6 minute read

9.2 Leading a Net-Zero Economy

The Canadian electricity industry has already taken impressive steps resulting in a cleaner environment.

Introduction to How the Canadian Electricity Industry is Leading the Way

In support of the Canadian government’s Net Zero by 2050 commitment, the Canadian electricity industry has made efforts to modernize the grid and develop new technologies to lower our carbon footprint. However, there is more to be done—particularly as electricity assumes a place of even more central importance within our economy.

4Ds—The Changing Electricity Landscape

The electricity industry is undergoing highly consequential change driven by evolving customer and societal expectations around decarbonization, decentralization, digitization, and democratization.

Decarbonization

Decarbonization is reducing CO2 emissions.

Canada’s electricity industry is committed to ongoing efforts to decarbonize the sector through the further reduction of fossil fuel-generated electricity along with other initiatives. For example, efforts are ongoing to green the vehicle fleets owned, managed, and operated by electricity utilities.

Decentralization

Decentralization is driving the adoption of microgrids and distributed energy resources, especially in remote communities with limited access to provincial and territorial grids.

The grid is under transformation. Originally designed for one-way delivery of electricity from generation through transmission and distribution to the customer, it is now rapidly changing to a multipath grid allowing the incorporation of many new forms of renewable generation from many sources, including solutions from the customer side of the electricity meter.

Digitization

Digitization is propelling tremendous improvements in communications technology to optimize system operations, using advanced technologies such as artificial intelligence, blockchain, and robotics. These technologies have reduced costs and enabled greater efficiencies across the electricity value chain and for consumers.

New capabilities enabled through the “Internet of Things” are allowing many new electricity management technologies and tools to help improve the grid and drive its ongoing development.

Democratization

Democratization is enabling new players to enter the electricity market, whether as proponents of distributed energy resources, suppliers of technology, or providers of supplemental services to customers.

Decarbonization is the most prevalent trend in the industry, given the urgency to act on climate change and the meteoric rise of clean energy investments.

Required Changes to Regulated Utilities

These trends are having a transformative impact on the electricity industry. It will be important for regulation to keep pace with these changes - changes that will enable regulated utilities to adapt to these trends and continue to leverage their expertise and asset bases as they proceed.

Modernization of Regulated Utilities

Many electricity companies have started to build innovation-based capacities and business offerings through non-regulated subsidiaries. While existing regulations are relatively risk averse, there may be opportunity to allow these innovations to occur within the rate-regulated system as well.

Promotion of Innovation

Ongoing responsive and proactive regulatory support is encouraged to help foster electricity industry innovation, modernization, improved service delivery, and customer energy management solutions.

Adaptation to the “Prosumer”

We are seeing the emergence of “prosumers” in place of traditional “consumers.” A prosumer is potentially both a producer and a consumer of electricity, and likely wants to take a much more active role in the management of their energy needs. Utilities will need to adapt their services accordingly.

Transitioning the Operational Model

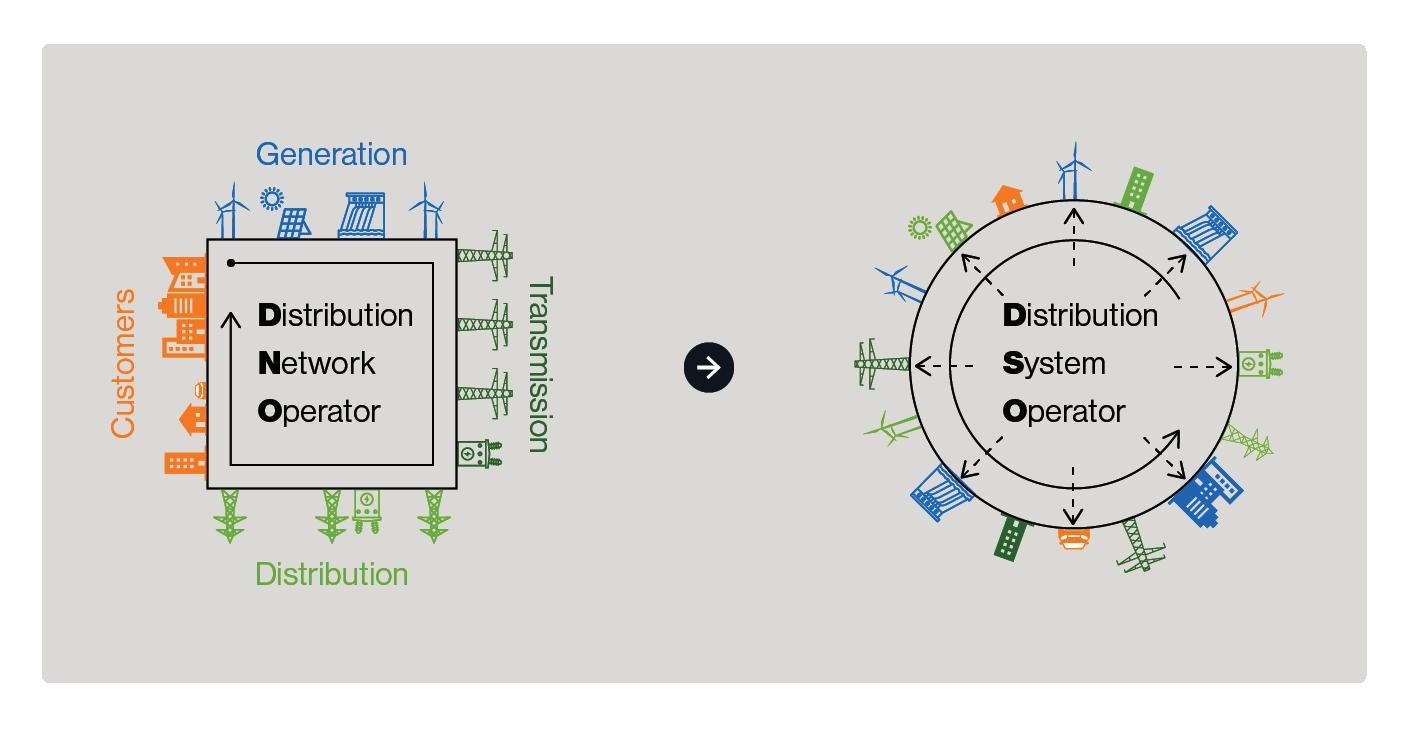

Overall, the grid is transitioning from the traditional Distribution Network Operations (DNO) model to a Distribution System Operations (DSO) model.

Distribution Network Operations (DNO) Model

Under the DNO model, electricity has traditionally flowed unidirectionally from generation through transmission and distribution to end customers, with a relatively small number of large industry players at each of those key stages.

Distribution System Operations (DSO) Model

The DSO model entails an integrated, interactive, and neural network of power systems with built-in intelligence. The system will do the following:

• Seamlessly integrate multiple sources of generation, of varying scales and increasingly skewing to renewables and non-emitting sources

• Deploy more multifaceted transmission and interconnection arrangements, with more generation located closer to electricity end users, and often even on customer premises

• Ensure continued delivery of reliable and affordable electricity, while enabling consumers to contribute to efficient grid operation through demand management, storage, and generation as they may choose

Inherent within this emerging model are tremendous opportunities for further decarbonization.

New Technologies

Several new technologies are also showing great promise.

Grid-Scale Storage

The ability to store electricity for later use will be an important asset as Canada changes how it generates power and sees increased demand. Storing unused capacity for later will allow for more efficient use of intermittent renewables and increase system reliability. Small-scale storage is installed in Canada already, including in remote communities where it will help reduce the use of diesel.

Small Modular Nuclear Reactors (SMRs)

SMRs offer the opportunity to provide affordable and reliable electricity without a grid connection. They could be used to backstop intermittent renewables such as wind and solar, to replace diesel generation, and to support heat intensive industrial processes. SMRs are still a nascent technology, but they are a promising potential future source of non-emitting baseload power. A potential global market for SMRs represents an opportunity for Canada’s nuclear industry.

Hydrogen

Hydrogen might be the simplest atom, but it is a complex energy solution. Produced with non-emitting energy or in conjunction with carbon capture, it is a clean fuel with a variety of potential uses. Excess wind power, for example, could be used to make hydrogen for future electrical generation. Hydrogen’s characteristics allow it to represent storable and portable electricity, with the opportunity to seize new market opportunities.

Carbon Capture, Utilization and Storage (CCUS)

Building the grid of tomorrow will not just mean scaling up new non-emitting generation technologies. It will also have to mean identifying ways of making existing technology non-emitting. Canadian electricity companies are leaders in CCUS already, with SaskPower’s Boundary Dam facility becoming the first power plant in the world to integrate it in 2014. It is now working towards the next phase in which captured carbon will be used to create commercially valuable products (in this case, carbon nanotubes that can be used to reinforce concrete).

The Flux Capacitor Podcast

The Electricity Canada continues to lead the conversation regarding the future of the industry, in part through a popular podcast called The Flux Capacitor. It features future-focused discussions with business and thought leaders in the electricity industry. Episodes touch on how we create, move, trade, and use energy, with each guest adding their own expertise and perspective to the conversation.

The Flux Capacitor podcast explores questions such as:

• What will be the impacts of technological change? • How will markets and customer demands respond to new technology? • What will social and technological changes mean for regulators, society, and the electricity industry?

The Future Roles of Technology

As the future of electricity in Canada unfolds, technology, regulation, policy, and economics will all play important roles. Key variables and considerations related to each are noted below.

Technology

How fast will new and potentially disruptive technologies roll out and be commercialized, particularly with respect to energy storage and the electrification of transportation?

Regulation

How will regulation adapt to the changing face of the sector—for example, at what point will distributed energy resources represent sufficient competition to incumbent utilities that rate regulation will need to be redesigned?

Policy

What role should incentives tied to specific outcomes have? And if some future policies are intended to meet societal goals, should the costs be more broadly shared by all taxpayers?

Economics

As new technologies integrate and overtake legacy systems, will some electricity assets become “stranded” (i.e., experience serious value erosion)? As with any critical infrastructure, this would have impacts extending well beyond the shareholder.

Wherever there is change—whether it involves technology, regulation, policy, or economics—there is opportunity, and Canada’s electricity sector has shown it is up to the challenges ahead!

Knowledge Check

• Enabling new players to enter the electricity market is democratization. • Improving communication technology to optimize system operations is digitization. • Diverting carbon emissions created from electricity generation is carbon capture, utilization and storage. • Changing to multipath grids and new forms of generation is decentralization. • Providing affordable electricity without grid connection is done by small modular nuclear reactors. • Reducing the use of fossil fuels to decrease CO2 emissions is decarbonization. • Storing electricity for later use is grid-scale storage.