The magazine industry continues to go through significant changes as the industry transitions from print to digital over the past few years with readers, paid subscribers, and online formats all shifting. These shifts, driven by technological advancements, changes in consumer behavior, and the evolving media landscape, also required Cal Broker to adapt.

Our number one focus is to continue to enable life and health insurance professionals' access to the resources and connections they need to provide solutions for their clients.

Over the past 12 months, California Broker magazine made the move to a digital media company. We provide a growing number of digital tools and products, and offer our readers, authors, and advertisers, new tools and tips with immediate access through this new digital experience.

The Cal Broker team is focused on ways to enhance the reader’s ability to connect with our authors and advertisers.

The digital capabilities enable us to provide the most current industry related News and industry events to our subscribers. In 2025, our eCalendar will include more events, access to more recordings of key webinars, and links to access a range of content covering the key topics our readers must have. California licensed professionals will have one location to find CA solutions and CA resources they can use to help their CA life and health insurance clients.

Our goal is to provide quality content and attract support from advertisers looking to reach YOU, their “target” audience with tips and tools to help our 255,000 subscribers.

Since 1981, soon to be 44 years running, we continue to remain committed to our Mission. For our continuous improvement we would like your feedback.

Please be on the lookout for upcoming emails with survey feedback.

We look forward to helping you in the same way you have enjoyed our content, AND in new Digital ways as well.

•Balance of Special Issues and Short Snackable Content.

For 2025 we plan to offer more content in new formats. With the rise of mobile and on-the-go reading, we will tailor our content to be more concise, visually driven, and accessible for fast consumption. Many readers love short marketing emails with valuable resources and solid offers for subscribers.

A few changes under consideration--

•Our eNewsletters will be three times a month and have varied content. Industry News, Partner Resource Education, and both our eCalender and eDirectory.

•More recorded/Video content.

We plan to feature our partner’s content in several of our media tools.

•S avvy and Seasoned

Some of the best ideas come from seasoned professionals. This information will impact your career journey. Learn from industry subject matter experts and benefit from their sage wisdom available on our website and in select newsletters.

You are a valuable subscriber and as part of our 255,000 CA life and health licensed insurance professionals, we appreciate you.

Our digital media company, Cal Broker Media, continues to be the leading industry resource for CA brokers.

Thank You!

Cal Broker’s commitment is to be the leading source of news and information for California brokers and agents operating in the health, life, and annuity industry. We are committed to connecting Life and Health insurance professionals to valuable resources and solutions they can provide to their insurance clients.

Tracking Trends and Making Plans

Our digital media company, Cal Broker Media, continues to be the leading industry resource for CA brokers.

By Phil Calhoun

Health & Wellness in the Holiday Season

The holidays are on their way, and it’s no secret that eating healthily during these times can be difficult! Here are two California voices which provide some tips, tricks, and food options that will be helpful during the holiday season.

By Emma Peters

Six Considerations Before Selling Your Business

In our ten years of helping health brokers with commission planning, it is clear that seller’s remorse is real. This article covers SIX key reasons and signs to consider before selling your business.

By Phil Calhoun & David Ethington

The Cost of Waiting: A Personal Long-Term Care Story

Long-term care insurance (LTCi) isn’t just a financial tool—it’s a way to safeguard families from the emotional, physical, and financial toll of caregiving. Learn from this author’s personal experience which unfolded within their own family that caused them to truly grasp the human cost of delaying these crucial decisions.

By Marc Glickman FSA, CLTC, LTCP

Long-Term Care Insurance Equals Family Care

LTC is about protecting those we love from the physical, emotional and financial consequences they’ll face when a parent or loved one needs help. It’s important that caregivers understand the costs (financial, social, physical, psychological), because it’s never too early to plan for long term care.

By Diane Stoddart

First, Seek to Understand Long Term Care

For this article focuses on how long-term care coverage is and how insurance can help alleviate funding concerns by providing financial support for extended care services. By learning about the ins and outs of longterm care insurance, you’ll help your clients effectively plan for their future health needs.

By Gretchen Barry

26

What Happens if an Insurance Company Goes Out of Business? What happens if an insurance company is liquidated? Learn more from this author on how the liquidation of insurance companies is an incredibly rare phenomenon.

By Phyllis Shelton

28 BUDDY INSURANCE

The Hybrid Life Insurance with LTC Connection: A Valuable Benefit for Women

Working women face multiple responsibilities, including employment and caregiving challenges, while juggling various responsibilities. Learn why the dual-benefit option can be extremely beneficial for women and ease their families’ financial burdens.

By Wendy Boglioli

30 HEALTH & WELLNESS

Nutrition As We Age

From hormone fluctuations and metabolic shifts to skin and hair color changes, our body’s needs evolve over time. In this article we will review the main dietary areas of concern for aging and what we can focus on in our meals and snacks to maximize health in our older years.

By Megan Wroe, MS, RD, CNE, CLEC

32 LTCi

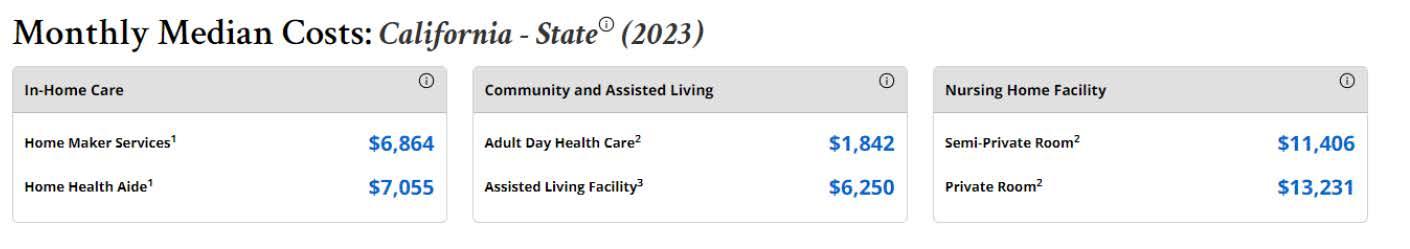

Long-Term Care Insurance Costs

As the aging population increases, you will likely see an uptick in long-term care needs for your clients. Knowing the average costs of long-term care can help you prepare your clients and choose the right long-term care insurance coverage for them as they enter their golden years.

By CalBroker Mag

34

LTCi

Long-Term Care Insurance Coverage

Insurance coverage for long-term care alleviates these concerns by providing financial support for extended care services. This insurance can give policyholders peace of mind and safeguard their financial futures. By learning about the ins and outs of longterm care insurance, you’ll help your clients effectively plan for their future health needs.

By CalBroker Mag

36

LTCi

Long-Term Care Insurance & Medi-Cal

Medi-Cal offers many benefits for Californians who need long-term care. However, residents must meet strict eligibility criteria and contribute a portion of their income. By understanding the relationship between MediCal and long-term care expenses, you can help your clients make strategic decisions about their financial and medical futures.

By CalBroker Mag

38

LTCi

Are your clients prepared for the “Silver Tsunami”?

Discussing future long-term care health needs and aging with Baby Boomers is tough. Yet, it’s important to have those delicate conversations about future care plans so you, your clients, and the people you love can live life on their own terms with significant difference in your cancer risk. Learn some topics to discuss with your clients so they’re fully prepared.

By Marcia Israel

Custodial & Skilled Care: What Medicare Pays

Medicare provides health coverage for more than 65 million Americans. Medicare, however, will only pay for short-term skilled nursing care. Read this article to consider certain medical situations to help your clients.

By Jennifer Turner

42

LTCi

The Case for a New Retirement Planning Model: The Missing 4th Phase

As retirees aged into the stage of life where they began to need some assistance and support, their best-laid ‘retirement plan’ was inadequate. Learn from this author’s retirement model which has more than a 3-phase model for retirement or wealth planning.

By Jon Thomas

Interview with Author Carroll Golden on: How Not to Pull Your Life Apart: Caregiving

Carroll S. Golden’s three simple steps in her newest book, How Not to Pull Your Life Apart: Caregiving, kickstarts critical conversations. In the following interview, we ask the author about the best ways to uncover a financially stable plan for you, your family, the people you love, and clients that are more likely than not going to deal with these issues at some point in their lives.

By Emma Peters

‘Tis the Season to Talk About Your Value During Holiday Social Gatherings

Let’s say you’re at a holiday party or other social event and someone asks, “What do you do?” How do you respond? Do you whip out your best elevator speech? Learn about how to best communicate your value at social events from this article.

By Bill Cates

PUBLISHER Phil Calhoun

Health Broker Publishing, LLC publisher@calbrokermag.com

PRODUCTION DIRECTOR Zulma Mazariegos Zulma@calbrokermag.com

DIGITAL DIRECTOR Carmen Ponce Carmen@calbrokermag.com

EDITOR ASSISTANT Emma Peters Emma@calbrokermag.com

CIRCULATION

zulma@calbrokermag.com

120,000 subscribers 12,000 monthly website visits

ADVERTISING

Health Broker Publishing 14771 Plaza Drive Suite C Tustin, CA 92780 714-664-0311

publisher@calbrokermag.com

publisher@calbrokermag.com

Subscriptions: U.S.: $15/issue Send change of address notification at least 20 days prior to effective date; include old/new address to:

Health Broker Publishing 14771 Plaza Drive Suite C • Tustin, CA 92780 714-664-0311

©2024 by Health Broker Publishing. All rights reserved. No part of this publication should be reproduced without consent of the publisher.

Patient advocates can help explain complex medical jargon, assist with billing, or even book appointments. Seniors living alone or juggling information about several conditions may find these advocates particularly useful. Learn more about patient advocates, their role within the health care system, and how they can help you navigate it.

In this article:

• What is a patient advocate?

• How do medical advocates support patient health?

• How can I get in contact with a patient advocate?

• What is a patient advocate?

The patient advocate definition changes depending on what is needed by the patient. Patient advocates generally answer health questions, educate patients and family members, and offer support according to the medical needs of the patient, as outlined by the University of Rochester Medical Center — Health Encyclopedia.

A patient advocate is also known as the following:

• Medical advocate

• Health advocate

• Ombudsman

• Patient liaison

• Care or case manager

Patient advocates don’t provide medical advice on their own, although sometimes physicians or nurses act as patient advocates and then provide medical advice. Generally, advocates help you to get the right advice from medical practitioners and understand it. Then, they help you manage the recommended care. Some patient advocates work as independent contractors or volunteers, while others are hospital or insurance employees.

How do medical advocates support senior health?

For aging seniors or busy caregivers, the reasons to consider working with a patient advocate are compelling.

READ FULL ARTICLE » https://bit.ly/3BJ1bPM

Long-term care (LTC) insurance primarily pays for supervision or assistance with everyday tasks (such as bathing or dressing) when you have a physical impairment or need supervision of these activities when you have a cognitive impairment such as dementia caused by Alzheimer’s disease. LTC takes place at home, in a community program, in an assisted living facility (ALF) or in a nursing home. LTC services are often provided by family members or nurses’ aides, and do not require the skilled care that nurses and doctors are licensed to provide.

LTC insurance benefits may be part of a life insurance or annuity policy or contained in a freestanding LTC policy.

More than 13,000 caregivers have enhanced or expanded their skills and confidence with CalGrows courses; Millions of dollars in incentives are available through August 30

Sacramento – California faces a looming shortage of caregivers for older adults and adults with disabilities over the next five to 10 years. The California Department of Aging (CDA) has committed to helping close the gap through the CalGrows direct care workforce training and career development program. CalGrows encourages, supports, and incentivizes home and community-based services (HCBS) caregivers. To date, more than 13,000 caregivers across the state have participated in more than 89,000 training courses, and qualified applicants have collected over $7 million in incentive payments.

READ FULL ARTICLE » https://bit.ly/3YxFIm8

By Don Thompson

SACRAMENTO — California Gov. Gavin Newsom will soon decide whether the most populous U.S. state will join 25 others in regulating the middlemen known as pharmacy benefit managers, or PBMs, whom many policymakers blame for the soaring cost of prescription drugs.

PBMs have been under fire for years for alleged profiteering and anticompetitive conduct, but efforts to regulate the industry at the federal level have stalled in Congress.

READ FULL ARTICLE » https://bit.ly/4hsZd6T

CMS and Medicare explain LTC and what Medicare beneficiaries can expect. Key take away is that none of the Medicare insurance or MAPD plans cover beyond what CAM and Medicare outline in this brochure.

READ FULL ARTICLE » https://search.app/uaL7VUSJymLonKGz6

By Jordan Rau

Video by Hannah Norman

Finding a nursing home for yourself or a parent can be daunting. Many facilities are understaffed, and the worker shortages have gotten worse since the start of the pandemic. KFF Health News senior correspondent Jordan Rau shares tips about finding nearby homes, evaluating staffing levels, what to look for when visiting, and more.

READ FULL ARTICLE » https://bit.ly/3A4a6Lt

California Medicaid Ballot Measure Is Popular, Well Funded — And Perilous, Opponents Warn

By Bernard J. Wolfson

The proponents of Proposition 35, a November ballot initiative that would create a dedicated stream of funding to provide health care for California’s low-income residents, have assembled an impressive coalition: doctors, hospitals, community clinics, dentists, ambulance companies, several county governments, numerous advocacy groups, big business, and both major political parties.

The Yes on Prop 35 campaign has raised over $48 million as of Sept. 9, according to campaign filings with the secretary of state. The measure would use money from a tax on managed-care health plans mainly to hike the pay of physicians, hospitals, community clinics, and other providers in Medi-Cal, the state’s version of Medicaid.

READ FULL ARTICLE » https://bit.ly/3YACIUX

Subject: Skilled Nursing Facility (SNF) care past 100 days

Medicare covers up to 100 days of care in a skilled nursing facility each benefit period. After Medicare coverage ends, you may consider these options.

Source: Medicare Interactive READ FULL ARTICLE » https://search.app/M6aWBcPw8sQodb486

With the annual Medicare open enrollment period now underway, KFF looks at the latest information about Medicare Advantage and Part D prescription drug plans and examines which beneficiaries are comparing their options--or not.

Additionally, in a new column, KFF’s President and CEO, Drew Altman, explores how Medicare, and other big health care programs, provide popular benefits valued by Americans from across the political spectrum even though the politics about them are partisan. And, we examine Vice President Harris’ recent proposal to broaden Medicare coverage of home care.

READ FULL ARTICLE » https://bit.ly/3YwkXqI

Medicare Part A Skilled Nursing Facility coverage is generally available to qualified individuals 65 years of age or older and individuals under age 65 who have been disabled for at least 24 months who meet the following 5 requirements: 1) the resident requires daily skilled nursing or rehabilitation services that can be provided only in a skilled nursing facility; 2) the resident was hospitalized for at least 3 consecutive days, not counting the day of discharge, before entering the skilled nursing facility; 3) the resident was admitted to the facility within 30 days after leaving the hospital; 4) the resident is admitted to the facility to receive treatment for the same condition(s) for which he or she was treated in the hospital; and 5) a medical professional certifies that the resident requires skilled nursing care on a daily basis.

Where these five criteria are met, Medicare will provide coverage of up to 100 days of care in a skilled nursing facility as follows: the first 20 days are fully paid for, and the next 80 days (days 21 through 100) are paid for by Medicare subject to a daily coinsurance amount for which the resident is responsible.

But beware: not everyone receives 100 days of Medicare coverage in a skilled nursing facility. Coverage will end within 100 days if the resident stops making progress in their rehabilitation (i.e. they “plateau”) and/or if rehabilitation will not help the resident maintain their skill level. Coverage will also be terminated if the resident refuses to participate in rehabilitation.

Written notice of this cut-off must be provided. When Medicare coverage is ending because it is no longer medically necessary or the care is considered custodial care, the health care facility must provide written notice on a form called “Notice of Medicare NonCoverage” to the resident and their designated representative. If you believe rehabilitation and Medicare coverage is ending too soon, you can request an appeal. Information on how to request this appeal is included in the Notice of Medicare Non-Coverage.

Don’t be caught off-guard by assuming your loved one will receive the full 100 days of Medicare. Be sure to have a plan in place to preserve assets while securing government benefits to help pay for long-term health care needs.

California law requires health plans to provide timely access to care. This means that there are limits on how long you have to wait to get health care appointments and telephone advice.

If you have a problem getting timely access to care, you should call your health plan. If your plan does not resolve your problem, contact the Help Center.

Wait Times from Date of Request for Appointment

Health plan members have the right to appointments within the following time frames:

Sutter Health’s systemwide agreement with Anthem Blue Cross (Anthem) expires on Dec. 31, 2024. For several months, we have actively engaged in good faith negotiations to renew this agreement. While discussions continue, we have not yet reached a resolution.

Unfortunately, Anthem recently informed us that it intends to send letters to their HMO members informing them they will be reassigned to non-Sutter doctors effective Jan. 1, 2025, if we do not have a renewal agreement by the end of this year. Anthem HMO members who are assigned to Sutter doctors may receive this notice as early as Nov. 1, 2024.

This action is concerning, as the current agreement includes a transition period that would allow patients to continue seeing their Sutter doctors after the expiration date for up to six months (June 30, 2025). This transition period is designed to avoid disruption in care while the parties continue to negotiate mutually acceptable rates and terms. It is unfortunate that it appears Anthem decided to opt out of using the transition agreement and instead intends to disrupt and cause concern with thousands of their HMO members — and our patients.

Note: the transition agreement between Sutter and Anthem also provides for Anthem EPO and PPO members to continue accessing their Sutter providers for up to six months (through June 30, 2025) as part of their in-network benefits, if the Sutter provider was a participating provider of the member’s plan on Dec. 31, 2024.

We remain hopeful that we can reach an agreement with Anthem and avoid any member or patient disruption in care.

Please note, the following Northern California payer agreements are renewed for 2025:

• Aetna – through June 30, 2025

• Alignment Health Plan, including Sutter Advantage HMO (Medicare Advantage)

• Blue Shield of California (Commercial and Medicare Advantage)

• Cigna Healthcare

• Health Net/Wellcare (Commercial and Medicare Advantage)

• Humana (Medicare Advantage)

• UnitedHealthcare (Commercial and Medicare Advantage)

Across the nation multiple insurance companies are making changes to the Medicare Advantage (MA) products, including MA product offerings in Northern California. We have confirmed that UnitedHealthcare will discontinue its MA PPO products across Northern California and will exit the MA HMO product in several counties. Wellcare by Health Net will exit its MA PPO products, and Humana will exit its MA HMO product in Contra Costa County. These changes are effective Jan. 1, 2025, and will impact many of our patients. Please review the following which you may find helpful for your clients:

Sutter Health patients who are affected by these changes will have the opportunity to review their plan options during Medicare’s Annual Enrollment Period (AEP), which runs from October 15 to December 7. During this period, patients can select a different MA plan (if available in their county) or return to Original Medicare.

We will support our affected MA HMO patients by sending them letters outlining the necessary steps to continue seeing their Sutter doctors in 2025. Additionally, insurance companies are required to inform their affected members about these MA changes.

If you’d like more information about any of the content in this update or have questions about Sutter Health, email us at brokers@sutterhealth.org.

For a complete list of the specific products that include Sutter Health's doctors, hospitals and other healthcare services, please check with the health plan directly or visit sutterhealth.org/health-plan.

Please note:

This notice is not applicable to Sansum Clinic serving the Greater Central Coast community.

About Sutter Health

Sutter Health’s integrated, not-for-profit system of aligned doctors and clinicians, employees and volunteers support approximately 3.5 million patients in communities across 22 counties. Headquartered in Northern California, Sutter Health provides access to highquality, affordable care through its network of hospitals, medical foundations, ambulatory surgery centers, urgent and walk-in care centers, telehealth, home health and hospice services. You can learn more by visiting us online.

» https://cahealthadvocates.org/

Available via an annual subscription, our 32 fact sheets cover 9 different Medicare and other health insurance topics. Those fact sheets pertaining to Long-Term Care include:

• Options for Financing Long-Term Care(H-001)

• An Overview of Long-Term Care Insurance (H-002)

• Frequently Asked Questions about Long-Term Care Insurance(H-003)

Websites and other resources:

AARP Report: Comparing Long-Term Care Insurance Policies: Bewildering Choices for Consumers

Authored by Bonnie Burns of California Health Advocates, this report reviews the long-term care (LTC) insurance options available to consumers and offers helpful recommendations.

Administration for Community Living

ACL advocates across the federal government for older adults, people with disabilities, and families and caregivers; funds services; manages programs; and invests in training, education, research and innovation.

Advance Planning Guides for People Living with Dementia

The National Alzheimer’s and Dementia Resource Center created a series of consumer guides to help people living with dementia and their family members or other care partners know what to plan for and how to get started. The guides cover 4 topics: 1) health care planning; 2) financial planning; 3) care planning; and 4) supporting someone living with dementia in making decisions.

California Advocates for Nursing Home Reform (CANHR)

1-800-474-1116 Offers consumer information on nursing homes, Medi-Cal, LTC, pre-placement counseling, quality of care and pension rights counseling.

California Association of Area Agencies on Aging (C4A) Services and programs for older adults and people with disabilities, including LTC services. Website includes each county’s Area Agencies on Aging

California Department of Aging

Oversees programs for older adults, people with disabilities, caregivers and LTC facility residents. Website includes Taking Care of Tomorrow, a booklet about LTC options. Available in English and Spanish.

California Department of Insurance

Offers consumer information on LTC insurance and a rate guide for companies selling LTC insurance.

California Medicare News

Variety of current articles on Medicare-related topics, including LTC.

California Nursing Home Guide

Provides information on all available nursing homes in California. This guide is produced and maintained by CANHR and was the first computerized nursing home information system in the country.

California Partnership for Long-Term Care

1-800-227-3445 Information on LTC insurance, including Partnership policies.

California Public Employees’ Retirement System (CalPERS)

1-800-982-1775 LTC insurance for California public employees, retirees, their spouses, parents, parents-in-law and adult siblings (age 18 and over).

California State Teachers’ Retirement System (CalSTRS)

1-800-228-5453 Information on retirement planning and benefits for California teachers.

CalQualityCare.org

Rates the care at nursing homes, hospice and home health agencies, and provides information on assisted living, retirement communities, and day care options. Also has a “Long Term Care Assistant” tool that uses 10 simple questions to help you choose among your long-term care options.

Federal Long Term Care Insurance Program (FLTCIP)

1-800-582-3337 LTC insurance for federal and postal employees, beneficiaries of annuities, members and retired members of the uniformed services, and qualified relatives.

Health Insurance Counseling & Advocacy Program (HICAP)

1-800-434-0222 Free counseling on Medicare and other healthrelated issues, including LTC and LTC insurance.

LongTermCare.gov

Provides tools and information on long-term care planning options and material on Medicaid eligibility for long-term care.

Long Term Care Ombudsman

1-800-231-4024; Sacramento: 916-323-6681 Offers information about nursing homes and resolves problems between nursing homes and residents or their families.

Network of Care

Comprehensive service directory for consumers, community-based organizations and municipal government workers. Provides links to pertinent websites and offers a comprehensive library, political advocacy tool and community message boards.

Nov 4-7 SHRM Inclusion 2024 Conference @ Aurora, CO

Nov 11-14 Becker's Healthcare 12th Annual CEO + CFO Roundtable @ Chicago, IL

Nov 11-14 SHRM The Women in Leadership Institute @ Orlando, FL & Virtual Nov 20 SHRM Workplace Law Forum 2024 @ Washington, D.C.

Feb 3, 2025 @9:30am-4:30pm CAHIP 2025 Innovation Expo @Long Beach, CA

Nov 6 @8:30am-9:30am BBSI Job Offer and Pre-Employment Best Practices @Long Beach, CA

Nov 6 @9:45am-10:45am BBSI Efficient New Hire Form Management and Effective Record Retention @Long Beach, CA Nov 6 @11-12pm

BBSI Create an Engaging and Efficient Onboarding Process @Long Beach, CA

Nov 7 @8:00am-12:30pm BBSI Red Cross Certification- Blended First Aid/CPR @Long Beach, CA

Nov 8 @8-11am BBSI Fall Protection Plan Workshop @Long Beach, CA

Nov 12 @ 8:00am-12:30pm BBSI Red Cross Instructor Led First Aid/CPR @Long Beach, CA

Nov 14 @9-10am BBSI Employee Anti-Harassment Training en Espanol @Long Beach, CA

Nov 19-Nov 20 @7:00am-12:30pm BBSI OSHA 10-Hour Construction Training Course @Long Beach, CA

Nov 14 @2:30-4:30pm EPI OC Chap Unlocking Hidden Value- Project Phoenix as a Sum of Its Parts @Costa Mesa, CA Nov 15

@5:30-7:00pm CAHIP Orange County It's A Pizza Party! @Irvine CA

Nov 20 @11:00am-1:00pm EPI Conejo Valley Optimizing After Tax Sale Proceeds @Westlake Village, CA

Nov 20 @2:30-4:30pm EPI Greater Los Angeles Chapter 2025 Pre-Election Economic Outlook @Los Angeles, CA

Nov 20 @ 2:30-4:30pm EPI San Diego Chapter Unlocking Hidden Value-Project Phoenix as a Sum of its Parts @Cardiff, CA Nov 21

@2:30-4:30pm EPI Inland Empire Chapter Inland Empire Case Study @Ontario, CA

VIRTUAL EVENTS

Nov 1 @10-11am The Real Fear of Missing Out: Coaching Clients Through Volatility

Nov 1 @12pm EST Live Call with David McKnight Brought to you by NAIFA

Nov 7 @11am EST Live Call with David McKnight Brought to you by NAIFA

Nov 12 @12pm EST Tax and Estate Planning Under a New Presidential Administration NAIFA-FSP WEBINAR SERIES

Nov 12 @1pm EST M&A Summit: Opportunity of a Lifetime Webinar In Partnership With NAIFA

Nov 12 @2-4:15pm BBSI Supervisor Anti-Harassment Training

Nov 14 @9-10:15am BBSI Employee Anti-Harassment Training

Nov 14 @11-12:15pm Webinar: Don't Be Scared of the Big Bad AI Wolf! NAIFA-Greater Bay Area

Nov 15 @9-11:15am BBSI Supervisor Anti Harassment Training en Espanol

Nov 20 @11am-6pm EST Trustworthy Selling

Nov 21 @10am EST Live Call with David McKnight Brought to you by NAIFA

RECORDED WEBINARS

Benefit Mall October Compliance Webinar w/ Misty Baker

Benefit Mall September Compliance Webinar

Benefit Mall August Compliance Webinar

By Emma Peters

Contributions from Sutter Health and the California Walnut Association

The holidays are on their way, and it’s no secret that eating healthily during these times can be difficult! Here are two California voices which provide some tips, tricks, and food options that will be helpful during the holiday season.

California is the healthiest state because of its lower smoking rate and higher amount of fitness and health locations.

California is the fittest state, with eight of the top 20 fittest cities.

By Meg Walker

The holidays are upon us! People are looking forward to spending time with friends and family. Along with the festive atmosphere and holiday cheer, comes tasty appetizers and big meals, and that can test your willpower and your waistline.

The truth is that a person can take in between 3,000 and 4,500 calories in a typical traditional Thanksgiving meal, according to Consumer Reports. Compare that to the calories a person generally consumes in a day: depending on your age, gender and level of exercise that can be from 1,800 to 2,500 calories, say dietitians at Northern California integrated health system Sutter Health.

Overeating happens all too quickly, and at this time of year Sutter nutritionists are counseling patients on how to handle holiday eating. Enjoy the events but take steps to practice healthy eating, they advise. “Food is a part of making connections with your family and friends,” says Kathy Solis, a registered dietitian and certified diabetes care and education specialist who works in the diabetes education program at Sutter Pacific Medical Foundation. “You want to be part of the group and enjoy the day, but still be cautious of food choices.”

Seema Karnik, manager for nutrition services for Mountain View Nutrition Services at Sutter’s Palo Alto Medical Foundation, adds: “Holidays are a time when we need to be mindful of how far we can go. We need to find a balance between healthy eating and having fun.”

Like most things, moderation and balance are key. To help you include healthy eating into your holidays, here are some tips from Sutter’s registered dietitians:

Don’t skip meals on the day of the big meal otherwise you will arrive at your holiday party hungry and risk making bad food choices.

Being active or exercising before and after a meal can help cut down calories.

Once you are at the event, concentrate on catching up with friends and family and having good conversations. Play games and spend time outdoors, if possible. Move around, especially if it’s a long, sit-down meal.

Start the meal with soup if that is offered, as it is a good way to cut down on your appetite. Focus on what you can add to your plate that is healthy and not calorie rich. Vegetables are king in this category as they are rich in fiber, which takes longer to digest and can help you feel full on less calories. And choosing colorful vegetables makes a plate look pretty and healthy at the same time. Some choices are squashes, green beans, beets, carrots and different colors of chard.

Also, go for these greens rather than grains such as bread or rolls. Some turkey is fine but go light on stuffing and sauces or gravy.

If you know you want to have dessert, cut down on other carbohydrates in the meal such as stuffing or bread.

Use the healthy plate method: half of your plate should be non-starchy vegetables (examples include broccoli, salad, asparagus, cauliflower, spinach, tomatoes); one quarter of your plate should be protein, including turkey or fish; and one third can be whole grains and starchy vegetables like sweet potatoes, corn or peas.

If you are going to drink alcohol, try to stick to a 5-ounce glass of wine or one beer or one cocktail. Consider not drinking alcohol if you can’t be moderate.

Consider bringing your own healthy dish, especially if you have food restrictions.

Now learn about a California-grown food that you might know the nutritional benefits of:

Consider incorporating these into your diet during this upcoming holiday season:

Food plays a big role in everyone’s identity, and those born between 1997-2012, commonly known as Gen Z, have been deemed the “foodie generation.” Gen Z is driven to a particular food by varied factors, but data suggests foods that support health and well-being by providing energy, managing weight, and fostering mental health are priorities.

Yet when it comes to choosing foods that support these needs, Gen Z, along with Millennials and beyond, often overlooks a convenient and important food group – tree nuts, including walnuts.

Nuts, including walnuts, are nutrient dense and considered a key component of many recommended dietary patterns, including the Mediterranean and vegetarian diets. They are also recommended for daily consumption in the latest U.S. Dietary Guidelines. Despite the recommendations, nuts remain under-consumed by the U.S. population, perhaps because nuts are calorie-dense, leading to potential concerns that including nuts in the diet could promote weight gain.

But new research suggests Gen Z and Millennials should reconsider nuts, like walnuts.

New Research Evaluates the Impact of Nuts on Weight Management for Gen Z and Millennials

In a recent observational study from Indiana University School of Public Health-Bloomington, funded by the California Walnut Commission, researchers observed that adolescents and young adults who consumed walnuts and other nuts had a lower prevalence of obesity when compared with those who consumed no nuts.

Researchers analyzed data from the National Health and Nutrition Examination Survey (NHANES) which included more than 19,000 adolescents (12 – 19 years old) and young adults (20 – 39 years old) to understand the associations between consumption of walnuts and other nuts with measures of obesity including relative fat mass (RFM), a validated tool for estimating body fat percent and regional fat composition.

Young women consuming only walnuts had a significantly lower prevalence of obesity when compared to non-nut consumers. However, this association was not found among young men, adolescent boys, or adolescent girls who consumed walnuts only. Researchers also observed that adolescent girls and young women who consumed walnuts only, or other nuts, had a significantly lower RFM compared to non-nuts consumers. Only young males in the walnut and other nut groups showed an inverse association with RFM compared to no nuts group, this was not found in adolescent boys.

These results are promising suggesting that there may be an association between the consumption of nuts, especially walnuts, with a lower prevalence of obesity and lower RFM within certain populations. However, cause and effect could not be determined, and additional research is needed to support these results.

“As a registered dietitian and a mom of a college student, I’m excited by the emerging research highlighting the potential cognitive, mental health, and metabolic benefits of walnuts for teens and young adults. Incorporating walnuts into kids’ daily lives is easy, delicious, and nutritious, and it’s a strategy that may help them thrive mentally and physically during these critical developmental years,” notes Samantha Cassetty, MS, RD.

Beyond Weight Management: Walnuts May Support Overall Physical and Mental Well-Being in Gen Z & Millennials

Teens and young adults crave food that supports both their physical and mental health, with over 30% seeking emotional and mental health benefits.1 Research suggests that daily walnut consumption could potentially support cognitive health and mental well-being in this unique population.

• Daily Walnut Consumption May Support Teens’ Focus and Attention –

In a multi-school randomized controlled trial of 771 healthy teenagers ages 11 to 16, those who consumed 30 grams of walnuts per day (1 ounce or 1 handful) for six months had improved scores for attention, fluid intelligence (i.e. problem solving, quick reasoning skills) and ADHD symptoms, when compared to the group not eating walnuts. The positive results in this study were only seen in those teenagers who consumed more than 3 servings of walnuts per week. While these results are positive it should be noted that less than half of the participants in the intervention group adhered to the protocol of

eating walnuts daily. Thus, the positive results of this study were only seen in the teenagers who regularly ate walnuts. While more research is needed, this study provides valuable insights and a basis for further research on the effect of walnuts on brain development in adolescents.

• Walnuts May Improve Mental Health and General Well-Being in University Students –

A novel study of 80 healthy university students ages 18 to 35 found that 2 ounces (or about 2 handfuls) of walnuts a day for 16 weeks prevented negative changes in self-reported mental health scores and scores of stress and depression during a stressful academic period, compared to those who did not eat walnuts. The group that ate walnuts experienced an increase in markers that protect against stress and a decrease in those that are linked with stress.

• Snacking on Walnuts May Improve Metabolic Health in Young Adults – In a recent study of 84 young adults, ages 22 to 36, with at least one metabolic syndrome risk factor, researchers found that snacking on 1 ounce of mixed unsalted tree nuts, including walnuts, twice daily, may improve metabolic health, when compared to carbohydrate-rich snacks. Among tree nut snack consumers, researchers observed a reduction in waist circumference and lipid markers in female participants and decreased blood insulin levels in male participants. Those consuming tree nut snacks also saw an effect on triglycerides and TG/HDL ratios with TG/HDL ratios reduced ~11% compared to those consuming carbohydrate-rich snacks.

These studies are not without limitations. While the findings cannot prove causality, they do shed light on how nuts, including walnuts, can be a part of a healthy diet that supports metabolic health and well-being. Additional research is needed to determine how these results apply to other populations.

Walnuts are tasty and versatile and can be added to meals and snacks to support optimal nutrition in Gen Z and Millennials, while also helping to close the gap in consumption.

Cassetty suggests toasting walnuts to toss into whole grain salads, roasted veggies like broccoli and green beans, and breakfast foods like yogurt bowls and oatmeal. “They also make green salads heartier and more enticing. Walnuts are also a natural fit for baked goods, and walnuts with dark chocolate is one of my favorite dessert pairings,” she added.

A 1-ounce serving of walnuts contains a powerhouse of nutrients for optimal health.

Simple ways to just add walnuts:

• Breakfast can be made easy with prep-ahead breakfasts, like a Banana Walnut Bread Overnight Oats recipe that eliminates the need to wake up extra early to make a meal or wait in line at a grab-and-go spot.

• Make snack time flavorful with a simple Rosemary and Sea Salt Walnut recipe. It’s also perfect for entertaining!

• Make lunch a time to refuel with nourishing meals, like this Walnut Balsamic Spinach Salad recipe that is tasty and filling to get through a busy afternoon.

• Dinnertime doesn’t need to be complex. A Walnut Mexican Street Corn Taco recipe makes the perfect weeknight dinner in just 18 minutes.

For more recipes and research on the health benefits of walnuts, visit walnuts.org.

There is a lot of temptation during the holiday season to eat poorly, but with these tips and tricks one can be mindful of what they eat and include healthy delicious recipes at the same time!

“ California is the healthiest state because of its lower smoking rate and higher amount of fitness and health locations.

California is the fittest state, with eight of the top 20 fittest cities. “

Emma Peters is the media assistant at California Broker Magazine. She recently graduated from Point Loma Nazarene University summa cum laude, with a Bachelor of Arts in Literature and a minor in Humanities.

Sources: SutterHealth https://vitals.sutterhealth.org/holiday-meals-can-pack-on-the-calories-nutritionists-give-tips-onmaintaining-healthy-eating/ Walnuts https://walnuts.org/blog/balanced-lifestyle/walnuts-may-be-a-key-ingredient-for-well-beingamong-gen-z-millennials/

By Phil Calhoun & David Ethington

The “Should I sell my business?” question comes to most business owners at some point. In our ten years of helping health brokers with commission planning, it is clear that seller’s remorse is real. In fact, 75% of business owners regret selling their company just one year after the transaction, according to a PwC research mentioned by the Exit Planning Institute

“From our experience we find some brokers have not kept current with technology and this is causing them to lose clients, miss out on finding leads, and experience difficulties with closing new business.”

This article covers SIX key reasons and signs to consider before selling your business.

As an experienced business owner, you may desire other opportunities of greater interest at some point. Starting a new challenge usually means you’ll need money or time, which leads to giving up your current business ownership. According to the Exit Planning Institute, 80-90% of business owners’ wealth is related to the value of their business. Taping into this value is tempting for some owners.

If you built your company early in your career, you might reach a point where you look for something that is more aligned with your current lifestyle.

Most of the brokers we work with are ready to retire. Few health brokers sell then get into a new industry. Some sell and stay in the industry. Working with carriers GAs or FMOs are considerations. Making an industry decision makes more sense and may bring more value both to the employer and their new employee, you. It is understandable for younger professionals to follow their desire to relocate as they have the drive to find a new opportunity and are willing to make more” dramatic” life changes than someone with family and significant local connections to lose.

When your business isn’t as profitable as it was before due to rising costs, a lack of growth in the industry, or a shift in market preferences, it’s a good sign to let go of it. It’s important to highlight that a lack of profitability alone doesn’t mean your business has no value.

There might be several different factors causing this issue and maybe you are not in the mood to turn things around.

With a commission-based business, unless you have added staff or have family in the business and need to share the success, profitability is not often a concern.

If you have a family business and there are no potential successors, planning the sale as a next step is the smart thing to do.

Doing exit planning allows you to train the next generation of the management team. It is common that as part of the transition and future of the business the seller will need to stay for a year or two to provide the experience the buyer needs.

We have found some sellers want out while others may complain but they have not looked at what is next. In the case where the seller is needed in a post-sale transition, this is ideal when the Buyer wants the Seller to gradually transition out.

Over the years it might be possible that the number of competitors in the industry and the risks of the business operations increase to a level with which you’re no longer feeling comfortable.

Relying too much on just a few referral sources in the local market can impact new business. Under these circumstances, some sellers decide to start the sales process.

When litigation risks can jeopardize the company’s future, sellers should disclose to potential buyers if there are any pending lawsuits or penalties. In most cases issues are discovered during due diligence.

In the state of CA there are many competitors who enter the state with advanced technology, unmatchable marketing resources, and new products that open the door open to catch the eye of your clients. More competition in health isnurance linesis forecasted in 2025 and beyond, so brokers not able to stay current with the competition will face an uphill battle.

If managing the business doesn’t feel any more like a challenge due to a lack of strategy for the future, then it’s possible that business owners feel like it’s time to move on. Additionally, through the year, entrepreneurs can face many new challenges. If there isn’t a contingency plan that can give some guidance and support against these potential issues, then the lack of business strategy can feel overwhelming.

Running a book of business is no easy job and can take a toll on the business owner’s health. This can lead to looking forward to retirement or simply taking time to rest. Whichever the reason, many business owners can always decide they’ve reached a point at which they should lay back and enjoy what they have worked so hard for.

From our experience we find some brokers have not kept current with technology and this is causing them to lose clients, miss out on finding leads, and experience difficulties with closing new business. The competition has the edge when they bring technology with CRM systems to service clients, methods to regularly touch clients, and marketing programs to reach out to more prospects. Consider today’s Medicare age ins are more tech savvy and most younger business owners and benefits decision makers look for technology solutions for their group benefits management. Brokers who do not have the ability to stay competitive will see their book of business shrink. And at some point, they are better off planning their exit.

Here’s situations where we can help:

• Have no idea about your future plan, Have family or employee(s) who will step in, we can help

Using your own money to cover operating expenses is not a plan but is a sign that funding new projects will be more difficult.

In our experience industry changes and challenges keep coming, 7 years with group benefits and nearly every other year with Medicare. Carriers change plans, federal and state laws drive change (ACA, CMS and Medicare marketing hurdles, DOI and DOL requirements, tax laws) and the cost of doing business. Partners can help (FMOs and GAs) bring resources to deal with industry changes and tech challenges. Finding advisors and mentors is also vitally important to build a successful business strategy.

Integrity Advisors is a health insurance agency which specializes in educating health brokers on the importance of commission protection. Commission Solutions is a program offered by Integrity Advisors.

Phil Calhoun MBA,is a board member of the Exit Planning Institute Orange County Chapter, he owns Integrity Advisors.

Click here to arrange a no obligation 15-minute coach session Phil@commissions.solutions 714-664-0311

David Ethington, is an expert in the process to acquire and transfer health commissions. He has trained many brokers in commission education and built the commission transfer planning module for Medicare commissions provided to our broker colleagues.

Click here to arrange a no obligation 15-minute coach session David@commissions.solutions 714-664-0605

By Marc Glickman FSA, CLTC, LTCP

Long-term care insurance (LTCi) isn’t just a financial tool—it’s a way to safeguard families from the emotional, physical, and financial toll of caregiving. As an actuary with over a decade of experience designing LTCi products, I’ve long understood the value of planning for longterm care. However, it wasn’t until a personal experience unfolded within my own family that I truly grasped the human cost of delaying these crucial decisions.

It all started with a simple phone call from my relative, Colin, a respected doctor and a family man, who was seeking advice on LTCi. Colin and his wife, Amy, were facing the same question that many families ponder: should they buy long-term care insurance, or could they afford to self-fund the costs? Although Colin was confident in their financial security, years of hesitation had kept them from moving forward with a plan. This phone call would lead us down a path of unexpected events that drove home the importance of timely planning for long-term care.

During our conversation, Colin reminded me of our family’s history with long-term care. My grandparents, whom we lovingly called Bubbe and Zedde, both needed extended care for many years. Zedde, a Holocaust survivor, had suffered severe trauma from his experiences during World War II, which led to mental health struggles later in life. He eventually suffered a stroke that left him physically incapacitated, and the family had to make difficult decisions about his care.

Bubbe also experienced a stroke, and I remember vividly how my mother took on the role of her full-time caregiver. For five years, my mother dedicated herself to caring for Bubbe, putting her own health and well-being aside. The burden was immense, both emotionally and physically. These memories stuck with me, and they were a driving factor in why I pursued a career in long-term care insurance. But for Colin and Amy, those memories were too painful, and the thought of repeating that experience with their own children gave them pause. However, decision and prediction algorithms aren’t yet ready for large-scale use without oversight. Recent lawsuits showcase issues with reliability, leading to common themes and complaints.

“Long-term

insurance (LTCi) isn’t just a financial tool—it’s a way to safeguard families from the emotional, physical, and financial toll of caregiving.”

Colin made it clear: “We don’t want our kids to suffer the way we did, caring for our parents.” Yet, despite this resolve, they had delayed purchasing LTCi, primarily because their financial advisor had suggested they could self-fund the risk. “He wasn’t sure if LTCi was worth the cost,” Colin admitted, echoing a sentiment I’ve heard from many clients over the years.

As an actuary, I’ve analyzed the self-funding argument extensively. While self-funding may seem like a viable option for affluent families, it’s fraught with risks. Market volatility, taxation, and the uncertainty of when care will be needed all complicate the notion of simply relying on personal savings. I explained to Colin that LTCi isn’t just about covering costs—it’s about leveraging insurance to provide peace of mind and, more importantly, protecting their children from the heavy burden of caregiving.

Colin and Amy had also delayed because of concerns about the cost of LTCi and potential rate increases. I reassured them that today’s LTCi market offers a variety of options, including prepaid plans and guaranteed premiums. There is even traditional lifetime payment plans that are more conservatively priced than in the past. Together, we could build a customized plan that fit their needs without breaking the bank.

Colin agreed to move forward, and over the next few days, we worked together to find the right LTCi product for them. Given their excellent health, I was able to secure a plan with superior longevity protection and excellent value. They were so pleased with the outcome that they even considered increasing their coverage to better prepare for future care costs.

However, as often happens in life, unexpected events soon intervened. Colin and Amy were traveling and wouldn’t be able to sign the application for another month and a half. I remember cautioning them: “Heaven forbids any health issue should happen before you return—you might not qualify for coverage.” At the time, it felt like a typical sales line, but it wasn’t long before that warning took on a much more personal significance.

Two weeks later, my mother called with a quiver in her voice. “Colin and Amy were at the gym, and Amy suddenly collapsed,” she told me. I was shocked to learn that Amy had suffered a brain aneurysm, a sudden and life-threatening condition. The first thought that crossed my mind was whether she would survive. Then, almost immediately, my mind shifted to the possibility of long-term care. What if Amy needed extended care? Would they still be able to qualify for LTCi? And then, I felt a deep sense of gratitude that I had spoken with them just two weeks prior.

Thankfully, Amy survived. She underwent a cuttingedge surgical procedure that repaired the aneurysm, and her recovery has been nothing short of miraculous. However, this close call underscored the reality that life’s unpredictable twists and turns can derail even the best-laid plans. Colin and Amy’s situation could have been much worse had they delayed their decision any longer.

This experience reinforced what I’ve always known: waiting to plan for long-term care is risky. For many families, it’s not just about the financial costs—it’s about ensuring that loved ones aren’t left to shoulder the burden of caregiving. Amy’s near-death experience highlighted the urgency of making decisions before it’s too late. While they may not have been able to move forward with their original LTCi Plan A, I was grateful to have a Plan B ready—one that still offers protection and peace of mind.

As I reflect on this personal story, I’m reminded of how powerful storytelling can be. It’s one thing to discuss insurance in terms of numbers, benefits, and features, but it’s another to share real-life experiences that demonstrate the importance of planning. Stories like these build trust with clients and help them connect on a deeper level with the products and services we offer.

For Colin and Amy, the story had a happy ending. But not every family is so fortunate. The lesson here is clear: don’t wait. Whether you’re considering LTCi for yourself or advising clients on their options, the best time to plan is now.

Marc Glickman,FSA, CLTC, is CEO and co-founder of BuddyIns, a leading long-term care insurance education, marketing and technology company. Marc is a licensed insurance agent in all 50 states and serves on the Board of Advisors for CLTC. Marc has over 15 years of experience as an actuary including as the chief investment officer and chief sales officer for a major LTC insurance company. Marc earned his degree in economics from Yale University. In 2019, he was named one of the top 20 innovators in the insurance brokerage space.

marc@buddyins.com 818-264-5464

By Diane Stoddart CLTC, LTCP

“Without LTC planning, many family members sacrifice their futures and savings for their own retirement years.”

Long-term care (LTC) planning has as much to do with the person needing care as it has to do with their caregivers’ wellbeing. LTC is about protecting those we love from the physical, emotional and financial consequences they’ll face when a parent or loved one needs help. About one (1) in five (5) of all adults (22 percent) will have a care need that extends beyond five (5) years.

November is long-term care awareness month. It’s important to understand the costs (financial, social, physical, psychological) to caregivers because it’s never too early to plan for long term care. Associated health costs continue to rise, and the expense of caring for patients for an undetermined number of days/weeks/months or years, can create significant financial difficulties.

In the 21st Century, people are living longer, and LTC can help make our senior years as comfortable and stress-free as possible. The incidence of memory disorders and cognitive decline is on the rise, and diagnoses of dementia create one of the most common needs for extensive long-term care.

Have you or a loved one said, “Please promise to never to put me in a nursing home…but I don’t want to be a burden…” Many try to keep those promises to their own detriment. Without LTC planning, many family members sacrifice their futures and savings for their own retirement years.

Case Study: I’ve witnessed families deplete their assets and sell their parents’ homes to pay for care. What happens when the money runs out? Without a home, the parents need to either move to a facility or move in with their kids. With that nursing home promise lingering in the background, discord among siblings results, and they frequently argue about costs of care or “a place for Mom.”

On the other hand, we meet seniors who planned and bought LTC insurance many years ago. Planning ahead provides time to discuss what kind of care they would like when care is needed. Some have already toured assisted living facilities/communities (ALFs) and decided where they would want to live, when they can no longer live independently.

Caregivers or adult children of senior parents, who purchased LTC insurance, are often able to couple the insurance proceeds + the patient’s income. With the combined funds, many can afford a nice ALF or 6-10 hours of in-home care per day.

Full-time or part-time (in-home) care enables caregivers and adult children to take care of their own families, knowing their parent is receiving appropriate care. Often, families select “step up” care that allows them to transition from the home until residential care in an ALF is needed.

Recognizing that there is no “one size fits all” plan (some clients prefer the idea of an ALF), it’s good that there is a wide assortment of LTC plan options today. Some use a lower premium that is paid over your lifetime, while others use a 1, 5, 10, 15 or 20 years paid-up funding strategy. Optimally, you will pay for the plan before reaching retirement.

New laws allow us to reposition cash value from life insurance and annuities to create LTC plans that pay tax-free benefits for care or pay your beneficiaries, if no care is needed. In fact, there are options for a full return of premium if a client changes their mind and cancels.

When we plan in our 40s and 50s, we often guarantee that both the LTC benefit, and the death benefit will pay significantly more than the premium paid.

With options, we need not feel like we are abandoning our loved ones to the nursing home. Nor do we need to feel like we will be abandoned. Instead, we can proactively plan, communicate, and carry out our loved ones wishes that were designed many years before care was needed.

We need to become more aware of what planning strategies and policy options are available today to help us prepare for tomorrow. Before you know it, we will be the ones living longer than we thought we would. It’s important that we protect our families from physical, financial and emotional devastation.

“With options, we need not feel like we are abandoning our loved ones to the nursing home. Nor do we need to feel like we will be abandoned. Instead, we can proactively plan, communicate, and carry out our loved ones wishes that were designed many years before care was needed.”

California Broker is pleased to have a collaborative relationship with Buddy Insurance, a leading long-term care insurance education, marketing and technology company. CEO Marc Glickman and his specialists will collaborate with health and life insurance professionals to help design LTCi options. Learn more about LTCi and refer clients — or learn how to write your own LTCi policies using Marc’s system.

CONNECT to Buddy Insurance LTCi PORTAL HERE:

Group: www.buddyins.com/program/calbroker/group

Individual: www.buddyins.com/program/calbroker/

Diane Stoddart, CLTC, LTCP, is a BuddyIns LTCi specialist who has been helping families plan for the financial exposure of an extended life since 1992.

Diane and her husband, Paul, bought their long term care policies at age 35. At 40, she was diagnosed with Multiple Sclerosis. By the grace of God, she has no symptoms or troubles with the disease. She is, however, uninsurable and is so grateful that she was led to plan early.

Diane designs customized plans through multiple top-rated insurance carriers. Diane works in all 50 states to help her clients plan today to be able to live at home later, when they need help living.

You can reach Diane at diane@buddyins.com.

By Gretchen Barry

As the demand for long-term care soars, so do anxieties about paying for these essential services. As someone who experienced this recently with a parent, I understand that anxiety. According to a 2023 KFF survey, 43% of respondents don’t feel confident that they’ll be able to afford care as they age. Additionally, only 28% of adults aged 50 to 64 have saved money for future living assistance expenses.1

For this article, I want to focus on how long-term care coverage is and how insurance can help alleviate funding concerns by providing financial support for extended care services. This insurance can give policyholders peace of mind and safeguard their financial futures. By learning about the ins and outs of long-term care insurance, you’ll help your clients effectively plan for their future health needs.

Long-term care insurance — also known as custodial care coverage — covers the costs of extended care services for people who need ongoing support. It pays for expenses not covered by Medicare or traditional insurance, such as assisted living and skilled nursing.2

A long-term care insurance policy can help pay for the cost of care that is needed due to a chronic illness, disability, or injury. Primarily, long term care insurance is designed to cover the costs of custodial and personal care, as opposed to medical care alone.

Coverage may include the cost of staying in a nursing home or assisted living facility, adult day care or in-home care.

So, what does long term care insurance cover? When your policy has been activated you can use it to cover many types of expenses, including:

• Respite care

• Alternative care

• Adult day care

• Nursing home

• Assisted living facilities

• Memory care

• Resident care

• Short term hospice

Ideally, someone would purchase coverage when they are still young and healthy people to cover future medical expenses.

“A long-term care insurance policy can help pay for the cost of care that is needed due to a chronic illness, disability, or injury. Primarily, long term care insurance is designed to cover the costs of custodial and personal care, as opposed to medical care alone.”

Long-term care insurance covers ongoing medical expenses for people with complex health needs that require extended and specialized support. Policyholders must meet specific criteria to begin using their long-term care benefits. Insurers require a physician’s diagnosis for cognitive or physical impairment.

Policy coverage typically includes these essential services:

In-home care coverage allows policyholders to receive healthcare services from the comfort of their homes. These services are available for seniors, people with disabilities, patients recovering from surgery or illness, and others.

In-home care takes many forms, including:

• Companion care: A caretaker provides non-medical services and social support to help patients stay engaged and prevent loneliness. For instance, an aging patient may go on daily strolls with their caretaker and get help with grocery shopping.

• Help with ADLs: An in-home care professional can assist with bathing, caring for dental hygiene, and other daily activities.

• Nursing care: A licensed healthcare provider travels to the patient to deliver healthcare services. For instance, a person recovering from knee replacement surgery may receive wound management and physical therapy.

In-home care allows older adults and others who need ongoing assistance to maintain their independence. Patients who receive these services can remain in their homes and communities instead of moving to an assisted living or skilled nursing facility. However, keep in mind that these services are in high demand. Depending on where one lives, it may be difficult to find a qualified caregiver.

Insurance coverage for long-term care also includes facility care. This type of care allows policyholders to receive healthcare services in residential settings.

Common types of facility care include:

• Assisted living: Residents live in independent units and receive help with ADLs. For instance, staff may provide housekeeping and remind residents to take their medications.

• Nursing home: These facilities provide comprehensive medical care and 24/7 supervision. Nursing homes are a great option for people with limited mobility, cognitive impairment, and other conditions that require around-the-clock support.

• Memory care: Memory units offer specialized support for people with Alzheimer’s disease, dementia, and other cognitive disorders. These facilities typically provide brain-stimulating activities and have security measures to keep residents safe.

Facility care allows residents to build social connections with peers, reducing loneliness. These communities also offer communal dining, recreational facilities, and other amenities that improve residents’ quality of life.

Many people require assistance with everyday activities due to age, disabilities, and illnesses. Long-term care insurance providers typically allow policyholders to receive benefits if they can’t perform two of these six ADLs:3

• Bathing

• Continence

• Dressing

• Eating

• Transferring in and out of a bed or chair

• Toileting

Long-term care insurance enables eligible policyholders to receive daily assistance with these tasks. For instance, a person with a spinal cord injury could have an in-home caretaker who helps them transfer from their bed to their wheelchair. Similarly, someone who experiences a stroke could move into an assisted living facility to receive assistance with bathing and toileting.

Assistance with ADLs improves patients’ quality of life and allows them to maintain their dignity. Coverage for these services also reduces the strain on family members and enables policyholders to receive professional support.

People often assume they can use their long-term care insurance whenever they need it, but that’s not the case. Policyholders must follow their insurance company’s filing process to get reimbursed for claims. At BuddyIns, we recommend that folks reach out to our Community Partner, Amada Senior Care, to get help understanding how to file a claim.

“As healthcare costs continue to rise, insurance coverage for long-term care has become a wise option for many people. This insurance can enable policyholders to receive necessary care without wiping out their savings or going into debt.”

We need to continue to educate more Americans about the importance of planning and communicating a plan to their loved ones. Long-term care services allow individuals to age with dignity and receive essential healthcare. However, these services can cost thousands of dollars a month, especially for people who need specialized care.

As healthcare costs continue to rise, insurance coverage for longterm care has become a wise option for many people. This insurance can enable policyholders to receive necessary care without wiping out their savings or going into debt.

As a reliable advisor, you can help clients understand the benefits of long-term care insurance and make informed decisions about their current and future health.

California Broker is pleased to have a collaborative relationship with Buddy Insurance, a leading long-term care insurance education, marketing and technology company. CEO Marc Glickman and his specialists will collaborate with health and life insurance professionals to help design LTCi options. Learn more about LTCi and refer clients — or learn how to write your own LTCi policies using Marc’s system.

CONNECT to Buddy Insurance LTCi PORTAL HERE:

Group: www.buddyins.com/program/calbroker/group

Individual: www.buddyins.com/program/calbroker/

Gretchen Barry, As Chief Marketing Officer for BuddyIns, Gretchen has been instrumental in shaping the company’s identity as a leading LTCi education, marketing, sales, and technology company. With over 20 years of experience in marketing leadership roles across financial services and tech start-ups, Gretchen brings a wealth of expertise and passion to her work. She oversees a diverse and talented marketing team that delivers innovative and effective solutions for BuddyIns’ clients and partners. Gretchen can be reached at gretchen@buddyins.com

Sources:

www.kff.org/health-costs/poll-finding/the-affordability-of-long-term-care-and-support-services/ www.americanbar.org/groups/law_aging/publications/bifocal/vol45/vol45issue1/ltc-insurancequal/ www.dhcs.ca.gov/services/ltc/Documents/Alert_Glossary.pdf

Recently, I received an important question through my website about what happens if an insurance company is liquidated. As most of you know, I’ve been in this business for decades and I’m pleased to report that the liquidation of insurance companies is an incredibly rare phenomenon.

It’s a fair concern and I’m sure it’s one that many of you have thought about. I’m sharing this information because I want you to be comfortable not only with the long-term care insurance policy that you purchased through my team but also the strength of the carrier who is bearing the risk of and responsibility for that policy.

Comment:

“I have a full paid-up 10-year-pay LTC policy. Per my state’s insurance office, having an active policy like this is not enough -- you need an active claim.”

According to a representative at the state’s Department of Insurance (DOI), “If the carrier were to undergo liquidation AND she did not have an active claim, then her policy would end.”

Signed “K” from Nebraska

My Response:

Thank you for your comment. I will respectfully disagree with the representative at your state DOI. When I have questions about carrier solvency and the laws and regulations around it, I go to the National Organization of Health and Life Insurance Guaranty Associations (NOHLGA) website (1). In this instance, I found specific answers that support my understanding that the guaranty associations will continue coverage and pay claims, not just handle active claims at the time of liquidation.

For instance, part of the response to Frequently Asked Question #2 says, “If a member company is ordered liquidated by a court with a finding of insolvency, the guaranty associations of the states where the company was licensed continue coverage and pay claims under the member company’s covered policies in accordance with state laws.” (2)

Additionally, the response to FAQ #3 repeats the “continue coverage” phrase: “Guaranty associations typically are activated to continue coverage and pay claims when a court issues a liquidation order with a finding of insolvency against a member company.”

Response to FAQ #4: “Depending on the type of contract and other factors, guaranty associations typically continue coverage to the owner of a policy, contract, or group certificate, and to the extent applicable, to the beneficiaries, assignees, and payees of those owners.”

Response to FAQ #10 states there is a specific amount of coverage which is typically $300,000 for long-term care insurance. This is more liberal than the $250,000 FDIC-insurance for bank deposits. What if your claim is more than that? It goes on to say,

“In most states, benefit amounts above the guaranty association levels become a claim against the estate of the insolvent insurer, and policy owners may recover a portion of that claim when the company’s assets are liquidated.”

You can check your specific state’s guaranty association here.

Response to FAQ #7 says the only time the policy is terminated is if the policyowner stops paying premiums that are due. This doesn’t apply to you as your policy is paid up.

You are more likely to see a bank failure than the failure and liquidation of an insurance company. I hope that this policyholder was able to go back to his DOI representative to provide this important information.

“You are more likely to see a bank failure than the failure and liquidation of an insurance company”

California Broker is pleased to have a collaborative relationship with Buddy Insurance, a leading long-term care insurance education, marketing and technology company. CEO Marc Glickman and his specialists will collaborate with health and life insurance professionals to help design LTCi options. Learn more about LTCi and refer clients — or learn how to write your own LTCi policies using Marc’s system.

CONNECT to Buddy Insurance LTCi PORTAL HERE:

Group: www.buddyins.com/program/calbroker/group

Individual: www.buddyins.com/program/calbroker/

Phyllis Shelton, is the President of Got LTCi, part of a long-term care insurance outreach that she founded in 1991. She is widely considered to be the leading long-term care insurance sales trainer in the country. Her book, Protecting Your Family with Long-Term Care Insurance, provides cutting edge information about all phases of financing long-term care. Suze Orman says, “Long-term care insurance for many is the most important insurance you can buy if you can afford it. Phyllis Shelton is the only person I trust to keep me up to date on what I need to know. Read this book.”

Phyllis can be reached through her website at Contact Us | Got LTCi.

By Wendy Boglioli

“It’s time for the collective financial services industry to help more Americans, especially women, take charge of this part of their financial futures and give them more options for long term care planning.”

Each week at BuddyIns, as we strive to inform more American employers and associations about the importance of planning for long-term care, particularly for women, we host educational sessions for employees and association members. These sessions focus on group hybrid long-term care with life insurance, raising awareness about how this dual-benefit option can ease the financial burden on families in times of need.

This educational effort is crucial, as recent industry trends show a growing interest in long-term care benefits. According to a Buck survey, 66% of employers plan to address long-term care benefits in the coming year, recognizing their importance not just for older adults but also for the labor market and younger generations. This is particularly important for women since we are the majority of family caregivers.

As an Olympic gold medalist and a veteran in the long-term care insurance (LTCI) industry for 27 years, I have witnessed the significant impact of long-term care needs for women. Working women face multiple responsibilities, including employment and caregiving challenges, while juggling various responsibilities. This includes being employed outside of their home, caregiving responsibilities for family and loved ones, and being among the 4 in 10 women who are the primary breadwinners in their families. This juggling act is becoming increasingly common, with more than 1 in 6 Americans working full-time or part-time reporting that they assist with the care of an elderly or disabled family member.

I have also personally witnessed the unfortunate circumstances of women passing away during their working years without the benefit of life insurance for their loved ones. It is heartbreaking to see a family scramble during that crisis. The immediate struggles with funeral expenses, mortgage payments, and then, of course, the day-to-day living expenses can be overwhelming. And for my recently deceased friend, who was a single woman and the primary breadwinner, not having life insurance left her dependents with very little financial support.