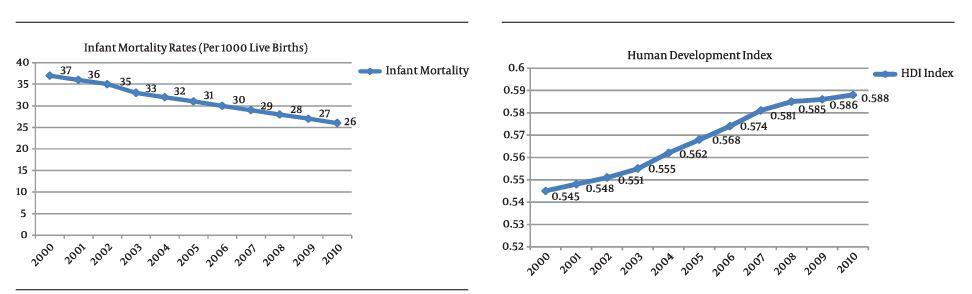

Spring 2024, Volume 17

EDITOR: Ramesh Mohan

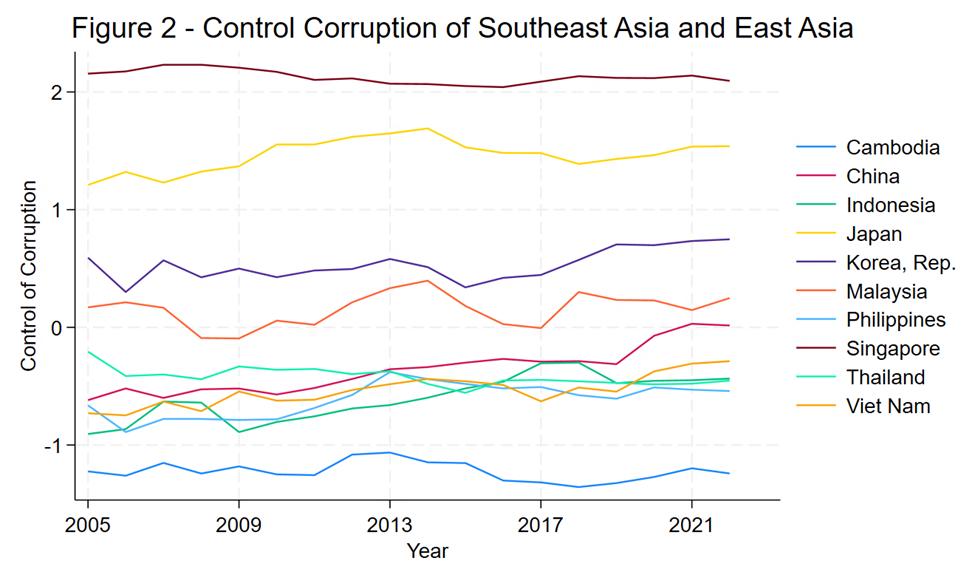

DESIGN & LAYOUT: Ramesh Mohan and Rebecca Marcus

MISSION STATEMENT: The Empirical Economics Bulletin is the undergraduate journal for the Department of Economics, Bryant University. The journal is produced in conjunction with the Bryant Economic Undergraduate Symposium. The focal point of the Symposium is on training undergraduate students in the art of writing, presenting, and publishing empirical research papers on a range of socio-economic and economic topics. The Symposium’s primary emphasis is empirical studies with policy relevance. Students are then able to publish their empirical papers in the Empirical Economics Bulletin. An objective of the Economics’ Department, Bryant University is to train students to conduct quantitative economic data analysis and to present the results in a coherent and meaningful way. This objective is met through having the Symposium and the publication of the Empirical Economics Bulletin. The first issue was in Spring 2008 and has been published annually with original work from an array of student authors.

SUBMISSION GUIDELINES: Students may submit their socio-economic and economic work here: Ramesh Mohan at rmohan@bryant.edu. Limit one submission per author. Each submission should have a title page with the title; name of author; abstract; keywords; JEL classification; author’s email. Previously published work is not accepted. The reading period is September 1 to December 1. Copyright reverts to author upon publication.

Any questions may be directed to Professor Ramesh Mohan at rmohan@bryant.edu.

© 2024 Empirical Economics Bulletin

Table of Contents

Economic Peaks, An Analysis of Financial & Real Estate Speculations in the Top 5 U.S Cities, Nicholas M. Basley .....................................................................................................................1

Beyond the Arc: Investigating the Impact of 3-Point Shots on NBA Revenue: An Empirical Analysis, Cameron Bolduc .17

The Role of Institutional Quality Factors on Inequality in Upper-Middle Income Countries in Latin America, Alexia Brandao ..................................................................................................32

Does Money Really Buy Success? Empirical Analysis of Money Spent Effect on English Premier League Team’s Performances/Success: A Panel Data Analysis, Barnaby Brandon .46

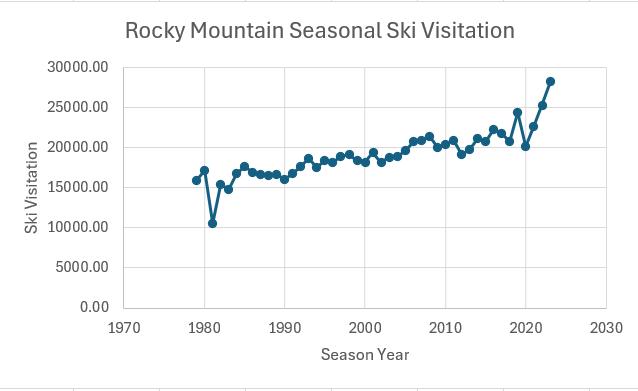

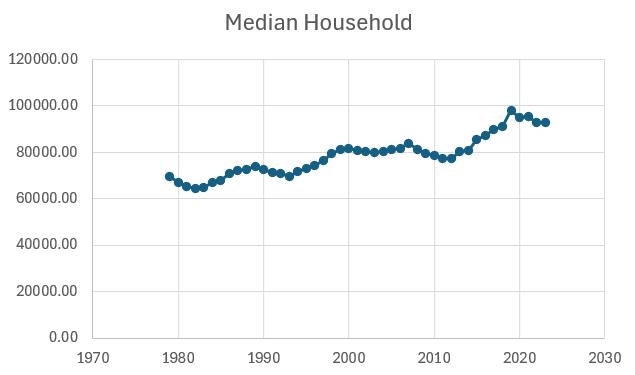

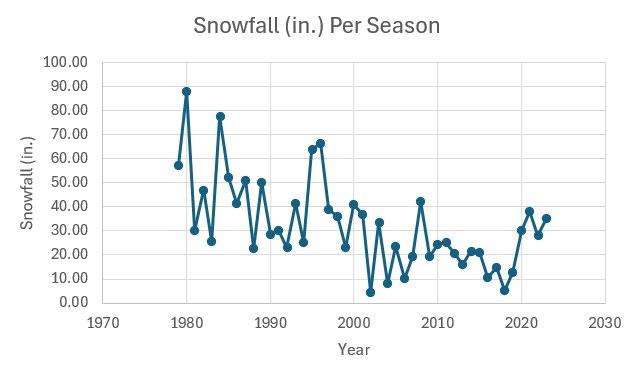

Time Series Analysis of the Impact of Climate Change on the Rocky Mountain Ski Industry, Charlotte Christo ....................................................................................................................57

The Causes All Time High Chronic Homelessness: A Panel Analysis, Robert Knight 76

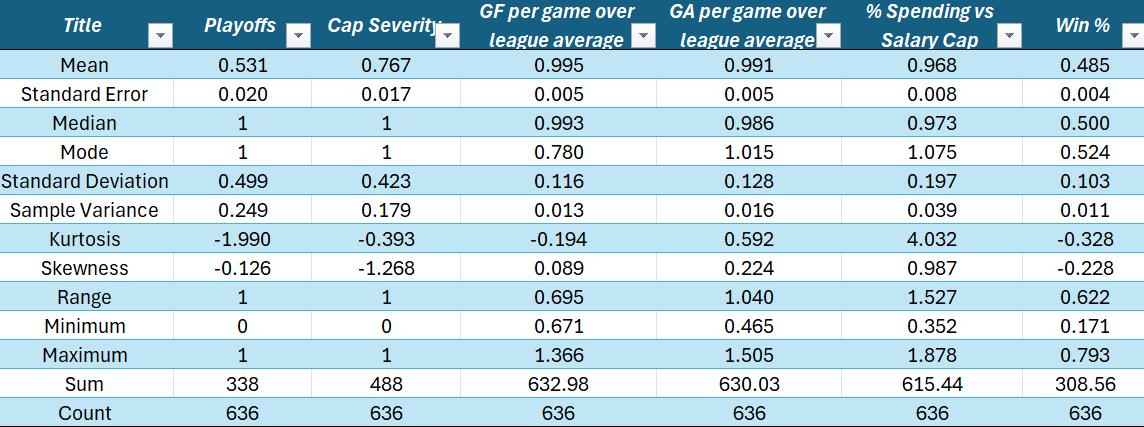

SHIFTING THE ICE: Analyzing the Impact of the 2013 NHL CBA to the Competitive Balance of the League, Ryan Lacy ..........................................................................................................93

How UNSDGs are Reflected in Folklore, Jacob Mann .............................................................110

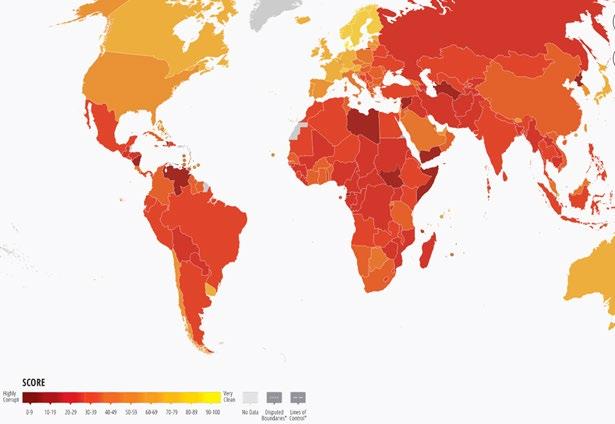

A Panel Data Analysis of the Effect of Corruption and Macroeconomic Factors on Inequality and Poverty in Latin America, Annie McDonald ............................................................................126

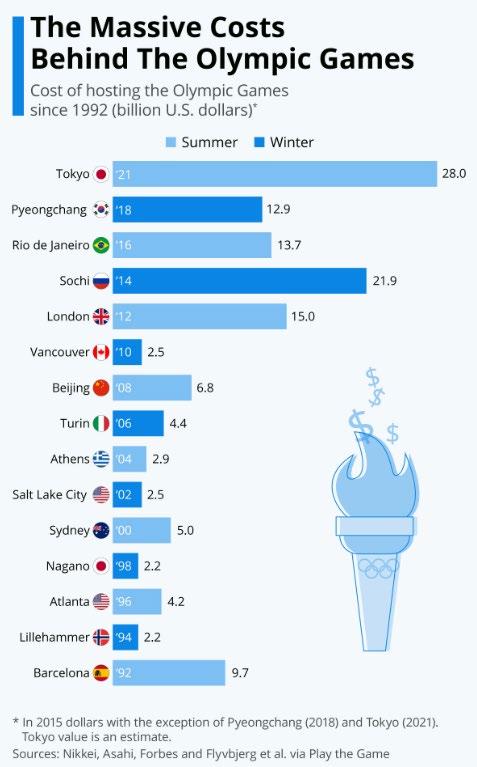

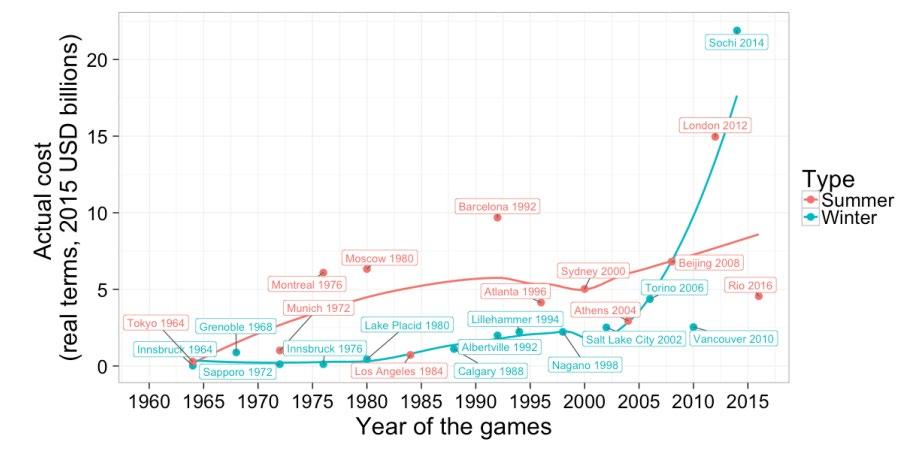

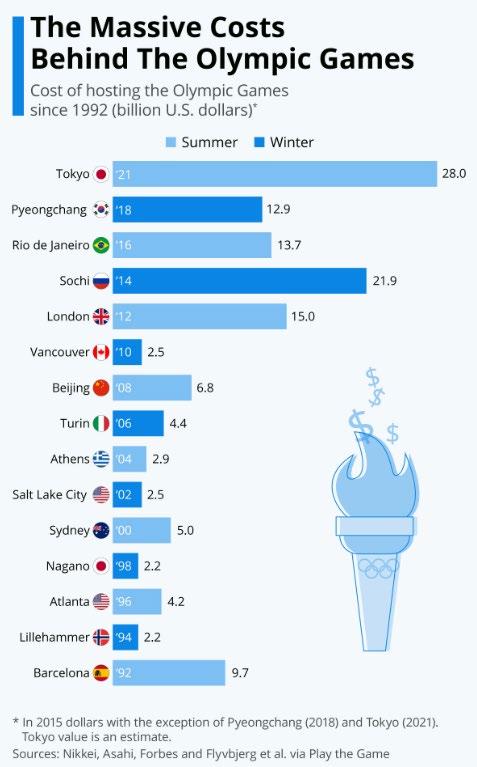

Hosting Mega Events Impact on GDP Growth: A Panel Data Analysis, Silas Pearce ...............143

Hitting the Books: An Empirical Analysis of the Effect of Education Expenditure on GDP per Capita and Economic Growth, Matt Simmons 157

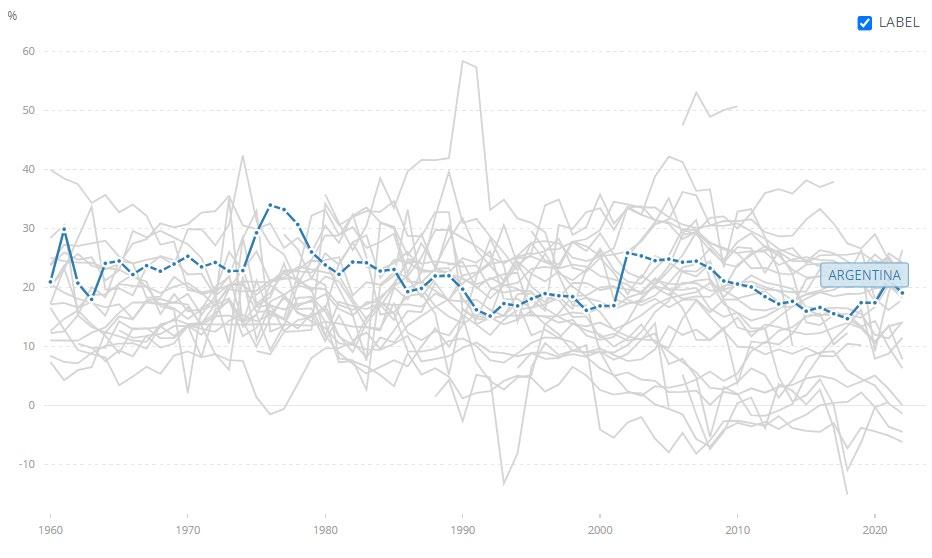

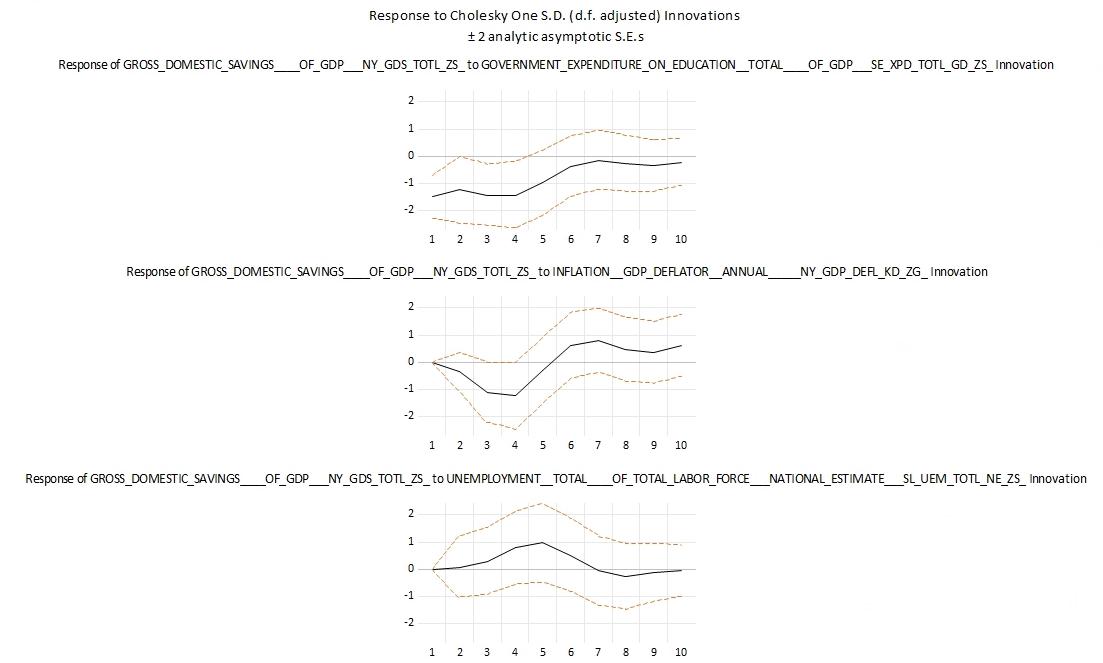

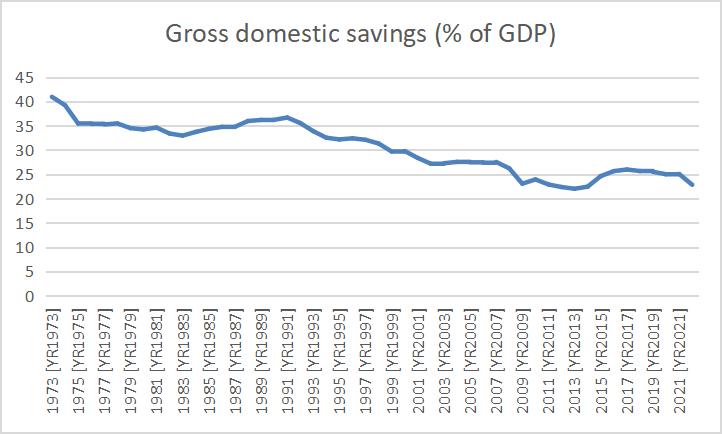

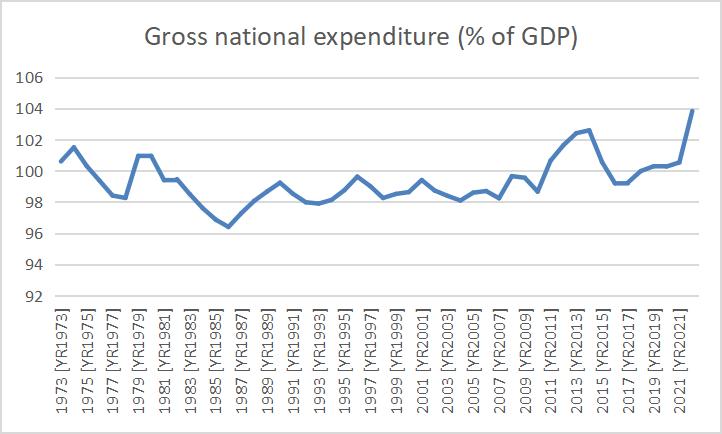

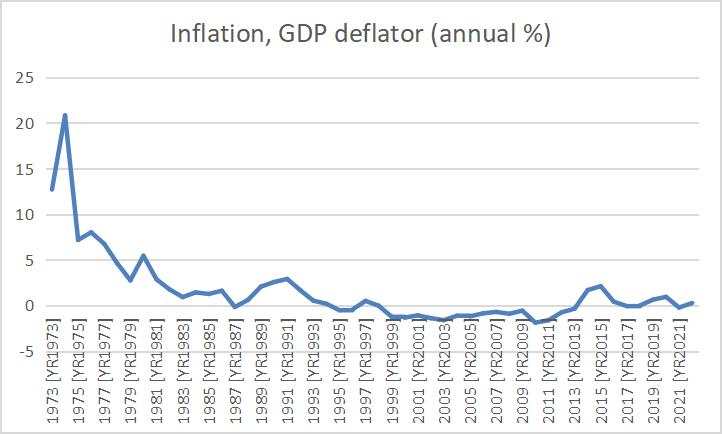

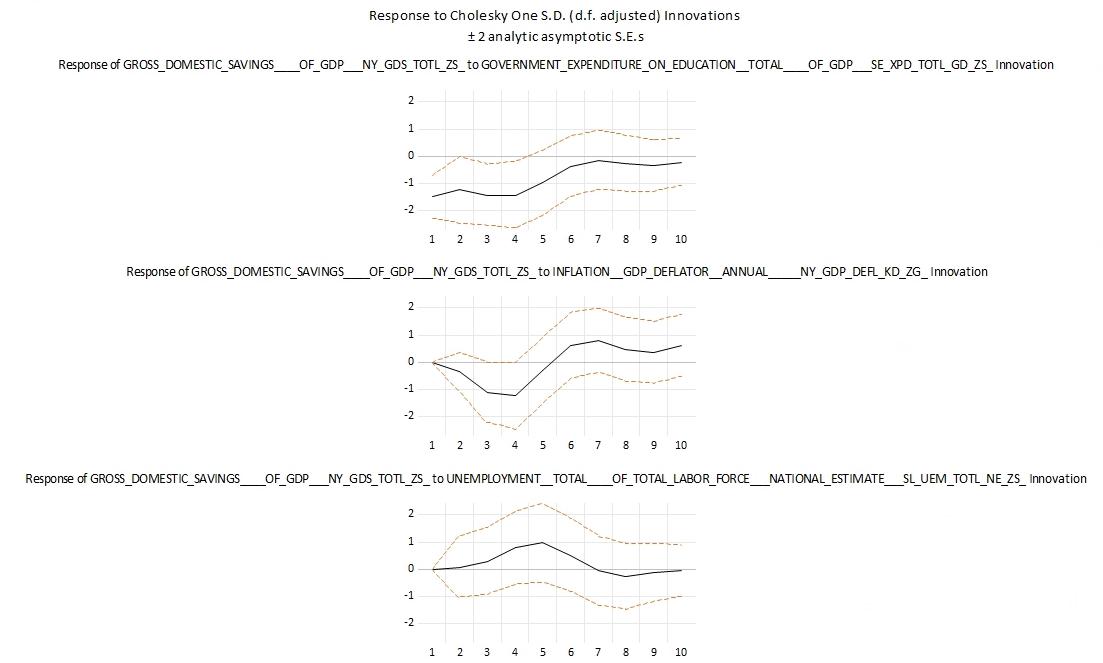

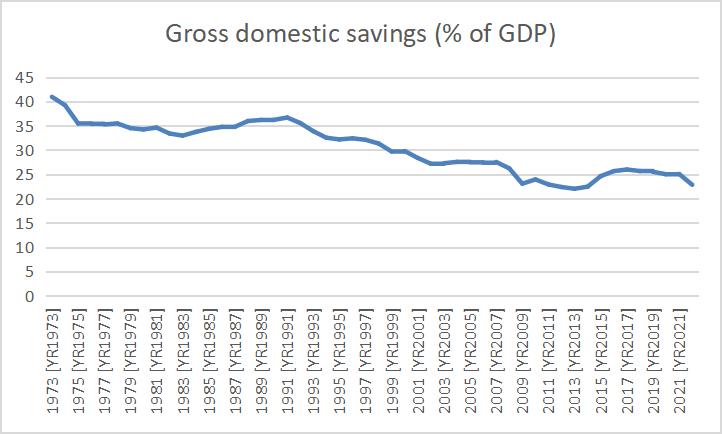

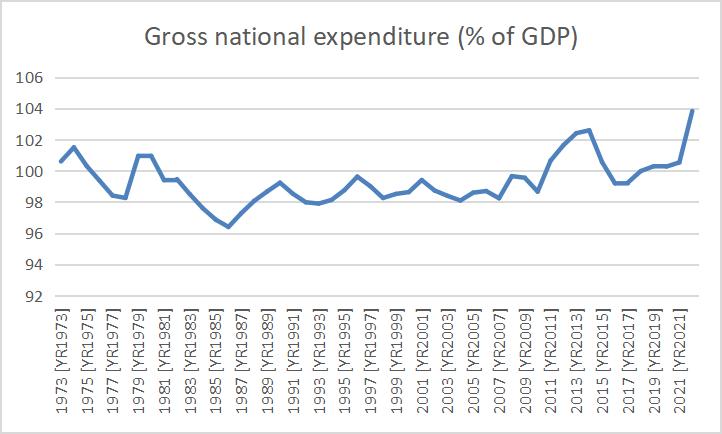

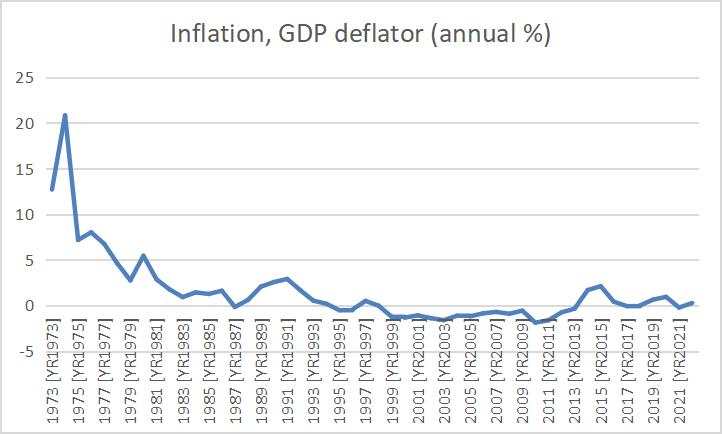

The Causal Nexus Between Government Expenditure on Education and Individual Savings Behaviorin Argentina, Amanda Spielman 172

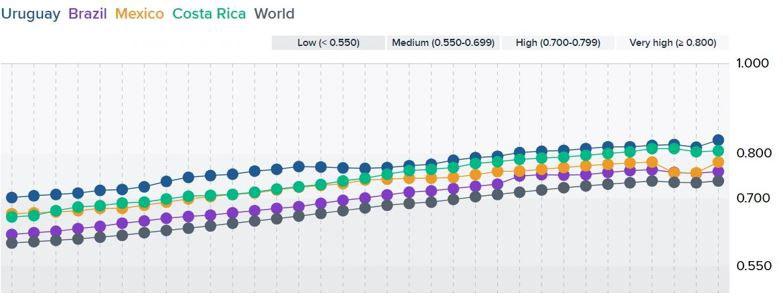

HDI and Standard of Living: A Panel Data Analysis of Latin America, Matthew Susich ......... 190

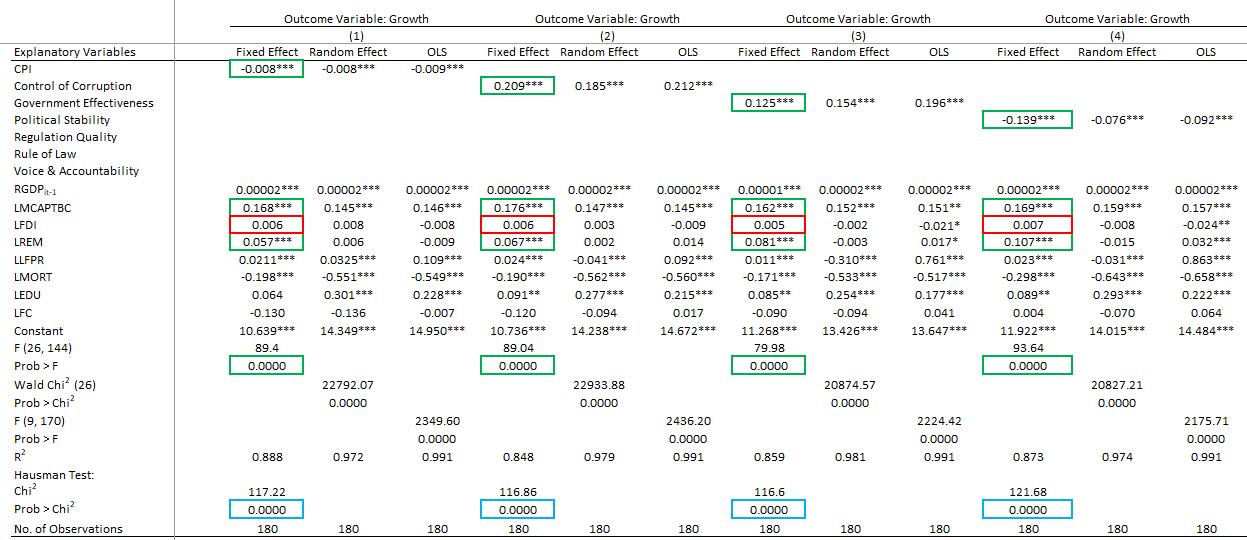

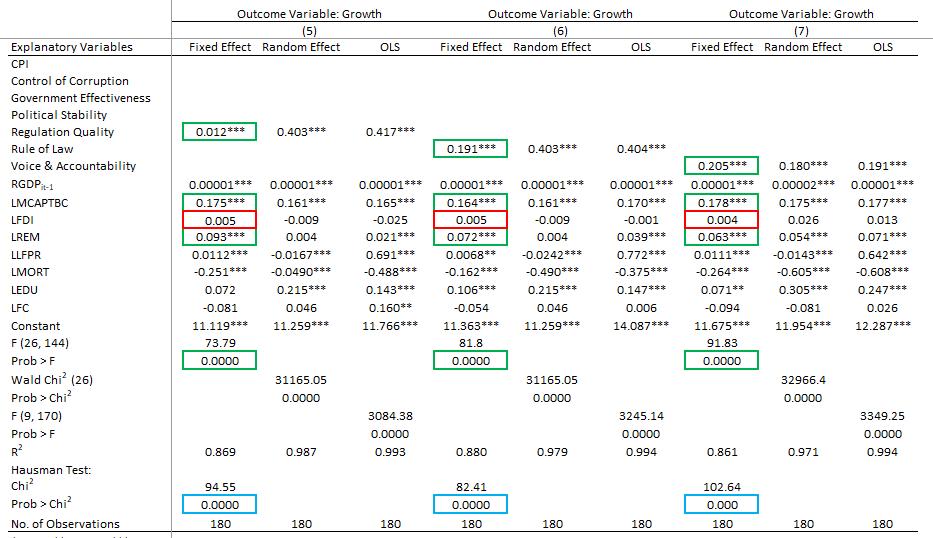

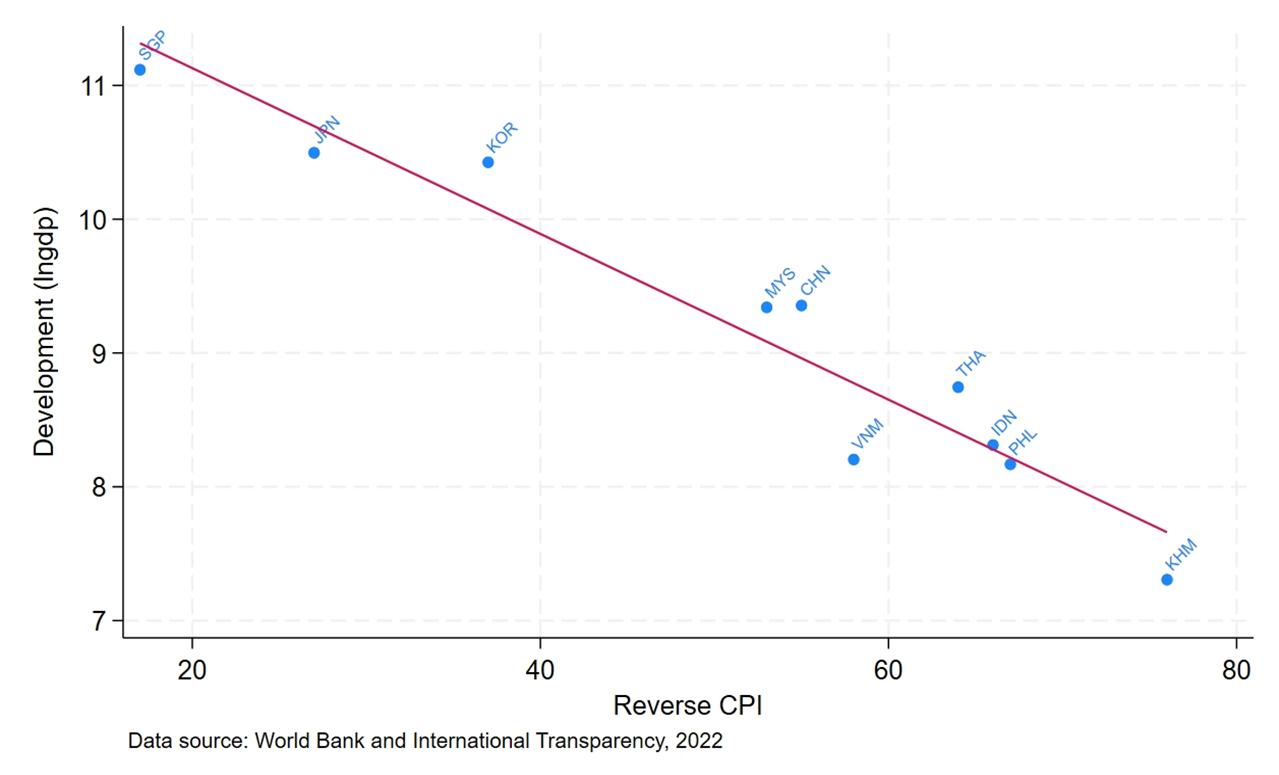

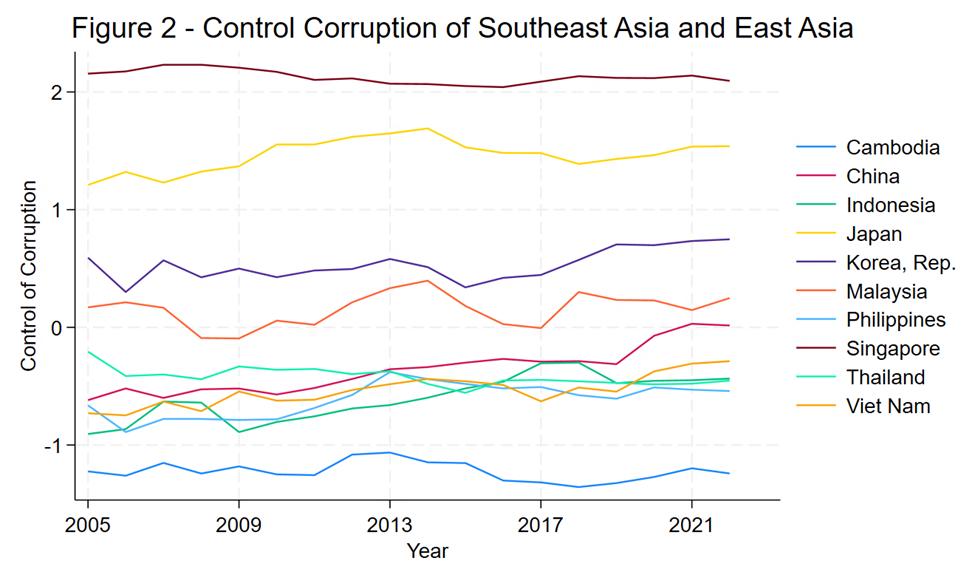

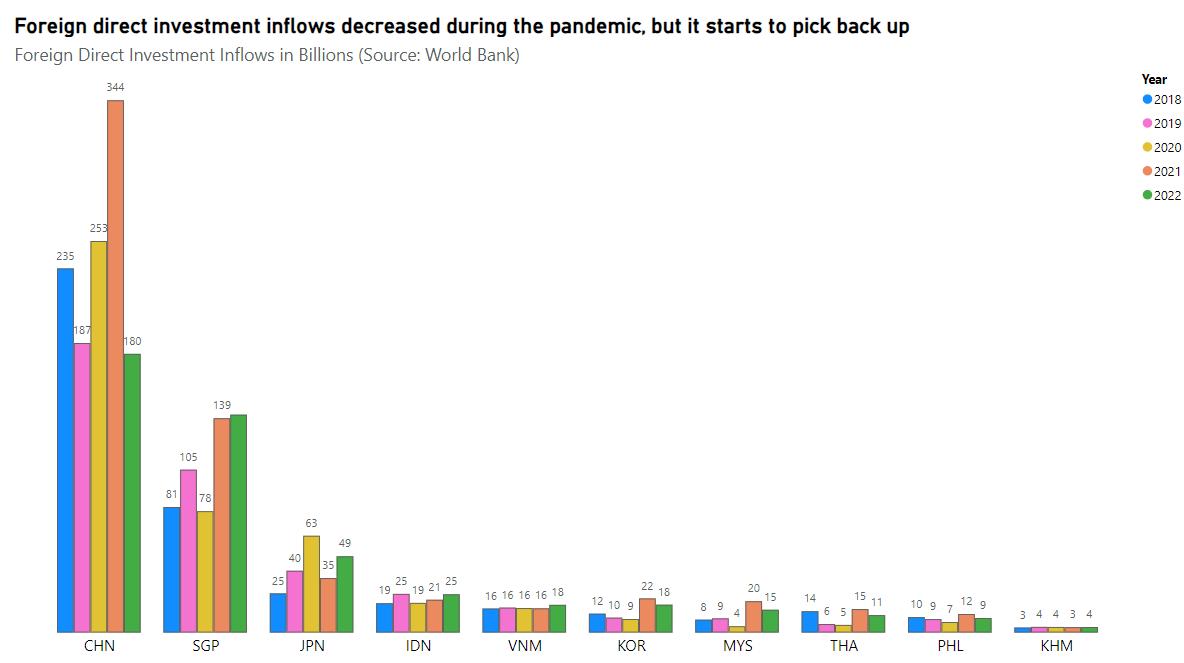

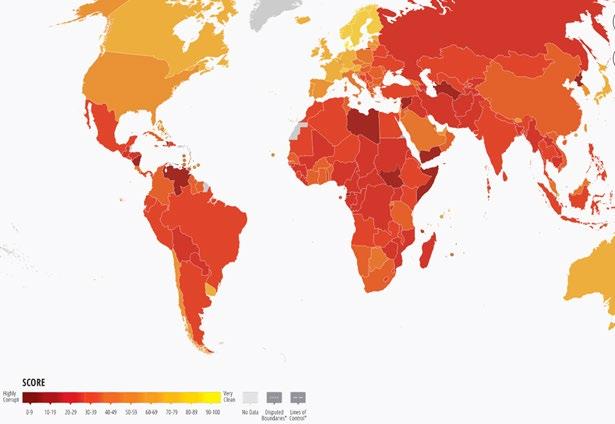

Capital Flows and Corruption on Southeast and East Asia’s Economic Growth: A Panel Data Analysis, TithVitou Teng .......................................................................................................205

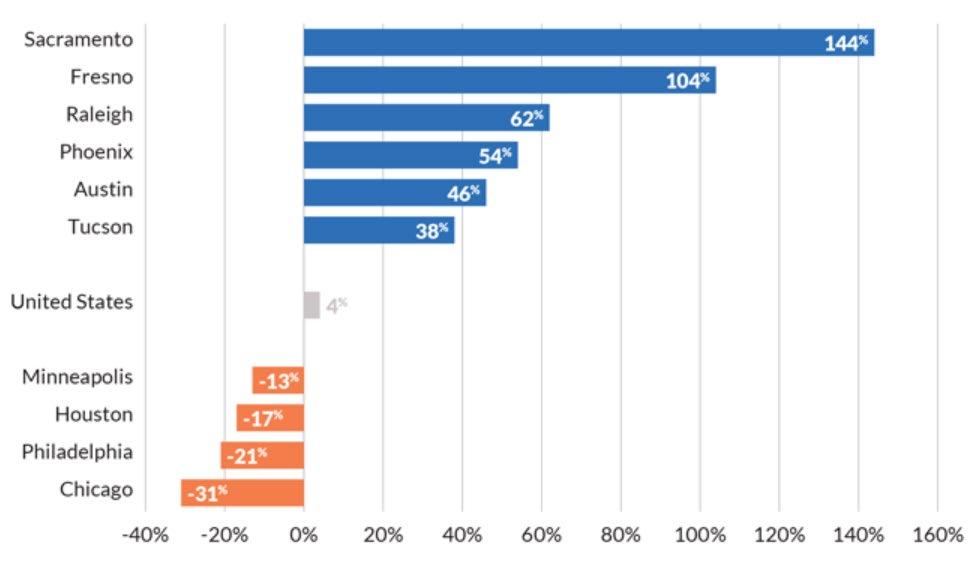

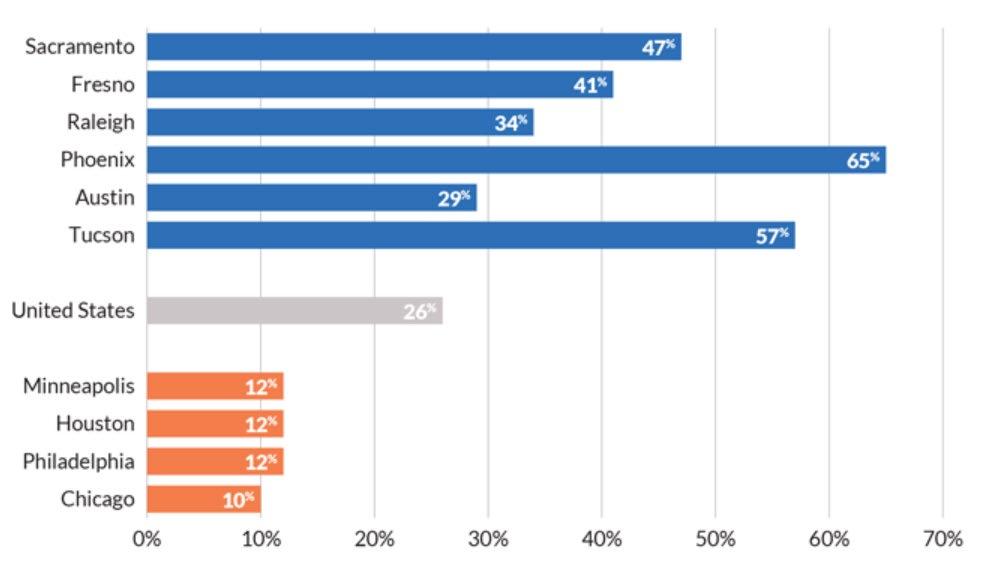

A Cross-Section Analysis of Factors Affecting Interstate 11 Migration in the United States, Kasey Thomas 227

An Empirical Analysis of the Status of Income Inequality New England in 2022, Aidan Wilkinson ...............................................................................................................................250

Broken Asset Bubbles: The Factors affect Japan's Economy from Prosperity to Decline, Mark Yang 262

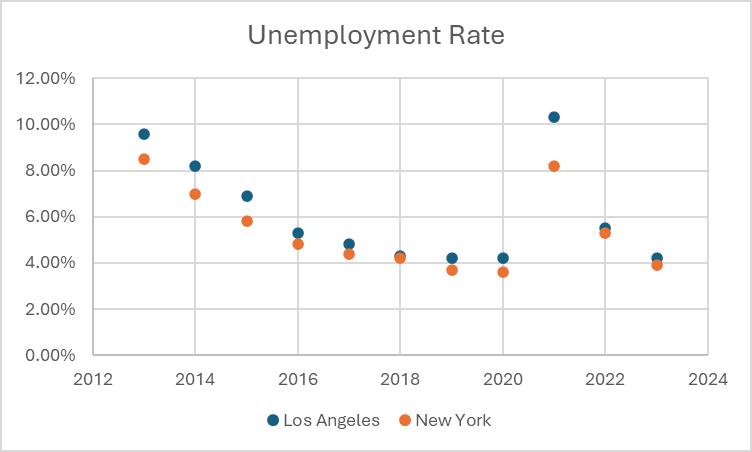

Economic Peaks, An Analysis of Financial & Real Estate Speculations in the Top 5 U.S Cities

Nicholas M. Basley

Abstract:

Economic Peaks conducts a comprehensive analysis of financial and real estate speculations in the United States, more specifically the top five cities per population in the United States. This study spans the period from 2000 to 2023, utilizing time series data to reveal economic trends and identify potential structural breaks during recession periods. By employing advanced statistical methods, the research aims to discern distinctive patterns in the housing and financial markets of each of the major cities, unveiling the presence of unsustainable price appreciation and the factors contributing to its emergence. This study seeks to offer valuable insights into the dynamics of economic fluctuations, enabling an understanding of the diverse trajectories these five cities experienced during the twenty-three year timeframe.

JEL Classification: —-

Keywords: Real Estate, Recession, NYC, PHOENIX, HOUSTON, LA, CHICAGO, Housing

Bryant University 1150 Douglas Pike, Smithfield, RI 02917

Owner- Basley Realty LLC. Phone: (860)-230-7152 Email: nbasley@bryant.edu

Empirical Economic Bulletin, Vol. 17 1

1.0 Introduction

The real estate market in the United States has undergone significant scrutiny and analysis in recent years, particularly in the aftermath of the housing market crises of the early 2000s.

Economic Peaks embarks on a comprehensive examination of financial and real estate speculations within the top five populous cities in the United States over the period spanning 2000 to 2023. Through advanced statistical methods, this research aims to uncover distinct economic trends, identify potential structural breaks during recessionary periods, and discern patterns within the housing and financial markets of each major urban center.

With a focus on the cities of New York City (NYC), Phoenix, Houston, Los Angeles (LA), and Chicago, this study aims to unveil the presence of unsustainable price appreciation and investigate the factors contributing to its emergence in these dynamic urban environments. By diving into time series data and employing rigorous analysis techniques, Economic Peaks seeks to offer valuable insights into the diverse economic trajectories experienced by these cities over the twenty-three-year period.

Beginning with an exploration of trends of structural breaks and their impact on the real estate market, this research sets the stage for understanding the evolving landscape of the housing sector. Additionally, the literature review explores the seminal research on housing bubbles, combining the findings from studies by Glaeser and Nathanson (2014), Baker (2018), Himmelberg, Mayer, and Sinai (2005), and Cheng, Raina, and Xiong (2013). This review aims to deepen the understanding of housing bubbles and inform strategies for mitigating their impact, laying a solid foundation for the analysis. Through a combination of empirical analysis and critical review of existing literature, Economic Peaks explores to contribute to the overall

Empirical Economic Bulletin, Vol. 17 2

knowledge on real estate speculation and economic fluctuations. By uncovering the underlying drivers of price appreciation and market dynamics within major U.S. cities, this research seeks to provide actionable insights for investors and stakeholders to promote sustainable growth and stability in the housing market.

The rest of the paper is organized as follows: Section 2 provides an overview of trends. Section 3 gives a brief literature review. Section 4 Outlines the Empirical Model, Data, and Estimation Methodology. Section 5 Presents/Discusses the Empirical Results. Followed by a Conclusion in Section 6.

2.0 TRENDS OF STRUCTURAL BREAKS AND IMPACTS ON THE REAL ESTATE MARKET

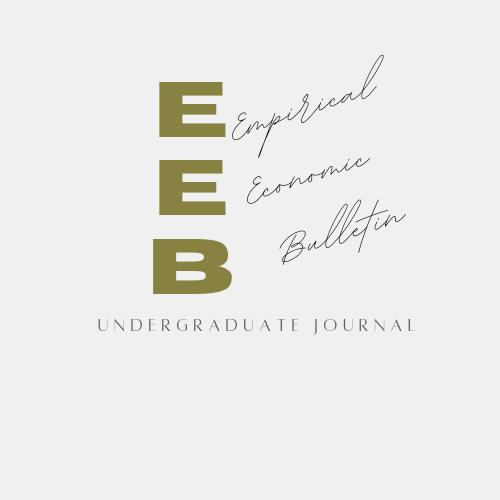

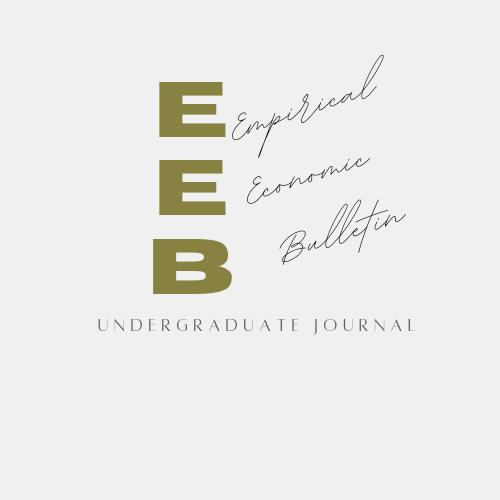

In Los Angeles, the homeless population surged to 41,290 individuals in 2020, representing a 61% increase over five years, with 70% of them remaining unsheltered. Projections indicate that the city's housing crisis will only escalate, as the population is expected to reach 4.3 million residents by 2029. To accommodate this growth, the city must facilitate the production of 456,643 housing units by 2029, a target that necessitates a fivefold increase in housing production compared to the previous decade.

The shortage of affordable housing has exacerbated the homelessness crisis, with only 83,865 housing units added between 2010 and 2019 despite a population increase of over 190,000 residents. As a result, Los Angeles has become one of the nation's most expensive cities, with 59% of renter households burdened by housing costs. This pressing issue underscores the urgent

Empirical Economic Bulletin, Vol. 17 3

need for comprehensive solutions to address housing affordability and mitigate the impact of homelessness in the city.

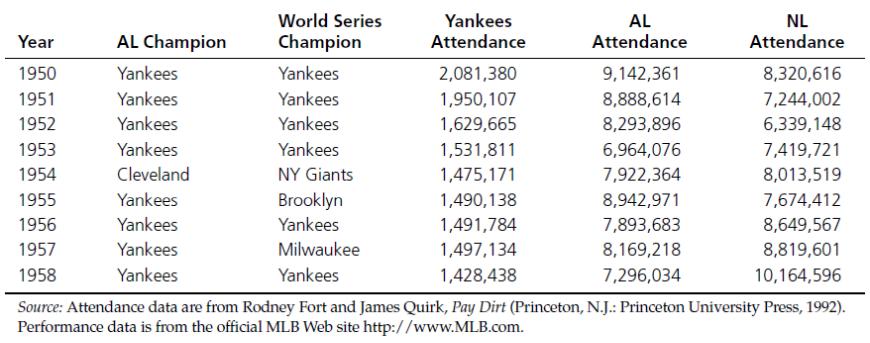

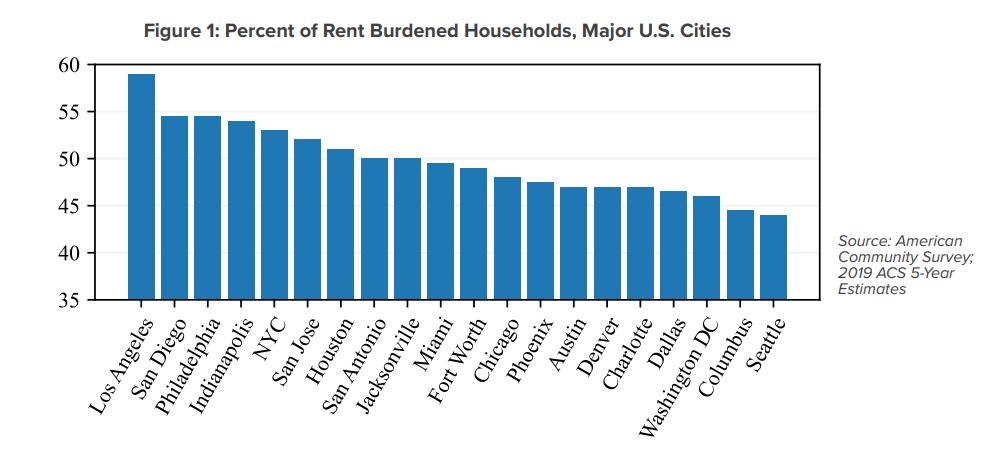

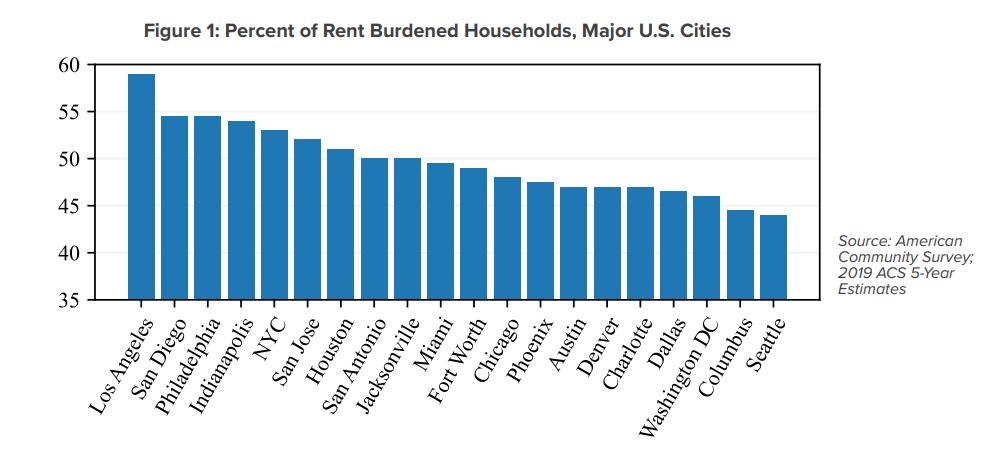

Source: U.S. Census Bureau, National Association of Realtors, and Real Estate Center at Texas A&M University

Figure 2: Total Housing Sales Texas vs. United States

Empirical Economic Bulletin, Vol. 17 4

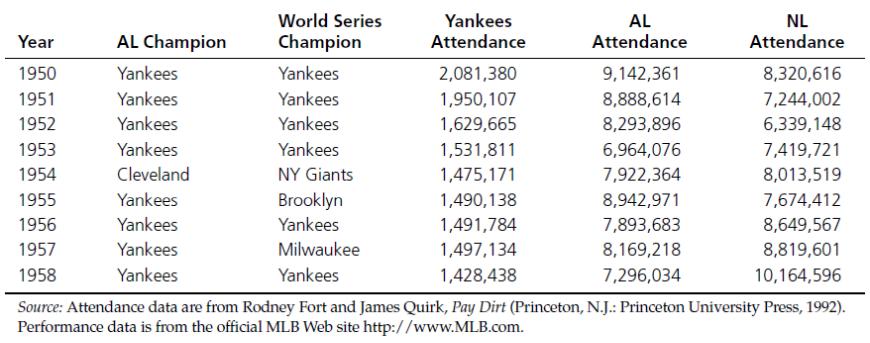

Figure 2 depicts the Total Housing Sales trend for Texas compared to the United States over the period from 2000 to 2020, highlighting the Trend-Cycle Component. It illustrates the fluctuating patterns of housing sales in both regions, capturing the cyclical nature of the real estate market. Notably, Texas concludes the two-decade period with an impressive 80-point increase compared to the average housing sales in the United States. This significant uptrend in housing sales underscores the robustness of the Texas real estate market and its resilience amid changing economic conditions.

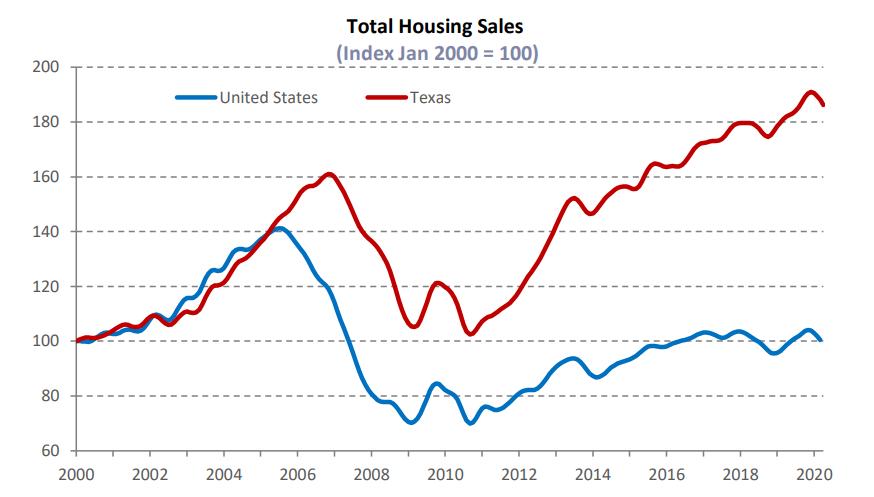

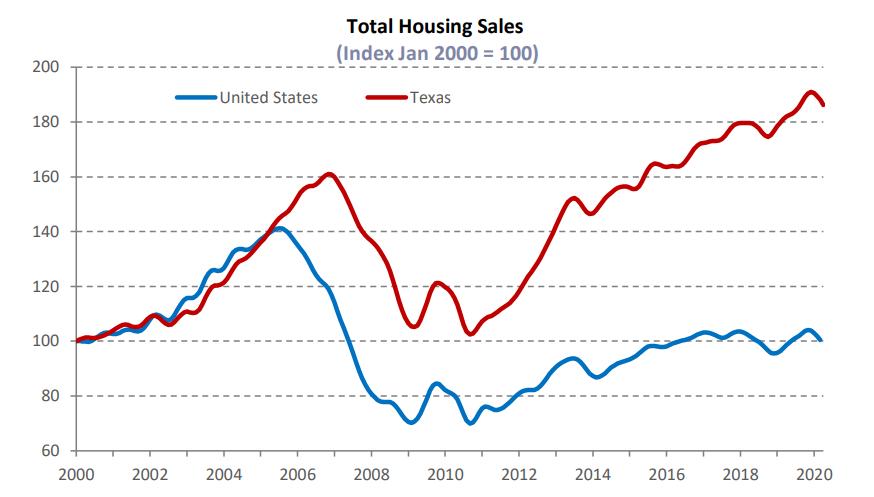

Source: Zillow Home Value Index, US Bureau of Economic Analysis

Arizona's housing market faces significant challenges, with rising interest rates leading to the highest home buying costs since 2007, requiring households to work approximately 68.72 hours per month to service mortgages, nearly double the requirements from September 2020. Despite a

Figure 3: Mortgage Affordability in Arizona

Empirical Economic Bulletin, Vol. 17 5

slight decrease in the housing supply deficit to 98,190 units in 2021, demand continues to outstrip supply, fueled by factors like brisk in-migration and increased housing demand during the pandemic. To meet demand, Arizona needs to add roughly 43,900 new housing units annually, rising to 63,580 units to close the shortfall within five years, highlighting the urgency for increased construction activity to address the housing shortage.

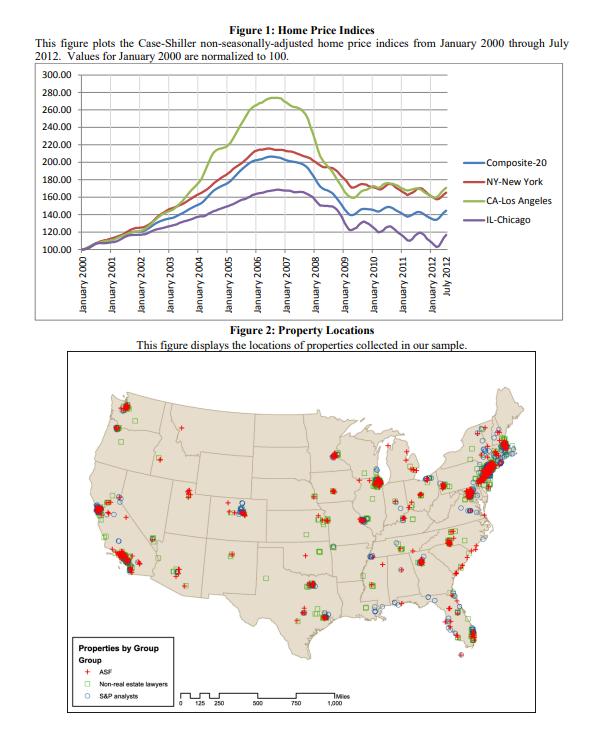

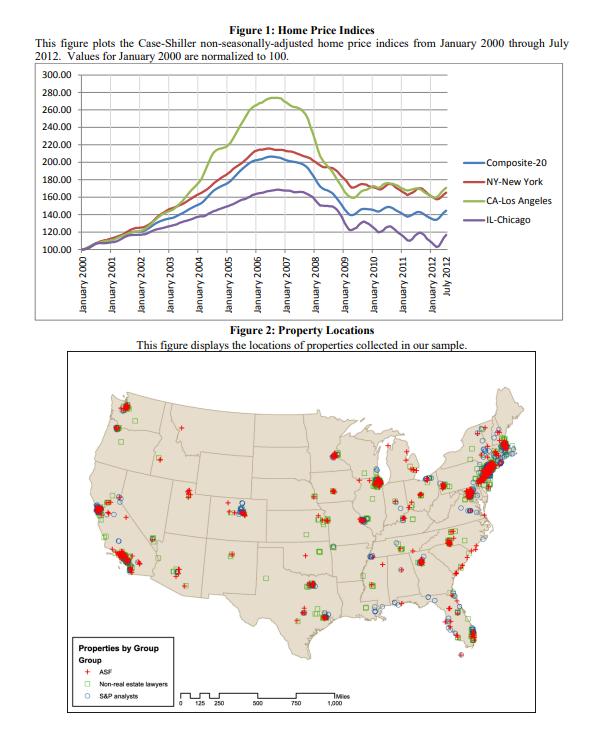

4: Combined Fig. 1&2 Home Price Index NY, CA, IL, and Respective Locations

Source: NATIONAL BUREAU OF ECONOMIC RESEARCH

Figure

Empirical Economic Bulletin, Vol. 17 6

Figure 4 depicts the indices in the study and analyzes the trends in the home price index across the United States from 2000 to 2007. It examines how home prices evolved over this period, considering factors such as location-specific effects and variations in housing market dynamics. The findings highlight fluctuations in home prices across different regions and their impact on the overall housing market during this timeframe.

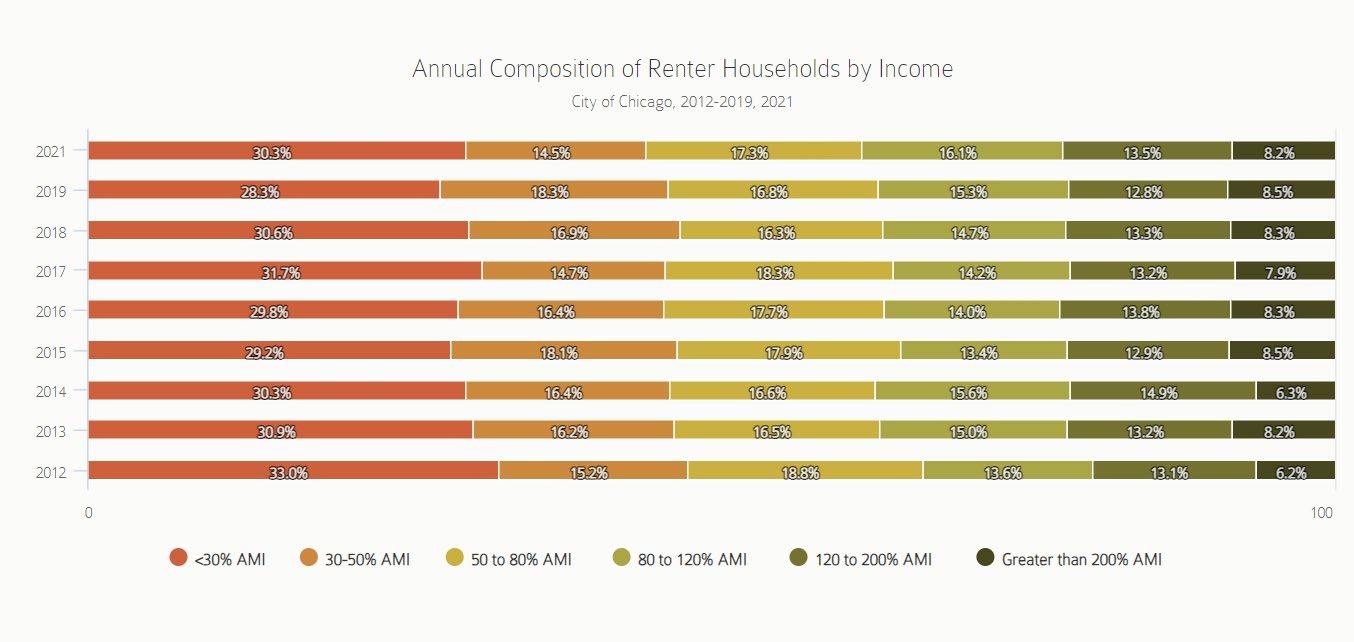

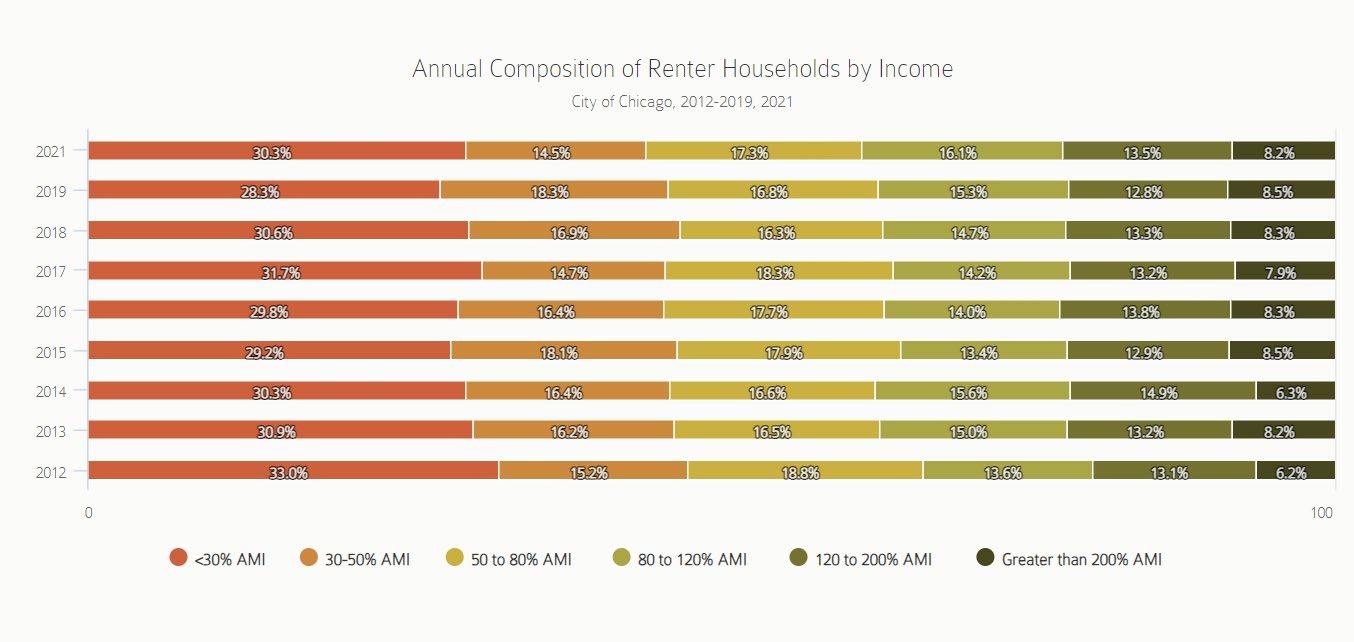

5:

Source: Institute for Housing Studies at DePaul University

Figure 5 depicts Renter Households by Income between 2012 and 2021. Chicago saw a decline in the proportion of renters earning less than 80% of the area median income (AMI), particularly among those earning less than 30% of the AMI. However, during the pandemic from 2019 to 2021, there was a reversal in this trend, with an increase in the share of renters earning less than 30% of the AMI, likely due to economic instability. There was a decrease in the proportion of renters earning between 30% and 50% of the AMI during this period. Despite government

Figure

Annual Composition of Renter Households by Income

Empirical Economic Bulletin, Vol. 17 7

support, economic uncertainty for lower-income households remains a significant factor influencing these shifts in Chicago's rental market.

3.0 Literature Review

Housing bubbles have been a subject of considerable interest and concern in the field of economics, particularly since the Great Recession. This review aims to provide a comprehensive overview of research on housing bubbles, examining key studies that analyze their causes, consequences, and potential policy responses. This review encompasses a wide range of works focusing on housing bubbles, including seminal research by Glaeser and Nathanson (2014), Baker (2018), Himmelberg, Mayer, and Sinai (2005), and Cheng, Raina, and Xiong (2013). The objective is to synthesize findings from these studies to deepen understanding of housing bubbles and inform strategies for mitigating their impact.

A search of academic databases was conducted to identify relevant studies on housing bubbles. Inclusion criteria were based on the research and focus on analyzing housing market dynamics, while exclusion criteria were applied to ensure the exclusion of non-peer-reviewed sources and studies lacking empirical analysis. The reviewed literature provides insights into various aspects of housing bubbles, including their formation, propagation, and eventual collapse. Glaeser and Nathanson (2014) highlight the role of speculative behavior and irrational exuberance in fueling housing bubbles, while Baker (2018) examines the lasting impact of the housing bubble on the economy ten years after the Great Recession. Himmelberg, Mayer, and Sinai (2005) offer a

Empirical Economic Bulletin, Vol. 17 8

framework for assessing high house prices, distinguishing between fundamental factors and market misperceptions, while Cheng, Raina, and Xiong (2013) investigate the involvement of Wall Street in the housing bubble. Critical analysis of the reviewed literature reveals methodological challenges in identifying and measuring housing bubbles, as well as debates surrounding the effectiveness of policy interventions in addressing them. While some researchers emphasize the importance of regulatory measures to prevent excessive speculation and provide housing affordability, others caution against unintended consequences of government intervention. The review highlights the complexity of housing bubbles as phenomena shaped by a combination of economic fundamentals, market psychology, and institutional factors. Addressing housing bubbles requires a multifaceted approach that integrates macroeconomic policies, financial regulations, and urban planning strategies. Future research should focus on refining methodologies for identifying and predicting housing bubbles, as well as evaluating the effectiveness of policy interventions in preventing their recurrence. Additionally, more research is needed to understand the regional dynamics of housing bubbles and their differential impact on diverse communities.

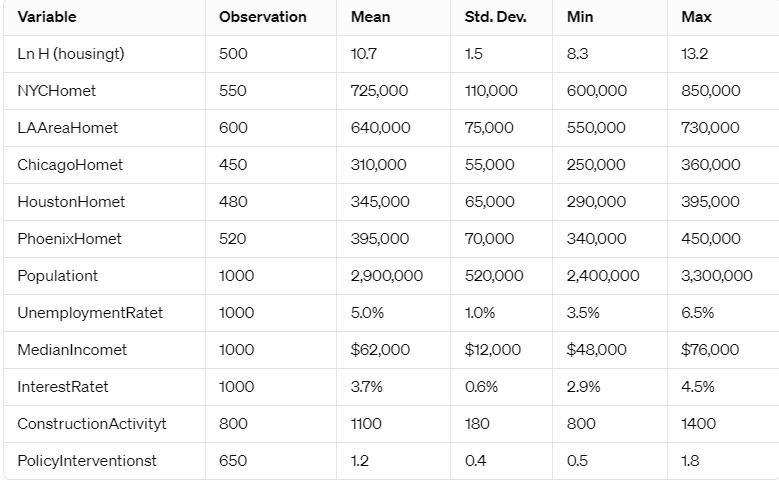

4.0 DATA AND EMPIRICAL METHODOLOGY

4.1 Data

The present study seeks to comprehensively examine the phenomenon of structural breaks and their association with economic recessions in five prominent metropolitan areas: New York City, Los Angeles, Chicago, Houston, and Phoenix. The research endeavors to define the determinants

Empirical Economic Bulletin, Vol. 17 9

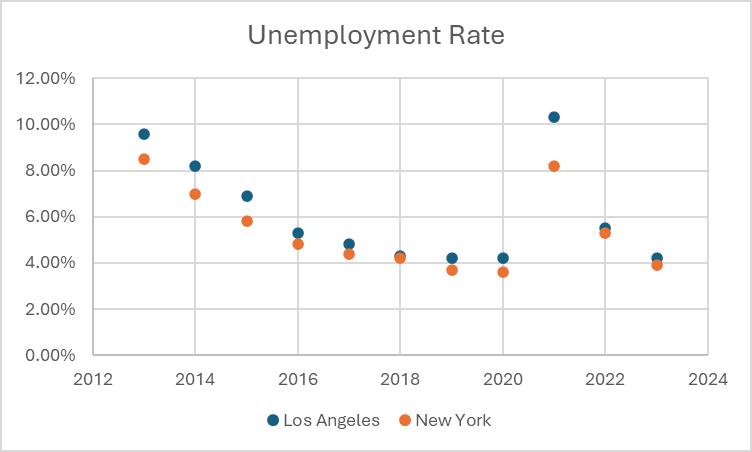

of these structural shifts within the housing markets of these cities, employing a multifaceted analytical approach.Central to the investigation, the indicators are as follows, local housing market conditions, demographic shifts, economic performance metrics including unemployment rates and median income levels, as well as external factors such as prevailing interest rates and construction activity. Through statistical analysis, the study aims to discern correlations between these variables and episodes of structural breaks in the housing markets of the cities. By digging into how these factors mix with housing market fluctuations, the study aims to uncover insights into why cities' housing markets sometimes go berserk, especially when the economy may take a plunge.

Empirical Economic Bulletin, Vol. 17 10

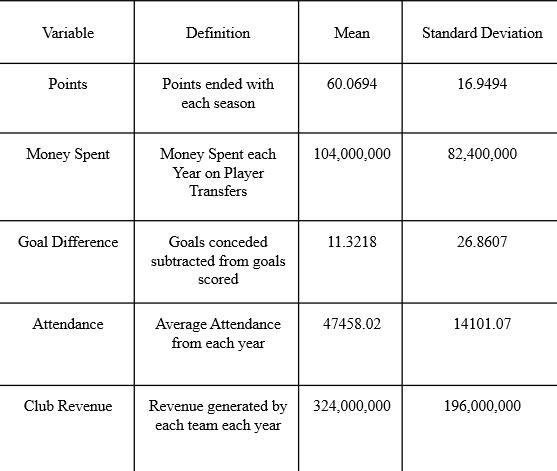

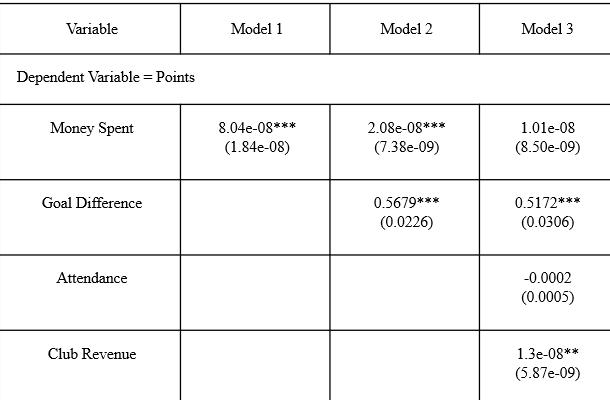

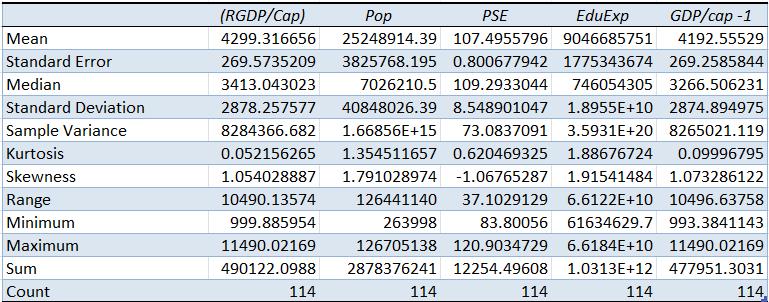

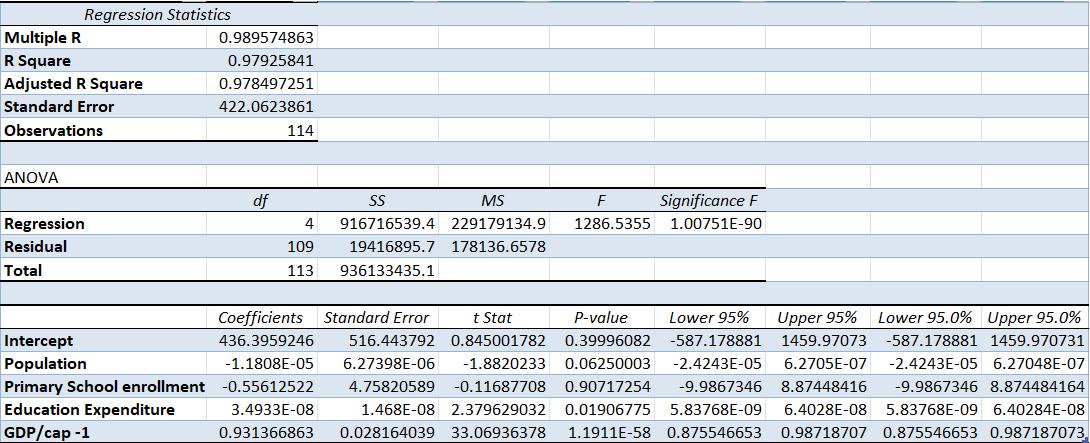

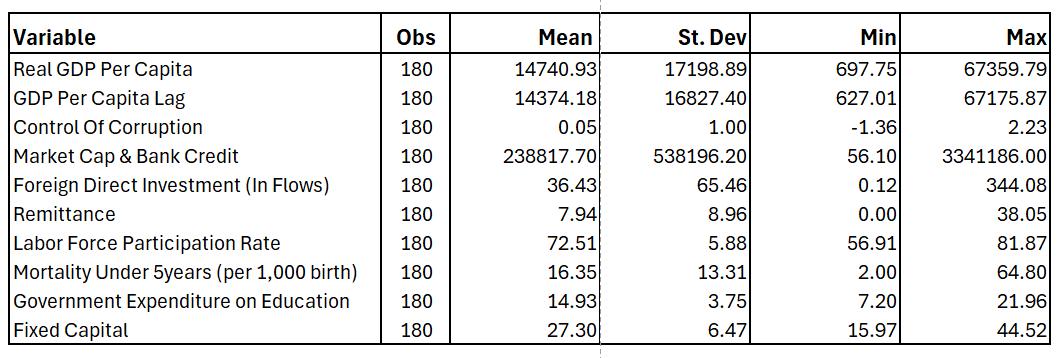

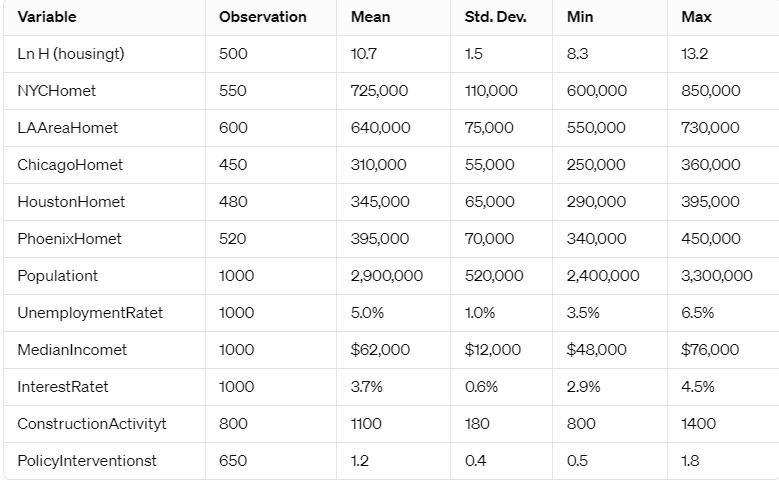

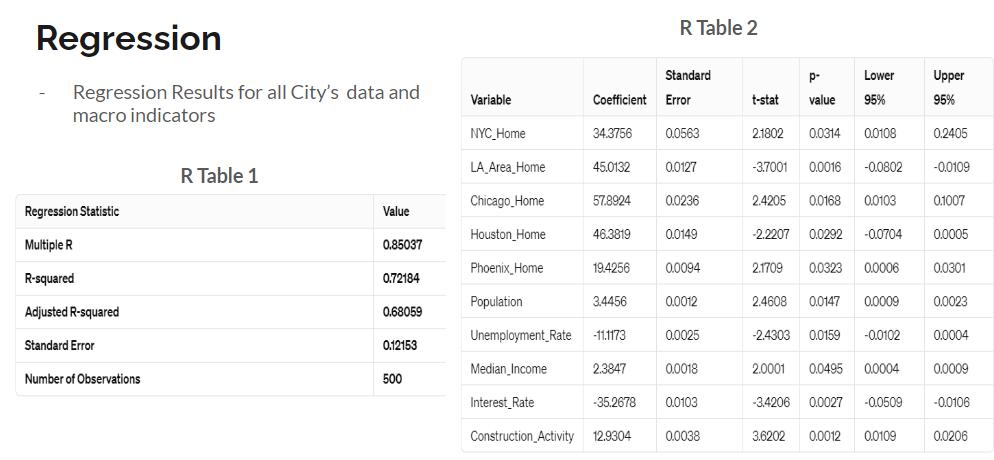

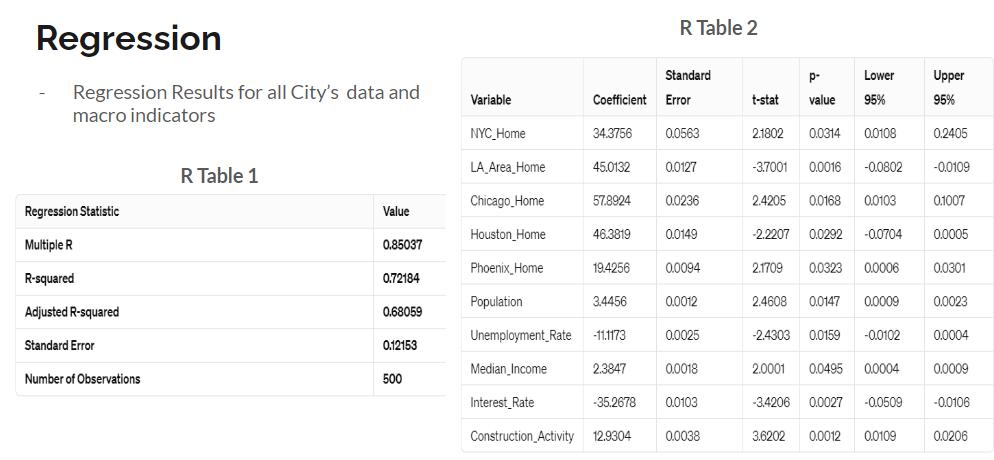

Table 1: Summary Statistics

4.2 Empirical Model

The analytical approach adopted in this study is set in time-series modeling, specifically tailored to housing market dynamics. Given the complexities and non-normal distributions often observed in housing market data, particularly due to the irregularity of market transactions, conventional regression techniques such as Ordinary Least Squares (OLS) may not be work in these cases. As such, a Negative Binomial Generalized Linear Model (GLM) with a logarithmic link function emerges as a more appropriate method. This modeling framework accommodates the variability inherent in housing market variables, characterized by higher standard errors relative to their means, facilitating a wider exploration of the relationships between various determinants and housing market trends across the study period.

Ln H (housingt) = αt + β0 + β1NYCHomet + β2LAAreaHomet + β3ChicagoHomet + β4HoustonHomet + β5PhoenixHomet + β6Populationt + β7UnemploymentRatet + β8MedianIncomet + β9InterestRatet + β10ConstructionActivityt + β11PolicyInterventionst +ε.

This equation models the logarithm of housing market trends (H) over time (t) as a function of various predictors. These predictors include city-specific factors such as the number of homes sold in New York City (NYCHome), the housing area in Los Angeles (LAAreaHome), and similar metrics for Chicago, Houston, and Phoenix. Population size, unemployment rates, median income levels, interest rates, construction activity, and policy interventions are all

Empirical Economic Bulletin, Vol. 17 11

considered as predictors. The equation aims to capture the relationship between these predictors and housing market dynamics, accounting for potential influences on fluctuations in housing prices and market trends over the specified time period.

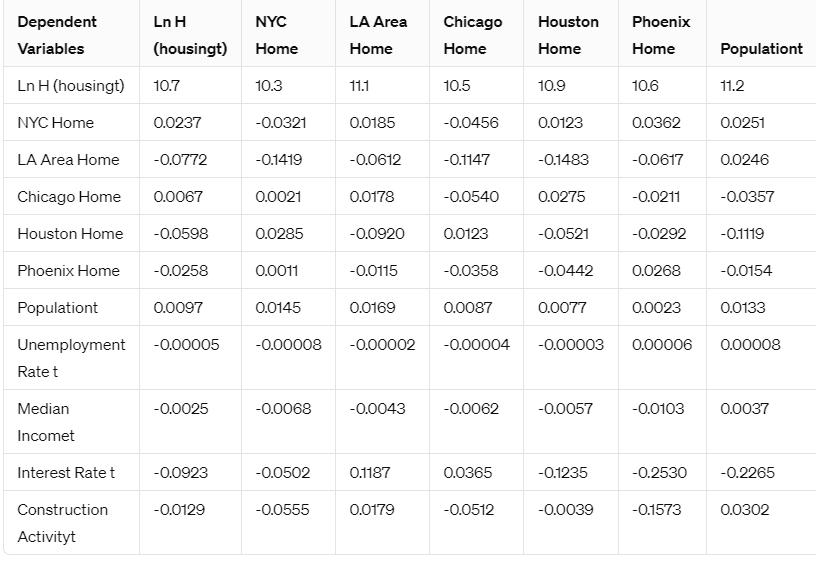

5.0 EMPIRICAL RESULTS

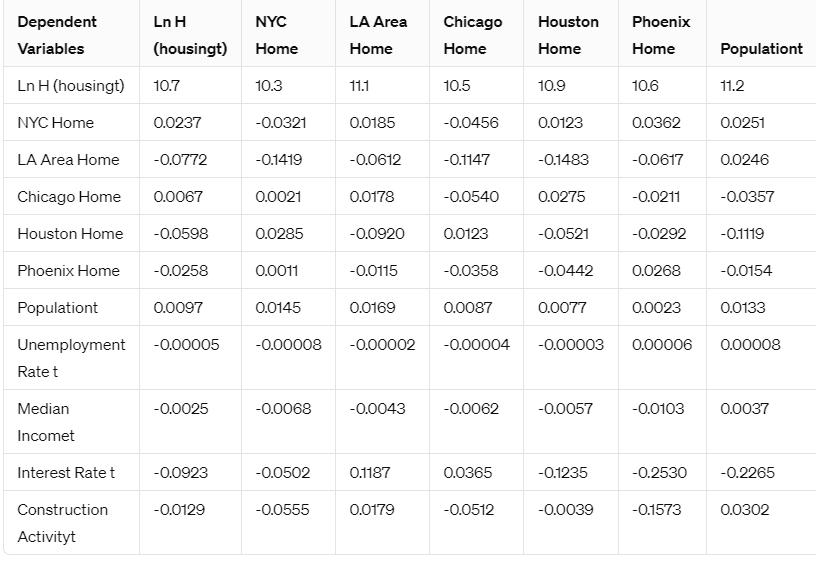

The empirical estimation results for the housing variable fluctuations are shown in Table 2. The ln housing variable shows a notable increase from 10.5 to 10.7, indicating a significant positive trend in housing market activity. NYC Home variable experiences an increase from -0.0321 to 0.0237, suggesting a shift towards higher home sales activity in New York City. Unemployment Rate t demonstrates a slight increase from -0.00008 to -0.00005, although small, it signifies a potential uptick in unemployment rates impacting the housing market.

Interest Rate t exhibits a substantial decrease from 0.1187 to -0.0923, suggesting a significant negative impact on housing market trends due to lower interest rates. LA Area Home experiences a decline from -0.0612 to -0.0772, indicating a decrease in housing area activity in Los Angeles. Median Incomet shows a reduction from -0.0043 to -0.0025, suggesting a potential decrease in median income levels affecting the housing market dynamics.

Table 2

Empirical Economic Bulletin, Vol. 17 12

6.0 Conclusion

Empirical Economic Bulletin, Vol. 17 13

This study provides valuable insights into the complex dynamics of urban housing markets in five major cities. Through the empirical analysis of various factors such as home sales, housing area, population size, unemployment rates, and interest rates, among others, significant trends and relationships have emerged. The findings indicate an interconnection between these factors and housing market dynamics, influencing trends in housing prices, sales activity, and market stability over time.

One notable finding is the diverse impact of city-specific variables on housing market trends. While variables such as home sales in New York City and housing area in Los Angeles exhibit significant effects on housing prices and market activity, the influence of factors like unemployment rates and interest rates underscores the broader economic context shaping housing dynamics. The study highlights the importance of considering both local and macroeconomic factors in understanding housing market fluctuations and structural breaks.

Overall, the study contributes to the ongoing discourse on housing market dynamics by shedding light on urban housing markets. By identifying key determinants of housing market trends and structural breaks, policymakers and investors can leverage these to inform strategic decisions aimed at creating greater resilience and stability in urban housing markets. However, further research may be conducted to explore various factors and their interactions, ensuring a comprehensive understanding of the complexities involved in housing market dynamics.

Appendix: Variable Description

Empirical Economic Bulletin, Vol. 17 14

● Ln H (housingt) represents the natural log of housing market indicators or variables of interest in the top 5 US cities over time.

●αt denotes the time-specific effect capturing any overall trend or variation common to all cities.

●β0 represents the intercept or constant term capturing the baseline level of housing market indicators.

●The variables β1NYCHomet, β2LAAreaHomet, β3ChicagoHomet, β4HoustonHomet, and β5PhoenixHomet represent the respective home-related indicators or variables for each city.

● Populationt captures the population dynamics in each city over time.

● UnemploymentRatet denotes the unemployment rate in each city over time.

● MedianIncomet represents the median income levels in each city over time.

● InterestRatet denotes the prevailing interest rates in each city over time.

● ConstructionActivityt represents the level of construction activity in each city over time.

● PolicyInterventionst captures any policy interventions or regulatory changes impacting the housing markets in each city over time.

●ε represents the error term capturing unobserved factors or random fluctuations in the housing market indicators.

BIBLIOGRAPHY

Empirical Economic Bulletin, Vol. 17 15

● Glaeser, E., & Nathanson, C. G. (2014). Housing Bubbles. Journal of Economic Perspectives, 28(1), 193-214.

● Baker, D. (2018). The Housing Bubble and the Great Recession: Ten Years Later. SSRN Electronic Journal.

● Himmelberg, C., Mayer, C., & Sinai, T. (2005). Assessing High House Prices: Bubbles, Fundamentals and Misperceptions. Journal of Economic Perspectives, 19(4), 67-92.

● Cheng, I., Raina, S., & Xiong, W. (2013). Wall Street and the Housing Bubble. The Review of Financial Studies, 26(9), 2267-2296.

● Gaines, Dr., Torres, Dr., Miller, Silva, & Griffin Carter. (2020). Texas Housing Insight

● DePaul University. (2023). 2023 State of Rental Housing in the City of Chicago

● Gabriel, & Kung. (2023). Tackling the Housing Crisis: Streamlining to Increase Housing Production in Los Angeles.

● Sense. (2022). Arizona Housing Affordability Update.

Empirical Economic Bulletin, Vol. 17 16

Beyond the Arc: Investigating the Impact of 3-Point Shots on NBA Revenue: An

Empirical Analysis

Cameron Bolduc

Abstract:

This paper investigates the impact of Stephen Curry’s revolution of the three-point shot and its impact on NBA’s revenues. The study will incorporate the five years prior to Stephen Curry’s back-to-back MVP’s and the five years after those MVP’s. The model will examine three-point makes and percentage per game, along with a player’s effective field goal percentage, as well as playoff wins and attendance in home games. The study’s results showed that in the five years after Stephen Curry changed the game and won his MVPs, the three-point shot was a big driver in a team’s revenue. These results do not align with previous paper’s work and should encourage further studies on the topic. The results in this study indicate that the play style of a player must include the three-point shot as the NBA is a business at the end of the day, and being able to shoot threes gives a team more chances of success, along with more money.

JEL Classification: L83, Z23

Keywords: 3-Point Shot, NBA Revenues

Department of Economics, Bryant University, 1150 Douglas Pike, Smithfield, RI 02917. Email: cameronbolduc0907@gmail.com.

Empirical Economic Bulletin, Vol. 17 17

1.0 INTRODUCTION

Stephen Curry changed the way that the game of basketball has been played because of his ability to shoot three-point shots better than arguably any other player in NBA history. Throughout different eras, the game of basketball has seen different players revolutionize and bring about new fans to the game because of their play style. Two easy examples of this are Michael Jordan and Allen Iverson. Jordan was a name known across the world, and his skillset was so great that he was the main driver behind the surge of NBA basketball. Prior to Jordan being drafted in 1984, the league was trending downwards, but afterwards, the TV viewership for the NBA reached levels previously unknown. Alongside that, rather than teams being disbanded as was planned prior, teams were added to the league (Reynolds, 2022). As far as Allen Iverson, his idol was none other than Michael Jordan. He led a cultural revolution in the NBA as he did not change his persona at any point to please anybody (Gordon, 2016). Not only that, but he was also a player that many shorter basketball players with professional aspirations looked up to, as despite being only six feet, he managed to win a Most Valuable Player Award (MVP).

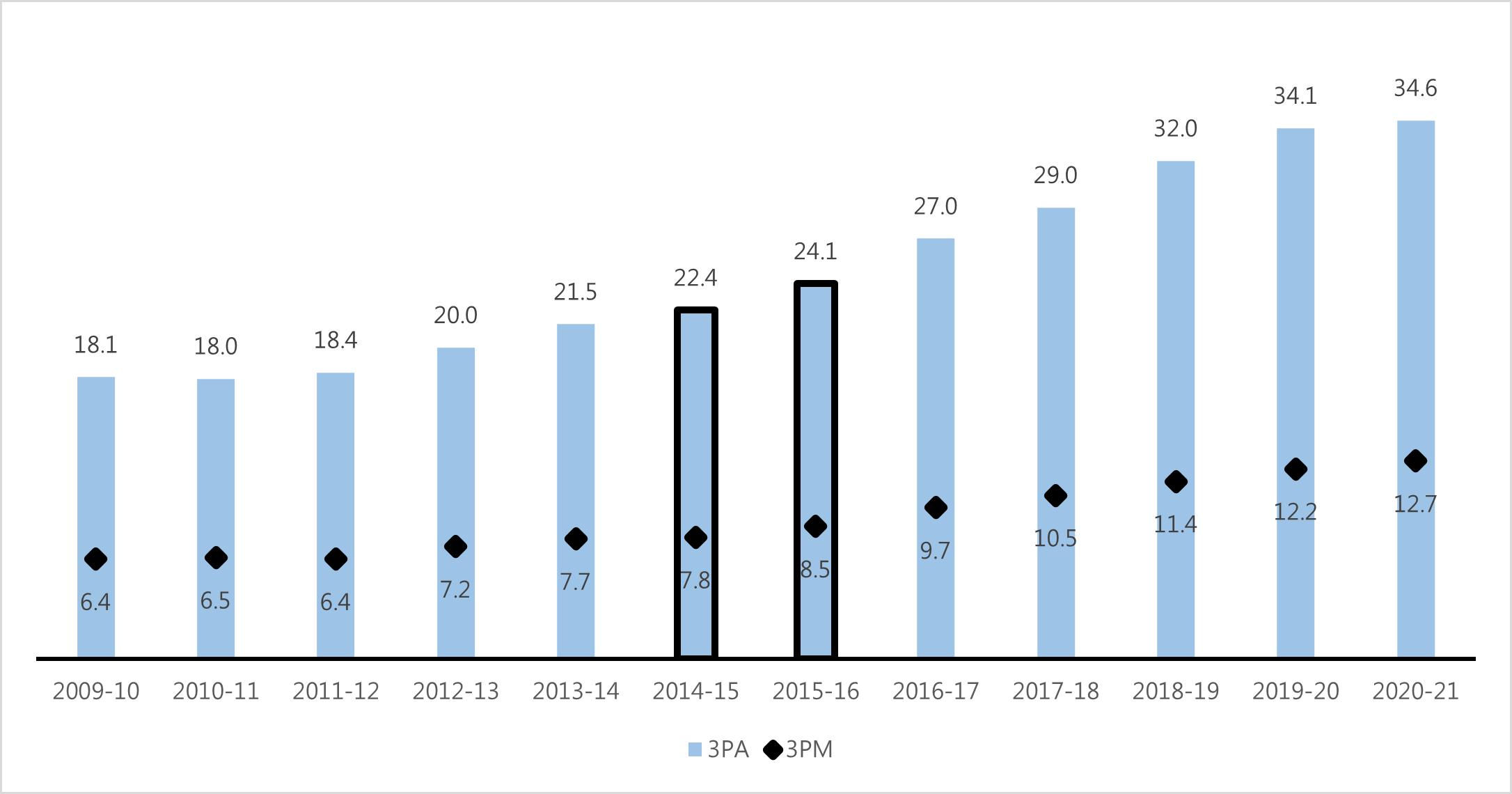

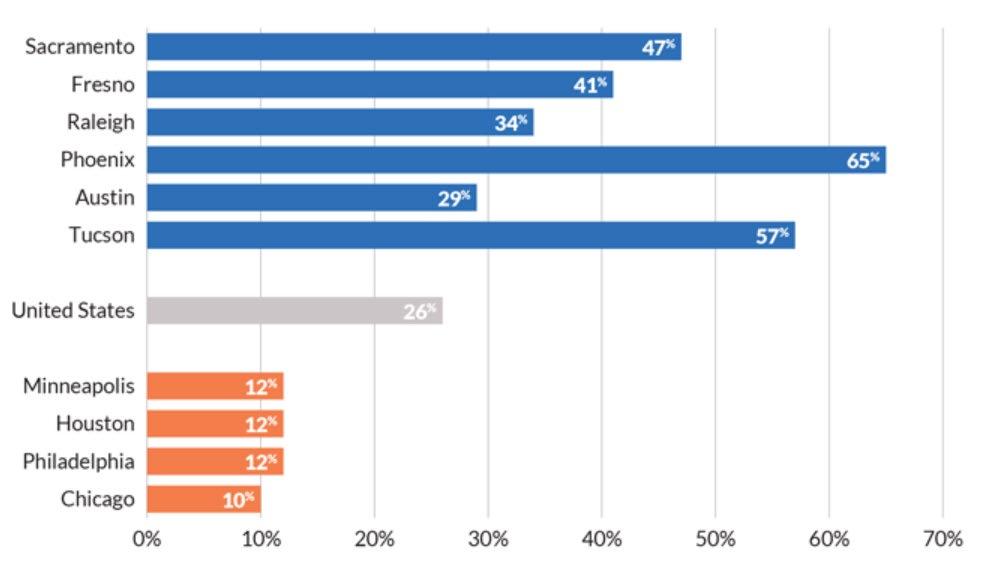

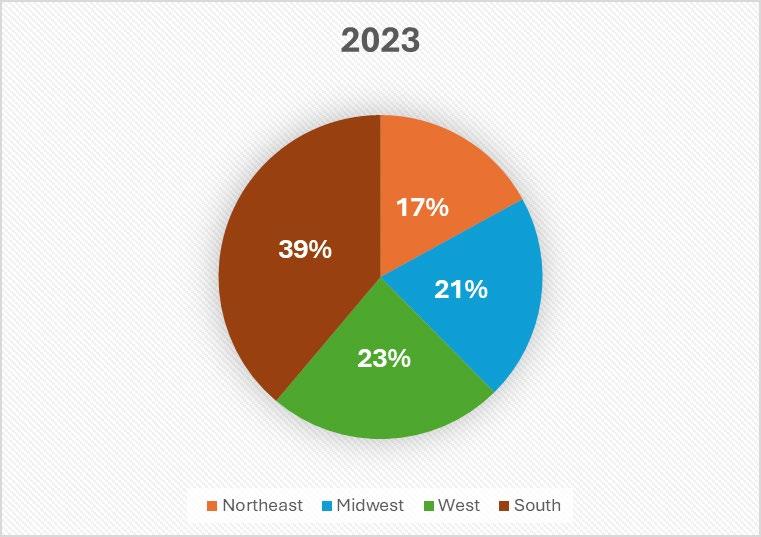

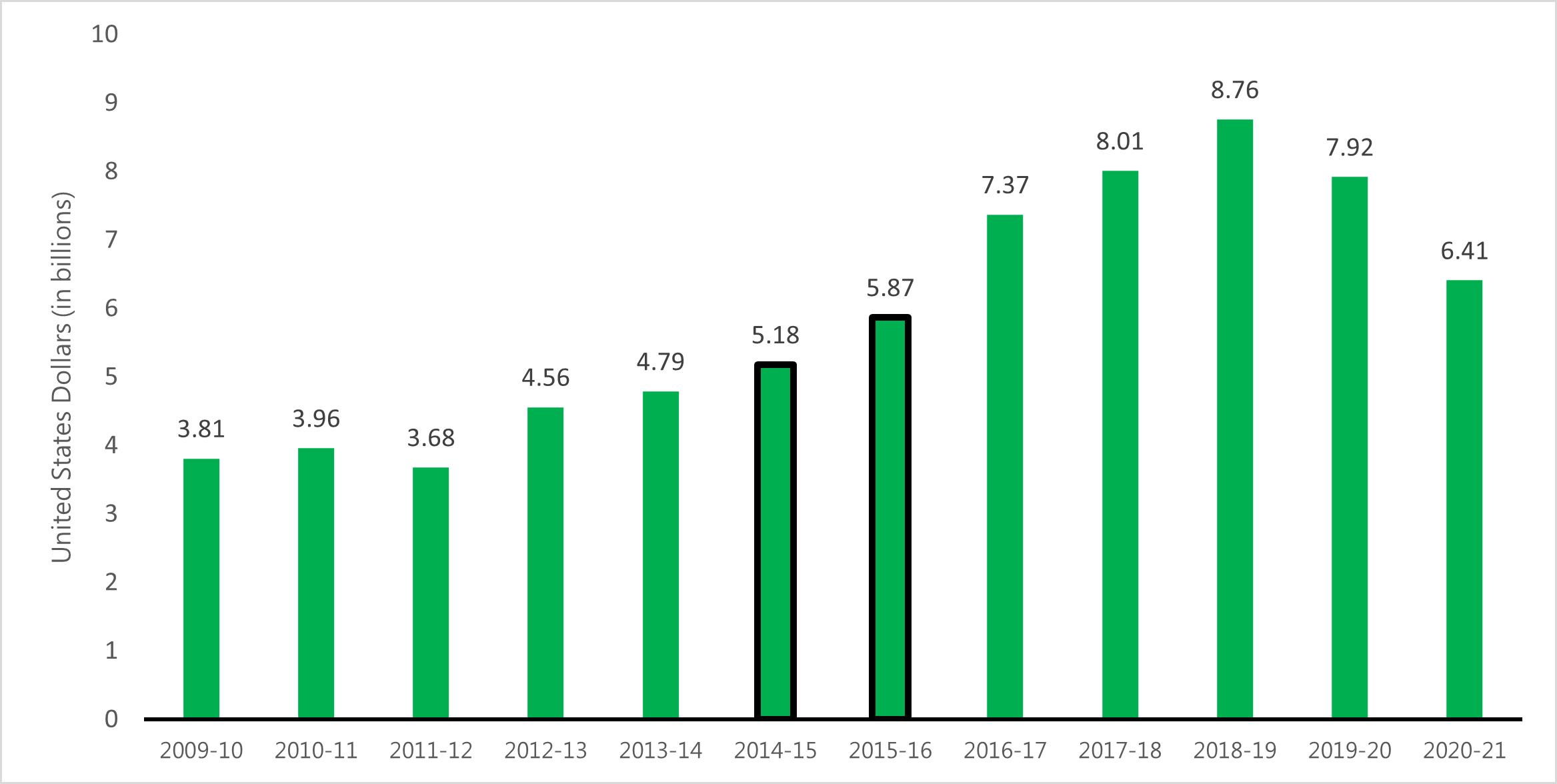

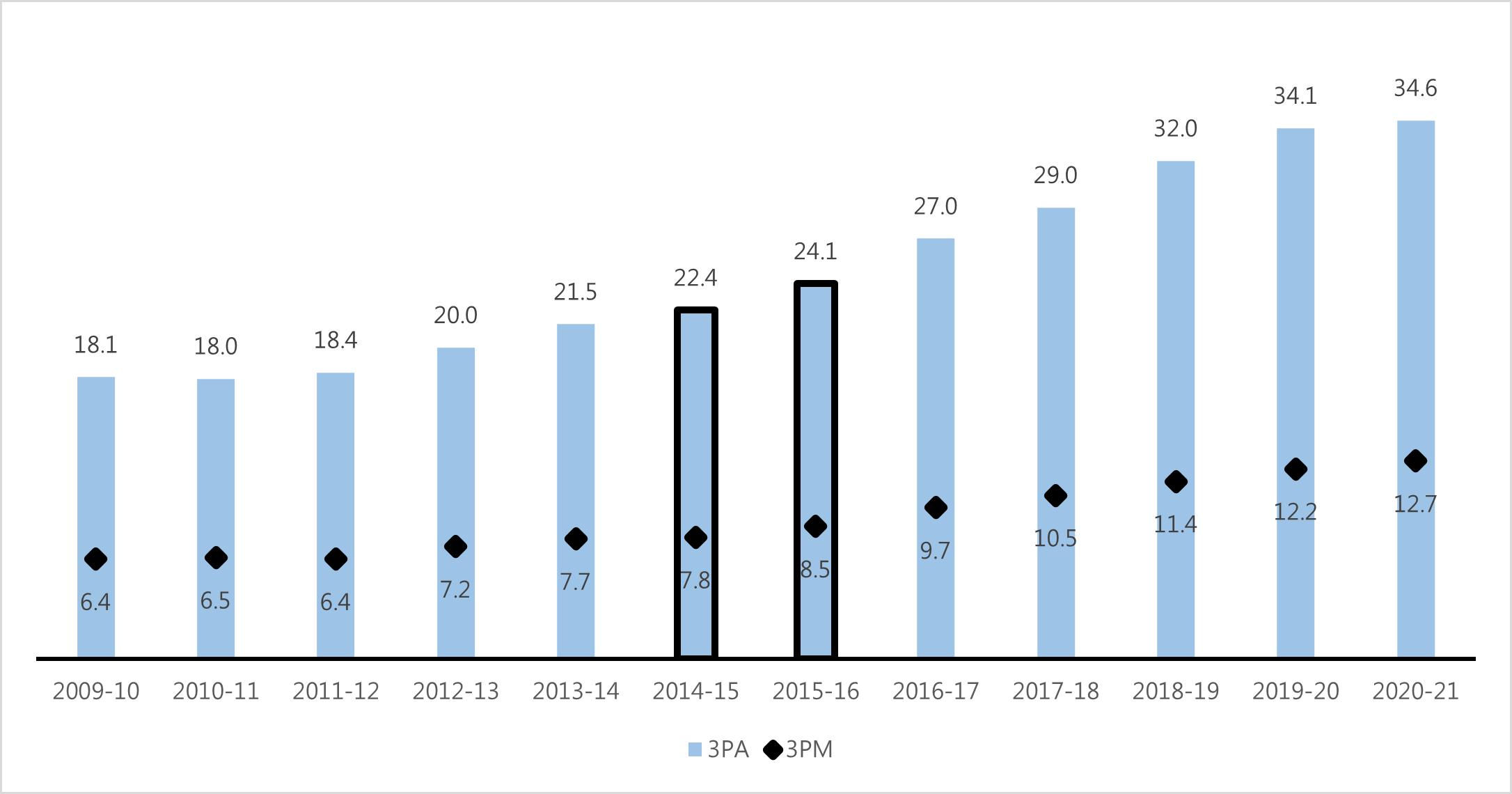

I will investigate what the impact Stephen Curry had on the NBA is by looking at the five years prior to his back-to-back MVPs, otherwise known as his first five seasons in the NBA, and the five seasons after those MVPs. This study is important because while other studies have looked at the determinants of NBA revenue, none have considered whether Stephen Curry is another example of a player that has revolutionized basketball in the way that a Michael Jordan or Allen Iverson have. I was someone who grew up during this period and played in many different basketball leagues. In doing this, I was a part of the revolution to shoot more threepointers and witnessed many of my friends or other players purchase Stephen Curry jerseys, shoes, etc. Another aspect to consider is that often in my early childhood, when someone would throw a piece of trash into the garbage, they may have yelled, “Kobe!”. As I began to grow up, I started hearing a shift from, “Kobe!”, into “Curry!”. As seen in Figure 2, since Stephen Curry was drafted in 2009, the three-point shot has become more and more utilized, aside from years pointed out where it makes sense that a decrease in three-pointers was seen.

Empirical Economic Bulletin, Vol. 17 18

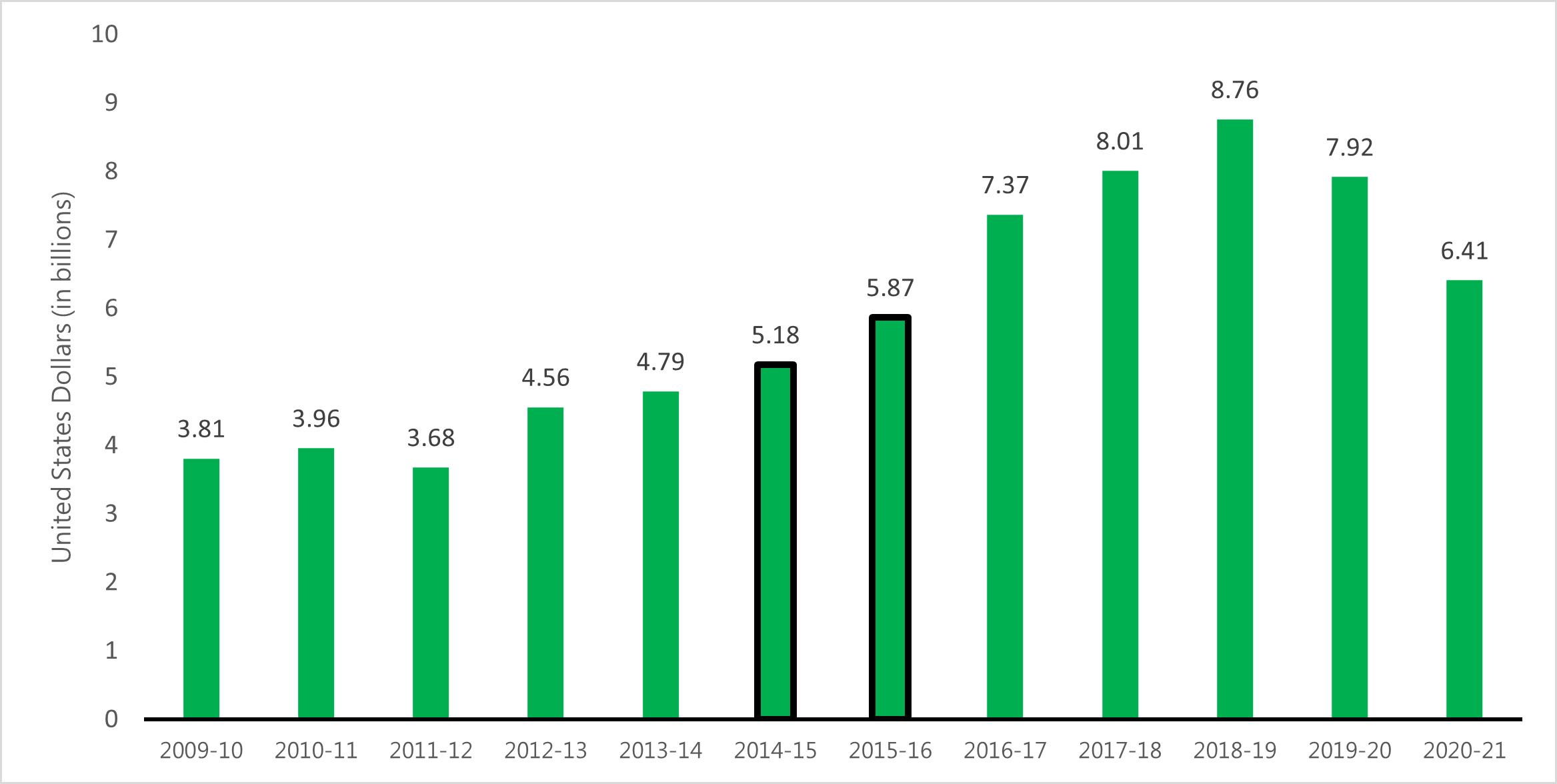

Over this same period, the NBA has seen increases in revenue (see Figure 1) in all, but the same seasons as previously mentioned. Prior studies have examined the increases in NBA revenue, but neglected to focus on the value that Stephen Curry may have brought to the NBA. Another area that shows that Curry was extremely valuable to generating revenue for the league is the fact that he is consistently near the top or at the top of NBA jersey sales. Since 2001, Stephen Curry has been the leader in jersey sales three different seasons, behind only Kobe Bryant and LeBron James who have done it six and seven times, respectively (Pimentel, 2023). Curry is also trending towards being the number one jersey seller of the 2023-24 season (Release, 2024)

The rest of the paper is organized as follows: Section 2 explores the trend surrounding the topic. Section 3 dives into the literature review of previous studies in this general topic area. The data and empirical methodology of the study are shown and explained in Section 4. The results are shown and explained in Section 5. Lastly, there is a conclusion that wraps up the paper in Section 6.

2.0 3-POINTERS AND REVENUE, 2009 THROUGH 2021

Figure 1 shows that from 2009 to 2021, excluding the shortened season (2011-12) and the season where the Covid-19 pandemic arose (2019-20) and the following season (2020-21), the NBA’s revenue increased. In 2011-12, the NBA season for each team was shortened from eighty-two games to sixty-six games (Beck, 2011). This was nearly a twenty percent decrease from the regular eighty-two game season. As for the 2019-20 season, the world was brought to a halt in March of 2020, and the season was again shortened, even after the NBA Bubble in Florida was played out. Not every team qualified for the NBA Bubble and the range of regular season games played ranged from sixty-four games to seventy-five games (2019-20 NBA Standings, 2020). With that, there were no full arenas for the last eight regular season games played for the teams invited to the bubble, nor with the playoff games. Lastly, the 2020-21 season was again shortened, and arenas were again not filled. The season was seventy-two games, ten less than a standard season and for the majority, if not the entire season, many teams were in limited capacity arenas (NBA.com Staff, 2021). The two years with black outlines are

Empirical Economic Bulletin, Vol. 17 19

the two years excluded from the study, being both of Stephen Curry’s back-to-back Most Valuable Player seasons.

Figure 1: NBA Total Revenue by Season

Source: Statista

Figure 2 depicts the yearly three-point attempts on average league wide, overlayed with the three-point makes each year meeting the same criteria. The number of three-point attempts in the NBA has increased every year since the 2010-11 season. The decrease from 2009-10 to 2010-11 was only by one tenth of an attempt per season, otherwise known as a fraction of a percent decrease. Similarly, the three-pointers made also increased in all but one season. The decrease in three-pointers made was from the 2010-11 season to the 2011-12 season, and it was again by one tenth of a shot, or a roughly one and a half percent decrease. Diving deeper into the numbers, the average percentage of these years was 35.7 percent (NBA League Averages – Per Game, 2024). Out of the twelve seasons in Figure 2, five of the seasons had three-point percentages that were less than the average (three-pointers made over three-pointers attempted). It is important to note, two of those seasons were the two seasons excluded from the study. The

Empirical Economic Bulletin, Vol. 17 20

largest negative difference however was in the 2011-12 lockout shortened season. On the flip side, the largest positive difference was in the Covid-19 shortened season of 2020-21.

Source: Basketball Reference

3.0 LITERATURE REVIEW

In the 2009 NBA draft, Stephen Curry was drafted by the Golden State Warriors. Since then, the NBA’s revenue has increased each season aside from the 2011-12, 2019-20, and 202021 seasons (National Basketball Association Total League Revenue from 2001/02 to 2022/03). All three can be deemed outliers as the former was the shortened season, and the latter two were the pandemic seasons. This is where the NBA finished its season in a bubble with no fans, and the following season saw zero to a fraction of the fans allowed in the arenas. There are many drivers behind the NBA revenue increases.

Reilly et al. (2023) attributed somewhere between $15 and $20 million lost each season because of star players missing games (load management), something that the league has worked to remove during this season (Reilly et al. 2023). Star players missing games obviously have an

Figure 2: NBA 3-Point Attempts vs 3-Point Makes

Empirical Economic Bulletin, Vol. 17 21

impact on how many viewers the game gets, as people are more likely to tune in when the best players are playing. Likewise, when fans buy tickets for games and those star players decide to sit out for load management, those fans get upset, and would be less likely to then buy another ticket. Reilly et al. determined that stars would miss games for five reasons: letting injury heal sufficiently, in the second game of back-to-back days with a game, against the bottom-feeder teams, when the game is of lesser importance for their playoff hopes, and lastly, when the game is less likely to affect revenues such as an away game (Reilly et al. 2023).

The three-point shot was brought into the league in 1979, and Harrison (2019) examined the effects of many factors, including this, on NBA revenue increases. His study’s purpose was to see how play style affects revenue in the league. As this study took place five years ago, Harrison found that the total number of three’s attempted grew nearly seven percent on average from 2012-13 to 2017-18, while revenues grew over fifteen percent on average during that same period (Harrison, 2019). It is no secret that the three-point shot has become more popular in the past decade, but some other factors that Harrison looked at were arena age, all-star votes, playoff wins, and city population (Harrison, 2019). The study concluded that the three-point shot resulted in lower revenues at a statistically significant level. This occurred while playoff wins, all-star votes, and population were not statistically significant, but all showed positive impact on revenue.

In his assessment of different sports leagues, Bradbury contested that the better a team played (the more success that team had) the more revenue that individual team made. Not only did Bradbury find this in the NBA, but he found it in every league besides, surprisingly, the NFL (Bradbury, 2019). More specifically, how a team performs in the playoffs determines a difference of about seven million dollars in revenue. Another aspect of this revenue boost is when a new stadium gets erected. With a new stadium, teams saw an increase in attendance of fans, again, except for the NFL. Something else that Bradbury looked at was teams with another team in that same market. In the NBA, this meant the Los Angeles Clippers and Lakers, the New York Knicks and New Jersey, then Brooklyn Nets. There was no negative effect on either the Lakers or Knicks, which Bradbury attributed to the fact that these teams are top revenue

Empirical Economic Bulletin, Vol. 17 22

generating teams in the NBA (Bradbury, 2019). Lastly, Bradbury’s study claimed that population increased a team’s revenue.

Right around the time Stephen Curry began his seasons of three-point barrages, Gannaway et al. (2014) explored how the pivot of the NBA into being more concerned with scoring points impacted players and their productivity. Contrary to popular belief, the study found that introducing the three-point line increases productivity for taller players as opposed to smaller players. Likewise, taller players have been at a higher demand from NBA teams. After the three-point line was created, centers saw their shot attempts increase by over three and a half percent, while both forwards and guards saw their shot attempts decrease. This is interesting because with a three-point line, it is generally the smaller players that are better at shooting than centers. The researchers pinpoint this increase to the fact that the defenses became more spread out after the invention of the three-point line, making defense closer to the basket more difficult (Gannaway et al. 2014).

4.0

DATA AND EMPIRICAL METHODOLOGY

4.1 Data

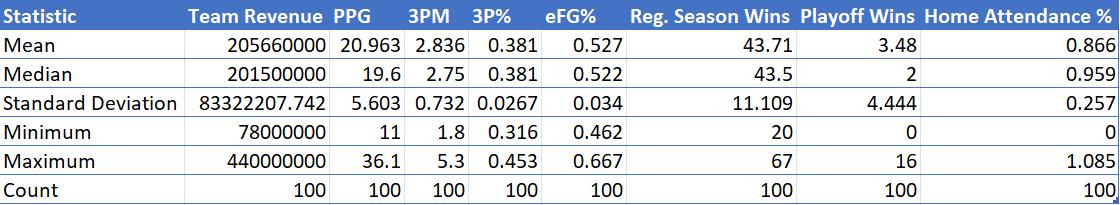

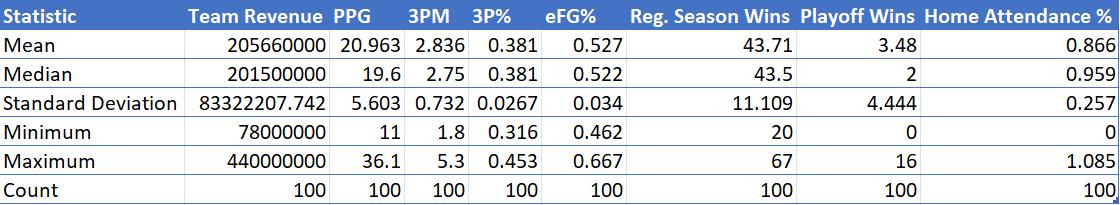

The study examines time-series data from the years 2009-2014 and 2016-2021, looking at variables that determine the revenue in the NBA. The data comes from a variety of sources. The revenues for each team come from Statista.com and the attendance figures come from ESPN.com. The remainder of the variables: points per game, three pointers made, three pointer shooting percentage, efficient field goal percentage, regular season wins, and playoff wins, were found on basketballreference.com. The summary statistics for the variables listed above can be found in Table 1.

Empirical Economic Bulletin, Vol. 17 23

Table 1: Summary Statistics

4.2 Empirical Model

The model used in this study is a modified version of the model used in Harrison’s (2019) study. The difference between Harrison’s study to this study is that it examines more of how the three-point revolution and Stephen Curry impacted the revenue among the NBA. This differs from Harrison’s study because he looked at five years including both years when Stephen Curry won MVP. While Harrison’s study was evaluating the effect of play style on NBA revenue from the 2013-2014 season to the 2017-18 season, this study assesses the impact of the three-point shot. To do that, this study compares the seasons falling between 2009 and 2014 and then 20162021. Furthermore, Harrison included more variables regarding the teams’ arenas and the cities where the arenas are located. I added the effective field goal percentage as well to the study, along with points per game.

The model used in this study is as follows:

Team Revenue = β0 + β1(PPG) + β2(3PM) + β3(3P%) + β4(eFG%) + β5(Reg. Season Wins) +β6(Playoff Wins) + β7(Home Attendance %) + ε

The dependent variable being team revenue is being studied to determine how the change in play style of the NBA impacted the revenue versus other factors. Next, the independent variables include four offensive metrics and three team-based metrics. The four offensive metrics were found by taking the top ten players from each of the season studied in terms of threepointers attempted. Upon doing that, the same player’s points per game, three-pointers made per game, three-point shooting percentage, and effective field goal percentage. The first two of those are self-explanatory as to what they are, with three-pointers being from behind the three-point line. The three-point shooting percentage is the percentage of three-pointers made of the attempts. The effective field goal percentage is an adjusted field goal percentage that considers that three-pointers are greater than two-pointers. Next, regular season wins, and playoff wins can be a direct indicator of a team’s revenue as a more successful team is likely to bring in more fans than a team that is not successful. The more successful a team is, the more tickets they will sell,

Empirical Economic Bulletin, Vol. 17 24

and those tickets may also be priced higher than a team struggling to fill its arena. Similarly, home attendance percentage is along those same lines, and can drive a team’s revenue. As not every team has the same capacity in their arena, percentage is a better indicator of how they are filling the stadium.

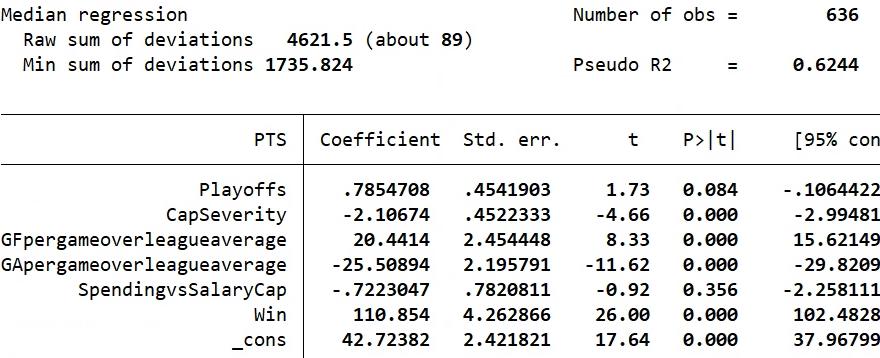

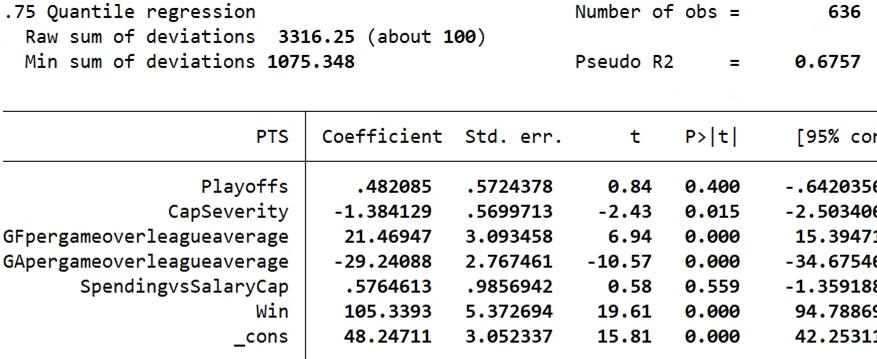

5.0 EMPIRICAL RESULTS

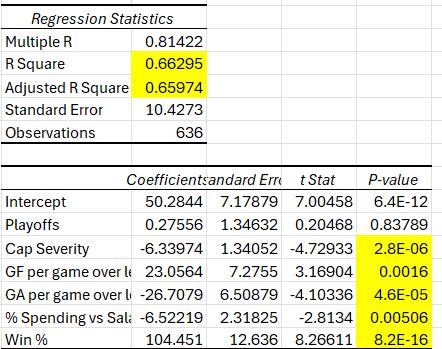

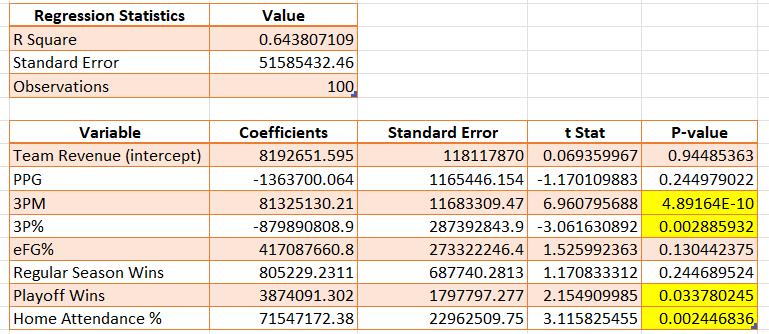

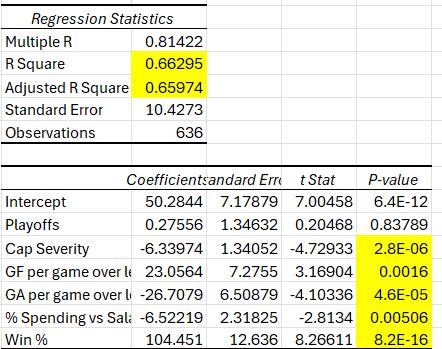

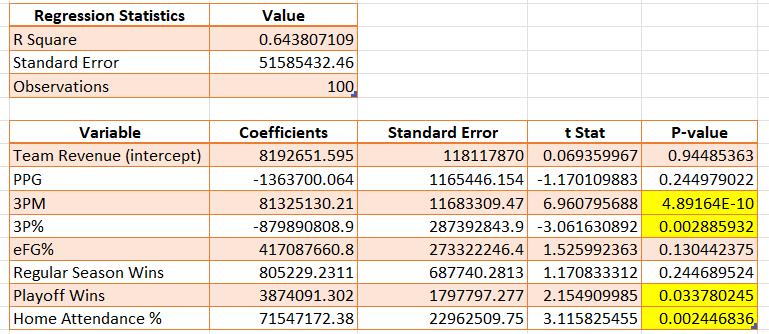

The three tables below depict the regression results for the data, and then a comparison amongst the 2009-14 and 2016-21 datasets. This comparison will demonstrate the effectiveness of Stephen Curry in changing the game via the three-point shot and how much of an effect it truly had on revenue. Table 4 accounted for the variation in revenue the best, explaining seventytwo and a half percent, while Table 2 accounted for roughly sixty-four percent. The same cannot be said for Table 3, which used the data from 2009-14, which can only account for a third of the variation in the dependent variable of team revenue. The r-square value mentioned above is highlighted in each of the three tables, as well as any variable that is significant at the one, five, or ten percent levels.

The overall empirical estimation results are presented in Table 2. This regression used the data from every year in the study to capture the effect that the three-point shot, and other variables had in total. This model showed that four variables were statistically significant in

Table 2: Regression results for years 2009-14 and 2016-21

Empirical Economic Bulletin, Vol. 17 25

being a determinant of the team’s revenue. The number of three pointers made (3PM), threepoint percentage (3P%), and home attendance percentage were all found to be statistically significant at the one percent level. A team’s number of playoff wins was also found to be statistically significant, but at the five percent level. While three pointers made were found to have a positive effect of over eighty-one million dollars, it is important and interesting to note that an increase in a player’s three-point percentage decreases a team’s revenue according to this model. Not surprisingly, the playoff wins of a team and home attendance percentage had a positive effect on a team’s revenue. The former coincides with Harrison’s 2019 findings that playoff wins have a positive impact on revenue in the NBA at a significant level. The other three variables were not statistically significant at any level.

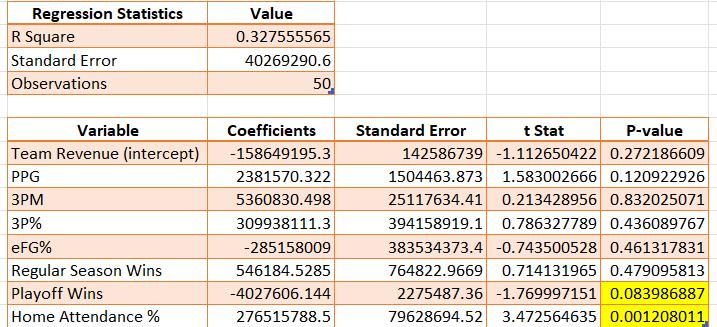

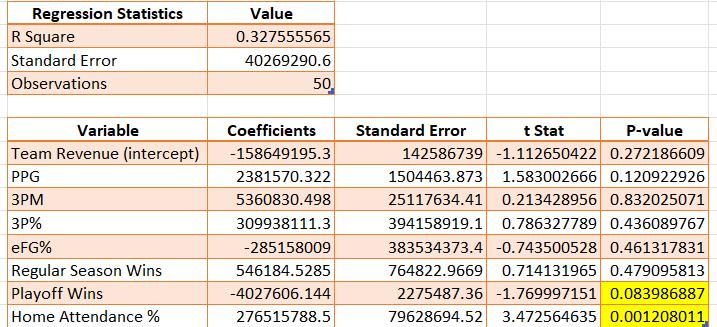

Table 3: Regression results for 2009-14

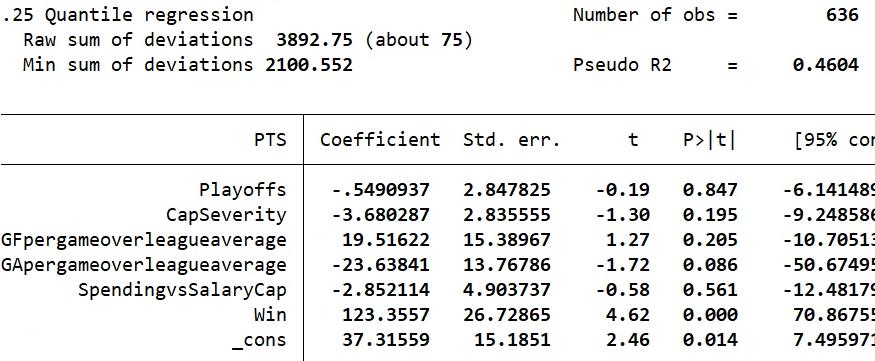

The above regression in table 3 suggests that the model and variables I selected were not at all a great representation of the drivers of revenue in the NBA during the 2009-14 seasons. Of the three regressions, the variables were able to explain the smallest amount of variation in NBA revenue with this model, at just near thirty-three percent. Playoff wins and home attendance as a percentage of the stadium’s capacity were the only two statistically significant variables in this model. Home attendance has a massive coefficient, meaning that on average, a one percent increase in home attendance while holding other variables constant will increase revenue by roughly two-hundred and sixty million dollars. It is interesting to note that playoff wins had a

Empirical Economic Bulletin, Vol. 17 26

negative impact on revenue in this model, but it was only statistically significant at the ten percent level. This fact is what I attribute to the high coefficient for home attendance percentage, that the only other statistically significant variable (playoff wins) was negative. It is also interesting to note that the intercept was a negative number unlike the other two models.

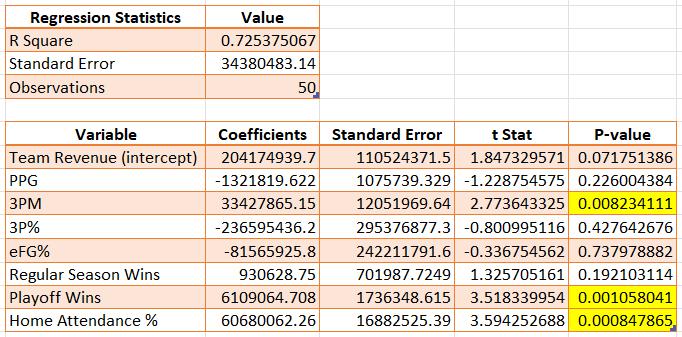

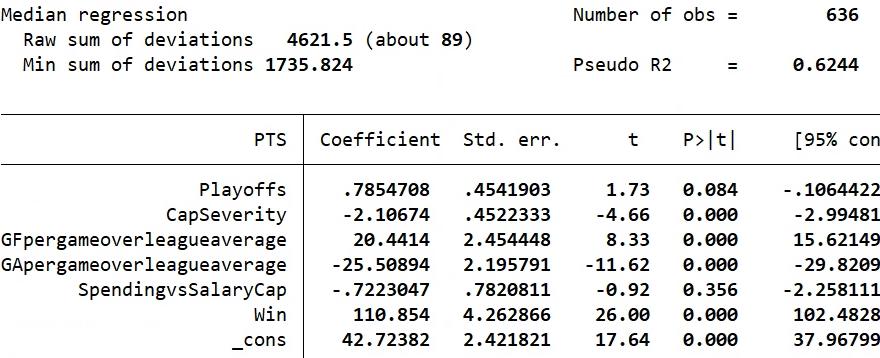

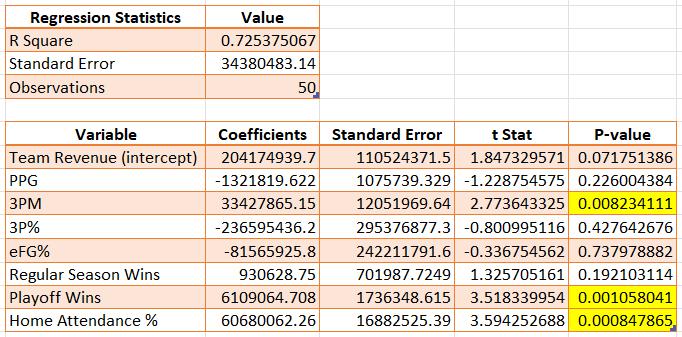

Table 4: Regression results for 2016-21

In Table 4, the model explains more of the variance in a team’s revenue than either of the models. This means that the variables I chose better explain the 2016-21 seasons as opposed to the 2009-14 seasons, as expected. This is a demonstration of how Stephen Curry impacted the game as variables related to his play style better determined revenue after his back-to-back MVPs. Unlike the 2009-14 regression, three pointers made were a large positive driver in revenue at a statistically significant level of one percent. The coefficient for 3PM means that on average, holding other variables constant, one more three-pointer made will increase a team’s revenue by over thirty-three million dollars. Something of importance is that this is a much smaller figure than the model in Table 2 suggests. However, like Table 2, which tested the data for all the years, playoff wins, and home attendance were statistically significant variables. In this case, both variables were statistically significant at the one percent level. From 2016-21, home attendance was a much larger driver than playoff wins. On average, a one percent increase in home attendance, ceteris paribus, increases revenue by over sixty-million dollars, while one playoff win, ceteris paribus, increases revenue by over six million dollars.

Empirical Economic Bulletin, Vol. 17 27

6.0 CONCLUSION

This paper examined the effect that Stephen Curry had on NBA revenue with his change around how the game of basketball was played because of his usage of the three-point shot. As it turns out, the three-point shot, and Curry did have a great effect on being a determinant of a team’s revenue in the NBA. There are, however, limitations in this study. In the first set of five years, there was a lockout meaning that the season was shortened, thus revenues went down. Similarly, in the second set of five years, after Curry won back-to-back MVPs, there was the COVID-19 pandemic which halted the entire world, never mind just the game of basketball. The effect on the NBA was that the season where the pandemic first hit was shortened and then finished without fans, in a bubble. The following season, states had differing policies on the Coronavirus, and some teams were able to fill their stands more than others, but it did not come close to pre-pandemic levels. Seeing as home attendance percentage was an independent variable in this study, the results may have been skewed.

Two key drivers of an NBA team’s revenue are playoff wins and fan attendance. It is important to consider that the three-point shot plays a large role in both playoff wins and fan attendance. Stephen Curry, the all-time leader in three-pointers made in the NBA has won four NBA championships, the first of which was in his first MVP season, the 2014-15 season. If a team is looking to generate higher revenue, a great way of winning games and getting fans to come watch is to utilize the three-point shot. This would mean that the traditional power forward and center positions must adapt to survive. This is already being shown because many of the taller players in the NBA have developed three-point shots. The players that have not adapted this feature to their skill set are often not as valued as they were prior to the Stephen Curry revolution.

Empirical Economic Bulletin, Vol. 17 28

Appendix A: Variable Description

and Data Source

Acronym Description

Team Revenue Revenue of the team in the NBA

PPG Points Per Game: the total number of a player’s points divided by number of games played

3PM 3-Pointers Made: the total number of a player’s made three-pointers divided by number of games played

3P% 3-Point Percentage: the total number of threepointers made divided by number of three-pointers attempted

eFG% Effective Field Goal Percentage: an adjusted statistical measure of a player’s field goal percentage accounting for three-pointers being worth more

Reg. Season Wins Regular Season Wins: a team’s number of wins in the regular season

Playoff Wins Playoff Wins: a team’s number of wins in the postseason tournament

Home Attendance %

Home Attendance Percentage: a calculated figure using the number of average attendees over the stadium’s capacity

Data source

Statista

Basketball Reference

Basketball Reference

Basketball Reference

Basketball Reference

Basketball Reference

Basketball Reference

Computed using ESPN data

Empirical Economic Bulletin, Vol. 17 29

BIBLIOGRAPHY

“2019-20 NBA Standings.” Basketball Reference, 2020. https://www.basketballreference.com/leagues/NBA_2020_standings.html.

Beck, Howard. “N.B.A. Reaches a Tentative Deal to Save the Season.” The New York Times, November 26, 2011. https://www.nytimes.com/2011/11/27/sports/basketball/nba-andbasketball-players-reach-deal-to-end-lockout.html.

Bradbury, John Charles. “Determinants of Revenue in Sports Leagues: An Empirical Assessment.” Economic Inquiry 57, no. 1 (September 11, 2018): 121–40. https://doi.org/10.1111/ecin.12710.

Gannaway, Grant, Craig Palsson, Joseph Price, and David Sims. “Technological Change, Relative Worker Productivity, and Firm-Level Substitution.” Journal of Sports Economics 15, no. 5 (July 15, 2014): 478–96. https://doi.org/10.1177/1527002514542740.

Gordon, Jeremy. “How Allen Iverson Changed the NBA.” The Wall Street Journal, September 9, 2016. https://www.wsj.com/articles/BL-DFB-23959.

Harrison, Jake. “The Effect of Play Style on NBA Revenues.” UC Berkeley Economics, May 10, 2019. https://www.econ.berkeley.edu/sites/default/files/Harrison_Jake_The%20Effect%20of%20 Play%20Style%20on%20NBA%20Revenues.pdf.

“National Basketball Association Total League Revenue from 2001/02 to 2022/23.” Statista, November 28, 2023. https://www.statista.com/statistics/193467/total-league-revenue-ofthe-nba-since-2005/.

“NBA League Averages - Per Game.” Basketball Reference, 2024. https://www.basketballreference.com/leagues/NBA_stats_per_game.html.

NBA.com Staff. “Where NBA Teams Stand on In-Arena Attendance.” NBA.com, May 28, 2021. https://www.nba.com/news/where-nba-teams-stand-on-in-arena-attendance.

Pimentel, Anatoly. “Top-Selling NBA Jerseys since 2001.” BetMGM, December 11, 2023. https://sports.betmgm.com/en/blog/nba/top-selling-nba-jerseys-since-2001-bm05/.

Reilly, Patrick, John L. Solow, and Peter von Allmen. “When the Stars Are Out: The Impact of Missed Games on NBA Television Audiences.” Journal of Sports Economics 24, no. 7 (June 4, 2023): 877–902. https://doi.org/10.1177/15270025231174616.

Empirical Economic Bulletin, Vol. 17 30

Release, Official. “Stephen Curry Leads Top-Selling Jerseys so Far This Season.” NBA.com, January 31, 2024. https://www.nba.com/news/top-selling-jerseys-first-half-2023-24.

Reynolds, Tim. “Stern, Talent Influx Led to NBA Transformation during 1980’s.” Fox Business, January 17, 2022. https://www.foxbusiness.com/sports/stern-talent-influx-led-to-nbatransformation-during-1980s.

Empirical Economic Bulletin, Vol. 17 31

The Role of Institutional Quality Factors on Inequality in Upper-Middle Income Countries in Latin America

Alexia Brandaoa

Abstract

This paper investigates the influence that institutional quality factors have on the power or spread of inequality across low-income countries, as opposed to high income countries. As such, an empirical study and analysis will be conducted to measure the impact of the following institutional quality factors: control of corruption, government effectiveness, political stability and absence of violence/terrorism, regulatory quality, rule of law, and voice and accountability. Specifically, cross-sectional or panel data from the World Bank will be utilized to look at upper-middle income nations in Latin America.

The factors will be simultaneously measured against the Gini Coefficient. These countries include Brazil, Argentina, the Dominican Republic and Peru from 2008 – 2022

Results from the panel data will show that a variety of institutional quality factors have significant influence over inequality factors and many variables contribute to this disparity, including Foreign Direct Investment and Global Competitiveness.

JEL Classification: I3, N4, O2, O4

Keywords: Institutional Quality Index, Foreign Direct Investment, Political Stability, Global Competitiveness, Gini Index

Bryant University, 1150 Douglas Pike, Smithfield, RI02917. Phone: (401) 536-7729

Email: abrandao@bryant.edu

Empirical Economic Bulletin, Vol. 17 32

1.0 INTRODUCTION

For a multitudinous array of reasons, lower-income nations face several disadvantages that hinder their overall development. Factors, such as limited resources, poor infrastructure, limited access to capital, health, education challenges, and so many more contribute heavily to the ever-growing constraints that are placed on the stimulation of economic growth, as well as improvement in living standards. In examining these variables, a question comes forth specifically in lower-income nations as to what is causing inequality, and if there are any ways to make change. With that being said, many nations are utilizing the Institutional Quality Index (IQI) and its indicators to reflect the strength of institutions that underpin social and economic development. By definition, this index is a composite indicator that measures the impact of aggregate and individual governance. It is composed of the World Governance Indicators and places importance on institutional control, with an emphasis on governance systems, procedures, and activities. As such, the factors that make up the index include the following: control of corruption, government effectiveness, political stability and absence of violence/terrorism, regulatory quality, rule of law, and voice and accountability. In addressing these concerns, impoverished nations can address specific weaknesses in their institutions to promote an environment of sustainable development and growth. Several studies have since uncovered that “local policies could be better targeted to reduce gaps and increase expenditure efficiency, foremost among which are anti-corruption actions… especially in regions which are lagging behind” (Ferrara & Nistico, 2019).

As such, this study will investigate the impact of the institutional quality index in a series of upper-middle income countries in Latin America, including Argentina, Brazil, the Dominican Republic, and Peru from 2008-2023. The study will aim to enhance the understanding of institutional quality factors, as well as the impact that the Gini coefficient plays within the policy implementation throughout these nations. The Gini Coefficient, which is an economic measure that analyzes the depth of inequality, is the most significant measure and variable within this study. Specifically, its value ranges from 0 to 1, with 0 representing perfect equality and 1 representing perfect inequality. In terms of economic policy, a higher Gini indicates greater inequality within a population, and vice versa. From a policy perspective, this analysis is significant toward the

Empirical Economic Bulletin, Vol. 17 33

comprehension of inequalities, as well as the make-up of policy structures. In taking a closer look at the failure of the institutional quality factors in lower income nations, this study will showcase the regional multidimensional inequalities within these six lower income nations.

This paper was guided by various research objectives that differ from other studies. First, it will investigate the possibility of interdependence between Institutional Quality Factors to the Gini Coefficient with the utilization of panel data. Secondly, it examines the influence of investment inflow and multidimensional well-being indicators on institutional quality. Lastly, this paper analyzes the difference between high-income countries (HICs) and low-income countries (LICs) in terms of inequality through an indepth comparative analysis between the two. As such, there is not a wide variety of existing literature that highlights the significance of institutional quality factors when in relation to LICs, but this paper successfully responds to many unanswered questions.

The remainder of the paper is outlined as follows: Section 2 outlines the trend of the given topic. Section 3 consists of a brief literature review. Section 4 dives into the data and empirical methodology, while section 5 reveals the empirical results of the research. Lastly, this is followed by a conclusion in section 6.

2.0 TREND

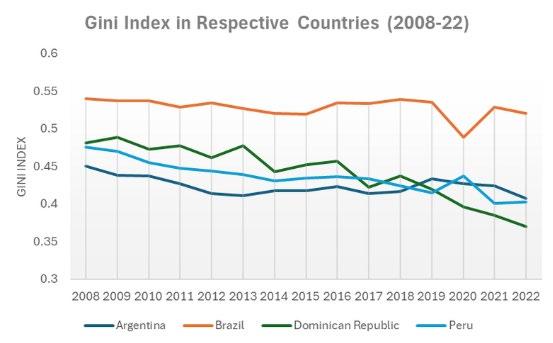

In order to measure the levels of inequality properly and effectively in relation to the institutional quality index, trends in the Gini Coefficient must be identified. As previously mentioned, the Gini index measures the extent in which distribution among individuals and households within an economy deviates from perfectly equal distribution. The utilization of the Gini index is essential in this study, as it aims to address levels of inequality across lower-income nations globally. Specifically, the index is useful in providing a standardized measure of income distribution, policy implications, and the respective countries relationship with development. Understanding this is imperative, and the coefficient successfully allows for comparisons over time across a multitudinous array of countries.

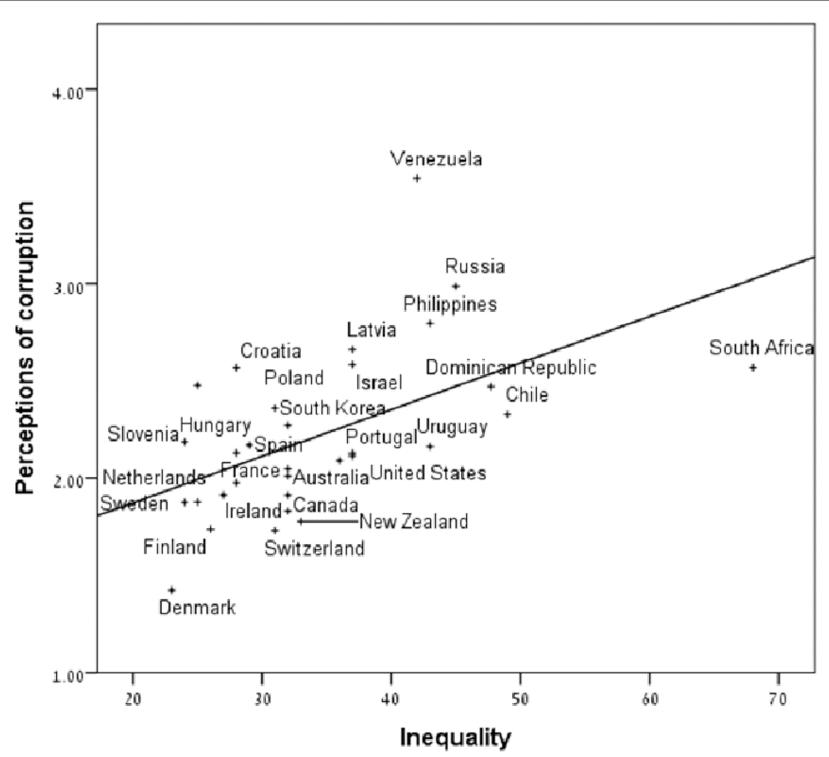

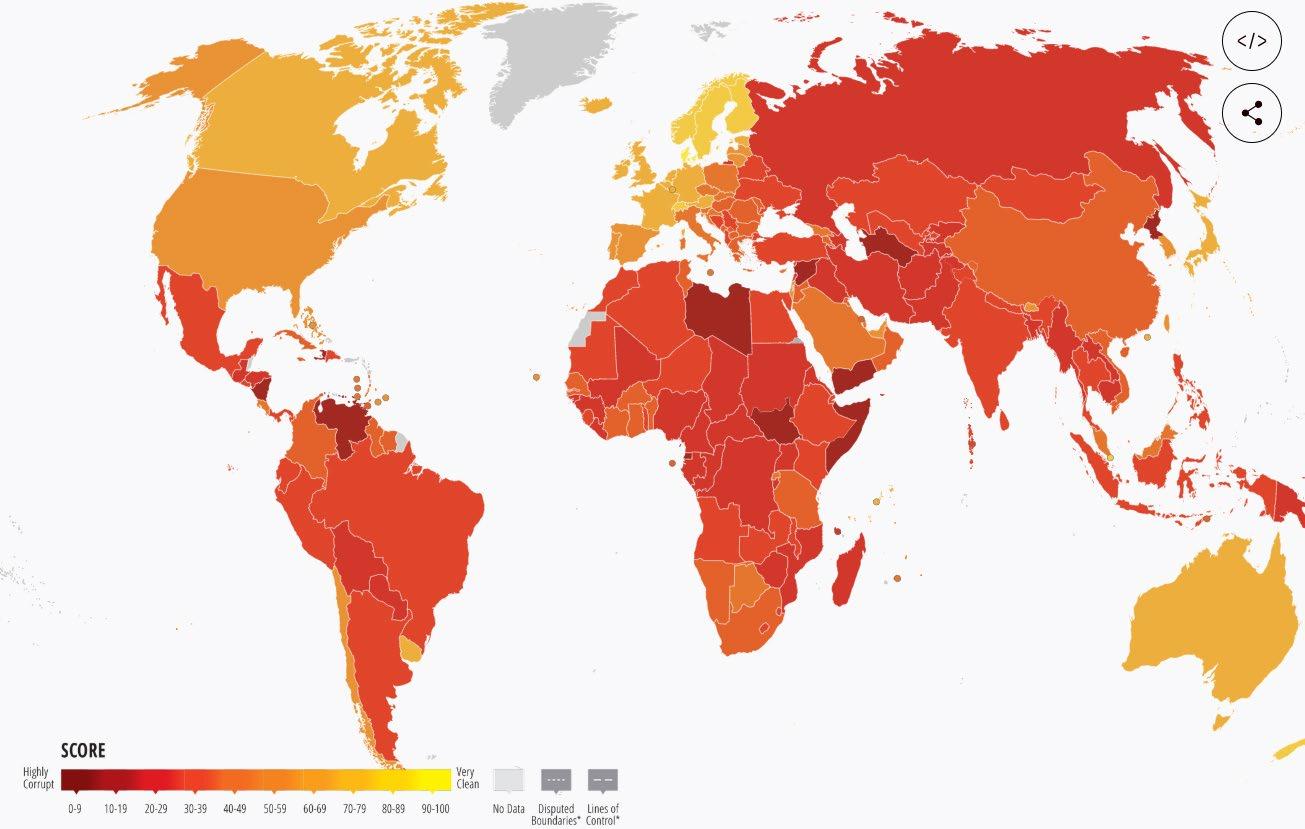

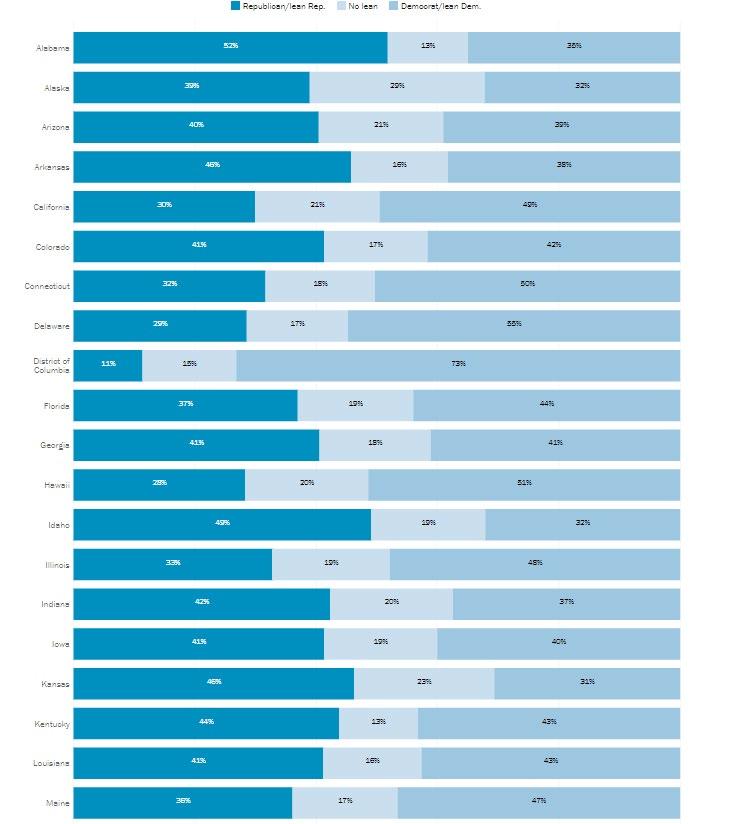

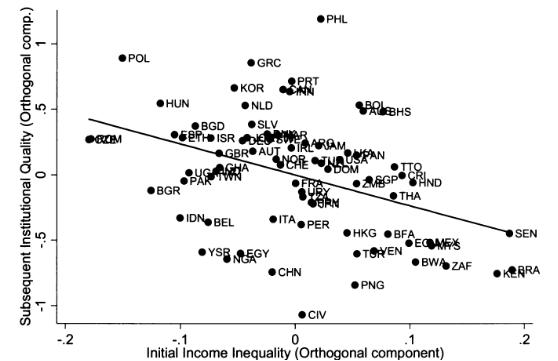

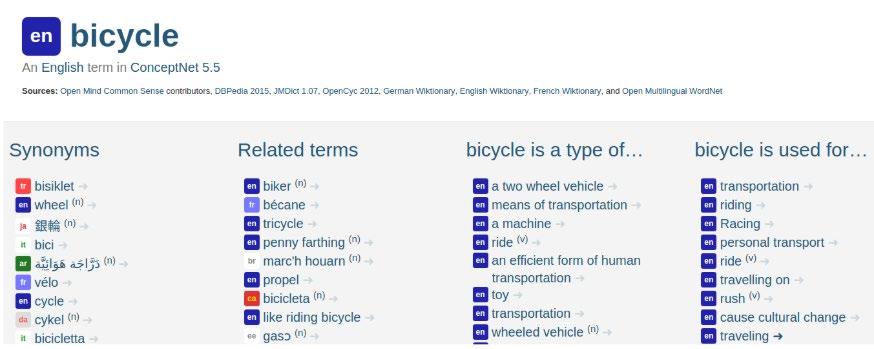

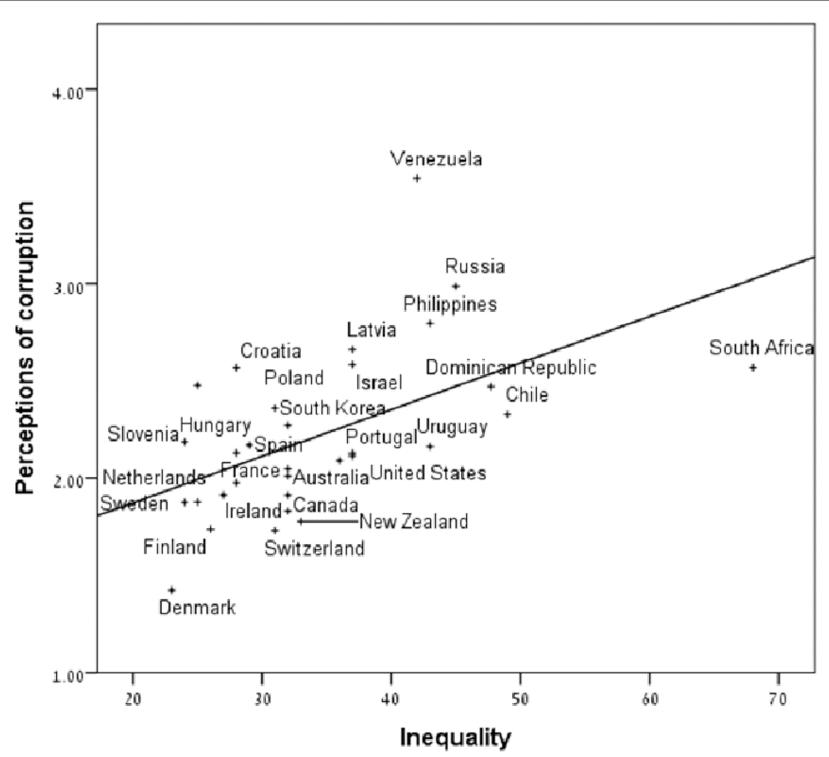

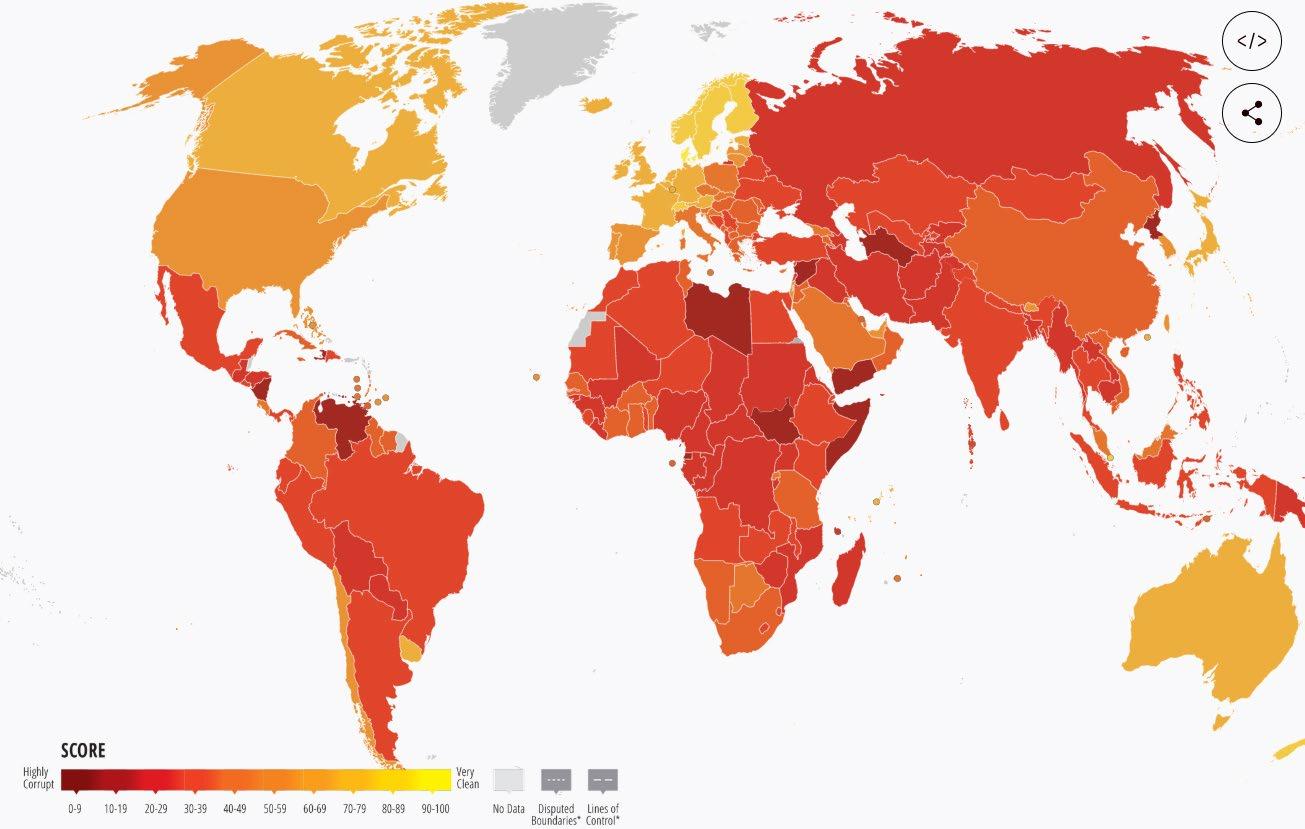

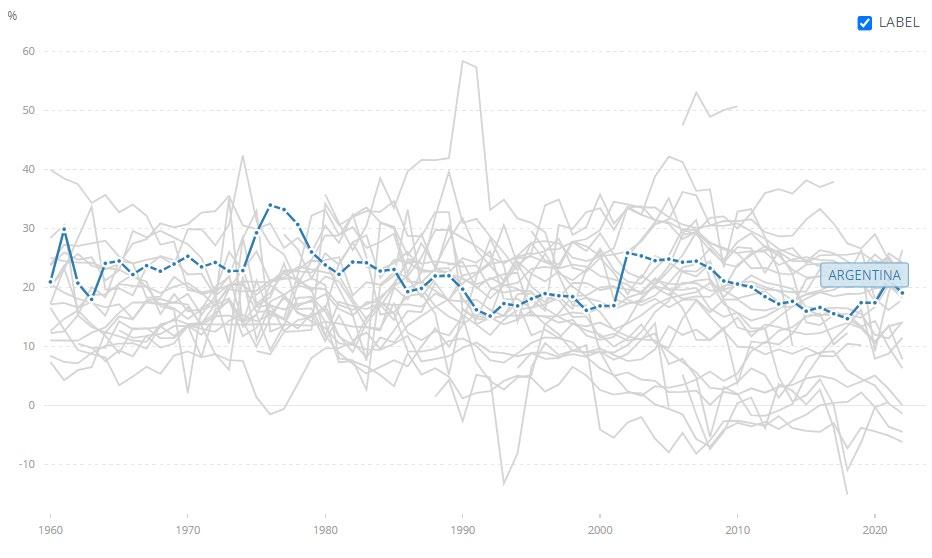

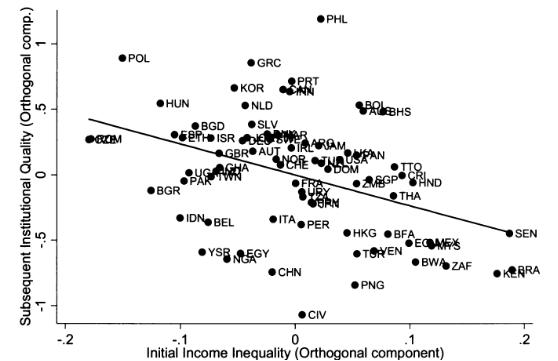

Figure 1 shows income inequality as captured by the Gini coefficient between 1981-1985 for a range of countries. This figure reinforces the correlation between income

Empirical Economic Bulletin, Vol. 17 34

inequality and institutional quality factors, as well as considering a range of economic conditions that also impact institutional quality as a whole.

Figure 1: Initial Income Inequality and Subsequent Institutional Quality

Source: The Review of Economics and Statistics

Per exploring a relationship between these two variables, it is easy to consider the impact that this will have on the following institutional quality factors: control of corruption, government effectiveness, political stability, absence of violence/terrorism, regulatory quality, rule of law, and voice and accountability. In many instances, as per depiction in Figure 1, poor institutional quality renders a higher degree of inequality. On the other hand, it is common that the opposite trend is seen within high-income nations, like the United States, China, and Singapore.

These variables can also be measured through the utilization of World Governance Indicators (WGI), which measure the quality of public governance at national and international levels. These indices are useful in understanding the different aspects of governance that have an overarching impact on governance quality, policy implications, social outcomes, and the overall growth and development of a country.

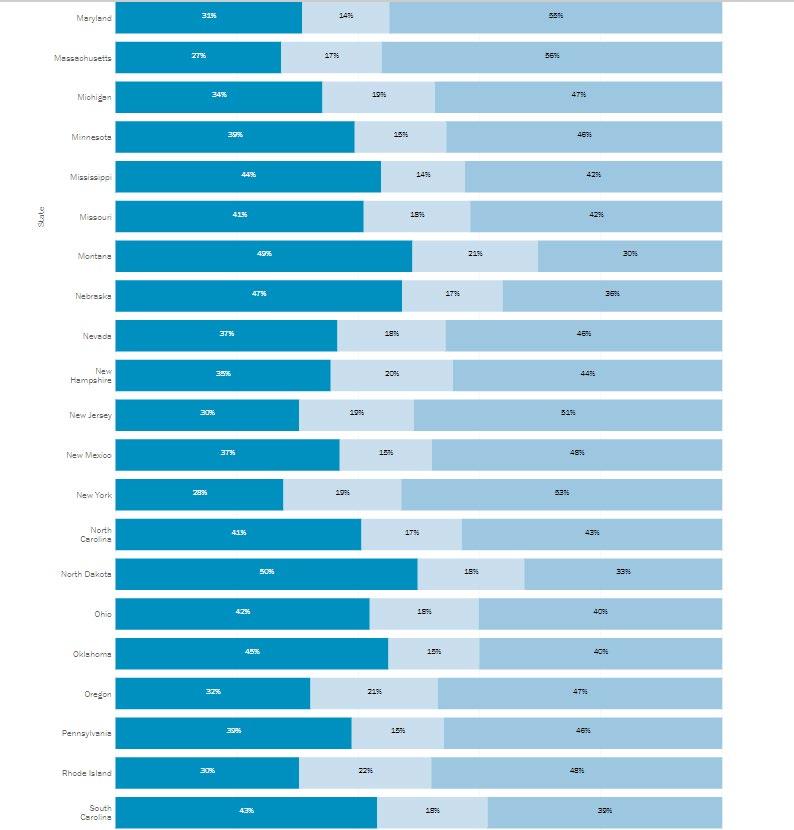

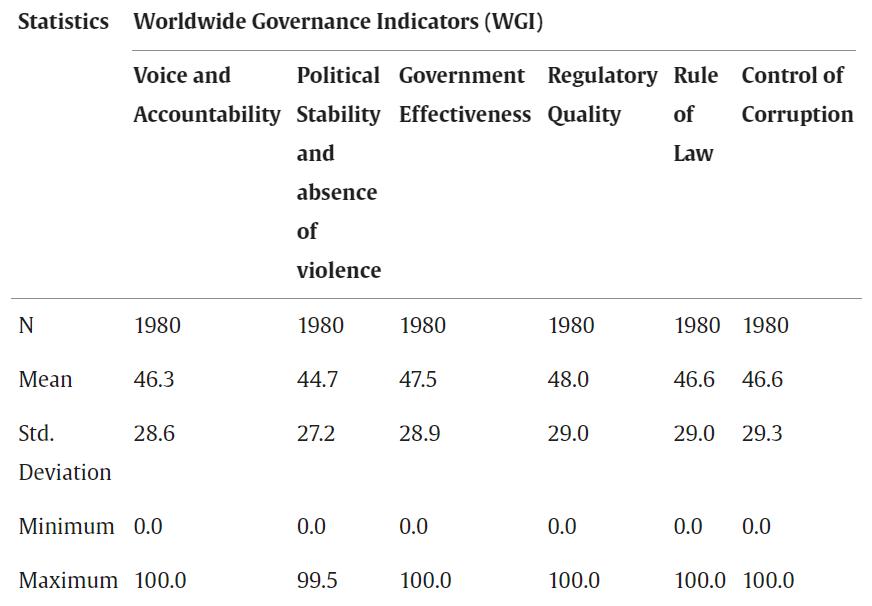

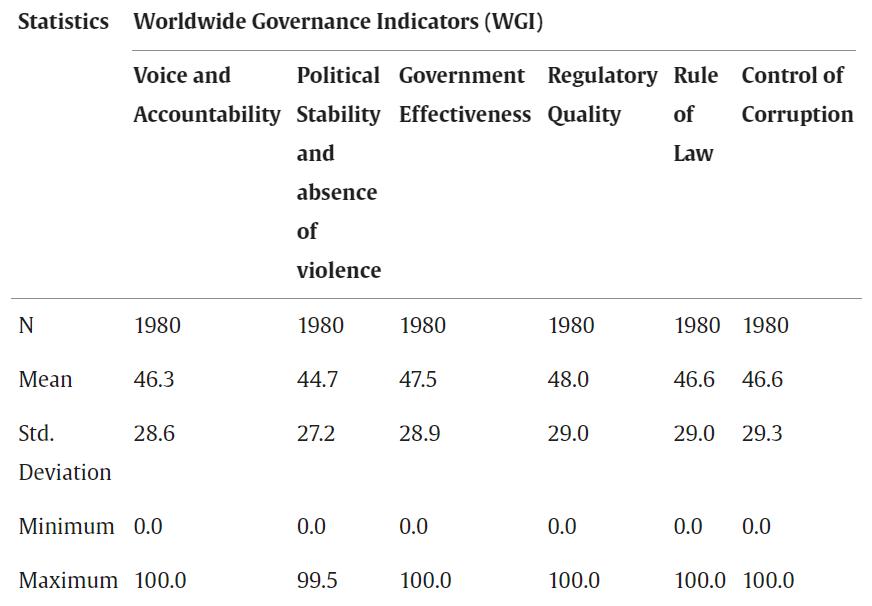

Figure 2 shows the descriptive statistics of World Governance Indicators aggregate data on a 10-year basis, which highlights the mean, standard deviation, minimum, and maximum for each indicator. In addition to this, these statistics provide a quantitative foundation for various policy implications within the latter half of this study.

Empirical Economic Bulletin, Vol. 17 35

Figure 2: Descriptive Statistics of WGI Aggregate Data (2012-2022)

Source: The Worldwide Governance Indicators

3.0 LITERATURE REVIEW

To shed light on the importance of the institutional quality index, various studies have been conducted in previous years. When examining institutional quality as a whole, a clear distinction must be made between low-income countries (LICs) and high-income countries (HICs). Simply put, this is due to the fact that the quality of institutions and their impact on economic growth varies significantly between countries. While lowincome countries are taxed with limited resources and higher levels of corruption, higherincome countries are oftentimes resource rich and have stronger structures. In a study conducted between high and middle-income countries, it is revealed that “An average MIC gains relatively more from improving its quality of legal system and property rights, whereas an average HIC benefits relatively more from each unit of improvement in its regulatory environment” (Parsa & Datta, 2023). In addition to this, researchers also dive into the difference between HICs and MICs when examining business start-ups. To understand why institutional quality plays a significant role, it is important to understand that governance, as well as size and strength of HICs, is truly a determinant of

Empirical Economic Bulletin, Vol. 17 36

entrepreneurial success. Furthermore, several policy implications in HICs outweigh those of MICs and LICs (Ben Ali, 2023).

On an international level, the same issues persist. Through looking at the Middle East and North African (MENA) regions, political regimes and governance play a significant factor that cannot be ignored when considering institutional quality. Similarly to analysis conducted in high, middle, and low-income nations, the MENA region provides insight on political stability and governance. Through a series of natural resource rents, socioeconomic status, and institutional quality factors shape the future of fiscal and monetary policies in order to reduce inequalities (Agheli, 2017). Evidence found from the Granger non-causality test uncovers unidirectional causation, meaning that “x” causes “y”, but “y” does not necessarily cause “x” to occur. This causation was, for the most part, found within MICs and LICs, where nations are impacted more so by improvements to regulatory environments. Since these nations are more commonly expected to be lackluster in terms of resources as compared to higher income nations, this trend is expected to occur.

Since the institutional quality index uncovers lots in terms of inequality, it is imperative to understand regional multidimensional factors. One case study focused on Italy uncovered that “disparities in multidimensional well-being go beyond the historical GDP divide between the Centre-North and the South of Italy… institutional quality matters in affecting regional multidimensional well-being inequalities and the effect varies heterogeneously according to the level of public expenditure, institutional dimensions, and spatial spillovers” (Ferrara & Nistico, 2019). Similar findings registered throughout Africa, where a holistic approach was utilized to look at environmental and housing factors. Once again, findings uncovered that governance and longevity of the regime / term of power have the power to exacerbate inequalities in all forms (Ongo Nkoa & Song, 2022). This is important to consider for the following: Foreign Direct Investment, Healthcare, Education, and Economic Development. In order to facilitate sustainable and effective development initiatives, these nations must be provided with the proper trajectory that will impact social, economic, and political outcomes.

A multitudinous array of research and development in relation to Foreign Direct Investment (FDI) inflows also lays within the institutional quality channel, per the

Empirical Economic Bulletin, Vol. 17 37

reasons listed above. Within reason, evidence outlines the potential role of institutional quality in terms of absorption in FDI spillovers. Due to the fact that quality of institutions is essential in the enhancement of market growth, literature shows that greater macroeconomic and financial stability indicate a positive relationship (Aziz, 2022). This can further be outlined in the understanding that institutional operations outline a certain level of attractiveness, which contributes to overall gross domestic product (GDP), as well as the Global Competitiveness Index (GCI). Within Central and Eastern Europe (CEECs), it is evident that “CEECs differ with respect to institutional quality (IQ)” (Dorozynski et al., 2020). Because sound governance is likely to attract aid, as opposed to corruption factors, it is evident that there are several forms of discrepancy in terms of institutional quality between low-income, middle-income, and high-income nations.

4.0 DATA AND EMPIRICAL METHODOLOGY

4.1 Data

The study uses panel data from 2008 to 2023. Data was obtained from the World Bank websites Worldwide Governance Indictors. As per the World Bank, it has been found that the WGI help researchers and analysts assess broad patterns in perceptions of governance across countries over time. Publicly available WGI data comes from across the world with these three criteria in mind: produced by credible organizations, provide comparable cross-country data, and are regularly updated.

4.2 Empirical Model

Following a study done by Lambert and Aronson in 1993, this study aims to look at the impact of institutional quality factors on inequality in upper-middle income countries in Latin America. Within Lambert and Aronson’s study, they observe an inequality decomposition analysis with the utilization of the Gini coefficient and Lorenz curve, but this model adds to the study by adding in the institutional quality index. The model could be written as follows:

Empirical Economic Bulletin, Vol. 17 38

Within this model, the following variables are considered: Gini Coefficient, Voice and Accountability (VA), Political Stability No Violence (PSNV), Government Effectiveness (GE), Regulatory Quality (RQ), Rule of Law (ROL), and Control of Corruption (CC).

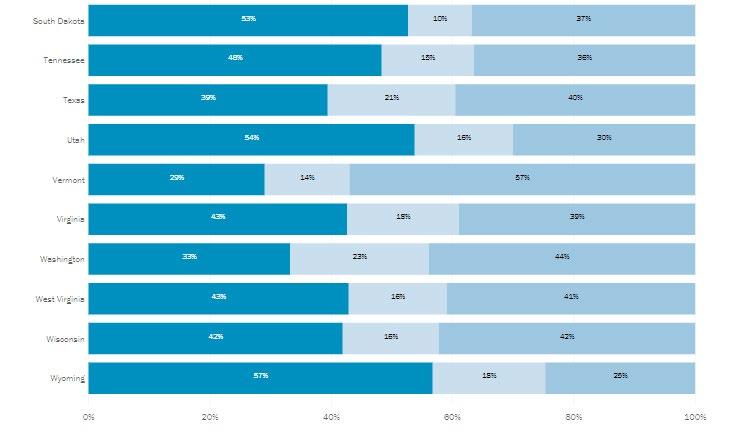

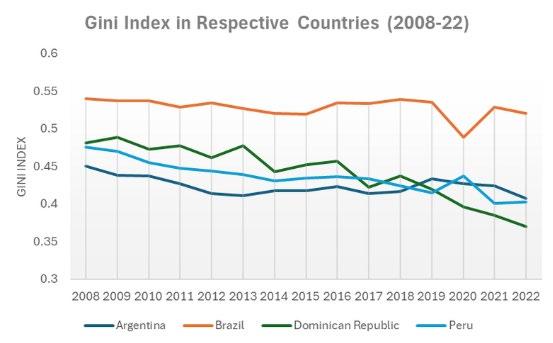

Figure 3 below shows the Gini Index in the respective countries from 2008-2022, which provided great insight prior to the actual running of the regression analysis. This variable analysis looks at the difference in aggregate flows, as well as impact on WGI and Institutional Quality.

Furthermore, the study has a series of independent variables that were obtained from various sources and research conducted. As such, the observation is looking at four countries in Latin America with similar populations and economic growth, but they are all tested against the independent variable. In simple terms, the independent variable is manipulated or controlled and is hypothesized to have a causal effect on the dependent variable(s). In this instance, inequality has an impact on all of the institutional quality factors: control of corruption, government effectiveness, political stability and absence of violence/terrorism, regulatory quality, rule of law, and voice and accountability. By looking at the Gini coefficient in this case, the research will be able to show a clear distinction between each country as per the provided data set.

Figure 3: Gini Coefficient in Respective Countries (2008-2022)

Empirical Economic Bulletin, Vol. 17 39

5.0 EMPIRICAL RESULTS

The empirical results of the regression are presented below and are displayed individually in relation to each country.

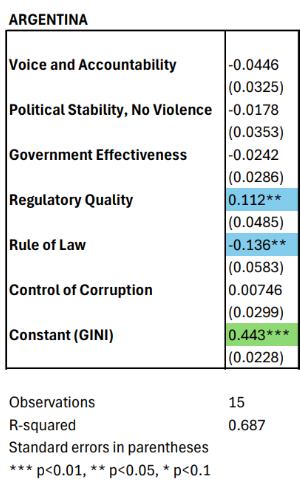

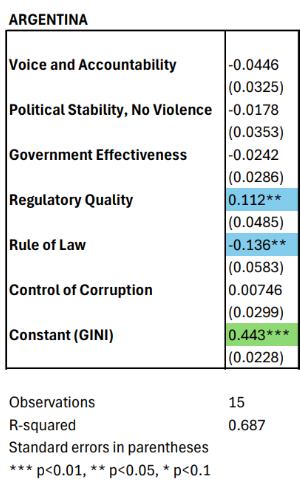

Table 1: Argentina Regression Analysis

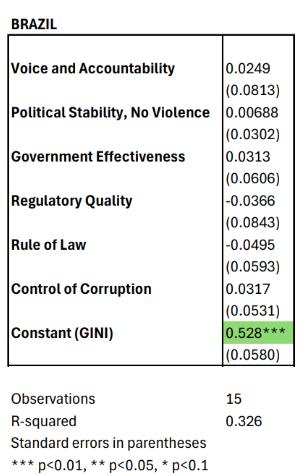

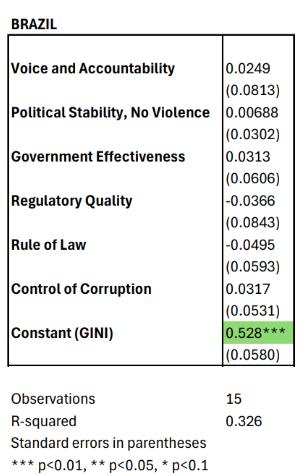

Table 2: Brazil Regression Analysis

Empirical Economic Bulletin, Vol. 17 40

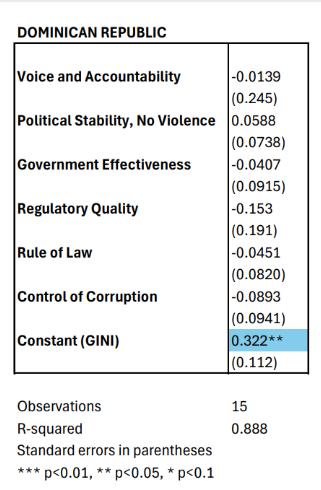

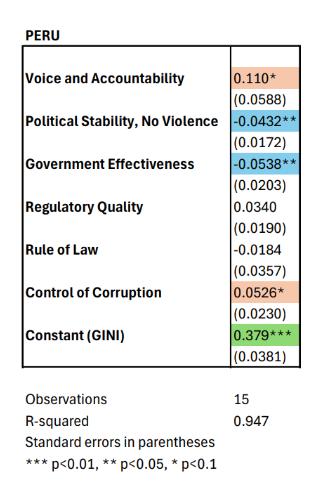

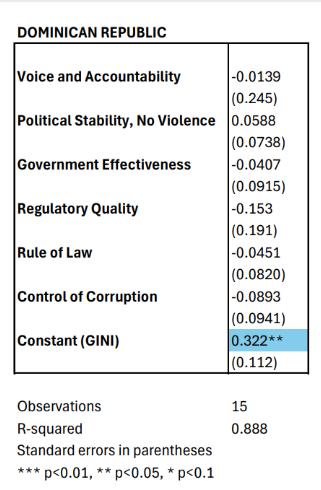

Table 3: Dominican Republic Regression Analysis

Table 3: Dominican Republic Regression Analysis

Empirical Economic Bulletin, Vol. 17 41

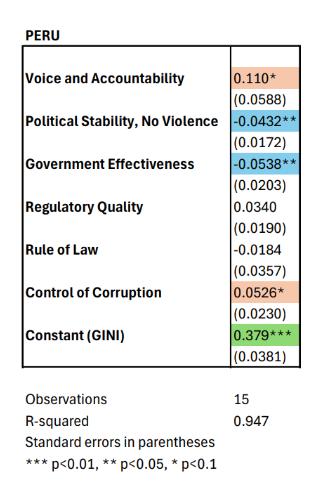

Table 4: Peru Regression Analysis

From these results, a few things can be stated in conclusion. First and foremost, when looking at Peru, it is evident that the Political Stability No Violence (PSNV) variable has a positive impact on income equality with a Gini of 0.379. In addition to this, Government Effectiveness (GE) in Peru essentially lowers the Gini Index, which in turn effectively lowers income inequality. Lastly, it is evident that Voice and Accountability (VA) for Peru has a positive coefficient, with its value being 0.110. With that being said, this can be interpreted in a variety of ways. For the purposes of this study, this means that even when people feel like they have a voice, there is still more income inequality within the respective country. Additionally, this implies that less fortunate people are more likely to speak up in contractionary or recessionary periods.

In addition to this, there were many significant variables found in the analysis of Argentina. First and foremost, when there is greater regulatory quality in Argentina, there is still an increase in the Gini index, which increases income inequality. In Argentina, this value came out to be 0.443. Additionally, when there is less rule of law, which equated to a value of -0.136, there is more income equality, not inequality. Based on what we can predict for the Gini Index, there is a strong likelihood that the role that the government plays in the economy and overall life in Argentina has a negative impact on income equality.

The analysis of the Dominican Republic and Brazil did not yield many results, which leads to the overall limitations of this research. First and foremost, the total number of observations was limited, especially since only four countries were considered for the study. In addition to this, there is a strong possibility that the reported data could be misreported, especially in countries that have high levels of corruption – which is evident in multiple nations across Latin America. This likely leads to the concept that the results could be insignificant due to possibilities of skewed data. Lastly, the size of governments, economies, and roles of the government likely play a factor in the inconsistency of results across the four observed countries.

5.0 CONCLUSION

In summary, this study was able to find that Argentina’s government likely has a negative impact on income inequality. This conclusion is based on the impact of regulatory quality and rule of law on the Gini Index. In addition to this, the study found

Empirical Economic Bulletin, Vol. 17 42

that overall, across various observed countries, when the government works in a way to help its citizens, it effectively lowers the Gini Index, or lowers income inequality. In addition to these findings, further research can be done to look at data on a more frequent basis and expand the topic to more countries of observation.

Empirical Economic Bulletin, Vol. 17 43

Appendix A:

Variable Name and Data Source

Acronym Description

FDI Foreign Direct Investment flows by country in millions of dollars

VA Voice & Accountability

PSNV Political Stability, No Violence

GE Government Effectiveness

RQ Regulatory Quality

ROL Rule of Law

CC Control of Corruption

GI or GC Gini Index or Gini Coefficient

Data source

US Bureau of Economic Analysis

World Governance

Indicators (World Bank)

World Governance

Indicators (World Bank)

World Governance

Indicators (World Bank)

World Governance

Indicators (World Bank)

World Governance

Indicators (World Bank)

World Governance

Indicators (World Bank)

US Bureau of Economic Analysis

Empirical Economic Bulletin, Vol. 17 44

BIBLIOGRAPHY

Agheli, L. (2017). Political Stability, Misery Index and Institutional Quality: Case Study of Middle East and North Africa. Economic Studies, 26(6), 30-46.

Aziz, O. G. (2022). FDI Inflows and Economic Growth in Arab Region: The Institutional Quality Channel. International Journal of Finance and Economics, 27(1), 1009-1024.

Ben Ali, T. (2023). How Does Institutional Quality Affect Business Start-up in High and Middle-Income Countries? An International Comparative Study. Journal of the Knowledge Economy, 14(3), 2830-2877.

Chong, A., & Gradstein, M. (2007). Inequality and Institutions. The Review of Economics and Statistics, 89(3), 454–465.

Dorozynski, T., Dobrowolska, B., & Kuna-Marszalek, A. (2020). Institutional Quality in Central and East European Countries and Its Impact on FDI Inflow. Entrepreneurial Business and Economics Review, 8(1), 91-110.

Ferrara, A. R., & Nistico, R. (2019). Does Institutional Quality Matter for Multidimensional Well-Being Inequalities? Insights from Italy. Social Indicators Research, 145(3), 1063–1105.

Ongo Nkoa, B. E., & Song, J. S. (2022). Does Institutional Quality Increase Inequalities in Africa? Journal of the Knowledge Economy, 13(3), 1896–1927.

Parsa, M., & Datta, S. (2023). Institutional Quality and Economic Growth: A Dynamic Panel Data Analysis of MICs and HICs for 2000-2020. International Economic Journal, 37(4), 675–712.

Empirical Economic Bulletin, Vol. 17 45

Does Money Really Buy Success? Empirical Analysis

of Money Spent Effect on English Premier League Team’s Performances/Success: A Panel Data Analysis

Barnaby Brandon

Abstract:

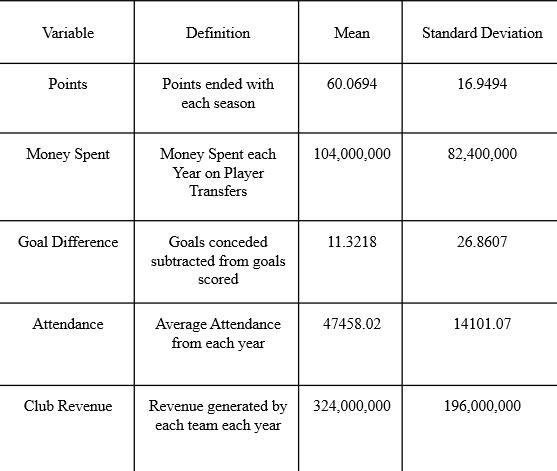

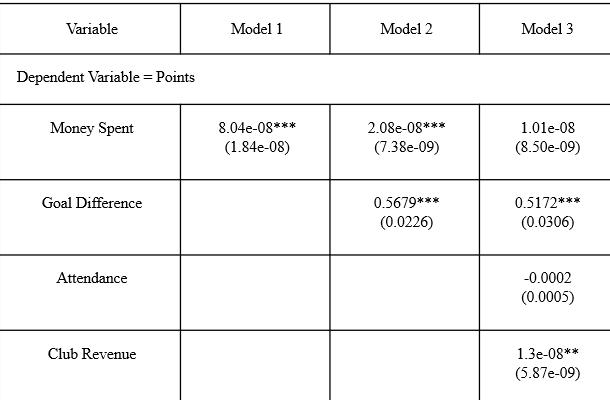

This paper investigates the empirical relationship between the wages of English Premier League teams and their success. This study incorporates information from the league regarding each team’s spending and the performance of each of these teams every year. Each team has a specific spending structure based on the magnitude of the club and ability of the players. The research will look at all teams that have stayed in the premier league for the past 10 years as some teams come in and out of the Premier League with the relegation and promotion system. The results will show whether having higher spending correlates with success or if it is purely about the ability of the team. A series of OLS regression models are estimated

JEL Classification: Z2, Z20

Keywords: Wages, English Premier League, Performance. Applied Economics, Bryant University, 1150 Douglas Pike, Smithfield, RI02917. Phone: (781) 995-7616. Email: bbrandon@bryant.edu.

Empirical Economic Bulletin, Vol. 17 46

1.0 INTRODUCTION

The influx of money into the English Premier League has led to it being revered worldwide as the most competitive domestic league in the world. Manchester City and Chelsea have both won the Champions League in the last 6 years with that competition having the best teams from Europe.

This study aims to enhance understanding of whether spending all the money that they do in the transfer market has the actual results on the pitch. For example, this past summer transfer window Chelsea spent over 600 million euros which is the most ever spent in a window and currently they are in 8th place. This study will go across the last 10 seasons and among 10 teams and will explore this relationship. The relevance of this study is that all these clubs tend to go for quantity over quality especially when they are coming up from the Championship which is the second tier in England. This will show the relationship in full, and owners can see that when approaching transfers spending all the money may not be the best.

In terms of research issues there aren’t many. To begin with a few of the clubs such as Aston Villa and Newcastle weren’t in the Premier League for 3 years and 1 year respectively. Although to have a good variety of teams and not just the top ten this had to be done, it shouldn’t be that much of an issue in the data and regressions. This is the only issue with the data that has been seen so far.

This paper was guided by 3 research objectives that differ from other studies: First it investigates the relationship between money spent and success on the pitch. This has been a hot topic in the world of soccer in recent years with Saudi, Qatari, and American owners and immediately thinking that spending money will lead to success. Second it incorporates multiple levels of teams while a lot of studies will just focus on those teams that spend the most which gives you a biased viewpoint and biased results. Lastly it also incorporates controls variables such as goal difference, and average attendance so that the results are more accurate as opposed to just comparing finishing position and money spent.

Section 2 gives a brief literature review. Section 3 outlines the empirical model. Data and estimation methodology are discussed in section 4. Finally, section 5 presents and discusses the empirical results. This is followed by a conclusion in section 6.

Empirical Economic Bulletin, Vol. 17 47

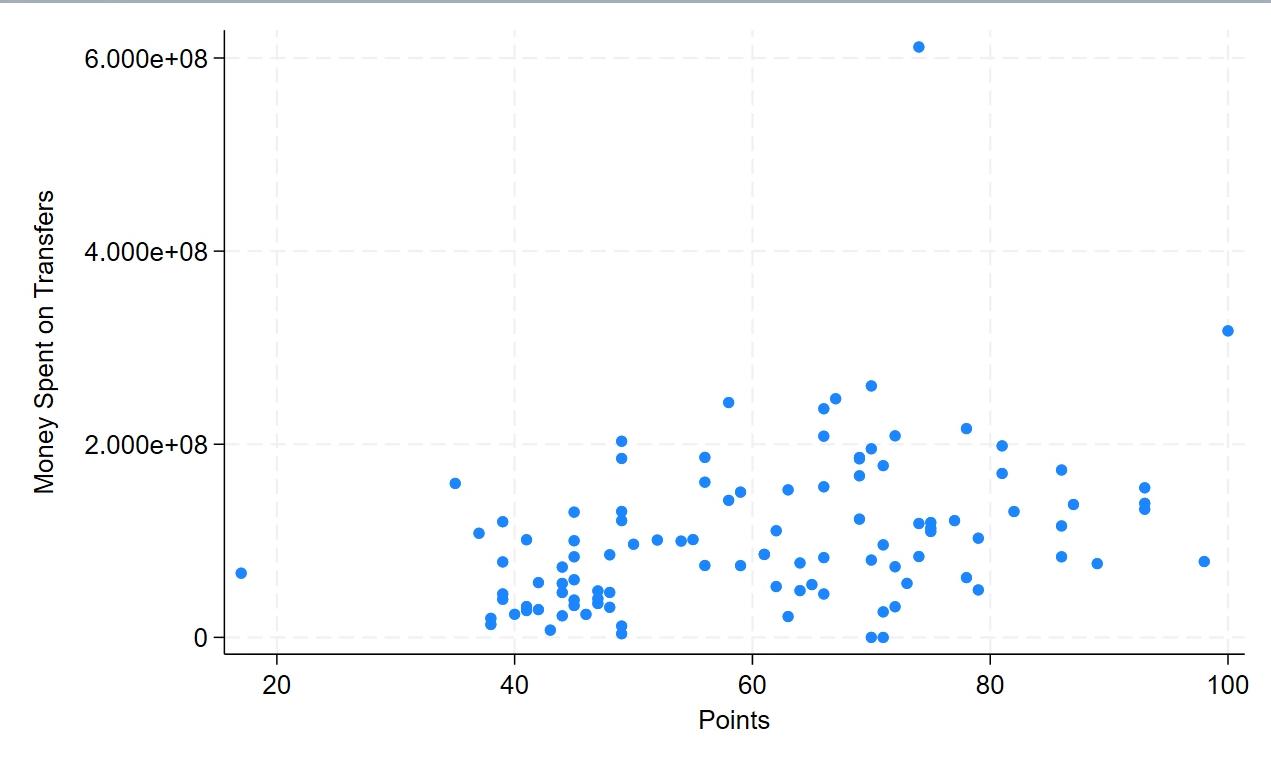

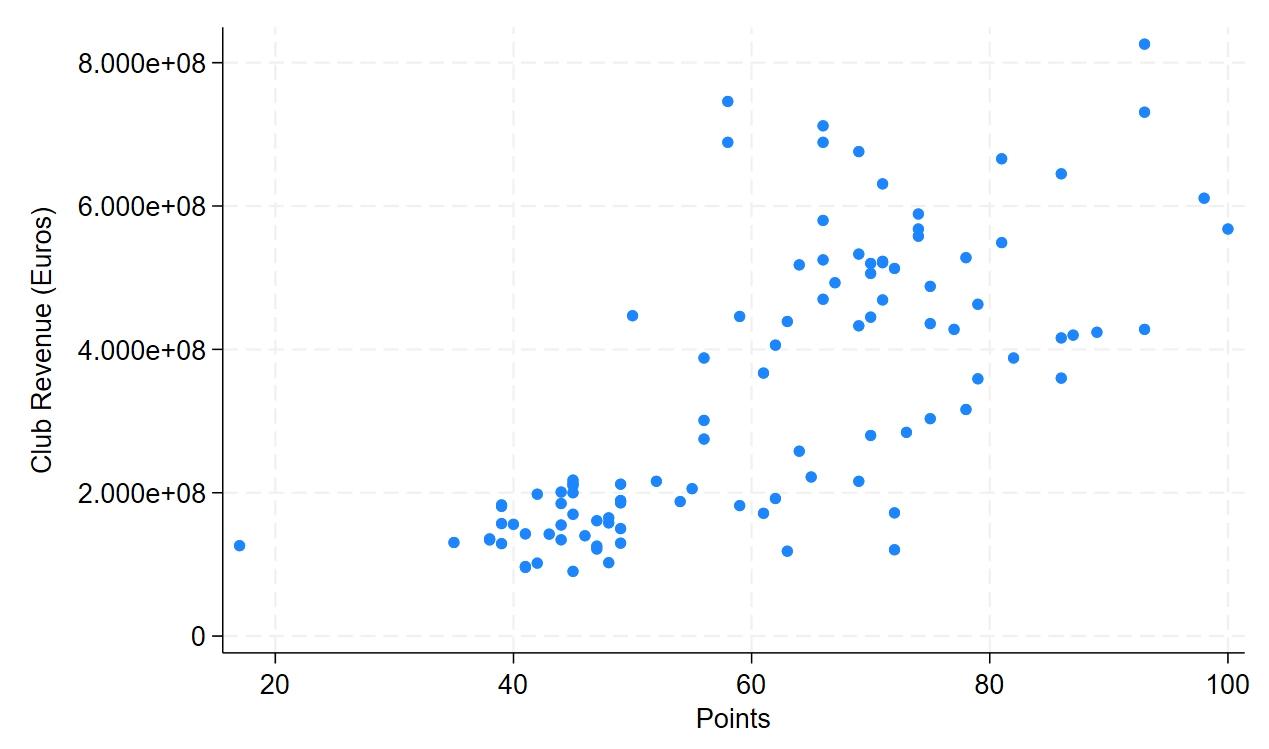

2.0 TREND

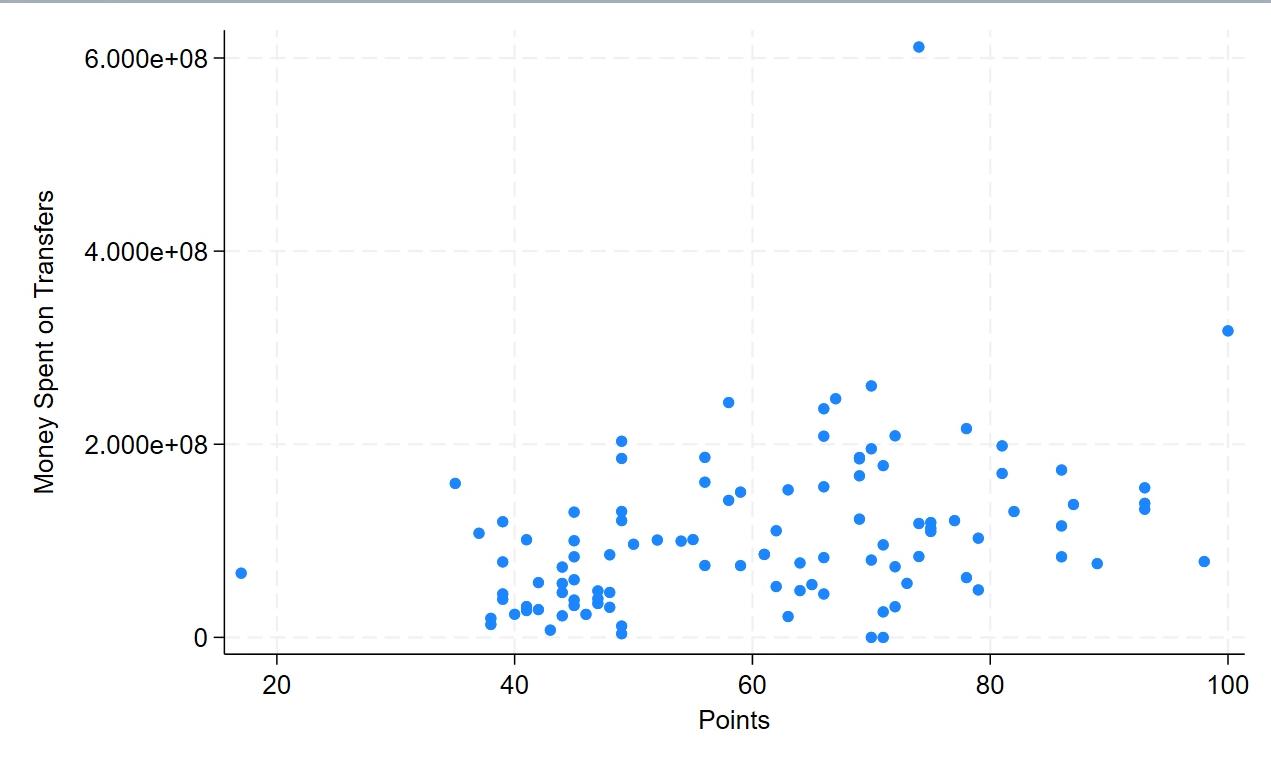

Money Spent on Transfers vs Points

Source: Transfer Markt, and Premier League

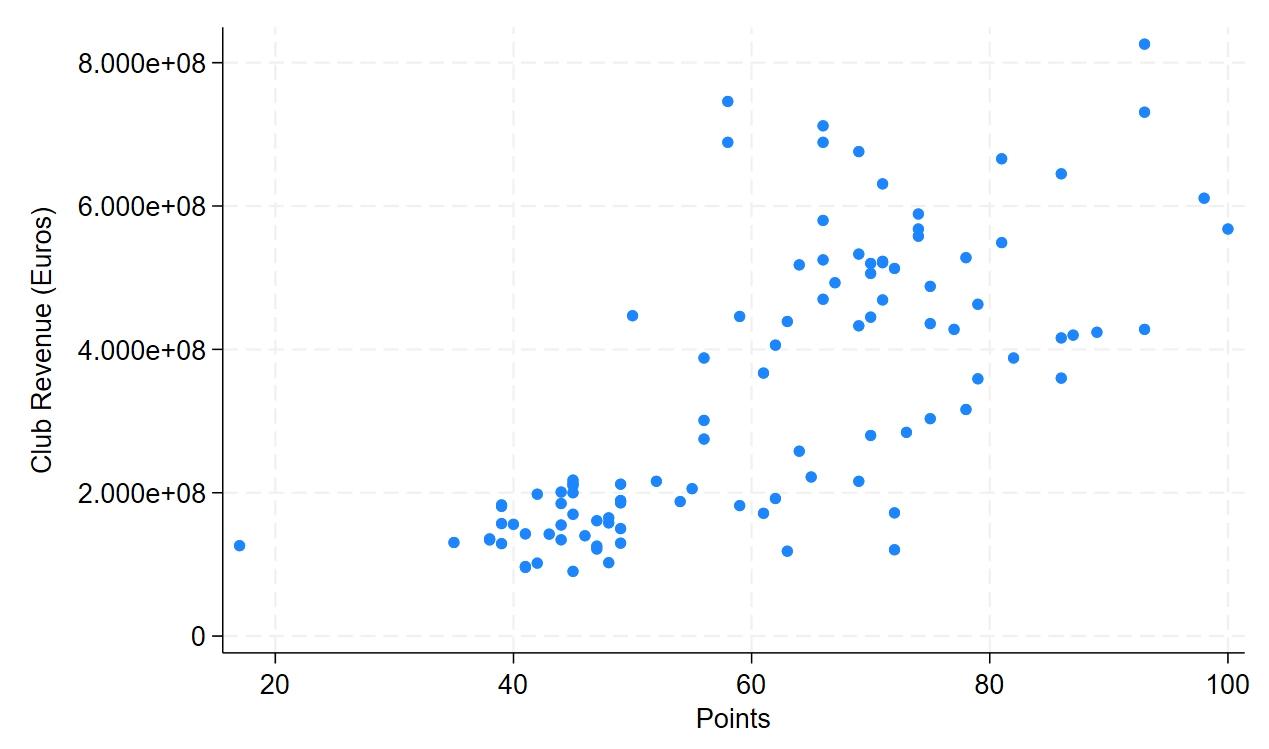

2: Club Revenue vs Points

Figure 1:

Empirical Economic Bulletin, Vol. 17 48

Figure

Source: Transfer Markt, and Premier League

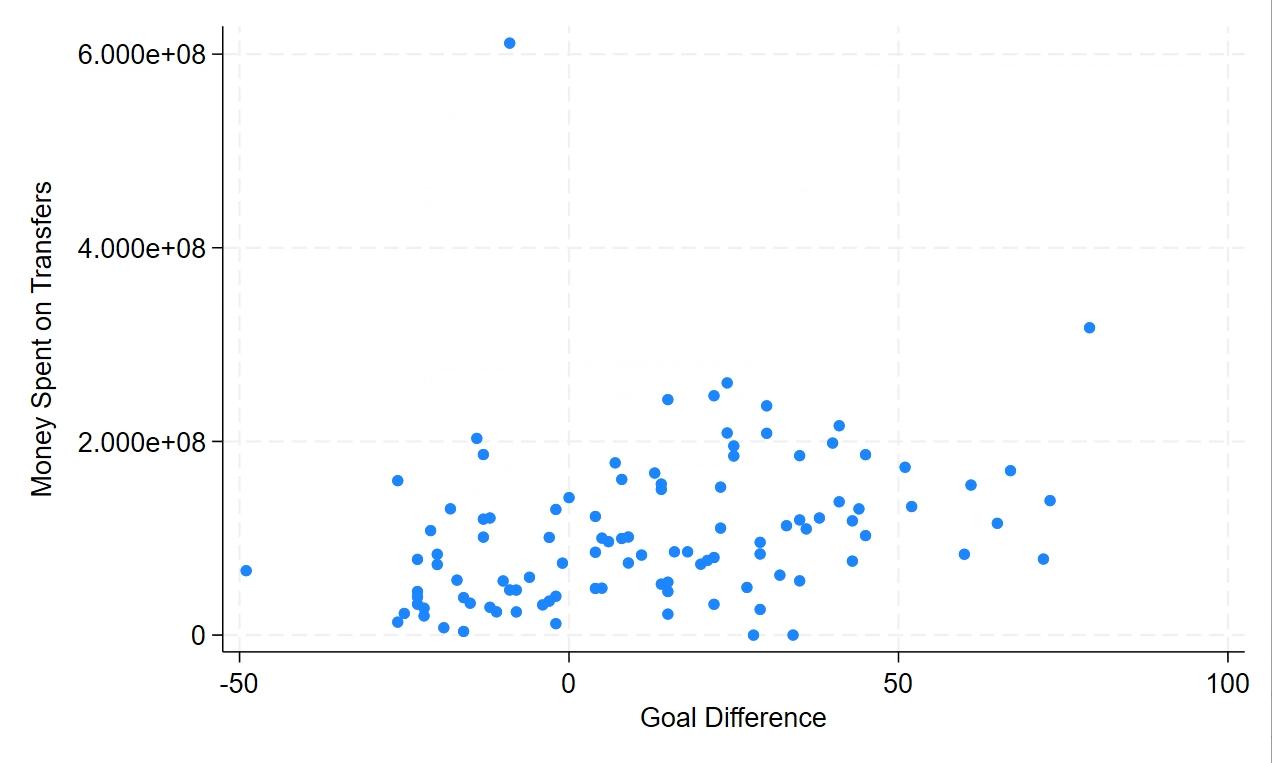

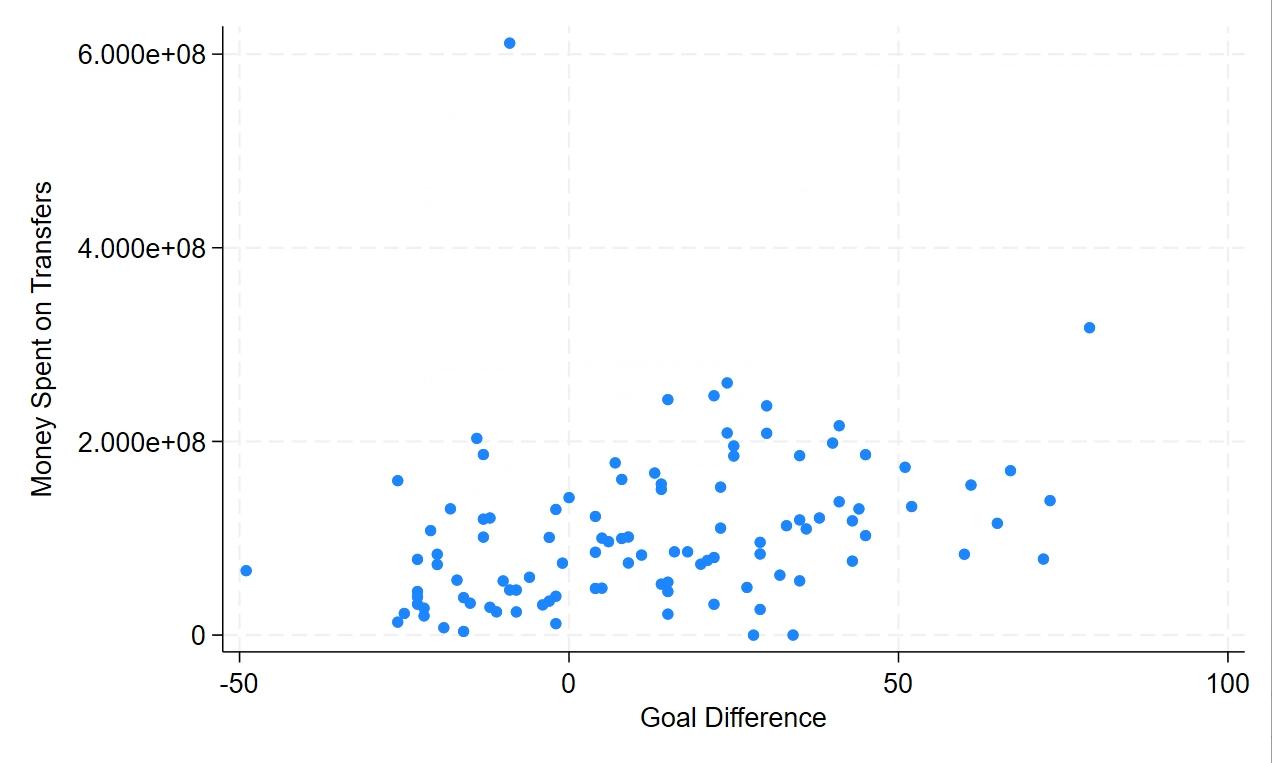

Figure 3: Money Spent on Transfers vs Goal Difference

Source: Transfer Markt, and Premier League

Empirical Economic Bulletin, Vol. 17 49

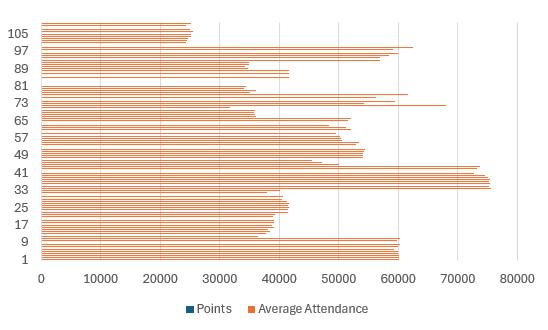

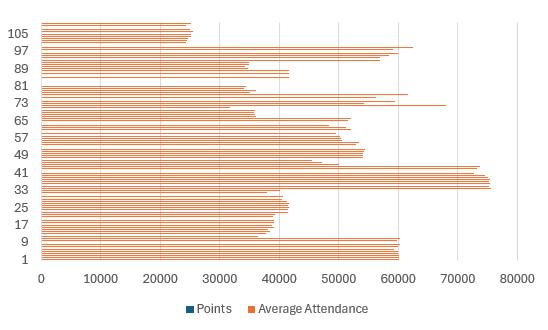

Figure 4: Average Attendance vs Points

Source: Transfer Markt, and Premier League

These are preliminary trends, but they still give off good information. Beginning with Figure 1 the comparison of points and amount spent in the transfer markets is the root of this research. As you can see there is a positive relationship between the two of them but if you are to look at Figure 2 you can see that club revenue and points has an even more positive relationship. Looking at these two in comparison you would think that immediately that it is revenue that makes clubs, but it is likely the case that those with higher revenue already have quality players compared to those who have to spend more in the transfer market. Moving onto Figure 3 this graph shows the trend of the amount of money spent and goal difference. Goal difference is the difference between goals scored and goals conceded in a season. Over the teams and years analysed you can see that although many of them have spent different amounts some will have the same exact goal difference pointing again to the point that money doesn’t buy success. Lastly looking at Figure 4 this compares points and average attendance as having a big home crowd can be a massive advantage. As points begins to increase the number of points also does but not consistently which points to the fact that sometimes

Empirical Economic Bulletin, Vol. 17 50

teams have the quality that no matter where they play they can win so looking at that attendance does have an effect but possibly not as much as people would like.

3.0 LITERATURE REVIEW

There is a plethora of research that has been done on the economics of Soccer/Football with it being one of the most profitable sports in the world. To begin with, in terms of the focus of the research there are many areas within soccer that you can conduct economic research on. For example, Wei conducted a study on the effects of temperature on the performance of players, this is relevant as it is good to see if anyone is using unique variables to track performance this wasn’t the case as Wei used physical and cognitive performance as the dependent (Wei, 2022). Along the same lines as this study Ashworth researched the effects of selection bias in soccer and once again there is the possibility of unique variables or viewpoints, but it was rather basic although you can still see how the study is performed (Ashworth, Heyndels, 2007). Various recent literature has done research that links a soccer team’s wages and the production and success of the team. The commonality among this set of research is the negative relationship between wage dispersal and team performance. Domizio’s work as well as Coates research found this relationship (Domizio, 2021; Coates, 2014). Coate’s research was unique as it was one of the first bit of research done into the MLS as it is a young league while Domizio investigated the Italian first division which is far more established (Domizio, 2021; and Coates, 2014). They both found that it doesn’t matter where it is if there is a large dispersal of a club’s wages then there will be a drop in performance which points to the idea of wages creating a disjointed team and the club underperforming as a result. The studies performed by Campa, Royuela, Thrane, and Lucifora all touch upon the idea of measuring performance within soccer and seeing how they are measuring it is extremely useful as soccer is so multifaceted a good performance to someone may be terrible to someone else. Beginning with Campa he explored the transfer values of players and whether their performance matches their transfer. The way performance was measured was using variables based on position but wasn’t exactly the best way possible to measure performance (Campa, 2021). Following Campa, Royuela was looking at the success of teams not just individual success. The use of elo points is far more reliable and in terms of the options to measure success this has been the most effective I’ve seen (Royuela, 2018). For

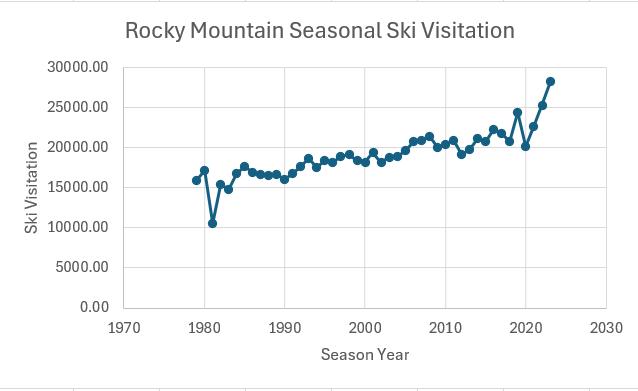

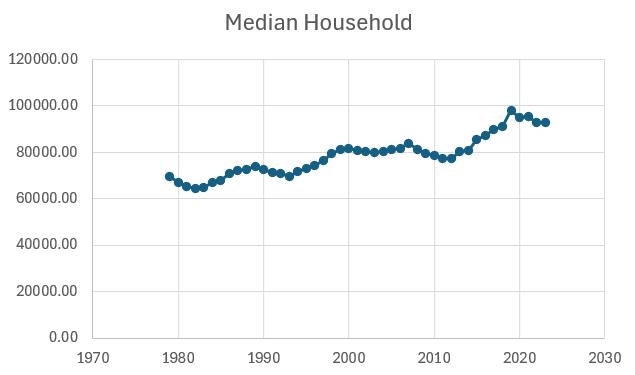

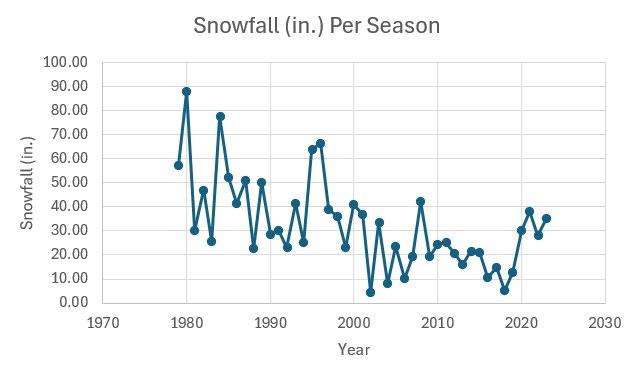

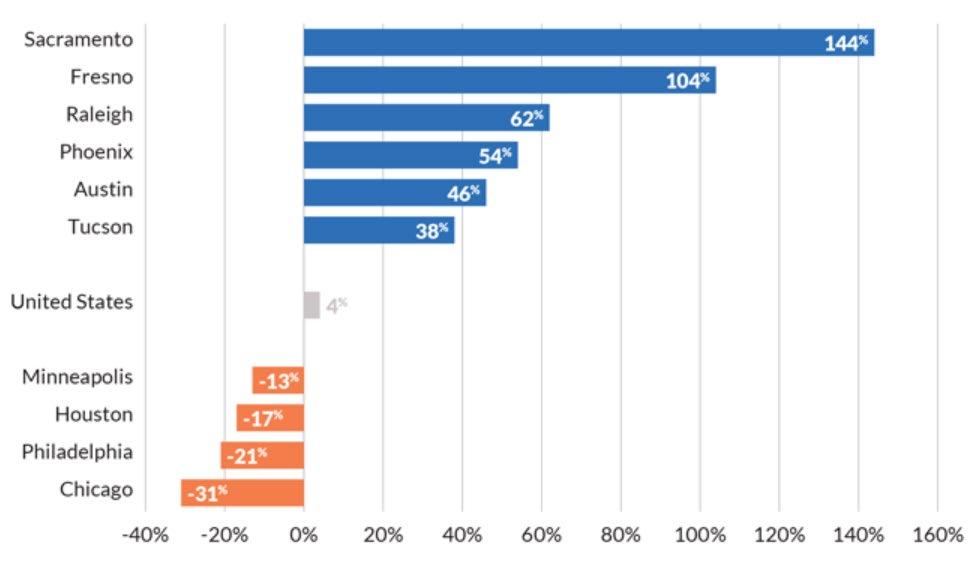

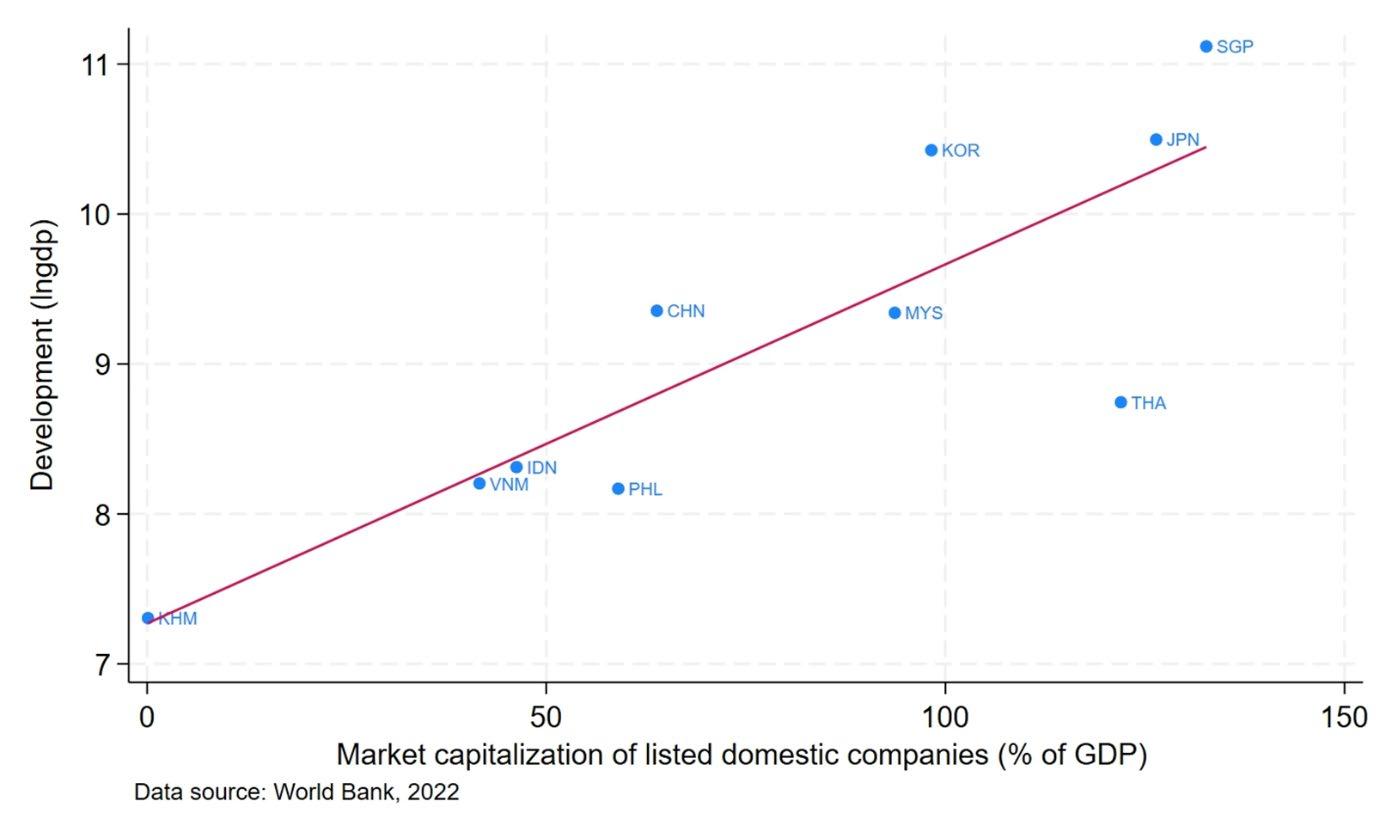

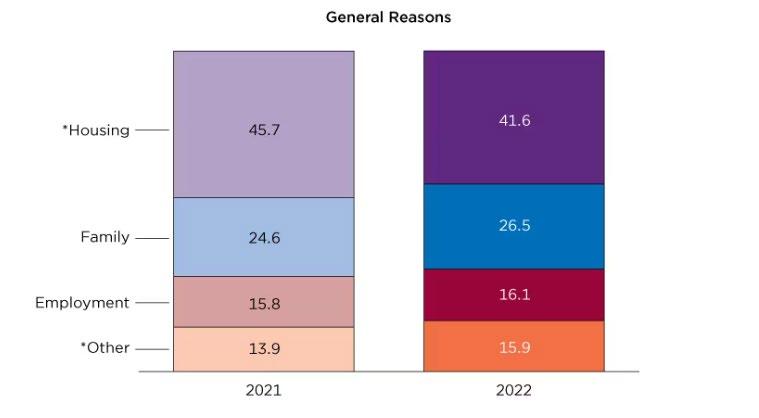

Empirical Economic Bulletin, Vol. 17 51