GEORGIA WINTER 2023 COMMUNITIES FIRST LEGISLATIVE SESSION | PROFESSIONAL DEVELOPMENT PROGRAMS | 2023 SCHOLARSHIPS BANKING IN THE LEGISLATURE

REGISTER TODAY ICBA.ORG/CAPITALSUMMIT MAY 14–17 INFORM • IMPACT • INSPIRE

AN ADVOCATE FOR YOUR COMMUNITY,

AN ADVOCATE FOR YOUR INDUSTRY. REGISTRATION IS FREE FOR ALL OF OUR NATION'S COMMUNITY BANKERS WASHINGTON, DC 2023

YOU'RE

BE

John McNair President & CEO john@cbaofga.com

Lori Godfrey Executive Vice President and Chief of Staff, Government and Regulatory Relations lori@cbaofga.com

Kristi Greer Senior Vice President Professional Development kristi@cbaofga.com

Lindsay Greene Senior Vice President Member Services, Marketing lindsay@cbaofga.com

Lisa McNair Director of Finance lisa@cbaofga.com

Cassie Cornell Assistant Vice President Digital Strategy and Professional Development Marketing cassie@cbaofga.com

Becky Soto Assistant Vice President Professional Development and LEAD Board becky@cbaofga.com

Connie Shepard Assistant Vice President Professional Development and Member Engagement connie@cbaofga.com

Ellen Shea, CMP Director of Association Services ellen@cbaofga.com

Gwen Lanaghan Staff Accountant gwen@cbaofga.com

Winter 2023 | Georgia Communities First | 1 CONTENTS 23 Education Buzz 25 Essentials of Commercial Credit Analysis 29 Compliance Professionals Package 31 Popular Schools & Conferences 35 Fixed rate of floating? 37 The Cost of Cyberattacks 39 Preferred Service Providers 40 Sponsorship & Advertising Opporturnities Community Bankers Association of Georgia 1640 Powers Ferry Road SE, Building 28, Suite 100, Marietta, GA 30067-1425 (770) 541-4490 or (800) 648-8215 • Fax (770) 541-4496 | www.cbaofga.com • cba@cbaofga.com FEATURES Winter 2023

the latest 2 Optimism & Opportunity Abound in 2023! 3 Light the Fire. Light the Way. 5 Getting to Know Sen. Summers 7 Bankers Serving the State of Georgia 13 CBA Advocacy Events You Don’t Want to Miss 17 Moving the Needle 18 CBA Scholarships 20 CONNECT Agenda, Keynote Speakers & Hotel Information stay connected @company/ cbaofgeorgia @CBAofGeorgia @CBAGeorgia professional development spotlights member services CONNECT in Charleston, SC, p. 20; Bankers Serving in Legislature, p.7

CBA STAFF

On the cover: Lori Godfrey, Executive Vice President, Government and Regulatory Relations CBA with Sen. Carden Summers (R) Chairman of the Senate Banking and Financial Institutions

John McNair President & CEO Community Bankers Association of Georgia

Optimism and Opportunity Abound in 2023!

As we enter 2023, the headwinds are many. Record inflation, changing interest rates, continued supply chain issues, employment gaps, new covid variants, and a variety of other non-pleasantries. Considering these challenges, I am reminded of the quote: “We cannot direct the wind; however, we can adjust our sails.” As community bankers, adjusting our sails is what we do best! We are small, agile, and totally dedicated to serving our customers and communities. As a result, I am extremely optimistic that 2023 will be a successful year!

While we do have a great track record of adjusting our sails, it doesn’t mean things will be easy; actually, quite the contrary. The pace of change is only accelerating; therefore, the challenge is two-fold: keep up with the change AND INNOVATE to stay ahead of it. As leaders, how best to

accomplish this dual objective? First, engage all employees and stakeholders in this process. Challenge all to come up with solutions to problems, to find new and innovative efficiencies, and empower all to implement. Second, task your partner firms to do the same. After all their success is based on your success. Finally, actively reach out to those that think differently than you do; HOWEVER, have the same forward-thinking mindset as opposed to those that are stuck in the current or the past.

The New Year, just like every other year, presents 365 opportunities to succeed, fail, try again, evaluate, and serve. Having served in the community banking industry virtually my entire career, I am confident that all will attack 2023 with a high degree of optimism and will create new opportunities for success and service.

2 | www.cbaofga.com | Winter 2023

VANTAGE POINT

Rebeca Romero Rainey President and CEO ICBA

Light the Fire. Light the Way.

‘Ohana is the Hawaiian word for family, and as we prepare to head to Honolulu for ICBA LIVE next month, I’m struck by how much that word describes this community. We are a family of community bankers, supporting one another and our communities through our shared mission, vision and values.

In many cases, we’re not only a chosen family; we’re related by blood as well. Many of us are fourth- or fifth-generation community bankers, embodying a long family tradition of caring for community. We’re passing that ethos down, too. In fact, we have more children attending LIVE this year than we have in the past, and I can’t help but think of the rising community bank leaders that may be right in front of us and all they will bring to the industry.

So, it’s fitting that this year’s theme for ICBA LIVE is “Light the Fire. Light the Way.” Not only are we looking at the next generation of leaders among us; we’re also focusing on what we can do today to preserve and grow community banks’ impact. It’s never been more important to keep that flame of community banking spreading throughout the country.

Our communities need our continued support through these complicated economic times. They need us to remain advocates for their needs. They need us to continue to serve them as people, not as transactions. So, when we assemble at LIVE, it’s about coming together to ignite the passion for community banking on behalf of our communities in a way that moves the industry forward.

As we look at the continued pace of change, we are met with our fair share of challenges but also great opportunities. When we come together, the energy that arises helps us collectively identify the path forward. Then, we lift our heads up and address the technical and nuanced aspects of what we do with a focus on the long-term future of the industry. We create progress and momentum.

But possibly the most rewarding part of LIVE is the opportunity to meet fellow community bankers from around the country. Those hallway conversations where we share anecdotes and make new connections exemplify who we are as community bankers. That sense of ‘ohana shines through, because in community banking we’re more than just business leaders. We are a family, and I hope to see you at LIVE to help us build the relationships that will shape the future of the industry.

Winter 2023 | Georgia Communities First | 3

FROM THE TOP

We recognize and thank our law partner John F Kennedy for his continued ser vice and leadership in the Georgia Senate.

Leadership:

Senate President Pro Tempore

Vice Chair, Banking & Financial Institutions Committee

Secretar y, Regulated Industries and Utilities Committee

Recent Legislation:

2022 Session:

Senate Bill 534

Senate Bill 276

Senate Bill 234

2021 Special Session:

Senate Bill 1 EX

Senate Bill 2 EX

House Bill 1 EX

2021 Session:

Senate Bill 234

2020 Session:

Senate Bill 373

Senate Bill 451

Senate Bill 1023

2019 Session:

Senate Bill 157

4 | www.cbaofga.com | Winter 2023

Getting to Know Sen. Carden Summers (R)

Chairman of the Senate Banking and Financial Institutions

Meet your new Chairman of the Senate Banking and Financial Institutions Committee: Carden Summers!

Sen. Summers was born and raised in Cordele, GA. His background is primarily in Commercial Real Estate. He owns and operates several residential rental properties and manages a billboard advertising agency, with signs in Georgia, Tennessee, and Alabama.

Sen. Summers represents Georgia’s 13th legislative district, located in south-central Georgia. Following recent redistricting, his district now includes the following counties: Ben Hill, Berrien, west Coffee, Crisp, Irwin, Lee, Turner, and Worth. He represents about 166,000 people and the district leans heavily Republican.

He won a special election to the State Senate in early 2020, following the death of Senator Greg Kirk (R-Americus) in December 2019. Sen. Summers secured a full two-year term later that year. He won in a contested GOP Primary in May 2022 and was unchallenged in the General Election in November. He formerly ran for House District 147 in 2008.

as Vice Chairman of the Senate Committee on Regulated Industries and Utilities. He is also a member of the Senate Committees on Agriculture and Consumer Affairs and Economic Development and Tourism.

Sen. Summers’ hobbies include flying his plane, farming, quail hunting, fishing, and anything to do with horses. The Summers own many horses on their farm.

Sen. Summers indicated that he has several legislative priorities this session including one to “clean up” hemp farming and medical marijuana provisions and another dealing with homelessness and other social issues. He made waves in the 2022 session when he introduced legislation that would have criminalized camping along roadways, in the woods, or in public spaces. He later went on to chair a study committee on homelessness, which focused on the supply and affordability of housing.

Sen. Summers also has experience at the local government level, previously serving a six-year term on the Crisp County Board of Commissioners. He is married to Janis and together they have two children. Their daughter lives in Buckhead with the couple’s first grandson; a son remains in Cordele.

In addition to serving as Chairman of the Senate Committee on Banking and Financial Institutions, Sen. Summers serves

Now entering his second full term, this is Sen. Summers’ first chairmanship assignment and his first time serving on the Senate Banking and Financial Institutions Committee. He is excited to work in this capacity and is grateful for the confidence Senate Leadership showed in placing him at the helm of such a crucial committee. He believes less regulation is better and is anxious to learn more about the community banking industry. He welcomes any comments and feedback that our bankers may have.

We look forward to working with Sen. Summers in his new capacity as Chairman. You may contact Sen. Summers at carden.summers@senate.ga.gov.

Winter 2023 | Georgia Communities First | 5

THE LATEST

6 | www.cbaofga.com | Winter 2023 SHAZAM is pleased to support incoming ICBA Chair Derek Williams VISIT US AT BOOTH 702 855-314-1212 / SHAZAM.NET /

Bankers Serving the State of Georgia

With the 2022 elections behind us, there are more than fifty new lawmakers serving in the General Assembly. Several of these freshmen are already familiar with the banking industry, currently serving as a director on a bank board or employed by a bank. Many veteran lawmakers are also affiliated with a community bank.

In preparing for this publication, I asked each of these legislators the same question: What tool or skill have you learned from banking that helps you in your legislative role? Any unique perspectives? Below are their answers and other critical information about each of them. Freshman lawmakers are listed first.

A successful government relations program is always focused on stakeholder education. With this group of well-respected new and returning lawmakers, the community banking community has advocates well-positioned within the House and Senate. Together with our staff and membership, I look forward to continuing to educate other legislators about the critical role our community banks play in their districts.

Community bankers are as diversified as the communities as they serve. Since legislators are a representation of their communities, it is not surprising that these bankers have had and will continue to have an impact in the overall well-being of Georgia.

Community banking and the legislative process are more similar than one may think. Finding out what the true needs of your community are and negotiating a solution that works best for all parties by listening, learning, and working together to strengthen where things began.

Rep. Scott Hilton

SouthState Bank, N.A. Senior Vice President, Commercial Banking Vice Chairman, Creative Arts & Entertainment

I talk to small business owners every day and hear all of their everyday concerns. We deal with numbers every day as a banker and it helps me dive into the budget discussions and any discussion on tax credits.

• Previously served in House from 2017-2019.

• Elected in 2022.

• Served as Executive Director of the Georgians First Commission during Governor Kemp’s first term.

Sen. Mike Hodges

Ameris Bank President of the Southeast Georgia Coast Market Secretary, Banking & Financial Institutions

The tool or skill learned in 48 years of banking that helps me most in the Legislature is the ability to listen and learn.

• Elected in 2022 and named one of Governor Kemp’s floor leaders in his first term.

• Founding Director and Senior Officer of First Bank of Brunswick.

Winter 2023 | Georgia Communities First | 7 THE LATEST

R–Peachtree Corners

R–Brunswick

Century Bank & Trust, Milledgeville

Incoming Chair of Independent Community Bankers of America®

8 | www.cbaofga.com | Winter 2023

Special thanks to our sponsors for the 2023 President’s Reception honoring Derek Williams

KAHUNA

LEVEL ALOHA LEVEL SUPPORTING LEVEL

BIG

LEVEL MAHALO

SouthState Correspondent Division

Bankers Serving Georgia cont.

Moultrie Bank & Trust, Director

Banks are a highly regulated industry…maybe even over regulated. The key to success is getting a good group of people together that understand the community.

• Won special election on 1/31/2023 to fill Sam Watson’s seat

• Serves as the Colquitt County Administrator

• Currently serving as a Lieutenant Colonel in the U.S. Army Reserve

South Georgia Banking Company Director (Tifton, Moultrie, Omega, Ashburn, Cordele, Vienna, Sylvester)

Chairman, Banks & Banking

I would say the best tool that we all possess is the ability to listen. If you listen more, then you can certainly learn and understand issues better.

• Elected in 2018.

• Board Member Crisp Regional Hospital.

• Chairman, Crisp Regional Foundation Board

Citizens Bank of Laurens County Advisory Director (Swainsboro, Dublin)

Chairman, Appropriations

• Elected in 2010.

• Previously served as the Governor’s Floor Leader, Chairman of the Majority Caucus, and Majority Caucus Whip.

Winter 2023 | Georgia Communities First | 9 THE LATEST

Rep. Charles “Chas” Cannon R–Moultrie

Rep. Noel Williams R–Cordele

Rep. Matt Hatchett R–Dublin

HAWAII

HILTON HAWAIIAN VILLAGE

ICBA LIVE is your destination for the latest in community bank education and innovation. Network with fellow community bankers, hear from inspiring speakers, and soak up the latest industry insights and fintech solutions. REGISTER TODAY

MARCH 12-16 REGISTRATION

IS OPEN

ICBA.ORG/LIVE

Bankers Serving Georgia cont.

Truist Bank Vice President

Secretary, Banks and Banking

I’d say the biggest skill I’ve learned from banking that helps me as a legislator is communication. Legislating, just like banking, is all about relationships and building trust. Being able to talk through things in an honest and transparent way makes you successful at work, and down here under the gold dome.

• Elected in 2018.

• Is a member of the Majority Caucus Whip team this year, helping to corral fellow Republicans on key votes.

Morris Bank Director (Dublin, Gray, Warner Robins, Statesboro, Brooklet, Perry)

Chairman, Insurance and Labor Secretary, Agriculture and Consumer Affairs

Financial forecasts that we receive as Board members of Morris Bank help me to get a sense of what all is going on in the local economy.

• Elected in 2015.

• Owns his own insurance agency

• If the name sounds families, his father – Larry Walker, Jr. – served 16 terms in the House, from 1973 to 2005.

River City Bank (Rome, Blairsville); Market President/Senior Vice President, Commercial Lending

Vice Chairman, House Banks & Banking Governor’s Floor Leader

Banking has helped me keep a watchful eye on the budgeting process and it helps bring balance to the process. As a banker, balancing is what we do every day.

• As one of the Governors floor leaders, he is responsible for advancing the administrations’ legilative priorities

• Elected in 2020

• Has served on the House Banks and Banking Committee since his first term, ascending to Vice Chair this year.

Winter 2023 | Georgia Communities First | 11 THE LATEST

Rep. Joseph Gullett R–Dallas

Sen. Larry Walker R–Perry

Rep. Will Wade R–Dawsonville

Bankers Serving Georgia cont.

United Community Bank (Blue Ridge) President of Fannin County

A mentor once taught me that you never make a decision without determining how it will affect our employees and customers. In the legislature, I will make decisions after determining how it will affect my constituents.

• Won special election on 1/31/2023 to fill the seat vacated by Speaker David Ralston after his death

• Worked in the banking industry for 37 years

• Serves as a Deacon at his church

Payment strategies are not one-size-fits all. We provide flexible, customizable and meaningful services designed to help you strengthen your merchant portfolio across every type of business.

12 | www.cbaofga.com | Winter 2023

Ready for a partnership that produces? Let’s get started. Sarah Humphrey

903-241-0977 Tanner Rizenbergs Manager of Financial Institutions trizenbergs@fitech.com

817-575-7930 THE LATEST

Director of Sales shumphrey@fitech.com |

|

Rep. Johnny Chastain R–Blue Ridge

The Advocacy Update is sent each Friday during the Legislative Session. To subscribe, please email cba@cbaofga.com asking to be added.

CBA Advocacy Events You Don’t Want to Miss

Town Hall Talks, Topgolf, Clay Shoots & T-Shirts

CBA’s Advocacy Committee is pleased to announce plans for 2023 advocacy events. Mark your calendar and plan to join CBA at Topgolf, Clay Shoots and the popular Town Hall Talks.

Proceeds from these events go to CBA’s advocacy funds. Since CBA maintains the only association advocating exclusively for Georgia’s community banks, the funds provide Georgia’s community banking industry a voice in state politics.

2023 Town Hall Talk Tours

Town Hall Talks are a multi-location Grassroots alternative to a Day at the Dome for you to meet your legislators in person. Regional information, networking, refreshments, and legislative updates at six locations across the state.

• Waycross, May 18, 2023

• Cordele, May 24, 2023

• Greensboro, May 25, 2023

• Dalton, June 22, 2023

• Vidalia, July 13, 2023

• Bainbridge, July 20, 2023

Topgolf Outings

Grab a co-worker and join CBA at Topgolf in Atlanta, Augusta, and Chattanooga. This open-air golf tournament offers a way to enjoy friendly competition, network, and raise money for an important cause. Registration includes three hours of golf, food, unlimited non-alcoholic drinks and an afternoon of fun! Learn more and register.

Winter 2023 | Georgia Communities First | 13 THE LATEST

SAFE SYSTEMS CONGRATULATES OUR LONGTIME CUSTOMER, DEREK WILLIAMS

Derek is the president and CEO of Century Bank and Trust in Milledgeville, Georgia, and newly elected 2023 chair of ICBA. We are confident that his experience will greatly benefit the ICBA and its members.

We’ve been helping community banks like Century Bank and Trust for 30 years We provide compliance centric IT services designed exclusively for community banks, ensuring that they are kept up to date on the current technologies, security risks, regulatory changes, and FFIEC guidelines. www.safesystems.com

Kai Xu, Manager of Security Services

Milledgeville, GA

CBA Fall Clay Shoots – Right on Target

CBA’s fall clay shoots bring together bankers, associate member companies, and community banking friends to honor two legendary community bankers. Great locations, beautiful fall weather, lunch and friendly competition make the clay shoots a popular event. Learn more and register.

The 2023 ADVOCACY Limited Edition T-Shirt!

Order before March 15th!

Thank you for supporting the community banking industry in 2022 through our t-shirt fundraiser. Monies raised are used to support advocacy efforts at our state capitol.

CBA’s LEAD Board has designed a new t-shirt for 2023. Don’t miss the chance to order this one-of-a-kind t-shirt!

Join your fellow bankers by wearing these to increase awareness of our industry brand.

• Special perks when you wear your t-shirt to certain CBA events!

• Same soft fabric & style you love from our 2022 PAC/PR t-shirt.

• Celebrate Community Banking Month in Style! (April 2023)

Don’t forget to share photos of your team in their limited edition shirts on social media #CommuniTeeBanking #CBAofGA

Winter 2023 | Georgia Communities First | 15 THE LATEST

Moving the NEEDLE

Colony Bank’s Innovation Journey

The innovation journey looks different for every Georgia community bank. Banks have questions about where to start, who to partner with, what bank peers are doing, regulatory concerns, current offers and more.

CBA invited Heath Fountain, CEO, Colony Bank, Albany, to share how Colony Bank began their innovation journey as well as his advice to community bankers starting their own journey.

In late 2021, Colony team members attended CBA’s Fintech Forum at the Georgia Tech Conference Center. “The presentation on Baas, Banking as a Service, by Eric Sprink, CEO, Coastal Community Bank, Everett, Washington, really got my team excited,” shared Heath. “The team ended up getting me on a video call with him. We really hit it off and stayed in touch. What they were doing got me thinking about all the things we could do.”

What were your innovation offerings/plans prior to the forum?

We really did not have any offering that I would consider to be “innovative” today - but we are working on a number of things.

Since December 2021, what has the innovation journey looked like? In terms of technology; investment; people?

I did not feel like we could do this on our own and felt like we needed some help. Through my relationship with Eric, I met Christian Ruppe, who we ultimately ended up hiring as our Chief Innovation officer.

What has CBA done to help with Colony Bank’s innovation journey and what more can CBA contribute or offer of value to assist your efforts?

The programming CBA has featured on innovation really opened our eyes to the possibilities and the introduction to Eric Sprink was critical in getting us down the road.

I think continuing what you are doing, and with the ICBA’s programs coming to Atlanta, helping us to network and vet out potential fintech partners will be great.

Where do you see Colony Bank’s innovation efforts in five years? Or – what does the future look like for your bank’s innovation efforts?

I think in five years, Colony will have a digital customer experience that rivals any of the large banks and the neo banks as well. I think we will be working with a dozen or more fintech partners to provide more services to our current customer base and will likely have a handful of niche products that we offer to customers on a nationwide basis. I think our mobile and online apps will be the go-to source for the financial needs of our customers. We will be using our core provider only for our core processing, and we will be using best of breed partners for all our customer facing applications.

Please share any advice to community bankers embarking on their own journey.

My advice would be to embrace change, and to expose yourself to as much as you can. Go to conferences, read articles, talk to bankers that are paving the way. The way we do business is going to drastically change in order to meet the demands of our customers. If you count on your core provider to get you there, you will be left behind.

Winter 2023 | Georgia Communities First | 17

SPOTLIGHT

<< Erik Sprink, Coastal Community Bank & Charles Potts, ICBA

CBA Scholarships

Opportunities for your community and your team

CBA’s LEAD Board is pleased to announce the Julian & Jan Hester Memorial Scholarship for high school seniors. The goal of the scholarship is to assist deserving high school seniors in their first year of college and to promote community banking. To compete, students must be sponsored by a local community bank, complete an activity record expressing their leadership activity in school, write a short essay on community banking, provide teacher recommendations and an official high school transcript. Awards are based on academic merit and not financial need. CBA will award four $1,000 scholarships.

The scholarship is named after former community banker and long-time CBA Chief Executive Officer, the late Julian Hester, and his late daughter, Jan Hester. Jan was a senior at the University of Georgia when she died in an auto accident on April 15, 1990. In addition to supporting community banking, this scholarship is an opportunity to pass on the positive qualities both Julian and Jan Hester exemplified to further the development of tomorrow’s generations.

Visit the Hester Scholarship page for bank information, a press release, student application and Frequently Asked Questions. Applications are due to the bank on April 7, 2023, and to CBA by April 14, 2023.

The J. Steven Walraven Scholarship is a $500 scholarship awarded to a Georgia community bank employee attending a college or university within the state of Georgia. The goal of the scholarship is to assist those employees interested in furthering their education to enhance their career in community banking. The scholarship is named for the late J. Steven Walraven, a former community bank president who dedicated much of his life to his community and community banking. Steve was a member of the Board of Directors of Community Bankers Association of Georgia and served as Treasurer. The deadline to submit applications to CBA is Friday, April 14, 2023, and the winner will be announced mid-May. Spread the word at your bank! Learn more.

18 | www.cbaofga.com | Winter 2023 SPOTLIGHT

Nair Family Scholarship

Honoring Nicholas R. Cimino

A Scholarship Designed for Adult Learners Working at a Georgia Community Bank

John and Lisa McNair, together with their family, announce the second annual McNair Family Scholarship, honoring Nicholas Cimino. The scholarship is designed for adult learners working at a Georgia community bank.

The McNair Family Scholarship recognizes and honors the achievements of Nicholas (Nick) R. Cimino. The scholarship will be awarded once per year to an adult learner who is currently employed at a Georgia community bank and plans to work towards an associate, bachelor’s, or trade degree.

An adult learner is defined as a student at least two years removed from high school. The student must work at least 25 hours per week at a Georgia community bank. The $1,000.00 award will be paid directly to the institution of higher learning to offset student expenses.

Learn more about Nick Cimino and his dedication to earning his college degree while working and raising his family. All applications must be received at the CBA office by May 1, 2023. The winner will be announced by the end of May 2023.

Winter 2023 | Georgia Communities First | 19 SPOTLIGHT www.eclipsebrandbuilders.com | 678.894.4360 + Architectur e & Engineering + Interior Design & Fur nishings + Constr uction Management + Facility & Mar ket Consulting + Br anding & Mar keting eclipse your competition! Our integrated design-build services provide turnkey results. From concept to grand opening, our team of industry experts guide you through a proven process that will transform your objectives into successful facility solutions. DESIGN-BUILD SOLUTIONS a Community Bankers Association of Georgia 1640 Powers Ferry Road, Building 28, Suite 100, Marietta, GA 30067 Phone: (770) 541-4490/(800) 648-8215 • Fax: (770) 541-4496 lindsay@cbaofga.com • www.cbaofga.com

55th Annual Convention & Mini-Trade Show • June 7-10, 2023

Wednesday, June 7, 2023

1:00 PM - 3:00 AM CBA Board Meeting

3:00 PM - 5:00 PM Convention Registration

3:00 PM - 5:00 PM Exhibitor Set-Up

6:00 PM - 6:30 PM Board Reception*

6:30 PM - 7:30 PM Board Dinner* *Events by invitation only.

Thursday, June 8, 2023

7:30 AM - 8:00 AM Breakfast

8:00 AM - 9:15 AM Welcome and Opening Session with Keynote Aaron Davis

9:15 AM - 12:35 PM Programming 12:35 PM - 8:00 PM Afternoon On Your Own 8:00 PM - 10:00 PM Night Event (PAC Fundraiser)

Friday, June 9, 2023

7:30 AM - 8:00 AM

Saturday, June 10, 2023

Address with Randy Gravitt

Sunday, June 11, 2023

Departures

20 | www.cbaofga.com | Winter 2023 SPOTLIGHT

Breakfast 8:00

Programming 12:35

Afternoon

AM - 12:35 PM

PM

On Your Own

7:30

Breakfast 8:00

11:15

Programming 11:15

12:35

Keynote

12:35

Afternoon

6:30

7:15 PM Reception 7:15

8:30

Chairman’s Dinner 8:30

Chairman’s

AM - 8:00 AM

AM -

AM

AM -

PM

PM - 6:30 PM

On Your Own

PM -

PM -

PM

PM - 11:30 PM

Party

Aaron Davis

Randy Gravitt

HOTEL INFORMATION & RESERVATIONS

Click here for online reservations.

To call in reservations, please reach out to The Charleston Place hotel directly. You will need to advise them that you were with the Community Bankers Association of Georgia group in order to receive our discounted rate. The reservations office is 800/611-5545 or via email at reservations@charlestonplace. com.

Cutoff date:

We encourage you to book your room prior to May 7, 2023. After May 7, rooms will be released, and CBA cannot guarantee the group rate or availability after that date.

Winter 2023 | Georgia Communities First | 21 SPOTLIGHT

SERV NO GEORGIA COMM N TY BANKS

ACG has proudly served the interest of Georgia Community Banks for over 30 years. We believe in a "Better Customer Experience" and ensure complete satisfaction. ACG has been an endorsed member of CBA of Georgia for over 17 years.

Branch solutions and much more:

R Re-Manufacturing & Branding - Re-Manufactured ATMs look and perform like a new product; they are environmentally friendly and a cost-effective way to upgrade and expand your fleet. ACG is the largest ATM remanufacturer in the world.

If the look and feel of your fleet needs an update, we offer wraps, canopies, custom screens and full-service turn-key deployment. Studies show that customers prefer to use an ATM that is branded by a bank, and properly maintained, with security features installed.

F Field Service - Our technicians are always on time, thorough and friendly. ACG is one of the largest suppliers of parts worldwide - we have the parts you need! Proper service eliminates downtime, maintains compliance, protects your brand, extends your equipment lifespan and increases the return on your investment.

ACG's online portal gives customers direct access to enter service requests, track calls, and view history.

Teller Cash Recyclers - TCRs are one of the most beneficial ways to offset staffing shortages, reduce labor costs, and enhance cash management and security while providing your customer with an experience, not a transaction. ACG is honored to be the U S Master Distributor for ATEC Teller Cash Recyclers, offering the larges t, fastest, and most feature-rich TCR on the market!

Contact

tracy.dobson@acgworld.com

chandler.wright@acgworld.com

us and find out how we "Make It Easy!"

Education Buzz:

Daily we are building our organization’s culture. Recently I heard Christie Drexler say, “If you can’t be a good follower then you can’t be a great servant leader.” That is an excellent reminder to those of us who are leading people that our daily example is being watched. A great servant leader knows how and when to follow and knows when to lead and when to serve. A leader completes an internal evaluation of

their behaviors to ensure consistency with their words and decisions. As we continue hearing the buzz that culture is essential to retaining employees, have you pondered your own thoughts, words and actions? Are you in alignment? Ongoing leadership development sets standards for our daily walk. CBA continues offering leadership development for our community bankers. Don’t miss out!

BANKING CHANGES. OUR COMMITMENT TO YOU NEVER DOES.

1964 Travelers becomes one of the first domestic markets to write Directors & Officers Liability insurance

2011

Travelers CyberRisk coverage is introduced to the market

Kristi Greer Senior Vice President Director of Professional Development Community Bankers Association of Georgia

2021

Travelers distributes more than $4 million to ICBA members participating in the policyholder dividend program

Throughout our long history, we’ve stayed focused on keeping community banks on the cutting edge. We do this with industry-leading specialists, expertise and offerings –all backed with local banking knowledge. Learn more at travelers.com/business-insurance/financial-institutions

Winter 2023 | Georgia Communities First | 23

PROFESSIONAL DEVELOPMENT

travelers.com Travelers Casualty and Surety Company of America and its property casualty affiliates. One Tower Square, Hartford, CT 06183 This material does not amend, or otherwise affect, the provisions or coverages of any insurance policy or bond issued by Travelers. It is not a representation that coverage does or does not exist for any particular claim or loss under any such policy or bond. Coverage depends on the facts and circumstances involved in the claim or loss, all applicable policy or bond provisions, and any applicable law. Availability of coverages

in this document may depend on underwriting qualifications and state regulations. © 2022 The Travelers Indemnity Company. All rights reserved. Travelers and the Travelers Umbrella logo are registered trademarks of The Travelers Indemnity Company in the U.S. and other countries. CP-9620 New 2-22

referenced

CBA COMMUNITYBANKERS ASSOCIATION OF GEORGIA collegeave.com/cbaga Find out more about partnering with College Ave Stu dent Loans. Brian Reed I 610-620-4322 breed@collegeave.com ©2023 College Ave Student Loans. All Rights Reserved College r.t�=f STUDENT LOANS ✓ Serve Your Best Customers Keep these families banking with you ✓ Avoid All Lending and Administration Simply refer your customers with student loan needs ✓ Generate Fee Income Receive revenue for each funded loan ✓ Private Student Loans Undergrad, Grad, Parent, and Refinance

Essentials of Commercial Credit Analysis provides bankers with foundational principles for effective commercial and real estate lending, commercial credit analysis, underwriting, and loan review. This 4- day series will prepare bankers to successfully analyze credits and make wise, evidence-based loan recommendations in today’s banking environment, where they must have the skills and flexibility to respond to a wide range of loan requests.

Audience

This series is targeted to Commercial Lenders, Commercial Real Estate Lenders, Commercial and Industrial Lenders, Small Business Lenders, Credit Analysts, Commercial Loan Underwriters, Loan Review Officers, and Management Trainees

Day 3 C&I Lending, Financial Statement Analysis, Direct (UCA) Cash Flow Analysis

• C&I Lending Defined

• Cash Conversion Cycle and Working Capital

• C&I Borrowing Causes and Loan Structure

• C&I Collateral Analysis and Monitoring

• Financial Statement Analysis: Trend Analysis, Common-Size Analysis, Ratio Analysis

• Statement of Cash Flow and Direct UCA Analysis

• Projecting Future Income and Cash Flow

• Real World C&I “Loans Gone Bad”

Day 4 Effective Credit Memos, Proper Loan Grading, Portfolio Management, and Relationship Building

• 5 C’s and the Effective Credit Memo

• Assessing Risk and Mitigation Strategies

• Proper Loan Grading

• Ongoing Loan Monitoring, Exception Management, and Loan Review

• Problem Loan Workouts

• Effectively Communicating with Credit Partners

• Building Loyal Client Relationships

Winter 2023 | Georgia Communities First | 25

PROFESSIONAL DEVELOPMENT

Instructor: Christie Drexler Performance Solutions Inc.

26 | www.cbaofga.com | Winter 2023 Is your bank well-positioned for the next credit cycle? Add IntelliCredit to your Loan Review Bid. Request a quote at www.intellicredit.com/quote. Get a Demo. Contact info@intellicredit.com Say goodbye to the sluggish old model for managing credit risk. IntelliCredit has revolutionized the process—helping your bank detect risk earlier and keep losses lower. Smart Loan Review™ Service – combines our Deep Credit Expertise + Online Portal for huge efficiencies and minimal staff intrusion—you see activity online as it happens. Smart Loan Review™ Solution for internal teams – uses a fintech approach to greatly streamline the annual and/or internal reviews you perform. Portfolio Analyzer – keeps your team well informed with insightful analysis of your portfolio and individual loans.

Do you have an employee that wants to understand the full picture of the community banking industry? We want to support your bank’s talent development by offering this brand new class. Participants will establish a strong foundation of the banking industry and improve cross functional contributions for overall bank success. This program prepares bankers to participate in Barrett School of Banking. Register today.

As a former community bank trainer, our director of professional development encourages your bank to choose an employee that can support your internal bank communication strategies. Register today.

CBA of GA was the first association to offer this elite school to support our community bank compliance officers. Join us on St. Simons Island for learning, networking, interactive workshops, roundtable discussions and leadership communication support. Compliance touches every aspect of banking – from product and service development, delivery, maintenance, servicing, and cessation. Yet, there is little training or orientation to what is involved in being a Compliance Officer, Manager, Specialist or Analyst. Register today.

Winter 2023 | Georgia Communities First | 27 PROFESSIONAL DEVELOPMENT

Repurpose pledged funds for balance sheet flexibility.

Reduce collateralized deposits and increase asset liquidity.

By significantly reducing the collateral it holds for pledging purposes, your bank can avoid having pledging requirements drive its investment strategy. Reducing collateralization can give your bank more flexibility to manage interest rate risk. And, decreasing the need to track collateral on an ongoing basis can save time for both your bank and its customers.

Talk to us today about IntraFi's solutions for collateral reduction.

Contact your Managing Director Danny Capitel at (866) 776-6426, x3476, or dcapitel@intrafi.com. IntraFi.com Use of IntraFi’s deposit placement services is subject to the terms, conditions, and disclosures in the applicable program agreements, including the IntraFi Participating Institution Agreement. Limits apply and customer eligibility criteria may apply. A list identifying IntraFi network banks may be found at https://www.intrafi.com/network-banks. The depositor may exclude particular insured depository institutions from eligibility to receive the depositor’s funds.

Q1: NSF/Overdrafts/ Representments & UDAAP

Q2: Appraisal Regulations & Flood Insurance Compliance

Q4: 3rd Party Risk Management & Environmental Social Governance (ESG)

We invite you to continue participating in CBA’s annual Compliance Program, the 2023 Compliance Professionals Package. CBA of GA continues to raise the bar on our program offerings to bring more benefits and value to our community bank compliance professionals. The Compliance Professionals Package will support your financial institutions strategies for managing an effective compliance program. As your professional development resource, we know you strive to continue growing your knowledge and skills as compliance professionals.

Your Compliance Professionals Package was built using our member’s ongoing feedback and survey results. Thank you for continuing to provide support and feedback so that we can offer the topics and ongoing resources you request.

CBA’s Compliance Professionals Package is intended to educate community bankers on updated compliance topics and regulatory issues that are useful and applicable to the ongoing bank strategy. These opportunities are designed for community bank professionals by providing annual education and techniques for monitoring and enforcing regulations which support the regulatory compliance success of community banks.

Why Join?

• Gain Continuing Professional Education Credits – CPEs.

• Receive Quarterly Professional Education Programs.

• Receive Special pricing to attend CBA compliance-related schools and seminars.

• Access to a Complimentary Legal Hotline.

• Access a complimentary toll-free compliance helpline. Within 90 days after a seminar/school led by a ProBank Austin speaker, attendees may call and discuss concerns with the speaker without charge.

• Collect Quarterly newsletters (InCompliance) that address current regulatory hot topics.

• Complimentary access to the CBA Compliance Officer online forums.

• Complimentary registration to attend Compliance R.A.P. sessions (including Banker Regulatory Forums)

*RAP = Roundtable Advice for Professional Development

Winter 2023 | Georgia Communities First | 29

We are taking suggestions now! Complete Survey.

PROFESSIONAL DEVELOPMENT

Popular Schools & Conferences

Compliance Officer Bootcamp

February 28–March 3 | St. Simons

Mortgage Lending School

April 3–5 | Perimeter

BSA/AML Fundamentals

April 18-20 | Perimeter

HR Conference

May 15–17 | Jekyll Island

Cyber Risk Summit

August 17–18 | Jekyll Island

Advanced BSA/AML Compliance School

August 21–25 | St. Simons

Retail Lending School

October 2–5 | TBD

Advanced Compliance School

October 23-26 | Jekyll Island

Join the 6th leadership group to meet your personal development growth goals! Register today.

Innovation Forum – Ag Tech

As agriculture has grown and changed, affecting what happens on a farm and its financing, community banks have drawn on technology to complement the human touch while never losing sight of what matters most. Explore where technology can help and not create a hinderance when guided by the best interests of customers.

Join your fellow community bankers to hear from Charles Potts, ICBA is lining up a showcase of technologies to support our ongoing innovation and learning. Plus, we will host round table discussion after our networking lunch. Register today.

Winter 2023 | Georgia Communities First | 31 PROFESSIONAL DEVELOPMENT

32 | www.cbaofga.com | Winter 2023 Call 800.340.7304 to start www.holtandmon.com Small businesses count on your expertise. You can count on ours. Your customers have never needed capital more than they do right now. Plus you need to offset narrowing margins by increasing noninterest fee income. SBA/USDA lending is the perfect answer. And ICBA recommends just one provider to make the process hassle-free: Holtmeyer & Monson. Give customers exactly what they need, at no net cost to your bank. Closing SBA loans keeps doors open.

Need a Career Path? This program is an excellent tool to cross-train and build the necessary skills for ongoing growth and development for both front-line and back-room retail focused roles in community banks. Register today.

Maximize the potential of your team members, retain talent, track performance, collaborate on employee strategies, and more. Your HR manger should join the league of community bank HR professionals. Register today.

Hotel Information & Reservations Schedule of Programming

Winter 2023 | Georgia Communities First | 33 PROFESSIONAL DEVELOPMENT

Day 1 Day 2 Day 3 2:00-5:00 8:00-3:00 8:00-12:00

THE DATE!

SAVE

IS YOUR COMMUNITY BANK BOND PORTFOLIO PERFORMING?

Meet Jim.

Jim meets with community bankers across the U.S. to discuss ICBA Securities’ investment products, services, and education through our exclusively endorsed broker, Stifel. Investing through ICBA Securities is a direct investment back into the community banking industry.

When Jim is on the road, he always takes time to enjoy local restaurants and share on social media.

As an ICBA member, you’ve got Jim’s help investing.

Learn more at icba.org/securities

34 | www.cbaofga.com | Winter 2023

Fixed rate or floating?

Hybrid ARMs give an investor both features

What’s your choice for the term of the decade so far (that is, other than COVID)? In the last three years, a number of expressions have come into fashion, some of which have been worn out, used out of context and deemed by linguists to be a blight on our vocabulary. I’m sorry to say these may be around for a while. Here are a few:

• Virtual

• Social distancing

• Pivot

• PPP

• Zoom (which I’ve noticed has become a verb as well)

• Supply chain

• Hybrid

Let’s stick with “hybrid” for a few minutes. This has gained popularity in several circles. Hybrid cars, powered by both fuel and electricity, now account for over 5% of new vehicle sales, and all major auto manufacturers are ramping up their capacity. Hybrid education programs which have both inperson and virtual components are likely to be with us for some time. And, in the investment world, hybrid bonds can offer an attractive risk/reward profile for community banks.

Not a ‘20s innovation

Adjustable-rate mortgages (ARMs) have been around since the 1980s, and portfolio managers have coveted these investments that “wrap” the loans into a liquid security. ARM pools backed by Fannie Mae, Freddie Mac and Ginnie Mae (GNMA) deliver all the normal benefits of mortgage-backed securities (MBSs) and more. In addition to the monthly cash flow, ARMs also can help control interest rate risk for banks that are exposed to rising rates.

The 2020’s versions of ARMs are, at least initially, hybrids. This means there is a fixed rate period for between three and 10 years, after which the remaining principal will adjust frequently, either semi-annually or annually. The volume of ARMs that are true floaters right out of the box is so small that the agencies have a hard time pooling them. Also, there are periods in which hybrids are not particularly attractive for community banks, due mostly to (no surprise here) the price levels. I’m pleased to announce that 2023 is a year in which hybrid ARMs are available at market prices that an investor will probably like over the next few years.

Borrower profile

Still, the vast majority of new mortgage loans is fixed-rate for the full term, whether 30, 20, 15 or 10 years. Over the last decade or so, only about 6% of new loans are adjustable, and that counts hybrids. So who are these borrowers, who are statistical outliers?

Jim Reber President & CEO ICBA Securities

They really line up into two groups. The first are those who are barely on the cusp of qualifying for conventional (or FHA/ VA) financing from a debt load standpoint. Hybrid ARMs will typically be offered at a lower rate than fixed, as the lender has to incent the borrower to accept some interest rate risk.

The second group consists of homeowners who expect to be in their home for a defined, relatively short period of time of ten years or less. These may be soon-to-be empty nesters, or possibly expect to move for employment reasons. If the borrowers do prepay before the first reset date arrives, they’ve saved some interest cost, and not exposed themselves to higher reset rates.

Current examples

Given the profiles and behaviors of the borrowers, the cash flows that hybrids produce are substantial. The loans have fully amortizing 30-year terms, so not a lot of principal is scheduled to amortize initially, but an investor can expect some early activity. Then, as the first reset date approaches, the prepayments speed up even more, sometimes dramatically. Some models predict paydowns of 25% or more annually during the fixed rate window, and even faster in the last few years before initial reset. For many community banks, fast prepayments are exactly what they want in 2023. This was not the case, clearly, in 2020 and 2021, when banks were drowning in liquidity, and interest rates were at record lows.

Another piece of good news is that current market prices for these newly-issued hybrids are near par, usually between 100 and 101. This means that significant paydowns won’t have much impact on your yields. Perhaps even better: The inverted yield curve makes the hybrids with the shortest first reset date (weighted average roll, or WAR) the highest yielding, at least until the WAR. For example, a GNMA hybrid with a 36 month roll date, that starts with a full 5% coupon, is currently available a just a slight premium. This significantly out-yields some longer MBS, at least for the next three years.

There’s more to the ARMs story that we have time and space for here (e.g., rate caps), but it’s fair to say hybrids are worth a portfolio manager’s look in early 2023. You may decide they’re virtual bargains, and that your security inventory should pivot and take down a supply.

Winter 2023 | Georgia Communities First | 35 MEMBER SERVICES

The Cost of Cyberattacks:

How much should you spend in Cybersecurity?

As we embark on a new year, warnings about devastating cyber attacks on the financial sector are making headlines. The urgency for financial institutions (FIs) to strengthen their cybersecurity measures and safeguard assets is fueled by the increasingly brazen attacks by cyber criminals. Along with evolving cyber threats comes the rumor of a potential recession, and budget cuts are imminent in anticipation of a decline in the economy. However, where you shouldn’t see cut backs is in the cybersecurity department. Instead, banks should be ready to evaluate and invest in fortifying their cyber defenses because the cost of an attack is just too great.

The cost of cyber attacks

According to IBM, in their report Cost of a Data Breach 2022, “Reaching an all-time high, the cost of a data breach averaged USD 4.35 million in 2022. This figure represents a 2.6% increase from last year, when the average cost of a breach was USD 4.24 million. The average cost has climbed 12.7% from USD 3.86 million in the 2020 report.” Given those statistics, financial institutions need to ask themselves: How much risk am I willing to incur? With the rising threat of cyber attacks, banks must weigh the financial and reputational impact of breaches versus the investment in more effective protection methods. Consider this: banks that succumb to a cyber attack suffer monetary theft, disruptions to service, hefty non-compliance fines, and compromised sensitive client data resulting in damage to their reputation. When the collective impact is measured, banks are realizing that they can’t afford to NOT invest in cybersecurity solutions.

How much should I spend on cybersecurity?

Budget is always the first question when it comes to bolstering cybersecurity. Before you start crunching numbers with the CFO, understand that setting a specific budget to spend on cyber risk management BEFORE deciphering your bank’s needs is not the most efficient first step. Banks should first conduct a thorough cyber risk assessment to understand the financial investment needed to prevent, detect, and respond to cyberattacks. You wouldn’t expect a mechanic to tell you how much it’s going to cost to repair your car before he peeks under the hood, and the same process applies to cyber risk management. So, let’s discuss how to identify the magic number.

Understanding your cyber risk to get the most bang for your buck.

Estimating a cybersecurity budget and throwing it into a one-size fits all security plan without proper guidance won’t get you the tailored solutions necessary for your bank. Ultimately, it could result in paying more for products and services your bank doesn’t need or will even use. Through a comprehensive risk assessment, your FI can identify the right combination of resources to address its precise security vulnerabilities. During this process you’ll also gain valuable insight into existing capabilities and deficiencies that impact detection, response, recovery, and resilience when faced with a breach. Implementing an approach based on aggregated data about your bank’s particular cyber risk landscape improves how you prevent a malicious attack or respond and reduce the impact of one.

Start by securing a partnership with a cybersecurity company well-versed in the unique challenges and regulations financial institutions face. Once you have an ally in the fight against cybercrime, the risk assessment is completed and evaluated. Your data will determine exactly what your bank needs to stay cyber risk ready. Then, an appropriate budget and allocation of funds is established so you can prioritize and invest in the most accurate, necessary, and effective solutions.

Cybersecurity planning can seem like a daunting financial burden. However, with guidance from an industry expert to create a strategic plan that is designed to address your bank’s cyber risk needs, the value of your budget is maximized, and a powerful approach is created to stop attacks before they happen.

Steve Soukup CEO DefenseStorm

Steve Soukup CEO DefenseStorm

Winter 2023 | Georgia Communities First | 37 MEMBER SERVICES

STS HELPS COMMUNITY SPIRIT BANK

DO MORE

WITH LESS

A t t h e e n d o f 2 0 1 9 S T S G r o u p b e g a n w o r k i n g s t r a t e g i c a l l y w i t h C o m m u n i t y S p i r i t B a n k o n s o m e o p e r a t i o n a l p a i n p o i n t s , i n c l u d i n g s t a f f i n g c h a l l e n g e s . T h e b a n k w a n t e d t o f i n d a s o l u t i o n t h a t d i d n ’ t i n v o l v e h i r i n g m o r e s t a f f a n d a l l o w e d t h e e x i s t i n g s t a f f t o c r o s s - t r a i n i n m u l t i p l e c a p a c i t i e s

W o r k i n g w i t h S T S G r o u p h a s a l l o w e d C S B t o s e r v e t h e i r c u s t o m e r s w i t h o u t d r o p p i n g t h e i r s t a n d a r d s o r o p e r a t i n g h o u r s I n f a c t , a c c o r d i n g t o E m i l y M a y s a t C o m m u n i t y S p i r i t B a n k , m a k i n g t h e s e c h a n g e s h a s h e l p e d t h e m b e t t e r p o s i t i o n t h e i r d e p o s i t o p e r a t i o n s s t r a t e g i c a l l y f o r t h e f u t u r e

“ W e c o u l d n o t h a v e b e e n m o r e p l e a s e d w i t h t h e o p e r a t i o n a l e f f i c i e n c i e s c r e a t e d b y t h e c h a n g e s w e i m p l e m e n t e d w i t h S T S E v e r y t h i n g r u n s s o s m o o t h l y , a n d w e w i s h w e h a d t a k e n a d v a n t a g e o f t h i s o p p o r t u n i t y s o o n e r ! ” – E m i l y M a y s , C o m m u n i t y S p i r i t B a n k

Scan the QR Code to read how STS Group helped Community Spirit Bank thrive at a time when many other financial institutions struggled.

R e a d y t o l o w e r t h e o p e r a t i n g c o s t s o f y o u r b r a n c h e ss p e c i f i c a l l y l a b o r c o s t s ?

T C R B e n e f i t s

• L o w e r l a b o r c o s t s f o r y o u r b r a n c h

• E n a b l e a “ u n i v e r s a l b a n k e r ” m o d e l

• T i m e - s a v i n g t o o l t h a t e n a b l e s t h e t e l l e r s t o h a n d l e c a s h m o r e e f f i c i e n t l y

• E l i m i n a t e t h e n e e d f o r d u a l - c o n t r o l c a s h b u y s t h r o u g h o u t t h e d a y .

W e h a v e m u l t i p l e o p t i o n s f o r d e s k s , t e l l e r s t a t i o n s , a n d d r i v e t h r u ’ s t o f i t y o u r s p e c i f i c n e e d s .

Scan the QR Code to schedule a no-obligation security and technology branch evaluation with your new Georgia Account Executive, Ryker Goodell:

S T S G R P . C O M

855-683-9259

S A L E S @ S T S G R P . C O M

CBA’S 2023 PREFERRED SERVICE PROVIDERS

DIAMOND LEVEL

ICBA Securities

Jim

Scott Brown | scott.brown@icba.org | 334.328.5731

James Bates Brannan Groover LLP Dan Brannan | dbrannan@jamesbatesllp.com | 404.997.6023

PLATINUM

Interested in becoming a Preferred Service Provider?

The Preferred Service Provider packages offers Associate Members the option of upgrading to package of your choice. A few benefits include early access to advertising, exhibiting and sponsorship opportunities, simplified budgeting and of course – increased exposure! All packages are reviewed by CBA’s Member Services Committee. To learn more, please contact Lindsay Greene at 770.541.0376.

Winter 2023 | Georgia Communities First | 39

Reber | jreber@icbasecurities.com | 901.762.5884 Independent Community Bankers of America

SHAZAM Alex Jernigan | jjernig@Shazam.net | 229.220.0064

LEVEL Genesys Technology Group, LLC David Saylor | david@genesystg.com | 770.729.4139

Rachel

843.251.4223

Skip

| 478.357.4441

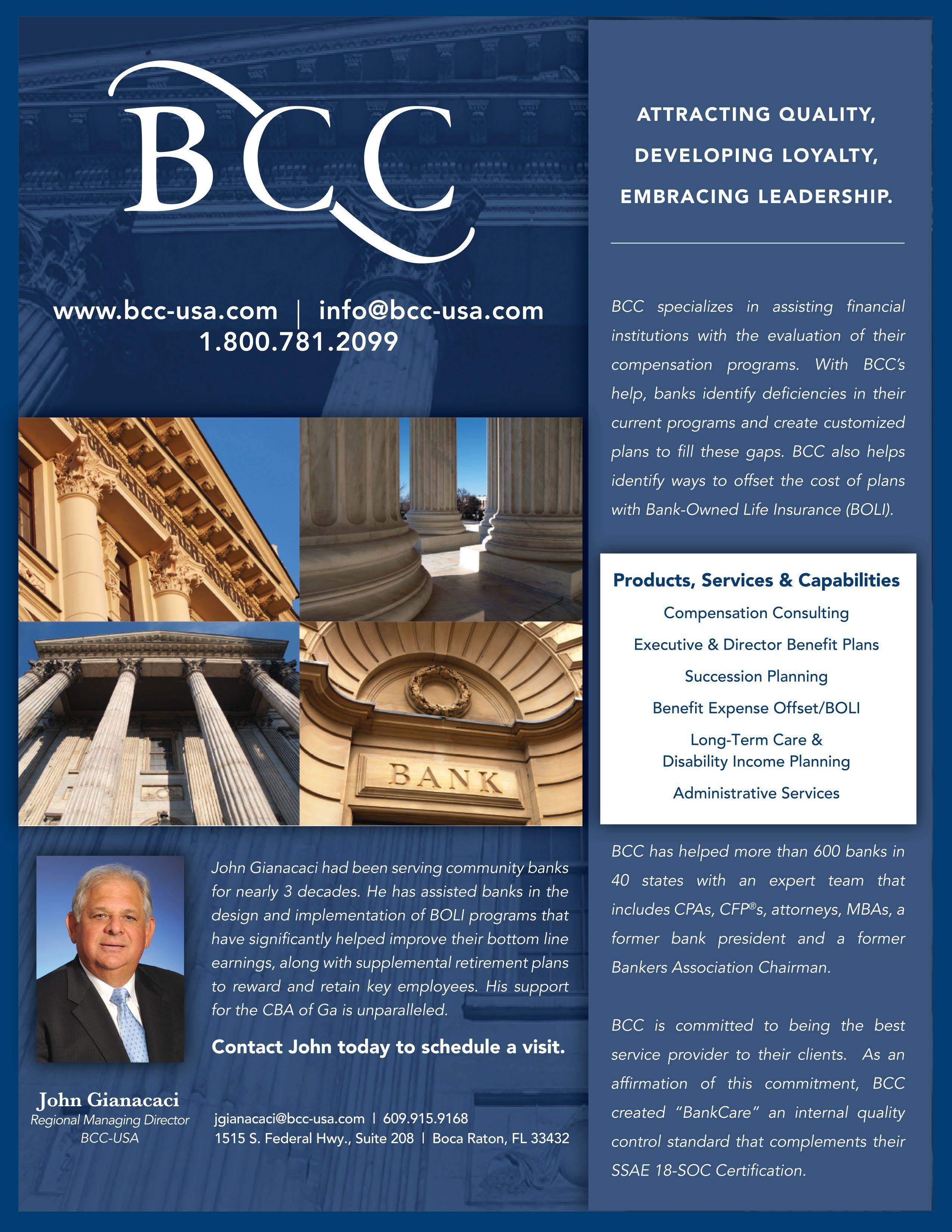

David

| 716.244.1107 FITECH Sarah Humphrey | shumphrey@fitech.com | 817.698.2268 Holtmeyer & Monson Arne Monson | amonson@holtandmon.com | 800.340.7304 IntraFi Network Danny Capitel | dcapitel@promnetwork.com | 770.630.6796 Mauldin & Jenkins Ron Mitchell | rmitchell@mjcpa.com | 229.446.3600 Point to Point Environmental Mark Faas | mfaas@p2penvironmental.com | 678.565.4435 Ext 151 STS Group Adam Stephens | adams@stsgrp.com | 256.957.8018 Travelers Diana Baker | dcbaker@travelers.com | 678.317.7882 Wipfli Summer Gustin | summer.gustin@wipfli.com | 480.289.6052 SILVER LEVEL ACG Phil Winn | Phil.Winn@acgworld.com | 678.458.9899 BCC-USA John Gianacaci | JGianacaci@BCC-USA.com | 609.915.9168 College Ave Student Loans Lexy Spikes | lspikes@collegeave.com | 214.232.5272 CRA Partners David Lenoir | david.lenoir@shcpfoundation.org | 901.529.4786 Eclipse Brand Builders Joel Thompson | jthompson@eclipsebrandbuilders.com | 678.894.4360 Executive Insurance Agency, Inc. Ryan Sower | ryan@executiveinsuranceagency.com | 770.474.2355 Kasasa Ryan Busenitz | Ryan.Busenitz@kasasa.com | 678.595.0625 Newcleus Bank Advisors JR Llewellyn | jr.llewellyn@newcleus.com | 678.427.1015 QwickRate Melissa Wallace | melissa.wallace@qwickrate.com | 678.797.4062 Stokes Carmichael & Ernst LLP Michael Ernst | mje@scelaw.com | 404-603-3441 BRONZE LEVEL AgoraEversole Chis Bates | chris@agoraeversole.com | 601.366.7370 Bahr Consultants, Inc. Hank Bahr | hank@bahrconsultantsinc.com | 865.694.6098

GOLD LEVEL BHG Financial

Thornton | rthornton@bhg-inc.com |

Crescent Mortgage

Willcox | swillcox@crescentmortgage.net

DefenseStorm

Cross | David.Cross@defensestorm.com

40 | www.cbaofga.com | Winter 2023

for

FNBB is more than a correspondent service provider, we are your trusted partner. As an FNBB partner, you gain the access to a financially stable provider and the assurance that we will never be your competition. We are committed to building lasting relationships that help you grow and move towards a brighter future! Always your partner. Never your competition. bankers-bank.com 800.318.6272 Contact: Charles Morris Regional President Jeff Sands Correspondent Lending Officer Chad Wilson Relationship Manager MEMBER SERVICES SPONSORSHIP & ADVERTISING OPPORTUNITIES A targeted audience of banking decision-makers is waiting for your message! Grow your organization’s exposure, heighten your brand recognition, and drive sales through sponsorship at one or more of our 2023 events.

discuss your goals and design the best package for your needs. Contact

Build

the Future with FNBB

Let’s

Lindsay Greene.

CRA Investment and Lending Test Credit For Protecting Local Seniors

Our foundation partners with community banks on programs that promote safety in nursing homes, HUD housing, and Veterans Homes across America. We support those that gave us so much with systems that prevent financial and physical abuse. Join the hundreds of banks that already participate. To get involved and earn CRA credit, please contact: info@shcpfoundation.org

Winter 2023 | Georgia Communities First | 41

CBA of GA Preferred Service Provider

Steve Soukup CEO DefenseStorm

Steve Soukup CEO DefenseStorm