FCC: 2022 ECONOMIC YEAR IN REVIEW meatbusinesspro.com $7.99 THE BEEF, PORK & POULTRY INDUSTRY DIGITAL MAGAZINE January 2023 USDA Invests in Projects to Strengthen Meat Supply Chain Global Animal Protein Outlook 2023 Donation to Feeding America Provides 200,000 Meals Government Strengthens Food Security in Communities Across the Country CoBank Releases 2023 Year Ahead Report Heading into Agriculture 2023

2 MEATBUSINESSPRO January 2023 meatbusinesspro.com https://www.yesgroup.ca

5 6 12 14 16 Justine Hendricks named Farm Credit Canada President and CEO FCC: 2022 Economic Year in Review USDA Invests in Projects to Strengthen Meat Supply Chain McDonald's Canada and 4-H Canada Launch National Youth Scholarship Program WTI Joins the National Restaurant Association as an Industry Partne January 2023 Donation to Feeding America Provides 200,000 Meals Government Strengthens Food Security in Indigenous, Remote and Northern Communities Across the Country Global Animal Protein Outlook 2023 CoBank Releases 2023 Year Ahead Report Heading into Agriculture 2023 18 20 22 24 28

https://www.reiser.com

PUBLISHER

Ray Blumenfeld

ray@meatbusiness.ca

MANAGING EDITOR

Scott Taylor publishing@meatbusiness.ca

DIGITAL MEDIA EDITOR

Cam Patterson cam@meatbusiness.ca

CONTRIBUTING WRITERS

Martha Roberts, Justin Sherrard, SeoRhin Yoo, Jack Roberts, Cam Patterson

CREATIVE DIRECTOR

Patrick Cairns

Meat Business Pro is published 12 times a year by We Communications West Inc

JUSTINE HENDRICKS NAMED FARM CREDIT CANADA PRESIDENT AND CEO

As announced recently by Marie-Claude Bibeau, Minister of Agriculture and Agri-Food, Justine Hendricks has been named the next President and Chief Executive Officer (CEO) of Farm Credit Canada (FCC). Hendricks joins FCC from Export Development Canada (EDC), where she currently holds the position of Chief Corporate Sustainability Officer and Senior Vice-President, Sustainable Business and Enablement.

“We have broken another glass ceiling with the arrival of Justine Hendricks at the head of Farm Credit Canada,” stated Minister Bibeau. “Her skills in finance, her expertise in sustainable development and her collaborative leadership makes her an ideal choice for this position.”

CO MMUNICATIONS W EST IN C

We Communications West Inc.

106-530 Kenaston Boulevard Winnipeg, MB, Canada R3N 1Z4

Phone: 204.985.9502 Fax: 204.582.9800 Toll Free: 1.800.344.7055

E-mail: publishing@meatbusiness.ca Website: www.meatbusinesspro.com

Meat Business Pro subscriptions are available for $28.00/year or $46.00/two years and includes the annual Buyers Guide issue.

©2020 We Communications West Inc. All rights reserved.

The contents of this publication may not be reproduced by any means in whole or in part, without prior written consent from the publisher.

Printed in Canada. ISSN 1715-6726

FCC Board Chairperson Jane Halford said, “Justine has significant experience in the financial industry and in leading teams that serve exporters and investors in a wide range of sectors, including agriculture. Her diverse leadership background and fluency in both official languages make her an ideal fit for FCC. Over the years, Justine has focused on innovating EDC’s products and services, including elevating sustainability.”

Hendricks is looking forward to the new role and sees great opportunity for the agriculture and food industry to support economic transition in Canada and across the globe.

“During my time with EDC, I have worked with various sectors from an export perspective on how we can grow and strengthen the Canadian economy,” said Hendricks. “Agriculture is an area of great importance to our economy, and the industry plays a global role in food security. The Canadian food system is wellrecognized around the world for its contributions, and we have an opportunity to do even more. I was attracted to FCC because of the opportunity to be part of the future of the Canadian agriculture and food sector.”

Hendricks will assume the new role on January 30, 2023.

ABOUT FCC

FCC is Canada’s leading agriculture and food lender, with a healthy loan portfolio of more than $44 billion. For more information, visit fcc.ca.

5 meatbusinesspro.com January 2023 MEATBUSINESSPRO

Volume

January 2023

24 Number 1

THE BEEF, PORK & POULTRY INDUSTRY DIGITAL MAGAZINE

FCC: 2022 ECONOMIC YEAR IN REVIEW

By Martha Roberts, Economics Editor, Farm Credit Canad

By Martha Roberts, Economics Editor, Farm Credit Canad

The ever optimistic among us hoped we’d seen the worst COVID impacts. If that were true, a moderation in demand would help to lower inflationary pressures without invoking dramatic monetary intervention from the Bank of Canada (BoC). But with inflation at 5.1% to start the year and the omicron wave underway, it wasn’t clear if that would amount to anything more than wishful thinking.

JANUARY

COVID had unleashed a storm of demand on global markets that had become increasingly costly to supply. As elsewhere, experts believed Canadian rate hikes would happen in 2022, moving the overnight interest rate (OIR) from the then-current 0.25% to end the year at 1.5%. With such hikes, expectations were that inflation would fall to around 3% by December. The economy was humming, doing better than expected, with strong forecasted growth.

There were, however, signs of the forces that would soon dominate headlines. Canadian agrifood producers were getting high commodity prices, realized from the ongoing strength of global demand and leading some to wonder if those prices laid at the root of global food inflation. China was cutting back its outsized influence that had dominated the 2020-21 global agri-food trade, and overall Canadian pork exports were down year-over-year (YoY) as a result. Hog slaughter capacity in eastern Canada had been reduced in response to packers’ COVID-related slowdowns in 2020 and 2021, creating a historically high backlog of hogs in Quebec.

But all that took a back seat with growing reports of Russia amassing troops at Ukraine’s borders.

6 MEATBUSINESSPRO January 2023 meatbusinesspro.com

FEBRUARY

Canada’s job market was strong, with the unemployment rate dropping to 5.5.%, slightly lower than its February 2020 pre-pandemic level. With the omicron restrictions, employment had fallen by 200,000 jobs in January but bounced back with 337,000 jobs in February. Production headwinds had nonetheless appeared in several of Canada’s livestock sectors.

Hog slaughters in Quebec and Ontario were destined to be cut further, putting additional strain on the pace of slaughter needed to clear the backlog noted in January. And Avian Influenza was reported in the eastern region of the U.S. and Canada. Twelve thousand turkeys were culled in Nova Scotia.

APRIL

Although GDP data showed that the Canadian economy grew in the first quarter at a 3.1% annualized rate, things were slowing down. April’s growth was expected to slow from the previous months. But that news took a back seat to more worrying reports. Overall inflation was 6.8%, and food inflation had climbed 8.8% YoY.

Avian influenza was spreading unchecked, with 700,000 birds euthanized to date and the end, not in sight. The outbreak hit Alberta hardest.

Another effect of the war? Investors were turning to the U.S. dollar as a haven in uncertain times and boosting its value relative to the CAD.

MARCH

On March 11, the BoC raised the OIR from 0.25% to 0.50%, and the market speculated that it would end the year as high as 1.75%. Such optimism didn’t last long. By monthend, markets expected the overnight rate to end the year near 2.25%.

The war in Ukraine was hitting the ag sector hard. Diesel prices increased as sanctions on Russian oil triggered short-term increases. Russian fertilizer imports in Eastern Canada slowed due to the West’s economic sanctions, leaving a supply gap and raising fertilizer prices. The market’s uncertainty about the availability of agrifood supplies inflated commodity prices and price volatility.

MAY

It was sinking in Canada-wide that our fears were gaining life. The month’s inflation rate was 7.7%, the highest in nearly four decades.

But it didn’t stop there: More global supply shocks raised food prices. The Russia-Ukraine war was pushing up prices. With forecasts of tighter stocks-to-use ratios for major commodities, Indonesia and India limited or banned exports of key agri-food commodities to secure their domestic supplies. Commodity prices soared. Markets made nervous by tight stocks meant such volatility would continue.

JUNE

At home, the BoC was making decisions few had foreseen. Hiking the rate by 0.5% for the second consecutive month (to 1.5%), they noted more hikes would be needed at the upcoming July 13 meeting. The year-ending OIR was expected to be 3.00% or slightly higher.

8 MEATBUSINESSPRO January 2023 meatbusinesspro.com

JULY

The long arm of COVID was receding in some livestock markets. Canada’s poultry producers recorded increased production due to three factors: a recovery from the COVID-led demand slowdown; chicken was a favourable purchase point relative to other meats; and a slowdown in imports from the U.S.

Q2 GDP numbers showed that the Canadian economy grew at an annualized rate of 3.3%, higher than Q1 (3.1%). Nonetheless, Canadian retail sales were down 2.5% from June to July, mostly driven by lower gasoline sales. Despite this slowdown in retail sales, the BoC delivered a supersized rate increase of 100 bps.

AUGUST

New OECD projections to 2031-32 supported suspicions that crop prices had peaked in the 2021-22 MY. They were expected to stabilize within the 2022-23 MY, although at higher levels than before the pandemic. While increased costs of production would keep them elevated, they were able to retreat from the highs of 2021-22, pressured lower by slightly improving stocksto-use ratios and the resolution of some of the worst logistics bottlenecks that arose during COVID.

With the latest CPI data showing inflation at 7.6% YoY in July, it had become clear that inflation was going to be that unwelcome guest who wouldn’t leave. Prices were expected to continue increasing, although at a slower pace than in the last 12 months.

9 meatbusinesspro.com January 2023 MEATBUSINESSPRO

SEPTEMBER

Hurricane Fiona landed on the east coast on September 24. The storm was the strongest hurricane and one of the wettest ever recorded in Canada. Massive damage was sustained across sectors, including dairy, potatoes, corn, greenhouses and fisheries.

Avian influenza re-emerged in Eastern Canada with the first case in four months. It was worse in the West. The disease had impacted 1.1 million birds in Alberta alone by September 27. More than 2.5 million birds had been disposed of across Canada.

The BoC hiked the overnight rate by 50 bps, but inanticipation of a 75 bps increase in the U.S. federal funds rate, the Canadian dollar continued to fall against the greenback. By October, it had lost 10% against the USD on the year, making U.S. imports increasingly more expensive.

OCTOBER

Transportation challenges were top-of-mind in Canada and south of the border as the possibility of a U.S. rail strike loomed and water levels fell in the Mississippi River - where 92% of U.S. ag exports pass. With transport costs soaring, Canadian producers were facing a dual-edged sword. The forecast of little rainfall for the river basin could mean a boost in Canadian crop exports, but input prices for Canadian farms and businesses could increase if the slowdowns weren’t resolved.

NOVEMBER

The year was perhaps best characterized as one of extreme price volatility, and it was back in the news. On October 29, Russia suspended the grain movement deal with Ukraine, resulting in swift commodity price increases. However, within several days, Russia reentered the deal, and futures dropped. On November 17, the deal was extended for four months.

The federal government unveiled the details of a $1.7 billion package to compensate the supply-managed sectors resulting from the impacts of the Canada-United States-Mexico Agreement (CUSMA), with payments starting in early 2024.

10 MEATBUSINESSPRO January 2023 meatbusinesspro.com

DECEMBER

Price volatility in agricultural commodities has calmed as winter has approached. That means prices could be more stable through to spring. At home, there was good news for farm revenues. Crop receipts were up 7.3% in the first nine months of this year relative to 2021. And with a much better 2022 crop in the Prairies, receipts will climb much higher in Q4.

Although livestock receipts increased 11.6% over the first nine months, the positive trend in gross income was muted by the large input cost increases recorded throughout the year. The BoC lifted its overnight rate to 4.25%, but we think borrowing costs overall are about to plateau for most of 2023 and that overall farm input inflation should moderate considerably.

11 meatbusinesspro.com January 2023 MEATBUSINESSPRO VEMAG REPLACEMENT PARTS https://www.dhenryandsons.com

USDA INVESTS IN PROJECTS TO STRENGTHEN MEAT SUPPLY CHAIN

U.S. Department of Agriculture (USDA) Secretary Tom Vilsack has announced the current administration will be investing $9.6 million across the country and taking several other steps to help farmers, ranchers, processors and rural businesses diversify the nation’s meat supply.

“USDA is putting the needs of farmers, ranchers and consumers at the forefront of the Biden-Harris Administration’s work to strengthen the resiliency of America’s food supply chain while promoting competition,” Vilsack said. “USDA has undertaken a department-wide approach to coordinate ways to deliver more opportunities and fairer prices for producers, to give people access to healthier foods, eliminate bottlenecks in the food supply chain and ultimately lower prices for consumers.”

Secretary Vilsack announced 25 new investments to increase independent meat processing capacity.

The Department is awarding 23 Value Added Producer Grant program grants totaling $3.9 million to help producer-owned companies process and market new products. USDA is also providing guarantees for a total of $5.7 million in loans to two companies through the Food Supply Chain Guaranteed Loan Program using American Rescue Plan funding. This program supports new investments in infrastructure for food aggregation, processing, manufacturing, storage, transportation, wholesaling and distribution.

Through these two programs, USDA is investing in 25 projects in California, Illinois, Iowa, Kansas, Kentucky, Maine, Montana, Nebraska, New York, Ohio, Oklahoma, Texas, Virginia, Washington and Wisconsin.

BELOW ARE SOME EXAMPLES OF HOW THE FUNDING WILL BE USED:

• Bottomland Prime LLC will use a $4.95 million Food Supply Chain Guaranteed Loan to acquire and expand Edes Custom Meats (“Edes”). Edes is a cattle meat processing and retail outlet in Amarillo, Texas. Bottomland Prime projects its business will include custom USDA-inspected processing for local producers and specialty markets, as well as local retail sales of beef cuts, sausage, jerky, pork and lamb. In addition, it will include wholesale markets through different convenience stores and cold storage services.

• In Kents Store, Virginia, Gillispie’s County Line Farm LLC is receiving a $44,000 Value Added Producer Grant to support the processing of pasture-raised chickens, beef cattle and hogs into individually cut and processed poultry, beef and pork products. The farm will sell the meat directly to retail consumers online and through farm sales. Gillispie’s also plans to hire new employees to assist with processing and sales labor, and expand its marketing activities to reach a larger customer base.

• Todd Family Meats in Big Timber, Montana, is receiving a $48,173 Value Added Producer Grant to increase its production of packaged beef and lamb to meet growing demand. The family-owned company also will use the funds for marketing, packaging and processing.

12 MEATBUSINESSPRO January 2023 meatbusinesspro.com

Secretary Vilsack also highlighted some of USDA’s accomplishments to date to support meat producers, promote competition and strengthen local and regional food supply chains. Last January, Secretary Vilsack joined President Biden at the White House to launch the Biden-Harris Action Plan for a Fairer, More Competitive, and More Resilient Meat and Poultry Supply Chain — part of USDA’s efforts to implement President Biden’s Executive Order on Promoting Competition in the American Economy.

He noted that under the leadership of the Biden-Harris Administration, USDA’s Agricultural Marketing Service (AMS) has provided $54.6 million to 278 businesses and individuals through the Meat and Poultry Inspection Readiness Grant Program (MPIRG) for strengthening and developing new market opportunities for U.S. meat and poultry processors.

To further these efforts, AMS also invested up to $25 million to establish the Meat and Poultry Processing Capacity Technical Assistance Program (MPPTA). This program consists of a nationwide network to ensure that participants in USDA’s Meat and Poultry Supply Chain initiatives have access to a full range of technical assistance to support their project development and success.

Facility improvements and expansions funded through MPIRG will help processors obtain a Federal Grant of Inspection or qualify for a state’s Cooperative Interstate Shipment program. Achieving a Federal Grant of Inspection or operating under a Cooperative Interstate Shipment program allows meat and poultry processors to ship products across state lines, develop new markets, increase capacity, and better meet consumer and producer demand along the supply chain. USDA also invested in efforts to strengthen its local and regional food supply chain with the Local Food

Promotion Program (LFPP). LFPP grants support local and regional food business enterprises that engage as intermediaries in indirect producer-to-consumer marketing. Projects that receive funding through LFPP focus on activities such as supporting the processing, aggregation, distribution and storage of local and regional food products; developing value-added products; and aiding regional food chain coordination.

Under the Biden-Harris Administration, Rural Development provides loans, grants and loan guarantees to help expand economic opportunities, create jobs and improve the quality of life for millions of Americans in rural areas. This assistance supports infrastructure improvements; business development; housing; community facilities such as schools, public safety and health care; and high-speed internet access in rural, Tribal and high-poverty areas. For more information, visit www.rd.usda.gov.

USDA touches the lives of all Americans each day in so many positive ways. Under the Biden-Harris Administration, USDA is transforming America’s food system with a greater focus on more resilient local and regional food production, promoting competition and fairer markets for all producers, ensuring access to safe, healthy and nutritious food in all communities, building new markets and streams of income for farmers and producers using climate-smart food and forestry practices, making historic investments in infrastructure and clean energy capabilities in rural America, and committing to equity across the Department by removing systemic barriers and building a workforce more representative of America.

For more information, visit www.usda.gov

13 meatbusinesspro.com January 2023 MEATBUSINESSPRO

MCDONALD'S CANADA AND 4-H CANADA LAUNCH NATIONAL YOUTH SCHOLARSHIP PROGRAM

$80,000 in scholarship awards over two years will help 4-H youth leaders advance important work and educational pursuits in agriculture and sustainability

McDonald's Canada and 4-H Canada recently announced the launch of the National Youth Scholarship program as a part of the next iteration of a longstanding relationship between the two organizations. As part of this partnership, sixteen scholarships totaling $80,000 will be awarded over two years to senior youth leaders from coast to coast to coast and will be aimed at advancing important work in sustainability and educational pursuits in agriculture.

"McDonald's Canada wouldn't be who we are today without Canadian farmers, ranchers and growers" said Gemma Pryor, Senior Director, Canada Impact Team, McDonald's Canada. "McDonald's World Famous Fries come from 100 per cent Canadian potatoes. Our menu is filled with iconic burgers made from 100 per cent Canadian beef. Your favourite McMuffin always comes with a freshly cracked Canada Grade A egg. And those are just a few examples. This new National Youth Scholarship program in partnership with 4-H Canada will help advance educational pursuits in agriculture across Canada and help support the next generation of Canadian farmers."

4-H Canada is empowering youth to be responsible, caring and contributing leaders that affect positive change in the world around them. The Leadership Development Pillars of 4-H Canada -Sustainable Agriculture & Food Security, Science & Technology, the Environment & Healthy Living, Community Engagement & Communications - are all areas that are incredibly relevant and important to the current generation of youth, and which align with the concerns of Canada's government, global community, and McDonald's Canada.

"Through the generosity of McDonald's Canada, we have an opportunity to empower youth leaders in achieving their educational goals," said Shannon Benner, 4-H Canada CEO. "This partnership ensures youth are given meaningful support to pursue studies to build a sustainable future, and explore subject matter important to them as global citizens."

14 MEATBUSINESSPRO January 2023 meatbusinesspro.com

McDonald's Canada works with partners and suppliers who align with its values to help build a thriving, resilient food system, and sources ingredients like Canada Grade A eggs, potatoes, dairy, and beef from nearly 50,000 Canadian farms.

NSF International in Canada recently launched a new website - www.nsfcanada.ca - to give Canada’s growing and complex food and beverage industry easy access to the global public health organization’s expertise and services in Canada. The website combines information on the depth, experience and capabilities of the NSF International Canadian office with access to NSF International’s global services dedicated to food safety and quality.

The McDonald's Canada and 4-H Canada National Youth Scholarships will be awarded in 2023 and 2024. During this time, the partnership will also see McDonald's Canada joining the 4-H Canada Leadership Awards as a Supporting Sponsor.

The 4-H Canada website will be updated when scholarship applications open in 2023.

Evolving regulations across countries and increasing complexities associated with a globalized food supply network present challenges for NSF International clients in Canada and around the world. The new Canadian website offers expertise and services to help companies navigate these challenges, including certification and auditing, consulting, technical services, training and education, food and label compliance, packaging, and product and process development.

NSF International’s Canadian website provides information on the following services:

For over 100 years, 4-H Canada has been one of the most highly respected positive youth development organizations in Canada. 4-H in Canada has over 16,000 members and more than 5,700 volunteer leaders. Our goal is to help young Canadians "Learn To Do By Doing" in a safe, inclusive and fun environment. We believe in nurturing responsible, caring and contributing youth leaders who are committed to positively impacting their communities across Canada and around the world. To learn more, visit 4-h-canada.ca and follow our Facebook, Twitter and Instagram pages.

accredited International Association for Continuing Education and Training (IACET) site. Topics include HACCP, food safety and quality, GFSI benchmarked standards, regulations (including FSMA), food science, food packaging, food microbiology and ISO standards. Training modalities include eLearning, on-site, customized and open enrolment.

Additionally, the website includes information about management system registrations for the food, automotive, environmental, information security, medical devices, aerospace and chemical industries, as well as for Ontario drinking water programs.

Visit the new Canadian website at www.nsfcanada.ca to review the food safety services capabilities video, find a list of Canadian food experts, learn about upcoming events and global news releases, submit a question or read an FAQ.

In 1967, Canada welcomed the first McDonald's restaurant to Richmond, BC. Today, McDonald's Restaurants of Canada Limited has become part of the Canadian fabric, serving more than one million guests every day. In both franchised and corporate-owned restaurants, nearly 100,000 people are employed from coast to coast to coast, and more than 90 per cent of McDonald's 1,400 Canadian restaurants are locally owned and operated by independent franchisees. Of the almost $1 billion spent on food, more than 85 per cent is purchased from suppliers in Canada. For more information on McDonald's Canada, visit mcdonalds.ca.

Certification & auditing: Third-party food safety audits and certifications, which are integral components of supplier selection and regulatory compliance. Accurate audits are the first step toward successful verification of a company’s food safety system, providing improved brand protection and customer confidence. Certifications and audits are available for animal and produce in the agriculture industry, GFSI certification and management system registration.

Consulting: A full-service team approach providing technical resources, expertise and insight for a wide range of food safety and quality services. NSF International provides finished product inspection testing for food, packaging and non-food testing for rapid analysis and insight to protect the brand, technical support services from on-site temporary or permanent technical staffing placements, and various types of consulting.

Technical services: A one-stop solution for food product compliance and formulation, from concept to finished product, including food and label compliance, packaging, product and process development, and shelf-life and product evaluation.

Training and education: Training for the global food and beverage industry across the supply chain as an

15 meatbusinesspro.com January 2023 MEATBUSINESSPRO

September/October 2017 CANADIAN MEAT BUSINESS 23 meatbusiness.ca YesGroup_CanadianMeatBusiness-Qtr-pg.pdf 1 2014-05-16 1:20:17 PM

INTERNATIONAL FOCUSES

CANADIAN FOOD INDUSTRY WITH NEW WEBSITE FOR SERVICES

Global public health organization showcases services for

growing and fast-changing https://www.yesgroup.ca ABOUT 4-H CANADA

NSF

ON

IN CANADA

Canada’s

ABOUT MCDONALD'S CANADA

WTI JOINS THE NATIONAL RESTAURANT ASSOCIATION AS AN INDUSTRY PARTNER

WORLD TECHNOLOGY INGREDIENTS, INC. (WTI), a leader in the functional food industry for more than 30 years, has announced that it has joined the National Restaurant Association’s Industry Partner Group.

“WTI is invested in the well-being of the restaurant and foodservice industries,” said Ralf Ludwig, Owner and President of WTI. “We drive innovation in food safety and provide simple, clean and safe ingredients that ensure that the food we eat each day is safe.”

WTI specializes in naturally-derived vinegar-based antimicrobials that improve shelf-life and reduce food waste; inhibit the outgrowth of pathogens, including Listeria monocytogenes and Clostridium spp.; control yeast and mold growth; and, enhance food quality and eating experience.

“One of the most important things the National Restaurant Association does is to bring the industry together. We couldn't accomplish this without Industry Partners like WTI,” said Allison Rhyne, vice president of Development for the National Restaurant Association and National Restaurant Association Educational Foundation, “As providers of services, supplies, technology, ingredients, equipment, and financial support, Industry Partners are extensions of the restaurant community. Industry Partners are essential to the success of the $899 billion-a-year restaurant and foodservice industry.”

As an Industry Partner, WTI also supports to the philanthropic efforts of the National Restaurant Association Educational Foundation (NRAEF) and its mission to enhance industry workforce training and education, career development, and community engagement efforts.

WTI has been leading the functional food ingredient industry for over 30 years, producing naturally derived, patented, and performance-validated food ingredients that are simple, clean, and safe. The global company is headquartered in Jefferson, GA with a subsidiary in Germany. For more information, visit www.wtiinc.com.

Founded in 1919, the National Restaurant Association is the leading business association for the restaurant industry, which comprises nearly 1 million restaurant and foodservice outlets and a workforce of 14.5 million employees. For more information, visit Restaurant.org and find @WeRRestaurants on Twitter, Facebook and YouTube.

16 MEATBUSINESSPRO January 2023 meatbusinesspro.com

ABOUT WORLD TECHNOLOGY INGREDIENTS, INC.

ABOUT THE NATIONAL RESTAURANT ASSOCIATION

https://www.beaconmetals.com

DONATION TO FEEDING AMERICA PROVIDES 200,000

Over this past holiday season, the North American Meat Institute (NAMI) announced a donation to Feeding America that will provide 200,000 meals for families facing hunger. The donation is made possible through Meat Institute sponsors’ generous support, including through sponsorship of the Protein PACT for the People, Animals & Climate of Tomorrow.

Through the Protein PACT, the Meat Institute has committed that it will work with the U.S. Department of Agriculture and Feeding America to help measure and fill by 2025 the “protein gap” - the difference between the high-quality meat food banks and charities need and what they are able to safely receive, store, and distribute.

Meat Institute President and CEO Julie Anna Potts stated, “The Protein PACT represents our firm commitment to ensuring meat will sustain generations to come, including by acting urgently to meet the needs of families facing hunger now. Meat Institute members are among the nation’s leaders in action to end hunger, and we will continue taking every step to support that mission.”

The Meat Institute, its members and sponsors, and Protein PACT partners across animal agriculture share a common commitment to ending hunger, as highlighted in Protein PACT input provided for the October 2022 White House Conference on Hunger, Nutrition, and Health.

EXAMPLES OF PROTEIN PACT PARTNERS’ CONTRIBUTIONS INCLUDE:

• The American Feed Industry Association (AFIA) made a donation to Feeding America supporting an additional 5,000 meals.

• The Beef Alliance and the U.S. Roundtable for Sustainable Beef are involved with the non-profit Beef Sticks for Backpacks (BSFB), whose mission is to produce and donate beef sticks to children facing food insecurity in Colorado. Since 2019, BSFB has provided more than 1.25 million beef sticks to children facing hunger. Each one-ounce beef stick contains 8 grams of protein and is produced by students at Colorado State University in their USDA facility.

18 MEATBUSINESSPRO January 2023 meatbusinesspro.com

The Meat Institute this year took the major step of designating food security as a non-competitive issue and created a new food security committee to facilitate information sharing and implementation of sector-wide best practices.

NEW SURREY

BFSB partners like the Food Bank of the Rockies and Totes for Hope get enough beef sticks for every food bag at no cost, and BSFB aims to increase production from the current 20,000 sticks per week to 30,000 sticks per week in order to provide beef sticks to every food bag program throughout Colorado.

SLAUGHTERHOUSE

‘WOULD OPEN DOOR’ TO NEW BEEF MARKETS

ABOUT THE NORTH AMERICAN MEAT INSTITUTE

Proposed 30,000-square-foot beef abattoir in Cloverdale would be B.C.’s largest such facility

By Amy Reid, Peace Arch News

• The National Pork Board, on behalf of pig farmers, aims to double the industry’s national giving by 2030 to help feed more food insecure people and bolster the overall health of rural communities, which often face higher food insecurity rates than the national average.

A federally licensed beef processing facility is in the works in Surrey, BC.

“There’s a new building coming forward, a new abattoir, I think that’s the French pronunciation of slaughterhouse,” said Councillor Mike Starchuk. “So Surrey will have a newer facility with a better capacity so people will have the ability to not have to ship an animal to Alberta to have it processed. The applications have gone through the Agricultural and Food Sustainability Advisory Committee.”

• The U.S. dairy sector increased dairy distributed in food banks by 50% from 2019 to 2021, and the Innovation Center for U.S. Dairy’s food security taskforce is working to rally industry for an additional 50% increase by 2025, aiming to reach 1 billion pounds of dairy distributed.

The facility is proposed on a 25-acre property within the Agricultural Land Reserve at 5175 184th St. The planned 30,000-square foot abattoir in Cloverdale would process up to 100 head of cattle per day.

Meat Institute members have announced more than $9 million in food security donations in 2022 alone, including to build and expand infrastructure to safely store and package fresh meat. An index of Meat Institute members’ efforts to end hunger is available here.

According to a city report, that would make it larger than any other processing facility in B.C.. But it would still be small by industry standards, compared to the largest meat processing plants in Alberta that process 3,000 heads of cattle per day.

The proposed facility would be fully enclosed and designed

The Meat Institute is the United States’ oldest and largest trade association representing packers and processors of beef, pork, lamb, veal, turkey, and processed meat products. NAMI members include more than 350 meat packing and processing companies, the majority of which have fewer than 100 employees, and account for more than 95 percent of the United States’ output of meat and 70 percent of turkey production.

so as to not emit odours. And while there is an operational 6,000-square-foot abattoir on the property now, it’s can only process a limited number of cattle.

Chris Les is general manager of Meadow Valley Meats, the company behind the project. Meadow Valley Meats is seeking a Canadian Food Inspection Agency license for the proposed abattoir, to become a federally registered meat establishment and expand the operation. This would allow the meat products to be transported beyond B.C.’s boundaries.

ABOUT THE PROTEIN PACT

The Protein PACT unites partners across animal protein in the first-ever joint effort to accelerate the entire animal protein sector’s progress toward global sustainable development goals for healthy people, healthy animals, healthy communities, and a healthy environment. To learn more, visit www.TheProteinPACT.org.

“Our focus is on trying to bring a more efficient, sustainable local product to the market, realizing we can do that now in a very limited sense,” said Les. “I caution people when talking to them and they say, ‘What a big plant, that’s going to go allow you to go mainstream.’ Well, yes, if you look in the context of B.C., but this is still a very niche plant and we’ll serve a niche industry for producers and for the market. It’s certainly not going to be a monstrosity of a plant but it’ll be a big upgrade from the site currently.”

https://www.tcextrade.com

19 meatbusinesspro.com January 2023 MEATBUSINESSPRO

Continued on page 32

GOVERNMENT STRENGTHENS FOOD SECURITY IN INDIGENOUS, REMOTE AND NORTHERN COMMUNITIES ACROSS THE COUNTRY

The Canadian Government has announced support for up to 79 new projects across the country that promote food security in Indigenous, remote and Northern communities under the fourth phase of the Local Food Infrastructure Fund (LFIF).

These community-led projects aim to have an immediate and long-lasting impact on food systems in communities that are experiencing the highest food insecurity, by improving processing, production and distribution capacity at the local level.

In total, up to $19.5 million will be invested, with between $100,000 and $500,000 per project. Of the 79 projects announced today, 56 are Indigenous-led, totaling up to $15.1 million.

Marie-Claude Bibeau, Minister of Agriculture and Agri-Food stated “Indigenous, remote and Northern communities are particularly vulnerable because of the higher cost of living and other geographic, social and economic factors. With these challenges, it is more important than ever to support food systems in these communities in the long term.”

20 MEATBUSINESSPRO January 2023 meatbusinesspro.com

In Morley, Alberta, for example, Stoney Nakoda Nations will receive up to $216,593 to purchase mobile food preparation equipment and infrastructure for raising chickens, gardening and fishing. This project will allow the community to create workshops to teach members about traditional food preparation and food waste reduction.

In Quesnel, British Columbia, Nazko First Nation will receive up to $260,746 to purchase a new greenhouse and canning equipment, create new garden beds, and install a new community kitchen and an outdoor smokehouse. This project will enhance community food production and serve as a teaching space for community members to learn traditional preservation methods to pass on for generations.

QUICK FACTS

• Since it was first launched in August 2019, LFIF has committed $56.1 million to supporting 900 growthgenerating food security projects across Canada, such as: community gardens and kitchens; refrigerated trucks and storage units for donated food; greenhouses in remote and Northern communities; and more. Of this total, LFIF has supported 180 projects led by Indigenous organizations for up to $21.4 million in approved funding.

• This announcement of up to 79 approved projects follows the official launch of the fourth phase of LFIF on March 23, 2022. In this phase, funding for each project ranges from $100,000 to $500,000 to support larger initiatives that will have a long-term impact in communities.

THE BEST DEFENSE A STRONG OFFENSE

• Projects and final funding are subject to negotiation of a contribution agreement. To date, contribution agreements are completed for 60 LFIF projects under the fourth phase of the program with more to follow in the coming weeks.

PROMOTING THE HEALTH BENEFITS

By Ronnie P. Cons

Red meat is often wrongly portrayed as being unhealthy. some in the media as unhealthy or not environmentally friendly.

• LFIF complements other ongoing federal efforts to address food security in Indigenous, remote and Northern communities, including through Nutrition North Canada.

Vegan, fish and other non-meat diets have been proposed as healthier alternatives. The result of this onslaught of negative meat messages has influenced many families to cut back on their meat and poultry purchases. Perceptions may reality but truth trumps misinformation. Parents and other consumers want what is best for their health and that of their families. They are also aware that a lot of false information is out there and as such, are open to scientific facts that can correct their misconceptions.

• In April 2020, $25 million was provided to Nutrition North Canada to increase the subsidy rate and reduce the cost of much-needed nutritious food and personal hygiene products in 122 Northern and isolated communities.

• Budget 2021 committed $163.4 million to expanding the Nutrition North Canada program and enabling the Minister of Northern Affairs to work directly with Indigenous partners, including in Inuit Nunangat, to strengthen local food systems and community-led food security initiatives.

This provides an opportunity for retail meat departments to implement an instore ‘Healthy Meat Facts’ nutritional campaign to set the record straight and convince their customers that meat and poultry are actually good for one’s health and that they should increase rather than decrease their purchases of it. The campaign outlined below can have a direct impact on sales: Start by displaying instore posters promoting the nutritional value of meat. They should be innovative, eye catching and be designed to specifically contradict any meat myths. The comments should all be literature based quoting research papers or MDs for maximum effect. Various posters should be made - each with a brief but powerful message covering one theme.

Posters can convey the following healthy meat fact messages:

1. Let’s IRON out the Truth on Meat! “You would need to eat a massive amount of spinach to equal (the iron content) in a steak,” says Christopher Golden, an ecologist and epidemiologist at Harvard University in Cambridge, Massachusetts. (As quoted by nature.com in the article ‘Brain food- clever eating’.)

For a woman to receive her recommended daily intake of 18 mg of iron, she would need just 300 grams of cooked bovine

liver, 625 spinach. Iron found found in absorption.

2. Eat Meat Being deficient linked with Dr. Charlotte California, Zinc is preserves 3. Boost Due to antibodies chronic 4. Power The protein Muscles building The protein growth

5. Meat Meat contains body cannot isoleucine, threonine, protein.

6. Eat Meat Meat contains production functioning Say ‘hello’ acid, vitamin The line only apply meat health Facts’ nutritional and poultry. education Ronnie P. meat and

https://www.mmequip.com

21 meatbusinesspro.com January 2023 MEATBUSINESSPRO

22 CANADIAN MEAT BUSINESS September/October 2017

GLOBAL ANIMAL

PROTEIN OUTLOOK 2023: DECIDING HOW TO GROW AMID CHALLENGES AND OPPORTUNITIES

By Justin Sherrard, Global Strategist, Rabobank

Even though global animal protein production is expected to grow modestly in 2023, it will be another year of change for the sector. The industry will face high costs along the full supply chain, swings in consumption, and other areas of uncertainty for producers, such as elevated disease pressure and regulatory and market-driven changes. As a result, margins will be squeezed as buyers push back on higher production costs. But opportunities still exist, although they will be more restricted.

GLOBAL SUMMARY

We see growth favoring value-for-money products, efficient producers and processors, agile companies, exporters advantaged by FX movements, and biosecure producers.

“Some animal protein companies will see 2023 as a year to recalibrate their growth expectations and plans,” says Justin Sherrard, Global Strategist – Animal Protein. “Some companies will maintain a near-term focus and strengthen agility so they can roll with the cyclical changes. Other animal protein companies will focus on longer-term growth and start investing and positioning for success given the structural changes ahead.”

The overall trend for 2023 is for production growth to slow further, with small gains in some regions but contraction in others for the main terrestrial species. Slow growth is expected in China across all species groups, and ongoing growth is expected in Brazil and Southeast Asia. Oceania will experience slow growth, while North American and European production will contract.

Aquaculture leads global growth across the species groups, once again, and its continuing expansion is supported by its relative independence from agri commodity prices. Poultry is set to maintain its consistent growth pattern, wild catch is set to expand slightly, beef production will decline slightly, and pork will see a decline.

Some key points from the outlook for animal protein in 2023

NORTH AMERICA

Beef will contract as the US cycle turns and enters a multiyear decline, and poultry will expand on strong demand, despite disease pressure, while pork stabilizes. Europe

Production will come under pressure for all species, on disease risks, market and regulatory-driven changes, and reduced exports. Consumption is expected to hold steady, with poultry benefiting while pork and beef will decline slightly.

China

Pork production will see marginal growth, with foodservice restrictions still suppressing demand. Poultry is expected to expand slightly, held back by high costs and uncertainties. Beef will ease.

BRAZIL

Beef production will continue to expand, supported by exports. Chicken and pork production are also set for expansion and export gains.

22 MEATBUSINESSPRO January 2023 meatbusinesspro.com

SOUTHEAST ASIA

Pork production is expected to recover in Vietnam and the Philippines as ASF risks recede. Poultry production is also expanding, slowly, as demand channels continue to recover.

DF: I don’t think being on the island has really impacted us negatively one way or the other. We’ve traveled a lot, met a lot of other farmers and livestock producers in other parts of Canada, and we all seem to have the same issues and same concerns.

CMB: I understand that your farm was the first in Atlantic Canada to be involved in the TESA program.

AUSTRALIA & NEW ZEALAND

Australia’s beef and sheepmeat production is expected to expand on the back of herd/ flock dynamics. In New Zealand, however, beef and sheepmeat production is expected to decline on market pressure.

SALMON

DF: Yes, I think we were the first farm east of Ontario as far as I understand. I’m not sure why the eastern associations wouldn’t have previously nominated anybody because there are many farms here on PEI doing every bit as much as we are as to attain a high level of sustainability. Anyway, we were very surprised when the PEI Cattleman’s Association nominated our farm.

A strong retail presence will support prices in 2023, despite weakening macroeconomic fundamentals.

CMB: And then you were attending the Canadian Beef conference in Calgary and you won.

SHRIMP

Supply remains strong, despite lower prices and higher costs. Ecuador and Latin America are expected to continue driving farmed shrimp supply in 2023.

FISH MEAL AND FISH OIL

DF: Yeah! That was a very nice moment for us. But I don’t like to use the word win actually. However, being recognized for our commitment was a real honour. If you want to know the truth, it was a pretty humbling experience. As I said to CBC when they phoned me after the conference, I was just floored, really couldn’t believe it.

Prices of competing commodities support prices for both, which may ease slightly in 2023.

CMB: So now that you have been recognized, do you think that will

ALTERNATIVE PROTEIN

2023 will be a year of consolidation. The recent stellar growth of plant-based products is on hold, and investors are shifting focus.

Prince Edward Island. We are small players in the national beef industry and I think it was a real credit to their organization to recognize us. They treated all the nominees royally and it was a real class act. It was a wonderful experience.

For more information, view this report at https://research.rabobank.com/far/en/sectors/ animal-protein/ap-outlook-2023.html

https://www.yesgroiup.ca

23 meatbusinesspro.com January 2023 MEATBUSINESSPRO September/October 2017 CANADIAN MEAT BUSINESS 17 meatbusiness.ca

COBANK RELEASES 2023 YEAR AHEAD REPORT –FORCES THAT WILL SHAPE THE U.S. RURAL ECONOMY

The U.S. economy still has considerable momentum and is not currently on the verge of recession. However, economists have never been more pessimistic and there are very legitimate reasons for concern. Over the past half century, inflation above 5% has never been tamed without incurring a recession. That portends a painful yet necessary chain of events will unfold in 2023, according to a comprehensive year-ahead outlook report from CoBank’s Knowledge Exchange.

“As financial conditions continue to tighten, we expect the U.S. economy will steadily soften through the first half of 2023, ushering in a brief, modest recession,” said Dan Kowalski, vice president of CoBank’s Knowledge Exchange. “The unemployment rate could rise as high as 5%, indirectly leading to a decline in consumer spending. Without this softening in the labor market and the associated slowing of wage gains and spending, it will be difficult to stabilize prices.”

The CoBank 2023 outlook report examines several key factors that will shape agriculture and market sectors that serve rural communities throughout the U.S.

GLOBAL ECONOMY: NO ESCAPING THIS SLOWDOWN

After two years defined by a strong economic rebound from the pandemic, the global economy will sputter in 2023. A persistent energy crisis in Europe, China’s messy exit from zero-COVID and higher interest rates globally will reduce world economic growth to a crawl. Europe, likely already in recession, will muddle through the winter with sufficient energy supplies. China, much less impacted by Russia’s invasion of Ukraine, will continue to struggle with the impacts of COVID. Greater Asia will be negatively impacted by sliding global demand for goods. Emerging markets will keep the global economy growing in 2023 as advanced economies collectively will be stagnant and could even shrink.

U.S. ECONOMY: SOME PAIN IS NECESSARY

The labor market remains very tight, consumers are still spending aggressively, and corporate profit margins have hit record levels despite high inflation. If a recession is coming, it will take several months for these factors to reverse course, delaying any potential recession until at least Q2 2023. Even then, it is unclear how readily businesses would lay off workers after experiencing such extreme staffing challenges over the past two years. The structural loss of more than 2 million workers since 2020 is contributing to higher inflation for both goods and services. However, the void that their exit has left could also cushion the economy from the worst of a downturn in 2023.

24 MEATBUSINESSPRO January 2023 meatbusinesspro.com

https://www.cfib.ca

MONETARY POLICY: MORE TOUGH DECISIONS AHEAD

The Federal Reserve’s job will not get any easier in 2023. In nine months, the Fed has raised its federal funds rate from zero to more than 4%. Now, as some economists argue that inflation is falling and the Fed has done enough, Chair Powell and the Federal Open Market Committee will make even tougher decisions about when to halt rate increases. The trickiest aspect of the Fed’s inflation fight is that there is no playbook or rule of thumb to tell the Fed when to pause rate hikes. The Fed’s preferred inflation measure, the personal consumption expenditures index, has fallen from its peak of 7% to 6%. That’s still much too high for the Fed’s comfort and Chair Powell has said that there is greater risk in stopping too early than raising rates for too long.

U.S. GOVERNMENT: UNIQUE MIDTERM RESULTS MUDDY FARM BILL’S PATH

The 118th Congress will convene in January marking the official beginning of the Farm Bill reauthorization effort. With a Sept. 30 sunset for the current Farm Bill, Congress will have just nine months to complete the enormous task of passing the next bill. As the reauthorization gets underway, a number of themes are anticipated; however, they differ significantly by party. Some interest groups are lined up to address consolidation in farming and agribusiness. Other groups will push policies to direct more resources to small and beginning producers. Ultimately, the Senate will have the upper hand in this debate and the policies that arise in the bill will impact agriculture for the next decade to come.

U.S. AGRICULTURAL ECONOMY: FARM MARGINS WILL TIGHTEN

Despite the global pandemic and a steady barrage of disruptive challenges, the U.S. agricultural economy has fared quite well for the last three years. However, in 2023 producers and related industries will begin to show financial strains. A relentless series of adversities including skyrocketing production costs, steeply higher interest rates and weakening demand will increasingly pressure farm income and margins. The ongoing drought and increasing political tensions with China — the U.S.’s largest agricultural export market — present additional downside risk. China has made it clear that it would like to minimize its dependence on imports of U.S. agricultural products, adopting a “buy only if we have to” attitude.

GRAIN, FARM SUPPLY & BIOFUELS: MOMENTUM BUILDS FOR BIOFUELS

Grain elevators and merchandisers face a mixed picture for the year ahead. The good news for U.S. farmers is that global grain and oilseed supplies are exceedingly tight. Ukrainian grain production and exports are still below average, providing underlying support for grain prices. Ag retailers begin 2023 on strong financial footing but face several challenges. Labor shortages and rising wages will negatively impact margins. Wholesale fertilizer costs will rise during the first half of 2023 as cooperatives absorb higher barge and rail costs and compete with export markets for limited supply. The outlook for biofuels is very strong, supported by positive policy and demand tailwinds from 2022. Ethanol will benefit from greater usage of E15 and growing demand for corn oil.

26 MEATBUSINESSPRO January 2023 meatbusinesspro.com

ANIMAL PROTEIN: PRODUCTION TO MODERATE DESPITE A TAILWIND OF ENTHUSIASM

Most U.S. animal protein industry segments have posted phenomenal financial performance over the past three years. However, this era of broad profitability will likely come to an end in 2023. The high costs of feed, labor and construction support the prevailing cautionary attitude toward expanding animal production. Add in climate uncertainties, ESG pressures, and increasing energy costs, and it’s likely that 2023 will be a year when major market participants pause, reflect and consolidate. On the demand side, consumers are reeling from rapidly declining real wages, a trend that’s likely to continue well into 2023.

DAIRY: MILK SUPPLIES TO GRADUALLY GROW AS DEMAND BASE SHIFTS

After a year of stronger profits that allowed producers to pay down debt, dairy producer margins will come under pressure in 2023. Despite record-high milk prices earlier in 2022, herd expansion has been minimal among the major exporting countries and this trend is expected to continue in 2023. Dairy product prices will eventually moderate in response to the gradual growth in global milk supplies. Meanwhile, economic weakness and resurging COVID infections in China, the top dairy-importing country, threaten to destabilize global dairy demand. Domestic demand for U.S. dairy products, particularly higher-priced brands, will face headwinds as consumers trim grocery spending.

SPECIALTY CROPS: DROUGHT, LABOR SHORTAGES, STRONG U.S. DOLLAR AMONG HEADWINDS

Specialty crop growers and processors face a multitude of headwinds in 2023. Costs of water, labor, fertilizer and other inputs are rising while a strong U.S. dollar and weakening global economy drag on the U.S.’s ability to sell products abroad. California in particular faces worsening conditions with the highest diesel prices and farm wages in the U.S. amidst a worsening drought. The drought has lifted the price of water to record highs as La Niña conditions persist into a third straight year.

Tight labor availability will require growers to lean harder on H-2A workers or adopt more automation in the field. Despite the headwinds, growers and processors will benefit from falling costs of shipping containers and fewer delays at ocean ports.

RURAL ELECTRICITY: TIME TO LOOK BEYOND YESTERDAY’S ENERGY CRISIS PLAYBOOK

The global oil shocks of the 1970s had a profound and wide-ranging impact on energy use, and today’s energy crisis foreshadows a similar response. The collective response to the 1970s crisis led to innovative policy measures, paving the way for greater energy security. These measures largely included dramatic conservation and fuel diversity but also funded moonshot projects for renewable development. Surging energy prices, caused in large part by the Russian invasion of Ukraine, are yielding similar levels of policy intervention today. And the initial seed investments made a half-century earlier are opening doors to greater opportunities for market substitution.

RURAL COMMUNICATIONS: CROSSCURRENTS SET THE STAGE FOR THE RURAL COMMUNICATIONS MARKET

The rural communications market is heading into 2023 with numerous crosscurrents. The increasing importance of broadband helps insulate the industry against economic weaknesses. However, new headwinds are emerging from a weakening economy, tightening capital markets and aggressive network build activity across a wide range of market actors. The biggest risk to network builds in 2023 will be the tight labor market and ongoing supply chain issues. This is of particular concern for smaller broadband operators who are competing against the larger national telecommunications companies for resources.

Read the full report, The Year Ahead: Forces That Will Shape the U.S. Rural Economy in 2023.

27 meatbusinesspro.com January 2023 MEATBUSINESSPRO

HEADING INTO AGRICULTURE 2023

What to expect for the new year in agriculture policy?

Happy new year to all of Canada’s producers and agribusinesses! We hope that it will be a favourable one for all. To begin 2023, we want to review some of the big issues and agriculture policies that will most certainly be affecting the sector this year.

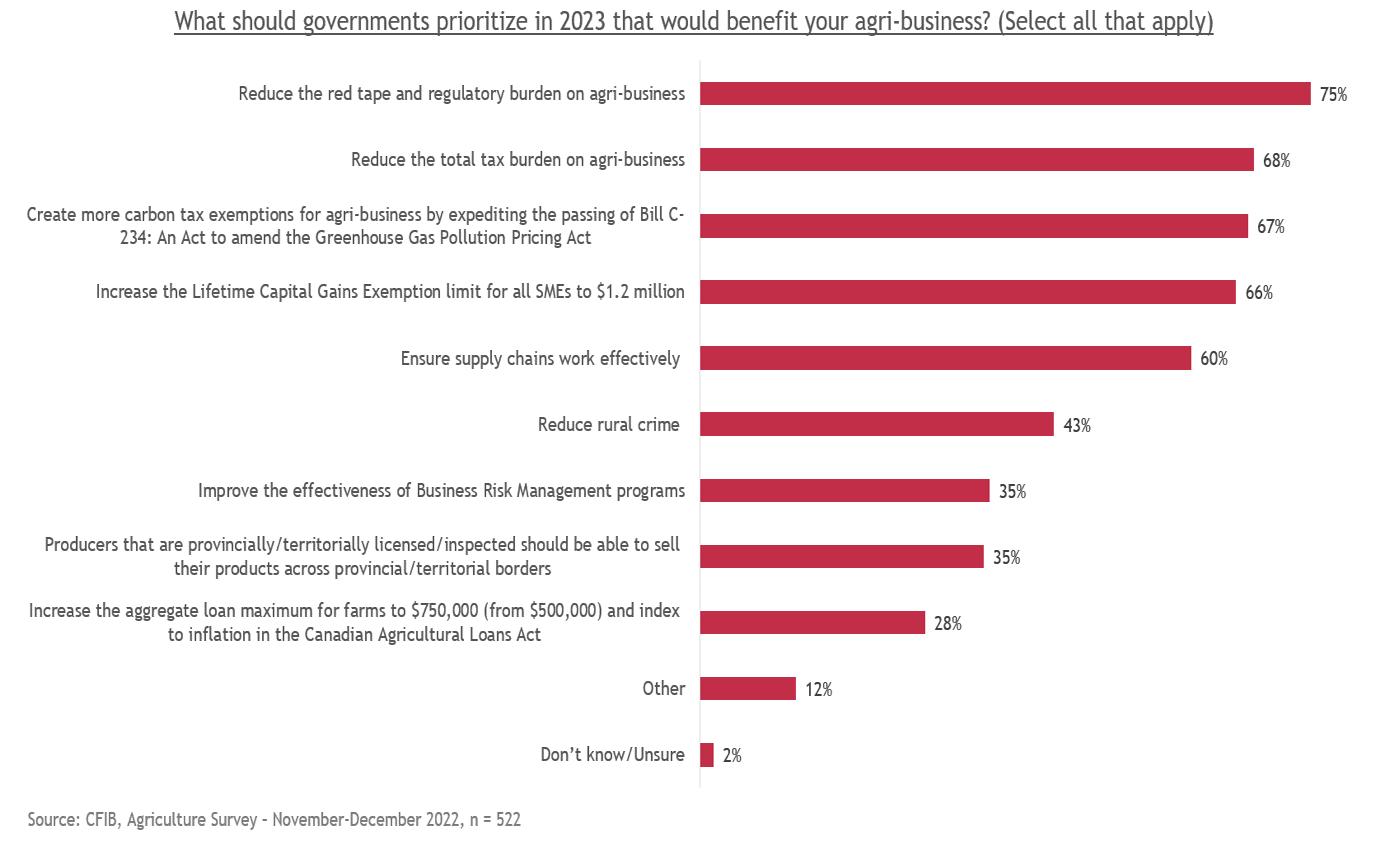

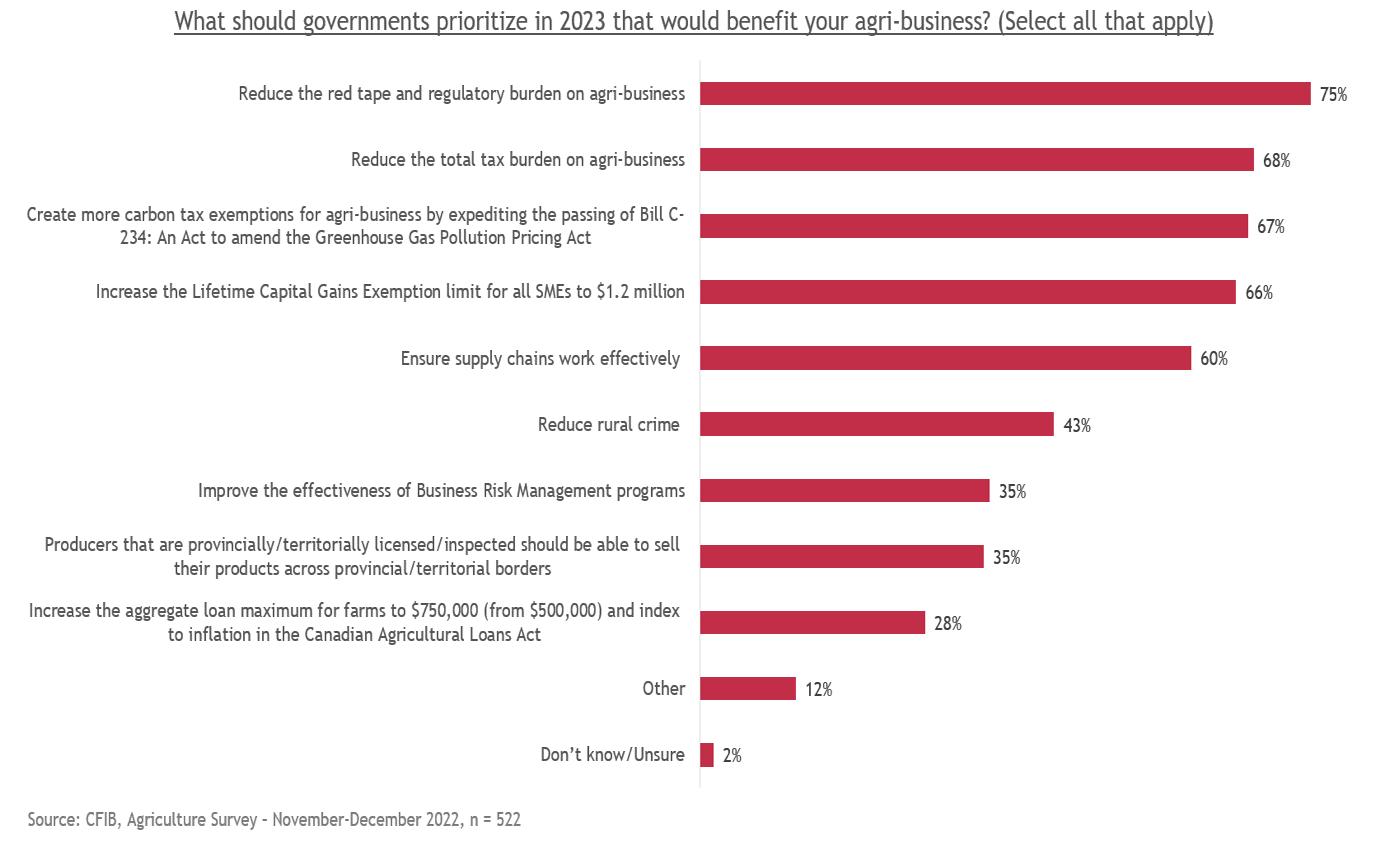

To guide CFIB’s advocacy and to determine the key issues for agri-businesses this year, we conducted a survey at the end of 2022, asking agri-business members what they believe government should prioritize in 2023 that would be of benefit to their business.

The carbon tax specifically will continue to be at the forefront of the current government’s environmental policy plan, especially as more provinces (Nova Scotia, Prince Edward Island, and Newfoundland) come under the federal system as of July 1st.

The annual agriculture survey identified the top three areas that producers would like to see policy reform in 2023. First, the survey found three-quarters (75%) of agri-businesses reported reducing the red tape and regulatory burden as the main area for policy change in 2023. Secondly, 68 per cent believe government policy should prioritize reducing the total tax burden on agri-businesses. Lastly, two-in-three agri-businesses (67%) want government to create more carbon tax exemptions for agri-businesses by expediting the passing of Bill C-234: An Act to amend the Greenhouse Gas Pollution Pricing Act (currently in its report stage after completing its consideration in committee back in November 2022).

28 MEATBUSINESSPRO January 2023 meatbusinesspro.com

ADDITION TO OTHER RESPONSES, AGRI-BUSINESSES WANT TO SEE: 1) Streamlined and user-friendly processes that make it easier to run their business, 2) A reduction in the cost of doing business, and

IN

3) Environmental policies being introduced with the agri-business community in mind to ensure that their efforts in environmental stewardship do not go unrecognized nor are they penalized.

service offerings. CFIB has been in close contact with policy officials from Agriculture and Agri-Food Canada (AAFC) who are looking at immigration and automation as potential ways to relieve some of the labour shortage – two potential solutions that have support from many agri-business owners.

SO, WHAT CAN AGRI-BUSINESSES EXPECT TO SEE IN POLICY THIS YEAR?

Some of the policies introduced this year will most likely include sustainability (including carbon tax), and labour (including immigration).

For example, the Agriculture and Agri-Food Canada announced back in December 2022 that they were launching consultations to help guide the development of a Sustainable Agriculture Strategy (SAS), open until March 31st, 2023. The purpose of the consultation is to get feedback from producers and industry stakeholders on potential policy initiatives that would improve environmental outcomes adhering to the federal government’s mandates outlined in the strategy’s discussion document.

We encourage all producers to get their voices heard by policymakers and participate in the consultation as an individual or through stakeholder organizations such as CFIB.

As one would expect, there were quite a few policy issues that were left over from last year that will undoubtedly continue to affect agri-businesses in 2023. One major policy area that is enduring into the new year concerns labour shortages. In 2022, labour shortages were negatively affecting many business sectors across Canada. According to CFIB research released in November, nearly three-quarters (74%) of agri-business owners worked more hours to make up for the lack of staff. Nearly half (48%) of agri-businesses have had to turn down sales or contracts due to labour shortages, while 41 per cent have had to decrease

Another example of an agriculture policy issue continuing in 2023 is Canada’s 35% tariff on Russian fertilizer, implemented back in the Spring of 2022. CFIB found that just over two-in-five (41%) of agribusinesses have been significantly negatively impacted by the tariff placed on Russian fertilizer. When asked all negatively affected agri-businesses approximately how much of their fertilizer costs changed during the past twelve months, 63 per cent responded that costs became significantly higher (20% and more), and 16 per cent answered that their fertilizer costs increased moderately between 5 per cent and 19 per cent. Policymakers must make a move on this issue to help decrease the cost of doing business for our farmers who rely on affordable fertilizer.

Last year proved that the resolve of Canadian agribusinesses is even greater than the industry’s obstacles. Keep an eye on these articles for policy updates as CFIB continues to champion agriculture policy issues on behalf of our agriculture members.

Not a member? JOIN CFIB today for more help and information.

SeoRhin Yoo is a Policy Analyst for the Canadian Federation of Independent Business (CFIB). CFIB is Canada’s largest association of small and medium-sized businesses with 95,000 members (6,000 agri-business members) across every industry and region. CFIB is dedicated to increasing business owners’ chances of success by driving policy change at all levels of government, providing expert advice and tools, and negotiating exclusive savings. Learn more at cfib.ca.

29 meatbusinesspro.com January 2023 MEATBUSINESSPRO

https://www.yesgroup.ca meatbusinesspro.com

By Martha Roberts, Economics Editor, Farm Credit Canad

By Martha Roberts, Economics Editor, Farm Credit Canad