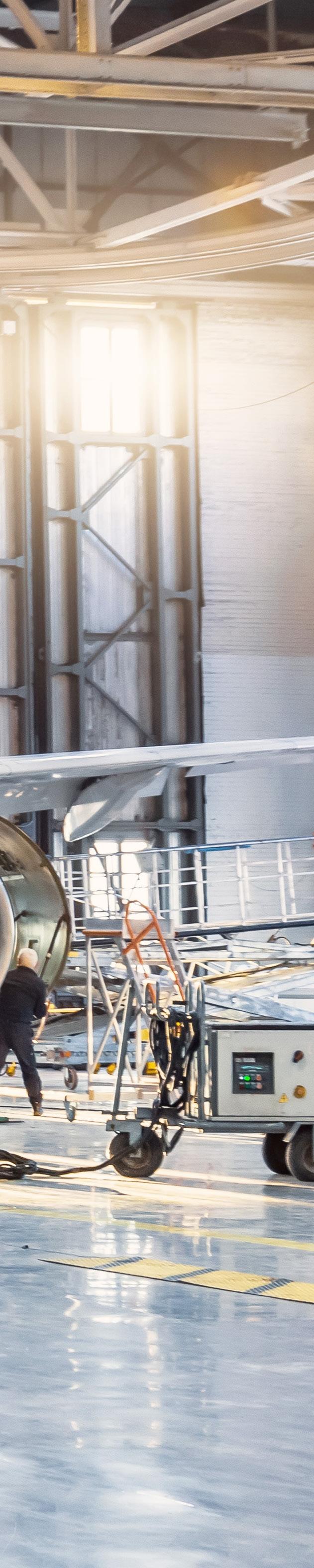

AUGUST/SEPTEMBER 2023 • £6.95 www.businessleader.co.uk BRITAIN’S LEADING MAGAZINE FOR ENTREPRENEURS AND BUSINESS PROFESSIONALS THE GREAT BRAIN DRAIN UK’S AMBITIONS AT RISK AS TALENT POOL DRIES UP - PAGE 14 SPOTLIGHT ON UK MANUFACTURING IS THE SECTOR DEFYING RECESSION FEARS? > PAGE 30

RISE OF REGIONAL POWER IS LONDON’S GRIP ON THE UK ECONOMY SLIPPING? PAGE 20 MEET THE MAN SCALING A GLOBAL POWERHOUSE FOR CHANGE - PAGE 10 ROC NATION SPORTS THE FALL & RISE OF BREWDOG HOW THE MAVERICK BEER BRAND REINVENTED ITSELF - PAGE 26

THE

EVENTS FOR YOUR CALENDAR

SEPTEMBER

5TH EVOLVING CONSUMER EXPECTATIONS AROUND E-COMMERCE AND HOME DELIVERIES

6TH SEVEN HABITS OF SUCCESSFUL BUSINESSES

14TH PLANNING FOR GROWTH AND BUILDING FINANCIAL RESILIENCE

19TH TALKING SHOP: THE FUTURE OF RETAIL DEBATE

REGISTER YOUR PLACE SCAN HERE »

A reputation built up over decades can be destroyed in hours by a botched response to a major issue. Controversy is nothing new to BrewDog. From toxic workplace to the best employer, how have turned things around?

The Midlands is often classified as an underdog. With a £238bn economy and a population of over 10 million, is the region one to watch?

Business Leader – The UK’s Voice for Business 1 CONTENTS LATEST NEWS 4 COVER INTERVIEW: MICHAEL YORMARK 10 We talk to the President of Roc Nation Sports International about how the company has revolutionised the world of sports management forever. FEATURE: BRAIN DRAIN 14 FUNDING ROUND-UP 18 FEATURE: RAISING CAPITAL 20 DEALS ROUND-UP 24 FEATURE: BREWDOG 26

SECTOR REVIEW: MANUFACTURING 30 REVIEW: GO:TECH AWARDS 2023 34 TOP 32: SPORTS STARS TURNED ENTREPRENEURS 37 INSPIRATION: OBEDIAH AYTON 48 FAST TRACK: KINGSFIELD IT 54 LEADER IN FOCUS: LEWIS RAYMOND TAYLOR 58 AGENDA: POLITICAL ROUND-UP 64 REGIONAL REVIEW: MIDLANDS 66

APPOINTMENTS ROUND-UP 70 BUSINESS LEADER BOOKSHELF 72 10 20 37 14 66 48 30

EDITOR’S COMMENT

Happy summer. We’re deep into the season of barbeques, out-of-office responses, and warm nights. Whilst many people have a brief respite from the daily grind, there’s no break from the headlines of high inflation, stubborn interest rates, and potential winter blackouts. Even though the mainstream news is packed with doom and gloom, the business world is brimming with enough positivity to warm the cockles of one’s heart.

The winners of the 2023 Go:Tech Awards were crowned at a gala ceremony at Hilton Bankside in London. The national awards, run by Business Leader, celebrated the best of UK innovation. Every award finalist truly represented the reason we should all be positive about the country’s prospects, despite the looming recession cloud.

This edition of Business Leader magazine is packed with the essential reading you need to get you through to your children’s first day of school. Under the microscope is BrewDog’s miraculous turn from taking a lagering for being an abusive environment to the hoppy accolade of the best place to work; a PR spin-job or a lesson in how to handle a crisis?

We met Roc Nation Sports International’s President Michael Yormark at their London HQ to talk about creating a team environment in the workplace, taking inspiration from some of the world’s biggest names in sports, and much more. We also look into the prospects of raising investment outside London, investigate the UK’s drain brain, and take a deep dive into the state of the manufacturing sector. Thanks for reading this edition and be sure to join the conversation on LinkedIn.

Josh Dornbrack Editor

Editorial@businessleader.co.uk | @JDornbrack

JOIN OUR COMMUNITY OF BUSINESS LEADERS

Connect with like-minded professionals, gain access to exclusive content, receive event invitations, and stay up-to-date with the latest industry trends – all delivered straight to your inbox.

EDITORIAL

Josh Dornbrack - Editor

E: josh.dornbrack@businessleader.co.uk

James Cook - Digital Editor

E: james.cook@businessleader.co.uk

Patricia Cullen - Senior Business Reporter

E: patricia.cullen@businessleader.co.uk

Alice Cumming - Editorial Assistant

E: alice.cumming@businessleader.co.uk

SALES

Sam Clark - Head of Awards Sponsorship

E: sam.clark@businessleader.co.uk

Tom Dyson - Advertising & Sales Executive

E: tom.dyson@businessleader.co.uk

DESIGN/PRODUCTION

Adam Whittaker - Head of Design

E: adam.whittaker@businessleader.co.uk

DIGITAL & WEB

Gemma Crew - Marketing Manager

E: gemma.crew@businessleader.co.uk

Rosie Coad - Marketing Executive

E: rosie.coad@businessleader.co.uk

CIRCULATION

Adrian Warburton - Circulation Manager

E: adrian.warburton@businessleader.co.uk

DIRECTOR

Oli Ballard - Director

E: oli.ballard@businessleader.co.uk

MANAGING DIRECTOR

Andrew Scott - Managing Director

E: andrew@businessleader.co.uk

OUR COMMITMENT

Business Leader Magazine is committed to a zero carbon future and supports the World Land Trust by using compostable wrap rather than plastic polywrapping. Carbon-balanced PEFC® certified paper, which is sourced from responsible forestry, is produced in an environmentally-friendly way to offset our CO2 emissions.

August/September 2023 2 WELCOME

CBP006462 PEFC/16-33-254 PEFC Cert fied This product is from sustainably managed orests and controlled sources www.pefc.org

Scan Me

BUSINESSLEADER.CO.UK/SUBSCRIBE subscribe@businessleader.co.uk Gain invites to year-round events STAY CONNECTED WHEREVER YOU ARE • Hassle-free delivery • Convenient online access BUSINESS LEADERS NEVER MISS AN ISSUE THE UK’S VOICE FOR BUSINESS

UK SMALL BUSINESS OWNERS REPORT POSITIVE OUTLOOK

79% of small business owners in the UK anticipate business growth in the next 12 months. According to a recent survey by American Express and Small Business Saturday UK, the same percentage of respondents believe their businesses are currently in good shape. Despite ongoing challenges, 64% of small businesses expect better performance in the final quarter of 2023 than in the previous two years.

However, the survey also revealed that running a business has become harder for 35% of respondents, primarily due to inflation and rising costs of goods, services, energy, and fixed costs like business rates and taxes. On a positive note, many small businesses are taking proactive measures to drive growth, with 30% planning to increase sales and marketing activities, 25% aiming to diversify their product or service offerings and 20% planning investments in new technology.

UKEF’S

£6.5BN BOOST FUELS UK BUSINESSES’ INTERNATIONAL EXPANSION

Hundreds of UK businesses, spanning various sectors from clean energy to life sciences, have received £6.5bn in support from UK Export Finance (UKEF) over the past year. This Governmentbacked support has enabled these companies to enter international markets, driving economic growth and contributing to up to 55,000 UK jobs.

UK FINTECH FUNDING DECLINES IN FIRST HALF OF 2023

New data from Innovate Finance reveals a dip in UK fintech funding in the first six months of 2023. Total cash raised by UK fintech firms reached $2.9bn (£2.2bn), marking a 37% decrease compared to the latter half of last year.

The decline in funding has been accompanied by a decrease in investment, with 111 out of 199 deals occurring in the first quarter, accounting for £2bn of the total. This trend aligns with the global decline in fintech funding, as market conditions continue to be unpredictable, and investors shy away from high-growth start-ups.

August/September 2023 4 NEWS

UKEF’s assistance, including loans, guarantees, and insurance, aligns with the Government’s goal of reaching £1trn in annual exports by 2030. Moreover, UKEF’s increased capacity of £60bn for 2023-24 ensures continued support for SMEs and facilitates further expansion into global markets. KEEP UP TO DATE WITH THE LATEST BUSINESS NEWS « SCAN HERE

USING MICROSOFT? Be fearless wi Protect Everything, Be Fearless Protect your business today. Your leading security partner delivering world class Microsoft Security tools in a new era of cyber threats. www.chorus.co hello@chorus co 0800 048 8090

SURVEY FINDS FOUNDERS MORE FOCUSED ON DRIVING POSITIVE CHANGE THAN 10 YEARS AGO

Entrepreneurs of small to mid-size companies are increasingly focused on driving positive change in their local communities, according to research conducted by the Entrepreneurs’ Organisation. The survey of nearly 500 business owners from 50 countries revealed that 24% believe the entrepreneurial spirit is more widely understood and embraced today compared to a decade ago. Furthermore, 20% expressed a greater focus on driving positive change in their communities than they did in 2013.

The study also highlighted coping strategies for personal stress, with 34% seeking support from peers, 26% engaging in activities like painting or exercising, and 20% confiding in family. Additionally, the research indicated that 18% of respondents plan to shift to AI and automation tools, while 30% intend to hire international talent or improve company culture for remote employees. Almost half of the survey participants (45%) expressed a responsibility to support the next generation of entrepreneurs through mentorships, internships, and investment.

LINKEDIN

23% NO

UK BUSINESSES SLAPPED WITH £13.5M IN FINES FOR DATA MISUSE

The Information Commissioner’s Office (ICO) has ordered eight businesses to pay hefty fines totalling £13.5m in the first half of 2023, as revealed by cyber security and data protection consultancy CSS Assure. Notably, social media giant TikTok received the largest penalty of £12.7m for breaching data protection laws, specifically mishandling personal data of minors. The ICO estimated that approximately 1.4 million children under the age of 13 in the UK had accessed the video-sharing platform in 2020.

The fines also targeted marketing firms for unsolicited calls and spam emails, energy companies for illegal marketing calls, a consultancy for unauthorised SMS messages, and an appliance service company for unsolicited marketing calls. In addition to the fines, the ICO reprimanded 15 companies, issued enforcement notices to eight others, and prosecuted three businesses for failing to meet their information rights obligations.

4% OTHER

73% YES

EUROPEAN COMPANIES COULD UNLOCK £2.5TRN BY CLOSING TECH GAP

European companies have the potential to unlock a staggering $3.2trn (£2.5trn) in additional revenue by 2024 if they bridge the technology gap with their North American counterparts, according to a new report by Accenture. The study emphasises the need for European companies to enhance technology expertise within their boardrooms, accelerate investments in research and development, and capitalise on their strengths in upskilling.

The report highlights that a mere 14.4% of European board members possess technology experience, while countries such as the Netherlands, Ireland, and the UK demonstrate the highest levels of technology expertise. Despite the gap, European firms are focusing on upskilling initiatives, potentially explaining their lower concern regarding a technology skill shortage compared to their U.S. counterparts.

August/September 2023 6 NEWS

SHOULD HUGE BONUSES, LIKE THE £3.7M AWARDED TO THE BOSS OF BRITISH GAS-OWNER CENTRICA, CHRIS O’ SHEA, BE A THING OF THE PAST?

POLL

UK ECONOMY ON THE BRINK OF A £31BN BOOM

WITH GENERATIVE AI ADOPTION

New research from KPMG reveals that the widespread adoption of generative AI has the potential to inject £31bn into the struggling UK economy. The ‘Big Four’ firm predicts that generative AI could increase UK productivity by 1.2%, equivalent to an additional output of £31bn annually.

Yael Selfin, Chief Economist at KPMG UK, suggests that generative

AI could free up workers, allowing them to dedicate more time to other activities. The report also highlights that around four in ten jobs may be impacted by generative AI, with 10% of occupations facing significant changes.

While generative AI may not eliminate jobs, it could pose transitional challenges for some industries.

EY STUDY REVEALS SURGE IN UK DEAL VOLUMES, BUT INVESTOR CONFIDENCE REMAINS FRAGILE

The UK financial services industry witnessed a significant surge in mergers and acquisitions (M&A) activity, reaching a 10-year volume high of 160 deals in the first half of 2023, according to EY’s latest analysis. This marks a 16% increase from the same period in 2022. However, the total disclosed deal value experienced a decline, plummeting from £11.5bn in H1 2022 to £4.7bn in H1 2023, representing the lowest level since the onset of the pandemic.

Breaking down the sector-specific M&A activity in the UK’s financial markets, the insurance sector saw an increase in the number of deals from 48 in H1 2022 to 54 in H1 2023. However, the total publicly disclosed deal value plummeted from £3.8bn to £16m year-on-year. In the banking sector, there were 39 deals in H1 2023, compared to 35 in H1 2022, but the total disclosed deal value declined from £4.0bn to £3.2bn year-on-year. The wealth and asset management industry experienced a rise in the number of deals from 55 in H1 2022 to 67 in H1 2023, yet the total deal value dropped from £3.7bn to £1.5bn year-on-year.

EUROPE’S SOLAR START-UPS SEE UNPRECEDENTED 398% FUNDING INCREASE

European solar energy start-ups have seen a remarkable surge in investment, with funding levels skyrocketing by 398% compared to last year, according to recent research. In the first five months of 2023 alone, these companies received a staggering $6bn (£4.6bn) in funding. Avnet Abacus, an electronics distributor, analysed Crunchbase data to shed light on the funding landscape in the solar energy sector.

The research unveiled significant trends, revealing that European solar start-ups experienced a 398% increase in total investment, surpassing $6bn (£4.6bn) by the end of May 2023, compared to $1.2bn (£929m) in the same period last year. The average investment in European solar reached an all-time high of $166.1m (£128.6m), surpassing the global and US averages.

Tom Groom, Global Client Services Partner at EY said, “The macroeconomic environment this year has undoubtedly impacted deal value, with a continued reduction in private equity involvement in particular.

“However, the key drivers of M&A – being growth, innovation and synergies between businesses – remain, and as firms develop approaches to deliver M&A in this higher rate environment, we anticipate a return to higher deal values.”

Business Leader – The UK’s Voice for Business 7 NEWS

Tom Groom – Global Client Services Partner, EY

DO

LINKEDIN

POLL

GLOBAL FINANCIAL WEALTH DECLINES FOR THE FIRST TIME IN 15 YEARS

6% OTHER 12% NO 82% YES

Global financial wealth experienced its first decline in 15 years in 2022, dropping by 4% to $255trn (£197.5trn), according to the Boston Consulting Group Global Wealth Report 2023. Factors contributing to the decline include rising inflation, increased interest rates, and poor equity market performance amid geopolitical uncertainty due to the Ukraine war. However, a rebound is anticipated in 2023, with

a projected 5% growth to $267trn (£206.8trn).

Notable highlights include a 6.2% increase in personal cash and deposits and a 5.5% rise in the value of real assets. While financial wealth continued to grow in some regions, North America and Europe experienced declines. The report also highlights shifting dynamics in booking centres, with Hong Kong expected to surpass Switzerland as the largest centre by 2025.

MERSEYSIDE MANUFACTURER COMMITS TO JOB CREATION THROUGH STRATEGIC PARTNERSHIP WITH WORKFORCE DEVELOPMENT ORGANISATIONS

Warwick North West, Merseyside’s largest trade manufacturer of windows and doors and a strategic partner of the Liverpool Chamber of Commerce, has joined forces with two separate renowned workforce development organisations, Nobody Left Behind and Inside Connections, in an effort to address the persistent skills shortage plaguing the manufacturing sector.

Nobody Left Behind uses sports to build positive mindsets among young unemployed people, before providing industry-specific skills training in preparation for sustainable and meaningful employment.

Inside Connections, meanwhile, is a community interest company providing support and training for prison leavers and young people at risk of offending, making a positive impact on individuals, families and communities.

John Burton, Founder of Inside Connections, said: “We are proud to be working with Warwick North West on this exciting initiative.

We are dedicated to changing lives by providing opportunities to gain important skills leading to employment, which can play

a significant part in diverting young people from crime and reducing reoffending.”

Through these partnerships, Warwick North West will help support comprehensive training programmes tailored to the manufacturing industry, providing the necessary skills and knowledge required to thrive in the sector.

The company also aims to absorb a significant number of qualified people into its workforce, enabling them to apply their newly acquired skills and contribute to the company’s overall growth.

Warwick North West Director Greg Johnson explains: “Not only are we proactively seeking solutions to the industry’s skills shortage, but we are trying to do it in a way that gives back to the city and community. As an employer, we genuinely care and want to provide employment opportunities to people in the manufacturing and fenestration industry.”

August/September 2023 8 NEWS

▴ Greg Johnson – Director, Warwick North West

YOU THINK THE JUST STOP OIL PROTESTS ARE DOING MORE DAMAGE TO THEIR CAUSE THAN GOOD?

Beyond Today Inspiring business leaders for tomorrow Thursday, 5 October 2023 The Beyond Today virtual conference brings together a programme of specialists to support you in assessing how your business may adapt for the challenges of tomorrow. Join us live on 5 October 2023 or watch on demand. Register now. Arthur J. Gallagher Insurance Brokers Limited is authorised and regulated by the Financial Conduct Authority. Registered Office: Spectrum Building, 7th Floor, 55 Blythswood Street, Glasgow, G2 7AT. Registered in Scotland. Company Number: SC108909. FP844-2023 Exp. 19.06.2024. © 2023 Arthur J. Gallagher & Co. | GGBRET5958 http://www.ajg.com/uk/beyondtoday

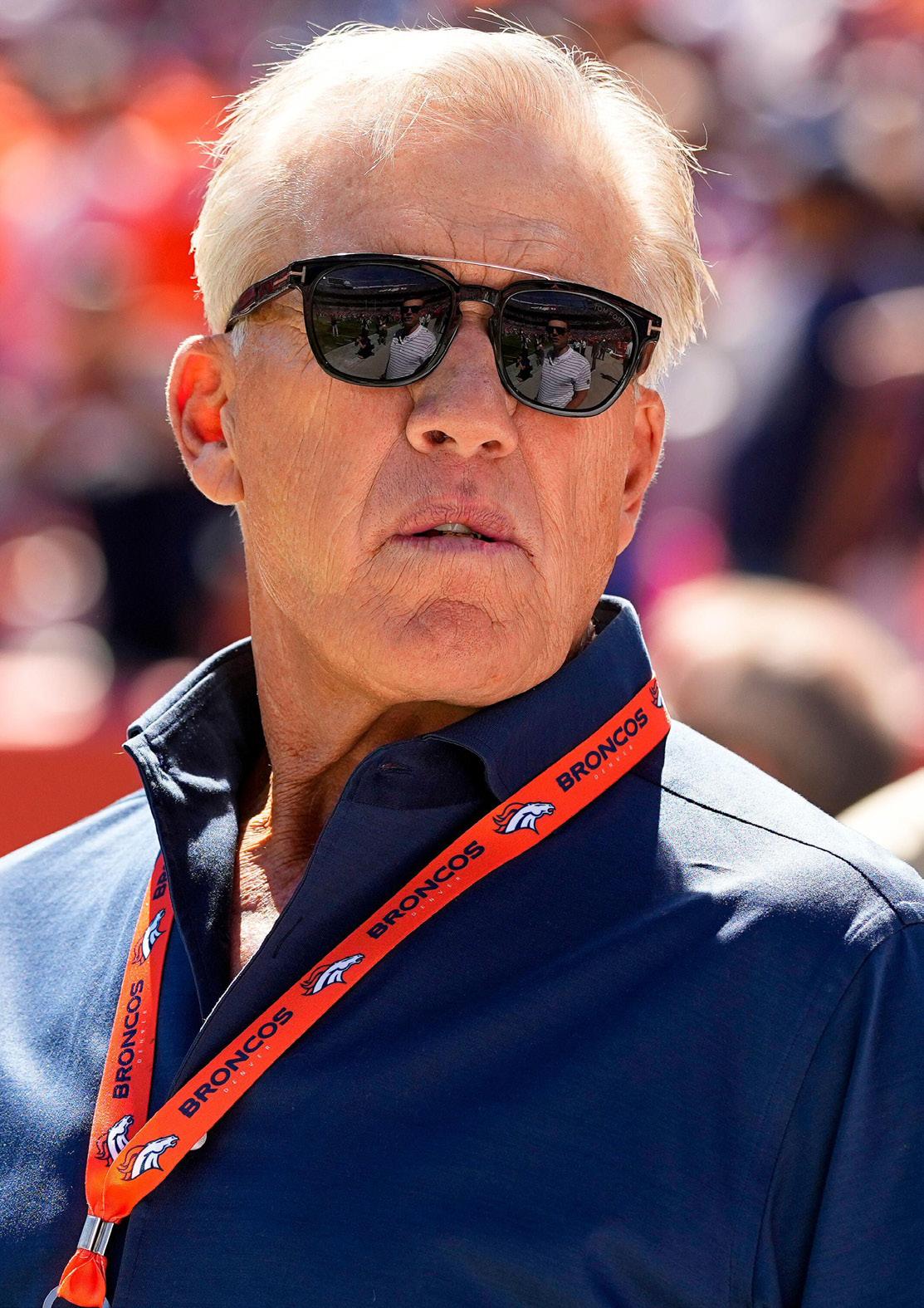

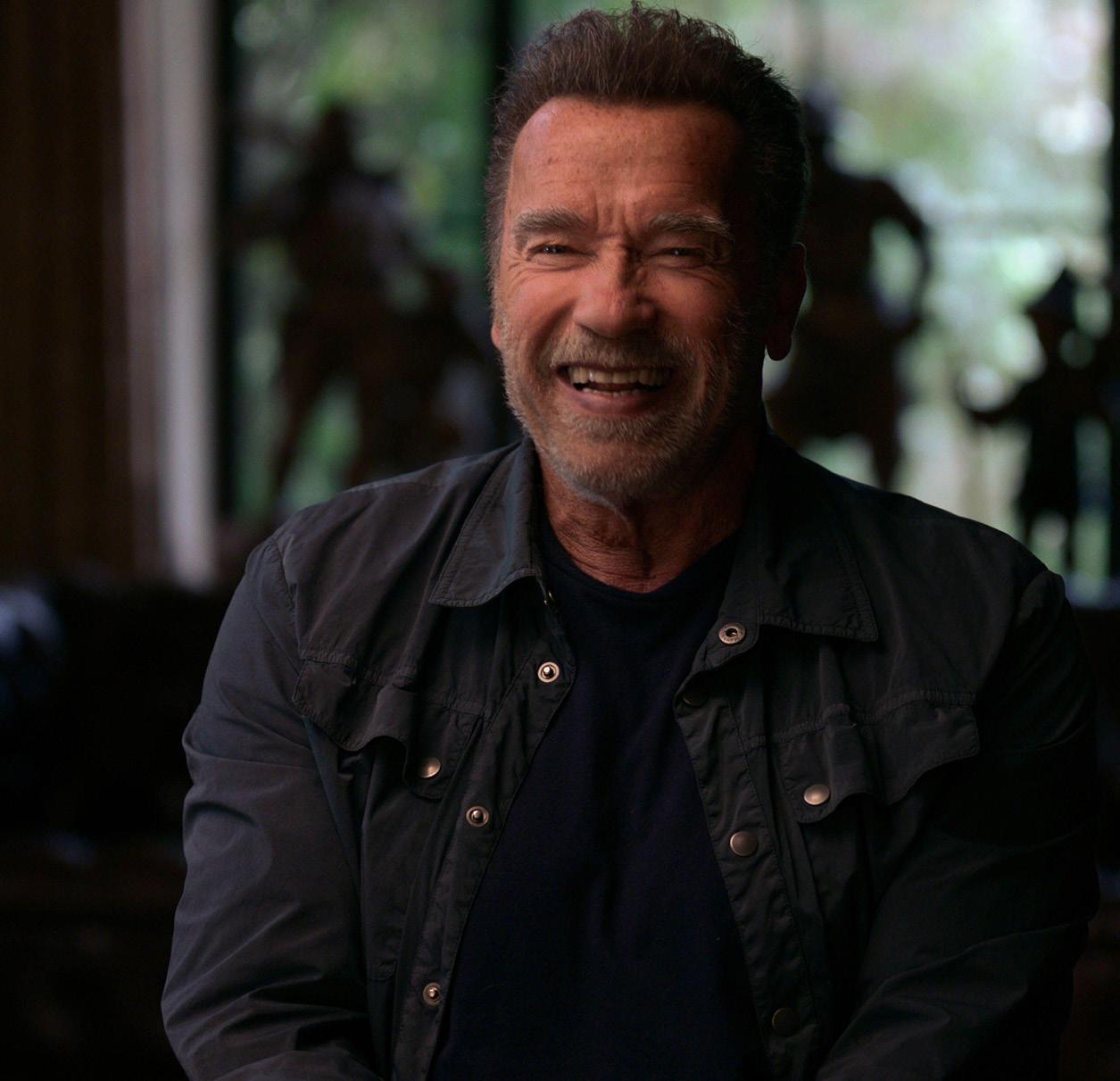

COVER STORY 10 watch the full interview here

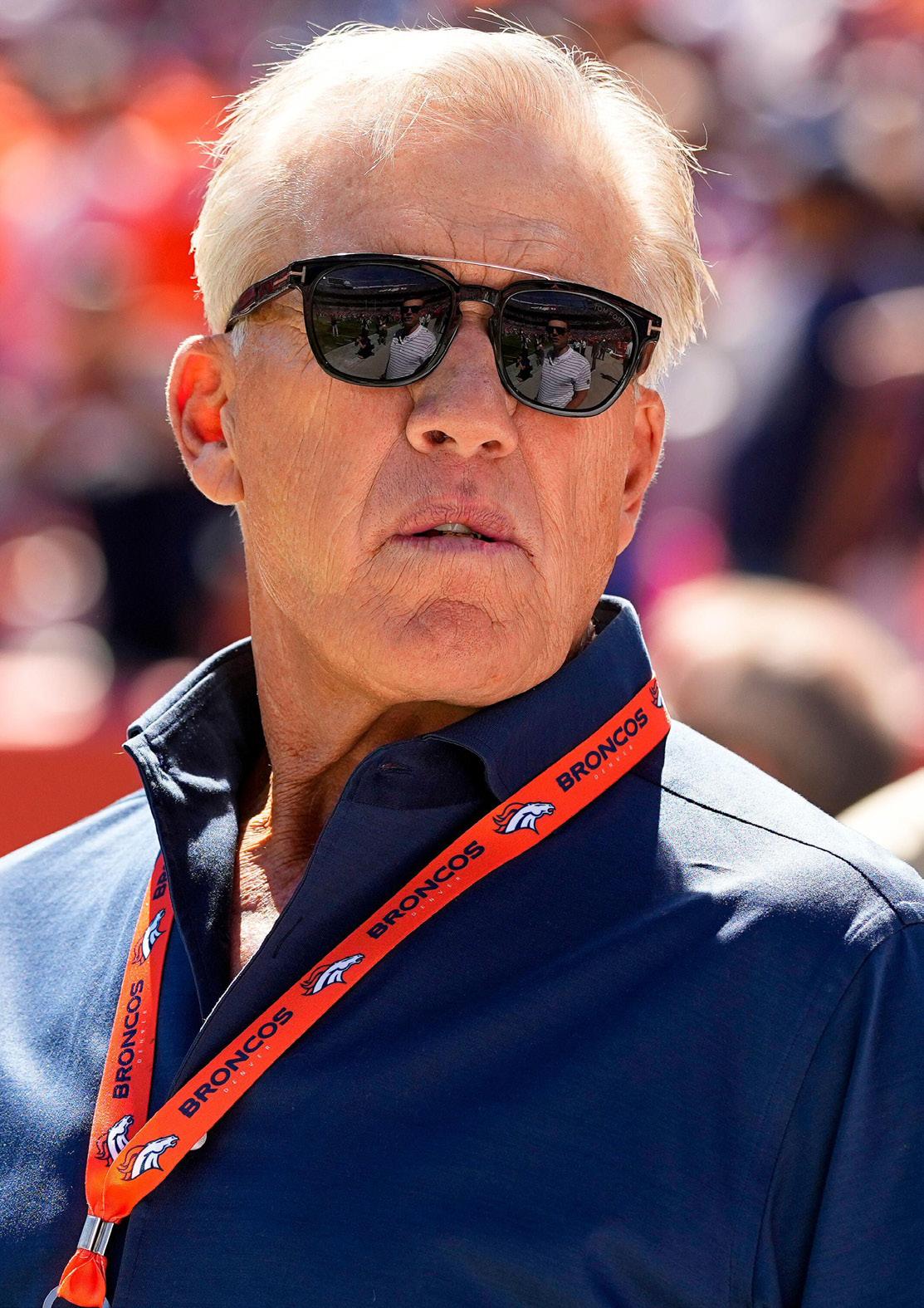

Roc Nation is an undisputed juggernaut. Since Hip-Hop icon Jay-Z founded the company primarily with the intent of signing pop and rap artists in 2008, Roc Nation has grown into the world’s preeminent entertainment company.

Boasting clients such as Rihanna, DJ Khaled, Jess Glynne, and Alicia Keys, the company announced the formation of a game-changing sports management division, Roc Nation Sports, dedicated to sports representation for professional athletes in 2013. Michael

Yormark was brought into the company a year later, and together, they’ve gone on to revolutionise the world of sports management forever.

Meeting Michael at Roc Nation Sports International’s London HQ, we spoke to him about being a disruptor, taking inspiration from his clients, the importance of leading by example, and much more.

MICHAEL YORMARK 11

Cont.

COULD YOU GIVE US AN OVERVIEW OF YOUR CAREER TO DATE?

I remember when I was 12 or 13 years old growing up in Morristown, New Jersey, talking to my identical twin brother, Brett, about what we wanted to do with our life. We both agreed that we’d love to be in sports somehow. My brother ended up taking a very similar career path to mine and he’s currently the Commissioner of the Big 12 college athletic conference. That’s where my passion and focus really started at a very young age.

Fortunately for me, after I came out of graduate school, I was able to get right into the business. I worked for a couple of different sports companies in New York City before I moved to South Florida, to get in on the team side of the business. I had the opportunity to work for the holding company of the Florida Marlins baseball team, the Miami Dolphins NFL team, and the Florida Panthers Ice Hockey team, which was an extraordinary experience. I spent about 20 years working on the team side of the business. I went from South Florida to Columbus, Ohio to start the NHL expansion team. I then went back to work for the Tampa Bay Lightning, and then ultimately returned to South Florida to be the CEO of the Florida Panthers.

After my professional journey on the team side of the business, I then decided to cross over and joined Roc Nation in 2014.

For the better part of the last decade, I’ve been working with Roc Nation out of their headquarters In New York, and here in Europe since September 2019. It was a big shift for me, not only from a job perspective, but it’s been an extraordinary journey. Now I get to work very closely with some of the biggest names in entertainment and sport, and it has truly been a blessing.

YOU DID A GREAT JOB GROWING THE FLORIDA PANTHERS BRAND AND THAT’S WHAT CAUGHT THE EYE OF JAY-Z. HOW DID YOU FIND THE EXPERIENCE OF GROWING A WINTER SPORT IN A WARM CLIMATE?

When you think about South Florida you think about big-time college athletics, such as the University of Miami. You think about the Miami Heat. You think about the Miami Dolphins, the oldest team in the state of Florida with an incredible history. You also have the Florida Marlins (now Miami Marlins), a team that’s won an MLB World Series. So, for the Florida Panthers, the area was a non-traditional market for ice hockey. However, we were a challenger brand. For me, it was a big challenge; how do I help the brand become relevant?

How do we break through and attract new fans, people that had never thought about hockey before the Florida Panthers entered the market in Miami in the mid-90s? The

secret sauce for me, was positioning the Florida Panthers as entertainment, not sport. We were very fortunate to be in an arena that was also very popular for concerts and shows. With some of the biggest artists and events coming through our building, I took a non-traditional sports team and built an entirely different narrative around the club. It had never really been done before and that’s where I met Roc Nation and its leadership.

YOU’VE GOT BIG-NAME CLIENTS AT ROC NATION SPORTS INTERNATIONAL, SUCH AS KEVIN DE BRUYNE, MARO ITOJE, ROMELU LUKAKU, AND SIYA KOLISI. IS THERE AN X FACTOR THAT DRAWS YOU TO AN ATHLETE THAT YOU WANT TO REPRESENT?

We want to associate with great people, first and foremost. Athletes that are truly the best at what they do, but also want to inspire and motivate people. They want to tell their story, they want to impact lives, and, in some cases, they even want to create hope for those that are coming after them. With Siya Kolisi, for example, you think about South Africa and about how he won the 2019 Rugby World Cup as Captain. You think about how inspiring and motivational that was and how he created hope for a nation, those are the types of individuals that we are attracted to, and that, I think, are attracted to us. I would also use the word ‘disruptive’ because we, as a global brand and as a company, are exactly that. We’re not about the status quo. We want to push boundaries and the athletes that we have both on the rugby side and the football side, are very similar. They want to do things differently, and they want to inspire, motivate, change lives, and create hope. If you’re able to accomplish that, then you’re building a legacy.

One of the things we talk to our athletes about all the time is, “how do you want people to talk about you when your career is over?” Also, “what are the opportunities you

August/September 2023 12 COVER STORY

“WE’RE NOT ABOUT THE STATUS QUO. WE WANT TO PUSH BOUNDARIES AND THE ATHLETES THAT WE HAVE BOTH ON THE RUGBY SIDE AND THE FOOTBALL SIDE, ARE VERY SIMILAR.”

want to create for yourself when your career is over?” Those are the types of athletes that we try to recruit, and those are the type of athletes that want to be part of our family.

DO YOU FEEL THAT WORKING WITH HIGH-PERFORMANCE ATHLETES GIVES YOU EXTRA DRIVE WITH REGARDS TO YOUR LEADERSHIP?

No question about it. For example, Siya Kolisi is one of the most inspiring individuals I’ve ever met in my life. He got injured a few months ago and the way he’s pushing to be ready for the Rugby World Cup in France is unbelievable. The dedication, the commitment, the understanding that so many people are hoping that he’s there, as the captain of their national team. To see him putting himself through what he’s going through to get ready is inspiring for me. So when I wake up in the morning and think about my morning workout at Jab Boxing Club, I ask myself, “shall I really go to the gym today? Maybe I can sleep an extra hour and a half?” I quickly get out of bed and say, “if Siya Kolisi is doing this, why shouldn’t I do it?”

A lot of our athletes inspire me that way. They drive me to be the best I can be. I’m dealing with it every day. Our company is dealing with very special, very unique, and very gifted people. It’s important that we, in many respects, represent what they represent. I can’t sit down with any of the athletes or clients we work with and tell them what they

should be doing better if I’m not doing it. If I’m not living the same lifestyle, based on commitment, passion, and sacrifice, how can I ask them to do the same? That’s one of the reasons why I get up at four o’clock in the morning and train in the gym every day. So that I can sit at the table with any client and feel comfortable giving them my opinion, as a leader, as a mentor, and as an advisor.

MANY LEADERS FIND THEMSELVES GETTING FRUSTRATED WITH THE TEAM AROUND THEM FOR NOT BEING AS HIGH-PERFORMING AS THEM, AND NOT THINKING IN THE SAME WAY AS THEM. IS THIS SOMETHING YOU’VE FOUND WHILE BUILDING YOUR TEAM AT ROC NATION?

I think we all have that frustration at times. We want everyone around us to be like us, but that’s not reality. You want to have different types of people in every company. You want diversity. Just because somebody perhaps is a little quieter, and doesn’t have as much outward passion, it doesn’t mean that they’re not as committed the same way. We have to try to pull the best attributes out of every employee we possibly can. We talk about “team first” at Roc Nation.

In a team, you’re going to have star players on a team, and you’re going to have some role players. Those role players may not have the same skillset or the same DNA as the

star players, but they’re very important for the overall success of the team. We have some star employees here, and we also have some outstanding role players. Those role players are as important as the stars because they play an important part in the overall success of the company. While it is frustrating at times that everyone may not be on the same page all the time, as a leader we have to accept that. I had to learn that throughout my career.

WHAT MAKES A GREAT BUSINESS LEADER TO YOU?

I’ve worked for a lot of leaders in my career and worked for a lot of different companies, and as I reflect on the leaders that I had the opportunity to work for, those that I admired the most are individuals that lead by example. Leaders that were doers, not talkers. Leaders that took accountability. Leaders that had an open-door policy, and that also didn’t expect everyone to be like themselves. That ultimately creates a winning culture for any organisation.

I send out a good morning message to every staff member every day. I use that as the first opportunity to inspire. I want every single staff member when they get up in the morning to see my message, read it and be inspired, be motivated, and I want them to want to achieve greatness every day.

Business Leader – The UK’s Voice for Business 13 MICHAEL YORMARK

ON THE WRONG SIDE OF THE BRAIN DRAIN

IS THE UK AT RISK OF LOSING ITS SKILLED WORKFORCE?

The UK Government remains focused on immigration while ignoring that many Britons are leaving the country. Brain drains are rampant in developing countries where the economy is unstable, but is the UK also at risk?

Whether it’s a broken property market or a cost-of-living crisis or a Government that changes every two minutes, things don’t look great in the UK. With net immigration on the rise, any brain drains that occur will likely be industry specific.

HIGH-TAX, LOW-WAGE BRITAIN

The UK is feeling the effects of the cost-of-living crisis more keenly than other countries, with food price inflation at a 40-year high. The rise in remote working is a major factor in young professionals leaving the UK, but for many, skyrocketing inflation has been the tipping point.

August/September 2023 14 FEATURE

Another big negative is the lack of funding for venture and growth stage businesses, which means they’re lacking the resources to hire, according to Alan Furley, Co-Founder & CEO at ISL Talent

“Funding across Europe has dropped so the UK isn’t alone in this challenge, but we’ve lost the big lead we had, meaning increased competition from countries like Germany and France.

“Brexit is another big factor. A few years back, one of my team realised that 13 of his last 14 hires wouldn’t have been eligible to work here once we left the EU – even though that’s not replicated across the market, the UK always relied on mobility in Europe to fill our talent pool,” he adds.

Alban Gérôme, Founder and Cybermetrics Implementation

Lead, reveals how some countries offer higher wages to attract talent.

“In this field, Germany and the Netherlands have been facing unique talent sourcing issues, which have resulted in salaries 20% higher than the salaries offered in the UK,” he says.

INFLOWS...

People come, and people go. But lots of people go.

According to the latest ONS statistics, 1.2 million people migrated into the UK and 557,000 people emigrated from it, resulting in a net migration figure of 606,000 as of the end of June 2022. Immigration decreased between 50 - 60% between 2019 and 2020, though some caution is advised when interpreting data collection around the pandemic.

If the UK is to become the ‘science superpower’ the Government wants it to be, then it must do more to support training and education in STEM and redesign the visa system to attract more international talent, according to a new report by the Campaign for Science and Engineering (CaSE).

The shortage of STEM skills is an ongoing problem and is estimated to cost the UK economy £1.5bn per year, the report notes. In 2021, the Government acknowledged that the R&D sector will need at least an additional 150,000 researchers and technicians by 2030 if the country wants to realise its ambitions. The same year, the Institution of Engineering and Technology estimated a shortfall of over 173,000 workers in the STEM sector.

According to the latest Hiring Trends Index report, over one-third (37%) of businesses reveal they are struggling to find the right people, with a quarter (25%) of businesses reporting lengthy times to hire as a top concern this quarter. In order to combat this, 35% of businesses are upskilling their staff, while over a quarter (29%) have increased salaries and/or bonuses.

When it comes to sourcing externally, over one in ten employers (11%) are looking overseas to find the talent they need, with this rising to 25% in social care and 19% in medical & health services. Despite the recent focus from the Government on re-engaging

candidates who have recently left the workforce, only 12% of businesses attract older/retired workers back into their business.

According to Julius Probst, Labour Economist at Totaljobs, 33% of resignations between Jan-April were driven by employees seeking higher pay.

... AND OUTFLOWS

The labour shortage is exacerbated by reduced net migration. According to the OECD, 50% of firms are having difficulty recruiting new workers, while one in five have problems retaining staff. Although some shortages are due to economic restructuring, according to a report by De Lyon and Dhingra, 10% of companies say that the UK point-based immigration regime is to blame. More than 557,000 people emigrated from the UK in 2022, and official figures show that the number of adults leaving the UK has steadily risen over the past decade.

While inflows have received the most headlines, Britain must look at outflows as well. Moving abroad is starting to appeal to more and more workers, notably the most highly skilled in London, as wages in the UK stagnate and costs rise. Countries are encouraging workers to escape the broken-Britain blues. The capital of EU member Lithuania is offering to cover relocation costs of up to €3,000 and says its rental prices are two-thirds more affordable than in London.

As of January 2021, EU citizens (except Irish) were subject to the same points-based immigration system that applies to non-EU members. Studies from the ONS indicate that EU net migration was negative in 2020, with approximately 94,000 more people leaving, rather than arriving in the UK.

MEDICINE AND SCIENCE

With the Government holding out on demands for pay rises, doctors are heading overseas. A study by Nuffield Trust, an independent health think tank, showed 1 in 10 health workers quit their jobs in the 12 months prior to June last year. Consequently, the NHS is facing severe staff shortages and burgeoning waiting lists for critical medical services.

Furthermore, the General Medical Council (GMC) reports that 6,950 UK doctors filed for a certificate to work overseas last year, up from 5,576 in 2021. More than half of the doctors who have left the UK are still employed abroad, with one in six moving to Australia, according to a GMC poll.

Despite recent progress with Brussels, Rishi Sunak is refusing to back Britain’s re-entry into Horizon Europe, the EU’s multiannual framework programme for research and innovation for the years 2021 to 2027, causing unease amongst leading scientists. What is being done to counteract this exodus? The Business Secretary announced up to £484m in research funding to support the R&D sector, but will this be enough?

A POSITIVE SHIFT

“Despite a falling number of vacancies, hiring is continuing and the number of employees on a payroll showed another monthly increase in March 2023 – reaching 30 million. Meanwhile, the total number of people in employment is 32.9 million,” says Probst. The main reason behind the increase in labour force participation has been the rise in the cost of living. The increase in employment over the latest three-month period was largely driven by part-time employees and self-employed workers.

Business Leader – The UK’s Voice for Business 15 SKILLS & WORKFORCE

“FUNDING ACROSS EUROPE HAS DROPPED SO THE UK ISN’T ALONE IN THIS CHALLENGE, BUT WE’VE LOST THE BIG LEAD WE HAD, MEANING INCREASED COMPETITION FROM COUNTRIES LIKE GERMANY AND FRANCE.”

Alan Furley Cont.

Tough economic conditions can present entrepreneurs with unique opportunities. There are plenty of huge companies that started during a recession, including Wilko, PC World, and Sipsmiths. Globally, half of all Fortune 500 companies began during a crisis. Furley notices a change in the air.

“Last autumn, a couple of people told me that they were fearful of launching businesses in the UK because of the Truss/Kwarteng political uncertainty. However, at this year’s London Tech Week, it felt there was more interest than ever in building in the UK.

“So hopefully Rishi Sunak’s visible support for the tech sector is making a difference, although the Government funding in areas like climate, AI, and quantum computing looks low when compared relative to the EU and US figures,” he warns.

OPENING UP

Reducing immigration is making headlines, but many non-UK citizens have emigrated to the UK to start businesses. We can’t afford to lose these innovators.

“Not many founders I speak to understand the way they can use visas to hire the talent they need, but this is an area you can argue has the potential to help bring the best talent to the UK.

“Options like Scaleup, Global Talent, and High Potential Visas can help access the vital people we need to

ALIGN YOUR BRAND WITH THE UK’S VOICE FOR BUSINESS

Business Leader will connect you with the entrepreneurs who are the UK economy’s energy and heartbeat via print magazine, our virtual and live events network, and digital opportunities.

help the UK compete – but only if routes are clear and red tape reduced,” advises Furley.

Rishi Sunak may discover that his commitment to cut net immigration from more than 500,000 people a year is more than possible - but not in the way he hoped.

The UK has long relied on luring professionals away from the developing world with promises of better salaries and working conditions. Now conditions must improve at home. Otherwise, the UK may experience what it is like to be on the wrong side of the brain drain.

41% NO

59% YES

Our goal is your success: Talk to us on 020 3096 0020 or email sales@businessleader.co.uk businessleader.co.uk

August/September 2023 16 FEATURE SKILLS & WORKFORCE

LINKEDIN POLL IS THE UK ABOUT TO UNDERGO A BRAIN DRAIN?

Powering future business growth

Simon Cooper Partner

THE TRIALS,

TRIBULATIONS AND TRENDS OF TRAVEL AND TOURISM

The Covid-19 pandemic forced us to reimagine travel as we knew it and make do with the ‘staycation’. But when we embraced the lack of international travel, the opportunities for campsites, B&Bs, hotels, and a multitude of other businesses up and down the country were significant, and the domestic businesses that have been able to adapt and remain agile are thriving.

Not everyone enjoys camping, for example. But, when scientists proved that we were less at risk of exposure to Covid-19 in nature, a slight change to the business model was all that was needed for many sites to invest in pods, shepherd’s huts and even converted shipping containers. Glamping brought in a different section of the consumer market.

A bi-product of pandemic ‘germaphobia’ has been the growth of touchless technology, allowing people to access menus, activate lifts, gain entry to their rooms, etc, on their phones. Of course, technology is here to stay and hotels have to be hot on these trends in the digital age.

But, while the bigger players in the market can afford such investment, how will the smaller businesses remain ‘current’ when costs are such an issue?

Organisations must return to what they have sight of when making business decisions and this reinforces the power of information. For example, there are hints at occupancy growth –a recent PWC report forecasts growth in the hotel sector in the Capital this year, but businesses across UK regions must pay a little more heed.

We’ve said it before – and PWC’s report reiterates it – that ‘cash remains king’ in the current climate. Now more than ever, cash management of what’s coming into your business and qualifying it against outgoings is crucial for a steady balance sheet, especially as those wanting to invest may find that financing is more expensive, given higher interest rates.

Monahans works with a large number of SMEs in the travel and tourism sector. For advice on the latest in the market or to discuss your business’s next steps, get in touch today.

T: 01793 818300 simon.cooper@monahans.co.uk

Business Leader – The UK’s Voice for Business 17 ADVERTORIAL COMMENT

Monahans July 2023 BL Ad.indd 1 10/07/2023 15:36

We only have one goal at Monahans: to help you achieve your tomorrow. Your success is our ambition.

DOUBLE DUTCH'S AMBITIOUS GROWTH STRATEGY BACKED BY £4M INVESTMENT

EMPLOYEE ENGAGEMENT PLATFORM SECURES £6.2M INVESTMENT

Milton Keynes-based, WorkBuzz has successfully raised £6.2m in a funding round led by YFM Equity Partners. The round also saw participation from existing investors Mercia and Foresight Group, utilising funds from the Midlands Engine Investment Fund (MEIF). With this fresh capital infusion, the company aims to expand globally, enhance sales, and marketing efforts, and introduce new technological innovations to serve its growing client base.

Founded in 2018 by employee engagement expert Steven Frost, the company has experienced remarkable growth, nearly doubling in size annually. Currently, the platform serves over 400 organisations, including renowned names like Five Guys, Shell Energy, and HS2. This marks the third funding round supported by Mercia and Foresight, who have been backing WorkBuzz since 2021 through MEIF funding.

Renowned producer of mixers and tonics, Double Dutch, has successfully concluded its latest funding round, attracting an impressive £4m investment. This announcement comes on the heels of the brand's remarkable 63% growth in distribution over the past year. The company's founders, Raissa & Joyce de Haas, are confident that the newly secured funds will fuel their expansion plans in the UK, allowing them to strengthen their sales team and drive further growth in export markets.

The company has set its sights on the Benelux region, its secondary home market, along with the UAE, and is even considering venturing into the APAC region. To fortify its presence in the UAE, the company has appointed Benita Bohsali, a seasoned professional with a background in supporting prominent businesses like MMI, Red Bull, and Heineken, as the Head of International Growth.

KEEP UP TO DATE WITH THE LATEST FUNDING NEWS

Advanced materials company, Material Evolution, has secured £15m in Series A funding to propel the production of its revolutionary low-carbon cement. This innovative cement boasts an impressive 85% reduction in carbon footprint compared to traditional Portland cement. The funding round was spearheaded by KOMPAS VC, an early-stage venture capital firm dedicated to decarbonising the built environment and manufacturing industry. Joining the round were Norrsken VC and CircleRock Capital, alongside existing institutional investors, such as Playfair Capital, At One Ventures, SkyRiver Ventures, and HG Ventures. Co-founded by Dr Elizabeth Gilligan and Sam Clark, Material Evolution has developed a game-changing low-energy, low CapEx manufacturing process that employs zero heat, addressing the high CO2 emissions associated with conventional cement production.

August/September 2023 18 FUNDING

MATERIAL EVOLUTION SECURES

£15M SERIES A TO REVOLUTIONISE LOW-CARBON CEMENT

▴ Members of the Material Evolution team

▴ Raissa & Joyce de Haas, Co-Founders of Double Dutch

▴ The WorkBuzz team

GAME-CHANGING PLATFORM RAISES NEARLY £6M TO FUEL SME GROWTH

FundMyPitch (FMP), a platform connecting investment-ready companies with investors, has achieved a significant milestone by raising £5.77m in funding for entrepreneurs within its first year of operation. Founded by entrepreneur Steven Mooney in 2022, FMP has experienced rapid growth, boasting 3,460 registered users, including 941 businesses seeking investment and 2,519 investors.

FMP’s success is attributed to its innovative video pitch model, enabling entrepreneurs to create compelling content to attract investor interest. With a focus on early-stage opportunities and a commitment to facilitating successful deals without upfront fees, FMP utilises advanced AI algorithms, an intuitive user interface,

BRITISH BUSINESS BANK ANCHORS MERCURI’S £50M FUND

TANDEM BOLSTERS GROWTH AMBITIONS WITH £20M CAPITAL INJECTION

Tandem, the UK-based purpose-led digital banking platform, has successfully secured £20m in Tier 2 capital from growth investor Quilam Capital, known for its expertise in the speciality finance sector. This investment further strengthens Tandem’s growth trajectory as it continues its mission to build a profitable and environmentally conscious banking platform. The capital raise, which concluded in late June 2023 with the assistance of financial services advisor Alantra, reflects Tandem’s commitment to helping households reduce their carbon footprint and supporting the country’s transition to a carbonneutral economy.

INTEGRUM RENEWABLE ENERGY GAINS MOMENTUM WITH MAJOR PE INVESTMENT

Mercuri, an early-stage media technology investor formerly known as GMG Ventures, has successfully raised £50m for its second fund from institutional investors. The British Business Bank, through its Enterprise Capital Funds (ECF) programme, has made a significant cornerstone investment. Leveraging their sector expertise in the convergence of media and technology, Mercuri’s new fund aims to support UK-based start-ups that are revolutionising traditional media models with artificial intelligence.

The fund’s focus is on technology-enabled products in the creation, distribution, consumption, and monetisation of content and data. Mercuri plans to make up to eight new investments annually, prioritising data governance and AI safety among its portfolio companies as a certified B Corp and Co-Founder of VentureESG.

UK-based Solar PV and Battery Storage developer, Integrum Renewable Energy Ltd, has received an investment from private equity firm Omnes, facilitated by the corporate team at independent law firm Burges Salmon. Omnes, dedicated to energy transition and innovation, has acquired a majority stake in Integrum through its Capenergie 5 fund, the latest renewable energy private equity fund. Omnes plans to deploy £150m of equity to further its advancement in the UK renewable energy sector, leveraging its existing pipeline of 2GW of utilityscale solar and battery energy storage systems. With a target operational portfolio of 1GW+ and a multi-GW pipeline, Integrum aims to become a fully integrated Renewable Independent Power Producer (IPP). The Burges Salmon team, led by Partner Jonathan Eves, supported Integrum Renewable throughout the transaction.

Business Leader – The UK’s Voice for Business 19 ROUND-UP

and strategic partnerships with financial institutions, venture capital firms, and start-up incubators.

▴ Senior members of the Mercuri team

▴ Steven Mooney, CEO at FundMyPitch

◂ Jonathan Eves, Partner at Burges Salmon

RAISING CAPITAL OUTSIDE THE CAPITAL

THE CHANGING LANDSCAPE OF INVESTMENT IN THE UK

Along with New York, London is in a category of its own. While other areas of the UK are developing and more businesses are setting up outside of the capital, does a London-centric bias still exist?

SHARE THE WEALTH

Growth is starting to spread across the country, rebalancing years of economic imbalance, which has seen growth in London and the South East outpace the rest of the country. Strategies focus on regeneration, levelling up, and as the Chancellor put it in his Spring Budget –realising the “significant untapped growth potential in the UK’s cities outside London.”

CAPITAL GAINS

Firstly, London’s position at the centre of the UK’s tech economy is safe. A new report by the Startup Coalition found 8 of the top 10 constituencies for technology were based in the capital. However, Manchester, Oxford, Cambridge, Edinburgh, Bristol, and Leeds have all become major players in the UK tech sector, each producing their very own unicorns.

Professor Ian Goldin, author of The Age of The City, thinks London will continue to capture the lion’s share of new capital and investment in Britain. Otherwise, locations boasting R&D institutions and leading universities will come up trumps.

“As generative AI accelerates the transformation of the economy towards more knowledge-based services and

Brexit accelerates the decline of traditional manufacturing, the advantages of London will grow,” Goldin says.

“In the intensifying war on talent, particularly for globally mobile, highly skilled people, who are at the forefront of new technologies and the accompanying legal and financial services, the cosmopolitan attractions of London are advantageous, particularly for young people.

“Elsewhere, it is the clusters around cutting edge research in great universities and places with deep expertise in new materials and health applications who are likely to be successful in raising capital.” he adds.

TRAILBLAZER DEALS

The Government is going for growth. A Department of Business and Trade (DBT) spokesperson said:

“The Government is committed to encouraging private investment across the UK as we strive to level up the country, grow regional economies and create more highly skilled jobs.”

August/September 2023 20 FEATURE

“THE GOVERNMENT IS COMMITTED TO ENCOURAGING PRIVATE INVESTMENT ACROSS THE UK AS WE STRIVE TO LEVEL UP THE COUNTRY, GROW REGIONAL ECONOMIES AND CREATE MORE HIGHLY SKILLED JOBS.”

Department of Business and Trade spokesperson

Results are already visible around distributing business opportunities and prosperity more evenly throughout the UK. The latest Rebuilding Britain Index (RBI), The Great British Migration, which tracks the UK’s social and economic progress against 52 measures on a quarterly basis, found that relatively little separates the UK regions and nations, with London achieving the highest RBI score (66/100) and Wales the lowest (62/100).

Levelling up strategies will further reduce regional disparities. A Levelling Up white paper from last year included trailblazer deals with Greater Manchester’s and West Midlands’ Combined Authorities, aiming to increase the current levels of devolution.

The Government’s promise was reiterated in the Spring Budget, which included these regions as a component of the growth initiative.

“Recent EY data showed that the UK is second only behind France as a top European investment destination. All parts of the country are benefitting from our support, with London remaining the number one location for inward investment, closely followed by Manchester, Edinburgh and Birmingham,” added the DBT spokesperson. Both sub-regions will have more authority over local transit, skills, jobs, housing, innovation, and net-zero priorities thanks to the agreements. Additionally, they will be given single financial settlements at the upcoming spending review, similar to those given to Government departments.

CapEQ Partner Doug Edmunds thinks the economic climate and fear of uniformity is dampening deals everywhere.

“The recent economic turbulence has made investors much more cautious since

these figures were compiled. While private equity funds are still very active, we are hearing that VCs are growing concerned that mainstay sectors, such as fintech and SaaS start-ups and scale-ups, lack differentiation in often saturated markets,” he says.

RAISING CAPITAL OUTSIDE THE CAPITAL

Danny Brewster, CEO and Co-Founder of twentyone believes there is still much life in the city.

“London’s fintech scene attracted $10.2bn in investment in 2022. When you consider the total amount raised for fintech businesses across the whole of the UK was only $12.5bn, then you begin to see the scale of London’s continued dominance in this area, which has been built up over many years.

Business Leader – The UK’s Voice for Business 21 Cont. RAISING CAPITAL

“WHILE PRIVATE EQUITY FUNDS ARE STILL VERY ACTIVE, WE ARE HEARING THAT VCS ARE GROWING CONCERNED THAT MAINSTAY SECTORS, SUCH AS FINTECH AND SAAS START-UPS AND SCALE-UPS, LACK DIFFERENTIATION IN OFTEN SATURATED MARKETS.”

Doug Edmunds

“Historically, it’s been harder to raise capital outside of London, but I think that is beginning to change. Perhaps it’s a case of a rising tide lifting all boats, but we’re starting to see increased interest in businesses in other parts of the UK. I think the emergence of genuine fintech hubs like Manchester, Birmingham and Leeds has massively helped here,” he adds.

Tim Mills, Managing Partner at ACF Investors, thinks London remains the centre, but it’s apparent that the landscape for investment across the country has improved. He outlines four circumstances that have brought about this change.

“Firstly, Covid-19 and lockdowns shrank the planet (at least in peoples’ minds) and reduced the concerns about investing remotely, so investors are more willing to invest around the country (and not just in the regions they are based).

“Secondly, there is just a lot more venture capital around (more money, more funds, more investors) so not only is there more competition to find great founders and businesses. Thirdly, more of those funds are dotted around the country; and finally, talent has always been widely spread but founders across the country have discovered they don’t have to travel to London to get funding and can often build businesses more efficiently in lower-cost centres,” he says.

There is no denying the magnetism of London for high-growth companies. It is still, and will remain, the UK epicentre for tech talent and capital, according to Andrew Noble, Partner at Par Equity

“Having said that, with growth in the number of tech companies being launched across the UK, what we are seeing in the data is the north of the UK starting from a “low base” to now being in receipt of further funding from London-based venture capitalists seeking quality deals at sensible valuations in other parts of the UK,” he says.

Noble, along with hundreds of others, realises the lure of the land north of London.

FAIR GEOGRAPHIC SPREAD ACROSS THE UK

Real levelling up is on the horizon thanks to new funding control authority granted to Greater Manchester and the West Midlands. Regarding this, Manchester received £532m last year, (marking an astounding 50% yearover-year increase), Noble reminds us to review these amounts with caution.

“It’s easy to get carried away by the headline numbers, but let’s remember that of the £532m, roughly £250m was invested into three companies in Manchester – Be.EV, Freedom Fibre, and Modern Milkman. So, the increase has largely been driven by these outliers. However, the trend is moving in the right direction, and this is true of other regions in the north of the UK. For example, tech funding in Scotland was up 37% in 2022 to record levels,” he says.

According to Mills, it is the result of a cumulative effect.

“Every ecosystem needs a certain critical mass to scale and Manchester’s growth in recent years has helped drive further expansion (talent attracts investors and capital crowds in talent). We are also starting to see some proper growth rounds (not just

seed of early-stage VC funding) really kick in and drive the numbers up,” he says.

According to the RBI, across the whole of the UK, as many as 19% of people are planning to relocate to a different part of the UK within the coming year, and in London, the figure reaches 35%. Noble reveals higher education institution funding as an explanation for this exodus:

“One of the reasons for the underlying trend is the growth of funding for university spin-outs right across the UK, and, as it happens, the north of the UK is blessed with an outsized number of universities which are deemed too world class for their research and innovation, and this is the potential bedrock for future tech success in this part of the UK.”

Regarding Manchester’s windfall last year, Brewster says:

“It’s an amazing statistic, which underlines the growth that the city’s fintech scene has seen in recent times. I can speak about the city’s appeal first-hand, as I decided to launch twentyone, a financial services provider here recently, inspired by Manchester’s affordable business leases,

August/September 2023 22 FEATURE

“I THINK THE EMERGENCE OF GENUINE FINTECH HUBS LIKE MANCHESTER, BIRMINGHAM AND LEEDS HAS MASSIVELY HELPED HERE.”

Danny Brewster

its deep tech talent pool and its culture of hard work and creativity.

“Much like the city we now call home, our team greatly values responsibility, honesty, and transparency. Ultimately, I think that’s the case for a lot of businesses here, who see the importance of launching in a city they feel truly aligned with. This combination leads to great businesses, which invariably end up attracting investment.”

Brewster, while acknowledging London’s recent lull in funding is quick to point out how well the city did compared to other global cities.

“All in all, London suffered a 5% dip in funding levels last year, but it still outperformed many other major cities around the world amidst a major slump. More broadly, the UK still receives more investment in fintech than all the next 10 European countries combined and is only second in the world to the US.”

MANCHESTER REIGNING CHAMPION

In cities like Sheffield, Manchester, and Birmingham, metro mayors have not only pushed for urban renewal but are also enhancing connectivity, bringing together

local governments, and opening up additional chances for regional economic and social growth. Brewster thinks Manchester recognised the success of London’s fintech scene and wanted to replicate that but in an authentic way.

“The city has made use of distinct advantages over London, such as lower business leases to attract companies who may have otherwise felt compelled to start up in the capital.”

Undoubtedly, cost has been a major contributor to this shift, but there are many other factors at play.

“Tech start-ups need solid talent pipelines, support from local authorities and a deep network of like-minded individuals and organisations to grow. Manchester ticks all those boxes, plus it’s also a great city to live and socialise in. The city is now full of intelligent entrepreneurs, fast-paced start-ups, innovators, and hyper-growth businesses, all of whom are looking to be the next big thing,” adds Brewster.

Edmunds thinks it’s no surprise to see more backing for North West businesses.

“Manchester has some exciting early-stage SMEs in the adtech, edtech, and fitness app markets with strong disruptive potential,” he adds.

IS LONDON LOSING IT?

Undermining London is not the answer to Britain’s problems – that will result in levelling down, weakening national competitiveness.

LINKEDIN POLL

17% YES 83% NO

“London is not ‘losing it’. People don’t realise that the north of the UK is now a one trillion-dollar economy. That’s the equivalent of the 8th largest country in Europe and the 20th largest country in the world. Key to the success for northern tech will be in its ability to attract the necessary scale-up capital and talent to build global category leaders,” says Noble.

“With the confluence of a rich engineering and manufacturing heritage across the north of the UK, and growing venture capital appetite for climate tech and health tech solutions, I expect to see some hugely successful companies in these areas being built in this part of the UK over the coming 5-10 years,” he adds.

London is still the largest market by some margin, but Mills points out that the opportunities for businesses and founders outside the capital will continue to improve as success spreads.

“The key for any centre is having the pool of skilled people, capital, access to customers, and entrepreneurial energy,” he adds. Brewster doesn’t think London is becoming substandard, rather he thinks other tech hubs like Manchester are catching up to its heights. As the old Irish saying goes, ‘it doesn’t matter where you are, there you are.’ Revolutionary ideas can come from anywhere.

“Funding is down worldwide, particularly in the fields of tech and fintech, but I still believe the cream always rises to the top. Whether you’re in London or not, a gamechanging idea is a game-changing idea and will always attract investors,” he adds.

Let’s wait and see if promises to ‘level up’ Britain’s forgotten regions come to fruition. Currently, with little progress in closing the gap between London and the rest of the country, the capital’s position within the UK won’t be seriously challenged overnight. Though it will have to work harder to maintain its position.

Business Leader – The UK’s Voice for Business 23 RAISING CAPITAL

IS ENOUGH BEING DONE TO ENCOURAGE INVESTMENT OUTSIDE OF LONDON?

“LONDON IS NOT ‘LOSING IT’. PEOPLE DON’T REALISE THAT THE NORTH OF THE UK IS NOW A ONE TRILLION-DOLLAR ECONOMY.”

Andrew Noble

TATA COMMUNICATIONS ACCELERATES GLOBAL GROWTH WITH KALEYRA ACQUISITION

DEAL VALUE: $100M (£77.8M)

Global digital ecosystem enabler, Tata Communications, has announced its definitive agreement to acquire Kaleyra, Inc. This strategic move aims to empower enterprises worldwide to deliver personalised experiences to their customers. Kaleyra is a leading omnichannel integrated communication services provider, offering targeted personalisation through messaging, video, push notifications, email, voice-based services, and chatbots.

With this transaction, Tata Communications gains access to Kaleyra’s proven platform, enhancing its capabilities and scale. Kaleyra’s strong presence in the banking and financial services,

KEEP UP TO DATE WITH THE LATEST M&A NEWS

WASSERMAN ACQUIRES SQUADRA SPORTS TO ESTABLISH WASSERMAN CYCLING

DEAL VALUE: UNDISCLOSED

Global sports, music, and entertainment agency, Wasserman has made a significant move in the world of cycling with the acquisition of Squadra Sports Management. The practice has now been rebranded as ‘Wasserman Cycling,’ as announced by Travis Clarke, Executive Vice President of Action Sports & Olympics. As part of the acquisition, Dries Smets, the Managing Director of Squadra, has joined Wasserman as Senior Vice President of Cycling, along with all former Squadra employees.

The impressive roster of Squadra Sports includes top riders with multiple Monument wins and Road World Championships. This acquisition further strengthens Wasserman’s presence in cycling, complementing their previous investments, such as the Circuit Racing International Tour (CRIT) partnership.

retail, and digital commerce industries across global markets further strengthens Tata Communications’ position. The cashonly acquisition is valued at approximately $100m (£77.8m), with Tata Communications assuming all outstanding debt. Tata Communications is advised by Lazard Frères & Co. LLC, while Kaleyra is represented by Willkie Farr & Gallagher LLP as its legal counsel.

CORLYTICS TAKES THE LEAD IN REGTECH INNOVATION THROUGH CLAUSEMATCH ACQUISITION

DEAL VALUE: UNDISCLOSED

Dublin-based financial services software company, Corlytics, has announced its acquisition of Clausematch. This marks Corlytics’ second acquisition this year, positioning the company to manage the complete regulatory risk value chain globally. By combining Corlytics’ proven intelligent regulations and regulatory data with Clausematch’s expertise in creating and mapping intelligent regulatory documents, the acquisition represents a significant breakthrough for the RegTech industry.

As part of the deal, Clausematch Founder and CEO Evgeny Likhoded

will assume the role of President of Corlytics, focusing on strengthening partnerships with major banks, insurers, and payment companies. The acquisition brings Corlytics’ client base to 80, including 14 of the world’s top 50 banks. John Byrne will lead the enlarged group as CEO, responsible for driving the company’s vision, growth strategy, and profitability.

August/September 2023 24 DEALS

▴ (L-R) Troy Reynolds, Chief Legal & Compliance Officer at Tata Communications, Mysore Madhusudhan, EVP Collaboration and Connected Solutions at Tata Communications, Tri Pham, Chief Strategy Officer at Tata Communications, Kathy Miller, Director Board Member at Kaleyra, Dario Calogero, Founder and CEO at Kaleyra and Dr. Avi Katz, Chairman of the Board of Directors at Kaleyra

▴ (L-R) John Byrne & Evgeny Likhoded

ZEUS GROUP BOOSTS MARKET PRESENCE WITH JAMES HAMILTON GROUP ACQUISITION

CARLYLE ACQUIRES MAJORITY STAKE IN LEADING SUSTAINABILITY FIRM ANTHESIS

DEAL VALUE: ENTERPRISE VALUE RUMOURED TO BE £400M

DEAL VALUE: UNDISCLOSED

Irish-owned packaging solutions business, Zeus Group, has announced the acquisition of Northern Irish print and packaging company, James Hamilton Group. James Hamilton Group boasts €18m (£15.4m) in annual sales and a dedicated team of over 120 employees. This strategic move aligns with Zeus Group’s 2023 growth strategy, aimed at surpassing group revenues of €500m (£427.2m).

The acquisition strengthens Zeus Group’s position in the food and retail packaging sector, enabling enhanced product offerings, operational efficiencies, and local manufacturing expertise in printed packaging. With its expertise in retail food packaging, food sleeves, cartons, and advanced label production, James Hamilton Group significantly enhances Zeus Group’s ability to cater to the needs of customers in the food, beverage, and retail industries.

Global investment firm, Carlyle, has announced its acquisition of a majority stake in Anthesis, a prominent sustainability advisory and solutions company. The deal sees Carlyle partnering with Anthesis’ employee shareholders, while existing shareholder Palatine retains a minority stake. The financial terms of the transaction remain undisclosed. With over a decade of experience, Anthesis has become a leader in delivering impactful sustainability, ESG, and net zero programmes for more than 4,000 clients worldwide.

The B Corp-certified company operates with a team of over 1,250 specialists across 39 offices in 22 countries. Carlyle’s investment through its Carlyle Europe Partners (CEP) platform will support Anthesis in expanding internationally, diversifying its service offerings, and continuing its successful M&A strategy.

This move highlights Carlyle’s commitment to addressing critical ESG issues and driving effective decarbonisation strategies across its investment portfolio.

LIMBS & THINGS EXPANDS PORTFOLIO WITH EOSURGICAL ACQUISITION

DEAL VALUE: UNDISCLOSED

Bristol-based medical task trainer specialist, Limbs & Things, has made a significant acquisition by purchasing laparoscopic surgical trainer and software specialist, eoSurgical. eoSurgical is renowned for its technology-driven approach and self-directed learning solutions in laparoscopic surgery. This deal allows Limbs & Things to integrate eoSurgical’s products into its existing lineup of laparoscopic trainers, expanding its offerings in the market.

Developed by consultant surgeons Roland Partridge, Paul Brennan, and Mark Hughes, eoSurgical’s simulators are widely used in over 90 countries, including the Royal College of Surgeons Improving Surgical Training Programme in the UK. The portable simulators and user-friendly software make it convenient for training in

departments,

Business Leader – The UK’s Voice for Business 25 ROUND-UP

various settings, including simulation environments, operating

or even at home.

▴ (L-R) Nick Hull, Managing Director of Limbs & Things, and Roland Partridge, Co-Director of eoSurgical with eoSim.

▴ (L-R) Alan Hamilton, Director at James Hamilton Group, Brian O'Sullivan, Founder of Zeus, and Keith Hamilton, Managing Director of James Hamilton Group

FROM TOXIC WORKPLACE TO BEST EMPLOYER BREWDOG’S ASTONISHING TURNAROUND

A crisis is a sliding doors moment for any business. A reputation built up over decades can be destroyed in hours by a botched response to a major issue.

Controversy is nothing new to BrewDog. Since its establishment in 2007, the self-described “Punk” of beer brewers have intentionally stirred the pot with shock strategies and as much profanity as possible.

PUNKS WITH PURPOSE

Difficult times can give a fresh incentive for companies to consider who they are, what they stand for, and what they hope to achieve. However, going from allegations over abuse of power and rumours of a toxic workplace to landing a place on the Sunday Times Best Place to Work listing is a big jump, even for the most positive of people.

In BrewDog’s case, issues stemmed from internal challenges. Punks with Purpose, a workers’ rights advocacy group striving for change, brought attention to concerns of a toxic workplace, including allegations of

a culture of fear, pressure, and employee harassment.

The company’s rapid development and desire, according to the former workers, had resulted in a disrespect for its employees, making working conditions difficult and unfriendly. Last year, Hand & Heart and Punks with Purpose, launched The BrewDog Affected Workers’ Platform for impacted BrewDog workers to independently register their employment experiences. BBC documentaries and podcasts followed.

CHANGING TIDES

The Aberdeenshire-based brewer began to experience a shift, thereafter, including a pay review, additional resources, and an independent evaluation that consulted all 1,694 employees.

Fast forward to today, and Brewdog is listed among The Sunday Times’ Best Places to Work in 2023. The Top Employers Institute certification assesses companies via an independently audited and fact-based HR Practices Survey, covering Steer, Shape, Attract, Develop, Engage, and Unite.

The list recognises companies that create a happier and more fulfilling working environment, by fostering engagement from their teams, yielding great business and performance in return. That is a far cry from the BrewDog of 2022. What a difference a year can make.

TICK TOCK

Timing is everything when dealing with a crisis. Say and do nothing and you’ll create a vacuum that will be filled with other people’s

August/September 2023 26 FEATURE

“MAKE SURE THE STRATEGY IS BASED AROUND A UNIQUE MISSION ETHOS, FOR EXAMPLE, BELIEVING IN SOMETHING THAT IS UNIQUE TO YOU AND YOUR BUSINESS.”

Matthew Hayes

take on the situation, only adding fuel to the fire.

Matthew Hayes, the MD of Champions UK plc., believes that when dealing with reputational crises, the key to a successful business strategy is consistency. Often when there is bad press, businesses fall into the trap of reacting immediately, which tends to escalate the situation, either by confirming there was a problem or presenting a loss of direction as to what they stand for.

“Make sure the strategy is based around a unique mission ethos, for example, believing in something that is unique to you and your business, and then be consistent in its delivery.

“If a business reacts quickly and in a positive way, the challenge itself can improve the ongoing relationship, as it demonstrates the way in which a business goes about confirming what it’s about and what matters to it,” he says.

HIGHS AND LOWS

Last year BrewDog opened two global flagship bars in Waterloo and Las Vegas, and there is an exciting pipeline of new bar openings, including at Gatwick Airport. They reported record revenues for 2022 and current trading is very strong. Boasting five of the fastest-growing beer brands in the UK, including Lost Lager, BrewDog is now ranked the world’s 14th most valuable beer

brand by Brand Finance, overtaking Carlsberg for the first time. Seems too good to be true...

Jonathan Hemus, Managing Director of crisis management consultancy Insignia and author of the award-winning book, Crisis Proof, thinks that BrewDog was helped in that its values and reputation have always been based on a maverick and anti-establishment approach, meaning that rather than damaging it, many of its ‘crises’ have in fact further reinforced its position as a maverick.

“Similarly controversial behaviour by a staid bank would not have played out so well,” he adds.

When asked about the recent transformation, going from allegations from former employees to Best Place to Work awards, James Watt, BrewDog Co-Founder and CEO, said that life in a fast-paced, high-growth business isn’t for everyone, but BrewDog have always been fully committed to doing the best they can by their people.

“That includes our commitment to paying the Real Living Wage, our unique company-wide profit share scheme, and amazing signature benefits like giving our people time off to look after a new puppy (we call it pawternity leave). Over the past two years, we have continued to invest in our governance, our team’s development, mental health support, progression opportunities and our employee ownership program. We are determined to continue to improve every element of what we do,” he said.

But is it enough?

SUPPORTING START-UPS

Alongside Trigger Happy TV star Dom Joly and professional investor Codie Sanchez,

Watt is putting £5m of his money on the line to help make a success of start-ups in the Next Unicorn competition. 750 keen entrepreneurs sent over their ideas, which was whittled down to 14 to pitch to Watt in person.

Having originally planned to back three out of the five businesses, Watt is now backing all five finalists, including edible bug business Yumbug, and Tallow & Ash with their planetfriendly laundry detergent. He announced that all five finalists will each be taking home a share of his investment – backing an extra two firms who expected to miss out at the contest’s Las Vegas final.

In a world-first, investment is now open via Crowdcube, allowing members of the public to invest in the five winners on the same terms as Watt. Given that hundreds of people applied, it’s clear that many are ready to ignore any current difficulties concerning Watt.

This is a sign that nothing sticks forever and possibly that controversies are more digestible when cash is involved.

INCLUSIVE CULTURE

Whether it’s meaningful change or merely paying lip service depends entirely on who you talk to, but BrewDog has partnered with LGBTQ+ charity MindOut, to help raise awareness of its mental health services and provide access and support to staff and customers.

Lauren Carrol, Chief Marketing Officer at BrewDog, acknowledges there is always more to do:

“We’re not perfect, but we’re committed to making BrewDog a great place to work, and to support LGBTQ communities that many of our employees and customers are a part of.

“Through our partnership with MindOut, we are delighted to support the fantastic work they do in Brighton and beyond. We take inspiration from the work they do as we continue to evolve and develop our DE&I policies to make sure every BrewDog employee and customer feels welcome, safe, and included in our spaces all year round,” she says.

The beer brand has announced that 50p from each sale of the limited edition 4.5% guava-infused pride month lager will go directly to the charity. Given that BrewDog’s culture seemed to slowly sour like beer left outside on a scorching day, any good associations are welcomed.

Business Leader – The UK’s Voice for Business 27 BREWDOG

Cont.

MEANINGFUL CHANGE

Crisis situations are catalysts for meaningful changes and can position companies in a much healthier place to deal with problems going forward.

Martin Calvert, Marketing Director at ICS, points out that often the most effective strategies are the ones that involve doing hard work in the right way. If there is fundamentally no change, then ‘astroturfing’ reputation will not help and the difference between the public story and the real situation will be even more damaging.

Watt published an open letter to the brewery’s ‘haters’ after the company was named on The Sunday Times’ Best Places to Work 2023 list. The letter, published on LinkedIn, was addressed to “the small group of individuals who seem to have made it their life’s work to take down our company.”

Calvert raises this approach as possibly problematic when repairing reputations.

“In order to equip PR professionals to do their jobs well, there has to be actual meaningful change and a story that isn’t easily punctured. With BrewDog, it feels like there are still some risks given the borderline aggressive tone used by company representatives when the topic of their reputation comes up,” he says.

No one wants to endure a crisis but, ironically, they provide a catalyst for positive change that less dramatic circumstances rarely do.

LEGAL IMPLICATIONS

When transforming reputations from bad to brilliant, Ashley Hurst, Partner at Osborne Clarke, says that a good corporate reputation has all sorts of advantages from a legal perspective.

“It means that the media will be more sceptical over damaging allegations and the company will find it easier to establish relationships with key stakeholders, including regulators.

“From a litigation perspective, it’s easier to take the moral high ground when coming from a position of reputational strength. Conversely, threats of legal action from a company that is on the ropes from a reputational perspective can lead to counterparties and journalists digging deeper for bad news,” he says.

John Morgan, Principal Associate at Eversheds Sutherland, reveals that the organisations who are most successful in truly resetting or evolving their culture and reputation are those who genuinely engage with their past (even where they believe allegations are undeserved), and use it positively and purposively to design their future organisation.

“The perception of fairness for staff and others cannot be underestimated – a brilliant reputation can transform your workplace, employee engagement, productivity, loyalty, recruitment prospects, and of course reduce the risk of claims or allegations. In large companies, whether private or listed, employee voice is part of corporate governance reporting requirements, which can therefore lead onwards to improved investment or sales opportunities and a well-deserved reputation for both S and G in the ESG sphere,” he adds.

A thorough investigation into not just certain circumstances or complaints, but overall culture in a more holistic way is important, according to Laura Pharez-Zea, Principal Associate at Eversheds Sutherland