CONTENT STRATEGIES

Uncovering programming opportunities worldwide…

Previously known as Schedule Watch, C21’s Content Strategies is a premium strand that provides constantly updated analysis of programming opportunities worldwide. In-depth interviews with commissioners and buyers at channels and platforms provide invaluable information for companies looking for opportunities in every genre.

C21’s Content Strategies offers a deep dive into hundreds of potential partners and allows you to understand the market in the most articulate way.

The world’s most successful producers and distributors use C21’s Content Strategies as a cornerstone of their route to market.

Join them, and make sure you have the unfair advantage. Find out more online at www.c21media.net/contentstrategies

…Your Unfair Advantage

tay in, or go out? That’s the question millions of people will be asking themselves this winter as they look to save money with a potential global recession looming, while the not-so-distant memories of lockdown keeps them craving day trips and nights out.

“Everybody wants to get back out there now without their face masks on and experience things,” says Owain Walbyoff, Banijay’s chief commercial officer, in our look at immersive events based on TV IP, on page 38.

But as Fremantle veteran Rob Clark points out on page 129: “If your gas bill is going through the roof, the first things that are going to go are those trips out with the family.”

These won’t be the only things cut. As pressure mounts on household expenditure, research released in September revealed over a quarter of UK consumers are considering cancelling their

streaming SVoD subscriptions in the next three months to save money.

Twenty-three percent of the 2,003 people from the UK, US and Germany surveyed by consumer research platform Quantilope have already cut media subscriptions from their budgets.

The resulting tightening of streamers’ belts and rising popularity of AVoD amongst consumers are among the recurring themes in these pages, as well as the perils of greenwashing as the climate emergency worsens (page 98) and the need for natural history programming to turn passive viewers into environmental activists grows (page 103).

We’ve also got all you need to know about the content strategies of major streaming players Netflix, Disney+ and Amazon’s Prime Video in key European markets, as well as the lowdown on how local players such as ITV, France Télévisions, ARD and RTBF are

fi

ghting back with their own expanded offerings online.

One unmissable feature, on page 14, is Jordan Pinto’s analysis of the ongoing problems at Warner Bros Discovery, where an apparent commissioning lull in unscripted is drawing the ire of producers.

You’ll also find reportage from recent conferences and markets around the world, including Série Series Festival, Natpe Budapest International, Sunny Side of the Doc, Edinburgh TV Festival, RTS London and C21’s Content Canada. The events circuit has well and truly returned.

The economic gloom has been at odds with the mood at these markets, as delegates have rejoiced at again meeting face-to-face. In many ways, this year’s Mipcom – where C21Media celebrates its 25th birthday – represents a grand reopening (even though The Grand may remain closed) for the TV community after last year’s tentative edition. It’s good to be back. Just don’t look at the bill. Nico Franks

REPORT: Fall 2022

C21’s quarterly outline of the biggest trends in the business looks at the impact of media and entertainment firms reducing costs and headcounts.

The return to UK screens of several bigname franchises has raised concern originality is suffering.

The clash of fantasy epics from HBO and Amazon signals a new phase in the streaming wars.

How Amazon and Apple are making their presence felt in live sports rights and putting pressure on traditional players.

Producers and crew are pushing for more rights and discontent is rife despite the continuing TV production boom.

NEWS ANALYSIS: Warner Bros Discovery

Producers are expressing real concerns about commissioning inactivity at the merged company and lack of clarity about its long-term strategy.

Despite the threat of recession, private equity investors are more bullish than ever about streaming.

The streamer’s UK commissioners hail risk-taking as a way to sustain diversity of content and create surprise hits.

CONTENT STRATEGIES: ITVX

How the forthcoming free streamer is opening up opportunities for the UK’s biggest commercial broadcaster.

Live events based on TV IP can provide vital revenue for rights owners keen to put the pandemic behind them.

Ukraine

local producers creating docs,

CONTENT STRATEGIES: Amazon Prime Video Spain

The streamer calls for a wide range of stories to help it stand out from rivals.

NEXT BIG THINGS: 21 on 21

Our selection of the top shows to watch out for and screen at Mipcom.

CONTENT STRATEGIES: Disney+

Disney+ is pursuing a local originals strategy in the UK and France that aims to put quality before quantity.

COUNTRYFILE: The Americas

Spanish companies are zeroing in on the Americas to capitalise on a gold rush around Spanish-language content.

THOUGHT LEADERSHIP:Catherine Tait

CBC/Radio-Canada’s chief on retaining the pubcaster’s creative reputation.

CONTENT STRATEGIES: France Télévisions

How the pubcaster takes a more flexible approach to international partnerships.

CONTENT STRATEGIES: ARD Mediathek

MY BIG BREAK: Mariam Naoum

THREE-YEAR PLAN: Halcyon

DEVELOPMENT SLATE: Helium

CONTENT STRATEGIES: Amazon Studios unscripted

C.J. Yu is seeking true crime series and docs with real access for Prime Video.

THOUGHT LEADERSHIP: Michael Palin

The Monty Python star’s latest Channel 5 travelogue takes him to Iraq.

CONTENT STRATEGIES: WaterBear

How the ad- and subs-free natural history streamer is succeeding in the economic slowdown.

AHEAD OF THE CURVE: Natural history

How are filmmakers and broadcasters getting the climate message across without alienating viewers?

DEVELOPMENT SLATE: Yeti Television

AHEAD OF THE CURVE: UK formats

What lies ahead for the UK business amid a gloomy economic forecast and a proliferation of reboots?

The USG exec is scouring publishing, podcasts and even TikTok for IP.

The streamer is set to double down on its investment in local original production.

A new linear channel and a buoyant streamer are offering opportunities.

MY BIG BREAK:Ofelya Tovmasyan

THREE-YEAR PLAN: Marblemedia

DEVELOPMENT SLATE: Fremantle

THREE-YEAR PLAN: Potato

CONTENT STRATEGIES: RTBF

The Belgian pubcaster seeks a wider range of doc copros and acquisitions.

THOUGHT LEADERSHIP: Nha-Uyen Chau

LGI Media’s CEO on why the popularity of AVoD could herald a wave of M&As.

CONTENT STRATEGIES: Qalbox

The VoD service celebrating the diversity of Muslim identities is stocking up.

PRESENT IMPERFECT FUTURE TENSE

Sally Mills at BBC Studios describes ways to avoid the dreaded ‘greenwashing.’

When the two biggest companies in the US start cutting jobs it’s usually a sign of downsizing to come elsewhere, especially with inflation reaching a 40-year high and expectations rising of a recession correspondingly deep.

Walmart trimmed 200 corporate roles in August – a tiny portion of its 1.6 million workforce, but these followed Amazon shedding 100,000 staff, equivalent to 6% of its global base, in June. Along with those of other retail giants like Target and Best Buy, the moves come as consumers feel the pinch of higher prices, with demand dropping back as the outsized Covid boost to online commerce fades.

The story is the same in media and entertainment, with those at the sharper end of tech often first to feel the squeeze in times of economic contraction. Snap, for example, the parent of popular instant messaging service Snapchat, recently abandoned its original content ambitions and laid off some 1,200 workers, amounting to a 20% reduction in personnel. Earlier in the summer, Vox Media –behind digital outfits like Thrillist and PopSugar – shed 40 positions, or 2% of its total. Meanwhile, Patreon, the popular paid-creator network, let go 17% of its employees (80 in total) last month and TikTok owner ByteDance axed hundreds of jobs in China.

In TV, Amazon continues to splash the cash, with The Lord of the Rings: The Rings of Power billed as the most expensive series ever (see page 8) and the acquisition of MGM for US$8.5bn. But even one of the true survivors and thrivers of the dotcom boom and bust has recently begun to streamline teams across its Prime Video and Freevee services.

At the apex of change, however, is Netflix, whose share price plunged in April on news of stalling subscriber growth, with 150 staff let go the following month, another 300 the one after and, most recently, 30 more trimmed from its

The C21 Content Business Trends Report, a quarterly outline of the biggest trends in the business, continues in this issue as economies around the world contract and consumers cut back, while media and entertainment companies do the same – reining in costs and reducing headcounts.

By Jonathan Webdale c c Banimation division. The cuts, which amount to 4% of its workforce, come as the company battles “revenue growth headwinds,” including the dire macro-economic situation and competition from new US studio streamers.

The latter category, of course, includes HBO Max, which is due to be brought together with Discovery+ as part of the US$43bn merger that created Warner Bros Discovery (WBD) earlier this year. The removal of duplicate roles and other cost savings that can be made thanks to economies of scale are an inevitable and intentional outcome of such transactions, but the US$3bn in synergies WBD is seeking are also happening against the backdrop of downward fiscal forces unanticipated at the time of the original deal.

Seventy positions at HBO Max were terminated in mid-August, including senior executives such as exec VP of non-fiction and live-action family originals Jennifer O’Connell, content acquisitions exec VP Michael Quigley and international originals senior VP Jennifer Kim. Another round of 30 layoffs focusing on Europe came the week after, seeing VP of original EMEA programming Johnathan Young, Nordics VP and commissioning editor of originals Christian Wikander and head of unscripted Annelies Sitvast depart. A further 100 jobs across WBD’s ad sales business went in September.

The reduction in headcount was accompanied by the sudden abandonment of a number of highprofile projects, including the nearly completed

Batgirl movie and another based on popular Cartoon Network comedy The Amazing World of Gumball, both coming on the back of a cancellation for J.J. Abrams’ US$200m sci-fi series Demimonde

These are unlikely to be the last, as WBD – along with rivals Disney and Paramount – take a long, hard look at the return on investment their unprecedented content expenditure of the past five years has generated in the bid to keep pace with Netflix and Amazon. Paramount Premium Group chairman and CEO David Nevins warned at the recent Edinburgh Television Festival that the industry was now in corrective mode.

Commercial broadcasters, too, will be exposed to any potential drop in advertising while public service providers like the BBC are already being squeezed as governments – counterintuitively, from a revenue perspective – seek to reduce funding for impartial voices that dare to challenge the establishment narrative. The BBC relieved 1,000 employees of their posts in May while a proposed sale of fellow UK pubcaster Channel 4 is still being debated.

The impact on independent producers will be profound. UK film and TV production company insolvencies leapt 69% in the past year, according to accountancy firm Mazars, with 113 going out of business in the 12 months to the end of June. While much of this was a result of struggles inflicted by pandemic lockdowns, a slowdown in commissions from the major streamers also contributed and is expected to exacerbate the situation.

Today [June 23] we sadly let go of around 300 employees. While we continue to invest significantly in the business, we made these adjustments so that our costs are growing in line with our slower revenue growth. We are so grateful for everything they have done for Netflix and are working hard to support them through this difficult transition.

Casey Bloys, chief content officer, HBO and HBO Max Unfortunately, the environment in which we operate is changing rapidly, and it is up to us to continue to refine our model to chart a course for long-term success. As we contemplate the Discovery content offering joining HBO Max for an eventual combined platform, we have had to make the incredibly difficult decision to disband or restructure teams.

Jack Conte, CEO, Patreon I’m more confident than ever that the world needs a better economic system for creative people, and Patreon will keep building that system for creators over the decades ahead.

However, the pandemic introduced volatility to the broader trend, starting with a rapid acceleration during Covid lockdowns. In response, we built an operating plan to support this outsized growth, but as the world began recovering from the pandemic and enduring a broader economic slowdown, that plan is no longer the right path forward for Patreon.

Evan Spiegel, CEO, Snap

The extent of this reduction should substantially reduce the risk of ever having to do this again, while balancing our desire to invest in our longterm future and reaccelerate our revenue growth.

These decisions were made against the backdrop of economic turbulence, in the media and technology industries in particular. Our aim is to get ahead of greater uncertainty by making difficult but important decisions to pare back on initiatives that are lower priority or have lower staffing needs in the current climate.

We are in a correction. We can’t just promise

spectacle and that’s not what TV needs. Costs are going up and we’re in a bad moment now with the costs of supply chain. Everything you’re doing costs more. There’s also a lot of production and that means talent costs keep going up.

When I took this job, I said that we needed to fight for something important: public service content and services, freely available universally, for the good of all. This fight is intensifying, the stakes are high. This is our moment to build a digital-first BBC. Something genuinely new. To do that, we need to evolve faster and embrace the huge shifts in the market.

Many production houses are reliant on work from streaming services. Losing a contract from a streaming service can be a major blow, especially as large production houses will also hire dozens of smaller firms for the project. Many of these will be let go as a knock-on effect of cost-cutting.

There is a sense, perhaps, that an article on the revival of classic TV shows is in itself a rehash of a decades old debate about originality in television – a medium which has thrived in no small part thanks to a string of ingenious hits that have come to be known and remade the world over.

TV reboots by their very nature are nothing new but it is notable that the UK, in particular, seems to be experiencing a rash of these of late. The tendency appears especially pronounced among the nation’s public service broadcasters, with perhaps the most high-profile being ITV’s decision to bring back Big Brother. The move, unveiled in August, will see the seminal reality show return to UK TV screens in 2023 after a five-year hiatus, having previously enjoyed a seven-year run on Channel 5 – that version itself a reboot of the franchise that ran for 18 years prior on Channel 4 (C4) and helped launch the latter’s youthskewing sibling E4. The format – among the Crown Jewels of European production giant Banijay – will seek to fulfil a similar role when it arrives on Love Island outlet ITV2 and new streaming service ITVX, which is gearing up for launch in November.

Meanwhile, Banijay is also owner of Survivor –another among the pantheon of television’s most successful series. Shortly after the news of Big Brother, the BBC announced it was reviving the archetypal adventure competition format, which last aired in Britain on ITV 20 years ago.

This development came swiftly on the back of confirmation muscle-bound MGM-owned physical gameshow Gladiators – having debuted on ITV 30 years ago – is also set for a BBC makeover, both due to land next year. 2023, at least on British mainstream TV, does indeed look like it’s shaping up for a golden age of TV reboots. These are the biggest titles among an array of familiar franchises seemingly set to fill scarce airtime and no doubt others are to come. For some within the creative community, the response has been despair, with C4 chief content officer Ian Katz recently describing such developments as “depressing” – a sentiment echoed by former C4 boss David Abraham at the Edinburgh Television Festival.

But while Katz’s complaint came with the assertion that C4’s mission was to focus on new programming, critics were quick to point out the network has itself been behind a swathe of reboots recently, with home makeover series Changing Rooms, quizshow GamesMaster and medical reality format Embarrassing Bodies among its recommissions. C5, meanwhile, is reviving classic BBC adventure gameshow Challenge Anneka, while Sky has brought back Fantasy Football League (originally on the BBC but last seen on ITV) and comedy music panel show Nevermind the Buzzcocks (another onetime BBC stalwart).

For the aforementioned Abraham – now founder and group CEO of Wonderhood Studios – such moves are a cause of grave concern, signalling a narrowing of opportunity for original ideas and a penchant among channel bosses for playing safe. Worse, he sees the situation as symptomatic of a wider malaise within British TV caused by the growing prevalence of US players and industry-wide consolidation, resulting in reduced risk-taking and the need to please shareholders.

The UK will see a swathe of big-name franchises return to TV screens in 2023, with new versions of Big Brother, Gladiators and Survivor all destined to hit the airwaves – raising concern within the industry that originality is being squeezed.

Not surprisingly, for purveyors of such franchises (especially those whose consolidation and shareholder value rests upon them) their return to TV screens is welcome justification of their worth. Hit formats do not achieve such status unless they have the capacity to bring in large audiences and the challenge for producers is to refresh winning formulae to appeal to younger viewers. For broadcasters, there is the halo of nostalgia, particularly in primetime, bringing families together, while updating tried-and-tested youth-skewing series for a new generation inevitably also appeals at a time of economic uncertainty.

Big Brother is the original and best reality format and one that I have never made before, so it’s a huge privilege to be making an all-new version with ITV2 and ITVX. Survivor is the greatest gameshow on earth for a reason. It has everything – reality, adventure, drama, and the ultimate game. I can’t wait to be boots on the ground to make this epic series for the BBC.

Paul Mortimer, director of reality commissioning & acquisitions and controller of ITV2, ITVBe and CITV, ITV

This refreshed, contemporary new series of Big Brother will contain all the familiar format points that kept viewers engaged and entertained the first time round, but with a brand new look and some additional twists that speak to today’s audience. We’re beyond excited to bring this iconic series to ITV2 and ITVX.

Ian Katz, chief content officer, Channel 4

Big Brother is a wonderful show. It did wonderful things for Channel 4 for a decade, it did a great job for Channel

5 for seven years. I’m sure it will bring an audience to ITV but I do think there is something depressing about this ‘microwave’ issue in TV, with so many old dishes being reheated.

What we’re seeing as the effect of the global digital platforms is the reduction of culture and choice and the amplification of franchises and return to previous franchises. This is profoundly depressing because most of us don’t wake up in the morning with a burning mission to reinvent something from 20, 30, 40 years ago.

Charlotte Moore, chief content officer, BBC

I don’t think it’s easy to bring titles back and make them successful. It would be a problem if it was all we were doing, but if you’re going to have impact with young viewers and get people to come to shows, there’s no doubt reboots create impact.

Kate Phillips, director of unscripted, BBC

We didn’t just say, ‘Yeah, Gladiators, let’s do that’. It took a long time and we worked really hard on what the format

should look like now. Seeing the public reaction when it leaked made me feel we should be doing it. Survivor is a global television hit and to be able to bring one of TV’s most successful formats to audiences in the UK in a uniquely BBC way is a very exciting prospect indeed.

Lucas Green, global head of content operations, Banijay Reboots are a hot topic and for good reason because these are great formats which have had huge success in the past and done a brilliant job for the channels that have commissioned them. It is important to position Big Brother in the context of its new home. This is not a repeat we’re talking about – this is a reboot, so it’s going to come back fresh and authentic. Gladiators will be just the same.

Jane Turton, CEO, All3Media Producers are complicit in this because there’s no way [Banijay UK exec chairman] Patrick Holland is sitting there and saying ‘ITV, please don’t buy Big Brother, it’s a reboot.’ We have to be realistic – we’re running businesses, we’re selling shows, people are buying shows. They will be more risk-averse in a recession – they always have been – but we are still selling new shows.

In an uncertain world, fantasy offers sanctuary from reality. For its creators, it is often a way to say something about the latter in an exaggerated, magical form which, in turn, makes subjects like war more palatable and enthralling for audiences: the struggle between good and evil, the ascendance of heroes, the quest for justice and adventure, the overthrowing of tyranny, the conquering of monsters, hope, power, corruption and love.

Sometimes, of course, it’s just about the sheer joy of a ripping yarn, the willing suspension of disbelief, immersion in alternative universes – ones that introduce the imagination to places and characters previously inconceivable or visited in dreams.

In some cases, it’s also about huge corporations battling to hook subscribers to the video streaming services in which they’ve invested billions. Thus is the lore of House of the Dragon and The Rings of Power – HBO and Amazon’s duelling prequels to Game of Thrones (GoT) and the Lord of the Rings respectively – which landed on TV screens within two weeks of each other towards the end of summer.

GoT, based on George R.R. Martin’s A Song of Ice & Fire novels, was previously the most expensive series in the history of television, with a perepisode budget rising from US$6m to US$15m over an eight-season run that ended in 2019, at an estimated total of US$1.5bn.

The Rings of Power, by contrast, cost Amazon US$250m before it had even hired writers, production crew or cast, with the online retail giant shelling out the gargantuan sum five years ago to secure TV adaptation rights from J.R.R. Tolkien IP rights holder The Saul Zaentz Company (a business that has since offloaded controlling division Middle-earth Enterprises to Swedish video games outfit Embracer Group). The price tag for the first eight-episode season comes in at a reported

HBO and Amazon have gone to battle with competing fantasy epics House of the Dragon and The Rings of Power, signalling a new phase in the streaming wars.

US$465m – with Amazon having committed to making five. Licensing aside, this means an initial US$58m per episode, dwarfing (pun intended) the US$20m per episode HBO is said to have spent on the first 10-part run of House of the Dragon, whose August 21 premiere became the network’s biggest ever with 10 million US viewers, quickly earning a recommission for showrunners Ryan Condal and Miguel Sapochnik (though the latter has since stepped down).

The Rings of Power landed globally on September 1, pulling in 25 million people in 24 hours, according to Amazon – the first time the company has ever released figures for its Prime Video streaming service, which comes as part of an expedited delivery subscription that counts 200 million customers worldwide.

For Amazon, the stakes are indeed high. Amazon Studios head Jennifer Salke and her team took a chance on two relatively unknown showrunners in Patrick McKay and J.D. Payne (the latter of whom purportedly impressed Tolkien’s grandson with his command of Elvish) and if nigh on US$60m an episode can’t make a decent TV show then the wrath of Sauron, or at least Jeff Bezos, should rightfully be unleashed. Still, a few billion dollars – while not quite a drop in the ocean – is comparatively small change to a conglomerate which last year reeled in US$470bn in revenue.

The reviews, at least from TV critics, have been broadly positive while the company was forced to pause the functionality for viewers to add their own ratings after itself falling victim to the fakes that blight its website. Bezos’ arch-rival Elon Musk took

to Twitter (still his preferred social media outlet despite a US$44bn takeover debacle) to pan the show but celebrated fantasy author Neil Gaiman – whose own Good Omens and The Sandman have already been adapted for Amazon and Netflix respectively – was among those to hit back.

For HBO parent Warner Bros Discovery (WBD), created earlier this year out of a US$43bn merger and seeking US$3bn in savings via a restructure, the House of the Dragon stakes are arguably higher. CEO David Zaslav now possesses a vast treasure trove of valuable IP spanning the DC Universe (Batman, Superman, Wonder Woman), Harry Potter, Friends and many more but the abrupt cancellation of a nearly complete Batgirl movie and US$200m J.J. Abrams sci-fi series Demimonde illustrate that nothing is sacred as the company gears up for the complex task of unifying HBO Max and Discovery+ into a single streamer from 2023.

So far, so good, however. Though House of the Dragon was not among this year’s Emmy contenders, HBO and HBO Max content chief Casey Bloys will be heartened the company still trounced Netflix in September’s awards – perhaps the greatest prize for a Hollywood (and now, too, New York) icon under threat of usurpation from technology titans.

No doubt the houses of WBD and Amazon will do battle at next year’s event, with Netflix, Disney, Paramount and Apple also launched into the fray, and with a GoT Jon Snow (Kit Harrington) sequel now on its way (among a number of other potential spin-offs) the war for one streamer to rule them all is set to be hard and long.

House of the Dragon

David Zaslav, president and CEO, Warner Bros Discovery

One of the strengths of the new Warner Bros Discovery is our unparalleled ability to connect with fans around the world through our exceptional and diverse storytelling. There is no better example of what distinguishes this great company than the extraordinary effort that has gone into HBO’s House of the Dragon. The entire team has shepherded what looks to be the next big cultural moment.

Casey Bloys, chief content officer, HBO and HBO Max House of the Dragon features an incredibly talented cast and crew who poured their heart and soul into the production, and we’re ecstatic with viewers’ positive response. We look forward to sharing with audiences what else George R.R. Martin, Ryan Condal and Miguel Sapochnik have in store for them this season.

The incredible body of work of J.R.R. Tolkien has inspired so many and has been our guiding light

throughout this journey. We’re so honoured to be able to expand on Tolkien’s journey and provide a supportive and passionate realm for this work to continue to inspire audiences all around the world.

We hope the human drama of it will be as engaging and accessible to anyone, as well as the super fans. We don’t think of the show in terms of what genre it’s in and other shows that may be out there. We really think about Tolkien’s life’s work, creating this middle world, the regions beyond Middle-earth. It drowns out what may be happening in another realm somewhere else.

After Amazon got involved in this project, my son came up to me one day, looked me in the eyes very sincerely and said, ‘Dad, please don’t f**k this up.’ He was right. We know that this world is important

to so many people. We know it’s a privilege to work inside this world and we know it’s a big responsibility.

Tolkien is turning in his grave. Almost every male character so far is a coward, a jerk or both.

Elon Musk doesn’t come to me for advice on how to fail to buy Twitter, and I don’t go to him for film, TV or literature criticism.

I am truly excited to have The Lord of the Rings and The Hobbit, one of the world’s most epic fantasy franchises join the Embracer family, opening up more transmedia opportunities. I am thrilled to see what lies in the future for this IP within the group. We also look forward to collaborating with both existing and new external licensees.

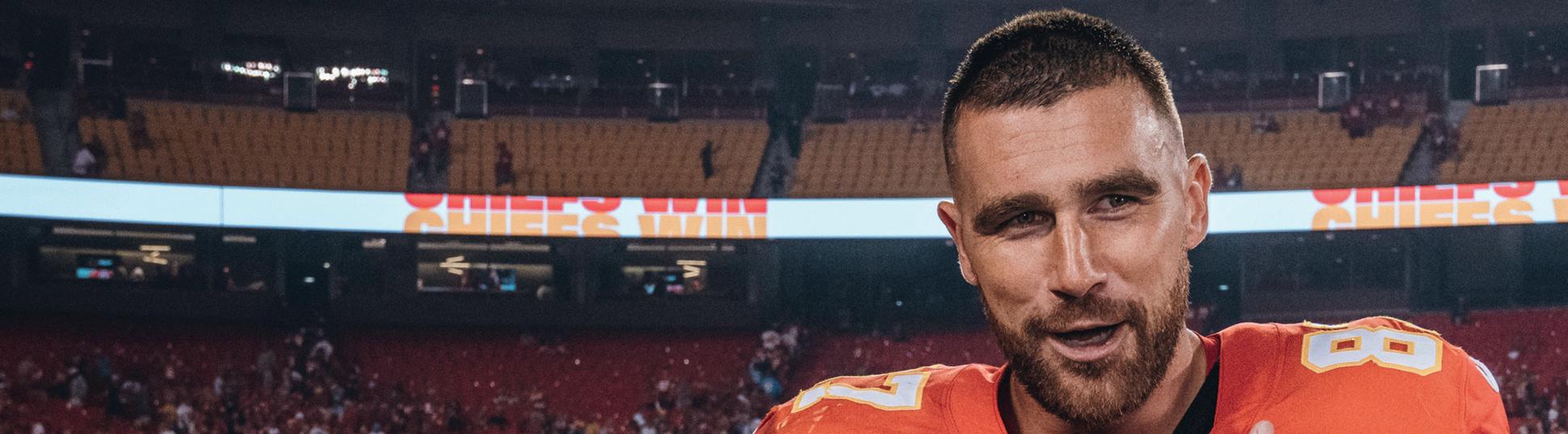

In March last year, Amazon agreed to pay the US National Football League (NFL) US$1bn per year for rights to screen weekly Thursday games live via its Prime Video subscription service. The 11-year deal was hailed as a game-changer for the industry, representing the first time the NFL had sold an exclusive package like this to a streamer. Fans could previously watch via Fox or on the NFL’s own platform, and last season when they did, each fixture averaged 12.84 million viewers, according to Nielsen.

But on September 15 this year, when Amazon’s Thursday Night Football (TNF) coverage kicked off, that figure was eclipsed as 13.3 million viewers signed into Prime Video to watch. A substantial portion of these were entirely new customers, subscribing to the e-commerce giant’s expedited

Amazon and Apple are making their presence felt in the competitive world of live sports rights and increasing pressure on traditional media players – just as newer entrants like DAZN up the ante as well.

delivery service in order to see the Los Angeles Chargers beat the Kansas City Chiefs 27 points to 24. During the three-hour ‘broadcast’ the company pulled in more customers than for any comparable time period for one of its popular annual Prime Day, Cyber Monday or Black Friday promotions.

Amazon global head of sports Jay Marine proclaimed TNF “a resounding success” by every measure and while it’s worth keeping the scale of the arrangement in perspective (TNF represents 15 out of a total 273 NFL games each year), the fact the pact shut out traditional TV is clearly worthy of note.

While live sports have remained terrestrial, satellite and cable’s great calling card in an era of cordcutting, streaming and its proponents are rapidly eroding this notion.

Apple earlier this year began offering Friday Night Baseball via its Apple TV+ service, having struck its first live sports rights deal in March with Major League Baseball, paying a purported US$85m per season over seven years. This US$595m package, which left Sunday games on the table for NBCUniversal-owned streamer Peacock, was followed soon after by a US$2.5bn exclusive contract

Jay Marine, VP Prime Video, global head of sports, Amazon

By every measure, Thursday Night Football on Prime Video was a resounding success. Our first exclusive TNF broadcast delivered the most watched night of primetime in the US in the history of Prime Video. This is a massive achievement. During our TNF broadcast, we also saw the biggest three hours for US Prime sign-ups ever in the history of Amazon – including Prime Day, Cyber Monday, and Black Friday.

Eddy Cue, senior VP of services, Apple

For the first time in the history of sports, fans will be able to access everything from a major

professional sports league in one place. It’s a dream come true for MLS fans, soccer fans, and anyone who loves sports. No fragmentation, no frustration — just the flexibility to sign up for one convenient service that gives you everything MLS, anywhere and anytime you want to watch.

Don Garber, commissioner, MLS

Apple is the perfect partner to further accelerate the growth of MLS and deepen the connection between our clubs and their fans. Given Apple’s

ability to create a best-in-class user experience and to reach fans everywhere, it’ll be incredibly easy to enjoy MLS matches anywhere, whether you’re a super fan or casual viewer.

We have a better understanding of ESPN’s potential as a standalone business and another vertical for Disney to reach a global audience to generate ad and subscriber revenues. We look forward to seeing [ESPN chairman] Mr Pitaro execute on the growth and innovation plans, generating considerable synergies as part of The Walt Disney Company.

for all Major League Soccer (MLS) matches over 10 seasons from 2023. Apple billed this agreement as historic, though the approach is somewhat different to Amazon, in that fans won’t need an Apple TV+ subscription to watch, rather an MLS one.

Nevertheless, sport is being used as a barker to draw consumers to Apple products, and at the same time the likes of Disney’s ESPN, Paramount’s CBS, Comcast’s NBC and Fox are finding themselves increasingly squeezed out.

Activist investor Daniel S Loeb of hedge fund Third Point recently penned an open letter to Disney CEO Bob Chapek pushing for a spin-off of ESPN as a separate entity, free to “pursue business initiatives that may be more difficult as part of Disney, such as sports betting,” but backtracked on this suggestion after receiving assurances about ESPN chairman James Pitaro’s future direction.

In August, Paramount agreed to pay a record US$1.5bn – equivalent to US$250m per season over six years – to extend its hold on US Englishlanguage broadcast rights to the UEFA Champions League. The deal cost more than double its previous one and came after NBC last year paid US$2.7bn over six years to retain rights to English Premier League (EPL) matches. While both arrangements, plus that of Apple and MLS, indicate the growing popularity of soccer in the US, they also signify the intensifying scramble around sports rights.

In the UK, where Amazon has increasingly been dabbling in EPL and Association of Tennis Professionals rights, the new Warner Bros Discovery in September closed a US$770m deal to acquire BT Sport (a significant EPL thorn in the side of Comcast’s Sky and UEFA Champions League player), which it will initially bring into a joint venture with its existing Eurosport business before deciding in three years’ time whether to buy completely.

The transaction snuffed out Access Industriesowned sports streamer DAZN’s hopes of taking over BT Sport, with the pair having been close to an agreement earlier in the year. DAZN – chaired by former Disney high-flyer and Candle Media coCEO Kevin Mayer – has leant heavily on billionaire Access founder Len Blavatnik to bankroll successful

Sean McManus, chairman, CBS Sports UEFA has been a key driver for Paramount+ since our launch and we are thrilled to extend this successful partnership showcasing even more world-class soccer through the 2029/30 season. UEFA is a perfect example of our differentiated strategy presenting marquee properties to drive and strengthen both our streaming and traditional linear businesses.

Andrew Georgiou, president and MD, Warner Bros Discovery Sports Europe Combining BT Sport and Eurosport UK together with Warner Bros Discovery’s world-class and

bids for domestic rights to top-flight soccer matches in Italy, Spain and Germany, plus myriad others in markets including the UK, US and Canada as it builds out its portfolio.

The company, which like all in sport was hit hard by the cancellation of events during the pandemic, is back on the front foot, however, having signed, for example, a long-term pact with British pugilist Anthony Joshua and promoter Matchroom Boxing in June.

More recently, DAZN acquired rival Eleven Group and youth-skewing sports network Team Whistle for an undisclosed sum, handing it rights to premier league soccer in Portugal and Spain, plus a strengthened relationship with World Cup organiser FIFA. As the tournament prepares to kick off on November 20, so the contest for global sports dominance is only just getting underway.

growing entertainment offering will result in an exciting new proposition for consumers. We are pleased the transaction has closed and we can now further engage all stakeholders in the process of establishing the joint venture and developing its extensive combined sports offer.

We see DAZN as the future of digital sports broadcasting and the ideal home for Eleven. Sport is global entertainment and joining with DAZN will

Above and far left: 13.3 million viewers signed into Prime Video to watch Thursday Night Football coverage begin in September

be transformative, allowing us to access greater economies of scale and a global platform for our talented team.

This deal marks an acceleration of our strategy to diversify our offerings and leverage our fantastic sports properties and our platform into new markets and business models. Team Whistle is a growing business that has a proven track record in monetising shortform content. It will be hugely valuable to DAZN as we look to generate the maximum value from our enviable rights portfolio.

TV production continues to boom despite the pandemic and a macro-economic environment forcing some to rein in costs. But producers and crew are pushing for better rights and malcontent is rife.

Thepandemic has made many people reappraise their lives. For those in TV –frequently required to work intense periods of extended and unsociable hours – not only did the hiatus deal a blow to finances, it also offered the chance to reflect on relations with a sometimes fraught and frenetic industry.

Disputes between employers and employees are nothing new, but as far as TV is concerned, while the on-demand era has delivered a welcome boom it has also placed greater demands on workers.

In the UK, this tension has manifested itself

in a stalemate between the Broadcasting, Entertainment, Communications and Theatre Union (Bectu), which represents some 40,000 staff within the creative industries, and the Producers Alliance for Cinema and Television (Pact), which counts around 750 independent production companies in its membership.

Negotiations between the two over the renewal of a five-year-old agreement governing working conditions in TV drama broke down in March, with the row turning increasingly sour as it went public. The pair had been in discussion since the previous

autumn, but each side rejected the other’s demands in areas such as pay, hours and expenses, resulting in a stand-off.

While Bectu expressed the need to address long days and the “wellbeing crisis” affecting its members, Pact pointed out the impact the pandemic has had on producers. The indie body rallied its membership to pen a joint letter arguing many shows would not be financially viable under Bectu’s proposals and urged crew to accept Pact’s or risk “the whole of scripted TV being damaged.”

The situation risks being exacerbated by a skills shortage within the business, highlighted in a broadly welcomed review of high-end TV production from the British Film Institute (BFI) over the summer. The organisation identified a critical crew shortage, in part due to an “urgent need to improve working culture and practices across industry.”

Meanwhile, the Bectu/Pact impasse has yet to be resolved, with the 2017 agreement having lapsed on September 1. However, the two parties agreed to an extension while Bectu considers an updated offer from Pact that goes to ballot October 14-23.

The row is not dissimilar to the dispute last year between the International Association of Theatrical

The UK TV drama industry has reached a critical point, with many crew suffering from burn-out and low morale and unable to sustain a family life and their own wellbeing. At a time when the industry is thriving, we know many talented workers are leaving due to the unsustainable long-hours culture. It’s time to meet these issues head on with an agreement that addresses our members’ concerns and is fit for the future to ensure the industry, and its staff, thrive for years to come.

The last few years have been some of the most challenging our industry has ever had to face. Everybody has played their part in getting productions back on the road – something which we should all be collectively proud of. Increased growth and

Lust

Stage Employees (IATSE), which represents crew in the US and Canada, and the Alliance of Motion Picture and Television Producers (AMPTP), which represents US studios including Disney, Netflix, Warner Bros, Paramount Pictures, Apple, Amazon and others in labour matters.

IATSE and AMPTP were in deadlock for months over deal terms, leading the former to threaten a strike that would have closed down TV and film sets across North America. With the deadline looming, the strike was narrowly averted and both sides came to terms in October last year.

There is scope for further unrest in the coming months with the Writers Guild of America (WGA), Directors Guild of America, The Screen Actors Guild – American Federation of Television and Radio Artists (SAG-AFTRA) and the AMPTP all due to engage in discussions over contract renewals in the first half of 2023.

North of the border, the Directors Guild of

demand have placed huge pressure on all parts of the industry, a situation both Pact and the producers are keenly aware of and sympathetic to.

A workplace reset is long overdue. If we can get this right, as well as investing in our crew and capitalising on the opportunity presented by our industry’s growth, we can accelerate creating a workforce that genuinely reflects our society. As we do that, we must also urgently address negative working practices and cultures, including the long hours routinely expected of crew.

At its best, the film and TV industry is an inspiring and supportive community. But all too often people feel lonely, overly pressured and bullied. Wellbeing, inclusion and mental health have to be top of the UK industry’s agenda now, or the

Canada in British Columbia reached a deal on new film and TV terms with the AMPTP and the Canadian Producers Association back in June after strike action was narrowly averted due to a wrinkle in Canadian labour laws.

Around the globe, the pandemic has given pause for thought and the halt in TV production prompted many to reassess their place within the pecking order and share of profits being made by those at the higher end.

In Denmark – home to some of the most celebrated series of recent years, with The Killing, Borgen and The Bridge having defined Nordic noir –production has this year ground to a halt.

Netflix suspended the development of new series and films in the country in June after the Danish Producers’ Association (DPA) and actors, writers and directors representative Create Denmark forged a new agreement requiring higher payments to artists. According to the US streamer, which

incredible growth and promise we’ve seen in recent years could well falter.

At ITV we are ramping up our own training and recruitment programmes to bring more people into our industry and upskill those already with us. However, many of the structural issues driving skills shortages are industry-wide and we are keen to work with others across the industry in addressing them.

We cannot commission or develop any new Danish films or series until further notice due to the challenges we have been facing in clearing rights with the Danish unions. Unfortunately, the structure simply doesn’t allow us to do so in a financially sustainable way. We fear we will not be alone in reaching that conclusion as the new agreement will

has faced challenges in many territories as talent and producers seek a bigger portion of backend revenues, the deal meant making shows in Denmark was no longer financially sustainable.

The company wasn’t alone. Danish broadcaster TV2 also discontinued development of new fiction for its streaming service, claiming the new twoyear pact made things too costly. Then Viaplay joined the fray and said it, too, was suspending such activities in the country.

The hiatus has been disastrous for producers, with the heads of companies including Lust producer Miso Films, SAM Productions, Apple Tree, Nordisk Film and Oxen producer SF Studios recently penning an open letter calling for compromise. The group warned that after nine months of stalemate, bankruptcies, firings and mass unemployment are all genuine prospects in an industry that faces potential “decimation.”

And winter is only just coming.

likely have negative consequences for the entire Danish creative community.

Until we have achieved a sustainable agreement, we see no other option than to put development of further Danish fiction projects on hold. In the longer term, we hope we can find a viable path so we can once again produce fiction in Denmark, thereby fulfilling our ambitious goal of becoming the leading provider of Danish-produced films and series.

Peter Bose, CEO, Miso Film 2022 has been a disastrous year for the Danish film and TV series business, the worst ever. And 2023 might be even worse. From being one of the most productive and leading countries within development and production of quality series and films to both streaming services and broadcasters, we have now come to a full stop.

S

p a

Six months on from the formation of Warner Bros Discovery, frustration is reaching boiling point, with producers expressing mounting concern about commissioning inactivity and lack of communication about the company’s long-term strategy.

When the US$43bn mega-merger of Discovery and WarnerMedia officially closed in April, it was safe to assume the road ahead would be bumpy. And so it has proved for the newly merged behemoth, Warner Bros Discovery (WBD), led by president and CEO David Zaslav.

A breathless six months has ensued, headlined by high-profile executive departures; axed projects; the swift death of CNN+; a retreat from live-action programming for kids and families; the closure of original commissioning hubs in the Nordics, Central Europe, Netherlands and Turkey; a planned return to third-party licensing; and confirmation that SVoD platforms HBO Max and Discovery+ will be combined.

Given the whopping US$55bn debt pile, industry observers expected the cuts to be deep and painful. They have been, and insiders expect more are on the way.

What appears to have caught the industry off guard, however, is the apparent paralysis when it comes to commissioning, leading to mounting anxiety from producers, creators and talent. The mere mention of the WBD merger elicits strong and often varied responses.

During any given conversation, you will hear the following: Zaslav and his team are ill-equipped to oversee a scripted TV juggernaut; the studios need

By Jordan Pintoto be leaner in this economic climate; the content sector is at the mercy of Wall Street like never before; and Zaslav and his team have been brought in to do a tricky but necessary job. Never has art been so at odds with commerce in Hollywood. The only common theme is that almost no one feels comfortable speaking on the record.

But as the months wear on, anger is beginning to simmer within the production community, which

The head of one US non-scripted production company, who has several projects on hold at brands under WBD, says: “It’s not so much that they’re passing or not passing on projects, it’s that they’re not telling us anything. That’s the issue – that there is no communication. Please, just say something to somebody out of respect for the fact that we’ve all been making your content and making you a lot of money for a very long time.”

“

What’s scary is that they have not bought a single piece of television in months. Yes, there’s announcements coming out, but those are things that were already greenlit.

US non-scripted producer

feels frustrated and insulted that so little has been communicated about the longer-term strategy.

Particularly on the unscripted side – where the combination of WarnerMedia and Discovery means a vast swathe of the biggest factual networks sit under the same umbrella – concern is growing around the lack of commissioning activity. C21 has spoken with multiple producers who say their projects are sitting in development purgatory.

The producer argues: “What’s scary is they have not bought a single piece of television in months. Yes, there’s announcements coming out, but those are things that were already greenlit.”

A lack of long-term visibility, of course, makes life complicated for production companies, which ideally need to plan at least two years ahead. That isn’t possible when “even people at a very senior level, general managers of networks, can’t give you an answer,” says the producer.

“If I don’t know when that market is going to loosen up, I have no idea what kind of resources and time to put into development – not for one network, not for two networks, for 10 networks. That’s a huge chunk of our market.”

Another producer tells C21 they had two pitches being actively shepherded by WBD execs. After not hearing anything for several months, the producer checked in to discover both WBD execs had been laid off, again highlighting the lack of communication cited by many sources.

WBD disputes the notion that there has been a commissioning slowdown on the factual side. In a statement sent to C21, Kathleen Finch, chairman and chief content officer, US Networks Group at WBD, says: “We are very much greenlighting factual content and will share details about several new series pick-ups once agreements are done. We are bullish when it comes to commissioning exceptional content in every category.”

For all the intense anxiety surrounding the merger, many acknowledge the cuts being carried out by Zaslav and his team may be a necessary evil.

“I do think studios generally need to be a bit leaner and meaner in this market. If they’re going to go up against streaming platforms, they need to get their shit together,” says one industry exec, who characterises the merger of Discovery and WarnerMedia as “cut-throat, cost-efficient meets fat and bloated.”

Now, the question turns to how long the cuts will continue for, and when the merged business will come out on the other side. “With any overgrown garden, you have to hack back the weeds and then

you can start growing, and so, for me, this is pretty much on a par with where I expected it to be. I don’t think it’s been worse.”

Amid the ongoing streamlining of the business, WBD’s stock has not performed well. Over the past six months, its value has fallen from around US$25 per share to under US$12 at the end of September.

But, of course, what is happening at WBD is not taking place in a vacuum. Stock prices are down across the board as Wall Street turns decidedly chilly on the long-term prospects of the streaming business. Netflix has been among the biggest casualties of 2022’s media stocks crash, slumping from a valuation of around US$700 per share a year ago to US$240 in late September.

WBD management has been tasked with finding US$3bn in savings within two years, and that means making unpopular and cold-hearted decisions. But some of the moves have incensed Hollywood, none more so than the decision to bin the Batgirl movie, even though US$90m had already been spent on it, as a tax write-off.

The move set off alarm bells in Hollywood, with the underlying concern being that WBD brass

doesn’t fundamentally understand how to work with talent – or worse yet, doesn’t respect talent.

Whether that is true or not, one thing is certain: the good will earned during Zaslav’s monthslong “listening tour” of Hollywood has essentially

“ We are very much greenlighting factual content and will share details about several new series pickups once agreements are done. We are bullish when it comes to commissioning exceptional content in every category.

Kathleen Finch WBDevaporated. The situation is likely not beyond repair, but things have not begun on the right foot.

“These guys are coming in and making decisions that experienced talent people wouldn’t make – that only bean-counters would make,” one US-based

talent agent tells C21. “You can’t treat talent that way. They spent a year or more of their lives on a movie – you have to release it and let the public decide, not a couple of executives.”

Butting heads with talent and their agents isn’t specific to the new regime, though. The previous leadership at WarnerMedia was also accused of not being talent-friendly, particularly after former WarnerMedia CEO Jason Kilar’s decision to release the entire Warner Bros movie slate day-and-date via HBO Max in 2021, a move that enraged the talent community due to the loss of back-end revenue from theatrical ticket sales. WarnerMedia paid out hefty sums to reimburse talent for loss of earnings.

The cost-cutting measures – and the apparent lack of empathy involved in the calculations –have certainly unsettled Hollywood’s TV and film community.

Chief financial officer Gunnar Wiedenfels’ assertion that the response to the Batgirl cancellation was “blown out of proportion” likely did nothing to mend any fences.

When asked if talent is actively avoiding taking projects to WBD, the agent says: “I mean, that’s absolutely happening. And it has to happen.

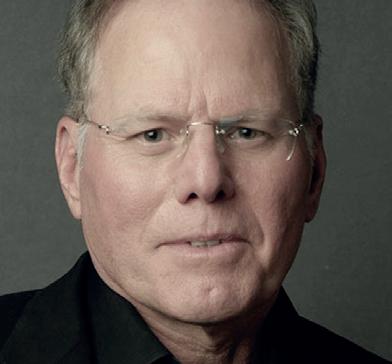

L-R: WBD president and CEO David Zaslav, US Networks Group’s Kathleen Finch and WBD international president Gerhard Zeiler. Top: HBO’s Emmy winner SuccessionWhen you’re selling a show or movie, the world is set up in such a way that each studio is its own ecosystem. When I look at the marketplace, I would prefer to sell elsewhere than Warner Bros Discovery.”

The notion that top talent may want to take their projects to studios other than WBD would certainly be an issue. In the short term, however, the company has enjoyed success, launching a hit with its Game of Thrones spin-off House of the Dragon, and sweeping aside the competition at the Emmys in September.

All told, WBD won 48 awards, including best drama series (HBO’s Succession), best limited series (HBO’s The White Lotus) and outstanding comedy for Ted Lasso, which Warner Bros TV produces for Apple TV+. HBO/HBO Max picked up 38 of the 48 prizes and consistently airs some of the strongest TV out there, including docu-comedy gems such as The Rehearsal and How To with John Wilson

But many in the industry are asking whether this rate of success can be sustained in the years ahead if the commissioning slowdown persists and if talent is wary of working within the WBD ecosystem.

One rumour that has gathered momentum over the past month is that Zaslav and his team might be gearing up to eventually sell the company. The whispers suggest Comcast could potentially be exploring a bid for the business, as part of a move to merge it with NBCUniversal.

While Zaslav shut those rumours down in late September – telling employees during a Zoom town hall that the company is “not for sale” and “we have everything we need to be successful” – speculation is unlikely to die down.

There remain big question marks across other parts of the business, including what will happen to London-based production and distribution giant All3Media, which WBD jointly owns with John Malone’s Liberty Global.

An M&A pundit tells C21 that one likely scenario could see Warner Bros International TV Production combined with All3Media. While there was speculation earlier this year that All3Media might be put up for sale following the official formation of WBD, the pundit says the strategic value of All3Media as a prolific programming supplier, and a profitable business in its own right, would potentially outweigh the benefit of selling it.

There’s also the question of whether Warner Bros/ HBO will continue its lucrative output deals with the likes of Sky in the UK and Bell Media in Canada, which rank among its richest output deals globally.

Speaking about the Sky partnership at the Royal Television Society (RTS) London Convention in late September, WBD international president Gerhard Zeiler said the company would “want to have our own streaming service in the UK outside of Discovery+.” However, with all Zaslav’s talk of maximising revenues, it would not be outside the realm of possibility that those output deals with Sky and Bell Media remain in place once the current agreements elapse.

Outside of North America, question marks hang over the evolution of its international business. At

RTS, Zeiler insisted that local content was a central pillar of WBD’s programming strategy. However, its actions suggest that isn’t quite true, after the company confirmed earlier this year that HBO Max original commissioning will stop altogether in the Nordics, Central Europe, Netherlands and Turkey.

These changes come as the company forges

ground to its biggest competitors, Netflix and The Walt Disney Company.

One of the repeated complaints about WBD is that short-term solutions are being used to keep investors happy, without considering the long-term strategy that will create a thriving media company.

“Right now, it seems like they’re making shortterm decisions to save money, which may not be the best decisions in the long run,” says the talent agent.

For many, revving up the commissioning engines will be the first step to restoring faith in the firm’s desire to take on Netflix and Disney. Sources on the non-scripted side say the US commissioning slowdown began in February or March and, as of press time, shows no signs of improving.

ahead with plans to combine HBO Max and Discovery+ into a single streaming platform, currently scheduled to launch next year. “We want to be a topthree media player and I will be disappointed if it’s a three in front of our name,” said Zeiler at RTS.

However, industry watchers argue that without the requisite level of content investment, it could lose

“I’m not trying to sound overly dramatic here, but the merger has been an unmitigated disaster for producers,” says the US unscripted prodco head, adding that the time for honest communication has arrived – even if the message isn’t a good one.

“Even if you’re going to cut budgets, even if you’re going to say, ‘hey, we’ve got to save a lot of money,’ communicate in a way with the producing community and the creatives that’s respectful. If you don’t do that, it will catch up to you.”

“ These guys are coming in and making decisions that experienced talent people wouldn’t make – that only beancounters would make. You can’t treat talent that way. US talent agentThe White Lotus

Dickinson from Wiip

After a quiet decade, private equity (PE) investment has made a forceful return to the content sector over the past 18 months.

Head-turning deals have included the launch of Peter Chernin’s The North Road Company, which acquired Red Arrow Studios’ US assets with backing from Providence Equity Partners; Kevin Hart’s Hartbeat securing US$100m in investment from Boston-based PE firm Abry Partners; Atwater Capital increasing its stake in Mare of Easttown and Dickinson prodco Wiip; and Apollo purchasing an undisclosed minority stake in US studio Legendary Entertainment for US$760m.

There’s also Blackstone-backed Candle Media, led by Disney alumni Kevin Mayer and Tom Staggs, which has been on an acquisition spree since last August, buying up companies including Reese Witherspoon’s Hello Sunshine, Israeli prodco Faraway Road Productions and CoComelon and Blippi owner Moonbug Entertainment, the latter for an estimated US$2.7bn.

An early indicator that the production business was once again piquing the interest of PE investors came in 2019 when UK-based natural history specialist Plimsoll (Tiny World, Hostile Planet) was taken out to market.

Before 2019, whenever production or distribution assets were put up for sale, the vast majority of bids would typically come from strategic investors, usually companies from the same industry looking for synergies and integration opportunities. PE

Despite a looming recession and belt-tightening across the content sector, private equity investors are more bullish than ever about the financial upside of the streaming revolution.

acr inv fin

By Jordan Pinto

acr inv fin

By Jordan Pinto

investors, also referred to as financial or trade investors, for the most part, wouldn’t get a look in.

However, something interesting happened when Plimsoll was put on the market in 2019, says Thomas Dey, CEO of London-headquartered ACF Investment Bank, which specialises in buying, selling and fundraising for businesses.

“What was very unusual was that half the buyers were financial, and we wouldn’t normally see that,” says Dey. “Instead, they went up against some of the biggest strategic players in the market and they outbid them. That’s unbelievable.”

The surprising turn of events was complete when LDC, the PE arm of the UK’s Lloyds Banking Group, acquired a minority stake in Plimsoll, led by CEO and founder Grant Mansfield, in a deal valuing the company at £80m (US$96m).

PE firms have remained involved in the global TV business over the past decade, but seeing so many of them in the running served as an eye-opener for ACF, says Dey.

“At ACF, we said, ‘OK, we need to up our financial buyer profile and interaction, because these firms are back.’ They’re here and they’re interested.”

When LDC left its position and

Plimsoll was again taken to the market in late 2021, there was even greater interest from PE firms, says Mansfield.

Of the 17 official bids, a meaningful number were from PE companies, mainly based in London and LA. Even when that list was whittled down to three, one PE firm remained in the mix with a very compelling bid.

Ultimately, ITV Studios acquired a

There is an increasing demand for content, it’s just driven by slightly different players than perhaps it was 24 months ago. PE houses see this as a growth sector.

“

79.5% stake in Plimsoll for £103.5m, valuing the enterprise at £131m, an increase of around £43m from less than three years before. Mansfield says the decision to go with a strategic investor, rather than a financial one, was down to the belief Plimsoll would benefit from additional specialist knowledge in its next phase of growth.

That isn’t to say, however, that PE companies have a rudimentary understanding of the content sector, notes Mansfield. Quite the contrary.

“There are some obvious

Tom Manwaring Helion Partners

specialists in the sector now, and certainly the [PE] company we were in talks with until late in the day didn’t need educating about the sector. They absolutely understood its potential value, and, frankly, its pitfalls – it’s not all champagne and roses. But we certainly had some very sophisticated bidders from PE.”

booming. While many other industries are still reeling, to varying degrees, from the effects of the pandemic, the content sector has rebounded well.

It can be easy to get lost in the negative headlines – and make no mistake, there have been many of those this year.

entertainment in times of economic hardship.

In that context, “paying £8.99 a month for Netflix or another platform of your choice is relatively good value to sit in and binge-watch TV,” says Manwaring.

PE investors also don’t view Netflix as the sole bellwether for the health of the streaming sector. “It’s fair to say that Netflix subs have flattened off in recent months but the overall subscriber rates and the demand for content amongst the other platforms – Apple TV+, Amazon, Disney+, Discovery+, Paramount+ and others – has continued to rise,” he says.

“Overall, there is an increasing demand for content, it’s just driven by slightly different players than perhaps it was 24 months ago. If you look at the TV production company level, the market demand for high-quality content is growing. That, in turn, drives the fact that these PE houses see this as a growth sector.”

“

This is still a period when Korean content is undervalued relative to its performance. Over time, it has to close up. It makes no sense why anything that resonates so much and has so much demand ends up being so much cheaper in terms of its unit economics.

Typically, when a PE firm invests in another company, there is a time horizon of either three-to-five or fiveto-seven years. However, each PE house has different criteria. Some, for example, don’t focus on the time but instead will hold their ownership until they have doubled or tripled their investment.

The initial plan was for LDC to hold its Plimsoll investment for between five and seven years. However, after achieving rapid growth in three, Mansfield instigated the process to find a new buyer. “Once they understood my thinking, they were very supportive. And they made a very good return, so everybody is happy,” he says.

The caricature of PE firms is that they have no empathy for the business they are investing in and only care about the bottom line. That was not the case for Plimsoll, says Mansfield, who calls LDC “hands-off and supportive.” Having LDC execs on its board was also valuable when it came time to find a new buyer.

Given the level of interest Plimsoll saw from PE investors, Mansfield says the demand remains strong despite potential industry headwinds. “For the right assets, there’s a real appetite from private equity,” he claims.

The reason for the demand is simple: the content business is still

Between Netflix’s stalling subscriber growth and the ruthless cuts at newly merged Warner Bros Discovery, to the likes of Snap and YouTube retreating from the original content space, there has been plenty of evidence to suggest that the content bubble has finally burst in the US. Things are no rosier in the UK, where the proposed privatisation of Channel 4 has been one of the dominant storylines of the past 18 months, and the BBC is contending with budget cuts of its own. Comparing the market values of each major US studio today versus a year ago also makes for sobering inspection.

Take a step back, however, and the picture isn’t so glum. According to UKbased research firm Ampere Analysis, spending topped US$220bn in 2021, up US$20bn (14%) from the previous year. This year, global content spend is projected to exceed US$230bn.

Even the threat of a devastating global recession, coupled with record rates of inflation, haven’t dented PE investors’ confidence in the long-term value of the content sector.

Tom Manwaring, partner at Londonbased M&A advisor Helion Partners, says the production sector and streaming platforms are “relatively well insulated from the downturn,” because people tend to cut out-ofhome entertainment (such as going to restaurants) rather than at-home

In the UK, there’s another interesting aspect to the M&A picture: the relative weakness of the British pound is making UK production companies “relatively good value” to US and international acquirers, says Manwaring. Both for PE and strategic investors, this will likely be a trend to watch in the coming months.

On the other side of the Atlantic, LA-based PE firm Atwater Capital is advancing its strategy as a specialist in the media space. With investments in Germany’s Leonine Studios and France’s Mediawan, Atwater has found a sweet spot partnering with European media groups that own and control rights.

The company recently increased its stake in Wiip, becoming the second largest shareholder behind Korean television company Studio LuluLala, (fka JTBC Studios). Atwater Capital is a strong believer in production companies retaining rights, says founder and managing partner Vania Schlogel, especially at a time when global streamers remain eager to gobble up worldwide rights.

“That type of uneven economic relationship continuing into perpetuity is not necessarily sustainable,” says Schlogel. “That’s actually one of the reasons Atwater invested in Wiip, which was set up by Paul Lee to be incredibly talent friendly. So there’s a shifting paradigm in trying to make sure that creators participate in backend economics.”

Aside from the fact it is focused solely on the media sector, Atwater is relatively unusual in that it is more involved than your typical PE firm. While many such companies take a backseat role in their portfolio companies, Schlogel describes Atwater Capital as an “operationally involved shareholder, to the extent that management wants us to be,” adding that “100% of our investments have been by invitation.”

While buying into European and US companies has been its bread and butter, direct investment in Asia could be next for Atwater. However, while the Asian marketplace, particularly South Korea, is evidently booming, Schlogel says the economics around content production don’t necessarily make sense for US-based PE houses looking to invest.

“Right now, Netflix is getting a heck of a deal when it comes to Korean content, because the unit costs are so much cheaper to produce content out of Korea versus the US, for example. But over and over again, Korean content is top-10 content,” she says.

“This is still a period when I believe Korean content is undervalued relative to its performance. Over time, it has to close up. It makes no sense why anything that resonates so much and has so much demand ends up being so much cheaper in terms of its unit economics.

“So that value gap needs to, and will, close up over time, and that will drive additional and renewed interest among American firms in Asian content.”

While the majority of PE firms want to invest in other businesses, some producers are finding innovative ways to structure deals so that they don’t have to sell pieces of their company.

One such outfit is LA- and Londonbased Atlantic Nomad – led by the former president of film at Content Media, Jamie Carmichael, and former Criminal Minds showrunner Simon Mirren – which last year closed a slate financing deal with Finnish venture capital fund manager IPR.VC, giving it access to overhead, development and production financing.

The investment has enabled Atlantic Nomad, which is majority-owned by Carmichael while Mirren has a minority stake, to acquire six pieces of IP (four books, one memoir and one graphic novel series), in addition to developing original projects with various creators internationally. In terms of development, the company currently has two projects in the US, several in the UK, two in Australia and one each in Ireland, Germany and France.

For its initial projects, Carmichael says he will split revenues 50/50 with producing partners, with Atlantic Nomad paying for the acquisition of IP,

development and creation of materials.

“It’s a simple, fair arrangement. Having access to capital allows me to be a helpful and positive partner to these other producers,” he adds.

Carmichael didn’t want to sell a piece of the company, especially so early in its existence, so the arrangement with IPR.VC is his ideal scenario. The deal, he adds, is evidence that PE firms also see the value of investing in other parts of the content chain, aside from simply taking ownership of production companies, while still believing they can make a healthy and meaningful return on their investment.

Carmichael forecasts continued industry growth for at least the next 10 or 12 years, saying that “smart and innovative investors” will reap the benefits of ongoing investment in the TV space.

ACF’s Dey agrees and dismisses the notion that PE investors would be deterred by the prospect of sustained industry belt-tightening.

“It’s one small blip in a market that is very buoyant overall. That is why PE is sitting in the middle of this market going, ‘this is a no-brainer,’” he says.

“LDC hung on to Plimsoll for 24 months and then sold them when they nearly doubled in size and made a huge return. It’s as simple as that. They just sat and held the investment, and then, bang – doubled their money.”

Jamie Carmichael of Atlantic Nomad

Jamie Carmichael of Atlantic Nomad

UK filmmaker Rowan Deacon and 72 Film, but Taylor also flagged up American Murder: The Family Next Door. While “potentially very American,” it comes from British filmmaker Jenny Popplewell, who was directing her first feature.

“It’s about telling the truest, most authentic story,” Taylor said.

When it comes to unscripted series, Kelly prioritises big, relatable shows able to cut through and resonate around the world. They typically have simple toplines, such as Studio Lambert’s The Circle

“British producers are exceptional at making really broad shows that travel,” Kelly said, highlighting the upcoming doc series about Tyson Fury, At Home With the Furys. Directed by Josh Jacobs and produced by Laura Leigh and Demi Doyle, the series is due to launch in 2023.

“Obviously, Tyson is a super British talent, but he’s a global sports name as well. We think that sort of contrast is really interesting, so we hope it’ll resonate here and then travel around the world,” said Kelly.

Currently in the works is an unscripted take on Netflix’s hit

Korean drama series Squid Game Squid Game: The Challenge is billed as the biggest reality series yet, featuring 456 contestants competing for a US$4.56m prize. The 10-episode show is a coproduction by Studio

person you don’t know,” said Dhand. Exec-produced by Oscar-winning Asif Kapadia (Amy) and directed by Joe Pearlman (Bros), the doc is coexec produced by Dominic CrossleyHolland, who heads RSA Unscripted, the new shingle launched by Ridley Scott Creative Group’s RSA Films.

Coproduction partnerships also remain firmly on the table for Netflix, across scripted and unscripted. Mensah flagged up recent BBC copro Red Rose and upcoming drama Champion, created by Queenie author Candice Carty-Williams as her first TV project. On the unscripted front is the recently greenlit cookery competition series Five Star Chef (6x60’), a Twenty Twenty copro with Channel 4.

Currently topping Kelly’s wishlist is a music talent format. “That’s a required space for us, and we think British producers have a history of making and developing shows that really pop and travel around the world. So we’d love to find that, as well those big, broad reality social experiments.”

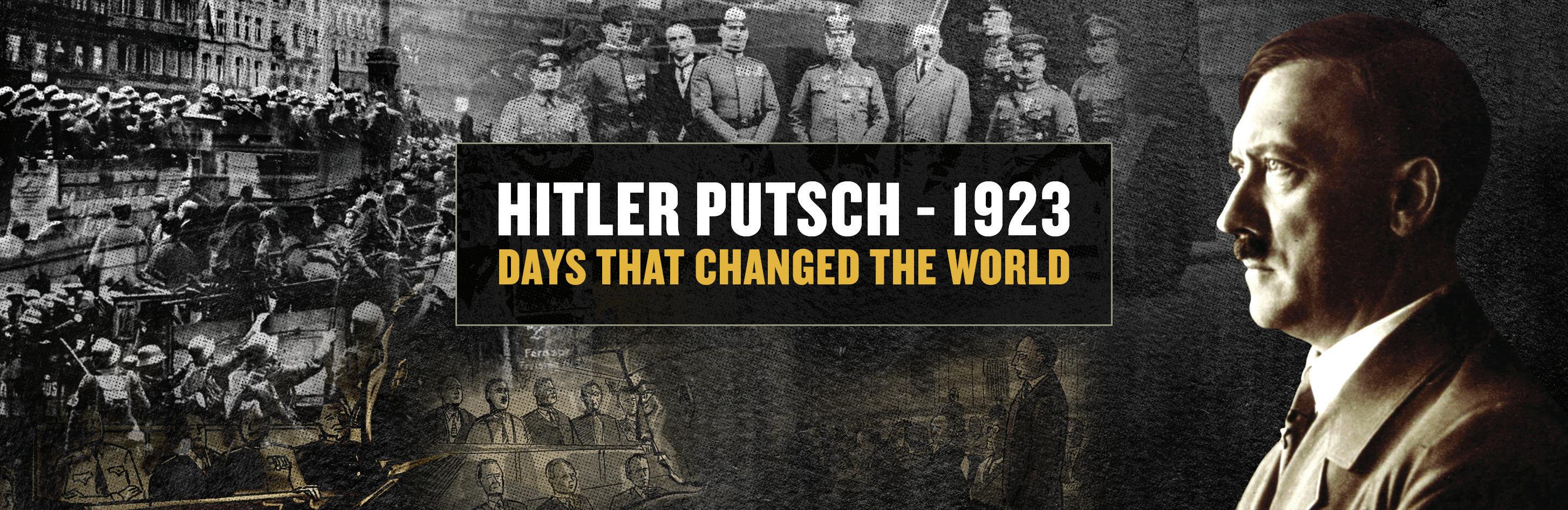

Dhand highlights a need for more doc series about contemporary history. Citing successes like Turning Point: 9/11 and the War on Terror, he said: “It’s an area we haven’t done a great deal on. There’s been a number of shows and there’s definitely a lot more to come down the tracks.”

Lambert and ITV Studios–owned The Garden and will be made in the UK.

Meanwhile, new on the UK doc series front is an as-yet-untitled official Robbie Williams series. Tapping 25 years of unseen archive material as well as exclusive access to the singer, the doc promises to show “the story you think you know but the

Mensah advised producers to keep pitching in the same space as existing shows. “There’s not just one YA story to be told, we’re making a tonne of them. There’s not one historical story to be told, not one gameshow or factual story,” she said. “Sometimes I think people over-worry about these things. Just come to us authentically and we’ll give you our authentic opinion back.”

“ There’s no sense we are changing course as a result of a customer crisis. We’re absolutely laser-focused on finding ideas that are going to be big and broad and noisy.

Ben Kelly Netflix

In years gone by, the notion that the programming boss at ITV would say ratings are not the be all and end all for the UK terrestrial broadcaster would be unthinkable. But times change and the imminent arrival of free streamer ITVX means the shackles of the overnights have been loosened a little within the offices of ITV as it pursues a strategy of “digital transformation” under managing director of streaming Rufus Radcliffe.

Who’s beating who on each night of the week remains an obsession for some (Ben Frow, controller of ITV rival Channel 5, is said to receive an alert at 09.37am each day with the overnights). However, at the recent Edinburgh TV Festival, Kevin Lygo, MD of media and entertainment at ITV, made it clear that the broadcaster is entering a new era.

ITVX will replace ITV Hub, the broadcaster’s existing, and clunky, catch-up service, in November. Marking the business’s somewhat belated leap into the world of streaming, ITVX will be a free, ad-supported service filled with around 15,000 hours of programming at launch, including thriller Without Sin

Crucially, ITVX will see the broadcaster commission programming that isn’t necessarily going to bring in millions of viewers at the first time of asking and instead pursue scripted and unscripted shows that skew younger than those who tend to tune in to Emmerdale followed by Coronation Street most weeknights for their soap fix.

But don’t expect ITV to suddenly start airing programmes about Roblox (ask a child) fronted by the latest TikTokker in primetime, though, with Lygo hinting at an evolution, rather than revolution, at the broadcaster, which as a listed company will always retain a commercial imperative.

“It’s not a huge shift. ITV is, and will remain, I’m sure, a mainstream broadcaster,” says Lygo. Nevertheless, ITVX

“

Nana Hughes, ITV

ITVX, the soon-to-launch free streaming service from the UK’s biggest commercial broadcaster, is opening up previously blocked avenues for ITV, freed from the pressure of overnight ratings.

aven the p ratin