Billion-dollar boost on the way for Brazil

Billion-dollar boost on the way for Brazil

Broadcasters reveal shi ing content needs

Brazilian TV develops taste for int’l copros

PLUS: Market snapshot | Streamer wishlists | VoD regulation Globoplay | Floresta | Banijay | Hot shows | Juliana Algañaraz

Markets have their moments. Through a combination of internal and external factors, usually sprinkled with a touch of grace, they gain special recognition from the international community, which suddenly turns its attention to their industry and talent. And what happens during this window of time can make a world of difference.

Welcome to Brazil, a giant with its own laws, diverse voices and a vibrant audiovisual industry that’s ready to take a major international leap – and is loudly demanding to do so.

and are now positioning themselves as attractive coproduction partners for the global market. The language barrier doesn’t seem to be holding back their ambitions.

After decades of self-reliance, the Brazilian TV market is approaching a turning point, where building bridges with the rest of the world will be crucial. In these pages, we aim to explore what this South American powerhouse has to offer in return.

The first answer is clear. After the government of Jair Bolsonaro (2019-2022) froze public support for the audiovisual sector, the policies of the current president, Luiz Inácio Lula da Silva, have brought about a revival of the industry. In 2024 alone, this strategy will inject US$1bn directly into the sector. Brazil now has the resources to tell its stories.

Added to this is the groundbreaking streaming regulation that is on the verge of being approved (page B43). If history repeats itself, as it did with pay TV in the last decade, this could pave the way for a real boom in independent production.

Independent prodcos, in fact, are among the major drivers of Brazil’s movement into the international market. They have gained prominence by producing local content for the major streamers,

However, to attract high-value productions to Brazil, the local industry knows it needs stronger public policies to incentivise filming (page B33). São Paulo and Rio de Janeiro already have cash rebate programmes in place, but much more is needed. According to consultancy firm Olsberg SPI, if a national incentive plan was launched this year, it could lead to a direct investment in audiovisual production of US$1.03bn by 2030.

For those looking to break into Brazil’s competitive TV market, we have dedicated several pages to discussing the content strategies of the country’s main screens – from Globoplay (the local hero of streaming, page B22) to the search for international formats and ready-made content by Globo, Record, SBT and Band, Brazil’s major freeto-air channels (page B29).

And for those there who still have the budget to buy, we provide a solid showcase of fresh formats and content made in Brazil, ready for broadcasters and audiences around the globe (page B47).

They say the Amazon is the lungs of the world. And at a time when producers in many regions are struggling to get their projects off the ground, working with Brazil could well be the breath of fresh air they need.

Markets have their moment and Brazil’s time is now. Let the games begin.

Pina Mezzera, co-editor of Cveintiuno

ANALYTICS: Brazil in numbers

A detailed look at the TV market, from the most influential players to the new opportunities within this vast nation with global ambitions.

CONTENT STRATEGIES: Global streamers

International pla orms are investing heavily in Brazilian production, but what are they making and what strategies are they following?

AHEAD OF THE CURVE: Copros in Brazil

Brazilian producers are using skills learned in the film industry to push into international TV coproduction.

CONTENT STRATEGIES: Globoplay

With plenty of cash to invest in content and technology, the streamer is eyeing new genres, formats and franchises.

CONTENT STRATEGIES: Broadcast TV

Buyers and programming directors from Brazil’s leading broadcasters reveal their acquisitions wishlists and current content needs.

FUNDAMENTALS: Shooting in Brazil

The Brazilian government is set to inject US$1bn into the country’s audiovisual sector this year – but will it be enough to attract the international industry?

DEVELOPMENT SLATE: Floresta

The prodco is gearing up with premium fiction and international copros for when the market rebounds, while remaining an active unscripted player.

DEVELOPMENT SLATE: Banijay Brasil

With the acquisition of A Fábrica and the launch of Banijay Estúdios, Banijay has made Brazil the centrepiece of two major moves in Latin America.

NEWS ANALYSIS: Streaming regulation

The Brazilian government aims to spark a production boom by regulating streamers and imposing local content quotas and financial contributions. But not everyone likes the idea.

NEXT BIG THINGS: Hot picks

Our selection of 21 shows that demonstrate the creativity available in the Brazilian market.

PERSPECTIVE: Juliana Algarañaz

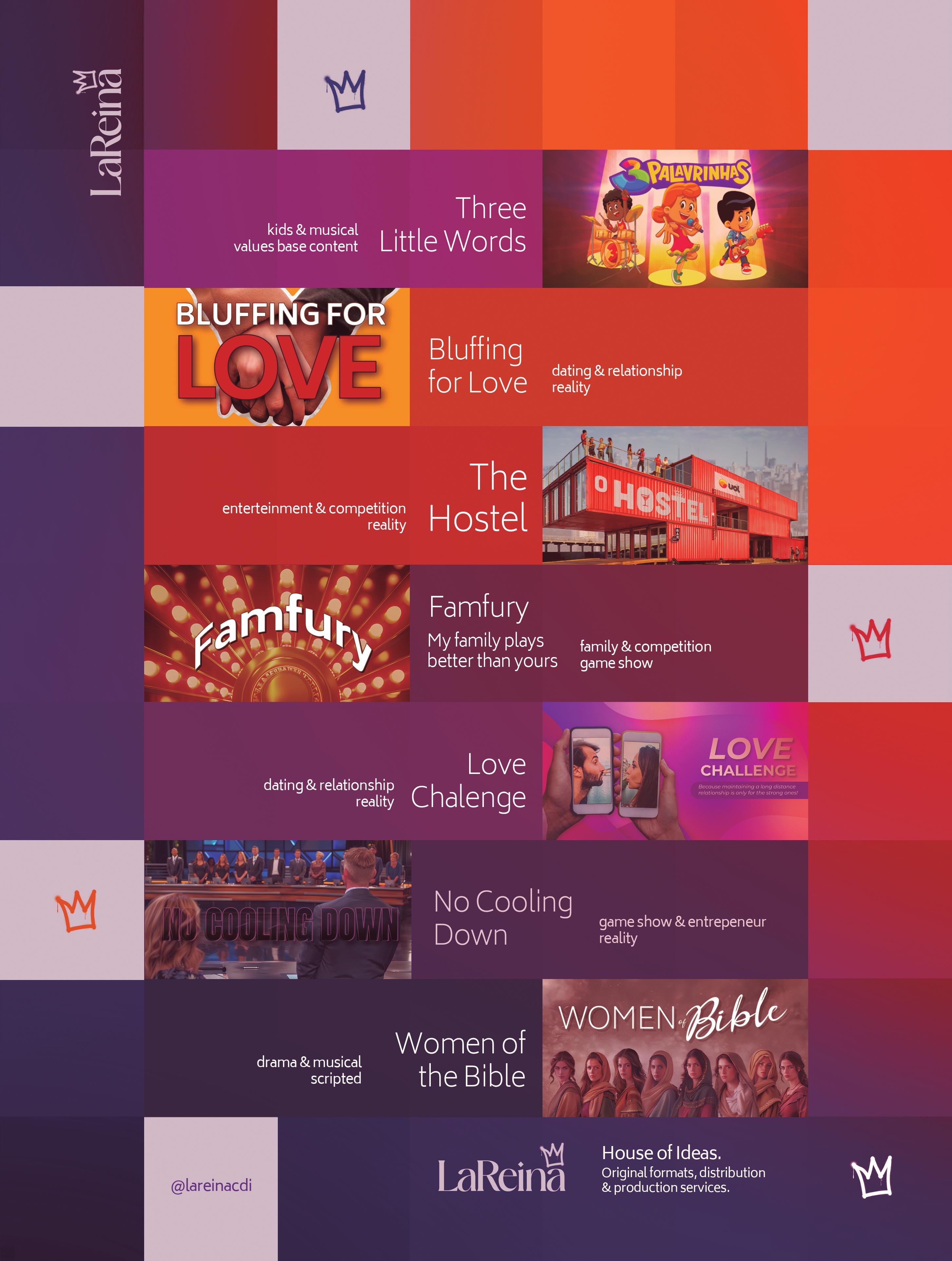

The founder of LaReina Casa de Ideias and former CEO of Endemol Shine Brasil discusses why it’s a great moment for the international market to start working with Brazil.

C21 explores the Brazilian television market, from the most influential players to the emerging opportunities within this vast, continent-sized nation with global ambitions.

By Sebastián Torterola

Brazil is the fifth-largest country in the world by size and the seventh by population. Its audiovisual industry is also one of the most developed on the planet and, according to its own producers, it was built “in the image and likeness of the US.”

It seems the opportunity for the international market is immense, especially in times of crisis. And yet it’s still waiting to be fully seized.

“It’s a gigantic market that offers fewer opportunities than its economic size would suggest,” says Diego Guebel, president of prodco Boxfish and former programming director at Brazilian broadcaster Band.

“Especially in the case of free-toair [FTA] TV, because channels produce much more in-house than in other markets and, as a result, the penetration of independent production is lower compared to other territories.”

Brazilian broadcast television has historically been dominated by four largely family-owned and highly vertical groups. TV Globo is led by the Marinho family, pioneers in the

national industry and telenovela production; SBT was founded by mogul and presenter Silvio Santos, who was succeeded by his daughter Daniela Beyrut following his death earlier this year; and Band is owned by the Saad family.

Then there’s Record, the fourth of the big channels, which is a different case. Having been a cultural reference in Brazil for decades since its launch in 1953, Record was acquired in 1990 by preacher Edir Macedo, leader of the Universal Church of the Kingdom of God, an Evangelical church particularly popular in Brazil.

Since then, it has focused its content strategy on news and melodramas, and in the early 2010s it pioneered a new genre in Brazil: biblical telenovelas. These epic period scripted productions have found success both domestically and internationally, with titles such as Moses & the Ten Commandments, The Promised Land, The Rich & Lazarus and, most recently, Esther, the Queen

Among the four groups, however, one has managed to stand out in

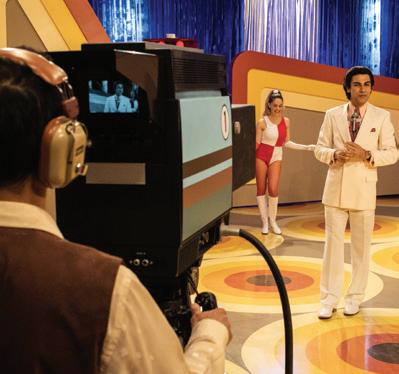

terms of popularity: Globo. Today, the giant owns free-to-air TV channels, pay TV channels, a streaming service and Estúdios Globo, an impressive production facility in Rio de Janeiro. With 192,000 square metres of constructed space within a total area of 1.7 million square metres, including scenic cities and 13 soundstages, Estúdios Globo produces eight hours of audiovisual content per day, six days a week.

“It’s like producing, shooting, editing and finishing four movies a day,” says Amauri Soares, director of the studios, who is also in charge of the group’s broadcast channel, TV Globo.

This content feeds the company’s various business units, from TV Globo to 57 pay TV channels and its streaming service, Globoplay. According to figures from January this year, Globo leads the Brazilian audience with a 33.21% share. Following are Record TV (10.58%), SBT (7.10%) and Band (2.86%), all of which, like Globo, are vertically integrated companies with powerful production studios that supply content across their platforms.

But while the situation remains largely unchanged in FTA TV, independent television production in Brazil has experienced two recent revolutions: the 2011 Pay-TV Law and the arrival of streamers a few years later. The first established minimum quotas for local and independent content, spurring a virtuous cycle of national production. The second resulted in a definitive leap in quality and production capacity for the sector.

According to data from Ampere Analysis, the average Brazilian household currently has 3.3 SVoD services (the global average is three), and the number of households with five or more subscriptions grew significantly in 2023, reaching 21%. Each household spends approximately US$12.48 per month on streaming subscriptions, a figure projected to rise to US$15.78 by 2028.

Source: Ampere Analysis

new model,” says Caio Gullane, partner at prodco Gullane Entretenimento (Senna, Sintonia). “Today, we believe it’s a very enriching exchange where we learn a lot in terms of governance, timelines and managing projects and talent. In some way, they are a mirror of what’s expected from production companies in the market.”

As a global pioneer, Netflix was the first streamer to produce original content in Brazil. It started building its local audience with its first series, the dystopian drama 3%, which debuted in 2016 and was produced by Boutique Filmes.

king in streaming. The streamer leads the market with 19.4 million subscribers and was the preferred option for 71% of Brazilian users as of Q3 2023. Among international platforms, Disney+ follows with 8.21 million subscribers, ahead of Prime Video with 5.9 million, and the recently launched Max with 5.6 million.

It didn’t take long for other international streamers, along with local service Globoplay, to start heavily investing in original Brazilian content. According to Ampere, in 2023 alone, streamers spent US$324m on local content, the largest investment in Latin America. Of that amount, 69% (US$248m) went to original production, while the remaining 31% (US$88m) went to acquisitions. The investment in originals in Brazil is projected to grow to US$289m (74% of total investment) by 2028. Additionally, data reveals that the action and adventure genre (14%) is the favourite among SVoD audiences, followed by sci-fi and fantasy (13%) then

21%. Each household streaming, we had to that the action and comedy (12%).

“With the arrival of streaming, we had to restructure the production company internally to meet this demand, which brought a

If Globo is the most popular broadcaster in Brazil, Netflix is currently the undisputed

A special mention goes to Globoplay, which despite the competition has managed to maintain its position as a national streaming option, ranking third in subscriber numbers (six million) and fourth in preference (28%). Launched in 2015, Globoplay has relied on Globo’s most famous brands, such as telenovelas produced by Estúdios Globo and movies from Globo Filmes. Yet it has expanded far beyond these offerings. The platform has ventured into various strategies, such as freemium streams of major carnival events, acquiring sports rights, adapting entertainment formats and international coproductions.

While the majority of the group’s production for free and pay TV is done in-house, Globoplay has opened its doors to the independent sector. According to the company’s own data, it has already collaborated with more than 170 local production companies, while 40% of the platform’s original content is currently produced externally.

like Malu Miranda, who had served as head of Amazon Studios Brazil. Similarly, Warner Bros Discovery made cuts, including such execs as Mônica Albuquerque, head of fiction development for Latin America, Marina Filipe from the kids’ division, and Roberto ‘Naná’ Nascimento from ad sales.

In response, the sector is more focused than ever on engaging with the international market, with multiple independent prodcos establishing offices abroad in recent months, such as Conspiração Filmes in Mexico, Glaz Entretenimento in Portugal and Grifa Filmes in Canada.

(

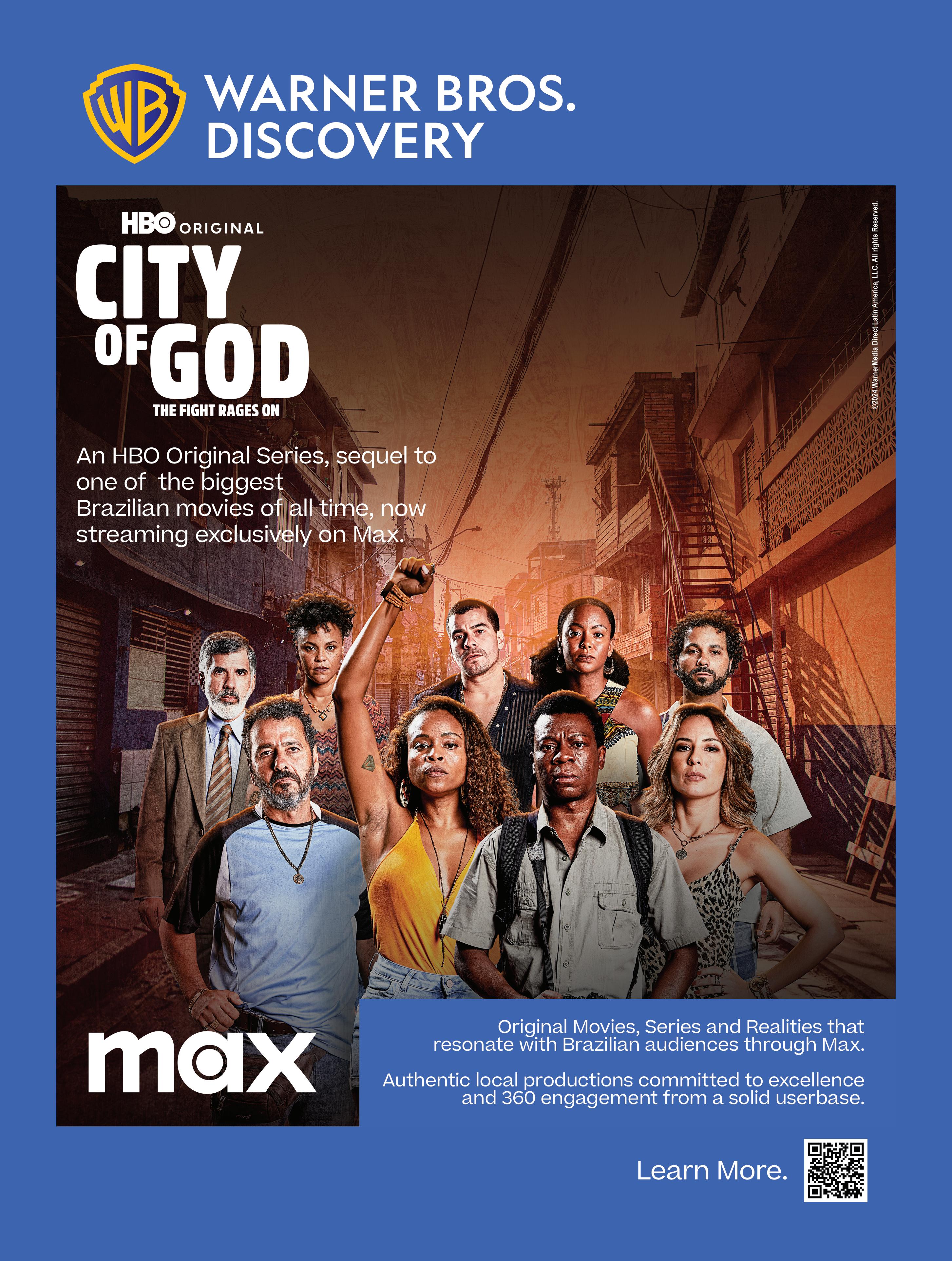

Thanks to the growth of these platforms in recent years, Brazil’s independent production sector is now much more robust, with companies like O2 Filmes (City of God, Max), the aforementioned Gullane, A Fábrica (Desperate Lies, Netflix), Floresta Divided Youth, Max), Conspiração (Dom, Prime Video), Boutique Filmes (Omniscient, Netflix) and AfroReggae Audiovisual The Game, Globoplay) among the most prominent. However, the global slowdown in the industry also poses a challenge in Brazil. While Q1 2023 saw a peak of 154 unscripted commissions and Q2 a peak of 42 scripted projects, Ampere’s data for Q2 2024 is far less encouraging: 35 unscripted and 18 scripted titles. This slowdown in local commissioning activity coincides with belt-tightening by major international players.

the

Moreover, all players are exploring new commercial and financing models: pre-sales with first-look/last-refusal agreements are making a comeback, success fees are being considered for originals contracts, and streamers are open to sharing windows. Meanwhile, producers and distributors are dividing box-office revenue and leveraging festival prestige.

for Q2 2024 is far less international players.

Amazon Brazil, for instance, cut 10 employees this year, including creative leaders

Even the more traditional players are catching on. SBT, for example, has announced it is “open for business” and is now including the international circuit as part of its strategy for content production, acquisitions and sales.

Simultaneously, the coming months could be pivotal, with potential injections of public funding and the possible establishment of a federal economic incentive plan (see p. B33), along with streaming regulations (see p. B43) that might, among other measures, require international platforms to reinvest a share of their profits in the local production market.

When Netflix launched the Brazilian sci-fi series 3% in 2016, it marked the beginning of a local production strategy soon followed by the rest of the global streaming platforms. These e orts collectively account for dozens of titles and a strengthened independent production community in the country. Streamers’ international expansion plans have always put Brazil front and centre. Today, the country leads Latin America in terms of revenue, subscriptions and content

investment from these players.

According to Ampere Analysis, in 2023 alone, global SVoDs invested US$324m in content in Brazil. This figure, which includes both original and acquired titles, represented 30% of total spending in Latin America, ahead of Mexico (US$289m), Colombia (US$204m) and

Argentina (US$191m).

But Brazil is a unique case. As the largest, most populous country in the region, and the only one where Portuguese is spoken, streamers have invested much more in original content than in acquisitions. In 2023, 69.7% of their spending (US$226m) went towards original content, compared with 30.3% (US$98m) for acquired TV series and films. Ampere predicts this trend will increase and, by 2028, spending on original content will rise to US$289m (74.5%), while acquired content will remain relatively steady at US$99m

content than in acquisitions. In 2023, 69.7% of their spending (US$226m) went towards original content, (US$98m) (25.5%). this

International pla orms are investing more in Brazil than in any other Latin American country, and the forecasts only point to more growth. But what are they looking for and what are their content plans?

With this projected growth, which contrasts sharply with the drop in production volumes in other key regions, the question is: how will Netflix, Amazon, Disney and Warner Bros Discovery (WBD) – the four major companies producing locally for their OTT platforms – fill their Brazilian catalogues? One of the biggest developments in Latin American streaming over the past two years has been its venture into telenovelas, the quintessential local genre. For Brazilian melodrama, this marks a milestone, as the genre moves beyond its traditional stronghold on the major free-to-air TV networks. Desperate was the first of this new breed, replicating the scale, talent and style of classic Brazilian telenovelas but condensed into a format and

regions, the question is: how will Brazilian catalogues? developments the past two years the as the genre moves

Netflix’s

By Pina Mezzera

pace better suited to streaming viewing habits. Spanning 17 episodes, the series follows a woman, played by Globo star Juliana Paes (The Clone), who dreams of becoming a mother.

The show’s performance suggests the streamer is eager for more. The week after its release on July 5, Desperate Lies was the most-watched non-English-language title on the platform, with 78.5 million hours viewed and 5.8 million views. It also became the sixth most-watched title worldwide, regardless of language.

A Fábrica, a Banijay Americas production company, is behind the show and is also developing an adaptation of Globo’s classic 1979 telenovela Pai Heroi for Max.

“ Projects in the early stages of production are desirable, as well as works with established IPs, provided the rights are secured. We prefer stories with active protagonists facing obstacles and specific goals.

Glauco Sabino

Amazon MGM Studios

WBD’s Max is another platform betting heavily on this strategy. In fact, it created a dedicated telenovela division, which, after several leadership changes, has been headed by Edna Palatnik since October.

Max will release its first two melodramas in 2025, each with 40 episodes: Dona Beija, a remake of the 1986 classic now produced by Floresta Produções, and Beleza Fatal, created by prodco Coração da Selva. To bring these stories to life, WBD has also attracted well-known Globo talent such as Camila Pitanga, Grazi Massafera, Giovana Antonelli and Caio Blat.

While some platforms are experimenting with the right balance of episode count, tone and budget, others

seem to be waiting to see how these initiatives perform before taking the plunge.

“We’re developing and figuring out what the right project for Amazon would be. What’s the story? What’s the right formula? We haven’t announced anything yet, but we’re analysing it because melodrama is our strength,” Javiera Balmaceda, head of originals at Amazon MGM Studios for Lat Am, told C21.

Although Disney’s Brazilian team said two years ago that it was looking closely at the genre, it hasn’t yet announced any projects. Perhaps it is waiting to see how its Spanish colleagues’ experiment performs, as Disney+ prepares to launch Regreso a Las Sabinas, its first melodrama, on October 11, with 60 episodes to be released daily.

Another trend that Brazilian commissioners are not escaping is the search for major IP capable of generating spin-o s, ideally, with big talent attached.

“True crime works very well on our platform. Our most recent example is Maníaco do Parque. In addition to the film, we will have two more related projects to announce soon,” said Rodrigo Guimarães, director of Brazilian films at Amazon MGM Studios, during the Rio2C event in June.

“Projects in the early stages of production are desirable, as well as works with established IPs, provided the rights are secured. We prefer stories with active protagonists facing obstacles and specific goals,” added Glauco Sabino, the company’s senior leader of unscripted.

True crime also appears on the other platforms’ wishlists, whether series, films or documentaries. Recent projects announced by streamers in this genre have included Tremembé, produced by Paranoid for Prime Video and set in the maximum security Tremembé prison, and Praia dos Ossos, from Conspiração for Max and based on the murder of 1970s celebrity Ângela Diniz.

Brazilian commissioners are also keen to continue telling stories about major local personalities. This trend, was seen in docuseries like Disney+’s Guga x Kuerten, about tennis star Guga Kuerten, and Max’s Romário, O Cara, about footballer Romario, and reaches new heights on November 29 when Netflix premieres Senna

The fiction series, based on the life of Brazilian Formula 1 champion Ayrton Senna, is Netflix’s biggest and most ambitious production in Latin America so far. Produced by Gullane with support from the driver’s family, Senna is directed by Vicente Amorim and stars Gabriel Leone in the lead role.

Meanwhile, formats are beginning to play an import part in streamers’ strategies in Brazil.

Ilhados com a Sogra (Stranded With My Mother-in-Law). The show, produced by Mixer, has already been renewed for a second season. Netflix has also greenlit its first local music talent show, Nova Cena, an adaptation of US format Rhythm + Flow, produced by Endemol Shine Brasil.

The good news for local producers, regardless of the type of content each platform is looking for, is the growing openness to coproduction and licensing models. “We’re open for business. We’ve broadened our mindset around coproductions and are also taking on more financial responsibility,” said Amazon’s Balmaceda.

After launching two seasons of comedy format LOL: Last One Laughing Brasil, Prime Video premiered a local version of Temptation Island in September, produced by Endemol Shine Brasil. The format, in which faithful couples are tempted by attractive singles, has aired on TV channels in more than 20 countries.

Netflix, which first ventured into Brazil with local versions of its own formats like Love is Blind, Too Hot to Handle, Iron Chef and Queer Eye, made the leap into locally created and produced reality formats in 2023 with

Netflix is already active in coproducing films in Brazil, such as medical drama Inexplicável, with Clube Filmes, an upcoming movie from Kleber Mendonça Filho and another made with Filmes de Plástico, set for release in 2027. The next step is to apply this model to series.

“We need to develop a scalable pre-sale model for series,” said Gilberto Toscano, senior director of legal and negotiations at Netflix Brazil, during Rio2C. “It is a work in progress, but it’s something we’re absolutely interested in.”

According to Ampere, only 29% of Brazilian households currently subscribe to SVoD services, but this number is set to grow in the coming years, with monthly spending on platforms expected to increase from US$12.38 to US$15.78 by 2028.

Unlike other major markets, Brazil still has room to grow in the streaming space. And that should be good news for the wider industry.

HA generation of Brazilian producers equipped with skills learned in the filmmaking business is making an unprecedented push into international coproduction –this time in television. By Sebastián Torterola

istorically dominated by a handful of players (see page B9), with a self-sufficient domestic market and a unique devotion to its own melodramas, Brazil’s television industry has traditionally remained closed to the international production community.

However, a generation of independent prodcos is now breaking the mold.

After a shared journey – gaining experience in advertising, growing through filmmaking and maturing via streaming and its global reach – many indies are now leading a drive into collaboration beyond their borders.

By chance or opportunity, this movement comes as the local industry faces serious challenges, principally a decline in linear TV consumption, lower advertising investment and reduced commissioning levels from streamers.

As a result, these producers are drawing on their skills in filmmaking – a sector long accustomed to international coproduction – to take advantage of the licensing and acquisition opportunities now offered by platforms.

“Those of us who work in film are used to the current windowing model, which involves taking more risks but allows us to retain control of our IP. Now we’re transferring this knowledge to series production,” explains Renata Brandão, CEO of Conspiração Filmes.

Conspiração is a leader in this trend. With around 40 films under its belt and having made the leap to premium series in 2005 with HBO’s Brazilian comedy-drama Mandrake, it has since established itself in TV and is now one of the

local prodcos pushing hardest into the global market. This expansion included opening offices in Mexico last year to produce locally.

“But finding projects that generate interest across multiple markets is a challenge; not all Brazilian content is attractive for coproduction,” admits Brandão, whose company recently produced three seasons of the Brazilian hit Dom for Amazon’s Prime Video and is currently preparing a documentary about Real Madrid football star Vinícius Jr for Netflix.

“It’s not easy to secure funding in the international market for a Portuguese-language series,” she adds. “But we ask ourselves, ‘Why not produce in other languages?’ That’s why we’re working on co-creation initiatives with local producers in other countries.”

Joining Conspiração are companies like O2 Filmes, which recently premiered a series continuing the story of iconic Brazilian film City of God on Max, and Gullane, which has just produced Netflix’s most ambitious project in Brazil to date: the highly anticipated Senna, about the late and revered Formula 1 driver Ayrton Senna.

For Gullane, which already has a long history in TV with series like Alice (HBO, 2008), Jailers (Globoplay, 2017) and The King of TV (Star+, 2023), its international expansion is heavily supported by its experience in cinema.

“Of the 60 independent films we’ve made, 25 were international coproductions – from Marco Bellocchio’s The Traitor, which has ties to Brazil but is predominantly

“Those of us who work in film are used to the current windowing model, which involves taking more risks but allows us to retain control of our IP. Now we’re transferring this knowledge to series production.

Renata Brandão Conspiração Filmes

Italian, to Karim Aïnouz’s Motel Destiny, which is entirely Brazilian but includes partners from France, England and Germany,” says Fabiano Gullane, a partner at the company.

Thanks to the incentives offered annually by Brazil’s National Film Agency (Ancine) through the Audiovisual Sector Fund, a total of 495 international coproductions with primarily Brazilian IP have been made in the country over the past 20 years. In the last decade, the country has averaged 34 international copros per year.

Portugal, unsurprisingly, is Brazil’s top coproduction partner (96 titles), but other frequent partners include Argentina (92), France (90), Uruguay (35) and Germany (35).

The next step is to transfer this experience to TV content.

“In the past, at trade markets, Brazilian executives were closed off. Their domestic market was so large that they didn’t need outside help. In today’s context, there’s a new-found interest from Brazilian TV in looking outward,” says veteran producer Dago García, VP of production and content at Colombian broadcaster Caracol TV.

“

We’re trying to act as catalysts in a market that’s showing signs of opening up but is still quite hesitant. Our company is very used to implementing hybrid models but others are not.

Kiko

Ribeiro

Grifa

Filmes

García has been travelling frequently to Brazil in search of new partners, and the company recently appointed former Globo executive Márcio Guilherme da Silva as VP of new business at its production unit Caracol Estudios, specifically to find Brazilian stories that can be internationalised.

the public organisation that promotes the audiovisual sector in São Paulo.

“Others took the opportunity to diversify their business models and are now producing worldwide. I believe the growth of Brazilian production is inherently tied to the growth of the international market,” he adds.

This reality isn’t new for some producers. For Grifa Filmes, partnering and collaborating both domestically and internationally has always been part of its DNA.

“We’re trying to act as catalysts in a market that’s showing signs of opening up but is still quite hesitant. Our company is very used to implementing hybrid models but others are not,” says Kiko Ribeiro, executive director of Grifa Filmes, which has 30 years in the market and owns a Canadian subsidiary, B2Win Films.

Ribeiro cites the documentary The Factory’s Basement, coproduced with Germany’s Gebrueder Beetz Filmproduktion, as an example. “It’s an €800,000 [US$890,000] production where we each contributed half the funding. Our coproducer secured deals with Arte in France and ZDF and WDR in Germany, while Grifa brought in TV Cultura in Brazil. We kept the rights for Latin America and Brazil, they took Germany and France and we split the rest based on investment proportion. Plus, we have a window open for streaming.”

Glaz Entretenimento has also joined the list of Brazilian production companies eager to collaborate globally. This strategy took shape with the opening of its first offices in Portugal.

“We

Grifa, which specialises in unscripted, is one of the driving forces behind the upcoming LatAm Content Market, which will have its first edition in Rio de Janeiro in March 2025, born from an alliance with France’s documentaryfocused Sunny Side of the Doc.

But according to Mayra Lucas, CEO and creative director at Glaz Entretenimento, the real reason for this renewed Brazilian interest in the international market lies in the local crisis.

“We were operating under a model based on incentives from Ancine that we thought would never end. But we realised that wasn’t the case, first with the pandemic and then with Jair Bolsonaro’s government,” explains the producer, who is currently working on the film and the sequel to Netflix’s hit Get the

In fact, documentary is one of the most produced genres in Brazil, making it an excellent opportunity for foreign producers interested in working with the South American giant.

According to Ancine, out of more than 50,000 productions registered in Brazil over the past two decades, 26% were documentaries.

In fiction, which accounted for 23% of those productions, Brazil has a long-standing tradition of producing telenovelas on TV and comedies in film, both of which remain strong in today’s risk-averse times.

And while the streaming boom compensated for many of these problems for a time, the bursting of the originals bubble has forced production companies to seek partners abroad once again.

bubble has forced production

“Brazilian production companies were forced to find other means of financing. Some relied heavily on the platforms and are now in crisis,” adds Luiz Francisco Vasco de Toledo, who until September was the director of investments and strategic partnerships at Spcine,

Yet the country has also experimented with new genres, particularly biopics about well-known personalities, like the aforementioned Senna, or docuseries such as Bituca (from Gullane for Globoplay) about musician Milton Nascimento and If I Were Luíza Sonza (Conspiração for Netflix), about singer Luíza Sonza.

It is often said that doing business in Brazil is challenging, that the language barrier is real and local rules can be hard for outsiders to grasp. As with any Latin American country, there’s also plenty of bureaucracy and the tax system can be quite rigid.

But judging by the current climate, there has rarely been a time when the Brazilian market was so eager to build international bridges.

In September, Brazil chose Walter Salles’ film I’m Still Here as its Oscar contender, following its Best Screenplay win at this year’s Venice International Film Festival and a 10-minute standing ovation.

While the journey to the Academy Awards is still long and there’s no guarantee it will be among the final nominees, the selection of I’m Still Here couldn’t have been more timely for Globos’ streaming platform Globoplay, which will premiere the film as its first original movie.

The property embodies part of the platform’s refreshed content strategy, which aims to expand the types of genre it produces.

“Everything that we’re doing needs to be pushing out of our comfort zone a little bit. So even though we’ve been very successful with some heavy TV dramas like Where My Heart Is, The Others or Justice, action crime series like The Game or biographies like Living on a Razor’s Edge, we believe in the mix,” says Alex Medeiros, head of content for drama, film and documentaries at Globoplay, which combines SVoD with AVoD, plus a free open tier.

“That means we’re looking for some romance, music shows or comedy. We want to add more feelgood content,” he adds.

With over US$1bn to invest in content and technology, Globoplay is redefining its original content strategy through expansion into new genres, formats and franchises.

By Gonzalo Larrea

With the BAFTA-winning director of The Motorcycle Diaries at the helm and appearances at major international festivals, including Toronto and San Sebastián, I’m Still Here is undoubtedly a prestige project for the platform.

This aligns with Globoplay’s newly launched original film line, which plans to release one or two original titles each year that “creatively enhance the Globoplay brands.”

These films add to the eight or so titles already released each year through its banner Globo Filmes and its in-house TV movies produced by Estúdios Globo.

However, Medeiros emphasises the goal is to go beyond this, venturing into broader content to reach diverse audiences, with genres like horror, fantasy and young adult, alongside the ones already mentioned.

includes more than 350 titles, along with acquired melodramas from Turkey and Mexico.

and Brazilian cultural icons, the original telenovela

And while the original documentary strategy will remain largely unchanged, with around 20 releases per year focusing on true crime, impactful cases and Brazilian cultural icons, the original telenovela strategy, under which titles such as All the Flowers were launched, will be reassessed.

“We are the house of the telenovela in Brazil, but we are redefining this strategy at the moment,” Costa says, explaining that original melodramas may shift towards shorter content of around 20 episodes.

“Globoplay is such a di erent streaming animal and since we have all our free TV telenovelas available on the platform, we understand that we need to make our investment in other areas,” explains Tatiana Costa, general manager of channels and content at Globo. Indeed, Globo’s free-to-air main channel, whose content is available on Globoplay’s free tier, has four daily telenovela slots.

understand that we need to make our investment in other areas,” explains

This change won’t a ect the upcoming launch of Warriors of the Sun (working title), a new original novela set to premiere in 2025 as part of Globoplay’s 10th-anniversary celebrations. Medeiros describes the show as “a great, epic western show” of 45 episodes, set in Brazil’s north-east during the 1920s and 30s. “We’ll see how it performs, but it was a major investment, and we believe we don’t need an original telenovela every year,” adds Costa.

The streamer also o ers the entire channel archive, which

available on Globoplay’s free tier, entire channel archive, which

Costa reveals that Globoplay manages a US$1.2bn budget between technology and content, which translates into 30 to 40 original productions a year, including series, films, documentaries and acquisitions.

Next year, the platform plans a similar number of releases. Medeiros explains that the limit isn’t so much about budget but rather about the platform’s capacity to promote its own shows.

“We find there’s a certain volume that you can promote on your platform, and we’re probably at the peak of that volume right now. Anyway, next year, we’ll have some very big shows, very strong originals,” he says.

Among those titles, Medeiros highlights the second season of the musical drama Rensga Hits!, which has already been renewed for a third run; a documentary on the Air France flight that crashed between Rio de Janeiro and Paris; a biographical series about Brazilian rocker Raul Seixas; a docuseries directed by Walter Salles about the legendary Brazilian footballer Sócrates; and a third season of action series Dissident Archangel

With S4 of the show already commissioned, Dissident Archangel is a prime example of the other type of content Globoplay is looking for: returnable series. “We’ve been able to create quite a few franchises that have been very successful. Some of our IPs that have been renewed are doing quite well,” Medeiros says.

Globoplay has also renewed drama In Treatment (six seasons), The Others (now in S2), the femaledriven Rensga Hits! and action series Anti-

Right: Renewed female-driven drama Rensga Hits! Below: Globoplay drama Justice

Kidnapping Unit (three seasons), as well as acclaimed medical drama Under Pressure (five seasons).

“Most of the series that we’ve been conceiving as returnable have been doing well and we’ve been commissioning more seasons. It’s very important for us to keep people coming back for those IPs,” says Medeiros.

These renewals are part of Globoplay’s user retention strategy. But unlike in more mature markets, Brazil’s streamers are still far from reaching their subscriber ceiling.

According to data firm Ampere Analysis, Globoplay is the third most popular platform in Brazil with six million subscribers. Netflix, its main rival, has 19.4 million and it hasn’t even reached its peak in a country with 215 million inhabitants.

As a result, Globoplay continues to prioritise subscriber growth and is therefore expanding into new genres – a strategy that has led to “double-digit growth” and ongoing assessments of its pricing, packaging and advertising strategies.

Angela Colla, head of international business and coproductions at Globo, on why format sales continue to be key for the company as its first Turkish adaptation hits the market.

Last year, Globo surprised the industry by selling the format to Brazil Avenue into Turkey. The local adaptation, titled Leyla, has just premiered. What have the initial impressions been?

The first episodes went very well and we are all happy with the results. It’s a great beginning and it’s going to be a great show. It looks like a top-tier, class A international production. We’re very impressed.

Did the adaptation involve many changes compared with the original?

Yes, but that’s the beauty of working with a scripted format; it gives the production company the freedom to change whatever is necessary. The main story is there and anyone who watched Brazil Avenue will recognise this is a new version but with some di erences. I love this type of business model because it’s all about the client. Clients need to be very attuned to the final customer. In the end, it’s about what the audience wants to watch.

“We are just at the beginning. Of course, we understand we have lots of challenges and economic issues here in Brazil, but we believe we have a whole path to grow, in both content and technology,” Costa says.

looking to take these classic stories, remake them and adapt them to our contemporary, modern times. I think that’s fantastic because, at Globo, we have so many good stories and IPs.

Is the US a key market for this strategy?

The US is probably the most mature production market in the world. As a major media company and a leading Latin production company in our country, we look at Hollywood and aspire to be more present there and part of that market. Probably one of the ways to do this is through formats. We have so many universal stories that resonate strongly with Brazilians and that have travelled extensively, but the US isn’t a market where we have significant penetration. So there is an opportunity to adapt our stories into American ones and we are focusing on that. We believe we can achieve it.

Which scripted formats from Globo would you highlight?

Our Globoplay original series

The Others is a good example. It’s a big hit in Brazil and the story is universal: a conflict between neighbours. There’s a lot of tension and that story could happen anywhere. Then you have our telenovelas. All of them could be adapted into di erent formats and genres. We can take the main plot and adjust it to whatever need the client has.

Are there other priority markets?

Will you continue focusing on format sales?

There’s so much content out there and we have so many options to watch that sometimes people just want to go back to a safe space and revisit what they know and love from past experiences. Classic shows are very trendy right now but there’s also a demand for original content. The market is

Mexico and Latin America as a whole. We believe that our stories, which are already well-known in the region, could be adapted for those markets. [Other priorities include] Portugal, of course, some countries in Africa, and di erent markets in Europe. Additionally, I would highlight the Middle East and Asia, which are markets that might not be easy for our ready-made content but are strong production hubs with specific needs for good stories.

Buyers and programming directors from Brazil’s leading broadcasters reveal their acquisitions wishlists and current content needs.

wishlists

By Sebastián Torterola

With budgets tight, Brazil’s major channels continue to rely on the proven popularity of established content, leaving innovation to their pay TV channels or in-house streaming platforms.

However, to grasp the acquisition strategies of Brazil’s leading TV groups, it is essential to first consider two factors: the editorial profile of each of the four main broadcasters and the structure of the channels each group operates.

When it comes to Brazil, it’s impossible not to start with Globo, not only because of its audience leadership but also because the group acquires content for both its free-to-air (FTA) channel, TV Globo, and its 57 pay TV channels, as well as its streaming service, Globoplay (see page B22).

“Our main demand is for gameshow formats, which we adapt as segments within our variety programmes, and reality shows, a genre that is very popular with Brazilian audiences,” explains Carolina Iacia, head of format acquisitions at Globo.

It’s no wonder that Banijay’s classic format Big Brother Brasil has been on air uninterrupted at Globo since its debut in 2002 and will reach its 25th edition next year. The local adaptation even holds a Guinness World Record, having received over 1.5 billion votes in one night during its 2020 edition.

Globo’s traditional Sunday studio show Domingão com Huck is the programme that incorporates these international format adaptations into the segments Iacia refers to.

These include gameshow To Tell the Truth (Fremantle), musical format Lip Sync Battle (Paramount Global Content), shiny-floor show Mystery Duets (Can’t Stop Media), Who Wants to be a Millionaire? (Sony Pictures Television) and The Wall (Banijay).

“For our pay TV channels, we’ve also licensed Hello Goodbye, which was aired on FTA TV this year, and The Taste, which was shown in tandem with Globoplay,” adds Iacia, referring to formats from Warner Bros International Television Production and Red Arrow Studios respectively.

In FTA, Globo’s schedule stands out for its variety, with no single genre dominating across daytime, nighttime or weekend slots.

In fact, the success of its in-house telenovelas, which make up just over 20% of TV Globo’s schedule, is complemented by news programmes (44% of daytime slots), series (36% of nighttime slots) and entertainment/ variety shows (50% on weekends), according to 2023 data from research firm JoveData.

“When it comes to film licensing, we focus on drama, comedy, romantic comedy, adventure and action since we have more than 600 slots per year on FTA TV across different time slots and days of the week,” notes Breno Sousa, head of finished programmes acquisitions at Globo. “In terms of series and miniseries, we look for drama and action, while for streaming and pay TV we take a broader view of genres and formats to complement Globoplay’s content portfolio. International telenovelas, series, miniseries, documentaries, factuals,

and drama and action, while for streaming and pay TV we

OM-MA is a consulting firm specializing in the entertainment industry, covering areas such as music, film, TV, theater, and live events. It is part of the prestigious international law firm ONTIER, which has over 50 years of experience and 400 lawyers in offices across 15 countries.

The OM-MA team, composed of highly qualified professionals with extensive experience in production consulting, offers comprehensive solutions at every stage of the production and distribution process. Our main services include:

• Structuring of tax incentives in various territories, with a special focus on Spain and the Dominican Republic.

• Financing of tax credits in Spain from the beginning of production.

• Comprehensive legal services in all areas and legal specialties for national and international productions.

• Access to on-site producers and other production resources in various territories.

• Advisory services in the negotiation of mergers and acquisitions within the sector.

• Access to alternative financing avenues to ensure project completion.

films, entertainment and kids content are always on our radar,” he adds.

The second major player in Brazil is Record, which, besides its main channel, also has a second FTA news channel, RecordNews, as well as a hybrid streaming service (AVoD and SVoD) called PlayPlus, for which it also acquires content.

Another notable highlight was the recent premiere of a Brazilian version of the classic gameshow Let’s Make a Deal, a format distributed by Can’t Stop Media that was produced locally by Mixer.

“Our acquisitions are divided into three areas: artistic, journalistic and streaming. For journalistic content, our focus is on factual documentaries about global issues, while on the artistic side, we look for action films featuring big names and a variety of formats. For PlayPlus, genres and types of content are more diverse,” says Moysés Macedo, Record’s head of acquisitions.

Record’s hallmark is journalism, which dominates its daytime (67%) and nighttime (31%) FTA programming, complemented by a weekend line-up heavy on feature films (48%) and weekly entertainment formats (33% in daytime).

The broadcaster is now preparing to launch the 16th season of the reality show The Farm (Fremantle) and has just premiered a local version of the popular gameshow Still Standing (Armoza Formats), produced by Boxfish in Argentina.

“Record acquires international formats for local adaptation, mainly gameshows, dating shows and music formats. We also occasionally buy standout series. This year, we acquired our first Turkish series, which has been well received and, I believe, is opening up possibilities for new types of content on our channel,” Macedo adds, referring to the Turkish drama Woman, produced by Medyapim and MF Yapim and distributed by Calinos Entertainment, which Record premiered in July in its 21.00 slot.

The third-largest broadcaster, SBT, is currently undergoing restructuring following the death of its owner, Brazilian TV icon Silvio Santos, in August. His daughter, Daniela Beyruti, is now tasked with updating the company.

“We’ve had a renewal of key positions within the broadcaster, which has been reflected in changes to our programming schedule. It has been a long time since we launched so many new shows at once,” explains Goyo Garcia, director of sales and acquisitions at SBT.

In the first quarter of the year, the broadcaster premiered six new original productions covering entertainment (É tudo nosso, Sabadou com Virginia), variety (Chega Mais), circus and magic (Circo do Tiru), family (Lucas Toon) and news (Tá na hora).

This renewed focus on original production leaves less room for licensed programmes in SBT’s lineup, where highlights include a long-standing deal with TelevisaUnivision for Mexican telenovelas and a Saturday morning animation block, which recently acquired the series Ghostforce from US cartoon studio ZAG.

“At the moment, we are interested in popular sitcoms in 13- to 26-episode formats, true crime with a focus on women, whether as victims or villains, and kids’ content,” adds Garcia.

SBT’s recently launched streaming platform, +SBT, offers more room for acquisitions. It aims to produce originals and acquire third-party content through previously announced partnerships with national and international studios and prodcos such as BBC Studios, Encripta, O2 Filmes and Cisneros.

“Our new platform, +SBT, will include licensed content. Some will be exclusive to the platform, while others will be available on both the platform and the channel. These two screens will be editorially aligned but won’t necessarily feature the same content,” explains Garcia.

Rounding out the list of major broadcasters is Band, known as ‘the sports channel.’ Its strong commitment to sports programming is complemented by big entertainment brands and a recent strategy of focusing on international series.

“One example was the airing of Outlander last year, which we brought in as a daily series because we didn’t have a telenovela slot, and it performed excellently. We were also the first broadcaster in the country to air all seasons of Vikings, and we’re currently broadcasting The Blacklist,” says Marianne Castro, manager of acquisitions and content distribution at Band.

Rodolfo Schneider, the company’s content director, adds: “In 2024, we’re focusing on the launch of the 11th season of MasterChef, which has been on air for 10 years, and we’re preparing the launch in November of MasterChef: Dessert Masters.” Centred on pastry and baking, this will be the first international version of the spin-off from the successful Banijay Entertainment cooking format.

Band also has its own streaming service, Bandplay, which, like its rival +SBT, is free. While primarily focused on providing access to Grupo Bandeirantes content, the company also acquires third-party shows for the platform.

The executives surveyed highlight certain types of content that were successful in the past but no longer fit into their line-ups. Those include highly niche shows like comedy sketches, variety and animation, which have migrated to on-demand platforms.

into their line-ups. Those include highly niche shows like comedy sketches, entertainment formats that don’t offer

Similarly, traditional studio shows, longform telenovelas and entertainment formats that don’t offer opportunities for interaction have lost out to more digitally anchored proposals.

And what is it that everyone is looking for? Multigenerational content capable of bringing the whole family together in front of the television, they all agree.

content capable of bringing

For nearly 30 years, Cesnik, Quintino, Salinas, Fittipaldi, and Valerio Advogados have contributed in a pioneering way to the development and sustainable growth of the Media & Entertainment industry in Brazil.

With solid and cutting-edge legal advisory services, CQS/FV Advogados provides the excellence and dynamism necessary to manage businesses and projects in a modern and unique way. The firm is internationally recognized "for its extensive experience in advising on complex regulatory matters and leading transactional mandates."

Around 200 national and local governments worldwide are currently competing to attract productions, filming and partnerships to their regions through tax incentives, cash rebates and direct or indirect investments.

And Brazil, a country of 215 million people with one of the most attractive audiovisual markets in the world, isn’t part of that race – at least, not through these widely adopted policies.

Even though the government has pumped millions of dollars into the sector this year and plans to add more in the coming years, it still hasn’t rolled out national tax or cash incentives to lure international film or TV productions. Instead, it o ers both direct and indirect support to strengthen the industry.

Direct support comes from funds provided by the National Film Agency (Ancine) and the Audiovisual Sectoral Fund (FSA). Both are generous but, according to many producers, more focused on theatrical releases.

Indirect support comes in the form of tax incentives provided by regulations like the Rouanet Law or the Audiovisual Law, allowing foreign companies operating in Brazil to reinvest taxes (such as income tax) in coproductions with local companies.

This is on the condition, however, that the works must be predominantly Brazilian. And that can be

The Brazilian government is set to inject US$1bn into the country’s audiovisual sector this year – but will it be enough to attract the international industry? By

prodco Mixer Films, responsible for series like O Negócio for HBO or reality shows like Ilhados com a Sogra for Netflix.

Indeed, since these public incentive tools were designed to boost national production, they always require independent Brazilian partners to be included in the project.

“It’s quite professional. Ancine publishes a classification of production companies based on their size and number of projects, which allows them to access specific credits or funding. Almost all projects that receive such funds must end up with Brazilian IP,” says Argentinian Diego Guebel, president of international prodco Boxfish and former programming director at Brazilian broadcaster Band.

However, he adds: “Although I don’t think it’s a bad thing, it would be more stimulating if there were hybrid options, as these mechanisms don’t allow, for example, discussions with streamers about originals.”

a problem.

“In Brazil, production companies are mostly working under two models: either we create original content for platforms and give up our IP or we do it with public funding like the FSA, where we partner with the foreign company but, by law, 51% of that content must be owned by a Brazilian production company,” explains João Daniel Tikhomiro , CEO of local

platforms Daniel Tikhomiro , CEO of local

Nonetheless, Brazil has been making strides to improve its o ering to the international market. After the Jair Bolsonaro government (2019-22) put the brakes on the sector and froze direct investment funds, these tools are now back in full swing.

In August, the Ministry of Culture and Ancine announced public calls for the second half of 2024 that will grant R$800m (US$142m) to the sector, adding to several previously announced funds that had accumulated from previous years but had not yet been executed. In total, this year’s injection is expected to reach US$1bn.

Since 2019, some Brazilian states and cities have begun experimenting with cash rebates, with Spcine in São Paulo

“We’re in a really special moment right now – there’s never been this much investment in Brazil’s audiovisual industry. This year alone, we’re looking at a US$1bn boost, which is on par with what Spain invests in growing its own industry.

Luiz Francisco Vasco de Toledo Formerly of Spcine

Sebastián Torterola

and RioFilme in Rio de Janeiro being the most attractive ones. “In 2019, we launched our cash rebate, Brazil’s first incentive programme for international productions. It’s geared towards large productions to make filming in Brazil attractive, particularly in São Paulo,” says Luiz Francisco Vasco de Toledo, who in September stepped down as director of investments and strategic partnerships at Spcine, a public company dedicated to the development of the sector in the São Paulo region.

Spcine’s international cash rebate line is aimed at non-Portuguese-langauge films and TV shows (fiction, non-fiction, extended reality or animation), o ering a rebate of between 20% and 30% with a cap of US$3m, while additional benefits are provided to projects that incorporate diversity themes.

Now in its third edition, the programme targets productions with a budget of around US$10m, requires a minimum investment of US$2m in the region, and remains active as long as funds are available. The funds are provided equally by the São Paulo municipality and the state. The previous edition, launched in December 2022, granted US$7.7m, benefiting four projects that invested US$12.7m in São Paulo, generating 4,200 direct and 16,300 indirect jobs.

Some results are already visible. Two recent projects supported by Spcine were featured at this year’s Cannes Film Festival: the BrazilNetherlands coproduction Baby by Marcelo Caetano, for which actor Ricardo Teodoro won the Rising Star award at the Semaine de la Critique, and Amarela by André Hayato in the short film competition.

RioFilme’s cash rebate scheme is more recent (launched in 2022) and is still emerging. In its third year, it has supported six international projects and o ers a reimbursement of 30% of the invested budget (up to 35% for projects using Rio de Janeiro as the main location), with a cap of R$2m.

“The main cash rebate is aimed at the international market, but people still need time to get used to it and trust that it’s here to stay if we want to become one of the top destinations,” says Daniel Celli, coordinator of the Rio Film Commission.

“Our cash rebate is very agile,” adds Maurício Hirata, director of investments at RioFilme.

project to signing the contract, it usually takes

“Even though the production company has to show proof of its own investment, RioFilme transfers their share as soon as the contract is signed, so there’s no risk. From submitting the project to signing the contract, it usually takes around two to three months for the funds to hit your account.”

Some international coproductions that have taken advantage of these incentives include the partnership between local prodco Boutique Films and Spiral International, the production and distribution company led by Zasha Robles in the US. First was their crime

thriller , which premiered on Prime Video in July 2023, and next came the medical modern others, like the FSA, still need modernisation because we’re still stuck with the requirement release

O Negociador, which premiered on Prime Video in July 2023, and next came the medical thriller , set to premiere soon on the same platform.

“Spcine and RioFilme have the most modern Brazilian financing mechanisms, but others, like the FSA, still need modernisation because we’re still stuck with the requirement to release films in theatres. It would be great for Brazil to expand its agreements to include series and other formats,” says Thiago Mello, a partner at Boutique Filmes.

Toledo believes a national incentive is necessary because it’s just not realistic for a state government to cover the costs of

incentives for big productions. “That’s something the federal government needs to handle,” he claims.

But why is Brazil only now addressing the issue of incentives? Why is it so di erent from Colombia, for example, which has had these policies in place for 20 years?

The answer lies primarily in the market’s huge size. Brazil’s 215 million consumers have led to a tradition of making content for local audiences, and most of these productions have traditionally relied on public funding from Ancine and the FSA.

However, winning over local audiences hasn’t always meant success internationally. For example, one of Brazil’s most successful recent films, Bacurau, only made US$25,000 at the box o ce in the US and Canada, according to IMDb.

“But that’s changing,” says Toledo. “We’re in a really special moment right now; there’s never been this much

Luiz Inácio Lula da Silva, president of Brazil

2024 is the year of the harvest. We will rebuild step by step and transform Brazilian culture into a powerful industry. However, the government does not have to be the sponsor of everything, but rather an inducer that enables conditions for cultural professionals to have access to resources. The business community must also have the position to finance films and series and believe that it will make profits. No one wants favors from anyone here.

Margareth Menezes, Brazil’s minister of culture

I celebrate the approval of R$800m for the FSA 2024 action plan. We are going through di cult times and it is important that we understand the process we are in – the process of listening, the process of reconstruction and progress, where we seek to create a policy aligned with the needs of the sector, strengthening the audiovisual industry and, at the same time, enhancing Brazilian cultural diversity, our greatest wealth.

Paulo Barcellos, CEO, O2 Filmes

Today we are certain that not only O2 but all of Brazil has world-class production capabilities. There is no longer a technical limitation, as there may have been in the past. But, unfortunately, the market for international productions depends heavily on incentive programmes such as cash rebates, and these are policies that are not yet present at the national level in Brazil. The international projects that currently come are linked to a story that takes place in Brazil. It would be great to be able to transcend that and attract more global productions.

Joana Braga, coordinator, Porto Alegre Film Commission

With the new national network of film commissions, we aim to consolidate something that we have been discussing and working on for more than a year. At this time, it is important to reinforce the role of institutional representation in the construction of public policies. We understand the strategic importance of acting together, of establishing good practices with the federal government. This is the time to act.

investment in Brazil’s audiovisual industry. This year alone, we’re looking at a US$1bn boost, which is on par with what Spain invests in growing its own industry.”

It should be noted that this fugure includes funds that were frozen under Bolsonaro and are now being released by Luiz Inácio Lula da Silva’s government: R$2.8bn from the Paulo Gustavo Law, which acts like an emergency fund to help the national audiovisual industry, constituting the largest investment in the country’s history in the sector, plus R$2bn from the FSA, half of which is for this year and the rest from previous years that had not been used.

This economic boost is combined with another survival factor: because public funds were frozen until 2022, a big part of the audiovisual sector had to look beyond Brazil and find partnerships in the global market. For a traditionally closed industry, this marked an unprecedented international push.

A clear sign of this is the fast increase in film commissions all over the country. In fact, in August a national network of Brazilian film commissions was created.

Diego Guebel

Thiago Mello

This has sparked talks about Brazil, a country of continental size, finally getting its own national film commission. It hasn’t happened yet, but several public entities, especially Embratur, the country’s agency for the promotion of international tourism, are pushing for it.

According to a recent study by consultancy Olsberg SPI, if Brazil launched a federal audiovisual production incentive plan this year, direct investment in audiovisual production could reach US$1.03bn by 2030, creating up to 15,000 new jobs in the sector and representing a 34% increase compared to 2021.

‘Reactivation’ and ‘consistency’ are the buzzwords in Brazil’s audiovisual scene right now. The giant is waking up, and this new version is more globally focused. But will these e orts be enough to give Brazil the international spotlight it needs?

Sony Pictures Television’s production company is gearing up with a slate of premium fiction and international coproductions for when the market regains strength, while also holding its position as one of the most active unscripted players in Brazil. By

Sebastián Torterola

Founded in 2010 and led since 2021 by Dida Silva, Floresta has managed to remain one of the most active production companies in Brazil, standing out in both fiction and entertainment. And it’s no coincidence.

“Floresta’s great success lies in being a multigenre production company. For instance, we’re currently focused on a strong fiction strategy, even high-end productions. But these aren’t for right now. We do this because we expect the market will see a new wave of significant investment in the next couple of years,” explains Silva, the company’s VP and managing director.

While preparing for the future, Floresta remains focused on the present, which involves “a strong dedication” to entertainment programming, which is in great demand among platforms and channels in Brazil today.

Part of this goes towards adapting global entertainment brands, such as the ninth season of Sony’s Shark Tank (Sony Channel), the adaptation of the UK format Ex on the Beach (De Férias com o Ex, Paramount+) and the Brazilian version of Top Chef (Record).

However, the company also dedicates significant resources to creating original formats, with examples

like Tunnel of Love for Globoplay and the Soltos (Wild & Free) franchise for Prime Video. The latter is a reality show featuring singles on holiday together, now in its fourth season in Brazil and adapted in Mexico by Nippur Media for Amazon’s platform.

“We always work in two ways. Sometimes a project comes to us nearly finished, we nurture it and then pitch it to streamers. In other cases, we receive an idea that we need to develop internally until it’s fully robust,” Silva explains.

At this October’s Mipcom, in fact, the company will present new original formats created in Brazil, such as Ageless Love, a feel-good dating show that brings together a group of single grandparents with the goal of finding love.

“We’ve just recorded a pilot here in Brazil but aimed at a Latin American audience. That’s why the production features a Mexican cast, with support from Sony Mexico,” Silva says.

At the same time, while continuing to meet demand for local content – “which is what global platforms are looking for in Brazil” – the company is advancing its international coproduction strategy with two projects already in development (although yet to be announced) in Colombia and Portugal.

Floresta is no stranger to international

“ We always work in two ways. Sometimes a project comes to us nearly finished, we nurture it and then pitch it to streamers. In other cases, we receive an idea that we need to develop internally until it’s fully robust.

Dida Silva

coproductions. The company produced the projects that emerged from the partnership between Globo and Sony Pictures Television, including premium series Rio Connection and Passport to Freedom

Looking ahead, Floresta is now strengthening its fiction department, having recently brought in Thiago Teitelroit and screenwriter André Rodrigues, director and writer of Luz, the first Brazilian children’s series on Netflix, produced by Floresta.

Children’s and youth is another strong genre for the company, which recently premiered musical series Use Your Voice and teen drama Divided Youth, both for Max. In this genre, Floresta is also preparing a highly anticipated project: a Brazilian pre-teen adaptation of Charlie’s Angels, in collaboration with Sony Pictures Television Kids.

In total, the company has 10 projects in various stages of production, including the much-anticipated Dona Beja, a 40-episode period drama that, along with Beleza Fatal, produced by Coração da Selva, will mark Max’s long-awaited entry into the melodrama genre for streaming.

With the acquisition of A Fábrica and the launch of Banijay Estúdios, Banijay has made Brazil the centrepiece of its two most recent moves in Latin America, building a powe ul local presence alongside Endemol Shine Brasil.

By Gonzalo Larrea

At the end of 2022, Banijay Americas announced the acquisition of Brazilian production company A Fábrica. And in April this year, the company inaugurated Banijay Estúdios in São Paulo, touted as “the largest independent production studio in Latin America.”

Both moves reflect the significance of Brazil for the Paris-based multinational giant, which already had a presence in the country through well-known unscripted prodco Endemol Shine Brasil.

Founded in 2016 by former Conspiração Filmes executive Luiz Noronha, A Fábrica specialises in scripted content. Among its titles are the football drama Galera FC (Max), the comedy Vai que cola (Globo) and the Netflix original telenovela Desperate Lies, which spent six weeks in the streamer’s top 10 non-English-language content list and reached number one in territories including Argentina, Chile, Mexico, Poland and Slovakia.

It was this expertise in fiction, Noronha explains, that Banijay sought when acquiring his company. “Seventy-five percent of Banijay’s profits come from unscripted and 25% from scripted. The group aims to balance that equation a bit more,” he says.

Building on the success of Desperate Lies, A Fábrica is now looking to further expand melodrama’s presence in the streaming space, with a new development underway with Max and the creation of a specialised team for this genre.

“We have an internal department entirely dedicated to working on this genre, where production and writing must be integrated from day one. It’s a product that is 100% a result of the process. If you don’t respect the process, you won’t be able to stay on budget.”

Brasil, now A Fábrica’s sister company and known for its unscripted work such as the recent Brazilian adaptation of Temptation Island for Prime Video, is also aiming to grow its scripted content to help balance that equation. And A Fábrica’s arrival could be crucial in this regard.

“Our goal is to debut in scripted with our sister company, A Fábrica. It’s a strategic move, but we’re still looking for the right idea and don’t want to rush it,” says Renato Martinez, VP of content and acquisitions at Endemol Shine Brasil.

major focus because if we’re smart enough in choosing the right stories, they do have the potential to travel to other countries,” he adds.

Meanwhile, both Endemol Shine Brasil and A Fábrica are benefiting from the launch of Banijay Estúdios this year, an initiative driven by Ben Samek, CEO of Banijay Americas; Laurens Drillich, president of Endemol Shine Latino; and Nani Freitas, CEO of Endemol Shine Brasil.

Simultaneously, and leveraging Banijay’s global reach, the prodco is moving ahead with international coproduction agreements in territories such as the US, Argentina and Mexico.

“One of the benefits of being part of Banijay is that the group operates in over 20 territories and controls around 140 production companies. We are currently in advanced talks with companies like Skybound Entertainment (The Walking Dead) and Argentina’s Kapow, and we’re developing three projects in Mexico with Endemol Shine Boomdog.”

Endemol Shine

In the meantime, the prodco continues to strengthen its documentary department, which has created content such as the docuseries Xuxa – The Documentary for Globoplay and the factual series Transgender Twins for Max.

“Expanding into documentaries is a major goal for us. Endemol Shine Brasil is already recognised for entertainment formats, reality shows and shiny-floor shows, but creating our own original formats that can travel worldwide isn’t easy from a Portuguesespeaking country,” Martinez notes, highlighting paper formats for Mipcom such as studio dating show Love & Hate and the detective playalong gameshow Strangely Familiar

“Original documentaries are a

Located in Guarulhos in the state of São Paulo, just 14 kilometers from the international airport, Banijay Estúdios covers 60,000 square metres and consists of three sound stages that have already hosted productions like The Wall and Domingão for Globo. These studios will be instrumental in the Brazilian expansion of the French giant.

“We’ve noticed record growth in original production over the past few years and an enormous demand for audiovisual resources. We decided to build this innovative new facility, where we can produce our own original content and offer third-party clients the opportunity to produce their series in this new and beautiful space,” said Freitas when announcing the opening of the studios.

A senate hearing into Brazilian media regulation

BThe Brazilian government aims to spark a national production boom with its proposal to regulate streaming pla orms, mandating minimum quotas for local content and financial contributions to the local industry. But not everyone likes the idea. By

razil is in the middle of a tense political stand-o , the outcome of which will be crucial to the entire audiovisual industry: the local regulation of streaming platforms.

On one side, Luiz Inácio Lula da Silva’s progressive government wants to impose minimum quotas for local and independent productions and for streaming platforms to pay the Condecine tax, set at 6% of their annual local revenue and with the funds directed into the local industry.

On the other side, ‘big-tech’ companies, such as Netflix, are lobbying for less interventionist measures, warning that if taxes are increased, the additional costs will have to be passed on to consumers.

The situation in parliament perfectly illustrates this clash, with two bills under discussion on the same subject, one from each side: PL 8.889/17, which was introduced in the Chamber of Deputies and supports the government’s position, and PL 2.331/22, a bill tailored to the streamers, introduced in the Senate and which is now under consideration in the lower house.

“Brazil is one of the few democracies in the world that has yet to implement its first regulation for streaming. Europe is already on its third. We have lost valuable time

during the administrations of Michel Temer and Jair Bolsonaro,” laments Alfredo Manevy, a member of the Superior Council of Cinema and former Secretary of the Ministry of Culture.

Manevy is referring to the period from 2016 to 2022, when Brazil’s audiovisual sector saw the dismantling of all national production incentive policies developed in previous years, along with a freeze on regulatory discussions.

“We’re trying to implement longoverdue regulation that must tackle unresolved issues from the past, along with the current challenges of a rapidly evolving market,” explains Manevy.

While there is general consensus that the regulation will eventually be approved, Brazil is currently in the middle of municipal elections, which run until November, halting legislative activities and tightening the parliamentary calendar. It is likely

“

Gonzalo Larrea

the regulation won’t be addressed until 2025.

The interest in approving regulation is broad, however, as the discussion involves not only the creation of new obligations for streamers but also updating the rules for all market players.

Currently, both pay and free-to-air (FTA) TV contribute to Condecine, while streaming, which is still unregulated, is not required to.

across multiple platforms (streaming, pay TV, FTA), the question now is

But in a converging market where the same players tend to operate across multiple platforms (streaming, pay TV, FTA), the question now is whether to regulate by technology, consumption model or content catalogue.

agreements must be reached among

The fact is, in the coming months, agreements must be reached among the various stakeholders to merge the two existing bills and consolidate them into a single proposal that can be put to a vote.

“We’re working to finalise the

“We’re working to finalise the razil

Brazil is one of the few democracies in the world that has yet to implement its first regulation for streaming. Europe is already on its third. We have lost valuable time.

Alfredo Manevy Superior Council of Cinema

“ Excessively interventionist regulation could have the opposite effect to what’s intended. Rather than fostering the sustainable development of our sector, it could deter investment and harm consumers.

Andressa Pappas

MPA

Brazil

bill and have it voted on this year, but it won’t be easy. We need strong mobilisation from society. There’s also an alignment between big tech and the far right,” warns Jandira Feghali, a government deputy responsible for handling one of the bills.

The interests of international streamers are being represented by the Motion Picture Association (MPA), which includes Disney, Netflix, Amazon, Paramount, Warner Bros Discovery, Sony and NBCUniversal.

Its goal is to ensure minimal regulatory intervention in their businesses, both in terms of tax obligations and requirements related to local content.

“We believe that excessively interventionist regulation could have the opposite effect to what’s intended. Rather than fostering the sustainable development of our sector, it could deter investment and harm consumers,” said Andressa Pappas, director of MPA Brazil, during a public hearing in parliament to discuss the bills.

As outlined, the funds collected through the Condecine tax are fully allocated to the Audiovisual Sector Fund, which serves as the largest source of financing for national productions and international coproductions (see page B33).

If the regulation is approved, it is expected there will be a significant increase in the funds available for local and international audiovisual productions in Brazil.