In this exclusive interview, we talk to John about his career, his new book Love, Pain and Money: The Making of a Billionaire, selling his ‘baby’, why anyone could do a better job than some of our politicians, and much more.

In this exclusive interview, we talk to John about his career, his new book Love, Pain and Money: The Making of a Billionaire, selling his ‘baby’, why anyone could do a better job than some of our politicians, and much more.

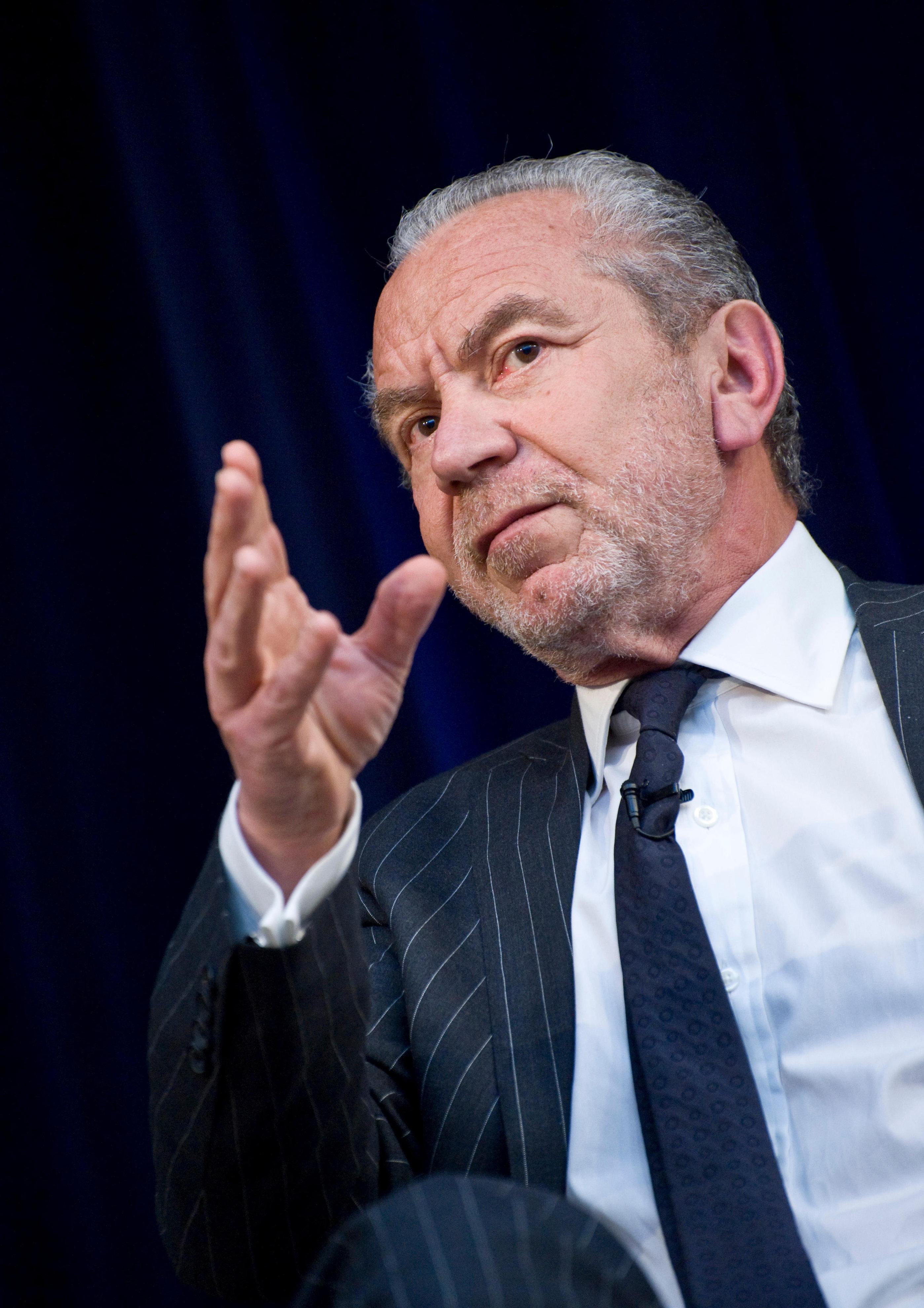

Meeting the billionaire founder of Phones4u, John Caudwell, at his house in Mayfair with the Business Leader team was an interesting first assignment as Editor. The beautiful home is just a sizable symptom of Caudwell’s success. Sitting in the interview chair while the team was setting up the cameras, I couldn’t help but think about the stories I’d read about Caudwell in preparation for the interview. The “ginger curly-haired” boy from Stoke was now one of the UK’s most renowned and influential business leaders.

We’ve profiled several other self-made billionaires in this edition, and taken a look at whether or not rapid growth can be toxic, along with a deep dive into levelling up: is it a political catchphrase or the future of economic prosperity? We’ve spoken to several experts, but we want to hear your thoughts on these topics. Connect with us on LinkedIn and add your voice to the thousands of leaders and entrepreneurs in the Business Leader network.

Entries for our national Scale-Up Awards are open until April 26th. Celebrate your company’s success by submitting your story to our prestigious panel of judges, including Dragon Touker Suleyman, CEO of the ScaleUp Institute Irene Graham OBE, and investor extraordinaire John Stapleton. Thanks to the brilliant sponsors of the awards whose dedication to UK enterprise shines bright for all to see: BKL, CapEQ, finnCap Group, Rocketmakers, Servcorp, Growth Lending, and Give a Grad a Go. Raise a glass to a successful Q2.

Josh Dornbrack Editor Editorial@businessleader.co.uk | @JDornbrackEDITORIAL

Josh Dornbrack - Editor

E: josh.dornbrack@businessleader.co.uk

James Cook - Digital Editor

E: james.cook@businessleader.co.uk

Serena Haththotuwa - Digital Editor

E: serena.haththotuwa@businessleader.co.uk

Alice Cumming - Editorial Assistant

E: alice.cumming@businessleader.co.uk

DESIGN/PRODUCTION

Adam Whittaker - Head of Design

E: adam.whittaker@businessleader.co.uk

SALES

Sam Clark - Head of Awards Sponsorship

E: sam.clark@businessleader.co.uk

DIGITAL & WEB

Nick Barnes - Video Editor

E: nick.barnes@businessleader.co.uk

Gemma Crew - Marketing Manager

E: gemma.crew@businessleader.co.uk

Rosie Coad - Marketing Executive

E: rosie.coad@businessleader.co.uk

CIRCULATION

Adrian Warburton - Circulation Manager

E: adrian.warburton@businessleader.co.uk

ACCOUNTS

Jo Meredith - Finance Manager

E: joanne.meredith@businessleader.co.uk

DIRECTOR

Oli Ballard - Director

E: oli.ballard@businessleader.co.uk

MANAGING DIRECTOR

Andrew Scott - Managing Director

E: andrew@businessleader.co.uk

Business Leader Magazine is committed to a zero carbon future and supports the World Land Trust by using recyclable paper wrap rather than plastic polywrapping. Carbon-balanced PEFC® certified paper, which is sourced from responsible forestry, is produced in an environmentally-friendly way to offset our CO2 emissions.

New research from open banking platform Yapily reveals businesses are potentially losing up to £656m in missed revenue at the last mile.

The research, which polled 2,000 adults in the UK, found that 52% of those surveyed have ditched at least one online purchase in the last 12 months due to a poor experience at the online checkout.

The need to manually input card details (25%), merchants not

accepting their preferred payment method (19%), and payments being blocked due to suspected fraud (15%) were among the most popular reasons for consumers abandoning their online purchases.

Abandoned sales were mostly priced between £21 and £60 (69%) and £61 and £100 (25%), with the average value of a discarded shopping basket sitting at £30.

A community of peers, advisers, customers and investors isn’t just a nice-to-have: many entrepreneurs claim community is critical to growth. However, over half (55%) of Series A founders claim engaging contributors in their business is their biggest challenge, according to the latest research by Koos.io.

Almost two-thirds (64%) of Series A founders said that sharing their business success with those who contributed was key to their success and growth, while almost twofifths (39.4%) recognised that building a loyal, supportive and engaged community of contributors was a contributing factor to helping their fundraising case.

At the same time, three-fifths (60.6%) admitted that demonstrating their business’s growth and impact has been the most challenging aspect when fundraising.

Wise, the global technology company, has released new research showing that banks took £3.6bn in often hidden FX fees from small- and medium-sized businesses in 2022.

Detailed in a new report, The Cost of Going Global: How are banks stifling dreams of overseas growth for UK SMBs?, it was found that last year all UK businesses lost £4.2bn in FX fees when selling goods and services overseas. The report details the scale of the problem for SMBs, which is compounded by exchange rate volatility and banks often hiding their fees.

For the sixth year in a row, Finland has been named the happiest country in the annual World Happiness Report published by the Sustainable Development Solutions Network, a global initiative of the United Nations. Research shows that satisfaction correlates with a wellfunctioning democracy, free elections, free press, and a low corruption index, along with inclusive social security services helping those who need assistance. These aspects combine to create a perception of well-being, and in these areas, Finland remains at the top globally.

Antti Aumo, Head of Invest in Finland from Business Finland, commented: “In Finland, the idea is that a well-functioning welfare state creates the prerequisites for a favourable business environment, enabling companies and individuals to succeed. This safety net functions as a trampoline in Finland, giving an extra lift for Finnish people and companies.”

As one of the world’s most competitive and open economies, Finland offers an outstanding launchpad for businesses. Here are three factors that create corporate happiness

Did you know that Finland enjoys the lowest corporate tax rate in the Nordic region and one of the lowest rates in the EU? The corporate tax rate in Finland is 20%, which is a fraction lower than the EU average (21.3%).

It all starts with education in Finland. The world-class educational system here is the foundation of the country’s cutting-edge research and innovation. With affordable daycare and free schooling available for all from preschool through university, Finns are not only highly educated and skilled but also represent the highest level of digital talent in Europe.

Finland ranks as the most stable country in the world2 when measured by political, social, economic and cohesion indicators. The business environment here thus offers extraordinarily high levels of continuity, trust, and transparency.

Transparent governance and effective state institutions are among the pillars of our well-functioning society, which in turn also reduces risks for international businesses.

PerfectTed is led by entrepreneurs, housemates and best friends, Marisa Poster and brothers Teddie and Levi Levenfiche. Together they have created Europe’s first matcha green tea-powered canned energy drink, which has now been launched in Tesco stores.

Powered by organic, ceremonial grade matcha, an antioxidantrich, Japanese matcha green tea,

PerfectTed contains 80mg caffeine (equivalent to a Red Bull or a small cup of coffee) and a more enduring and stable energy source.

Marisa Poster, Co-founder of PerfectTed, said: “We’re thrilled to partner with the UK’s leading grocer to grow the natural energy category and make healthier matcha green tea energy more accessible to consumers nationwide”.

Glovo, a multi-category app, has announced the launch of Impact Fund, a first-of-its-kind in the rapidly growing delivery industry where a small amount of Glovo’s earnings from every order will be dedicated to boosting Impact & Sustainability projects.

By the end of 2023, the Impact Fund will have dedicated up to five million euros (£4.4m) for projects related to supporting local communities, climate action initiatives, the digitalisation of small local businesses, closing the gender gap in tech, and upskilling programmes for couriers. This includes funds that have been allocated to these projects since mid-2021.

Staffordshire-based Top Online Partners Group, which owns the UK’s cashback site TopCashback, has expanded into Australia with the launch of TopCashback Australia.

The new cashback site already features over 600 popular Australian brands, offering members savings on everything from fashion to food, travel, technology, and much more.

Like its UK counterpart, the site’s aim is to help its members save as much money as possible by securing the best cashback rates on offer.

TopCashback Australia joins the group’s five-strong network of existing cashback sites (UK, USA, China, France, and Germany) which have a membership base of over 21 million people worldwide.

The new launch also marks a key milestone for the group as it’s on a mission to become the world’s best and biggest cashback provider.

Last year, TopCashback won the Queen’s Award for Enterprise in the International Trade category, which recognises businesses who have demonstrated substantial growth and commercial success overseas.

Graham Jenner, Director of International Growth of Top Online Group Partners, says: “We are delighted to add yet another country to our ever-growing list of international cashback sites, which brings us a

step closer on our journey to become not only the best and most respected cashback provider in the world, but also one of the biggest.

“With our focus on giving our members the best service and cashback rates, we’re confident that we have a winning service that is exportable across the globe.

“We look forward with optimism to continued growth and expanding into even more territories.”

Indigo Sun has reported its best-ever results, recording a turnover of more than £26m and almost £5.6m profit in its latest financial year.

The family-owned Scottish business has seen both turnover and profits double on the previous financial period when performance was hampered by months of Covid lockdowns. However, owners of the firm, which is headquartered in Stirling, say the impressive figures far outstrip performance even in preCovid years, giving the business a platform for an ambitious period of expansion.

Frank Taylor, 72, the founder and CEO of Indigo Sun, said: “In 2022 we saw full freedom from Covid closures. As the economy reopened, our customers were determined to get back to normal and to go on holiday with great enthusiasm.”

Amazon UNIVERSITY Esports has launched UNIVERSITY World, a project that brings the Metaverse to the esports and education sectors to connect students across the globe.

UNIVERSITY World is the newly launched virtual world of Amazon UNIVERSITY Esports, the esports and education project aimed at university students from 16 countries on four continents. In this newly designed space, students, and

wider audiences who want to access the space, will be able to interact with each other, both in a central hall common to all countries, as well as in the specific rooms of each one.

This will create a community among players from all over the world, being able to communicate through the integrated chat, score points to win prizes through different mini-games, and other multiple activities.

The UK’s number 1 search and discovery platform for home furniture and furnishings has raised £3.4m in seed funding following on from a £1.8m pre-seed in 2020. This brings the total funding to over £5.2m since the platform launched.

The business has attracted an impressive list of investors, both male and female who have a varied background and bring different insights and value add to

ufurnish.com, such as Michele Connolly, Partner at KPMG and Rosaleen Blair, founder and Chair of Alexander Mann Solutions.

Deirdre Mc Gettrick, the founder of ufurnish.com, comments, “It is invaluable to be able to reach out and share challenges and opportunities from my business with my investors. Often given their experience, they have insights over and above what I might have considered”.

The Bank of England has raised interest rates for the 11th time in less than 18 months. Following the latest jump in inflation, interest rates have risen to 4.25%. With interest rates going up again, the Bank of England hopes to drive inflation down.

However, Pietro Castelli, Head of Finance at Board, says the rise will place further pressure on businesses. He comments: “New data by Board International reveals a fifth (22%) of businesses do not have the tools to deal with another interest rate rise. There are lots of different ways companies can mitigate against economic fluctuations – increasing prices, changing suppliers, leaving, or entering new markets – but leaders must ensure that their planning and decision-making processes have the agility to deal with multiple scenarios and adapt quickly. In other words, they must develop a new set of planning muscles.”

With its growth of 522% over the past year, UK CBD company TRIP has become the fastest-growing soft drinks brand. The brand is growing at more than twice the rate of the second fastest-growing brand (compared with other brands with over £500,000 in sales the year before).

Founder Olivia Ferdi described the year’s achievements as “a special milestone for us, showing how far TRIP has come in our mission to destigmatize conversations about mental wellbeing and rework misconceptions about CBD, helping millions prioritise their health.”

But why the sudden demand? Studies show that people are increasingly giving up drinking, and since most alcohol alternatives generally don’t have the same calming effect, people are switching to CBD drinks to help them unwind without the threat of a hangover.

As a business leader, you know that the hardest climb isn’t Kilimanjaro, Denali or Everest. It’s the CEO’s leadership journey, and it’s fraught with all kinds of challenges and opportunities, setbacks and advances. The good news is you don’t have to go it alone. You can travel with an experienced guide who knows the lay of the land and an elite team of peers who’ve got your back.

You can equip yourself with world-class resources to navigate changing environments and uncertain conditions. You can take an approach forged over 65 years and travelled by 100,000+ CEOs of small and medium sized businesses around the world.

With that kind of support, how high could you ascend?

If you’re ready for the climb of a lifetime, the path starts here. Learn more at vistage.co.uk

Almost everyone on the planet has an obsession with the mindset of a billionaire. Many of these super-wealthy individuals began life with a distinct lack of a silver spoon and have scratched, clawed and worked ungodly amounts to achieve this privileged status.

Making the trip to meet with John Caudwell, founder of the Caudwell Group – which included mobile phone retailer Phones4u –at his house in Mayfair, showed just how far this young “ginger curly haired boy” from the streets of Stoke-on-Trent has come. In this exclusive interview, we talk to John about his career, his new book Love, Pain and Money: The Making of a Billionaire, selling his baby Phones4u, why anyone could do a better job than some of our politicians, and much more.

IF WE WENT BACK TO SPEAK TO A YOUNG CAUDWELL AND TOLD HIM THAT ONE DAY HE WILL BECOME A BILLIONAIRE, AND HELP OVER 65,000 CHILDREN AND THEIR FAMILIES THROUGH CAUDWELL CHILDREN, WHAT WOULD YOUR REACTION BE?

Even if you’d have asked a 30 or even 35-year-old John Caudwell… I would have been incredulous. Helping the children that might have been likely from day one, because I’d always had desire to help change some parts of the world as much as I was able to. However, you can’t do that without the wealth. You can do little bits without the wealth, but you can’t do big things without the wealth.

I would have never thought that I could be a multimillionaire, let alone a billionaire. You make your first bit of money, and then you start thinking, “could I get into the Sunday Times Rich List?” Looking back, it seems like such a superficial target to have, but you measure your success over years in different ways. In those early years, being valued at say £50m and making the Sunday Times Rich List seemed like I’d hit the jackpot.

COULD YOU TELL US ABOUT THE EARLY YEARS OF BUILDING THE CAUDWELL GROUP?

It originally started when I was trading cars. If I needed to call a customer, and couldn’t get to a BT phone box, I’d lose

the opportunity for the car. Then I saw this guy come into the auction with a great big suitcase phone, and thought, “wow, what is that?” This is 1986, so none of us had ever seen a device like that. I went over and started chatting to him and found out that it was a (very large) mobile phone.

I just thought it was incredible that this device existed because I didn’t know anything about them. I went back to the office and tried to find a supplier of mobile phones. Given where we are today, it’s unbelievable looking back because you couldn’t find anybody that could sell your mobile phone. I rang BT, who owned Cellnet at the time, but nobody knew anything about it.

I eventually set up a dealer account with Motorola and bought 26 phones. I lost money every month for two years.

WHEN YOU WERE LOSING MONEY, DID ANY PART OF YOU THINK THAT IT WAS TIME TO PACK IT IN AND ADMIT FAILURE?

I was making about £5,000 a month in car sales and losing about half it, which was very painful. But I absolutely believed in the future of mobile phones. I could not see why they wouldn’t catch on. At that time, I certainly didn’t see phones becoming the product they are today where every single person has one or more, but I did see every businessperson having one.

The turning point was two years later. I had six people running my two businesses, and then suddenly three of them resigned. As a result, I had to focus on the mobile phone business, and within three or four weeks, I turned a £2,000 loss into £20,000 profit. All of a sudden, I found levers that I could pull that were hugely profitable.

THE CAUDWELL GROUP WAS KNOWN FOR HAVING GREAT TALENT. HOW DID YOU MANAGE TO RETAIN THAT TALENT?

It’s not replicable in every business, but there’s a number of levers you can use to motivate people. One of the levers for me was that I was intending to be the UK’s most successful cellular business. Most people who are ambitious want to be part of a hugely winning formula, so the prestige of working in the Caudwell group was one of those levers. However, it’s nowhere near enough on its own. You also have to make sure that what you’re doing is paying people appropriately, putting in big bonuses for exceptional performance, but for the top people, I always put in a wealth creation scheme. It was designed in such a way that gave me quite a lot of control, but at the same time, it gave the employee a real chance of a significant payday.

THE CAUDWELL GROUP WAS WELL KNOWN FOR ITS COMPANY CULTURE. IN A WORLD OF WORKING FROM HOME, DO YOU THINK IT WOULD BE DIFFICULT TO BUILD A SIMILAR CULTURE TODAY?

I think from a point of view of employee relations, undoubtedly, it would be more difficult. I never believed in working from home, and I still don’t. It’s good for certain people, certain employees and certain situations, but what you want is a big dynamic environment, where everybody’s learning from each other. Where managers can coach, peers can help, and you get a dynamic environment that’s exciting.

If you’re an architect working from home, you don’t need that buzz while you’re designing things. But a business like Phones4u, and the wider Group, was all based on dynamicism, excitement and hype. We were also big on teaching and coaching – how can you do that if people are working from home?

COULD A BUSINESS LIKE PHONES4U BE REPLICATED TODAY?

It can’t be replicated now no. It was a land grab by the networks. Both the networks and the manufacturers desperately needed volume, as it was a real crucial part of the game. That gave me negotiating power. Not that that was easy, it was a constant edge of the seat thing, because every time I negotiated a deal enabled me to grow market share. Every time I grew my power, they tried to clip my wings.

They were constantly looking at how they could get the best out of Phones4u, but not let us get too powerful. And they did some horrible things over the years. One of the reasons I ended up selling the business in 2006 was because the stress level of managing a business where you’ve got somebody who completely controls your existence is a very uncomfortable place to be.

“MOST PEOPLE WHO ARE AMBITIOUS WANT TO BE PART OF A HUGELY WINNING FORMULA, SO THE PRESTIGE OF WORKING IN THE CAUDWELL GROUP WAS ONE OF THOSE LEVERS. HOWEVER, IT’S NOWHERE NEAR ENOUGH ON ITS OWN.”

WHEN YOU EXITED THE BUSINESS IN 2006, WAS IT A DIFFICULT DECISION OR DID YOU HAVE YOUR HEART SET ON SELLING?

Selling the business was very much an evolution. I’d had about 16 years of massive stress, and some of the challenges I faced were potentially terminal. One of those challenges was Motorola cancelling my contract in the early days, when it was 90/95% of my business. I found a way through, but each time you go through that, the stress levels are enormous. It was a very difficult and lonely place to be.

After 16 years of fighting like that, I also realised that I hadn’t fulfilled much of my charitable endeavours. At that time, I’d founded Caudwell Children and we’d helped about 4,000 or 5,000 children, but it was nowhere near the change that I wanted to make during my lifetime. I ended up just thinking, maybe the time is right to sell. From then, I started positioning the company for a sale, which went through a few years later.

DID YOU HAVE ANY SELLER’S REMORSE AFTER EXITING YOUR BUSINESS?

It was an interesting progression. If you go from 2002, can I really sell this baby? Because it’s exactly that, I’d grown it from zero and there was only me, to having over 12,000 employees. In certain aspects like distribution of phones and accessories, we’d become the biggest in the world. The sense of satisfaction and achievement that goes with that is huge. It’s your entire life, your family, your ego, it’s your identity, it’s everything. So in the early days, it was very, very difficult to admit that I’m selling my baby. However, as we got nearer to the sale, the stresses and pressures were just continuing at a massive pace. When we were going through the sale process, it was really hit and miss all the way through, and when the day came when we finalised the deal, it was actually a massive sense of relief. That feeling has never changed because it then enabled me to do everything that I wanted to do from a charitable perspective and from other opportunities.

SOME PEOPLE BELIEVE IT’S BEST TO PREPARE FOR A SALE FROM WHEN YOU FIRST START YOUR COMPANY, BUT OTHERS BELIEVE THAT IT CAN BECOME A DISTRACTION WHILE BUILDING A BUSINESS. WHICH APPROACH DO YOU BELIEVE IS BEST?

I’d say both. As long as you’re not ducking and diving and manipulating the situation, the two are one in the same side of the coin. They only become different sides of the coin, if you’re taking short-term strategies to try and sell your business, selling it out on a high but actually sacrificing the future as a consequence.

We see that happening in business all the time, where some chief executive sacrifices the future by under investing. You’ve got to take this balanced view of grooming the business in the most profitable way. For the short-, medium- and long-term.

WHAT ARE YOUR THOUGHTS ON THE TREND OF COMPANIES RAISING A LOT OF MONEY, WITH WILD VALUATIONS, BEFORE EVEN TURNING A PROFIT?

I think it’s easier to become super wealthy today than it’s ever been because of the

dot-com boom, which of course, came and went and now is back again. If you’ve got a globalised strategy with an internet-based product of any sort that can be successful, you can roll that out on a phenomenal scale. In my day, you couldn’t really do that.

Towards the end of Phones4u, we of course had internet sales, but the internet only really came into its own in the last 10/15 years. With the internet today, the opportunities are immense. If you get the right product or right application, your ability to create billions of wealth is phenomenal. That that was never the case 30 years ago.

WHAT IS YOUR PROGNOSIS FOR THE UK ECONOMY CURRENTLY?

Well, I’m very disappointed with where we are. In March 2020, I launched Caudwell Pandemic Recovery because I visualised the catastrophic consequences of the pandemic on the economy. There were four focal points, but the main one was to have a huge area somewhere in the UK, which for a number of years would be a tax-free enterprise zone.

It would only be for environmentally friendly technologies. We would recruit businesses from all over the world to come to this zone, and they’d because of the tax advantages that we’d be able to give them. One of the reasons I was a very strong Brexiteer, was because you could not do this as part of the EU. They just wouldn’t allow it. Having this enterprise zone could have created a huge future for Britain.

We’d still be in the same economic gloom that we’re in today, but the future would be brighter. We could be saying, “We’ve already got 50 companies signed up for this, we’ll get another 1,000 and we’ll be producing environmental technologies that the whole world will be wanting in the future.”

We would be able to export the product and the intellectual property all over the world, and Britain will be booming in 10 years’ time. We’d have something to tell the world that would be phenomenally exciting and positive. Unfortunately, the Government has done nothing. I’m devastated for the UK, because the opportunity hasn’t been grasped, and there was a massive opportunity. Now we find ourselves in a mess with the economy looking like growing the least and in Europe, and the “Great” in Great Britain slipping away. The politicians have just not done the right job.

“I THINK IT’S EASIER TO BECOME SUPER WEALTHY TODAY THAN IT’S EVER BEEN BECAUSE OF THE DOT-COM BOOM, WHICH OF COURSE, CAME AND WENT AND NOW IS BACK AGAIN.”

THERE’S A TRAIN OF THOUGHT THAT BILLIONAIRES SHOULD BE BROUGHT INTO DISCUSSIONS ABOUT POLICY, AND THE DELIVERY OF THOSE POLICIES BECAUSE THEY AREN’T AFFECTED BY A FOUR- OR FIVE-YEAR CAMPAIGN CYCLE LIKE POLITICIANS ARE. WHAT ARE YOUR THOUGHTS ON THAT?

I think anybody getting involved could do a better job than some of our politicians. The problem with politics is people get in it for the wrong reasons. They get in it for power. They get in it for fame. So all the time, they’re just driving for a different set of objectives. What we really need is politicians who are commercially minded, who are driving Britain as a PLC, because that’s all we are. We need to create wealth, and from that wealth, we can look after the poorer members of society, we can provide wonderful social

services, great health care, etc, etc. However, if the business doesn’t prosper, we can’t do any of that. First and foremost, we need to get the business right, and we never do.

YOU’RE A BIG ADVOCATE OF SUSTAINABILITY, AND YOU PUT YOUR MONEY WHERE YOUR MOUTH IS WITH YOUR DEVELOPMENTS SUCH AS 1 MAYFAIR. YOU ALSO FAMOUSLY PREDICTED THE 2008 FINANCIAL CRISIS BEFORE IT HAPPENED. LOOKING AT SUSTAINABILITY AND WHAT IS GOING ON IN THE GOVERNMENTS AROUND THE WORLD AT THE MOMENT, WHAT DO YOU THINK THE FUTURE HOLDS?

If you asked me what are my big concerns in life, number one is the viability of the earth to survive. I don’t think anywhere near enough is being done. It’s not just about climate change, it’s one of the factors, but the real issue is water shortage.

My number two concern is security and the very toxic world we’re living in. Russia’s invasion of Ukraine, megalomaniacs in North Korea and the relationship between Russia and China, what we seem to have is a real attack on Western style democracy. These genocidal people who don’t spare a thought about human life and who are prepared to slaughter as many people as they will need to do to fulfil their own objectives. Going back to the Greek Empire, Roman Empire, British Empire, it’s always going to be the case, but I think, for me, the Russians invading Ukraine, have really brought that home in a big, big way.

HOW DID YOU FIND THE EXPERIENCE OF WRITING YOUR BOOK, LOVE, PAIN AND MONEY: THE MAKING OF A BILLIONAIRE?

It came about as a result of the pandemic, because I suddenly couldn’t go anywhere. I suddenly found a little bit of spare time, and people have been encouraging me to write an autobiography for 20/30 years, so I suddenly bit the bullet and slowly started doing it.

It was incredibly emotional, because I had to search to the depths of my darkest moments in life to tell the story. Some of those stories were very emotional for me reliving devasting memories. However, despite being sad and painful it was enjoyable. That’s why the “pain” comes into the title, as my life is all about love, all about pain, and all about money.

“THE PROBLEM WITH POLITICS IS PEOPLE GET IN IT FOR THE WRONG REASONS. THEY GET IN IT FOR POWER. THEY GET IN IT FOR FAME. SO ALL THE TIME, THEY’RE JUST DRIVING FOR A DIFFERENT SET OF OBJECTIVES.”

If these uncertain times have presented an opportunity for organic growth and you need funding, our expertise spans debt, equity and everything in between.

Put simply, our advisory service builds funder confidence in you and your business. We present your growth strategy to the right funders, in the right way and negotiate the best terms for you, giving you the best chance of unlocking your growth potential. Here’s how we can fund your growth ambitions:

• Business acquisition financing

• Growth funding

• Management Buy-in & Management Buyout financing

Whether it’s to become an owner, strengthen your market position or to expand your existing portfolio, our M&A experts help individuals and management teams to buy a business at the right price, on the right terms, and with the right funding in place. Here’s how we can help accelerate your growth:

• Acquisitions

• Management Buy-in (MBI) & Management Buyout (MBO)

• Business mergers

When it’s time to sell the business you’ve grown, our ‘sellside’ advisory services help owners sell to the right buyers, at the right price, and on the right terms whilst maximising and protecting the value you have created. Here’s how we can help you sell your business:

• Developing your business exit strategy

• Business valuations

• Business sales (Trade, Private Equity, MBO & EOT)

• Pre-sale tax planning advice

VISIT: SHAWCORPORATEFINANCE.COM

BOOK A MEETING: 0330 127 0100

“Shaw & Co very effectively ran first our debt raise and then subsequently our equity deal – recognising and addressing our needs extremely competently throughout both processes. Our faith in Shaw & Co’s expertise to deliver these transactions to completion was vital as it allowed us to maintain focus on ensuring the performance of the business met the expectations of our shareholders and investors.”

Dr Simon Tyler, Chief Commercial Officer at CatSci Ltd

Our entire approach is focused on helping you achieve your greatest ambitions. We succeed only when you do – whether raising finance, buying a business or selling one you have grown.

£26M TRADE SALE OF KEEP IT SIMPLE TO THE PANOPLY HOLDINGS PLC

“I would enthusiastically recommend Shaw & Co to anyone looking to go through the same process we just completed.”

Grant Harris, Founder & CEO at Keep IT Simple Ltd

For many business founders, selling their firm will be the culmination of their hard work. Founders sell for different reasons. Some run out of cash, some find their business doing so well that buyers come knocking, while others realise they need help from an acquirer to take their business to the next stage of its journey.

Whether you’ve just started your business journey, or have been building your company for some time, our warts and all guide to selling a business will help you understand what goes into selling your baby.

Every founder will have their own reason for wanting to exit a business. Perhaps you’ve had a dispute with a co-founder, or sales are slowing. It’s important to remember the reason you’re selling your business throughout. This will make the process more focused as you will come back to the original purpose of the sale at every step of the way. Deals can take a long period of time, and buyers will want to know the reason for you

selling, so identifying this is an important part of the process.

WHAT TYPES OF EXIT STRATEGIES ARE THERE?

MBO

MBO or Management-Buy-Out is when the company is sold to its senior leadership team. An MBO makes sense if your management team is integral to the business and they have become essential to the fabric and DNA of the company.

MBOs come in two different forms. Buy-In Management Buyout (BIMBO) is when the management team brings in an outside manager to facilitate the acquisition, whereas a Vendor Initiated Management Buyout (VIMBO) is when the existing senior management team initiates the business purchase.

MBI

The opposite of an MBO is an MBI or Management-Buy-In. While an MBI involves a business’s internal management team purchasing the company, an MBI involves an external management team acquiring a

company and replacing the existing management team.

MBIs usually take place within companies with a weak or undervalued management team. Despite this, an MBI has the advantage of having existing managers who understand the business while acquiring it.

Selling to a private buyer is the quickest way to sell a business as private equity investors don’t need to raise money for the purchase. As a result, founders might not receive the full value of the business.

Private equity investors won’t get involved in the running of the business, therefore founders will need to ensure buy-in from the senior management team or exist within the business for some time.

This sale involves selling the business to a competitor, either nationally or internationally. This can sometimes be a good move for small to medium-sized businesses because competitors are likely

to value the business in a way that investors may not. Typically, this type of sale can add more value to your business.

This type of sale involves selling to a customer or supplier and can be both international and national. Selling your business internationally can be lucrative due to favourable UK exchange rates. However, a vertical sale usually takes more time than other types of sales and the company’s senior management team may need an incentive to continue within the business.

Otherwise known as an IPO, this is when a private company’s shares are offered to the public. IPOs can be very lucrative, making it appealing to founders. However, going through an IPO can be a long and expensive process, making it an unlikely opportunity for smaller businesses.

When it comes to selling your business, it’s good to have a structured approach. Here are some steps to follow to ensure your transaction runs smoothly: Research tax you might need to pay

When you sell your business for a profit, you need to pay capital gains tax on any amount over your tax-free allowance. Despite this, there are a few tax reliefs that can lower this expense, including business asset disposal relief, business asset rollover relief, incorporation relief and gift-hold over relief.

You will also need to think about the VAT your company pays – this can usually be transferred to your buyer and should be thought about during the deal.

Next is the part you’ve been waiting for. It’s time to get your business valued. A business’s valuation is decided based on physical assets, projected profits, the industry and your business’s reputation. It helps to get an expert to come up with this valuation. A valuation

isn’t necessarily what your business will sell for but will help set your expectations when selling.

If selling to a buyer, they will carry out extensive and comprehensive due diligence on your business to ensure they’re making the correct decision buying your company. It’s recommended to get a legal professional to help with this process as any holes in the business will surely put potential buyers off. Even though due diligence may seem tedious, it also brings any issues in your business to the surface, so can be tremendously beneficial to your firm.

Some of the things you may want to do in preparation for due diligence includes gathering financial documents and tax returns, paying off any liabilities, making it clear what the position of the shareholders is, and reviewing contracts with employees and clients.

Be ready to negotiate

An important part of your sale process will be the negotiation stage. If selling to a buyer, they will likely want to get your business for a lower price than you are asking for. In this case, you’ll want to remember what your business was valued at and don’t be afraid to put up a hard bargain.

Despite this, it’s worth having some space on your side of the bargain and be willing to settle for a little less than what you have said you want. Make sure your buyer has the necessary experience and capital to successfully buy your business without any setbacks.

Choosing the right time to sell your business can be the difference between a modest and eye-watering sale. Not all sellers will have the luxury to, but selling when your business has high profits and is in a good state is likely to attract more buyers and secure a good deal.

It’s also a good idea to sell when the economy and market conditions are doing well, and there’s an increased appetite for acquisitions.

After your sale is finalised, you will need to make clients, partners and employees know how the sale will impact them and the company. You should avoid doing this during the sale process to avoid any disruptions, or in case the sale falls through.

Essentially, the best exit strategy depends on many factors including the size of your business, your management team and whether they want to run the business, if you’re desperate to sell, and whether you want a fast or profitable sale. No matter how you decide to exit your business, it’s important to prepare your business for a sale effectively – hopefully, with this guide, you will be able to do just that.

IPO activity suffered a bit of a reality check in 2022 after the dizzying heights of the previous year. With interest rates rising, high inflation and economic growth slowing globally, 2023 could be another year where IPO activity is subdued. As of March 8th 2023, there have been 25 IPOs on the US stock market in 2023, compared to 70 this time last year, a drop of 64.23%.

However, according to a survey conducted by KPMG, 16% of UK Capital Markets leaders expect IPO activity to pick up in Q1 2023 and 72% believe an upturn can take place in the second half of the year, so confidence of a stronger 2023 remains. Here are five IPOs which could happen this year.

In April 2022, Bloomberg reported that Blockchain.com, a company that develops an online cryptocurrency wallet and provides tools, statistics and charts for cryptocurrency markets, started interviewing banks for an IPO. However, sources told Bloomberg that the IPO may happen in 2023, or perhaps not at all. If an IPO does happen, Blockchain.com’s regulatory approval issues with the Financial Conduct Authority (FCA) could suggest a US listing is more likely.

Happy Drinks Co makes a range of soft drinks and flavoured, low-calorie tonic waters which are free from chemical sweeteners. In an interview with The Times in March last year, the Liverpool-based startup, which also trades as Skinny Tonic, said they were hoping to float within 18 months. Following its most recent funding round in April 2022, the company reached a valuation of £48.7m.

Sports gamification firm Low6 successfully raised $5m in January last year in what several news outlets described as a pre-IPO funding round. Although no concrete plans for an IPO have been announced by the Birmingham-based company, Low6 raised an additional $500,000 from Australian online wagering company, BlueBet in October 2022, meaning it might be edging closer to an IPO in 2023.

Cornish Lithium is a mineral exploration company focused on the sustainable extraction of lithium and other battery metals. The firm was initially set to IPO last year, but in an interview with The Times in October 2022, the eco-technology company said their flotation was being put on hold because of tough market conditions and is now unlikely to happen until 2023.

eToro is an online stockbroker that enables its users to trade shares, ETFs and cryptocurrencies. Operating in over 140 countries, the Israeli company was expected to IPO via a special purpose acquisition company (SPAC) deal in mid2022, after a previous delay from December 2021. However, in July 2022, eToro announced the $10bn deal with FinTech Acquisition Corp V (FTCV) was mutually terminated. Although no IPO has been confirmed since, it’s likely the company will attempt to go public again in the near future.

Typically, the overall time required to sell a business is between 9-12 months. As you might expect, this can vary depending on the business being sold or the type of transaction.

At BCMS, each sale process we run will be tailored to meet the specific need of the client, and therefore may vary from the illustration below. However, as a guide, you could consider the process as segmented into three stages, each of which lasts approximately three months:

Stage 1: Preparation

This stage is crucial and involves a thorough review of your business, from a legal, financial and commercial perspective. It also involves market research of your competitors and analysis of your position within your core markets, as well as profiling and identifying potential buyers. In this stage, you will need to develop a robust financial forecast based on historic Key Performance Indicators (KPIs) and known new opportunities.

A Virtual Data Room is also prepared in readiness for Due Diligence. One output of this phase is a detailed Information Memorandum (IM), which you can think of as being the Sales Prospectus for your business. It provides detail on all aspects of your business – operational, commercial, financial – and will also include a section on future growth opportunities.

Stage 2: Go to Market

Creating competitive tension is critical to successful negotiation, and this stage

includes contacting potential acquirers and building a market for your business. At BCMS, we do not approach any buyer unless you have confirmed you are happy for us to do so.

Upon signing of a Non-Disclosure Agreement (NDA) to ensure confidentiality, interested buyers/investors are provided with your IM. After that, Initial Offers are invited, terms discussed, commercial synergies explored, and additional information exchanged. Following this, selected buyers are asked to submit a Final Offer.

Following agreeing and signing Heads of Terms with your preferred buyer, there will be an Exclusivity period.

Once we have the commercial terms agreed in principle, the buyer will take the next month or so to conduct its Due Diligence (DD). This is a detailed review of all key aspects of your business and its operations. Typically covering commercial, legal, financial and tax matters, its purpose for the preferred buyer is to verify its valuation and assess future risk.

Once DD is complete, the focus moves for all parties to finalising the Share Purchase Agreement (SPA) and any ancillary legal documentation such as Service Contracts.

When should you start exploring the sales process?

Preparation is critical, so you do need to plan ahead. A rule of thumb would be to identify a

date when you would ideally like to exit your business and then work backwards from there – at least two years.

There are some key questions to consider as you begin to explore a sale. To mitigate risk, an acquirer may wish to keep you in the business for an extended handover post sale. Could you avoid this if you made some senior level hires now and transitioned yourself out of the business? How is your business performing today, how might it be performing in a year or two, what might you do now to influence that performance? What else might be improved in the meantime?

A corporate finance advisor can help you answer these questions, fully evaluate all options and provide you with fresh perspective on key business decisions you might need to make. Start planning early and you can take control of the timeline. Remember, you are embarking on one of the most important journeys of your life.

For advice on your options and how to drive value in your business, contact BCMS

“Selling or securing investment for your business is a marathon not a sprint. We started seriously working on the business of securing investment 9 months before it happened. This isn’t a side line activity; this is a full on, full throttle experience which requires you to be on your game from the get-go.

“You are going through every contract that you have created, checking on every piece of IP and industry regulation with a fine tooth comb, and that’s before you gather irrefutable evidence of the growth potential of your brand to enable you to write a killer Investment Memorandum on why your business is the best in class. I am a fatalist, and when we met PZ for the first time 6 months before we eventually sold to them, I just knew they were the ones for us. They had a strategy into which Childs Farm would fit like a glove, they had real and tangible purpose for sustainability and wanting to become a B Corp, and the people are genuinely talented, capable and loved the brand.

“I can honestly say other than the moments of sheer exhaustion and terror at the amount we had to turn around each night for the last month, the external team and our internal team leaders. We had some slightly punch-drunk moments when the gallows humour came into play, but as a team we had a really fun experience, and all remain friends to this day.

“It also made me appreciate the loyalty they had too: I remember calling my R&D Director Dr Lou Norman one night at midnight to ask her to turn something around in 2 hours. She got up from bed without a qualm and got the work done. She was also in the office at 7am the next day. I could have done this to anyone of this core team. They were golden. Seeing these really loyal folks work shoulder to shoulder and made me unbelievably proud of their resilience, drive and determination.

“Of course, there were negative times which usually involved last minute turnarounds, being unable to find something vital and being asked the same question seemingly 15 different ways. But if it was that easy, everyone would be doing it. And they are not.”

(TO PROTECT THEIR IDENTITIES, THE FOUNDERS IN THESE STORIES ARE BEING KEPT ANONYMOUS)

Co-Founders A & B were clients of a strategic partner of mine and were looking to exit their business through a sale. They thought they had identified the perfect buyer for the business - and had an agreed valuation. However, the negotiations had taken a long time - nearly two years - and it turned out that they were so focused on the business sale process that they took their eye off the ball in terms of maintaining growth. In fact, the last set of figures that went into the document vault showed that the business had been flatlining for the last 12 months...

“The buyer had based their offer - as most

buyers do - on continued revenue growth. At the very last minute, Co-Founders A & B learned that the deal they had counted on was reduced by over one third. They were not prepared to accept the reduced valuation (having got used to a fixed figure), and everything fell apart.”

“Founder C ran a highly successful, fast growing, tech business. They had always planned that part of their growth strategy would be through acquisition, and thought they’d planned their first purchase well. However, there was a mismatch in understanding between the two companies about the rationale for buying the business,

complicated by a lack of clarity about the on-going role of the Founder in the business that was being bought, and a lack of understanding about the importance of cultural and values fit.

“I started working with Founder C the month after the acquisition, and the first year of our work together was largely spent dealing with the fallout from the deal and mitigating the impact on their business. Employees in the bought business (including the former MD) started to sabotage operations, due to a complete mismatch between the values and patterns of behaviour in the two companies.”

“Over the years, my business partner and I had chatted now and again about what we would be willing to sell the business for. This came into sharper focus when the owner of our biggest competitor flew to the UK, invited us to dinner in a country pub and wrote a number down on a napkin! It was a big number. We liked the number. But it was without context - was that an accurate valuation or a bargain? We simply didn’t know. At this point, we decided to attend a seminar held by a sell-side M&A advisor. We liked what we heard and engaged them to research our business and the potential buyers that it could attract.

We decided that we weren’t quite ready for sale, so we went away and refined several aspects of the business: Clarifying contracts, defining additional KPIs (and generating historical data), improving processes, as well as implementing a share option scheme to show commitment to our staff during a time that we thought they may find stressful or uncertain. We returned to the M&A advisor a couple of years later and took the business to market.

“There were some challenges - the buyer wanted to accelerate the purchase, to fit in with their own requirements. This necessitated us completing the due diligence in 6 weeks, which was a tall order. However, we did manage this. The warranties and indemnities took some serious negotiation time and we did run over schedule by about a week.

“It was a wholly positive experience. The changes we made within the business, originally for the purposes of the sale, were beneficial to the running of the business day-to-day. Personally, I also found the sale process to be ‘a bit of a rush’. By this time, I had been running the business for 15 years and the entrepreneurial adrenaline was no longer there - I found the sale process to be energising in the same way that the early years of the company were for me. When we selected our M&A advisor, we really didn’t know them that well, or how appropriate their recommendations were. Along the way, they made recommendations of lawyers to use, as well as wealth management advisors who could help make the most of our funds post-sale. Their recommendations turned out to be spot-on and along the way I got to work with several people who really were at the top of their game.”

“Selling your business can be a series of mixed emotions. However, when you find the right partner it settles any nerves. It’s important to make the decision based not only on your personal goals but those that align with your teams, customers and the company’s future vision.

“There weren’t too many challenges for us, it was a decision that was made easily due to the synergies between the brands and being

transparent with the buyer on your vision for a future combined model. Being honest about your teams strengths, future vision and values is important.

“Picking the right partner for the future is more important than the price point. Knowing that you can build something amazing together when combining resources or your team and customers are in good hands if you are selling to completely exit.”

“Our business was not actively for sale, but we were approached by a consolidator in our sector. However, once we met the company, the deal and the price were not to our liking. Off the back of this, we approached other consolidators in the sector telling them that although we weren’t for sale, we might be willing to listen to offers. One of them came back and said they would be interested in buying us. A few phone calls and we very quickly agreed a deal. The deal then went to the lawyers, which took another four months until we signed on the dotted line.

“It was generally a positive experience. The reasons for this was that the deal structure was perfect (all cash, in three tranches within 90 days of the sale) and the price was above market multiples at the time of sale. There was also very little handover required (purchaser's preference).

“The two biggest challenges were the legals of the deal and telling my team, along with the fallout from that. The purchaser's lawyers were American which caused issues, but they, as a plc, had a number of key people who all wanted their two cents worth on the minutia of the contract wording. This all meant we spent way too long on the legals. I had the difficult task of not only telling my team that we'd sold the business, but also that the new owners were giving them all three months notice. Unsurprisingly this caused major upset.”

Thomas Clark, partner and corporate lawyer at Moore Barlow, highlights the most common pitfalls that business leaders fall into when planning and preparing for a sale. Any M&A advisor will tell you about the mad rush in the run-up to a deal completing. But those final days and weeks are normally the culmination of months, if not years, of preparation.

Selling a business is a monumentally complex operation, with potential pitfalls at every stage.

Here are the biggest mistakes I see businesses make, and how to ensure you don’t do the same.

Leaving it too late

When a business owner starts thinking about selling for the first time they are, at best, 18 months to two years away from a successful completion.

That’s the length of time needed to get all your ducks in a row.

The majority of this planning is to make the business as attractive, organised and profitable as possible.

The legal work ahead of a deal focuses on ensuring the buyer does not find anything concerning in their due diligence. This includes: making sure company books up to date; ensuring agreements with suppliers and customers have change of control provisions; and checking the business has appropriate internal policies.

For example, employment contracts which follow best-practice and include realistic and enforceable restrictive covenants will make the business look well run.

Early tax planning is also vital. The higher the value of a business, the more complicated it becomes to structure it in a tax-efficient way, so owners should do this as soon as possible. Effective tax planning is difficult to do with a sale approaching.

Business owners should start personal tax and estate planning to manage any windfall they receive from the sale.

Underestimating the resource needed Often owners don’t appreciate that selling a business is a job in its own right. The drain on time and people power can impact business-as-usual activity.

Sales run most smoothly when the seller establishes a ‘deal team’ – people who are taken partially away from the day-to-day to manage the transaction. Included in this team will also be external legal and financial advisors.

Identifying the right external support early is essential – look to firms with specialist M&A experience.

It’s important that there is cover for the deal team. Sometimes this means hiring more senior resource or upskilling future leaders. This also makes the business more attractive because it is not so reliant on the founders and key board members.

Not thinking about post-sale

Owners can be caught up in getting the deal over the line and de-prioritise a crucial stage of a deal – what happens afterwards.

Quite often, a sale agreement will require the owners, board members or key leaders

For more information on selling a business, please contact thomas.clark@moorebarlow.com

moorebarlow.com

to stay on the pay roll for a period to manage the transition. It’s also common for a seller’s payout to be based on future earnings or other performance milestones.

This makes it essential to set the business up for further growth post-sale. Buyer’s will want to see, for example, that efforts are made to retain key staff – incentive schemes are useful here.

An Enterprise Management Incentive (EMI) may be useful. This is a share scheme approved by HMRC that facilitates low tax options for employees, alongside various tax reliefs for employers as well.

Growth shares or other equity arrangements can also ensure that key staff are retained, and performance continues to advance post sale.

There’s no easy way to sell a business and, while the rewards are often worth it, the process can be overwhelming. The key for any would-be-seller is appreciating the size of the task, finding the right colleagues and advisors, and starting the work immediately.

DEAL VALUE: ESTIMATED TO BE $20M OVER FIVE YEARS INCLUDING CASH AND ROYALTIES

The Healing Company has recently announced its acquisition of Chopra Global’s well-being experiences businesses, in a partnership for both companies. Dr. Deepak Chopra has spent a lifetime bringing integrative healing to hundreds of millions of people, authoring more than 90 books, creating educational content for his 20M social followers, leading thousands of events, and developing best-in-class healing products and experiences that have changed lives worldwide.

With this bold vision in mind The Healing Company and Chopra Global enter into this partnership, working to usher the brand into a new era of growth. Chopra Global sits at the nexus of three high-growth sectors: integrative healing ($100bn market, 22% CAGR), Ayurveda ($7bn, 15% CAGR), and meditation ($5bn, 30% CAGR), and reached over 100 million people last year.

Dalata Hotel Group has acquired a newly finished hotel 192-bedroom hotel, bar and restaurant, at 240 Seven Sisters Road, adjacent to Finsbury Park Station, will launch in the summer under the Maldron brand. Dalata were advised by lawyers at the Bristol office of international law firm Osborne Clarke.

DEAL VALUE: UNDISCLOSED

The French group GBH has announced their agreement to acquire Mangrove Global Ltd. London-based Mangrove joins SPIRIBAM, which coordinates all of the spirits activities of GBH, the familyowned and diversified group founded in 1960 by Bernard Hayot.

Nick Gillett, Co-Founder and current Managing Director of Mangrove, remains at the helm of the company and will lead the distribution of all GBH rum brands for the UK. John Coe, majority shareholder and co-founder of Mangrove in 2006, leaves the business to focus on his other business interests after a remarkable career in the spirits industry.

Prior to opening, Dalata will invest in excess of £2m to enhance the property, which has expected stabilised annual earnings of £4m. It will be Dalata’s first Maldron hotel in London, its 18th in the UK, and will create more than 50 jobs.

Under the transaction, Dalata has purchased the entire issued share capital of Tide Developments Limited (TD4) for £44.3m from Furadino Holdings Limited. TD4 has a gross asset value of £45.1m and owns the freehold interest of the hotel property. The total consideration will be financed from Dalata’s existing cash and banking facilities.

“I WAS DELIGHTED TO LEAD THE OSBORNE CLARKE TEAM AS WE ADVISED DALATA ON ITS LATEST TRANSACTION. WITH EXCELLENT SUSTAINABILITY CREDENTIALS AND THE PROVISION OF OVER 50 JOBS, THIS ACQUISITION IS A FURTHER STAGE IN DALATA’S STRATEGIC UK GROWTH PLAN AS IT FURTHER EXPANDS ITS REACH.”

NICK SIMPSON – REAL ESTATE PARTNER, OSBORNE CLARKE

DEAL VALUE: UNDISCLOSED

Craven Street Wealth has successfully acquired London-based Bernard Barrett Associates Ltd. This follows the successful integration of Tarvos Wealth Ltd into the ambitious financial planning and wealth management group earlier in February, with this latest acquisition resulting in a group with the expertise of 18 Financial Planners, 11 of which have achieved Chartered Financial Planning status and a total of £1.25bn of assets under management.

All Bernard Barrett Associates staff will remain within the business immediately post-acquisition and continue to operate from a London office. Bernard Barrett will continue employment, over time phasing into a relationship management capacity, whilst Stuart Bates will join the Craven Street Wealth management team.

DEAL VALUE: UNDISCLOSED

Paramount Retail Group has recently announced that it has acquired the business of four major online retailers: Fetch, Medic Animal, Pet Supermarket, and Pet Meds, from the Speciality Stores previously owned by Ocado Group.

Generating a combined turnover of over £50m in 2021, the brands join a strong portfolio of companies owned by The Paramount Retail Group. This latest move positions Paramount as a major player in the pet sector.

DEAL VALUE: £30M

European orthodontic provider Impress has announced its exciting acquisition of London-based invisible aligner brand, Diamond Whites, creating the largest UK network of orthodontic clinics and expanding Impress’ offering of oral care, whitening products, and cosmetic dental treatments.

This acquisition will allow Impress and Diamond Whites to combine talent and operations to offer the best orthodontic patient experience across 60 cities in the

UK. In addition, Impress and Diamond Whites will launch cosmetic dental treatments under the supervision of Dr. Richard Marques.

Diamond Whites’ aligner patients will benefit from Impress’s tech-first approach to orthodontists in its flagship clinics across the UK. Impress clinics, orthodontic support and proprietary software will enable Diamond Whites to treat a variety of orthodontic patients, as well as more complex cases.

DEAL VALUE: UNDISCLOSED

RSK, a global provider of sustainable solutions, has announced the acquisition of Richard Irvin FM, a technical facilities management and energy solutions company. With a network of offices across Scotland and the north of England, Richard Irvin FM has a team of 230, including engineers, operations staff, project managers and compliance specialists, and an annual turnover in excess of £25m.

Chief Executive Officer Mark Buchan, who will continue to lead Richard Irvin FM, said: “We are delighted with the acquisition, and we strongly believe that joining RSK will help us move forward as a company, building and strengthening our reputation even further.”

As RSK continues to deliver its ambitious growth strategy, it now comprises more than 175 companies with 11,000 people. The group’s annual turnover at the end of FY22 was £796m. The acquisition adviser was Satvir Bungar of BDO.

Dominic McGregor, Co-Founder of Social Chain and Fearless Adventures, scrutinises the saying “Too Big To Fail” and gives his prognosis of the M&A market.

In the last few months the newspapers have been lined with stories of a major banking crisis, which we haven’t seen since 2008. The star of the Tech and VC scene Silicon Valley Bank (SVB) has been rescued by HSBC in the UK for a peppercorn £1.

Credit Suisse one of the major global banking institutes has been snapped up by rival UBS and this feels like just the beginning. There’s a saying in business “Too Big To Fail” which is given to a lot of large corporations that have become part of the establishment and embedded into our everyday lives. In the UK we have a number of these businesses which I would put into this category across a number of major sectors. Everyday household names, like M&S or Natwest.

From my experience in businesses, this statement is very much a myth. As you scale a company and begin to introduce processes, operations and scale you lose the entrepreneurial foundations on which businesses are built on. You introduce a risk that someone may come along and disrupt you. Large businesses are able to pay bigger salaries, and bring in all the experts they can afford but, in my opinion, fail to be able to adapt and move quickly to an ever-changing landscape.

The added complexity of running a large multinational corporation means that these companies are constantly trying to keep up with the pace of small businesses. In a small business, you can literally change the direction of an organisation in days. Bring new products to market in a much quicker way and pivot to the constantly changing demands of the market and consumer habits.

When uncertainty strikes, which we have seen in the last 3 years with a global pandemic, the war in Ukraine and interest rates spikes - smaller companies are best positioned to evolve and create huge value. In the last 18 months, speaking to early-stage founders who are constantly trying to innovate and improve outdated markets there is a huge sense of optimism for their companies. They see how much the world is changing and this presents opportunity.

The rate of change is also constantly increasing and the big boys are needed to play catch up in areas like Tech, Digital Skills, Recruitment and Marketing - all of which smaller early-stage founders realise are their strengths. This leads to the only option for larger companies to acquire the smaller ones - as in the majority of instances their access to capital is their only advantage.

I’m predicting when the markets settle down, we are going to see a flurry of activity in the M&A market of large businesses needed to access and acquire the smaller companies which are disrupting them - my advice to founders who are in these positions is to wait, these bigger companies need you more than you need them and you can continue to build something valuable that you will soon overtake and surpass the household names. Don’t sell too soon, keep building, and keep dreaming because your potential is bigger than even you realise.

Monahans prides itself on being a local firm with international reach. We stay true to our commitment of being a trusted partner to our clients, helping them achieve their ambitions.

The Chancellor’s Budget confirmed UK businesses’ fears that the main rate of UK Corporation Tax would rise from 19% to 25%, with effect from 1st April 2023. However, to soften the blow, a replacement for the super-deduction due to finish this month was announced. This newly proposed ’full-expensing’ regime will allow businesses to write off up to 100% of qualifying plant and machinery investments.

In a period where many businesses are experiencing financial turbulence due to inflation and a particularly tight labour market, this will be a welcome measure. Having said that, the detail of the measure suggests that this relief will operate in a very similar way to the current super-deduction and first year allowances regimes so care should be taken by businesses to fully understand the rules, particularly those surrounding future asset disposals. Although the allowance extension is useful, businesses still face the additional challenge of navigating changes to the way Corporation Tax rates are calculated. Businesses had enjoyed being taxed at a flat rate, regardless of a company’s size, since 2015, giving them sight of current and future liabilities and allowing them to plan cashflow accordingly.

But, from 1st April, companies with taxable total profits of more than £250,000 will face the higher rate of 25%, whereas those earning profits of £50,000 or less will be unaffected – at a rate of 19%. There will be complexities for those in the £50,000-£250,000 bracket, whereby the amount of tax payable by a company will start at 25% but will be reduced (where possible) by a marginal relief factor.

Businesses must also consider their ‘associated’ companies, namely those where there is common control, i.e. one company controls the other or both companies are controlled by the same person(s), in determining their taxable limits. For example, companies within a large corporate group are likely to pay corporation tax at a rate of 25% due to the impact of their related entities, but it is also possible that smaller companies could be subject to a higher rate if the individual shareholders of those companies have other interests.

Understanding where your business stands will be key in navigating the next tax year. If you would like any advice relating to the impact of these changes, please get in touch today.

In November last year, China had its 20th National Congress of the Communist party, which saw Xi Jinping secure a third term as party chief. Spectators looked to Xi’s unprecedented length of rule with an awareness that he has his work cut out.

The International Monetary Fund revealed that Chinese GDP was at a four-decade low last year, while the country continues to suffer from a property crisis and the results of its strict zero-Covid policies, which has impacted its supply chains, manufacturing and ultimately, its superpower status. The world’s second biggest economy isn’t as powerful as it used to be, but exactly how much has China’s superpower status been threatened?

CHINA’S ‘ZERO-COVID’ POLICY

There’s no denying the impact of the war in Ukraine on

global supply chains, especially in the energy sector. Nonetheless, China has an economy ten times the size of Russia, and China’s zero-Covid policies, which saw considerable restrictions and closures in its main cities, may have had a more significant impact on the global economy.

Why is this? China is often referred to as ‘the world’s factory’ because it is responsible for 28.7% of global manufacturing, followed by the US which is responsible for 16.8%. This compares to the UK which is responsible for a modest 1.8% but is still the ninth-highest manufacturing country in the world.

In December 2022, the Chinese government announced it would be loosening its zero-Covid policies, which had been active since the start of the pandemic to decrease the spread of the virus and prevent strain on Chinese

healthcare. Major Chinese cities such as Shanghai – which alone is worth 40% of China’s GDP – came to a halt, and as a result so did its manufacturing and economy.

Oliver Chapman, Founder and CEO of OCI, comments: “The Chinese supply chain will recover, but it may not grow to the extent that seemed likely pre-Covid. In short, the danger to China’s role in the supply chain is not so much that it won’t recover but rather to its growth beyond that. There is now an understanding that supply chains need to be more robust, and over-reliance on any one country is risky.

“This understanding will certainly reduce China’s longterm opportunity with the supply chain. We are, for example, likely to see organisations focus on developing opportunities in the mining and refining of certain metals and minerals, where China is currently vital, in other regions. However, China has emerged as the world’s leading economy in renewables. As the shift to net zero gathers momentum, China’s expertise in renewables and battery technology is likely to be in high demand.”

China exports a third of the world’s intermediate goods, explaining why its zero-Covid policies had such an extreme impact on international trade and its own economy.

At the end of last year, Foxconn’s iPhone factory in Zhengzhou was shut down, which reportedly cost Apple a third of its Christmas sales.

Logistics and transport companies have also been impacted as a result of zero-Covid. At the end of 2022, rail and road shipments from China had dropped by 36%. Major car manufacturers, such as Honda and Volkswagen, stopped production at their factories and experts have claimed that this will have a long-lasting impact for many major tech and car manufacturers, such as Apple and Tesla.

As a result, many companies who have historically relied on China for manufacturing are moving production to, or seeking parts from, other countries boasting cheap labour, such as India and Vietnam. Ultimately, industries have realised that they needed to diversify their supply chains without only relying on China. With multinational companies moving out of China, investment has followed. Zero-Covid policies have also led to a significant drop in foreign direct investment. Companies and investors became less concerned about making money in China and more focused on getting their money out of the country before it was too late.

As a result, economists have raised concerns that movement of manufacturing and investment to other countries could have serious consequences for inflation and the global economy. This is because it’s not guaranteed that other countries where manufacturing is being moved will be able to match China’s low costs. Therefore, having an impact on consumer prices. Cont.

“AS THE SHIFT TO NET ZERO GATHERS MOMENTUM, CHINA’S EXPERTISE IN RENEWABLES AND BATTERY TECHNOLOGY IS LIKELY TO BE IN HIGH DEMAND.”

Oliver Chapman

Christopher Tang, UCLA professor in Global Supply Chain Management, comments: “As multinational firms’ operations in China suffered from a significant drop in consumer demand, many firms either scaled back their operations in the country immediately and others plan to reduce their investments. When both supply and demand came to a halt, China experienced a slow growth rate of 3% in 2022.

“Besides the anaemic growth rate of 2.24% in 2020 during the first year of the pandemic, this 3% growth rate was unprecedented since its economic reform in 1978. And youth unemployment in China has surged to nearly 20% in 2022. The economic decline has pushed back the forecast for China to overtake the US as the world’s largest economy from 2030 to 2035.”

TAIWAN

Geopolitical tensions have forever impacted power dynamics on the world stage. In 2019, Xi Jinping claimed that the unification of China and Taiwan was ‘inevitable’ and has since performed a variety of threatening military acts. Many countries, including the US, have shown support for Taiwan – but what impact does this have on China’s superpower status?

Chapman comments: “China’s position with Taiwan is complex. Its Government has created much political capital among its population with its anti-Taiwanese rhetoric. This political capital was especially important at a time when there was popular disquiet with the Chinese government’s Covid policies. The economic risk to China with its political stance on Taiwan lies partially in the danger of economic sanctions.

“It may seek to reduce its vulnerabilities to sanctions via closer ties with countries such as Russia and Iran. It may also seek closer trade links with India, although this is problematic thanks to border disputes.

But perhaps a bigger short-term risk than actual sanctions is that trading partners may see sanctions as a possibility. Organisations concerned over the possibility of future sanctions may therefore take steps to reduce the reliance on China in the supply chain; this is the biggest short-term risk to resulting from China’s policies regarding Taiwan.”

Indeed, interference in Taiwan could cause another situation where businesses lose confidence in the Chinese economy, while geopolitical tensions and a divide with ‘the West’ may dampen Chinese influence globally.

Jonathan

Sullivan,China

Specialistand Political Scientist at The University of Nottingham, comments: “China’s equivocal stance on Ukraine and belligerence in the Taiwan Strait have accelerated the sharpening of a global divide between the western democracies and China and its sphere of influence. China and ‘the West’ are still interdependent and are not on a collision

“THE ECONOMIC DECLINE HAS PUSHED BACK THE FORECAST FOR CHINA TO OVERTAKE THE US AS THE WORLD’S LARGEST ECONOMY FROM 2030 TO 2035.”

Christopher Tang

course nor ‘decoupling’, but the differences between them are becoming much clearer. The major critique of China is that it is not a ‘responsible stakeholder’ or committed to upholding the ‘rules based international order’. China’s rebuttal is that it does not interfere in other countries’ sovereign affairs and has a legitimate right to defend its own core interests.

“For ‘the West’, China’s stance is a problem. For the rest of the world, not so much. But what it means is that China can expect less of a ‘free ride’ from the West, and a more complicated economic, diplomatic and strategic environment. And other rising powers like India may benefit. But China’s trajectory is towards ‘superpower’ in numerous sectors, and this will continue, even as the US and others try to limit China’s access to the most advanced semiconductors.”

Tang highlights the impact these tensions have on the power dynamic between China and the US in particular. He comments: “From President Xi’s perspective, reunification with Taiwan is only a matter of when. Pursuing unification with Taiwan has intensified the political tension between China and the United States.