We believe the world becomes a better place when we mix beyond our differences. This bottle design encapsulates the power of unity and how weaving the world’s diverse threads together can break conventions and make us stronger.

With nearly 400 pubs closing last year in England and Wales, how are the remaining outlets coping with market challenges? Siobhan Kielty talks to one publican to find out how his business fared over the festive period.

Spotlight

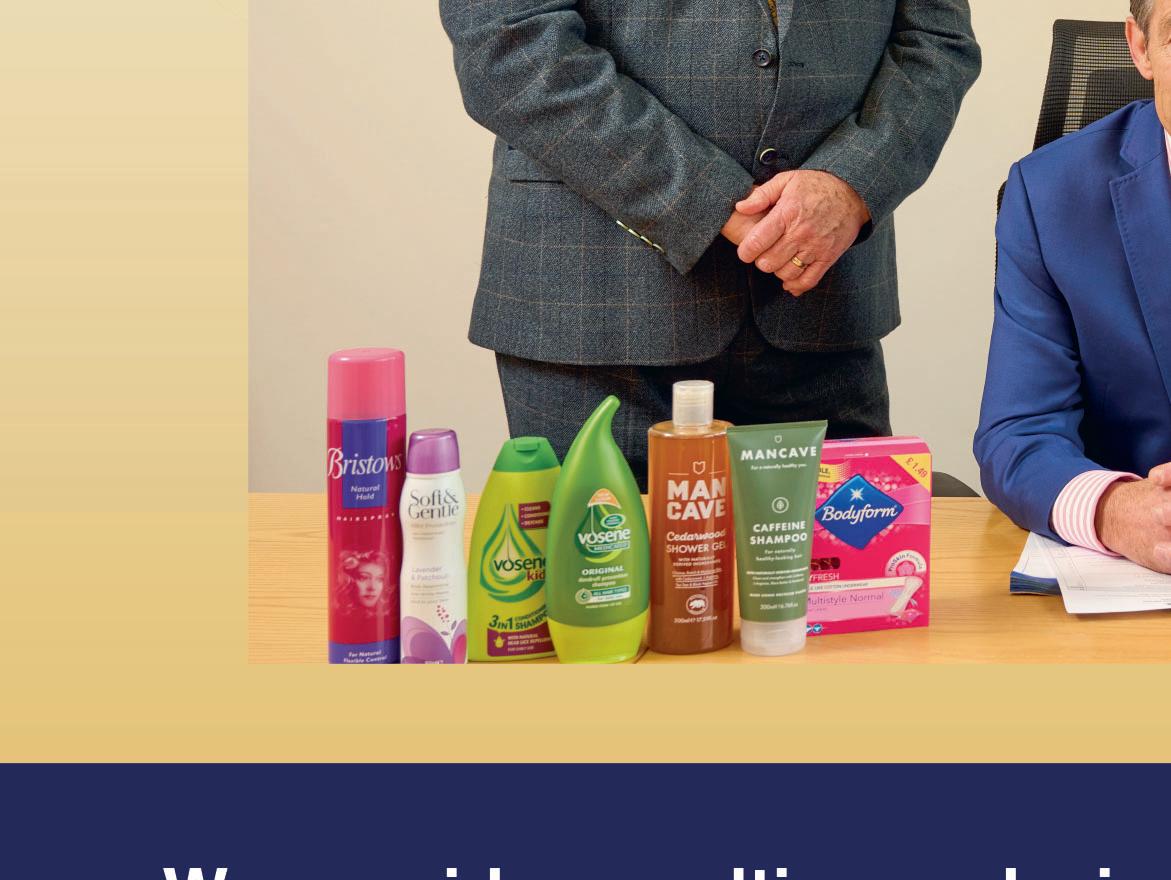

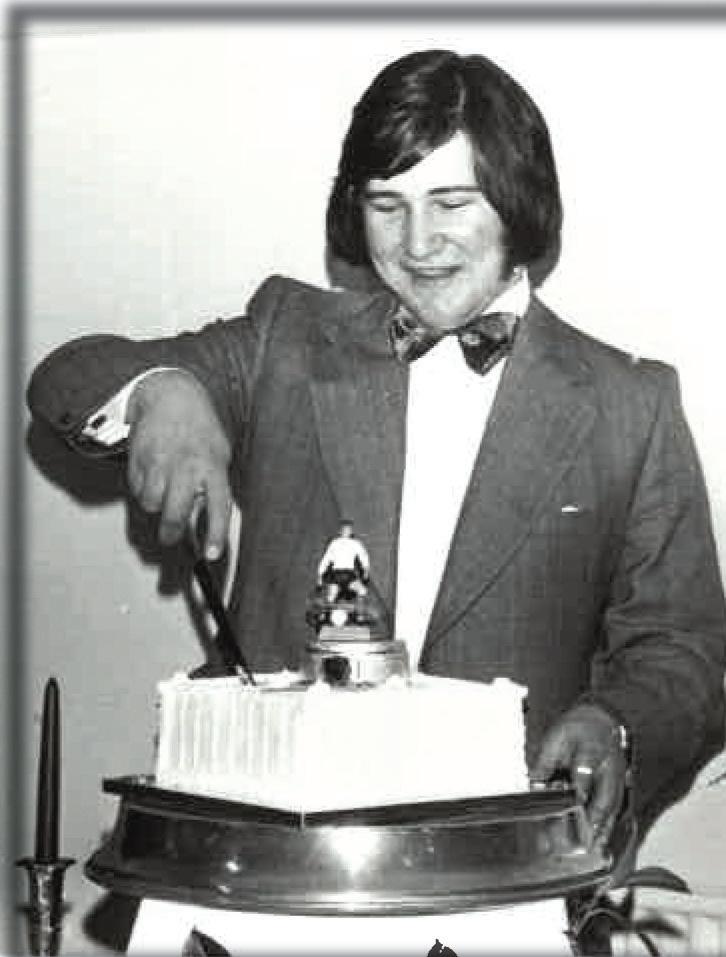

Phil Parker, procurement director of Pilgrim Foodservice.

The winning foodservice ownbrand products are announced at an exclusive awards lunch.

Manufacturers are confident that consumers will still want to spend on special occasions like Easter.

Updates from three leading suppliers on the solutions they offer to wholesalers.

Unilever and Diversey come together to give you Pro Formula, a complete range of ready to use professional cleaning products, paired with trusted Unilever brands.

The range is specifically developed for your professional cleaning needs, and comes with free online cleaning & HACCP guides, helping you meet hygiene standards.

Domestos Pro Formula Disinfectant Toilet Cleaner kills germs, protects your business, and leaves your toilet clean and limescalefree with a fresh lime scent.

This conveniently-sized 750ml bottle will help kill germs and get rid of limescale whenever you need it to. Add this descaler to your supply of washroom cleaners for longer-lasting results, as this toilet gel grips for longer below the waterline to remove all limescale and kill the germs that live within it.

Domestos Pro Formula Disinfectant Toilet Cleaner is also 3 times thicker than other toilet limescale removers – so, germs need to watch out!

Energy costs are the single biggest threat to the pub industry right now, according to Emma McClarkin, chief executive of the British Beer & Pub Association.

The announcement by the Treasury that a new Energy Bills Discount Scheme will provide further discounts for businesses for 12 months from April – but at a much lower rate than previously – was branded disappointing by trade bodies, publicans and wholesalers alike (pages 9 and 12).

“The reduction in the level of this support is extremely worrying and comes at a time of acute pressure on pubs,” said McClarkin. “Significant price increases will be the last straw for businesses that have been struggling for three years to remain solvent and serve their communities.”

The Scottish Licensed Trade Association (SLTA)) also expressed “very serious concerns” over the reduction in support in the revised scheme.

“Many businesses in the hospitality sector in Scotland had a bitterly disappointing December – normally one of the year’s key trading periods for the sector – as a direct result of the economic crisis, train strikes, poor latenight public transport and lack of taxi provision in some towns and cities,” pointed out SLTA managing director Colin Wilkinson. “We’re into the second week of January and these challenges remain.”

“This new Energy Bills Discount Scheme does not offer much hope for vulnerable sectors like hospitality when you consider that energy costs now account for around 8-10% of turnover for an average pub or bar,” he added.

McClarkin reported that publicans are “doing whatever they can to keep going”; one example is David Green, who runs The Bath House in Walton-onthe-Naze, Essex, who is considering reducing the pub’s opening hours in order to cut costs (page 12).

Wholesalers can play their part by offering publicans and other hospitality operators products that are cost-effective but still exceed consumer expectations. We’ve seen deskilling in kitchens, partly to save money, and therefore quality products that reduce preparation time are often of great appeal.

Many own-brand lines have all of these attributes, and our CCM Chefs’ Own-Brand Awards, run in partnership with the Craft Guild of Chefs and judged in blind tastings, celebrate the best foodservice own-brand products (pages 17-24). As Andrew Green, chairman of the judges, said: “Own brands have really come on. Please keep developing them because it is the way forward for the industry.”

Kirsti SharrattPrinted by Bishops Printers ISSN 1352-254X

All media rates, feature lists and deadlines can be accessed online by visiting: cashandcarrymanagement.co.uk

Nikki Fox has been promoted to head of catering at Booker.

Fox (pictured) joined Booker in 2019 as category manager – foodservice, and last April she became interim head of sales at Ritter Courivaud, which is owned by Booker and supplies speciality food ingredients to the foodservice market.

S&W Wholesale has moved to an Employee Ownership Trust (EOT) model of ownership.

Control of the 106-yearold business, headquartered in Newry, has changed from private ownership to a trust, which will manage and control the shares indirectly on behalf of employees. This is designed to provide an innovative succession plan for the current owners.

The wholesaler currently employs over 320 people and is one of the largest known firms in Northern Ireland to have switched to this model of ownership.

The new structure will see no visible change in the business, with day-to-day control remaining in the hands of the current leadership team.

and closed by an investor.

Fox’s previous experience also includes two years as sales controller at Creed Foodservice, five years as a regional sales manager at Philip Dennis Foodservice, and four years in a similar role at 3663.

In addition, she has held buying roles with Pelican Procurement Services and PSL.

Norman Savage, S&W director, said: “S&W has played a valued role in the retail community for more than one hundred years. We have been working on a succession plan for some time to secure the future of the business, while allowing for growth. We didn’t want to become another name swallowed up by the bigger players or potentially bought

“We have a loyalty to our people, customers and supply partners. We also have ambitious growth plans, with a new purpose-built site currently in the planning system. We want this ambition to carry through the next generation of the business.”

S&W CEO Michael Skelton added: “We took considerable advice and guidance before making the decision, so we are satisfied that the EOT model gives us everything that we need for the future sustainability of the business.

“Our shareholding will effectively be bought over

time by the trust, with the majority of the business shares held in the trust collectively on behalf of the employees. This means that when the company does well, the employees, as beneficiaries, will do well. The nature of the structure allows for incentives such as taxfree bonuses and other inducements as the business model continues to mature.

“We will remain on the board but as exiting shareholders we know that the hundred-year-old legacy of the S&W journey will live on for many years to come.”

Financial details of the transaction were not given.

Kitwave Group has acquired WestCountry Food Holdings, a specialist fresh produce wholesaler, for £29 million.

Established in 1856, WestCountry has depots in Falmouth, St Austell and Newton Abbot. The wholesaler serves both foodservice and retail customers in the South West of England, and in the year to 1 January 2022 had a turnover of £29.7 million and profit before tax

of £3.9 million.

The WestCountry business will be incorporated into Kitwave’s existing foodservice division which currently comprises the trading

operations of HB Clark & Co, David Miller Frozen Foods and MJ Baker Foodservice.

Commenting on the acquisition, Paul Young, chief executive officer of Kitwave, said: “The acquisition of WestCountry enables us to expand our product range to include high-quality fresh produce and complements our existing foodservice offering in the South West, following the acquisition of

MJ Baker earlier in 2022.

“We are delighted to welcome the WestCountry team to Kitwave and look forward to successfully integrating the business into the group’s foodservice division and further extending our nationwide reach.

“The group continues to trade well and, despite wider macroeconomic pressures, the directors believe the outlook remains positive.”

AF Blakemore & Son has announced 19% sales growth to £1.19 billion for the year ending 1 May 2022. However, it reported a pretax loss of £3.3 million, down from a pre-tax profit of £6 million in the previous year.

“Our new Bedford depot is the cornerstone of our long-term supply chain strategy and was built and opened during the height of the Covid-19 pandemic. The development, combined with significant labour shortages across the UK, required us to incur an unplanned £17 million in our total logistics operation,” explained chairman Peter Blakemore.

“Maintaining a high level of supply chain performance required us to make a significant investment during this period and as a result, the group delivered a pre-tax loss of £3.3 million. Underlying pre-tax profit was £2 million after exceptional costs but, as always, our

Commenting on the sales uplift, Blakemore said: “This has been delivered by a robust performance across our core SPAR network and our ability to use opportunities across recovery sectors such as travel and foodservice.

“We also saw a steady return to growth for the Philpotts chain of preparedfood stores, while enabling an impressive performance from home delivery and quick commerce, where we

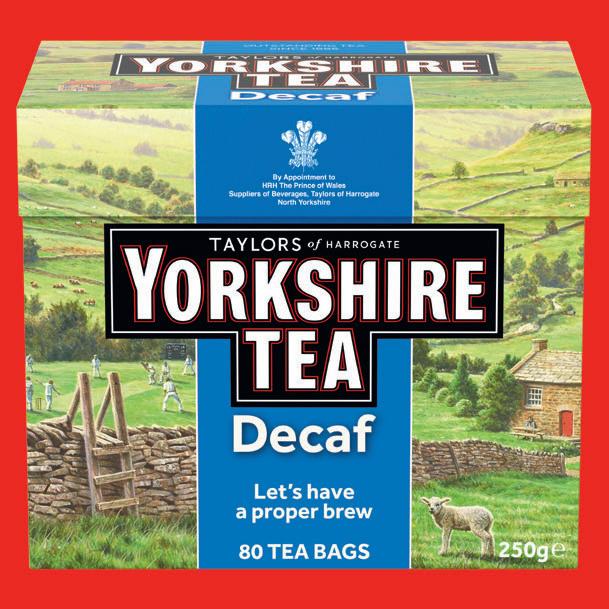

SPAR has introduced five new own-label confectionery lines, supported with in-store PoS to drive consumer awareness and sales.

Giant Strawberries, which are vegan and vegetarian friendly, Yummy Bears, and Sour Gummy Mix are all available in take-home bags, while Tilly the Turtle and Sour Flames are sold in impulse packs. The launch of Tilly the Turtle follows the success of Myles the Meerkat sweets.

The packaging for the take-home products features

the new design for SPAR confectionery, which takes inspiration from the traditional sweet shop style stripes.

Hannah Such, assistant brand manager, said: “These new products allow SPAR to modernise and add a point of difference to the current own-label range. We will be filling gaps within our confectionery range by offering new and exciting flavours; this will give our SPAR stores a fantastic opportunity to earn additional sales.”

were pivotal in helping this new channel scale-up.”

Despite supply chain upheaval, the group achieved an underlying EBITDA [earnings before interest, taxes, depreciation, and amortization] of £20 million.

CEO Jerry Marwood said: “We have continued to perform well into this current year and after 24 weeks our sales for 2022/23 show a further growth of 9%. When considering last year’s growth, this is a fantastic performance. Being an independent business means we can

continue to invest even through the most challenging times.”

Marwood added that the decisions made by AF Blakemore in 2021/22 have resulted in stable outbound supply, growth in new format propositions and the successful trial and roll-out of its new commercial system.

“Process improvement and investment in technology have also delivered greater efficiency and a corresponding improvement in our base margin; however, given the macro-economic turmoil predicted in the next 18 months, we must continue to work hard to protect our customers interests,” he said.

Blakemore concluded: “The results for the year to May 2022 reflect a challenging time; however we believe that there is continued growth opportunity for a values-based business that invests for the long-term, within our industry.”

Appleby Westward has appointed Duncan Jelfs as commercial director.

Jelfs (right) was formerly business development director at Costcutter between 2009 and 2018, and he then joined Bestway Wholesale as sales development controller. A year later he was appointed head of central operations at Bestway Retail, a role he performed until May 2021 when he was named as head of Bargain Booze and Co-op Franchise.

Commenting on his appointment, group sales director Rodney Tucker told Jelfs: “I am really excited about working together

again. Congratulations on this great move to a fast growing company.”

In addition to being SPAR’s wholesaler in the West Country, Appleby Westward operates a retail division of over 100 convenience store under the SPAR banner in the South West.

paramount interest is in ensuring the long-term interests of our customers.”

JW Filshill has strengthened its KeyStore business support team in the north of England with the appointment of Arwel Carter as regional development manager.

Carter (pictured) previously spent nearly nine years at McCurrach, latterly as a key account manager. In his new role, he reports to Graham Cairns, who is promoted to sales & business development manager for the north of England.

Cairns, in turn, replaces Jeanette Gordon, who has left Filshill to support her husband with his training business.

Bidfood is to open two new depots in 2023 as part of a wider plan to strengthen its existing 24-strong depot network and offer customers a truly local service.

The first of the new sites will be in Glasgow. The 90,000 sq ft site will cover the West of Scotland and is set to open in early spring.

The second site is in Bedfordshire and aims to commence trading in the autumn. At 160,000 sq ft, it will be one of the company’s largest sites to date and it will enable the wholesaler to strengthen its service across the South East of England.

Both new depots have been designed with the latest state-of-the-art systems, technology and fittings to support Bidfood in reducing its carbon footprint.

Mark Wood, chief operating officer at Bidfood, said: “This is a really exciting time

for the business, as we continue to grow our infrastructure to strengthen our support for customers.

“Both sites will enable us to operate from a high quality and modern facility which will alleviate pressure on existing depots in Scotland and the South East, as well as serve the communities in which they operate by providing jobs to local people.”

A third additional depot –in the Midlands – has also been commissioned; how-

ever, this will not be active until 2024.

In other news, Bidfood has announced that its application for a £3,000 grant for FareShare UK from The Royal Warrant Holders Association‘s charity fund has been successful.

The grant will cover the installation and one year’s running costs of new route planning software for seven vehicles at FareShare’s Greater Manchester distribution centre.

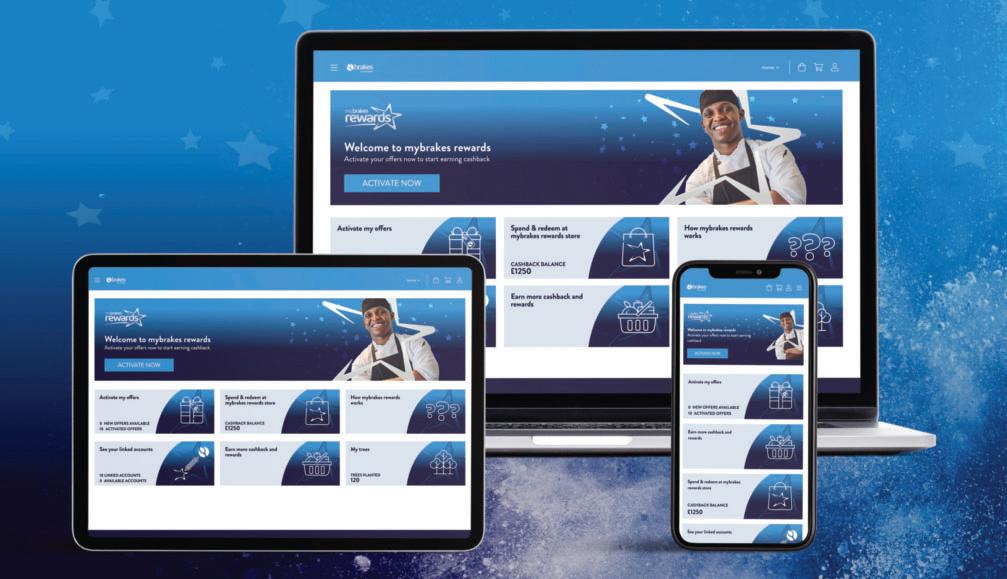

Brakes has introduced mybrakes rewards, a personalised customer rewards programme.

The scheme will enable customers to make savings, earn cashback, receive gifts and donate to charity. In addition, when customers redeem their cashback, up to five trees will be planted on their behalf in partnership with Eden Reforestation Projects, supporting worldwide communities impacted by deforestation.

Brakes’ customers were previously able to access the Nectar rewards programme, but mybrakes is based on feedback that showed they wanted more bespoke options, with a wider choice

of rewards, and to earn cashback of a known value, not points.

As well as redeeming cashback on their spend, customers can save on merchandise, including new electronics, kitchen items, days out, holidays and gift cards, at the mybrakes rewards

store. Alternatively, customers can donate their cashback to selected local charities.

Customers will earn cashback on all online Brakes purchases, and those signing up in January will also receive an extra tree planted on their behalf.

Leon French, customer

marketing director at Brakes, said: “It’s clear that while the market remains so tough, everyone in foodservice needs some support. Mybrakes rewards will offer our existing and new customers the opportunity to reinvest in their business, themselves, staff and communities.

“We believe that mybrakes rewards is a real step forward. Customers will know exactly what they’ve saved, and what it’s worth, benefiting from a massive choice of rewards, while continuing to support communities and great causes on a local and global scale, as well as further enhancing the customer support they receive from Brakes.”

The new Energy Bills Discount Scheme for UK businesses will come into effect when the current scheme ends on 31 March 2023 and provide a discount on high energy costs until 31 March 2024.

All eligible non-domestic customers will see unit discounts of up to £6.97/MWh automatically applied to their gas bill and up to £19.61/MWh applied to their electricity bill.

“This level of support does not offer much help to any businesses, especially those who are vulnerable

signed fixed contracts at way above that level in 2022. However, the discount is so small it won’t make a huge amount of difference, and they will still be paying much higher energy bills than this time last year.”

due to high energy bills,” commented FWD chief executive James Bielby.

“The wholesale energy price will probably fall below the 30.2p per kWh threshold due to market forces, and therefore few businesses will get help, except those who

He added: “The Government has also taken the easier option in giving blanket support, rather than taking into account the vital nature of food distribution and the unavoidably high energy consumption that it involves, and supporting it accordingly.”

Andy Needham, MD of Surplus Group, Morris & Son and Approved Food, is one wholesaler that took to social media to spell out the impact of the reduced support package on his businesses –

“I’d normally like to thank people for helping but in this instance they can stick it…so far out of touch it’s untrue. My sympathies go out to employers who are losing their businesses and employees who will be out of work. The next six months will truly be carnage.”

New service

digital marketing agency. In his new role, he is tasked with creating, developing and executing the group’s digital marketing strategy and ensuring that the marketing assets offered to members are relevant and efficient. He is also working on developing the group’s communication tools that key brands can utilise to reach catering customers across the membership.

The Country Range Group has strengthened its central office team with three new recruits.

Rachel Porter and Graham Caldwell have joined the group as marketing managers, while Tom Holdsworth has become a category buyer.

Porter has 17 years’ experience in brand management,

product development and marketing, latterly in the education sector. In her new role, her focus is on driving the group’s marketing strategy and engaging with key stakeholders in the central team and the membership. She will also oversee the Country Range own-brand range.

Caldwell has spent the last nine years working at a

TWC is launching SmartView Convenience, which it claims will be the most representative EPoS market read of independent retail and wholesaler-supplied symbol stores.

The service is in partnership with I-TG, which will provide the data. TWC has picked a sample of around 6,500 stores (combined turnover £5.6 billion), and its analytics platform contains algorithms to extrapolate this sample to represent total GB independent convenience.

Data reporting on what is selling in the stores will be available in value and volume for MAT, YTD, 13 weeks, four weeks and weekly. Regional reporting will also be available.

www.cashandcarrymanagement.co.uk January 2023 09

The Sittingbourne-based wholesaler Q Catering has appointed Tony Blake as its new commercial director.

Blake previously led the buying & marketing function at Kent Frozen Foods (KFF), where he spent a total of 18 years. Before that he had similar roles at Brakes for over a decade.

In his new role, he heads up the procurement, marketing and supply chain teams, and is tasked with introducing more structure to the business and helping to improve efficiencies and relationships with suppliers.

Blake is the third person that Q Catering has recruited from KFF in the past few months – Caroline Martin joined as sales director and Nick Jennings as financial director.

Q Catering’s managing director Steve Clarke previously worked for KFF for 25 years; when Sysco (Brakes’ parent company) bought KFF, he was tied in for two years, and then the two years came to an end. His building of a senior leadership team is part of his plan for Q Catering to reach £20 million turnover by 2030.

LWC Drinks is holding its first Wine Trade Tasting in the South West region on 8 February at The Custom House in Plymouth.

The wholesaler will have over 100 wines from its portfolio available to taste, as well as some of its signature brands.

The event takes place from 1-5pm, and everyone who attends will receive a 10% voucher for the next wine order they place with LWC before the end of February.

Fresh fish is now available to JJ Foodservice customers through the wholesaler’s Advance Order platform.

Wild-caught cod and haddock, sea bream, sea bass and salmon fillets are on offer through the service.

“The fish are deboned and filleted to order, and are promptly vacuum-packed to retain optimum flavour,” said chief product officer Sezer Ozkul. “Early sales are promising and we look forward to developing the fresh fish and seafood category based on customer feedback.”

The Advance Order marketplace has also been used to extend the product range in JJ’s Dagenham branch –one of its smaller sites. Using internal transfers from the Enfield branch, the wholesaler has increased the range by 500 products, including fresh fruits and vegetables, soft drinks and cleaning materials.

“Our goal is to offer more than a thousand new products in our Dagenham branch without the need for additional warehouse space,” said Okzul.

Caterforce is encouraging a collaborative approach to business by promoting its services to suppliers.

It is inviting suppliers to invest in the Caterforce Sales Hub for 2023 to gain insight into what customers want.

The group is also offering its suppliers integrated marketing campaigns to promote their products across multiple touchpoints including sales teams, ecommerce platforms and promotional brochures across all eight member wholesalers.

“These campaigns will be designed by Caterforce’s team of creatives and digital experts to make sure that

suppliers’ products are showcased in the best light possible and USPs are highlighted,” said group marketing director Lucy Boland.

“By taking a holistic approach to marketing we are ensuring that the same consistent message is provided to customers regardless of how they interact with their wholesaler. While an increasing percentage of customers purchase online these days, we found that by incorporating sales teams as well as print advertisements [into marketing campaigns], our suppliers benefit from a more impactful campaign.”

In addition, Caterforce is

planning a number of supplier presentation days where suppliers can meet buying teams across the group. These events will be held at Derby County Football Club on 28 March, 27 June and 4 October.

“These events have been hugely popular [in the past],” said Joanna Halucha, group buying, own brand & technical manager. “They follow a speed-dating format, providing suppliers with the chance to talk about their range, and for our members to sample products. This results in new ranges being stocked and new suppliers being introduced to the group.”

David Green runs The Bath House, a well-established and popular seafront pub in Walton-on-the-Naze, Essex.

The pub is known for showing sports and he capitalised on World Cup fever with a promotion of £3/£3.50 for a pint of standard/premium lager or bitter. There was also a good turnout for a Christmas Day dinner service. “It wasn’t a bad Christmas, it was a steady Christmas,” says Green. New Year’s Eve was also a busy night, with the pub takings at around £4,000 – a good result, particularly after what had been a fairly grim year for the hospitality trade.

However, even the opportunities afforded by the festive season and the added benefit of a winter football World Cup – an established on-trade and offtrade boom – are just part of a story that’s far from a fairytale.

As 2023 beds in, it’s still a tumultuous time for the on-trade. The pressures are multiplying, painting quite a bleak picture for many publicans for the start of this year. “These next eight weeks will be tough and we’re probably going to reduce hours to save on costs. We’re haemorrhaging too much money, staff-wise,” Green admits.

With the end of festive spending and a quiet couple of months predicted, some cheering news from the Government regarding future support for the hospitality industry was needed,

and so the announcement of a drop in extended energy support relief for pubs from April onwards has come as a disappointment.

Publicans and hoteliers have an enormous set of obstacles to overcome as prices continue to creep up and consumers’ disposable incomes are squeezed. On top of this, the current wave of industrial action is affecting the pub trade and resolution doesn’t seem to be around the corner. “The train strikes have affected business – and the issue with border control strikes as well,” reports Green.

“The cost of living and cost of electricity are obviously going to play a massive part,” he adds. “I’m lucky, I’ve got fixed rates and so the electricity is still okay.”

As the economic climate continues to be challenging, wholesalers’ customers may be looking for more help and input than they’ve previously required. Green uses Booker, Pilgrim Foodservice and Bidfood, and has also found support from suppliers to be important. The pub has a 60:40 drinks to food split, and Green has recently managed to create a bit of good news by negotiating a deal with Carlsberg Marston’s that should help boost profits.

While these relationships all play a part in helping the long-term business prospects of the hospitality industry, Green seems accepting of a tough few weeks ahead. “I think January and February will be the hardest months, but it is what it is,” he says.

The number of pubs in England and Wales fell from 40,173 in December 2021 to 39,787 at the end of 2022, according to analysis of official government data by real estate adviser Altus Group. This works out at a loss of around 32 venues a month across the two countries.

Emma McClarkin, chief executive of the British Beer & Pub Association, comments: “While these figures are upsetting, they are unfortunately not surprising. Pubs and brewers are facing extreme challenges; they are doing whatever they can to keep going.”

Last year, many pubs were forced to reduce opening hours or temporarily close to cope with soaring food and energy costs and falling customer demand.

The Government’s current energy support package is due to expire at the end of March, and further support will fall sharply.

McClarkin commented: “We are very disappointed by the Treasury’s announcement which will mean a dramatic drop in extended energy support relief for pubs come April.

“Whilst the Government has accepted the need for continued energy bill support for another 12 months, the reduction in the level of this support is extremely worrying and comes at a time of acute pressure on pubs.

“Significant price increases will be the last straw for businesses that have been struggling for three years to remain solvent and serve their communities. We urge the Chancellor to work with us in looking at how additional support can be provided to particularly vulnerable businesses across the UK that mean so much to so many but could close because of the energy price crisis.”

To maximise the sales opportunity presented by Easter, wholesalers should encourage retailers to begin to stock Easter products and drum up excitement from January onwards, maintains Ferrero UK.

“We’re confident that consumers will still want to spend on special occasions such as Easter, looking towards trusted and well-known names to help them enjoy those thoughtful treating moments with their friends and family,” says Levi Boorer, customer development director. “The ‘early season’ (approximately seven or eight weeks before Easter) is the ideal time for retailers to start driving awareness with mini eggs and self treat products.”

He adds: “For smaller locations, which could be exempt from HFSS regulations, Easter presents a big opportunity. With supermarkets and bigger convenience stores unable to showcase confectionery in the same way at the front of store, smaller shops can become a hub for treats – and merchandise their store in the most effective way to increase sales.”

Ferrero is introducing a new 100g Chocolate Bunny for Easter 2023, and it is also launching two boxed egg packs: a Ferrero Rocher Egg and a Ferrero Collection (Milk) Egg, both of which comprise a large 175g egg and six pralines.

Also new is a white chocolate Thorntons Bunny in a 90g format. A full pack redesign will feature on Thorntons figure eggs, with the aim of increasingly stand-out on shelf.

In addition, Ferrero has refreshed its Kinder packaging with a more distinctive design and a new Easter bunny image. “We’re confident that 2023 will be even bigger for the Kinder brand, especially as we have a licence agreement with Disney’s Avatar to provide figurines in our 100g Surprise Easter eggs,” says Boorer.

New from Mars Wrigley for 2023 are M&M’s Easter Shapes – hollow chocolate shapes filled with mini M&M’s and individually wrapped in colourful foil. The product comes in two designs in mixed cases, which are stackable for building in-aisle displays. Shapes are a growing category, with 15% of households purchasing Easter shapes and 13% of shoppers repeat purchasing gift shapes during the Easter period (Kantar).

Impulse purchases in the early part of the season account for 45% of total Easter confectionery sales (Nielsen), and one of the company’s products in this category – M&M’s Speckled Eggs – features a new packaging design.

Cadbury Creme Eggs have been an icon of the Easter season for over half a century, and they are purchased four times more than the average Easter product (Nielsen). This year, Mondelez International is releasing the brand’s first ever product innovation: Cadbury White Creme Egg.

“Shoppers have been speculating and anticipating this new flavour for years – and now it’s finally here for everybody to enjoy,” says trade communications manager Susan Nash. “White chocolate is growing fast in the category so in combination with the number one Easter brand (Nielsen), this is set to be a truly incremental new product.”

Following its success in 2022, the Cadbury Creme Egg ‘How Do You Not Eat Yours?’ campaign will return this year. Shoppers will be warned once again to keep an eye out for an extra special half milk chocolate, half white chocolate Cadbury Creme Egg. If they can resist eating it, the unique treat can win them up to £10,000.

Retailers should heed the warning as well because if a winning egg is found in their store, they will win too – more than 20 Amazon vouchers are up for grabs for retailers, including a top prize of a £1,000 voucher.

“We were absolutely blown away by the response to our ‘How Do You Eat Yours?’ campaign last year,” says Nash. “Our fans rose to the challenge of resisting the temptation of these delicious half-and-half Creme Eggs to win their prizes.”

This year, with social, digital and out-of-home activations, plus PoS material, “everyone will know that the goo is back”, she adds.

Another best-seller at Easter is Cadbury Mini Eggs – the 80g bag is the No.1 Easter SKU, with 115 bags bought every minute (Nielsen).

“While evidently an ideal seasonal treat, we’ve increasingly seen shoppers whipping up delicious baked goods with the Easter staple, and so for 2023, the brand is launching a new 1kg bag format that caters to this occasion too,” Nash reports.

In other news from Mondelez, bags of Cadbury Dairy Milk Orange mini eggs are available across the market for the first time this year. Nash says: “This delicious treat sees the nation’s favourite chocolate (Nielsen) combined with real orange oil to create this popular flavour combination and is certainly set to be a hit with shoppers.”

What are your interests outside work?

I enjoy walking and swimming, something I aim to do most days, and I’m also very happy in the garden, sawing logs and enjoying the outdoors.

What is your favourite film, book and song/piece of music?

My favourite piece of music is a toss up between Stairway to Heaven by Led Zepplin and Midnight Rambler by The Rolling Stones. The book I’ve read the most is the Bible: its teachings, especially the ten commandments, are something I have always tried to live my life by. And the best film must be The Godfather with Marlon Brando.

What would people be surprised to know about you?

What have been your biggest achievements in work and outside work?

There are two that instantly come to mind. The first was bringing Castell Howell into the Caterforce group. I could see instantly the benefit to them and to Caterforce (of which I became a director in 2004), but it wasn’t an easy sell.

Outside of work, apart from the obvious – marrying my wife, having my children and grandchildren – I’d have to say project managing the build of our family home. The 18-month project enabled me to develop skills I didn’t know I had and brought a great deal of satisfaction.

Also, I have to mention that receiving the Lifetime Achievement Award last year from Caterforce was a real honour – it meant a lot to be recognised among such dedicated and inspiring people.

Who has been the biggest inspiration to you?

My father has always been my biggest inspiration. He’s sadly no longer with us but he was a captain in the Merchant Navy and his leaderships skills were a great influence on me, plus he always maintained his wicked sense of humour!

As a child I remember him saying, ‘You achieve nothing without hard work’ and

those words have held me steadfast.

Peter Bateman [Pilgrim Foodservice’s founder] has also been a key figure in my career, as a boss, a mentor and a friend. He has taught me a great deal over the years, mainly that with drive and tenacity you can achieve anything.

What were your ambitions when you were growing up?

Once I realised I was never going to play professionally for Leeds United, I suppose I followed my family’s love of food. My grandfather was a butcher and my mother was a fantastic cook. They inspired me to go to catering college where I found a passion for cooking. At the age of 19 I was fortunate enough to be able to combine this with working at sea, something my father’s family had always done – my first job was as a chef on a cruise liner. It wasn’t the most glamorous role but by 21 I’d travelled around the world twice and visited over 40 countries.

What approach do you take in business (and in life)?

I’m the kind of person who likes to think things through. I’ll always gather the facts and take my time to consider the options before making a decision I’m confident in.

I’m a bit of an adrenaline junkie. During my visits to New Zealand, I’ve been white water rafting, jet boating, wild swimming and travelled at 150km an hour on a zip wire! This February I’ll be completing my fifth bungy jump at Taupo Bungy, in aid of Connaught Court Care Home in York: https://www.justgiving.com/crowdfunding/emma-benham. It’s a bit of a family tradition as my father Billy did it on his 70th birthday, so that’s how I plan to mark mine too. CCM

After leaving school, Phil Parker studied Catering & Hotel Management which enabled him, at 19, to get a job as a chef on the cruise liners. Three years later he sought a more grounded job and began at Ross Foods as an area salesman, working his way up to regional account manager. He joined Pilgrim 40 years ago as a salesman when it had just three employees and one lorry; it now has over 260 employees and 68 lorries! Over 40 years he has held a number of roles, and in 2011 he joined the board as procurement director, becoming the first non-family director of the business.

The CCM Chefs’ Own-Brand Awards, which recognise the best foodservice own brands available from wholesalers, have grown in status and size every year since their launch five years ago – and that is in no small part down to the care with which the judges test each product.

At a prestigious awards lunch held at The Royal Horseguards Hotel in London, Andrew Green, chief executive of Craft Guild of Chefs and chair of the judges, explained: “What we do is make sure that every item is given a real opportunity to shine – for example, if we are testing a butter we will try it with bread as well as on its own.”

The blind tastings were conducted by Green and his fellow judges: Matt Owens, chairman of the Craft Guild of Chefs and development chef of Alliance Group, and Jason Gordon, catering manager for the General Medical Council.

As always, the judging was intense, and six of the products were rated so highly that they were awarded a ‘Best of the Best’ accolade.

“Own brands have really come on,” Green commented. “Please keep developing them because it is the way forward for the industry.”

Martin Lovell, managing director of Cash & Carry Management, added: “Faced with cost pressures, foodservice operators are looking to their wholesalers to provide high quality products at a good price. Many also want the added benefit of convenience so that their food prep is quick and easy. Own-brand products meet all these requirements, and these awards aim to raise the profile of own brands even further by highlighting the best product in each category.”

A special feature of the awards is that feedback is provided on every product entered.

Left

As ecommerce sales continue to increase across the wholesale industry, it is more important than ever that businesses have online capabilities that maximise revenues whilst exceeding customer expectations.

While most wholesalers do have some form of ecommerce system, and therefore think they are sorted, many of these systems are a legacy system and work in isolation from the rest of the business, according to Andy Pratt, sales manager at Oporteo. As a result, he says, “businesses are missing out on vital omnichannel capabilities and functionality that could keep them ahead of the competition”.

So what is it that wholesalers should be prioritising in their ecommerce strategy this year? “Ecommerce is such a fast-paced industry, and technology is constantly moving forward, so there is always something new for businesses to take advantage of,” comments Pratt.

Firstly, he argues that businesses need a platform that can bring offline and online revenue streams together with modern integration capabilities to create a real-time omnichannel system. “This is vital to creating a seamless customer experience that can make or break a sale,” he maintains.

Next, he says that a selfservice solution is crucial for businesses wanting to streamline their customer service. This can ease the burden on staff and empower customers to resolve common queries themselves. “Giving customers access to a dedicated account portal means they can easily view their account, purchase history and invoices, even for orders placed via other channels, such as phone or fax – yes, they are still used!” he points out. A self-service solution is a ‘must-have’ because wholesalers always need to be increasing efficiency and reducing time-costly processes.

Thirdly, in a volatile economic climate, dynamic pricing capabilities have never been more critical, especially for wholesalers with multiple channels to keep updated and complex pricing for individual customers to keep on top of, says Pratt.

Real-time pricing capabilities give wholesalers the power to adjust to changing conditions quickly. They also enable competitive price matching across all channels. This allows businesses to become more competitive in terms of pricing and encourages customer loyalty.

Finally, businesses should enable sales any time, any where with mobile responsive channels – whether that is a Progressive Web App (PWA) enabled website, which gives app-like experiences without additional cost and hassle, or having a presence on social selling platforms and marketplaces.

According to research and online statistics, at least 70% of B2B searches are made on mobile devices and can influence 40% of sales. “Mobile commerce is changing the online user landscape,” Pratt points out. The number of people using their smartphones or tablet to browse the internet now exceeds desktop computers. “This trend is set to continue, especially within the workplace as digitally-enabled employees embrace the convenience of online and mobile facilities,” he adds.

However, with all these exciting solutions, the level of interconnectedness needed for them to work effectively is heavily reliant on businesses having omnichannel capabilities with a digital-first platform, says Pratt.

Overcoming the restrictions of outdated ecommerce solutions and embracing omnichannel innovations has been a game-changer for Oporteo’s customers.

“At Oporteo, our goal is to help wholesalers embrace the power of omnichannel so they can thrive in today’s online world,” he states. “Our solutions provide limitless digital opportunities and have enabled our customers to expand to new markets, increase sales, and ensure higher customer retention.”

Andy Pratt: ‘Our goal is to help wholesalers embrace the power of omnichannel.’

We have all been through economic storms before but the waves of recent years have been relentless, leaving wholesalers feeling battered and weary as they swim into 2023. It is no surprise, then, that many are clinging to the life raft of the status quo, says Ivan Durkin, managing director of STL.

“However, this is no time to be treading water. That’s the fastest way to go under,” he maintains. “The wisest operators are boarding the steadiest ship they can find. For leading wholesalers that means STL.”

Both Dhamecha and Parfetts have recently extended their end-to-end STL solutions to support the opening of their new depots in Nottingham and Birmingham respectively. Their continuing loyalty to STL is in part driven by the fact that STL’s highly regarded executive team has remained steady at the helm, committed to their founding vision of ‘providing modern technology and great service specifically for wholesalers’, Durkin explains.

Guy Swindell, joint managing director of Parfetts, says: “We need strategic suppliers we can trust to help us streamline our own operations, champion a superior customer experience and plan the future with confidence. It’s a tall order but, with its deep understanding of the wholesale sector, sophisticated solutions and continuous investment in product evolution, STL has become one of our lead technology partners.”

Increasingly, smaller but no less ambitious operators are following Parfetts’ lead – like First Choice Foodservice which recently switched to STL’s flagship MMS Evo.

“New customers tell us they’ve chosen STL because we’re more than technology experts; we also have a deep understanding of the business needs of wholesalers,” says Durkin.

He attributes this to the fact that STL’s senior executives all have their roots in the industry and have actively sought to build their technical crew from the UK’s wholesale sector. This has given STL a ‘unique core of specialist knowledge’ that enables it to guide customers assuredly through system planning and

implementation and help them adopt the best business practices and optimise their return on investment.

“Above all, these tech experts understand the vital importance of a smooth IT implementation, with minimal disruption to everyday operations,” Durkin points out.

Last year STL hired wholesale IT project management professional Andy Payne to further streamline its migration processes and support customers transitioning from outdated competitive products to the next-generation STL MMS Evo.

STL also installed a sophisticated, secure cloud-based Help Desk solution that simplifies the service request process and increases resolution efficiency. This new STL Customer Portal enables customers to access help from STL’s ‘can-do’ team in more ways, from any device at any time, and even incorporates an extensive library of guides to help them resolve simple issues themselves.

“This blend of technical and industry mastery has drawn a new wave of new customers to STL – such as First Choice Foodservice,” Durkin reports.

Over the last decade, the operator has established 1,000 catering and restaurant customers, 5,000 product lines, a 30-strong fleet and annual revenues of £15 million. To accelerate growth over the next 10 years, with the economic climate looking set to stay stormy for some time yet, its directors realised they needed a more intelligent business solution and more responsive support service.

“They chose STL in part for MMS Evo’s rich, wholesalespecific functionality and agility, and its open Microsoft platform which makes it is easy to install, integrate, customise, and scale up or down to match current needs – but also, crucially, because they felt STL was a safe hand on the tiller,” says Durkin.

Steve Ainger, managing director of First Choice, says: “The idea of moving our whole operation onto a new IT platform at this time was daunting. But STL’s team worked hard to get us shipshape by, for example, prioritising our operational requirements and tidying up our source data. They then helped us navigate any issues as they arose. In all, we completed our migration in just four weeks.”

Now, First Choice is benefiting from MMS Evo features like real-time Key Performance Management reports which are helping it to confidently adjust for prevailing conditions while staying on its long-term course, according to Durkin. Further, the seamless integration between MMS Evo and First Choice’s cloud-based Sage Standard accounting software makes it easier to share the latest data whilst reducing the administrative effort.

Ainger remarks: “These things are never plain sailing, but thanks to STL’s expertise and can-do approach we are now heading into 2023 full steam ahead.”

The storm of recent global events aren’t forecast to calm down any time soon.

For help in navigating these troubled waters, the nation’s top delivered, foodservice and cash & carry operators have turned to the industry experts: STL.

As experienced wholesalers, we know how to design IT solutions that support best wholesale practices.

Our modern, open and flexible platform means they are easy to customise and integrate with other business

systems such as Sage. And, they automatically absorb the latest security and functional updates, and keep you compliant with all your sector regulations.

Continuous investment Plus, we’re continuously developing new solutions and services to help you go full steam ahead, no matter what the future brings.

TWC provides sales reporting for 49 wholesalers across retail and foodservice, and its platform is used by more than 150 suppliers. It is therefore well placed to tell wholesalers and suppliers what is happening in wholesale.

Overlaying this data with trade and consumer research, it can explain why trends are arising. Meanwhile, its consulting division can support wholesalers and suppliers in building a plan to maximise their opportunity within the channel.

“As the ‘go-to’ for route-to-market insight, our power lies in our deep understanding of the channel, which allows you to hit the ground running – because we have a realistic grasp of what works and what doesn’t,” says TWC’s managing director Tanya Pepin. “Our breadth of solutions covers reporting, market research and insights.”

TWC’s SmartView platform harnesses wholesale shipments data for some of the UK’s leading wholesalers including Unitas, Confex, Caterforce and Country Range Group.

“Increasingly, our clients are taking advantage of our ability to integrate retail sales data into the same tool, allowing suppliers to seamlessly track product performance through depots, into retail and out to the consumer, toggling between wholesale and retail metrics,” Pepin reports.

“This approach enables the most progressive operators to educate their retailers on what is driving performance in their stores, by providing full visibility of the supply chain and incentivising the right behaviours.

“We are very excited to announce a further development in the form of a convenience market read – SmartView Convenience – which will be the most representative view of independent convenience in the market, based on a balanced sample of over 6,500 unaffiliated and symbol retailers with a combined turnover of £5.6 billion.

“The data will be accessed via our leading-edge technology, rated nine out of 10 for ease of use by our supplier users, and backed up by our industry leading customer service. More information is coming soon, with the launch imminent.”

TWC also offers its WholeView solution for those suppliers wishing to aggregate their wholesale shipments data from multiple wholesalers into one online reporting tool. “Once again, this is powered by our easy to use, intuitive technology, providing a single view of performance and one version of the truth across the business,” points out Pepin.

The TWC Trends programme seeks to get behind the ‘why’ of what’s happening in wholesale, using a range of methodologies and by speaking to consumers, wholesalers, retailers and foodservice operators. “We can design and deliver bespoke projects to address your business questions – tap into our extensive industry knowledge and vast network to unlock route-to-market insights,” says Pepin.

TWC has partnered with Mealtrak – described as the nation’s leading continuous tracking programme for food-togo and out-of-home consumption. “This comprehensive and authoritative source of market intelligence allows you to quantify the food-to-go market and your share within it, split by key retail and foodservice channels,” Pepin explains.

TWC Consulting brings TWC’s offer together – recognising that many businesses operating in the channel do not have the resource or detailed understanding of the route to market to execute channel-specific, data-led analysis. “We can get to the insight that is sitting in any, or all, of your data sources; identify where the biggest opportunities are; and pull together a plan to exploit them,” says Pepin.

“We are committed to the wholesale channel which includes its suppliers and customers. Our mission is to harness data to empower wholesale. We do business transparently, especially when it comes to costs and timelines; we strive for longterm partnerships and put our customers front and centre. We are ambitious; as champions of wholesale we want to see this route to market thrive, which fuels our vision for a channel that is truly data led, with TWC at the heart of it. And that’s why you wouldn’t want to do wholesale data without us.”

PMPs

Looking at the financial landscape, it is clear that the beginning of 2023 will be tinged with uncertainty: 22% of households currently class themselves as struggling, and 90% are concerned about rising grocery prices (tradingeconomics.com/ONS). More than ever, retailers can use price-marked packs to convey an affordable product that will help with value savings, says Adrian Hipkiss, marketing & international business director at Boost Drinks.

Last year, the supplier expanded its portfolio with the launch of its 500ml Juic’d range. “Made using real fruit juice and priced at £1, the price-marked pack helps retailers to communicate great value amidst increased price consciousness,” says Hipkiss. The 500ml can segment is the fastest growing category in energy drinks (IRI).

Swizzels recently introduced price increases on its range of price-marked packs for the first time in its history. New £1.15 PMPs are available to wholesalers now.

“In order to protect, and in some cases increase retailers’ and wholesalers’ margins, we have taken the decision to break the £1 hanging bag PMP on sugar confectionery,” explains sales director Mark Walker.

“We fully believe that the £1.15 PMP offers value for money and will protect consumer trust in tough economic times, whilst at the same time protecting our valued wholesale partners and diligent retailers,” adds Walker.

Before introducing the changes, Swizzels partnered with The Fed to conduct research among retailers. The study showed that 74% of independent retailers view PMPs as extremely important to their business.

“Of the retailers we surveyed, 44% said that the majority of suppliers across all categories had already moved above the £1 PMP,” Walker reports. “In fact, 75% stated that they saw slightly higher sales or no change, proving that moving above the £1 PMP is a low-risk move.

“We also discovered that 60% of retailers were comfortable stocking a higher priced PMP, provided their margins were protected.”

Boost also expanded its energy stimulation range with the reformulation of its Fruit Punch flavoured 250ml Energy SKU – available in 65p PMPs – and Boost Iced Coffee Mocha, price-marked at £1.

“In times of inflation retailers may be hesitant to purchase large quantities of PMP stock and commit to prices on products with long shelf lives,” concedes Hipkiss. “However, new research shows that 78% retailers would prefer to retain PMP packs (Shopt). The biggest driver behind retailers choosing to stock PMP formats is that it builds trust between retailers and their shoppers and helps to set up an easier shopping experience for consumers.”

Red Bull recommends stocking price-marked packs across bestsellers at all times, to demonstrate range and offer customers a transparent choice whilst driving sales and profit for operators.

‘Price and value’ is the second biggest driver for consumers behind ‘taste and flavour’ when selecting an energy drink from the shelf (Tribes). In particular, 56% of all impulse shoppers indicated that they would be more likely to buy a price-marked pack, significantly overindexing within the 33-44-year-old age demographic (Lumina).

As the nation continues to navigate the ongoing economic pressures, price-marked packs will become even more important for retailers to demonstrate value and give shoppers confidence that they are getting a fair price, maintains Matt Gouldsmith, channel director, wholesale at Suntory Beverage & Food GB&I.

Last year the company introduced reduced-price PMP bottles of Ribena Sparkling to help retailers tap into demand for value. “PMPs should be balanced alongside shopper insight and store-specific requirements in order to meet the needs of consumers,” points out Gouldsmith.

He adds that, as shoppers become more price-conscious and look to spend time with friends and family at home, the trade should stock up on larger soft drinks formats, such as Ribena Sparkling Zero Sugar two-litre bottles, price-marked at £1.29.

are more important than ever in giving consumers reassurance that they are getting good value – but the margins must be acceptable for all in the supply chain.

Price-marked-packs have always been an important part of Perfetti Van Melle’s offering across its leading brands. “They’re a tried-and-tested mechanic that provides shoppers with confidence that they are getting great value for money,” explains Paul Robinson, controller –convenience & wholesale. “This is even more pertinent now as purse strings tighten.”

Sales of Fruittella £1 PMP Juicy Chews have grown by 15.1% and Fruittella £1 PMP Duo Stix by 15.4% (IRI).

Robinson adds that while there is sometimes concern about the impact of price-marked packs on profit margins, “the allure of a PMP will help to increase impulse purchases, encourage repeat custom and ultimately drive stock through more quickly”.

Popular brands offering PMP formats helps to drive category sales and boosts additional trials of new products in a range, maintains Mars Wrigley. For example, Maltesers’ latest innovation, Dark Maltesers, is available in a £1 PMP treat bag.

Other examples of Mars Wrigley lines in £1 PMPs are M&M’s (four flavours) and Skittles Squishy Cloudz.

Kervan Gida UK reports that 82% of retailers say that £1 PMPs are ‘must stock’ items (HIM), and £1 PMP ranges are the main driver of growth in convenience & impulse (Kantar).

The supplier offers Bebeto 160g Laces & Pencils, 150g Gummies and 70g Spaghetti as PMPs.

“PMPs continue to perform significantly well in retail and convenience, particularly in the confectionery category as they communicate a value deal to shoppers and encourage impulse buys,” says Andy Walvin, UK sales manager. “In fact, three in five consumers (60%) believe that the PMPs they see on-shelf are on a special promotion.”

In the confectionery category, promotions are a key consideration when retailers make their purchases, but rate of sale and cash margin are more important to independents (Lumina). At the same time, retailers who are purchasing confectionery in wholesale focus on the customer benefits of PMPs and understand that they are an important tool for convenience (Lumina).

“Price-marked pack confectionery will make the purchase decision process easier for retailers, and hence will boost confectionery sales in wholesale,” says Susan Nash, trade communications manager at Mondelez International. “Differentiate PMP listings from non-PMP listings to ease the purchase process and encourage quick sales.”

In the breakfast biscuit category, Mondelez International has introduced a new £1.49 price-marked multipack format for belVita Honey & Nut – the bestselling flavour in the convenience channel (Nielsen).

Amy Lucas, brand manager for belVita, says: “The clear communication of value from a brand that shoppers trust and can depend on to deliver great taste makes stocking belVita Honey & Nut PMP an excellent option for convenience retailers.

“A fifth of shoppers say they would choose a particular convenience store if they knew it stocked PMP products (Lumina), and 56% of retailers say they have been selling more PMP products during recent times, which emphasises the importance of value within the category.

“At Mondelez International, it’s our purpose to provide the right snack for the right moment, so we’re really excited to bring this new format to retailers and consumers alike.”

The Weetabix price-marked pack range covers a range of lines across its cereal and drinks portfolio, at a range of price points. These include £1 PMPs of Weetabix On The Go breakfast drink, which were brought back last year by popular demand, backed by a field sales campaign to increase distribution in the impulse channel.

“PMPs are a major growth area for convenience stores, as consumers are increasingly looking for reassurance on value,” says head of sales Darryl Burgess.

“We work hard to ensure that our pricemarked packs offer competitive shared margins,” he adds.

FareShare is a safety net for us.

it’s there has been really comforting during these unusual times.