ADVOCACY PRIORITIES | NEW CBA UNIVERSITY PROGRAMS | CBA SCHOLARSHIPS

JAN/FEB 2021

15 Million Award-Winning Connections

Harland Clarke’s dedicated professionals become an extension of your team, delivering seamless, best-in-class experiences during M&As, digital banking conversions, and other change events. Get the award-winning support you need, when you need it, to create positive engagement that delights your customers and strengthens your brand.

harlandclarke.com/ContactCenterCX Š 2020 Harland Clarke Corp. ContactCenterCX is a trademark of Harland Clarke. All rights reserved. Source: Harland Clarke Data, 2019

1.800.351.3843 | contactHC@harlandclarke.com

CONTENTS

F E AT U R E S January/February 2021

C B A S TA F F John McNair President & CEO john@cbaofga.com Lori Godfrey Executive Vice President and Chief of Staff, Government and Regulatory Relations lori@cbaofga.com Kristi Greer Senior Vice President Professional Development kristi@cbaofga.com

2021 Scholarships, page 27 2

Find Your Center of Focus

3

Meeting Customer Needs

professional development

t h e l at e s t

5

22

New CBA University Programs

member services

CBA’s Advocacy Update

25

s pot l i g h ts

7

21 Education Buzz

2021: A Year of Change

11 The Challenge/CBA Wellness Solutions trends

Sponsorship Opportunities

26 New Preferred Service Providers and Associate Members 27

Scholarship Applications

29

CBA’s Preferred Service Providers

14 Solutions for Success 17 Questions to Answers

Lindsay Greene Senior Vice President Member Services, Marketing lindsay@cbaofga.com Lisa McNair Director of Finance lisa@cbaofga.com Cassie Cornell Assistant Vice President Digital Strategy and Professional Development Marketing cassie@cbaofga.com Becky Soto Assistant Vice President Professional Development and LEAD Board becky@cbaofga.com Connie Shepard Assistant Vice President Professional Development and Member Engagement connie@cbaofga.com

19 “Audit” is not a Four-Letter Word

Tyler Eck Government and Regulatory Relations Associate tyler@cbaofga.com s tay connected

@CBAofGeorgia

@CBAGeorgia

@company/ cbaofgeorgia

Community Bankers Association of Georgia 1640 Powers Ferry Road SE, Building 28, Suite 100, Marietta, GA 30067-1425 (770) 541-4490 or (800) 648-8215 • Fax (770) 541-4496 | www.cbaofga.com • cba@cbaofga.com J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C om m un i ti es F i rs t | 1

VANTAGE POINT

Find Your Center of Focus In light of the past year and events that are unfolding before our very eyes, it is easy to get caught up in the moment and lose focus on what is most important in our lives. One can easily waste considerable time and energy worrying about things beyond our circle of control and influence. All of this can easily lead to increased levels of stress and exhaustion resulting in lost productivity and personal growth – and even worse – lost opportunities with our faith, family and friends. We need to continually remind ourselves what our center of focus is, or should be, so we can live in a positive and productive manner. It’s interesting how our past experiences can influence our living patterns, including the things that provide and shape our focus. For me, one particular professor from my undergraduate studies provided a major pillar in my ongoing outlook and focus. Although I earned my B.A. degree in Economics from the University of Delaware, my passion throughout my college experience was the study of history. Every semester, I would search through the upcoming class offerings for history classes taught by Dr. Gary May. This professor was engaging and had a unique ability to bring history to life. Dr. May could discuss events of those times (late 1980s) and put them into historical context which made sense and allowed for better understanding of the material. I made it a point to fill every elective credit that I could with history classes taught by Dr. May. His teaching style and the lessons I learned in his classroom provided invaluable experience for me to understand the concept of cycles throughout time. Cycles are defined as a series of events that are regularly repeated in some order. Merriam-Webster provides this definition for cycle: an interval of time during which a sequence of a recurring succession of events or phenomena is completed, and a course or series of events or operations that recur regularly and usually lead back to the starting point. Looking back just over 100 years, which is a very short period of time, it is easy to see multiple cycles that have occurred in the United States. Cycles have included

2 | ww w. cbao fga.com | Jan ua ry / F ebrua ry 2021

John McNair President & CEO Community Bankers Association of Georgia

great economic depression and great economic booms. They have included times of war, peace, national unity, division, and yes, even pandemics – multiple ones in fact. Dr. May’s teachings made students aware of the fact that no matter what the circumstances of the current times, it is highly likely that a search through history will reveal the fact that similar circumstances have occurred. Through study and reflection, one could learn how a situation was dealt with before and discover what worked and what didn’t and apply the lessons accordingly. Regarding today, the fact is we have lived through similar times before. Our country not only survived such times, but we thrived. Throughout history you will find good leaders, bad leaders, civil challenges, pandemics, economic crises, and sometimes international conflicts. At the center of it all is the individual. I believe it is important during times of strife to identify those values and belief systems that make up our individual center and focus precious time and energy on enhancing those values which you identify. In other words, tune out the noise and focus on the priorities in your center: family, faith, community, and service. As individuals, the items in our respective centers are things we can control and directly influence. For me, my focus for 2021 and beyond will be to ensure my center of focus is aimed towards these important areas. I know this effort to maintain my center of focus will benefit me greatly and hopefully will help those around me fulfill their center of focus. Finally, I believe the events of the current times are particularly difficult for our younger generation. They have not had the benefit of time and experience and with the combination of instant digital communication, they can feel overwhelmed and troubled. I strongly encourage everyone to consider taking time to counsel and mentor a young person to help them gain perspective and find their own center of focus. Who knows, you just might be the Dr. May in someone’s life.

FROM THE TOP David Lance President & CEO Greater Community Bank 2020-2021 CBA Chairman

Meeting customer needs in an ongoing socially distanced environment remains a priority When Congress passed a new $900 billion stimulus bill to further assist individuals and small businesses the sighs of relief could be heard amongst our many communities. As our small businesses continue to be impacted by the COVID-19 pandemic, now, more than ever they are leaning on their local community banker for support and guidance as they navigate through these challenging times. Being a resource for our customers is something of which we can and should all be proud. For businesses, the new stimulus bill brings additional funding for the Paycheck Protection Program (PPP) for first time borrowers and the addition of the “Second Draw� program for existing PPP borrowers. This bill also changes how PPP expenses are taxed by repealing the IRS code 2020-32. The bill made significant changes to eligible PPP expenses, extended unemployment benefits, and provided food and farmer assistance with another $13 billion in direct payments.

For individuals, the new stimulus bill provides a second round of relief in the form of direct deposits, checks and debit cards. Individuals will receive a payment of $600, while couples making up to $150,000 will receive $1,200, in addition to $600 per child. The new deal also makes the stimulus checks more accessible to immigrant families. For Georgia community banks, meeting customer needs in an ongoing socially distanced environment will remain a priority. As our industry moves forward, enhancing the delivery of online, mobile and other digital banking opportunities will be key. As we enter 2021, it is imperative that we all stay mindful that while there have been many challenges presented over the last year, we are entering a new year of opportunity. The new stimulus bill, enhancements in digital offerings, and good old ingenuity and hard work, will continue to allow community bankers the opportunity of providing service and guidance to our loyal customers during a time in which they need us most.

J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C om m un i ti es F i rs t | 3

Corner GENERAL COUNSEL

legal news and updates for cba members

Have a topic you would like to see covered in “General Counsel Corner?” Email us at generalcounselcorner @ jamesbatesllp.com

cbahotline

@ jamesbatesllp.com

David B. Anderson

Attorney (478) 336-5517

danderson@jamesbatesllp.com

Corrie E. Hall

Attorney (478) 749-9949

chall@jamesbatesllp.com

G. Grant Greenwood

Attorney (478) 749-9935

January/February 2021

COVID-19 Vaccination: Can You Mandate it? Should You? By David B. Anderson, Corrie E. Hall and G. Grant Greenwood

At long last, some welcome news—two COVID-19 vaccines have been developed and approved for use by the FDA. First line responders across the United States, including in Georgia, have already begun receiving a vaccine. While vaccine supplies are limited at this time, the Centers for Disease Control and Prevention (“CDC”) assures the public that it expects supplies to increase over time, allowing for all adults to get vaccinated by late 2021. This is exciting news and suggests the return of some “normalcy”. Yet the availability of two vaccines presents its own set of issues for employers. Many employers, including financial institutions, have been grappling with whether to mandate that employees must receive a vaccine. In March 2020, the U.S. Equal Employment Opportunity Commission (“EEOC”) updated its guidance in response to the COVID-19 pandemic. In this guidance, the EEOC suggested that an employer can mandate that its employees must receive a vaccine when available, subject to exceptions. Two major exceptions are: (i) if an employee has a disability under the Americans with Disabilities Act (“ADA”) that prevents vaccination; or (ii) if the employee has a sincerely held religious belief, practice, or observance which prevents vaccination. Until recently, the EEOC was relatively quiet with respect to this guidance. As a result, employers called for more guidance from the EEOC as potential vaccine distribution drew nearer. On December 16, 2020, the EEOC answered this call by publishing guidance specifically related to a vaccine and employers. This updated guidance will assist financial institutions as they struggle with whether to mandate vaccination of employees in the workplace. In its updated guidance, the EEOC again confirmed that an employer can mandate that its employees receive the vaccine, subject to the exceptions discussed above. The guidance additionally confirms that an employer can host on-site vaccinations without a third party’s administration of the vaccine being considered a medical examination under the ADA. Yet the guidance also warns that certain pre-screening questions during such vaccine administration may be a disability-related inquiry, which is generally prohibited under the ADA. While this guidance is helpful, this area remains murky.

Consider the following scenario: ABC Bank adopts a policy that requires its employees to receive a COVID-19 vaccine. In doing so, ABC Bank takes a step to protect its employees from direct threats of COVID-19 caused by heavy foot traffic and workforce numbers in its branches. As a result, ABC Bank may experience less workforce disruptions due to COVID-19 and its high-risk customers may feel more safe entering ABC Bank’s branches. However, ABC Bank must now also navigate employee requests for accommodation under the ADA or due to a sincerely held religious belief. While these requests are very appropriate, ABC Bank must navigate these requests uniformly to ensure no disparate treatment results. Further, ABC Bank may also have to address situations where high-performing employees refuse to receive the vaccine, whether due to good reasoning or misinformation. Generally, employees do not like their employers telling them what to do with their health. In lieu of mandating a vaccine, your financial institution can nevertheless strongly encourage that its employees receive a vaccine. By strongly encouraging employees to receive the vaccination, a financial institution may still avoid its branches becoming an exposure site. However, this route is not immune from issues as well; for example, an employee could still claim that its employer failed to keep the employee safe from a direct threat of COVID-19. Unfortunately, there is no clear-cut answer for an employer with respect to mandating that its employees receive a vaccination. Accordingly, we recommend that any decision on mandatory vaccination be made by management and your institution’s Board of Directors. Further, we strongly encourage that point of entry signs bearing the appropriate warning language under Georgia Senate Bill 359 be placed at all physical locations for employees and/or customers to shift the risk of liability for COVID-19 exposure to the employee and/or customer. Should you want to discuss the EEOC’s guidance, appropriate workforce policies and plans, or point of entry disclaimers, please contact us with any questions, and we will be happy to assist you.

ggreenwood@jamesbatesllp.com

PRESENTED BY GEORGIA’S LAW FIRM: OFFICES MACON + ATLANTA + ATHENS

“General Counsel Corner,” a recurring column featuring legal news and information of interest to CBA members, is brought to you by James-Bates-Brannan-Groover-LLP. Visit us at GeorgiasLawFirm.com

THE LATEST

Stay in the Know with CBA’s Advocacy Update The CBA Advocacy Update is your guide to all things taking place at the Gold Dome this session. Weekly updates will change a little this year as there will be a team of two down at the dome. Tyler Eck, Government and Regulatory Relations Associate, joins CBA’s seasoned lobbyist Lori Godfrey, EVP, Government and Regulatory Relations. This session will go down as another notorious historic year. The pandemic still looms over everyone's heads, and new procedures and protocols are in place to keep everyone safe under the dome, meaning there are already several challenges to overcome that we are happy to take on. There are quite a few new faces around the Capital this session; 24 new House representatives and 11 new Senators this cycle took their oath and were sworn in. Friday’s Advocacy Update was chock-full of information including: • • • • • • •

Weekly Update New Committee Membership Legislation CBA is Tracking CBA PPP Resources ICBA PPP and EIP News SBA Paycheck Protection Program Click here to subscribe to CBA’s Advocacy update.

J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C om m un i ti es F i rs t | 5

WE’RE IN THIS BOAT TOGETHER

TRADITIONAL ACCOUNTING

What we’re experiencing right now is unprecedented. These are uncharted waters but we can help you navigate through them. We may begin relationships with traditional tax or audit services, but clients quickly realize we can offer so much more. By listening to your bank’s needs, we connect you with our experts to help accomplish what’s important to you. From technology solutions and regulatory compliance, to human resources and executive recruiting, it’s time to take a closer look at Warren Averett and all we have to offer. Let’s thrive together.

CORPORATE ADVISORY SERVICES RISK, SECURITY & TECHNOLOGY HR SOLUTIONS PERSONAL SERVICES

Alabama | Florida | Georgia www.warrenaverett.com

FINANCE TEAM SUPPORT 6 | ww w. cbao fga.com | Jan ua ry / F ebrua ry 2021

For more information, contact Lisa Small at Lisa.Small@warrenaverett.com.

SPOTLIGHT

The word of the year for 2020 was “pivot” and Georgia’s community bankers certainly did just that showcasing flexibility, technology, and personal touch, all while safely serving their customers. “In my opinion, 2020 will also be remembered as the year of the community banker. During a national time of need, community bankers from across the country answered the call to help inject job saving capital into the small businesses they served,” said John McNair, President

“In my opinion, 2020 will also be remembered as the year of the community banker.” — John McNair & CEO, Community Bankers Association of Georgia.” Georgia’s community banks led the way making over 93,000 PPP loans which, in turn, saved the jobs of 1 million fellow Georgian’s. Small business owners, politicians and the media alike watched in awe as the nation’s community bankers literally worked night and day for weeks on end to save jobs, livelihoods, and the economy. I am proud to say that your CBA team answered the call as well and worked around the clock to help navigate the PPP process.”

in 2021 and beyond,” explained Greg Proffitt, President, Newton Federal Bank, Covington. “Maximizing the bank’s net interest margin (NIM) will be a focal point and will be challenging if the interest rate environment remains similar to what we have experienced in 2020. Lastly, I would say that we will continue to try to find ways to generate more non-interest income since our NIM will be squeezed.”

Greg Proffitt President

Independent Banker’s annual Community Bank CEO Outlook survey asked bank executives how they plan to move their institutions forward this year. The results of this year’s survey show a different set of challenges—and opportunities—for community bank leaders. What will be your community bank’s greatest business challenge in 2021?

CBA asked several of our bankers and partner firms what they plan to do differently in 2021 as a result of what they learned last year. Many CBA members shared that the bank was well positioned for the pandemic. “For 2021, we will continue to focus on deepening our relationships with our customers and our communities that we serve. Building loyalty with our customers can be challenging so defining and demonstrating our value proposition will be critical. We will also continue to look for ways to make it easier for people to do business with us. Technology will play a role there for sure. Having options to meet more of our customers banking needs without having to be face-to-face will be a must have J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C om m un i ti es F i rs t | 7

Correspondent Banking Fed Funds Management Servis1st Access Online Settlement Services Credit / PCard Program

Holding Company Loans Reg O Loans - Stock Loans Participation Loans De Novo & Escrow Services

Tim Finney Vice President - Georgia 478.952.6497 tfinney@servisfirstbank.com 2500 Woodcrest Place Birmingham, AL 35209 855.881.0364 correspondentbanking@servisfirstbank.com

8 | ww w. cbao fga.com | Jan ua ry / F ebrua ry 2021

Member FDIC | Equal Housing Lender

SPOTLIGHT “When COVID permits, I intend to spend more time with our team members and customers. Later in the year, we will plan more companywide gatherings so our employees can get more acquainted with one another. COVID has prevented many of our inter-departmental Mike Sale gatherings and relationship President & CEO building between our employees,” The Commercial Bank commented Mike Sale, President Crawford & CEO, The Commercial Bank, Crawford. “In 2021, we will try to make up for some of this lost time in this arena.

Does your bank anticipate having fewer or more brick-and-mortar branches at the end of 2021? “At our bank, we do not have any major changes for 2021. We are bracing for an Doug Nichols income challenge due to the low-rate President & CEO environment for loans and securities,” Peoples Bank shared Doug Nichols, President & CEO, & Trust Peoples Bank & Trust in Buford. Buford

“We did reclose our lobby and are only waiting on existing customers by appointment only. We have had a number of our staff with Covid-19 and presently have four quarantined and one in the hospital. We can’t trace the virus from inside contact with employees and it seems to be with employee contact from outside of the bank. We have about a third of our employees working from home and have a rotation system in place.”

Which of these revenue streams is most likely to drive your community bank’s profitability 2021?

Fowler Williams, President & CEO, Crescent Mortgage Company, Atlanta, shared his thoughts. “I believe 2021 will be a year where we must continue to adapt. Community Banking has long been a relationship business. We must all find ways to create new relationships and Fowler Williams, strengthen existing relationships while AMP, CMB expecting less face to face interactions President & CEO that we have become accustom to. The Crescent winners are not necessarily going to Mortgage be the biggest. It will be those who can Company adapt the best.” Atlanta

Regarding technology, many bankers interviewed said their bank has already invested in new core systems and upgraded digital offerings. Goals for 2021 are ensuring stronger banking relationships in a socially distant world— including online loan applications, account opening and treasury management services. “Communities across the state are fortunate to have the dedication and commitment of Georgia’s community banks,” said Mr. McNair. “As we move forward in the new year, CBA stands ready to assist our members with first-class professional development, John McNair services and of course advocacy efforts. President & CEO It is an honor to serve you.” Community Bankers Association of Georgia

Special thanks to Independent Banker Magazine for sharing the 2021 Community Bank CEO Outlook.

J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C om m un i ti es F i rs t | 9

1 0 | ww w. cbao fga.com | Janua ry / F ebrua ry 2021

The Challenge As a business leader, what comes to mind when you hear the term “health insurance”? If you are like other mid-market businesses, you’ve probably been frustrated with continual cost increases, as well as the need to pass on higher out-ofpocket costs to your employees. After all, benefits are one of the top costs of most businesses and needs to fit within a limited budget. If you are frustrated, it is both justified and understandable, particularly since insurance company profits have reached new highs and are now among America’s top stock picks. For instance, from 2018: “The S&P Managed Care sector, made up of the largest insurers, has gained more than 1,100 percent during the market’s bull run. That’s more than twice as much as the gains in the biotech sector. The iShares Nasdaq Biotech Index ETF is up about 500 percent during the period.” https://www.cnbc.com/2018/08/19/health-insurers-are-a-big-winner-duringlong-running-bull-market.html

More recently, Anthem reported a quarterly revenue increase of 16.81% for the 2nd quarter of 2020, and 12-month revenue increase at the time of 17.28%. Not too shabby, but since 2020 was a year where many avoided care because of Covid-19, could it have been a fluke? Nope, their previous year (2018 to 2019) was 13.15%. Wouldn’t we all like our businesses to grow like that, particularly if we are a mature one. (https://www.macrotrends.net/stocks/charts/ANTM/anthem/revenue)

SPOTLIGHT

The Kaiser Permanente Foundation recently published their latest results in terms of annual cost increases. Keep in mind that these are all cost increases after plan changes, including deductible, co-pay and out-of-pocket costs for plan members being increased – meaning higher cost and less benefit. The CBA Solution CBA of Georgia decided to get ahead of the challenge and has developed a solution to decrease cost volatility and allow the stabilization to provide member health plans an upside in years where there are low claims and protection in bad years. A series of webinars will be offered over the next several months to provide details, but here are some highlights in terms of its results and benefits: • The model has a 14-year history of delivering average renewals that are 10% below national averages after “good” claim years and 20% lower after “bad” claim years. • A portion of each company’s premium is put into a fund that pays for high claims for members (i.e., employers) participating in the solution. If there is money left in the fund at the end of the year, it is distributed to participating members and those who help make it successful, even companies who have bad claim years. Distributions have been paid out over 75% of the time.

J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C o m m un i ti es F i rs t | 11

INTEREST RATES MAY BE NEAR ZERO,

BUT FEE INCOME DRIVERS FOR YOUR BANK ARE LIMITLESS. With short-term interest rates near zero, community banks need other avenues to drive revenue. That’s where Fitech can help. Our modern technology makes it simple for your business customers to accept payments, send invoices and manage both their cash flow and business operations with real-time transaction reporting. These

value-added services generate non-interest income for your institution and protect your relationship with small business owners—two key objectives in today’s environment.

Banks that control how their small businesses get paid, control where the deposits go.

Partner with Fitech today to deliver meaningful, personalized service and grow your portfolio.

Contact Tanner Rizenbergs 817-575-7930 | trizenbergs@fitech.com www.fitech.com Endorsed Partner of the CBAG

FI_00017_12.20

1 2 | ww w. cbao fga.com | Janua ry / F ebrua ry 2021

SPOTLIGHT • It allows CBA to leverage its considerable membership to aggregate costs and services that best help their health plans operate optimally. • Each plan is underwritten on an individual basis and does not share risk with any other company. The fund, however, dilutes risk for every participating company. • The model includes an employee engagement model that “hand-holds” employees and dependents who need medical care or procedures so they can access the best options and have someone help them decipher interactions with medical provides in ways that enhance their decisions. • An employer can leave the program at the end of any plan year if they desire. However, only two employers in 14 years have done so, both of which had competitive renewals. • From an employee perspective, this operates just like a “normal” health plan that they are used to. • Rates do not change during the year, nor are they agebanded. • The model can be carved out to become an asset for CBA Georgia and participating banks after it reaches certain milestones (to be determined), Please look for communications from CBA of GA for the webinars that will go more into “how” the program works.

William “Robbie” Burlas Partner - Captive Solutions & Options LLC 404-593-5013 | www.CSOCaptives.com

Exploring health insurance options has never been easier…

In late 2020, CBA launched CBA Wellness Solutions featuring an innovative health insurance program for its community bank members and partners. While only a few months old, the program is already proving to be a game changer for our members by driving down costs and increasing plan flexibility. CBA’s offering will change the way members look at association health care programs forever. For more information, contact John McNair at 770.541.4490.

J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C o m m un i ti es F i rs t | 13

TRENDS

Solutions for Success:

Measuring the Impact of Teller Automation The Solutions for Success features timely issues and best practices from CBA Associate Members. CBA recently met with Phil Winn, President of ACG, to ask a couple of questions regarding Teller Automation. ACG is a Master Distributor for ATEC Teller Cash Recyclers. ACG warehouses, distributes, and supports all US bound products. Many CBA member banks have adopted Teller Cash Recycling technology. Some are considering the deployment. What are the benefits of TCR’s? Community Banks can transform “heads down, cash counters” into Sales Consultants--INCREASE Revenue Community Banks know there is untapped potential in their existing branch network. Selling more product offerings is very possible. In order to capitalize on the potential, FI’s should evaluate the age-old practices of their tellers. Teller Automation enables tellers who currently spend a significant part of their day counting and reconciling cash into consultative sellers of the bank offerings. Developing the “sales culture” of tellers is not always easy and will not happen without process, measures, and focus, but it does happen with the effort and tools to enable their success. Customers will notice a difference! –IMPROVE Customer (and teller) Satisfaction Customers are accustomed to entering a branch, sometimes waiting in line, and then working with a transactional teller. TCRs allows the branch staff to perform the same number of transactions in greatly reduced time. Community Banks who have removed the “cash burden” from the tellers allow them to focus on the customer instead of the cash. ‘Repurposing’ their staff to become more product and customer centric. Improve Security—DECREASE Risk One of the most reoccurring reasons to implement teller automation is security. The ability to virtually eliminate cash in the teller drawer and secure all cash in a safe, is a large benefit. Cost Savings—DECREASE Costs There are many potential cost savings. The cost saving may be realized in several ways including reduced FTE head count and cash-in-transit costs, through improved cash inventory management. Many FI’s have found that removing the pressures associated with handling and reconciling cash reduces turnover. This in turn reduces hiring and training costs.

1 4 | ww w. cbao fga.com | Janua ry / F ebrua ry 2021

Use of Technology—IMPROVE your Brand! Customers notice the technology utilized by Community Banks. The use of TCR’s will improve speed of transactions. All improving your “Brand” in your customers and future customers view. Allowing your staff to focus on the customer and not cash… Is there a Return on Investment by implementing Teller Automation? There absolutely can be a very powerful ROI. It is universally agreed that the use of TCRs will allow FI’s to do the same number of transactions in significantly less time/staff resources. The time needed for cash drawer set up, balancing, customer transactions, vault buys/sells, night deposit bag processing, and more are dramatically reduced. What is done with this time savings is of course up to the FI. You may want to request an analysis to estimate how much time you will save. The analysis will use YOUR inputs by branch considering transaction volumes and YOUR estimates of time for each type of transaction, number of tellers, etc. The analysis will estimate total time savings, which can easily be converted into cost savings estimates. Often there is a powerful ROI just on the time savings. Add reduced cash-in-transit costs, reduced overtime, reduced frequency of dual control needs, reduced vault costs (typically on remodel or new branch builds) and potentially reduced insurance costs. These cost savings while enabling your tellers to sell/promote more products makes it easy to understand why teller automation is one of the fastest growing technologies being deployed by FI’s across the country.

TRENDS If a Georgia Community Bank is uncertain if Teller Automation is right for them, what do you suggest? To understand if there is benefit at any branch, the FI should have their cash handling times and processes analyzed at that branch. I would suggest requesting a branch analysis from a qualified Teller Automation supplier to really understand the time being spent on cash handling, potential benefits of utilizing automation and ultimately making an informed decision. ACG is a worldwide company based out of Atlanta. ACG has been serving Georgia Community Banks since 1986 and an Endorsed CBA member (now silver provider) for more than 15 years. ACG not only provides TCRs but also remanufactured ATMs, branch equipment and field service.

Phil Winn President ACG

Tracy Dobson Account Manager ACG

J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C o m m un i ti es F i rs t | 15

TRENDS

Questions to Answers

Jim Reber

President & CEO ICBA Securities

Net interest margin in jeopardy? Here are some solutions. To start out the year, I’d like to both properly memorialize the late, great Alex Trebek and provide some helpful suggestions for investment management in this challenging rate environment in which we find ourselves. And I’d like to do it in the space of this column, so let’s pick up our signaling devices and see what answers we have in front of us. ANSWER: This segment of the municipal bond market is being embraced by community banks after being shunned for the last three decades. QUESTION: What are general market munis? General market munis are differentiated from bank qualified (BQ) munis in two ways. First, there is no limit on the size of the issue (BQs are limited to $10 million per issuer, per year). Secondly, the uses of the proceeds in general market munis are virtually limitless; BQs must be for essential services. As to why BQ issues have been favorites of community banks since 1986, they qualify for beneficial tax treatment related to an institution’s cost of funds. This TEFRA application normally creates higher tax-equivalent yields for bank-qualified issues. However, this advantage begins to shrink when tax rates and/ or cost of deposits decline, and both of these conditions have been in play since 2017. The result? Community banks have been buying roughly twice the volume of general market issues vis-à-vis BQs lately. We’ll see if that trend continues if cost-offunds levels—or marginal tax rates—ever rise again. ANSWER: Community bank bond strategies have recently begun including these types of mortgage-backed securities (MBS). QUESTION: What are multifamily MBS? All three of the major housing agencies, GNMA, FNMA and FHLMC, have stepped up their issuance of multifamily MBS in the past five years. The main reason for the growth is that more of us are living in 5+ family dwellings than ever before. Another is that they can offer some structural advantages over generic pass-throughs. For example, many multifamily pools have short state final maturities of seven to 10 years. Another is that they almost all have some type of prepayment penalty baked into the structure. While penalties (or “yield maintenance” provisions) are common in commercial real estate lending, they’re almost non-existent for single family loans. The prepayment protection they afford are especially attractive in yield environments like we have at the present.

QUESTION: What are borrowers’ rate, loan size and geography? At the end of the day, there are only a few criteria that can provide tangible protection against wholesale refinancing (read: prepayment risk) in generic MBS. The one with the most causal relationship is the borrowers’ rate (in bondspeak, the “gross WAC”). Obviously, the lower the current rate, the harder it is for a homeowner to economically benefit from a refinancing. There is a high correlation between note rate and prepayment speeds. Similarly, the more a borrower owes on his or her dwelling, the more likely the math works in favor of a refinancing. What isn’t quite as universally known is that certain states (e.g., New York and Florida) have punitive taxes and fees that make the prospects of cutting the debt service costs much more difficult. As an investor, you can ask for “prepayment friction” pools containing some type of specific collateral that can significantly reduce prepayment risk. ANSWER: This is by far the most popular month for municipal bond maturities and calls. QUESTION: What is January? Given that we’re embarking on a new calendar year, and, generally speaking, community banks have more cash and liquidity than they prefer, it’s worthwhile to mention in the near term there will be a lot of money being turning over in muni land. It’s possible that the “January effect” could play out in all its glory this year. That is the outcome from a lot of money chasing a limited supply of bonds. Many municipal borrowers, and this certainly includes BQ issuers, don’t tap the market until later in the year. So, it’s entirely plausible that the combination of the wave of redemptions coupled with scant early-year supply will put a serious lid on yields. Many community banks forward purchase in January and February once they identify which bonds in their portfolio will be maturing or will be called away. ANSWER: This financial services sector punched above its weight in extending credit to small businesses at the height of the COVID-19 pandemic. QUESTION: What are community banks? Jim Reber (jreber@icbasecurities.com) is president and CEO of ICBA Securities, ICBA’s institutional, fixed-income broker-dealer for community banks.

ANSWER: These three factors can each help limit prepayment risk on amortizing securities. J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C o m m un i ti es F i rs t | 17

Managing your bank’s risk requires a

trustworthy insurance expert. We analyze insurance risk for community banks on a fee-only basis. We put your interests first.

O u r Expertise: Preferred Service Provider of CBA 30+ years experience Specializing in financial institutions

The GA Department of Banking recommends an outside review of fidelity coverage every 3 years.

Contac t us today to get your risk managed

1-888-272-794 3 Hank@BahrConsultantsInc.com BahrConsultantsInc.com 1 8 | ww w. cbao fga.com | Janua ry / F ebrua ry 2021

TRENDS

“AUDIT” is not a Four-Letter Word Insurance companies do it; FDIC regulators do it; even the Georgia Department of Banking and Finance “highly recommends” doing it. Why do it? Why have an Insurance AUDIT? Can it ever save you money? A risk management and insurance audit, done correctly, can be both helpful AND might just save you money. As everyone knows, if you know what you want, you are far less likely to be “sold” something you don’t want, and far more likely to get what you DO want at a competitive price. An objective, professional audit of your risk management insurance program should provide you with a blueprint of your insurance needs. With this blue print you can obtain competitive prices on just the program you need without the frills. There are three important elements you should look for in your audit: 1. First and foremost, whoever does the audit should be totally objective, and to get a truly objective Audit, it should be done by one of the following: a) An insurance company auditor (NOT your insurance company) b) A qualified insurance agent (Not yours) c) An attorney (again, not the Bank’s attorney) that specializes in insurance law, or d) A Fee Only insurance consultant whose specialty is financial institution insurance analysis. Having your audit done by an employee of your bank will not satisfy the objectivity required by the Georgia Department of Banking and Finance. 2. Competency - Be sure the individual doing the audit has an expertise in Financial Institution insurance. Bank insurance is a very specialized field. Ask for the auditor’s educational background, and references showing experience in the Financial Institution insurance field.

a) A complete overview of your present program. Your present program should be explained simply and completely. You should have a good understanding of your current program including what it covers and what it does not cover. b) Recommendations for improvement of your program, if necessary, should be provided. Methods of handling loss exposures other than insurance should be discussed where appropriate. All catastrophic loss exposures should be addressed with recommended methods of properly addressing them. c) Cost reduction methods should be mentioned where viable. The most cost-effective ways of addressing loss exposures should be discussed. This discussion should include non-insurance methods, as well as insurance options. Finally, be sure to make your expectations from the audit clear to the auditor. If you want emphasis placed on claims reduction, possible self-insurance opportunities, coverage gaps, or reduction in premium cost, tell the auditor, so he/ she may attempt to meet your needs. Conclusion If done properly and used efficiently, the Insurance Risk Management Audit can be an effective tool in combating the rising costs of insurance while not compromising loss protection. The well-informed banker is far more likely to purchase what he/she needs at a competitive price, than the banker who is vulnerable to the ravages of the marketplace. Used correctly, the Insurance Risk Management Audit should result in a seven-letter word, “Savings.” W. Hank Bahr CPCU, ARM, CIC, CRM Bahr Constultants, Inc

3. Integrity - Your auditor will have to examine some sensitive corporate material. Any proposal for services should include some sort of Confidentiality Agreement. What should you expect from an insurance audit? There are several benefits of an Insurance and Risk Management Audit. You should expect your report to contain:

J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C o m m un i ti es F i rs t | 19

Travelers is delivering $4.4 million in dividends to qualifying policyholders. Are you in?

SPOTLIGHT

If your bank is a Travelers policyholder, you’re currently enjoying outstanding Independent Community Bankers of America (ICBA) benefits. If you’re not, you might want to consider the following reasons why you should be insuring with Travelers:

•

•

•

Travelers ICBA Insurance program’s Policyholder Safety Group Dividend plan has been paid for 18 consecutive years. The most recent program year produced policyholder dividends of $4.4 million – for a total of nearly $65 million in dividends paid over the past 36 years. Industry-leading risk management solutions and insurance protection tailored to community banks. Financial strength you can rely on.

To learn more, talk to your independent agent or broker or visit travelers.com.

travelers.com Travelers Casualty and Surety Company of America and its property casualty affiliates. Hartford, CT 06183 © 2020 The Travelers Indemnity Company. All rights reserved. Travelers and the Travelers Umbrella logo are registered trademarks of The Travelers Indemnity Company in the U.S. and other countries. CP-9143 Rev. 2-20

2 0 | ww w. cbao fga.com | Janua ry / F ebrua ry 2021

All property casualty coverages may not be available in certain areas; certain lines of coverage may not be eligible for dividend payout. Dividends are not guaranteed and are subject to the approval of the company’s board of directors.

Education Buzz:

PROFESSIONAL DEVELOPMENT

Have you checked your learning pulse?

Did you learn something today? What was the last education program you attended? Did you exit the learning event with a list of actionable items for your personal and professional success? Have you implemented your action items? Do you know how you learn best? Do you have a learning plan? Do you support your team’s learning goals? Ongoing learning and development programs are vital to workplace success, change, and transformation. As an adult education practitioner, I encourage you to avoid making learning an emergency event. Set a plan for your learning; either have annual goals for personal success or by working closely with your organization to ensure training programs are available. Have measurements for your learning success. Remember learning is a process. Create a learning experience for yourself by being organized, set a schedule, create a space, have your learning tools in hand, engage, listen, take note, highlight, and ask questions. Share what you learn with others. You can be your own learning advocate. Contact CBA First when you have a training need or desire.

Kristi Greer

Senior Vice President Director of Professional Developent Community Bankers Association of Georgia

J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C o m m un i ti es F i rs t | 21

PROFESSIONAL DEVELOPMENT

Meet Your Professional Learning Goals With CBA University

Join the 4th graduating leadership class and put leadership skills to action! “CBA’s Leadership Academy was not your ordinary leadership-training course, and far exceeded my personal expectations! Not only was the training material valuable and engaging, the trainers and attendees brought the program to another level! Early on, the training staff had compelled group participation without us even knowing it, and this not only allowed our leadership skills to blossom, but also, created networking friendships that we know will last a lifetime. The trainers were focus driven and spent time relating techniques to real life situations for both work and personal life. The program was very much about self-reflection, and putting into play, the changes we can make to better our teams, our overall workplace, and ourselves. “ Ashley LanierElston, BSA Officer – First National Bank of Coffee County Inspired by CBA’s LEAD Committee, the Community Bank Leadership Academy is designed specifically for the future community bank leader. This series of four sessions will benefit the attendees through individual self-discovery, personal and professional growth and career development. Each participant will walk away with their own personal development plan. The workshops are designed to bring continuity and sustainable accomplishments which will allow each participant to build positive influence, team connections and ongoing learning resources. The Academy aims to support Georgia’s community banks in the development of its people so that these bankers will become impactful leaders of influence - for the bank, themselves and their communities. Leaders choose to professionally grow their knowledge. This series will encourage not only workshop participation but also ongoing self-development. The sessions are designed to build upon each other so that each leader can create action plans for successful practice in their banks. You will see value plus change.

2 2 | ww w. cbao fga.com | Janua ry / F ebrua ry 2021

PROFESSIONAL DEVELOPMENT

Workshop 1 - February 18 New Year - New Start: Key Components for a Successful Year The Branch Leadership Series will focus on the critical success elements of managing and leading a performance-focused sale and service team. Each workshop is designed either as a series or as a stand-alone, packaged full of checklists, job aids, case studies, examples, and “real world” situations. The Series provides a branch manager and the branch management team with current, proven solutions to managing a successful branch today. The Branch Leadership Series is four workshops that may also be completed as stand-alone sessions. The Branch Leadership Series is designed for Retail Managers, Branch Managers, Assistant Branch Managers, Branch Manager Candidates, head tellers, teller supervisors, Personal/Universal Bankers and anyone responsible for the direction and development of a retail branch. The agenda includes: • Where Am I Today –Self-Assessment of Current Skills and Talents • The Leadership Challenge for Today’s Retail Banking Team • Unleashing Your Leadership Abilities • Communication Tools for Today’s Branch Leaders • Understanding and Leading Today’s Team of Different Generations • Implementing the 3 C’s to Excellence –plus one more • Coaching the Team to Engagement • Getting the Right Person in the Right Seat - Recruiting a Winning Team • Employee Onboarding - First 90 Days • Discovering Learning Styles • Defining the Performance Management Process for 2020 • Developing Performance Expectations for the Team • Top 10 Human Resource “Must Knows” for Today’s Retail Management • Branch “Best Practices” and Action Planning

Instructor: Dianne Barton Performance Solutions Inc.

REGISTER TODAY!

J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C o m m un i ti es F i rs t | 23

2 4 | ww w. cbao fga.com | Janua ry / F ebrua ry 2021

MEMBER SERVICES

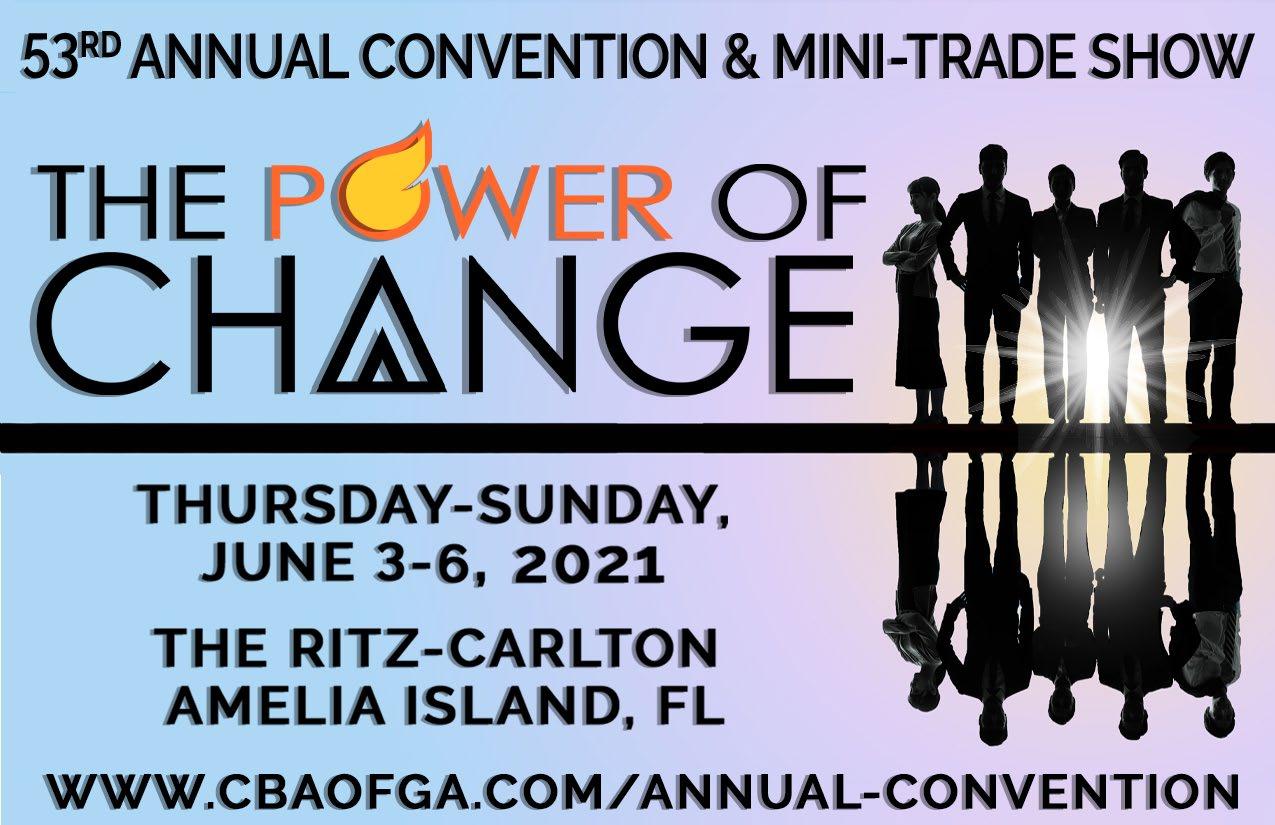

The opportunities to reach your audience have never been greater! CBA offers a wide variety of sponsorships, designed to fit any budget and target your specific audience. Stand out at professional development programs, clay shoots, Topgolf outings, legislative programs, networking events, and of course CBA’s Annual Convention, offering first-class content for both bank CEOs and LEAD representatives. For more information or to request a customized proposal, contact Lindsay Greene at (770) 541-0376. Upcoming Sponsorships: • CBA App Sponsorship, Q2 2021 • Credit Analyst I | February 2 – 3, 2021 • 2021 Retail Banking Forum | February 17, 2021 • IRA Fundamentals | March 18, 2021

Build for the Future with FNBB FNBB is more than a correspondent service provider, we are your trusted partner. As an FNBB partner, you gain the access to a financially stable provider and the assurance that we will never be your competition. We are committed to building lasting relationships that help you grow and move towards a brighter future!

Always your partner. Never your competition. bankers-bank.com

800.318.6272

Contact: Charles Morris Regional President Chad Wilson Relationship Manager

Jeff Sands Correspondent Lending Officer

J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C o m m un i ti es F i rs t | 25

MEMBER SERVICES

CBA Member Services Committee Approves Two New Preferred Service Providers

Associate Members who wish to increase their engagement with CBA member banks have the option to participate in the Preferred Service Provider (PSP) program. Interested members complete an application and are reviewed by CBA’s Member Services Committee, which is comprised of bankers from across the state. The committee recently approved the following companies – Congratulations!

Bankers Healthcare Group Brian Mullett | bmullett@bhg-inc.com 315.663.1121 bankershealthcaregroup.com Mauldin & Jenkins Ron Mitchell | rmitchell@mjcpa.com 229.446.3600 | mjcpa.com

2 6 | ww w. cbao fga.com | Janua ry / F ebrua ry 2021

WELCOME NEW CBA ASSOCIATE MEMBERS!

CBA would like to welcome new Associate Members who were recently approved by the CBA Board of Directors. Throughout the year, CBA’s Board approves quality vendors who provide products and services to CBA members. CBA’s online Associate Member directory puts these providers at your fingertips. For more information, contact Lindsay Greene at lindsay@cbaofga.com. Atlanta Media Services, LLC Mr. Nick Snider Marietta, GA Advertising/Marketing Compliance Core LLC Ms. Jacqueline Maduneme Atlanta, GA Compliance/Risk Management Novus Architects Ms. Olivia Shoffner Peachtree Corners, GA Building Designers/Consultants

Olsen Palmer LLC Mr. Michael Rediker Financial Services Washington, DC United Bankers’ Bank Mr. Trey Moore Bloomington, MN Correspondent Banking Upgrade, Inc. Ms. Rebecca Bacon San Francisco, CA Financial Services

MEMBER SERVICES

CBA’s Memorial Scholarship Applications Are Available! CBA’s Leadership Division proudly assists with this initiative. The Walraven Scholarship is awarded in the amount of $500 to a bank employee who desires to continue their education while working full-time at a CBA member bank. The scholarship is named after the late J. Steven Walraven, an active community banker who exemplified professionalism and community involvement. To compete, employees must write a short essay on how community banking has impacted their life and how it will enable them to give back to their community. The Community Bankers Association of Georgia (CBA) is proud to offer the 2021 Julian & Jan Hester Memorial Scholarship and the J. Steven Walraven Scholarship! The Hester Scholarship is open to Georgia high school seniors who will be entering a Georgia college, university or technical school (two year program or more) in the fall semester of 2021. The scholarship is named after the late Jan Hester, daughter of Lalia and the late Julian Hester, long-time CEO of the CBA. The four winning recipients will be awarded a $1,000 scholarship.

Applications for either scholarship should be returned to the bank no later than Friday, April 2, 2021. All completed applications should be submitted by the bank to CBA no later than Friday, April 9, 2021. Only complete applications will be eligible. A panel of independent judges will review the applications and winners will be announced in late April 2021. Please visit www.cbaofga.com to download the scholarship applications and encourage participation from your community. For more information, please contact Lindsay Greene at lindsay@cbaofga.com.

EXECUTIVE INSURANCE AGENCY, INC.

Call Us for All Your Collateral Insurance Needs! • • • •

VSI Flood Creditor Placed Collateral Protection

• • • •

REO GAP Blanket Tracking Services

Executive Insurance is a Preferred Service Provider of the CBA of Georgia, and has been working with community banks in Georgia since 1980. We are totally committed to the future of community banking and consequently are setting the standard in service, knowledge and innovation in this very important area. We encourage you to call on us for a comprehensive review of your specific needs.

Mr. Ryan Sower • P.O. Box 480 • Stockbridge, GA 30281-0480 770-474-2355 • 800-772-1404 • www.executiveinsuranceagency.com

J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C o m m un i ti es F i rs t | 27

2021 ADVERTISING OVERVIEW Reserve Your Ad Space Today!

If you want to target top decision makers in Georgia’s community banking industry, you will find the CBA offers numerous ways to help you accomplish your goals and stretch your marketing dollars. Show your support for CBA and promote your business at the same time. If you have questions, please contact Lindsay Greene at lindsay@cbaofga.com or (770) 541-0376.

Georgia Communities First Magazine

CBA Today eNewsletter Advertising

Published six times a year, Georgia Communities First provides coverage of community banking industry trends and developments both on a state and national level. The magazine also features upcoming professional development programs, legislative efforts as well as features on CBA members. All issues are published digitally.

Published weekly, CBA Today has a distribution of over 5,000. This digital newsletter includes information on upcoming association events, educational opportunities, associate members, as well as state and national industry news.

CBA Home Page Advertising

2021 Georgia Financial Directory

CBA’s website, www.cbaofga.com, is the source of information on educational programs, events, industry articles, legislative updates, convention information and much more. Ad space is available on a monthly basis and can link to your home page or the destination of your choice.

Published annually, the 2021 Georgia Financial Directory is your complete resource within the Georgia financial industry and contains information on banks, holding companies, banking products and services, and more. The 2021 version is digital only and located in the Members Only section of CBA’s website. All CBA members can access the pdf and online which means exposure to a greater number of positions within the bank.

High-performance tools. For high-performance community banking. With QwickRate®, your bank can access tools and services that larger banks have long enjoyed. Community banks all over Georgia count on us for non-brokered CD funding and investing, performance analysis and regulatory tools. Now they can also stem credit losses with our loan review and credit risk management tools. Contact Melissa Wallace today to learn more and sign up for your 6-month free trial of QwickAnalytics®.

Premier online source for non-brokered CD funding and investing

Powerful online analytics and regulatory tools that every bank can afford

High-tech risk management tools and cost-effective loan reviews that drive down credit losses

Schedule a private tour of our solutions at www.qwickrate.com. Sign up for 6 months of free access to QwickAnalytics at www.qwickrate.com/cbaofga.

800.285.8626 www.qwickrate.com 2 8 | ww w. cbao fga.com | Janua ry / F ebrua ry 2021

CBA’S 2021 PREFERRED SERVICE PROVIDERS DIAMOND LEVEL

Harland Clarke Christine Ahlgren | christine.ahlgren@harlandclarke.com | (678) 500-5330

ICBA Securities Jim Reber | jreber@icbasecurities.com | (901) 762-5884 Independent Community Bankers of America Scott Brown | scott.brown@icba.org | (334) 328-5731

James Bates Brannan Groover LLP Dan Brannan | dbrannan@jamesbatesllp.com | (404) 997-6023 SHAZAM Alex Jernigan | jjernig@Shazam.net | (229) 220-0064 PLATINUM LEVEL

Warren Averett Lisa Small | lisa.small@warrenaverett.com | (770) 393-6151 Wipfli Mary Boortz | mboortz@wipfli.com | (715) 858- 6677 GOLD LEVEL

ATM Response Tony Webb | twebb@atmresponse.com | (770) 855-2989 Bankers Healthcare Group Brian Mullett | bmullett@bhg-inc.com | (315) 663-1121

BFS Group John Gianacaci | JGianacaci@bfsgroup.com | (609) 915-9168

Crescent Mortgage Skip Willcox | swillcox@crescentmortgage.net | (478) 357-4441 FITECH Matt Mingenback | mmingenback@fitech.com | (316) 518-8850 Genesys Technology Group, LLC David Saylor | david@genesystg.com | (770) 729-4139

Holtmeyer & Monson Arne Monson | amonson@holtandmon.com | (800) 340-7304

IntraFi Network Danny Capitel | dcapitel@promnetwork.com | (770) 630-6796

Point to Point Environmental Mark Faas | mfaas@p2penvironmental.com | (678) 565-4435 Ext 151 STS Group Chris Nelson | cnelson@stsgrp.com | (205) 567-3613

Travelers Diana Baker | dcbaker@travelers.com | (678) 317-7882

SILVER LEVEL

ACG Phil Winn | Phil.Winn@acgworld.com | (678) 458-9899

CBIZ Kris St. Martin | kstmartin@cbiz.com | (763) 549-2267

Eclipse Brand Builders Michael Smith | msmith@eclipsebrandbuilders.com | (678) 890-1140

Executive Insurance Agency, Inc. Ryan Sower | ryan@executiveinsuranceagency.com | (770) 474-2355 Kasasa Ryan Busenitz | Ryan.Busenitz@kasasa.com | (678) 595-0625 Mauldin & Jenkins Ron Mitchell | rmitchell@mjcpa.com | (229) 446-3600

QwickRate Melissa Wallace | melissa.wallace@qwickrate.com | (678) 797-4062 BRONZE LEVEL

AgoraEversole Craig Eversole | craig@agoraeversole.com | (601) 366-7370

Bahr Consultants, Inc. Hank Bahr | hank@bahrconsultantsinc.com | (865) 694-6098

Interested in becoming a Preferred Service Provider? The Preferred Service Provider packages offers Associate Members the option of upgrading to package of your choice. A few benefits include early access to advertising, exhibiting and sponsorship opportunities, simplified budgeting and of course – increased exposure! All packages are reviewed by CBA’s Member Services Committee. To learn more, please contact Lindsay Greene at 770-541-0376. J an u ar y/ Fe b r u ar y 2 0 2 1 | G e or g i a C o m m un i ti es F i rs t | 29

3 0 | ww w. cbao fga.com | Janua ry / F ebrua ry 2021