A FOODIE INFLUENCER’S IMPACT | NOVAQUEST’S STRATEGY | RALEIGH’S CBD SEEKS A REVIVAL

A FOODIE INFLUENCER’S IMPACT | NOVAQUEST’S STRATEGY | RALEIGH’S CBD SEEKS A REVIVAL

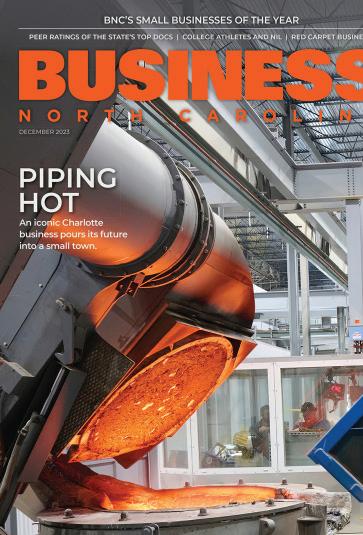

Rick Hendrick’s auto dealership group takes the checkered flag in our annual private company ranking.

4 UP FRONT

CEO Mary Jo Cagle says Cone Health will be a distinctive force in making N.C. healthcare more affordable.

A Charlotte influencer’s clout with diners; Is downtown Raleigh rebounding?; Fayetteville State University plots a turnaround plan; Why Giselle Bündchen loves Transylvania County; Natron Energy electrifies eastern N.C.

80 PROJECT PLANS

An Olympic Games in North Carolina? Dreamers are hoping it can happen, aided by state investments that have shown an unclear payoff.

30 ROUNDTABLE: CHARLOTTE

Charlotte has proven credentials as a vital, livable global business center, local business and civic leaders agree.

64

North Carolina’s heart and cancer centers are on the cutting edge, and patients reap the benefits.

70

From certificates to diplomas, N.C. colleges and universities offer abundant possibilities to students.

CAR CRAZY

BY DAVID MILDENBERG

Charlotte icon Rick Hendrick discusses building empires by pursuing his greatest passions.

BY PETE M. ANDERSON, DAVID MILDENBERG AND KEVIN ELLIS

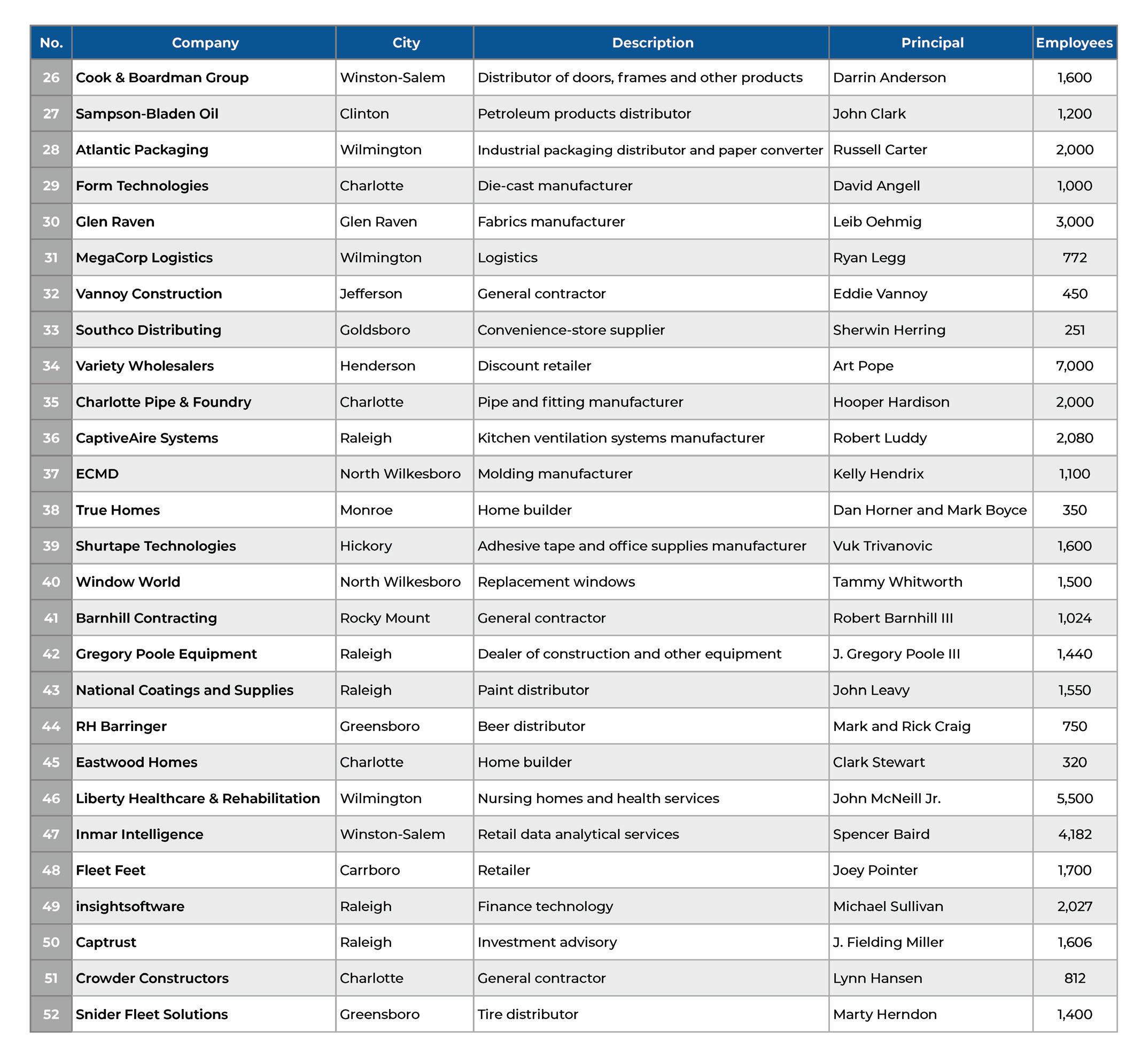

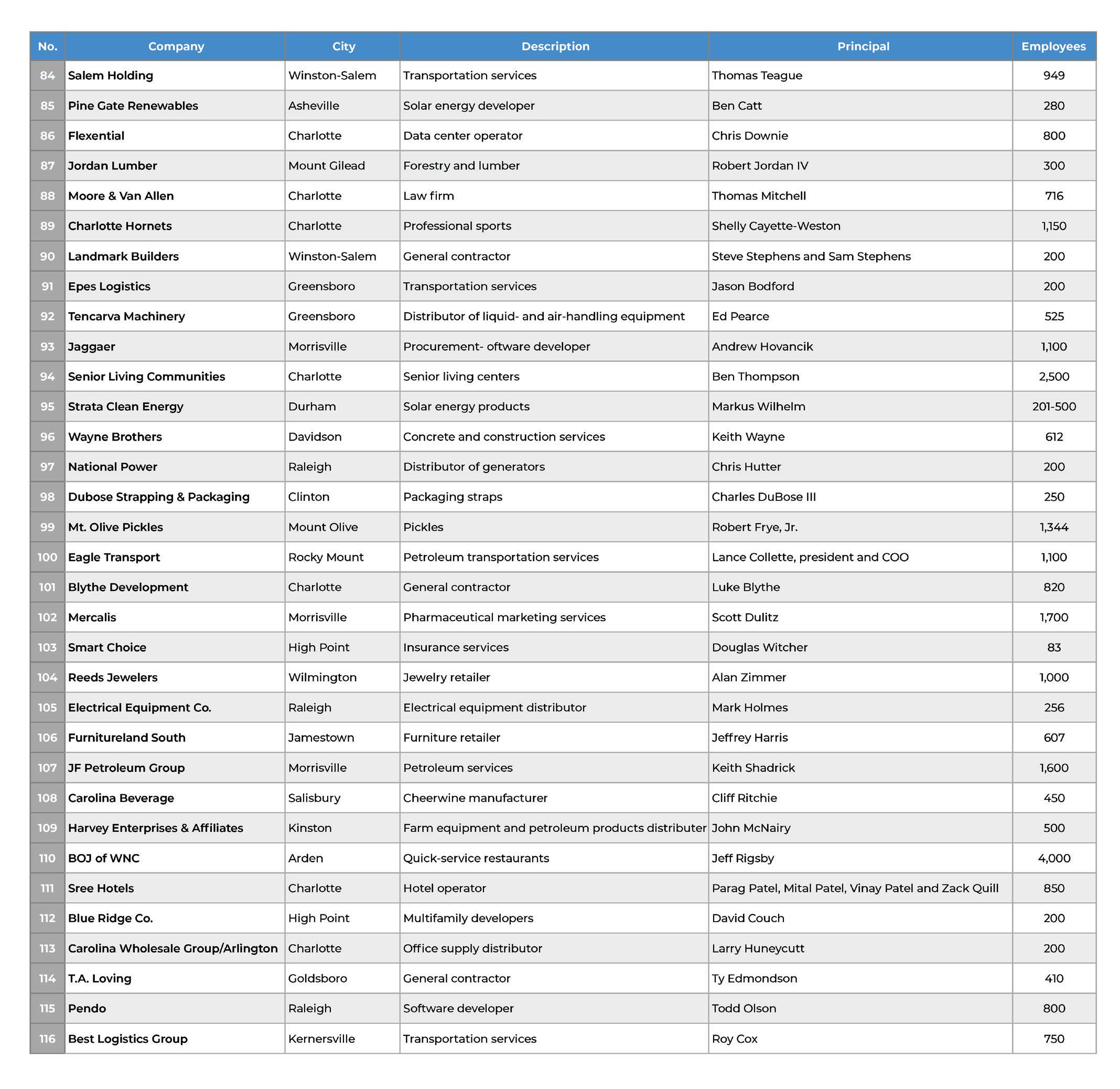

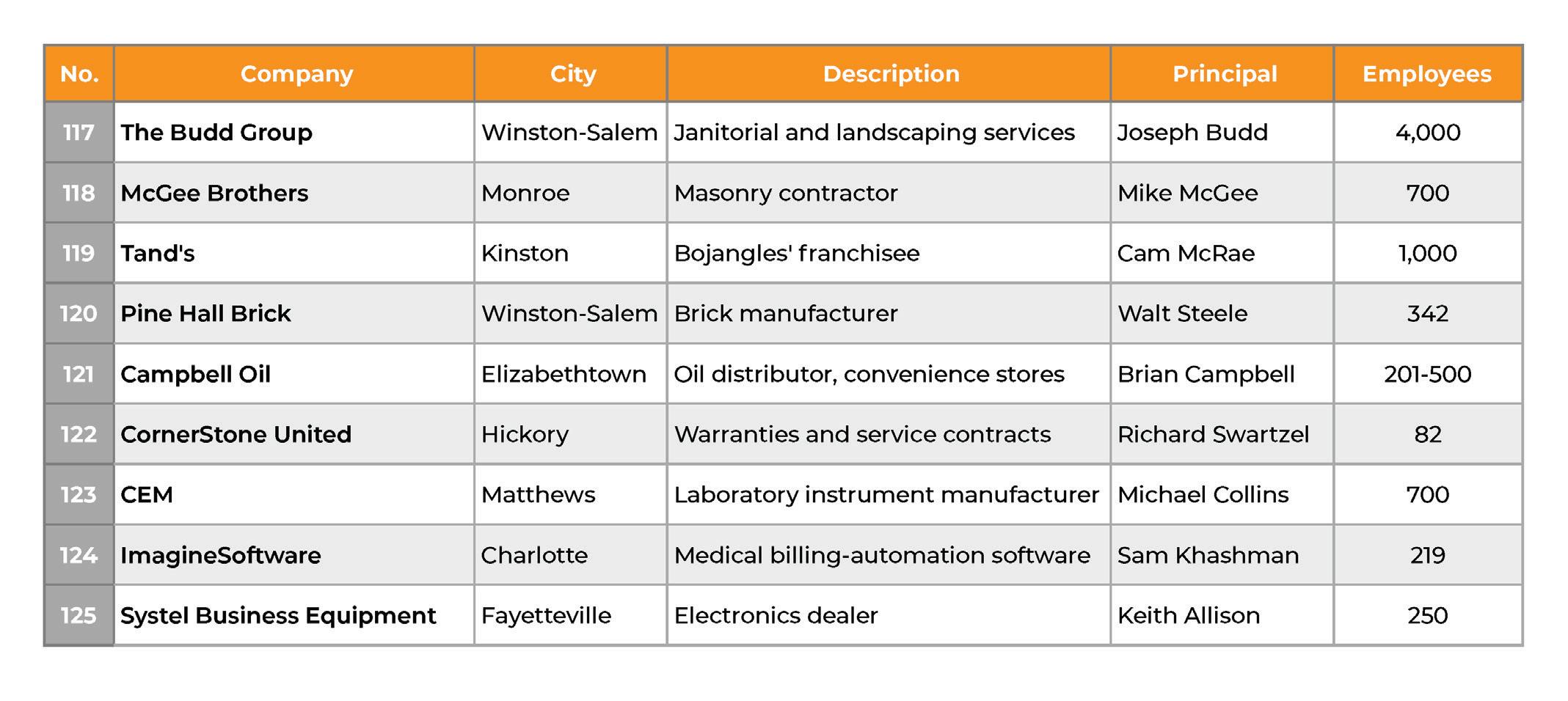

The annual list of the biggest closely held businesses that boost North Carolina’s economy.

BY MIKE MACMILLAN

It isn’t sexy, but the N.C. clinicalresearch industry keeps growing at a robust pace.

BY CHRIS ROUSH

Raleigh’s NovaQuest plays a pivotal role in boosting the state’s life sciences sector.

Thhe start of the school year always makes me consider the commitment to providing opportunities to society’s key assets, our kids and youth. Partisan e orts try to dumb down the issues, but it’s not simple stu . Fortunately, some folks do more than ponder, including the North Carolina Board of Science, Technology & Innovation, a unit of the N.C. Department of Commerce. For nine years, it has detailed how our state stacks up against other states on 42 measures of “innovation capacity.”

My colleague Ray Gronberg summed the report in our North Carolina Tribune newsletter: “We don’t have anything to get complacent about economically because we’re not doing as well as we may think.” at view matches the report’s overall tenor.

North Carolina’s GDP per capita, nearly $67,000 as of 2022, ranked 32nd nationally. e national average is about $77,600, and we’re trailing Georgia, Tennessee and Virginia. e latter state bene ts from massive federal outlays, but surely we can match the Peach and Volunteer states?

e report contends that a century of investing in infrastructure, institutions and human capital that fuels innovation has been insu cient to propel North Carolina’s income levels above the national average.

History teaches that North Carolina started from a tough spot, but made progress in the 1960s (lots of credit to Research Triangle Park) and the 1980s (both Reagan and Clinton administrations.)

But the state treaded water over the past 25 years, even as the Triangle and Charlotte metro areas became national business centers. Per capita income was 89% of the national average in 2022, versus 91% in 1998. Despite a fast-growing population, the state’s productive capacity and wage levels aren’t keeping pace overall, the report notes. e poverty rate remains above average.

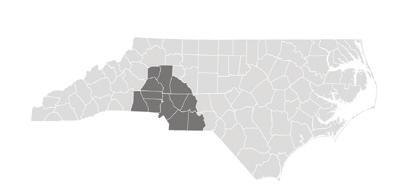

e study implies that North Carolina essentially has two economies. One is the

Charlotte and Raleigh-Durham metro areas, which account for about half of state GDP, and more than half of the “innovation measures” such as R&D, venture capital and educational attainment. e other economy is everyone else.

What is happening to break this apparent malaise, outside of the two big metro areas? Most of our state’s most powerful lawmakers, who don’t live in Charlotte and Raleigh, are sticking to a tradition of emphasizing higher education. at includes pumping $500 million into the NCInnovation e ort aimed at promoting research outside the three key research campuses in Chapel Hill, Durham and Raleigh.

Overall, the state spends a higher percentage of state GDP on higher education than all but four states. Conversely, it spends a lesser percentage on K-12 education than all but one state, citing Census Bureau data.

At the K-12 level, key Republican lawmakers are focused on promoting school choice initiatives, such as providing statefunded vouchers for private school. (Because of a legislative dispute, they’ve botched getting money to about 55,000 parents who want help paying tuition this fall, as of press time.)

Leaders appear disinterested in boosting teacher salaries to match regional or national levels. For now, N.C. teacher pay ranks low, re ecting distrust for a system that still teaches 80% of our students.

But let’s close on a positive note. Using its most current analysis, the report says that North Carolina ranks 11th nationally for its overall innovation economy. Virginia is 12th and Georgia, 25th.

“Overall, North Carolina’s statewide innovation ecosystem is healthy, has improved since the early 2000s, and at a rate comparable to the U.S. as a whole,” the report concludes. e success just needs to spread out. ■

Contact David Mildenberg at dmildenberg@businessnc.com.

PUBLISHER Ben Kinney bkinney@businessnc.com

EDITOR David Mildenberg dmildenberg@businessnc.com

MANAGING EDITOR Kevin Ellis kellis@businessnc.com

EXECUTIVE EDITOR, DIGITAL Chris Roush croush@businessnc.com

ASSOCIATE EDITOR Cathy Martin cmartin@businessnc.com

CONTRIBUTING WRITERS

Pete M. Anderson, Ray Gronberg, Michael MacMillan, Michael J. Solender

CREATIVE DIRECTOR Cathy Swaney cswaney@businessnc.com

GRAPHIC DESIGNER Pam Fernandez pfernandez@businessnc.com

MARKETING COORDINATOR Jennifer Ware jware@businessnc.com

ADVERTISING SALES

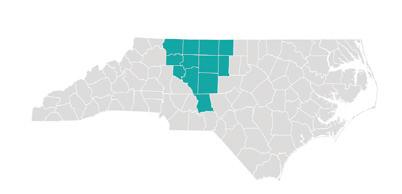

ACCOUNT DIRECTOR Melanie Weaver Lynch, eastern N.C. 919-855-9380 mweaver@businessnc.com

ACCOUNT MANAGER AND AUDIENCE DEVELOPMENT SPECIALIST Scott Leonard, western N.C. 704-996-6426 sleonard@businessnc.com

CIRCULATION: 818-286-3106

EDITORIAL: 704-523-6987

REPRINTS: circulation@businessnc.com

OWNERS Jack Andrews, Frank Daniels III, David Woronoff, in memoriam Frank Daniels Jr.

PUBLISHED BY Old North State Magazines LLC

PRESIDENT David Woronoff BUSINESSNC.COM

Cone Health CEO Mary Jo Cagle joined High Point University President Nido Qubein in the Power List interview, a partnership for discussion with some of the state’s most influential leaders. Business North Carolina’s annual Power List publication spotlights the state’s powerbrokers.

Mary Jo, your life has been extraordinary. You are the first woman and first physician to be the CEO of Cone Health. That’s got to make you feel really proud.

Well, I’m delighted to have been asked. It was really a big honor and it’s a big job. So there are lots of challenges, but lots of rewards as well.

Health care touches every one of us. What would you say is the biggest challenge you have in running Cone Health?

One of the biggest challenges that we face right now are the changes in the workforce during the pandemic. We had many employees who decided

Cagle is a Jasper, Alabama, native who knew from an early age that she wanted to be a doctor. She earned bachelor’s and medical degrees at the University of Alabama. She practiced as an obstetrician and spent much of her career in Greenville, South Carolina, before joining Greensborobased Cone Health as chief medical officer in 2013. She became CEO in 2021 and now leads more than 13,000 employees. This interview occurred before Cone announced in June it was being sold to Kaiser Permanente’s Risant Health startup. Comments were edited for brevity and clarity.

to retire. We had the phenomenon of the travel nurse who decided to move to different parts of the country and work. And we had to face how the workforce was changing, which created shortages. We had to approach how we were going to supply enough nurses, enough pharmacy technologists and laboratory technologists. Practically every organization had to deal with people either being sick or wanting to work remotely or work two or three days a week.

The hospital part of your business demands people being there, taking care of patients 24-7. How did you deal with that challenge?

We had to be very creative. Certainly we had to go out and have contracts with some of these traveling nurses as well as contract folks for our laboratory, and other areas as well. But now we began to say, perhaps we need to provide a different way for our team to work where it is possible.

We’ve allowed some of our staff to work remotely in areas that are nonpatient-facing, including backroom operations, HR and finance. We’ve also allowed greater flexibility and scheduling for our nurses. We’ve gone to some nurses who retired early and said, would you be interested in working 20 hours? We have to be innovative and flexible. We found more people who were willing to come and work with us as long as we’re more flexible with them.

Running the patient to payment cycle, the security, the maintenance – all of that strikes me as very complex. Multiply that with how you get paid, how you run your organization and so on. Is there a hope down the road that we can make this simpler and easier?

I do believe there’s hope. I don’t believe it will be easy. It will require many of us working together. But I do think there’s a better way coming. For the past 12 years, we’ve been working on what we call value-based health care.

Now, that’s an easy term to say, but harder to understand. We believe there is a way that we can increase the quality and safety of your care and decrease the cost and have you pay your premium once a year. And for us to take some of the risk.

As a health system, if we lower your cost, you do better also. With our goal of seeing you in a doctor’s office and keeping you healthy, the insurance company does better, and we as a health system do better. All of us have lower costs.

If we keep you out of the hospital and the emergency room and everybody stays healthier, the payers are not paying big hospital bills. Because we’re at risk and we have said we’re going to lower the cost of care, if we don’t lower the cost, we’ll pay a penalty.

Pay a penalty to whom?

Let’s say it’s Blue Cross Blue Shield, we’ll pay a penalty to them because we went over the limit of care. But if we lower the cost of care and we create savings, then we split the savings.

It’s a win-win for everyone because we saved people money. Ultimately, that ought to decrease what people are paying to have insurance. We’ve been able to prove over the last decade that our physicians and our health system working together can lower the cost of care and decrease the number of times people are admitted to the hospital.

We believe this can work and it’s time to scale it to more people.

Help me understand, as a layman in simple terms, why is health care so complex?

Part of the reason it is so complex is we built a system that is unnecessarily complex. Sometimes you get the results of the system that you’ve built.

There are all of these negotiations behind the scenes that are required to be confidential by law between the hospital and the insurance company. And the contracts are hundreds of pages long. Diagnoses by diagnoses, saying what will be paid. And then there’s the negotiations between the pharmacies and the hospital and the insurers that determines how much they’re going to charge for each drug. So you begin to see the layers of complexity that go into the billing. It would be very, very different if the patient just said, I’m going to pay the bill and we’ve removed that intermediary payer.

Can they afford it? If someone is making $40,000 a year, and they have to go have some kind of an operation, it can be thousands of dollars.

I would suggest that the cost would come down because part of the cost of the health system is there’s a whole department that does nothing but process bills from those payers, which adds another level of costs.

Is there a way to improve it? I think there is. Health systems like Cone Health have an obligation to lower our costs. Year over year, we’ve been removing cost from our system. We’ve been using lean processes, which manufacturers have been using for decades.

Last year, we removed $100 million worth of cost from our system year over year. But it requires intentional focus and a new way of doing things. And I do believe that we’re going to partner with the payers and to be at risk to intentionally lower the cost?

The payers want to make money, right? Are they really motivated to do that?

This week I had the opportunity to have breakfast with one of the CEOs of one of the payers. While we don’t agree on everything, we agree that ultimately our goal is the same: to provide great care at a better price. So I do think that if we could

focus on the things we have in common, the goals that we want to reach together rather than our differences, that we could get there. When there’s a will, there’s a way.

What is the most difficult part of your job?

I believe everything I do is through relationships with people. The pace of change today is faster than it’s ever been. Probably the most important thing I do is work with people to help them through the pace of change, to help them see and accept it, and to have a vision of the future and where they fit in it.

If people are experts at the way things are today, the idea of changing to a future where they have to give up their current expertise is not very comfortable. Letting go of that to go to a future that is somewhat unknown, where I will no longer be the expert, is quite daunting and difficult.

A big part of my job is to help people see a vision of the future where it’s OK to take an appropriate, calculated risk to move into the future.

What would you say to someone on a college campus who wants to do well in life?

Never give up on your dreams. Find people who can mentor you and encourage you. I was very fortunate as a 3-year old little girl to audaciously tell my family doctor, Dr. Carey Gwin in Jasper, Alabama, I want to be a doctor like you when I grow up. I grew up in a little town where if you made the honor roll, your name was in the paper, and Dr. Gwin would cut that out of the paper and send it to me and say, ‘You’re doing all the right things.’

When I was valedictorian of the high school, he cut it out and sent it to me. What a simple thing. What a very great impact. I would say, not only to young people, but to all adults, that you can have a huge impact by doing simple things.

I think what you’re saying is we all need heroes, models and mentors in our life. We need people who plan and see greatness. Work hard. Keep at it. Don’t say I can’t.

So speak out loud your dream. Go ahead. Speak it into existence and understand that it does take hard work and perseverance. Surround yourself with other people who’ve succeeded.

I also think I really believe in reading books about successful people. Dr. Gwin told my mother, go get this girl a library card. I read the biographies of all kinds of successful people, and it’s still a habit that I have. And I would really encourage young people to find some heroes and understand how they did it.

I’ve seen you in many settings where often you’re the only female in a world that’s dominated by male CEOs. I’ve also seen you stand tall and speak your piece with confidence and conviction. So you’re hopeful about health care and its delivery to more people through more affordable systems?

I am. I look at the young people who are still going into health care and people who are dedicated and passionate about making certain that we provide good health care to everyone, regardless of their color or their religion in a socially inclusive society. That gives me hope as long as we have the next generation who are called to serve. ■

With school back in session at North Carolina’s colleges and universities, alumni and donor relations activities are in full swing and year-end fundraising efforts are fast approaching for nonprofits of all types. And as summer turns to fall, nonprofit institutional investors are navigating their own season of change in the form of portfolio and risk management complexities inherent in today’s environment.

“As nonprofit organizations, including colleges and universities, continue to be tasked to do more with less against the backdrop of inflation and economic uncertainty, PNC’s support for these institutional investors is rooted in delivering solutions that are innovative, efficient and customizable,” says Raleigh-based Barb Harsha, PNC Institutional Asset Management® market leader for the Carolinas.

Bringing additional depth to PNC Institutional Asset Management’s local presence and commitment are the capabilities of such discipline-focused specialty groups as Nonprofit Solutions and Insurance Solutions, led nationally by Winston-Salem-based Henri Cancio-Fitzgerald and Charlottebased Wade Meadows, respectively.

This comprehensive scope of advice and solutions, says Harsha, allows the local PNC team of advisors and analysts to deliver on the full breadth of opportunities available to higher education and nonprofit financial decision makers. And no discussion these days is complete, she says, without addressing three ongoing trends in institutional asset management: Outsourced Chief Investment Officer (OCIO) services, planned giving and captive insurance companies.

At the most basic level, an OCIO model enables an organization to delegate responsibility for the day-to-day management of its investment program by shifting discretionary investment responsibility for some or all investment functions from the asset owner to an investment advisor, says Harsha.

As an alternative to in-house asset management and traditional consultant models, OCIO services can provide an effective vehicle for institutions looking to enhance their investment capabilities and gain fiduciary support, while allowing the organization to focus on the investment policy and oversee overall performance.

This is the thirty-third in a series of informative monthly articles for North Carolina businesses from PNC in collaboration with BUSINESS NORTH CAROLINA magazine.

“OCIO services are ultimately designed to help an organization reduce costs, better allocate resources, participate in more sophisticated investment strategies, take on greater agility and timeliness in their actions and more accurately report on results,” says Cancio-Fitzgerald. “As a result of PNC’s focus on scaling and growing this service in recent years, we have helped clients – including nonprofit organizations – realize cost savings and risk controls that were previously only available to much larger organizations.”

While a nonprofit’s primary focus is delivering on its mission – and raising the necessary funds to achieve that mission, a successful development office takes this focus one step further by incorporating gift planning and planned giving to advance or exceed fundraising goals, says Cancio-Fitzgerald. “A planned giving program targets funds that will benefit an organization for years to come,” he says. “It can be used as broadly as endowment-building or can be targeted to fund future projects.”

Barb Harsha

Establishing a planned giving program requires additional time and a strong acumen in administration, compliance, investment and donor relations. For many organizations, a planned giving program can begin as a reasonable in-house operation, but with growth and over time, the program can become burdensome as financial decision-makers balance day-to-day administration with managing relationships with this important donor set.

To help nonprofits address these challenges and maintain planned giving programs in a more passive manner, PNC Institutional Asset Management enables organizations to outsource the investment and back office functions of their planned giving program. “We also offer assistance with education, training and gift planning consultation to help organizations offer their donors a more thorough understanding of the organization’s charitable mission and articulate the many methods available to make an impact through gift planning and blended giving strategies,” says Cancio-Fitzgerald.

In recent years, a hardening commercial insurance market has generated increased interest in captive insurance companies, which function as direct insurers or reinsurers for an organization’s parent company or affiliates.

As the third-largest domicile for captive insurers in the U.S., North Carolina is known within the industry for its captivefriendly environment. Since the passage of the North Carolina Captive Insurance Act more than 10 years ago, the state has become home to more than 1,500 such licensed risk-bearing entities, according to the North Carolina Department of Insurance.

The potential benefits of a captive, says Harsha, include the ability to tailor coverage to the needs of the organization, better take advantage of often predictable insurance market cycles, offer creative risk solutions, provide coverage that the commercial markets do not and consolidate risk management.

“Typically, the primary reason for organizations, including nonprofits, to create a captive is to provide improved risk management, as captives can make financing risk more costeffective and ultimately reduce an organization’s total cost of risk,” explains Meadows. “As a platform for an organization’s risk management, captives also can help improve cash flow management and provide investment returns which, through

Weston Andress, Western Carolinas: (704) 643-5581

Jim Hansen, Eastern Carolinas: (919) 835-0135

proper captive management, can offer overall insurance premium cost savings.”

Because organizations have different needs, says Meadows, every captive should be structured differently. “Maximizing the benefits of a captive means understanding and responding to the various risk lines and concerns within the organization,” he says. Because a captive entity is subject to complex regulations, Meadows recommends that interested organizations conduct a feasibility study and analysis before making the decision to form a captive.

While the above-referenced strategies represent important considerations for nonprofit institutional investors in today’s market, Harsha is quick to note that each organization has its own unique set of opportunities and challenges to consider when it comes to managing assets, risks and fundraising.

“As a philanthropically minded and community-centric organization, we recognize the intrinsic value that the higher education ecosystem and nonprofit space create for the health of North Carolina’s economy and communities,” she says. “That reality is never far from our minds as we work alongside these organizations to deliver on their investment and risk management goals.”

These materials are furnished for the use of PNC Bank and its clients and do not constitute the provision of investment, legal, or tax advice to any person. They are not prepared with respect to the specific investment objectives, financial situation, or particular needs of any person. Use of these materials is dependent upon the judgment and analysis applied by duly authorized investment personnel who consider a client’s individual account circumstances. Persons reading these materials should consult with their PNC account representative regarding the appropriateness of investing in any securities or adopting any investment strategies discussed or recommended herein and should understand that statements regarding future prospects may not be realized. The information contained herein was obtained from sources deemed reliable. Such information is not guaranteed as to its accuracy, timeliness, or completeness by PNC. The information contained and the opinions expressed herein are subject to change without notice. Past performance is no guarantee of future results. Neither the information presented nor any opinion expressed herein constitutes an offer to buy or sell, nor a recommendation to buy or sell, any security or financial instrument. Accounts managed by PNC and its affiliates may take positions from time to time in securities recommended and followed by PNC affiliates. Securities are not bank deposits, nor are they backed or guaranteed by PNC or any of its affiliates, and are not issued by, insured by, guaranteed by, or obligations of the FDIC

By Michael J. Solender

Miranda Mounts knows her social media audience is hungry to experience Charlotte’s hottest restaurants.

Her marketing company, Where to Eat Charlotte, works with restaurant owners to increase awareness and drive tra c to their businesses.

“Every restaurant starts with a story or an idea,” she says. “We share a deeper dive into why the restaurant is what it is, and what makes every restaurant special. It’s not just dining out, it’s (making the) connection.”

Collaboration is key for Charlotte restaurateur Andre Lomeli, who has worked with Mounts for two years to promote his Mexican restaurants Mal Pan and El Malo. “We have an annual package of posts with Miranda,” he says, along with separate e orts to boost late-night or brunch specials. “ ey drive tra c. We see sales spike for up to a month a er the posts. It absolutely works for us.”

As of August, Mounts’ Instagram account, (@wheretoeatcharlotte) had more than 191,000 followers. Eager to connect with her audience, Charlotte restaurants such as Mal Pan, Yama Asian Fusion and Community Matters Cafe are paying for social media posts, videos, story bundles and promotions via the Instagram, Facebook and Tik Tok channels. Her features on openings, new o erings, specials and latest deals typically score thousands of engagements. ese likes, comments and shares are the coin-ofthe-realm for restaurateurs seeking diners with dollars to spend.

Originally from Columbus, Ohio, Mounts, 30, moved to North Carolina to play varsity volleyball at UNC Wilmington. A er earning a bachelor’s in communications and media studies, she worked in sales for a seafood wholesale company. She moved to Charlotte in 2018 and started a food blog for fun, re ecting her love for restaurants.

“About a year in and as my audience grew, restaurant owners began asking if I could do an exchange, if they could give me free food to do a post. My business has evolved from that.”

Mounts doesn’t view herself as a food critic, unlike dozens of others who cover North Carolina restaurants for media outlets or their own digital programs. Her limited liability corporation has expanded with a podcast that debuted in July;

a revamped website featuring curated restaurant guides and a periodic newsletter. She has tapped a consultant to help her with marketing, new products and pricing.

Of Instagram’s 104 million Instagram users, 10.2 million are considered in uencers, capable of swaying purchasing decisions and audience behavior, according to the In uencity research rm. at’s four times as many people with such in uence as in 2020, the group says.

Like many in uencers, Mounts’ most valued asset is probably the skill of re ecting her personality through colorful, creative posts. She o ers a plucky girl-next-door, wiser-sister vibe that appeals to women and men alike.

“Social media is integral to being successful as a restaurant,” says Corri Smith, owner of Charlotte-based Black Wednesday, a public relations and social media rm. “ ese are small businesses. ey don’t have huge budgets for billboards, automated websites or commercials on TV. ey rely on more organic forms of marketing, such as social media, online reviews and word of mouth.”

In uencers add value by “putting together directives, what to do, where to go, where to eat, what’s cool, what’s new,” she says. “People are looking for direction, they don’t know where to go, and (a recommendation) makes their lives easy. ere’s a big opportunity there for people that want to make other people’s lives easy.”

at’s especially true for the crowd in the 18-44 age range who make up 78% of Mounts’ audience. ey are most coveted by many restaurant owners because of their dining out habits. For diners belonging to Gen Z (born between 1997 and 2012), and the Millennial cadre born between 1981 and 1996, eating out is a frequent, planned-for expense. About 36% of the those cohorts plan to splurge on dining out, according to a McKinsey & Co. report.

Smith says in uencers tend to fall into three categories, with “micro-in uencers” having fewer than 10,000 followers and may get paid with a free meal as a trade. e next tier of as many as 40,000 followers seeks a combination of trade and payment, while those with bigger followings are most likely to charge fees for various services.

Fees are always negotiable and vary widely by service, product and in uencer. But Smith says a rule of thumb is a cost of about $11 per thousand followers. So someone with 100,000 followers might be able to charge Restaurant X more than $1,000 for an Instagram post.

A key selling point of social media is that sales data can help evaluate a campaign’s e ectiveness. But other metrics are less tied to immediate revenue returns and might focus on brand burnishing, for example. “ e launch of a seasonal menu or introducing a new promotion, we’re looking at

in uencers to have an ongoing relationship with restaurant clients,” Smith says.

Mounts says her fees are competitive, given her reach, engagement rate, and quality of work. “ ere’s an extensive process before we highlight a restaurant,” she says, noting she checks health department ratings, visits each restaurant and meets the owner to see if the business aligns with her standards and values. “We work with a variety of budgets and are exible with how we showcase our clients.”

It’s a larger mission for Mounts than just advising her followers where to eat. “ ere’s a deeper passion rooted in something a lot bigger, though. We’re highlighting stories,” she says. “ at’s a calling to me, it’s connecting these people to an experience, and of course to the food.” ■

A $63 million College of Education building is among the projects helping revitalize Fayetteville State University. It is expected to open in 2026

Military appeal, summer courses, state lawmakers’ support and a popular restaurant signal a revitalized Fayetteville State University.

By David Mildenberg

Buying half of a strip shopping center near the Fayetteville State University campus that the school didn’t already own may be a relatively small real estate transaction. But the $5 million transaction signals the institution’s bigger ambitions.

A Chick- l-A is opening this month at the Bronco Midtown development, which since 2002 has housed a mix of o ce and retail tenants, including the Greater Fayetteville Chamber. Fayetteville State spent about $1 million on updates, a sliver of the $200 million in capital projects aimed at improving the second-oldest UNC System university, which dates to 1767.

“We’re very appreciative of the signi cant investment that is being made,” says Darrell Allison, who became chancellor in 2021 a er serving on the UNC System Board of Governors. “It’s already helping us turn the corner. We want to be an institution that sustains these gains and continues to be desirable and a ordable.”

Allison inherited one of the state’s most challenging higher education jobs. “We were last in student retention of the 16 campuses, last in graduation rates, and last in alumni giving,” he says.

Still, there’s a clear demand for the public university in the state’s h-largest city. Fayetteville State’s enrollment increased 16% between 2014 and 2023 to about 6,850,

including about 1,000 graduate students. Overall, UNC System enrollment gained 9% during the same period.

About a h of Fayetteville State’s students graduate within four years and a third within ve years, according to system statistics. at compares with a four-year graduation rate of 50% for the entire system, and a 65% ve-year rate.

Nobody likes that performance, though there’s plenty of history to explain some of the challenges. About half of Fayetteville State’s students are age 25 or older, compared with about 30% for the UNC System.

Fayetteville is among the system’s ve historically Black campuses, which have historically struggled to receive resources. It’s the last system campus to add a substantial recreation center, which Allison says has become an essential tool to recruit and retain students and faculty. Fayetteville State’s wellness center is slated to open in January 2026.

While a designated HBCU, nearly 40% of Fayetteville students are not Black. at compares with fewer than 15% at the state’s two largest HBCUs, N.C. A&T State and N.C. Central universities.

Fayetteville’s main economic driver is Fort Liberty, the largest U.S. military base that is located eight miles from the university campus. It has a transitory population with di erent needs than a traditional college campus.

To improve graduation and retention rates, Allison has stressed a ordability and convenience for a student population that di ers from most N.C. campuses. In 2022, Fayetteville State joined the state’s NC Promise program that limits tuition to $500 per credit hour for in-state undergraduate students.

Allison also has helped create a public-private fund that provides free tuition for military-a liated students. “We’ve seen a 25% increase in the number of military students since [2021] with about 33% of our nearly 7,000 students military-a liated. We lead the system by far in that category.”

Bee ng up summer programs has become a key agenda. Two-thirds of students took summer courses this year, a much higher percentage than the UNC System average. Incoming freshmen are promised 28 credithours of tuition-free summer courses,.most are o ered online, which Allison says is preferred by most students and instructors.

Emphasizing high-demand educational areas is essential, so Fayetteville State is bee ng up programs in cybersecurity, supply chain and construction management.

“Our leading question is whether our education is really worth it and how do we respond with an emphatic yes,” Allison says. “We know we have to be exible and change strategically to meet students where they are.” ■

By Chris Roush

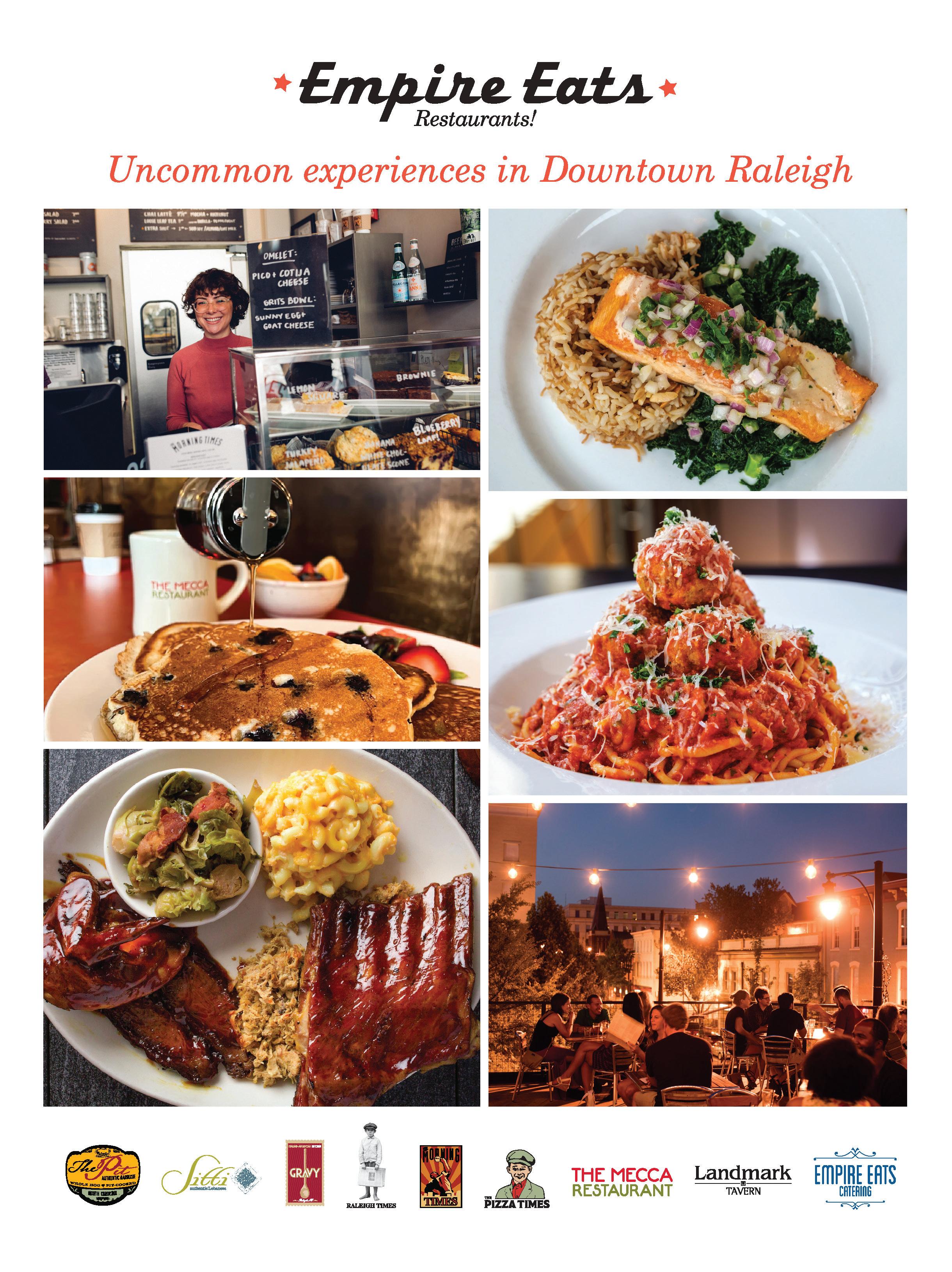

Downtown Raleigh’s revitalization hinges on friendships, groceries, safety and Dix Park.

When Larry and Randall Miller’s children moved out of their Cary home, the couple decided they wanted to live in a more urban environment. So they moved into a 1,600-square-foot condominium in the Glenwood South neighborhood of downtown Raleigh. Now, they can walk to a Publix grocery story and their favorite restaurants.

“Cary was a good place to raise kids, but we wanted a place that was more walkable,” says Larry Miller. “We’ve met a lot of people and made a lot of friends. When we lived in Cary, we’d drive home at the end of the day and go into the garage and close the door and that was about it.”

Raleigh is looking for more people like the Millers. Over the past year, economic development boosters have implemented a plan to make the downtown more attractive for residents and visitors. Art and exercise equipment were added, along with signs directing people to the three big state museums near the state Capitol. ey also encouraged restaurants to add outdoor seating on Fayetteville Street, the city’s main drag.

“You have these beautiful wide sidewalks on Fayetteville with the pavers,” says City Council member Jonathan Melton, who lives downtown and rides his scooter or walks. “I think we have a real opportunity to recalibrate and reinvent that space.”

Now, the group is looking beyond Fayetteville Street. Talks are being held about creating pedestrian and biking paths between Dix Park and the downtown district, especially the convention center and hotels. at follows an April trip to Atlanta in which a group of city leaders saw the Georgia capital’s hugely successful Beltline network of public parks, trails, transit and a ordable housing projects along a historic 22-mile railroad corridor.

Connecting downtown to Dix Park is “one of the more strategic issues of Raleigh’s next phase,” says Dix Park CEO Janet Cowell, who is leaving that position in October and is running for mayor. City leaders and the nonpro t Dix Park Conservancy are redeveloping the former location of a state mental-health hospital that is a mile southeast of downtown.

Businesses and real estate developers are paying attention. In the rst quarter, 19 new businesses opened downtown, with ve closings. ere are more than 2,200 residential units (up from 786 units right before COVID started) and 410 hotel rooms under construction. A $387.5 million expansion of the Raleigh Convention Center will add 300,000 square feet when it’s completed in 2028.

In July, JLL Capital Markets raised $85 million of debt and equity nancing for the 252-unit Oldham & Worth, an apartment development located in downtown’s West End neighborhood. It’s the second phase of Kane Realty’s re-development of contractor Clancy & eys’ headquarters; the rst phase of Platform apartments is now leasing for $1,250 to $4,000 per month.

Meanwhile, CBRE has begun leasing retail space at e Creamery, a downtown mixed-use development slated to include the 306-unit, 37-story Highline Glenwood apartment building from developer Turnbridge Equities. It is expected to break ground early next year and would be Raleigh’s tallest building.

Like many center cities, Raleigh is ghting perceptions of too much crime and homelessness. e Downtown Raleigh Alliance hired two social workers two years ago to help homeless people nd shelters and permanent housing. It also pressed Raleigh police to increase patrols, resulting in a 22% decrease in crime in the past year, with burglaries down 70%.

David Meeker, who owns several downtown businesses and properties, says his State of Beer sandwich and beer shop has seen a 15% increase in sales since developer Trammell Crow opened its 400H apartment complex this past year. e 242-unit building is three blocks west of the state Capitol.

Still, the pandemic caused many workers to abandon downtown. “It felt like the comeback should have come quicker,” Meeker says. “ is year, downtown Raleigh feels di erent and more active.” In the downtown district, food and beverage sales have increased 7.9% this year, while hotel room revenue is up 6.7%.

Raleigh-based Kane Realty has added two downtown residential developments in the past ve years, says CEO Mike Smith. Both feature grocery stores, the aforementioned Publix at the Smoky Hollow development and a Weaver Street Market at Kane’s Dillon apartments. Kane is the developer of North Hills, the mixed-use district ve miles north of downtown that has attracted more than $1 billion of development over the past two decades.

“ e key to having residents and vibrant downtown communities is to have groceries,” Smith says. He predicts major growth in downtown Raleigh’s west side because of the Dix Park revitalization.

When Downtown Raleigh Alliance CEO Bill King rst saw the city a decade ago, it was considering whether to be a “big city or more of a town.” e reality is that Raleigh “is growing rapidly. And the issues are more complicated. We’re a big city now.”

About 5,400 people live in an area bounded north-south by Peace Street and Lenoir Street and east-west by East Street and West Street. Average rents have dropped to $1,807 from a high of $1,916 in early 2022 mainly because of increased supply.

DOWNTOWN RALEIGH RESIDENTIAL UNITS UNDER CONSTRUCTION:

King would like to see more minority- and women-owned businesses populating the district. Downtown businesses are 90% locally owned and 46% women-owned. Attracting life sciences companies and labs is another goal, similar to e orts that have proved successful in neighboring Durham and Chapel Hill.

e Alliance counted about 1.5 million unique downtown visits in the rst quarter, nearing their pre-COVID level of 1.6 million in the rst three months of 2019. Overall downtown storefront occupancy is about 84%, though it’s only about 70% on Fayetteville Street.

Connecting Dix Park to downtown is complicated by the four-lane Western Boulevard and some railroad tracks that make it challenging for pedestrians. Among the solutions being oated is a gondola or a pedestrian bridge covered with grass and trees.

“It ought to be connected,” says King, noting convention attendees would enjoy early morning walks or runs to the park. “We need to gure out how to get from here to there.” ■

Foreign companies seek growth in Transylvania County.

By Kevin Ellis

Gisele Bündchen’s face has graced more than 1,200 magazine covers in a decades-long career. She even out-earned her former husband, retired NFL quarterback Tom Brady, during his Super Bowlwinning years.

Last year, work brought Bündchen to Brevard in western North Carolina, far from the usual fashion hotspots where one might expect to see a supermodel. But the Brazlian, who now lives in Costa Rica, wasn’t there for a Versace photoshoot.

Bündchen had become a “wellness ambassador” for Gaia Herbs, one of an increasing number of biotech and life sciences companies that are making their headquarters in Transylvania County.

Bündchen’s visit explored how Gaia Herbs manages its 350-acre farm, where it grows between 30 and 40 di erent types of plants that make up about a quarter of its total botanical usage, says Brian Traylor, who joined Gaia Herbs in 2016 and has been its chief operations o cer since 2021.

“She wanted to come out to the farm and get her hands in the dirt,” he says.

Gaia Herbs started in western Massachusetts in 1987 and moved to Brevard in 1996. Founder and former CEO Ric Scalzo was drawn by the region’s biodiversity and favorable soil and climate conditions. Despite its long history, a former executive described the company as the “biggest secret” in the industry and an “incredibly quiet company.”

Bündchen’s star power has helped ignite social media buzz, bringing Gaia Herbs exposure on health-related programs along with name drops in news articles about Bündchen in publications ranging from People magazine to Harper’s Bazaar.

When the CBS TV show “Sunday Morning” featured Bündchen talking about “modeling, divorce and her true self,” part of the 8-minute segment showed Bündchen at the picturesque Gaia Herbs farm talking about her children liking the products, and her years as a customer, speci cally Gaia’s Black Elderberry Syrup in support of immune health.

“She’s a great ambassador for us,” says Traylor.

Gaia deserves credit for helping cement western North Carolina’s reputation in natural products, says Jonathan Snover, who heads the Asheville o ce of the Durham-based North Carolina Biotechnology Center.

A er starting with about 90 employees in North Carolina, Gaia Herbs now has about 250, with 100 at a distribution center in Mills River in neighboring Henderson County, says Traylor. Another 20 temporary agricultural workers stay for seven to eight months on visas during each growing season.

Gaia Herbs sells products nationally at Whole Foods, Sprouts and other retailers, while e-commerce is its fastest-growing segment and accounts for about as much as 45% of sales, Traylor says.

e private company declined to share nancial details except to say it is experiencing consistent annual growth. e global herbal supplements market grew 7.5% last year to $10.14 billion in 2022 to $10.91, according to Reportlinker.com, and is expected to expand to $14.8 billion by 2027.

Gaia Herbs is the old-timer of the cluster of companies. Two more recent entries, Pisgah Labs and Raybow USA, received $71 million in foreign investment from India and China for expansions, says Burton Hodges, executive director of the Transylvania Economic Alliance.

“Each one has its own story, but the fact that they’re all three in such a small town as Brevard is interesting,” says Snover.

It’s unclear why particular kinds of companies congregate in particular areas, he says. North Carolina has emerged as one of the most signi cant agriculture-tech hubs in the U.S., but not all areas of the state are equal, he says. Some have built-in advantages, such as Raleigh, which includes the Research Triangle Park.

“ e ‘R’ in RTP is for research and the Triangle references three major research universities (NC State University, Duke University and UNC Chapel Hill),” says Snover. “ ose are assets more rural communities in North Carolina, and frankly in most other states, cannot duplicate.”

But communities can play to their strengths. “ at’s how our region has garnered the life science companies that are already here,” he says.

“From my perspective, the answer would be that some people just want to live in a beautiful place and start a company,” says Snover. Mountainous Transylvania County, which is famous for its waterfalls, certainly quali es. “And, you know, I want to nd more of those people.” ■

While they don’t have Gisele Bündchen out ont, Transylvania County’s Pisgah Labs and Raybow have strong stories. Both were bought by much larger foreign businesses. Both have expansion plans underway.

Ipca Laboratories, based in Mumbai, India, paid about $9.6 million for Pisgah Labs in 2018. Pisgah Labs started in1981 and makes active pharmaceutical ingredients for other drugmakers. Pisgah had seven employees at the time of the sale, says Dani Bradley, a 27-year company veteran and now the Pisgah Labs site manager for Ipca.

Where previous owners located the company on a 125acre site, Ipca has helped the company grow, says Bradley. In 2022, Pisgah Labs announced a $55 million investment to expand, promising 57 new jobs with average annual salaries of almost $60,000. e company has grown from 28 to 45 employees since then, and should have more than 100 in the next four to ve years, Bradley says. Pisgah Labs will be able to make sterile injectables and liquid/oral pharmaceuticals a er the expansion.

“ ere’s really nothing else like us in the area that does what we do,” she says. Blue Ridge Community College helps with worker training, as most jobs at the company don’t require a college degree.

China-based Jiuzhou Pharma bought PharmAgra Labs in 2019 from North Carolina entrepreneurs Peter Newsome and the late Roger Frisbee for a reported $16 million, and renamed it Raybow USA. e company had about 30 employees, including about a half who hold doctoral degrees.

In 2021, Raybow announced a $15.8 million investment to create 74 positions over the next ve years. Raybow provides contract research and development in organic and medicinal chemistry. ■

By Kevin Ellis

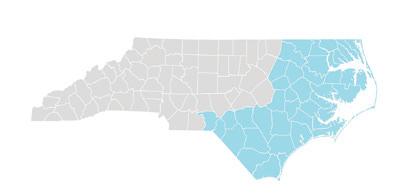

dgecombe County, which hasn’t had an unemployment rate lower than 5% since 1990, has attracted a $1.4 billion, 1,062 job project that is raising hopes for economic rebirth in northeast North Carolina.

ESanta Clara, California-based Natron Energy evaluated more than 70 sites across nine states before selecting the 2,187-acre Kingsboro megasite, about nine miles east of downtown Rocky Mount. Natron will occupy about a h of the site, or about 437 acres.

Its proposed 1.2-million-square-feet facility would build sodiumion batteries, with production launching in 2028. Average salaries are expected to be nearly $64,100 annually, which is 40% more than the county average of about $43,200.

Natron picked Edgecombe County over sites in South Carolina and Tennessee because of incentives, operating costs, available talent pool and supply chain considerations.

“ is is the best place for our new home. We choose to build here, we choose to grow here for decades to come,” says Natron co-CEO Colin Wessells, who founded the company in 2012 as a Stanford University graduate student.

State and local incentives total about $186 million over the next 12 years, including nearly $130 million in tax subsidies from the county. Most of the money won’t transfer to Natron until they hit investment and job targets.

While Edgecombe’s unemployment rate was 6.1% in June, North Carolina’s overall rate hasn’t exceeded 4% since December 2021.

Edgecombe started acquiring land for the Kingsboro megasite in the early 2000s, according to the Economic Development Partnership of North Carolina. In 2017, Chinese-owned Triangle Tyre announced plans for an 800-employee tire-making operation, but canceled the project in 2022.

About 345,000 potential workers live within an hour’s commuting distance of the site, which is about 15 miles from Interstate 95, says Rocky Mount Mayor Sandy Roberson. Consultants hired by the

EDPNC ranked the site No. 1 in the state for readiness. No other site considered by Natron was comparable, Wessells says.

“It’s sort of our eld of dreams,” says Roberson. “It’s not just a piece of land, it’s a gateway to opportunity.”

Natron’s announcement builds on North Carolina’s reputation as a “battery belt” leader. e biggest project is Toyota Battery Manufacturing’s planned $14 billion complex, expected to eventually employ more than 5,000 in Randolph County. In Durham, Kempower opened its EV charging manufacturing headquarters in June and has 120 employees, with plans to hire 200 more.

Natron will manufacture batteries for various industrial, datacenter and military uses and EV fast-charging stations. Its technology is distinct from the lithium-ion batteries used in most electric vehicles developed by Toyota and others.

Natron says its batteries are non- ammable and do not require lithium, cobalt, copper or nickel, most of which comes from outside the U.S. Instead, sodium-ion batteries rely on a domestic supply chain, including aluminum, iron, manganese and sodium electrolyte.

Last year, the company raised $318 million from private investors, including United Airlines, which plans to use the batteries for its airport operations. In 2020, the U.S. Department of Energy granted Natron about $20 million to support “potentially disruptive new technologies.”

e Edgecombe site will expand Natron’s current production capacity by 40 times. It opened a much smaller manufacturing facility in Holland, Michigan earlier this year.

“You couldn’t draw up any better company or design anything better when you think about the need for electri cation. is is a safe product that is for the most part U.S.-based,” says Bob Pike, CEO of Carolinas Gateway Partnership, which promotes Nash and Edgecombe counties and the cities of Rocky Mount and Tarboro. “It is a paradigm shi in terms of a disruptive product. We have a tremendous asset with Natron being our catalyst.” ■

ServiceTrade, a leading provider of software solutions for commercial service contractors, is excited to announce the appointment of William Chaney as its new Chief Executive Officer. Chaney brings a wealth of experience and a proven track record of leadership in SaaS software, specifically for field service contractors. With a career spanning over twenty-five years, Chaney is well-equipped to lead ServiceTrade into its next growth phase. With software solutions tailored to fire protection and mechanical contractors’ unique needs, deep customer relationships, and a unique combination of industry and SaaS technology expertise, ServiceTrade is poised for continued success and industry-leading growth.

Goodwyn Mills Cawood (GMC) has expanded its landscape architecture services to the Carolinas with the addition of Tripp Barrineau as vice president of landscape architecture in the firm’s Charlotte office. His almost two-decade career includes working with municipalities, architects and private developers to achieve their vision. He has a passion for preserving the natural environment in his planning of greenways, streetscapes, trails, creek restoration, environmental improvements and more.

BNC’s Movers + Shakers offers an exciting way to announce executive hires, promotions, board appointments, special announcements and philanthropic activities Your news will be published to 17,000+ emails of top executives throughout NC, seen on Business North Carolina’s website, and printed in our magazine.

Premium Listing: For $325, submitted premium Movers + Shakers listings will appear online and in our Daily Digest newsletter. Submissions will also appear in the next published issue of Business North Carolina.

Standard Listing: For $125, submitted standard Movers + Shakers listings will appear online and in our Daily Digest newsletter

by Melody King and Bill Durr

One's ownership in a closely held business (often a family business) may be affected by a separation or divorce. In many situations, the business will be joined as a party in an equitable distribution lawsuit (the term used in North Carolina for a lawsuit involving the division of marital property after a married couple separates). Once the business is a party to the lawsuit, it might need its own attorney – separate from the attorney for the spouse with the ownership interest.

There are three essential steps in any equitable distribution lawsuit: classification, valuation, and distribution.

Classification

Initially, the Court/attorneys must determine what property might be subject to distribution. Property is a very broad term and includes LLC membership interests and shares in any corporation.

"Marital property" means all real and personal property acquired by either spouse or both spouses during the marriage and before the date of separation. Marital property includes, but is not limited to, ownership interests in businesses. Marital property is distributed between spouses in an action for equitable distribution.

If, during the marriage, a spouse acquires an interest in a closely held business (including a family business) and that acquisition does not come about by gift or inheritance, the interest will be classified as marital property, and the interest will have to be valued. It does not matter that your spouse is not a legal owner of the business.

"Separate property" means all real and personal property acquired by a spouse before the marriage or acquired by gift or inheritance during the marriage. Separate property is generally not distributed in an equitable distribution action, with exceptions as outlined in this article.

Business interests are often acquired before the marriage or acquired during the marriage by gift or inheritance, most often from a parent. One might conclude that this business will be classified as separate property, and the spouse will not be entitled to any share of the business's value. Well, not so fast…

How might a non-owning spouse acquire a marital interest in a business that is by definition the separate property of the recipient/owning spouse? The most common answer is through the contribution of "funds, talent, or labor" of the marriage. One or both spouses may contribute marital funds to the business or work in the business during that marriage. To the extent the value of the business increases due to marital contributions or efforts, the increase in the business's value due to these contributions or efforts likely will be considered marital property.

Another way to analyze whether some component of a family business may be a marital asset is to consider an active/passive analysis. If the value increased passively (for example, through market factors or the labor of third parties), then the business will likely remain separate. If the value increased actively (for example, through the management or labor of one or both spouses), then there will likely be a marital component to the business.

Quantifying the increase of a business due to marital contributions is a diff icult task. The valuation process often requires one or both parties to retain a business valuation expert. Presentation of credible evidence as to the value of the business is critical, and failure to present credible evidence could lead to an unfavorable value or the court's refusal to value and distribute the property.

The final step of the process is to distribute the property.

So how will the business be distributed? If the ownership interest is a marital asset, then a Court could distribute the ownership interest to one spouse, both spouses, or, conceivably, to the spouse who previously had little or no involvement in the business.

The analysis becomes far more complex if the owning spouse acquired his/her ownership interest in the family business through gifts made to him/her by her parents, but he/she worked in the business and was the driving force behind the family business's growth throughout the marriage. Let's complicate it even further: the non-owning spouse also worked in the family business and is very familiar with the business operations. Could the Court distribute to the non-owning spouse an ownership interest in the business? It is possible.

First and foremost, do not comingle/contribute marital property into a business that is otherwise your separate property. It is also advisable to distance your spouse from a business that is otherwise your separate property. However, the most protective strategies to limit the exposure of a business in an equitable distribution action is through written agreements.

A premarital agreement is one option. A business owner may insist that any family member who has an ownership interest in the business, or who might acquire a future interest, enter into a premarital agreement. This is far more common than one might expect.

If you or a family member is already married, then a post-marital agreement is an option. For example, prior to gifting an ownership interest to a child or grandchild, one might require the married recipient of the gift to execute a post-marital agreement with the recipient's spouse.

A third option, which can be combined with either of the first two options, might be the modif ication of the business's governing documents so as to specify who may hold an ownership interest in the business, as well as certain buy-out provisions in the event of separation or divorce. However, if one utilizes only this third option, it does not eliminate consideration of the value of the spouse's ownership interest in the business as a part of the equitable distribution process.

It is important to understand that unless additional steps are taken, a thriving family business may experience unintended and disastrous consequences. ■

Melody

King Family Law Attorney

mjking@wardandsmith.com

Bill Durr

Family Law Attorney

wsd@wardandsmith.com

Read additional articles in our new series "The Power of Preparedness" throughout September at wardandsmith.com

This article is not intended to give, and should not be relied upon for, legal advice in any particular circumstance or fact situation. No action should be taken in reliance upon the information contained in this article without obtaining the advice of an attorney.

Cogentrix Energy, an independent power producer, was sold to Quantum Capital Group, a Houston-based private equity firm, for $3 billion. Cogentrix reported $640 million in revenue in 2023. It has ownership interests in 27 facilities in 14 states and the Dominican Republic. It is a leader in the cogeneration of power produced at manufacturing sites and sold to Duke Energy and other utilities. The seller is private equity group Carlyle, which bought Cogentrix in 2012.

Jacksonville, Florida-based Zawyer Sports and Entertainment bought a majority interest in the Charlotte Checkers hockey team. The team will continue to play home games at Bojangles Coliseum. Michael Kahn, who had held majority ownership since 2006, will remain the largest minority partner.

Krispy Kreme agreed to sell a majority stake of Insomnia Cookies for more than $172 million It is retaining a 34% stake that is valued at $350 million. Insomnia Cookies has more than 250 locations worldwide. The new majority owners are Verlinvest and Mistral Equity Partners.

Elevation Church , the megachurch led by Steven Furtick, took in $108 million in tithes and offerings in 2023, according to its annual report. That compares with $104 million in unrestricted donations a year earlier.

Dentsply Sirona, the largest manufacturer of professional dental products and technologies, plans to lay off as many as 640 workers globally. The company has 16,000 employees and operations in 40 countries. The restructuring may save as much as $100 million annually.

Columbus McKinnon will close its Duff-Norton manufacturing site on Sept. 29, resulting in the loss of 73 jobs. Some of the work done at the site here will be moved to a plant in Monterrey, Mexico.

Driven Brands appointed Michael Diamond as chief financial officer of the automotive service company. He had been CFO of The Michaels Cos. since 2020.

Truist Financial signed a seven-year agreement as title sponsor of the PGA Tour’s annual stop at Quail Hollow Club. Financial terms weren’t disclosed. The event will be renamed the Truist Championship. Wells Fargo had been the title sponsor since 2003. Next year’s Truist Championship will be held May 5-11 at The Philadelphia Cricket Club’s Wissahickon Course. Quail Hollow is hosting the 2025 PGA Championship, one of golf’s four major tournaments.

TD Bank named Chris Ward regional president of the mid-south metro region, which includes Delaware, Maryland, the District of Columbia, Virginia, North Carolina and South Carolina. Ward will oversee more than 4,000 employees and 135 branches. He has been the small business credit executive at Bank of America since 2017.

The North Carolina Department of Transportation will open express lanes on Interstate 485 here by late next summer. The project will add an express lane in each direction on I-485 between I-77 and U.S. 74 (Independence Boulevard), and a general-purpose lane each way between Rea Road and Providence Road. Construction started in 2019 and completion was initially set for 2022.

Transportation company RXO secured $550 million in private financing to aquire a UPS subsidiary. RXO struck a deal with MFN Partners and accounts managed by Orbis Investments. RXO is acquiring Coyote Logistics from UPS for about $1 billion.

Habitat for Humanity of Gaston County will join Habitat for Humanity of the Charlotte Region by Oct. 1. The affiliate will operate under the Habitat Charlotte Region name and serve Gaston, Iredell and Mecklenburg counties.

CommScope will sell two business units to Connecticut-based Amphenol for $2.1 billion in the first half of 2025, pending regulatory approval. Amphenol is buying the company’s outdoor wireless network and distributed antenna systems units. CommScope is seeking to reduce its $9 billion debt load. The two businesses are expected to have combined sales of $1.2 billion this year. They have 4,000 employees.

A donor gave $200 million to Catawba College. Two-thirds of the money will come as unrestricted funding, while the balance is reserved for environmental and conservation efforts. The Catawba donation follows a $200 million gift in 2021 that has helped push its endowment to more than $580 million. The college enrolls about 1,230 students. While the donor asked to remain anonymous, Salisbury is home to billionaire investor Fred Stanback, who has been a generous donor to Rowan County and environmental causes for many years.

Houston-based Data Journey spent about $4 million on a former Bed Bath & Beyond data center in Claremont and converted it into a facility to lease for hosting servers and other network equipment. The colocation center will serve local and regional clients. The investment in the building was almost $7 million, including expenses related to the prior owner’s bankruptcy.

Atrium Health and the family of former owners of Cannon Mills settled their lawsuit over a $17 million family trust. Half of annual net income distributions will go to Wake Forest University Baptist Medical Center, which is part of Atrium Health. A deleted section had named the former county-owned Cabarrus Memorial Hospital as the recipient of distributions; Atrium gained ownership of the hospital. It remains unclear who gets the other half of the income distributions. Atrium Health acquired Wake Forest Baptist in 2020.

Smithfield-based Deacon Jones Auto Group acquired Performance Automotive from co-owners Ingrid Burgess and Terry Lee.The deal includes the former Chrysler-Dodge-Jeep-Ram and Ford dealerships.

The new Amazon Fulfillment Center near Fort Liberty has opened. The 1.3 million-square-foot facility located in the Military Business Park plans to hire 1,000 employees.

American Titanium Metals will invest $868 million and create 304 jobs with a 500,000-square-foot titanium plant that’s expected to be fully operational by the end of 2027. The company will roll, melt and finish titanium for the aerospace industry. The $123,476 average salary for the new jobs is more than twice the average wage in Cumberland County of $45,951.

Golden Leaf Foundation gave an $8 million grant to Methodist University to pay for equipment and other costs as it creates a medical school in partnership with Cape Fear Valley Health School of Medicine. The school is expected to create 260 jobs and eventually graduate 120 doctors per year. The first class will enroll in the summer of 2026.

Japan-based Nipro will invest $400 million to build a medical device plant is expected to create 232 jobs over the

next five years. Nipro is getting about $14 million in state and local incentives over the next 12 years. Nipro’s first U.S. plant will make devices for patients with chronic kidney diseases and other renal health issues.

Raleigh-based Attindas Hygiene Partners will invest $25.2 million and create 25 jobs at its facility here. Attindas manufactures disposable adult incontinence, baby care and clinical products. The facility currently has 325 workers.

On Ocracoke, the Hyde County Education Foundation plans to renovate a former daycare center and create 10 apartments for teachers. The Dare Education Foundation, already with apartment complexes at Run Hill in Kill Devil Hills and Buxton, is moving forward with plans to add more apartments.

A $1.375 million grant from the Golden LEAF Foundation is earmarked for Robeson County to develop a preliminary design plan for an 80,000-square-foot shell building at the COMtech Business Park. The empty building may bring a business that would invest $9.2 million in private capital and the creation of 75 jobs averaging a $45,000 salary.

Pfizer will lay off about 60 workers at its facility here that employs more than 3,000 workers and contractors. Pfizer makes nearly 50 products here, including almost 25% of its sterile injectables used in hospitals. A line will be decommissioned and more contract workers will be hired, according to the company.

Weyerhaeuser will close its lumber mill here in September, resulting in the loss of 73 jobs. Ten of the 73 have been offered other jobs with the Seattle-based company.

In August 2023, Martin General Hospital owner Quorom Health closed the 73-year-old institution, which had formerly been county owned. Now, Martin County officials are hoping to reopen the site as a rural emergency hospital. The project requires many more steps before coming to fruition, officials say.

In November, Avelo Airlines will launch two new nonstop flights at Wilmington International Airport, one

to Fort Myers, Florida, and another to Hartford, Connecticut. In February, Breeze Airways will begin to operate nonstop service to four Hartford, Connecticut; Orlando and Fort Myers, Florida; and Providence, Rhode Island.

The New Hanover Community Endowment’s latest funding commitment will go to an agency with a mission to preserve and create affordable housing. Wilmington Housing Authority is receiving $5.7 million to support the Hillcrest Development Plan, which includes 256 public housing units.

Wisconsin-based Placon , which manufactures packaging for the food industry, will close its plant, resulting in the loss of 70 jobs. Placon acquired the location in 2021, but reported a decline in company-wide revenue company wide led to the closing.

Maine-based IDEXX Laboratories will invest $147 million and create 275 jobs with a new manufacturing plant to produce veterinary diagnostics products. The average total compensation for the new positions will be $65,873, compared with current average wage in Wilson County of $52,619.

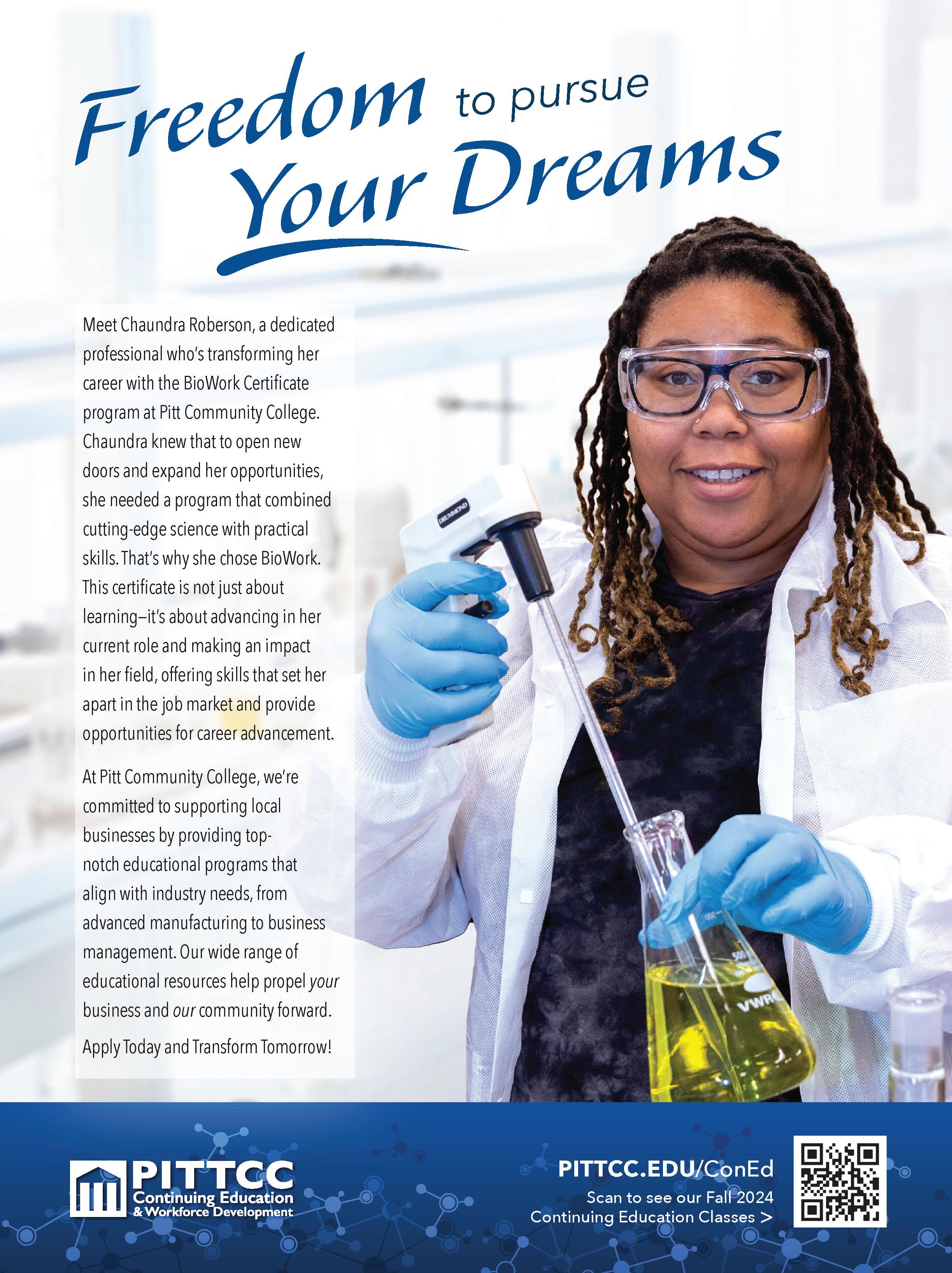

Maria Pharr succeeded Lawrence Rouse as president of Pitt Community College. Pharr had been president of South Piedmont Community College in Monroe since January 2017. She is the sixth president of Pitt Community College in its 63-year history and the first woman in the post.

High Point University’s campus has $100 million in construction projects underway ahead of the university’s centennial anniversary this month. Construction is taking place on the Workman School of Dental Medicine and the Kenneth F. Kahn School of Law. The university announced a five-year bonus plan for its 2,000 faculty and staff members that would total about $19,240, or $3,848 per year.

Miami-based Cosmetics & Cleaners International, a contract manufacturer of cosmetics and personal care products, will spend $8.4 million and add 24 jobs at a new factory. C&C Industries distributes products in 50 states to large department stores and retailers for national and global brands. The new plant will cover 108,000 square feet of manufacturing, warehousing and distribution operations. The average annual wage will be $59,333, compared

with the Guilford County average of $58,843.

Guilford Technical Community College will break ground on a $55.8 million, 100,000-square-foot aviation training center at its Cameron Campus in the second half of 2025. The first phase of the building is expected to open in January 2027, and will increase instructional capacity for GTCC’s aviation programs by 40% to just over 600 students.

Upstream Care Company laid off 66 workers after losing its contract with physician-run Triad Healthcare Network, which is affiliated with Cone Health and has more than 1,300 affiliate providers and manages care for nearly 200,000 patients in Alamance, Guilford, Randolph, Rockingham and part of Forsyth counties. The layoffs left Upstream with 115 employees who provide clinical, technological and business support for physicians.

Jorgenson Consulting merged with The Pace Group of Dallas to form the executive search firm of Jorgenson Pace. The firm focuses on searches for leaders of economic development, chambers of commerce, downtown development, government, community development and nonprofit groups.

William Dalton Edwards, 25, pleaded guilty to a conspiracy charge for his role in a $1 million scheme involving the theft of cattle. Edwards conspired with another person to defraud livestock markets, also known as sales barns, in Iredell and Cleveland counties, and in Texas, Oklahoma and Virginia. Over four years, Edwards and his coconspirator obtained more than 3,000 head of cattle and caused losses to sales barns in North Carolina, Virginia and Texas.

Air Products, a global provider of industrial gasses such as nitrogen, plans to construct new air separation units at its facilities here and Conyers, Georgia. The company has facilities in more than 50 countries with an overall workforce of more than 23,000. At last count, Air Products had 41 employees here.

Novant Health paid $17 million to buy 11.5 acres in Greenville, South Carolina. The purpose is “to further our commitment to expand access to high-quality, affordable care,” according to a spokesperson. Novant also agreed to buy a 200-provider urgent care group in Columbia from Blue Cross and Blue Shield of South Carolina. UCI Medical Affiliates includes its affiliates Doctors Care and Progressive Physical Therapy. Doctors Care employs 1,100 healthcare professionals.

Cook & Boardman Group acquired Brymer Communication Services of Hutto, Texas, for an undisclosed amount. BryComm specializes in

design engineering, installation, and maintenance of infrastructure networks and serves customers throughout Texas. BryComm is Cook & Boardman’s seventh acquisition since Platinum Equity acquired a majority interest in the company in 2023.

The town has begun charging a fee at its public electric vehicle charging stations, ending the free service of supply to EV drivers. Starting Aug. 12, most of the town-owned stations will charge users 20 cents for each kilowatt hour, as well as processing fees, officals said.

After 48 years, Mama Dip’s has closed on Rosemary Street. Mildred Council, more commonly known as Mama Dip’s, started the restaurant known for its Southern cu isine. Council died in 2018.

Lee Roberts is now the 13th chancellor of UNC Chapel Hill. A state budget director under former Gov. Pat McCrory, Roberts had been the interim chancellor since January. He replaces Kevin Guskiewicz, who left to become president of Michigan State University.

Fennec Pharmaceuticals, which develops oncology drugs, appointed Jeff Hackman as its CEO. Hackman succeeds Rosty Raykov, who has been Fennec’s CEO since 2009 and will remain a director. Over the past 12 years, Hackman has worked on oncology projects for Sigma Tau, Baxalta, Shire and EUSA Pharma.

Danish healthcare company

Pharmacosmos will acquire cancer drug developer G1 Therapeutics in a deal worth about $405 million. Formed in 2008, G1 was spun out of research at UNC Chapel Hill’s Lineberger Comprehensive Cancer Center. The company became publicly traded in 2017, but it has never posted a net profit.

A Japanese candy company that makes

Hi-Chew will expand its operations in Orange County, spending $136 million with plans to add more than 200 jobs. Morinaga & Co. was founded in Tokyo in 1899. The company and its subsidiaries produce and distribute products such as milk caramel, chocolate, cookies and frozen desserts. It opened the plant here in 2015.

Ironshore Therapeutics, which developed the attention-deficit hyperactivity disorder drug Jornay PM, agreed to be purchased by Stoughton, Mass.-based Collegium Pharmaceutical for $525 million. The deal would be boosted by an additional $25 million depending on the drug’s sales in 2025. Jornay PM is expected to produce sales topping $100 million this year after a 32% increase in prescriptions during the first half of this year, compared with a year earlier.

Join the Lake Norman Chamber and connect with a vibrant network of local businesses dedicated to growth and success. We provide invaluable resources, professional development, and networking opportunities tailored to help your business thrive. From exclusive events to community initiatives, our Chamber is your gateway to building meaningful relationships and gaining exposure in the Lake Norman area. Discover how we can support your business goals and become part of a dynamic community that fosters innovation and collaboration. Visit our website or contact us today to learn more about membership benefits and upcoming events.

Pendo acquired Zelta AI, a New York company that collects customer feedback and analyzes it for clients, for an undisclosed amount. The deal expands Pendo’s artificial intelligence operation. The company has released nearly a dozen artificial intelligence features and products in the past year, including Pendo Listen, which helps companies build and launch new products. Zelta AI will become part of Pendo Listen.

The Western Carolina University Foundation received more than $35.8 million in gifts and pledges from nearly 4,000 supporters during the last fiscal year. That’s a $23.2 million increase compared with the previous fiscal year’s $12.6 million. The money is part of an overall $75 million fundraising campaign.

Insurance solutions provider King Insurance Partners, based in Gainesville, Florida, has acquired Barnette and Coates, an insurance agency for more than 50 years here and in the surrounding regions. King Insurance has made 36 acquisitions over the last three years alone, and is targeting $75 million in revenue by the end of the year.

UNC Health Blue Ridge hired Gary William Paxson as its new CEO. The Burke County healthcare system has a 184-bed hospital and more than 40 locations across a three-county region. Paxson had been the CEO of the smaller White River Health System in Batesville, Arkansas, since 2018. Blue Ridge also opened its $136 million, six-story tower, which triples the size of its emergency room and in 2025 will take its ICU unit from 16 beds to 30. ■

Find all of your BNC needs in one spot! Visit our store at businessnc.com to see all we have to offer.

We do what nobody else does — cover one very special place, this state, and its economy, which is as diverse as the people who call it home. We produce quality, in-depth journalism, digging behind the scenes producing stories and information that is current, thorough, and enlightens and entertains our readers. Whether it’s in the boardroom or on the factory floor, we seek to show not only trends and events but the human face of commerce. Business North Carolina magazine delivers qualified business owners, C-level and top senior executives at your fingertips.

Reprints are an easy way to educate your audience, reinforce your company message, and strengthen your marketing and sales efforts. They can be used as training and educational aids, direct mail promotions, as well as excellent additions to press kits and trade show handouts. Professional custom article reprints feature high-quality replications of original editorial coverage featuring your company, product, service or industry.

High quality plaques showcasing your company’s article or award in Business North Carolina are available in a variety of formats. Promote your good news to your visitors, clients, and employees with a customized plaque. Visible achievement awards confirms what the company values and rewards. The success you recognize today is more likely to continue in the future.