on.”

– Sharon Vaz-Arab, Chapman Freeborn

Sharon Vaz-Arab. CREDIT: CHAPMAN FREEMAN

By Carly Fields

IN CONVERSATION

MPVs Cut the Bulk, Box Purse Strings

Heavy-lift Ships Forge Their Own Freight Path

The multipurpose vessel market is undergoing significant changes, with the container and bulk markets no longer driving its fortunes, according to Christophe Grammare, managing director of AAL Shipping (AAL).

The bulk market suffered a trough due to the slowdown of China’s production, while the container market has declined sharply. However, the MPV market is doing well on the back of contracts signed in 2022.

Speaking with Breakbulk, Grammare said the MPV market had always been driven by the other two sectors, but for the first time in his career, he saw “a path where at least MPVs are making their own way.”

He said the MPV market had cooled down, with rates coming down as a result of a “standoff” between shippers, expecting a further decline of freight levels in line with the container sector, and project carriers, still having strong forward bookings. Grammare said he saw the heavy-lift market staying steady, at reasonably sustained freight rates, with supply and demand of ships about matched.

He highlighted the importance of a more harmonious relationship between forwarders, shippers and carriers, which he believed the last two years have brought about. This has levelled up the playing field – which was needed – and given AAL the opportunity to plan longer term together with clients.

“I feel like the last two years have brought more of a balanced relationship,” he said. “There is an open dialogue. Typically, in a shipper’s market, shippers can pick a ship easily, so there’s no need for planning too far ahead for cargo movements. Now we have closer communication with shippers on their upcoming needs and greater transparency in our negotiations.

“This has been a wake-up call and now our clients and AAL are working together on a more level basis. We certainly don’t want to overcharge customers on the freight, rather we aim to quote levels which are sustainable. At the same time, we need them to understand the cost of running ships and what it takes to deliver the regularity of sailings and quality of global service they demand.”

AAL has designed a new generation of ships – methanolready and featuring three 350-tonne cranes with a

max 700-tonne lift and 80,000 CBM cargo intake – and is investing in emissions reporting and improvements in sustainability. “It’s perfect timing because at an average age of 10 years our core fleet is not old. It’s a reasonably young fleet,” Grammare said. “The newbuildings were designed by our own engineering team, with our project cargo customers in mind, and have both technical and design innovation, with greater cargo intake, accommodation forward – which helps with sailing visibility – and an extendable deck on the starboard side. This will give us a chance to operate and test these vessels before we further renew the existing fleet.

“The challenge is more for the longer term: what will the next generation of ship looks like? We’ve got a design now coming out, the ships are methanol ready, they are fitted and ready to go and will be delivered in a year. But I don’t think the market will be ready to supply methanol, so we are really in that ‘in between’ window where there’s only so many things that can be done. And yet we are aiming to be carbon neutral as an industry. That is going to be a quite a process.”

Addressing the issue of measuring emissions in the MPV sector, Grammare said that MPVs get the short end of the stick compared with container ships and bulk vessels. Heavy-lift vessels are designed to safely transport cargoes of extreme size and weight, typically requiring reinforced tank tops, twin decks and hatch covers as well as a reinforced structure to withstand the additional forces, point load, torsions and bending moments generated when loading heavy cargo or transporting inhomogeneous loads. With such designs, heavy-lift MPV vessels are typically “sturdier” but also “heavier” than equivalent size container or bulk carrier vessels and therefore comparatively less fuel efficient – but they have been included in the same standards.

“So, we are already penalized,” he said. “But it’s early days and what we have found is that usually logic prevails. The heavy-lift fleet is fulfilling an important role in the project transportation market, and we are sure that eventually it will be assessed under its own merits and characteristics rather than widely declared uncompliant.

“Nevertheless, we are encouraging our customers to be more selective about their carrier choices – based upon sustainability and ESG parameters – and understand that the long-term viability of the sector demands that every stakeholder in the supply chain does their bit.

26 BREAKBULK MAGAZINE www.breakbulk.com ISSUE 2 2023

Christophe Grammare. CREDIT: AAL SHIPPING

UpFront

Breakbulk Europe 2023 Agenda Unveiled

Nuclear Power, Offshore Wind and Women in Breakbulk Among This Year’s Sessions

Breakbulk Events is delighted to announce the main stage agenda for Breakbulk Europe 2023, happening on June 6-8 at the Rotterdam Ahoy Convention Centre in the Netherlands.

The world’s premier event for breakbulk and project logistics will play host to a series of engaging sessions featuring expert speakers drawn from companies and organizations from across the entire supply chain.

Kicking off this year’s programme on the Wednesday morning will be the first session, “Examining the MPV Fleet,” an overview of how today’s fleet capacity will likely stand up to project cargo demand over the next 12 months.

The session will be followed by a “Business and Market Outlook”, with a professional panel drilling down into the challenges facing the multipurpose shipping sector amid a still-uncertain economic climate, as well as key opportunities for project logistics.

Next up, “Nuclear Power Projects in Europe,” is a deep dive into how energy transition and disruption to natural gas supplies are driving investment in nuclear energy throughout the region. Our panel will focus on Poland’s Lubiatowo-Kopalino project, one of several large-scale plants set to provide breakbulk with a major source of cargo-carrying contracts in the coming years.

After lunch, a “Planning for the Future of Project Logistics” session will help unpack some of the challenges for the sector in this so-called “age of chaos.” Join the conversation as speakers discuss key trends such as future-oriented work and sustainability, the adoption of AI chatbots and the shift towards more modular construction.

This will be followed by “Measuring and Pricing CO2 Emissions,” an update on an ongoing industry initiative to standardize the way we record and report carbon emissions. The success of a similar standard developed for the container sector has prompted a cross section of the industry – in collaboration with non-profit group Smart Freight Centre – to work together to devise a set of guidelines that will help breakbulk achieve its sustainability goals.

After a short break, industry representatives will provide an overview of some of the key developments affecting female professionals in a “Women in Breakbulk” report. Our Women in Breakbulk networking platform brings together women from across the supply chain to share their experiences and talk about the challenges they have faced while building a successful career in the breakbulk, project cargo and maritime industries.

Closing the day’s programme will be “Air Cargo Solutions for Project Logistics,” an eagerly awaited follow-up to last

year’s session at the Breakbulk Americas event in Houston. The panel will outline some of the challenges that shippers, forwarders and carriers face when accessing cargo aircraft for heavy-lift transport.

Thursday’s programme will kick off with a “Global Project Review.” This not-to-be-missed session will examine current and future sources of cargo-carrying contracts in the energy sector and assess the readiness of the supply chain to meet rising demand for cleantech projects.

This will be followed by “ESG Across the Supply Chain,” a timely session bringing together industry experts and regulatory bodies to scrutinize the latest developments in one of the most critical areas of an organization’s business model.

The buildout of offshore wind energy is set to be another hot topic at this year’s event. In “Managing the Offshore Wind Boom,” speakers will assess the readiness of the breakbulk supply chain to respond to the surge in worldwide offshore wind projects.

The Breakbulk Europe 2023 programme will conclude with “The Role of European Ports in Supply Chain Efficiency: Challenges, Opportunities & Demand.” Amid labour shortages, industrial action and rising costs, our expert panel – including representatives from leading European ports – will debate potential solutions going forward.

The full list of speakers for each session will be released shortly. Check out our website https://europe.breakbulk. com for regular updates.

BREAKBULK EUROPE

www.breakbulk.com BREAKBULK MAGAZINE 27

CREDIT: HYVE GROUP

FROM THE SIDELINES

Wilhelmsen Targets Double-Digit Growth in 2023

Frederic Fontarosa Speaks to Breakbulk on the Sidelines of Breakbulk Middle East

By Liesl Venter

As the project sector continues to recover from the Covid pandemic, the breakbulk shipping and port services arm of Wilhelmsen Group in the Middle East is optimistic of double-digit growth in 2023.

“Covid is now behind us,” said Frederic Fontarosa, the group’s Dubai-based vice president for the Middle East, Africa and the Indian subcontinent. “Project activity levels have returned to normality and the industry is picking up once again more or less where it left off before the pandemic.”

Speaking to Breakbulk on the sidelines of Breakbulk Middle East 2023 in Dubai, Fontarosa said he was optimistic about the year ahead and the robust state of the market.

“We are now noticing an uptick in the project sector, especially in the Middle East, and we are back to preCovid levels of involvement in the region. I would go so far as to say there has even been a slight increase in activity, especially with our team’s focus and involvement with certain UAE national energy renewable projects such as the first UAE windfarm project supporting Roll Group. It is, of course, difficult to judge the entire sector, but from our level of involvement, we are seeing very positive developments.”

Many projects that had been placed on hold during the pandemic were finally back on track, along with renewed interest to invest, particularly in the Middle East, he said.

“We booked over 150,000 tonnes…amid a very challenging 2022 for a roll-on, roll-off freight market challenged with space capacity,” Fontarosa said.

“With our continued involvement in several initiatives ahead of the COP28 (United Nations Climate Change Conference) to be hosted by the UAE, we are targeting double-digit revenue growth this year,” he said. “With our focus on roll-on, roll-off, heavy-lift, general cargo and renewable energy projects, presently we are very confident that we will achieve this.”

Fontarosa said the sector was posing far less risk than had been the case during the pandemic, and indications were that the project sector would see sustained growth over the next few years, particularly in the energy and renewables sector which is seeing high demand for projects in the Middle East.

“In Africa, we are seeing more challenges than we do in the Middle East, particularly around the lack of infrastructure that does have an impact on ports and the movement of cargo. In the Middle East, there continues

Frederic Fontarosa

to be a high level of investment in infrastructure. Most of the countries here see their income generated by the price of oil that last year reached very high levels, and so there is a sustainable investment.”

According to Fontarosa, Wilhelmsen has identified Dubai and Abu Dhabi as logistical hubs for cargo into East Africa. “Together with our parent company and valued principals’ tonnage, we transport from here into East Africa using smaller vessels that the ports in these regions can accommodate. It does require a lot of logistics coordination, but it addresses the infrastructure challenges faced on the continent. On the positive side, investment into African ports is increasing with countries such as Mozambique, Kenya and Tanzania having identified port development as priorities.”

From a shipping line perspective, investment into innovation was ongoing, he said. “There is a major focus on driving down our environmental footprint, and we are investing heavily in digitalization.

“What does this mean for the project logistics sector? Improved track and trace of cargo delivery, easier enduser access to information and improved efficiency of operations. We continue to focus on the value-add that we can bring to clients with a sharp eye on the carbon footprint.”

28 BREAKBULK MAGAZINE www.breakbulk.com ISSUE 2 2023

UpFront

GREEN HYBRID SYSTEM SAVES > 50 % ENERGY

PORT MATERIAL HANDLER THE WORLD’S LARGEST

Bulk handling up to 40 m

Container handling up to 28 m

Customer specific: Rail gantry, crawler or mobile undercarriage

Best overview from 22 m eye-level

Balancer

Balancer

SENNEBOGEN Maschinenfabrik GmbH 94315 Straubing, Germany michael.plecity@sennebogen.de

Duty Cycle Crane Telehandler Material Handling Crawler Crane Mobile Harbour Crane Telescopic Crane Michael Plecity

PROFILE BE AMBITIOUS, BUT BE TRUE TO YOURSELF DHL’s Sue Donoghue Talks Leadership, People 30 BREAKBULK MAGAZINE www.breakbulk.com ISSUE 2 2023

BY LIESL VENTER

Most people joining a corporate company aspire to climb the ladder. Maybe not all are aiming for the executive suite, but up seems to be the general direction they want to go. Most companies, on the other hand, make a big deal about the fact that only the brightest and highest potential will get it right. It’s a cutthroat culture often associated with ruthless ambition.

Fast-forward to my meeting with Sue Donoghue, Arab Cluster CEO for DHL Global Forwarding, to talk about corporates, leadership and how to get to the top. Within minutes of meeting, it is clear that she does not subscribe to ‘ruthless ambition’. She may be a senior executive in an international forwarding company, but she remains kind, compassionate, and caring.

Very soon into our discussion, I realize that while companies have impressive histories, excellent sustainability records, and the most sought-after products or services, all of this is essentially nothing without people. And no matter what the corporate culture or even the attributes of its employees, great leadership stands out.

“If I think about being a leader and what it takes to be one, then I have to go back to when I was a child. I was brought up with the notion that I should always try my best no matter what I am doing. I was taught to always be true to myself and who I am as a person first.”

As a young girl growing up in the UK Donoghue developed her moral compass – one that has guided her throughout her career. At school, she stood out as someone to turn to for guidance. As a Brownie and later a Scout leader and a swimming coach, she was able to hone her leadership skills, understanding what she considered to be right and acceptable for her as a person, and what was not.

“For me, it has always been important to be respectful, to be kind. I

have always wanted to make sure that everyone is okay and part of the group. To a certain degree, I think I have a natural affinity for leadership. Did I ever see myself as CEO of a Middle East Cluster for a logistics company, working in Saudi Arabia? Not at all! I did, however, know that I needed to do my best and give my best in whatever career I was going to choose. And there was always a certain desire to make it to the top.”

LOGISTICS BY CHANCE

Donoghue came to logistics by chance when a friend working for a freight forwarding company asked her if she would be willing to help out as a receptionist for two weeks. Displaying the same attitude and qualities that she does now as a cluster CEO, she took on the job and within weeks had managed to get herself appointed as a trainee forwarder.

“I had drive, I was curious, and I worked hard,” she said. “I was determined to be the best version of myself that I could ever be. The only person you can ever compare yourself to is you of yesterday. You measure your success on yourself, not on what someone else is doing or achieving. You can’t live anyone else’s life but your own.”

Donoghue also realized early on in her career that business is about people first and foremost. “I am the boss, but at the same time I am also a member of the team. I have my job because everyone that works around me, next to me, or even below me, all do so to the best of their ability to make DHL successful. But at the same time, I’m ambitious and encourage my team always to reach new heights. Of course, this also makes it necessary to make tough decisions and sometimes have the last word, but you should never lose sight of the human touch. You need to have a balance of respect and results, and you have to be authentic. And I’m glad that I work for a company where this is clearly reflected in the leadership attributes – where we should lead with head, heart and guts.”

For her, it has always been about creating an environment where people can thrive. “Leadership is a privilege that one earns. It is not a right and I am grateful for the opportunities I have had every day.”

MAKING A DIFFERENCE

Not one to underestimate the importance of hard work, Donoghue is a firm believer that nothing of value comes without effort. “I understand how I got to be where I am today, and I am not going to ask anything from anyone on my team that I am not prepared to do myself. I have done every job that you can think of in forwarding, one way or another. I understand an all-nighter, I understand difficult customers, I understand month-end and piles of invoices.”

Getting to the top, she said, is about good communication. “The ability to listen is very much a part of that. When you can listen and talk to people it becomes easier to get them to work together, building their strengths, improving their weaknesses, and not leaving anyone behind. It might sound idealistic, but for me, it is an approach that has paid off.”

Speak to anyone within the organization and they will tell you that Donoghue is somewhat different to the norm. “I have heard people say that I create a different sense in the teams I work with. I don’t necessarily see myself doing anything out of the ordinary or different. I follow my moral compass, trying to be kind and creating an environment that fosters respect. All I do is listen and guide my team as much as I can,” she said. “In every leadership role I have had, I have not always known at the get-go how I was going to achieve the goals required. I have, however, always known that I can only do it by being me and staying true to that. If I am different, I hope I have shown that different is not always bad.”

Donoghue has always emphasized the importance of a kind approach and of listening to one another. “We spend so much time at work and with our teams that in some way it does

PROFILE

www.breakbulk.com BREAKBULK MAGAZINE 31

become like a family. It is not always moonshine and roses. There are sometimes hard discussions that need to be had and incidents that are hurtful, but it means that one does not walk away when the going gets tough; you keep trying and you keep going because it matters.”

FOCUSED ON OUTCOMES

With people at the heart of the business, giving chances becomes just as important. “I am a firm believer in this,” Donoghue said, pointing to herself as someone who has achieved in her career thanks to someone being willing to give her an opportunity.

“There is no rulebook on how to climb the corporate ladder but when given the chance – take it. Push yourself forward and be noticed. It is of course important to also believe in yourself. Too many of us doubt that we can do it or we take things that happen at work far too personally, feeling that we are not enough.”

Her advice is clear. “Stop. Take a breath. Look at what you have accomplished and take the time to celebrate that. Early on in my career, there was an opportunity that I was passed on

because I was not a man. Yes, it stung but I refused to let it define me. It’s important that we measure ourselves by what we have achieved and not by what we haven’t accomplished.”

Has she achieved all she set out for? Not even close. “I still want to go further. I can’t tell you what that looks like, but I know there is more that I still want to do. I love the job that I am doing right now, but I like to think there is still another level in me and that I have more to give.”