4 minute read

2OOg BusinessForecast: A new year for southern pine

By Lionel J. Landry President Southem Forest Products Association

THE business climate for producI ers of southern pine lumber remains most challenging, just like so many other industries.

Just three years ago, during 1999, our industry established an all-time production record of 16.92 billion bd. ft. Homebuilding has remained strong in these first years of the New Millennium, encouraged by low mortgage rates. Eventually, lumber supply stretched demand as market dynamics shifted in the closing quarter of 2000. Total production for 2001 remained a healthy 16.10 billion bd. ft. Unlike the nation's economy, our industry is still in a recession due to moderate demand-not strong, not weak-with record-setting imports of softwood lumber.

A relatively healthy housing market throughout 2002 is what many observers believe kept our nation's economy from remaining in a longterm recession. True, housing was strong as interest rates fell further, but lumber producers were squeezed to make a profit considering their high timber costs. Throughout 2002, a good week in the lumber business was a rare event, at best, aggravated by weak markets, and hefty import volumes. The downward production trends continued through last summer;

Southern Forest Products Association estimates tota\ 2002 southern pine production at 15.5 billion bd. ft., a 2.5Vo decline from 2001.

The events of Sept. I I have put the economic brakes on nonresidential construction activity, and this market segment failed to show any signs of recovery during 2002. Quite simply, lumber markets are oversuppliedsome say overproduced. Low mort- gage rates have encouraged both repair and remodeling activity, plus helping turn potential homebuyers into homeowners. Affordability with the historically low mortgage rates, personal income growth and low unemployment makes the purchase of a home a reality for many more Americans.

Unlike the nation's economy, our industry is still in a recession due to moderate demand-not slrong, not weak.

The installed cost of framing lumber remains very competitive when measured against alternative building materials-steel, concrete, and other non-wood substitutes.

SFPA member companies produce half of the nation's southern pine lumber, and their outlook for 2003 is, at best, guarded. Most companies have curtailed operations and many mills have been shut down. Ifthe poor eco- nomic climate persists, additional permanent closures are a distinct possibility.

A number of factors will influence business in 2003. Softwood imports from Canada continue to impact southern pine's traditional framing markets. The industry's Coalition for Fair Lumber Imports was successful in obtaining a combined 27.27o countervailing duty.

Another hurdle for southern pine producers is increased imports from overseas producers. Competing softwood species from Europe and South American continue to adversely impact our domestic market. A strong dollar and foreign competitors have also hampered southern pine exports throughout 2002. Kiln-dried southern pine is now recognized in the materials handling markets as the logical choice to meet phytosanitary requirements for shipments to the European Union. SFPA's efforts have explained the new regulations to pallet and crate makers nationwide.

Treated lumber markets were the bright spot for the southern pine industry in 2002. Despite the EPA's announcement last February to remove CCA-treated products from most consumer-type residential applications by the end of 2003, the transition to non-arsenical-based preservatives proceeds smoothly. SFPA actively participates in the Treated Wood Council (TWC) to counter environmental misinformation and to educate audiences about the merits of treated products, emphasizing their proven service track record of more than 75 years. In mid-2002, an authoritative panel of six Florida doctors released a comprehensive report reaffirming the safety of CCA-treated products. TWC also provided the EPA's Scientific Advisory Panel with scientific studies supporting the safe use of CCA-treated products. It's important that specifiers and users understand that CCA-treated wood is not being completely phased outt it will remain available for industrial applications such as highway and agricultural uses, poles, piling, and saltwater marine exposures. SFPA estimates treated lumber production to total 7 billion bd. ft. in 2002, dropping to 6.51 billion ft. in 2003.

As this new year is launched, SFPA begins the fourth year of its ambitious five-year marketing program, Priorities & Partnerships, promoting southern pine products for raised floor foundation systems, engineered floor and roof trusses, porches, and permanent wood foundations, among many other applications. SFPA's promotion of finger-jointed southern pine studs combines both new technology and an environmentally friendly message to builders and architects. Strategic partnerships with our customers and allied organizations are other strategies SFPA is using to move our industry forward. SFPA is an association sponsor of the Wood Promotion Network, reaching both consumers and professional audiences with positive, factual messages about our industry. In cooperation with APA, SFPA will showcase the latest equipment and technology at Expo 2003 in June.

SFPA has successfully weathered challenging market cycles since its founding some 85 years ago. Market downturns are nothing new. SFPA's programs and activities are designed to meet the challenges ahead.

- For a complete summlry of SFPA's activities and accomplishments, see its 2002 annual report, available late this month at www.sfpa.org.

EAX to 949-852-0231

or call (949) 852-1990 or mail to Building Products Digest, 4500 Campus Dr., Suite 480, Newport Beach, Ca.92660-1872.

Building Products Digest - January 2003

Name (P/ease print)

E-mail address

For more information on products or companies (see list at right), circle the appropriate Reader Service FAX Response number(s):

For more information from advertisers, use FAX Response numbers in brackets.

Bean Lumber Co., Curt I1071 ................7

Bowie Sims Prange tf231 ......................26

Building Products Digest......................32

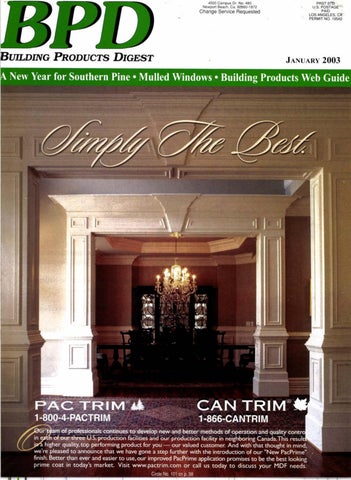

CanTrim [101] ...............-.--.-.....Cover I

Cedar Creek Inc. [131]........-.--...........34

Chemical Specialties, Inc. t1341 .....Cover III

Cox Wood Preserving [108]....................8

Crumpler Plastic Pipe, Inc. [128].........31

Custom Lumber Manufacturing Co. trlsl

Distribution Management Services Inc. 11171.............. ..............2r

DixiePly t1031...........................................3

Do it Best Corp. [135]................Cover IV

Elder Forest Products ll25l .................27

FiberTechPolymers [130] ....................33

International Paper Corp.-Engineered

Wood Kubinec Division If 051...........................5 Strapping Solutions [f 14]......f 9

M&M Lumber ll22l .............................25

Matthews International U321...............35

McEwen Lumber Co. [120] ..................23 tl 1 Year ($18) E 2 Years ($29) E 3 Years ($39) d For Qualified Southern Retailers and Wholesalers (Free) tr

Want to Subscribe? Check the appropriate boxes to begin receiving your monthly issues.

Bill Me tr My Check Is Enclosed

News or Comments? We welcome your comments on articles, the magazine, or news of your company such as promotions, new hires, expansions or acquisitions (z/ris is afree senice).

Osmose t1021 ...............................Cover II

NatureWood I1021 ......................Cover II

PacTrim t1011 ...............................Cover I

Rusco Packaging [1 f 4]..........................19

Sirnpson Strong-Tie [106] .......................6

Siskiyou Forest Products [129]............3f

Smith Millwork, Inc. [110] ...................15

Snider Industries [1 13]..........................18

Somerset Door & Column Co. [126]....30

Southern Forest Products Association Ir2rl

Southern Pine Inspection Bureau trlel

Stambone & Associates U14l ...............f9

Swan Secure Products [116]...........20, 36

Vinyl Window & Door Corp. [f27]......31

White Lumber Co., Ray tt241..............26

Williams & Son, Jerry G. [111]............17

Woodfold-Marco Mfg. Co. [f lE]..........22