BEST TAX TIME DEALS The tool combo kit offers you can’t pass up DOLLARS & SENSE The latest tax updates for employees and business owners ATO TOP TIPS All your end-of-financialyear questions answered POWERPASS CLASS How the smart Trade card can transform your work life YOUR EXPERT GUIDE TO SMOOTH RETURNS IT’S TAX TIME FREE MAGAZINE

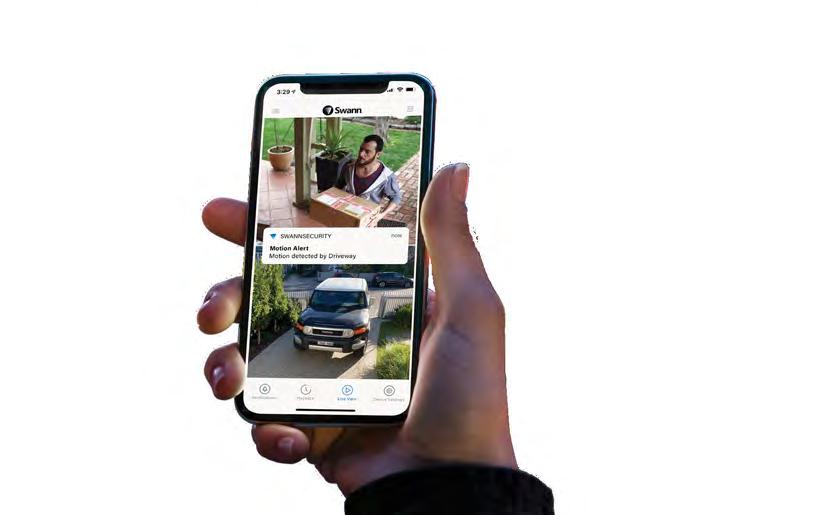

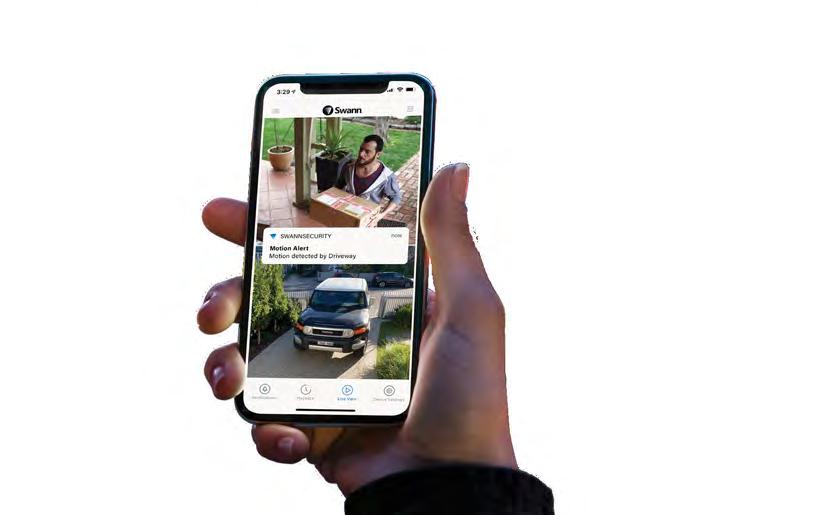

Works with Swann Security AllSecure650™ 2K Wireless Security Kit Always charged, always secure. Hey Google works with Rechargeable & Easy Installation True Detect™ Controllable Spotlights & Sirens Night2Day™ Color Night Vision Free Recording Weatherproof Talk & Listen Offline Option No Security Downtime NVR Power Hub with Charging Bay Charge & Swap Camera Batteries Extra Battery Backup for 5 Hours if there’s a Power Outage Wi-Fi NVW-650 NVR Power Hub Charging Bay with 3 x 2K 100% Wireless Cameras with Spotlights, Siren, 4 x Rechargeable Batteries to Charge/Swap, 1TB HDD, 2-Way Talk & 2 Years Free Recording Learn more at bunnings.com.au

hether you’re running your own business or working for one, the end of a financial year seems to come around at pace. So we’re making it easy to get across both the paperwork and the business of preparing returns with this tradie-targeted tax time special.

We sat down with the Assistant Commissioner at the Australian Taxation Office, Tim Loh, to find out what you can deduct and claim, and quizzed three PowerPass account holders about how they use their PowerPass membership to streamline their business and their finances. Plus, we review some beaut combo kit offers to help you upgrade or fill any gear gaps at a time of year when there are some of the best deals.

Read on to set yourself up for many happy returns.

5

LET’S TALK ABOUT TAX

Unsure about what you can claim on your tax this year? ATO Assistant Commissioner Tim Loh answers the important questions

11

WHY POWERPASS IS THE SHARPEST TOOL IN THE KIT

A PowerPass account is an invaluable business tool and the recently updated app simplifies invoicing and tax time

12

WHAT THE TRADIES SAY

Three tradies reveal how PowerPass helps with so many aspects of their work – from managing receipts to navigating stores

16 SIMPLY BRILLIANT BUYS

There’s no better time than the end of the financial year to invest in your business –and these combo kits are great value

22 TRADE SERVICES

Everything you need to know about our battery trade-in offer. Plus, three great reasons to download the PowerPass App

Photography (cover) Sue Stubbs, styling Samantha Pointon

Welcome! TAX TIME

WTo find out more about Bunnings Trade and the services offered, visit trade.bunnings.com.au CONTENTS

12 16 22 DeWALT ‘XR’ 18V 5.0Ah brushless 9 piece Li-ion combo kit bunnings.com.au 3

5 11

The best start with paint jobs

Painter’s Tape

Painter’s Tape

LET’S TALK ABOUT TAX

AUSTRALIAN TAXATION OFFICE ASSISTANT COMMISSIONER TIM LOH ANSWERS ALL THE IMPORTANT QUESTIONS ABOUT LODGING YOUR TAX RETURN THIS YEAR

Tax time is right around the corner. And whether you’re employed as a tradie, you’re a sole trader or running a company or trust, you’ll no doubt have some questions about what you can and can’t claim in your next return. Here to help is Tim Loh, Assistant Commissioner at the Australian Taxation Office (ATO), to explain your obligations at tax time. With tradespeople and the construction industry in mind, we will

drill into the details of buying assets for your business, the records that you need to keep when claiming deductions, explain decline in value (depreciation) and help you understand personal services income.

And, if you’re one of the five million people who worked at least some of the time from home during the 2022/2023 tax period, then Tim’s explanation of recent changes to calculating your work-from-home deductions is essential reading.

QWhat are the general rules to keep in mind when claiming a deduction? Do the rules differ if I’m running a business or if I am an employee?

AIf you’re a business owner, you can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related to earning your assessable income. When claiming a business expense, there are three golden rules to remember.

1 The money must have been spent for your business (not a private expense).

2 If it is for a mix of business and private use, you can only claim the portion that is related to your business.

3 You must have a record to prove it. If you’re an employee and you’re

“Keeping records is essential and my advice would be to keep digital records”

Tim Loh, ATO Assistant Commissioner

TAX TIME bunnings.com.au 5

claiming a deduction, again there are three golden rules to remember.

1 You must have spent the money yourself and were not reimbursed.

2 The expenses must directly relate to earning your income.

3 You must have a record to prove it (such as a receipt).

QFor business owners who can claim home-based business expenses, what is the difference between running expenses and occupancy expenses? When can you claim both?

AIf you operate one or more businesses from home, you may be able to claim the business-use portion of expenses you incur which relate to the use and ownership of your home. This includes the following: Running expenses: expenses related to the use of facilities within the home, including electricity, gas, stationery, computer consumables, phone and internet usage, and the decline in value of assets.

Occupancy expenses: expenses relating to the ownership or use of your home, including mortgage interest or rent, council rates, land taxes and home insurance premiums. You can claim both running expenses and occupancy expenses if you have

an area of your home set aside exclusively as a ‘place of business’. If you do not have an area set aside exclusively as a ‘place of business’, you may still be entitled to claim a portion of your running expenses. However, keep in mind that you may not be able to claim occupancy expenses if personal services income (PSI) rules apply to the income of your business. (See PSI question, opposite page.) Be aware that you may have to pay capital gains tax (CGT) when you sell your home if you used part of your home for business purposes.

NOTE To read more, visit ato.gov.au and search ‘homebased business expenses’.

QCan you claim improvements or renovations to the business area of your home? For example, converting a garage into a business-only workshop or client-facing home office.

AYes, there are special rules that may allow you to claim deductions over time for the cost of renovations or improvements done to convert part of your home to a place of business. However, if you do convert your home to a place of business, it will likely impact your entitlement to the main residence exemption for CGT purposes when you sell your home.

NOTE To understand what you may be entitled to claim, the records you need to keep and how this will impact your entitlement to the main residence exemption, visit ato.gov.au and search ‘capital works deductions’.

QWhat advice can you offer to employees and smallbusiness owners to assist with their record-keeping?

AKeeping records is essential, and while the old ‘throw the receipts in the glove box’ trick might have worked for you in the past, my advice would be to keep digital records. This

sure to only claim the business portion of an expense, like car usage Keeping records for tax purposes is essential if you own a business

“Occupancy expenses relate to the ownership or use of your home, including mortgage interest or rent”

Be

6 bunnings.com.au

has many advantages and there are a range of options to choose from. For example, record-keeping software. Some software allows you to securely send, receive and store eInvoices, simplifying your invoicing process and record-keeping.

If you’re an employee or sole trader, the myDeductions tool within the ATO app helps you keep and organise your tax records on the go by simply snapping a photo. You can even upload your records straight to your tax return or to your registered tax agent. This is a real time saver.

Remember to back up your digital records to keep them safe from flood, fire or theft. Generally, you will need to keep records for five years from the date your tax return is lodged.

In addition to keeping your records, the ATO app has several other helpful features and tools you can use to keep on top of your tax and super.

NOTE To learn more, visit ato.gov.au and search ‘digital record keeping’.

QAnd what about Personal Services Income (PSI)?

What is it and how do you know if it applies to you?

AIf more than half the income you’ve received from a contract is a reward for your personal efforts or skills (rather than from the use of assets, the sale of goods or from a business structure), then

your income is classified as personal services income (PSI). You can receive PSI in almost any industry, trade or profession. For example, as a construction worker, engineer, financial professional or IT consultant.

PSI rules help keep a level playing field among individuals. They do this by preventing PSI from being diverted or split with other individuals or entities in an attempt to pay less tax. The PSI rules can affect the deductions you claim and how you report your PSI in your tax return. If you earn PSI, it’s important to check whether these rules apply to you.

NOTE For more information, visit ato.gov.au and search ‘personal services income’, or talk to your registered tax agent or local industry association.

“Remember to back up your digital records to keep them safe from flood, fire or theft”

The ATO website has a number of handy tools to help you at tax time

bunnings.com.au 7 Photography Getty Images

QThere were some recent changes to the way taxpayers calculate their deductions for working-from-home expenses. What can an employee claim when they work from home?

AIf you’re eligible to claim workingfrom-home expenses, you can use either the revised fixed-rate method or the actual cost method to calculate your deduction.

The revised fixed-rate method allows you to claim 67 cents per hour worked from home, which covers your electricity, gas, stationery, computer consumables, internet and phone usage. You can also separately claim a deduction for expenses that are not included in the hourly rate, for example, the decline in value of depreciating assets, such as a laptop or office furniture.

As the name implies, the actual cost method allows you to claim a deduction for the actual expenses you incur as a result of working from home, but this method will probably require a bit more work to calculate your deduction.

You can choose the method that gives you the best outcome, as long as you meet the eligibility and recordkeeping requirements.

NOTE Visit ato.gov.au/home to learn more about which method is right for your circumstances.

QWhat records do employees need to keep to back up their workingfrom-home deduction?

AThe records you need to keep will depend on the method you use. If you’re using the revised fixed-rate method, you’ll need to have a record showing the total number of hours you

If you work from home, there are a couple of ways to approach deductions

worked from home during the income year using a diary, timesheet roster or similar. However, there is a transitional arrangement in place for July 1 2022 to February 28 2023 only, allowing you to keep a representative record (for example, a diary or similar) for a four-week period. For the remainder of the year, you’ll need the full records.

You’ll also need to keep one bill or invoice for each of the expenses you incurred that are covered by the revised fixed rate (such as a phone or internet bill), and records for any other expenses not covered by the hourly rate that you claim separately. For example, if you are claiming the decline in value of depreciating assets, you will need to keep records for the purchase of those assets, and records which show your work-related use.

The actual cost method requires more detailed calculations and records. For example, you will need to know and have records of the cost per unit of electricity and average units used per hour.

NOTE You can read more about the records required at ato.gov.au/home.

QLet’s talk about depreciation and temporary full expensing rules – how does it work?

AIf you’re an employee, you can claim a deduction for tools or equipment if you use them for work purposes. If a tool or item of equipment is only used for work and:

8 bunnings.com.au

Keep track of your business expenditure throughout the year for easier returns

Costs more than $300: you can claim a deduction for the cost over a number of years (that is, decline in value or depreciation)

Costs $300 or less: you can claim an immediate deduction for the whole cost of the work product.

If you are buying depreciable assets for your business, such as tools or machinery, you can immediately

deduct the business portion of the cost of the asset under temporary full expensing rules – but you need to meet the eligibility criteria. The rules apply to new depreciable assets and the cost of improvements to existing eligible assets that are first used or installed by June 30 2023. It also applies to second-hand assets if you’re a small business.

Eligible assets include most assets used in the running of a business, such as tools for use on a worksite, like drills, ladders and toolboxes; equipment, including a fridge or a grill; and shelving and storage.

NOTE Visit ato.gov.au/tradies to learn more.

QFinally, when do you recommend is the best time to lodge your tax return?

AIf you lodge your own tax return, the best time to do it is from late July, when information from employers, banks, health funds and government agencies is automatically pre-filled into your tax return. All you need to do is check your information is correct and add anything that’s missing. We see lots of people making mistakes when they rush to lodge in early July, which can also delay your return from being processed. But if you wait just a few weeks, most of this information should be there waiting for you. Lodging at the end of July will also give you time to find those receipts for work-related expenses since July 1 last year to maximise your tax deductions.

If you use a registered tax agent to lodge your return, they will work with you to determine the best time to lodge it.

“If you’re an employee, you can claim a deduction for tools if you use them for work purposes”

bunnings.com.au 9 Photography Getty Images

“If you lodge your own tax return, the best time to do it is from late July”

DISCLAIMER: This information is of a general nature only and should not be regarded as financial or legal advice. It does not take into account your individual circumstances or objectives. You should always seek advice from a suitably qualified professional.

Ideal for: Architraves, Beading, Mouldings, Skirting Boards, Quads, Panelling and Stair Rails

PPN-Master TM Fasten metal connectors with speed and precision IMPULSE® PAIR

Price valid until 30 June 2023 I/N 0413184 Price valid until 30 June 2023 I/N 0359135

Ideal for: Hardwood, Framing, Trusses, Flooring, Joists, Roofing, Decking, Eaves and Cladding

NEW TOOL, OUT NOW! TAX TIME SPECIAL Available May 8 While stocks last Follow us on paslode.com.au $1,179 $1,599

FrameMaster™ PowerVent Nailer TrimMaster™ Angled Bradder

WHY POWERPASS IS THE SHARPEST TOOL IN THE KIT

TAP INTO e RECEIPTS ON THE POWERPASS APP TO MAKE YOUR ESSENTIAL BUSINESS RECORD KEEPING A BREEZE

Bunnings Trade PowerPass membership is a well-loved tool for tradies that offers members exclusive benefits, including flexible payment options and much more. Plus, members have access to the free PowerPass App, which has a load of other useful features – including your eReceipts – to make staying on top of business bookkeeping so much easier.

All Australian businesses must keep written records for five years to back up the information they submit in their tax return. Receipts are a big part of proving you spent what you said you did, and how it relates to the operation of your business – if you bought new power tool batteries, for example, or invested in a pair of new work boots.

The PowerPass App lets you keep your business-related receipts digitally – no more stuffing bits of paper in forgotten drawers or the glove box – and in one place. So when you come to complete your tax return (or hand off the required information to your accountant or tax agent), you can find and collate them easily.

Any transactions linked to your PowerPass account can be accessed via the PowerPass portal on the Bunnings Trade website. Receipts are listed by store, date and time of purchase, so they’re easy to find, and you can download and collate them as a PDF to file or share when invoicing clients. And if you need to exchange anything, you’ve always got a record.

The PowerPass App allows you to keep business-related receipts digitally – no more stuffing them in the glove box

TAX TIME bunnings.com.au 11

WHAT THE TRADIES SAY...

THREE REGULAR POWERPASS MEMBERS SHARE HOW THEIR MEMBERSHIP HELPS RUN AND GROW THEIR BUSINESS

Thomas Taylor

Thomas Taylor Carpentry, NSW

For Thomas, whose northern beaches-based company mainly works on renovations, custom timber work and building decks and pergolas, PowerPass is invaluable for tracking spending across his jobs.

“I’ve been using PowerPass for four or five years now and it’s good for many reasons,” he says. “But most importantly, I can send one of my guys into Bunnings and, when I’m back in the office later on, I’m able to track expenditure on that particular job. That’s such a big help when you’ve got a lot of different projects going on.”

Wrangling surplus materials is also straightforward. “If I don’t end up needing all the timber I’ve ordered, it can be returned – and all the information is there, which makes the process so simple.”

Checking prices and stock is another great time-saver. “I often jump on the app to look at pricing as well as to check stock – that’s especially helpful if you’re looking for something a bit specialised. And you can find out where that stock is if it’s not in your local store,” he says.

thomastaylorcarpentry.com

“I’m able to track expenditure on particular jobs... that’s such a big help”

12 bunnings.com.au

Thomas Taylor, carpenter

Photography Sue Stubbs

Brodie Young

Brodie Young Design, Vic

Based on the Mornington Peninsula, Brodie’s main focus is landscape design and creating outdoor rooms, with the occasional renovation project.

“All of these jobs require many visits to Bunnings, and plenty of long nights spent scrolling the PowerPass App for products and answers to our design quandaries,” he says.

The app, says Brodie, is a great tool to have in the bag. “You can instantly look up items, do budgets, see what quantity is where and, best of all, show clients real-life images of what product they’re going to get – things like feature steel screens or a side entrance gate,” he says.

“The fast check-out feature allows me to quickly swing by my local store, grab those extra four bags of cement or a box of screws and shoot straight out again – avoiding a stop at the registers altogether. Another great feature is the ‘similar searched items’ section at the bottom of a product description, which sometimes helps me to think laterally when something isn’t available.”

Brodie often finds himself visiting other Bunnings stores beyond his local one, and says it is easy to switch locations on the app. “While most store layouts are similar, some catch you off-guard,” he explains, adding that the aisle guide and stock location is a “massive plus”.

“The history of receipts and job breakdowns is also a fantastic benefit, allowing me to easily track my progress and the spend on all of my projects,” he adds. “It means I can provide accurate quotes on new, similar jobs based on what my spend was on previous ones. It’s like having a databank I can reference.” instagram.com/brodie_young_design

“The fast check-out feature allows me to quickly swing by my local store, grab those extra four bags of cement or a box of screws and shoot straight out again”

bunnings.com.au 13

Brodie Young, landscape designer

Put PowerPass to work

How to streamline business operations and your returns with PowerPass

Enjoy exclusive PowerPass pricing on a wide range of commercial products across the store.

Call on a dedicated trade team in store and on the road to help with quotes, orders, deliveries and more.

Leverage Click & Collect or direct-to-site delivery from the Bunnings network across Australia.

Apply for flexible payment, like credit or 30 Day Account options.

Natasha Dickins

Little Red Industries, NSW

Natasha is a sole trader with a small, but busy, business that relies on being able to access hardware materials quickly and easily.

“I regularly do home improvements, renovating projects, make furniture and build structures like decks and retaining walls,” says Natasha, who’s also a DIY content producer. “I’m in Bunnings every week, so PowerPass is an essential part of my business. I have the PowerPass card and the app, which makes shopping quicker, saves me cash and keeps a record of all my purchases, so I can always check exactly what I’ve bought, from screw sizes to paint colours.

“It makes exchanges super simple, too – no more fading bits of paper in the glove box! It’s also essential for bookkeeping and invoicing clients, as I can pass on the receipts easily.” Each project Natasha does requires

researching products online, so she finds the list feature invaluable. “Once I’ve found what I need, I either click and collect, or go in store and use the list to find the aisle numbers and use the store map,” she adds. “Then I simply pay with the PowerPass App on my phone, saving me time at the check-out.” littleredindustries.com

Hire quality equipment via the Hire Shop. Plus, unlock PowerPass pricing on our select Coates Hire range.

Store e-receipts and records digitally, ready for tax time. Any transactions linked to your PowerPass can be accessed on the app or downloaded via the portal, ready for invoicing or tax time claims.

For more information and to apply for PowerPass membership: trade. bunnings.com.au/PowerPass

Read it!

Scan the QR code

14 bunnings.com.au

18V 18V 18V

SIMPLY BRILLIANT BUYS

UPGRADE YOUR TOOLKIT WITH THESE EOFY OFFERS

The last couple of months of the financial year are the perfect time to review how your business is going and consider purchases that might help your working life run more smoothly in the future. And you may be able to offset a businessessential buy against your tax.

Whether you want to overhaul your old toolkit or expand it with new additions, there are plenty of great deals to be had in store right now. Chippy brothers Tim and Mat share their thoughts on these fantastic new offers.

AEG ‘Fusion’ 18V and ‘Force’ 5.0Ah 10 piece combo kit

This selection of high-quality, heavyduty Fusion tools from AEG will cover a broad range of jobs on site, and comes with three 18V 5.0Ah Force batteries. The Fusion hammer drill delivers up to 141Nm of torque and has an anti-kickback feature for added safety. The compact Fusion 4 mode impact driver with 260Nm lets you choose the right speed and torque to suit the task, including Tek-screw mode to tackle metal fasteners.

Get tough with the Fusion ½" midtorque impact wrench, with 1100Nm breakaway torque. “The torque of the impact wrench is really impressive,” says Tim. “With that tool in particular, torque is really important, because it’s designed for taking out big bolts, so it’s really handy to have.”

The hardworking Fusion SDS+ rotary hammer drill has a special anti-vibration handle to help reduce fatigue if you’re using it on a big job. “That’s obviously very good because using that tool can wear on your body a bit,” adds Tim.

For grinding and cutting tasks, you can’t go past the Fusion 125mm angle grinder, with safety features including anti-kickback, an electronic disc brake and a dead man paddle switch. Adding to the round-up of cutting tools is the durable but lightweight Fusion 184mm circular saw, which will cut up to 65mm deep, and the Fusion reciprocating saw, with a stroke length of 32mm and orbital action for fast, aggressive cuts into timber.

The versatile 18V brushless multitool can be used for all sorts of jobs, with a tool-free blade change to make switching between tasks quick and easy. Working on gloomy afternoons or in dark corners? Light up with the 3200lm 18V spotlight, featuring three lighting modes and a 30m beam. Completing the collection is the 18V worksite blower and inflator/deflator, which has a three speed fan for easy end-of-day cleanups, and handy nozzles for use on inflatables such as air mattresses.

AEG ‘Fusion’ 18V and ‘Force’ 5.0Ah 10 piece combo kit, $1,999, I/N: 0439249 Watch it! Scan the QR code For more offers and trade info, visit: trade.bunnings.com.au/ campaign/tax-time-trade-deals TAX TIME 16 bunnings.com.au

DeWALT ‘XR’ 18V 5.0Ah brushless 9 piece Li-ion combo kit

Here’s a kit that will help you take on plenty of tasks. “A lot of the tools are quite compact and lightweight,” says Tim. “Obviously, working with them all day, the lighter the tools, the more you can use them.” For example, the XR Atomic 18V brushless hammer drill driver, with 65Nm of torque and a 15-position torque control to handle screw-driving into multiple materials. And the XR 18V brushless 3 speed impact driver, which offers PrecisionDrive mode for extra screwdriving control. With up to 205Nm of torque, it’s a fast operator with heavy applications and has a ¼" drop-in bit holder for speedy one-handed changes. “They didn’t sacrifice on power either,” adds Mat. “I think the impact driver had more torque than some of the other tools we picked up, so they’re quite powerful, too.”

The Atomic SDS+ 18V brushless rotary hammer delivers 1.4J of impact energy in a lightweight, ergonomically designed package. Use it for drilling anchors and fixing holes into concrete, brick and masonry from 4mm to 16mm.

Next out of the box is the Atomic XR 18V brushless reciprocating saw, with a cutting capacity of up to 90mm and a tool-free blade clamp for fast blade changes. If you need to rip, cross cut or bevel wood and other construction materials, turn to the XR 18V 184mm brushless circular saw, which will give you a cut depth of up to 64mm.

The 18V brushless 3 speed oscillating multi-tool delivers a range of cutting and sanding tasks and lets you select the speed setting, with up to 20,000rpm of power and a

patented Quick-Change accessory system. “I thought the multi-tool was really impressive with the quick change blade,” says Tim. “I thought that was a cool feature. I hadn’t seen that before.”

Featuring a no-load speed of 9000rpm, the XR 18V 125mm brushless angle grinder gives you extended working time. It has an electronic clutch to reduce the kickback reaction in case of a pinch or stall.

Rounding out the collection is the compact and lightweight

BONUS REDEMPTION

If you purchase this kit before June 30 2023 you can redeem a bonus DeWALT 18V mitre saw, valued at $689/skin only (battery and charger sold separately), via the DeWALT website. T&Cs apply, visit website for details.

XR 18V jobsite blower. It includes an inflator/deflator attachment, useful for tackling more than just clean-ups. Shine on with the XR 18V LED pivot task light, which has a nine-position articulating head so you can direct it where you need it. Also included is a 550mm duffle bag, which has multiple inside pockets for storing tools, plus three XR 18V Li-ion 5.0Ah battery packs, and an XR multi-voltage charger, which covers DeWALT Flexvolt XR 10.8V, 14.4V, 18V and 18V/54V battery packs.

DeWALT ‘XR’ 18V Li-ion brushless 5.0Ah 9 piece combo kit, $1,999, I/N: 0441394

DeWALT ‘XR’ 18V Li-ion brushless 5.0Ah 9 piece combo kit, $1,999, I/N: 0441394

“I thought that was a cool feature. I hadn’t seen that before”

bunnings.com.au 17

Tim, carpenter

*vs. DEWALT DCB184 battery, not in application **Usable energy vs. DEWALT DCB184 battery, not in application ***Charge cycles vs. DEWALT DCB184 battery. POWERSTACK BATTERY TECHNOLOGY 50% more power* with 50% more work per charge** RUBBER OVERMOLD Increases durability and offers a non slip base 18V XR COMPATIBILITY Works with your existing 18V XR tools and chargers FUEL GAUGE Easily and quickly view state of charge Part of the 18V XR POWERSTACK platform and comptaible wit 18V XR tools Revolutionary pouch cells deliver increased power* and work per charge** 18V XR POWERSTACK 5AH BATTERY DCBP518-XJ I/N : 0389820 †vs. DEWALT DCB184 battery, not in application ††Usable energy vs. DEWALT DCB184 battery, not in application †††Charge cycles vs. DEWALT DCB184 battery.

AEG ‘Fusion’ lawnmower kit

There’s much to love about a battery-powered lawnmower. “You don’t have to worry about mixing fuel,” says Tim. “Or running out of it!” adds Mat. The Fusion 2 x 18V 6.0Ah 18" lawnmower has the latest in AEG’s advanced brushless motor technology, operating on two 18V batteries running simultaneously (in series) for excellent cutting power.

“One thing I liked about the lawnmower was that it looks cool, but it has a steel base, which makes it quite durable,” says Tim. The reinforced handles can be folded down for storage when the job’s finished. And its 7-position height adjustment feature means you can achieve a short lawn trim or longer cut with minimal fuss.

“It’s also a lot lighter than a petrol lawnmower, so is a bit easier to move around,” says Mat. “I carry my mower from the shed to the lawn – I’ve got a battery one so I can just pick it up, whereas the petrol one is a bit too heavy.”

Choose from side throw, mulching or catching modes, with a side throw shoot, mulching plug and 50L catching bag included in the kit, along with two Force 18V 6.0Ah batteries and two standard chargers, to start turning rough grass into smooth, lovely lawn.

DeWALT double bevel slide compound mitre saw and stand

This package brings you the 305mm (12") double bevel slide compound mitre saw and mitre saw stand A heavy-duty, solid piece of kit, it produces an excellent cutting performance from small profiles right up to construction timbers of 110mm x 303mm. A blade diameter of 305mm delivers a maximum depth of cut of 170mm, and it has a bevel capacity of 49/49 degrees and a mitre capacity (right/left) of 60/50 degrees. The XPS shadow line cut indicator assists with precise blade alignment. “This helps you cut more accurately, especially if you’re doing a mitre or something like that,” says Tim. “It’s a really cool feature.”

Built to last, this mitre saw has a large, dual sliding fence to give maximum support when cutting large materials at any angle or combination of angles. The blade speed is adjustable from 1900rpm to 3800rpm via an electronic speed control, allowing you to set the cutting speed to suit when you are working with materials other than wood, and a dust control and deflection feature to help keep the cutting area clear. Team it with the stand: It has a generous 1.7m beam which extends to support material up to 3.83m in length and 227kg in weight.

BONUS REDEMPTION

If you purchase this kit before June 30 2023 you can redeem a bonus DeWALT 184mm 1350W circular saw, valued at $209, via the DeWALT website. T&Cs apply, visit website for details.

DeWALT double bevel slide compound mitre saw and stand, $1,299, I/N: 0441385

AEG ‘Fusion’ lawnmower kit, $899, I/N: 0028229

bunnings.com.au 19

Makita 18V brushless 9 piece combo kit

“Tim uses Makita every day so he’s a big fan,” says Mat. “I’ve got a few Makita tools too – they’re always reliable.” The company created its 18V Lithium-ion cordless tool category in 2005; today’s LXT 18V range has all the benefits of Makita’s long experience of efficient, brushless technology in a convenient cord-free package. They’ve sorted through the world’s largest 18V cordless tool line-up for nine tools essential for anyone who knows their way around a worksite.

First on the list is the 18V brushless heavy duty compact hammer driver drill, which offers tough aluminium gear housing, mechanical 2 speed gearing with all-metal gear construction, and 60Nm max lock torque. It has a single sleeve keyless chuck and LED light for working in darker spaces. Pair it with the lightweight and compact 18V brushless impact driver, with its 170Nm of max fastening torque and high rotational speed for a quick result.

The 18V 125mm brushless slide switch angle grinder is your friend when it comes to tackling concrete: it has a deep concrete-cutting capacity at 20mm. “The deeper a smaller angle grinder will cut through concrete is very handy,” says Tim. “It saves you getting the big nine inch out.”

The 18V 165mm brushless circular saw can slice through suitable materials of up to 57mm, with a bevel capacity of up to 50 degrees. It has up to 5000rpm no-load speed and an innovative automatic torque drive, which increases torque to help push through any cut. The lightweight size of the 18V brushless compact reciprocating saw is a boon when operating in tight spaces, while a counterweight feature helps reduce vibration for less fatigue when working for long periods. A 22mm stroke length at 3100spm delivers fast cutting speed. Smooth operators will like the 18V 82mm mobile planer, with its

BONUS REDEMPTION

If you purchase this kit before June 30 2023 you can redeem a bonus Makita 18V 5.0Ah battery , valued at $189, via the Makita website. T&Cs apply, visit website for details.

14,000rpm motor and planing-depth adjustment knob to give cutting depths of up to 2mm. A clever fan design helps with ejecting chips away. Fine-tune the job with the 18V random orbital sander. With three speed settings – 7000, 9500 and 11,000 – it deals with removing material quickly, while the 2.8mm random orbit action is designed for fast sanding without leaving telltale swirls on your treasured piece.

“Usually, not too many of these 9-piece kits come with a planer,” comments Mat. “That’s a big bonus, especially if you’re a carpenter or you work with timber.” Adds Tim: “I thought the sander was a good little addition as well.”

Once you’re done for the day, clean up in no time with the 18V blower and 18V mobile vacuum

cleaner. Even with attached battery, this efficient blower pulls just over 2kg, while the variable speed trigger and 3-stage air volume settings let you easily direct the clean-up. Easy to manoeuvre, the vacuum has powerful suction and a 650ml dust container with filter for a fast cleaning fix.

Your new tools need power, so the combo kit also comes with two 18V 5.0Ah batteries – which have a useful gauge that indicates how much charge is left – and a single port rapid charger, which can charge a Li-ion 5.0Ah battery in just 45 minutes. The clever charger also determines the optimum charging method by gathering information from the battery’s memory chip. Finally, tidy up your tools with a handy tool bag. Its large, deep main pocket lets you quickly find what you’re looking for.

Makita 18V 9 piece brushless combo kit, $1,999, I/N: 0441335

20 bunnings.com.au

TRADE SERVICES

BUNNINGS MAKES LIFE EASIER FOR TRADIES WITH A BATTERY TRADE-IN OFFER AND THE HANDY POWERPASS APP

Battery trade-in offer

Trade in your old 18V power tool battery for $50 off a new battery twin pack

We love a trade deal – and we love it more when the impact is kinder on the environment. So we’re predicting that our Battery Trade-In offer for this tax time will be a winner.

All you have to do is bring your old 18V power tool battery to the Tool Shop Desk at your local Bunnings store, trade it in and get $50 off selected twin-pack batteries: choose a 5.0Ah battery twin pack from Makita, AEG, DeWALT, Bosch Blue or Metabo,

or a Hikoki Multivolt 18/36V 5.0/2.5Ah battery twin pack. You don’t have to stick to the same brands; for example, you could trade in a Makita battery for a Makita twin pack, or bring in an old Makita battery and go home with an AEG twin pack. In fact, you can trade in any 18V battery, even if the brand isn’t stocked at Bunnings.

The offer is for one battery per transaction: you’ll receive $50 off each new twin pack for every 18V battery you trade in. And, if your preferred

battery isn’t available in your local store, Bunnings can process a special order for you or direct you to a store in the area that has stock on hand.

While you’re in store, why not drop off any end-of-life household batteries at the battery recycling unit? Bunnings’ national battery recycling program has been running since November 2021. For more about the scheme and which batteries are accepted, check online at bunnings. com.au/recycle-batteries.

22 bunnings.com.au TAX TIME

Ask a helpful team member for more information

PowerPass App

Why you need to get the FREE app in time for Tax Time

The PowerPass App is one of the best FREE tools for tax time! And we’ve made loads of updates and improvements in the past year.

The App allows you to check stock levels in your preferred store before you arrive, check your exclusive PowerPass pricing, store all your receipts in one place, plus skip the registers in store by using the self-checkout function.

Scan the QR code

Read it!

Three reasons to download the PowerPass App today!

Get all you need to make running your business smoother

1 SELF-CHECKOUT

Skip the registers and get back to work even faster with easy self-checkout.

2 PRICING

View your PowerPass pricing and check stock availability before you head in store.

3 eRECEIPTS

Access eReceipts for easy bookkeeping and fuss-free product exchanges.

To learn more about the PowerPass App, visit: trade.bunnings.com.au/ powerpass-app bunnings.com.au

23

A designer look from the ground up

EMBEDDED

The bold, vertical look built your way

SAVE TIME SAVE COMPLEXITY

NEW Hardie™ Brushed Concrete Cladding, reminiscent of softly brushed concrete, provides a distinctive embedded textured finish which can be used from the ground up.

Hardie™ Oblique™ Cladding 300mm Hardie™ Oblique™ Cladding 200mm Hardie™ Oblique™

Hardie™ Oblique™ Cladding evokes a striking, contemporary aesthetic with wide grooves and bespoke design flexibility. ©2023 James Hardie Australia Pty Ltd ABN 12 084 635 558. ™ and ® denote a trademark or registered trademark owned by James Hardie Technology Ltd. Hardie™ Oblique™ Cladding and Hardie™ Brushed Concrete Cladding are available to order at the Trade Desk or enquire through your Bunnings Account Manager.

Cladding

Hardie™ Brushed Concrete Cladding

TEXTURE Linea™ Weatherboard NEW Hardie™ Brushed Concrete Cladding

EASY TO INSTALL COST EFFECTIVE COMPLIANCE

Painter’s Tape

Painter’s Tape

DeWALT ‘XR’ 18V Li-ion brushless 5.0Ah 9 piece combo kit, $1,999, I/N: 0441394

DeWALT ‘XR’ 18V Li-ion brushless 5.0Ah 9 piece combo kit, $1,999, I/N: 0441394