FUTURE’S SO BRIGHT

How Nido Qubein shocked the world at High Point University –and plans to keep it revved.

4

UP FRONT

6 POWER LIST INTERVIEW

Biscuitville CEO Kathie Niven dishes on the recipe that has made the ‘Fresh Southern’ chain thrive.

8 NC TREND

Wilmington’s endowment’s growing pains; Durham’s Higharc brings tech to home design; Greensboro software company helps NASA pick space travelers; Making sustainability practical in the Queen City.

72 PROJECT PLANS

Japanese transportation and pharaceutical companies are investing heavily in North Carolina.

COVER

STORY

HPU’S TURNAROUND

24 ROUND TABLE: LIFE SCIENCES

Life sciences needs more workers and capital to keep thriving in Tar Heel state, experts agree.

34 NC PROFILES:

Investing in relationships can help build a career, but it also takes an investment in one’s self to succeed.

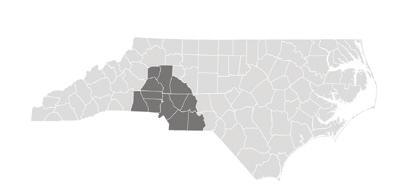

64 COMMUNITY CLOSE UP: IREDELL COUNTY

Available land, proximity to Charlotte and two interstates makes Iredell County a place to grow manufacturing, distribution and logistics businesses.

Nido Qubein’s approach to higher ed turns doubters into believers. He explains it was a team effort.

BY DAVID MILDENBERGHIGHER EDUCATION

Our annual guide to the state’s public and private colleges and universities, from enrollment, to cost, to graduation rates.

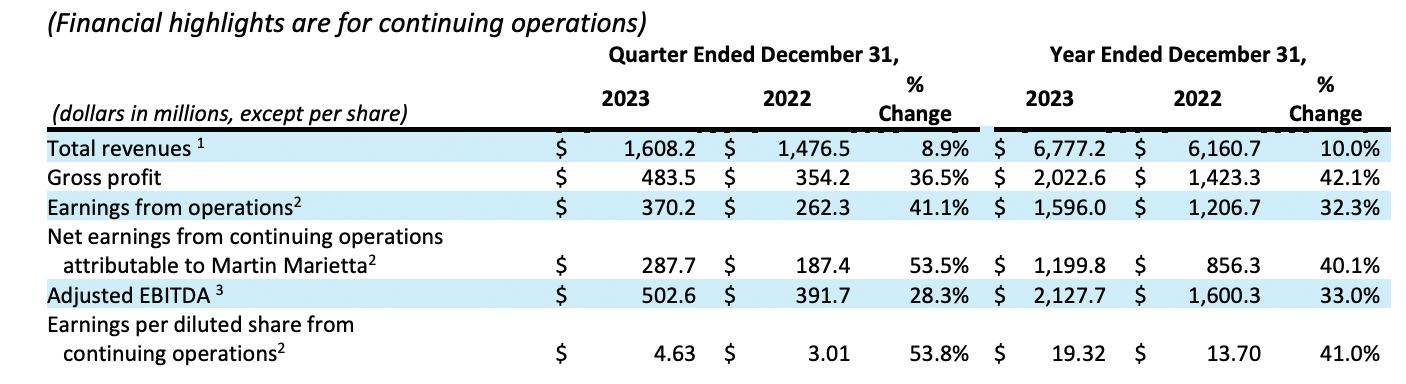

BY PETE ANDERSONCRUSHING IT

Martin Marietta Materials spent 30,000 work-hours coming up with a business plan. It worked so well, Duke University students now study the blueprint in a finance course.

BY CHRIS ROUSHDEFENSIVE DRIVING

General Motors returns to its military roots in the heart of NASCAR

BY DAVID MILDENBERG

A BRIGHT FUTURE

As we enter the month of May, some are thinking about college graduation. I know my wife and I are because our oldest son plans to walk down the aisle at Appalachian State University later this month (as of press time, I hope that’s still the plan). We’ll be taking the family up the mountain as we celebrate his four years in Boone and what’s to come. A lot of families will be doing this across the state this month.

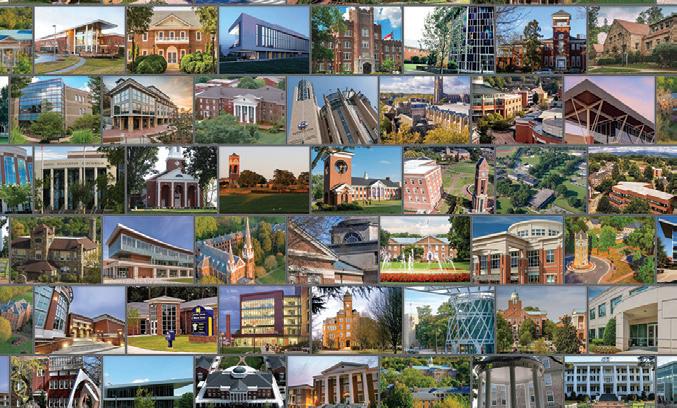

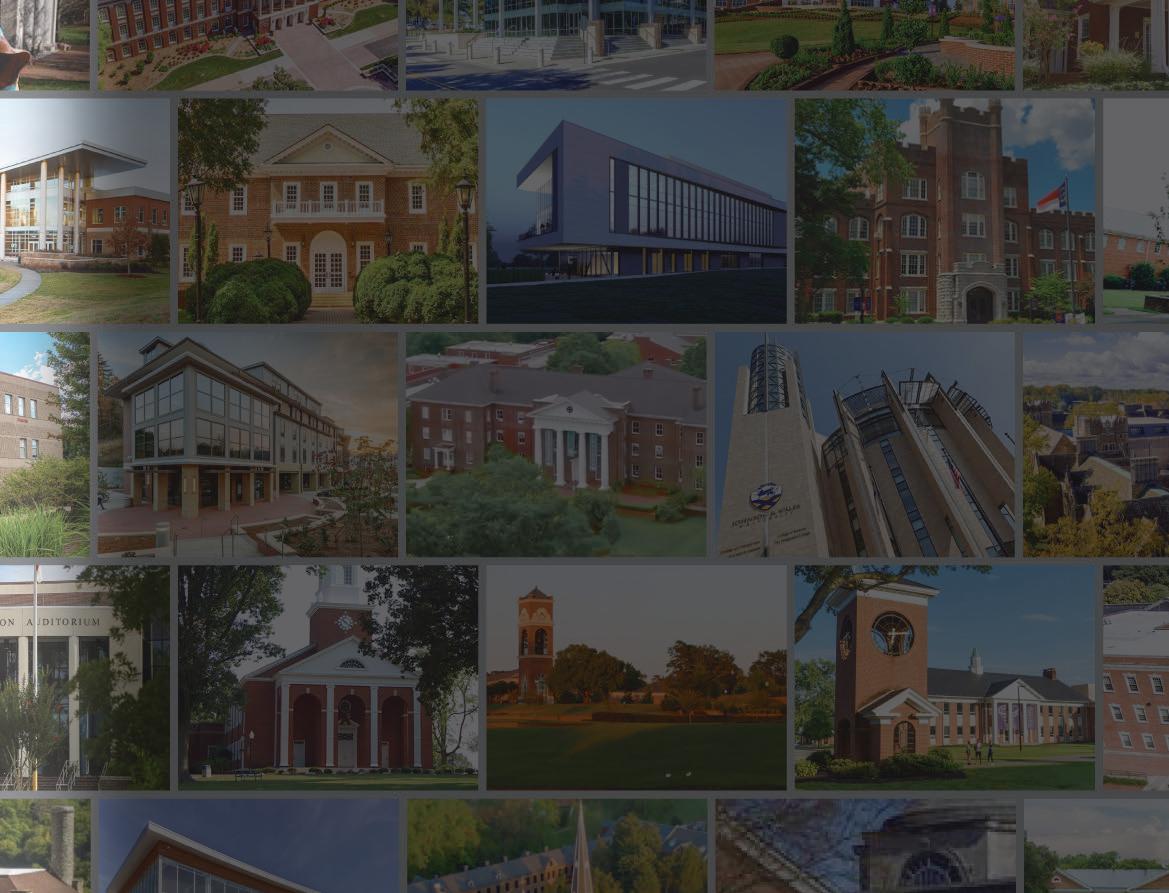

So it’s tting that this issue features our Higher Education Directory. is annual listing of the state’s universities and colleges really tells an incredible story of our state’s rich history in higher ed.

North Carolina has 16 public universities, 58 private institutions and 58 community colleges. Each listing includes enrollment gures, overall costs and other insightful information on why N.C leads the nation in higher education.

Our university system, both public and private, has grown and thrived over the years. e three powerhouses in the Triangle — N.C. State, Duke and UNC Chapel Hill — have been beacons for economic development. Another great story is the growth of other public universities such as N.C. A&T State, UNC Wilmington, Appalachian State University and UNC Charlotte.

Private institutions such as High Point University, Elon University, Davidson College and Campbell University have expanded and become integral parts of local and regional economies.

Equally impressive is the work that our community colleges are doing in terms of assisting economic development e orts.

Examples include the work that Guilford Technical Community College is doing with aviation industries in the Triad; collaborations between AB Technical Community College and Blue Ridge Community College and manufacturers in the West; and how Wake Tech and Pitt Community College, among others, are working with pharmaceutical companies in the Triangle and East.

I’ve traveled quite a bit over the years, visiting many of these places for one reason or another. To really understand their impact, you really need to visit the schools when classes are in session and buzzing with student activity.

I have done this at Fayetteville Technical Community College on numerous occasions. It’s a huge campus tucked away in a quiet neighborhood.

Once I arrive, I’m taken aback by the size of the place and the number of students there. It’s bustling. It makes you think about how much training is taking place at one time in one place. is is happening every day across our state. ese visits make me feel very con dent about our future.

Check out the directory starting on Page 38. I think it will help you feel the same way.

Contact Ben Kinney at bkinney@businessnc.com.

PUBLISHER Ben Kinney bkinney@businessnc.com

EDITOR David Mildenberg dmildenberg@businessnc.com

MANAGING EDITOR Kevin Ellis kellis@businessnc.com

EXECUTIVE EDITOR, DIGITAL Chris Roush croush@businessnc.com

ASSOCIATE EDITOR Cathy Martin cmartin@businessnc.com

SENIOR CONTRIBUTING EDITOR Edward Martin emartin@businessnc.com

SPECIAL PROJECTS EDITOR Pete Anderson

CONTRIBUTING WRITERS Heath Pulliam, Ray Gronberg, Vanesssa Infanzon

CONTRIBUTING GRAPHIC DESIGN Andie Rose

CREATIVE DIRECTOR Cathy Swaney cswaney@businessnc.com

GRAPHIC DESIGNER Pam Fernandez pfernandez@businessnc.com

MARKETING COORDINATOR Jennifer Ware jware@businessnc.com

ADVERTISING SALES

ACCOUNT DIRECTOR

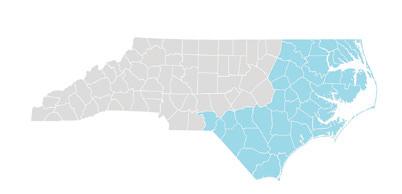

Melanie Weaver Lynch, eastern N.C. 919-855-9380 mweaver@businessnc.com

ACCOUNT MANAGER AND AUDIENCE DEVELOPMENT SPECIALIST Scott Leonard, western N.C. 704-996-6426 sleonard@businessnc.com

CIRCULATION: 818-286-3106

EDITORIAL: 704-523-6987

REPRINTS: circulation@businessnc.com

OWNERS

Jack Andrews, Frank Daniels III, David Woronoff, in memoriam Frank Daniels Jr.

PUBLISHED BY Old North State Magazines LLC

PRESIDENT David Woronoff

KATHIE NIVEN

LIST INTERVIEW

FAST AND FURIOUS

Biscuitville CEO Kathie Niven joined High Point University President Nido Qubein in the Power List interview, a partnership for discussions with some of the state’s most influential leaders. Business North Carolina’s annual Power List publication spotlights the state’s power brokers.

Kathie Niven joined Biscuitville in 2011 and has helped it rebrand as Fresh Southern, revamp its menu and triple annual revenue to $150 million. The Elon University grad had worked for Arby’s, Burger King and other fast food giants when she joined the regional chain, where she became CEO in 2021.

One of her early innovations was creating a “menu management assembly” process that produced the most successful promotional product-launch in company history – the spicy chicken and honey biscuit – resulting in product sales of $5.2 million annually and a 7% revenue impact. She also developed Biscuitville’s accredited college summer internship program.

Biscuitville’s roots go back to its founder, Maurice Jennings, opening two bread and milk stores in Burlington in 1966. The first Biscuitville opened in 1975 in Danville, Virginia. The chain now has 75 locations and still builds its reputation on scratch-made biscuits, Southern-style breakfasts. Stores close at 2 p.m. every day.

Niven took over as CEO from Burney Jennings, the founder’s son, who is now executive chair.

This story includes excerpts from Niven’s interview and was edited for clarity.

What makes the Biscuitville biscuit so good?

I think it’s a lot of things. I think it starts with the fact that it’s a family recipe. So when Maurice Jennings, our founder, started the company, it was a recipe that was personal for him. And then I think being family owned, how that quality comes across to the consumer is personal for the family. They take great pride in it.

The other important ingredient is that we use the same three ingredients that we always have. The first is the flour, and that’s from a company here in North Carolina. The second is we use shortening, and the third is our buttermilk. That is also from this area. So the ingredients matter a lot.

People can also watch us make them, and the integrity of how we make them the old-fashioned way.

You’re in North Carolina, South Carolina and Virginia. Why aren’t you all over the country?

I think the family has always been committed to making sure that the culture of the company is in each one of the restaurants, and that just takes time to build. It’s about making sure that we go slowly enough to make sure that our processes are appropriate, the culture is appropriate, and meets the standards of the company.

So this is 100% family owned. It’s not a franchise or license based business?

That’s correct. Every restaurant is owned by the family and run by an operator who works directly with the family.

Tell me about your own background. What was your first job?

As soon as I graduated from college, I had spent the last four or five years really preparing for law school. So I came out of college doing an internship with the district attorney in Graham, North Carolina. On the side, a friend of mine, Nancy Allison, purchased a second Arby’s in Graham, and she asked if I’d help her on the weekends.

I didn’t know much about the industry, and she didn’t know much, which was sort of the magic. Everything was possible for us. So my father said, you know, this might be a better fit than law school.

I ended up staying for an extra year, and then before I knew it, it was seven years and we’d built those two restaurants up.

I suspect one of your biggest areas of focus is people in your business.

The recipe is the flour, but the people make it or break it. One of the most important things that the brand has focused on since 2014, when we did the full rebranding project, is how do we attract the talent that gets us where we think we can go?

We have agreed and spent years on this, and it came from the inside, not from top down. In addition to the values we looked at, we looked at who people would want to work beside.

What traits do they have?

We added something in the last five years called cultural norms, and they keep moving and morphing and those are just specific ways in which we treat each other. And so the agreement is you can come from any background, you can be anybody. As long as we can agree on these basic norms, you’re going to love it here.

Treating people with respect is a big one. One of the norms people love is the concept of communication. I can’t just yell something across the restaurant at you. Making people accountable for getting what they need by asking the right way is a surprising norm that came up from the people in the organization that has really made an impact. We have 19 of them. And so they’re similar to that sort of sentiment.

Consumers sometimes say there’s nothing fast about fast food. How do you manage that?

It’s important. It’s breakfast, right? Everybody’s like, nobody leaves home an hour early for work, so we’re always dealing with consumers who are in a hurry and they have very high expectations. And being late is a problem. So that’s a condition of being in the breakfast business that we take very seriously. We want to be convenient, and we want to get people there on time. So we invest in double drive-throughs. Every restaurant we build now will be double drive-through, which helps a lot. It’s just a big focus for us, and we spend a lot of time making sure.

How do you combine a griddle cooked egg that is cracked on a griddle and get it out the door in 90 seconds and make it the way you want it? There’s a real process and formula there that works.

Now, if you’re behind 10 cars, obviously it’s going to be a little bit different.

It just fascinates me how that system can keep up with all these demands.

It doesn’t matter how many systems or processes you have in place, those are never going to trump having a group of people who care about what’s happening. When the group cares about how fast it is, when they care about the quality, when they care about what they’re doing, it trumps the process and takes the process into a completely different level.

You started helping your friend at Arby’s on weekends and eventually became president in 2018 of Biscuitville. In 2021, you became CEO.

What is it about you that made you successful?

I think I was a sponge. First of all, I am a continual learner, and I look for that in the folks that run Biscuitville. We’re always looking for somebody who recognizes they can keep being better at what they do in their craft.

And I think the other piece is I care deeply about the products I create. This really came from my mom and dad and just the family values of leaving it better than you found it. And I think that’s really ingrained and matters because people want to see that.

What is it that makes you proud of being in business and working for a North Carolina company?

I think one of the most important things for being successful in the state, and I think it makes the state successful, is having a state that doesn’t give unfair advantages to companies, but that supports the fact that companies employ our people. They create the revenue that creates the systems that make it so enjoyable to be in North Carolina.

What’s next for Kathie Niven?

It’s interesting because we were all sharing our goals at a retreat two weeks ago, and I’ve sort of named mine CEO 3.0, which is what it is going to take in my development. What changes do I need to make to be the leader that the company needs now?

We’ve got an amazing leadership team. They could take it from here. So what value do I bring now? And I think part of that is spending more time just getting out there and building that culture, but also creating opportunities for some of the folks who work for us, who don’t have it. ■

SPREAD THE WEALTH

Wilmington’s new endowment encounters growing pains as it seeks `transformational’ change.

By Edward Martin

By Edward Martin

The Cape Fear River laps at the hull as smells of breakfast ll the air. Soon, Sunday regulars are arriving at Anne Bonny’s Bar & Grill, a Wilmington barge restaurant used for a weekly worship service and breakfast provided by Anchor United Methodist Church.

Some of the 30 or so visitors smell of nights in alleys and vacant warehouses. ey sip co ee and enjoy sweet rolls, some wandering o before Pastor Jamie ompson’s message that God cares even for those without a street address.

“We don’t require them to stay. is is about meeting folks where they are,” says the Methodist pastor. “We try to connect them to professional services that we as a church aren’t equipped to provide,” such as healthcare and addiction treatment.

Anchor’s unconventional worship exists in part because of a $32,000 grant from the New Hanover Community Endowment. It was created with $1.25 billion in proceeds from the county’s sale of 800-bed New Hanover Regional Medical Center to Novant Health in 2021. It rivals Asheville’s Dogwood Health Trust, formed a er the 2019 sale of Mission Health, as among the largest community-building nonpro ts created in state history.

Other signi cant initial donations by the endowment include more than $15.6 million to various UNC Wilmington groups, $10 million to Cape Fear Community College and $4 million to the YMCA of Southeastern North Carolina. e endowment charter focuses on social and health equity, community safety and community development. e group has a goal of becoming a “transformational, move-the-needle,” organization, board Chair Bill Cameron says. Improving healthcare is not the sole focus.

Be tting its broad charter, the group in February approved

spending $6.8 million over three years to partner with the county on a nonpro t community grocery store in northeast Wilmington, where o cials say area residents have no convenient fresh food options.

But a deluge of money resulting from the sale of local hospitals can result in bruised feelings and disagreements over strategy and execution, other communities have found. at appears to be the case in Wilmington, where CEO William Buster, 52, le abruptly in early February without explanation.

At his hiring in March 2022, the foundation cited Buster’s experience as a senior vice president of Dogwood Health, which was created a er the $1.5 billion sale of Mission Health to HCA Healthcare. Buster had previous experience at foundations in Texas, Michigan and Winston-Salem.

No one will discuss the CEO’s departure. Buster issued a statement thanking the endowment for giving him an opportunity and saying his work set up the foundation for future success. He could not be reached for comment.

Asked what happened, Cameron says, “ at’s a personnel matter,” declining further comment. Executive Vice President Lakesha Day is now overseeing day-to-day operations. e board hired the Durham-based moss+ross search rm to nd a new leader.

Buster may have clashed with his board a er feeling rushed to pump out grants to show the endowment was progressing rapidly,

according to people familiar with the matter. Dozens of small, onetime grants have been made to groups such as Anchor Methodist.

Also, the former CEO was known for being outspoken. In an interview with WHQR public radio in Wilmington, he said, “If I lived in Pender County, I would be mad as hell. If my family … if my grandmother and my you know, my mom, and all my sisters, and everybody gave birth in that hospital and everybody, grandma had to go there, and we shared, and I and I saw the numbers and the number was 68% of the revenue came from outside of the county. It’s a sincere question that any rational person would have,” Buster said.”

That’s a sticky situation he inherited in Wilmington because the group’s bylaws restrict donations solely to New Hanover County. “That’s the major issue,” says County Commissioner Rob Zapple.

New Hanover partisans reason that county residents financed and built the operation, so they should benefit from its sale. But more than 40% of the hospital system’s revenue “has been derived from surrounding counties,” says Steve Stone, manager of adjoining Brunswick County, among the fastest-growing in the state. “Demographically, we’re one of the oldest counties in North Carolina, with a lot of retirees and similar residents.”

Stone’s estimate may be low; state data supports Buster’s view that more than half of system revenue historically came from residents outside of New Hanover. Beyond Wilmington, Novant operates smaller hospitals in Brunswick and Pender counties, plus more than 100 other medical offices regionally.

“If Pender or other counties had wanted their own, they could have built them like we did,” says New Hanover County Commissioner Jonathan Barfield. The endowment charter is final and stipulates the proceeds be spent in New Hanover, Cameron adds.

The hard feelings aren’t going away, however. “There’s the basic issue of fairness,” says Stone. “It seems to have gotten lost in the transition.”

Another concern is that Novant isn’t operating the system as well as the county. The system, which has major market share in Winston-Salem and Charlotte, is also working on its $2.4 billion acquisition of three coastal South Carolina hospitals in February.

“The transition simply is not going smoothly,” Zapple says. “Everybody has my number, and they tell me problems are not being addressed. The hospital used to be the best in southeast North Carolina. Not under Novant.”

In February, Novant named former UNC Health executive Ernie Bovio as CEO, marking the third person to hold the job during the Winston-Salem-based system’s short ownership.

Bovio is a 20-year UNC Health veteran who had led UNC Rex in Raleigh.

“He’s from outside Novant and seems to have identified the problems,” says Zappple. “It’s hard to get any kind of continuity when you have so much turnover. I have high hopes for him.”

To be sure, public complaints about Novant’s efforts in Wilmington haven’t reached the same level as in Asheville, where public officials, nurses, physicians and local residents have roasted HCA Healthcare after its purchase of Mission Health. HCA officials contend that they are addressing concerns and the system is operating well.

New Hanover County sold its hospital after a lengthy public auction process, led by a community advisory board co-chaired by former Mayor Spence Broadhurst and healthcare executive Barb Biehner. Most community leaders advocated for a sale, thinking the area would be better served with a well-capitalized system operating the 8,500-employee hospital. It had been among the largest U.S. hospitals still owned by a municipality, posting annual revenue of nearly $1.5 billion.

Transparency and the endowment board’s racial makeup are other key issues to watch at the developing institution. N.C. Attorney General Josh Stein’s review of the sale included a requirement that the group hold a public annual meeting. But most other business can be handled in private, despite the endowment’s receipt of $1.25 billion in public funds. Under IRS rules, it will have even fewer public disclosure requirements as it changes from a public charity to a private foundation in 2028.

Stein, the Democratic nominee for governor in November’s election, also emphasizes that the board should “reflect the diversity of New Hanover County.” The 13-member group, whose appointments are made by Novant (six), the county (five) and board itself (two), has two Black directors and one Hispanic. About 75% of New Hanover’s population is Caucasian.

Meanwhile, the endowment is ramping to eventually provide $60 million in annual grants. The Wilmington area is home to hundreds of nonprofit enterprises, most with annual budgets of less than $1 million. There are no shortages of hands reaching out in the Port City region, as the hungry Sunday morning visitors at Anchor Methodist can attest. ■

BANKING ON LIFE SCIENCES IN NORTH CAROLINA

This is the thirty-first in a series of informative monthly articles for North Carolina businesses from PNC in collaboration with BUSINESS NORTH CAROLINA magazine.

As home to the largest research park in the United States, three Tier 1 research institutions, a favorable business environment and a robust startup ecosystem that attracts its fair share of venture capital activity, North Carolina has leveraged this cross-section of competitive strengths to build a thriving life sciences landscape of global renown.

According to the North Carolina Biotechnology Center, North Carolina today is home to 830 life sciences companies that employ 75,000 highly skilled workers, with an additional 2,500 companies supporting this vital sector.

And as life sciences organizations with a presence in North Carolina continue to produce cutting-edge research and life-changing technologies, the banks that serve this vital industry are innovating solutions of their own to help facilitate success, growth and sustainability for this meaningful sector.

Delivering banking, capital markets and corporate finance solutions within a sector as dynamic and nuanced as life sciences requires the support of bankers with specialized industry knowledge and experience. Raleigh-based Rich Brown, who leads PNC Bank’s national Pharmaceuticals & Life Sciences corporate banking group, is one such banker.

As head of this specialized group, Brown serves as the senior PNC executive for a coast-to-coast book of business with a focus on pharmaceuticals, life sciences, medical devices and pharma services – collaborating with PNC Corporate Banking relationship managers in key markets across PNC’s footprint to help provide tailored financing and banking solutions to pharmaceuticals and life sciences companies.

He brings to this role a multi-faceted background in banking, venture capital and technology as he helps life sciences companies navigate an environment that is anything but linear. “Being a trusted banking advisor for pharmaceuticals and life sciences companies is about so much more than reviewing financials and recommending a solution,” says Brown. “There are so many industry-specific variables and nuances to consider – from underlying market drivers, to intellectual property and patents, to reimbursement dependencies and regulatory developments.”

Among the industry segments for which Brown and his team have delivered innovative financing solutions is pharmaceutical services & technologies – and, specifically, contract research organizations (CROs), which originated in North Carolina and provide clinical trial management support for pharmaceutical, biotech and medical device companies and institutions.

To help optimize the capital structures of CROs – organizations that, by design, deliver contract-based work and traditionally hold minimal physical assets – PNC Bank was a pioneer in structuring and implementing accounts receivable securitization credit facilities, which have helped some organizations optimize their capital structures, enhance profitability and support their strategic objectives, says Brown.

At the most basic level, an accounts receivable securitization is a committed capital facility used to finance or monetize a company’s accounts receivable portfolio. This financial application is designed to efficiently leverage the value of a company’s accounts receivable portfolio into a low-cost, committed financing platform, which is customized to meet the parameters and needs of each company.

“An accounts receivable securitization can be a meaningful component of a CRO’s debt capitalization stack because it can serve as a tool for achieving expense savings, cash flow improvement and reported leverage reduction,” says Brown. “Securitizations typically deliver interest rate savings relative to other sources of committed financing and also can be used for balance sheet improvement, such as working capital and leverage ratios, when accounted for as a sales or monetization program.”

And in the life sciences industry, which is rife with M&A activity due to a range of factors driven by patent life considerations, it is not uncommon for organizations to consider using the proceeds of accounts receivable securitizations to pursue strategic transactions or refinance debt, says Brown.

A veritable economic engine, the life sciences industry contributes more than $88 billion in economic impact statewide, according to a November 2022 report prepared for the North Carolina Biotechnology Center.

And, as Brown notes, the tremendous scale and growth of the industry represents a remarkable success story that underscores the contributions of visionary leaders. “I have had the privilege to work with many leaders of life sciences companies who skillfully create unique value propositions, innovate new technologies and realize commercial success,” he says. “There are many leaders in North Carolina who have achieved this trifecta, and their respective bodies of work serve as inspiration for what our region can accomplish.”

In an industry as dynamic as life sciences, ongoing efforts to build scale and innovation unfold against the backdrop of an ever-evolving regulatory landscape.

Among the pending and recently enacted regulatory changes PNC is monitoring – changes that have the potential to impact life sciences organizations as 2024 progresses – include:

Inflation Reduction Act (IRA) – Pharmaceutical companies continue to encounter challenges stemming from the Inflation Reduction Act, which has given Medicare increased leverage in negotiating drug pricing. The pharmaceutical industry has opposed the passage of the law, and several companies and lobbying groups have filed lawsuits in an effort to overturn the legislation or limit its impact.

Mergers and Acquisitions (M&A) – The Federal Trade Commission and Department of Justice have proposed updates to U.S. merger guidelines that could affect regulation of consolidation in the healthcare industry. If guidelines are finalized, vertical and cross-market mergers will not be allowed to create anticompetitive market structures, and regulators will be able to examine vertical mergers even if they are below 50% market share.

Pharmacy Benefit Managers (PBM) – Lawmakers have proposed federal legislation to investigate PBM business practices around pricing transparency. PBMs,

which help administer prescription drug insurance benefits by negotiating prices with drug manufacturers and pharmacies and establishing drug formularies and pharmacy networks, are under scrutiny, given the level of concentration of their services (with three PBM firms controlling the majority of the market) and vertical integration with insurers and pharmacies.

Lab Regulation – The Food and Drug Administration (FDA) has proposed regulations that would bring laboratory-developed tests under the agency’s purview. These tests were previously exempted from some regulatory requirements, but the FDA is now making efforts to include all tests under one regulatory framework.

Sterilization Technologies For Medical Devices – Increased Environmental Protection Agency (EPA) standards may require transitioning away from the use of ethylene oxide (eto) to new sterilization technologies. The industry has concerns about the EPA’s proposed timeline and emissions targets.

For more information, please

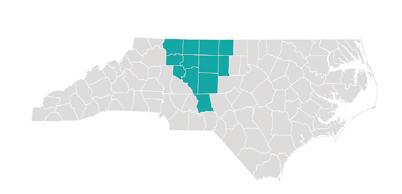

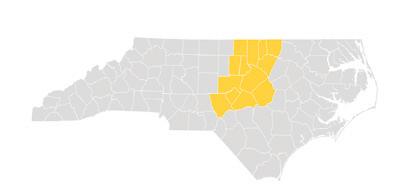

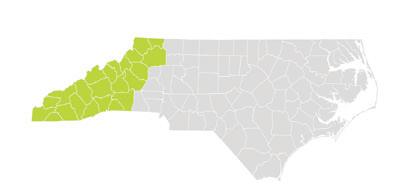

REGIONAL PRESIDENTS:

Weston Andress, Western Carolinas: (704) 643-5581

Jim Hansen, Eastern Carolinas: (919) 835-0135

These materials are furnished for the use of PNC Bank and its clients and do not constitute the provision of investment, legal, or tax advice to any person. They are not prepared with respect to the specific investment objectives, financial situation, or particular needs of any person. Use of these materials is dependent upon the judgment and analysis applied by duly authorized investment personnel who consider a client’s individual account circumstances. Persons reading these materials should consult with their PNC account representative regarding the appropriateness of investing in any securities or adopting any investment strategies discussed or recommended herein and should understand that statements regarding future prospects may not be realized. The information contained herein was obtained from sources deemed reliable. Such information is not guaranteed as to its accuracy, timeliness, or completeness by PNC. The information contained and the opinions expressed herein are subject to change without notice. Past performance is no guarantee of future results. Neither the information presented nor any opinion expressed herein constitutes an offer to buy or sell, nor a recommendation to buy or sell, any security or financial instrument. Accounts managed by PNC and its affiliates may take positions from time to time in securities recommended and followed by PNC affiliates. Securities are not bank deposits, nor are they backed or guaranteed by PNC or any of its affiliates, and are not issued by, insured by, guaranteed by, or obligations of the FDIC or the Federal Reserve Board. Securities involve investment risks, including possible loss of principal.

“PNC” and “PNC Bank” are registered marks of The PNC Financial Services Group, Inc.

©2024 The PNC Financial Services Group, Inc. All rights reserved.

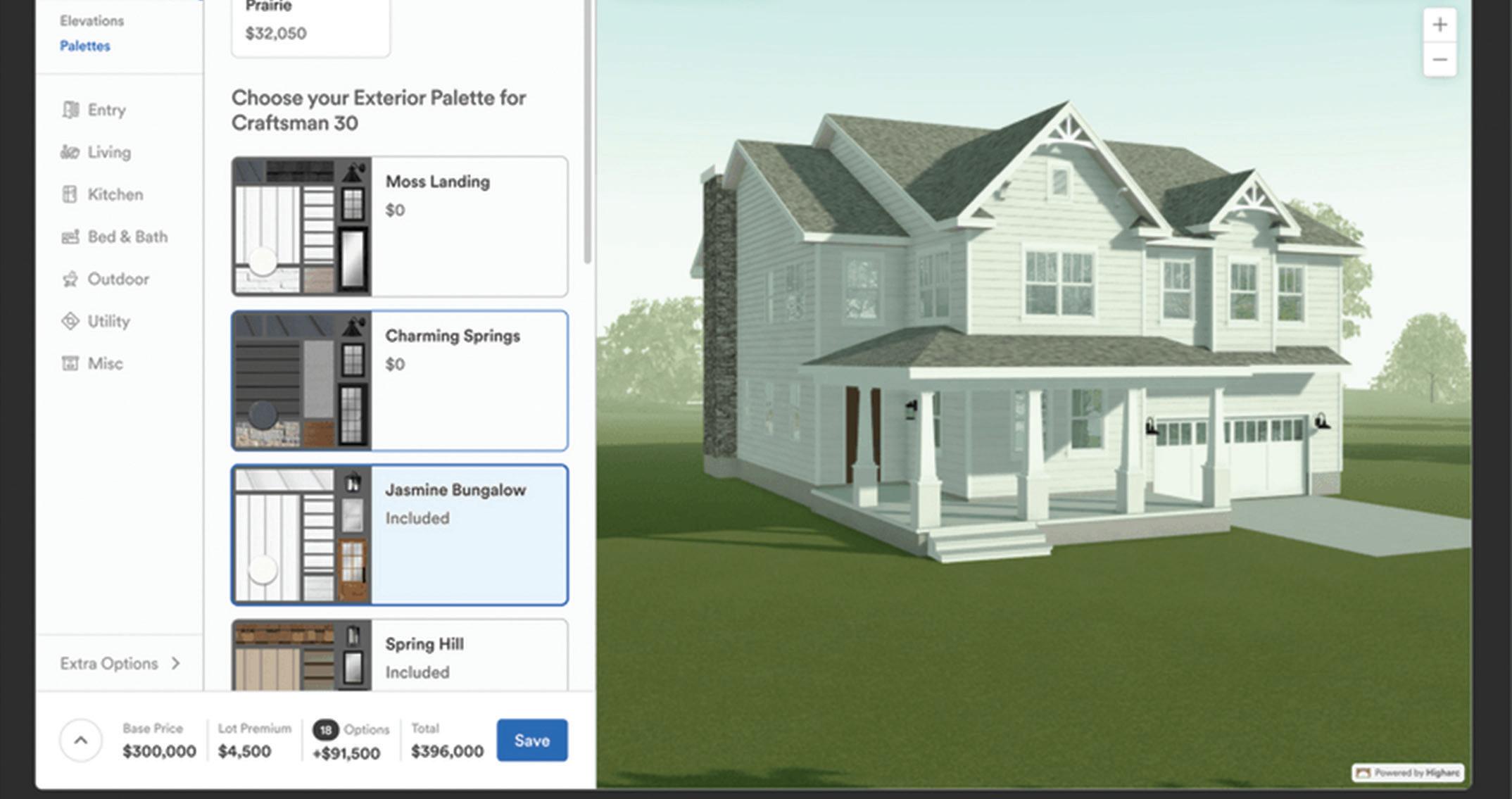

DESIGNING A BETTER HOME

By Chris RoushIn 2018, Marc Minor wanted to build his family a new home in Durham, just north of Interstate 85. But he became frustrated during the design process at how long it was taking.

“It was very surprising to me how much of the Dark Ages the housing industry was in using software,” says Minor. “I realized that we could make the process much better for builders and for homebuyers by applying many of the software ideas used in manufacturing.”

Minor, who had been working for 3D printing startups Carbon3D and Desktop Metal, raised $5 million to start Durhambased Higharc with three co-founders. Two used to work for AutoDesk, a San Francisco-based software company with annual revenue of $5 billion, and one from the videogame industry.

Homebuilders now use Higharc software to help design homes, order building materials and market to potential homebuyers. They can sit down with builders to adjust color schemes or configuration of rooms using the software, which automatically changes orders for wood, paint and other supplies. The software can reduce the time required by builders to design and market new-home communities by 75%.

Higharc’s efforts are attracting prominent investors, who put up $53 million in February. The 18-member group included Home Depot and former AutoDesk CEO Carl Bass. Since 2018, the business has raised $78.7 million.

Minor expects Higharc to turn a profit within a few years. “We’re in it for the long run,” he says, sitting in his 3,000-squarefoot home, which was finished during the pandemic and served as inspiration for the company’s software. “We’re in it to influence how homes are designed and built.”

Epcon Communities, which built about 300 homes in the

Raleigh and Charlotte markets last year, started using Higharc’s software in the fall of 2021, says Paul Hanson, president of franchising and product development. He says the company previously designed homes using one software, marketed in another software and developed pricing estimates for construction in a third.

“We were skeptical [about Higharc],” says Hanson. “We tested it in a community in Cincinnati and spent a lot of time giving feedback on what we wanted to see in the drawings. And so they changed what they were doing.”

Now, the software has “purchasing capabilities and instant access to the amount of materials such as drywall and studs and windows. And they have a feature where sales consultants can see the inside of the house and walk through selections with a customer.”

Such features eliminate confusion by the buyer, Hanson adds. “Now they can see everything down to the color selections,” he says. “We’re really thrilled with the marketing capabilities.”

The cost of the Higharc software is more than what it was previously using, but Epcon had digested that expense because of the shorter sales cycle and the elimination of construction errors, he says. He declined to share details because of a confidentiality clause.

Minor believes that the software, which is primarily employed by smaller and regional builders, will eventually be used to build most homes. AutoDesk’s AutoCAD, introduced in 1982, now has a 90% market share in U.S. home design.

He also notes that Higharc’s software allows builders to adjust for market changes, such as higher interest rates that can force buyers to adjust their ideal price. “If the home market changes and buyers all of a sudden don’t have as much purchasing power, how do you change what you’re building?” he asks. “Our strategy is to enable the people who build houses to have a higher margin and in the long run, improve the affordability of houses.” ■

MARS MISSION

By Heath PulliamAsmall North Carolina technology out t is making waves in the eld of Mars travel. Xtern So ware, a Greensboro custom so ware development company, is playing a behind-the-scenes but integral role in Artemis, NASA’s upcoming manned mission to the moon.

Back in the early ’80s, 10-year-old Greensboro native Keir Davis spent a lot of free time tinkering with computers. “ is hobby that I’ve had, maybe it could really be a career,” he recalls thinking. A er earning a degree in broadcast communications at UNC Chapel Hill, Davis veered into so ware and earned a master’s in computer science in 2000.

A er working for a so ware integration business, Davis founded Xtern So ware in 2002.

Xtern’s initial successes involved desktop so ware for manufacturing companies, though work has now shi ed to be more web- and mobile-focused. e company’s core clients remain manufacturers such as furniture maker Lloyd Flanders, though other clients include Lagos Fine Jewelry and various departments within UNC Greensboro.

One of Xtern’s value propositions is that their work is done locally and not outsourced. “If you can dream it and think it up, then we can build it for you,” says Davis, who remains the company owner.

One of space travel’s biggest challenges is preventing interpersonal con ict onboard the vessel. e constant isolation, con nement and prolonged separation make selecting and monitoring astronauts huge factors of a successful mission.

Teaming up with NASA, researchers from Northwestern University’s Communications and Engineering departments are building a so ware interface called Tool for Evaluating And Mitigating Space Team Risks, or TEAMSTaR. e team uses the behavior modeling tool to study the optimal composition of

astronauts for long-distance missions.

As the Northwestern team is building the algorithms that predict human behavior, they require a special so ware for TEAMSTaR. It required a great depth of knowledge in so ware development. A er responding to Northwestern’s RFP, Xtern was selected for the task. Most of Xtern’s developers have master’s degrees in computer science, company o cials say.

While the project’s data modeling and simulation so ware is done by Northwestern, Xtern handles the website and infrastructure side. “What we’ve created is the entire interface around it that the people in Houston will use on the ground to interact with and run models, and on the spaceship as well,” explains Davis. TEAMSTaR will help determine which four people, out of 115 candidates, will be selected for the Artemis mission.

Although Xtern has its sights on space, it focuses on the Greensboro community. “We are so proud to recruit and retain technology talent within the Triad,” Davis says. Nine of its 13 employees are UNC Greensboro graduates. Its o ce is located at the edge of Greensboro’s historic Fisher Park neighborhood, across from Latham Park, which the sta helps maintain through the city’s Adopt-a-Park program. Xtern also takes part in home repair with Community Housing Solutions and hosts site visits for UNC Greensboro students interested in technology. All but one of Xtern’s employees live and work in Greensboro.

Reliable so ware poses a di cult task in space travel. e connection between Earth and Mars is slow, as data must travel millions of miles each way. ere won’t be a way for astronauts to communicate with Earth in real time, so Xtern’s so ware has to function independently. Northwestern’s behavioral models will need to be rerun during the mission to continue monitoring the crew, 24 hours a day. at’s a huge task, given that a Mars mission is expected to occur over a few years, not months. e bulk of the work being done now by Xtern and Northwestern is for Artemis II, which is slated for September 2025. is mission is being viewed largely as a manned test run, gathering data for a Mars mission as early as the 2030s. Davis and his team are proud to work on a historic mission. ey’re making sure everyone’s mark gets le in space. “ e code set that we’re putting together, every single employee has contributed at least one line of code for a spaceship, even the o ce manager,” Davis says. ■

TALKING IN CIRCLES

Charlotte seeks to show environmental leadership through attainable projects.

By Vanesssa Infanzon

Charlotte’s 100 Gardens, which grows kale, lettuce and other leafy greens, was a natural t to lease space at the Innovation Barn incubator for environmentally conscious enterprises. e 400-foot space is plenty for the nonpro t vegetable grower, which sells or donates its products to local restaurants.

“It is a perfect match because we can have a public-facing facility that we can use for a variety of di erent reasons,” says Sam Fleming, 100 Garden’s executive director. “And they (Innovation Barn) can use us as an educational partner.”

Innovation Barn is part of Envision Charlotte, a publicprivate entity founded in 2011 when Center City Partners, Cisco, the city of Charlotte and Duke Energy wanted to boost awareness of sustainability initiatives. e goal is for the Queen City to be an environmental leader.

e e ort has attracted considerable notice. In 2014 and 2020, Envision Charlotte’s projects were selected as nalists at the Smart City Expo World Congress in Barcelona. In October, Newsweek named it one of ve cities worldwide making waves in sustainability, citing the group’s involvement in what insiders call “the circular economy.” at is shorthand for eliminating waste through creative recycling, rather than just pitching stu in the trash.

DIVERTING FROM THE LANDFILL

Envision Charlotte’s rst project in 2011 was an energy e ciency program for uptown’s largest buildings. Sixty-one buildings with a combined 23 million square feet of o ce space signed up, allowing meters to be installed that helped track energy usage. Over ve years, the program delivered an average reduction in energy use of 19%, just shy of the project’s 20% goal.

“It was this rst project that put us on the international map because we used data and technology to drive e ciency and sustainability,” says Amy Aussieker, Envision Charlotte’s executive director since 2013.

Envision Charlotte’s focus has shi ed to promoting “zero waste” by diverting concrete and demolition materials, organics, plastics and textiles from the land ll. By partnering with businesses, nonpro ts, universities and utilities, the e orts promote innovation and job creation, says Aussieker, a former business consultant and marketing executive at the Charlotte Chamber.

Among Innovation Barn’s projects, it recently has been collecting can carriers from local breweries. e barn’s plastics lab grinds down the carriers and molds them into bricks, furniture or tiles. It’s among several experiments to see what can be done with plastic.

“We are trying to look at the items the city of Charlotte already buys that we can produce instead of buying,” Aussieker says. “Like the water meter cover — it’s just a molded piece. Why aren’t we doing that with our excess plastic?”

Last year, Envision Charlotte began collecting glass bottles from the Spectrum Center in uptown Charlotte. ree tons of glass were crushed, si ed and broken into ve levels of sand and used as an aggregate in concrete. A local company, Resource Flooring, is using the recycled product for construction projects, while making donations to Envision Charlotte. e arena hopes to use the processed glass as a concrete aggregate in upcoming projects.

“We’re thinking about putting this (machinery) into a shipping container and making it mobile in the community,” Aussieker says. “We can have little pods around the community, bringing jobs and taking care of the glass in those areas.”

Envision Charlotte’s team operates the labs and projects, serves as the property manager and provides educational tours and eld trips for more than 100 visitors a week.

Last year, 3,500 volunteers worked on Innovation Barn projects, including an Earth Week community sanitation program called “Clean the Queen.”

Envision Charlotte operates with a $900,000 annual budget, aided by a mix of public and private sponsors. Corporate backers include Coca-Cola Consolidated, Duke Energy, Ikea and Lowe’s. Mecklenburg County budgets $75,000 a year for the Innovation Barn’s educational center, exhibits and kiosks. e U.S. Conference of Mayors made a $250,000 grant last year, while individuals kicked in about $12,000.

throw it in there,” she says. “But in Europe, they don’t have the land, plus they have more progressive policies.”

e Innovation Barn building is next to the city’s Solid Waste Services Department, and is leased for $1 a year. Six businesses and ve nonpro ts occupy space at the Innovation Barn, paying $8 to $15 per square foot in monthly rent.

BUILDING A REPUTATION

Aussieker envisions a future in which the circular economy is much more ingrained. In 2015, she invited 10 cities, chosen through an application process, to participate in workshops to learn how to launch a similar program in their own regions.

In 2017, she took a group of city leaders including the city manager, mayor pro tem and solid waste manager, to Amsterdam, Barcelona and Rotterdam, to see how the European cities manage waste.

“In the U.S., we have a ton of land, so we dig a big hole and

In February, Envision Charlotte hosted a two-day conference on the circular economy that attracted 110 representatives from California, Florida, North Carolina and Tennessee. e gathering featured the leader of Netherlands-based Metabolic, a consulting business that champions sustainability with a holistic approach and helps clients set zero-waste goals.

Envision Charlotte recognizes it needs long-term partnerships with funding attached to projects, says Jennifer Grabenstetter, an Envision Charlotte board member and a local technology and marketing consultant. If the program is of value, companies will pay for services that include generating jobs and providing training and skills development, she says.

Jobs created through Envision Charlotte support the 2050 Circular Charlotte vision to be a more equitable, sustainable community, says Danielle Frazier, special assistant to the city manager for workforce development.

“We were the rst city in the United States to make that political commitment to a circular economy as a municipal strategy,” says Frazier, who is a board member of the nonpro t.

“We have a number of organizations and municipalities that ock to the city of Charlotte to ask, ‘How did you do it? How can we make it happen in our communities?’ I think that speaks to the leadership and where we are and where we are going.” ■

HAVING THE TALK: HOW EMPLOYERS SHOULD PREPARE FOR DIFFICULT DISCIPLINARY SITUATIONS

by Justin Hill and Ken GrayEvery employee hired is expected to be a team player and integrate into the employer's culture to cultivate success. However, nearly all employers find out at some point that new hires do not always work out as planned. Unfortunately, disciplinary action must be taken at times, and termination of employment becomes necessary far more often than many expect. Even worse, regardless of whether termination is justified or meritless, terminations can lead to lengthy, expensive legal battles. For business owners, proper planning can prevent them from expending six figures in legal fees (or losing their business altogether due to an exorbitant jury verdict).

DON'T WALK IN BLIND

Before inadvertently inviting costly litigation, employers should prepare for termination decisions and alleviate risks to the extent possible. This process starts with understanding the legal limitations of discharging employees.

First, the employer should review its relationship with the employee. Although at-will employment is the default rule in the United States (with the exception of Montana and Puerto Rico), employment contracts can provide a guaranteed term of employment. If an employer and employee agree to a term other than at-will employment and do not provide for termination without cause, then the employment relationship is terminable only for cause, which should be defined within the agreement. Additionally, contrary to popular belief, at-will employment does not allow employers to terminate employees for any reason. Instead, employers may terminate an employee's at-will employment for any reason or no reason, with or without notice or cause, provided that it is not for an unlawful reason.

Next, the employer must understand the applicable laws that may create a basis for wrongful termination claims. Examples include Title VII, the Americans with Disabilities Act, the Age Discrimination in Employment Act, the Family and Medical Leave Act, the National Labor Relations Act, and many more federal, state, and local laws. Employers also must recognize public policy exceptions to at-will employment, which prohibit termination from employment in specific situations. In summary, all of these laws prohibit discrimination, retaliation, or harassment against employees based on protected classes or protected actions.

While employment laws place limits on terminating employees, they do not prevent terminations based on legitimate grounds. However, if challenged, the onus generally falls on the employer to prove that an employee was terminated for legitimate, lawful reasons (and not rely upon the fact that an employee was employed at-will).

BUT DID YOU DOCUMENT IT?

Assuming termination is not for an unlawful reason, employers should look to their policies to support the decision to terminate an employee. Employers' policies should be crafted to match their practical standards and expectations. Moreover (and this step is important), employers must follow their policies and hold employees accountable for failing to abide by the policies. Oftentimes, proper documentation and implementation of policies serve as the first line of defense in wrongful discharge claims. Documented violations of company policies will help undercut an employee's burden to prove a wrongful discharge claim.

On the other hand, an employer's failure to effectively document an employee's issues prior to terminating

employment may indicate to the applicable agency (such as the Equal Employment Opportunity Commission) or a jury that the employee was actually terminated for an unlawful reason. Documenting the motives for termination in real time through performance evaluations, written warnings, and meeting notes is completely in the employer's control, so failure to prepare such documentation reduces an employer's chance of meeting its burden to offer a facially nondiscriminatory reason for termination. On the whole, it is essential that employers train their management-level employees to give timely, honest, and constructive criticism in an objective manner and maintain a sufficient written record to bolster defenses in potential litigation.

THE END

Once the appropriate documentation has been reviewed and the decision is made to terminate an employee, employers should deliver the message promptly and appropriately in a private meeting. Any disciplinary records or other documentation relevant to the termination should be assessed in advance to communicate clearly, concisely, and in accordance with the written record. The termination meeting, similar to other discipline, should be documented, and a human resources representative or another member of management should be present as a witness. When delivering the message, employers should be prepared for a negative response and avoid arguments related to the decision. Rather than debating facts, employers should lean on the documented issues and move the meeting towards a conclusion.

If applicable, the employee should be reminded of any ongoing obligations that survive the end of the employment relationship, such as restrictive covenants or confidentiality

agreements. When concluding, the employer should discuss the employee's final pay, any continuing benefits, and whether a separation and release agreement will be provided as consideration for any severance payment. Finally, employers should be aware of any notices required by state and local law to ensure that those final obligations are met. Although not required, it is generally recommended that employers send a follow-up termination letter encompassing the termination meeting and providing any required notice in writing.

CONCLUSION

Every termination is different, and any disciplinary action taken by an employer has some risk of being misconstrued. However, employers who put the time and effort into documenting issues in advance stand a much better chance of having a former employee's claims dismissed at minimal cost. Conversely, those who fail to do the work on the front end generally pay for it (figuratively and literally) on the back end.

Ultimately, there is no singular script for terminating an employee. There is no avoiding the fact that disciplining an employee is a difficult situation. Nevertheless, thoughtful employers prepare for these situations and hopefully avoid additional legal disputes arising out of these situations down the road. ■

Ken Gray Labor and Employment Attorney smg@wardandsmith.com

Justin Hill

Labor and Employment Attorney jthill@wardandsmith.com

Read additional articles in our new series "Laboring through Difficult Times" throughout May at wardandsmith.com

This article is not intended to give, and should not be relied upon for, legal advice in any particular circumstance or fact situation. No action should be taken in reliance upon the information contained in this article without obtaining the advice of an attorney.

CHARLOTTE

CHARLOTTE

Arizona-based Resideo Technologies expects to acquire Charlotte’s Snap One for $1.4 billion in the second half of the year. Resideo said it will combine Snap One into its security products distribution. Snap One’s has complementary products in its smart living market and innovative Control4 technology platforms.

Rodgers Builders has been sold to Japan’s Kajima, a publicly traded company and one of the world’s largest contractors. Kajima also owns Batson-Cook, an Atlanta-based contractor. The late B.D. Rodgers started his business in 1963. His wife, Pat, has run the firm since 1987.

Investment giant Vanguard Group paid $117 million for the 91-acre campus in University City originally planned to house insurer Centene’s East Coast headquarters. Pennsylvania-based Vanguard will consolidate its Charlotte

operations, including 2,400 employees, into the 700,000-square-foot office complex. Vanguard opened its first local office in 1997.

Wegmans Food Markets plans to open a store in Charlotte’s Ballantyne neighborhood in 2026. The Rochester, N.Y.-based grocer has 110 stores, including four in North Carolina with another planned for Holly Springs in Wake County. The family-owned company has $12 billion in annual sales.

McShane Partners, an investment advisory firm, was sold to Birmingham, Alabama-based Waverly Advisors. McShane was founded in 1985 as one of the first fee-only registered investment advisers in the city. McShane CEO Daniele Donahoe is majority shareholder and has grown the firm to more than $700 million in assets under management since joining it in 2010.

Ally Financial named Michael Rhodes as its new CEO. The move comes about five months after former CEO Jeff Brown announced he would become president of Hendrick Automotive Group. Rhodes will be based in Charlotte. He was named CEO of Riverwoods, Illinois-based Discover Financial Services in February

after working for Toronto-based TD Bank for more than 12 years. Capital One agreed to buy Discover for $35 billion, pending regulatory approval. Rhodes wasn’t getting a top role at the combined company

Krispy Kreme has agreed to sell its doughnuts in 13,500 McDonald’s restaurants by the end of 2026. The move is expected to double Krispy Kreme’s current distribution. McDonald’s started selling Krispy Kreme doughnuts in 2022 at some of its Kentucky stores.

Bojangles is opening its first restaurants in Los Angeles County. Lorenzo Boucetta and Poulet Brothers plan to open 30 restaurants over the next six years through a Bojangles franchise agreement. The company, founded in 1977, has more than 800 locations in 17 states.

Duke Energy named Harry Sideris as president, a title that CEO Lynn Good held. Sideris, a 28-year Duke veteran who will be responsible for Duke’s electric and gas utilities, including customer service and operations, has been executive VP of customer experience, solutions and services.

Piedmont Natural Gas wants an 11.7% base rate hike. The Duke Energy subsidiary says it needs the rate increase to recoup costs of complying with federal safety regulations and to build infrastructure to meet increasing energy demand. If the N.C. Utilities Commission approves the hike, it would take effect in November. The company serves 810,000 N.C. customers.

The Charlotte Symphony heard chaching after it received more than $40 million in contributions from local groups and foundations in a campaign led by retired Bank of America executive Pat Phillips. Bank of America and the C.D. Spangler Foundation each put up $10 million, while the Knight Foundation added $5 million. It’s part of a $50 million campaign.

Atlanta-based United Parcel Service announced it would cut 75 mostly part-time jobs at a Charlotte facility. The company has reported an overall logistics and shipping slowdown.

The N.C. Economic Investment Committee canceled the $2 million Job Development Investment Grants for Cognizant Technology Solutions, a large New Jersey-based tech company. Cognizant failed to meet its promise of creating 300 jobs “due to economic uncertainty and decreased demand,” the company said.

Hudson Automotive Group acquired Toyota of North Charlotte, owned by siblings Joe and Bob Siviglia. The dealership opened in 2003. Charleston, South Carolina-based Hudson now owns 54 dealerships in North Carolina, South Carolina, Georgia, Kentucky, Louisiana, Ohio and Tennessee.

Maynard Nexsen law firm acquired the North Carolina criminal defense firm Dysart Willis of Raleigh. The move expands Maynard Nexsen’s white collar criminal defense and government investigations practice. Maynard Nexsen also has offices in Greensboro and Raleigh, plus five locations in South Carolina.

BELMONT

Piedmont Lithium received state approval for its planned Gaston County mine, and will seek a necessary zoning change from county commissioners. Piedmont submitted its application in August 2021 to the N.C. Department of Environmental Quality’s Division of Energy, Mineral and Land Resources.

Novant Health established an endowed chair for its breast health department as the result of a $1 million donation from Bank of America Charitable Foundation. The foundation provided the donation in recognition of the 40 years of service of longtime BofA executive Catherine Bessant, who now leads the Foundation for the Carolinas.

Honeywell International is considering selling its personal protective equipment division in a deal that could value the unit at more than $2 billion. The company’s PPE products, ranging from respiratory protection to work boots and face masks, saw a surge in demand during the COVID-19 pandemic.

Autobell Car Wash opened its first Delaware operation, and 89th overall. Autobell is one of the largest U.S. familyowned car wash companies, employing more than 3,000 team members in North and South Carolina, Virginia, Maryland, and now Delaware. The late Charles Howard Sr. founded the business in 1969

and subsequent generations still own and operate Autobell.

HARRISBURG

Power Test, an electrical testing business, was sold to Texas-based Shermco Industries. A group of technicians and engineers formed Power Test in 2005 and it now provides field service, maintenance, testing, repair and analysis of power distribution and equipment to numerous customers across the state.

HUNTERSVILLE

Bharat Vats is the new CEO at Atom Power, succeeding founder Ryan Kennedy, who started the business based on research at UNC Charlotte. Atom raised $100 million from South Korea’s SK group in 2022, and last year received a $1.2 million N.C. job development grant, pending investment of $4.2 million and hiring of 225 employees over the next 12 years. Atom employs 100 and does EV charging installations.

NC TREND ›››

KINGS MOUNTIAN

Catawba Two Kings Casino is preparing to add 12 live table games this summer in addition to the existing 1,000 slot machines and electronic table games, retail sportsbook and restaurant. To support the operation of table games, the casino is opening a free card-dealer school.

SHELBY

Site Selection magazine named Shelby the top “micropolitan” in North Carolina for 2023 and No. 7 in the U.S. Cleveland County Economic Development Partnership had seven projects that resulted in an investment of $94.7 million and the creation of 399 new jobs in 2023, says Brandon Ruppe, the group’s associate executive director.

PINEVILLE

Houston-based Hines, a real estate company that owns Cary’s Fenton mixeduse development, entered the rental-home market here. Hines U.S. Property Partners bought Blu South, which has already finished 341 of a planned 551 houses on 75 acres, from Athens, Georgia-based Landmark Properties. Hines believes the “build-to-rent” sector is a financial winner because higher interest rates preclude many from buying homes.

TROUTMAN

Two North Carolina animal attractions — Zootastic, on 186 acres here, and Aloha Safari Park, on 68 acres close to Fayetteville — are on the market. Zootastic, dubbed the largest privately owned and operated zoo in the state, boasts a $16 million price tag. Aloha Safari Park offered for $4.5 million.

EAST

ELIZABTHTOWN

Campbell Oil and others agreed to a $700,000 settlement resolving allegations that the company conducted charter flights violating safety regulations. The United States District Attorney’s Office filed a complaint in March 2023 alleging that Campbell Oil, Executive Aircraft Services, and others illegally operated more than 150 paid, passenger-carrying flights that didn’t adhere to safety regulations. The settlement was not an admission of wrongdoing.

FAYETTEVILLE

Fayetteville State University faculty held a no-confidence vote regarding Provost Monica Terrell Leach, the school’s chief academic officer, over their workloads. Professors are angry that Leach is advancing a plan to require full-time faculty to teach four classes per semester instead of the current minimum load of three classes.

HAMLET

Graham-based Big Rock Sports is closing its 300,000-square-foot distribution center here and consolidating operations with its Charlotte warehouse. The center distributes a full range of fishing, hunting, shooting, camping, electronics and boating supplies and will close in June or July, resulting in the loss of 81 jobs.

KENANSVILLE

Highly Pathogenic Avian Influenza, commonly referred to as Bird Flu, has been confirmed in a herd of dairy cows at an undisclosed N.C. site. The virus is highly contagious among waterfowl and poultry, according to the N.C. Dept. of Agriculture. So far this year, HPAI has been confirmed

in commercial turkey flocks in Duplin and Lenior counties.

KINSTON

Tommy Sowers, the president of flyExclusive, resigned from the charterflight company. In a LinkedIn post, Sowers wrote, “My family needs me through my wife’s cancer treatment. While I love my work family, my family comes first, and I hope you understand.” flyExclusive began trading on the New York Stock Exchange on Dec. 2.

NASHVILLE

Canadian pet food company The Crump Group will spend $85 million to expand its manufacturing plant, slightly more than a year after it began production here. The company produces dog treats for Costco, PetSmart, Walmart and others. The initial 2021 investment of $13.2 million was expected to create 160 jobs. The number of jobs added by the latest expansion will be announced later.

NEW BERN

A German-based plastic injection molding operation will lay off about half of its 120 employees starting in May. Wirthwein will consolidate the automotive part of its business with a Fountain Inn, South Carolina, location that makes parts for BMW. Wirthwein’s remaining employees here will continue to make parts for appliance-maker BSH, which has a nearby plant.

TOPSAIL ISLAND

North Carolina land preservation organization Coastal Land Trust agreed to buy about 150 acres of undeveloped property here for nearly $8 million. Todd Olson, CEO of Raleigh software company Pendo, had previously proposed plans to develop 20 out of its 150 acres at the site.

WILMINGTON

An ongoing project will change the ways rail travels through the city, including closing some crossings and making improvements to new ones. The changes include permanent closure of five rail crossings and will be made to the existing 13-mile CSX rail line, which is the only active track through the city.

Additional cargo shipments are headed to North Carolina’s coast amid the ongoing Baltimore Port closure, North Carolina Ports disclosed. North Carolina Ports says it is working with an existing port customer that plans to utilize the Port of Wilmington as a contingent port until the situation improves in Baltimore.

YouTuber MrBeast — aka Jimmy Donaldson — struck a deal with Amazon’s Prime Video to host a reality competition series called “Beast Games.” The show will have 1,000 contestants competing for a $5 million reward, which promoters claim is “the biggest single prize in the history of television and streaming.”

Visit businessnc.com/smallbusiness or scan the code above to go directly to the nominations page.

We are looking to find the best Tar Heel small businesses.

2024 marks our 29th year of honoring the contributions small businesses make to our state’s economy. Help us to fi nd the small businesses that best represent North Carolina. The winners will be profiled in the December 2024 BUSINESS NORTH CAROLINA magazine. Please submit your nominations by June 18, 2024 .

SPONSORED BY

NC TREND ››› Statewide

New Hanover County approved more than $3.3 million in incentives to help fund the expansion of Wilmington Trade Center, to help fund the expansion of Wilmington Trade. It would be one of the largest industrial parks in the state. County incentives will help fund the infrastructure and investment needed to add 10 buildings. Plans call for 13 buildings overall with a combined space of 3.2 million square feet.

nCino President Josh Glover left the fintech company to pursue an opportunity outside of financial services. Paul Clarkson, a former executive vice president at Global Banking, was named executive vice president of Global Revenue. Other executives will take on the president’s duties.

WILSON

Germany-based Schott Phama will invest $371 million to build a pharmaceutical production facility that will create 401 jobs. It will the company’s first U.S. facility to manufacture pre-fillable polymer syringes, while adding to the nation’s supply of prefillable glass syringes. The company’s first of six U.S. manufacturing facilities.

A Circle K located off U.S. Highway 264 plans to add a 24-vehicle charging station

that will be the largest supercharging site in the state. The expansion will also include the only Krystal fast-food location in the area.

TRIAD

EDEN

Nestlé Purina PetCare opened its $450 million renovation of the former MillerCoors brewery. The 1.3-million square feet of production space sits on a 1,365-acre site. The Purina facility occupies about 80% of the site. It is parent company Nestlé’s first manufacturing facility in North Carolina.

THOMASVILLE

Davidson County officials cleared the way for another megasite in hopes of luring another large industrial development project to the Triad. A rezoning vote for property off U.S. 64 southwest of the city limits gives the Charlotte property owner more than 1,000 acres of land zoned light industrial. The

GREENSBORO

Boom Supersonic took a step toward its passenger jet ambitions by completing the first flight of its demonstrator plane, called XB-1, at the Mojave Air & Space Port in California. The startup jet maker has an agreement with North Carolina to build a $500 million flagship at Piedmont Triad International Airport, including as many as 1,761 workers.

proposed megasite is next to the property where Nucor is building a $350 million plant to make steel rebar.OINT

GREENSBORO

Cone Health and the N.C. A&T Real Estate Foundation confirmed their partnership on a $32 million mixed-use development branded as The Resurgent. The development is focused on revitalizing the area around East Market Street, across from N.C A&T State University and close to U.S. 29.

The new owner of the historic Spencer Love House released a statement about the decision to destroy the historic home. “We had hoped to renovate the home, but ultimately found that was not a feasible option to meet our needs,” said new owner Roy Carroll, who acquired the home from Bonnie McElveen-Hunter for $4.5 million.

WINSTON-SALEM

Hanesbrands will give some current and former employees the option of credit and identity monitoring, up to a $50 Hanes store credit and $6.99 in shipping costs, or a cash payment of $35 in a proposed settlement of a federal lawsuit tied to a May 2022 ransomware attack. Separate lawsuits were filed in February 2023.

Novant Health named Alice Pope as its new executive vice president and chief financial officer, effective May 13. She has been CFO at Falls Church, Virginia-based Inova Health System, and had similar posts at healthcare systems in Arizona and Tennessee during a nearly 35-year career.

Brookridge Retirement, a community of the nonprofit ThriveMore, partnered with Forsyth County nonprofit Imprints Cares to establish a childcare center called the Center for Thriving Children. The planned facility, serving children from infancy through middle school, is estimated to cost about $4.5 million.

Novant Health wants Forsyth County Board of Commissioners to approve a resolution allowing the nonprofit health care system to issue tax-exempt bonds valued at $750 million. Novant made a similar request to Mecklenburg commissioners to borrow up to $785 million in tax-free bonds, mostly for construction and expansion projects. Federal law requires approval for the issuance of certain tax-exempt bonds.

TRIANGLE

BURLINGTON

Labcorp made its fifth acquisition since spinning off its clinical trials business last year. The laboratory services company will pay $237.5 million to acquire select assets of BioReference Health, a wholly owned subsidiary of Miami-based OPKO Health. The assets generate approximately $100 million in annual revenue.

DURHAM

8 Rivers Capital, a decarbonization technology developer, hired Christopher Richardson as CEO. Interim CEO Dharmesh Patel, the former vice president and financial controller, will become senior vice president of finance. Richardson previously was the head of the Americas energy and infrastructure projects section at the global law firm White & Case.

Duke University discontinued its Reginaldo Howard Memorial Scholarship Program for “top applicants of African descent” in the wake of last year’s Supreme Court decision that ended race-based affirmative action in college admissions. The scholarship was established in 1979 and named in honor of Howard, Duke’s

first Black student government president who died in a car wreck during his sophomore year in 1976.

RALEIGH

Highwoods Properties sold nine properties for $79.4 million, including eight office buildings near Rex Hospital. Seven of the eight office buildings in Rexwoods were purchased by one buyer for continued medical and office use. The other building will be redeveloped.

More than 104,000 people attended the Dreamville Festival, a two-day, hip hop music event created by Fayetteville native and rapper J. Cole. The event set an attendance record at Dix Park in its fourth year, festival organizers say, with fans from all 50 states and representing more than 20 countries attending.

The governing board of North Carolina’s 58-campus community college system wants to restructure the funding model to make it more responsive to the state’s workforce needs of employers. The price tag for the first year of the Propel NC project would be about $100 million, in addition to the $1.5 billion already budgeted for community colleges.

The Raleigh-Durham Airport Authority Board passed a $419 million budget for the fiscal year beginning April 1. Traffic is expected to top 5.5 million passengers, a 1.1 million passenger increase compared to fiscal year 2023-2024.

Lab-testing company Mako Medical agreed to pay the state $2.1 million after state investigators identified unnecessary Medicaid billing for urine drug tests over five years. Mako allegedly gave health care providers the option to order two urine drug tests for patients, which were conducted on the same sample at or near the same time.

WEST

ASHEVILLE

UNC Asheville terminated a dozen staff members as part of a plan to address a projected $6 million budget deficit for the current fiscal year and an $8 million projected deficit for the following fiscal year, according to Chancellor Kimberly van Noort. UNC Asheville has faced a roughly 25% enrollment decline over the last five years.

George Briggs will retire Aug. 1 from the North Carolina Arboretum, ending a 37-year-career. The Reidsville native is credited with creating The Arboretum.

BOONE

Sheri Everts stepped down as chancellor of Appalachian State University due to “significant health challenges,” she said. She had been chancellor since 2014. UNC System President Peter Hans named Heather Hulbert Norris, provost and executive vice chancellor, as interim chancellor.

CHEROKEE

Plans for the state’s first legal recreational marijuana sales are on hold as the Eastern Band of Cherokee announces their marijuana dispensary will only sell medical marijuana during its April grand opening. The Great Smoky Cannabis Company dispensary will be the first in the state. A joint statement issued by tribal leadership said there are still too many questions about the implementation of recreational marijuana to start sales April 20. ■

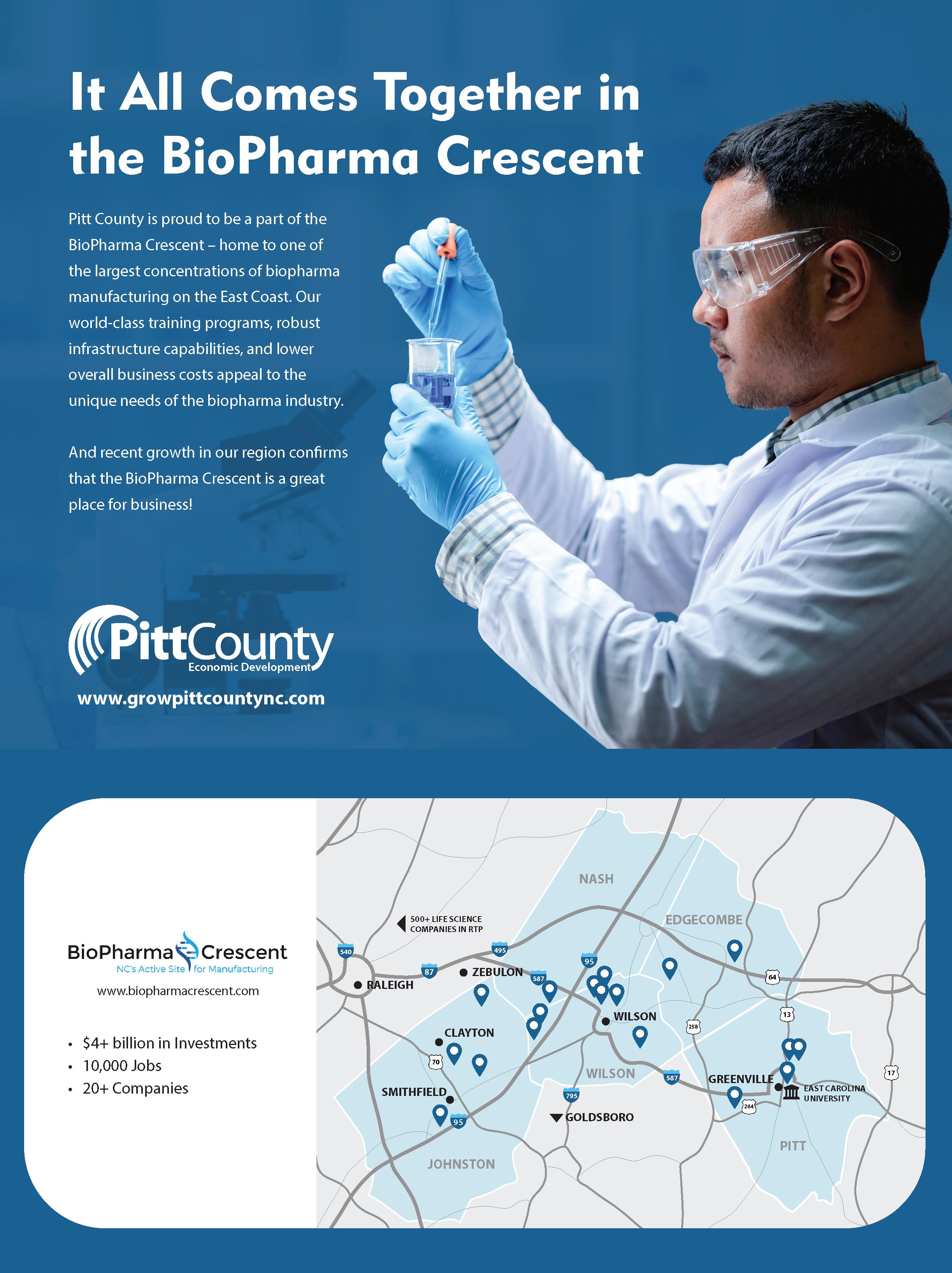

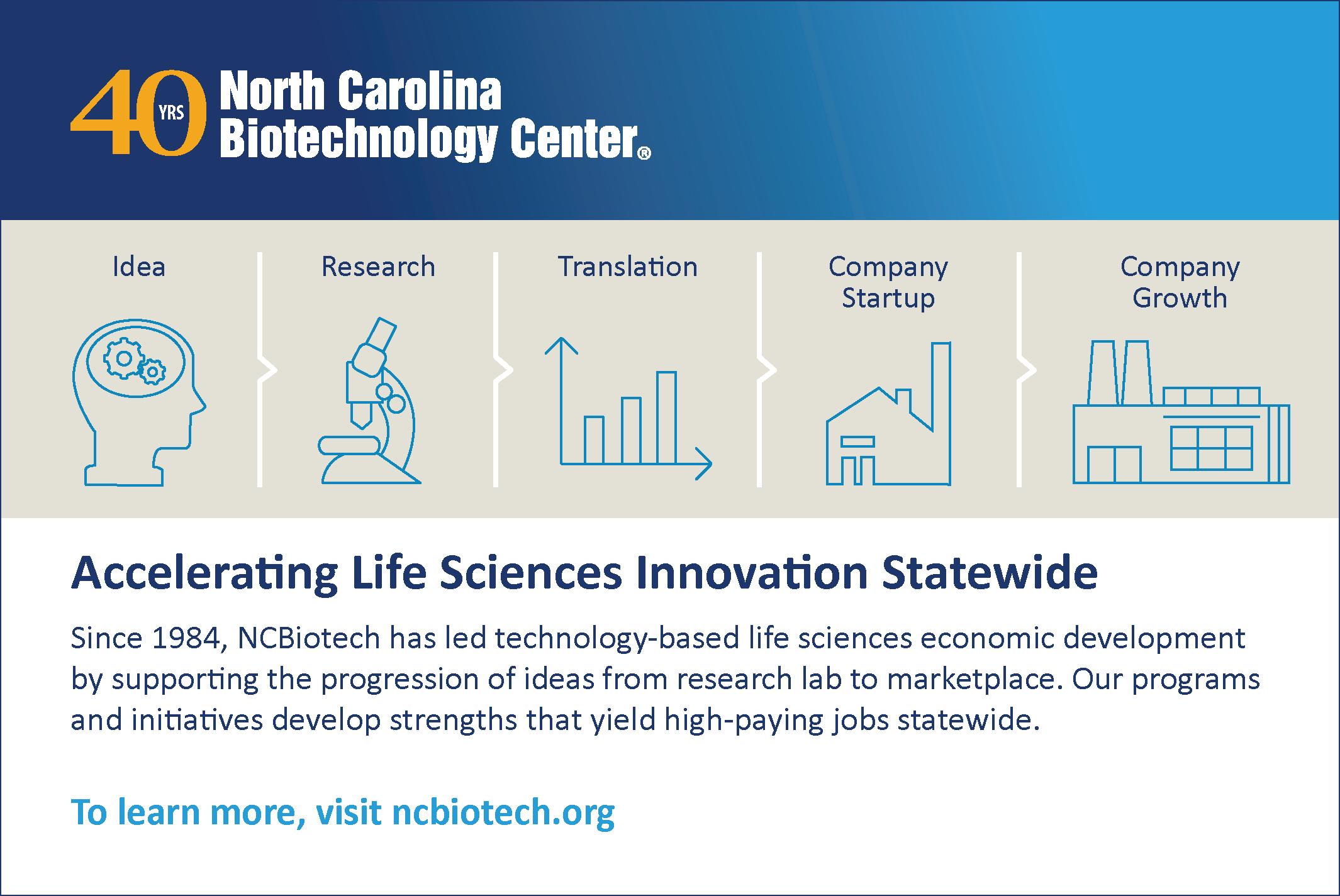

LIFE SCIENCES LEADERS

North Carolina is home to 830 life sciences companies that directly employ 75,000 people, emerging as a leader in biotechnology, pharmaceuticals, medical devices and agricultural biotechnology. In 1984, the state’s General Assembly established the North Carolina Biotechnology Center to encourage the development of the life sciences across the state.

North Carolina is ranked among the top three states for biotechnology strength, according to Business Facilities Magazine. North Carolina is among the world’s largest and most mature life sciences clusters and is highly specialized in biomanufacturing and clinical research.

Business North Carolina and the N.C. Biotechnology Center recently gathered a panel of biotech experts and leaders to frame the issues around the life sciences industry. The panel was moderated by Executive Editor Chris Roush and has been edited for clarity.

Photography by Bryan ReganThe discussion was sponsored by:

•N.C. Biotechnology Center

•N.C. Central University

•NC Life Sciences

•Pappas Capital

•Pitt County Economic Development

WHAT DO YOU SEE AS THE BIGGEST CHALLENGES IN THE LIFE SCIENCES INDUSTRY?

JORDAN: The biggest issue that I see is access to capital to fund some of the exciting innovations that the biopharma industry is creating. As we understand more about disease and wellness, it takes capital to get these technologies approved.

EDGETON: I agree with that. But I also say probably from our perspective, the workforce for the growing industry is a big challenge. We are facing shortages of workers in the thousands. And so we

want to make sure that the state is ready for the next generation of opportunities that are coming our way.

BAXTER: We think that microplastics are one of the most pressing issues today. We’re as a species depositing about 1 million metric tons of plastic waste every single day. And we are also consuming too many microplastics every single week, which has been linked to things like cancer, heart disease, inflammation and fertility. And we’re just really scratching the surface of all of the health issues. We think that that’s an area of study that needs to be significantly more funded and addressed.

PAPPAS: I’m gonna flip it around because everyone talks about capital, and I agree with what Doug says in terms of manpower. But the other side of the coin in terms of capital for the market is really entrepreneurial leadership to lead and build our companies. If we have those correct people in place, I think they’re going to be able to raise money. We’ve shown that money can come into the state if we’ve got the right leaders.

SMITH: I think one of the biggest concerns that we may have is making sure that there’s enough people of diverse backgrounds that can get jobs in this industry.

KUENZI: In Morrisville, we’ve had a site there for quite some time and we are currently building one of the largest bio manufacturing facilities in the country in Holly Springs. It’s going to be a $2 billion investment (increased to $3.2 billion investment since this discussion). And with that comes a lot of need for talent. That’s one of the biggest needs we have as a company is to not just attract talent, but to grow it and sustain it in this area. We’re going to need talent for years to come. And we’re looking for a diverse set of talents and people that have real skills when they come into the workplace. Not just book smarts, but people that have touched the equipment and really know how to get in and work in the industry.

MONTEITH: Interestingly, I just finished meeting with most of our members who have manufacturing facilities in the state. The No. 1 thing I heard was our workforce – not just entry level but also mid-management level positions. Currently, there isn’t a pipeline to fulfill those. Manufacturing sites have to go outside the state, which is something we would rather not be doing.

I’m going to throw one other thing in there that I haven’t heard yet. The second biggest thing I heard was infrastructure — wastewater management, water availability, power reliability. North

Carolina is known for the education and industry collaboration that occurs, especially in life sciences, to work on workforces. But I think what we’re suffering from right now is our success. We’ve grown extremely fast. Last two weeks, there were three new life sciences companies that have been announced coming into the state. Those are all drawing on the same resources. And that’s something I think we need to really be focusing on as we move forward to be able to maintain our position and become one of the central biomanufacturing hubs.

HOW DO WE GET THOSE TALENTED WORKERS INTO NORTH CAROLINA AND INTERESTED IN THE INDUSTRY? HOW DO WE TRAIN THEM?

KUENZI: One of the things that’s a real advantage for us here is that we have a university and community college system