HowJimmyDonaldson ofGreenvillekeepsrocking socialmediawithastonishing stuntsandflashygiveaways. NORTH CAROLINA’S TOP 100 GOLF COURSES & 15 KEY FAIRWAY INFLUENCERS SUCCESS IN LUXURY FURNITURE | WALTER DAVENPORT’S PERSISTENCE | A FAYETTEVILLE SCAM Price: $3.95 businessnc.com APRIL 2023

4 UP FRONT

6 PILLARS OF N.C.

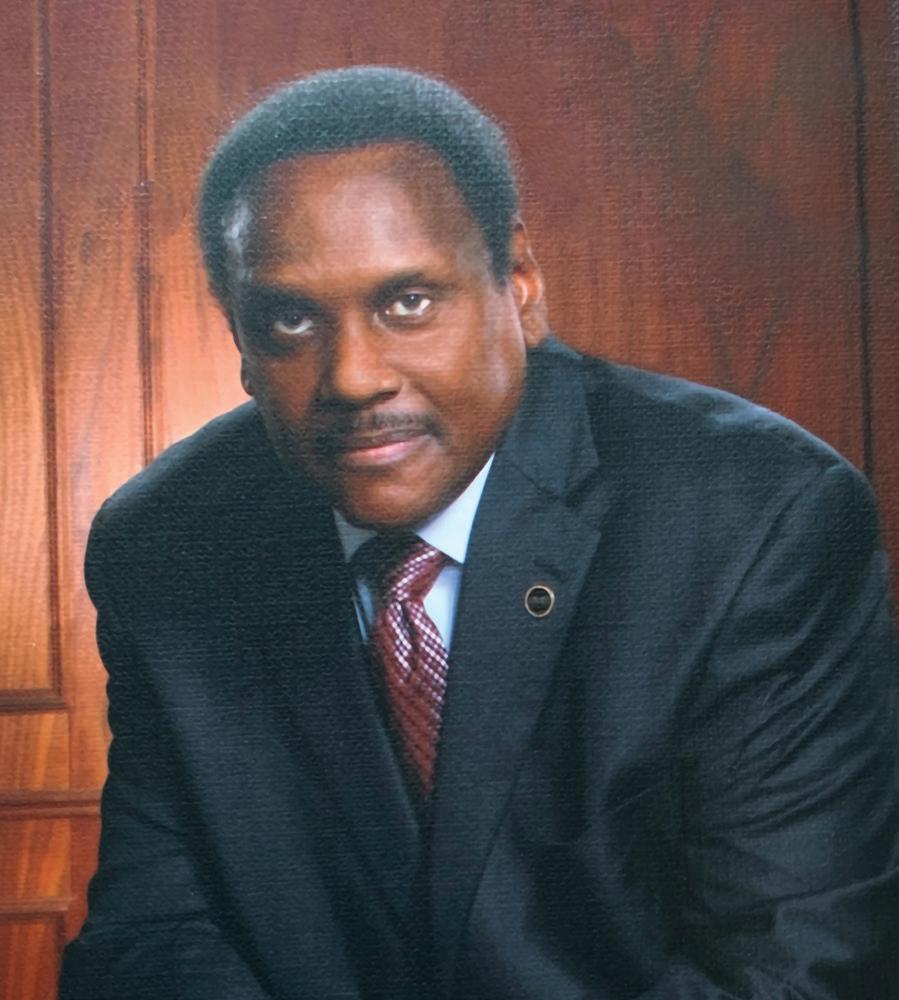

Walter Davenport overcame racism as a pioneering CPA and a board member at key N.C. institutions.

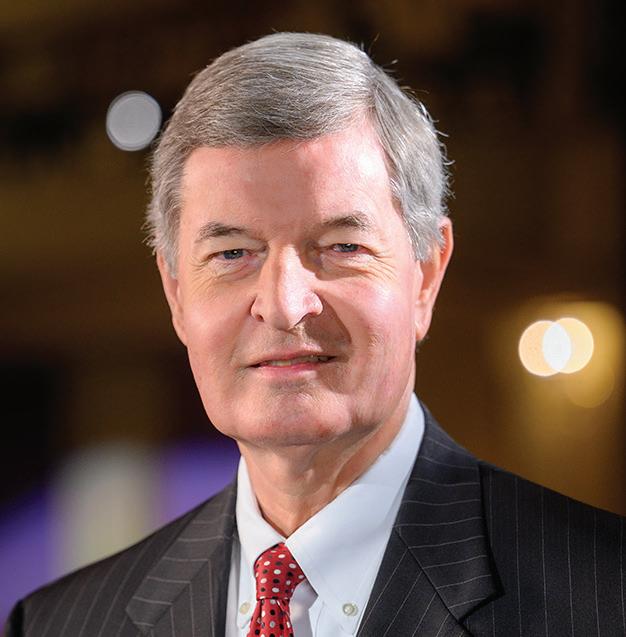

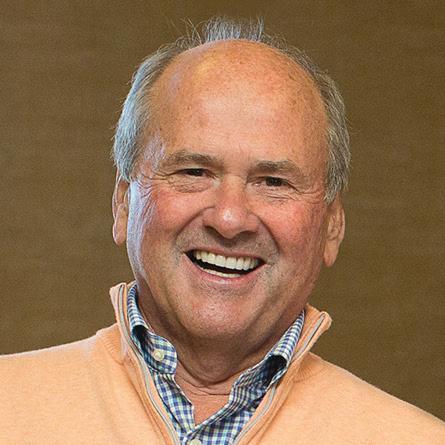

10 POWER LIST INTERVIEW

Former Truist CEO Kelly King discusses leadership and happiness.

14 NC TREND

Asheville’s baseball save; The case of the missing $25 million in Fayetteville; Can Biomason disrupt the cement business?; Novant Health’s Wilmington leader discusses the hospital sale; Auto companies veer electric; Lawmakers focus on economic development.

96 GREEN SHOOTS

Statesville’s once-sleepy downtown peps up, aided by wider paths, live music and tasty doughnuts.

32 ROUND TABLE: TRANSPORTATION & LOGISTICS

Mobility leaders address the state’s strengths and challenges in keeping commerce and travel robust.

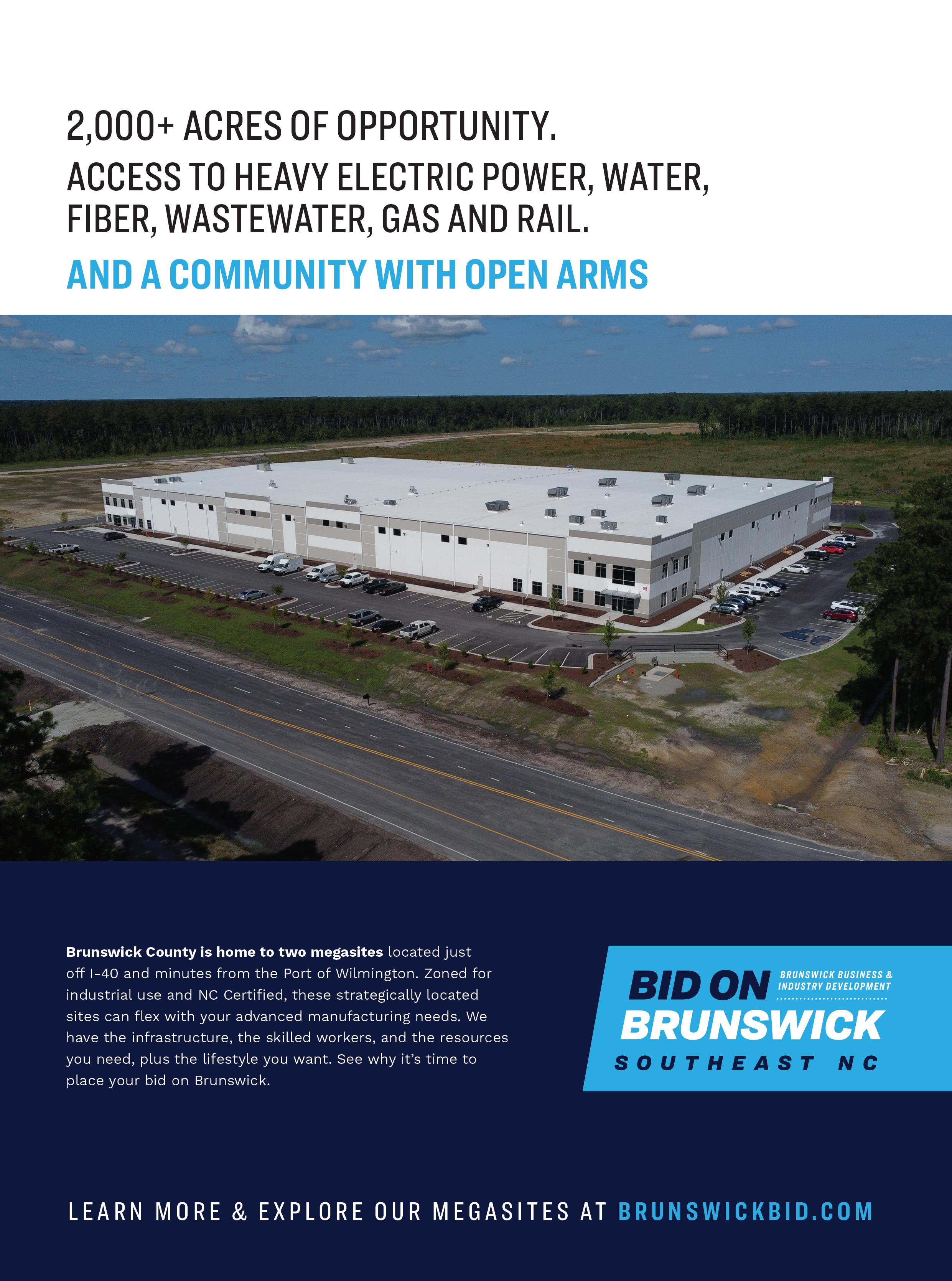

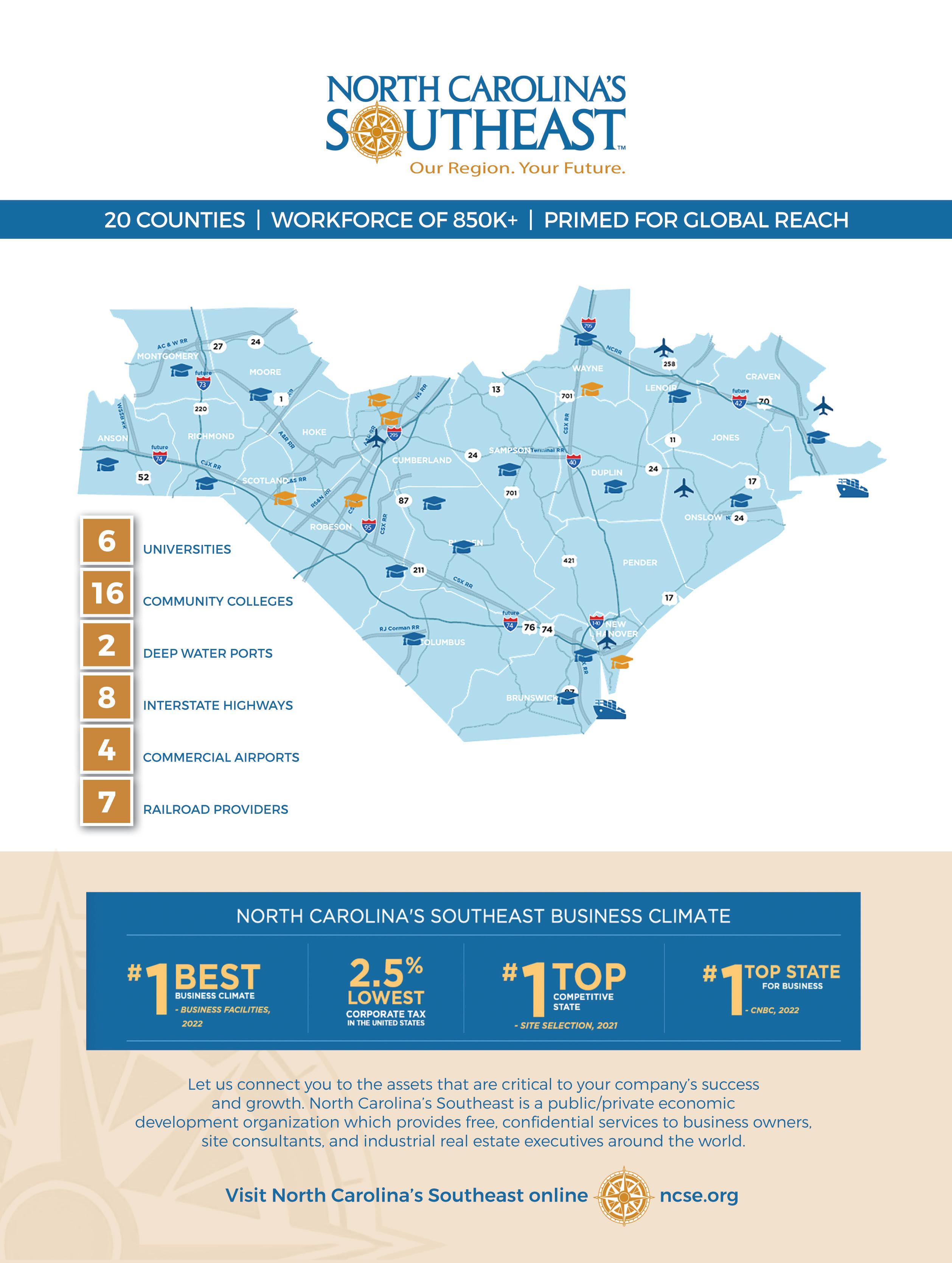

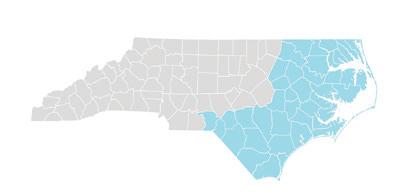

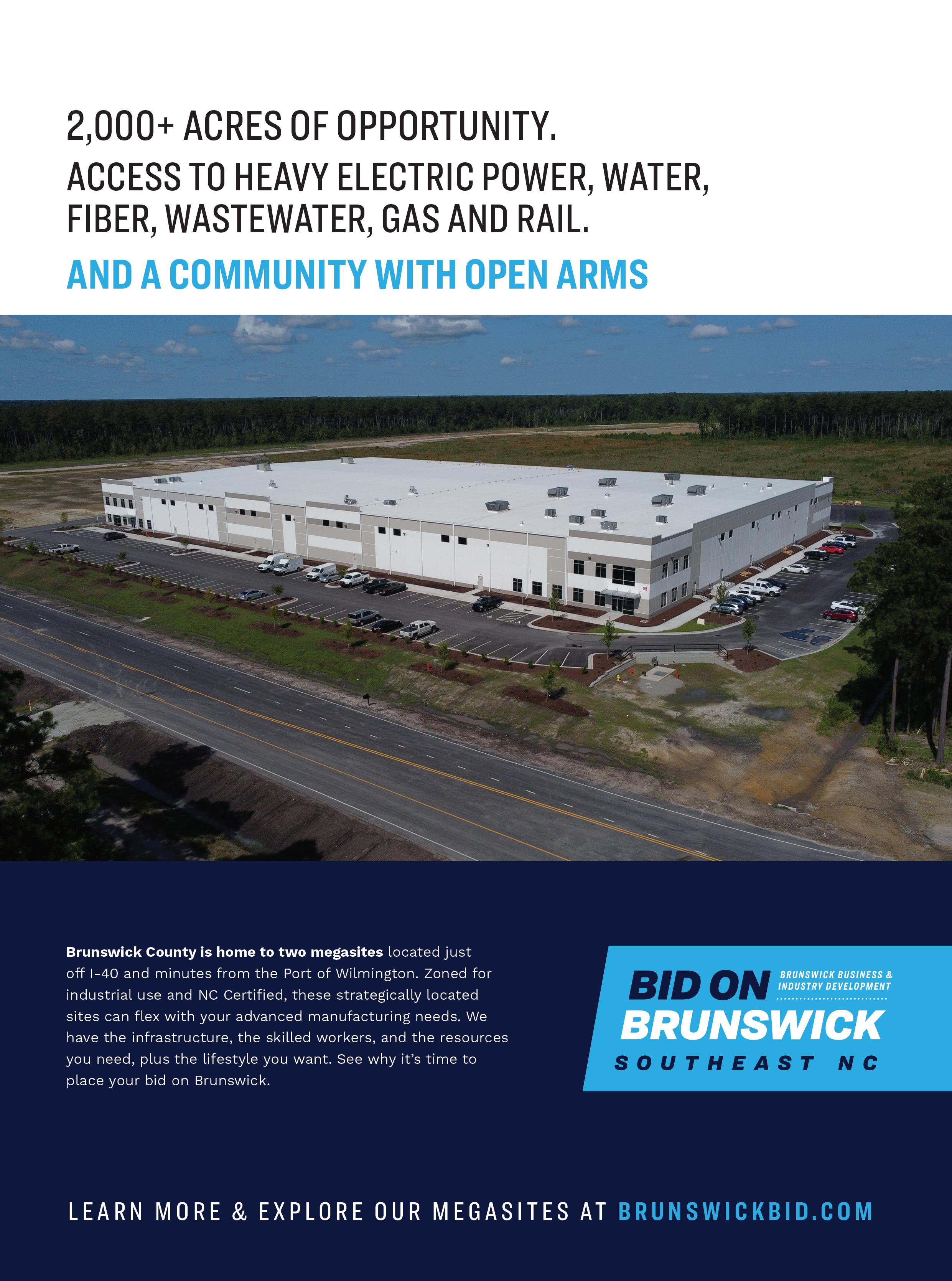

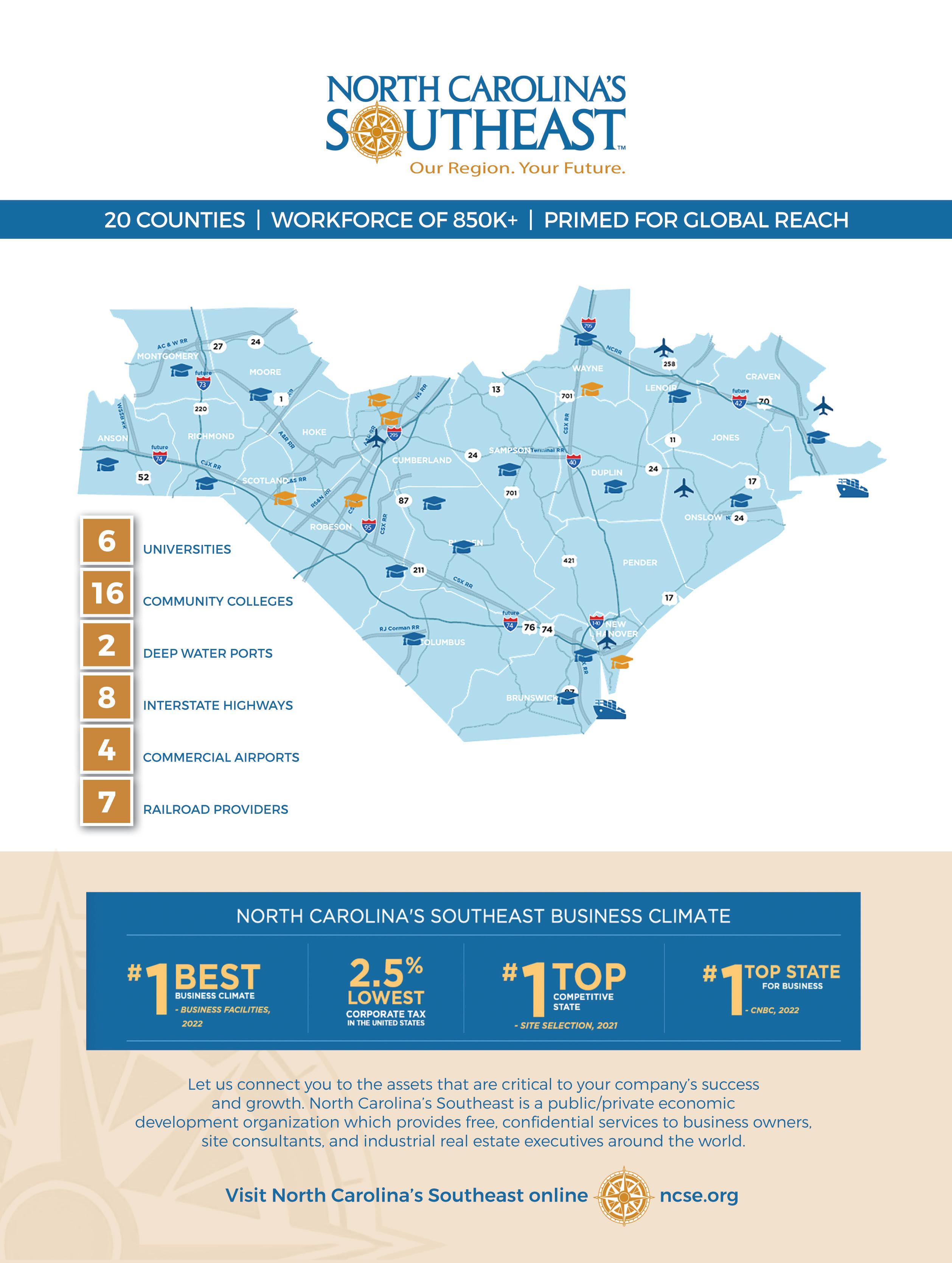

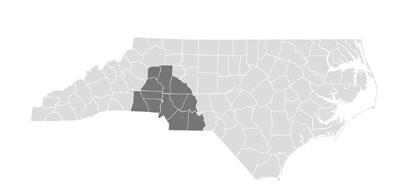

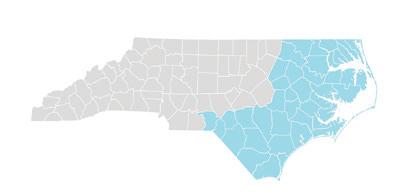

68 REGIONAL SPOTLIGHT: SOUTHEAST N.C.

The area extending from the coast to the Piedmont offers a unique mix of resources and opportunities.

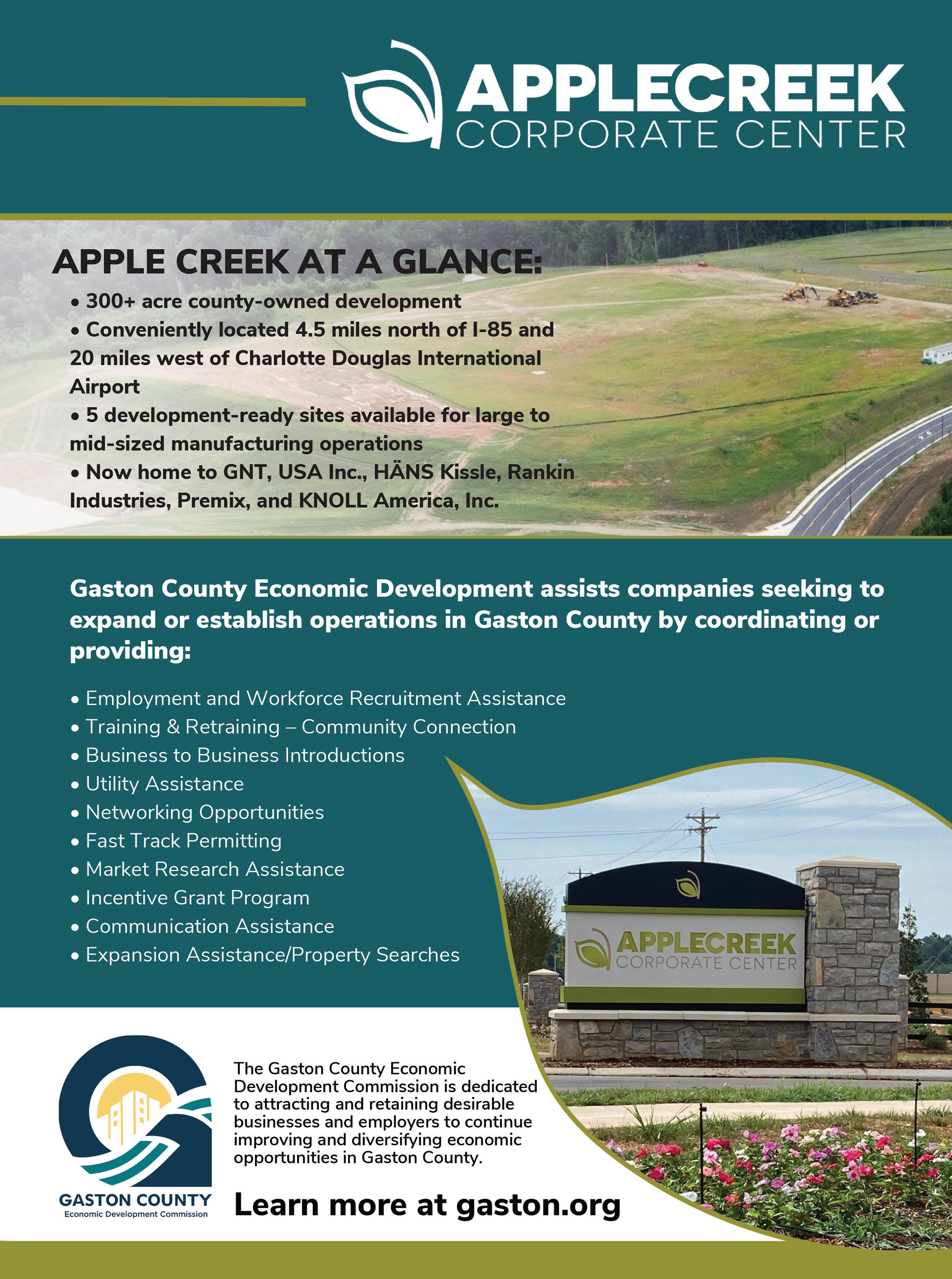

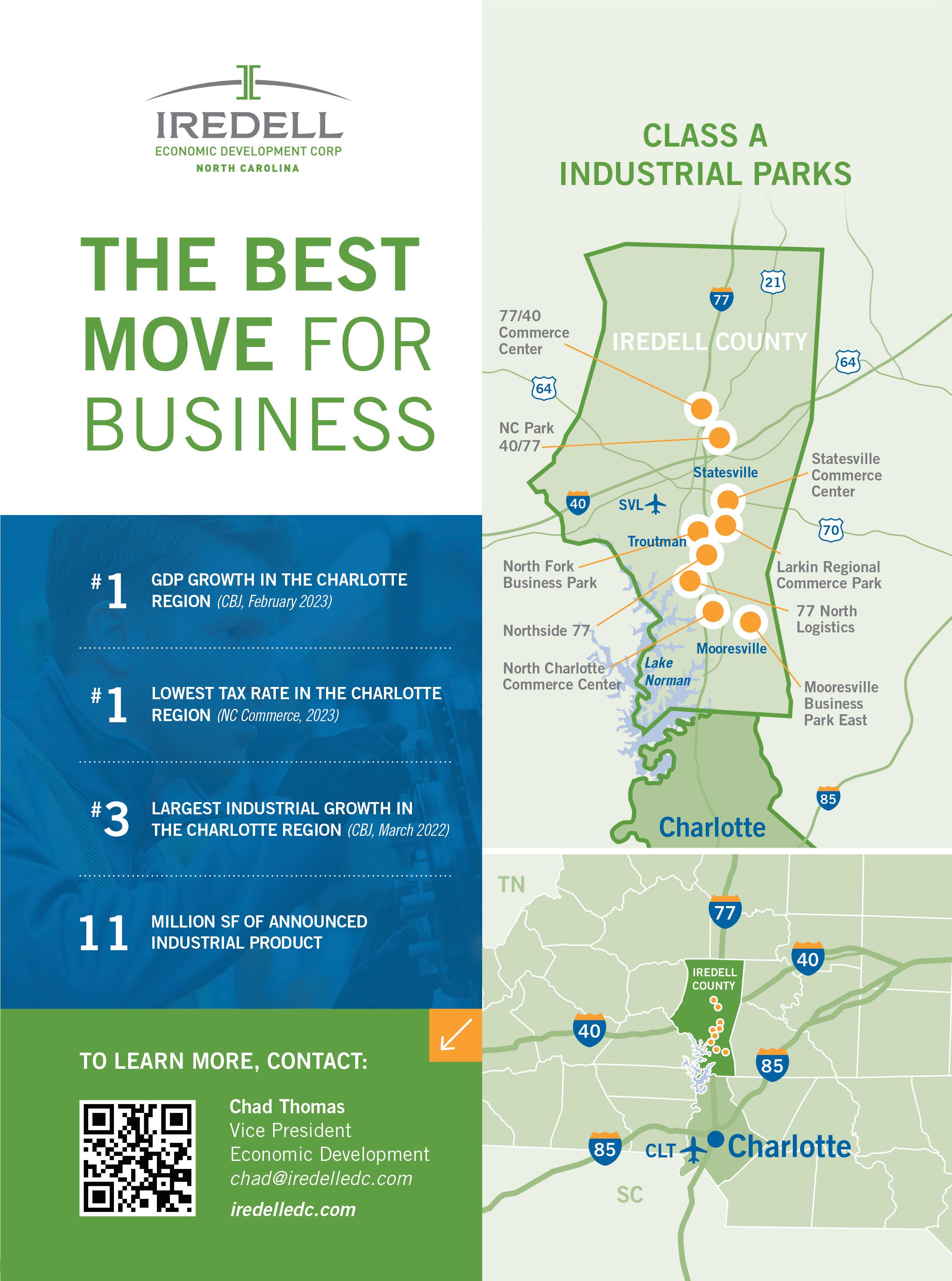

84 ECONOMIC DEVELOPMENT: INDUSTRIAL

PARKS N.C.

Partnerships with counties help create sites that bring jobs and prosperity to rural parts of the state.

NC GOLF

COVER STORY

BEAST MODE

Jimmy Donaldson thrills millions with creative videos and heartwarming charitable projects.

BY NOELLE NORENE HARFF

BY NOELLE NORENE HARFF

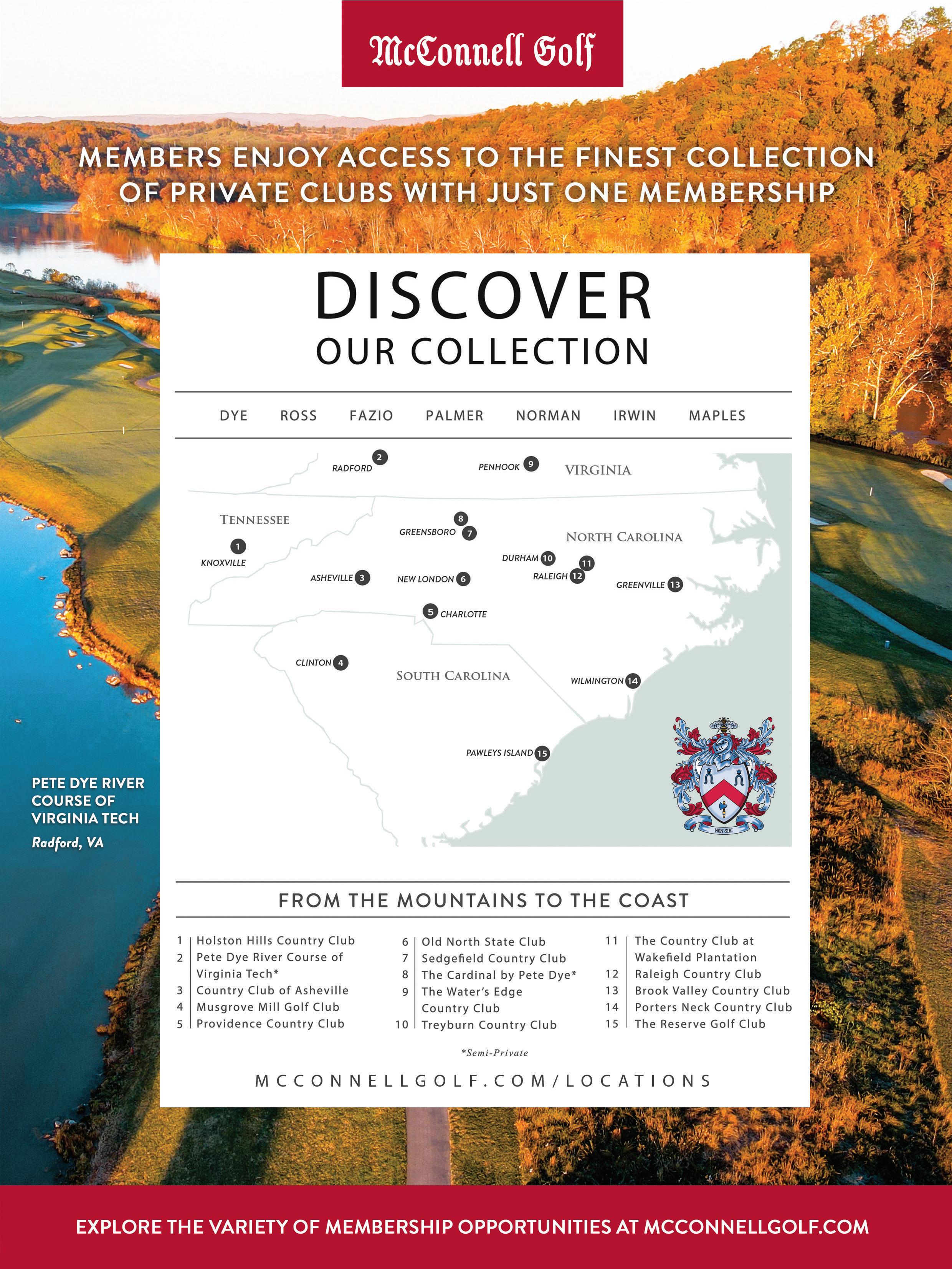

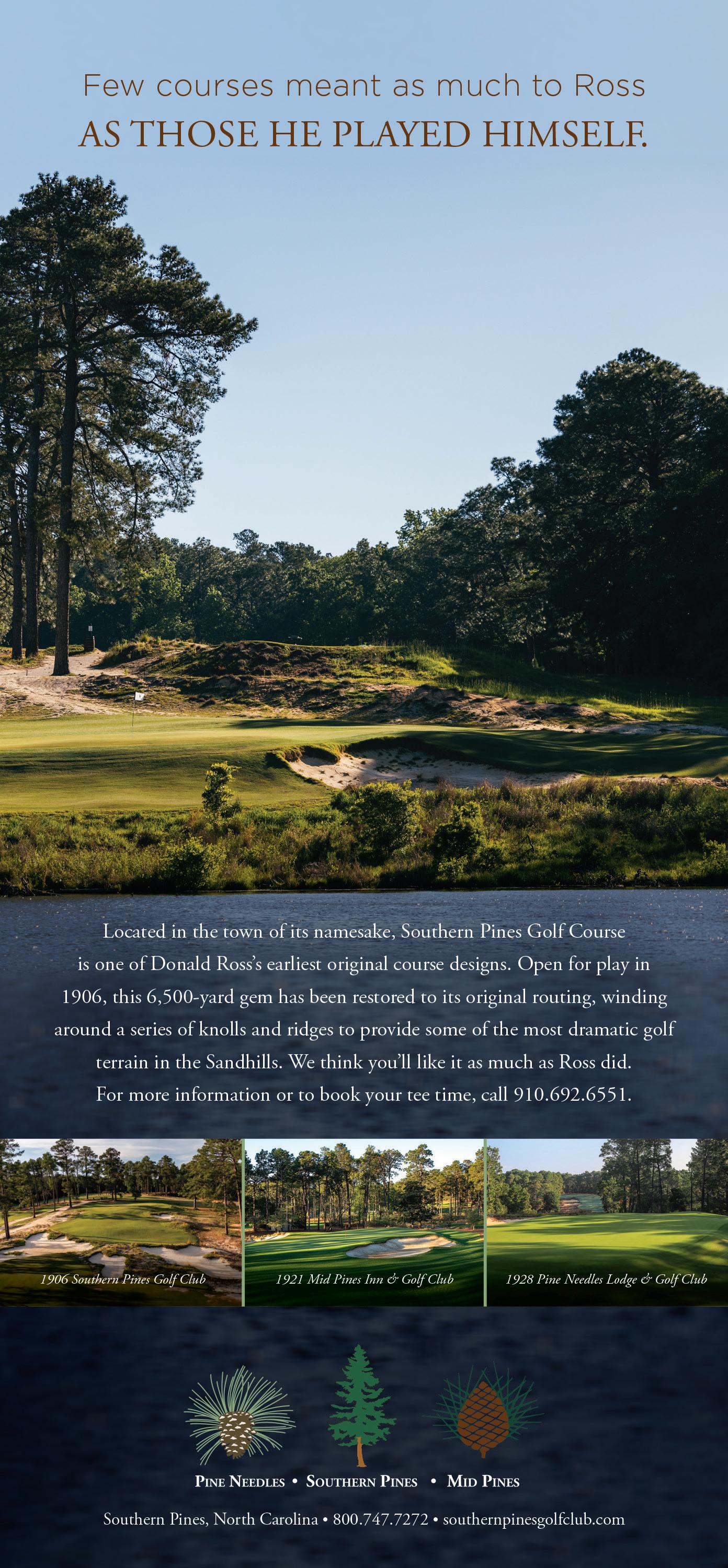

FAIRWAY FEVER

The North Carolina Golf Panel selects the state’s 100 best courses.

THE IN CROWD

Sorry purists, but the most popular way to play golf is no longer strolling traditional fairways and greens.

BY BRAD KING

RATING GAME

Famed golf designer Tom Doak explains what it takes to make a course better than average.

BY JIM POMERANZ

BY JIM POMERANZ

TEE TOPPERS

Industry experts helped BNC pick 15 leaders who play influential roles in the state’s golf community.

BY BRAD KING

CRAFT RENEWING

A Morganton manufacturer excels with artisans crafting luxury furniture for discerning consumers.

BY KEVIN ELLIS

BY KEVIN ELLIS

3 APRIL 2023 April 2023, Vol. 43, No. 4 (ISSN 0279-4276). Business North Carolina is published monthly by Business North Carolina at 1230 West Morehead Street, Suite 308, Charlotte, NC 28208. Phone: 704-523-6987. All contents copyright © by Old North State Magazines LLC. Subscription rate: 1 year, $30. For change of address, send mailing label and allow six to eight weeks. Periodicals postage paid at Charlotte, NC, and additional offices. POSTMASTER: Send address changes to BUSINESS NORTH CAROLINA, 1230 West Morehead Street, Suite 308, Charlotte, NC 28208 or email circulation@businessnc.com. Start your day with business news from across the state, direct to your inbox. SIGN UP AT BUSINESSNC.COM/DAILY-DIGEST.

58 64

APRIL 2023 40

UP

FRONT David Mildenberg

A

My hunch was that Jimmy Donaldson, who then had more than 1 million YouTube subscribers, would extend his 15 minutes of fame for a bit longer, then move on to more conventional pursuits.

Wrong, like usual.

MrBeast keeps getting more popular, churning out a steady stream of bizarre, entertaining videos of mind-boggling competitions and charitable e orts. For a couple of years, we wanted to produce a strong story on the MrBeast phenomenon, but we struggled to nd a writer enthused enough to take a deeper look at the creative Pitt County resident, knowing that he probably wouldn’t talk with us. Pro les in Rolling Stone and the New York Times in the past two years included some negative comments that evidently made him more distrustful of the media.

Fortunately, our columnist and part-time UNC Chapel Hill journalism instructor Dan Barkin connected us with a talented writer with an unlimited future. Noelle Norene Har is a Colorado native and a sophomore at Chapel Hill with a passion for journalism and nance. As one might expect of a sharp collegian, she has a keen understanding of the internet. Like Taylor, she has a younger brother who grooves on MrBeast, apparently like almost every other teenage boy in the world.

Noelle produced this month’s cover story, which delves into how the graduate of Greenville Christian Academy became a global YouTube celebrity attracting millions of dollars in marketing support. A key reason,

bout ve years ago, our former colleague Taylor Wanbaugh mentioned how much her younger brother enjoyed the zany YouTube videos of a 20-year-old guy from Greenville. We looked and were amazed at the creativity of MrBeast, so Taylor wrote a short story about his popularity.Noelle reports, is that Donaldson, 24, has remained rooted in eastern North Carolina and passionate about helping others.

•••••••••

Two veteran North Carolina journalists have joined our team, bringing loads of experience and wisdom. Kevin Ellis comes aboard a er a lengthy career at e Gaston Gazette, where he had been editor since 2019. Kevin is a UNC Asheville graduate with a passion for sharing news stories, nding new places to walk with his wife, Amy, and his rst grandchild, Ellis, who was born in October.

Ray Gronberg is editor of our North Carolina Tribune newsletter, which provides subscribers with exclusive news on legislative and political a airs. Ray is the former editor of the Henderson Dispatch, which covered Granville, Vance and Warren counties for the past ve years, a er spending most of his career at the News & Observer in Raleigh and Herald-Sun in Durham. He’s a UNC Charlotte graduate who a longtime Raleigh insider describes as “deeply experienced, widely knowledgeable and smart as hell.”

So much journalism is now rooted in partisanship, with organizations having distinct or fairly covert points of view. at’s OK, because journalists at those groups produce some important stories. But Kevin and Ray embody Business North Carolina’s mission to be unbiased, nonpartisan and respectful of a wide variety of viewpoints. ey have quickly picked up on our privilege of writing about MrBeast, furniture makers, golf in uencers, thieves, and many other people and organizations across our amazing state.

PUBLISHER

Ben Kinney bkinney@businessnc.com

EDITOR

David Mildenberg dmildenberg@businessnc.com

MANAGING EDITOR

Kevin Ellis kellis@businessnc.com

ASSOCIATE EDITOR

Cathy Martin cmartin@businessnc.com

SENIOR CONTRIBUTING EDITOR

Edward Martin emartin@businessnc.com

SPECIAL PROJECTS EDITOR

Katherine Snow Smith

CONTRIBUTING WRITERS

Dan Barkin, Connie Gentry, Noelle Norene Harff, Vanessa Infanzon, Brad King, Jim Pomeranz

CREATIVE DIRECTOR

Peggy Knaack pknaack@businessnc.com

GRAPHIC DESIGNER

Cathy Swaney

CONTRIBUTING GRAPHIC DESIGNER

Emily Harding

MARKETING COORDINATOR

Jennifer Ware jware@businessnc.com

ADVERTISING SALES

ACCOUNT DIRECTOR Melanie Weaver Lynch, eastern N.C. 919-855-9380 mweaver@businessnc.com

ACCOUNT MANAGER AND AUDIENCE DEVELOPMENT SPECIALIST Scott Leonard, western N.C. 704-996-6426 sleonard@businessnc.com

CIRCULATION: 818-286-3106

EDITORIAL: 704-523-6987

REPRINTS: circulation@businessnc.com

BUSINESSNC.COM

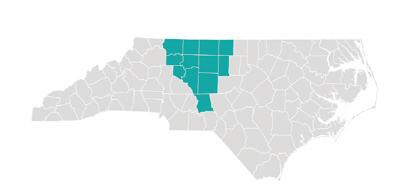

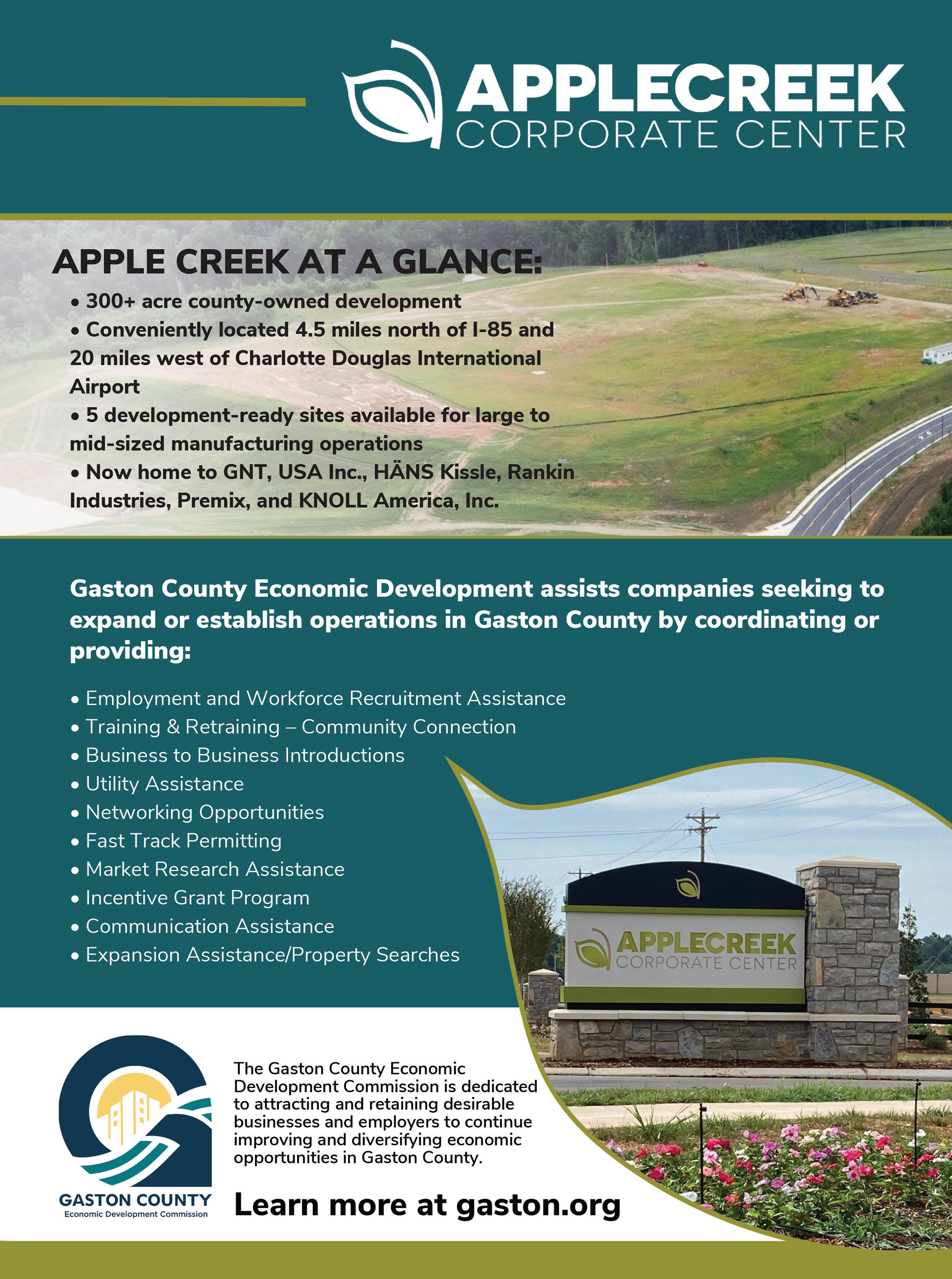

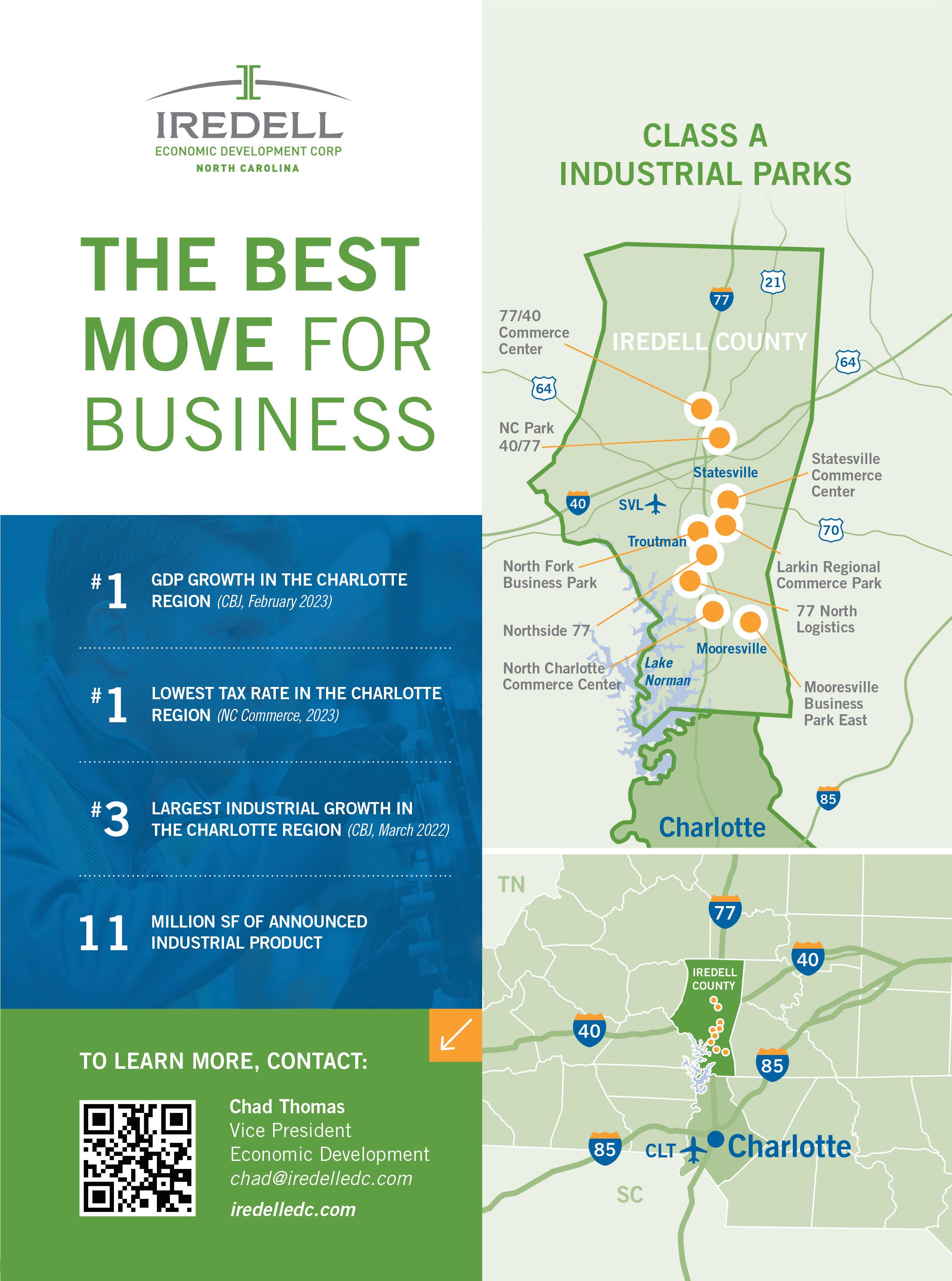

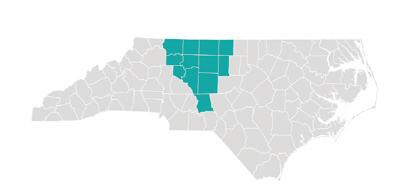

OWNERS

Jack Andrews, Frank Daniels III, Lee Dirks, David Woronoff, in memoriam Frank Daniels Jr.

PUBLISHED BY Old North State Magazines LLC

4 BUSINESS NORTH CAROLINA

PRESIDENT David Woronoff VOLUME 43, NO. 4

RISING STARS

Contact David Mildenberg at dmildenberg@businessnc.com.

He says he wants to be the next Elon Musk. Go for it, MrBeast!

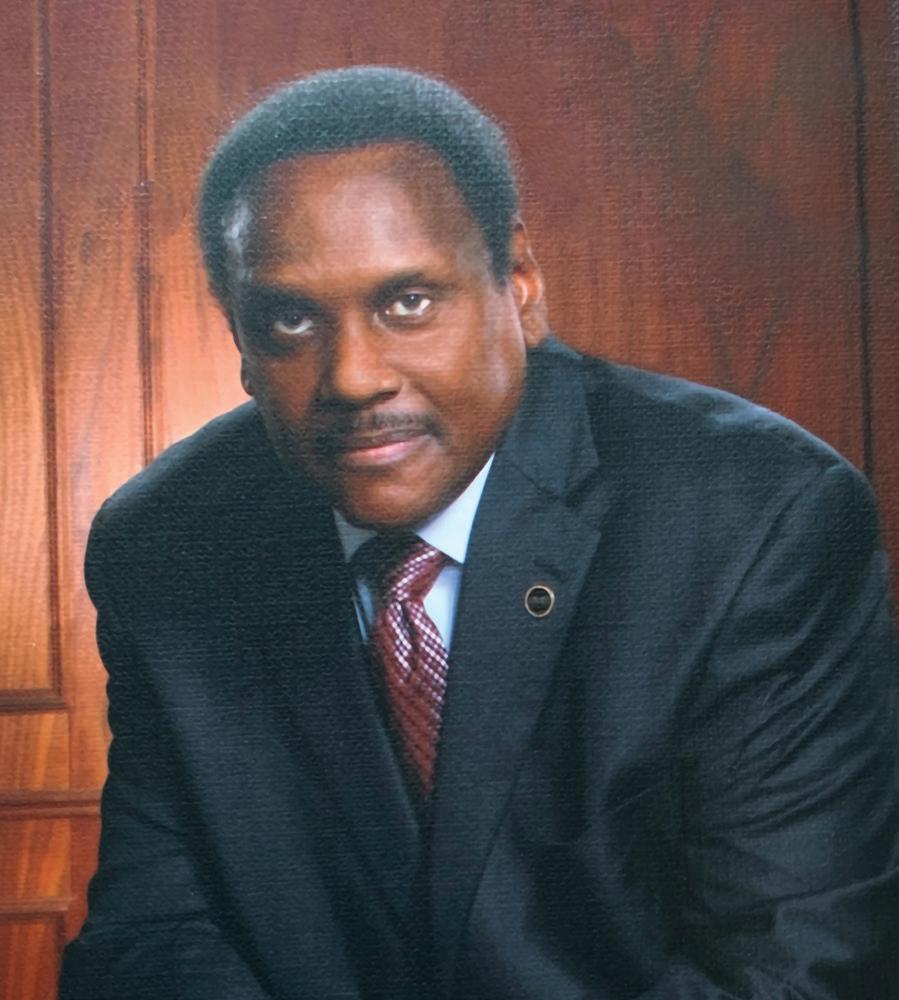

WALTER DAVENPORT

By Vanessa Infanzon

Even in high school, Raleigh native Walter Conaway Davenport knew he wanted to be a certi ed public accountant — it says so under his senior photograph in J.W. Ligon High School’s class of 1966 yearbook. At the time he graduated, he’d only heard of one Black accountant, Nathan Garrett, a CPA in Durham.

Davenport attended Morehouse College in Atlanta, graduating in 1970 with a degree in business administration. He then joined Arthur Andersen & Co., one of ve Black sta ers among more than 300 employees in the Atlanta o ce.

In 1974, he was hired by Garrett’s rm as a senior accountant. A er passing the CPA exam a year later, he became a partner. In 1988, the duo formed Garrett & Davenport, the largest minorityowned CPA rm in North Carolina with six CPAs and 20 sta ers in Durham and Raleigh. In 1998, the rm merged with Cherry Bekaert, a large regional rm with roots in North Carolina and Virginia. Davenport led the rm’s nonpro t sector for a decade before retiring in 2008.

Davenport, 74, has been active in many industry, civic and business groups, including serving 10 years on the UNC System Board of Governors. He’s on four boards, including Blue Cross Blue Shield of North Carolina and Wake Tech Community College, while serving as a treasurer for N.C. Sen. Dan Blue’s campaign committee.

6 BUSINESS NORTH CAROLINA

Overcoming racism, the Raleigh native and CPA made his way into some of the state’s most powerful boardrooms.

In 2018, he su ered a septic embolism and was put into a medically induced coma. He spent six months at WakeMed, a rehabilitation center and in assisted living before returning to his Raleigh home.

He spends time at his timeshare at Atlantic Beach and with his two sons and two granddaughters.

Comments are edited for length and clarity.

I was part of the honor guard when Dr. Martin Luther King Jr. laid in state at the Sisters Chapel on Spelman College’s campus. [Like Davenport], Dr. King was a member of Alpha Phi Alpha Fraternity, so the Alphas stood over his casket for a three- to fourday period while people came in to view him.

Everyone at Arthur Andersen did not accept “us.” ey hadn’t bought into the idea of Black people being in the rm. I had a partner tell me I was o an engagement because the client did not want a Black person. ere are more stories similar to that. In spite of that, I became a CPA a er enduring that kind of treatment.

I met Nathan (Garrett) in 1974 when I was being recruited by a company in the Northeast to be their chief nancial o cer. His rm was the auditor for the company. I didn’t really like my experience in the Northeast and subsequently, I joined Nathan’s rm. Nathan is 18 years older than me. He was a mentor to me. Ultimately, we became gol ng partners, business partners, and good friends. I followed in Nathan’s footsteps. During his career, Nathan was on the North Carolina State Board of Certi ed Public Accountant Examiners and he served as secretary. Almost 20 years later, I was on that board as president, vice president and secretary.

7 APRIL 2023

Davenport with his sons, Winston and Walter Jr. Lower right, he represented the UNC Board of Governors at a UNC Greensboro graduation ceremony.

I became involved with nonpro ts on the accounting side when I was with my accounting rm. Nonpro ts were the only ones we could provide services to. e for-pro t industries didn’t want to use a minority CPA rm.

Looking back at it now, you accept what happened. We succeeded in spite of. I don’t know what drove them (boards and management of other companies) to make certain decisions.

We cared about the nonpro ts. We cared about the mission. We were serious about trying to help nonpro t organizations stay on a sure footing. But I always told my sta , “We provide a lot of services to nonpro t organizations, but don’t let a nonpro t organization make us a nonpro t organization.”

When Nathan and I were together, we were an integrated rm. We didn’t care about the color of their skin. We looked at the potential they had or could have, hired them and developed them.

My inauguration speech (in 2014 for the National Association of State Boards of Accountancy) was titled, “Embrace the future,

even when you can’t see it.” We are an aging population and as CPAs retire, young folks have got to come behind us.

NASBA, the accounting profession and the state board needed to be more diverse in their representation. ey needed to start looking like the population.

Dan (Blue) and I are fraternity brothers. I met Dan in 1984, and he became a tax client of mine. He asked me to be his campaign treasurer. I’ve always thought every candidate needs to have a quali ed treasurer — somebody who knows what they’re doing and knows the rules — to keep up with the money.

[When I got sick in 2018] they told my family to make peace with me because I wasn’t going to make it.

When I got out of WakeMed, I went to a rehab center. I had to learn to speak clearly again. I had to learn how to walk. I could not move. One day, I went to therapy and I couldn’t get out of the chair because I had lost all feeling. I remember the rst time I took steps by myself; I cried like a baby. I bounced back. ■

8 BUSINESS NORTH CAROLINA

Davenport (left) has served on several powerful boards since retiring in 2008. And he’s enjoyed his two grandchildren.

with Nido Qubein at High Point University

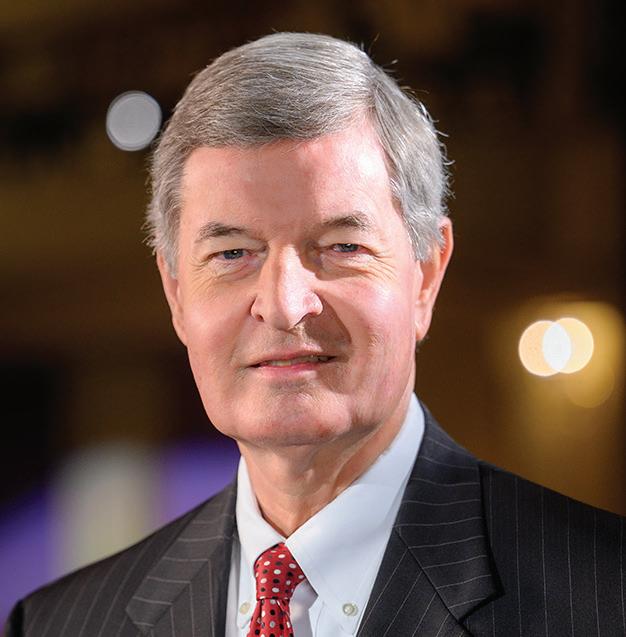

LESSONS IN LEADERSHIP

Retired Truist CEO Kelly King joined High Point University President Nido Qubein in the Power List Interview, a partnership for discussions with some of the state’s most influential leaders. Interview videos are available at www.businessnc.com.

Kelly King, 74, is a legend in North Carolina banking. A Raleigh native who grew up in a family of modest means, he paid his way through East Carolina University and joined Branch Banking and Trust in 1972. King succeeded John Allison as CEO in 2009, then led acquisitions of banks in Kentucky and Pennsylvania and the 2019 merger of equals with Atlanta-based SunTrust. King retired as CEO in September 2021. He works with his son, Ken, at KSK Investors in Charlotte.

This story includes excerpts from King’s interview and was edited for clarity.

Kelly King, your life has been a phenomenal story. You grew up on a tobacco farm in Eastern North Carolina and you traveled a path to become chairman and CEO of the sixth-largest financial institution in America: 55,000 employees and assets of $550 billion. You have been a major architect of the largest bank merger since the Great Recession. Along the way, things like service and leadership filled your heart and nurtured your mind. I want to ask you about the ingredients that make for a good leader?

I’ve tried to learn along and figure out how to take complex subjects and make them simple. So, I sat down one day and asked, “What are the characteristics of an outstanding leader?” And there are three. No. 1, they are honest about the reality they face.

What does that mean?

Leaders will face difficult circumstances, and they’ll say, ‘Oh, it’s not that bad.’ You see company leaders talking to their boards and saying, “Well, we’re having a little tough patch, but it’ll go away,” when it’s really fundamental structural tough issues. They’re not talking about the real, tough reality issues.

How do you define “reality”?

Reality is the circumstances that you are facing that are within and without your control that are going to exist whether you like it or not.

What if you and I

look at the same challenge and define it in two different ways?

In the pursuit of reality, you have to add objectivity. You might think the sun rises in the west and sets in the east. I’d say well, I appreciate your perspective, but you happen to be wrong. As effective leaders, we have to apply objective analysis to perspectives.

10 BUSINESS NORTH CAROLINA

LIST INTERVIEW

How does one learn how to be objective?

Reasoning and reality go hand in hand. You don’t have to be super smart, but you have to know when you are not smart enough to reason through circumstances, then you surround yourself with people you trust who can help you find discernment. A lot of my objectivity and reasoning comes from my faith. Sometimes it’s just too complex, so I go to a higher power and I pray about it. It takes a lot of thought.

What’s the second characteristic?

To be clear about your vision about how to make it better. Not everyone is an outstanding leader. Some people will not be honest about the reality. Some people are honest about reality, they just don’t have a clue about what to do about it. Doesn’t make them a bad human being. They’re just not outstanding leaders. They might be outstanding followers. Each is important.

They’re just not going to be in leadership positions.

We all have different roles in life, in our families and in our business and in our communities. I’m not saying leaders are more important, you just have to have leaders to get from A to B. You have to have effective followers to follow that leader. But the leader has to have clarity about the vision and be able to communicate it.

What’s the third characteristic?

Courage. It’s the commitment to take action in spite of the challenges and circumstances. Even if you get criticized. Even if you don’t know exactly where to go. An example of this was John Kennedy when he said, “We’re going to the moon, and we’re going to do it in 10 years.” Scientists thought we only had 10% of the scientific capacity to do that. He wanted to show our country that we could be bold. It happened because he laid out a clear vision and had the courage to put his cachet on the line. Great leaders are not trying to be popular. They’re trying to change the world.

Was there a time in your life when you executed courageously and got beat up for it?

Early on in the BB&T journey, I wanted to be sure to get everyone’s attention. I put up on a big slide, for our board and for investors, I said, “Disrupt or Die.”

The question is, do we disrupt ourselves or wait for somebody else to do it? If you go back over 25 or 30 years as this paradigm shift occurred where people demanded more ‘right here, right now.’ Some people got it, like Jeff Bezos with Amazon, and the rest is history. Others missed it.

How did you deal with criticism?

I viewed it as an opportunity to educate and to explain. It didn’t make me mad that they didn’t accept my view. I explained and listened. I might be 90% right. One of my pet philosophies on dealing with change is that it’s better to have 100% execution of an 80% idea than a 50% execution of a 100% idea. Start moving down the river and adjust as you go along.

A lot of young people starting in business talk about life-work balance or remote work? What advice would you give them?

People need to decide if they really want to be a high achiever. I believe there are five traits to being an outstanding leader. The first trait is to believe absolutely in what you are trying to accomplish.

Olympians will practice 10 hours a day, seven days a week, 52 weeks a year. They’re not saying, ‘well, maybe I can be No. 13.’ They believe, to their toes, that they can be No. 1.

You have cited three key traits as beliefs, committing the energy and, and skill development. [Another important trait is to] enjoy the journey. It’s deeper than liking. They draw a sense of self-achievement, a sense of self-enrichment. These are the people that’ll work 14-hour days, they’ll go home dead tired, they’ll take a deep breath and they say, ‘I can’t wait to get up in the morning and do it again.” Why? They draw energy from it.

What’s the fifth trait?

The fifth is to have enthusiasm and a positive attitude because obstacles come along.

Does that mean positive thoughts?

It’s not superficial. It’s kin to optimism. A pessimist faces some bad situations and says, “this bad thing happened, it’s going to ruin my whole life, it’s going to last forever, and it’s all my fault.” An optimist facing the same thing says, “this bad thing happened, it’s not going to affect my whole life, it’s probably not going to last all that long. I just have to deal with it.” You have to do some hard work, and then move forward with a positive energy and an optimistic belief.

You also spend time talking about happiness. What’s that about?

I’m deeply concerned about the level of unhappiness in our country today. It is rampant. When you talk to young people, about 60% will say they are very unhappy. Most will say that they have had thoughts of anxiety, depression, even suicide. I saw it exhibited through the pandemic.

That’s not a healthy way to live, and I actually came up with some steps to how to be happy in difficult circumstances. The first step is to choose to be happy. Most people don’t see it as a choice. They think they are victims. Bad things happen, I’ve got to be unhappy. Choose to be happy. Take control of your life.

The second is to be clear about the purpose in your life. And I recommend one of my five great books called “Man’s Search for Meaning” written by Viktor Frankl,. In it, he says, “If you know your ‘why’, you can endure any ‘how.’” Very, very important. Be clear about your purpose in life. Think about it. Pray about it. The third also comes from [author Carol Dweck’s book) “Have a Growth Mindset.”

Versus a fixed mindset?

If you have a growth mindset, that is a mindset that says I can learn, I can grow, I can improve, I can do things. You can move forward. And the fourth is really powerful. It’s to help others. When you help others, two great things happen. You help them, and you help yourself. You’ve heard about the runner’s high? That’s actually true because at a certain point, the brain causes the body to emit a chemical called endorphins and that makes you feel better. The same thing happens when you help other people. The brain says, “release endorphins” and you just feel better.

You picked your lane in life — your personal, spiritual, values, service, leadership lane, and you constantly make sure you’re on track, and you constantly learn. I learn so much from you. Thank you, and best wishes always.

Blessings to you. ■

11 APRIL 2023

DRIVING A VITAL INDUSTRY FORWARD

Few industries drive North Carolina’s economy — both literally and figuratively — as profoundly as trucking. According to the North Carolina Trucking Association, the state is home to more than 44,000 trucking companies, with the sector accounting for nearly 240,000 — or 1 in 15 — jobs. And few regions nationwide exemplify the vital infrastructure and nexus of trucking, logistics and manufacturing as deeply as the Triad, with its access to four interstate highways and a rich network of strategically located distribution centers and hub facilities.

Driving the trucking industry forward in the Triad, which boasts one of the largest concentrations of trucking firms on the East Coast, and beyond is an entire fleet of partners, including financial institutions that form part of the axle of this essential sector.

For Donna Perkins, who leads PNC Bank’s Commercial Banking business for the Western Carolinas market and has served as a trusted advisor to several local trucking companies during the course of her nearly 30-year career, being an effective banker in this space is about much more than fulfilling the obvious function of equipment lending. It’s about financing growth opportunities, helping owner-operators plan for the future of their companies, understanding the unique challenges facing the industry and offering solutions to help deliver on these challenges, including employee recruitment and retention – all against the backdrop of accelerated innovation and technology adoption within the industry.

“The trucking industry is evolving right in front of us,” says Perkins, a longtime member of the North Carolina Trucking Association and the Women In Trucking Association. “From advanced technologies that are making trucking more efficient, safe and environmentally sustainable, to the futuristic prospect of driverless vehicles, there’s no question this industry is on a course of significant change.”

The implementation of new and emerging technology and operations capabilities comes at a cost, of course. To that end, Perkins and her team collaborate with PNC Equipment Finance colleagues to structure loans and leases that can help companies stay on the cutting edge of technology while controlling infrastructure costs, leveraging working capital, preserving cash flow and effectively managing equipment obsolescence.

The imperative to invest in business-critical assets and equipment is playing out as the industry confronts the reality of an aging workforce — and the daunting projection that the sector will need to hire nearly 1 million drivers nationwide by 2030 in order to meet the pace of industry growth and replace drivers as they retire or exit the industry, according to data from the American Trucking Associations.

North Carolina’s trucking companies are not insulated from the industry’s worker shortage, a challenge that often dominates discussions between Perkins’ team and their clients. “There’s no doubt that hiring currently is the No. 1 challenge for many owners and operators of trucking companies,” says Chad Weatherford, a Greensborobased Commercial Banking relationship manager on Perkins’ team. It’s a predicament that impacts more than the bottom line. “Paying off the debt on a truck that is sitting idle because there is nobody to drive it is a major source of frustration for these companies,” he says. “As an advisor, we want to understand and help address the workforce challenge, and we work closely with companies to help deliver competitive employee benefits that can ultimately help them recruit and retain workers.”

To empower trucking companies – and employers in a wide range of industries – to deliver these benefits, Weatherford and his colleagues offer the PNC Organizational Financial Wellness program, which allows businesses to provide enhanced employee benefits,

SPONSORED SECTION 12 BUSINESS NORTH CAROLINA

PNC leaders reflect on the trucking industry’s contributions to the N.C. economy and the business opportunities and challenges unique to this regionally significant sector.

This is the twenty-fifth in a series of informative monthly articles for North Carolina businesses from PNC in collaboration with BUSINESS NORTH CAROLINA magazine.

a measure that gives credence to a 2022 American Transportation Research Institute survey’s finding that expanded benefits represent the second-most important retention practice among younger drivers — those aged 18-25 — for small fleets.1

To implement this program, PNC Organizational Financial Wellness consultants collaborate closely with companies’ human resources decision-makers and benefits managers to design custom programs that meet employees’ financial wellness needs, such as Health Savings Accounts, online financial education, retirement plan services and personalized banking solutions. Additionally, PNC continues to innovate new payment options that companies can offer workers, including 1099 contractors and employees with the desire to access earned pay prior to payday.

The age dynamics, together with other external factors, also are driving consolidation within the industry — a trend Perkins and Weatherford have observed with increasing frequency following the onset of the pandemic, which amplified the industry’s vital role and value proposition

in commerce and brought along a host of challenges and opportunities.

“When we reflect on the past 20+ years, there have been three major inflection points that have impacted the trucking industry in a significant way: 9/11, the Great Recession and the pandemic,” says Perkins. “That is more than enough for any owner-operator to endure. Add to that the intense competition and business opportunities in this space, and more than a few have made the strategic decision to sell or pass down their business.”

As the trucking industry continues to evolve, Perkins and Weatherford are optimistic about the substantial role it will continue to play in driving the economy in the Carolinas — and in PNC’s ability to meet the wide-ranging needs inherent in this space, from structuring a company’s first loan to engaging in business succession planning discussions. Says Perkins, “Trucking is here to stay, and PNC will continue to support this industry with the consistent counsel that has helped local companies grow and thrive amidst economic environments of all types.”

This article was prepared for general information purposes only and is not intended as legal, tax, accounting or financial advice, or recommendations to buy or sell securities or to engage in any specific transactions, and does not purport to be comprehensive. Under no circumstances should any information contained herein be used or considered as an offer or a solicitation of an offer to participate in any particular transaction or strategy. Any reliance upon this information is solely and exclusively at your own risk. Please consult your own counsel, accountant or other adviser regarding your specific situation. Any views expressed herein are subject to change without notice due to market conditions and other factors.

PNC and PNC Bank are registered marks of The PNC Financial Services Group, Inc. (“PNC”).

Bank deposit, treasury management and lending products and services, foreign exchange, and derivative products (including commodity derivatives), bond accounting and safekeeping services, escrow services, and investment and wealth management and fiduciary services, are provided by PNC Bank, National Association (“PNC Bank”), a wholly owned subsidiary of PNC and Member FDIC Lending, leasing and equity products and services, as well as certain other banking products and services, require credit approval.

©2023 The PNC Financial Services Group, Inc. All rights reserved.

13 APRIL 2023

PRESIDENTS:

Andress,

Carolinas: (704)

Hansen, Eastern Carolinas: (919)

REGIONAL

Weston

Western

643-5581 Jim

835-0135

1. Alex Leslie and Danielle Crownover, Integrating Younger Adults into Trucking Careers, American Transportation Research Institute (July 2022).

FOR MORE INFORMATION, PLEASE CONTACT YOUR PNC BANK RELATIONSHIP MANAGER OR VISIT PNC.COM.

LATE INNING SAVE

Asheville is spending millions to keep Tourists in town.

By Kevin Ellis

Part of the allure of a summer night of baseball watching at Asheville’s McCormick Field comes from the Blue Ridge Mountains enveloping the city.

e city-owned stadium, which opened in 1924 and was last renovated in 1992, lacks modern amenities for Asheville Tourist players and fans, to be sure. But the natural beauty and history make it among the most eclectic in the baseball world.

e Tourists start their season April 6 at home against the Bowling Green (Kentucky) Hot Rods. It could have been the last Opening Day for minor league baseball in Asheville, if not for a late-inning save. Major League Baseball told the Tourists it would lose its minor league license a er this season unless it makes major improvements at the 4,000-seat downtown stadium.

In mid-March, Asheville City Council voted unanimously to spend $875,000 a year for the next 20 years to pay for a $37.5 million upgrade to McCormick Field. Buncombe County and its tourism authority had previously agreed to kick in a combined $1.6 million annually for the project. e team, which had been paying $1 a year, will start making annual lease payments averaging about $470,000 over two decades.

“ is is the city’s largest investment in any one project since the building of the Civic Center in the 1970s,” says Chris Corl, director of the city’s community and regional entertainment facilities, which includes McCormick Field.

E orts to keep the team in Asheville stemmed from sentiment and economic factors. Almost 180,000 fans attended 66 home games at McCormick Field last year for the High-A a liate of the Houston Astros, contributing an impact of nearly $10 million to the county.

AGAINST A DEADLINE

A decision to invest in a stadium project did not sneak up on the Asheville Tourists or the city. In 2020, Major League Baseball issued a facility standards requirement to its minor league a liates, along with a deadline for improvements. Under a scoring system for minimum standards, McCormick Field scored in the bottom 10% of more than 100 stadiums across the nation. Major League Baseball warned that not making improvements would cost teams their licenses.

Asheville nearly lost its minor league a liation in 2020 when Major League Baseball contracted from 160 teams to 120 in an e ciency drive. So the team knew that improvements were required to avoid the team’s departure, says Tourists’ owner Brian DeWine. His family, which includes his father, Ohio Gov. Mike DeWine, bought the business in 2010 from a company that owned the Detroit Pistons’ NBA team.

e Tourists missed the spring 2023 deadline for completing renovations, but negotiated with Major League Baseball to have nancing in place by April 1, Brian DeWine says. With the agreement in place, McCormick Field should be fully renovated by early 2026. It is expected to have a concourse wrapping around the whole eld, new video board, better locker rooms and improved facilities for female coaches, umpires and sta . e changes will enable the city to use McCormick Field year-round, Corl says, for events including concerts, Christmas light shows and beer festivals.

Nine other North Carolina cities have minor league baseball teams. Stadium issues are a factor in speculation that another team may move within the state. Zebulon’s Five County Stadium, the home of the Single-A Carolina Mudcats, reportedly needs as much as $15 million in repairs to meet Major League Baseball standards.

14 BUSINESS NORTH CAROLINA NC TREND ››› Sports

14 Sports 16 Courts 18 Technology 20 Medical 22 Automotive 24 Public affairs 26 Statewide

In February, the Mudcats signed an agreement with Wilson, located about 25 miles east, to explore moving to a potential stadium there. e Mudcats have played in Zebulon since 1991.

Keeping the Tourists in Asheville is important to the city beyond just business, says Corl.

“It’s like that awesome family entertainment that even in 2023 doesn’t gouge you,” he says. “It’s part of the city’s identity. It’s one of those things that’s hard to pinpoint, but it de nitely wouldn’t be the same without them.” ■

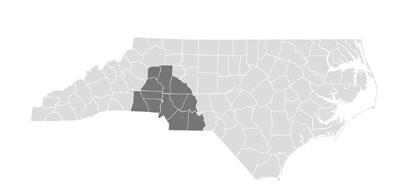

MINOR LEAGUE BASEBALL IN NORTH CAROLINA

ASHEVILLE TOURISTS

High-A affiliate of the Houston Astros. More than 30 different beers sold at McCormick Field.

CAROLINA MUDCATS

Single-A affiliate of Milwaukee Brewers. Muddy the Mudcat is one of the most popular mascots and logos in the entire league. Play at Zebulon’s Five County Stadium, 30 miles east of Raleigh. Fried catfish is on the menu.

CHARLOTTE KNIGHTS

Triple-A affiliate of Chicago White Sox. Play at Truist Field, which opened in 2014 and is one of the most visited venues in Minor League Baseball. Friday night fireworks light up the Uptown skyline.

DOWN EAST WOOD DUCKS

Single-A affiliate of Texas Rangers. Inaugural season in 2017 brought baseball back to Kinston. Win and Wine Down Wednesdays offers wine at half price and a ticket provides free admission the following Wednesday if the Wood Ducks win.

DURHAM BULLS

Triple-A affiliate of Tampa Bay Rays. Play at Durham Bulls Athletic Park since 1995. Classic baseball film “Bull Durham” was filmed at the team’s previous ballpark. A giant 20-foot bull invites players to “Hit Bull Win Steak.” Raleigh-based Capitol Broadcasting has owned the team since 1991.

FAYETTEVILLE WOODPECKERS

Single-A affiliate of Houston Astros. Play at Segra Stadium, which opened in 2019. Because of proximity to Fort Bragg military base, the Woodpeckers’ name and colors pay homage to those who serve.

GREENSBORO GRASSHOPPERS

High-A affiliate of the Pittsburgh Pirates. Play in downtown Greensboro’s First National Bank Field. Willie Mae Mays, a black lab, retrieves bats and takes balls to the umpire between innings.

HICKORY CRAWDADS

High-A affiliate of Texas Rangers. Mascots Conrad and Candy Crawdad married on the field in 2018. Super Saturdays features postgame concerts and celebrity appearances.

KANNAPOLIS CANNON BALLERS

Single-A affiliate of Chicago White Sox. Play at the $52 million Atrium Health Park, which opened in 2021. Team name pays homage to the town’s textile mill heritage.

WINSTON-SALEM DASH

High-A affiliate of Chicago White Sox. Play at downtown WinstonSalem’s Truist Stadium, which opened in 2010. It replaced Ernie Shore Field, which was built in 1956. Offers all-inclusive tickets that include seat, food, beverages and parking.

OTHER TAR HEEL BASEBALL TEAMS

COLLEGE SUMMER LEAGUE BASEBALL

Asheboro Zookeepers, Boone Bigfoots, Burlington Sock Puppets, Forest City Owls, Holly Springs Salamanders, High PointThomasville HiToms, Morehead City Marlins, Wilmington Sharks, Wilson Tobs

UNAFFILIATED PRO TEAMS

Gastonia Honey Hunters and High Point Rockers

15 APRIL 2023

McCormick Field Opening Day, 1924

PRECIOUS JEWELS

By Edward Martin

By Edward Martin

This was no boardroom. ey were just Muzzy and Chris, shooting the bull, talking business outside the o ce. Square-jawed with thinning hair, Muzzy, a prominent Texas businessman, preferred the nickname rhyming with Buzzy to Mouzon Bass III.

He owned or had stakes in more than a dozen enterprises, including Fayetteville-headquartered EbenConcepts, now known as eBen, which provided employee bene ts and human resource services to companies in North Carolina, Georgia, Texas and Virginia.

Christopher Scott Harrison was CFO with a $300,000 annual salary and a majority stake in EbenConcepts. He had a penchant for ne things, like timepieces. His $1.2-million Fayetteville home on Forest Creek Drive featured two-story, square brick pillars and an ornate grandfather clock in the foyer. Harrison now awaits sentencing this spring in federal court for nancial wrongdoing.

“Muzzy and Chris would sit at Muzzy’s kitchen table and talk about how things were going, the nancials and all that,” says an EbenConcepts executive. “ at’s why Muzzy is so angry. It wasn’t just an employee relationship. He was a friend.”

Between 2012 and 2018, Harrison withdrew $25 million from EbenConcepts in a stunningly simple scheme of purchasing personal items and reporting them as business expenses, which led to him underreporting his income, according to court records. He had help from the company controller, according to a person familiar with the matter.

Now, based on court records, company sources, state and

federal investigators and others, EbenConcepts appears to be a textbook case of fraud, playing out over years and motivated by a time-worn impulse. “Money,” says a Bass acquaintance familiar with the company, “is thicker than friendship sometimes.”

Harrison’s scheme and subsequent prosecution paint a detailed look inside the American justice system. He was targeted by the Internal Revenue Service’s criminal division, rather than the Federal Bureau of Investigation or other agencies more o en associated with crime.

If Harrison goes to prison, it won’t be because he stole $25 million of his company’s money. Rather it’s because he failed to pay $6 million in taxes that U.S. Eastern District Attorney Michael Easley Jr. in Raleigh says he would have owed if he earned and reported it legally.

Such prosecutions have long been a weapon against those who commit nancial crimes. Gangster Al Capone famously escaped punishment for countless murders and mayhem, but he couldn’t escape the IRS. He went to prison in 1931 for tax evasion.

Closer to home, similar tactics were used to nail Tar Heel moonshiners who otherwise laughed o $50 nes and weeklong jail sentences. “One thing I learned when I was in the U.S. Attorney’s O ce was that there were a lot of prosecutions in the 1920s and 1930s, where bootleggers didn’t pay tax on their alcohol,” says Ripley Rand, who later became a Superior Court judge.

at’s how the state came to have three federal court districts. With so many cases coming out of western North Carolina, “the federal government created a third district,” says Rand. “Federal

16 BUSINESS NORTH CAROLINA NC TREND ›››

Courts

A Fayetteville benefits consultant mixed personal and business accounts and missed a tax filing, catching authorities’ eyes.

law enforcement follows the money, and that’s why today, a lot of the investigations get started because of some other wrongdoing like embezzlement, but end up with the IRS when it follows the money.”

Rand, a partner in Raleigh’s Womble Bond Dickinson’s law firm, is Harrison’s defense attorney. He says his client admits taking the money, but Rand declines to discuss other details of the case. Harrison, who is in his mid-50s, pleaded guilty in January to willfully filing a false tax return. He faces as much as three years in prison, restitution to the IRS, and a possible fine, according to the U.S. Attorney’s Office.

Sabrina Hooten, the former company comptroller, has been accused in civil court documents of taking nearly $2 million from Orchestrate HR, another part of Bass’ holding company. She has not been charged with a crime.

“You don’t brag about the 4-inch-fish,” says an EbenConcepts officer, who adds that an IRS investigator told him the agency didn’t have the resources to pursue smaller cases. The agents also say being too aggressive in cases like Harrison’s might jeopardize bankruptcy settlements.

EbenConcepts remains healthy, says Senior Vice President David Smith, who is based in Raleigh. “No client money was ever taken,” he says. “Last year was one of our best years ever.” The company has about 100 employees and expects revenue of $20 million this year.

EbenConcepts, rebranded as eBen in 2021, dates to 1999. Harrison joined the business in 2002, and worked his way into Bass’ confidence.

From 2012 to 2018, Harrison “began to lavishly spend company funds for his own benefit,” Easley says. Over the years, he traveled to New York to buy a $145,000 Rolex watch, an $85,000 Tiffany bracelet and a $100,000 Cartier necklace of diamonds for his wife.

In the meantime, contractors installed a $300,000 swimming pool in the backyard of his Fayetteville home.

In Dallas, the IRS, by September 2019, was working in conjunction with the Secret Service, piecing together accusations against Hooten, the controller.

Bass, knowing that she and Harrison were privy to the company’s trade secrets, internal data and attorney-client dealings, filed a lawsuit to shut her up. Using information from that lawsuit, the Secret Service moved in, accusing Harrison and Hooten of using company credit cards to buy personal goods, usually coding them as “travel” or “office” expenses. In addition to protecting the president, the Secret Service investigates counterfeiting, credit-card fraud and other crimes.

Harrison was accused of buying $2.2 million in jewelry in four years, secreting it at his Fayetteville home, uninsured to avoid detection. Court documents show his wife, Brandy, has refused to return the bling.

In December 2019, a month after Hooten was hit with Bass’s restraining order, Harrison filed for bankruptcy in North Carolina.

The noose tightened during the federal bankruptcy hearings in Judge Stephani Humrickhouse’s court in the Eastern District of North Carolina. Harrison initially cited memory lapses about details of trips to New York to buy jewelry. Humrickhouse replied that Harrison’s remorse and promises to make amends to creditors and the IRS struck her as hollow, “too little, too late.”

During the month he filed for bankruptcy, he’d converted 3.46 million American Express “Platinum Card” credit-card points to his own use. He’d racked up those points by claiming personal purchases as business expenses, then used them to buy Christmas gifts for friends and family, the judge noted.

If Harrison’s case springs unusual, it might be because much of it stems from his bankruptcy filing, in which he conceded he owed the IRS millions that he couldn’t pay. He said he didn’t realize how much the long history of withdrawals from EbenConcepts totaled.

In Dallas, the Texas businessman who once chatted over coffee with Harrison, is now sole owner of Eben. Muzzy Bass notes that the bankruptcy court awarded him and his companies $30 million in judgments. ■

17 APRIL 2023

Mouzon “Muzzy” Bass

Chris Harrison

CONSTRUCTION VEERS GREEN

By Connie Gentry

Whether you’re a science nerd or a nance geek, Biomason is a North Carolina startup worth watching as it uses biology to produce cement.

Biomason predicts its proprietary technology can eliminate 25% of global carbon emissions from the concrete industry by 2030. Investors bought in to the tune of $65 million in venture capital funding in February 2022. It was among the state’s biggest venture capital investments last year, on par with the $70 million raised by Morrisville-based JupiterOne, which creates cybersecurity so ware.

Biomason had previously raised about $10 million since its inception in 2012. Its continued development caught the attention of lead investor 2150, a London-based venture capital company that says on its website that it backs entrepreneurs who “have suspended our disbelief in a sustainable future built on cuttingedge technology innovation that is sometimes hard to imagine.” ree companies tied to North Carolina are also investors: Zebulon-based Noël Ventures owns engineered-foam product maker Nomaco; Raleigh-based Martin Marietta is one of the biggest U.S. aggregates companies with $6.1 billion in revenue last year; and Novo Holdings, the investment arm of Danish biotech giant Novo Nordisk, which has major Triangle plants.

A er water, concrete is the most-consumed material on earth, with roughly 30 billion tons of concrete — requiring roughly 4 billion tons of cement — consumed per year. In terms of environmental impact, 2150 reports the cement industry is responsible for as much as 8% of all global CO2 emissions. at makes Biomason CEO Ginger Krieg Dosier and her biocement, which is grown from microorganisms, a potential game-changer for overcoming climate adversity in the construction sector. e company employs about 100 people and has a production plant in Durham of about 10,000 square feet.

“Given its trillion-dollar scale and continued global use, cement and concrete decarbonization represents both a massive business opportunity as well as possibly one of the most actionable and scalable methods for reducing global CO2 emissions,” 2150 stated in its assessment of the industry.

Dosier’s passion for cement mixes started as a child in Huntsville, Alabama, where her father worked as a NASA scientist. “Growing up we had piles of aggregate, sand, and cement as part of his weekend concrete projects,” she said in an April 2022 interview with San Francisco-based Celesta Capital, another Biomason investor. “He taught me how to make concrete in a Dixie cup when I was 7 and ever since I’ve been fascinated with ‘liquid stone.’”

Dosier, who declined an interview request, has a bachelor’s degree in interior architecture from Auburn University and a master of architecture from Cranbrook Academy of Art near Detroit. She previously taught in the United Arab Emirates and as a visiting assistant professor at N.C. State University.

In June, Biomason announced a partnership with Netherlandsbased StoneCycling to drive sales of Biomason’s precast tile products used for walls and oors in interior and exterior surfaces. StoneCycling creates building materials from waste materials. e company is planning a production plant in Denmark with Danish concrete manufacturer IBF. Plans call for a capacity of 35,000 square meters of product this year.

Globally, the cement market rings in at $300 billion annually and concrete is a $1 trillion enterprise. Biomason’s technology uses bacteria to create calcium carbonate that combines with aggregates or sand at existing temperatures.

Anders Bendsen Spohr, a senior partner at Biomason investor Novo Holdings, says his rm “truly believes that biotechnology has the potential to become a spearhead for the green transition of society.” ■

18 BUSINESS NORTH CAROLINA NC TREND ››› Technology

Smart money is banking on a Triangle firm’s biology-based cement.

COASTAL CATCH

By David Mildenberg

February marked the second anniversary of Novant Health’s $1.5 billion purchase of New Hanover Regional Medical Center in Wilmington and a smaller hospital in Brunswick County. e sale occurred in a public, competitive process because the medical center was then county-owned.

e Wilmington hospital recorded about 256,000 patient days in the rst half of 2022, which is more than 40% greater than Novant’s main hospitals in Winston-Salem (177,000) and Charlotte (168,000). Unlike Wilmington, Novant faces hospital rivals in the latter cities.

Former NHRMC CEO John Gizdic is executive vice president and chief business development o cer at Novant Health, which was selected over sale nalists Atrium Health and Duke Health. He oversees New Hanover and has corporate responsibility for human resources, including diversity, inclusion and health equity. is interview with Gizdic was edited for clarity and brevity.

John Gizdic

John Gizdic

WHAT IS YOUR IMPRESSION OF THE MERGER, TWO YEARS LATER?

ese are unusually challenging times and the past two years have been some of the toughest nancial years for health care in decades. Our merger was made exponentially harder because of the pandemic. But we really view change as more of an opportunity than a threat.

New Hanover Regional was operating at a position of strength, but no one predicted the big in ation spike that occurred. Fortunately, Novant has enabled New Hanover to do much that we couldn’t have accomplished otherwise.

HOW HAS NOVANT IMPROVED THE WILMINGTON SYSTEM?

We have invested more than $65 million in higher employee compensation. Our minimum wage later this year will be $17 an hour. at compares with $12.50 in 2018.

We’ve more than tripled the number of people who bene ted from nancial assistance by making it eligible for those with income at 300% of the federal poverty rate. e standard had been 200%. More than 26,000 patients bene ted in 2021 and 2022, compared with about 7,000 in the previous two years.

20 BUSINESS NORTH CAROLINA NC TREND ›››

Medical

Novant’s top Wilmington executive reflects on the hospital system’s seaside expansion.

We’ve expanded our UNC Health and UNC School of Medicine relationship. Third- and fourth-year residents can now attend in Wilmington. We have boosted the number of students from 16 to 24 and we hope to get to 30 very soon.

Fourth, we’ve continued to invest more than $300 million in capital projects. New Hanover County could not have done this without raising taxes. This includes adding a 108-bed Neuroscience Institute; a 66-bed Scotts Hill Community Hospital; and Michael Jordan Family Clinics.

LIKE MANY PEERS, NOVANT HAS FACED STAFFING SHORTAGES. WHAT IS THE STORY THERE?

We are facing the same problems as others are on a national basis. We had benefited historically from a “come to the beach” approach in recruiting. But we have now had a record number of resignations and retirements by our providers. At the same time, we have had very heavy volume because so many people have put off care during COVID-19.

The situation would have been much worse as a standalone hospital. Having Novant backing us up with its recruitment and retention programs has helped our pipeline of nurses. Staffing problems also can be due to the increased acuity of patients. Wilmington has lots of retirees and, therefore, a heavy reliance on Medicare payments. Those folks can require a lot of care.

Wilmington is also the only major trauma hospital within a couple of hours, so it draws many serious medical-care cases.

It’s a very complicated balance, but Novant is very satisfied now with the quality of care that is being provided.

HOW DID FEDERAL FUNDING RELATED TO THE COVID-19 PANDEMIC AFFECT YOUR SYSTEM?

It helped, but it didn’t cover all of the hospital’s costs, and it was short-lived. The needs have continued, which is a factor in the financial difficulties facing hospitals.

The health care finance model is broken. Hospitals are facing double-digit cost increases, but they can’t raise fees at double-digit rates like a gas station or grocery store. The payment system doesn’t work that way. And health care isn’t connected to the consumer’s premiums in many instances.

HOW IS THE SYSTEM FOCUSED ON MAKING HEALTH CARE MORE AFFORDABLE?

Novant knows that hospital care needs to become more affordable. We know that improving social determinants are key to reducing costs because they affect 80% of a person’s

well-being. Hospitals treat the rest. It’s the reason we believe efforts to improve health equity through diversity, equity and inclusion programs are so important.

WHAT WERE THE KEY REASONS THAT NOVANT WAS PICKED OVER ATRIUM AND DUKE?

A key reason was the view that Novant would be more adept at attacking social determinants. Novant Health is only one of two health systems in the country to receive the National Committee for Quality Assurance’s Health Equity Accreditation Plus status. (Gizdic cited industry recognition for Novant’s efforts at health equity, including programs for mobile health clinics and mammogram screenings.)

We realize change is difficult, but partnering was the right decision. We had three great choices in Novant, Atrium and Duke. North Carolina is very fortunate to have so many great health care systems.

Absolutely, we made the right decision. I’m elated that we made the decision when we did because of what’s happened since then. Scale is very important. I’m not sure of the best size, but the key is whether scale leads to increased access and better affordability. You can’t just grow for the sake of growth.

[A key merger benefit] is that the Wilmington area got a $1.3 billion community endowment, which is unlike anywhere else in the United States. It will make things so much better in southeast North Carolina. ■

21 APRIL 2023

New Hanover Regional Medical Center opened in 1967.

SHIFTING GEARS

By Dan Barkin

By Dan Barkin

It has been a year since Wake Technical Community College dedicated the $42 million Hendrick Center for Automotive Excellence in north Wake County. Since then, Wake Tech has tripled the number of students in its automotive systems technology program and added a new degree program in collision repair.

In March, the college received a $939,041 federal grant to help jump start the Hendrick Center’s electric vehicle training program. It was part of the $1.7 trillion spending bill signed by President Joe Biden in December.

e grant comes amid an obvious transformation of the economy from gas-powered cars and trucks to electric vehicles. Electric cars have gone from being something exotic to something that requires trained technicians to service. e electric economy is evolving in places like the northern Wake County campus and throughout North Carolina. If the shi to electrics goes fast, a lot of work needs to be done fast.

e federal government’s target is for half of all vehicles sold in 2030 to be battery electric, plug-in hybrids or fuel-cell electrics. Gov. Roy Cooper’s goal is to have 1.25 million zeroemission vehicles in North Carolina by 2030. At the start of this year, there were about 54,000 zero-emission vehicles, including 38,400 electrics, and 15,600 plug-in hybrids, according to state registration data. Hitting Cooper’s target will require big changes on car lots around the state.

But inventories are increasing as car manufacturers scramble to roll out EVs with more millennials hitting peak earning and family-formation years. Gen Z’s are right behind. Many folks may be driving their last gasoline car right now. at has everyone’s attention in car factories, dealerships, oil-change shops, convenience stores and state highway departments fueled by gas taxes.

North Carolina is emerging as a center of electric-vehicle technology. Toyota is building a $3.8 billion battery plant near Greensboro in a partnership with Panasonic. Siemens is creating charging stations for electric buses and other large vehicles in Wendell, in Eastern Wake County. Kempower, a Finlandbased company, plans a fast-charger manufacturing facility in Durham.

North Carolina is also a key source of lithium, a metal that has been referred to as “the new white gold” because of its use in EV batteries, says Louis Martin-Vega, engineering dean at N.C. State University. “ at’s one of the reasons that Albemarle Corp. is building a research and technology park in Charlotte,” he says.

Albemarle also plans to reopen a Cleveland County mine with lithium deposits that has been closed since 1988. Likewise, Belmont-based Piedmont Lithium is seeking regulatory approval to operate a lithium mine and processing plant in Gaston County, 30 miles west of Charlotte.

“North Carolina’s on the leading edge of this,” MartinVega notes.

e path to a transformed economy is full of potholes, to be sure. In March, Vietnam-based VinFast said it was delaying the start of electric-vehicle production at its proposed plant in Chatham County to 2025, a year later than previously announced. In an email to Chatham County Economic Development, VinFast said “this is the result of administrative delays” and “we remain fully committed to the development of our rst U.S. production facility in North Carolina.”

e six-year-old company has said it expects to produce about 150,000 SUVs a year at the factory for North American customers, eventually employing as many as 7,500 people and entailing an investment of $4 billion.■

22 BUSINESS NORTH CAROLINA NC TREND ››› Automotive

North Carolina seeks a front-row slot as the automotive industry electrifies.

TRIBUNE NORTH CAROLINA INDEPENDENT INTELLIGENT INFORMATIVE

Our paid daily newsletter provides detailed interviews with key lawmakers, Q&As with other political leaders and lots of stories tracking daily happenings at the state legislature during the current session. Here’s some of what you missed. Sign up today at nctribune.com.

A NEW ECONOMIC DEVELOPMENT CAUCUS

Thirty-seven House members have banded together to form what they're calling the Economic Development and Foreign Trade Caucus.

House Majority Leader John Bell, R-Wayne, and Minority Leader Robert Reives, D-Chatham, are co-chairing the group, which aims to "establish durable relations with the private sector" and foreign countries.

eir announcement said the group wants to act as "a versatile and responsive mechanism within the General Assembly for engaging with the private sector and foreign dignitaries."

Reives noted that Chatham County has bene ted from "a whirlwind of economic-development deals in the past two years."

e most prominent of them was the 2022 announcement that state and local governments had joined forces on a $1.2 billion incentives package that convinced Vietnamese carmaker VinFast to build EVs in a $4 billion factory near Moncure. O cials expect the VinFast project could create about 7,500 jobs.

e truism that politics stops at the water's edge still holds when it comes to industrial recruiting, which in this state has proceeded on a bipartisan basis.

CHILD CARE PACKAGE

Members of the bipartisan Early Childhood Caucus rolled out ve bills that address child-care issues and between them call for $430.4 million in spending over the next two scal years.

e centerpiece of the package is House Bill 342, which would allot $300 million in federal and state funds to continue the subsidies child care centers started receiving during the COVID pandemic.

All ve bills will have Senate counterparts with sponsors from both parties, and Rep. David Willis, R-Union, said the caucus has "had support from both corner o ces" — meaning House Speaker Tim Moore and Senate President Pro Tem Phil Berger — "throughout this process."

Nor is that all.

"Our state's business community is aligned," said Debra Derr, director of government a airs for the N.C. Chamber. "North Carolina's employers have identi ed child care as a crucial factor in our state's workforce challenges."

DERAILMENTS HAVE LAWMAKERS ASKING TRAIN QUESTIONS

February's derailment of a chemical-laden Norfolk Southern freight train in East Palestine, Ohio, has some North Carolina legislators seeking reassurances about the state's relationship with the company.

e company leases the state-owned, 317-mile N.C. Railroad that connects Charlotte and Morehead City. So N.C. Railroad Co. CEO Carl Warren had some questions to answer a er he nished a budget brie ng.

"What's the most important thing we can learn and how can we make sure it doesn't happen in North Carolina?" asked Sen. Michael Lazzara, R-Onslow.

Warren responded that he's "pretty happy" with Norfolk Southern's maintenance of the corridor. He said safety is "part of the reason" his organization is "so careful about managing new

uses" on the corridor, including passenger service and utility encroachments.

While some of the line's older bridges remain "sound and within legal standards," he would like "to see some additional investment."

Rep. Frank Iler, R-Brunswick, asked whether the East Palestine incident could undermine Norfolk Southern's nances. " ey'll have a huge liability up in Ohio," Iler said, alluding to remediation and litigation costs because of the spillage and burn-o of toxics.

e trackage-rights agreement with Norfolk Southern accounts for about 75% of N.C. Railroad's annual revenue, which was $25.1 million in 2022, according to an unaudited report.

"In terms of us getting paid by Norfolk Southern, I don't see any risk in that sense," Warren said. He hopes the incident heightens attention to safety culture throughout the rail industry. ■

24 BUSINESS NORTH CAROLINA NC TREND ›››

Public affairs

PHOTO CREDIT: KELLY SIKKEMA FOR UNSPLASH

Canton’s paper mill, a key part of western North Carolina’s economy for 125 years, is slated to close in June a er New Zealand billionaire Graeme Hart’s Pactiv Evergreen declared the operation as no longer economically viable. e closing, which is expected to a ect about 1,100 workers, surprised state and local o cials, who hope the plant can be sold to a new owner rather than demolished.

e decision came amid labor discord at the mill, where testy relations between the union workforce and ownership has been a common theme for many years. Pactiv Evergreen’s labor agreement with the United Steelworkers’ local union expired last May, and union workers twice rejected company proposals since then.

e plant produces coated paperboard that is used in co ee cups, milk cartons and other products. e company went public in 2020 and reported a 14% increase in revenue

last year to $6.2 billion. It had operating income of $319 million, compared with $33 million a year earlier.

Champion Fibre opened the plant in 1908 to take white pulp from chestnut wood. e rst application involved the leather industry. It has supplied the paper-products business for most of its history.

Gov. Roy Cooper’s budget proposal in mid-March included at least $5 million to support the Canton area following the plant closing.

BELMONT

Belmont Abbey College, a Roman Catholic school in Gaston County, announced a $100 million capital campaign, of which $73 million has already been collected. Plans call for $15 million for a monastery, performing arts center and programs aimed at religious freedom. Another $30 million will fund academic programs, with $55 million going to the endowment and student loans.

Piedmont Lithium says it has secured a $75 million investment from South Koreabased LG Chem. e deal also includes supply agreements for thousands of tons of raw materials. In exchange for the money, LG Chem gains nearly 6% of Piedmont’s stock. e company is based here.

CHARLOTTE

PAPERTOWN BLUES CHARLOTTE

Honeywell International CEO Darius Adamczyk, 57, will retire June 1 and be replaced by COO Vimal Kapur. Adamczyk moved the company’s headquarters to Charlotte from New Jersey in 2019 and quickly established himself as a community leader. He will become executive chairman of the Honeywell board until at least April 2024. He says there’s no major reason for the change except he wants to do something else.

Charlotte Hornets owner Michael Jordan is close to selling his majority stake in the NBA team, according to media reports. Likely buyers are a group including Hornets minority owner Gabe Plotkin and Atlanta Hawks minority owner Rick Schnall. Jordan bought control of the team for $275 million in 2010 from Bob Johnson. In 2020, he sold a stake to Plotkin, who is a New York hedge fund investor. Forbes esimates the Hornets’ value at $1.7 billion. He’s the only Black majority owner of an NBA team.

CONCORD

e city council here approved an incentives grant for a Hendrick Motorsports a liate that is involved in a proposed development of a 269,500-square-foot advanced manufacturing facility. e project, which includes an estimated $23.7 million investment, would be developed speculatively on a 30-acre site adjacent to the Hendrick campus near Charlotte Motor Speedway.

Charlotte-based Krispy Kreme is closing a doughnut factory here, and cutting about 100 jobs. Layo s will take e ect May 11 and will be permanent, the company says.

GASTONIA

e local branch of the North Carolina Association of Educators and two teachers have led a lawsuit against the Gaston County Board of Education over payroll problems that have lasted for more than a year. e lawsuit alleges the school board bought an Oracle payroll system even though it had hundreds of errors in

26 BUSINESS NORTH CAROLINA NC TREND ››› Statewide

testing. Teachers and other staff say the system pays them the wrong amounts and fails to put money into their retirement system. The school system employs almost 4,000 people, making it the county’s second-largest employer.

KINGS MOUNTAIN

Hound’s Drive-in Theater closed after seven seasons, leaving only five such establishments in the state, about 300 nationwide. During the pandemic, owners allowed churches and schools to use the property for worship services, concerts, and graduations.

EAST

EDENTON

Timbermill Wind won state environmental approval to build a wind energy generating facility in Chowan County. Developed by Apex Clean Energy, Timbermill Wind is expected to have up to 45 wind turbines, with a capacity of as many as 189 megawatts that can produce enough energy to power up to 47,000 homes every year. The permit is the first for a facility under a state law passed in 2013.

FAYETTEVILLE

Methodist University and Cape Fear Valley Health are partnering to create a four-year medical school at Methodist University, pending approval by accreditation groups. The campus will be

located in a $50 million facility at Cape Fear Valley Medical Center. Classes are set to begin in July 2026 with plans for 80 students.

A Superior Court judge here denied a motion by Dupont and Chemours to dismiss a state lawsuit against the two companies in October 2020. The state alleges in the lawsuit that the companies emitted PFAS into the Cape Fear River, which damaged drinking water and other natural resources. PFAS are associated with cancer, poor child development, liver and kidney problems and are sometimes referred to as “forever chemicals” because they do not break down in the environment.

HOLLY RIDGE

UPS will locate a $12.3 million distribution facility in this Onslow County town and add 98 jobs. It’s the largest economic development project for the county in 40 years. The expected average annual wage is $67,657.

MCADENVILLE

Coats America is laying off 41 workers from its industrial thread plant here effective April 24. London-based Coats bought the plant in 2019 from Pharr HP, which exited the textile business after 80 years. Pharr still sponsors the town’s holiday lights, which transforms the tiny town into Christmas Town U.S.A and attracts hundreds of thousands annually.

MOORESVILLE

Novant Health said it will buy Lake Norman Regional Medical Center here and Davis Regional Medical Center in Statesville from Tennessee-based Community Health Systems. Novant will pay $320 million for the hospitals and affiliated clinical operations, pending regulatory approval.

BALD HEAD ISLAND

A construction company has been ordered to pay a combined $30 million resulting from several judgments related to its allegedly fraudulent activities in obtaining contracts to work on Bald Head Island homes damaged by Hurricane Florence. The cases surround the alleged illegal conduct of Disaster America USA and its subsidiary, Disaster America of North Carolina.

27 APRIL 2023

RODANTHE

In the wake of the collapse of several oceanfront homes, Cape Hatteras National Seashore officials warned visitors to use caution when participating in recreational activities on the beach. Dare County and park officials may implement a beach nourishment project there to attempt to try to combat beach erosion.

SNOW HILL

Dexter Duncan pleaded guilty in November to creating fictitious businesses so he could divert $180,988 in federal COVID-19 loans to himself. In March, he was sentenced to 31 months in prison and ordered to pay restitution by a federal judge in New Bern. Duncan was not working, but lived a “lavish lifestyle” with taxpayer money, according to the U.S. Attorney’s Office.

TRIAD

ARCHDALE

Ohio-based packaging manufacturer Axium Packaging will make a $32 million investment and add 118 jobs here in 2024. Axium makes packaging for personal care products, household chemical products, and over-the-counter pharmaceuticals and food products. The company has 3,000 employees and 18 existing sites.

LEXINGTON

A division of German engineering giant Siemens AG will build a passenger rail car manufacturing plant here. Siemens Mobility will make a $220 million investment and add 506 jobs over five years to support an established factory in Sacramento,

California. Siemens plans to start operations next year. The state plans to offer Siemens $5.6 million in incentives over the next 12 years, while Lexington and Davidson County are pledging $8 million and $7 million in incentives, respectively.

Japan-based Daido Steel purchased Elizabeth Carbide Die, a nearly 50-yearold manufacturer here. The forging die manufacturing business with a former headquarters in Pennsylvania will now be called Lexington Technologies. The plant has 24 employees with plans to hire as many as 40 more in the next two years.

MCLEANSVILLE

Burlington-based LabCorp moved out of its leased 176,778-square-foot office building here, off Interstate 40. Raleigh-based APG Capital owns the building. It’s part of about 650,000 square feet vacated by LabCorp, including other office space in Burlington, Durham and Raleigh due to more remote work, APG’s Jim Anthony said.

WHITSETT

Precor Manufacturing said its Peloton unit notified 123 employees at its plant here that it is closing. The layoffs are permanent and expected to be completed by Oct. 31. Peloton said the layoff is due to a business restructuring and that employees don’t have bumping rights to take other jobs in the company.

WINSTON-SALEM

WINSTON-SALEM

Tex-Tech Industries will add 49 new jobs in a $24.8 million manufacturing expansion. The Kernersville-based specialty textiles company will build a 170,000-square-foot building. The company’s fabrics serve the aerospace, automotive, defense, medical and protective apparel industries.

A dairy co-op’s decision to eliminate its ice cream lines led to 78 workers at DFA Dairy Brands Fluid here losing their jobs. The existing fluid milk line is unaffected and some workers may work there. Dairy Farmers of America is a co-operative owned by about 11,000 farmers that markets its products under several regional and national brands.

28 BUSINESS NORTH CAROLINA NC TREND ››› Statewide

29 APRIL 2023

TRIANGLE

CARY

Real estate services provider Fathom, sharing unaudited results, said revenue was about $412 million in 2022, a 24% increase from last year. The company said its net loss was about $28 million in 2022, versus a loss of $12.5 million in 2021. It completed nearly 45,000 transactions, up 14%.

DURHAM

Duke University intends to challenge whether its graduate students can be considered employees under the National Labor Relations Act, likely delaying students from holding an election and possibly forming a union. The university made a similar — and unsuccessful — attempt in 2017.

MONCURE

VinFast has delayed its plans to start vehicle production here until 2025, a year later than previously disclosed. The Vietnamese carmaker assured local government officials that there are no changes in the scope or vision for the $4.5 billion project — which includes 7,500 jobs. The project could be aided by $1.25 billion in state and local incentives.

WEST

ASHEVILLE

Asheville-based Poppy Handcrafted Popcorn closed its first-ever funding round, securing $3 million from 19 investors, according to a securities filing. CEO Susan Aplin said proceeds from the sale will be used to expand, and includes doubling its manufacturing footprint in Asheville.

BILTMORE FOREST

KNIGHTDALE

State regulators approved WakeMed’s plans to add a 150-bed behavioral health hospital here and a hospital with two operating rooms in Garner. WakeMed already has a free-standing emergency department in Garner. UNC Health and Duke Health had opposed the WakeMed plans.

RALEIGH

The UNC System Board of Governors authorized North Carolina State University to purchase the University Towers property on Friendly Drive in Raleigh for an appraised value of $29.6 million, expanding student housing capacity. The university plans to spend millions on renovations to the building before the fall 2025 academic year.

A Wake County grand jury indicted Raed Abel Amra on 15 charges related to the alleged embezzlement of $1.6 million in sales and use tax from the N.C. Department of Revenue. Amra is president Tobacco Road Sports Cafes in Durham and Raleigh, and was also the president of the now-closed Chapel Hill location. The state alleges the offenses occurred between 2012 and 2019.

An English Tudor-style mansion here sold for $9.6 million, a record for Buncombe County, according to Canopy MLS. The 9,538-squarefeet home with five bedrooms and five-anda-half bathrooms sits on 1.5 acres near the Biltmore Estate near Asheville. Charlotte-based Canopy Realtor Association serves 23 central and western North Carolina counties and three in South Carolina.

FLETCHER

Tageos, a high-tech radio-frequency identification, inlays and tags manufacturer based in Montpellier, France, will open its North American headquarters here. It plans a $19.25 million investment and 64 jobs that pay an annual average salary of $70,203. compared with Henderson County’s average salary of $47,949. ■

30 BUSINESS NORTH CAROLINA NC TREND ››› Statewide

READY TO ROLL

Leaders of the state’s transportation network gathered for Business

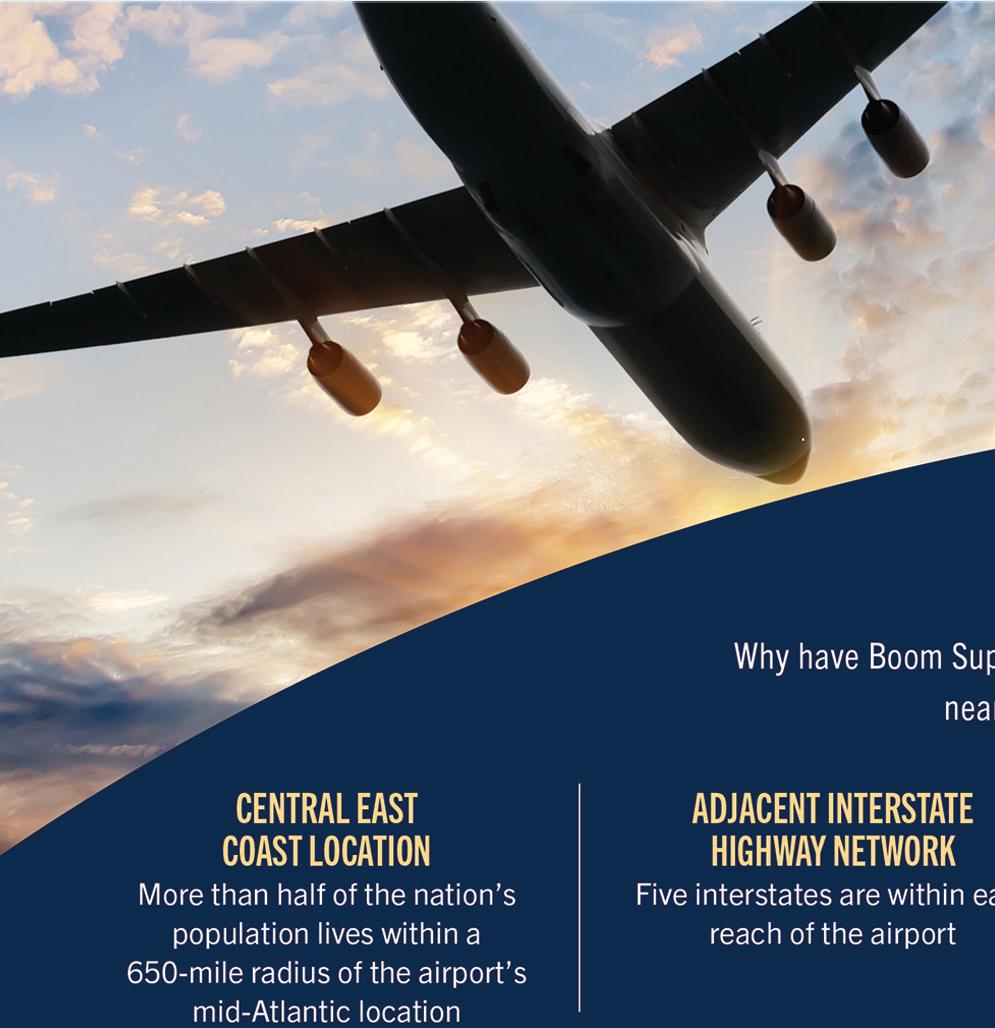

North Carolina’s roundtable discussion on the same day that Siemens Mobility announced a $220 million light-rail manufacturing plant in Davidson County. About 500 jobs are expected to be created at the Lexington site. The big announcement underlined the critical role that the state’s transportation system plays in luring business of all kinds, as well the impact of mobility-related businesses.

The conversation also covered a possible standard vehicle levy to replace sagging gas taxes; drones delivering artificial organs; driverless shuttles; and a projection that in 10 years, every new vehicle will be at least a hybrid or electric.

SPONSORED SECTION 32 BUSINESS NORTH CAROLINA ROUND TABLE TRANSPORTATION & LOGISTICS

Joe Milazzo executive director, Regional Transportation Alliance

Kevin Baker executive director, Piedmont Triad International Airport

Michael Fox chair, the North Carolina Board of Transportation; president, Piedmont Triad Partnership

Martin Marietta, Smith Anderson, North Carolina Railroad Company and Piedmont Triad Airport Authority sponsored the discussion. It was moderated by Business North Carolina editor David Mildenberg and was edited for brevity and clarity.

WHAT IS THE IMPORTANCE OF TRANSPORTATION TO ECONOMIC DEVELOPMENT?

FOX: Transportation is one of the key questions that any business leader looks at in deciding where to expand their business or locate a new business, along with the workforce. We’re really fortunate here in North Carolina that we have spent decades improving our transportation infrastructure. I’ve been told personally by the decisionmakers of many of the largest economic development announcements in our state’s history that we’ve had in the last year, that the transportation infrastructure was a critical piece to them making the decision for North Carolina.

WARREN: Transportation is vital. Not only do you need to think about things

like international air service, but rail is also a critical differentiator for winning economic development projects. I’ve observed over the last several years that I’ve been back in North Carolina and the 10 years before that when I was at CSX, when states were going after big manufacturing projects, being able to put together a rail solution that also included the port and also included a good linkage between them in the state’s approach to recruiting economic development deals was a big differentiator for a lot of the manufacturing projects.

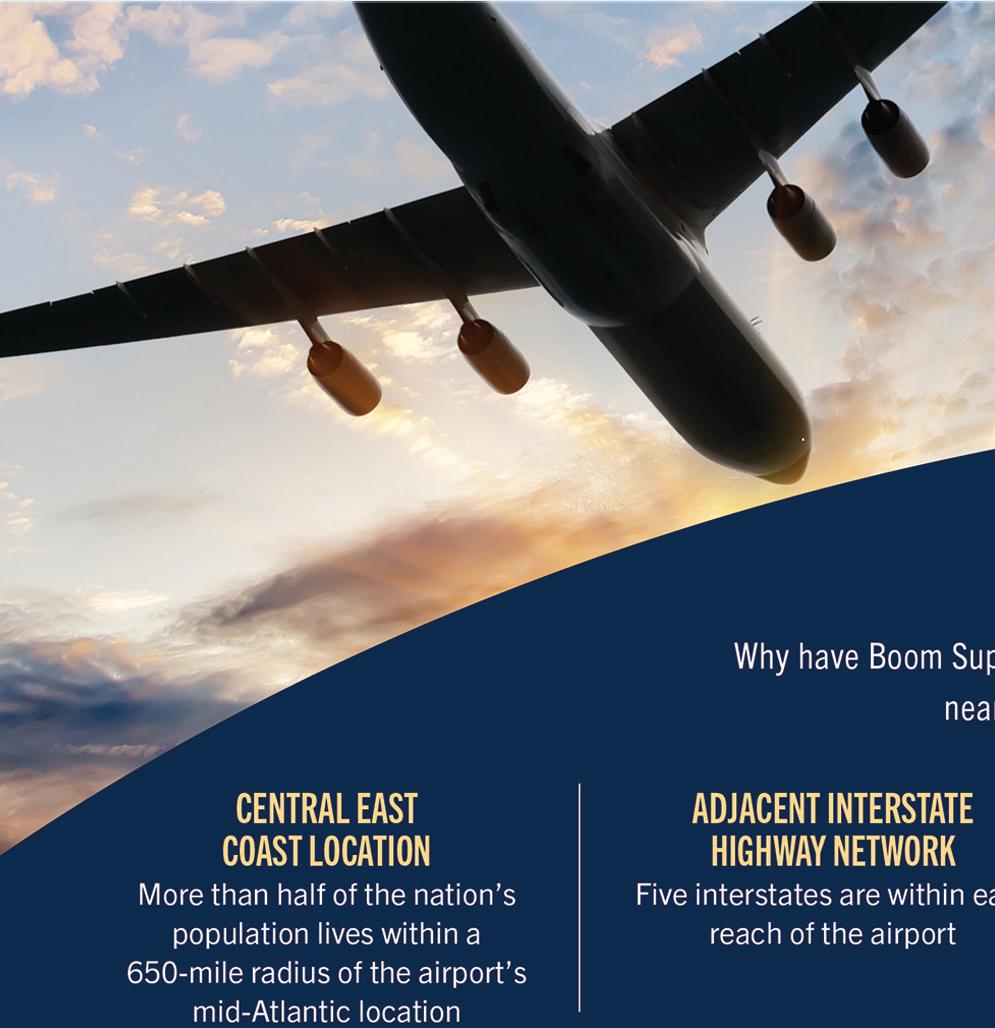

KEVIN, YOU’VE LED THE PIEDMONT TRIAD AIRPORT FOR 15 YEARS, AND IT’S ATTRACTING MUCH ATTENTION BECAUSE OF BOOM SUPERSONIC AND OTHERS. TELL US ABOUT THE AVIATION INDUSTRY.