关于新加坡佛牙寺龙华院

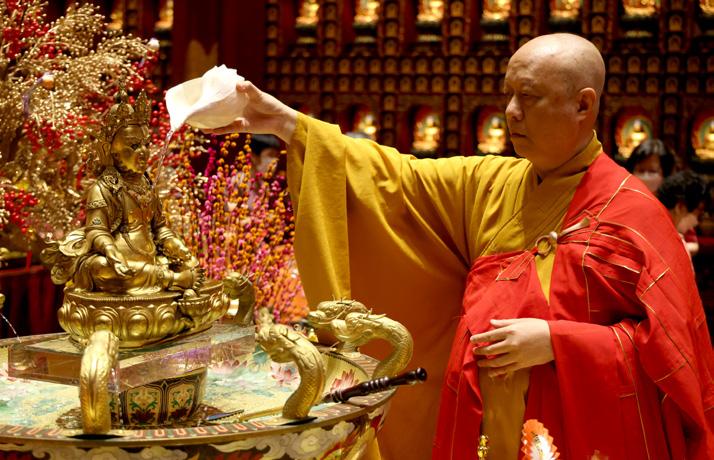

新加坡佛牙寺于2002年由法照大和尚创立,并于2003年2月20日在社团法令下注册成为宗教团体,于2004 年1月8日在新加坡慈善法令下注册成为慈善团体。新加坡佛牙寺在2005年成功筹集资金,在新加坡桥南路 288号建设一栋文化综合中心。文化综合中心于2007年竣工并命名为新加坡佛牙寺龙华院(BTRTM)。

新加坡佛牙寺龙华院正殿供养一尊庄严的弥勒尊佛,又称“一生补处菩萨”或又称“未来佛”。

Buddha Tooth Relic Temple (Singapore) (BTRTS) was founded in 2002 by Venerable Chao Khun Shi Fa Zhao BBM. It was registered as a society under the Societies Act on 20th February 2003, and as a charity under the Charities Act on 8th January 2004. BTRTS raised funds for the construction of a new cultural complex at 288 South Bridge Road Singapore 058840 in 2005. Construction of the cultural complex was completed in 2007 and it has been named Buddha Tooth Relic Temple and Museum (BTRTM).

BTRTM is dedicated to Bodhisattva Maitreya, who is regarded as the future Buddha.

在新加坡佛教、文化和传统中办演重要角色,并成 为杰出的佛教艺术与文化中心。

To play a vital role in the Buddhist, cultural and heritage landscape in Singapore and be an outstanding centre of Buddhist art and culture.

Mission 使命

• 受彌勒佛对人間真爱的啟发,我们的使命是: Inspired by Maitreya Buddha’s Values true love for the world, we seek to:

• 透过供奉舍利、文化及艺术弘扬佛教 Promote Buddhism through relic veneration, culture and art

• 提供佛教课程与研究 | Provide Buddhism courses and research

• 协助众生离苦得乐 | Relieve the suffering of all sentient beings

• 不分种族或宗教信仰,为贫病和需要援助者提 供福利服务

To provide welfare services to the sick, poor and needy, regardless of race or religion

我们遵循以下四个真爱元素的价值观:

• 慈无量 - 愿能给予别人幸福快乐

Boundless loving-kindness (maitri) - Giving happiness to others

• 悲无量 - 愿能帮助止息别人的痛苦

Boundless compassion (karuna) - Helping to ease the suffering of others.

• 喜无量 - 愿能将喜悦送给周围的人,因为他们 的幸福快乐而感到喜悦

Boundless joy (mudita) - Giving joy to others and feeling joyful because of their happiness.

• 舍无量 - 愿能不存分别心地接纳一切

Boundless equanimity (upeksa) - Treating everyone impartially.

当你爱时,是因为众生需要你的爱,而不是因 为他是你的家人、国家或宗教里的人。当到达 这种境界时,你就是在实践真爱。

If you love simply because the sentient beings need your love and not because they are your family or of same nationality or religion as you, you are indeed practising true love.

弥勒尊佛因位之万行圆备,果位之万德充满,住寿凝 然无去来。

The Buddha image represents Buddha Maitreya’s completeness of spiritual practice and perfections of virtues (paramitas), having achieved cessation of rebirth and death and neither appearing nor disappearing.

种子真言之心,于一切真言最为无上,乃一切佛部所 住处。

Om is a powerful bija (Sanskrit term, literally seed) mantra. It is considered a supreme mantra, hailed by all Buddhas.

佛光如晓日辉照世间,慈悲喜舍安置众生于善趣与 三乘。

The rays of light represent the four immeasurable virtues (i.e. kindness, compassion, joy, and equanimity) that pervade the world like the rays of rising sun that illuminate the world. The four immeasurable virtues help to ensure the rebirth of the sentient beings in higher realms of existence where they can achieve enlightenment through the three‘Vehicles’(‘Vehicle’means a mode or method of spiritual practice in Buddhism).

法界真如之常、乐、我、净四德。众生不被烦恼污染之 清净。

The Lotus represents the four sublime attributes of Nirvana (i.e. eternity, bliss, true self, and purity) which prevent the sentient beings from being tainted with afflictions, thus achieving tranquillity.

威权宏伟之势,愤怒镇慑之威,善静热烈之情。

The colour red represents the magnificent power of Buddha’s teachings that can suppress anger or hatred. It also represents fervent kindness and warmth.

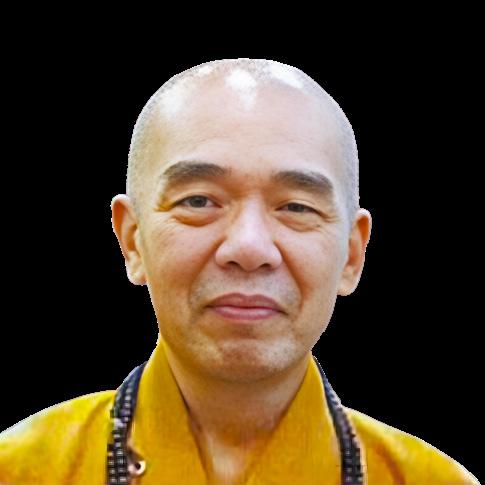

昭坤法照 BBM

Venerable Chao Khun

Fa Zhao BBM

创寺主席

Founding President

孙宇建先生

Mr Soon Yeu Kian

名誉秘书 Honorary Secretary

释续振

Venerable Shi Xu Zhen

副主席 Vice President

刘嘉扬居士

Mr Lau Kah Yong

严局渊医生

Dr Ngiam Kee Yuan

冯佩琦居士

Ms Fong Pui Kee, Jenny

苏智谦先生

Mr Saw Tee Kiam, James

名誉财政 Honorary Treasurer

陈炜强居士

Mr Tan Wui Khiang

助理名誉财政 Asst. Honorary Treasurer

林永车居士

Mr Lim Eng Koo BBM

梁江汉先生

Mr Patrick Neo Kang Han

郑嘉兴先生

Mr Tay Khay Heng, Jimmy

组织结构图 ORGANISATION

会长

昭坤法照 BBM President Ven. Chao Khun Fa Zhao BBM

理事会 Management Committee

僧伽 Sangha 小组委员会 Sub-Committees

执行董事 Executive Director

副执行董事 Deputy Executive Director

助理执行董事 Assistant Executive Director

财政与

行政部 Finance & Admin

Information Technology

Community Relations

Donor Relations

Facilities 莲芯膳坊 Lian Xin Restaurant

南无佛!尊敬的大德法师们,亲爱的善信们,大家吉祥! 我怀着深深的敬意和感激之情,代表新加坡佛牙寺向大家致辞。当我们聚在一起回顾过去一年的旅程,并展望未来时,我不 禁想起一则永恒的智慧箴言:“就像蜡烛不能没有火焰一样,人不能没有精神生活。”你们坚定不移的支持和奉献,成为了支 撑佛牙寺使命和活动的火焰。

以韧性迎接挑战

2023年是佛牙寺充满挑战和转变成长的一年。在通货膨胀压力增加和持续的国际冲突扰乱全球供应链的情况下,我们展示 了非凡的韧性和集体努力的力量。我们的僧伽部、工作人员和志工们的团结和奉献,使我们能够在这些艰难时期继续我们的 精神提升和社区服务工作。

致力于社会福利

在慈悲和仁爱的原则指导下,我们积极参与了众多社会福利活动。尽管面临经济压力和全球性动荡,我们的努力为社会中弱 势群体提供了重要支持。我们的素食食阁【莲芯膳坊】以低廉价格提供素食餐,这成为了我们承诺为社区提供健康、可负担餐 食的重要部分。

促进文化和精神和谐

遵循相依性的教导,我们也致力于促进文化和精神和谐。佛牙寺一直是精神成长和学习的圣地,提供多种多样的活动,如佛 学班,佛法讲座、禅修、禅茶和文化节庆。这些活动不仅培养了信众的精神福祉,也促进了不同社区之间的理解和团结。 展望更加光明的未来

华严经云:“菩提心灯,大悲为油,大愿为炷,光照法界。”受到这一教导的启发,我们致力于广泛传播智慧、慈悲和和平的光 芒。尽管面临经济挑战和全球性动荡,我们将继续拓展我们的社会和文化项目,努力创造一个更加融洽与和谐的社会。

最后,我向每一位对佛牙寺给予不懈支持和奉献的人表达最深切的感谢。让我们共同走在佛法的道路上,用我们的集体光芒 和慈悲照亮世界。

谢谢大家,愿你们平安喜乐、福慧圆满。

Namo Buddhaya! Respected Sangha and dear devotees, blessings to all!

It is with deep reverence and gratitude that I address you today on behalf of the Buddha Tooth Relic Temple Singapore. As we gather to reflect on the past year’s journey and set our sights on the future, I am reminded of the timeless wisdom: “Just as a candle cannot burn without fire, human cannot live without a spiritual life.”Your unwavering support and dedication have been the flame that has sustained our temple’s mission and activities.

Embracing Challenges with Resilience

The year 2023 has been one of profound challenges and transformative growth for our temple. Amidst rising inflationary pressures and ongoing international conflicts that have disrupted global supply chains, we have demonstrated remarkable resilience and the power of collective effort. The commitment and unity of our Sangha, staff, and volunteers have enabled us to navigate these difficult times while continuing our work of spiritual enrichment and community service.

Commitment to Social Welfare

Guided by the principles of compassion and loving-kindness, we have actively engaged in numerous social welfare initiatives. Despite economic strains and global disruptions, our efforts have provided vital support to the underprivileged and vulnerable members of our society. Our food court, Lian Xin Vegetarian Restaurant, which offers vegetarian food at economical prices, has been a significant part of our commitment to making healthy, affordable meals accessible to our community.

Fostering Cultural and Spiritual Harmony

In alignment with the teaching of interdependence, we have also focused on fostering cultural and spiritual harmony. Our temple has been a sanctuary for spiritual growth and learning, offering a variety of programs such as Buddhism courses, Dharma talks, meditation class, Zen Tea and cultural festivals. These activities have not only nurtured the spiritual wellbeing of our devotees but also promoted understanding and unity among diverse communities.

Looking Towards a Brighter Future

As mentioned in the Avatamsaka Sutra:“Bodhicitta lamp: Great compassion as the oil. Great vows as the wick, illuminating the Dharma realm.”Inspired by this teaching, we are committed to spreading the light of wisdom, compassion, and peace far and wide. Despite the economic challenges and global disruptions, we will continue to expand our social and cultural initiatives, striving to create a more harmonious and enlightened society.

In closing, I extend my deepest gratitude to each of you for your unwavering support and dedication to the Buddha Tooth Relic Temple. Together, let us walk the path of Dharma, illuminating the world with our collective light and compassion.

Thank you all, and may you be blessed with inner peace, joy, and good health on this bodhi journey together.

Yours in the Dharma,

昭坤法照 BBM

Chao Khun Fa Zhao BBM 新加坡佛牙寺创寺会长

Founder and President

Buddha Tooth Relic Temple (Singapore)

寺务部是佛牙寺的关键部门,负责组织法会、共修以及管理零售业务。我们在培养与信众的牢固关系方面发 挥着至关重要的作用,确保信众的需求和贡献得到最高水平的服务和尊重。我们致力于为所有信众提供优质 服务,了解并协助他们在佛牙寺所需的服务和产品,并增强佛牙寺与信众之间的紧密关系。

通过多达四个前台服务柜台,信众的慷慨可以通过我们友好的员工或自助服务亭在佛牙寺以多种方式表达, 包括:

• 认捐经书、文物和佛教饰品

• 参与各种佛教仪式及法会

• 在安养堂安奉祖先莲位

• 参加周年纪念日仪式

• 奉献香花和明灯供养诸佛菩萨

• 供养尊敬的僧伽和提供公众的素食 此外,我们还组织海外佛教朝圣旅游,并为我们的信众安排特别的旅游配套。

The Donor Relations Department is a key component of BTRTM, responsible for organising Buddhist ceremonies, group practices, and managing retail operations. This department plays a crucial role in fostering strong relationships with donors and ensuring their needs and contributions are met with the highest level of service and respect. We aim to provide excellent service to all our donors by understanding and assisting them with their needs regarding the services and products available at BTRTM, and by enhancing the close relationship between BTRTM and our donors.

With up to four Front Office service counters, donors’generosity can be expressed in various ways at BTRTM through our friendly staff or self-service kiosks, including:

• Sponsorship of BTRTM’s sutra books, artifacts, and Buddhist ornaments

• Participation in various Buddhist ceremonies

• Sponsorship of ancestral tablets in the Ancestral Hall

• Participation in ceremonies on anniversary observance days

• Offerings of flowers and lights

• Sponsorship of vegetarian meals for the venerable Sangha and the public

Additionally, we organise overseas pilgrimage tours and arrange special tour packages for our devotees.

药师佛圣诞法会 Buddha Bhaisajyaguru Blessing Ceremony

母亲节祈福会 Mother’s Day Celebrations

上供 Offerings to Buddha 冬至法会 Winter Solstice Festival Ceremony

禳星祈福法会 Protection and Blessing Ceremony

演放焰口 Offerings to Pretas

黄财神法会

接太子 - 传灯 Light Offerings and Bathing of the Buddha

三归五戒 Three Refuges & Five Precepts Ceremony

全年 共修梁皇宝忏

每个月的

第一个星期日

-

Blessing Ceremony (Zodiac Cow and Tiger)

04 Oct - 06 Oct Vimalakirti Sutra Group Practice 08 Oct Eight Precepts Ceremony

10 Oct - 12 Oct Cundi Repentance Group Practice 18 Oct Bodhisattva Acala Blessing Ceremony (Zodiac Rooster)

23 Oct - 29 Oct Protection and Blessing Ceremony

庆生感恩会

每个月的 农历初一 弥勒法会

01月07日 - 01月08日 太岁值年还愿会

01月12日 - 01月16日 黄财神法会

01月22日 - 01月27日 新春祈福法会

01月30日 玉皇尊天诞 - 供佛斋天法会

02月03日 - 02月04日 安太岁保运会

02月05日 扛大藏经开运招福会/供万盏灯

02月09日 - 03月02日 华严经共修卷

03月03日 - 03月04日 华严忏法会

03月06日 - 03月10日 庆祝观音菩萨圣诞

03月12日 庆祝肖龙肖蛇守护本尊普贤菩萨圣诞法会

03月14日 - 03月16日 海龙王经共修

03月18日 八关斋法会

03月24日 - 03月27日 大方广圆觉经共修

03月30日 - 04月01日 僧伽吒经共修

04月04日 - 04月05日 清明法会 - 演净请圣/告赦安灵

04月08日 - 08月23日 大般若经共修卷

04月15日 - 04月16日 文殊开智祈福会

05月01日 三归五戒

05月12日 庆祝肖鼠守护本尊千手观音菩萨圣诞法会

05月14日 母亲节祈福会 - 佛说父母恩重难报经

05月22日 庆祝肖兔守护本尊文殊菩萨圣诞法会

05月25日 接太子 - 传灯

05月27日 庆祝肖羊肖猴守护本尊大日如来圣诞法会

06月02日 - 06月04日 卫塞节 - 庆祝释迦牟尼佛圣诞法会/礼金刚宝忏/药 师经

06月18日 父亲节祈福会 - 佛说父母恩重难报经

06月22日 昭坤法照生日祈福会

07月21日 庆祝肖牛肖虎守护本尊虚空藏菩萨圣诞法会

08月05日 观音菩萨成道日 - 礼千佛名经卷中

08月09日 国庆祈福会 - 诵护国仁王经

08月28日 庆祝肖马守护本尊大势至菩萨圣诞法会

08月29日 - 09月02日 盂兰胜会

09月10日 - 09月14日 庆祝地藏菩萨圣诞

09月16日 - 09月17日 进考祈福会

09月18日 庆祝黄财神圣诞法会 - 礼金刚宝忏

09月25日 - 09月29日 尊胜佛母护摩会

10月04日 - 10月06日 维摩诘所说经共修

10月08日 八关斋法会

10月10日 - 10月12日 准提忏共修

10月18日 庆祝肖鸡守护本尊不动明王圣诞法会

10月23日 - 10月29日 禳星祈福法会

11月02日 观音菩萨出家日 - 礼千佛名经卷下

11月05日 - 11月12日 药师佛圣诞法会

11月15日 - 11月16日 楞严经共修

11月21日 - 11月27日 供佛大斋天祈福法会

11月29日 - 12月01日 大乘金光明经共修

12月04日 - 12月06日 诵佛母大孔雀明王经会

12月08日 - 12月10日 法华经共修

12月11日 - 12月12日 法华忏共修

12月15日 - 12月17日 占察善恶业报经共修

12月21日 - 12月22日 冬至法会

12月24日 三归五戒

12月26日 无量寿经共修

12月27日 大阿弥陀经共修

12月28日 净土忏共修

12月29日 庆祝肖狗肖猪守护本尊阿弥陀佛圣诞法会

Introduction 介绍

受弥勒佛爱世精神的启发,我们致力于通过社区参与来回馈社会并推广佛教。我们的使命包括通过文化、艺 术和佛教相关课程来推广佛教,并为所有需要帮助的人提供福利服务,无论其种族、性别、宗教或国籍。以下 是我们在2023年对社区的贡献概述。

Inspired by Maitreya Buddha’s love for the world, we are dedicated to engaging the community to give back to society and promote Buddhism. Our mission encompasses promoting Buddhism through culture, art, Buddhism-related courses, and offering welfare services to those in need, regardless of race, gender, religion, or nationality. In alignment with our mission, here is a summary of our contributions to the community in 2023.

总统挑战是一项呼吁来自各行各业的人们齐心协力关怀不幸人士的一项慈善运动。佛牙寺每年在卫塞节向 总统挑战捐款。2023 年也不例外,我们为总统挑战捐赠了 $50,000。

The President’s Challenge represents a coming together of people from all walks of life to help those who are less fortunate. We donate to the President’s Challenge annually on Vesak Day. 2023 is no exception and we contributed $50,000 to the President’s Challenge.

每年在农历新年元宵节期间,我们会邀请来自万达、振瑞和惹兰固哥乐龄活动中心的300位老年人,与我们一 起庆祝新年。活动中提供素食晚餐,并特别安排了文化表演,让他们享受节日气氛。在晚宴期间,还会向他们 分发红包和装有生活必需品的“慈爱袋”。这是我们对那些为新加坡的国家建设和进步做出重大贡献的老年 人表达感激和感谢的一种方式。

Every year, during the Chinese New Year Yuan Xiao Festival, we invite 300 senior citizens from three Kreta Ayer Senior Activity Centres to celebrate Chinese New Year with us. Vegetarian dinners are served, along with cultural performances specially arranged for them to enjoy the festive season. Hong Baos (red packets) and Maitri Bags (containing essentials) are also distributed during the dinner event. This is our way of showing gratitude and appreciation to our seniors, who have contributed significantly to Singapore’s nation-building and progress.

Annual Vesak Day 年度卫塞节庆祝活动及晚宴

卫塞节是世界各地佛教徒的重要日子,纪念释迦牟尼佛的诞生、成道和涅槃。许多佛寺会举行各种仪式。佛牙

寺每年在这一天还会安排300邀请來自万达、振瑞和惹兰固哥乐龄活动中心的三百位年长人士的老人们共进 素食晚餐,观看文化表演。我们还会为每位参加佛诞庆典的老人派发红包和慈爱袋。这是我们表达对新加坡 年长者在国家建设过程中所扮演角色的感激之情的一种方式。同时让他们参加庆祝这一重要场合。

Vesak Day is significant for Buddhists worldwide, honouring Buddha Shakyamuni’s Birth, Enlightenment, and Mahaparinirvana. Many temples hold ceremonies. We host 300 seniors from three Kreta Ayer Senior Activity Centres in Chinatown annually. They enjoy a vegetarian dinner, cultural performances, and receive red packets and goodie bags. This gesture expresses gratitude to Singapore’s elderly for their role in nation-building and supports underprivileged seniors in Chinatown.

我们一直在举办年度流感疫苗接种活动,邀请来自万达、振瑞和惹兰固哥乐龄活动中心的300位老年人前来 佛牙寺免费接种流感疫苗。这些疫苗由Infectious Disease Partners Pte Ltd的黄乘佑医生慷慨捐赠。黄医 生和他的一队敬业护士也会在现场为老人们接种流感疫苗。

在2023年,我们很荣幸邀请到牛车水-金声民众联络所的名誉主席张亦辉先生作为活动的主宾。张亦辉先生 向老年参与者分发了慈爱袋。

We have been conducting the Annual Flu Vaccination event, where 300 elderly individuals from the Banda, Chin Swee and Jalan Kukoh Senior Activity Centres are invited to BTRTM to receive free flu vaccinations. The vaccines have been generously donated by Dr. Wong Sin Yew of Infectious Disease Partners Pte. Ltd. Dr. Wong and his team of dedicated nurses are also on-site to administer the flu vaccinations.

In 2023, we were honoured to have Mr Danny Chong, Patron of Kreta Ayer-Kim Seng CCC, as our guest of honour for the event. MR Danny Chong distributed Maitri Bags to the elderly attendees.

Buddhism Courses: Basic 1, Basic 2 & Intermediate (25 February to 29 September 2023)

佛学班 : 初級佛學1,2 中級佛學班- 2月 25日到年9月29日

我们很荣幸也很感激昭坤法照大和尚, 宝深法师,道宏法师和永佳法师, 无私地与学生们分享佛法。2023年 的课程是在周日举办。

We were honoured and grateful to have Ven. Chao Kun Fa Zhao, Ven. Bao Shen, Ven. Dao Hong and Ven. Yong Jia who selflessly shared Dharma with the students. The classes in 2023 were held on Sundays.

在2023年10月17日和18日,由开照法师主持的为期两天的慈爱禅修课程成功举办。课程深受欢迎,参与者从 开照法师的指导中受益匪浅。

On 17 and 18 October 2023, a two-day Meta Bhavana (loving-kindness) meditation course was conducted by Ven. Khai Zhao. The course was well-received, and participants greatly benefited from Ven. Khai Zhao’s guidance.

这座珍贵而重要的砂岩佛教石碑,可追溯至东魏时 期,于2023年新近收购,目前在博物馆展出。石碑雕刻 精美,中央人物很可能是释迦牟尼佛。这次收购与我 们通过艺术推广佛教的使命相一致,并且补充了博物 馆的一个主题:佛陀的一生。

This rare and significant sandstone Buddhist stele, dating back to the Eastern Wei dynasty, was newly acquired in 2023 and is now on display at the museum. Exquisitely sculpted, the stele features a standing central figure, likely Buddha Shakyamuni. This acquisition aligns with our mission of promoting Buddhism through art and complements one of the museum’s themes: the Life of Buddha.

慈明学校洒净开启仪典

南普陀寺

南普陀寺

莲芯膳坊,前身为五观堂,多年来一直为僧侣和虔诚的人士提供美味的素食。2022年,莲芯膳坊进行了翻新, 并向公众开放,旨在通过其高质素的素食来为社区服务,并传播佛陀的教义。

Lian Xin Restaurant, formerly known as Wu Guang Tang, has been serving delicious vegetarian meals for monks and devotees for many years. In 2022, Lian Xin underwent a renovation and opened its doors to the public, aiming to serve the community with its high-quality vegetarian meals and spread the teachings of Buddha through its food.

我们在莲芯膳坊的使命是为社区提供实惠、健康和美味的素食,同时推广佛陀关于慈悲、正念和可持续性的 教义。

Our mission at Lian Xin is to provide affordable, healthy, and delicious vegetarian meals to the community while promoting the teachings of Buddha on compassion, mindfulness, and sustainability.

在2023年,莲芯膳坊加强了在社区内的存在,坚定地向公众提供优质素食,并积极参与各种社区活动。我们

最引以为豪的成就之一是我们对在春节和卫塞节期间提供免费餐点的承诺。这一举动使我们得以触及更广 泛的受众,倡导素食主义的美德,为那些面临食品不安全问题的人提供安慰。

Throughout 2023, Lian Xin strengthened its presence within the community, steadfastly delivering premium vegetarian fare while actively engaging in various communal activities. One of our proudest achievements was our commitment to providing complimentary meals during both Chinese New Year and Vesak Day. This gesture allowed us to reach a wider audience, advocating the virtues of vegetarianism and providing comfort to those facing food insecurity.

莲芯膳坊还参与了一些活动,如农历新年晚宴、创办会长 - 昭坤法照华诞斋僧法会以及其他社区活动。这些活 动让我们有机会向更广泛的观众展示我们的高质素素食,并与那些与我们价值观和使命相符的人士建立联系。

Lian Xin actively participated in a variety of events throughout the year, including the esteemed Chinese New Year dinner and commemorating the birthday of our revered founding president, Venerable Chao Khun Fa Zhao. These events served as platforms for us to showcase the splendor of our vegetarian cuisine, forging connections with individuals who share our values and mission.

展望未来,莲芯膳坊将坚定不移地致力于捍卫素食主义的优点,为社区提供价格合理、美味可口的餐点。我们 设想通过多样化我们的烹饪产品、与志同道合的组织建立联盟,并为那些在牛车水范围内的人提供外部餐饮 服务。我们的目标是扩大我们的信息和使命的影响力,确保每个人都能获得滋养的素食选择。

Looking ahead, Lian Xin remains committed to championing the merits of vegetarianism and providing affordable, delectable meals to our community. We envision expanding our influence by diversifying our culinary offerings, forming alliances with like-minded organisations, and venturing into outside catering services for those in the Chinatown vicinity. Our goal is to extend the reach of our message and mission, ensuring that everyone has access to nourishing vegetarian options.

回顾2023年的成就,莲芯膳坊自豪地屹立,准备继续传承我们为社区提供优质素食和通过我们的烹饪工艺践 行佛陀教义的遗产。我们向我们的顾客、合作伙伴和支持者表示衷心的感谢,期待着前进和扩张之旅的到来。

As we reflect on the achievements of 2023, Lian Xin Restaurant stands proud, poised to continue our legacy of serving the community with exceptional vegetarian cuisine and upholding the teachings of Buddha through our culinary craft. We extend heartfelt gratitude to our patrons, partners, and supporters for their continued patronage, and eagerly anticipate the journey of growth and expansion that lies ahead.

设备维修部的目标是提供一个安全、可持续和有利的工作场所,重点为实现佛牙寺的目标。设备维修部部通 过设施规划和管理采用最佳做法解决日常设施挑战,确保寺佛牙寺的顺利运营,实现成本效益。在设备维修 部负责通过综合设施管理、设施规划、营运和维修,卫生清理服务, 防火措施和保安,并且协助法会、庆典等活 动的场地设置的工作。

The Facilities Department’s aim is to provide a safe, sustainable, and conducive workplace that supports BTRTM’s objectives. Through effective facilities planning and management, the Facilities Department addresses daily facility challenges and adopts best practices to ensure the smooth operations of BTRTM, achieving cost-effectiveness. Additionally, the Facilities Department manages our outsourced partners for Integrated Facilities Management, Housekeeping, Fire Safety, Security and facilitates the setting up of festive decorations.

佛牙寺即将迎来二十周年,在定期结构检查(PSI)期间发现了各种退化和小缺陷。此外,喷涂的红漆是采用生 漆工艺是自2007年施工上漆至今,随着时间的推移已经褪色,颜色缺乏丰富性。

As the temple approaches its 20th anniversary, various deterioration and minor defects were detected during the Periodic Structural Inspection (PSI). The red lacquered paint, last applied in 2007, has faded over time and lost its richness.

因此,下一项重大工程是为寺院的建筑外墙木结构拟议维修和重漆工程,并按照指定专业工程师(PE)在PSI 期间的建议进行修复缺陷。

The next major project is therefore the repair and repainting of the temple’s exteriors and timber fixtures, to address the defects as recommended by the appointed Professional Engineer (PE) during the PSI.

维修及重漆工程将需要庞大捐款来资助该项目,该工程可能需要高达一千万元的巨额资金。

Funding is required for the proposed repair and repainting works, as the project may require a substantial sum of up to $10 million.

Listed below are some of the Facilities Department’s plans for 2024

以下是设备维修部2024年的部分计划:

• 拟议寺院外墙木结构维修及重漆工程

Proposed Repair and Repainting Works to Building Exteriors and Timber Fixtures

• 拟议提升门锁系统

Proposed Upgrade of the Card Access System

• 拟议安装电动汽车充电系统

Proposed Installation of Electric Vehicle charging stations

• 拟议设计莲芯膳坊新点心和面包摊

Proposed Addition of Dim Sum Stall & Bakery Kiosk for Lian Xin Vegetarian Restaurant

New eCommerce category additions to BTRTS website 新的网站服务类别添加到BTRTS网站

为了让信徒能够在线注册更多寺院服务和活动,我们已经在BTRTS网站上添加了以下网站服务类别:

To enable devotees to register more selections of temple services and activities online, we have added the following eCommerce categories to our BTRTS website:

• Services 服务

信徒现在可以在我们的BTRTS网站上注册各种7天燃灯祈福/追善和其他相关服务。探索诸如生诞、 事业和家庭等类别,以找到适合您的推荐。

Devotees can now register for various 7-day blessing/memorial lamps and other related services on our BTRTS website. Explore sub-categories such as Birth, Business/Career, and Family to find recommendations.

• Events 活动

信徒现在可以在我们的BTRTS网站注册课程、庆生一日游及本地一日游。

Courses, monthly birthday trips, and local tours are available for online booking. Devotees can•express interest in Dharma and meditation courses, as well as monthly outings from our BTRTS website.

Expanding our online presence 扩展我们的在线存在 除了我们的主要BTRTS网站之外,我们还推出了两个新平台以更好地与社区联系:

In addition to our main BTRTS website, we have launched two new platforms to better connect with our community:

• BTRTS电子商务商店(https://www.buddhatoothrelictemple.org.sg/eshop) 随意浏览独家的手链、钥匙扣等选择。我们的电子商店为本地在线订单提供服务,将佛牙寺的一部分 带到您家门口。

BTRTS eShop (https://www.buddhatoothrelictemple.org.sg/eshop )

Browse exclusive selections of bracelets, keychains, and more at your leisure. Our eShop serves local online orders, bringing a piece of Buddha Tooth Relic Temple to your doorstep.

• 莲芯膳坊网站(https://www.buddhatoothrelictemple.org.sg/lianxin)

口碑传播促使我们创建了莲芯膳坊网站。通过我们的新莲芯膳坊网站,您可以随时了解餐厅的通告。

Lian Xin Vegetarian Restaurant website (https://www.buddhatoothrelictemple.org.sg/ lianxin )

Word-of-mouth recommendations have led us to create the Lian Xin Vegetarian Restaurant website. Stay informed about our restaurant updates via our new Lian Xin Vegetarian Restaurant website!

New technology upgrades 新科技升级

跟上科技的步伐,为了提供更好的服务我们实施了以下项目:

Staying current with technology ensures better service for our devotees:

• Teams Voice

我们的电话线现在在云端中运行!Teams Voice为打电话到寺院的信徒提供无缝的电话体验。

Our telephone lines now operate in the cloud! Teams Voice provides a seamless telephony experience for donors calling into the temple.

• Virtual temple kiosks 虚拟寺院亭

将虚拟寺院与实体寺院整合,互动式亭子允许信徒在参观寺院时浏览我们的网站。

Integrating our virtual temple with the physical temple, interactive kiosks allow devotees to explore our website during their temple visits.

在我们2024年的路线图上,我们计划了以下项目:

On our roadmap of year 2024, we have scheduled the following line-up:

• Kiosk v3

我们的自助亭即将被升级了!自助亭(第三版)将具备改进的用户界面,使信徒更容易获取信息和服 务。此外,我们将NETS添加成支付方式之一。这一增强旨在为所有访客提供无缝体验。

We are excited to announce the upcoming upgrade of our kiosks! Kiosk v3 will feature an improved user interface, making it easier for devotees to access information and services. Additionally, we are adding NETS as one of the accepted payment modes. This enhancement aims to provide a seamless experience for all visitors.

为了提高效率,我们将实施家族谱功能。该功能将允许我们记录信徒之间的家族关系。通过这样做, 我们简化了祖先服务的注册流程,节省时间并确保准确性。

In our commitment to efficient service, we will be implementing a Family Tree function. This feature will allow us to record familial relationships among devotees. By doing so, we streamline the registration process for ancestral services, saving time and ensuring accuracy.

佛牙寺信徒是本寺的核心,我们想要表达我们的感激之情。通过忠诚计划,我们以独家优惠和服务来 奖励与庆祝对佛牙寺做出贡献的功德主。

Our devotees are the heart of our community and we want to express our gratitude. Through this initiative, we will celebrate and honor lifetime contributions to the Buddha Tooth Relic Temple. Exclusive perks and services await our dedicated supporters.

BUDDHA TOOTH RELIC TEMPLE (SINGAPORE)

(Registered in Singapore)

UEN No. T03SS0035G

(Registered under the Singapore Societies Act 1966 and Charities Act 1994)

FINANCIAL STATEMENTS

31 December 2023

UHY LEE SENG CHAN & CO Public Accountants and Chartered Accountants

We have audited the financial statements of Buddha Tooth Relic Temple (Singapore) (the Temple), which comprise the statement of financial position of the Temple as at 31 December 2023, and the statement of financial activities, statement of changes in funds and statement of cash flows of the Temple for the year then ended, and notes to the financial statements, including material accounting policy information.

In our opinion, the accompanying financial statements are properly drawn up in accordance with the provisions of the Societies Act 1966 (the Societies Act), the Charities Act 1994 and other relevant regulations (the Charities Act and Regulations) and Charities Accounting Standard (CAS) so as to present fairly, in all material respects, the state of affairs of the Temple as at 31 December 2023 and of the results, changes in funds and cash flows of the Temple for the year ended on that date.

We conducted our audit in accordance with Singapore Standards on Auditing (SSAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Temple in accordance with the Accounting and Corporate Regulatory Authority (ACRA) Code of Professional Conduct and Ethics for Public Accountants and Accounting Entities (ACRA Code) together with the ethical requirements that are relevant to our audit of the financial statements in Singapore, and we have fulfilled our other ethical responsibilities in accordance with these requirements and the ACRA Code. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

The Management Committee is responsible for the other information. The other information comprises the information included in the Statement by the Management Committee set out on page 1.

Our opinion on the financial statements does not cover the other information and we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit, or otherwise appears to be materially misstated. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

Independent Auditor’s Report to the Members of Buddha Tooth Relic Temple (Singapore)

Management is responsible for the preparation and fair presentation of the financial statements in accordance with the provisions of the Societies Act, the Charities Act and Regulations and CAS, and for such internal control as the Management Committee determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the Management Committee is responsible for assessing the Temple’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Temple or to cease operations, or has no realistic alternative but to do so.

The Management Committee’s responsibilities include overseeing the Temple’s financial reporting process.

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with SSAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with SSAs, we exercise professional judgement and maintain professional scepticism throughout the audit. We also:

• Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Temple’s internal control.

• Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the Management Committee.

December 2023

7,773,571

Statement of Financial Activities Financial year ended 31 December 2023

The accompanying notes form part of these financial statements.

Tooth Relic Temple (Singapore)

Statement of Changes in Funds

Financial year ended 31 December 2023

The accompanying notes form part of these financial statements.

Statement of Cash Flows

Financial year ended 31 December 2023

Notes to the financial statements

31 December 2023

These notes form part of and should be read in conjunction with the accompanying financial statements.

Buddha Tooth Relic Temple (Singapore) (the Temple) was registered as a Society under the Societies Act 1966 on 20 February 2003 and as a Charity under the Charities Act 1994 on 8 January 2004 with its registered office and principal place of business located at 288 South Bridge Road, Singapore 058840.

The principal objectives of the Temple are:

to develop a Chinese Buddhist cultural complex to venerate the Sacred Buddha Tooth & Relics;

to promote and showcase Buddhism, Chinatown and Singapore culture;

to provide Buddhist education and research;

to support other Voluntary Welfare Organisations; and

to support welfare services to the sick, poor and needy, regardless of race or religion.

The financial statements of the Temple for the financial year ended 31 December 2023 were authorised for issue by the Management Committee on 7 May 2024.

2.1

The financial statements of the Temple have been prepared in accordance with the Charities Accounting Standard (CAS) issued by the Singapore Accounting Standard Council. The financial statements have been prepared under the historical cost convention, except as otherwise disclosed in the accounting policies below.

The financial statements are presented in Singapore dollar ($), which is the functional currency of the Temple.

The accounting policies adopted are consistent with those of the previous financial year except that in the current financial year, the Temple has adopted all the new and revised CAS that are relevant to its operations and effective for annual period beginning on 1 January 2023. The adoption of these new/revised CAS does not have any effect on the financial statements of the Temple.

Notes to the financial statements

31 December 2023

2. Material accounting policy information (continued)

2.2

Investments in financial assets are investments in debt instruments.

Investments in financial assets are recognised as an asset when the Temple becomes a party to the contractual provision of the instrument and are initially measured at cost. Cost of investments in financial assets is the transaction price excluding transaction costs, if any. Transaction costs are recognised as expenditure in Statement of Financial Activities as incurred.

Investments in financial assets are measured subsequently at cost less any impairment losses. Investments in financial assets are not measured at fair value subsequent to initial recognition.

2.3

Other receivables excluding prepayments shall be initially recognised at their transaction price, excluding transaction costs, if any. Transaction costs shall be recognised as expenditure in the Statement of Financial Activities as incurred. Prepayments shall be initially recognised at the amount paid in advance for the economic resources expected to be received in the future.

After initial recognition, other receivables excluding prepayments shall be measured at cost less any accumulated impairment losses. Prepayments shall be measured at the amount paid less the economic resources received or consumed during the financial year.

2.4

The Temple assesses at each reporting date whether there is objective evidence that a financial asset or a group of financial assets is impairment and recognises an impairment loss immediately in the Statement of Financial Activities when such evidence exists.

An allowance for impairment is established when there is evidence that the Temple will not be able to collect all amounts due according to the original term of the receivables. To determine whether there is objective evidence that an impairment loss has been incurred, the Temple consider assessable data that come to the attention of the Temple.

The recognised impairment loss is subsequently reversed if the amount of the impairment loss decreases and the decrease is related objectively to an event occurring after the impairment is recognised. The reversal shall not result in a carrying amount of the financial assets, net of any allowance account that exceeds what the carrying amount would have been had the impairment not previously been recognised. The reversal of impairment loss is recognised in the Statement of Financial Activities.

Notes to the financial statements 31 December 2023

2. Material accounting policy information (continued)

Trade and other payables (excluding accruals), are recognised at their transaction price, excluding transaction costs, if any, both at initial recognition and at subsequent measurement. Transaction costs are recognised as expenditure in the Statement of Financial Activities are incurred. Accruals are recognised at the best estimate of the amount payable.

Financial liabilities are recognised on the balance sheet when, and only when the Temple become a party to the contractual provisions of the financial statements. The Temple derecognises financial liabilities when, and only when, the Temple’s obligations are discharged, cancelled or expired.

2.6

All items of property, plant and equipment are initially recorded at cost. Subsequent to recognition, property, plant and equipment are measured at cost less accumulated depreciation and any accumulated impairment losses. The cost of property, plant and equipment includes its purchase price and any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management. Dismantlement, removal or restoration costs are included as part of the cost of property, plant and equipment if the obligation for dismantlement, removal or restoration is incurred as a consequence of acquiring or using the property, plant and equipment.

Depreciation of property, plant and equipment is calculated using the straight-line method to allocate depreciable amounts over their estimated useful lives. The estimated useful lives are as follows:

Notes to the financial statements

31 December 2023 2. Material accounting policy information (continued)

(continued)

Fully depreciated property, plant and equipment are retained in the financial statements. The residual value, useful lives and depreciation method are reviewed at the end of each reporting period, and adjusted prospectively, if appropriate.

An item of property, plant and equipment is derecognised upon disposal or when no future economic benefits are expected from its use or disposal. Any gain or loss on derecognition of the asset is included in profit or loss in the year the asset is derecognised.

Inventories are stated at the lower of cost and net realisable value. Cost is determined primarily on a first-in-first-out method and includes cost of purchase and other costs incurred in bringing the inventories to their present location and condition. Where necessary, write-down is made for deteriorated, damaged, obsolete and slow-moving inventories to adjust the carrying value of inventories to the lower of cost and net realisable value. Net realisable value is the estimated selling price in the ordinary course of business, less estimated costs of completion and estimated costs necessary to make the sale.

Income is recognised in the statement of financial activities when the following three factors are met:

The Temple becomes entitled to the income;

The Temple is virtually certain that it will receive the income; and

The amount of the income can be measured with sufficient reliability

Donations

Donations are recognised on receipt basis.

Donations-in-kind are recognised when the fair value of the donations-in-kind can be estimated with sufficient reliability.

Charitable incomes

Charitable incomes are generated from charity events and ceremonies. They are recognised on both receipt basis and accrued as and when they are committed.

Income from the sale of goods is recognised when the Temple has delivered the products to the customer; the customer has accepted the products and the collectability of the related receivables are reasonably assured.

Notes to the financial statements 31 December 2023

2. Material accounting policy information (continued)

2.8 Income recognition (continued)

Income from services

Income from services is recognised over the period in which the services are rendered, by reference to completion of the specific transaction assessed on the basis of the actual service provided as a proportion of the total services to be performed.

Interest income on banks’ current accounts, fixed deposits and investments in financial assets placed with financial institutions are recognised on a time-proportion basis using the effective interest method.

2.9

Employee entitlements to annual leave are recognised as a liability when they accrue to employees. The estimated liability for annual leave is recognised for services rendered by employees up to the end of the reporting period.

Contributions to defined contribution plans are recognised in the same financial year as the employment that gives rise to the contributions.

Provisions are recognised when the Temple has a present obligation (legal or constructive) as a result of a past event, it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation and the amount of the obligation can be estimated reliably.

Provisions are reviewed at the reporting date and adjusted to reflect the current best estimate. If it is no longer probable that an outflow of economic resources will be required to settle the obligation, the provision is reversed. If the effect of the time value of money is material, provisions are discounted using a current pre-tax rate that reflects, where appropriate, the risks specific to the liability. When discounting is used, the increase in the provision due to the passage of time is recognised as a finance cost.

Operating leases - where the Temple is a lessee

Leases where a significant portion of the risks and rewards of ownership are retained by the lessors are classified as operating leases. Payments made under operating leases are recognised in statement of financial activities on a straight-line basis over the period of the lease.

Notes to the financial statements

31 December 2023

2. Material accounting policy information (continued)

2.11

(continued)

Operating leases - where the Temple is a lessee (continued)

When an operating lease is terminated before the lease period has expired, any payment required to be made to the lessor by way of penalty is recognised as an expense in the period in which the termination takes place.

Goods and Services Tax (GST)

Revenues, expenses and assets are recognised net of the amount of GST except:

Where the GST incurred on a purchase of assets or services is not recoverable from the taxation authority, in which case the GST is recognised as part of the cost of acquisition of the asset or as part of the expense item as applicable; and

Receivables and payables that are stated with the amount of GST included.

The net amount of GST recoverable from, or payable to, the taxation authority is included as part of receivables or payables in the statement of financial position.

Cash and cash equivalents include cash on hand, cash at banks and deposits with financial institutions that are subject to an insignificant risk of change in value. Cash and cash equivalents are carried at cost.

Fixed deposits that have short maturities of three months or less from the date of acquisition are included in cash and cash equivalents. All other fixed deposits are reported separately in the statement of financial position.

Government grants are recognised as a receivable when there is reasonable assurance that the grant will be received and all attached conditions will be complied with.

When the grant relates to an expense item, it is recognised as income on a systematic basis over the periods that the related costs, for which it is intended to compensate, are expensed. When the grant relates to an asset, the fair value is recognised as deferred income on the statement of financial position and is recognised as income in equal amounts over the expected useful life of the related asset.

Where loans or similar assistance are provided by governments or related institutions with an interest rate below the current applicable market rate, the effect of this favourable interest is regarded as additional government grant.

Notes to the financial statements

31 December 2023

3. Critical accounting judgements and key sources of estimation uncertainty

In the application of the Temple’s accounting policies, which are described in Note 2, the Management Committee is required to make judgements, estimates and assumptions about the carrying amounts of assets and liabilities that are not readily apparent from other sources. The estimates and associated assumptions are based on historical experience and other factors that are considered to be relevant. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised if the revision affects only that period, or in the period of the revision and future periods if the revision affects both current and future periods.

3.1 Critical judgements in applying the Temple’s accounting policies

In the process of applying the Temple’s accounting policies, management is of the opinion that any instances of application are not expected to have a significant effect on the amounts recognised in the financial statements.

3.2 Key sources of estimation uncertainty

The key assumptions concerning the future and other key sources of estimation uncertainty at the end of the reporting period that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year are discussed below:

(a) Depreciation of property, plant and equipment

Management estimates the useful lives of property, plant and equipment to be as disclosed in Note 2.6.

Changes in the expected level of usage and technological development could impact the economic useful lives and the residual values of these assets. Hence, future depreciation charges could be revised.

The carrying amounts of the Temple’s property, plant and equipment are disclosed in Note 9.

(b) Allowance for inventory obsolescence

Management reviews the carrying amount of its inventories to ensure that they are stated at the lower of cost and net realisable value. In assessing the net realisable value and making appropriate allowance, management identifies inventories that are slow-moving or obsolete, considers their physical conditions and the market price of similar items. Where items of inventory have a market price that is lower that their carrying amounts, the management estimates the amount of inventory loss as allowance on inventory.

The carrying amount of the inventories at the end of the reporting period is disclosed in Note 7 to the financial statements.

Notes to the financial statements

31 December 2023

4. Cash and cash equivalents

5. Fixed deposits

Fixed deposits with maturity of 6 to 18 months (2022 : 6 to 18 months) with interest at rates of 2.00% to 3.55% (2022 : 0.10% to 4.00%) per annum 8,696,966 3,064,348

Fixed deposits include an amount of $50,000 (2022 : $50,000) which is pledged as security for corporate credit card facility granted by a bank.

6. Other receivables

Amounts due from related parties are unsecured, interest-free and repayable in cash on demand.

Notes to the financial statements

31 December 2023

7. Inventories

Cost of inventories recognised as an expense and included in cost of goods sold (Note 14) 1,026,043 619,029 - inclusive of inventories written off 21,105 -

8. Investments in financial assets

Quoted debt securities, at amortised cost

1,254,275 2,006,863

As at 31 December 2023, the quoted debt securities have nominal values of $1,250,000 (2022 : $2,000,000), with coupon rates ranging from 2.63% to 3.20% (2022 : 2.55% to 3.20%) per annum and maturity dates ranging from 21 August 2025 to 17 September 2025 (2022 : 23 November 2023 to 17 September 2025).

Buddha Tooth Relic Temple (Singapore)

9. Property, plant and equipment 2023

9. Property, plant and equipment (continued) 2022

Notes to the financial statements

31 December 2023

10. Trade and other payables

Trade payables are non-interest bearing and are generally settled within 30 (2022 : 30) days.

Non-trade amounts due to related parties are unsecured and repayable in cash on demand.

Maitreya Charity Fund

This fund was set up in year 2011 for charitable donation purposes and for the following beneficiaries:

(a) Chinatown Community

(b) Buddhist Organisations

(c) Social Service Agencies (SSA) & President Challenge Charity

(d) Educational Institutions

(e) Chinese and Cultural Organisations

(f) Overseas Charities

(g) Any other deserving organisations or individuals, as decided by the Management Committee.

Notes to the financial statements

31 December 2023

11. Funds (continued)

Maitreya Charity Fund (continued)

Donors can donate directly to this designated fund. Each year, 20% of the Temple’s current year’s surplus or any amount decided by Management Committee, will be transferred to this fund. If the fund has been used up, the Management Committee will decide on the amount to be topped-up. All donations given out will be from this designated fund, instead of general fund.

Museum fund

The Museum fund was initially set up in year 2004 for the purpose of funding the operations of the museum, acquisition and maintenance of antiques inside the Temple. At least 20% of each financial year’s net surplus attributable to accumulated general fund shall be set aside for this fund.

In year 2020, the purpose of Museum fund has been revised to be only for the acquisitions and maintenance of antiques inside the Temple.

Project and sinking fund

This fund was set up in year 2004 to provide fund for repairs and maintenance, decoration and other improvement of the Temple’s building. At least 20% of each financial year’s net surplus attributable to accumulated general fund shall be set aside for this purpose.

Investment fund

This fund was set up in year 2018 to provide fund for the purpose of the purchase of investments in financial assets. At least 20% of each financial year’s net surplus attributable to accumulated general fund shall be set aside for this purpose.

12. Charitable income

14.

The annual remuneration (comprising basic salary, bonuses, allowances and employer’s contributions to Central Provident Fund) of the six (2022: four) highest paid staff including two key management employees (Note 18) classified by remuneration bands are as follows:

Notes to the financial statements

31 December 2023

17. Income tax status

No provision for taxation has been made in the financial statements as the Temple is exempt from income tax under Section 13(1)(zm) of the Income Tax Act 1947.

18. Compensation of key management personnel

Short-term benefits paid to key management personnel

The above disclosure on remuneration (comprising basic salary, bonuses, allowances and employer’s contributions to Central Provident Fund) relates to two key management employees with annual remuneration exceeding $100,000.

19. Related party transactions

In addition to the related party information disclosed elsewhere in the financial statements, significant transactions that took place at terms agreed between the Temple and related parties during the financial year are as follows:

During the financial year, the Temple entered into the above transactions with its related parties. Related parties are entities that are founded by the President of the Temple, Venerable Chao Khun Fa Zhao, BBM.

During the financial year, two (2022 : two) of the management committee members received chanting fee amounting to $66,800 (2022 : $48,500) representing honorarium paid to them. None of the other management committee members received any remuneration during the financial year.

Notes to the financial statements 31 December 2023

There is no paid staff in the Temple’s Management Committee.

Committee members are required to disclose any interest that they may have, whether directly or indirectly in the transactions, that the Temple may enter into or in any organisations that the Temple has dealings with or is considering dealing with, and any personal interest accruing to him as one of the Temple’s supplier, user of services or beneficiary. Should there be any potential conflict of interest, the affected Management Committee member may not vote on the issue that is the subject matter of the disclosure. Detailed minutes will be taken on the disclosure as well as the basis for arriving at the final decision in relation to the issue at stake.

21. Commitments

Operating lease commitments - as lessee

At the end of the reporting period, the Temple has outstanding commitments for minimum lease payments in respect of premises under non-cancellable operating leases falling due as follows:

22. Capital commitments

At the end of the reporting period, the Temple has Nil (2022 : $19,400) outstanding capital commitments.

Notes to the financial statements

31 December 2023

23. Financial instruments, financial risks and capital risks management

23.1 Categories of financial instruments

Financial instruments as at the end of the reporting period are as follows:

Financial assets measured at amortised cost

Cash and cash equivalents (Note 4) 3,267,093 4,021,775

Fixed deposits (Note 5) 8,696,966 3,064,348 Other receivables (Note 6)

176,078

financial assets measured at amortised cost12,591,709 7,262,201

Financial liabilities measured at amortised cost Trade and other payables (Note 10) 1,870,388 1,981,018

23.2 Financial risk management

The main risks arising from the Temple’s normal course of operation are credit risk, interest rate risk and liquidity risk. The Temple’s overall risk management strategy seeks to minimise potential adverse effects of these risks on the financial performance of the Temple.

Risk management policies and procedures are reviewed regularly to reflect changes in market conditions and the Temple’s activities.

Credit risk

Management has a credit policy in place and the exposure to credit risk is monitored on an ongoing basis.

At the end of the reporting period, the Temple’s maximum exposure to credit risk is represented by the carrying amount of each financial asset presented on the statement of financial position. Cash is placed with banks which are regulated.

There is no financial asset that is past due and/or impaired.

Notes to the financial statements

31 December 2023

23. Financial instruments, financial risks and capital risks management (continued)

23.2 Financial risk management (continued)

Interest rate risk

Interest rate risk is the risk that the fair value of future cash flows of the Temple’s financial instruments will fluctuate because of changes in market interest rate.

The Temple is exposed to interest rate risks through the impact of changes in interest rates on its fixed deposits and investments in financial assets as disclosed in Notes 5 and 8 to the financial statements.

At the end of the reporting period, an increase/decrease of 25 basis in interest rates of fixed deposits and investments in financial assets would increase/decrease the Temple’s surplus for the financial year by $24,867 (2022 : $12,661).

Liquidity risk is the risk that the Temple will encounter difficulty in meeting financial obligations due to shortage of funds.

The Temple monitors its liquidity risk and maintains a level of cash and cash equivalents deemed adequate by management to finance its operations and to mitigate the effects of fluctuations in cash flows.

All financial liabilities in 2023 and 2022 are repayable on demand or due within one year from the end of the reporting period.

The funds of the Temple comprise the General fund, Maitreya Charity fund, Museum fund, Project and Sinking fund as well as Investment fund. The Temple aims to maintain an optimum level of funds to ensure that it will be able to continue as a going concern. The Temple’s overall strategy remains unchanged from the prior year.

The Temple is not subject to any externally imposed fund reserve requirements.

We are committed to maintaining excellent corporate governance standards and supporting our organisation's values of accountability and transparency. We adhere to the standards set forth in the Charity Council's Code of Governance (for Charities and Institutions of a Public Character).

The 11 members of the Management Committee (or "MC"), which is our governing body, are chosen in accordance with our Constitution. The MC currently consists of the President, Vice President, Honorary Secretary, Assistant Honorary Treasurer, and six other elected Board members. They bring skills and expertise from a variety of areas, including accounting, auditing, business, communications, engineering, finance, fundraising, human resources, management, and technology. The MC ensures that we run effectively and responsibly.

The Honorary Treasurer and Assistant Honorary Treasurer roles have a maximum tenure limit of 4 consecutive years.

Each year, the MC undertakes a self-evaluation to analyse its performance and effectiveness.

The MC holds at least six meetings every year. During the financial year that ran from 1 January 2023 to 31 December 2023, 6 meetings were held.

President Venerable Chao Khun Fa Zhao BBM 25 Jun 2023 6/6

Vice President Venerable Shi Xu Zhen 25 Jun 2023 5/6

Honorary Secretary Mr Soon Yeu Kian

Honorary Treasurer Mr James Saw Tee Kiam

Assistant Honorary Treasurer Mr Tan Wui Khiang

25 Jun 2023 6/6

25 Jun 2023 6/6

25 Jun 2023 5/6

Member Ms Fong Pui Kee, Jenny 25 Jun 2023 5/6

Member Mr Lau Kah Yong 25 Jun 2023 6/6

Member Mr Jimmy Tay Khay Heng 25 Jun 2023 5/6

Member Mr Lim Eng Koo 25 Jun 2023 1/6

Member Dr Nigam Kee Yuan 25 Jun 2023 3/6

Member Mr Patrick Neo Kang Han 25 Jun 2023 4/6

Venerable Chao Khun Fa Zhao BBM

President 25 Jun 2023

Venerable Shi Xu Zhen Vice President 25 Jun 2023

Mr Soon Yeu Kian

Mr James Saw Tee Kiam

Mr Tan Wui Khiang

Honorary Secretary 25 Jun 2023

Honorary Treasurer 25 Jun 2023

Assistant Honorary Treasurer 25 Jun 2023

President 15 Jun 2019

Vice President 19 Sep 2021

Abbot & President, Buddhist Temple

Abbot & Vice President, Buddhist Temple

Committee Member 19 Jun 2021 Vice President DBS Bank Ltd

Assistant Honorary Treasurer 19 Jun 2021

Director/Partner of Jimmy textiles & Jimmy Textiles Investment Pte Ltd

Member 24 Jun 2017 Retiree

Officer Bearers

Venerable Chao Khun Fa Zhao BBM

Venerable Shi Xu Zhen

Mr James Saw Tee Kiam

Golden Pagoda Buddhist Temple Abbot and President

Metta Welfare Association President

Golden Pagoda Buddhist Temple Management Committee Member

Golden Pagoda Buddhist Temple Management Committee Member

To further strengthen our corporate governance, the MC has formed the following six sub-committees, as documented.

Terms of Reference:

1. Nominating Committee

2. Audit Committee

3. Finance Committee

4. Human Resource Committee

5. Information Technology Committee

6. Programmes & Services Committee

4. Senior Management Team

Mr Ee Tiang Hwee Deputy Executive Director 1 Sep 2003

Mr Christopher Tan Ming Tatt Assistant Executive Director & Legal Counsel 1 Jan 2023

Our senior management team comprises individuals possessing the requisite skill sets and competences to effectively oversee the organisation and meet the MC's expectations for performance.

Our Vision, Mission, and Values are approved and reviewed by the MC to ensure that sure we remain relevant in light of the ever-changing demands and environment. These are presented to all stakeholders and the general public through a variety of channels, including the annual report and the company's website. Our strategic plans are reviewed and updated on a regular basis by the MC to ensure that our business activities align with our projects.

The annual budget that management prepares is reviewed and approved by the MC and the Finance Committee. The operational and capital expenditure budgets are monitored on a regular basis.

We are committed to providing audited statements that present an accurate and fair overview of our financial status, ensuring that they comply with the authorities' standards.

For financial matters, we have established procedures in place for important areas such as procurement and controls, payment procedures, receipting, and mechanisms for authority delegation and approval limitations.

We have rigorous standards for enterprise risk management, and we undertake annual internal ISO audits on critical areas of our business operations. The Audit Committee works with the MC to provide risk management oversight, while the Senior Management Team monitors and verifies the integrity of the internal control systems.

Independent internal and external auditors undertake periodic audits to ensure that our internal controls are in place and that our financial, investment, and fundraising rules are followed. The Audit Committee reviews the findings and suggestions made by the internal and external auditors and reports them to the MC.

All donations are fully accounted for and promptly deposited.

We have policies and processes in place to manage and avoid potential conflicts of interest. All MC members, Sub-Committee members, and our staff are expected to declare conflicts of interest at the start of their terms or at the point of recruitment, on an annual basis, and whenever such conflict or the prospect of such conflict occurs. When a conflict of interest emerges, persons who are conflicted are not permitted to participate in decision-making or vote on the issues at hand.

We preserve some reserves to ensure long-term financial stability. We maintain a maximum reserve level of up to 5 years of annual operational expenditure. Our reserves exclude the Building/Project Fund, Endowment/Charity Fund, and Sinking Fund.

We are dedicated to maintaining the greatest levels of honesty, transparency, ethical and legal conduct, and accountability. We have implemented a whistleblowing policy, which is published on our corporate website. The whistleblowing policy is intended to provide a channel for employees, volunteers, beneficiaries, and other third parties to voice legitimate concerns about suspected improprieties without fear of retaliation.

We have a privacy policy in place, which is available on our corporate website. We use a variety of techniques to comply with the Personal Data Protection Act of 2012 ("PDPA"). Data is only used for the purposes stated, unless otherwise permitted by law. To comply with PDPA obligations, reasonable security measures have also been implemented.

Our Annual Report is available on our corporate website and offers detailed information about our programmes, operations, audited financial statements, MC members and subcommittees, and senior management team.

There is no monetary remuneration for MC members' services.

No employee is accountable for setting his or her own salary.

There are no salaried employees who are close members of the Executive Head's or Board Members' families who receive more than $50,000 annually.

UEN : T03SS0035G

Address : 288 South Bridge Road Singapore 058840

Auditors : UHY Lee Seng Chan & Co.

Bankers : 1. Oversea-Chinese Banking Corporation (OCBC)

2. United Overseas Bank (UOB)

3. Standard Chartered Bank (SCB)

Submission Form for Governance Evaluation Checklist (Enhanced Tier)

Please note that this checklist is based on the Code of Governance (2017).

Instructions: Please fill out the boxes. Input the reason if the selection is non-compliance for each field. Applicable to large charities with gross annual receipts or total expenditure of $10 million or more; And IPCs with gross annual receipts or total expenditure from $500,000 to less than $10 million.

Board Governance

1 Induction and orientation are provided to incoming governing board members upon joining the Board.

Complied

Are there governing board members holding staff1 appointments? (skip items 2 and 3 if“No”) No

2 Staff does not chair the Board and does not comprise more than one third of the Board.

3 There are written job descriptions for the staff’s executive functions and operational duties, which are distinct from the staff’s Board role.

4 The Treasurer of the charity (or any person holding an equivalent position in the charity, e.g. Finance Committee Chairman or a governing board member responsible for overseeing the finances of the charity) can only serve a maximum of 4 consecutive years.

If the charity has not appointed any governing board member to oversee its finances, it will be presumed that the Chairman oversees the finances of the charity.

5 All governing board members must submit themselves for renomination and reappointment, at least once every 3 years.

Complied

guideline is not complied with)

6 The Board conducts self evaluation to assess its performance and effectiveness once during its term or every 3 years, whichever is shorter.

Complied Is there any governing board member who has served for more than 10 consecutive years? (skip item 7 if“No”) No

7 The charity discloses in its annual report the reasons for retaining the governing board member who has served for more than 10 consecutive years.

8 There are documented terms of reference for the Board and each of its committees.

9 There are documented procedures for governing board members and staff to declare actual or potential conflicts of interest to the Board at the earliest opportunity.

10 Governing board members do not vote or participate in decision making on matters where they have a conflict of interest.

Complied

Complied Strategic Planning 11 The Board periodically reviews and approves the strategic plan for the charity to ensure that the charity’s activities are in line with the charity’s objectives.

12 The Board approves documented human resource policies for staff.

Complied 13 There is a documented Code of Conduct for governing board members, staff and volunteers (where applicable) which is approved by the Board.

14 There are processes for regular supervision, appraisal and professional development of staff.

Complied

Are there volunteers serving in the charity? (skip item 15 if “No”)

Yes

15 There are volunteer management policies in place for volunteers. 5.7 Complied

Financial Management and Internal Controls

16 There is a documented policy to seek the Board’s approval for any loans, donations, grants or financial assistance provided by the charity which are not part of the charity’s core charitable programmes.

17 The Board ensures that internal controls for financial matters in key areas are in place with documented procedures.

6.1.1 Complied

6.1.2 Complied

18 The Board ensures that reviews on the charity’s internal controls, processes, key programmes and events are regularly conducted. 6.1.3 Complied

19 The Board ensures that there is a process to identify, and regularly monitor and review the charity’s key risks.

20 The Board approves an annual budget for the charity’s plans and regularly monitors the charity’s expenditure.

Does the charity invest its reserves (e.g. in fixed deposits)? (skip item 21 if“No”)

6.1.4 Complied

6.2.1 Complied

Yes

21 The charity has a documented investment policy approved by the Board. 6.4.3 Complied

Fundraising Practices

Did the charity receive cash donations (solicited or unsolicited) during the financial year? (skip item 22 if“No”)

22 All collections received (solicited or unsolicited) are properly accounted for and promptly deposited by the charity.

Yes

7.2.2 Complied

Did the charity receive donations in kind during the financial year? (skip item 23 if “No”)

Yes

23 All donations in kind received are properly recorded and accounted for by the charity." 7.2.3 Complied

Disclosure and Transparency

24 The charity discloses in its annual report —

(a) the number of Board meetings in the financial year; and (b) the attendance of every governing board member at those meetings. 8.2 Complied

Are governing board members remunerated for their services to the Board? (skip items 25 and 26 if“No”) No

25 No governing board member is involved in setting his own remuneration. 2.2

26 The charity discloses the exact remuneration and benefits received by each governing board member in its annual report. OR The charity discloses that no governing board member is remunerated.

Does the charity employ paid staff? (skip items 27, 28 and 29 if “No”) Yes

27 No staff is involved in setting his own remuneration. 2.2 Complied

28 The charity discloses in its annual report —

(a) the total annual remuneration for each of its 3 highest paid staff who each has received remuneration (including remuneration received from the charity’s subsidiaries) exceeding $100,000 during the financial year; and

(b) whether any of the 3 highest paid staff also serves as a governing board member of the charity.

The information relating to the remuneration of the staff must be presented in bands of $100,000. OR

The charity discloses that none of its paid staff receives more than $100,000 each in annual remuneration. 8.4 Complied

29 The charity discloses the number of paid staff who satisfies all of the following criteria:

(a) the staff is a close member of the family3 belonging to the Executive Head4 or a governing board member of the charity;

(b) the staff has received remuneration exceeding $50,000 during the financial year.

The information relating to the remuneration of the staff must be presented in bands of $100,000. OR

The charity discloses that there is no paid staff, being a close member of the family belonging to the Executive Head or a governing board member of the charity, who has received remuneration exceeding $50,000 during the financial year.

30 The charity has a documented communication policy on the release of information about the charity and its activities across all media platforms.

8.5 Complied

9.2 Complied

1 Staff: Paid or unpaid individual who is involved in the day to day operations of the charity, e.g. an Executive Director or administrative personnel.

2 Volunteer: A person who willingly serves the charity without expectation of any remuneration.

3 Close member of the family: A family member belonging to the Executive Head or a governing board member of a charity —

(a) who may be expected to influence the Executive Head’s or governing board member’s (as the case may be) dealings with the charity; or

(b) who may be influenced by the Executive Head or governing board member (as the case may be) in the family member’s dealings with the charity.

A close member of the family may include the following:

(a) the child or spouse of the Executive Head or governing board member;

(b) the stepchild of the Executive Head or governing board member;

(c) the dependant of the Executive Head or governing board member.

(d) the dependant of the Executive Head’s or governing board member’s spouse.

4 Executive Head: The most senior staff member in charge of the charity’s staff.

I declare that my charity’s / IPC’s governing Board has approved this Governance Evaluation Checklist and authorised me to submit on its behalf. All information given by me in this checklist submission is true to the best of my knowledge and I have not wilfully suppressed any material fact. The full responsibility for providing accurate and updated checklist information will rest with my charity’s / IPC’s governing Board.

在2023年,新加坡佛牙寺的弥勒慈善基金捐助给以下的机构单位:

In 2023, BTRTS donated to the followin beneficiaries from our Maitreya Charity Fund:

BENEFICIARIES (受益人)

Chinatown Community 牛车水社区 :

i) Ang Bao Distribution to Elderly on CNY 2023

ii) Ang Bao Distribution to Elderly on CNY 2023

iii) Kreta Ayer - Kim Seng CCC (Donation for National Day 2023 Dinner)

iv) Chinatown Festival Mid Autumn 2023

Buddhist Organisations 佛教组织 :

i) Donation to Temples during CNY 2023 Visiting

ii) Donation to Wat Ananda Metyarama

iii) Donation to Shan Fook Thong

Social Service Agencies (SSA) & President Challenge Charity 社会服务机构, 总统捐赠活动 :

i) Garden City Fund "Plant A Tree Programme" Jan 2023

ii) Garden by the Bay for Mid Autumn Festival

iii) Metta Welfare Association - Carnival on 19 Mar 2023

iv) Metta Welfare Association -Charity Golf

v) Vesak Day Donation :

1) President’s Challenge

2) Kreta Ayer CCMC

3) Kreta Ayer Seniors Activity Centre

4) Tanjong Pagar – Tiong Bahru CCC CDWF

5) Kidney Dialysis Foundation

6) Society of Buddhist Volunteers

7) Dot Connections Growth Centre Ltd

8) Tai Pei Old People’s Home

9) Man Fut Tong Nursing Home

10) Ramakrishna Mission

11) Muhammadiyah Welfare Home

Chinese and Cultural Organisations 华族文化团体 :

D

i) Di Zang Lin -《遇见观音》音乐剧 2023 (24-26 Nov 2023)

Overseas Charities and Any other deserving organisations or individuals as decided by Management Committee 海外慈善机构和其他任何有资格的组织或个人 (理事会批准)

E Donation to Mahakaruna Buddhist Society -Robes Offering and Pindapata Ceremony on 26/11/2023

F Offering Donation to Ven.Galboda Gnanissara Thero (celebrate 80th Birthday Sri Lanka)