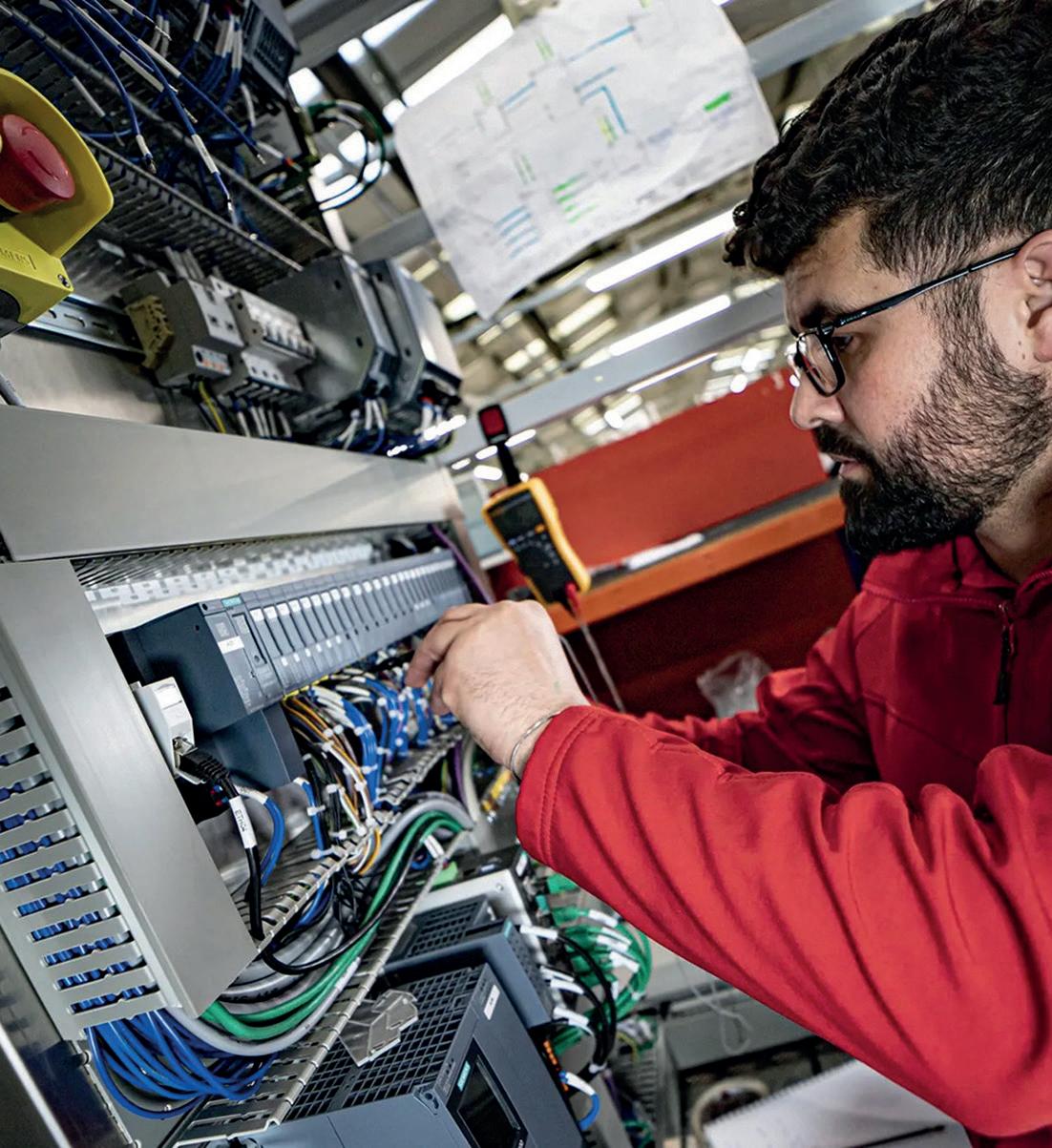

We take a deep dive into training and recruitment, looking into its state post-Covid and unveiling the successes and where things need to be improved.

We take a deep dive into training and recruitment, looking into its state post-Covid and unveiling the successes and where things need to be improved.

Welcome to Q4 and the latest edition of Business Leader magazine. Exciting news came out of our HQ last month, with HomeServe PLC Founder and Chairman, Richard Harpin, acquiring the publication from the Ascot Group. The deal signals a new era in our journey to solidifying our place as the voice for UK businesses, and the team are excited for the future. Andrew McLaughlan takes over as CEO of Business Leader, with Founder Andrew Scott staying with the business as Chairman.

In this edition, we explore the world of co-founder prenups, look at the state of the South West economy, ask if the reign of the outspoken leader is over for good, and much more. The team took the trip to West London for our latest cover interview with the global icon that is Kelly Hoppen. Meeting Kelly at her beautiful design studio, we discussed her upbringing, building her “overnight” success over more than four decades, and her time on Dragons’ Den.

We also take a deep dive into the cost of UK visas and the effect it’s having on our talent pool, highlight the top 32 manufacturing stars to watch, and ask what effect a Labour Government would have on business. Thanks for reading our publication and, as always, we want to hear from you. Reach out to us if you have any feedback on this edition through LinkedIn or pop us an email.

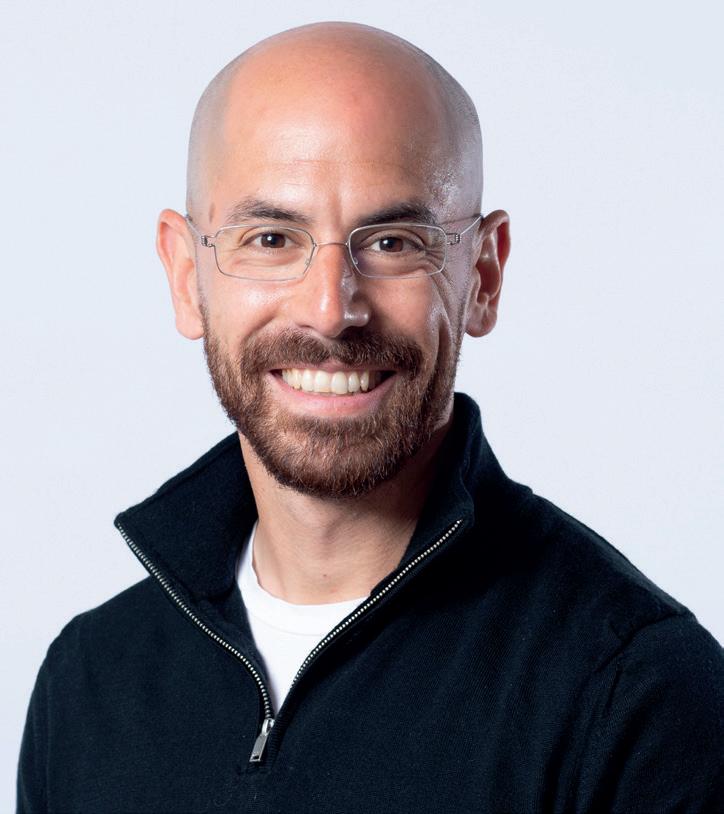

Josh Dornbrack Editor Editorial@businessleader.co.uk | @JDornbrack

Connect with like-minded professionals, gain access to exclusive content, receive event invitations, and stay up-to-date with the latest industry trends – all delivered straight to your inbox.

EDITORIAL

Josh Dornbrack - Editor

E: josh.dornbrack@businessleader.co.uk

James Cook - Digital Editor

E: james.cook@businessleader.co.uk

Patricia Cullen - Senior Business Reporter

E: patricia.cullen@businessleader.co.uk

Alice Cumming - Editorial Assistant

E: alice.cumming@businessleader.co.uk

SALES

Sam Clark - Sales Director

E: sam.clark@businessleader.co.uk

Tom Dyson - Advertising & Sales Executive

E: tom.dyson@businessleader.co.uk

DESIGN/PRODUCTION

Adam Whittaker - Head of Design

E: adam.whittaker@businessleader.co.uk

DIGITAL & WEB

Gemma Crew - Marketing Manager

E: gemma.crew@businessleader.co.uk

Rosie Coad - Marketing Executive

E: rosie.coad@businessleader.co.uk

Lee Irvine - Head of Multimedia and Video

E: lee.irvine@businessleader.co.uk

CIRCULATION

Adrian Warburton - Circulation Manager

E: adrian.warburton@businessleader.co.uk

MANAGEMENT

Andrew McLaughlan - CEO

E: andrew.mclaughlan@businessleader.co.uk

Andrew Scott - Chairman

E: andrew@businessleader.co.uk

Oli Ballard - Director

E: oli.ballard@businessleader.co.uk

Business Leader Magazine is committed to a zero carbon future and supports the World Land Trust by using compostable wrap rather than plastic polywrapping. Carbon-balanced PEFC® certified paper, which is sourced from responsible forestry, is produced in an environmentally-friendly way to offset our CO2 emissions.

According to the latest research from American Express, the majority of small and medium-sized businesses (SMEs) in the UK are focusing on increasing sales by intensifying marketing efforts and investing in new products and services. The annual Business Barometer, surveying 1,000 UK SMEs, revealed that 64% of respondents are diversifying customer offerings to strengthen business performance.

Growth strategies include enhancing customer communications (43%), introducing new services (38%), offering special deals (32%), and ramping up marketing activities (41%). The study also highlights the importance of innovation, with 32% planning to introduce new payment methods. American Express has relaunched its campaign highlighting the benefits of accepting Amex for small businesses.

The UK Government has unveiled plans to rejoin Horizon Europe, the £85bn EU science research initiative, ending its two-year absence postBrexit. The UK's earlier exclusion resulted from the failure to negotiate a continued participation agreement. Downing Street revealed that the reentry into Horizon would occur through a tailored arrangement with the EU, and the UK will be a fully associated member until 2027.

This collaboration, involving Europe's top research institutions and tech firms, allows EU member states to contribute funds, which are then distributed based on merit. The move opens doors for UK firms to collaborate with nations like Norway, New Zealand, and Israel, who are also part of the program. UK researchers can now apply for grants and project participation.

UK Fintech Growth Partners, a London-based investment firm, has unveiled a £1bn growth fund aimed at bolstering the UK's rapidly expanding fintech sector. This initiative comes in response to a recent downturn in fintech funding, with a year-on-year drop of 8% in 2022. In H1 2023, funding reached $2.9bn (£2.2bn), representing a 37% decline compared to H2 2022, according to Innovate Finance data.

With over 1,600 fintech firms currently in the UK, this number is anticipated to double by 2030. Supported by leading entities like Mastercard, Barclays, NatWest, the London Stock Exchange Group, and Peel Hunt, the fund's objective is to assist fintech companies in the Series B to pre-IPO phase. The initial capital injection is expected in Q4 2023, followed by four to eight annual investments ranging from £10m to £100m.

BMW is set to produce its forthcoming electric Mini in Oxford, thanks to a £75m Government investment. The German automaker is poised to disclose details of its £600m investment, anticipated to safeguard around 4,000 jobs. With BMW's forthcoming announcement, recent investments in the UK's automotive sector will surpass £6bn, according to Government officials.

The funding is aimed at converting the Cowley plant to all-electric production by 2030. Prime Minister Rishi Sunak stated that the Government's support is securing jobs and boosting the economy, making the UK "the best place to build cars of the future.”

Susannah Streeter, Head of Money and Markets, Hargreaves Lansdown says: “There will be relief for thousands of car workers in the UK today as BMW is set to reveal the details of plans to build two new electric Mini models at its plants near Oxford. Concerns had been rising about the lack of infrastructure in the UK, particularly plants to build batteries, but funding from the Government’s Automotive Transformation Fund has clearly helped clinch this deal.

“This will help secure the future for 4,000 employees who currently work at the plants, but there will be knock-on benefits across supply chains and also ancillary services which support the workforces in the region. News of the development may also help propel interest in EV ownership, given the iconic nature of the mini brand here in the UK.”

New data from HM Revenue and Customs (HMRC), obtained by HR and finance expert MHR, reveals the substantial financial impact of incorrect or missing payroll reporting on UK businesses. HMRC has imposed penalty charges totalling £75,154,200 since 2020 on firms repeatedly failing to comply with payroll reporting requirements, with 27% of this sum imposed in the past financial year (April 2022 to April 2023).

This significant financial burden underscores the need for businesses to adopt automated technology for accurate reporting and avoid such needless penalties, particularly as many companies continue to report manually.

A recent survey conducted by Miro, the visual workspace for innovation, underscores the unanimous agreement among business leaders and information workers that innovation is vital for success. However, economic uncertainty, fear, and outdated practices hinder many from capitalising on this opportunity.

Globally, 98% of leaders and 90% of information workers view innovation as

urgent, with 79% of leaders and 76% of workers stating it's necessary for competitive advantage. Despite this consensus, economic uncertainty causes 57% of leaders to perceive innovation as a luxury and 62% admit fear obstructs innovation efforts. Outdated technology and cross-functional collaboration challenges are also significant barriers, cited by both leaders and workers.

A report titled "Global Horizons: Realising the Services Exports Potential of UK Nations and Regions" has highlighted the need to address regional disparities in service exports across the UK. The report, developed by the Institute of Export & International Trade in partnership with Flint Global, was presented at a parliamentary event.

It emphasises that improvements in connectivity, education, and immigration policies are crucial to narrowing regional gaps. While services contribute significantly to the UK's economy, they are concentrated in London and the South East. The report recommends investments in infrastructure, education, and research and development at both national and regional levels to boost services exports and foster economic growth.

A survey conducted by HR software firm Personio has unveiled a significant disparity between UK employers' and employees' confidence in workplace misconduct handling. While 51% of employers expressed extreme confidence in their misconduct management, only 27% of employees shared that sentiment.

Moreover, 91% of UK employees expressed concerns about retaliation against whistleblowers. With UK whistleblowing laws under review and new legislation in place across Europe, organisations are urged to establish safe and anonymous channels for whistleblowing. Despite 75% of surveyed employers claiming to have a whistleblowing policy, 27% of employees were unaware of their organisation's policy.

New research from Bibby Financial Services (BFS) highlights the substantial impact of current economic conditions on small and medium-sized manufacturing enterprises (SMEs) worldwide. In a survey spanning nine key international markets, 40% of manufacturers agree that global business conditions are currently worse than during the pandemic, with 27% stating that the situation is worse than following the global financial crisis.

The outlook for the sector is also pessimistic, with only 16% believing in a strengthening global economy, while 13% still consider a recession a possibility. Top concerns for SME manufacturers include inflation (56%), energy costs (55%), and economic uncertainty (29%).

Despite these challenges, 86% remain confident in their business prospects for the year, with 72% anticipating increased sales in the next six months.

New research from global consulting firm Slalom indicates that 84% of businesses in the UK and Ireland have adopted AI in some capacity. Contrary to the perception of AI hesitancy, only 13% of businesses have not yet ventured into AI. Most businesses fall into the exploratory stage (26%), having conducted successful trials and now considering integration.

Another 24% are confident, with AI tools already integrated across their organisations. A pioneering 6% have bespoke AI solutions and a clear adoption strategy. Senior executives tend to trust AI more, with 97% of C-suite respondents and 93% of business owners finding it trustworthy.

Leadership Dynamics, the proprietary platform of The LCap Group, has released insights into the future of the C-Suite, emphasising the role of AI-driven leadership in the corporate world. The report predicts the rise of new C-Suite positions, including Chief Supply Chain Officer, highlighting the importance of global operations, Chief AI Officer (CAIO) to lead organisations into an AI-driven future, Chief Growth Officer (CGO) emphasising technology and customer-centricity, and Chief Empowerment Officer (CEmO) signifying a shift in leadership dynamics.

As businesses navigate rapid technological changes, succession planning gains importance in preparing leaders for roles that may emerge in the future. The report provides a roadmap for AI adoption and addressing associated challenges.

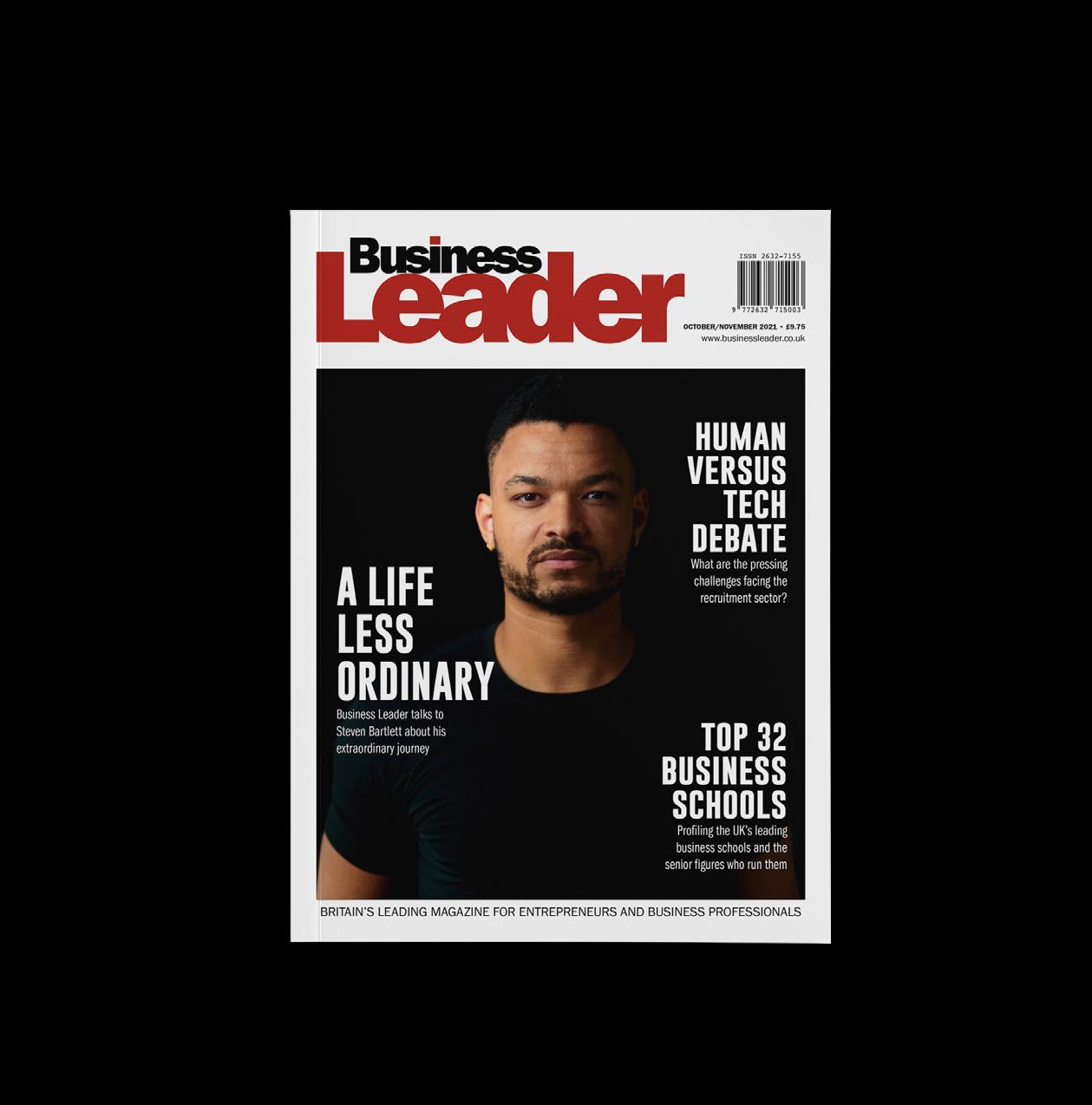

The Ascot Group has finalised the sale of Business Leader, its B2B media and events firm, to Richard Harpin, Founder and Chairman of HomeServe PLC. Business Leader caters to ambitious entrepreneurs, professionals, and business leaders across the UK through various channels, including a print magazine, newsletters, podcasts, and a news website.

It is also renowned for hosting prominent business events like the Scale-Up Awards. With Richard Harpin's backing, Business Leader aims to evolve into an influential publication for UK entrepreneurs, offering guidance, fostering networking, knowledge sharing, and inspiring leaders among the nation's 110,000 medium-sized businesses. Andrew McLaughlan will assume the role of CEO in this transition.

NEW

Market analysis by debt advisory experts, Sirius Property Finance, reveals a 9.7% annual surge in new lending through asset financing, amounting to £31bn. This growth is significantly driven by the service and construction industries. Asset financing enables businesses to expand without the hefty upfront costs of essential operational equipment, opting for agreed periodic payments instead. Businesses prefer asset financing as it's often more cost-effective than other financing methods, although it may entail equipment usage restrictions. In 2022, commercial vehicles, company cars, and plant and machinery equipment were the top assets acquired by UK businesses, together accounting for 79% of new lending.

Tech Nation, the start-up growth network that ceased operations in March, is making a comeback during Birmingham Tech Week this October. After losing out on a £12m Government grant to Barclays Eagle Labs earlier this year, Tech Nation closed its doors but was subsequently acquired by the Founders Forum Group in April. Carolyn Dawson, CEO of the Founders Forum Group, will unveil the vision for "Tech Nation 2.0" during the official relaunch on October 16th.

The revived Tech Nation will reinstate its four start-up growth programs: Libra for ethnic minority founders, Rising Stars for earlystage start-ups, The Climate Programme for climate tech firms, and Future Fifty for late-stage businesses.

SCVC, an early-stage deep tech venture capital firm, has announced the first close of its second fund, aiming for up to $100m (£80m). The Bristol-based firm, founded in 2020, focuses on advanced technologies to enhance health and sustainability, spanning biotech to quantum tech.

The fund will target pre-seed and seed stages, with initial investments ranging from $500,000 (£401,000) to $3m (£2.4m), along with follow-on funding for Series A rounds up to $7m (£5.6m) for top-performing start-ups. VyperCore, a RISC-V startup, is the fund's first investment, and another in a gene therapy platform start-up is imminent.

Bought to you Business Leader, these awards will celebrate the best businesses in the UK. Guests will be treated to a night of entertainment, with unique networking opportunities and the perfect staff motivator to show personal growth.

Sponsored By:

She has an unstoppable worldwide brand, her name has become a verb synonymous with class and style, she’s a former Dragon, a renowned presenter and author, and a champion of British enterprise. Kelly Hoppen is without doubt an icon.

However, Kelly’s story isn’t one of overnight success. She was relentlessly bullied at school, she’s dyslexic, she suffered from severely low self-esteem, and her father passed away when she was just 16 years old. At 16 and a half, she convinced her stepfather’s friend to let her redesign his kitchen. Around this time, her friend was having an affair with a famous racing driver, so she became the interior designer of his house as a front to their affair… and the rest, as they say, is history.

Over the next four decades, Kelly has worked for some of the most well-known names on the planet, from the Beckhams to P. Diddy, and worked with homes, yachts, jets, hotels, restaurants, and more. She’s written over a dozen books and won numerous awards. We met up with Kelly at her studio in West London to talk about how business has changed, building a global brand, being a Dragon, and more.

YOU STARTED YOUR BUSINESS BEFORE THE AGE OF GOOGLE AND SOCIAL MEDIA. DO YOU THINK YOU’D STILL BE SUCCESSFUL IF YOU STARTED YOUR BUSINESS TODAY?

If I could rule the world for a day, I would shut down technology, because I think people need to really understand what it is to go and find creativity and use your imagination. When I started my business, I would look at magazines, go to libraries and I would get in my little beaten-up old car and drive to find things like fabric. My style came from my travelling and my imagination, whereas today, you go on Pinterest, social media, or Google and you can copy it.

I wouldn’t want to change my journey. I like the way my business grew organically, and I still feel it grows organically to this day. I think everything today is so instant, and I’m not sure that I would have had the same life and the enjoyment that I got out of it. If you’re good enough, you can be very successful very quickly today, but I think there’s also a massive amount of competition.

I am so glad I didn’t have to see what everyone else was doing when I first started out because I was just following my own path and my own destiny. I remember over the years being asked, “what great designers do you admire?” and I didn’t know because I was in my own little bubble.

YOU’VE MENTIONED BEFORE THAT YOU WERE QUITE SHY GROWING UP. HOW DID YOU OVERCOME THIS CONSIDERING NETWORKING HAS PLAYED A BIG PART IN GROWING YOUR BUSINESS AND BRAND?

My ex-husband Ed (Miller) was really good for me, in that he was almost part of my team. I would host these events, and I would be so nervous, but he would be right there with me. There was an incredible PR company called Camron PR, and I worked with Judy Dobias to start this networking thing that really took off. The events were quite forward-thinking because everyone had to come with a business card, and I would say, “you cannot leave without exchanging cards because something will come out of it.” People really respected me for sharing, and to grow anything in life - it doesn’t matter what it is - you have to share. If you give, you get back.

Another key moment came from working with David Zelman, who is a life coach in New York. I had one session with him in his corner office, and he explained to me that if you run a business and your name is at the top, everybody underneath has to feel like it’s their business. He also showed me that if you share every piece of knowledge you have, your business will become bigger. This is part of why I started writing books. I came away from the session thinking that the sky was the limit. I had to just keep on going because I thought I had reached that point of success, and he showed me I hadn’t even started.

YOU’VE NEVER RAISED EXTERNAL FUNDING FOR YOUR BUSINESS. WAS THAT A VERY SPECIFIC CHOICE?

I’m a grafter. I get up every day at 5:40, have my black coffee, and I’m in the gym. That’s my moment to prepare for the day, and then I come to work. People have asked me for years why I still work, and I just say it’s my life and I love it. It never ever occurred to me to go and ask somebody for money, I just worked to make money. Maybe sometime down the line, I might look to sell some of the business, but for the 40+ years I’ve been doing this, I’ve wanted to own 100% of it.

I wouldn’t class myself as competitive, I would say that I don’t like to fail. I’m not somebody that goes up against people because, under this stern businesswoman, I do have a nice nature, but I don’t like to fail. Any entrepreneur will know that if you fail, it doesn’t matter because you’ve already got another idea. That’s something I try and teach young people that you shouldn’t hold on to something so much that if it doesn’t work or you’ll never move forward.

“PEOPLE HAVE ASKED ME FOR YEARS WHY I STILL WORK, AND I JUST SAY IT’S MY LIFE AND I LOVE IT.”

WHEN YOU GOT THE OFFER TO BE ON DRAGONS’ DEN, DID IT COME AS A SURPRISE AND HAD YOU DONE MUCH INVESTING BEFORE?

I did invest in small businesses but the call to be a Dragon definitely came out of the blue. I thought it was a great opportunity but then I thought “what am I doing?” I remember the night before filming, I got a reassuring call from Duncan Bannatyne saying that I’d be fine.

I do wish that I could do it now. I almost feel like I was too green behind the ears to do it and I’ve learnt so much since then. I loved doing the show, I loved all of the Dragons, but I hadn’t factored in that it wasn’t just the 21 days of filming. Once you invested in something, you had to run those businesses. My thing was I wanted to invest in young entrepreneurs, which I did, but they need a lot of time, so I had to employ more people etc. I still watch the show though, I think it’s brilliant.

MENTORSHIP, NOT JUST IN THE DEN, IS VERY IMPORTANT TO YOU. WHY IS THIS?

Maybe it’s because I started my own business so young. I have a large following on social media, and I came to the realisation of how powerful it was, especially after the Covid-19 lockdowns. Every day, I walk down the street and people stop me saying, “if it wasn’t for you, and what you were saying and teaching me, I wouldn’t have got through it.” I’m one of those people that doesn’t quite understand social media, but I started to understand how powerful it could be as a tool to help people. I still do the teaching and mentorship on Instagram, and I think it’s really important because people are struggling right now.

YOU RUN A GLOBAL BUSINESS AND BRAND. HAVE YOU COME ACROSS ANY PRACTICES THAT YOU WISH WE APPLIED HERE IN THE UK?

As the world has become smaller, I think you find fewer things to discover. What I’ve always loved about travel was that you would go to New York, and you’d go to a diner because you hadn’t been to one in London, or you go to China and the food and their manners would blow you away. I believe that every culture should own what it has. We have a rich history in Britain, that’s who we are. I think if we changed and became like another country, then it becomes less exciting.

HOW DO YOU COMPARE THE DOOM AND GLOOM WE HEAR ABOUT THE CURRENT CLIMATE TO OTHER ECONOMIC CRISES THROUGHOUT YOUR 40-PLUS-YEAR BUSINESS CAREER?

I’ve lived through a global recession before, and I think that was very frightening. When you suddenly hear the word ‘global’, it hits home that it’s bigger than just our country. But we survived our previous global recession, and we will survive this. Everyone said after Brexit “give it eight years”, but we didn’t factor in Covid-19, which has probably been the worst thing I’ve lived through.

Everything always works itself out, and inflation will plateau. Unfortunately, the cost-of-living for people is where the problem is. The bigger the divide between rich, middle, and poor, the bigger the problem is, so we have to try and make that work better.

HOW HAS YOUR BUSINESS BEEN AFFECTED BY ONGOING SUPPLY CHAIN ISSUES, SUCH AS THE WAR IN UKRAINE?

Across the board, things are taking longer. Brexit hasn’t helped and there are some companies that will not supply at all. If you take our business, for example, we’re building a 50,000 square foot house in Hong Kong, or Miami to get things from A to B, with the price increases, and the lack of stock… Who would have known that when you went to buy a sofa, it would take six months? That is a small price to pay compared to real-world issues, but in terms of my business, it has definitely affected us.

That’s where you learn to factor it in, and you find other avenues. I am one for always looking to find a way. If something doesn’t work and you’re at a dead end, there’s got to be another road somewhere, because there’s always somebody that’s using that opportunity to create something. I’ve always said in my talks that there is an opportunity here for young new businesses and new entrepreneurs to take over some of this production line. I’d like to be producing more in Great Britain. I’m a great advocate for the GREAT Campaign, because we just sold our soul, and everything went overseas. We have to be more in control of what we do here.

“I BELIEVE THAT EVERY CULTURE SHOULD OWN WHAT IT HAS. WE HAVE A RICH HISTORY IN BRITAIN, THAT’S WHO WE ARE.”

Estonian electric vehicle charging start-up, VOOL, has successfully concluded another seed investment round, securing €1.3m (£1.1m) in funding. Adding to this, VOOL recently received a substantial grant of €1.6m (£1.3m), totalling its funding at €7.6m (£6.5m). VOOL’s technology is known for its remarkable efficiency, utilising the existing grid three times more effectively than the average without causing overload, ensuring reliable and cost-efficient EV charging for businesses and individuals.

The fresh investment will primarily support the expansion of EV charger production and international sales, alongside enhancing customer support in Nordic countries. VOOL also continues to develop new products, incorporating its innovative three-phase technology for household use. This latest funding round, spearheaded by Specialist VC, attracted a mix of notable investors, including real estate developers such as Kaamos Group and Astri Group, and investment company Amalfi.

Mindgard, a deep-tech start-up specialising in AI security, has secured seed funding from IQ Capital and Lakestar to launch its unique enterprise platform. With a £3m investment, the London-based company plans to boost growth and expand its operations. Mindgard’s comprehensive enterprise platform is engineered to tackle AI security concerns head-on.

Developed in collaboration with Lancaster University, it draws upon years of PhD-level AI security research and features an automated threat analysis, detection, and response platform already adopted by the intelligence community. Mindgard’s platform seamlessly integrates with leading cybersecurity products and is part of the prestigious NVIDIA Inception Programme and Microsoft Founder’s Hub.

Wayflyer, the e-commerce-focused revenue-based financing and growth platform, has entered into an off-balance sheet program, set to acquire up to $1bn (£800m) worth of assets from funds managed by investment management firm, Neuberger Berman. This strategic move enables Wayflyer to continue offering competitive capital solutions to its customers while addressing the surging demand from US-based e-commerce businesses.

In addition to this development, Wayflyer recently secured a renewed $300m (£240m) debt line from J.P. Morgan in June 2023, aimed at fostering its growth and providing accessible, flexible, and rapid funding for e-commerce clients. These steps, along with Wayflyer’s successful Series B round, reflect the company’s strong financial position, marked by remarkable

growth, with a 100% increase in capital deployment from 2021 to 2022. Impressively, more than 80% of Wayflyer’s customers return for additional financing after their initial funding transactions, underlining its value in the e-commerce industry.

AssetCool, a thermal metaphotonics company spun out of the University of Manchester, has successfully concluded a £2.25m Series A funding round. The primary contributor to this round is Northern Gritstone, an investment firm focused on university spinouts and techenabled businesses in Northern England. They join existing shareholders, including the Northern Powerhouse Investment Fund managed by Mercia Asset Management and Kero Development Partners.

Global population growth, increased use of electricity-intensive products like electric vehicles, and renewable energy integration are straining electricity networks. AssetCool addresses this challenge by coating new overhead conductors and offering retrofits for existing electricity networks, including through aerial coating robots. This funding will support the commercial rollout of AssetCool’s coating and further development of retrofitting techniques for existing grids.

TechMet has successfully concluded its latest equity fundraising round, raising $200m (£157.3m). This achievement sets the company on a path to surpass a billion-dollar valuation in the coming months. The fresh funding will be channelled into TechMet’s existing portfolio of ten assets, where expansion in extraction, processing, recycling, and manufacturing capacity is underway.

Founded in 2017, TechMet is a permanent capital platform dedicated to developing

projects across the critical minerals value chain, crucial for clean energy technologies. Key shareholders include the US International Development Finance Corporation (DFC) and Mercuria Energy, with significant contributions from London-based Lansdowne Partners, S2G Ventures, and others in this recent funding round. In the past year, TechMet has invested over $180m (£141.5m) in various critical minerals companies worldwide.

Stonewater, one of the UK’s largest housing associations, has secured a £200m funding injection from Lloyds Bank to bolster its ongoing development efforts. This organisation, overseeing around 36,000 homes for over 78,000 residents primarily in central and southern England, has refinanced its existing £125m facility while increasing it by an additional £75m. Furthermore, Stonewater has transformed this facility into a sustainability-linked loan, contingent on three key performance indicators.

These KPIs encompass retrofitting existing properties to exceed minimum regulations by achieving at least an EPC C rating by 2030, and elevating energy efficiency standards for new homes to surpass minimum planning regulations, targeting SAP 86 and above for a significant proportion of new properties. Finally, Stonewater is currently rated as “Gold” via the independent SHIFT sustainability framework – an amalgamation of 15 separate ESG KPIs into one overarching score. Stonewater is looking to enhance its SHIFT score year-on-year with an ultimate ambition of achieving SHIFT “Platinum”– an accolade that no other social housing provider currently holds.

Mandie Sewa, Head of Immigration at Brevis Law, thinks the new student visa rules will potentially shake up the landscape for employers seeking international talent. These rules may impact the availability and accessibility of international students as potential employees.

“From January 2024, the rules will make it impossible for international students to bring their dependants, unless they are studying on postgraduate programmes with a research focus, such as researchbased PhDs and research-based master’s programmes,” she adds.

Subject to final confirmation and the passage of the necessary legislation, the main rate

will increase to £1,035, and the discounted rate for students, their dependents, those on Youth Mobility Schemes and under-18s will increase to £776.

The cost of work visas and visit visas will increase by 15%, and the cost of study visas, certificates of sponsorship, settlement, citizenship, wider entry clearance and leave to remain visas, and priority visas by at least 20%.

Karendeep Kaur, Legal Director for Migrate UK, thinks the increased visa fees will be a strain on employers. However, if they are willing to cover these application fees, they are less likely to lose out on overseas talent, especially to competitors who are

willing and able to cover these fees. She also acknowledges it will be the smaller organisations that will be more affected.

“It is worth noting that those coming to the UK on a shortage occupation role will benefit from lower UKVI (UK Visas and Immigration) fees and can be paid less. However, this does not affect the HIS (Immigration health surcharge) fees payable. As a result, forward planning is key.

“Due to these increases, overseas candidates will certainly be encouraged to seek employment elsewhere other than the UK. Therefore, something for the UK Government to consider, with a view to assigning higher fees to other sectors where there isn’t a shortage or for those roles

THE UK NEEDS TO RECRUIT A QUALIFIED WORKFORCE, AND NEW REGULATIONS ARE TURNING PEOPLE OFF

which tend to offer higher salaries,” she says.

Juliana Lobo, a Brazilian national living in the UK on a work visa with her husband and two children, says the increased fees will affect British universities, which rely on overseas students, as well as British companies, which need to employ hard-to-find skill sets from outside the UK.

“A recent study showed that international students starting their studies in 2020/21 would generate up to £41.9bn for the UK economy. This is compared to the estimated £4.4bn it costs the UK to host them and any dependents they may have, implying a net benefit of £37.4bn for the UK economy,” she adds.

Skill shortages are problematic. There is no universally accepted definition of a labour or skills shortage and no one obvious flawless policy response.

Sewa goes on to say that the visas will discourage many international students to choose the UK as their destination of study. As a result, employers may face challenges in recruiting and retaining international talent.

“The Government has stated that that the current Skilled Worker route will remain an option for overseas migrants to come and work here.

“However, as many employers are aware, integration of migrants to the UK can be an issue, if they haven’t been to, or lived in, the UK before.

“The advantage of hiring an individual who has studied in the UK is that they will already be familiar with the way of life, working practices and other cultural norms and values,” she adds.

The new rules could lead to a decrease in the pool of qualified candidates for particular positions and industries, potentially affecting the overall competitiveness of certain businesses.

Additionally, employers may need to adapt their recruitment strategies and explore alternative avenues for attracting international talent, which will lead to increased costs on businesses that are already overstretched, according to Sewa.

The Government maintains that only foreigners will be impacted by the significant increases. However, with the exception of work visas they will primarily impact British families. Even for non-British families, the reforms will have a detrimental effect on UK businesses, which may be forced to choose between firing an employee or assisting them with visa expenses.

A Home Office spokesperson said: “It is right and fair to increase the Immigration Health Surcharge and visa application fees so we can fund vital public services and allow wider

funding to contribute to public sector pay.”

This will allow more funding to be prioritised elsewhere in the Home Office, which will include paying for vital services and supporting public sector pay rises. But what does it mean for talent?

UK businesses should focus on prioritising and investing in their talent. Hiring, upskilling, and empowerment is the lynchpin to executing strategic priorities and giving an organisation the best chance to thrive in an uncertain future.

Dr Sarion Bowers, Head of Policy at the Wellcome Sanger Institute, said: “We have staff from over 70 countries in the world working on Sanger’s transformative science. Our work has supported the UK to be the global leader in genomics. It costs a family of four around £10,000 in visa costs to move to the UK and now those looking to bring their talent to the UK are being asked to pay £1,035 per person per annum for the NHS, on top of already paying through their income tax.

“We are finding recruitment increasingly difficult, and any loss of talent will not only impact our science, it will impact the UK economy.”

The increase in visa fees may negatively impact on the UK economy. Higher visa fees are likely to discourage international students, workers, and businesses from choosing the UK as their destination, according to Sewa.

“This could result in a decline in the number of international students enrolling in UK universities, a decrease in foreign workers filling skill gaps, and a reduction in foreign investment and business expansion in the country.

“WE ARE FINDING RECRUITMENT INCREASINGLY DIFFICULT, AND ANY LOSS OF TALENT WILL NOT ONLY IMPACT OUR SCIENCE, IT WILL IMPACT THE UK ECONOMY.”

Dr Sarion Bowers

“INTERNATIONAL STUDENTS STARTING THEIR STUDIES IN 2020/21 WOULD GENERATE UP TO £41.9BN FOR THE UK ECONOMY.”

Juliana Lobo

“These factors can have a detrimental effect on various sectors of the economy, such as education, healthcare, technology, and finance, which rely on international talent and investment. Furthermore, a decrease in international students and workers may lead to a loss of revenue for universities, businesses, and the Government, impacting future economic growth and development,” she adds.

According to Kaur, there is an increase in sponsor licence applications, with statistics showing that over 6,000 sponsor licences were approved in the last 3-month reporting period. This is a strong indicator that the UK is still very much reliant on overseas labour. “The next reporting period post fee increases will determine whether these increases are proving to be a detriment. Without overseas talent filling the UK’s shortage gap, employers in certain sectors may be forced to close their businesses which would be a huge impact across the UK economy,” she warns.

The UK can take several measures to decrease the barriers facing foreign talent and attract international individuals to work and study in the country. Sewa outlines some potential actions:

• Streamlining visa processes

Offering attractive visa options including expanding the range of visa options that cater to the needs of international talent. For example, creating specific visas for skilled workers, business owners, and graduates to attract individuals with the desired skills and

qualification, so increasing the number of designated bodies and providing clear published criteria for existing visas, such as the Innovator Founder.

• Providing incentives for employers

Offering incentives to employers who hire foreign talent, such as tax breaks or grants, to encourage them to actively seek international candidates and invest in their recruitment and integration. Enhancing support services, by providing comprehensive integration support services to foreign talent, such as language training, cultural integration programmes to enhance intercultural communication, awareness, and understanding to help ease the transition and make the UK a more attractive destination, whilst enhancing business operations.

• Promoting diversity and inclusion

Emphasising the value of diversity and inclusion in the workforce to create a welcoming environment for foreign talent. Encouraging employers to adopt inclusive hiring practices and fostering a culture of acceptance would make the UK more appealing to international individuals. Research has shown many benefits of a diverse and inclusive workplace, including higher revenue growth, greater readiness to innovate, increased ability to recruit a diverse talent pool, and 5.4 times higher employee retention.

ALTERNATIVE ANSWERS

Lobo recommends that instead of increasing fees, the Government should take into consideration the amount of money the

overseas employees already pay and apply a reasonable/fair proportional rate, as they are contributing to the UK’s development and helping British businesses to grow.

“Foreign talent will start considering other countries when thinking about living abroad, as the UK is making it harder and harder for those people to afford to live here. At the end of the day, the extortionate fees will become a barrier for those talents who wish to come to the country,” she warns.

Kaur agrees that a freeze on fee increases would be the obvious answer. Alternatively, the UK Government should add the current sectors facing a shortage to the shortage occupation list to lower the salary requirements and visa application fees.

“However, the key to this being a success is if the UK implements an effective immigration system that is responsive to economic needs,” she advises.

Despite the ever-increasing obstacles around immigration laws, foreigners continue to see the UK as a desirable alternative. Given its high-spending consumer market, multicultural population, and innovative businesses, in addition to the language, location, and financial climate for start-ups and new firms, the UK still attracts top talent. However, will transnational workers still choose the UK? Let’s hope so, or it will damage an already fragile economy.

LINKEDIN POLL

ARE UK VISA COSTS PUSHING AWAY GLOBAL TALENT?

YES 79% NO 19% OTHER 2%

“WITHOUT OVERSEAS TALENT FILLING THE UK’S SHORTAGE GAP, EMPLOYERS IN CERTAIN SECTORS MAY BE FORCED TO CLOSE THEIR BUSINESSES.”

Karendeep Kaur

CEOs and owners of small and medium sized businesses must often navigate rugged, unpredictable terrain alone. But as a Vistage member, you’re travelling a proven, time-honoured path to new levels of success.

So go ahead and set your sights on that next great peak –because your peers and your guide have your back.

Scan the QR code to find out how the world’s leading CEO peer advisory and executive coaching organisation can help you reach new heights.

In today's complex business funding landscape, securing capital for start-ups and scale-ups has become increasingly challenging. Traditional avenues like bank loans are subject to more onerous lending conditions. Meanwhile, venture capital firms are demanding higher standards and more tangible metrics.

Against this backdrop, angel investing represents a viable funding route that not only provides capital but also invaluable expertise, mentorship, and network connections. So what are the advantages of this form of funding and why should young and ambitious businesses consider it?

The aftermath of the global pandemic has left many entrepreneurs and businesses grappling with financial uncertainty.

Economic pressures, combined with embedded inflation and rising mortgage rates, have created an environment where access to traditional funding sources is not as straightforward.

According to a report by the Federation of Small Businesses (FSB), the number of UK businesses that are struggling to access finance has increased by 25% in the past year. Meanwhile, the average time it takes for a business to secure a bank loan has

increased by 50% in the past year and the cost of bank lending has increased by 10% during the same period.

Venture capital firms, once seen as the bastions of early-stage financing, have also adjusted their approach. The focus has shifted from certain growth metrics to a more discerning look at profitability and far stricter terms that can be off-putting for young businesses.

Companies that previously boasted impressive growth figures are now under scrutiny for their inability to translate those metrics into sustained profitability. This shift has led to a new emphasis on start-ups' ability to achieve quick routes to profitability, rather than other growth metrics that may flatter to deceive in real business terms.

Amid these challenges, angel investing has emerged as a beacon of hope for start-ups seeking not only capital but also strategic support.

According to Beauhurst, a data platform for the UK's start-up ecosystem, angel investment in the UK reached a record high of £2.7bn in 2022. This was a 25% increase from 2021 and the highest level of angel investment since 2008. Overall, the number of angel-backed deals in the UK increased by nearly 50% between 2014 and 2022, which is clearly a very positive trend.

The reason more start-ups are turning to angel investors is that they bring a diverse set of benefits that extend far beyond funding alone. These include:

• Expertise and guidance

Most angel investors are experienced entrepreneurs, businesspeople and/ or industry experts who have navigated the challenges of building successful businesses. Their insights, advice, and mentorship can provide start-ups with a roadmap to success, helping them make informed decisions and avoid common pitfalls.

• Network connections

Angel investors often have extensive networks in their industries of interest. These connections can open doors to potential customers, partners, and collaborators, giving businesses a head start in building crucial relationships.

These connections can also help startups hire the right service providers, from accountants and lawyers to marketing agencies, distributors, and supply chain partners. Start-ups need to look after every penny, and hiring the wrong company can end up being a very expensive mistake. So introductions to trusted partners can be invaluable.

Unlike venture capital firms, angel investors can have a personal interest in supporting a start-up's mission and objectives. They may have a real passion for a specific sector, due to their areas of expertise, or they could be aligned with certain purpose-driven ventures.

On the Angel Investment Network platform, we have seen interest in impact-related terms skyrocket in recent years, and there has been a surge of interest among investors who prioritise the societal and environmental impact of start-ups.

Angel investors who care deeply about the problems a start-up aims to solve would be more likely to invest due to their personal vested interest in the company’s purpose and potential success.

At the early stages of a start-up's journey, aggressive deal terms from venture capital firms can be a hindrance. Angel investors tend to be more flexible and collaborative, allowing start-ups to maintain more control over their vision and growth trajectory.

Indeed, for many, they are simply the most appropriate form of funding at a pre-Series A stage. Something many entrepreneurs only find out later. We did some research among successful entrepreneurs and asked them to offer their one most important piece of advice. The theme of not going to VCs too early came out loud and clear. Typified by this comment from Benjamin Carew, Co-Founder of affordable workspace solution Othership: “If VCs keep being really nice but don’t invest, you are probably too early. Save yourself the time and build more traction and try and do an angel round or friends and family.”

ANGEL INVESTING IN TODAY'S CLIMATE

While angel investing offers a promising avenue for start-ups seeking funding and support, it's important to note that competition for angel investment has intensified. Many angels have curtailed their investment activities due to changing financial circumstances. Additionally, a focus on start-ups with more proven traction has become more pronounced.

In my next article, I will consider the key factors that drive investors' decisions in the realm of angel investing. Understanding these factors can provide start-ups with valuable insights and strategies to enhance their chances of securing the support they need to thrive. In conclusion, angels continue to play a pivotal role in propelling businesses to success, especially in a challenging and competitive funding landscape. Their expertise, mentorship, and network connections, coupled with a shared vision for a start-up's success, can make all the difference in transforming a fragile young business into a thriving, profitable venture. As start-ups navigate the evolving business landscape, it could be time to believe in angels as catalysts for business success.

DEAL VALUE: “SEVEN-FIGURE MBO”

A group of healthcare-focused businesses, comprising recruitment, consultancy, and technology sectors, has successfully completed a seven-figure MBO. The Clive Henry Group encompasses three distinct entities, each making a unique contribution to the healthcare industry. Mprove is a consultancy firm specialising in delivering high-quality solutions for clients in health and care. Woodrow Mercer Healthcare specialises in healthcare sector recruitment, connecting expert interim consultants with the NHS. Meanwhile, Tech Canal excels in digital healthcare solutions, specialising in sourcing SaaS-based solutions for its clientele.

Corporate Finance guidance was provided by Peter Williams and Fraser Pirie from UHY Hacker Young,

while legal counsel came from James Down and Olivia Jones at Hill Dickinson. Praetura Commercial Finance led the funding, with Stuart Bates and Adam Hooson at the helm, and assistance from Grant Thornton and Addleshaw Goddard.

DEAL VALUE: UNDISCLOSED

Meadow, a prominent UK value-added ingredients company, has announced its acquisition of Naked Foods Limited, a strategic move to solidify its standing as a trusted partner in supplying crucial food ingredients to renowned UK brands. This expansion plan encompasses both organic growth and strategic acquisitions. The acquisition not only allows Meadow to diversify its product portfolio but also fosters synergies between the two entities, leveraging their expertise in product development and manufacturing.

DEAL VALUE: $140M (£110.2M)

Sprout Social, a prominent social media management software provider, has unveiled its acquisition of Tagger Media, an influencer marketing and social intelligence platform. This strategic move solidifies Sprout's leadership position in the social media software arena, offering brands an all-encompassing platform to execute comprehensive social strategies on a large scale.

The acquisition of Tagger Media was completed with a cash consideration of $140m (£110.2m). Funding for this acquisition was sourced from Sprout Social's cash reserves and their newly established revolving credit facility. This investment underscores Sprout's commitment to enhancing its social media management capabilities.

Naked Foods is a well-regarded manufacturer in the food and beverage industry, operating from its BRC A* grade facility in Kent. Since its establishment in 2003, the company has organically expanded its offerings to include over 300 recipes and several thousand tonnes of sauces annually. These products encompass fruit preparations for yoghurts, dairy drinks, ice cream, plant-based items, and sweet fillings for bakery and dessert goods.

DEAL VALUE: UNDISCLOSED

Paragon, a leading provider of transformative business services, has expanded its footprint in Western Europe with the acquisition of Canon France Business Services (CFBS), a subsidiary of Canon Europe in France and a prominent player in the Business Process Services (BPS) sector.

CFBS is known for its customer-centric culture and expertise in IT security and process optimisation technologies, including AI solutions. The integration of these two firms will boost the group’s growth in this domain, providing added value to their existing customer base in France. CFBS boasts over 400 employees and serves clients in diverse sectors, including defence, nuclear, health insurance, and banking.

DEAL VALUE: UNDISCLOSED

OANDA Global Corporation has announced its acquisition of a majority stake in Coinpass Limited, a UK-based crypto asset firm regulated by the Financial Conduct Authority (FCA). Founded in 2018, Coinpass facilitates cryptocurrency investment and trading for retail investors, professional traders, and businesses, offering a wide array of fiat/crypto, crypto/crypto, and stablecoin pairs through its proprietary trading technology.

DEAL VALUE: UNDISCLOSED

Insight Enterprises has completed the acquisition of UK-based Amdaris, a specialist in software development and digital services. Amdaris operates service delivery centres across Eastern European countries. This strategic move allows Insight to expand its solutions portfolio and IT supply chain capabilities by incorporating Amdaris’ innovative software development, application support, managed services, and consultancy offerings.

Amdaris, a Microsoft-Gold Certified Partner for over a decade, is known for delivering transformative digital journeys. With over 800 employees, their expertise in outsourced extended delivery teams for enterprise and consumer software applications aligns perfectly with Insight’s global Modern Applications and Data & AI practices, accelerating customised solutions for back-end, cloud, mobile, data analytics, and web front-end to support clients in their digital transformation efforts.

DEAL VALUE: UNDISCLOSED

International legal firm Osborne Clarke has provided counsel to A-Gas' management team in their majority stake sale to climate investment strategist TPG Rise Climate. Despite this change, KKR, the majority owner of A-Gas, will maintain a substantial minority stake in the company, fostering collaboration with both TPG Rise Climate and A-Gas' leadership. For over three decades, A-Gas has played a pivotal role in capturing refrigerant gases for reuse or safe disposal, creating a closed-

loop system that curbs harmful gas emissions.

With TPG Rise Climate's support, A-Gas intends to expand its global operations, meeting the rising demand for refrigerants and further promoting sustainability in the refrigerant gas supply chain. Osborne Clarke's team, led by Private Equity Partners Alisdair Livingstone and James Taylor, along with Senior Associate Jack Wellington, provided guidance for this transaction.

LINKEDIN POLL

DO YOU THINK THE ERA OF OUTSPOKEN BUSINESS LEADERS IS COMING TO AN END? NO 68%

YES 25% OTHER 7%

Brash leaders can achieve brilliant results. In business, where the stakes are high and the margin for error is low, taking a bold approach to drive a company to new heights is admirable. But at what cost?

The business landscape is changing, alongside a change in values and expectations. The leadership styles that have been successful in the past are not likely to work in 2024 and beyond. Will traditional, alpha leaders struggle to deliver the high level of innovation required by the changing times?

Every crisis gives cast to a new style of leader. In difficult times especially, leaders need to steady the ship and make decisions to calm the waters as they set a new course for the business. Simon Jeffries, a leadership strategist, thinks a brash approach might lead to short-term gains, but if it also leads to instability, the net effect is negative.

“Pay cheques are no longer the primary motivation. Empathy, communication, and mentorship are valued as much as salary. Externally, a 24/7 media cycle creates constant scrutiny.

“Controversial actions create a PR nightmare causing reputational and financial damage. A brash approach might lead to short-term gains, but if it leads to instability in the long run, the net effect is negative,” he warns.

The economy currently faces a growing demand for a level of innovation that ‘alpha’

CEOs who run their teams in a commandand-control manner simply cannot meet. Leaders who make it through difficult times typically distinguish themselves from the pack by traits like courage, resiliency, and a forward-looking outlook.

BOARDROOM DISRUPTERS

Change is in the air. BBD Perfect Storm created a specialist division called New Macho, which focuses on how brands and advertisers can talk to, and relate to, modern men.

According to Fernando Desouches, Managing Director at New Macho, there is a growing call for a more conscious type of leadership, which is becoming increasingly appealing. A recent New Macho study, concerning a sample of men aged 18-75 in the UK and US, showed a shift in values between pre-pandemic and current times. “In the past, male aspirations were centred around making money, seeking fame, or living a glamorous lifestyle. However, presently, men aspire to more intangible goals: finding happiness in everyday life, fostering good relationships, and maintaining good health,” according to Desouches.

Regarding work expectations, the majority agreed that “work should be meaningful, helping both myself and others.” However, when asked about social expectations, they still perceived that the “work hard, play hard” mantra dominates.

WHY BRASH BUSINESS LEADERS MIGHT BE FADING AWAY

“A BRASH APPROACH MIGHT LEAD TO SHORT-TERM GAINS, BUT IF IT LEADS TO INSTABILITY IN THE LONG RUN, THE NET EFFECT IS NEGATIVE.”

Simon Jeffries

Sally Percy, leadership journalist and author of the book ‘21st Century Business Icons: The Leaders Who Are Changing our World’, thinks that while outspoken, largerthan-life leaders help their companies to stand out from the crowd, they can also be immensely polarising figures who embroil their businesses in unnecessary controversies, alienating both customers and employees.

“Most businesses will not want to expose their brand to these risks. Instead, today’s leaders are increasingly expected to be empathetic and inclusive individuals, who are sensitive to the opinions and perspectives of their own organisation’s stakeholders, as well as evolving trends within society more broadly,” she says.

BOLD VERSUS BRASH

It is time to redefine the concept of “man-up”. Either business leaders and organisations adopt the emerging principles required to adapt to the future, or we run the risk of returning to the past, which can be risky for society as a whole, as well as for business.

Dr Alexandra Dobra-Kiel, Innovation & Strategy Director at Behave, says that long-term productivity, which requires more creativity and innovation, can benefit from the decline of the brash leadership style. Creativity and innovation can only thrive in an environment that allows employees to explore, reflect, and experiment.

The characteristics required in the Special Forces are mirrored in business. According to Jeffries, in the special forces, you need someone capable of taking calculated risks without being paralysed by fear or

uncertainty. Decisions must be made with conviction and backed by decisive action.

“But this must be tempered with emotional intelligence. Mission success requires a ‘one team on one mission’ approach. If a leader stands at odds with those expected to follow, failure becomes inevitable,” he adds.

A BALANCING ACT

Desouches thinks that intelligence without wisdom (or consciousness) can lead to selfdestructive outcomes.

“I believe this realisation lies at the core of the change in our leadership values. Leadership solely based on intelligence can solve problems but may also be harmful or unsustainable. Therefore, there is a growing call for a more conscious type of leadership, which is becoming increasingly appealing and necessary,” he says.

A brash leader tends to be dominant, assertive, and unapologetic in expressing their opinions. According to Dobra-Kiel, this can have a positive effect on employees’ short-term productivity, as a high-pressure environment can push employees to focus, make quick decisions, and prioritise effectively.

“However, working in a high-pressure environment over a prolonged period often leads to the build-up of negative emotions amongst employees, which narrow their scope of attention, cognition, and action and therefore drive employees to focus on task completion. Negative emotions can increase ethical risk, as less attention for anything but the task at hand is provided,” she warns.

According to Percy, business leaders should invest in developing their emotional

intelligence skills, paying particular attention to empathy. She goes on to say that it is only by understanding the expectations, motivations, and needs of others that they will be able to inspire people to follow them and help them achieve their vision of business success.

THE

“We will still see brash leaders because their ‘force of nature’ personality traits can force huge success. But, as the business world continues to evolve, I think they will become the expectation rather than the rule,” says Jeffries.

Coming into 2024, leaders are facing huge challenges; people are questioning how and why we work and the shifts across the working landscape are now fast in play.

According to Desouches, where it’s daunting for many leaders who are trying to navigate these changes, there is also a huge opportunity for meaningful change. He believes that men (and the world) are at a tipping point, as we are witnessing some of the most important leaders in the Western world (not just business leaders) sometimes behaving like children, inviting others to fight in the school playground.

“These are not the type of leaders we need to address the significant social, environmental, and economic issues we are collectively facing. Instead, we require grounded, mature men who understand that the leadership values we expect are shifting from control, competitive, unconscious, and individual to creative, collaborative, conscious, and connected,” he adds.

Various studies highlight what leadership tactics are popular right now, but in essence, there are many effective approaches to lead. Instead, true trailblazers will concentrate on their ongoing development, banishing archaic methods and building the kind of company that never stops seeking a better way.

“Anyone can hold the helm when the sea is calm” - Publilius Syrus

“THERE IS A GROWING CALL FOR A MORE CONSCIOUS TYPE OF LEADERSHIP, WHICH IS BECOMING INCREASINGLY APPEALING AND NECESSARY.”

Fernando Desouches

No one could have predicted that our working process would change irreversibly in the last three years. Navigating global lockdowns hasn’t been easy – many struggled to adapt, facing issues of loneliness and difficulties setting boundaries between work and their personal lives when confined to dining room tables – but, with around half of us now working from home or in some sort of hybrid capacity (a mix of home and office-based work), the concept is here to stay.

So how do we embrace it?

Shifts in working patterns wouldn’t have been possible without modern technology, and businesses have realised the opportunities that communication channels such as Zoom and Teams bring. They facilitated easy meetings between managers and colleagues and a raft of cost - and time-saving efficiencies for both companies and clients.

The use of this technology also extends to communicating with colleagues to help them navigate changes, overcome uncertainty and reassure them that they’re being listened to. After all, when it comes to announcing changes, you can’t simply ‘tell’, you have to ‘ask’ as well. Doing so breeds insight; you can act in the best interest of colleagues if you fully understand their needs and drive engagement by getting employees involved in key decisions.

And how do we implement it?

Managers and HR teams must be the conscience of the business, maintaining as much structure as possible between people in different locations. This is where collaborative technology can be so powerful, even if this is simply facilitating regular team meetings, get-togethers over lunches, or organising a focus for the day. Colleagues will benefit from human connection and meetings can promote collaboration or spark ideas. For younger staff, this can be the best alternative to the learnings derived from face-to-face interactions.

In summary, change brings uncertainty and colleagues need to understand how they will be affected and how they will benefit. The use of technology for clear communications and employee engagement becomes paramount when managing people in multiple locations.

T: 01793 818300 sophie.austin@monahans.co.uk

Through all of life’s ups and downs, we’re next to you every step of the way.

We only have one goal at Monahans: to help you achieve your tomorrow.

Harriet Green is the real deal. She’s run some of the world’s largest companies and has been banging the drum on the tangible benefits of inclusivity for over two decades.

From 2018 to 2020, she served as the Chair and CEO of IBM Asia Pacific, where she focused on driving innovation-led growth within the organisation. Prior to that, she was the leader and Founder of the IBM startup Watson Internet of Things from 2015 to 2017. Green’s expertise and leadership contributed to the advancement of IBM’s initiatives in the Internet of Things domain.

Before her tenure at IBM, Green held the position of CEO at Thomas Cook Group from 2012 to 2014. During her time there, she played a crucial role in transforming the company’s fortunes. Under her leadership, Thomas Cook Group’s market worth skyrocketed from £148m to over £2bn, and the company’s share price experienced a staggering increase of 829%.

Following the announcement of Green’s departure, the company’s share value suffered a significant drop of over £350m. This incident highlighted the impact of her leadership on the organisation’s financial performance and investor sentiment.

In addition to her roles at IBM and Thomas Cook Group, Harriet Green also served as the CEO of Premier Farnell from 2006 to 2012 and has been a board member of BAE Systems, a multi-national defence, security, and aerospace company.

Green’s notable achievements and track record in driving growth and innovation demonstrate her strategic vision and ability to deliver substantial results in various industries.

We spoke to Harriet about how innovationled growth could get us out of the global economic struggles, restructuring a business with empathy, the importance of building trust with your employees, and much more.

I would describe my career as having panned five different industry sectors and have been deeply privileged to live and work on four continents whilst being a global executive. I just like to do what other people may consider as hard and important things. It’s always been a big part of my life.

I remember in my first CEO role working for Sir Peter Gershon, Chairman of Premier Farnell plc, my first strategy was called ‘People, Planet, and Profits’. The City, and certain investors that stick in my mind, basically said, “Drop the people and the planet stuff. Just focus on delivering us profit Ms Green, if you wouldn’t mind.” Even way back then, I always felt that ‘People, Planet, and Profits’ should be woven into the organisation.

My first pledge in 1996, way before people did pledges, was around respecting, engaging, and working with people, because of their enormous differences. Whether that’s age, sex, colour, creed, sexuality, orientation, or physical or cognitive abilities, we should joyfully make our teams full of richly different individuals. That has continued to be my mantra when putting together groups of people to get great stuff done. It’s so good that this is now in the mainstream vernacular.

AND INNOVATION. COULD YOU TELL US ABOUT THIS?

When you want to grow little companies, medium-sized companies, or giants, history has proven that you don’t cost-cut your way to greatness. You innovate your way to growth, and that’s been proven throughout the decades. The 1950s is perhaps the best example of that.

There are many parallels between the 1950s and the time we’re living in today. In the ‘50s, they went through a brutal global influenza pandemic, where as many as 50 million people lost their lives. Most of the Western World was recovering from a diabolical war and all of the upheaval and horror that was inflicted upon the surviving societies. But what really transformed the ‘50s was innovation. This included the creation of grids throughout the world, that gave people the ability to turn on a switch and have electricity. It was also a time when the mighty Sony came up with a transistor radio, which launched a whole new mobile entertainment and communications environment.

I’m a huge believer that two things determine growth. The first is innovation. The second is that the critical communities - your employees, your clients, your suppliers, those who help you stabilise the robust supply chain - have to trust in the product or the capabilities that you are creating, and that it will help make the world, and those that you’re serving, a better place. The combination of innovation and trust, I think, is as important now as it was in the 1950s. YOU’VE ALWAYS BEEN VERY OUTSPOKEN ABOUT DIGITAL TRANSFORMATION BEFORE IT WAS WIDELY ACCEPTED. WHY WAS THAT SO IMPORTANT TO YOU AND WHERE DID THE DRIVE TO MAKE A DECISION LIKE THIS COME FROM?

I found that it was very important, as a new CEO, to listen to those you respect and those who are involved in the technologies

“I JUST LIKE TO DO WHAT OTHER PEOPLE MAY CONSIDER AS HARD AND IMPORTANT THINGS. IT’S ALWAYS BEEN A BIG PART OF MY LIFE.”

and the business models of the future. It became clear to me then that paper-based models could be so much more powerful, cost-effective, and useful to the client base if they were digitised. Then it became about seeking out great partners who had already built e-commerce platforms (such as IBM).

I spent time looking at models, what’s working and what’s not. Piloting was important; you don’t go all out on something unless you really see that it works.

We created a community for customers and clients to talk to us, which online did so powerfully. Technology and disruption allow you to do things that you were just unable to do before. I remember my youngest daughter Gemma said, “What did people do before eBay?” and that is a great question because, before those types of technologies, a global online auction environment was simply not possible.

I think those themes still work today, particularly in a decade where we have very expensive money. I spend a lot of my time listening, really understanding what’s new, what’s happening out there, what models are working and what isn’t. There’s also a need for a different type of leadership. Often, we find ourselves in beleaguered and tired environments, after what we have all been through, so never was there a greater need for these things.

YOU OVERSAW THE CUTTING OF 2,500 JOBS IN YOUR TIME AS CEO OF THOMAS COOK. HOW DID YOU DEAL WITH MAKING DIFFICULT DECISIONS LIKE THIS AND DO YOU HAVE ANY TIPS FOR PEOPLE WHO MAY HAVE TO DO THE SAME?

First of all, what we were most proud of at Thomas Cook is that in the nearly three-year period, no one lost money on our watch. We raised billions of pounds as we grew the company. Of course, with such a dramatic transformation, we needed to change the shape of Thomas Cook. We needed to hire new digital people, product people, and many others who could help us with the change and the transformation.

We also had other changes we needed to make. For example, we had to stop procuring hotels by country because Thomas Cook Belgium and Thomas Cook Germany were competing to buy beds for the summer season. It is always with great sadness that anyone no longer has a job on your watch, but I think there are a couple of things that I have always done.

The first is to make sure that your communication is so honest, empathetic, and regular, that if your own children were being laid off and bringing that information home, you would feel that the very best was being done to inform, to advise, and to add support. So, your Chief Communications Officer is as important as your CFO and CPO in these environments of change and transformation. The second is we put a great deal of time and energy into reskilling and helping people find other roles to ease the

passage of those we had sadly needed to reshape in terms of the new Thomas Cook.

I think the essence of leadership is to be able to embrace employees in an increasingly polarised world. It’s even more important, and it’s the essence of leadership. My tips would be, first of all, what is your purpose? What is your commitment and promise? What is it that you are offering the world, offering your employees, offering your customers, offering those in the supply chain? If you can’t answer that in a meaningful way, then you know, that’s the challenge. How will you drive innovation-led growth?

Half the world has been doing this for a decade already, led by many of the tech firms, I saw this done brilliantly at IBM and I have done this myself, with teams of all different cultures and ages and backgrounds, and cognitive skills to design things together. What are the one or two big problems that we face? And how do we solve them as a team? An hour of design and thinking a day keeps the ills of disaffected employees and unhappy clients away.

Secondly, even though you may be employeecentric, without clients, you don’t have a business. Are you spending a huge chunk of your time really listening to your customers and understanding what they need? What about what they want in the next two-to-three years, and involving all of your organisation around that? Design Thinking is something you could start. Pull five people together this afternoon and have a session. It’s fun, it’s productive, it’s insightful, and if you’ve got richly diverse and inclusive teams, you will get amazing solutions. People know what the world needs, we just have to release and harness that.

“THERE’S ALSO A NEED FOR A DIFFERENT TYPE OF LEADERSHIP.”

After the volatility of the pandemic, the UK has entered the “aftermath economy.” Leaders should use this period of relative economic stability to best prepare themselves for the next growth cycle. Those who focus on retention can ensure their talent won’t quit as soon the job market re-accelerates to the white-hot pace of 2021-2022.

While there are many ways CEOs can address their workforce velocity rates, or the speed at which employees quit, one of the most overlooked comes down to the basics: infrastructure.

Infrastructure encompasses everything from the factory floor to equipment, office space and remote setups. A physical working environment is fundamental to employee experience, regardless of where or how the work is being done.

Whether it’s a warehouse or construction company, distribution service, or accounting firm, strong infrastructure boosts output and eliminates the distraction of frustration.

The following are four approaches CEOs can take to maximise their investments in technology.

It is critical companies get good at collaboration. The myriad of communications tools available, compounded by the rapidly developing hybrid workplace, demands organisations to review their suite of collaboration tools (e.g., Microsoft Outlook, Gmail, Google Drive, Slack, Zoom, Microsoft Teams), rationalise use-cases for each tool and standardise company expectations for how and when they are used.

While many individuals had to learn how to function in the work-from-home environment rapidly during the pandemic, we are now in a state of finding best practices that can be applied throughout entire organisations.

The workplace is the foundation for performance and can be a competitive advantage when looking to attract and retain talent. Ensuring employees have the best tools, applications and workspace conditions demonstrates a commitment to their development and provides a powerful boost to employee engagement.

Before investing in new technology, it’s important leaders first make sure they are

By Joe Galvin, Chief Research Officer of Vistage

taking full advantage of the features that are already in place. A key piece of this is training employees on every applicable function. Not every capability will be missioncritical, but there is almost always more efficiency and knowledge to extract from current systems before implementing entirely new business applications.

Finally, AI will impact individual productivity long before organisations are equipped to capitalise on it. CEOs should identify the best AI applications for their team and then train them on them extensively. This will allow employees to figure out how it will best help them in their specific role. Then, as AI gains speed, leaders will be poised to accelerate their digital transformation as well.

In today’s hybrid, digital-first world, infrastructure is no longer as simple as having an open office space and a few computers. Leaders who fail to put their technology at the top of their priorities and invest in creating a best-in-class work environment stand to miss out on top talent and fall short when the next growth cycle inevitably ignites. And, as leaders learned during The Great Resignation, having the right team in place during a tight labour market can be the difference between success and failure.

WWW.VISTAGE.CO.UK

4 Ways leaders can maximize technology in the “aftermath” economy

A dream team. One shared vision. Founding a start-up can challenge even the strongest individuals. Add to that founding a start-up with a close relative and things can get interesting. Tales of start-ups are filled with broken partnerships on the precarious road to success.

We have seen some great family dynasties including the Rothschilds and the Mercks. These are the positive stories. Then there are many that didn’t make the cut.

David Davies, Corporate, Commercial & Finance Partner at Kingsley Napley LLP, reveals that setting up and running a business with a relative or a close friend is relatively common – particularly among younger entrepreneurs – and whilst the depth of the pre-existing relationship can bring a sense of relative freedom to running a new business, if it goes wrong, it can go very wrong.

Take the historical example of brothers Rudolph and Adolf Dassler, who founded one of the world’s first athletic shoe companies. When their personal relationship broke down, so did their company, subsequently leading to an infamous feud and a long-lasting rivalry between their successive companies, Adidas and Puma.

Statistics show that strong personal relationships don’t necessarily equate to strong professional relationships. Noam Wasserman, author of The Founder’s Dilemma, states that 65% of start-ups fail due to co-founder conflict.

The odds are not in your favour. Doing business with family members has huge benefits, such as comfort, understanding, transparency, and trust. However, it can also be laden with disadvantages, such as conflicts and resentments in long-standing relationships.