On September 21, 2022, Canadian cattle producers marked the 5th anniversary of the implementation of the Comprehensive Economic and Trade Agreement (CETA) between Canada and the European Union (EU) with disappointment and resolve.

The Canadian Cattle Association (CCA) remains a leading supporter of opening access for Canadian beef exports to the European Union. Although the CETA created quotas for nearly 65,000 tonnes of duty-free access for Canadian beef, unresolved technical barriers have prevented CETA from delivering its full potential.

Back in 2017, CCA had estimated that when the CETA quotas were fully implemented, there would be potential to export $600 million of Canadian beef annually to the European Union. In 2021, exports to the EU were 1450 tonnes valued at $23.7 million. CCA projects a similar total for 2022.

“Our exports to Europe are minimal, a far cry from what we expected and certainly much less than the amount of beef Europe is sending to Canada,” commented Reg Schellenberg, CCA President.

The imbalance in the Canada-EU beef trade is striking. In 2021, Europe exported 16,295 tonnes of beef worth $100 million to Canada and for every pound of Canadian beef exported to Europe, Canada has imported eleven. In 2022, that imbalance has increased to a 17 to 1 ratio.

“Despite the disappointing results thus far, CCA remains resolved in unlocking trade potential in the EU,” said Schellenberg.

The main problem is that the EU does not recognize the Canadian food safety system as a whole. Instead, they impose their individual requirements on Canada, with the result that when our regulatory frameworks don’t completely align, Canadian processors have to re-work their operations for special Europe runs and then switch back to comply with Canadian requirements. This results in increased costs that largely make exporting beef to Europe not profitable.

CCA representatives visited Brussels last week to discuss solutions to address the obstacles. CCA has submitted scientific evidence on why the EU should recognize the efficacy of our system. We are hopeful that their review of the science will result in an approval of the way we do things. Such approval will pave the way for both Canada and the EU to enjoy beneficial growth in bilateral beef trade in the future.

Maple Leaf Foods Inc. has announced that it has completed construction of its new, state of the art, value-added poultry plant in London, Ontario, slightly ahead of schedule. Equipment testing has begun and new people are being hired to enable production startup on schedule in Q4 2022.

"I am incredibly proud of our team for achieving this important milestone ahead of schedule in a very challenging environment," said Michael H. McCain, Chief Executive Officer. "As we get closer to commercial production, we know we are well on our way toward realizing the benefits and returns on this $772 million strategic investment. We expect the plant to generate approximately $100 million annually of incremental Adjusted EBITDA on a run-rate basis once production is fully ramped up around the end of 2023.

This landmark investment in one of the largest, most technologically advanced poultry processing facilities in the world, is yet another example of how Maple Leaf Foods is strategically positioned to serve growing markets, while remaining true to its sustainability commitments."

Chicken continues to be the most consumed and fastest growing meat protein in Canada, offering versatility, nutrition and a lower environmental footprint. There is particularly high demand for raised without antibiotics and halal chicken products, categories where Maple Leaf Foods has a strong collection of leading national brands, including Maple Leaf Prime® and Mina®. With a footprint of 660,000 square feet, or the equivalent of over 11 football fields, combined with leading-edge innovation and technology, the London Poultry plant provides Maple Leaf Foods flexibility and capacity to meet growing demand.

"Our investment in industry-leading food safety, environmental and animal care technologies will allow us to efficiently deliver a premium mix of value-add poultry products to meet steadily growing consumer demand, while also strengthening Canada's food system and advancing our vision to be the most sustainable protein company on earth," said Curtis Frank, President and Chief Operating Officer. "London Poultry is truly a next generation plant that exemplifies Maple Leaf Foods' approach to delivering shared value for all stakeholders."

A key part of the planning through start up is building up the operations team. Maple Leaf Foods expects to hire about 600 people by the end of 2022 and will employ about 1600 people once the plant is operating at full capacity. In addition to recruiting new team members, the Company is also working with existing team members who wish to transfer over from legacy poultry plants as these legacy operations are rolled into London Poultry. Maple Leaf Foods recognizes the need to attract and retain great talent and has taken this into account in the design of the plant, incorporating many features to create a modern, inviting and inclusive environment.

By Kyle Burak, Senior Economist, Farm Credit Canada

By Kyle Burak, Senior Economist, Farm Credit Canada

Farm Credit Canada (FCC) has released its mid-year update for food and beverage processing in Canada. It appears that a lot has changed since their 2022 Food and Beverage Reports earlier this year:

• Inflation and interest rates have risen faster than initially expected

• Global economic growth forecasts have weakened

• Profitability is challenged due to rising input costs

• Workforce talent continues to be an issue

Leading this sales growth is grain and oilseed milling. Despite sales up 22%, volumes are estimated to have declined, primarily the result of lower crop yields in 2021.

Food and beverage manufacturers remain well positioned amid challenging conditions, and the outlook remains positive.

Food and beverage manufacturing sales have increased 12% during the first half of 2022. Sales growth is expected to slow into Q4 as inflationary pressures ease, global economic growth moderates and Canadian consumer savings dwindle. They project sales to increase 6% in the second half, finishing the year up 9% (Table 1).

Other industries with healthy volume trends include sugar/confection, fruit/vegetable preserving, specialty foods, soft drinks and bakeries. Sales of these industries are forecasted to finish the year strong.

Global public health organization showcases services for Canada’s growing and fast-changing

to the global public health organization’s expertise and services in Canada. The website combines information on the depth, experience and capabilities of the NSF International Canadian office with access to NSF International’s global services dedicated to food safety and quality.

The impact of higher prices on consumer demand is evident in some industries. They estimate that sales volumes declined for dairy, seafood and all alcohol manufacturing industries in the first six months of 2022. While inflation in some categories, like breweries, is below average, we’re seeing consumers forced to cut purchases based on inflation in other areas. Of these industries, they forecast that seafood, breweries and wineries will see sales slip in 2022. Seafood sales have been weaker due to lower exports to the U.S. and Japan.

Evolving regulations across countries and increasing complexities associated with a globalized food supply network present challenges for NSF International clients in Canada and around the world. The new Canadian website offers expertise and services to help companies navigate these challenges, including certification and auditing, consulting, technical services, training and education, food and label compliance, packaging, and product and process development.

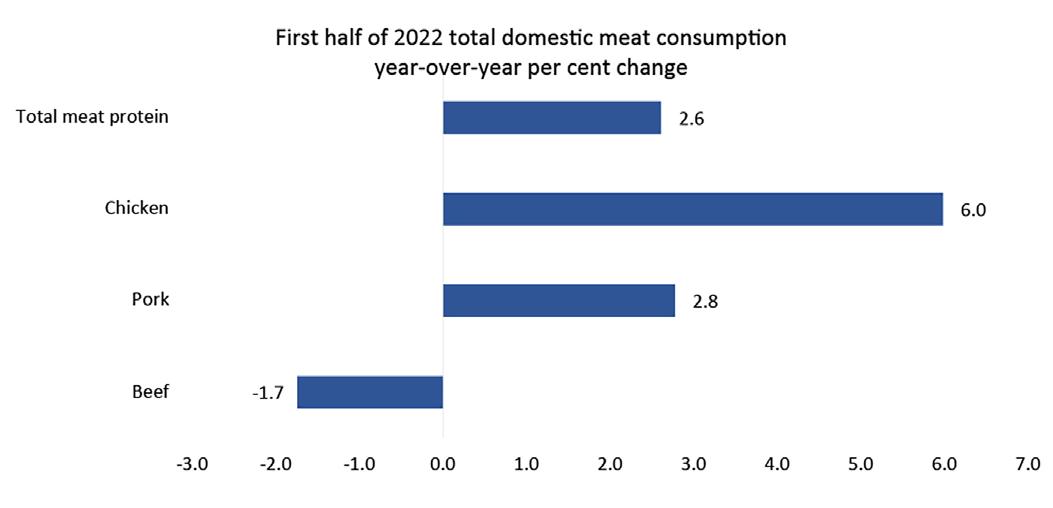

Meat manufacturing price inflation slowed to an estimated 3% in the first half of 2022 after rising 8% in 2021. Total meat consumption has risen in 2022 due to strong demand for chicken and pork, while consumers have cut back on beef consumption (Figure 1). Beef exports have remained strong, offsetting weaker domestic demand. In Q3-to-date, they are seeing more positive trends in red meat, and expect consumption and sales to rise further in 2023.

NSF International’s Canadian website provides information on the following services:

Certification & auditing: Third-party food safety audits and certifications, which are integral components of supplier selection and regulatory compliance. Accurate audits are the first step toward successful verification of a company’s food safety system, providing improved brand protection and customer confidence. Certifications and audits are available for animal and produce in the agriculture industry, GFSI certification and management system registration.

FIGURE 1: Meat consumption rose in 2022, led by increases in chicken and pork

Consulting: A full-service team approach providing technical resources, expertise and insight for a wide range of food safety and quality services. NSF International

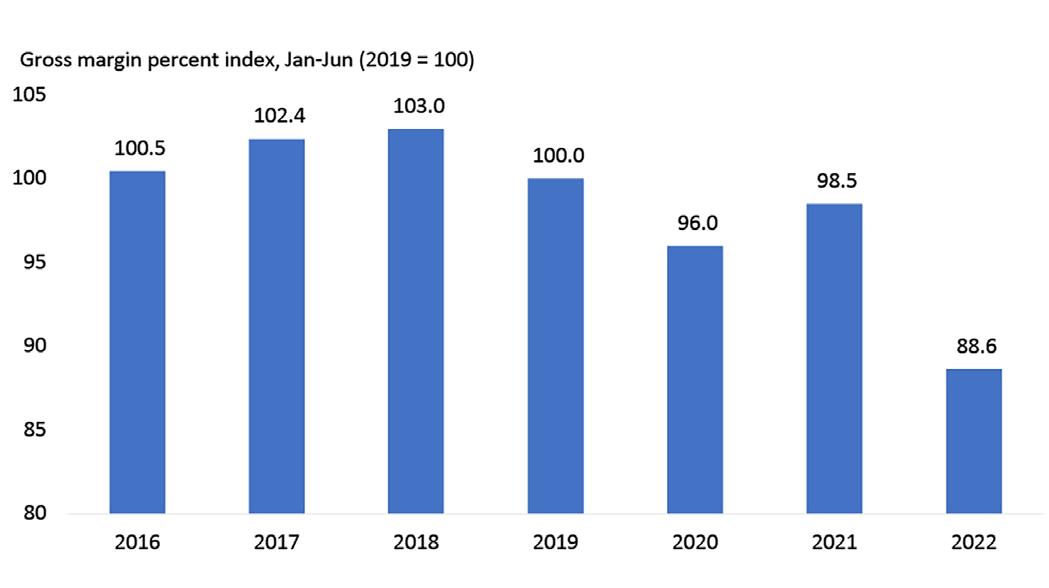

With consumers focused on purchasing lower-margin basics in the face of higher retail prices and input costs remaining elevated relative to selling prices, manufacturing gross margins have been under pressure. FCC Economics’ gross margin index in food manufacturing fell nearly 10% during the first half of 2022. With commodity prices declining, they anticipate margins will start to improve, although projections of weaker economic growth over the next 12 months will continue to be a headwind.

accredited International Association for Continuing Education and Training (IACET) site. Topics include HACCP, food safety and quality, GFSI benchmarked standards, regulations (including FSMA), food science, food packaging, food microbiology and ISO standards. Training modalities an FAQ.

and beverage industry across the supply chain as an

The OECD’s forecast is for global GDP to grow 3.0% in 2022 and 2.8% in 2023, a downgrade from their earlier projections. Our biggest trading partner in the U.S. has had two consecutive quarters of negative GDP growth, even as consumer spending was up 1.5% in Q2. Growth over the next few quarters is expected to be moderate as recession fears persist. China’s GDP is expected to grow ~3%, well below their historical growth rate.

Job vacancies continue to plague many industries, including food manufacturing. The most recent data (June) showed more job vacancies than unemployed people, forcing businesses to increase compensation to attract talent.

Food manufacturing employee weekly earnings are up on average 11.5% in the first six months compared to a year ago, while manufacturing selling prices are up 9.9%, pressuring margins.

Last year, the story was about pent-up post-pandemic demand and how elevated household savings would benefit foodservices. While this played out, for the most part, it was muted by inflation. Subsequently, grocery food sale volumes are estimated to be down roughly 6% in Q2 2022, although this is partially explained from consumers continuing to shift purchases back towards restaurants and fast-food. As the rate of inflation slows, we expect consumers to return to normal shopping habits. The household saving rate fell to 6.2% in Q2 versus 14.5% in Q2 last year. Yet, savings are surprisingly resilient considering inflation and interest rate increases and were doubled what they were prior to the pandemic at the end of Q2

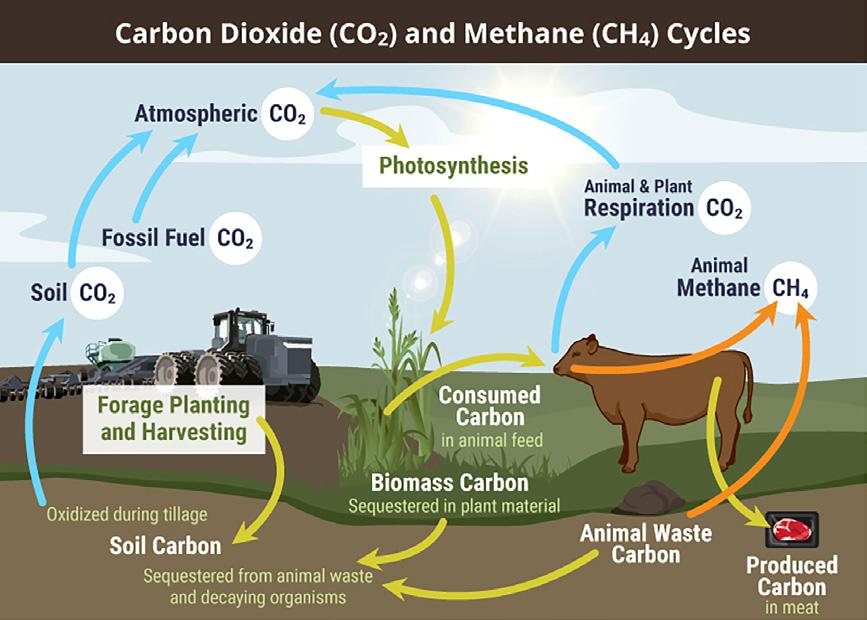

In late September, Environment and Climate Change Canada (ECCC) released Faster and Further: Canada’s Methane Strategy. The Strategy outlines the Government of Canada’s plan to reduce domestic methane emissions by more than 35% by 2030, compared to 2020 levels. Notably, the agriculture sector is expected to reduce methane emissions by 1% from 2020 levels—an expectation previously announced in the Government of Canada’s Emissions Reduction Plan.

“Canadian cattle farmers and ranchers take a lot of pride in how we sustainably produce safe, high-quality beef for dinner tables in Canada and around the globe,” said Reg Schellenberg, President of the Canadian Cattle Association (CCA). “We stand by our practices and the world can count on Canada to be a leader in sustainable cattle production.”

Advancements in sustainable beef production have been a priority for Canada’s beef industry for many years. The creation of Canada’s National Beef Strategy has led to the development of ambitious 2030 goals, which includes a target of reducing the greenhouse gases (GHG) emission intensity of cattle production in Canada by 33% by 2030. These 2030 goals put Canada’s beef industry on track to meet the Government of Canada’s domestic methane emissions reduction goal and were recognized in the Strategy today.

As a next step, the Government of Canada will launch a consultation on how to achieve these expectations, as part of their Green Agriculture Plan, where CCA will be actively engaged. We will also continue to advocate and build upon the Strategy’s themes which include beef’s holistic environmental benefits, including building biodiversity and providing the majority of wildlife habitat on food producing land. The world needs more Canadian beef and Canada’s beef industry is proud to lead the world in its sustainable production.

Europe has experienced its worst bird flu crisis ever this year with nearly 50 million poultry culled, and the persistence of the virus over the summer has raised the risk of widespread infections next season, the EU’s Food Safety Agency (EFSA) said.

The spread of highly pathogenic avian influenza (HPAI), commonly called bird flu, is a concern for governments and the poultry industry due to the devastation it can cause to flocks, the possibility of trade restrictions and a risk of human transmission.

An unprecedented number of outbreaks were reported in wild and domestic birds this summer, causing massive mortality among sea bird breeding colonies on the north Atlantic coast according to a joint overview by the EFSA, the European Centre for Disease Prevention and Control and the EU reference laboratory.

By Sybille de La Hamaide, Reuters“As autumn migration begins and the number of wild birds wintering in Europe increases, they are likely at higher risk of HPAI infection than previous years due to the observed persistence of the virus in Europe,” Guilhem de Seze, a senior official at the EFSA, said in a recent statement.

Bird flu usually strikes during the autumn and winter months. It is transmitted by infected migrating wild birds’ feces or direct contact with contaminated feed, clothing and equipment.

This season’s epidemic affected 37 European countries in total, the largest geographical reach on record, and the virus crossed the Atlantic for the first time along migration routes, causing a severe epidemic in poultry in several Canadian provinces and U.S. States, EFSA said.

Overall, this season’s ongoing bird flu crisis is the worst ever seen in Europe with a total of 2,467 outbreaks reported in poultry and 47.7 million birds culled, it said.

In addition, 187 detections were notified in captive birds and 3,573 HPAI events were recorded in wild birds.

EFSA recommended rapid implementation of risk mitigation and surveillance strategies for an early detection of the virus.

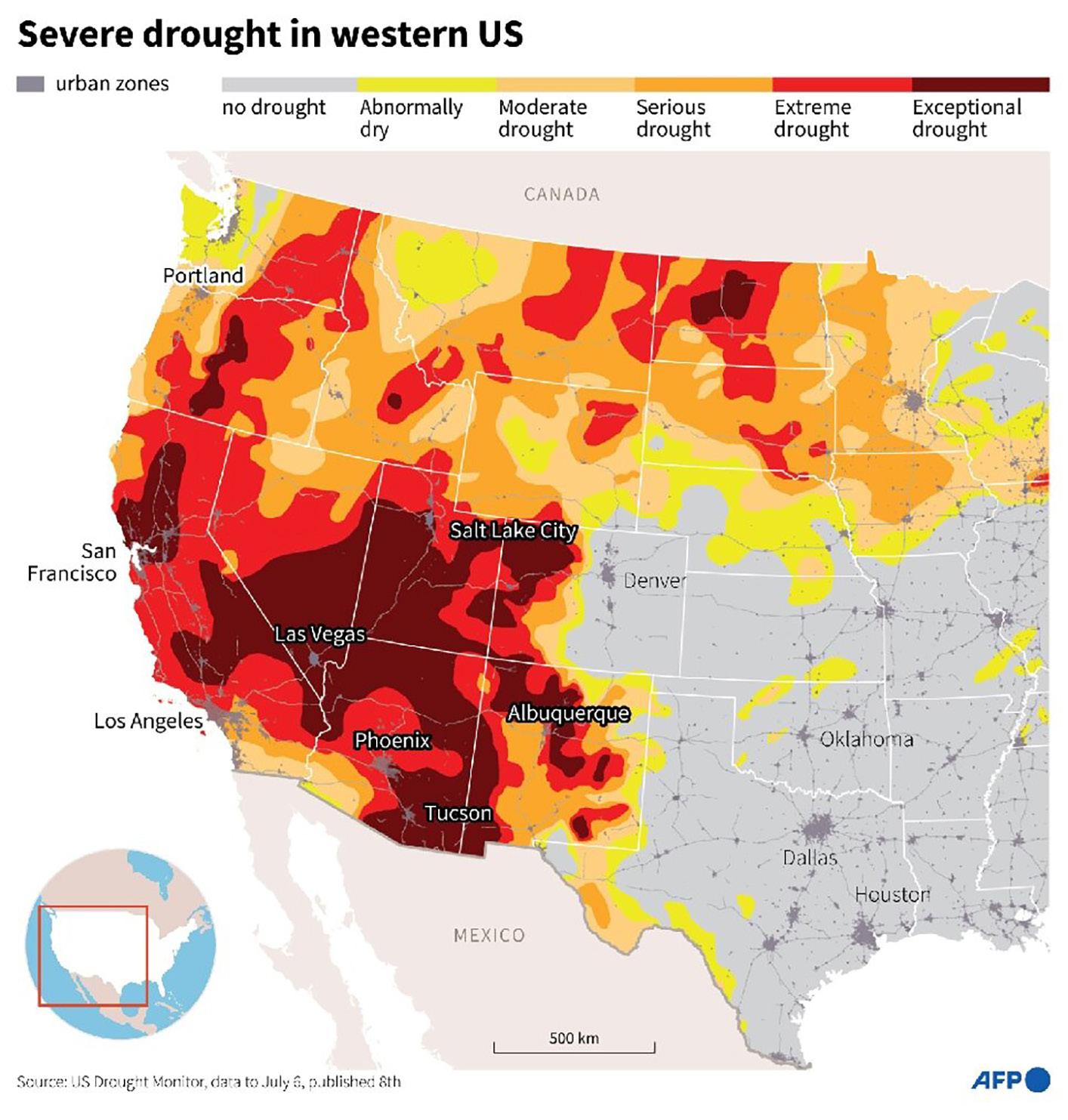

Ranching in the U.S. Southwest has always been a difficult business. Unlike the green pastures of the Midwest and Mid-Atlantic, pasturelands such as Arizona, New Mexico, and western Texas are vast but historically unpredictable, with drier years than wet ones.

The west is now in uncharted territory, as once singular conditions become the norm. Its mightiest reservoirs – Lake Mead and Lake Powell – are at record low levels and steadily shriveling. Prolonged, triple-digit heatwaves are making cities like Phoenix and Las Vegas almost unlivable during summers. And wildfires now spark year-round as parched forests and grasslands are more primed than ever to burn.

Scientists now report that the drought that began in 2000 was the region’s driest mega-drought in 1,200 years. Many ranchers (some of whose families have been tending cattle in the Southwest for more than a century) wonder if their grandchildren can carry on the tradition.

Tim Kohler, an archaeologist and professor at Washington State University, says the current megadrought is different from prehistoric dry periods. “This one seems to be more severe than any of the previous droughts and just as long,” he says. “But the really bad news is all the previous megadroughts took place without the influence of increasing greenhouse gases. Now we are playing a new ballgame and scientists don’t know what to expect.”

U.S. WESTERN ‘MEGADROUGHT’ IS THE WORST IN 1,200 YEARS

There are approximately 25,000 ranches in the American Southwest. Two-thirds of ranchers have had to sell part of their herds as drought conditions worsen across the region, according to a survey conducted this summer by the United States Federation of Farm Services. By 2022, the average herd size across the region is expected to decline by 36%, with New Mexico down to 43% and Texas down to 50%.

Increasingly dry and hot conditions in the United States are also killing animals. A heat wave hit Kansas in June, killing 2,000 cattle. In the past, the federal government has made subsidy payments to ranchers as a temporary measure to help them survive in dry years. But over the past decade, these temporary programs appear to have become permanent. So how to help ranchers who are struggling to provide enough feed and water for their livestock, or who are forced to reduce their herd size.

The drought affected not only water supplies, but also ranchers’ ability to feed their livestock. They usually send their herds to eat the grass that grows on the land, but they can grow grain in the summer and supplement their cattle with store-bought fodder in the winter. In 2015, 71% of ranchers drove cattle off pastures due to lack of feed, forcing them to buy more expensive feed.

By Ronnie P. ConsRed meat is often wrongly portrayed as being unhealthy. some in the media as unhealthy or not environmentally friendly.

Darren Scott, spokesman for the Bureau of Land Management’s New Mexico office, says drought conditions tend to favor crops that cattle may not eat, “The bland plant like creosote is a long-lived shrub that survives even under exceptional drought conditions.”

Vegan, fish and other non-meat diets have been proposed as healthier alternatives. The result of this onslaught of negative meat messages has influenced many families to cut back on their meat and poultry purchases. Perceptions may reality but truth trumps misinformation. Parents and other consumers want what is best for their health and that of their families. They are also aware that a lot of false information is out there and as such, are open to scientific facts that can correct their misconceptions.

liver, 625 spinach.

Last year, the Hopi government called on ranchers to reduce or eliminate their cattle herds because of the drought. The Land Management and Forest Service are also urging licensed ranchers to reduce herd sizes during periods of drought. “Usually ranchers make the decision to reduce the herd size themselves,” Scott said. “Many ranchers in New Mexico’s BLM Land have already reduced herd sizes due to the drought in recent years and are simply not restocking.”

This provides an opportunity for retail meat departments to implement an instore ‘Healthy Meat Facts’ nutritional campaign to set the record straight and convince their customers that meat and poultry are actually good for one’s health and that they should increase rather than decrease their purchases of it. The campaign outlined below can have a direct impact on sales:

Start by displaying instore posters promoting the nutritional

Iron found found absorption. 2. Eat Being linked Dr. Charlotte California, Zinc is preserves 3. Boost Due to antibodies chronic

4. Power The protein Muscles building The protein growth

5. Meat Meat contains body cannot isoleucine, threonine, protein.

mg of iron, she would need just 300 grams of cooked bovine

https://www.mmequip.com

6. Eat Meat contains production functioning Say ‘hello’ acid, vitamin The line only apply meat health Facts’ and poultry. education Ronnie P. meat and

Turkey prices have been on the rise with Thanksgiving Day still more than a month away, according to a Texas A&M AgriLife Extension Service expert.

Market forces coupled with a force of nature – avian influenza – have disrupted the supply chain and caused turkey prices to trend upward, leading to shortages for some wholesale buyers.

Wholesale prices for whole turkeys are sky high, said David Anderson, Ph.D., AgriLife Extension economist, Bryan-College Station. Last year, turkeys reached a record high of $1.39 per pound in early November, but that price had climbed $1.79 per pound by Oct. 15, according to U.S. Department of Agriculture data.

Anderson said the primary driver of this increase on already historically pricey whole birds has been bird losses to highly pathogenic bird influenza outbreaks over the past several months. The highly contagious and deadly avian influenza began hitting U.S. poultry production this spring, with the first case in a Texas poultry flock reported on April 2.

The USDA-Animal and Plant Health Inspection Service reported more than 47.45 million commercial poultry birds, including broiler and egg-laying chickens, turkeys and various fowl have been lost to the virus that has been reported in 42 states, including Alaska. The disease has hit hard certain production farms that have egg-laying chicken flocks and turkeys. For this year, turkey production is about 5% less than last year.

“The outbreaks may not be making headlines, but they are popping up here and there still,” Anderson said. “I saw that it wiped out 50,000 turkeys at a farm in California, and it is happening to other poultry farms. These occurrences have dramatically impacted wholesale turkey prices and availability for some businesses.”

DF: I don’t think being on the island has really impacted us negatively one way or the other. We’ve traveled a lot, met a lot of other farmers and livestock producers in other parts of Canada, and we all seem to have the same issues and same concerns.

CMB: I understand that your farm was the first in Atlantic Canada to be involved in the TESA program.

Anderson said the avian flu impact on turkey is especially disruptive because the length of time it takes to grow them – eggs incubate for 28 days and another 10-18 weeks for those hatchlings to reach their harvest weights. That means turkey flocks, and other longer-term poultry like egglaying hens, are at risk of potential exposure to the pathogen. It takes 3.5-5.5 months to replace a flock lost to avian influenza.

Holiday shoppers should not fret, he said, but they should be prepared to buy early or shop around for a Thanksgiving Day centerpiece turkey.

DF: Yes, I think we were the first farm east of Ontario as far as I understand. I’m not sure why the eastern associations wouldn’t have previously nominated anybody because there are many farms here on PEI doing every bit as much as we are as to attain a high level of sustainability. Anyway, we were very surprised when the PEI Cattleman’s Association nominated our farm.

CMB: And then you were attending the Canadian Beef conference in Calgary and you won.

DF: Yeah! That was a very nice moment for us. But I don’t like to use the word win actually. However, being recognized for our commitment was a real honour. If you want to know the truth, it was a pretty humbling experience. As I said to CBC when they phoned me after the conference, I was just floored, really couldn’t believe it.

CMB: So now that you have been recognized, do you think that will draw more attention and garner more nominations out of Atlantic Canada going forward?

The good news is that Anderson is not concerned about a shortage of whole birds for the holidays. Stocked turkey supplies build throughout the year to make sure they are available to major grocers in November. Most grocers have order contracts with suppliers that are set up to a year in advance. Demand from big buyers like major grocers will be the priority when it comes to the available supplies.

DF: Absolutely. We’ve gotten a lot of good press highlighting the island cattle industry. I’m positive you’ll see more farms in our neck of the woods nominated next year. And I have to give the Canadian Cattleman’s Association recognition for choosing a farm from Prince Edward Island. We are small players in the national beef industry and I think it was a real credit to their organization to recognize us. They treated all the nominees royally and it was a real class act. It was a wonderful experience.

Anderson said cold storage stocks of whole turkeys are about 3% lower than last year according to USDA cold storage stocks data, which indicates suppliers are working to meet holiday demand. While the data shows about 13% fewer tom turkeys in storage, there are about 12% more hens in storage.

The price of whole turkeys could be higher at grocery stores, he said, but grocers may also take losses on whole birds as features or specials to entice consumers into stores in the hopes they continue shopping for other items.

Consumer preferences on turkey brand, size, fresh or frozen could all play into the price and availability, Anderson said. But grocers also know consumers might consider other options – a ham or rib roast – and competitive deals by one store could drive others to commit to a more enticing deal.

When it comes to turkey, historically there are two major markets for birds – deli meat and whole birds for the holidays. There is niche demand for turkey legs around fair season and consistent demand for turkey breasts from restaurants, but the bulk of turkey is committed to deli meats and Thanksgiving.

While large grocers and big buyers of turkey may be facing higher prices, the demand for whole birds and turkey breasts amid a continuing avian influenza outbreak is stressing smaller-scale buyers such as local meat markets and restaurants.

“As a consumer, it might be a good idea to have a strategy this year,” he said. “Last year, when prices were high, I went to the store the first day because we wanted a particular size. The store had specials on them then, but then I saw a store had a terrific deal on turkeys the day before Thanksgiving. They had turkeys still on hand and needed to move them., and that translated into lower prices.”

The local deli that brines and bakes its own birds or barbecue joints with smoked turkey are struggling to find wholesale sellers willing to part with stock.

“I’ve had this conversation with multiple mom-and-pop businesses about the wholesale turkey supply,” he said. “It’s not because they’re high priced; it’s that they can’t even get them, and that’s really hurting those smaller buyers.”

By Cam Patterson

By Cam Patterson

Avian Flu (H5N1) is spreading across Canada, with the highest concentration of outbreaks reported on prairie farms and showing no signs of slowing down with over three million birds inflected.

Last week, U.S. new sources reported over 47 million birds were culled or died from the infection which will no doubt have a massive impact on chicken and turkey in grocery store shelves not to mention contributing to already inflationary prices ahead of the approaching holiday season.

Meanwhile in Canada, the virus, while spreading quickly, is largely concentrated to prairie provinces yet will have no less of an impact on import bans, effecting trading stock, and contributing to inflation.

The Canadian Food Inspection Agency (CFIA) maintains the outbreak does not constitute a food safety concern. However the impacts are being felt by a poultry industry hoping for a banner year following weather and COVID pandemic hardship over the last few years.

• Alberta has 28 infected sites with an estimated 1.3 million impacted birds

• British Columbia has 14 infected sites and 230,000 birds

Health Canada has not reported any human infections from the virus. But one in the U.S. and one in the UK has been reported.

Proposed 30,000-square-foot beef abattoir in Cloverdale would be B.C.’s largest such facility

For more information on H5N1 and reported infections visit www.inspection.canada.ca

By Amy Reid, Peace Arch News

By Amy Reid, Peace Arch News

• Manitoba claims 17 infection sites for 289,000 birds

A federally licensed beef processing facility is in the works in Surrey, BC.

• Saskatchewan has 14 sites and 265,000 birds

• Ontario tallies 13 infected sites and 623,000 birds

• New Brunswick has one site and under 100 birds

“There’s a new building coming forward, a new abattoir, I think that’s the French pronunciation of slaughterhouse,” said Councillor Mike Starchuk. “So Surrey will have a newer facility with a better capacity so people will have the ability to not have to ship an animal to Alberta to have it processed. The applications have gone through the Agricultural and Food Sustainability Advisory Committee.”

• Quebec has 8 sites and 300,000 birds

The facility is proposed on a 25-acre property within the Agricultural Land Reserve at 5175 184th St. The planned 30,000-square foot abattoir in Cloverdale would process up to 100 head of cattle per day.

• Newfoundland and Nova Scotia with zero sites and just over 12,000 birds

According to a city report, that would make it larger than any other processing facility in B.C.. But it would still be small by industry standards, compared to the largest meat processing plants in Alberta that process 3,000 heads of cattle per day.

The proposed facility would be fully enclosed and designed

market. It’s certainly not going to be a monstrosity of a plant but it’ll be a big upgrade from the site currently.”

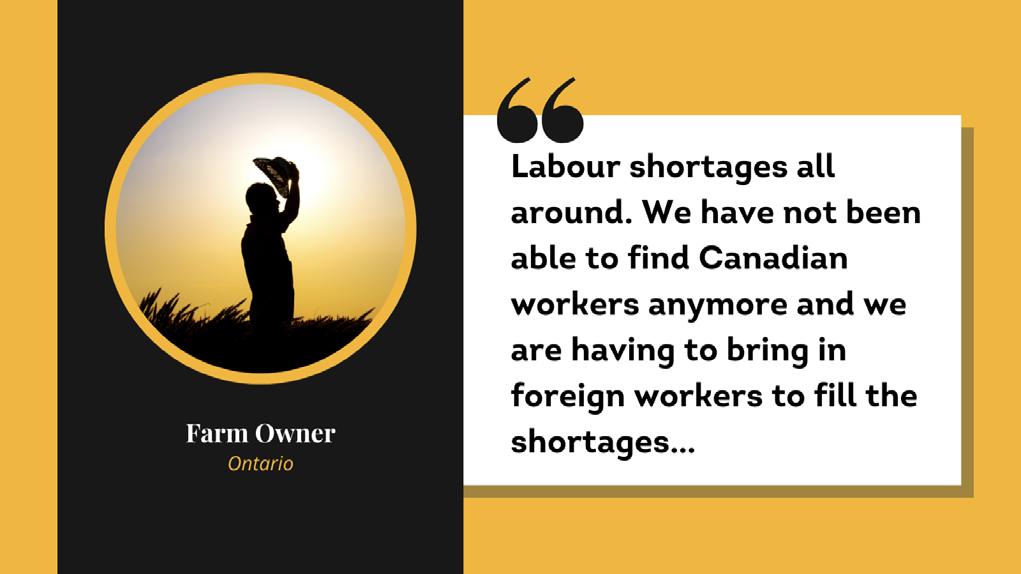

Labour shortages in agriculture have the potential to damage current food productivity, spell trouble for global food security, and will have a severe impact on the future of Canadian agriculture if left unaddressed. Agriculture and Agri-Food Canada (AAFC) is currently developing a sector-specific strategy to address chronic labour shortages in farming and food processing. The Canadian Federation of Independent Business (CFIB) is working with AAFC and urging policymakers to focus on the underlying issues exacerbating chronic labour shortages in agriculture in our upcoming report to be released at the end of October.

In order to keep up with global demands, our hardworking farmers and agri-business owners have resorted to working longer hours, asking current employees to work more hours, and some have even returned to work after retirement to help out.

According to Statistics Canada, there were 189,874 farms, 262,455 farm operators and 242,052 paid employees in Canada as of 2021. That is a lot of labour going into a multi-billion-dollar industry! The Royal Bank of Canada is also estimating there could be 123,000 unfilled jobs in agriculture by 2030. Although the sector is projected to grow, Canadian agriculture cannot reach its full potential without enough labour to support it.

So, what are some of the underlying drivers of labour shortages in agriculture? The first driver is the everincreasing tax burden on agri-businesses. Having to pay excessive taxes on almost every aspect of their business takes away the capital needed to increase efficiency and hire more workers. In a CFIB survey from November 2021, most agri-businesses (70%) have indicated that with a reduced tax burden, their business would invest in more efficient equipment and increase employee compensation with the savings they would generate.

Another driver of the agriculture sector’s chronic labour shortages is the lack of qualified staff. Over half (59%) of agri-business owners have found it difficult to find staff due to the lack of candidates with the necessary skills and experience in agriculture.

“Labour shortages all around. We have not been able to find Canadian workers anymore and we are having to bring in foreign workers to fill the shortages… The government must provide some benefits to encourage people to work. For example, create write-offs for possible work-related expenses like travel, clothing, etc., anything to help.”

Some of the solutions that farmers and agri-business owners have taken upon themselves to alleviate labour shortages include:

• increasing employee wages,

• applying for more Temporary Foreign Worker (TFW) permits and programs,

• hiring once-retired workers, and

• investing in automation.

Although these solutions have helped, they do not work for every type of farm, nor do they provide any permanent relief to chronic labour shortages in agriculture.

Relieving labour shortages is the key to ensuring the industry’s future and global food security. As AAFC works to develop a sector-specific strategy to address chronic labour shortages in farming and food processing, CFIB urges them to focus on the underlying issues contributing to the problem.

If you are a farmer or agri-business owner that relies on labour, keep an eye out for more details on the National Agriculture Labour Strategy and provide your input so we can all support the future of agriculture and ensure food security for Canadians and the rest of the world.

Share your feedback with CFIB by contacting our Business Help Line at cfib@cfib.ca or call 1-888234-2232.

Get involved in our campaign to support Bill C-234 to help support farmers and protect our food supply: https://initiatives.cfib-fcei.ca/en-ca/ saveourfarms

Not a member?

JOIN CFIB today for more help and information.

Taylor Brown is the Policy Analyst, Western Canada & Agri-Business for the Canadian Federation of Independent Business (CFIB). CFIB is Canada’s largest association of small and medium-sized businesses with 95,000 m embers (6,000 agribusiness members) across every industry and region. CFIB is dedicated to increasing business owners’ chances of success by driving policy change at all levels of government, providing expert advice and tools, and negotiating exclusive savings. Learn more at cfib.ca.

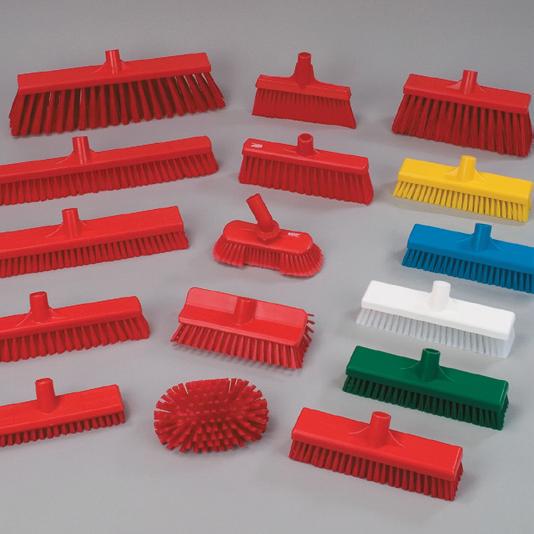

201 Don Park Road Unit 1, Markham, Ontario, L3R 1C2 Phone: 905-470-1135 1-800-465-3536 Fax: 905-470-8417 Website: www.yesgroup.ca email: sales@yesgroup.ca

Remco products are colour-coded to help divide the production cycle into different zones. By identifying these zones as different cleaning areas, the movement of bacteria around the production area can be blocked. No matter what colour-coding plan is implemented, Remco Products from The Yes Group provides significant added value at no additional cost. From scoops to squeegees, from brushes to shovels, we have the products and the colours to enhance any professional quality assurance program.

Our products were developed with the Hazard Analysis Critical Control Point (HACCP) in mind.