THE LEGENDS

Issue 5 2023 THE AMERICAS ISSUE

LEARNING FROM

Bechtel’s Stephen “Spo” Spoljaric on His Two-Decade Career in Project Logistics

Cover Story

Learning From the Legends

Bechtel’s Stephen “Spo” Spoljaric on His Two-Decade Career in Project Logistics

Mark Your Calendars for Upcoming Breakbulk Events

Breakbulk Americas

26-28 September 2023

George R. Brown Convention Center, USA

Breakbulk Middle East

12-13 February 2024

Dubai World Trade Centre, UAE

Breakbulk Europe

21-23 May 2024

Rotterdam Ahoy, Netherlands

Breakbulk Americas 2024

15-17 October 2024

George R. Brown Convention Center, USA

40

32 Americas Heavy Mettle in the USA Breakbulk Cargo Holds Considerable Potential for Mid-size U.S. Ports

36 Americas Caribbean Project Market Heats Up But Guyana Continues to Lure Lion’s Share of Investment

40 Americas Keeping Up With the Jones’ Jones Act Challenges to US Offshore Wind Development

44 Profile “Grand Plans” for Americas Roll Group USA’s Edward Talbot Extols the Allure of Projects

48 Americas Problems and Pitfalls of Incoterms Need for Training on Trade Terms Evident

50 Thought Leader All-electric Haulage Realities Decarbonization Challenges and Opportunities in the Trucking Industry

52 Americas Climate War on Waterways Movement of Heavy-lift Cargo Could Be Curtailed

57 Thought Leader Rise and Rise of US Gas Navigating Opportunities in a Rapidly Evolving Landscape

59 Americas Latin America’s Natural Gas Challenge Region Needs More Development to Offset Production Declines

63 Global Powering Up Port Calls MPVs Ready to Take the Next Electric Step

68 Global Green Corridors, MPV Opportunities Green Corridors Provide Breakbulk Shipping a Route to Decarbonization

73 Thought Leader Dichotomies of the Multipurpose Fleet No Fleet Renewal in Sight Despite Solid Earnings

4 Breakbulk Magazine Issue 5 2023 breakbulk.com Inside this Issue

28

Credit: Schulte & Bruns

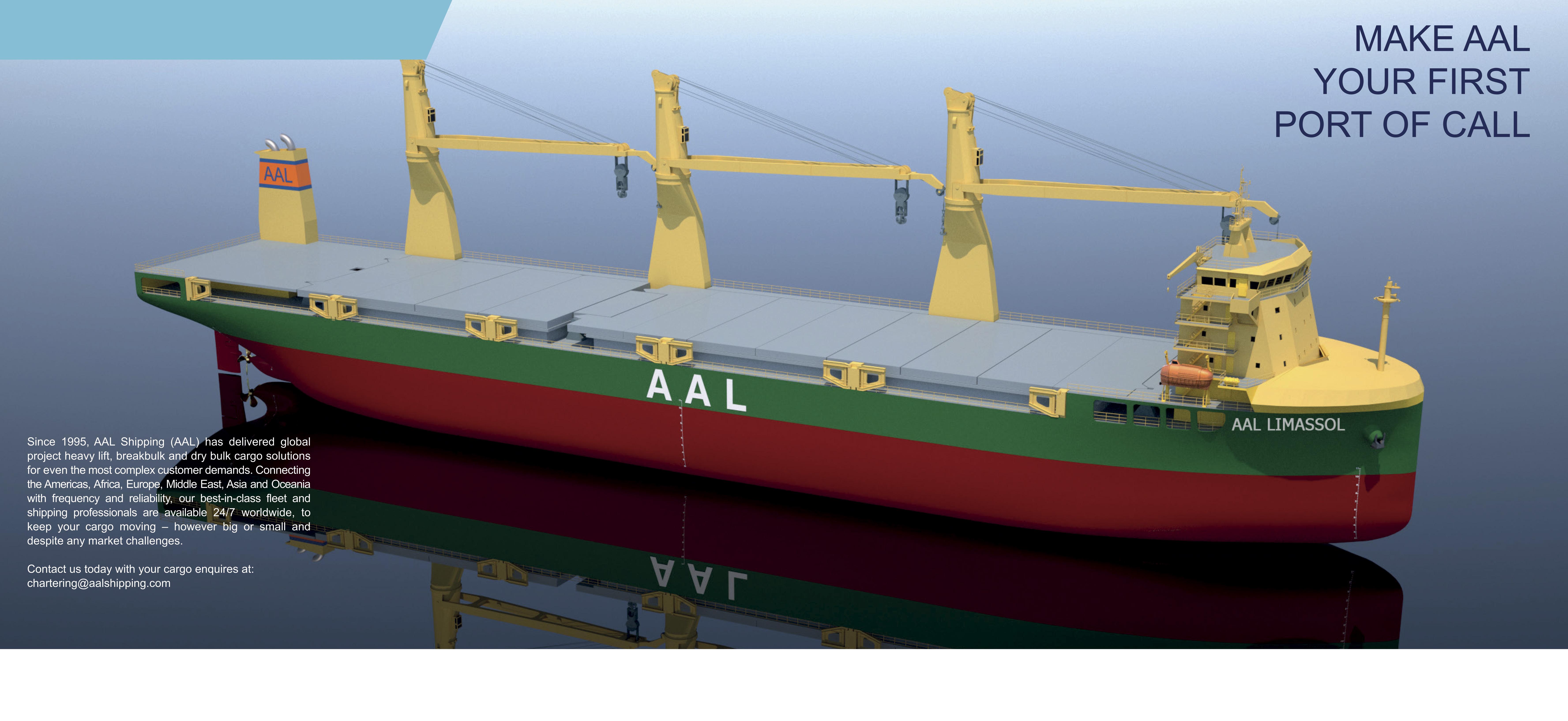

www.swireprojects.com chartering@swireprojects.com A division of Swire Shipping, a private and wholly owned company of John Swire & Sons. MOVING THE FUTURE Efficient, trusted and flexible shipping solutions for global industrial projects.

76 Global Calling on the Cargo Connectors Forwarders Back in Favor After Pandemic Blip

80 Global Clampdown on Corruption Project Cargo Not Immune to Bribery, Exploitation

84 Middle East & Africa Mozambique Returns to World Stage Resilient Investment Powerhouse Worth Over $100 billion

88 Middle East Gas Takes Gold in Qatar LNG Expansion to Provide Steady Flow of Work

91 Europe Navigating the Project Logistics Landscape

GEODIS’ Luke Mace Talks Talent and Sustainability

92 Europe Throwback: When Basic Logistics Discovered Brilliance

The Da Vinci Crane Case Study

94 Europe

“A Multitude of Opportunities Ahead” Daan Koornneef, CEO of Jumbo Maritime, on the Future for Jumbo and the Heavy-Lift Sector

97 Europe Path to Sustainable Project Logistics

Insights from deugro Leaders on Balanced Sustainability

6 Breakbulk Magazine Issue 5 2023 breakbulk.com Inside this Issue

Also in this Issue 07 Foreword 11 UpFront 99 Best of BreakbulkONE 102 Projects in This Issue 88 94 Credit: Qatar Gas

DECARBONIZATION - AN ENDURING TOPIC

This year will mark the 34th anniversary of Breakbulk Americas, where Breakbulk Events and Media began. And this issue –focused on the Americas – is especially eye-opening. Packed with project opportunities from the Americas region and in other parts of the world, it also offers insight into the impact of decarbonization across our entire industry that includes shaping the project mix that creates jobs for project cargo and breakbulk specialists.

As I was looking back through our 25th anniversary special, not quite a decade ago, it struck me that many of the topics we discuss here in the magazine and onstage at the events haven’t changed all that much. Industrial components keep getting bigger and require bigger equipment for transport, economic downturns both large and small impede project financing decisions, natural disasters strike, geopolitical events close markets, and the list goes on.

Yet, even with the occasional ‘black swan,’ the people of this industry persevere, innovate and move forward. And these are the stories we want to tell. We’ve highlighted the main challenge and solution in each story to convey the ‘lessons learned’ with the hope that the lessons can be applied to your own project challenges.

Inside the Americas section, you’ll find a rundown on a mix of project opportunities in the Caribbean and South America (both written

by our senior reporter Simon West who works in Colombia), as well as a proven growth strategy for midsized U.S. ports. In a similar vein, DHL’s Andy Tite challenges the notion of a forwarder as a middleman and lays out a blueprint for raising the role of project forwarder in “Calling on the Cargo Connectors.”

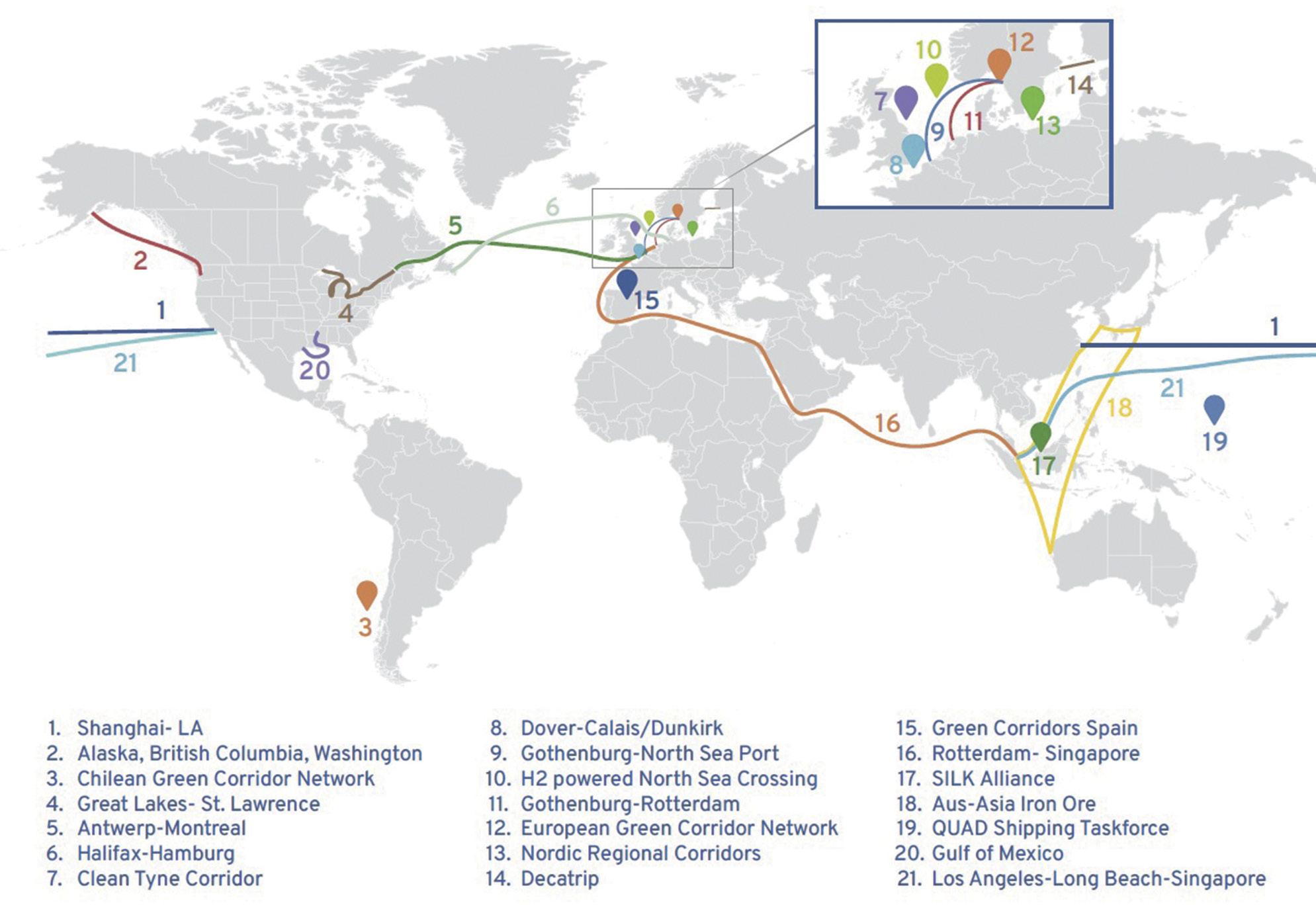

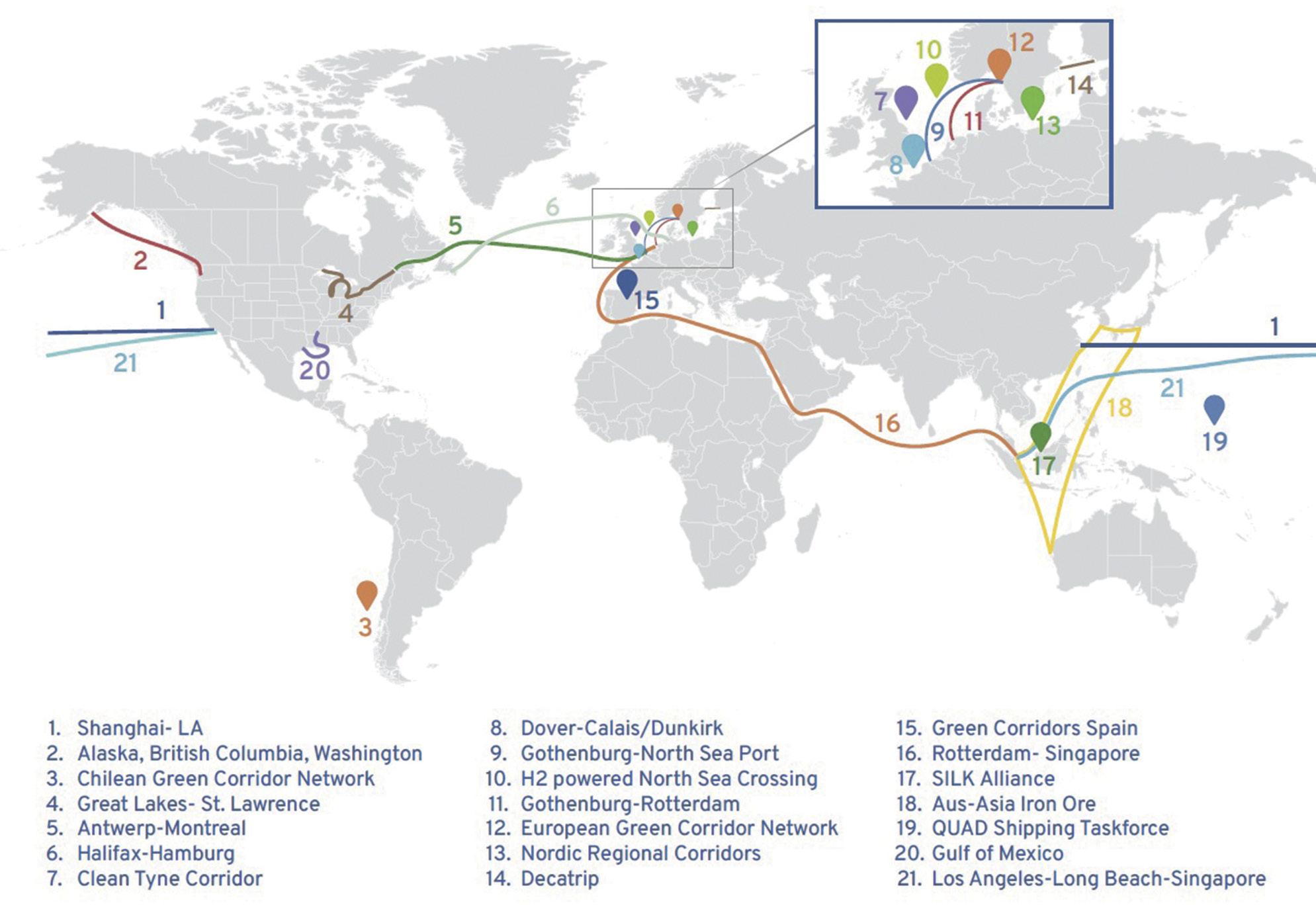

One thing we did not face a decade or so ago was decarbonization and its many facets. Decarbonization is not just about vessel fuels and emissions but touches every sector of logistics and transportation. To get an idea of the sweeping impact of these initiatives, read Carly Fields’ piece on shore power, “Powering up Port Calls,” Jeremy Bowden’s global look at “Green Corridors, MPV Opportunities,” Felicity Landon’s “Climate War on Waterways,” and a thought leader piece “All-Electric Haulage Realities” from Jeffrey Short of the American Transportation Research Institute (ATRI) who will continue the conversation on the main stage at Breakbulk Americas’ Journey Towards Decarbonization session.

The challenges to reach a zero-carbon future are many and each sector has its own set of variables. However, it is only through collaboration that this can be achieved – shippers, forwarders, carriers, barge operators, equipment manufacturers, heavy haulers, ports, as well as technology experts working together, sharing ideas and finding consensus. Think of this magazine as the vehicle for ideas and information, and the Breakbulk events as the places to come together and plan the route to the future.

Best,

Leslie Meredith Marketing and Editorial Director Breakbulk Events & Media

Marketing and Editorial Director

Leslie Meredith / +1 (801) 201-5971

Leslie.Meredith@breakbulk.com

News Editor

Carly Fields carly.fields@breakbulk.com

Senior Reporter

Simon West

simon.west@breakbulk.com

Designer Mark Clubb

Reporters

John Bensalhia

Jeremy Bowden

Felicity Landon

Iain MacIntyre

Liesl Venter

Breakbulk Editorial Advisory Board

John Amos, emeritus

Amos Logistics

Dennis Devlin

Maersk Project Logistics

Dharmendra Gangrade

Larsen & Toubro Limited

Margaret Kidd University of Houston

Anders Maul

Blue Water Shipping

Dennis Mottola, emeritus

Global Logistics Consultant

Sarah Schlüter

Hapag-Lloyd

Stephen “Spo” Spoljaric Bechtel Corporation

Roger Strevens Wallenius Wilhelmsen

Jake Swanson DHL Global Forwarding

Ulrich Ulrichs

BBC Chartering

Johan-Paul Verschuure

Rebel Group

Grant Wattman Combi Lift Americas

Portfolio Director

Jessica Dawnay

Jessica.Dawnay@breakbulk.com

To advertise in Breakbulk Media products, visit: http://breakbulk.com/page/advertise

Subscriptions

To subscribe, go to https://breakbulk.com/page/ breakbulk-magazine

A publication of Hyve Group plc. The Studios, 2 Kingdom Street

Paddington, London W2 6JG, UK

7 Breakbulk Magazine Issue 5 2023 breakbulk.com Foreword

Leslie Meredith

American Transportation Research Institute: “All-Electric Haulage Realities” (page 50)

Baker Hughes: “Rise and Rise of US Gas” (pages 57-58)

Balena Projects: “Climate War on Waterways” (pages 52-56)

Bechtel: “Learning from the Legends” (pages 28-30); “Rise and Rise of U.S. Gas” (pages 57-58)

Bertling Logistics: “Bertling, Clemenger Form Joint Venture in Australia” (page 100)

Blue Water Shipping: “Caribbean Project Market Heats Up” (pages 36-38)

deugro: “Climate War on Waterways” (pages 52-56); “Clampdown on Corruption” (pages 80-82); “Path to Sustainable Logistics” (pages 97-98); “deugro Moves 263,000 FRT for Uruguay Pulp Project” (page 99)

DHL Global Forwarding: “Latin America’s Natural Gas Challenge” (pages 59-62); “Calling on the Cargo Connections” (pages 76-78)

DSV: “Mozambique Returns to World Stage” (pages 84-87)

dteq Transport Engineering Solutions: “deugro Moves 263,000 FRT for Uruguay Pulp Project” (page 99)

GAC: “Gas Takes Gold in Qatar” (pages 88-90)

Halliburton: “Problems and Pitfalls of Incoterms” (pages 48-49)

Jumbo Maritime: “A Multitude of Opportunities” (pages 94-96)

“K” Line: “Latin America’s Natural Gas Challenge” (pages 59-62)

Maersk Project Logistics: “Caribbean Project Market Heats Up” (pages 36-38)

North Carolina Ports: “Heavy Mettle in the USA” (pages 32-35)

Port of Corpus Christi: “Latin America’s Natural Gas Challenge” (pages 59-62)

Port of Everett: “Heavy Mettle in the USA” (pages 32-35)

Port of San Diego: “Heavy Mettle in the USA” (pages 32-35)

Ports America: “Heavy Mettle in the USA” (pages 32-35)

Qatar Energy: “Gas Takes Gold in Qatar” (pages 88-90)

Roll Group: “Grand Plans for Americas” (pages 44-46)

Royal Roos: “Powering Up Port Calls” (pages 63-65)

SAL Heavy Lift: “Powering Up Port Calls” (pages 63-65)

Schulte & Bruns: “Keeping up with the Jones’” (pages 40-42)

Siemens Games Renewable Energy: “Powering Up Port Calls” (pages 63-65)

South Jersey Ports: “Heavy Mettle in the USA” (pages 32-35); “Paulsboro Terminal Handles Giant Monopiles” (page 101)

Swire: “Green Corridors, MPV Opportunities” (pages 68-72)

Technip Energies: “Gas Takes Gold in Qatar” (pages 88-90)

Técnicas Reunidas: “Gas Takes Gold in Qatar” (pages 88-90)

TotalEnergies: “Mozambique Returns to World Stage” (pages 84-87)

UTC Overseas: “Caribbean Project Market Heats Up” (pages 36-38)

Wallenius Wilhelmsen: “Green Corridors, MPV Opportunities” (pages 68-72)

8 Breakbulk Magazine Issue 5 2023 breakbulk.com Inside this Issue

Featured in this issue are the following Breakbulk exhibitors, sponsors and members of the Breakbulk Global Shipper Network:

Your Indispensable Partner

https://nbpc.co.jp

Credit: Port of Beaumont New Faces at Breakbulk Americas Networking Tips Movers & Shakers DP World Q&A Gulf of Mexico Ports Student Research Poster Competition Waves of Cargo Photo & Video Winners Tailgating Gift Guide INSIDE

NEW FACES AT BREAKBULK AMERICAS

Get to know some new exhibitors at Breakbulk Americas 2023

Gebrüder Weiss

Michael Ruediger, Director of Industrial Projects & Energy Transport Solutions

– North America

United States

Freight Forwarder

Booth Q22

What is the most interesting thing about your business?

There are two answers:

As a company, Gebrüder Weiss is well over 500 years old. We are the oldest and still privately held logistics and transportation company. That history is well documented and we take a lot of pride being part of a company with such a great heritage. As an industry, the most interesting thing is the people and the friendships that I have made over the last 30 years.

What made your company want to exhibit at Breakbulk Americas?

Gebrüder Weiss has made a multi-million dollar investment in the United States and we have grown very quickly in the last five years. We want to be part of the Breakbulk community and exhibiting at Breakbulk Americas (and Europe) is important for us.

What is your company’s outlook on project opportunities in the Americas at the moment?

There are tremendous opportunities in the Americas. We have customers who are developing large alternative / green energy projects and it is exciting to be part of the green economy. One in particular is building a plant to recycle electric car batteries. We are very diversified as a company and also in the project space so we are tracking traditional oil and gas projects as well. It is a great time to be in the project business!

ARL Logistics

Kegan Nelmapius, Regional Manager

Freight Forwarder

United States

Booth Q15

What is the most interesting thing about your business?

40 years, family owned and operated, drayage and breakbulk expertise.

What made your company want to exhibit at Breakbulk Americas?

We had a great experience visiting last year while a hurricane was looming back home. We saw how the global exposure was unmatched at Breakbulk Americas, so we decided to exhibit this year.

What is your company’s outlook on project opportunities in the Americas at the moment?

It is great to see demand spread across the country and new shipping lanes get established outside of the traditional ports. We are excited for conditions to stabilize, and we are positioned nicely to grow new relationships on top of our longstanding partnerships.

DP World FZE

Jemima Summers, Senior Account Executive, Edelman (representing DP World FZE) Ports & Terminals

United Arab Emirates

Booth R28

What is the most interesting thing about your business? What distinguishes DP World is our innovative approach, which seamlessly integrates every aspect of the supply chain. DP World Americas is investing in automation and robotics to help our customers prepare for the shifting supply chain demands of the future. We are building new processes and digital products to enhance the flow of trade around the world. For example, we synchronize the flow of goods across the globe through centralized platforms, meaning cargo is always trackable via the fastest, greenest, and most costeffective route possible.

What’s more, we embrace sustainability and strive to make a meaningful impact on the economies, societies, and communities in which we operate to ensure a brighter future for generations to come. The agility and flexibility that we bring to the supply journey helps reduce costs and improve access for consumers and businesses alike. And this way of working is more sustainable – not only minimizing impact by getting goods onto smaller vessels or lower carbon modes, but creating more resilient trade that makes sure people get access to the goods they want.

12 Breakbulk Magazine Issue 5 2023 breakbulk.com

What made your company want to exhibit at Breakbulk Americas?

As Lead Global Port Partner, our partnership with Breakbulk allows us to connect with key industry players to showcase the ways in which DP World Americas is delivering new and better supply chain solutions through constant innovations in technology, modes of transport and processes.

At Breakbulk Americas, we will showcase our industryleading end-to-end capabilities and cutting-edge innovations. For example, we are expanding our port terminal plan at DP World Caucedo with the objective of directly contributing to the transformation of the Dominican Republic into the principal logistics hub of the Americas.

We are excited to connect with our industry peers at Breakbulk Americas to discuss in detail how we can work together to make the movement of goods more sustainable and efficient, and work together to help deliver economic prosperity and opportunity to the communities we serve.

What is your company’s outlook on project opportunities in the Americas at the moment?

We are highly optimistic when it comes to project opportunities in the Americas, where the economic significance and growth potential continue to make it an attractive region for investment.

For example, in Brazil, a key market, we recently signed a term sheet for the construction of a new terminal for the export of grains and the import of fertilizers at the Port of Santos. In Peru, the Bicentario Berth Project expansion continues to progress; the first part of the project will be ready by the end of the year, with full project completion by April 2024. Meanwhile, the Dominican Republic’s strategic location and economic prospects continue to make it a promising destination for project opportunities in the Americas. In recent years, we have seen how inefficiencies and disruptions to global supply chains affect us all, increasing the price of goods and destabilizing society. As such, our outlook is forward-facing and long-term – we are investing in smart technology to lead the future of world trade. At the same time, we believe in protecting our people and our planet through world-class safety and environmental standards and measures.

OpenTug

Jason Aristides, CEO

IT

United States

Booth N46

What is the most interesting thing about your business?

OpenTug offers the first integrated digital barge and terminal booking

platform to make it easier to ship breakbulk cargo affordably and sustainably. We enable breakbulk shippers to move freight faster by searching, quoting and booking barge, trans load, and industrial storage service in one click.

What made your company want to exhibit at Breakbulk Americas?

OpenTug is exhibiting at Breakbulk Americas because it’s the number one show to connect with freight forwarders, heavy haulers, shippers, barge carriers, terminals, and ports. Every shipment usually requires a wide array of stakeholders, and Breakbulk Americas enables us to connect with all of them under one roof.

What is your company’s outlook on project opportunities in the Americas at the moment?

Our company is extremely optimistic about project opportunities in the Americas. Every day multiple shippers and forwarders find our platform and request project freight moves - we have had over 2 million tons requested within OpenTug in the first two quarters of 2023 alone.

Jillamy

Jeannine Judge, Senior

Marketing Coordinator

Freight Forwarder

United States

Booth L42

What is the most interesting thing about your business?

The most interesting part of our business is that we have started in-house segments that cover all aspects of freight movement, both international and domestic, We are an NVOCC, an IATA carrier, licensed customs broker, assetbased truck owner including high and heavy, as well as warehousing and fulfilment so any project that is given to us we can handle every aspect in-house.

What made your company want to exhibit at Breakbulk Americas?

As we have poised ourselves to be able to handle all parts of any project or freight movement, we feel it’s time to make ourselves known in this unique business.

What is your company’s outlook on project opportunities in the Americas at the moment?

We think now that freight has normalized somewhat post pandemic that there is nothing that can’t be done.

13 Breakbulk Magazine Issue 5 2023 breakbulk.com

NEW EXHIBITORS AT BREAKBULK AMERICAS 2023

Aerodyne C40 United States Air Transport Aeros R06 United States IT AGT Global Logistics N26 United States Freight Forwarder ARL Logistics Q15 United States Freight Forwarder Atlantic Logistics N45 United States Freight Forwarder Bollore Logistics S16 United States Freight Forwarder Boxxport GmbH P26 Germany Industry-related Services BR PARTNERS R12 Brazil Freight Forwarder C.H.I. Overhead Doors R13 United States Equipment Combilift USA LLC P47 United States Equipment Cornerstone Logistics Q11 Canada Freight Forwarder Dagen Trucking Q18 United States Road Transport Dawn Services LLC S15 United States Maritime Transport DP World FZE R28 United Arab Emirates Ports & Terminals Encompass Logistics LLC B09 United States Freight Forwarder ERHARDT PROJECTS M24 Spain Freight Forwarder Duma Trans C49 United States Freight Forwarder Freight North Group S41 Canada Road Transport Gebrüder Weiss Q22 United States Freight Forwarder Greystone Construction Company S21 United States Industry-related Services Gulf States Trucking S01 United States Road Transport Heavy Haul Solutions K48 United States Road Transport HLI RAIL & RIGGING F52 United States Freight Forwarder Hotel Engine E51 United States Road Transport Jillamy L42 United States Freight Forwarder Kawasaki Kisen Kaisha, Ltd P08 United States Maritime Transport Lee-Exco S19 United States Road Transport Little John Transportation Services J08 United States Road Transport Mallory Alexander International Logistics P20 United States Freight Forwarder Momentum Solutions S17 Canada Freight Forwarder Multiboxx Energy J50 Hong Kong Equipment Nippon Express Q01 United States Freight Forwarder NXGEN G51 United States Industry-related Services OIA GLOBAL L41 United States Freight Forwarder OpenTug N46 United States IT OTH Pioneer Rigging P46 Canada Equipment The Pacific Companies K42 United States Equipment Pacific Harbor Express, LLC L40 United States Industry-related Services Palco Transportation B49 United States Road Transport PCC LOGISTICS J42 United States Freight Forwarder PGT Services N22 United States Road Transport ProStack P17 United Kingdom Equipment Puerto Ventanas S.A. S02 Chile Ports & Terminals Seahorse Express P14 United States Road Transport Silk Way West Airlines D48 United States Air Transport Smart Tec U.S H51 United States IT STX LOGISTICS Inc L09 United States Freight Forwarder Summit Logistics Inc. M46 Canada Road Transport Swire Projects R43 Singapore Industry-related Services The GTI Group J09 United States Freight Forwarder TICO TERMINAL TRACTORS Q08 United States Equipment Toll Global Forwarding K46 United States Freight Forwarder Tranix Technologies R15 United States IT TRT International Q13 United States Freight Forwarder

Company name Booth number Country Sector 14 Breakbulk Magazine Issue 5 2023 breakbulk.com

NETWORKING AT BREAKBULK AMERICAS 2023

Take a look at the list of networking activities at Breakbulk Americas this year

“My favorite part of Breakbulk Americas is the networking. Go to the booths that interest you the most and introduce yourself to someone that is there and ask them about what their company does. I also recommend attending the main stage presentations and speaking to people before and after those sessions.”

Jake Swanson, Regional Vice President- Americas Operations, Industrial Projects, DHL Global Forwarding

Visit Main Stage Sponsor DHL Industrial Projects at Booth S36

Maritime Workers Emergency Medical Fund Golf Tournament

Tuesday, September 26, 6:30 AM – 12:30 PM

Relax while you play golf under the majestic emerald canopy of stately old oak trees, unwind on the airy veranda of the modern clubhouse and satisfy your appetite with delicious food.

Welcome Reception

Tuesday, September 26, 5:00 PM – 8:00 PM

Join the project cargo industry on the first night of Breakbulk Americas to kick off the event with an evening of networking.

After Party at The Rustic (Sponsored

by Port Houston)

Tuesday, September 26, 8:00 PM – 11:00 PM

Keep the party going! Walk over to The Rustic just steps away from the George R. Brown. (Entry is FREE, but you must register beforehand)

55th BUSINESSrun (Sponsored by UHL and ITJ International Transport Journal)

Wednesday, September 27, 7:30 AM

Participate in a unique event that combines running, networking, and giving back to the community.

Women in Breakbulk Breakfast (Sponsored by dship Carriers)

Wednesday, September 27, 9:00 AM – 11:00 AM

Latin America Happy Hour

Wednesday, September 27, 2:15 PM – 3:15 PM

Keep the party going! Walk over to The Rustic just steps away from the George R. Brown.

Following the session on the Main Stage, Latin America Spotlight: Outlook, Projects, and Opportunities, the panel will host a happy hour open to all.

“No matter the reason you are attending Breakbulk Americas, talk to everyone! Pass out business cards, make every connection that you can. Knowing the most people in this industry, no matter what they handle or what they do, can be beneficial to you in the long run.”

Alyssa Dye, Director of Sales, Swan Transportation Services

For even more networking, join Swan Transportation Services at the Swan Freight Station at Booth B22

Breakbulk Americas

Event Director

Breakbulk Americas

Event Director

15 Breakbulk Magazine Issue 5 2023 breakbulk.com

Evan Carthey and Leslie Meredith at The Rustic

DP WORLD’S GRAND PLANS FOR THE AMERICAS

Breakbulk caught up with Morten Johansen, COO of DP World Americas, for an update on the Dubaibased company’s extensive operations in the Americas region.

Q: DP World already has strong presence in South America, with port, terminal and logistics operations in Brazil (Santos), Argentina (Rio de la Plata), Chile (San Antonio and Lirquén), Suriname (Paramaribo), Peru (Callao and Paita) and Ecuador (Posorja). What plans does the company have to expand further on the continent, either at its existing facilities or new ones?

South America continues to play a key role in our mission to become a leading provider of end-to-end supply chain solutions. Recognizing its potential, we are opening new freight forwarding offices in strategic locations such as Panama and Mexico; this not only amplifies our logistics business but illustrates our commitment to broadening our freight forwarding operations throughout the region.

In Peru, DP World Callao is set to undergo a significant expansion with the Muelle Bicentenario Project. This endeavor aims to enhance the terminal capacity by 80 percent, elevating its ability to handle up to 2.7 million twenty-equivalent-units annually, a substantial increase from its present 500,000 twentyequivalent-units. Completion is slated for April 2024.

Over in Brazil, we’re channeling a US$35 million investment towards the enhancement and modernization of our infrastructures at the Port of Santos. In Ecuador, our collaboration with Emergent Cold Latin America at DP World Posorja is poised to pioneer refrigerated warehouse solutions, broadening our scope of temperature-regulated integrated logistics services throughout the region.

Q: Could you give more details on DP World’s overhaul of its facilities at the port of Santos, one of Brazil’s largest private port terminals? How will this investment benefit breakbulk and project cargo throughput?

The Port of Santos is a pivotal hub for transportation and logistics in the area. We recently celebrated 10 years in Brazil, having begun operations at the Santos terminal in 2013 with containers and general cargo on a 653-meter quay with a capacity of 1.2 million twenty-equivalent-units. In 2020, we inaugurated the largest and most modern pulp handling complex in the country, expanding the quay to 1,100 meters, and building a 35,000-square-meter warehouse. A multiyear partnership with Suzano, the second largest global producer of eucalyptus pulp, will see us continuing to grow our cellulose pulp operations.

We are currently expanding our terminal to boost capacity from 1.2 million twenty-equivalent-units to 1.4 million twentyequivalent-units annually, extending the quay to 1,290 meters and expanding the warehouse to 50,000 square meters to help increase annual capacity of the cellulose export complex from 3.6 tons to 5.4 million tons. The project will be completed in 2024. In August, we also discharged a nine-rail grinding train, marking the first time this equipment was imported to Brazil. This was a huge breakbulk operation.

Q: Could you outline some of the key gains for the Port of Vancouver following the completion of the US$260 million Centerm Expansion Project? How important is the Port of Vancouver for international trade and project cargo movements?

The Centerm Expansion Project marked a significant milestone for Canada’s growing trade network. The award-winning project expanded the terminal’s footprint by 15 percent, increasing container capacity 60 percent from 900,000 twenty-equivalentunits to a remarkable 1.5 million twenty-equivalent-units. The project also helps reduce the terminal’s environmental impact by adding capacity for container ships to connect to electrical shore power; converting diesel yard cranes to electric; eliminating wait times for vehicles at train crossings, helping to reduce emissions; and building to LEED and Envision certification sustainability standards.

16 Breakbulk Magazine Issue 5 2023 breakbulk.com

The Port of Vancouver, Canada’s largest port, plays a vital role in the nation’s supply chain and economic trade by providing a crucial link between Canadian businesses, consumers, and products. The port is a significant source of tax revenue and employment for surrounding communities, facilitating US$240 billion in trade, supporting over 115,000 jobs (equating to US$7 billion in wages), and contributing nearly US$12 billion to the national GDP. The port is also the primary hub for breakbulk cargo like forest products, steel, and machinery in the Pacific Northwest. The port provides flexible cargo handling, efficient vessel services, and connects to extensive road networks and established corridors for overweight and over-dimensional project cargo. Serving as Canada’s entrance to over 170 global trading economies, it accounts for $1 of every $3 in Canada’s non-North American trade.

Q: DP World’s 2021 acquisition of syncreon, a contract logistics provider based in the U.S., hints at new investment in the region. How does the company see the U.S. playing into its Americas strategy?

The U.S. is central to DP World’s growth strategy. The Americas represent one of the largest combined markets in the world, housing three of the top 10 largest economies, with strong production of consumer, industrial and agricultural products across the region. In fact, DP World’s Americas regional headquarters are in Charlotte, North Carolina, where we are currently expanding our facilities and opening a brand-new building in early 2024.

In 2021, we acquired a company called syncreon that is based in Auburn Hills, Michigan. A leading provider of supply chain solutions, syncreon provides services to customers in auto, tech, consumer goods, industrial, and healthcare companies.

We currently have dozens of legacy syncreon sites across the U.S.

Going forward, the U.S. will be key to our freight forwarding expansion plans. As we continue to grow this business, we plan to open nearly a dozen new offices in key locations across the U.S. These new locations will complement our existing portfolio in Latin America and Vancouver and help expand our U.S. contract logistics capabilities across the region.

Q: How important is DP World’s port facility at the Punta Caucedo peninsula in the Dominican Republic for the redistribution of cargo to the Caribbean, the U.S., Central America and South America? Could you provide an update on the company’s new air cargo logistics center with Punta Cana Free Trade Zone? When is it likely to come online?

A: Leveraging its advantageous geographical position, DP World commenced operations in the Dominican Republic in 2003. This strategic foothold acts as a critical juncture for cargo redistribution across the Caribbean, the U.S., Central America, and South America. Today, the Dominican Republic has emerged as the Caribbean’s premier trade and logistics hub. The added advantage of the nearby Punta Cana International Airport allows the center to provide a wide array of cargo management services to address global logistics needs.

We are thrilled to unveil the forthcoming inauguration of our air cargo logistics hub within the Punta Cana Free Trade Zone, slated for the end of this year. This partnership seeks to further amplify the Dominican Republic’s role as a central freight and logistics hub for international markets. The expansion includes a state-of-the-art logistics center and modern infrastructure platforms to facilitate the seamless integration of air, land, and sea cargo. Moreover, this alliance will propel a dynamic regional commerce strategy, aiming to draw increased re-export and import cargo volumes from global commercial, tech, industrial, and agricultural sectors.

Q: DP World has expanded its support of Breakbulk events from host port at Breakbulk Middle East to Global Port Partner. How has this partnership benefited the company?

A: We are looking forward to serving as a Global Port Partner at Breakbulk Americas. This partnership underlines our commitment to enhancing our presence and influence in the cargo and logistics sector. Breakbulk events are recognized worldwide for offering unique interactions with industry trailblazers and thought leaders, and for providing an invaluable stage to showcase DP World’s expertise in global logistics. We believe that our partnership with Breakbulk and our sponsorship of this conference is not just an investment in an event but an investment in the future of logistics in the Americas.

Evening aerial view of Prince Rupert port in province of British Columbia.

17 Breakbulk Magazine Issue 5 2023 breakbulk.com

Credit: DP World

MOVERS AND SHAKERS

Highlighting Recent Industry Hires, Promotions and

deugro

deugro has further strengthened its position in the wind energy sector after appointing Stefanie SchöttleChristiansen as head of its wind renewable energy Germany division. In her new role, the executive, who boasts more than 23 years of experience in logistics, will ensure deugro continues to meet the rising demands of the wind energy sector, the company said. Previously Schöttle-Christiansen worked for Siemens Gamesa as team lead – logistics project management for Northern Europe and the Middle East, overseeing the transport and handling of wind turbine components for onshore and offshore projects.

“The wind energy sector is rapidly growing, and I am eager to contribute to deugro’s success by delivering exceptional service to our clients. Together with a talented team, I am confident that we will continue to set new standards in the industry,” Schöttle-Christiansen said.

Clemenger Bertling Projects

Chris Nicholson has been chosen to head up a new joint venture in Australia between Bertling Logistics and Clemenger International Freight. The Perth-headquartered venture, Clemenger Bertling Projects, will target new and existing business opportunities in Australia’s flourishing energy, mining and construction sectors.

Nicholson, who boasts more than 35 years of experience in freight

forwarding and project logistics, had been working for Clemenger since 2015; prior to that, the executive was Bertling’s commercial manager in Australia.

“Absolutely delighted to be leading our new joint venture in Australia and really looking forward to introducing the business to current and prospective clients across the country,” Nicholson said. “Knowing the strengths of each company, I am positive that Clemenger Bertling Projects represents a whole host of knowledge, resources, and innovative ideas from both partners, each bringing their unique strengths to the industry.”

DHL Global Forwarding

DHL Global Forwarding has named Max Sauberschwarz as the new head of Global Air Freight, effective October 1. Sauberschwarz will replace industry veteran Thomas Mack, who is stepping down after five years at the helm. Mack, who has worked in the air freight sector for more than four decades, will continue with the company as a senior adviser until his planned retirement in October 2024.

Sauberschwarz, currently DHL Global Forwarding’s senior vice president for its air charter division, Global StarBroker, has held several senior management roles in the air freight sector on a global level as well as in Europe and Asia. Prior to joining DHL Global Forwarding in 2019, the executive spent nearly eight years with Kuehne+Nagel and four with DB Schenker.

“We are delighted to have found a worthy successor to Thomas Mack in Max Sauberschwarz. In his previous role, he demonstrated not only his deep industry knowledge, but also his leadership skills and we look forward to driving the business forward together in the years ahead,” said Tim Scharwath, CEO of DHL Global Forwarding.

The Heavy Lift Group

Elisabeth Cosmatos has been elected the first female president of The Heavy Lift Group, taking over from FOX Brasil’s Murilo Caldana, who steps down after serving two consecutive, two-year terms. Cosmatos, general manager of Greek transport and logistics firm Cosmatos Group, has been part of the THLG executive committee for more than six years, previously overseeing the group’s marketing and corporate image.

Departures

Chris Nicholson

Stefanie SchöttleChristiansen

Max Sauberschwarz

Departures

Chris Nicholson

Stefanie SchöttleChristiansen

Max Sauberschwarz

18 Breakbulk Magazine Issue 5 2023 breakbulk.com

Elisabeth Cosmatos

Founded in 1987, the THLG is a worldwide network of companies involved in large-scale industrial project forwarding, oversized road transport, crane operations, machinery installation and rigging, vessel chartering, port operations, engineering and barge operations.

“THLG’s decision to appoint a female president as part of a majority-female executive committee demonstrates the group’s commitment to gender equality and women’s empowerment in the heavy-lift industry,” Cosmatos said. “Together, we will continue to lead THLG along the successful and innovative path that has made it a pioneer in project cargo networking.”

Rhenus Group

Global logistics provider Rhenus Group has appointed Bruna Ventura as managing director of Rhenus Brazil, succeeding Paul Schabbel, who has taken on a new role at the company. Ventura, who boasts more than 16 years of leadership and management experience in logistics, has been with Rhenus for eight years, most recently as chief operating officer, air and ocean. The executive has also worked for Plus Cargo do Brasil, Costa Porto and CMA CGM.

“Our goal remains on growth and expansion through a customer-focused and engaged team, always seeking solutions for our clients and connecting them with Rhenus capabilities in this country of great dimensions and opportunities,” Ventura said.

Rhenus Brazil is headquartered in Sao Paulo and provides logistics solutions for imports and exports via air and ocean, road transportation, and oversize loads for all types of goods. The company is launching two new offices in the cities of Belo Horizonte in central Minas Gerais state and in Itajaí in southern Santa Catarina state.

Logistics Plus

Andriy Blagovisniy has begun a new position as global director of air chartering at U.S.-headquartered Logistics Plus. As part of his remit, the executive has been selected to head up LP Aero, a new London-based entity launched by Logistics Plus to enhance the company’s air charter services.

Blagovisniy has worked in the aviation and air charter business for more than 24 years – nearly

16 years of those with Ukraine’s Antonov Airlines. Most recently, the executive served as project cargo sales manager at Diplomat Freight Services UK.

“Andriy brings an impeccable record in chartering, DOD, aerospace, and all types of heavy-lift projects,” said Yuriy Ostapyak, COO for Logistics Plus. “LP Aero will become our platform to increase our service offerings, to optimize carrier relations and rates, and to support the development of charter projects worldwide.”

Bertling Logistics

Bertling Logistics has named Gerd Illing as its new managing director in Germany. Founded in 1865, Hamburg-headquartered Bertling specializes in project logistics and heavy cargo transport. Its 700-strong workforce is based in 50 offices in 30 countries all over the world.

“Gerd has vast experience in logistics and forwarding overall and knows the project business from top to bottom. We look forward to him contributing his commercial skill set and drive to our offices in Hamburg, Bremen, and Neuss,” Bertling said.

SLSMC

The St. Lawrence Seaway Management Corporation in Canada has announced the appointment of Tony Valeri and Julie Lambert to its Board of Directors. A former Canadian transport minister, Valeri is managing director of Ridge Strategy Group. Lambert, who has a legal and business background, is president of Petro-Nav, a subsidiary of Quebec City-based marine transport specialist Desgagnés.

The SLSMC is a private, not-for-profit corporation, created in 1998 to operate and maintain the Canadian locks and channels of the St. Lawrence Seaway. More than 3 billion tons of cargo have been transported via the waterway since the Seaway’s inception in 1959.

“We welcome Mr. Valeri and Ms. Lambert to the Board and look forward to benefiting from the knowledge and experience they bring to the table,” said Terence Bowles, president and CEO of the SLSMC.

Bruna Ventura

Andriy Blagovisniy

Tony Valeri

Julie Lambert

19 Breakbulk Magazine Issue 5 2023 breakbulk.com

Gerd Illing

GET TO KNOW THE PORTS IN THE GULF OF MEXICO

Breakbulk Events & Media reached out to several ports within the Gulf to gain insight into what makes their port special and how they see the ports in the Gulf changing in the coming years.

Ernest Bezdek, Director of Trade Development

Texas

Booth Q14

What is the most interesting thing about your business?

I think the most interesting thing about the Port of Beaumont is our versatility and ability to adjust to different types of cargoes. We are a niche port that is expanding and growing yearly.

What made your company want to exhibit at Breakbulk Americas?

We wanted to exhibit because the conference attracts a diverse cross-section of shippers, forwarders and 3PLs (3rd party logistics) companies.

How does your company see ports in the Gulf of Mexico changing over the next 10 years?

Dramatic growth! All ports (including the Port of Beaumont) are undergoing needed infrastructure updates to handle the larger, heavier project cargoes now moving. It is an exciting time to be in the port business.

Therrance Chretien, Director of Cargo and Trade Development

Louisiana

Booth D10

What is the most interesting thing about your business?

Our economic diversity. Our port district is home to the nation’s No. 1 center for liquefied natural gas exports — a multi-corporation sector that continues to grow. Also, we serve a world-class petrochemical complex in our region. Further, our extensive waterside property holdings are host to a pair of casino resorts! That’s in addition to our own work at the port of handling breakbulk, bulk, specialty, and project cargo — from lumber to barite, to oversized components for industrial construction projects.

What made your company want to exhibit at Breakbulk Americas?

Breakbulk cargo has been the port’s niche since its inception in 1926. We’ve handled, warehoused, trucked and railed cargoes of all volumes, shapes and sizes for nearly a century.

We’re looking for more opportunities for breakbulk cargo on a domestic and international level. That’s because our ongoing efforts to improve and strengthen our infrastructure mean we will have even more capability and capacity to offer.

How does your company see ports in the Gulf of Mexico changing over the next 10 years?

Evolving shipper and market-based demands and preferences can’t help but drive smart ports to make smart strategic choices in the time ahead.

Port of Beaumont

Port of Lake Charles

20 Breakbulk Magazine Issue 5 2023 breakbulk.com

A personal example from our port: We’re the nation’s 13thbusiest, based on tonnage, but we are also exploring the region’s newly designated potential for offshore wind power. Our Gulf Coast proximity, deep-dredged ship channel and available inland properties make us an ideal site for the assembly, placement and maintenance of offshore wind turbines.

Port of Pascagoula

Rafael Quesada, Director Trade Development

Florida

Booth H13

What is the most interesting thing about your business?

Our business is very dynamic in an environment where market forces,

weather, and world events have a direct impact on our performance as a logistics organization.

What made your company want to exhibit at Breakbulk Americas?

We have been participants of Breakbulk Americas since the beginning. This conference is one of the most important venues where we can be exposed to shipping companies, exporters, and importers from around the world over the course of 3 days.

How does your company see ports in the Gulf of Mexico changing over the next 10 years?

The ports of the Gulf of Mexico will play an important role in the years to come due to the increasing congestion of the ports in the Northeast and West Coast with the increase of international trading.

21 Breakbulk Magazine Issue 5 2023 breakbulk.com

Credit: Port of Pascagoula

BREAKBULK AMERICAS STUDENT RESEARCH POSTER COMPETITION 2023

The authors of the top 3 submissions will receive a cash prize during an awards ceremony on the main stage at Breakbulk Americas on Thursday, Sept. 28.

Competition Industry Advisory Committee

Beth Heyn Kennedy - Supply Chain Client Executive, Gartner

Bill Keyes - Director of Logistics, Fluor

Dennis Devlin - Head of Growth, North America, Maersk Project Logistics

Esmeralda Smith-Garcia - Business Development for Global Projects Industry Solutions, DB Schenker

Breakbulk Events & Media is thrilled to announce the launch of its Student Research Poster Competition at Breakbulk Americas 2023.

The competition, sponsored by Bechtel, UTC Overseas, 4D Supply Chain Consulting and Cullen College of Engineering-University of Houston, is built around three main themes: global capital projects, sustainability/energy transition, and port infrastructure. Student research may include interviews, literature reviews, an explanation of emerging technology, policy analysis, case studies or other relevant topics presented in a visual and creative way. Through this program, students can make valuable connections with a wide variety of industry executives, receive practical feedback and open the door to new career opportunities.

The competition is chaired by Margaret Kidd, program director, Supply Chain & Logistics Technology at Cullen College of Engineering’s Technology Division and supported by a group of project cargo professionals.

“The student research component of Breakbulk Americas is a great opportunity for undergraduate and graduate students to showcase their talent and network with industry leaders,” Kidd said.

“As Houston is the ‘Global Capital Projects and Energy Transition Capital’ for the Americas this is a win-win to bring students from regional universities together with leaders in the sector to talk about the world of opportunities along with sharing best practices related to capital projects, sustainability, energy transition and port infrastructure.”

Breakbulk Events & Media has been a passionate supporter of students and young professionals through its Education Day, an initiative to fill the industry’s talent gap.

Jake Swanson - Regional Vice President - Americas Operations, Industrial Projects, DHL Global Forwarding

John Hark - Head of Growth, North America, Maersk Project Logistics

José Manuel Velarde – Senior Manager, Indirect ProcurementCAPEX, MRO, Maintenance, Tars, Staffing - N. America & Latam, Huntsman Corporation

Kattya Di Stefano - Business Development Manager - Industrial Projects, DHL Global Forwarding

Leandro Brusque - Supply Chain Manager, Subsea Construction, Ocyan Oil & Gas

Marco Poisler - COO – Global Energy & Capital Projects, UTC Overseas

Noureen Faizee - Director, Inside Sales, Worley

Payne Fischer - Regional Manager – Project Logistics North America, Kuehne + Nagel

Peter Dill - Senior Purchasing Manager - Indirect, Huntsman Corporation

Peter Jessup - Supply Chain Consultant, Proactive Change LLC

Sandra Guadarrama - Senior Project Logistics Manager, Linde Engineering

Stephen Spoljaric - Corporate Manager of Global Logistics, Bechtel Corporation

Thomas Skellingsted - President, 4D Supply Chain Consulting

Toni Harrison - Business Development for U.S. Projects, Geodis

Session Information

Student Research Poster Awards

Thursday, Sept. 28

11:45 AM - 12:00 PM

Sponsors

22 Breakbulk Magazine Issue 5 2023 breakbulk.com

Margaret Kidd and Leslie Meredith at Breakbulk Americas https://americas.breakbulk.com/page/student-research-poster-competition-2023

Sponsored by

In the annual Americas photo contest, close to 30 companies shared their photos and videos of their awe-inspiring journeys of massive cargoes, from across the oceans, through the gulfs, and up and down the world’s coasts and inland waterways. By popular vote, here are the top five photo winners and the three most popular videos.

Unloading wind blades from a ship in Romania to be delivered by barge to Serbia. Visit them at Breakbulk Americas, Booth L05

Photo Contest WINNER Contractors Cargo Company (CCC)

Photo Contest WINNER Contractors Cargo Company (CCC)

23 Breakbulk Magazine Issue 5 2023 breakbulk.com

Fourth Place

dship Carriers

Keith navigating the icy wonderland of Antarctica. Women in Breakbulk Breakfast sponsor at Breakbulk Americas

Second Place

Encompass Logistics

LLC

Green Energy Storage. A 78,000-pound lithium-ion battery container being transported in the U.S. Visit them at Breakbulk Americas, Booth B09

Third Place

AsstrA-Associated Traffic AG

Out-of-gauge heavy-lift transport of a wash tower from Spain to Poland.

Fifth Place

Mercer Transportation

By air or sea, Mercer Transportation is your open deck carrier!

24 Breakbulk Magazine Issue 5 2023 breakbulk.com

Video Contest - WINNER

AsstrA-Associated Traffic AG

https://youtu.be/Wm5dr620A40?si=YZJYe-CMGko7icO_

Out-of-gauge heavy-lift transport of a wash tower from Spain to Poland.

Third Place

Port of San Diego

https://youtu.be/

km9ACBI6kNY?si=_saziy7uqcjrTzOZ

There’s no better way to welcome North America’s first all-electric mobile harbor cranes. Check out this time-lapse of their arrival at the Port of San Diego. Not only will these cranes transform cargo handling with their battery-powered build, highperformance, and 400-tonne lift capacity, but they’ll also allow the U.S. West Coast to handle cargo previously only handled by Gulf ports. Visit them at Breakbulk Americas, Booth G46

Second Place

Contractors Cargo Company (CCC)

https://youtu.be/

K8KFBKoZ0wM?si=BwY0uCnS9sCSSbTu Transport near the Gulf of Mexico, U.S. Visit them at Breakbulk Americas, Booth L05

25 Breakbulk Magazine Issue 5 2023 breakbulk.com

TAILGATING GIFT GUIDE

Get ready for a season full of football and fun!

GCI Outdoor Kickback Rocker Chair

$67

Kick back and relax wherever you are. www.rei.com

Giant Jenga

$118

Two games – great for groups to play in-between quarters. www.amazon.com

Growlerwerks Ukeg With Tap Handle

$165

Make warm and flat drinks a thing of the past. Store and share carbonated beverages with this beautifully designed growler. Keep beer, champagne, carbonated cocktails and other sparkling beverages carbonated and fresh the whole day. www.markandgraham.com

Bean Bag Toss Set 10pc - Hearth & Hand

$79.99

www.target.com

26 Breakbulk Magazine Issue 5 2023 breakbulk.com

Mastercanopy Durable Ez Pop-Up Canopy Tent

$126

All the fun outside, without all the sun. www.amazon.com

Portable Gas Grill - $89.99

Perfect for tailgating, this lightweight, portable grill can be easily packed into your car and set up on the spot. All you’ll need is the propane! www.amazon.com

BrüMate Hopsulator Trio in Azure | 12/16oz Standard Cans

$29.99

With patented 3-in-1 technology: fitting 16oz cans, with a freezable adapter for 12oz cans and includes a locking lid to convert it into a 100% leakproof tumbler. www.brumate.com

Chef’n S’mores Roaster - $49.95

A fun and portable way of making s’mores with friends and family after a day of tailgating www.crateandbarrel.com

Yeti Tundra® 35 Hard Cooler

$275.00

Holds enough for a small crew for the day. Up to 29 lbs of ice or close to 40 cans. www.yeti.com

27 Breakbulk Magazine Issue 5 2023 breakbulk.com

By Simon West

LEARNING FROM THE LEGENDS

Bechtel’s Stephen “Spo” Spoljaric on His Two-Decade Career in Project Logistics

28 Breakbulk Magazine Issue 5 2023 breakbulk.com

Profile

Stephen “Spo” Spoljaric’s introduction to logistics was, he said, “a bit of a curveball.”

Still in his first semester at New York City’s Fordham University, the freshman was leaving football practice one August morning when he bumped into a retired priest at his college who offered to help him get a summer job at a trucking firm back in his hometown of Harrisburg.

“As an economics major in the capital of the world, that wasn’t quite what I imagined,” Spoljaric said. “But I went to work for that company in Pennsylvania and fell in love with it the first year I was there.”

Since that chance meeting with the minister from the Bronx more than two decades ago, Spoljaric has carved out for himself a hugely successful career in project logistics, with early managerial stints at GE/Allyn and Alstom Power.

After joining Bechtel in 2012, the executive rose through the ranks quickly, culminating in his appointment four years ago as the engineering, construction and project management firm’s corporate manager of global logistics. Based at Bechtel’s offices in Houston, he oversees a 100-strong team of logistics professionals tasked with masterminding cargo movements for some of the world’s largest and most ambitious construction projects.

Spoljaric, who holds the position of Bechtel Distinguished Technical Specialist, the first for logistics in Bechtel’s 125-year history, is quick to acknowledge the grounding his old summer job in Harrisburg gave him.

“It really taught me the ropes,” he said. “My boss wouldn’t let me use the computer for the first two years. Everything had to be out in the yard, hands-on, assisting drivers to secure loads, figuring out how many straps they need. And then in the office, auditing freight invoices manually, learning how to look up in the old freight books what the rates should be, ordering

permits by hand – it was all about understanding how things worked.

“Learning the basics from the ground up has really allowed me to bring practical engagement to more complex problems and gain appreciation for the details.”

The “Legends” of Logistics

Spoljaric, who last year was among 25 new members appointed by U.S. Transport Secretary Pete Buttigieg to the Maritime Transportation System National Advisory Committee, is keen to point out others who, through their leadership style and groundbreaking approach to logistics, have influenced his career – “legends,” as he dubs them.

Among those he namechecks are Greg Gowans, Sandro Lepori and Phil Glatfelter at Alstom Power, David Hammerle and Dennis Mottola at Bechtel, Mike Izdebski at GE/Plug Power, Tony Vasil at the Port of Albany and Carl DeSisto at Stone & Webster.

“I feel quite lucky with some of the people I’ve had a chance to interact with. And a lot of these connections came via Breakbulk conferences,” Spoljaric said.

“Having close working relationships with these people, I think it made a difference for me and I know for a lot of others in our careers. Even now – although some are gone – if I have an opportunity, I try to pick their brains because we see cycles in our industry. Some of them have been through these cycles before and they recall how they dealt with them.”

Just as he has learned – and continues to learn – from others, Spoljaric is always ready to share his knowledge and experience with the newer generations coming through the ranks at Bechtel.

The executive stresses the “Holy Trinity” of skills new recruits should be looking to develop.

“Firstly, are they commercially aware – do they understand supply and demand? Secondly, are they technically capable – can they do

29 Breakbulk Magazine Issue 5 2023 breakbulk.com

Profile

“I FEEL QUITE LUCKY WITH SOME OF THE PEOPLE I’VE HAD A CHANCE TO INTERACT WITH. AND A LOT OF THESE CONNECTIONS CAME VIA BREAKBULK CONFERENCES”

the math? And finally, can they communicate and explain these things in a simple, easy-to-understand way? If you can do those three things, you’ll probably have a really good career in logistics and the potential to work in my role at some point.”

More than a third of his team have been with Bechtel for less than a year, meaning a good chunk of Spoljaric’s work focuses on training, tutoring and introducing his team members to the carriers and forwarders with whom the company enjoys close working relationships.

“We have won a lot of work lately, and as that work starts to pick up over the next year or two, we need to make sure those people are ready,” he said.

Bechtel’s Milestone Year

Since its inception in 1898, Bechtel has worked on more than 25,000 projects in 160 countries worldwide. The Hoover Dam in the U.S., the Channel Tunnel linking the UK and France and the Jubail Industrial City in Saudi Arabia –the world’s largest industrial city – are some of its towering achievements.

Just this year, the constructor was selected to work alongside U.S. firm Westinghouse on the design, engineering and construction of Poland’s first large-scale nuclear power plant, while in the U.S., a Bechtel-led team destroyed the last munition in the country’s chemical weapons stockpile at the Blue Grass Chemical AgentDestruction Pilot Plant in Kentucky.

The symbolic disposal of the final projectile marks the end of the US’ commitment to eradicate all its chemical weapons before Sept. 30 this year, in line with the Chemical Weapons Convention pact ratified in 1997.

“At almost every major global turn in our history, as industry has evolved, our company has been there driving those changes,” Spoljaric said.

“Now we have energy transition, and that’s going to be major – new infrastructure, new pipelines, new

storage, new ships, new everything. From the business side of it, we want to be out front as we have been at every other major industrial revolution.”

As projects become bigger and the critical equipment used to build them more complex, the work of those charged with managing logistics becomes ever more challenging. In a bid to stay ahead of the curve, Bechtel has launched an “engineered logistics” concept designed to boost predictability in project execution and transportation planning.

The concept – which Spoljaric, who has a master’s degree in industrial engineering from Clemson University, cited as one of his proudest achievements at Bechtel – aims to deploy on a much wider scale advanced technologies such as 4D/5D simulation, virtual reality visualization tools, logistics concepts using magnet technology and drones to spot potential project pitfalls and prevent downtime.

The approach also gives weight to project safety and environmental footprint.

As Spoljaric puts it, “we’re not staying on the docks yelling, ‘where’s my truck!’ We live for a challenge –always looking for a better way. We’re much more sophisticated in how we engage with our suppliers, partners and our customers, and we really look to bring a more well-rounded approach to finding efficiency and optimization, and how we manage that.”

Spoljaric has also been at the forefront of an ongoing industry initiative to standardize the way that carbon

emissions are recorded and reported. The success of a similar guideline developed for the container sector has prompted EPCs, forwarders and carriers – in collaboration with nonprofit group Smart Freight Centre – to work together to devise a set of standards that will help breakbulk achieve its sustainability goals.

Several round table meetings and panel sessions at Breakbulk events – often headed by Spoljaric – have provided the industry with regular updates on the initiative.

Thinking back to his football-playing days, the executive recalled his old coach urging him and his teammates to play on the front foot rather than react to their opponents’ plays.

Such lessons could also be applied to business, the executive said.

“Our coach basically told us, ‘listen, we’re going to control the game – we are not going to react to how the other team wants us to react‘,” he said.

“Sustainability is a hot topic right now. We strive to be thought leaders and, in line with our enterprise priorities and our vision, values, and commitments, we are helping to guide the industry in the right direction.”

Spoljaric is a member of the Breakbulk Americas Advisory Board, a group of industry professionals brought together to help shape the program for this year’s Breakbulk event in Houston. Bechtel is a member of the Breakbulk Global Shipper Network.

30 Breakbulk Magazine Issue 5 2023 breakbulk.com Profile

Colombia-based Simon West is senior reporter for Breakbulk.

Spo, his wife Dawn and their children Lucianella, Serafina, Santino and Vincenzo enjoy some vacation time.

The State of New Jersey is building a Wind Port near to Paulsboro Marine Terminal.

Credit: South Jersey Ports

The State of New Jersey is building a Wind Port near to Paulsboro Marine Terminal.

Credit: South Jersey Ports

Poised to take advantage of the heavy-lift market, American ports are investing in both equipment and expertise to ensure that they deliver at the highest level.

“South Jersey Ports is positioned to be at the epicenter of the heavylift industry,” said Dennis Culnan Jr, marketing consultant for South Jersey Ports. “Our Paulsboro Marine Terminal is the only location in the U.S. where monopiles are being manufactured and as such, we have ‘first mover’ advantage in being a key hub for manufacturing and supplying monopiles to the offshore wind industry in North America.

“Additionally, the State of New Jersey is building a Wind Port nearby which will serve as a marshalling site for the component pieces. They have already received their first tenant.”

Heavy-lift is proving to be a viable alternative to other more competitive sectors.

Greg Borossay, principal for maritime business development at the Port of San Diego, cites the example of the container space. With volatilities

and the sheer investment involved in the container market, he said it is hardly worth the effort to compete.

“Take a port like ourselves,” Borossay said. “We’re in the shadow of Los Angeles/Long Beach. From a container standpoint, it makes very little sense to try to go in and cherry-pick much of their business and compete directly with that. You can look around the world and there are any number of medium-sized ports such as San Diego that again, stand in the shadow of large, established container ports.

“So, we ask ourselves: ‘How do we build our portfolio so that it’s a mixed, healthy portfolio?’ We have done so with automobiles, military, bulks, cruise... and we are now putting the press on the breakbulk space. We have the cranes now, which will be a huge difference maker, and we have the expertise.”

Borossay explained that the reason for ports looking to enter the heavy-lift sector is twofold. “The competitive factor is Number One. Number Two: it allows a mediumsized port to play in that space and there’s a myriad of things that they can become involved in.”

Reaping the Rewards

The rewards for entering the heavy-lift market are encouraging, as the sector is helping U.S. ports to boost their year-on-year growth. North Carolina Ports reported 12 percent year-on-year growth for general cargo volume. The port’s annual report spotlighted the Ports of Wilmington and Morehead City, which in FY23, moved nearly 4.6 million short tons of bulk and breakbulk cargo.

Region: Americas

Problem: Sitting in the shadow of huge container ports makes it difficult for medium sized ports to compete for cargo

Solution: Regular breakbulk and heavy-lift business offers a steady revenue stream for U.S. ports ready to take the risk

Industry Sector Review: Mining, Oil and Gas, Renewables and Manufacturing

Wednesday, Sept. 27

12:00pm - 12:20pm

benefits with respect to heavy-lift cargo. “You have the revenue aspect, where if you don’t have a huge amount of layout space or massive terminals as we don’t – we are in San Diego and San Diego is known well for the Navy, tourism, and ‘oh by the way, we have a couple of cargo terminals.’

“We do really well with them, but we have a 97-acre facility on Tenth Avenue, which is where we focus on breakbulk, and then we have another automotive terminal, which is about 130 acres. You compare that to a terminal elsewhere in Long Beach – one terminal is 400 acres, and they have 13 of them (between LA and Long Beach). The same goes for other ports on the east coast – ports like Baltimore that do some containers... you have ports that are focused on this breakbulk space because of the revenue and because of the lack of land.”

The Port of Everett’s chief operating officer Carl Wollebek explained that the port has reaped the benefits of heavy-lift for many years. “We identified several years ago that project business was the best and highest use for our facilities given our geography, rail and road connections, labor, and equipment availability. We also pride ourselves in supporting this industry.”

Borossay said that there are other

The other factor for a port like San Diego is that it is a regional port, serving the Baja California area. The region includes San Diego county, Imperial Valley and the border of Mexico. “So, for projects that are coming up in the breakbulk space, the Port of San Diego can be a good solution for many of the shippers. We don’t have the supply chain issues and again, when you focus on containers, there’s so much infrastructure investment required there, so that breakbulk for those ports becomes a case of ‘oh, by the way, we can do breakbulk, but we really don’t do it so well.’”

33 Breakbulk Magazine Issue 5 2023 breakbulk.com

Americas

Greg Borossay

AT BREAKBULK AMERICAS…

Americas Safety Strategies

Despite the promise of heavy-lift cargoes, there are still challenges to be managed, an important one being safety.

Keith Palmisano, general manager of Ports America Louisiana, said that the biggest safety challenge is working aloft when rigging gear. However, he added that planning is key to safe and successful operation: “Having a good strategy plan prior to the vessel’s arrival is critical for providing a safe working environment.”

Borossay outlined a general problem that some ports face. “If you have a port that’s not accustomed to working with multiple breakbulk pieces, and you’re doing this with a labor group that’s not really trained or geared towards that, then it could be a safety issue for the workers and staff and maybe even issues with damage for the vessels and so forth.

“We have the required expertise to handle breakbulk safely and efficiently. We feel really good about the fact that our labor group here have really good expertise. They are people who have been doing this work for decades and know how to handle this kind of piece.”

Safety issues outside the gate again relate to how cargo is run through an urban area. “You need to get the permitting,” Borossay said. “We get our permits all the way up to the California border. We have to take great pains to ensure that the drayage companies are well equipped for that. Also, clearances for railroads have to be calculated before the cargo can leave the dock.”

Another consideration is cost. While as Borossay explained “cost is everybody’s biggest challenge and it’s certainly ours,” in order to effectively compete in the heavy-lift world, U.S. ports still need to splash the cash to get a good return on investment.

“The U.S. west coast is not inexpensive,” Borossay said. “We are challenged in that sense because labor costs are high. We’re working really hard to electrify every aspect of our supply chain and to set an example in California to be on the leading edge

of electrification. The downside of that – at least for now – is that this is more costly, the same sort of paradigm that we all know – electric cars are expensive now, but maybe in a decade they won’t be so expensive, they’ll be the norm. So, to be on the leading edge, means a little bit higher expense.”

In the short term, he said the port has to “muddle through” until everybody else catches up. He gives the example of Texas, which is known for being a state that focuses heavily on fossil fuels. “They are not leading the way with environmental issues and many shippers just look at cost. We really have to sharpen our pencil on that

and sometimes, it makes no sense at all. We’re not going to compete for certain cargoes if the end points don’t make sense. But we do think in particular that for cargo coming out of Japan, Korea, North China and South East Asia – because of the deviation of the Panama Canal and because there’s this significant back-bulk cost from Texas to the south western states, that we do have a benefit.”

Palpable Payback

The Port of Everett continues to prioritize infrastructure investments that support growth in the breakbulk/ project sector. “Over the past decade,

34 Breakbulk Magazine Issue 5 2023 breakbulk.com

Galveston handles a Liebherr crane.

Credit: Ports America

South Jersey Ports’ Paulsboro Marine Terminal is the only location in the U.S. where monopiles are being manufactured.

Credit: South Jersey Ports

the port has invested more than US$150 million to modernize its seaport facilities and expand cargo handling capabilities,” Wollebek said. “From adding terminal capacity, modernizing facilities, adding on dock rail capacity, procuring additional cargo handling equipment, and implementing sustainability features to help ‘green’ the supply chain.”

Two game changing upgrades have also been recently completed by the Port of Everett. These have increased the port’s capacity and provided the ability to support more breakbulk and project cargoes. “In 2021, the port opened its modernized South Terminal,” Wollebek explained. “The US$57 million upgrade added another full-service berth in Everett with two post-panamax container cranes to support larger ships and heavier cargo.”

In December 2022, the port opened

the first all-new cargo terminal on the U.S. West Coast in over a decade, adding critical cargo capacity to the global supply chain. The new US$40 million Norton Terminal project nearly doubled the port’s upland capacity to support even more breakbulk and project cargo. It features 40-acres of paved, lit and secure cargo yard, with future opportunity for adaptive reuse of an existing 396,000 square foot warehouse. Looking at the future, Ports Americas Louisiana’s Palmisano expected there would continue to be support for multipurpose vessels carrying breakbulk, bulk, project cargo, and heavy-lifts. “By working in the heavy-lift sector, ports can support growth and improvement in our country’s infrastructure.”

South Jersey Ports’ Culnan Jr added: “We are certainly seeing more

ports position themselves for heavylift business along the Atlantic Coast in order to support the growth and to capture the economic benefits of the burgeoning offshore wind industry.”

Wollebek said that government and private infrastructure investments should make this a viable industry for years to come, while Borossay concluded that the breakbulk industry is a stable, regular business and one that will always remain. “It makes a lot of sense to build breakbulk into the portfolio because it’s the kind of cargo that keeps coming on a regular or semi-regular basis and it also has the capability of adding quite a lot of revenue as compared to the amount of volume that you’re handling. The payback there is palpable.”

FLORIDA’S

BREAKBULK DISTRIBUTION HUB

•

•

• New and expanded container services with Central America, Mexico and Asia

35 Breakbulk Magazine Issue 5 2023 breakbulk.com Americas

John Bensalhia is a freelance writer and author with 25 years’ experience of writing for a wide range of publications and websites.

Florida’s largest and fastest growing market

• Closest port to

500,000 SF of on-dock warehouse

and 7,000 linear feet of berth

Nearly

space

largest steel port

• Florida’s

Expanding lumber, perishable, container, project cargo, and heavy-lift business

PORT TAMPA

WWW.PORTTB.COM

BAY

CARIBBEAN PROJECT MARKET HEATS UP

But Guyana Continues to Lure Lion’s Share of Investment

Speak to project professionals about opportunities around the Caribbean and talk quickly turns to Guyana, the former British colony perched on the northern tip of South America that in less than a decade has become the world’s most exciting hotspot for offshore oil and gas - and a mine of wealth for companies involved in handling breakbulk and project cargo.

On the back of a string of discoveries, ExxonMobil and its partners are looking to deploy six floating production, storage and offloading, or FPSO, vessels by the end of 2027, which would lift Guyana’s

production capacity to more than 1.2 million barrels per day, or bpd.

A sense of excitement surrounding Guyana’s neighbor Suriname is also palpable, with the former Dutch colony

Region: Americas

Problem: Lack of coordination and standardization across the Caribbean makes planning for project handling difficult

Solution: Pioneering countries are setting their own parameters to propel project development

By Simon West

on the verge of its own offshore boom. Production sharing contracts have already been inked between state-run energy company Staatsolie and several oil majors, including TotalEnergies, Chevron, Shell and QatarEnergy. But move north from mainland South America to the Caribbean islands and territories, and the discussion becomes a little more circumspect.

Roberto Fernaine, regional head of Latin America & the Caribbean at Maersk Project Logistics, or MPL, said project opportunities in much of the archipelago – which comprises

36 Breakbulk Magazine Issue 5 2023 breakbulk.com

Americas

Trinidad’s ports and infrastructure have been used to handle most of the heavy and oversized cargo destined for Guyana’s offshore oil and gas projects.

Credit: Ramps Logistics

13 sovereign states, 12 dependent territories and thousands of smaller islands and cays stretching from the Bahamas off the coast of Miami down to Trinidad and Tobago off the northern shores of Venezuela – were “in a smaller number.”

“That doesn’t mean that they don’t have potential, but it’s just small in comparison to everywhere else in the region. The businesses in those islands are not necessarily related to a particular project logistics volume, but you do have specific projects that sometimes arise,” said Fernaine, who has worked on projects in the Dominican Republic, Guatemala, El Salvador, Nicaragua, Suriname, and Trinidad and Tobago.

“If you go to the smaller islands – to Aruba or Saint Martin, or to Bonaire or Curaçao – you may have an expansion of a refinery or a processing plant here and there. But these are very small capex approvals with a very limited amount of resources that sometimes take too much time for a company like ours to be dedicated to. Those projects are usually awarded to smaller service companies dealing in the project logistics business.”

Building Up Expertise

One project professional, who asked not to be named, has worked on projects throughout the Caribbean – mostly on a spot basis.

“I’ve managed operations for multiple companies, and in my time in the Americas, there’s always been a project that we’ve had to execute in the Caribbean. But we’d always parachute our team in, they’d execute the job, we’d bring some equipment from elsewhere, and as soon as our job was done, everybody scatters,” the executive said.

“There’s not the same level of investment and focus in these countries because the activity just isn’t there. So we ask ourselves, how do we justify involvement, or how do we start to strategize and put someone in position?”

The executive pinpointed some of the challenges facing logistics

firms in the Caribbean, where many of the dependent territories have their own laws and regulations that can complicate the movement of breakbulk and project cargo. Shipments to Puerto Rico, for example, are still bound by the requirements of the Jones Act – the century-old law that says goods and equipment can only be transported between U.S. ports by vessels that are built, owned and manned by U.S. citizens.

“When we get into discussions for any type of project activities, supporting operations, transport – it’s critical that we understand what the requirements are in each country.”

“A case in point – there was no streamline of protocols regarding how Covid vaccines were going to be received from island to island. It was completely different everywhere. Aruba had one set, Puerto Rico had a set, St. Thomas had a set, Dominican Republic had their rules and quarantine. Everything was completely different. It never got standardized.”

One solution could be the expansion of regional trading blocs such as the Caribbean Community, or Caricom, which comprises 15 members and five associate members of mostly English-speaking nations plus Suriname and Haiti, or the creation of new alliances to harmonize policies and boost economic growth.