Tom

Tom

Booker’s like-for-like sales were up by 5.4% in the 12 months to February 2024, according to Tesco’s preliminary results.

Booker’s total sales were ahead by 4.6% to £9.08 billion. Of this, retail (excluding tobacco) accounted for £3.2 billion; catering (including small business sales) £2.5 billion; tobacco, £1.86 billion; and Best Food Logistics, £1.52 billion.

Like-for-like retail sales (excluding tobacco) grew by 11%, supported by a further 211 net new retail partners (Londis, Budgens, Family Shopper and Premier fascias)

in the second half and ‘record levels’ of availability. There were 354 net new Booker retail partners in the whole year.

The company’s entrylevel ranges, Euroshopper and Jack’s, performed particularly strongly, with sales up by 16% year on year as the number of lines within these ranges was expanded in response to customer demand.

Tobacco sales declined by 4.3%, reflecting an ongoing market volume contraction.

Like-for-like catering sales increased by 10.2%, with particularly strong growth recorded in the own-label Chef’s Essential and Chef’s Larder ranges. Booker launched its largest ever Price Lock, on over 700 products during the festive period, and there are a further 600 products price-locked until the end of this month.

Hancocks has cut the prices on its pick & mix multibuy offers.

The new deal features more than 300 lines of Kingsway pick & mix bags ranging from 2.5kg to 3kg. Customers save 20p per bag on 10-19 bags and 50p per bag on 20 or more.

With the average customer buying 40 bags per week, the Hancocks team says that the new deal could save retailers £1,000 a year.

Sweets that feature the offer include Kingsway Value Peach Rings, Sour Bears, Sour Dummies, Jelly

Blue Babies, Fizzy Cola Bottles and Fizzy Cherry Cola Bottles.

Head of marketing

Kathryn Hague said: “The new version of our exclusive Kingsway offer rewards smaller customers and means they don’t need to spend as much to enjoy the benefits.”

She adds: “We hope our Kingsway range will continue to be as popular as always among our existing customers and new ones. This offer brings them maximum return and delicious confectionery to share with their customers.”

Booker’s On-Trade Club now offers almost 9,000 licensed customers access to discounted prices, and the company also has 45,000 customers signed up to its Fast Food Club.

In November, the company converted its Makro branch in Fareham into a 120,000 sq ft retail hub to offer its retail customers a broader range whilst creating capacity in its branches to grow its catering business. “We have plans in place to

further enhance our capacity in the current year,” said a spokesperson.

Best Food Logistics’ sales declined by 0.1%, which includes a sales drop of 5.4% in the second half. According to Tesco, this decline was driven by its actions to exit unprofitable contracts.

Another development in the last year (June 2023) was the sale of the Booker fine food subsidiary RitterCourivaud to Musgrave for an undisclosed sum.

Country Range has unveiled its first Signature dessert –the Signature by Country Range Chocolate & Marmalade Marble Cake.

Featuring Belgian chocolate buttercream and chocolate orange segments, Seville orange marmalade, an orange cream and two layers of chocolate and orange swirled marble sponge, the new Signature dessert comes frozen in 16 portions. The cake just needs to be thawed before serving.

The Signature by Country Range collection features carefully sourced, premium ingredients and products from across the globe, and is aimed at discerning chefs and foodies.

Rachel Porter, Country Range Group’s marketing manager, said: “We were thrilled to launch our Signature collection last year and the response from caterers thus far has been outstanding, so we’re excited to add to the portfolio with our first ever Signature dessert. Elegant and delicious, it’s a real showstopper of a dessert.”

JJ Foodservice has acquired London-based Asian wholesaler Gatelands Supplies.

With over two decades of expertise in importing authentic Thai, Chinese, and Japanese goods, Gatelands brings a skilled team to support JJ’s plans to supply more Asian restaurants.

The Gatelands team has joined JJ’s Enfield branch, and over 300 new Asian products have been added to JJ’s range.

Baris Kacar, chief sales officer for JJ, said: “By combining Gatelands’ expertise with our distribution network, we’re reinforcing our commitment to support the Asian restaurant sector.”

Christopher Christofi, director of Gatelands Supplies, commented: “With over 35 years of experience in the hospitality sector, JJ Foodservice stands as a

prominent industry leader. Strategically situated across 12 locations, its expanded infrastructure means our customers will benefit from local collection, fast deliveries and an extensive product range.”

Kacar added: “We’re dedicated to continually growing our product range and increasing our knowledge and expertise through strategic acquisitions.

“We welcome any interested parties to reach out and explore potential collaborations.”

Kitwave and Unitas have mutually agreed that it would be in both parties’ interest for Kitwave’s foodservice businesses to move out of Unitas.

Therefore, MJ Baker, Miller Food Service and WestCountry will leave the group in October 2024 and have become members of Fairway Foodservice.

However, Kitwave has confirmed that membership of Unitas remains paramount to the future growth and success of its retail and on-trade businesses: Turner & Wright, HB Clark, Eden Farm, Westone Wholesale, M&M Value, Automatic Retailing, and Squirrels.

Ben Maxted, CEO of Kitwave, said: “We have exciting growth plans for Kitwave, and we see Unitas as a key strategic partner to support us.

CJ Lang & Son has acquired three convenience stores that previously traded as Eddy’s Food Station stores, located in Larbert, Greenock and Leuchars.

Colin McLean, CEO of CJ Lang & Son, said: “We are happy to welcome these three convenience stores into the SPAR Scotland family, following the sad news of its previous owner recently entering into administration.

“We recognise the challenges facing many convenience store operators at the moment, but we are pleased we have been able to work quickly to secure the future of these stores and the store staff involved. This will ensure local jobs are

retained and the stores remain open to continue serving their communities.”

Work has started on transferring the three stores to SPAR. The stores will be fully serviced and supported by CJ Lang’s distribution depot in Dundee.

In other news, the company has launched its 2024 SPAR Scotland Awards programme.

The award winners will be announced on 26 September in Aviemore, and the categories are: a Independent Community Store of the Year

a Company Owned Community Store of the Year a Independent Store of the Year

a Company Owned Store of the Year

a Supplier of the Year (multiple categories)

a Future Stars Award in partnership with the Scottish Football Association. This is a new award and is designed for CJ Lang colleagues based at the distribution centre and head office in Dundee.

Winners will be selected by a panel of CJ Lang area managers and executive team members, as well as category sponsors. The Supplier of the Year awards will be judged by SPAR Scotland trading managers.

‘Now

“We have ambitious plans for foodservice which will no doubt include further acquisitions, and we both agreed that now is the time for that part of our business to step out of Unitas.”

John Kinney, MD of Unitas, added: “Kitwave is a fantastic business, and we look forward to working together even more closely with the team as they continue to expand their retail and on-trade businesses.”

Fresh Direct – part of Sysco –has launched vegan-friendly mushroom ‘meat’.

Rather than waste mushroom stalks, Fresh Direct has partnered with specialist Irish mushroom grower, Umi Foods, to harvest, cook and shred the surplus products.

Ian Nottage, head of food development at Fresh Direct, said: “The texture of the mushroom meat provides a fantastic alternative to more traditional centre-of-plate options.”

Brakes is running three major live food events this year, each featuring more than 60 stands hosted by small firms and national brands, alongside demonstrations and presentations on food trends.

An online event is running alongside the physical expo, allowing customers to access content from the live event virtually.

The first Foodie Expo was held in Scotland on 1 May and others will take place in Birmingham on 22 May, and in the South of England on 25 September (venue to be confirmed).

In Birmingham, the event will be held at Edgbaston Cricket Ground, where customers will be able to see demonstrations highlighting topical events and the latest trends in foodservice, as well as specialist care and education presentations.

Paul Nieduszynski, Sysco GB CEO, said: “This year we’ve expanded the Foodie Expo to include live demonstrations so that we can provide practical examples of how products can be used in kitchens.”

Brakes’ online event showcases 45 virtual stands. Customers are able to take part in competitions and earn mybrakes rewards cashback on the products featured.

Parfetts has appointed Richard Bone as commercial director. He will join the business in late summer from Unitas where he was finance director for over three years.

Bone (pictured) will join Parfetts’ board to support its commercial development in line with its growth targets of a £1 billion turnover and 2,000 symbol store estate.

Bone said: “Parfetts’ employee-owned model appealed to me because it allows the business to invest back into better serving its customers and supporting its staff.

“You can already see the impact of this approach with the fast growth of the depots and Go Local fascia, alongside a happy and long-serving team. I look forward to contributing to the continued

success of the company.”

Guy Swindell, joint managing director of Parfetts, added: “Richard brings a wealth of experience and talent to the business, and we look forward to the impact he’ll make.

“We are constantly looking for new ways to improve our business and the service we offer customers. I believe that Richard strengthens our management team and will be a real asset.”

In its latest results, Parfetts’ turnover rose by 6.7% to £646 million and operating profits increased by 51% to £8.5 million.

Unitas is losing another key member of staff: commercial director Kirsty Cooper is also leaving the group.

Cooper, who is going ‘to pursue alternative opportunities’, joined Unitas in November 2023 to oversee strategic projects and has been instrumental in the implementation of the Unitas Procurement solution with Auditel.

She has also delivered a central distribution solution and a supply chain optimisation strategy – projects that are now at the stage of moving into business as usual, according to Unitas.

Pricecheck has assembled a network of volunteer Sustainability Champions to act as a focal point for environmental issues throughout the business.

The eight eco-conscious individuals from different departments aim to bring about transformation by improving processes and promoting responsible behaviours among their peers.

Headed up by HR director Lucy Goddard, the team is set to meet quarterly to discuss and evaluate the progress of sustainability initiatives.

The Sustainability Champions have already introduced new incentives to encourage colleagues to think, act and be greener. For example, a partnership has been launched with the

Treekly app to provide a daily walking challenge for Pricecheck employees that supports mangrove reforestation. Completing 5,000 steps on any 20 days in a month converts to one tree planted in Kenya, with the reforestation methods aligned to 10 UN Sustainable Development Goals.

Goddard said: “Like most

companies, we continue to invest in technologies and processes to reduce our impact and achieve our ESG goals, but many businesses are leaving out one big influence – their people.

“True progress cannot be made unless our workforce is on the same page, and that’s where our Sustainability Champions come in.”

Stuart Lane (pictured), one of the founding members of National Buying Consortium (NBC) and its first chairman, is standing down as a director. This follows the sale of his business, Lansdell Soft Drinks, to Chapple & Jenkins in April 2023.

“We are privileged to have been able to have Stuart on our side and in those first formative years,” said NBC chairman David Longfellow. “We are in a much better place having had his leadership and guidance available to anyone that needed it.”

Lane added: “It has been a tremendous pleasure to have worked with a group of businesses that have the same values and principles.

“Whilst we have had

many challenges during our journey, the group has gone from strength to strength, and the leadership team that has evolved over such a short period of time has ensured that the group is now well positioned for the future. That allows me to focus my own time and attention to new challenges.”

NBC is now seeking applications from its membership for member director.

More than 500 delegates were joined by 45 suppliers at James Hall & Co’s ‘SPAR Transform’ retail event.

Held at the Harrogate Convention Centre, SPAR Transform featured business updates, a tradeshow and social activity in one day for the first time.

Tobias Wasmuht, MD of SPAR International, was the keynote speaker, and guests heard a succession of SPAR retailer case studies, which highlighted transformed food-to-go sections, category expansion, sales performance, promotional activity and store development.

In addition, James Hall & Co’s G&E Murgatroyd company-owned stores division joined SPAR independent retailers to share best

With care homes across the UK facing staff shortages and skill challenges, Bidfood has provided an all-in-one immersive support platform through the launch of its Interactive Care Home.

This digital initiative spotlights innovation and solutions for the six key areas found in UK care homes –bedroom, lounge, dining room, kitchen, office and garden.

Users can explore each room, watching videos where one of Bidfood’s experts offers their professional advice on various areas including menu planning, nutrition, creating innovative and delicious dishes, and how to shop and save time using the e-commerce site Bidfood Direct.

With over 75 interactive elements to discover, users

are also able to access support tools on specialist diets, product guides and increase their knowledge via Bidfood’s free e-learning site, Caterers Campus.

There are over 16,000 care homes in the UK (Carehome.co.uk), most of which are operating with tight budgets, rising food costs and limited resources. Bidfood’s Interactive Care Home has been designed with this in mind, delivering an easy-to-use platform that demonstrates how the

wholesaler’s services, expertise and relevant ranges seamlessly integrate within a care home.

Gavin Squires, Bidfood’s business development controller for education & healthcare, said: “We are thrilled to have launched this latest campaign for the sector. Our aspiration is for this platform to become the go-to industry source, where all care homes can access a comprehensive overview of the support readily available for their care home from Bidfood.”

practice. This included improved in-store administration efficiencies through utilisation of platforms such as Zebra Reflexis and a focus on the success of Q-commerce in G&E with Deliveroo and Just Eat.

A spotlight was also shone on SPAR own brand, with a new range of 24 SPAR International lines now available to SPAR North of England retailers.

Harlech Foodservice is investing £1 million in six more low-emission delivery trucks this year, as it gears up to build new markets from its latest base in Carmarthen. It is also looking at the feasibility of equipping the sales fleet with all-electric vehicles.

Harlech has a net zero target of 2050 and has already made some major savings by switching to more environmentally-friendly coolant gas for its freezer rooms at its headquarters and for its refrigerated transport fleet.

Alongside head of operations Ian Evans, sales administrator Janette Jones has overseen the company’s drive towards net zero. She said: “It is really important to embrace the green agenda because so many of our public sector customers demand it now.”

Appleby Westward’s recent SPAR South West tradeshow and conference in Sandy Park, Exeter, featured presentations from the directors of the Appleby Westward leadership team and SPAR UK representatives, retailer panel discussions with key Wessex Guild Members, and networking with 70 suppliers.

Retailers heard about ways in which SPAR South West is working towards saving their stores money, including reducing energy costs through experts in energy management and sustainability, lowering waste costs, and introducing new range propositions based on data analysis of consumer chosen products and new time-saving technology like Shoplink.

Available in all SPAR South West stores by July, the Shoplink web-based

ordering platform is modern and user friendly with a search and add-to-order system. It is also able to filter and view the full available ranges.

Appleby Westward MD Mike Boardman said: “There are huge benefits to being in the SPAR South West club. We use our scale, range proposition, payroll and e-learning assistance, our SPAR own-label range and local Wessex Guild colleagues to drive the business forward. As industry leaders there is a strong case for independent retailers to join SPAR.”

Fairway Foodservice has announced the launch of a new wholesale data service in partnership with TWC.

Fairway Foodservice is made up of 19 UK and European wholesale members, with a combined annual membership turnover of over £1 billion.

Coral Rose (right), managing director of Fairway Foodservice, said: “We are delighted to announce the launch of our new data initiative, due to go live later this summer. It is clear that wholesalers, buying groups and suppliers need access to good quality data to grow their sales and profits, and run more efficient supply chains.

“Our members and our suppliers will soon be able to access ‘one version of the truth’ from the Fairway Foodservice membership

and this should prove pivotal in growing everyone’s sales – including most importantly our members’ customers’ sales. We have always been focused on having quality, accessible data and the TWC SmartView platform is the perfect complement to Connect, our current online data sharing tool.”

She continued: “There is no company who comes even close to TWC when it comes to their knowledge and passion for the UK wholesale sector.”

SoSweet has joined Sugro.

Based in Bideford, Devon, SoSweet is a speciality sweet business with retail, wholesale and online platforms. It currently operates 14 SoSweet Stores across Devon, Cornwall, Dorset and Somerset, and is aiming to grow to 20 stores by 2025.

SoSweet is ranked in the top 10 food sellers on Tik Tok and it dominates the Sweets & Snacks category on the platform with its range of ‘viral’ SKUs.

The company has also just launched a new delivered SoSweet Direct service, whereby its team of reps deliver to convenience and speciality operators in the South West of England.

SoSweet director George

Robinson said: “As a highvolume retail and wholesale business, we rely on strong direct relationships with suppliers to increase our variety and availability across our range.

“Our strong physical presence across the South West also presents many opportunities for brand partnerships and activations. We are very excited for a long and fruitful

experience within the Sugro group.”

In other news, Sugro is giving its members an opportunity to save on their energy costs through a partnership with Trustkeys.

Emma Senior, Sugro managing director, said: “Our members, along with everyone else, are impacted heavily by the cost-of-living crisis, so this is an excellent

way of how a buying group can benefit them.”

a Over 270 members, suppliers and guests attended Sugro’s recent trade show at the Liverpool Exhibition Centre.

At an awards dinner, E-Natural was awarded the Environmental & Sustainability Award; Brand Factory was recognised as Digital Champion of the Year; Sandea Wholesale took the Group Rising Star Award; and Courtney & Nelson won Retail Member of the Year.

The Community & Charity Champion Award went to Morris & Son; ICS won the Foodservice Wholesaler Award; and Shree Sai Trading claimed the Specialist Wholesale Award.

Pricecheck has had a recordbreaking year, quarter and month for company revenue.

The hat-trick of success includes generating £151 million in turnover for the 2023/24 financial period, a 15% increase on the previous year. Sales for the final quarter reached £44 million, which was 22% higher than the same period last year.

Pricecheck also recorded its biggest month ever in April 2024 with revenue of £17.2 million – a figure that

represented the company’s annual turnover 16 years ago, when brother and sister duo, Mark Lythe and Debbie Harrison, took the reins of the business from their parents.

It is the tenth consecutive year of growth for Pricecheck.

The business’s core offering of delivered wholesale remains the biggest contributor to turnover but the launch of new supplier partnerships, an increase in digital sales, and developments within its brand distribution division continue to push Pricecheck forward.

Joint managing director Debbie Harrison commented: “It’s been a very busy year and we’re delighted to have ended 2023/24 stronger than ever. Our team have embraced all new opportunities whilst not forgetting our core business and this is reflected in the results.”

CJ Lang & Son, the wholesaler for SPAR in Scotland, has strengthened its executive team with two new appointments.

Chris Boyle (pictured) has joined the company as finance director from United Wholesale Scotland where he held the position of finance director for two years.

Before that, he had a variety of finance roles at retailers M&Co and Botterills Convenience Stores.

The second appointment is Della Myers, who will join CJ Lang in June as trading director, replacing Richard Collins who is retiring later this year.

Myers was formerly trading director for convenience for Costcutter Supermarkets, which is part of Bestway Retail. She spent six-and-ahalf years with Costcutter.

The annual wholesale, convenience and foodservice charity bike ride ‘Bikes Against Bombs’ (bikes againstbombs.co.uk) has this year raised over £280,000 for MAG (Mines Advisory Group).

The initiative was set up in 2015 by Neil Turton, nonexecutive director at Alliance Stores, and Tom Fender, development director of TWC, to raise money for the Manchester-based landmine clearance charity, Mines Advisory Group (MAG).

The 2024 ride comprised a 350km route from Hue to Hoi An in Vietnam. This year’s event was the eighth international ride, and there was also one ride in the UK.

Alongside Fender and

Turton, this year’s ride saw 43 industry executives take part, including Creed Foodservice chairman Philip de Ternant, Henderson Foodservice managing director Cathal Geoghegan, Unitas managing director John Kinney, Harvest Fine Foods managing director Steve Whitwam, and Confex COO Jess Douglas.

At the finish line, Turton

said: “We have just finished 350km in 37-45 degrees heat and have a group of happy and proud people. As someone said this week, it is like waking up on the hottest day ever in the UK, deciding to cycle from Manchester Airport to Nottingham over the Peak District and then doing the same thing several days in a row – all for awareness and funds for MAG.”

Myers started her career at Asda before moving into convenience retailing.

Colin McLean, CEO of CJ Lang & Son, commented: “We are delighted that Chris has joined the executive team and he has settled in well to the role. We’re looking forward to officially welcoming Della to the company in the next few weeks. I’m delighted that they have both chosen to join CJ Lang as we continue on our exciting journey.”

JJ Foodservice is now offering open banking for both online and in-branch payments.

After successfully launching the Pay by Bank open banking payment method for online transactions in 2022 to address rising credit card fees, the company has now expanded the option to counter payments.

The in-branch Pay by Bank option debuted at JJ’s Wimbledon branch and was recently introduced at the Enfield HQ. Plans are under way to extend the service to all 10 remaining branches. More than 55% of JJ customers now Pay by Bank.

The transition to open banking, via Trustly, has also resulted in significant annual savings for the wholesaler.

After extending its own cash & carry last year, Monmore Confectionery has acquired two more depots to drive further expansion into new regions, explains managing director Skip Mehta.

The acquisition by Monmore Confectionery of two cash & carries already this year supports the wholesaler’s longterm vision to grow across the UK.

In January, Wolverhampton-based Monmore bought the Morris & Sons Stockport branch, and this was followed in February with the purchase of Salford-based Corolldraw, which trades as Northern Confectionery.

Managing director Skip Mehta told Cash & Carry Management why the time was right for these acquisitions: “After successfully expanding our West Midlands-based cash & carry last year, increasing our space to 50,000 sq ft, our focus turned to further growth across new regions. Not only did we expand our physical footprint, but we also achieved an impressive 40% year-onyear growth. Therefore, our logical next move was an acquisition to sustain this momentum and drive further expansion.

“The acquisition of the new cash & carries – both in Greater Manchester –fits perfectly with our existing operation

at Monmore Confectionery. We believe it’s a great market opportunity for us to increase brand awareness throughout the UK. In terms of competitive advantage, by acquiring the new cash & carries, we hope to gain an edge over other UK wholesalers as we grow our economies of scale.”

Morris & Sons in Stockport was established in 2009. After outgrowing the original 5,000 sq ft depot, it moved to the current 15,000 sq ft premises at Yew Street. Morris & Sons offers in excess of 2,000 products, ranging from lollipops and fudge to novelty lines. The cash & carry is open to trade customers only, and orders can be delivered to customers across the UK by courier service.

Monmore has changed the business name from Morris & Sons Stockport to Stockport Sweets, and has retained the manager, John Torkington. “We are pleased to welcome John – who has over 35 years of experience in the confectionery trade – to our team,” says Mehta. “With his wealth of knowledge we know that he will be an asset to The Monmore Group.”

Torkington adds: “Joining Monmore Confectionery will be an exciting new challenge and a great opportunity to build the Stockport Sweets brand and deliver great products, services and prices to our customers.”

Corolldraw was incorporated in 1981, and the founder was a market trader who diversified into wholesale.

Some of the firm’s most recognised brands are Kandy King, Glorious Sweets and Lite. Northern Confectionery has grown into one of the largest and most reliable confectionery wholesalers in the UK and Ireland, says Mehta.

Northern Confectionery’s depot is 12,000 sq ft, and its customers range from small businesses to large retail chains. Like Monmore Confectionery and Stockport Sweets, Northern Confectionery is open to trade customers only but encourages members of the public to place orders online.

Mehta says: “We plan to build on the existing customer base of both cash & carries and increase revenue. We have already begun cross trading and expanding ranges between all three cash & carries, and will continue to enhance the services we offer.

“Monmore has reached a significant point in its journey,” he continues. “This major milestone stands as a testament to our dedication, hard work, and the unwavering support of our valued customers and suppliers.

“Whether it’s our expansion into new regions, the acquisition of new businesses, or the continuous enhancement of our services, each step has been crucial in shaping our success story.

“As we celebrate this milestone, we express our gratitude to our dedicated team members who have played an instrumental role in making this achievement possible.”

Mehta concludes: “Looking ahead, Monmore remains committed to providing high quality products and services, and we are excited about the opportunities that lie on the horizon as we continue to grow and evolve our Monmore family. We are always keeping an eye out for potential expansion and further acquisitions.” CCM

‘I

What have been your biggest achievements in work and outside work?

At work over recent years, I’ve taken much pride in building a diverse team with new roles focused on digital marketing, design, e-commerce, product development, data and sustainability. Outside of work, I graduated with both BA and MSc degrees – being the only member of my family to attend university and something not too common for a lad from a large council estate in East Hull.

How would you describe your personality and what approach do you take in business (and in life)?

Whether I’m in or out of the office, I’m extremely relaxed and very self-confident, and I try to see the positives in everything. I take a methodical, common-sense approach. I do love calculated risk and never shy from giving my opinion!

Who has been the biggest inspiration to you?

My Dad, who sadly passed when I was

only 11 years old. (Tom and his Dad are pictured above.) I was a mini version of him growing up. He hugely influenced my favourite sports, hobbies, music and food. Going through that experience has widened my sense of compassion and gave me a steely determination to succeed in anything I do.

What were your ambitions when you were growing up?

In my primary school yearbook, I wrote that I wanted to be a snooker player. I grew up watching and playing snooker – every weekend I used to visit my local snooker hall, but my break building isn’t what it used to be.

What are your interests outside work and how do you maintain a work-life balance?

I live a pretty straightforward life, so when I’m not working, I’ll be going to see the mighty Hull City, or watching other football matches, F1 or rugby league. Admittedly, I haven’t perfected my work-life balance; however I have two dogs – Red the beagle and Cash the

dachshund – who are a great escape from everything foodservice.

What is your favourite film, book and song/piece of music?

I’m absolutely rubbish at watching films because I fall asleep too quickly, and being dyslexic, I’ve never read a book from start to finish in my life. But my favourite song is Old Pine by Ben Howard – give it a listen and thank me later.

If you won a holiday, where would you go and who would you take with you?

I’m not a beach holiday person; I much prefer a busy city break. But I’ve never had any dream of travelling anywhere in particular, so it would have to be a trip away with my two dogs. Maybe we’d go on a road trip in a motorhome but that would be pure chaos!

What would people be surprised to know about you?

It’s maybe not a career highlight but I was once a dancer in a club – during my time at uni I was a promoter for a bit and for ‘Cheeky Mondays’ I dressed up in a monkey outfit and hit the stage every week! That might not be a surprise for those who have seen me in the middle of the dance floor at numerous events (never sorry!).

CCM

Tom English achieved both Batchelor’s and Master’s degrees in Management from the University of Hull. Before graduating he had already racked up five years of experience in food retail, and the opportunity to join Turner Price seemed to him a perfect fit. Starting off in a sales & marketing support post in 2014, English now leads the marketing and e-commerce functions within the business – a role he took on in 2016. Based in Hull, Turner Price is a member of Country Range Group.

‘We

In his first interview since joining WestCountry in February, managing director James Russell explains how he intends to build on the company’s rich heritage.

Not many wholesalers would entertain the idea of offering 13 deliveries per week with no minimum order quantity, but then WestCountry is not your typical wholesaler.

Established in 1856, WestCountry is the oldest and largest specialist wholesaler of fresh produce in the South West of England. It began by provisioning ships in the port of Falmouth and has grown to service different types of customers with a wide choice of products to complement its fresh produce heritage.

Acquired by Kitwave in December 2022, WestCountry still has an extraordinary level of customer service as its USP, to the point that recentlyappointed managing director James Russell describes the wholesaler as the larder for its customers.

Russell (pictured), who was formerly managing director of Blakemore’s wholesale and foodservice business,

Turnover: £40 million.

Locations and sizes of depots: Falmouth, 25,000 sq ft. Includes the head offices and will see the addition of a 9,000 sq ft frozen warehouse; St Austell, 10,000 sq ft; Newton Abbot, 10,000 sq ft (being replaced with a new 80,000 sq ft purpose-built warehouse).

Number of lines: 4,500.

Number and types of customers:

3,000, mainly hospitality and foodservice outlets, but also education and healthcare clients and retailers including convenience stores.

Number of employees: 220-250.

Size of delivery fleet: 90 vehicles, mainly 3.5-tonne vans that can navigate the narrow roads in the areas served.

Directors and their job titles: James Russell (managing director), Andy Vercoe (operations director), Lee Bartholomew (finance director), Luke Philpott (head of sales).

talks to Cash & Carry Management’s managing editor Kirsti Sharratt about his decision to join the Cornwall-based company and his plans for its growth.

How did you come to be appointed MD of West Country?

I have known the Kitwave Group for a long time and I rate Paul Young [founder and former CEO] and Ben Maxted [new CEO] very highly.

The previous managing director of WestCountry, Roger Rossignol, had been in the business for 20 years and had successfully steered it through the transition to Kitwave, but he wanted to move on and try something else. Therefore, the opportunity came up for me to join the company, and I was fortunate to spend a month with Roger meeting key partners and understanding the finer points of the business.

What appealed to me about WestCountry is that it is a real food service business. There are elements of our proposition that you just don’t see anywhere else. We do 13 deliveries a week, we’re phenomenally service oriented, and we have superb relationships end to end.

We buy produce on the market like other wholesalers but we’ve also got a

very strong grower network in Devon and Cornwall, and incredible relationships with our customers.

We’re in the process of building a new 80,000 sq ft distribution centre in Devon, which is a Kitwave investment that will enable us to scale up and broaden our offering. The challenge of doing that and maintaining, or even improving, our service model makes WestCountry a really exciting place to be. The chance to lead the business through that change is one I didn’t want to miss.

How did your nine years at Blakemore equip you for your new role?

In my last role we scaled our accounts business by nearly five times. We also did a lot of work on refining our proposition, including through new systems and processes, so there’s an obvious parallel with my current role as we have just gone live with a new system [Swords].

Particularly from a foodservice perspective, I spent the last 12-18 months at Blakemore working relatively closely with some of the other Consortium members, and that showed me how vibrant and successful well-run regional wholesale businesses could be.

Incidentally, WestCountry is a member of Fairway Foodservice and we are working to introduce more of Fairway’s own-brand products.

What about your experience gained working for JTI and Britvic – have you been able to draw on any of that?

Not so far. At WestCountry, our proposition is produce-led and we have incredible relationships with local suppliers. In fact, local suppliers account for more than 50% of our business.

There’s a very vibrant, independent food scene across Devon and Cornwall, and if we’re going to push some products, such as soft drinks, we will generally lead with the local suppliers because regionality and provenance is so important to our customers.

That said, with the investment in our infrastructure, and, as we increase our capacity, there could be a role for other brands and other products. Therefore, building relationships with the bigger suppliers is an opportunity if it adds value to the business.

However, in a lot of instances, the bigger suppliers focus their energy on major conurbations and haven’t necessarily looked at the opportunities in places that are more difficult to reach. The value of the wholesaler’s voice is so much higher here, and big brand suppliers could tap into that.

What are the different divisions of WestCountry?

WestCountry Fruit Sales is the business that started it all and continues to focus

on fresh produce; The Essential Food Company offers dry grocery products and chilled goods; Plough to Plate focuses on local artisan fine foods; and Canara Farm represents seasonal fresh produce. Customers can choose from these ranges and put everything in the same basket.

What types of customers do you service?

The core of our business is in hospitality and foodservice – restaurants and hotels. We also service some education and healthcare accounts. In terms of customer numbers, 10-15% of our customer base is retail, be it farm shops, convenience stores or other types of retail outlets.

We’ve also got a great partnership with Waitrose in Truro: it has a Cornish Larder store within its store, which sells local and regional products. Because we’re going around collecting lots of products from local growers and suppliers, we’re able to consolidate the supply chain for Waitrose as well as for our independent customers.

Can you tell me more about the customer service you offer?

We’ve got nearly 3,000 customers and, of those, three-quarters will order at least every day and a lot of them twice a day, particularly in the high season. We’ve got integration into most of the menu platforms, including Saffron and Procure Wizard, but the bulk of our orders come from customers speaking to a telesales operator, which is great because our team are able to offer advice. We also take orders by email and by voicemail at night.

We are developing online ordering and expect it to go live in late summer, but we’re still backing the personal service model because we’re so service oriented. For example, the customer can order up until midnight and get the product on the first run the next day. If they order before 11.30am, they’re able to get product delivered the same day.

Our warehouses operate 24/7 because it is important that we receive produce as fresh as possible and deliver it to our customers as fresh as possible. We run two shifts but with some staggered start times to ensure we’ve

got three-shift (24-hour) coverage. Our first deliveries go out at about 4am. A lot of kitchens do their prep really early in the morning so we need to get the produce to them in time. Our second deliveries go out at 1pm and run until about 6pm.

We are truly our customers’ larder, which is handy for them because if they have a busy morning, it’s not going to impact their daily takings as they’re able to get stocked back up for the evening.

In fact, most of our customers have set up their businesses to be almost reliant on the level of service that we offer. No operator wants to have a large larder, because if they can convert that larder to two or three tables, it’s going to enable them to increase their throughputs and reduce utility costs.

We also offer a great deal of flexibility: customers can order three lemons, 3kg of lemons or three boxes of lemons! Customers can also ask for a product to be delivered frozen, chilled or ambiently – for example a customer might want their usual frozen bread rolls to be shipped ambiently because they want them to arrive defrosted so that they can serve them the same day.

We may not be the cheapest but we are brilliant with our service.

How do you manage the seasonal aspect of your business?

Our sales from May to October are significantly higher than during the rest of the year. Depending on the location, a customer’s business could expand two or three times during that period. For WestCountry, it’s a difficult balance to

strike because we’ve got to have the ability to scale the business up while maintaining the service and then keep costs under control in the other periods.

We are lucky that some of our colleagues are happy to work for us in the summer and then go off and do something else for six months. It’s one of those situations that’s beneficial for them and for us. We use some temporary labour as well during the peak season.

How efficient is it to offer 13 drops a week?

Typically, operational efficiencies come from low frequency high drops. The nature of Cornwall and Devon makes this a challenge so we flip that on its head and drive a high density, high

frequency small drops model. It works for customers and works for us.

What growth opportunities have you identified since joining the business?

Our market penetration is very strong, so we then look at how to grow our basket. We’ve got a sister company [through Kitwave] in MJ Baker, which is strong in complementary products, so we’re working closely with MJ Baker, and this will expand the range for both customer sets.

Our new distribution centre, which is currently in construction in Newton Abbott, will give us the capacity to expand our range and network, while maintaining our service.

I also think that retail offers us plenty of scope for growth. We’ve got nearly the entire proposition to go after those customers, but when we do it, we want to make sure that we do it right, so we are looking at that.

Also, WestCountry set up a direct-toconsumer business during Covid and, as we bring our e-commerce on, we will reintroduce that element. When we do come to market with e-commerce, we expect to take a solid leap forward as there will be a great range on there that isn’t currently available from other wholesalers.

We could also make more of our brilliant relationships with our suppliers, for example by helping our customers bring to life the story of the produce that is being served – in a lot of instances there are incredible stories behind it.

For example, for one of the family farming businesses that we deal with, we collect all of the spare packing crates we use during the season, send them to him and co-invest with him on ice making. He is then able to pack his broccoli with ice, which gets the product to our customers extra fresh. That type of endto-end relationship is part of what makes the WestCountry business so special, and we will continue to cultivate relationships like these.

Will the new distribution centre replace existing depots?

Yes, WestCountry and MJ Baker both have depots in Newton Abbot. I would describe them as characterful! Both of those warehouses will end up closing down and we’ll move into the new 80,000 sq ft purpose-built multi-temp premises, which will be WestCountry branded. We’re working towards early autumn as an opening date.

By investing in the new depot, we’re giving ourselves a platform for growth, efficiency and productivity.

Are you making any other changes to the infrastructure?

Yes, we’re at the planning stage to add a 9,000 sq ft chilled and frozen warehouse to our Falmouth premises.

How important is environmental, social, and governance (ESG) to the business?

Very important. Being a produce business, we work hard to reduce waste. We’ve got some partnerships with local farmers who will take produce that is past its best and feed it to their pigs.

We’re looking at other relationships to deal with surplus dry goods.

We’ve trialled electric vehicles (EVs) but we’ve still got the challenges of getting the right level of mileage out of them and inadequate charging infrastructure. However we think there will be a role for EVs in the future.

We support some carbon offset schemes, such as tree planting, and we’re in the process of further developing our net zero plan.

How involved is Kitwave in the WestCountry business?

Kitwave is there to help; it is effectively an investment vehicle. Our local management structure is flat. That means we can get together, have a conversation about what we want to do, sleep on

it and then say, ‘Let’s do it’, rather than having to go through loads of governance. That gives us the flexibility you would expect to see from a smaller business. Being part of Kitwave, we’ve still got that ability to be entrepreneurial and adaptable, but with the support you would want from a big organisation.

How would you describe your management style?

I’ve got strong drive and I’m challenging, but I’m also very much about enabling people to do their jobs. I’m evangelical about WestCountry – it’s fantastic and doesn’t need someone to thump the fist. This is a business that just wants a little bit more vision, and my job is to help our team move it forward as quickly and as sustainably as we can.

How do you view the future for the business?

Really positively. We’re a business that has enormous recognition. You’d struggle to go into a kitchen in the South West of England and meet somebody who didn’t know of us. Chefs move from one kitchen to another so we get a high referral rate – great endorsement from the people that count most of all. We’ve got a model that works well for our customers. We’ve got great heritage and offer excellent service, and, with the investments we’re making, we will be able enhance our range and provide more solutions for our customers. That puts us in a very strong position.

From summer-themed promotions to flavour innovation, drinks suppliers have been busy creating sales opportunities for wholesalers and retailers. Siobhan Kielty reports.

There is an undeniable profit possibility for savvy convenience retailers over the summer. With the correct ranging and merchandising, they can tap into the premiumisation trend and surge in demand for moderation in spirits, ready-to-drink products, beers, wines and ciders as consumers look to make the most of socialising opportunities in the sunshine. Meanwhile, the £12 billion soft drinks market is promising a raft of supplier activity to promote the category and help wholesalers and retailers boost customer spend over the summer.

Convenience heavyweight Boost Drinks has unveiled a new look across its range, with an eye-catching design that gives each product a slicker and more refined look. An integrated creative campaign covers trade and consumer advertising with a multi-channel approach incorporating online and out-of-home formats.

Boost Drinks has also introduced NPD in both its Energy and Sport ranges: Tropical Blitz and Apple & Raspberry Sugar-

Free Energy (250ml), and limited-edition Watermelon & Lime Sport (500ml).

These introductions come at a time when the sugar-free energy drinks category is seeing 23% year-on-year growth (Circana). This highlights the trend in health-conscious consumers, with one in three now opting for more sugar-free beverages (INK). Flavours now represent 32% of energy stimulation sales, marking 28% growth year on year (Circana), underscoring demand for new and existing taste variations within the energy space.

Meanwhile, the sports drinks category is currently sitting as the fastest growing soft drinks category (Circana). Building on the success of the limited-edition Raspberry & Mango flavour in 2023, which has now been integrated into the core range, the new Watermelon & Lime flavour highlights Boost’s commitment to continually delivering innovative products that align with the increasing enthusiasm for limited-edition drinks and bold flavours.

Boost is the third largest brand in the energy stimulation category and the second largest brand in sports drinks.

The supplier encourages stocking PMPs as a retail strategy and prides itself on its ‘honest broker’ commitment. “While we are dedicated to developing a range that appeals to consumers, we are also committed to being a transparent and collaborative partner to wholesalers and retailers,” says Adrian Hipkiss, commercial director.

“We’re constantly monitoring the ever-evolving retail landscape and consumer trends so we can advise across all touch points, including which products our partners should be stocking and how they should be marketing them, to ensure the best success for their business.”

The supplier has demonstrated longstanding commitment to its wholesale customer base with a stream of sales support, advertising and sampling activity, along with a programme of NPD to continue to generate excitement in the flourishing energy sector. “The total UK soft drinks market continues to grow and is now worth more than £12 billion, maintaining its spot as a top three category in convenience. Within the soft drinks category, sports and energy account for £1 billion,” explains Hipkiss.

‘We’re constantly monitoring the ever-evolving retail landscape and consumer trends so we can advise across all touch points’

Adrian Hipkiss, commercial director, Boost Drinks

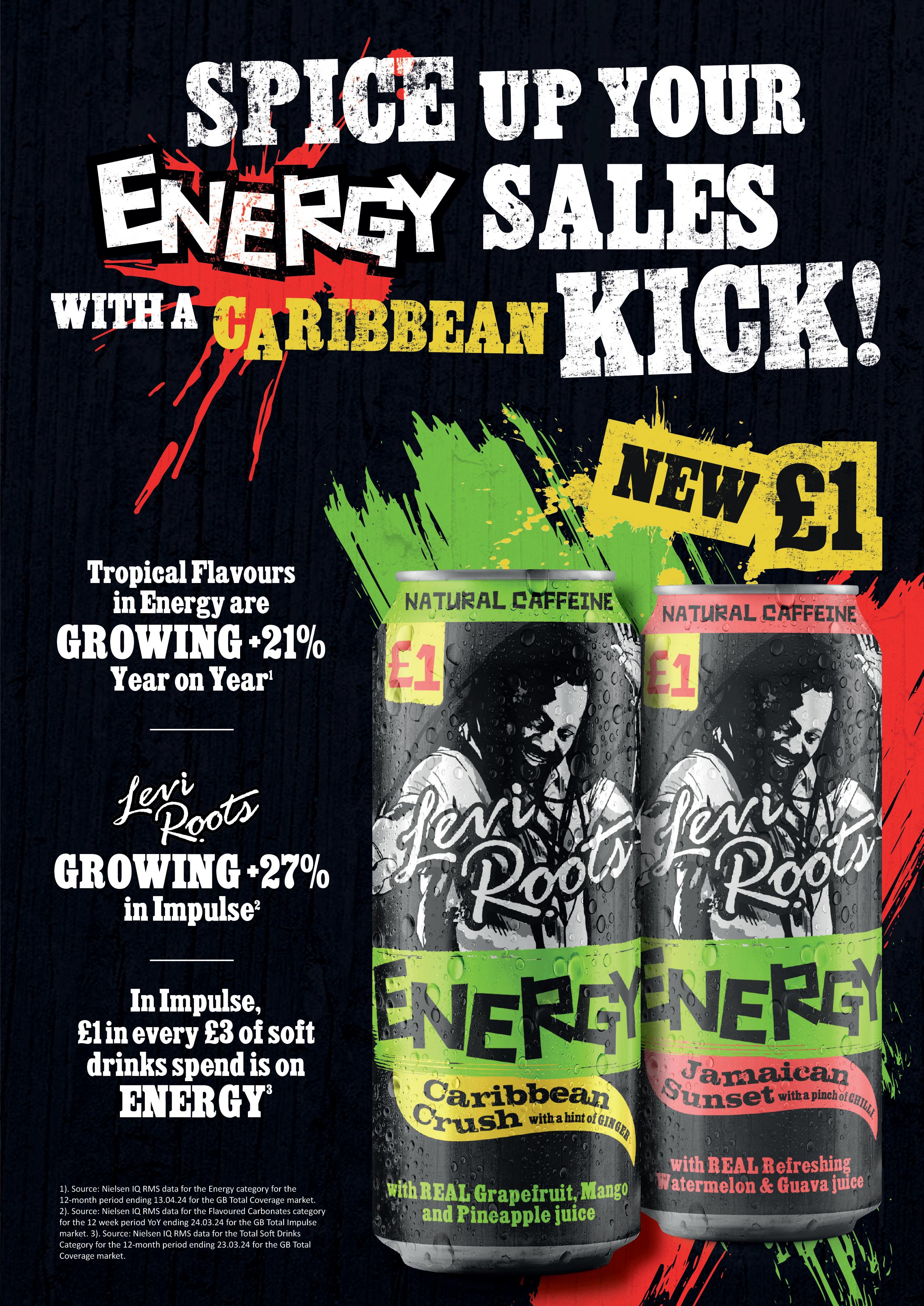

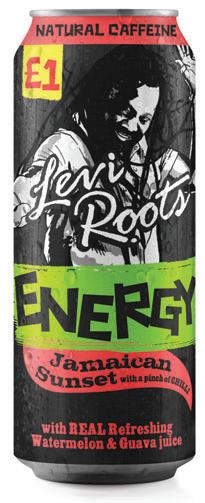

Nichols’ Levi Roots brand is entering the energy segment with two new products. Levi Roots Energy Caribbean Crush with a hint of ginger and Jamaican Sunset with a pinch of chilli contain natural caffeine and vitamin B6 and B12 in a 500ml can format.

The brand also has a new design for the 500ml PET range and a new format for the Caribbean Crush lead flavour – a 330ml can. “2024 represents an exciting year for Levi Roots Soft Drinks and the brand is perfectly placed to provide a flavourful, on-trend choice,” says Angela Reay, group marketing director.

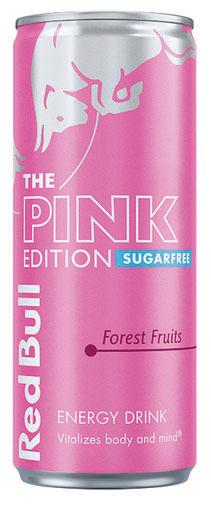

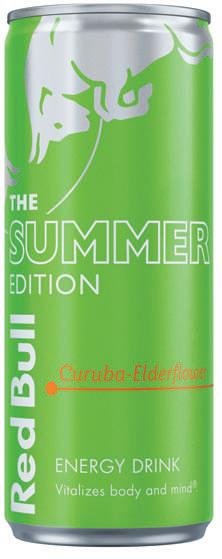

Red Bull continues to perform strongly in the energy category, bolstered by the success of the Red Bull Editions range. “Sports and energy has been the fastest-growing category of the last 12 months, adding £411 million to soft drinks and contributing 47% of all category value growth. In symbols and independent stores, sports and energy is already the No.1 soft drink category, accounting for 40% of all value sales and growing share (Nielsen),” says a company spokesperson.

“Innovation has been vital to the success of energy drinks growth this year, with particular engagement around new flavours, which has helped broaden the category’s appeal to new groups of shoppers, where taste was previously a barrier. Last year 71% of shoppers that were new to energy drinks bought a flavoured product (Kantar).”

The spokesperson continued: “For Red Bull, NPD has been largely incremental, with 50% of shoppers that bought into the

Editions range being new to the Red Bull brand, and 75% of Red Bull Editions value was incremental to total sports & energy (Kantar), so having them alongside their core range is likely to attract incremental shoppers.”

Red Bull’s recent NPD is the Summer Edition Curuba Elderflower variant, available in 250ml, 250ml PMP, 355ml Sugarfree and 250ml Sugarfree four-pack. Boasting a flavour profile described as exotic, refreshing and floral with hints of melon, pineapple and elderflower, the new Red Bull Summer Edition performed well in consumer testing with more than two-thirds of energy drink buyers saying they would likely purchase it.

The manufacturer has also introduced a new permanent Sugarfree Edition this summer with Red Bull Pink Edition Sugarfree, available to wholesalers from July after an initial launch through Booker. The taste profile is raspberry, forest fruits and the herbal notes of verbena, and the available formats are 250ml, 355ml and a 4 x 250ml multipack.

Suntory Beverages & Food GB&I has relaunched its Lucozade brand with a redesign featuring an updated logo and packaging, supported by a masterbrand campaign encompassing TV advertising, social media, in-store activation and consumer sampling.

“Bring the Energy is a new era for us, an insight-backed move to bring all sub-brands together to strengthen the incredible power of our brand,” says Elise Seibold, marketing director. “With a multi-million-pound media investment backed by in-store activation and sampling, we’re making sure Lucozade is unmissable throughout this mega summer of sport and beyond.”

CCEP is offering additional merchandising support to retailers in the energy segment. Sales Supercharged has been relaunched in partnership with the Monster Energy Co and more independent convenience retailers to offer information on the latest trends, details on key segments, and tips and advice on ranging and execution.

“More than half of energy drinks are sold through the convenience channel in Great Britain and this continues to grow, making it a big opportunity for convenience retailers,” says Helen Kerr, associate director of portfolio development. “For store owners who want to make their energy fixture work harder, we recommend visiting SalesSupercharged.co.uk and keeping an eye out for the campaign within the trade press over the coming months.”

Also in the energy sector for CCEP is the Relentless brand. In time for summer, a new variant, Relentless Fruit Punch, will hit the shelves in both plain and price-marked 500ml cans, with accompanying PoS materials and digital downloads available to drive trial.

“The energy drinks market is booming and innovation is key to driving this momentum,” Kerr says. “This latest

Water is the second fastest growing segment within soft drinks this year in convenience1

Di erent formats cater for di erent shopping missions, ranging from 500ml to 1.5L, with all formats suitable for on-the-go. Water is worth over £8k per year in each C-store1, with

arrival follows the introduction of the Relentless Zero Sugar range, which has generated nearly £9 million since launching in summer 2022 and continues to deliver doubledigit volume and value growth (NIQ).

“Over the last decade energy drinks have become more mainstream, offering the same great taste and choice as soft drinks, with added functional benefits. We know that energy shoppers are three times more likely to buy innovation versus wider soft drinks.”

In the functional beverages sub-category, there is a new brand with a mission to attract health-conscious consumers through its range of all-natural, zero-sugar sodas that contain probiotics and prebiotics.

The FHIRST line-up consists of Cherry Vanilla, Ginger Mandarin, Passion Fruit and Lemon Lime, and each can delivers two billion living probiotic cultures, 5g prebiotic plant fibre, and zinc.

“Now, more than ever before, consumers are searching out healthier soft drinks options with a particular focus on those offering functional benefits,” says founder Steven van Middelem. “We believe FHIRST is uniquely placed to capitalise on this increased consumer interest.”

Kingsland Drinks has flagged the sporting season as a key sales driver for the beers, wines and spirits categories over the summer. “The opportunities for depots, as well as independent and convenience retailers, are there to be tapped into for still and sparkling wines,” says Jo Taylorson, head of marketing and product management.

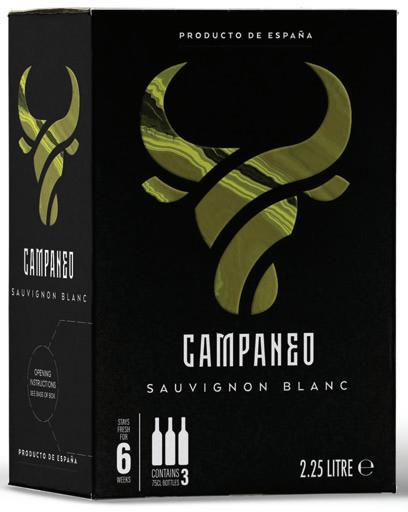

“Against the backdrop of the cost-of-living crisis, we’re expecting consumers to shop more cautiously, with value wines becoming more important to the category. Campaneo’s brand proposition, centred around its outstanding reviews, affordable price points and exceptional quality, helps cement its place on drinks fixtures. Developed specifically for the value end of the market, Campaneo wines have the look, feel and taste of a premium wine brand, but at an affordable price point.”

The choice of formats is another draw for shoppers. A 2.25 litre bag-in-box Sauvignon Blanc offers recyclability, value and longer-lasting wine.

“New consumers to the bag-inbox category realise the benefits in terms of convenience, freshness and quality,” Taylorson adds.

“It’s a great format to have in the house for a party evening and beyond; bag-in-box wines stay fresh for up to six weeks.”

While the total beer category saw a drop in volume of 4.8%

over the past 12 months, it also showed value growth at 1.4% (Nielsen). Sales of BrewDog’s core craft range in convenience are up 8.6% MAT against a declining beer category (-0.9%).

“Multipacks are a key growth driver for the category, and we’ve placed our focus on mid-size multipacks, as they become more commonplace within the consumer repertoire, particularly for socialising,” says Caitlin Brown, category executive. “BrewDog Punk IPA is the No.1 craft beer brand (Nielsen) and therefore acts as a signpost for the category – available in multiple formats, including single cans, four-pack, eight-pack and 12-pack, making it accessible for shoppers in all channels.”

The supplier is offering up to £10,000 to consumers through a cross-channel promotion ‘Drink Beer. Win Cash’ on four-packs of Punk IPA and Hazy Jane, mixed eight and 12-packs, and mixed alcoholfree eight-packs.

Shoppers find out immediately if they are a successful, with the prize value stickered on winning cans and instructions on how to claim it before 30 August, when the competition closes.

“Awareness will be high, with the campaign supported instore and outlet, as well as digital and out-of-home activation to drive purchase, so we encourage retailers to ensure they have stock of promotional packs on shelf to meet consumer demand,” advises Lauren Carrol, chief marketing officer.

With a nod to the current trend for sessionable drinking, BrewDog has introduced Wingman to the impulse channel in time for summer. The 4.3% abv session IPA targets the modern drinker and is available in a single 440ml can, 4 x 330ml can multipack and 12 x 330ml can multipack.

“We are placing significant investment into the launch and anticipate Wingman will become our biggest launch of the year,” says Carrol. “Our shoppers love to experiment and try new styles, and with its great-tasting liquid, quirky new packs and stand-out marketing activity we are sure Wingman will quickly become a fan favourite.”

Badger Beers is investing in its premium bottled ale range with a £200,000 marketing spend over the year. Activity includes AI-enhanced and geo-targeted digital advertising, as well as a summer out-of-home presence and attendance at key events such as the London Craft Beer Festival.

The supplier highlights the retail potential of the

blurring of the lines between craft beers and premium bottled lagers and ales. “Demand for craft beers will continue, particularly from more mainstream drinkers. These drinkers are looking for the interesting, on-trend flavours of the craft sector but in beers that are accessible, with abvs that make them more sessionable than some craft brands,” advises Giles Mountford, drinks marketing manager.

“While craft beer is in growth, independent retailers need to appeal to a wide range of drinkers rather than just ‘beer geeks’ – especially given limited shelf and chiller space. Having a good selection of craft beers with more mainstream appeal, and premium bottled ales that can attract craft drinkers, will deliver higher sales and more repeat visits.”

Heineken advises wholesalers and retailers to pay attention to the formats and styles that best respond to seasonal missions when deciding on ranging.

“With beer, the opportunities for key occasions are vast. Peak seasons include summer occasions, such as sporting events and festivals, as well as Christmas and New Year, where big nights in come into the spotlight. To ensure that retailers are best placed to tap into these occasions, it’s not only important to consider the types of beers and brands that will be popular with their consumer customers, but also which formats can cater best to these different occasions,” advises Alexander Wilson, category & commercial strategy director. The supplier has tapped into two of the major trends in lager with its latest NPD. Foster’s Proper Shandy (3% abv) is a nostalgic twist on classic lager innovation that caters to the increasing number of adult drinkers who want to moderate their drinking.

In the world lagers category, NPD comes from the Birra Moretti brand. The new Birra Moretti Sale di Mare is an unfiltered, medium-bodied premium lager made with a hint of Italian sea salt. It is backed with a nationwide marketing campaign.

“We have noticed that more customers, across all demographics, are keen to explore new styles of beer, including a growing interest in world lagers. This is where innovation from familiar brands comes into play, as people are gravitating towards NPD from brands they are familiar with,” Wilson continues. “While classic lager remains a core category for retailers and drives purchase, introducing new sub-brands into the mix presents a clear trading up opportunity, especially as we venture into the warmer months.”

Kingfisher Drinks also encourages the trade to exploit the rising popularity of world beers.

“Consumers are enjoying discovering premium world lagers from all sorts of different places, which are a great option for retailers to stock, as they are bang on trend and can typically be charged at a minimum of 30% more than other more mainstream options,” says John Price, head of marketing.

Molson Coors’ brand Sharp’s Brewery has launched its Offshore Pilsner to the off-trade in six-can and 10-can multipacks. The 4.8% abv Pilsner was introduced in 2018 and has become the best-selling discovery lager in the South West of the UK.

“We’re helping our off-trade customers tap into the lager category this summer, while giving beer lovers a crisp, clean, fruity beer that delivers on taste,” says James Nicholls, marketing controller.

Meanwhile, in the cider category, Molson Coors’ Aspall Cyder brand now features a new super-premium cider in a 330ml can for the off-trade. The launch has a dedicated marketing and PR campaign running through the summer months, alongside in-store activations.

West Midlands independent drinks start-up firm Virtus Brands has taken a major step in expanding its UK sales after signing a deal with Parfetts.

The Dudley-based company, which manufactures and distributes 15 drinks brands, has joined Parfetts’ dropshipping scheme, giving it access to 1,000 independent retailers nationwide through Parfetts’ symbol group.

Virtus Brands has been added to the Parfetts approved supplier list, meaning that the drinks collective can offer and supply all of the products in its range –which include vodka, tequila, prosecco and Champagne – via Parfetts’ direct-to-store partnership with the discount buying organisation Procuria.

Virtus Brands is planning a number of activation events at stores across the country, while retailers will receive a free case of the company’s Pink prosecco when they place their first order.

Virtus Brands founder Baz Kooner (pictured) says: “The dream for Virtus Brands is for our brands to be stocked worldwide in high-end bars and restaurants and big-name retailers, and signing this deal with Parfetts is a major step on the road for us,” he says.

“Consumers, especially at the younger end of the market, are increasingly looking for new, independent brands offering something they’ve never seen before. This is precisely what Virtus Brands is all about and we’re excited about the prospect of getting our products better known and meeting this demand.”

The company’s flagship Jatt Life ultra-premium vodka is now available in 15 countries.

“More people are looking towards cider in cans but there’s a gap in the market for a super-premium option. Aspall Crisp Apple Cyder is perfectly placed to tap into that opportunity,” says Stuart Ayre, marketing controller for cider.

“Early consumer research showed that the product appealed to both existing cider drinkers and consumers who would usually drink RTD cocktails, so we’re confident that it can increase the category’s penetration and appeal to a wider range of consumers.”

Meanwhile, the consumer demand for new flavours in the cider category is being met by premium fruit cider brand Rekorderlig. Blackberry-Blackcurrant flavour offers a dark fruit option with year-round appeal, while a Peach-Raspberry flavour is designed to offer a refreshingly light taste without too much sweetness. Both ciders have an abv of 3.4% and are available in 500ml bottles. The launches are supported by a summer campaign across major media channels.

Also in the cider segment, Aston Manor is offering wholesalers and retailers the opportunity to win a branded chiller worth £2,000, along with Crumpton Oaks stock. “We’re excited to be running a new competition, giving retailers and wholesalers the chance to win a fully stocked branded chiller,” says Katie Walker, brand manager. “Not only is it a great way to bolster brand awareness, it also allows us to continue giving back to businesses during challenging times and to show our support for the industry.”

To enter, wholesalers and retailers must upload a valid invoice from a qualifying case of Crumpton Oaks cider before 30 June to win.crumptonoaks.com. There are no limits on entries, with one invoice per entry permitted.

The competition is running at a time when brand awareness is set to be raised by the return of Aston Manor’s ‘Straight Outta Crumpton’ advertising campaign. Running until July, it sees Aston Manor bring to life the world of cider through the lens of hip-hop.

Crumpton Oaks looks to offer more affordability to customers without trading down on quality, says the company. Value cider is growing by 3%, ahead of mainstream ciders, which are up by 1.42%. Notably, Crumpton Oaks is growing at a much faster rate of 10.8% (TWC).

The Crumpton Oaks fourpack pint cans variant provides further reassurance that shoppers are not being overcharged with its price-marked packaging.

Asahi has highlighted the rising sales opportunities for convenience stores that respond to the low/no alcohol trend.

“No and low alcohol is incremental to the category, so with the right range available, no and low alcohol products should bring additional sales for retailers,” says Steve Young, sales director. “The improved taste of no-alcohol drinks is helping them evolve from drinks that are a substitute to beverages that compete comfortably in the alcohol occasion.”

Low/no alcohol beer is growing at 29% to increase its share of total beer, with stout being the fastest-growing type.

In the wine category, low and no options are showing slower growth than beer, with a 1% share of still wine (Nielsen). However, Accolade Wines highlights the unrealised potential of the sub-category – if the barrier of taste can be overcome. To address this, Accolade’s Hardys Zero sub-brand uses cutting-edge de-alcoholising technology to remove the alcohol while retaining the brand’s taste credentials.

“28% of category drinkers would be persuaded to buy non-alcoholic drinks if they had a similar taste to that of their alcoholic counterparts,” says Tom Smith, marketing director.

Specialist in low/no alcohol beer, Nirvana Brewery is extending its portfolio with Bavarian Hefeweizen, a 0.3% abv wheat beer, and Cloudy Lemon Lager, a nod to the ‘radler’ beer tradition in southern Germany.

“This pair gives no/low drinkers more choice in the country’s biggest-selling style – light, superrefreshing lagers perfect for the warmer months,” says Becky Kean, founder & brand ambassador.

‘Aber Falls is a real trailblazer’

The Aber Falls Distillery in North Wales is providing a neighbouring farm with malted barley from the whisky stills to feed cows. The distillery has impressive eco credentials, with water provided by a borehole, a visitor centre that features solar panels, and electric company vehicles.

“Aber Falls is a real trailblazer, not just in terms of making wonderful Welsh whisky but also in the innovative ways they operate in such an environmentally friendly way,” says Ashley Rogers, CEO, North Wales Business Council.

3 units sell every second!

40% of Fruit Carbonated shoppers buy 1.5Ltr/2Ltr bo le once a week or more**

Nichols has a ‘Love the Taste or Your Money Back’ campaign running on selected Vimto products. The promotion lasts until the end of June on core flavours, as well as innovation – including Vimto’s new carbonates subbrand Vimto Discovery on both Mango & Dragonfruit and Passionfruit & Lychee flavours and on the new Vimto Squash flavour Blood Orange with a Citrus Twist.

The campaign is being supported with a £3 million investment that includes video-ondemand, outdoor, cinema, digital and social activity.

Meanwhile, the manufacturer’s Slush Puppie brand has seen the addition of a Green Apple variant in its Fizzie range. The zero-sugar Green Apple variant is being backed with in-store activations, social media and PR support. “With the external landscape evolving at pace, ‘newness’ is critical to delivering long-term sustainable growth and creating value. We also know that equity brands play a key role in maintaining category growth, both through core product range and innovation,” says Angela Reay, group marketing director.

‘With the external landscape evolving at pace, ‘newness’ is critical to delivering long-term sustainable growth and creating value’

Angela Reay, group marketing director, Nichols

Radnor Hills is offering households the chance to win Go Ape vouchers through its schools-compliant Radnor Fizz brand. The ‘Fuel the Fun’ promotion runs until November and is backed by a marketing campaign that includes social media, out-of-home and in-store activity, along with a brand introduction for catering managers.

Suntory Beverages & Food GB&I is running an experiential promotion across its Ribena range this summer. Prizes include UK holiday packages, experience vouchers and cash prizes, with entry via an on-pack QR code.

“It’s a great sales opportunity for retailers during the key selling season for soft drinks, capturing those additional sales at an important time,” says Aurelie Patterson, head of Ribena. “It’s our most extensive summer promotion ever.”

Barr Soft Drinks has launched its ‘Release the Sunshine’ campaign for the Rubicon brand, with a TV advert on channels including Netflix and Disney+, outdoor media in cities across the UK, and digital and social media activity.

“Rubicon is a truly incremental sales opportunity for retailers. 80% of our growth last year came from consumers adding us to their shops alongside their usual purchases (IRI), and we are also seeing growth from new shoppers entering the category,” says Jonathan Kemp, commercial director.

“Last year, our ‘Made of Different Stuff’ out-of-home campaign alone drove a 25% increase in penetration in the cities it featured, highlighting an unmissable sales opportunity for retailers who stock the brand this summer.”

The campaign is supported by PoS materials, enabling wholesalers to create in-depot theatre.

Earlier this year, Barr Soft Drinks launched limited-edition IRN-BRU XTRA Raspberry Ripple and Wild Berry Slush variants. “New flavours always lead to a buzz around the fixture, so the limited-edition aspect of a new product serves to enhance shopper engagement and excitement, especially in relation to unique flavour combinations that are new to market,” Kemp says.

The IRN-BRU brand has also seen investment in a sporting campaign. Ahead of a summer of football, IRN-BRU will feature special footy packs, giving shoppers the chance to win branded supporters’ toolkits throughout the Euros.

“During the World Cup, the brand delivered 10% incremental category volume and it was the second biggest national brand at the last Euros (Circana),” says Kemp.

“IRN-BRU will be the brand of summer soft drinks and we’re encouraging retailers to plan ahead, increase facings and make the most of our new packs and eye-catching PoS to maximise this profit opportunity.”

Britvic has rebranded its Pepsi line-up to engage with younger shoppers. Ben Parker, retail commercial director GB, says: “As the No.1 soft drink category, worth £6 billion (Nielsen), cola represents a major sales opportunity and this rebrand will help retailers maximise sales by sparking a renewed interest in the brand.”

The manufacturer has also introduced NPD in the flavoured carbonates segment, with Tango Mango launched earlier in the year and available for 12 months. The sugar-free drink is part of the Tango Editions range and is supplied in 330ml cans, 500ml bottles, two-litre bottles and 8 and 24 x 330ml multipacks.

“We understand that retailers don’t have infinite space for new products, but the Tango Editions range has already proven to drive additional sales, and the rotational change seasonally maintains excitement and engagement with the brand,” Parker says. “In addition, Tango Mango aims to attract a broader range of shoppers, including Gen Z and families.”

CCEP has reformulated and redesigned Fanta Orange Zero. The new recipe brings the taste closer to that of Fanta Regular Orange while the bold new packaging is designed to give clearer differentiation between the two products. The launch is supported by out-of-home and social media advertising, influencer activity and an app game that offers a free Fanta Orange Zero coupon to drive trial.

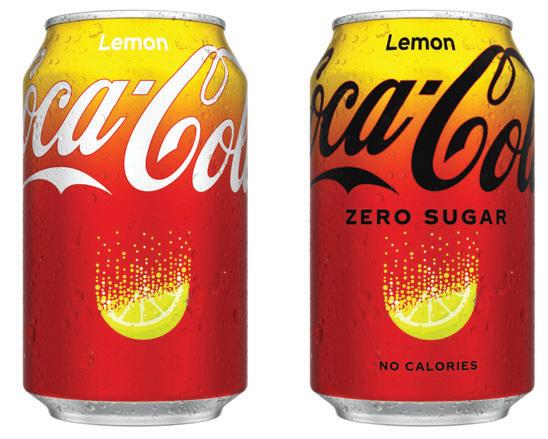

In further brand activity, CCEP has extended its Coca-Cola range with Coca-Cola Original Taste Lemon and Zero Sugar Lemon variants.

“With soft drinks worth more than £12.5 billion in retail (Nielsen), retailers and wholesalers should focus on stocking soft drinks in key categories such as colas, carbonates and mixers,” advises Amy Burgess, senior trade communications manager.

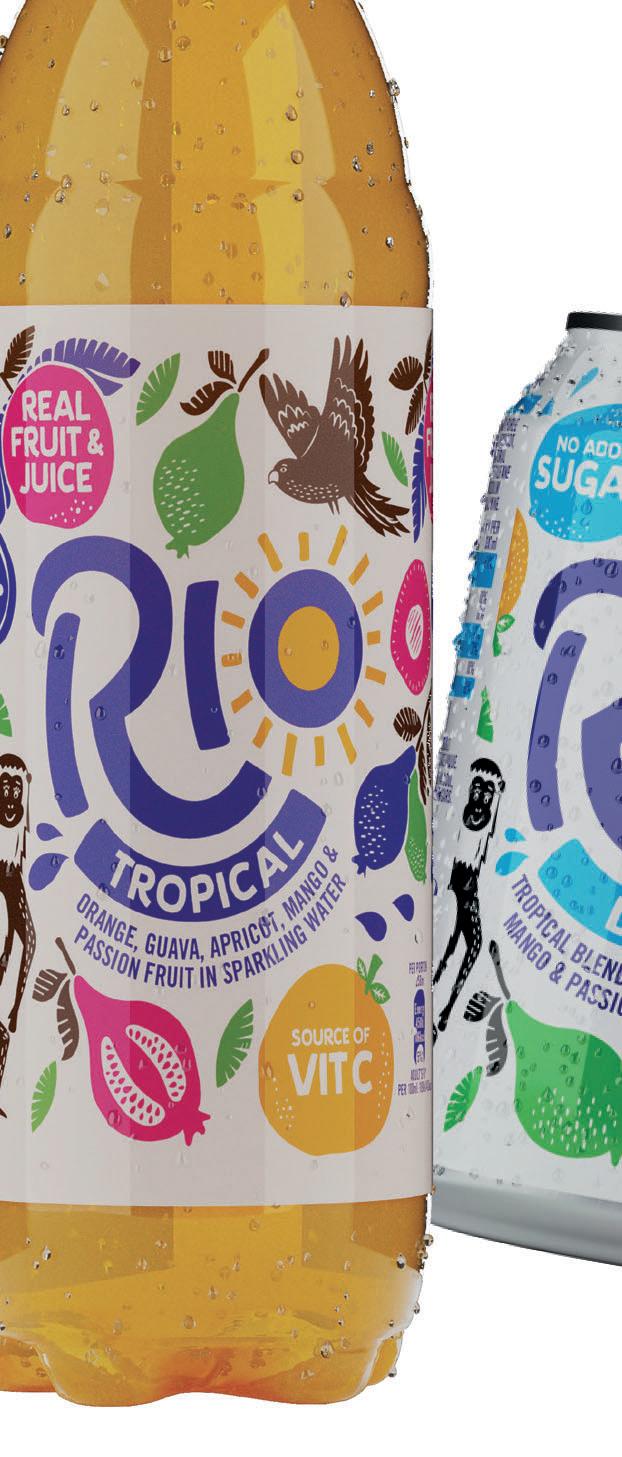

Boost Drinks has a range of formats and bold packaging to increase summer sales for its Rio brand. “Flavoured carbonates is the third-largest category in soft drinks and is now worth over £357 million and growing 2% year on year (Circana),” points out commercial director Adrian Hipkiss.

“Tropical is the second fastest growing fruit flavour in the category, growing 22% and adding £2.5 million at retail sales value in the last year.

“Rio, which contains exotic guava and passion fruit, is growing by 3% year on year and is in the top three (by rate of sale) of all fruit carbonates (Circana).”

Health and wellbeing continue to drive consumer purchasing decisions in the soft drinks category, and Nestlé Waters’ Pure Life accounted for 20% of branded plain water sales last year. It was also the fastest-growing water brand in convenience in summer 2023, with value sales growth of 91% (Circana).

”During the summer of 2023, soft drinks in convenience saw a 21% increase versus the February-May period, which makes it a great opportunity for independents to maximise for summer 2024. The anticipated warm weather will lead to more impulse purchases in the channel, with water seeing the greatest uplift over the summer last year (Circana),” says a Nestlé Waters spokesperson.

‘The anticipated warm weather will lead to more impulse purchases in the convenience channel, with water seeing the greatest uplift over the summer last year’

Nestlé Waters spokesperson

The company offers advice for retailers: “Having plentiful water at front of store or on shelf will help address the needs of those who prefer water at ambient temperatures (around 36% of consumers, CTP). During the high temperature peaks, water from a chiller becomes a destination purpose and is often a more impulsive sale (Lumina).” CCM

SHS Drinks has brought out a range of premium vodka spritz cans from its Bottlegreen soft drink brand, in collaboration with English distiller Edwards 1902.

The 250ml cans are available in Elderflower, Raspberry, and Lime & Mint variants with a 5% abv and fewer than 150 calories. The launch is being supported by social, influencer and sampling campaigns, as well as shopper activations.

Sarah Lawson, head of marketing at Bottlegreen, says: “Our research identified a gap for something premium and lower in calories but without any compromise in taste.”

By offering a selection of classic favourites and indulgent new products, wholesalers and their customers can meet the demands from consumers for bakery staples and treats.

The growth in bakery occasions is a long-term trend, with volumes 20% higher than pre-Covid, reports Warburtons. More than half of bakery snacks are eaten at breakfast, with crumpets the largest sector, selling over three million packs per week. There were also an extra 10 million packs of muffins, potato cakes, and pancakes sold in 2023.

Last year, Crumpet Thins joined the Warburtons crumpet range. According to the company, this product has become a firm favourite for consumers wanting a breakfast with fewer calories or a new snacking option. Last year, Warburtons also launched Soft Naans, which can be heated in the toaster to create a convenient meal accompaniment or base for a snack.

This year, the company has introduced Protein Power loaves, which are designed to offer consumers a great tasting