HIGHER ED DIRECTORY: A LOOK AT THE STATE’S LEARNING INDUSTRY LENDINGTREE CLIMBS BACK | MAKING SENSE OF MAKERSPACES | JOHNSTON’S PHARMA PROWESS Price: $3.95 businessnc.com MAY 2023

4 UP FRONT

6 POINT TAKEN

Public-private cooperation pays for pharma giants in Johnston County.

10 POWER LIST INTERVIEW

Lawyer Mike Fox juggles key roles in development, transportation posts

12 ENERGIZERS

An Air Force pilot and Kinston dentist build a conglomerate of businesses that reflect their passions.

16 NC TREND

How the Liquid Pleasure band keeps grooving; Brewer bets on canned cocktails; Methodist University plans to produce physicians in Fayetteville; First Citizens Bank shows perfect timing; Top N.C. execs press plan to boost state’s R&D investment.

72 GREEN SHOOTS

A $50 million program aims to propel overlooked N.C. businesses.

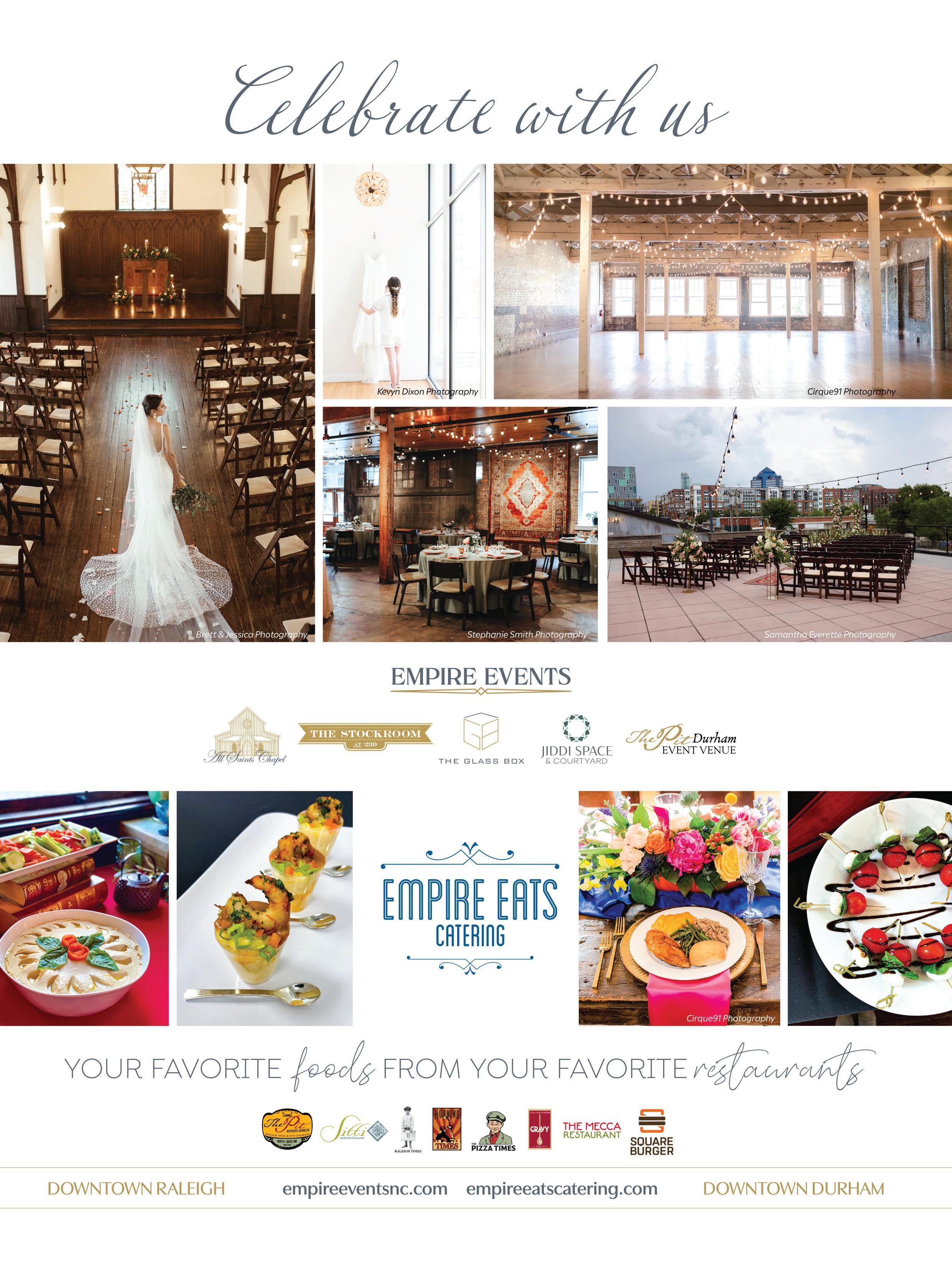

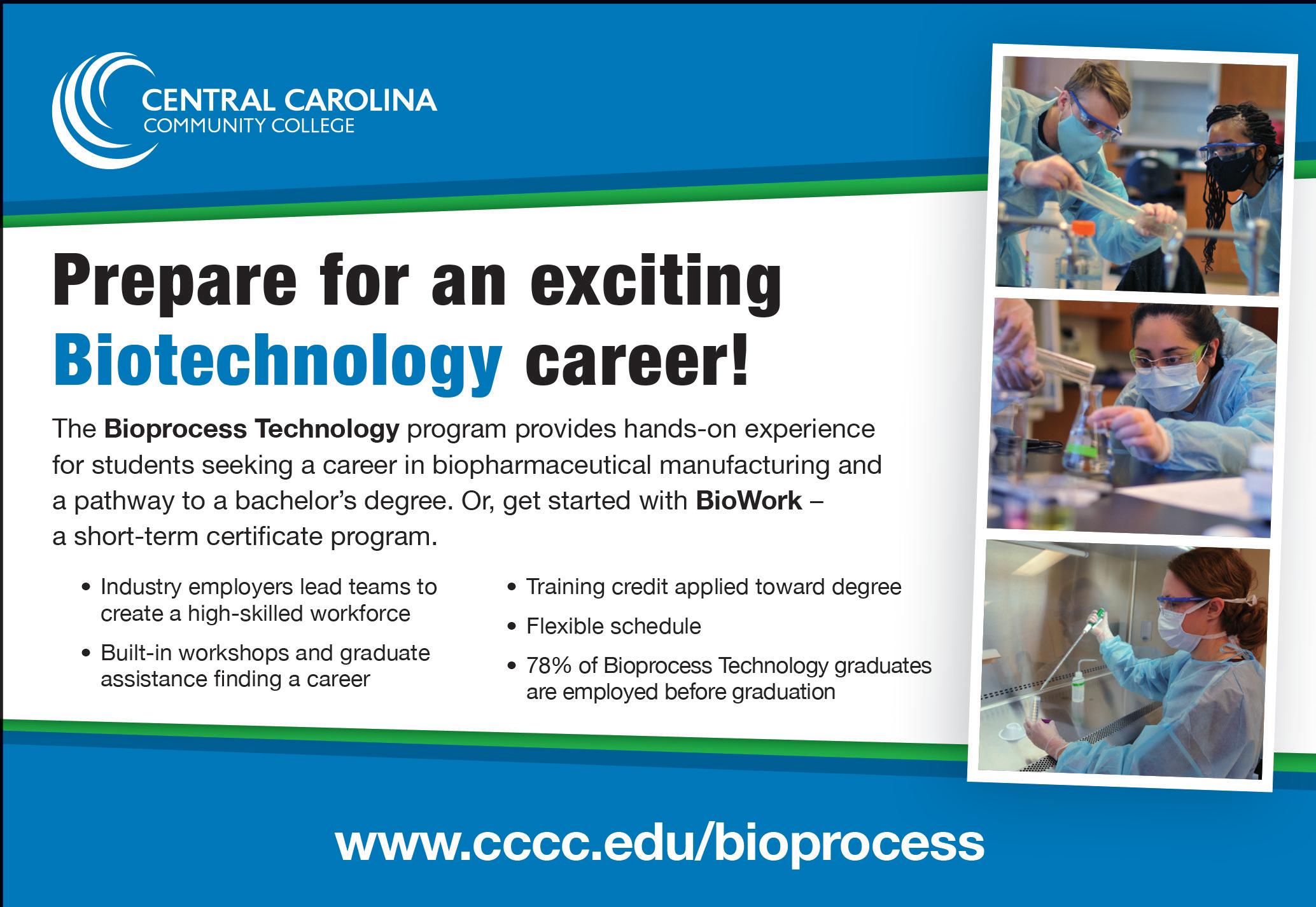

28 ROUND TABLE: BIOTECHNOLOGY

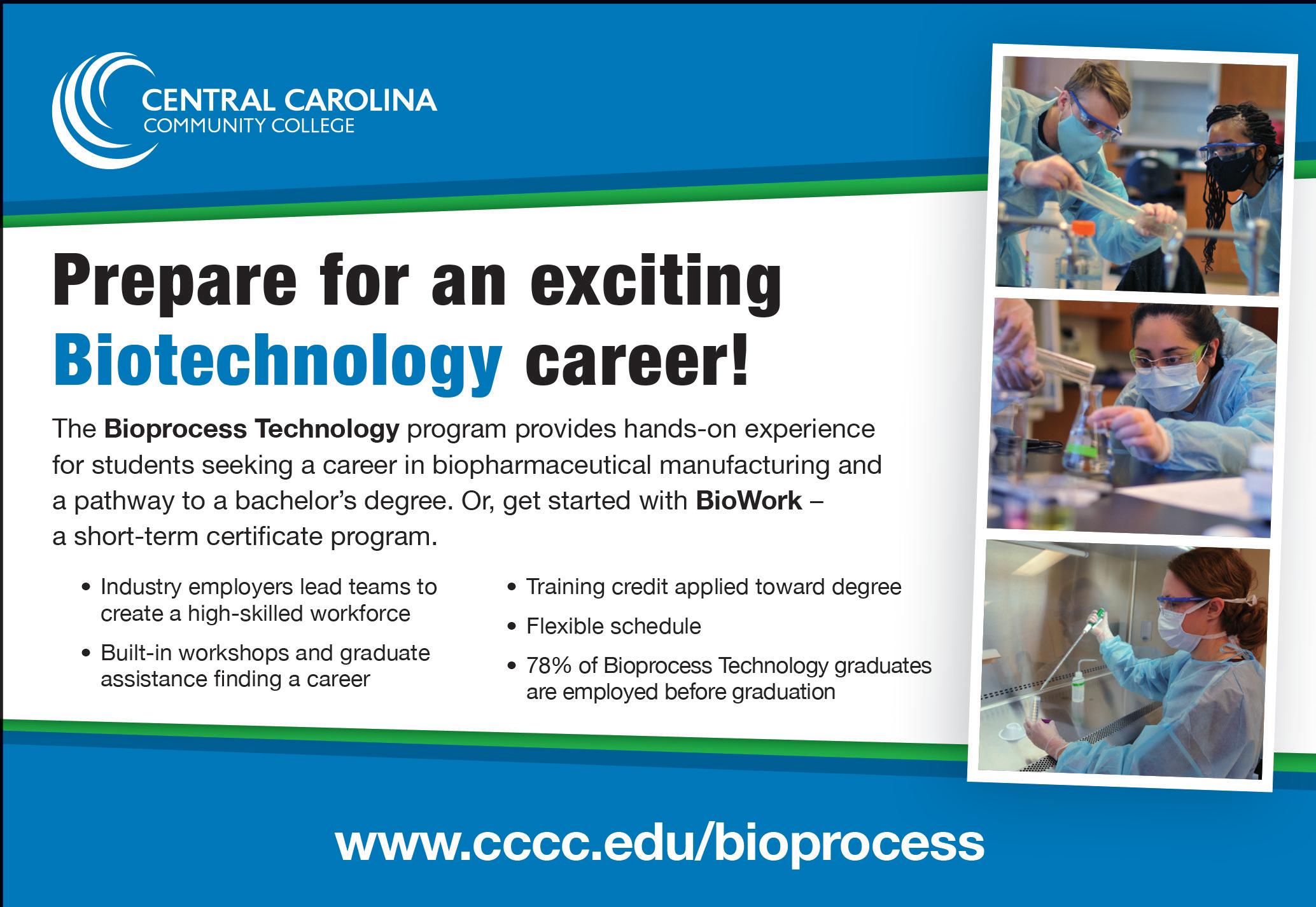

Biotech companies discuss plans to attract students and workers to their fast-growing industry.

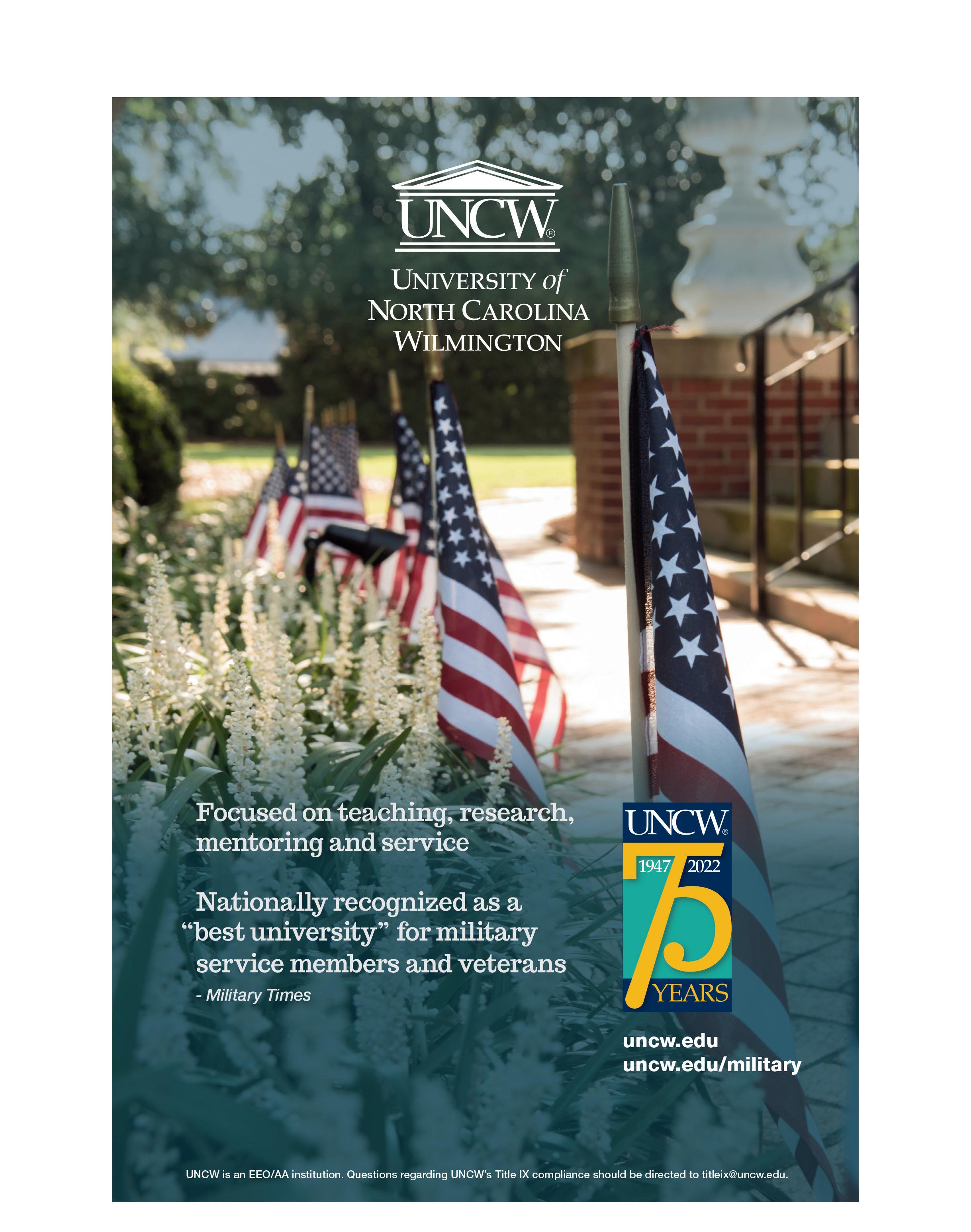

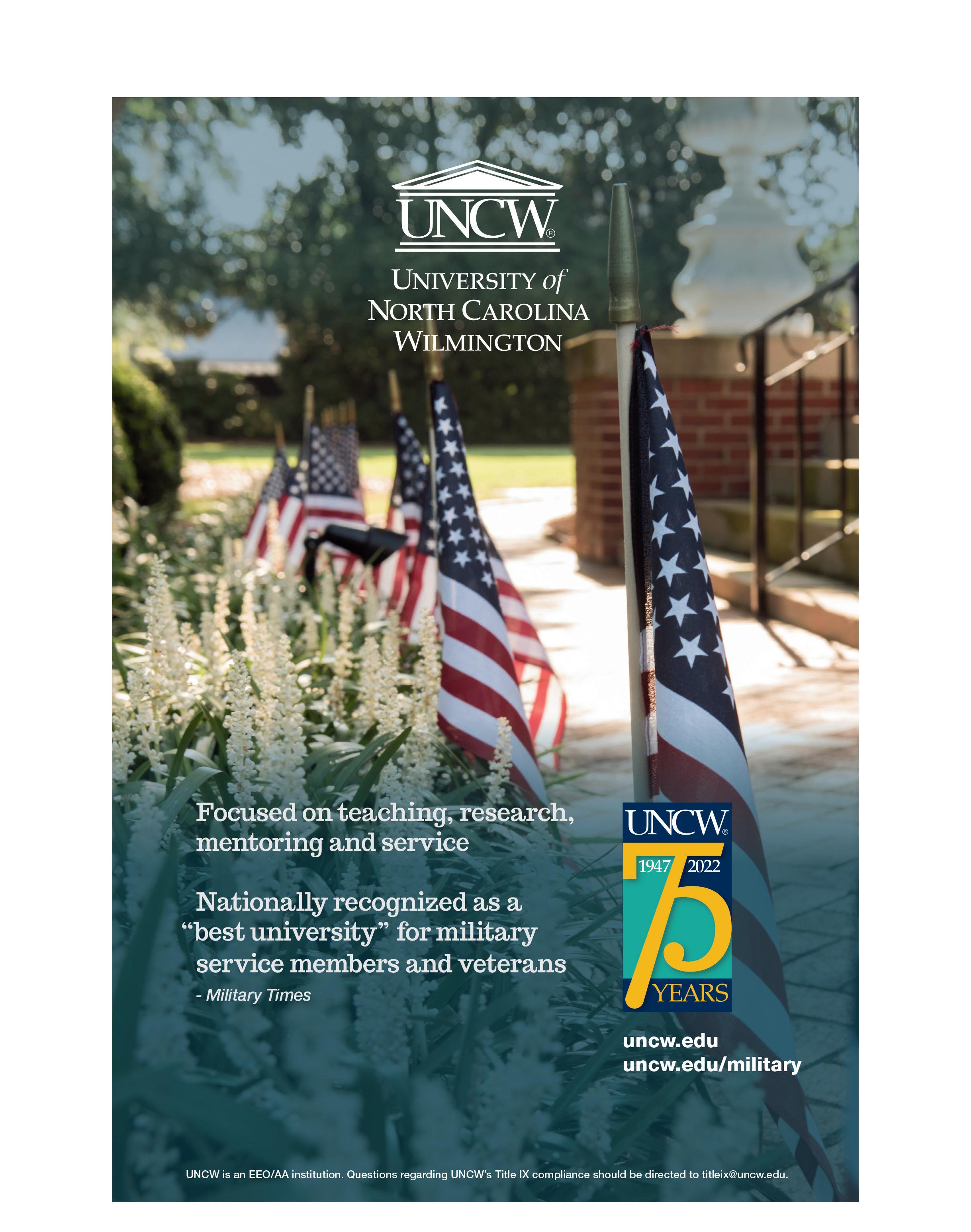

38 NC PROFILES: BUSINESSES SUPPORTING VETERANS

Organizations across the state are focused on supporting and hiring veterans.

64 COMMUNITY CLOSE UP: UNION COUNTY

Manufacturing and aerospace add to growth in a county that also hosts a thriving agricultural sector.

COVER STORY

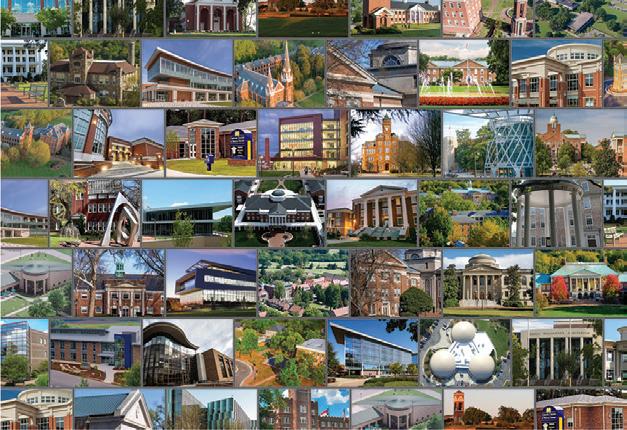

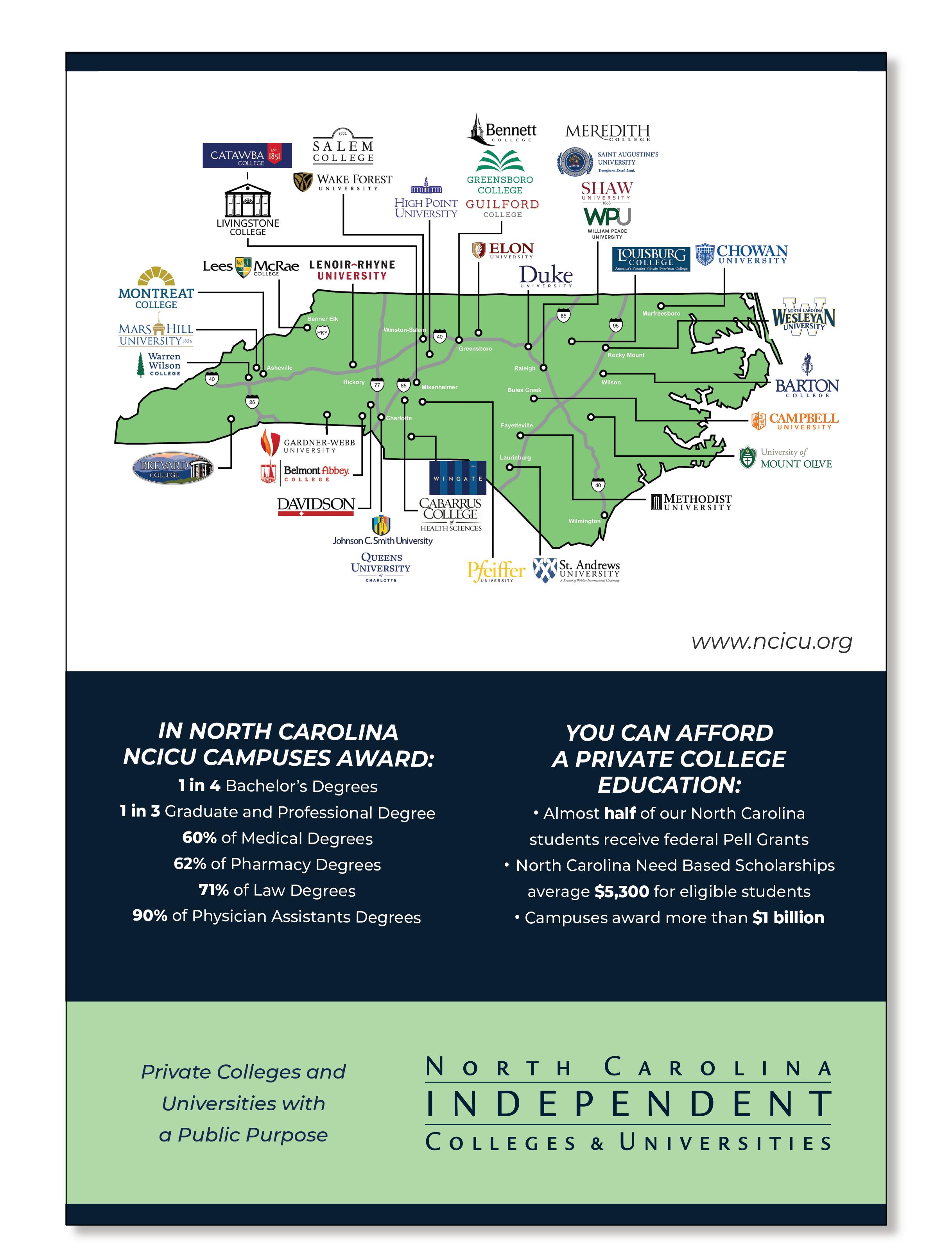

HIGHER EDUCATION

Our annual guide to the state’s public and private colleges and universities, from enrollment, to cost, to graduation rates.

BY EBONY MORMAN

BY EBONY MORMAN

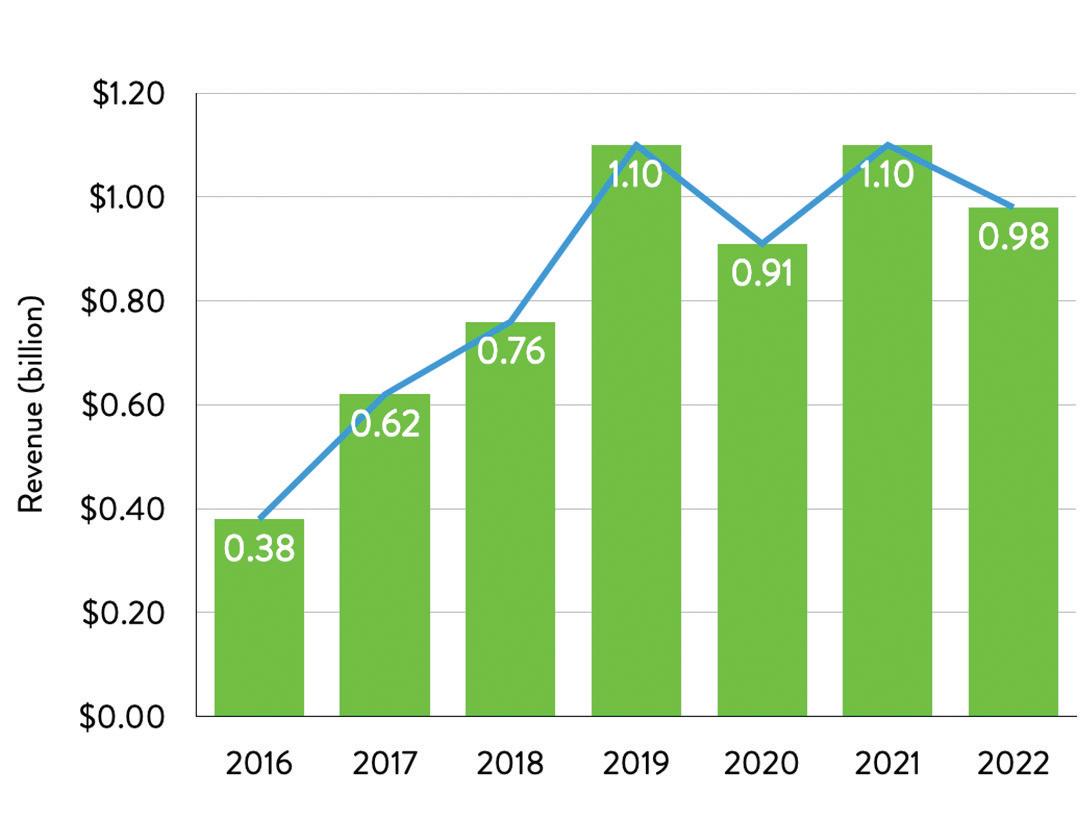

PRUNING TIME

Fintech innovator LendingTree recharges after some larger rivals stole its thunder.

BY MIKE MACMILLAN

BY MIKE MACMILLAN

DO IT YOURSELF

Makerspaces give Tar Heel entrepreneurs, do-it-yourself enthusiasts, and artists the tools and space to grow.

BY SHANNON CUTHRELL

BY SHANNON CUTHRELL

3 MAY 2023 May 2023, Vol. 43, No. 5 (ISSN 0279-4276). Business North Carolina is published monthly by Business North Carolina at 1230 West Morehead Street, Suite 308, Charlotte, NC 28208. Phone: 704-523-6987. All contents copyright © by Old North State Magazines LLC. Subscription rate: 1 year, $30. For change of address, send mailing label and allow six to eight weeks. Periodicals postage paid at Charlotte, NC, and additional offices. POSTMASTER: Send address changes to Business North Carolina, 1230 West Morehead Street, Suite 308, Charlotte, NC 28208 or email circulation@businessnc.com. Start your day with business news from across the state, direct to your inbox. SIGN UP AT BUSINESSNC.COM/DAILY-DIGEST.

MAY 2023

42

56 60

David Mildenberg

W

Seriously, the settlement of a muchpublicized defamation lawsuit in mid-April raised important issues on how the media operates in 2023. My sense is that most readers don’t care about the inner workings of the news business. But hang with me to consider a few key issues. We know having readers’ trust is important.

Credibility based on a pursuit of accuracy is the most important concern, of course. If the sky is Carolina Blue, but we report that it is Wolfpack Red to curry favor with the N.C. State University crowd, it’s a problem. Especially if someone nds an email saying I’m bbing to get tight with the Raleigh crowd.

Breathe easy, this magazine has never intentionally lied about Red versus Blue, or anything else, based on pure bias. Seems like a low bar, but it’s a di erent age. Everyone has biases because of their life experience. But our predecessors made an e ort to tell the story straight, despite outside pressure. We try to continue that tradition.

It can get cloudy because of economics, however. In the 1980s journalism world, dominant media companies were among the most lucrative businesses in their communities. It wasn’t cigarettes or so drinks, but a monopoly local newspaper or TV station was golden. Today, most for-pro t media groups operate on much thinner margins, while many news groups operate with subsidies from foundations, advocacy groups, wealthy individuals or government entities. ey understandably have biases. (Business North Carolina’s owner is a closely held, for-pro t business.)

Given the economic pressures, it’s impressive to see news organizations produce well-reported stories that challenge powerful institutions, whether one agrees with the coverage or not. Recent examples include private-equity-owned McClatchy’s series

ell, our magazine made it through another month without e Brass paying any critics $787 million. Let’s count that as a success.of stories criticizing North Carolina’s giant poultry industry for placing too much production near low-income rural residents; or the nonpro t Asheville Watchdog’s reports on how HCA Healthcare’s ownership of Mission Health has a ected health care in western North Carolina.

One can nd cracks in both cases. e McClatchy stories, which target readers in vibrant Raleigh and Charlotte, understate the poultry industry’s economic value in struggling regions. HCA backers contend the negativity stems from biased nursing-union organizers and does not acknowledge the tough decisions about sta ng levels across the industry because of labor shortages and margin pressures.

Fortunately, reporters still ask challenging questions of in uential enterprises and individuals. e key is for fair-minded people to eventually agree on the underlying facts and then gure out solutions. Sure, that’s utopian. But on too many civic issues, the media allows extremists to gain control of the debate. In the defamation case cited above, that seemed intentional, which led to a $787 million payout.

Let’s hope the big check leads to a wiser, fairer journalism environment.

•••••••••

Correcting the world’s wrongs is noble. We take our shots periodically, but our magazine’s mission is concentrated on sharing stories of interesting North Carolina people and enterprises. is month features an entrepreneurial couple in Goldsboro; a legendary Chapel Hill wedding band; a powerful Greensboro lawyer who in uences key development and transportation projects; and a star Charlotte tech company seeking a new growth strategy.

PUBLISHER

Ben Kinney bkinney@businessnc.com

EDITOR

David Mildenberg dmildenberg@businessnc.com

MANAGING EDITOR

Kevin Ellis kellis@businessnc.com

ASSOCIATE EDITOR

Cathy Martin cmartin@businessnc.com

SENIOR CONTRIBUTING EDITOR

Edward Martin emartin@businessnc.com

SPECIAL PROJECTS EDITOR

Katherine Snow Smith

CONTRIBUTING WRITERS

Dan Barkin, Shannon Cuthrell, Connie Gentry, Mike MacMillan, Tucker Mitchell, Ebony Morman, Emilee Phillips, Ray Gronberg

CREATIVE DIRECTOR

Peggy Knaack pknaack@businessnc.com

GRAPHIC DESIGNER

Cathy Swaney cswaney@businessnc.com

MARKETING COORDINATOR

Jennifer Ware jware@businessnc.com

ADVERTISING SALES

ACCOUNT DIRECTOR

Melanie Weaver Lynch, eastern N.C. 919-855-9380 mweaver@businessnc.com

ACCOUNT MANAGER AND AUDIENCE DEVELOPMENT SPECIALIST Scott Leonard, western N.C. 704-996-6426 sleonard@businessnc.com

CIRCULATION: 818-286-3106

EDITORIAL: 704-523-6987

REPRINTS: circulation@businessnc.com

BUSINESSNC.COM

OWNERS

Jack Andrews, Frank Daniels III, Lee Dirks, David Woronoff, in memoriam Frank Daniels Jr.

PUBLISHED BY Old North State Magazines LLC

4 BUSINESS NORTH CAROLINA UP FRONT

PRESIDENT David Woronoff VOLUME 43, NO. 5

Contact David Mildenberg at dmildenberg@businessnc.com.

GETTING THAT MINDSET

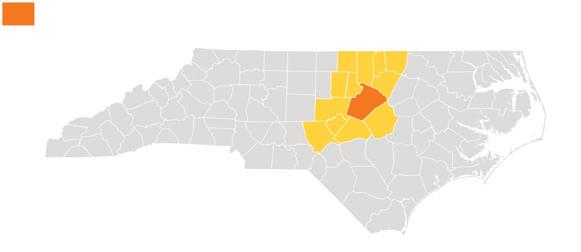

On the east side of Clayton, in Johnston County, are two large biotechnology manufacturing plants, one operated by Denmark-based Novo Nordisk and the other by Grifols, headquartered in Spain. Near these two plants is the two-story building Workforce Development Center, run by Johnston Community College.

e companies have expanded greatly here in the past decade, and one reason is the workforce center. “In economic development, there’s about four things you gotta have,” says Tony Copeland, a former North Carolina commerce secretary. “No. 1 is employees.”

Everyone talks about the workforce. We don’t have enough workers. We don’t have enough workers with the right skills. Well, I think they have hit on something in Clayton with the workforce center.

ere are about 3,400 workers at Novo and Grifols in Clayton.

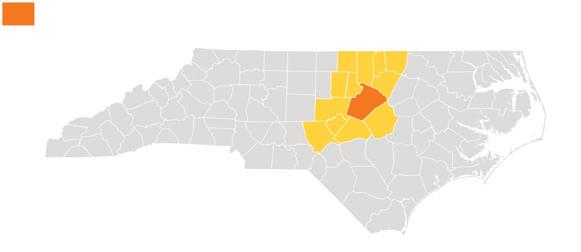

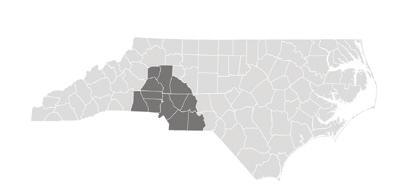

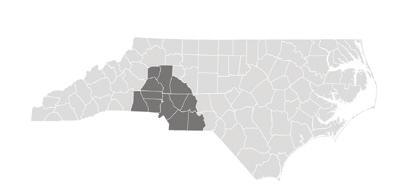

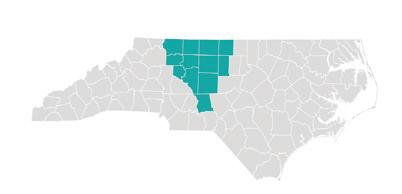

e annual payroll for pharmaceutical and medicine manufacturing in Johnston County is around $268 million, about 11% of the state’s total, and No. 2 behind Durham County, which has Research Triangle Park. ree decades ago, Johnston Co. industry was mainly textiles and tobacco. Now it is one of the state’s leading life sciences manufacturing hubs. Johnson County along with the Eastern North Carolina counties of Edgecombe, Nash, Pitt and Wilson — that form the BioPharma Crescent.

When Novo Nordisk announced a major expansion in 2015, it said the jobs would pay more than $68,400, on average. e Johnston Co. average was $34,400.

HOW THEY GOT HERE

Novo Nordisk makes diabetes and obesity products here and came to Clayton in 1991. It acquired a plant that was abandoned by another company. “When we bought it, it was just a shell with a dirt oor,” says Chad Henry, general manager of product supply, quality and IT for Novo in the U.S.

Novo dominated the European insulin market. It was building a 100-employee plant in Clayton to challenge Eli Lilly in the U.S. e plant would get ingredients shipped from Denmark, process them, and then ll vials and cartridges. Drug plants are highly regulated and starting a new one is a long process. It took until 1996 to get the FDA approvals.

Across the railroad tracks from Novo’s building was a small plant that would eventually grow into the Grifols complex. In the early 1970s, it was built by Cutter Laboratories, a California company that extracted substances from donated blood plasma that could be turned into medicine. Cutter was attracted by a labor force of folks struggling to

6 BUSINESS NORTH CAROLINA

POINT TAKEN Dan Barkin

Unusual public-private cooperation has sparked billions of dollars of pharma investment in Johnston County.

Chad Henry

make a living on small farms who wanted to stay in rural Johnston, not yet a booming Raleigh suburb. Cutter saw hard workers who could be trained by the new Johnston Technical Institute.

SNAKES, SQUIRRELS AND A WORKFORCE PLAN

Over the years, both businesses expanded. Cutter was acquired by Bayer, then by Talecris and in 2011 by Grifols, the same blood plasma fractionation business. Novo Nordisk remained Novo Nordisk.

More than 20 years ago, the companies began experiencing problems with an unreliable power grid. Every so often, a snake would get into a substation and cause outages. “That happened quite a bit because it was also a squirrel story, and it was a bird story,” recalls Henry, an N.C. State graduate who started at Novo in 2001 as a night-shift packaging supervisor.

A meeting with county, state and power company officials led to assurances that the problem would be solved. And then a legislator asked company representatives, “Is there anything else you need?” recalls Chris Johnson, the county’s economic development director.

“How about some help training a workforce?” the expansionminded companies asked.

The technical institute, which had become Johnston Community College, agreed to build an adjacent training center. It would provide specific programs with training needed for work at Novo or Grifols, or any other life sciences plant, including how to fill vials, clean equipment and keep records. Instructors would also teach about fermentation, quality standards, and the like. It would also offer customized training.

Johnston’s lawmakers got legislation through the 2003 session to create a research training zone mostly around the two plants. The special tax zone now raises around $1.1 million annually to support the new workforce center.

Novo donated the land. The $4.4 million, 30,000-square foot building was funded with a USDA loan, around $750,000 from the companies and nearly $400,000 from the Rocky Mount-based Golden LEAF Foundation.

The workforce center opened in 2005 with three science labs, two computer labs, and seven classrooms. It was called the first of its kind in the state and a model of collaboration. Johnston County was on the rise, said former state Sen. Fred Smith, a developer who is now on the county commission. The county would attract more jobs because of the center, Smith said. He was right.

A $2 BILLION PROJECT

In 2015, a decade after the workforce center opened, and thousands had been trained, Novo Nordisk announced it would open a second plant in Clayton, across Powhatan Road, doubling its payroll. Its research and development labs were developing a tablet to treat Type 2 diabetes, which would be preferable to injections. The company needed new capacity to manufacture active pharmaceutical ingredients, and a lot of it, especially with a Novo tablet plant to come in Durham.

State and local incentives helped Clayton win the $2 billion project, but incentives don’t run a factory. Novo needed a bigger workforce, and one that could use things like DeltaV, an automation operating system used to run a phenomenally complicated set of valves, pipes and tanks to be installed in the new plant. That’s not software you can train folks on during production. The Workforce Development Center purchased DeltaV software and installed it on its computers. Trainees then learned by watching a scale model of the kinds of equipment that it runs.

“So we could take our new employees that had no experience with DeltaV, the Workforce Development Center would train them long before we actually had DeltaV set up in API,” says Henry. “Because we can’t have folks training live on live product.”

In tandem with the new plant, the workforce center got a $1.3 million upgrade in 2018 to help support the new processes.

7 MAY 2023

Grifols North Fractionation Facility (top); Novo Nordisk Injectable Finished Products (IFP) facility (bottom)

Johnston County’s Workforce Development Center.

“The Workforce Development Center, it’s also a main driver in decision-making of where to expand for our company,” says Henry. “Essentially, we’re investing to be able to get something back. And people all over the country are just fascinated by it.”

Both companies have land for expansion, around 104 acres in Novo’s case. Grifols bought 467 acres in 2018. It plans a 10 million liter-a-year plasma processing plant which will employ another 300 employees.

Grifols’ Clayton operations are the company’s largest manufacturing site, helping make the company the third-largest global manufacturer of plasma-derived medicines. In 2010, the site had a fractionation capacity of less than 2.5 million liters of plasma a year. Today, it has 9 million, and that will grow to 12 million liters later this year. Grifols also has more than 400 employees at offices in RTP.

A PLANT WITH CLASSROOMS

I took a tour of the center. From the outside, it appears to be a typical academic building. Inside, it looks like a biopharma plant with classrooms. Students can earn associate degrees, but the core of the center is its BioWork certificate program, which gets folks ready to turn left down Powhatan Road and go to Grifols or turn right and go to Novo.

Melissa Robbins is head of the college’s biotechnology department. The Johnston County native says the demand is great for trained workers with BioWorks certificates. “It’s one semester and someone can start their career immediately,” she says. “They do interviews in the classroom. We’ve actually had to say, ‘Can you wait until they’re finished?’”

While touring Grifols, I got the perspective of the center’s importance from Doug Burns, a 23-year plant employee who has been head of the site for four years. He came to Clayton as a researcher after earning his doctorate at the University of Delaware.

“We’re so [standard-operating procedure]-driven. Everything has to be done by procedure. A lot of it’s just getting that mindset. What does it mean to be clean? How can it go wrong if we don’t follow the procedure as it’s written?”

A new employee “can advance so much faster when they’ve gone through that [BioWork] training in advance,” he says.

“Because you know what pH means. You know how to clean a vessel. You know how to fill out a batch record. And if you’ve had exposure to DeltaV, and you know what that looks like, it doesn’t mean you can run a process because we’ve got to teach you how to run a process. But you know the basics of how to navigate the software, and Grifols can train you from there.”

A MINDSET

“Getting that mindset,” is an expression that you hear repeatedly from folks around the industry, from RTP to the Biomanufacturing Training and Education Center at N.C. State, where Henry is on the board, to the BioPharma Crescent. New employees have to learn that “clean” in drug manufacturing is unlike anything else they have seen. Everything is documented, because if it isn’t written down, it didn’t happen. Folks have to learn the difference between proper recordkeeping and sloppy record-keeping.

“Every batch that we make generates a stack of paper,” says Burns. “Every one of those papers has to be reviewed by quality to make sure that it’s right. They look for stray marks, miscalculations. Documentation is key.”

I talked to Bill Bullock, senior vice president at the NC Biotechnology Center, about the training operation. “The Workforce Development Center,” he says “is kind of best practice on how to do this.”

“When other communities are thinking about the possibility of building out some kind of workforce programming or center, everybody just goes there, because it’s just way ahead of its time. “

As Burns told me: “I’ve had colleagues from our plants in Los Angeles and Spain come here, and they’re incredibly envious. They have nothing like this. And they’re astounded that we have it. Because there’s something very beautiful about being able to train people on aseptic techniques and gowning – all those things where you worry about maintaining a clean environment – outside of that clean environment.” Each year, nearly a couple hundred new Grifols hires are likely to go through the workforce center, and as many as 300 existing employees go for continuing education.

THE PICTURES

Over at Novo, Henry took me down a long corridor in the old plant to show me a cluster of pictures on the wall. It helped me understand why Grifols and Novo are so committed to the workforce center.

“These are our employees. These are our family members. All these people take our medicine. All these people either work here or they’re family members for what we do. We’re not making car seats. We’re making medicine to keep people alive. It has to be right the first time. You have to have a particular mindset. You have to think a certain way.” ■

8 BUSINESS NORTH CAROLINA POINT TAKEN Dan Barkin

Veteran journalist Dan Barkin went to high school in Newton, Massachusetts, arrived in the South for college in 1971 and moved to North Carolina in 1996. He can be reached at dbarkin53@gmail.com.

Employees on the manufacturing floor at Novo Nordisk’s API faciliity and training at the Johnston Community College’s Workforce Development Center.

9 MAY 2023 GET THE UNBIASED STORY HERE VISIT NCTRIBUNE.COM TRIBUNE NORTH CAROLINA N.C. Legislative Building, Raleigh

THE TRIAD CATCHES UP

Greensboro lawyer Mike Fox joined High Point University President Nido Qubein in the Power List interview, a partnership for discussions with some of the state’s most influential leaders. Interview videos are available at www.businessnc.com.

Mike Fox is a triple-play threat in state civic affairs. The partner at the Tuggle Duggins law firm has chaired the N.C. Transportation Board since 2017. In 2021, he became president of the Piedmont Triad/Carolina Core economic development group.

The graduate of Appalachian State University also has a law degree from UNC Chapel Hill. His wife, Angela Bullard Fox, is an elected District Court judge. They have seven teenage and young adult children.

This story includes excerpts from Fox’s interview and was edited for clarity.

Why is North Carolina suddenly so attractive to everybody?

The rest of the world is finding out what we’ve known here in North Carolina for a long time. It’s a great place to locate your business. It’s a great place to raise your family. And it’s a great place to vacation. We’ve finally gotten the word out and we’ve got an incredible business climate as well as a lot of advantages in infrastructure, not just roads, bridges and rail, but also electricity, water, sewer. All of those things make it attractive for a business to come here.

What do DOT board members talk about?

Our board is about policy, so we’re looking at setting the policies for our state, and we’re looking a decade out. If we’re thinking about what’s happening today, then we’ve missed the boat. We look at the

projects that will be needed in the next decade. How do we get those built? Equally important is there’s going to be a huge change in how we fund transportation and infrastructure over the next decade because our traditional source is the motor fuels tax, which you pay every time you put gasoline in your vehicle at the pump.

What about high-speed rail?

There’s a lot of federal money going toward rail, and improving the infrastructure. Notably for North Carolina, there are two things that happened — one in North Carolina and one in Virginia — that are key. In North Carolina, the [CSX-owned] S-Line will create a new line from Richmond directly to Raleigh along an old track. The other is money that was appropriated to repair a bridge across the Potomac River in Washington, D.C. That has been a bottleneck for the entire East Coast.

10 BUSINESS NORTH CAROLINA

with Nido Qubein at High Point University

LIST INTERVIEW

What makes North Carolina attractive for business?

Our tax rate is relatively low. We’ve also built a reputation of doing everything we can to try and make you successful, and that goes from not only providing traditional infrastructure like roads, water, sewer, electricity, natural gas, but also employees and workforce. And I think our workforce is one of our greatest strengths.

What makes North Carolina’s workforce different?

We have a history of manufacturing here. Going back to the textile companies, tobacco companies and furniture companies, we have a culture of manufacturing where it’s viewed as a positive job. We’ve transitioned now to advanced manufacturing. We have an automotive battery plant, we have an automotive plant, we have a number of other high-tech industries.

Are we ready for a future with continued growth?

We have to be thinking ahead for the next decade, not only in basic infrastructure, but also workforce development and education. Our educational system here in North Carolina is one of the most attractive things that people look at from every level, from pre-K up through higher education, including our community colleges. We have a world-class system.

Is the state competitive in offering incentives to recruit industry?

At the local and the state level, we have come to a place where we realize that is the way of the world, you have to participate. But you have to participate in a smart way such that there are some guardrails. When a Toyota comes to invest $3 billion, that has a ripple effect throughout the entire community. So, whatever money they are granted in incentives is paid back many times to our citizens and to our local government in taxes.

Where exactly is the Carolina Core?

It’s roughly the geographic area between the Charlotte and Research Triangle Park metro regions. We’re in the middle. Those two areas have seen extraordinary growth over the last 20 years and there’s been good growth in the Carolina Core, but only recently have we caught up to be that third economic engine of North Carolina.

What makes the Piedmont Triangle Partnership distinctive?

The No. 1 thing that distinguishes PTP is it’s a private nonprofit and it’s funded entirely by its investors, who tend to be business leaders in the Carolina Core area who have stepped up to say, “We need to find a way to promote this region.”

Are the Triad’s college graduates staying to live and work in the Carolina Core?

They’re actually a huge target for us in terms of retention of a workforce. Even the folks from out-of-state who choose to go to school here. They chose to come spend at least four years of their life here, so we need to make sure that they understand that not only is this a great place to get an education, but it’s a great place to start your career or perhaps raise a family.

Post NAFTA, this 11-county region lost 90,000 jobs. Are we recovering from that period?

When we launched the Carolina Core brand in 2017, we set a goal of 50,000 new jobs by 2037. We’re in 2022 and we’re at 40,000 new jobs, 80% of the goal. We’re doing very well.

Companies like Boom Supersonic demand more skilled workers. Do you get resistance from companies that say you’re killing me on pay scales?

Our business leaders have understood that creating a climate, an ecosystem where people want to come here and work, will benefit everybody.

What do you see in the next five years for North Carolina and the Carolina Core?

2022 was a record-setting year, not only for the Carolina Core, but also North Carolina. It had the largest investments and jobs announced in state history in terms of VinFast and Wolfspeed following Toyota in late 2021. Chris Chung, of the Economic Development Partnership says the pipeline is even fuller in 2023 than it was in 2022. The interest is strong. We potentially could have another great year.

What are the short-term challenges?

One is the workforce. I don’t think there’s one magic bullet. It is continuing to have the good investments that we’ve had in the university systems and the community colleges, and also in our primary and secondary education because a lot of these jobs do not necessarily require a four-year degree or even an associates degree, so we’ve got to be turning out high school graduates with good basic skills.

The second thing is, we’ve got to be able to invest in our infrastructure. Highways and bridges, but water and sewer, too. North Carolina, unlike a lot of other states, does not have a water crisis.

What about affordable housing?

In the Carolina Core, we have a cost advantage as our prices are not as expensive as they are in Raleigh and Charlotte. But we’ve got to continue to build up our inventory. Any time you create 17,000 jobs in one year in an area, you’re going to need more housing.

How is rural North Carolina faring in terms of transportation and access to health care?

North Carolina will not be successful if only part of it is successful. It just can’t be the urban areas. Our DOT board is geographically dispersed. We have 20 members, 14 appointed by the governor from all over the state, and six appointed by the legislature. The key to improving lives in our rural areas is being able to connect them to whatever they need — education, health care, jobs and recreation.

When I first came on the Board of Transportation, a group of business leaders from Rockingham County told me that the most important road for their county is going to be built in Guilford County. And it was I-73. They realized that the connection to the heart of the Triad was going to be critical for their population to be able to get medical care, to be able to get jobs, to be able to travel to the airport, all of those things. That was insightful. ■

11 MAY 2023

ALL OVER THE MAP

She keeps teeth shining, he flies Uncle Sam’s fighter jets, while building a thriving conglomerate from Goldsboro.

By Connie Gentry

Those lucky enough to be on a luxury yacht sailing the Carolina coast might be served by stewards Melissa Mertely, 28, and Tyler Brennan, 29. at would be Dr. Mertely, owner of the Kinston Smiles dental clinic, and Capt. Brennan, an Air Force Academy graduate and experienced F-15 ghter pilot.

ey occasionally perform hospitality duty as owners of Carolina Yacht Charters, while juggling their day jobs in dentistry and the U.S. Air Force. But that’s just a part of their frenetic daily mix, which involves three other businesses that employ more than 100 people and posted revenue of more than $21 million last year.

e high school sweethearts were newlyweds in 2020 when they made their rst business acquisition, a oundering South Carolina golf course. ey bought it with pro ts from a business previously built from scratch, Orlando, Florida–based Race Day Quads.

Seven years ago, Brennan was selling drone supplies out of the back of his 2015 Jeep Grand Cherokee, nanced with his life savings of $10,000 from lawn mowing and car washing gigs. On a busy day, he’d ship 10 or 15 packages of drone supplies. at was the start of Race Day Quads, an online store selling parts to professional and amateur drone racers in an underserved industry. e business now ships nearly 500 packages per day.

“I was probably one of the top drone racers in the world at that time (2016), and there was a cry in the racing community that we needed a good store,” Brennan says. “It’s a high-volume, thin-margin

industry and not something Amazon can do because there’s a huge customer support [aspect]. e retailers were owned by business people who didn’t know how to stock the right items or support them in the right way.”

Four years later, the business had annual revenue of $18 million.

“When Race Day Quads peaked in 2020, we were able to start taking a pro t, and, instead of paying taxes, our overall strategy is to acquire other businesses,” says Brennan.

ey started by looking at golf courses and settled on e Club at Brookstone, an 18-hole golf course near Anderson, South Carolina, and 20 minutes from Clemson University. ey paid $850,000 and expected to invest $250,000 more. at ballooned to about $700,000 for improved greens, additional sta , better equipment and other costs. e turnaround took a couple of years, not several months as they had expected.

“A er becoming the largest drone-racing distributor in 2020, I was very con dent in what I could do,” Brennan says. “When we saw this golf course, not in great shape but in a great location, with poor management and no TLC put into it, I said, ‘We’re going to do XYZ and this place is going to be jamming.’”

eir timing proved savvy with increasing demand to get outside amid the pandemic. Brookstone is now pro table and reported revenue of $1.7 million in 2022, a 40% increase from a year earlier, the couple told Forbes last year. It’s among the most popular public courses in the Upstate, according to tee-time booker Golf Now.

12 BUSINESS NORTH CAROLINA

ENERGIZERS

Enterprising young Tar Heel entrepreneurs.

All of this occurred as the couple established their careers. She earned her dental-surgery doctorate at the University of Maryland, then gained a residency at East Carolina University, which drew her to North Carolina. A er completing her degree, she took over Lancaster Family Dentistry and changed its name to Kinston Smiles Family Dental when the former owner retired in December 2021.

e Lenoir County business now employs nine people. She hopes to add a dentist this year and expand o ce hours.

In 2021, they diversi ed further by buying doggie day care businesses in Greenville and Wilmington. Last October, they bought a yacht with an intention of creating a charter business, which has quickly drawn a solid clientele.

“Tyler and I have always decided to take on a business based on pure personal interest — we are huge dog lovers that enjoy being on the water, playing golf, and making a di erence in people’s lives,” she says.

ey have learned that growing pains inevitably accompany entrepreneurial startups. “ e golf course taught me that when you go to acquire a business, what they’re not [disclosing] is where you need to dig in,” Brennan says. “It’s about reading the information the broker sends you and then nding out what’s not there.”

e couple has never raised capital from friends, family or

institutions. Instead, they have paid cash and relied heavily on seller nancing. ey’ve leveraged their Race Day Quads business to secure the later purchases and are paying interest rates of at least a couple of points below the mid-April prime lending rate of 8%.

“Instead of making payments to a bank, we pay the seller,” he says. eir transaction terms range from ve years with a balloon payment to as much as 15 years. eir plan is to have each of the businesses paid o by 2030.

Negotiating accelerated payments can optimize deals, Brennan notes. A year a er buying the golf course, he asked the sellers if they would accept a $100,000 immediate payment in return for writing o $120,000 payable over several years. “ ey agreed and it was a win-win. at’s an example of how seller nance is something you can totally cra . You and the seller can make it whatever you want, so it’s always going to be better than a bank or Small Business Administration note.”

Brennan is getting all this done while working as a thricedeployed ghter pilot based at Seymour Johnson Air Force Base in Goldsboro. As an academy graduate, he’s committed to serving through 2028, then will decide whether to re-enlist.

Surprisingly, he’s found that some of his most e cient work has occurred during o times while serving overseas. “When I was in the

13 MAY 2023

Brennan and Mertely paid cash for a 72-foot Mangusta yacht last year to start a charter service. The three-bedroom boat can sleep as many as eight people or carry as many as 12 for day trips.

Middle East and not focused on the deployment stuff, there was nothing else to do, so it ended up being a positive thing for us.” He says he dug deeper into the businesses while overseas, and he caught some employee theft in the process.

Managing from afar also requires hiring effective staff members who adhere to systems and processes that echo the discipline of military training. “Our GMs are paid above industry norm. We have a lot of trust in each of them, and we get very detail-oriented about the processes of each business, to an excruciating level of detail,” Brennan says.

Within 90 days of buying a business, the couple learns each job themselves and defines, in a written manual, how they want each role performed. There’s a checklist for each task and employees are required to initial in ink as work is completed.

General managers compile the checklists weekly, including their workload and send the information to Brennan’s assistant, who reviews the reports and sends a one-paragraph summary to him. Each business is a separate entity, although all employees are covered under one health plan. A full-time accountant and managerial assistant handle the back-office administration.

Still, two professional careers, five businesses and daily life can be overwhelming, by any stretch. “We both hit a little bit of

a breaking point in terms of workload and stress after I realized during my deployment that we were missing a lot of simple things,” he says.

So they decided to automate or hire others for as many daily tasks as possible.

“Now we have a full-time cook that works for us six days a week and an in-home assistant that does all the grocery shopping, pays all the bills, and does all the standard stuff, so we can focus on our jobs and the businesses,” Brennan says. That freed up about 20 hours a week.

Their goal is to acquire more pet-care sites, though three previous offers have been topped by private-equity firms also excited about the industry. That’s a reality for entrepreneurs wanting to buy small businesses, he says.

“We’re facing the great retirement of the boomer generation, and often millennial and Gen Z children don’t want to run mom and dad’s company. So that’s creating really good opportunities for returns that aren’t found anywhere else in the market.”

They now seek to buy solid businesses that can be improved. “When there’s passion, there’s commitment, and we both provide very different perspectives in each business that has been essential in their growth,” Mertely says. ■

14 BUSINESS NORTH CAROLINA

Passion for golf and a low price prompted the couple’s purchase of a struggling public course near Anderson, South Carolina, in 2020. Now, the Club at Brookstone is profitable.

Mini-Berkshire Hathaway?

The Brennan-Mertely enterprise

RaceDayQuads.com

Online store for first-person view drone racing parts

Started: 2016

Location: Orlando, Florida

Employees: 14

TheClubatBrookstone.com

18-hole public golf course with clubhouse

Acquired: 2020

Location: Anderson, S.C.

Employees: 20–30 (seasonal)

TheDogPlaySpot.com

Dog day care, boarding, grooming and training

Acquired: February 2021

Locations: Greenville & Wilmington

Employees: 60

KinstonSmiles.com

Dentistry care

Became owner: December 2021

Location: Kinston

Employees: 9

CarolinaYachtCharters.com

Overnight charters, day cruises and dockside events

Acquired: October 2022

Employees: A captain and sailing crew

Melissa & Tyler

Married: January 2020

Residence: Goldsboro

Future home: Wilmington

Favorite business: The Dog Play Spot

LIFE OF THE PARTY

By Katherine Snow Smith

Kenny Mann thought he and his Liquid Pleasure bandmates had a real shot at a music career when the group landed a contract with the Hit Attractions booking agency in 1981.

More than 40 years later, Mann debated which Raleigh restaurant to choose for dinner with a top executive of Richmondbased East Coast Entertainment, which has represented the group since 1990. e agent wanted to schmooze the veteran musician, who chose Perry’s Steakhouse & Grille in northwest Raleigh.

From choosing venues to negotiating contracts, Mann, 68, is in the driver’s seat now that Liquid Pleasure is one of the best-known U.S. wedding bands. e group also entertains at events sponsored by Fortune 500 companies, nonpro ts, professional sports teams and at presidential inaugurations.

“When Barack Obama got elected, we got that call to pack our bags and come to D.C. I was overwhelmed with emotions,” says Mann. “I got up the next day and looked at every major headline around the world, and it had Obama’s inauguration schedule. Seeing Liquid Pleasure’s name even in the Moscow newspaper, it didn’t get much better than that.”

At an o cial Obama ball, the band shared top billing with fellow North Carolina native James Taylor. at followed similar performances at inaugural events for Presidents Bill Clinton and George W. Bush. ey’ve also played at Mar-a-Lago, the Florida resort owned by Donald Trump.

e group formed in 1966 when the original members were in middle school in Chapel Hill. Now, they y to Florence, Italy, and Cabo San Lucas, Mexico, for weddings a few times a year. An overseas wedding reception with all 14 performers can run about $75,000, which covers as much as $40,000 in travel and other costs.

High-end domestic performances are closer to $30,000, while the band lls in its calendar of 110 shows a year with lower-ticket appearances such as the recent 75th Anniversary Gala for the Chapel

Hill-Carrboro NAACP or the free North Hills summer concert series in Raleigh.

“We have a version of Liquid Pleasure for every price range,” Mann says. “We do charity events for much less.”

ACADEMIC ROOTS

In the ‘80s, the band’s main clientele was fraternities and sororities, rst at southern schools and eventually at some Ivy League campuses. Mann quickly realized that the partying college kids would become brides and grooms seeking wedding entertainment in a few years.

“ ey’re a loss-leader. You get so much business from those parties that turns into wedding and corporate events,” he says, Indeed, Michelle Robinson, a Chicago-born coed who attended Liquid Pleasure events in the early 1980s at Princeton University, had something to do with a future inaugural celebration a er she had married Obama.

Liquid Pleasure is a longtime hot commodity for East Coast Entertainment. “ ey travel the United States on a more regular basis than any of our bands,” says Barry Herndon, a managing partner in Raleigh. “Liquid Pleasure goes from North Carolina to Texas to California and to all points in between. I’ve booked them in Montana for August.”

He credits the musicians, dancers and back-up singers for their talent and strong work ethic. Liquid Pleasure has never canceled a show, even it meant chartering a private plane at the band’s expense or driving through the night when commercial airlines canceled ights. e band’s chemistry with each other and the audience are also key factors to its longevity.

Mann has been performing since fourth grade, when he took piano classes in an a er-school music program on the UNC Chapel Hill campus. But his key role is as a frontman and businessman. His easy dialogue and wise cracks with college kids, CEOs and great-

16 BUSINESS NORTH CAROLINA NC TREND ›››

Entertainment

PHOTO

PHOTOGRAPHY

Superstar wedding band Liquid Pleasure keeps loosening up crowds in its fifth decade.

CREDIT: BILL REAVES

grandmothers have endeared Liquid Pleasure to audiences as much as the band’s catalog of more than 2,000 songs.

“Kenny has a great ability to emcee. He’s a charmer. He knows how to make people feel special,” Herndon says. “He’s the master of everything. He’s hilarious. He’s witty. He’s got a personality that people warm up to.”

Mann’s skills were on full display with a crowd of about 500 at Swansboro’s Mullet Festival in October.

“Raise your hand if you love your wife,” he instructed folks sitting in folding chairs or slightly swaying to the music. “Well, if you love your wife and want her to keep putting up with your sorry self, ask her to dance for this next song.” Couples who haven’t slow danced in years were soon laughing and swaying to The Temptations’ “My Girl.”

A BUSINESS DECISION

Not all of Mann’s stage manners have been innocuous.

When Liquid Pleasure was fresh on the college fraternity circuit in the early ‘80s, he suggested a contest to loosen up a crowd at the University of Alabama. Mann was a devotee of the coarse comedy of another Chapel Hill band, Doug Clark and the Hot Nuts, as well as comedian Richard Pryor. So he invited fraternity boys to come up on stage and see who could yell the N-word the loudest.

His bandmates had mixed reactions, from rolling their eyes at Mann’s antics to quoting Black empowerment leader Malcolm X after the show. Once the hesitant audience got going, Mann established Liquid Pleasure as a band that wanted its crowd to have fun and let loose.

They charged $500 extra for fraternities trying “the contest” for about nine months, then cut it off. By then the group was in high demand, not for the self-deprecating gimmick, but for its music and personality.

When asked if the racial slur contest was worth it, Mann says: “We became the No. 1 fraternity band in 18 months so, business wise, yes. But morally, no. But, you know, I don’t think I would change it. It was important to separate your band from competitors.”

The tension felt by Black musicians playing for mostly white audiences is something Mann has pondered throughout his career, he noted in an 2019 Oxford American story. He explained how the band has used its business success for positive causes, such as improving the segregated neighborhoods where members grew up.

“We’ve got to keep making money,” he said.

Early in his career, Mann made a shrewd business decision that paid off when the pandemic hit in 2020.

“Ninety percent of our calendar got canceled in two weeks. I felt like I was on the musical Titanic,” he says. “But fortunately, we had done what most bands had not done. We had set ourselves up as a legitimate business. We pay taxes. So when the PPP loans came out, we got two of those.” The bands’ federal government pandemic loans totaled $37,380, and were both forgiven, filings show.

While talent is foremost when Mann fills the rare open position, the ability to mesh with his group is also important.

“We don’t smoke. We don’t drink,” he says. “So the people who came into the band who smoked and drank and did all that stuff, if they were really talented, we’d put up with them. If they could be substituted, we’d ease them on out.”

HOMETOWN HISTORIAN

Mann’s roots run deep in Chapel Hill and Carrboro. His father, Kenny Mann Sr., was the revered cook at The Rathskeller from 1949 to 2003. The restaurant’s lasagna with cheese that stretches from table-to-mouth is his recipe. His mother, Effie Marie Mann, taught protestors how to lie in the street for peaceful protests.

Kenny Mann Jr. was one of the first Black students to attend Carrboro Elementary School in the 1960s. A classmate, Sharon Smith, joined a middle-school precursor to Liquid Pleasure. She was UNC Chapel basketball coach Dean Smith’s daughter.

“Sharon was so pretty that we figured we were going to have her in the band one way or another,” he recounts. “She sat right beside me in band class. She played the clarinet. We weren’t going to play any Benny Goodman, but she had the personality and the look.”

He recalls seeing Sharon’s legendary father march in protests against Chapel Hill’s segregated restaurants. “Dean Smith and all of Brinkley Baptist Church were there. He wasn’t hiding in the background, he was right up front.”

He also saw James Taylor singing carols in the city’s Christmas parade. Taylor’s first album in 1968 was released by the Beatles’ newly formed label, Apple Records.

“One day we looked up, and at the Carolina Coffee Shop there was James Taylor and Paul McCartney sitting in there,” Mann recalls. “Seeing Paul McCartney in Chapel Hill was a big day for me.”

Any day with Liquid Pleasure on stage is also a big day. ■

17 MAY 2023

Liquid Pleasure kicked off the Follow Me to Fuquay-Varina signature outdoor concert series in April.

PHOTO CREDIT: ROBERT LOUNSBERRY

SPIRITS IN THE PINES

By Emilee Phillips

Since its 2014 founding, veteran-owned Southern Pines Brewing Co. has grown to become one of the state’s largest cra -beer producers, and has added a second taproom in its Moore County hometown.

e brewery is led by Micah Niebauer, who co-founded the company a er retiring from the U.S. Army’s Special Forces unit. Now the sole owner, he’s adding Southern Pines Spirits, which o ers ready-to-drink canned cocktails.

RTDs, as they are called by insiders, are the fastest-growing alcohol category nationally with supplier revenue gaining 42% to reach $1.6 billion in 2021, according to the Distilled Spirits Council of the U.S. Convenience is a key factor: People don’t have to invest as much to mix their own cocktails and they can drink one wherever they are. A 4-pack sells for $15.95.

e Southern Pines brewery’s goal is to foster community “and we do that through continuously reimagining the cra beverage and hospitality experience,” Niebauer says. “Why not keep evolving, and using the equipment and talented people that we have to enter into new market sectors?”

A few N.C. brewers share that enthusiasm. In 2018, Raleigh brewery Lonerider released a bourbon whiskey nished in sherry casks. A year later, the brewery debuted its “Whiskey Mule” RTD cocktail. It is now available at many bars, restaurants and most ABC stores statewide.

“Our sales have been steadily increasing each year since its launch. One good thing about the pandemic, people gravitated toward things like canned cocktails,” says Derek Tenbusch, vice president of marketing for Lonerider. Lonerider has ve tasting locations.

Canned cocktails have been on Niebauer’s radar since November 2021, when he heard that North Carolina lawmakers

might allow their distribution beyond ABC stores and into supermarkets. at restriction remains in place, but Southern Pines Brewing will be ready if the law changes.

“We have all the equipment to do them in-house, and we have a huge competitive advantage over almost every distillery in the state if these start to go into grocery stores,” says Niebauer, who has invested more than $100,000 in the expansion. “ ey don’t have distributors. ey don’t have retail relationships. ey don’t have canning lines.”

Many cra brewers oppose allowing canned cocktails to be sold in grocery stores, fearing a loss of precious shelf space. e state also taxes distilled spirits at a higher rate than malted liquors such as White Claw, which are sold at groceries.

But Niebauer thinks spirits “allows us to cater to more people. Not everyone likes beer and those that do may want something else from time to time.”

Rather than install a still, he secured a federal distillery permit and sourced white-label spirits from existing distilleries. Creating the cocktails was a sort of Willy Wonka science, aiming to create avors that aren’t too sweet out of a can, yet sweet enough that they held their taste when served over ice, Niebauer says.

Niebauer’s team mixed components by hand, canned their creation, and sent it to a Kentucky company that extracted the avor compounds, mixed in a avor additive, and sent it back for approval. e Southern Pines group then tasted the beverage and sent notes back, rinse and repeat, for 12 months. ■

18 BUSINESS NORTH CAROLINA

NC TREND ››› Manufacturing

A brewer moves beyond suds to offer cocktails in a can.

Micah Niebauer

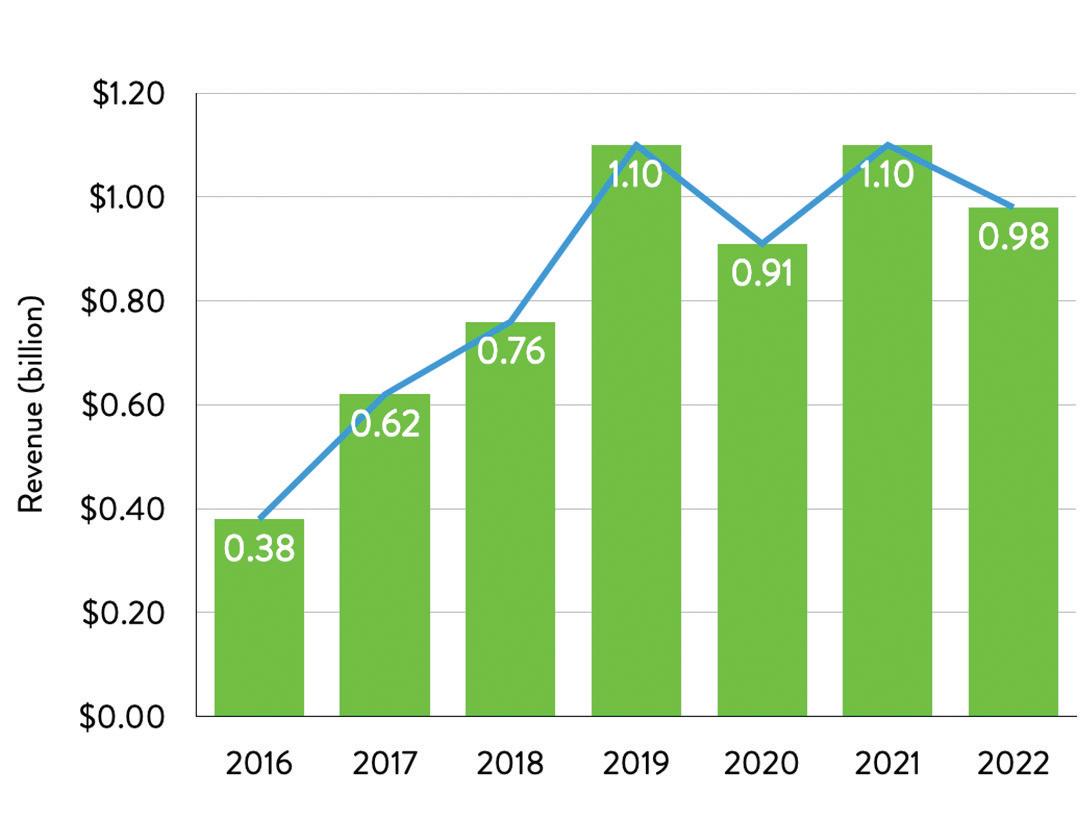

PERFECT TIMING

By David Mildenberg

For 125 years, First Citizens BancShares operated in relative obscurity as the nation’s largest familyowned bank. That changed overnight in March when it plucked $72 billion of Silicon Valley Bank’s deposits and loans about two weeks after the biggest U.S. banking collapse since 2009.

In a transaction negotiated with the Federal Deposit Insurance Corp., the Raleigh-based bank gained 18 branches, received a discount of about $16.5 billion on Silicon Valley’s assets, and gained relationships with thousands of successful tech companies and tech investors at the California-based institution.

First Citizens’ stock, which traded at about $585 in late March, soared to more than $900 when news of the deal broke. In mid-April, shares were trading for about $1,000, putting the company’s market value around $14.3 billion. Its $218 billion in assets puts it among the 20 largest U.S. financial institutions with more than 500 branches in 23 states.

The FDIC took over Silicon Valley on March 10 after depositors pulled more than $40 billion within a few days from the bank, following a multibillion dollar loss on the sale of bonds and other investments hurt by rapid interest rate increases. Under the FDIC agreement, the government will share in any potential losses on the commercial loans acquired by First Citizens over five years. About $90 billion in Silicon Valley securities that were “underwater” will remain with the FDIC.

The deal largely stemmed from First Citizen’ opportunistic style, reflected in more than a dozen previous failed-bank deals negotiated with regulators since the 2008 financial crisis. “First Citizens has a history of troubled banks,” according to Herman Chan, an analyst with Bloomberg Intelligence. “It’s a strategy to grow the bank when times are difficult — to conduct M&A at advantageous prices.” ■

19 MAY 2023 NC TREND ››› Banking

HEALING HOPES

Methodist University and Cape Fear Valley have ambitious plans for training physicians in Fayetteville.

By Tucker Mitchell

Methodist University’s plans to open a medical school in partnership with Cape Fear Valley Health may have raised an eyebrow or two among educational and medical professionals.

Both Fayetteville-based institutions are small relative to their peers, and starting a medical school from scratch is an ambitious project.

But proponents say this tall order appears to be the right order, given the urgent shortage of doctors, nurses and other health care providers. e problem is particularly acute in the rural counties of southeastern North Carolina, all of which are federally designated Health Professional Shortage Areas.

“ ere’s a great need in all (medical) specialties, in all areas, so someone starting a new school that will produce more doctors — hey, that’s good news,” says Dr. Alison Whelan, chief academic o cer for the Association of American Medical Colleges, a Washington D.C., nonpro t that represents 640 institutions.

“ e basic idea of this school, as I understand it, is to bring more providers to a particular area that’s in need, to a rural area, and there is research that indicates that’s a strategy that does work. So, this is a smart strategy, a useful strategy.”

Methodist and Cape Fear have their work cut out for them. Methodist’s plans an initial class of 80 students in 2026 with goal of about 120 per class as the school develops. e school could be home to nearly 500 students when enrollment is maxed out. Medical schools remain oversubscribed, says Whelan, so lling slots shouldn’t be a problem.

at’s good news. But paying for the school will not be as

easy. It’s expensive to hire instructors and establish labs and other space.

Moreover, the existing doctor shortage that plagues so many communities will undoubtedly trouble the medical school as it looks for residency slots for its new graduates down the road. ird- and fourth-year medical students rotate through a series of “clinical clerkships” that form the bulk of their education during those last two years of school. A er that, doctors must serve residencies lasting three to seven years before they’re full- edged physicians.

e training requires doctors or other seasoned medical professionals to serve as preceptors who teach and direct the students.

Methodist’s basic thesis is that students trained in Fayetteville will be more likely to begin their practice in Cumberland County and neighboring counties served by Cape Fear and its six other hospitals or rehab centers. Cape Fear had revenue of $1.17 billion in the 2020 scal year. Plans call for adding nearly 100 beds at the main 524-bed Fayetteville hospital in the next few years.

Alternatively, med school grads may head o for a residency in a far- ung post with a bigger name and not return.

“ at will be a challenge,” says Whelan. “You’d like to keep them all there, and that is the best plan. But there is a serious shortage with regard to the availability of residencies and preceptors. Not every doctor wants to do this. When you spend time with students, guess what? You don’t see as many patients.”

Having Cape Fear Valley as a partner will be helpful, she adds. “Everyone — doctors, the school, the hospitals involved — needs to understand this and see the long-term picture. It’s

20 BUSINESS NORTH CAROLINA NC TREND ›››

Education

good that they have a hospital as a partner. I can’t imagine doing it any other way.”

e Fayetteville system has o ered clinical rotations and post-grad residences for many years. at means that some slots are already spoken for. For instance, Cape Fear has more than 200 residents from Campbell University’s Jerry M. Wallace School of Osteopathic Medicine. Osteopathic schools supply slightly di erent training than medical schools, but put students on the path to becoming a doctor.

Suzanne Blum Malley, Methodist’s provost, calls Cape Fear’s residence program, “a huge advantage as we start a medical school based in Fayetteville.” Prospective residents are “matched” with available residencies through a nationwide system. Methodist’s goal is for its medical students to “match” in the Cape Fear system, but Malley says the school realizes that won’t happen in every case.

Two-thirds of students who complete their medical degrees and residencies in the same area stay in that area to practice, according to the medical school trade group.

Methodist o cials also expect that the in ux of residents and medical students will improve access to medical care. at’s one of many “halo bene ts” that Methodist and Cape Fear o cials project for the hospital’s service area. Including construction, the medical school could lead to more than 800 new jobs. A study by an N.C. State University economist projected the school would add $750 million to the regional economy in the school’s rst 10 years.

“ e advent of the school will have a transformative e ect on the community over time, improving the quality of medical care, attracting and retaining medical care providers and new areas

of specialization, attracting other medically-related businesses, increasing the median income level, adding to the tax base, and bringing in new revenue from the purchase of goods and services,” says Stanley Wearden, Methodist’s president since 2019.

It should also boost enrollment at the university’s health care specialties. Methodist has about 2,300 students and o ers an undergraduate degree in nursing and advanced degrees for nurse practitioners, physician assistants, occupational therapists, and physical therapists.

Funding the expansion is expected to involve a mix of federal grants, tuition income and private donations.

Faculty and support personnel have to be hired. Preceptors rarely work for free either, and residents are paid a stipend. Cape Fear’s current residency program pays $54,000 to $66,000 annually, not including a standard full-time bene ts package.

Methodist, which has an endowment of about $35 million, will own and operate the medical school. e Cape Fear system is contributing to start-up expenses, including the school’s main building, which is expected to cost $50 million. e not-forpro t system had about $614 million of net assets on its balance sheet as of mid-2020. its latest public tax ling shows.

In Charlotte, the heavily promoted plan for a Wake Forest University medical school campus is backed by Advocate Health, which has capital exceeding $12 billion, and major corporate support in the state’s biggest city.

Malley says Methodist can handle the Cumberland County project. “ rough our partnership (with Cape Fear Valley Health) we are prepared for those expenses,” Malley says. “We are also exploring all sources of potential external funding, including government and philanthropic sources.” ■

21 MAY 2023

*School of osteopathic medicine | source: Association of American Medical Colleges MEDICAL SCHOOL STUDENTS (2023) UNC Chapel Hill 893 Wake Forest University 602 Duke University 586 Campbell University* 424 East Carolina University 384

REVVING RESEARCH

By Ray Gronberg

Retired banker Kelly King is leading a public-private e ort to boost commercialization of university research across North Carolina, winning initial support from key lawmakers and Gov. Roy Cooper. A House bill seeks $50 million in state funding, which could lead to a ood of future investment for the project over the next decade.

e money would go to NCInnovation Inc., which contends that the state’s tech-transfer e orts are falling behind peers across the nation. “RTP isn’t the end,” its pitch book says, referring to the world-famous business park in Durham and Wake counties. “It’s just the beginning.”

“Innovation de nes North Carolina’s past, from our research universities to RTP,” says King, the retired BB&T/Truist CEO who chairs NCInnovation’s board. “But if we’re to compete and win in the future, then what we’ve built so far must be only the beginning.

King and other project leaders started conceiving NCInnovation in 2018. Since 2021, the group has undertaken market research, formed a board and raised $20 million from 11 banks, Duke Energy, Blue Cross Blue Shield of North Carolina and other businesses including Capitol Broadcasting, Flow Automotive and Martin Marietta.

Bennet Waters, a former professor in UNC Chapel Hill’s Gillings School of Global Public Health and global security consultant, serves as CEO. e chief strategy o cer is Je Sural, who led the state’s broadband initiative in the N.C. Department of Information Technology from 2015-2021.

e next phase of the initiative would be to advocate for “at least a $250 million annual public commitment over a minimum of 10 years, or $2.5 billion total, supplemented with private resources” to build on existing strengths in agricultural

technology, biohealth, defense innovation, power electronics and cloud computing. It would be a massive expansion by state government.

e group is working on potential hubs and is in talks with leaders of four universities — UNC Charlotte, East Carolina, N.C. A&T and Western Carolina — and the UNC System.

NCInnovation notes that Duke, UNC Chapel Hill and N.C. State account for almost 87% of the state’s academic R&D e ort. With other regions le out, North Carolina has “some of the poorest economic mobility in the country,” and half its counties lost population between 2010 and 2020.

NCInnovation envisions a broader set of regional hubs that can link researchers throughout the state with mentors and funding needed to start and sustain new businesses. ere’s also a need for more venture capital, and access to experienced executives who can help “infuse real-world business acumen into university research commercialization e orts.”

King leads a six-member board that would expand to 36 members, half from the private sector and half from the public sector. Other members are real-estate developer Kirk Bradley of Chapel Hill; retired Wells Fargo banker Stan Kelly of WinstonSalem; former Waste Industries CEO Ven Poole of Raleigh; biotech executive Neal Fowler of Raleigh and Kelly Fuller, who previously led the NC Chamber Foundation.

King, who lived in a rural Wake County home without electric service early in his life, was part of a management team that built what became the seventh-largest U.S. bank a er the BB&T merger with Atlanta-based SunTrust Banks in 2019.

State lawmakers are pressing NCInnovation leaders for more details on the group’s plan, including a comparison with more traditional approaches led by individual universities. ■

22 BUSINESS NORTH CAROLINA NC TREND ››› Statewide

Top execs press unprecedented plan to boost state’s R&D investment.

CHARLOTTE

BELMONT

Wilbert Plastic Services CEO Greg Botner retired after 15 years leading the business, which moved here from Chicago in 2010. Botner started in plastics manufacturing 45 years ago as a supervisor trainee at an automobile manufacturer in Michigan.

CHARLOTTE

Atrium Health CEO Eugene Woods received total compensation of $13.97 million in 2022, a 40%-plus bump from $9.8 million a year earlier. His pay included a $5.4 million bonus and $2.5 million in other incentive pay. Eleven other Atrium executives earned more than $1 million in 2022, including seven who received at least $2 million.

Mecklenburg County hospitals are exempt from $23 million in annual property taxes, according to an analysis. Atrium Health and Novant Health say the tax breaks are offset by massive delivery of discounted medical care. The county is mulling possible property tax increases after a revaluation showed soaring values.

Truist completed its sale of a 20% stake in Truist Insurance Holdings, the sixth-largest insurance brokerage in the United States. Greenwich, Conn.-based Stone Point Capital bought the equity for $1.95 billion, which valued the business at $14.75 billion.

Novant Health, based in WinstonSalem, announced that several high-level executives were among about 50 jobs eliminated by the system. Departing leaders include Jesse Cureton, an executive vice president and chief consumer officer, and Paula Dean Kranz, a vice president of innovation enablement.

I-77 Mobility Partners generated more than $59 million in toll revenue in 2022, almost a 70% increase from the previous year. The average toll transaction was $1.70 last year, compared with $1.20 a year earlier.

Crescent Communities broke ground on its 1,400-acre River District project near the Catawba River. Plans call for 5,000 homes and apartments, millions of square feet of office space, half a million square feet of retail and 1,000 hotel rooms.

KINGS MOUNTAIN

Jason Harris, assistant chief of the Catawba Nation, is running for chief of the Native American tribe. Chief William Harris plans to step aside. The Catawba Tribe owns the Catawba Two Kings Casino here.

SALISBURY

Mid-Carolina Regional Airport is considering adding five new hangars, with

Charlotte-based Charter Jet Transport expected to be one of the first tenants. The private charter company’s clients include the Charlotte Hornets.

STANLEY

Keter US said 65 people would lose their jobs when the manufacturer of outdoor storage devices and furniture closes its local operations. The effective date for the closure is June 30, according to a public filing. The company laid off 68 workers last year.

STATESVILLE

Australia-based environmental remediation company EPOC Enviro will invest $4.1 million and create 226 jobs with its first North American production site. EPOC Enviro manufactures SAFF, which stands for surface active foam fractionation, used in landfills, airports, military bases and sewage treatment sites to remediate PFAS, also known as “forever chemicals.”

CHARLOTTE

Indianapolis-based real estate investment trust Simon Property Group, owner of SouthPark mall, purchased the nearby 124-room Hampton Inn & Suites at Phillips Place for $42 million. The previous owner bought the 0.72-acre site in 1996.

23 MAY 2023

EAST

ELIZABETHTOWN

Peanut sheller Severn Peanut will invest $17 million and hire 44 employees here to upgrade its facilities and improve its peanut butter production. Severn Peanut is a division of South Carolina-based Meherrin Agricultural and Chemical Co. It has been in business for more than 75 years.

LAURINBURG

Pilkington North America will make $86.8 million in improvements at its glass manufacturing plant and create 20 jobs. The UK-based company produces float glass for the architectural market at its Scotland County plant.

TOPSAIL BEACH

The town planning board reviewed a proposal submitted by Pendo CEO Todd Olson to create a family compound on the southernmost tip of Topsail Island, amid opposition from neighbors. Olson is one of the state’s most celebrated tech executives. The board has about two months to rule on the application.

WILMINGTON

nCino reported a loss of $103 million for 2022, compared with a deficit of $49 million a year earlier. Revenue increased 49% to $408 million as more banks signed up for the company’s software services. The company reduced its workforce by 7% in January.

GREENSBORO

TAT Piedmont Aviation, a maintenance, repair, and overhaul company, expanded its operations near the Piedmont Triad International Airport with a $12.8 million investment that created 85 jobs.

Aswani Volety, a first-generation college graduate and India native, was installed as the seventh chancellor at UNC Wilmington. He is a former dean of UNCW’s College of Arts and Sciences.

TRIAD

ASHEBORO

Vann York Auto Group bought two dealerships here. The acquisitions of Strider Subaru and Strider Buick GMC are the seventh and eighth locations of High Pointbased Vann York.

GREENSBORO

Omega Sports will close its seven stores two years after filing for Chapter 11 bankruptcy protection. Founded by Phil Bowman and Thom Rock in 1978, the retailer was acquired by former Fresh Market CEO Craig Carlock in 2017.

24 BUSINESS NORTH CAROLINA NC TREND ››› Statewide

The Department of Justice seized $5.2 million from Gate City Transportation, which was convicted on one count of healthcare fraud in 2018. According to court records, the medical transport company misrepresented its services on reimbursement applications from November 2010 until February 2015. More than $5.5 million will be paid to the victim.

Imperial Brands is repurchasing $620 million of company stock as part of a $1.24 billion share buyback program. The U.K.-based parent company of ITG Brands said the program runs through Sept. 30. Imperial Brands sells cigarette, cigar and e-vapor brands

WINSTON-SALEM

Collins Aerospace plans to lay off about 195 employees by June 30. The company, which said the layoffs would be permanent, blamed the move on continued weakness in demand in the aircraft industry.

25 MAY 2023

TRIANGLE

ABERDEEN

Habitat for Humanity of the Sandhills bought more than 100 areas in Moore County. Executive Director Amie Fraley of Sandhills Habitat for Humanity cited the project at a Habitat event that raised more than $250,000.

RALEIGH

10 Federal, which operates about 75 self-storage facilities in 16 states, raised more than $30 million for further growth, including three new Georgia sites. Brad and Cliff Minsley started the business in 2010.

PNC Arena, better known for hockey and college basketball, hosted the North American League of Legends esports event, drawing an estimated 8,000 spectators. It’s the second major esports event for PNC, having hosted the Apex Legends Global Series Year 2 Championship in July.

Life sciences firm ProPharma will relocate its global center here from a Kansas City suburb. The regulatory consulting firm, which was founded in 2001, estimated its new headquarters will bring 75 to 100 new jobs to the area in the next two years.

DURHAM

WEST

ASHEVILLE

A lawsuit filed by two cardiologists against a clinic affiliated with Mission Health and HCA Healthcare was dismissed. Both physicians are now working at UNC Health Care-affiliated Pardee Memorial Hospital Foundation.

CANTON

The Haywood Waterways Association received $2 million from the North Carolina Land and Water Fund, aimed at mitigating the floods that have repeatedly along Haywood County’s Pigeon River. It’s the largest grant in the association’s history.

CARY

SAS Institute owner Jim Goodnight is the richest person in North Carolina with an estimated net worth of $7.4 billion, according to Forbes’ annual list of global billionaires. Tim Sweeney, the owner of Epic Games, has a net worth of $4.7 billion, down from $7.4 billion a year earlier, the magazine reported.

Outbreaks plans to start sales of its first over-the-counter medicine, having raised $500,000 from nine investors. The company’s first product is an all-natural solution for treating cold sores. The cold sore market was valued at $825 million in 2021.

MORRISVILLE

Jaggaer CEO Jim Bureau left the procurement software company after more than three years in the role. Jaggaer, which confirmed layoffs in December, has more than 1,100 employees.

Startups in the Raleigh and Durham metro areas raised more than $414 million in the first quarter, according to the PitchBook research firm. That’s an increase of 34% from the previous quarter and 61% year over year.

Sports technology firm Teamworks raised $65 million to spur expansion. The company started by former Duke University football player Zach Maurides has raised $165 million overall. It employs more than 300 employees, many of whom are remote.

SILER CITY

Durham-based Wolfspeed , a manufactur er of chips for electric vehicles and other products, would emit a half dozen air pol lutants at its new Chatham County plant, totaling 203 tons per year, state documents show. The factory is expected to create 1,800 jobs. The Division of Air Quality is still reviewing the permit, which will be subject to public comment.

RUTHERFORDTON

FreightWorks Transport announced 180 workers, including about 140 truck drivers, lost their jobs immediately when the company shut down after 11 years of operation. Company leaders said some major customers had demanded “massive rate and volume concessions,” resulting in major financial losses. ■

26 BUSINESS NORTH CAROLINA NC TREND ››› Statewide

ABERDEEN PHOTO CREDIT: BJ GRIEVE

BIOTECH BOOM

As North Carolina lands new biotech companies and longtime industry employers continue to grow, a shortage of staff to fill the jobs has evolved. But leaders in biotech education and business are confident new programs and better outreach will meet employers’ needs and advance the careers of N.C. students and workers.

28 BUSINESS NORTH CAROLINA SPONSORED SECTION 28 ROUND TABLE BIOTECHNOLOGY

Photography by Bryan Regan

Doug Edgeton president and CEO, North Carolina Biotechnology Center

Bernadette Donovan-Merkert professor of chemistry, University of North Carolina at Charlotte

NORTH CAROLINA

John Kegerise vice president, CSL Seqirus

Central Carolina Community College, CSL Seqirus, The NC Biosciences Organization, North Carolina Biotechnology Center, UNC Charlotte, UNC Nutrition Research Institute sponsored the discussion. It was moderated by Ben Kinney, publisher of Business North Carolina. It was edited for brevity and clarity.

WHAT ARE SOME NEW THINGS HAPPENING IN BIO MANUFACTURING AND RELATED INDUSTRIES THAT NORTH CAROLINIANS SHOULD KNOW ABOUT?

EDGETON: For NCBiotech, we have been working on ways to better prepare the life sciences workforce in our state. Part of that effort is via the Federal Economic Development Administration’s (EDA) Build Back Better Regional Challenge (BBBRC) grant. NCBiotech coordinated the request for proposal response among 28 partners spread across North Carolina. Our state was one of 60 EDA BBBRC awards out of 529 proposals submitted nationwide.

The purpose of this award is to stimulate career opportunities for people in locations that have not historically benefited from employment in the rapidly growing life sciences sector. This is particularly true for eastern North Carolina. The Phase 2 BBBRC award provides about $20 million to the community college system for buying equipment to provide training. Another $5 million will go to the Historically Black Colleges and Universities (HBCUs) and one Historically American Indian University (HAIU) for more advanced training programs in biomanufacturing. Lastly, NCBiotech will utilize about $1.5 million to create and execute a campaign targeting North Carolina residents to raise awareness about training and career opportunities in this growing field.

One of the big challenges is that many people do not know these jobs exist. If people are aware of the career opportunities, they may not know where to look to secure training or employment.

WAGNER: The Biotechnology Center and the Commerce Department working together did a great job over the last five years bringing a lot of new projects, both expansions of existing and new projects to the area. There’s a lag of two or three

years from groundbreaking to hiring. … They’ve got to build these facilities before they start hiring, but (the hiring) is hitting now. What’s happening initially now is companies are just stealing from each other. Employees are moving from one to another. They tend to migrate toward startups. So we really need to work hard to make the pie bigger, so that there are more workers and it’s just not shells moving back and forth. And I think that’s the biggest focus right now.

KEGERISE: The problem John (Wagner) identified around the amount of talent in the area also continues as those companies grow and their expansions come live. We recently completed our own expansion at CSL Seqirus but there is more construction underway. We have a lot more jobs than we do people in the area. Our solution has been to look at different geographical areas or different partners who we can collaborate with to bring in new talent. We need to think about how we advertise that the pharmaceutical industry has a variety of different needs and a variety of different jobs. You don’t need to be a chemist or a biologist to have a job in the industry. You can be a finance major, for example, or you could work as a mechanic.

29 MAY 2023

Scott Ralls president, Wake Technical Community College

Lisa Smelser program director for biotechnology, Central Carolina Community College

John Wagner program manager, Biotech Manufacturers Forum

WAGNER: Many people are intimidated by the biotech industry. You don’t need to be a Ph.D. in chemistry, biology or whatever to work. In fact, most of the jobs don’t require a technical degree. We need to get that word out, especially in some of the underrepresented populations.

SMELSER: Community colleges really can provide some of that service. At Central Carolina specifically, we’ve trained over 300 people through our Biowork program since May of 2020. And the best part of what I get to do is see these people who maybe have some college and they really want a better life for themselves go through this shortterm training program to connect to an industry role that is extremely meaningful for them … and gives access to these great paying jobs.

BERNADETTE, FROM A UNIVERSITY STANDPOINT, WHAT ARE YOU HEARING FROM FOLKS REGARDING THIS?

DONOVAN-MERKERT: The state has really supported UNC Charlotte. For example, we opened a new science building that brings research and education together by housing stateof-the-art undergraduate teaching laboratories in chemistry, biology and physics along with research laboratories in which faculty and students from these same disciplines conduct research in the broad area of biomolecular sciences. The building has open spaces and is designed to promote collaborations. We have graduate students conducting research, but undergraduate students as well. We have incredibly strong opportunities for undergraduate research at UNC Charlotte.

HOW DO BIOTECH ENTITIES COLLABORATE WITH EACH OTHER AND THE COMMUNITY?