Interview with Dr. Aditya Gupta, COO, Supply Chain Management Centre, Indian Institute of Management, Bangalore (IIM-B)

Interview with Dr. Aditya Gupta, COO, Supply Chain Management Centre, Indian Institute of Management, Bangalore (IIM-B)

Dear Readers,

The India Budget 2025 has reinforced the nation’s commitment to infrastructure development, a critical pillar for economic growth. With increased allocations to logistics corridors, multimodal connectivity, and digital infrastructure, the budget lays the foundation for a more seamless and efficient supply chain ecosystem. However, challenges such as execution delays and regulatory roadblocks remain key areas that demand urgent attention.

As we delve into this month’s cover story, Navigating the Future of Next-Generation Value Chains, we explore how industry leaders are addressing infrastructure bottlenecks, regulatory complexities, and the widening skills gap in emerging technologies. The supply chain of the future is not just about efficiency—it is about resilience, intelligence, and adaptability.

The transition towards sustainable supply chain practices is another crucial imperative. In our expert interview this month, we discuss the role of cleaner technologies in reducing transportation emissions. From electrification and alternative fuels to smart route optimization, industry pioneers are actively reshaping logistics for a lower-carbon future. However, achieving true sustainability is not just about adopting new technologies—it requires collaboration across the ecosystem. Companies must work closely with suppliers, customers, and regulators to build a supply chain that is not just efficient but also responsible and future-ready.

Additionally, our Special Report on Cold Chain takes a deep dive into how far the industry has come. From evolving cold chain infrastructure to groundbreaking technological advancements, the sector is undergoing a transformation that promises sustainable growth and enhanced efficiency.

As we stand at the intersection of rapid transformation, one thing is clear: The future belongs to those who embrace innovation while staying committed to sustainability. We hope this edition provides valuable insights and inspiration as you navigate your own journey towards next-generation value chains.

Let’s build the future, together!

Happy Reading!

Charulata Bansal Publisher Charulata.bansal@celerityin.com

www.supplychaintribe.com

Edited by: Prerna Lodaya e-mail: prerna.lodaya@celerityin.com

Designed by: Lakshminarayanan G e-mail: lakshdesign@gmail.com

Logistics Partner: Blue Dart Express Limited

“India is now poised to set global benchmarks for supply chain excellence in the 21st Century,” writes Sanjay Desai, General Manager – Asia, Supply Technologies.

Dr. Aditya Gupta, COO, Supply Chain Management Centre, Indian Institute of Management, Bangalore (IIM-B), highlights, “To achieve sustainable supply chain management, companies need to work closely with suppliers, customers, and other stakeholders.”

at the Helm:

Next-generation value chains are the epitome of innovation, weaving together Digital Technologies, Sustainability, and Resilience to create Agile, Intelligent Networks of Production and Distribution. India, poised on the cusp of transformation, is positioning itself as a dynamic player in these value chains. However, to truly flourish, India must overcome challenges such as infrastructure bottlenecks, regulatory hurdles, and a skills gap in emerging technologies. If navigated wisely, these hurdles could usher India into an era of unparalleled economic prominence, firmly embedding it in the core of nextgen global value chains. Our Cover Story unravels all these facets and more…

A collective and impassioned effort has been underway to foster innovation, elevate the cold chain sector’s competitiveness, and bring it on par with global standards. In this Special Report, we offer you a glimpse into expert insights on the evolving landscape of cold chain infrastructure, the groundbreaking technological strides, and the burgeoning promise of sustainable growth.

Capturing two of the latest events

• India @ Davos

• Key Takeaways from Union Budget 2025-26

all the care taken, errors or omissions may have crept inadvertently into this publication. The publisher shall be obliged if any such error or omission is brought to her notice for possible correction in the next edition. The views expressed here are solely those of the author in his private/professional capacity and do not in any way represent the views of the publisher. All trademarks, products, pictures, copyrights, registered marks, patents, logos, holograms and names belong to the respective owners. The publication will entertain no claims on the above. No part of this publication can be reproduced or transmitted in any form or by any means, without prior permission of the publisher. All disputes are subject to the exclusive jurisdiction of competent courts and forums in Mumbai only.

India is experiencing a remarkable shift in its supply chain footprint, driven by combination of advanced technology plus manufacturing growth, aided by a strong focus on ESG principles. With a strong foundation built over the last decades, India is now poised to set global benchmarks for supply chain excellence in the 21st Century. Building on these advancements, India’s supply chain leadership must push the nation beyond its current limits to meet its ambitious objectives. This visionary leadership will be instrumental in achieving India’s $6 trillion economic target and establishing it as a global manufacturing powerhouse, writes Sanjay Desai, General Manager – Asia, Supply Technologies.

THE ‘Make in India’ initiative has transformed the manufacturing landscape, attracted global players and fostered domestic innovation. These innovations have significantly enhanced efficiency, reduced costs, and strengthened resilience across networks. Simultaneously, the growing importance of ESG principles has steered businesses toward sustainable practices, ethical governance, and reducing carbon footprints. This shift reflects a broader economic strategy that aligns growth with environmental responsibility.

The last ten years have also witnessed the rise of green energy initiatives and digital platforms, underscoring India’s commitment to a balanced approach to industrial progress. These efforts have not only cemented India’s position as a global manufacturing hub but have also positioned it as a pioneer in sustainable supply chain practices. Let us take a quick

look at few major milestones in past decade which redefined India’s supply chain landscape.

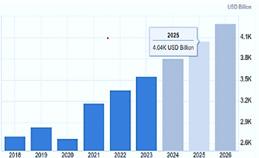

Economic Growth: India's GDP surged from approx $1.67 trillion in 2010 to around $3.57 trillion in 2023, reflecting a robust annual growth rate. Our desire is to achieve a 6 to 7% YOY growth to reach 5.0++ trillion in the next five years. This growth will be fuelled by sectors

Sanjay Desai is an experienced commercial operation professional. Currently he is running Asia Commercial Vertical for Supply Technologies, USA as VP/GM based out of Singapore. In the past, he has been running profit & loss for over 500 million USD leading more than 2000 professionals located remotely across 30 international markets. He has led many Fortune100 multinationals in various segments like Pharma, FMCG, Oil & Gas, MedTech, IT/ Technology and Chemicals successfully for the last 40 years. Sanjay’s expertise lies in developing commercial & operational strategies, developing people’s skillset, and enabling market growth. He is a mentor for a couple of startup incubators. He sits as an advisory member on multiple startups and MSME organizations in SEA.

like petroleum, pharma, electronics & textiles, with increasing contributions from renewable energy, high-value manufacturing to US, UAE, China & European nations.

Manufacturing Sector: The ‘Make in India’ initiative has significantly accelerated manufacturing growth in India, transforming it into a global manufacturing hub. This growth is further complemented by the ProductionLinked Incentive (PLI) schemes, which have earmarked $26 billion to incentivize domestic production across sectors such as electronics, automotive, and pharmaceuticals. The manufacturing sector's contribution to GDP increased from 15.1% in 2014 to 17.4% in 2024, reflecting robust expansion driven by policy support and investments.

Exports touched record high: India’s total exports value touched 770-775 USD billion during FY 2024. Industry segments which contributed majorly are electronics, API/ pharmaceuticals, and engineering goods including Services. India signed significant new FTZ and FTAs especially in Asean region during the last couple of years have unlocked new markets. India’s IT sector accounts for over 55% of global outsourcing demand.

FDI as a percentage of GDP stood at 1.5% in 2024, reflecting sustained growth in foreign investment inflows. These are driven by India’s robust economic growth, market potential, and policy reforms. Sectors such as technology, manufacturing, e-commerce, and renewable energy have attracted significant investments. Notable

examples include Apple's expansion of manufacturing in Chennai, Amazon's investment of over $6.5 billion in Indian e-commerce, just to give you a few examples.

Technological Advancement: India’s IT and technological landscape has witnessed phenomenal growth over the last decade. In 2014, Indian IT sector was valued at approx. $118 billion, contributing around 7.5% to GDP. By 2024, the sector’s market size has surged to an estimated $245 billion, accounting for over 10% of GDP, with a consistent annual growth rate of over 9%. The export component has also expanded, with IT and ITES exports rising from $99 billion in 2014 to $190 billion in 2024, reflecting India's growing dominance in the global tech arena. Some key initiatives that propelled India on the Global format are Digital India Program (2015), Start-Up India (2016), National AI Strategy (2018), PLI Scheme for IT/ Electronic, etc.

Unified Payment Interface: India's Unified Payments Interface (UPI) has emerged as a frontrunner in the global digital payments landscape. With an impressive 46% of the global real-time payment transactions occurring in India, UPI has firmly established itself as a significant player in this sector. UPI number of transactions surged from 300 million in FY 2014-15 to 13.1 billion in FY 2023-24, marking a CAGR of 129%. The value of UPI transactions leapfrogged from ₹1 trillion in FY 2017-18 to ₹200 trillion in FY 2023-24. This rapid growth of UPI adoption underscores India's commitment to digital financial inclusion and the scalability of its payment infrastructure.

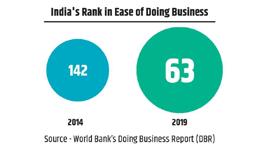

Ease of Doing Business: India made remarkable progress to improve its business environment, climbing from 142 number in 2014 to 63rd in the World

Bank’s Doing Business Report (DBR) 2020. This 79-rank jump over reflects the government’s sustained efforts to simplify regulations, reduce bureaucratic hurdles, and create a more businessfriendly environment, significantly boosting investor confidence to do business with India.

Logistics Performance index: Logistics costs in the India amount to almost USD 400 billion, or 14% of our GDP. A comparison with global peers shows that logistics costs amount to 8-10% of GDP in the US and Europe, and 9% in China. The global average is close to 8% of GDP. The 6% gap in our domestic logistics cost compared to global average cost - is about 180 billion USD. India ranked 44th in the World Bank Logistics Performance Index, far behind the US at 14 and China at 26. See below chart released last in 2018.

Foreign exchange reserves are assets held by the Reserve Bank of India in foreign currencies, gold, and India’s reserve position in the International

Monetary Fund (IMF). These reserves help stabilize Indian rupee, manage external debt & ensure liquidity during economic crisis or trade deficits. Our reserves have reached the highest point during year 2024 presently at 678 million USD.

The next five years hold immense promise for India as the nation accelerates its economic growth trajectory, driven by key initiatives and reforms. India is poised to consolidate its position as a global manufacturing hub, bolstered by the success of the ‘Make in India’ campaign and significant investment in infrastructure, digital transformation, and skill development. With GDP growth expected to remain robust, the focus will shift toward enhancing export

competitiveness, targeting diversified global markets, and scaling value-added manufacturing.

Building on these advancements, India’s supply chain leadership must push the nation beyond its current limits to meet its ambitious objectives. This visionary leadership will be instrumental in achieving India’s $6 trillion economic target and establishing it as a global manufacturing powerhouse. Let us examine key priorities that supply chain leaders must focus over the next five years…

Integrate ESG into core supply chain strategy: Global businesses must consider ESG risks when formulating growth strategy and executing business decisions. This includes regular training and audits on the ground with local partners, facilitating alignment with the more stringent Indian ESG disclosure requirements, and building sustainable supply chains.

Responsibility: CSR in India is mandated under Section 135 of the Companies Act, 2013. Companies meeting certain financial thresholds are required to spend at least 2% of their average net profits over three years on CSR activities. These activities typically focus on philanthropy, community development, and addressing social and environmental challenges.

Use Technology to drive supply chain architecture: In today’s world, digitalization is not an option, but

a necessity. The Indian supply chain needs to adopt and assimilate nextgen technology including Industry 4.0 applications to build tech-enabled smart supply chain networks. India needs to implement strategic technologies such as artificial intelligence, blockchain, and the IoT. Digitalization of supply chains architecture will foster an integrated platform, facilitating real-time information sharing among stakeholders and decision-makers at every stage of the value chain. These will contribute to reduce waste and cost out of business with the potential to reduce expenditure by 30-40%.

Integrate supply chain for end-toend visibility: Creating a flexible and agile supply chain necessitates platforms that seamlessly integrate processes, such as omni-channel supply chains, piggy-backing multiple lanes/ sources of supply. These integrated systems deliver a unified experience for consumers, regardless of the channel they choose. Supply chain visibility is a pivotal factor in determining responsiveness and operational efficiency. It empowers manufacturers, distribution centres, and retailers to seamlessly adapt to fluctuating consumer demand without additional labour or resources. Technologies like RFID and barcodes enable real-time visibility, enhancing forecasting accuracy and ensuring demand-supply alignment across the entire supply chain.

Build agility in the supply network: Establishing agility within supply networks necessitates creating a

flexible ecosystem with decentralized production hubs which are strategically located closer to consumer bases. This enables supply chains to adapt swiftly and operate seamlessly. Equally crucial is cultivating dynamic teams capable of quickly adjusting to external challenges. Prompt responses to disruptions can accelerate transformation while mitigating potential damages effectively.

Mindset shift from risk mitigation to risk management: Like in the past, organizations faced vulnerabilities within the supply chain as well as due to disruptions, often incurring significant financial losses. But these were considered as ‘unavoidable’. During last 5 years, it is becoming known that growing risks linked to factors such as limited supply chain transparency and data restrictions have hindered the ability to proactively evaluate the likelihood and impact of these risks. Transitioning from traditional risk mitigation to initiativetaking risk management necessitates addressing these gaps, thereby fostering greater resilience and adaptability.

Build logistics & warehousing infrastructure: India will aim to reduce its logistics cost to 7-8% of GDP, closing the USD 500 billion competitiveness gap with best-practice countries globally. For that to happen, companies need to improve their logistics infrastructure by benchmarking the logistics modal mix and emphasizing the use of electric vehicles (EVs) for last-mile deliveries. In warehousing, we need to improve out to expand

infrastructure

As technology reshapes the supply chain landscape, organizations need to re-prioritize skilling their workforce with advanced digital and analytical skills. Senior leaders must embrace AI, data analytics, and digital transformation to drive informed and agile decision-making. They must re-focus on upskilling employees in automation, IoT, and data-driven operations while fostering innovation through cross-functional teams. Attracting new talent and reskilling existing staff will ensure seamless integration of emerging technologies into supply chain processes, enabling faster and smarter operational outcomes.

to bridge the gap between required and available capacity and aim to reduce agricultural produce wastage to less than 10%.

Strengthen regulatory and policy support: Government involvement is unavoidable in strengthening India’s supply chain infrastructure. Investments in multimodal logistics networks and broadband connectivity are essential to extend physical and digital access to rural areas. Regulatory reforms, such as GST consolidation and the establishment of supply chain clusters, can transform the manufacturing landscape. Additionally, fostering a robust supply base through the development of MSMEs will drive growth, enhance local sourcing & create a skilled workforce that supports longterm supply chain efficiency.

Transition towards a green supply chain: Organizations are increasingly prioritizing sustainable supply chain practices to meet environmental goals and regulatory expectations. Reducing carbon emission is a key target, to be achieved through green logistics solutions. Adoption of EV (Electric vehicle) which can comprise a high % of number of the delivery fleet, will help reduce GHG consumption. Route optimization will improve transportation efficiency, at the same time moving to biodegradable or recyclable packaging will minimize waste. Companies need to adopt the ‘Reduce, Reuse, Recycle’ approach to create eco-friendly and future-ready supply chains.

Develop skills and talent for a techdriven supply chain: As technology reshapes the supply chain landscape,

organizations need to re-prioritize skilling their workforce with advanced digital and analytical skills. Senior leaders must embrace AI, data analytics, and digital transformation to drive informed and agile decision-making. They must re-focus on upskilling employees in automation, IoT, and data-driven operations while fostering innovation through crossfunctional teams. Attracting new talent and reskilling existing staff will ensure seamless integration of emerging technologies into supply chain processes, enabling faster and smarter operational outcomes.

MSME digitalization and growth:

Micro, Small, and Medium Enterprises (MSMEs) play a vital role in India’s supply chain, contributing over 30% to GDP and 45% to exports. Accelerating their growth through initiatives like Udyam Registration and governmentbacked e-marketplace (GeM) platforms will increase efficiency and market access. Access to affordable ERP solutions, cloud computing, and digital payment systems will enable MSMEs to integrate into global supply chains and compete internationally. The goal is to empower MSMEs to scale operations, enhance productivity, and contribute significantly to India’s $6 trillion economy aspiration by 2030.

Financial Inclusion and credit access: Expanding financial inclusion and ensuring easier access to credit are critical for the growth of India’s supply chain ecosystem, particularly for MSMEs and rural entrepreneurs. Initiatives such as the Pradhan Mantri MUDRA Yojana (PMMY) and Jan Dhan-AadhaarMobile (JAM) trinity have already

provided financial access to millions, but further enhancements are required. Digital lending platforms and fintech innovations can simplify loan approvals and offer customized financial products. Expanding trade credit insurance and invoice financing will enable businesses to manage cash flow more effectively. These measures will not only empower businesses but also ensure a financially robust and resilient supply chain to meet the demands of a growing economy.

India will be one of the top twenty countries in the World Bank Logistics Performance Index by 2030. The supply chain industry will be an optimized and automated logistics ecosystem, with a simplified distribution system and a sustainable, green, resilient, and flexible supply chain. It will be powered by next-gen technologies such as big data, AI, blockchain, and Internet of Things, backed by 21st-century infrastructure. It will be aligned with best practices across the world and stand on par with global standards. The reimagined supply chain will make India “Atmanirbhar” and strongly complement Make in India and Startup India, building a globally competitive supply chain across domestic and international markets!!!

Next-generation value chains are the epitome of innovation, weaving together Digital Technologies, Sustainability, and Resilience to create Agile, Intelligent Networks of Production and Distribution. India, poised on the cusp of transformation, is positioning itself as a dynamic player in these value chains. The country is rapidly embracing digital technologies, led by remarkable initiatives such as Digital India, while bolstering its manufacturing sector through the Make in India campaign. However, to truly flourish, India must overcome challenges such as infrastructure bottlenecks, regulatory hurdles, and a skills gap in emerging technologies. If navigated wisely, these hurdles could usher India into an era of unparalleled economic prominence, firmly embedding it in the core of next-gen global value chains. Our Cover Story unravels all these facets and more…

How has Make in India impacted technology adaption in manufacturing? How does it support India’s aim to be a global manufacturing hub?

Pratibha Nath, Director of Supply Chain – APAC, Alstom: The ‘Make in India’ initiative was launched nearly a decade ago with a focused approach to specific industries that the government identified as having the potential to transform the economy. Initially, it covered around 25 sectors, including automotive, textiles, electronics manufacturing, and renewable energy. Significant progress has been made since then, particularly in infrastructure development, such as railroads. This initiative presents a great opportunity to generate employment and enhance the Ease of Doing Business in India. Additionally, it aligns well with India’s vast pool of engineering talent— Bengaluru alone boasts over 100 engineering colleges. Emphasizing localization through such initiatives makes perfect sense.

From a supply chain perspective, having a localized ecosystem is highly beneficial. Ideally, suppliers should be in close proximity, allowing businesses to respond quickly to demand fluctuations. This flexibility is essential and Make in India facilitates this by fostering strong local partnerships for sourcing components. It also enables direct supplier evaluations to ensure quality standards are met. Various government schemes, such as the Production Linked Incentive (PLI) program and Customs Duty exemptions, further support businesses in achieving growth. It is up to each industry player to leverage these opportunities effectively.

Moreover, India is not just manufacturing for itself—it has established itself as a global manufacturing hub. With strong engineering capabilities, large-scale production, and a growing number of global capability centers, the country is well-positioned to serve international markets. The existing ecosystem provides a solid foundation to strengthen India’s role as a preferred global manufacturing destination. One crucial aspect that cannot be overlooked is the need for consistent quality. It is not enough to build a great prototype; maintaining high standards across production must be a priority. Ensuring reliability and excellence will be key to sustaining India’s reputation as a world-class manufacturing hub.

Nilanjan Das, VP & Head – SCM, Tata Hitachi Construction Machinery Co. Pvt. Ltd.: To make the ‘Make in India’ initiative a success, one has to deliver capabilities, in terms of producing goods of equivalent quality / durability and at lower cost. While cost advantage may naturally come to Indian manufacturers due to advantages in lower cost of labour, power, commodities, etc., they have to really scale up in terms of reliable and consistent quality in comparison to global best standards. To do this, Indian manufacturers have to adopt cutting edge automation to improve productivity and avoid human errors. It also helps shorten the learning curve. Hence, we see growing use of Cobots, articulated robots, AGVs, apart from advanced IT systems in manufacturing like Industry 4.0 and others. Poke yoke and failsafe methods of manufacturing are also

While manufacturers might be adopting the latest technology tools, but if their partners – the extended workforce including the suppliers, manufacturers, or the 3PLs aren’t onboarded, then that’s a big roadblock for end-to-end tech deployment. It’s high time that manufacturers convince and encourage the supporting partners in their ecosystem to start adopting those technologies and that’s when we would be able to realize the impact of such big bang transformation. You need to co-develop the tech infrastructure with your partners to not just share best practices but ensure that your partners also grow with you.

moving onto automated systems. Hence to shorten the journey on the road to reliable manufacturing, one has to rely on increased level of automation.

Hanuman Swami, Global Planning and Fulfilment Manager, ABB: The Make in India initiative has been instrumental in accelerating technology adoption in Indian manufacturing by emphasizing innovation, quality, and productivity. The policy incentivizes companies to invest in advanced technologies such as IoT, robotics, and automation, which are pivotal for enhancing operational efficiency and scalability. Additionally, government-led initiatives like the Production-Linked Incentive (PLI) schemes have made manufacturing sectors more competitive, aligning them with global standards. By fostering an environment conducive to innovation, Make in India enhances India’s positioning as a global manufacturing hub. The focus on infrastructure development, skill enhancement, and regulatory ease ensures that both domestic and foreign investors view India as a viable production destination. With an increasing emphasis on Industry 4.0 technologies, the initiative supports India’s goal of integrating into global supply chains, reducing import dependencies, and bolstering exports.

Gaurav Middha, Senior Manager –Procurement, ITC Ltd.: The ‘Make in India’ initiative has significantly impacted large food manufacturers by encouraging the adoption of cutting-edge technologies. Simplifying regulations and improving the ease of doing business

AI-driven solutions are unlocking new levels of efficiency. Predictive maintenance, powered by AI, can significantly reduce downtime by forecasting equipment failures. AI also optimizes production schedules and enhances quality control through realtime monitoring and defect detection. Over the next decade, the integration of AI and blockchain will enable Indian manufacturers to streamline operations, meet global standards, and strengthen their position in the international market. Collaborative ecosystems will emerge, driven by these technologies, to foster innovation and agility.

have made it more attractive for these companies to invest in modernizing their operations. Large food manufacturers have started integrating automation, AI, and IoT into their processes, which has resulted in increased productivity and efficiencies. However, challenges remain, especially for smaller companies that may struggle with the costs and need for workforce upskilling.

The initiative supports India’s goal of becoming a global manufacturing hub by creating an ecosystem that attracts foreign investments and fosters innovation. Special economic zones and policy reforms have encouraged both domestic and international companies to set up manufacturing bases in India. By emphasizing skill development, ‘Make in India’ also ensures a capable workforce equipped to handle advanced manufacturing technologies. As India’s food manufacturing sector continues to evolve, it strengthens the country’s position in the global supply chain, making it a formidable player on the world stage.

What are the biggest challenges in digital transformation for Indian manufacturers?

Pratibha Nath: One of the biggest challenges is data. While we have a vast amount of it, much of it is highly inconsistent. This inconsistency often leads to failures in digital initiatives. We tend to build front-end systems without giving enough attention to the back

end, only to realize later that the data is not delivering the expected results. At that point, it becomes clear that our data is out of sync. To ensure quality output, we must invest time in cleansing and organizing data before using it. Otherwise, it becomes a case of ‘Garbage In, Garbage Out’. In this context, data management is a fundamental part of digital transformation – something that needs to be addressed even before we begin digitizing operations. Despite the availability of numerous data analytics tools, challenges remain in data collection and interpretation. Many people hesitate to use these tools due to a lack of awareness or understanding of their necessity and impact. Overcoming these barriers is crucial to leveraging data effectively in digital transformation efforts.

Hanuman Swami: Digital transformation in Indian manufacturing faces several challenges. The first is the lack of uniform technological infrastructure, particularly among small and medium-sized enterprises (SMEs), which form the backbone of the industry. High initial investment costs and limited access to affordable digital tools deter widespread adoption.

Another significant hurdle is the skill gap. Employees often lack training in handling advanced technologies, leading to the underutilization of resources. Additionally, there’s resistance to change among traditional manufacturers who

are accustomed to legacy systems. Data management and cybersecurity also pose challenges. While transitioning to digital platforms, manufacturers must navigate concerns around data security and compliance, especially when working with international clients. Overcoming these challenges requires a collaborative approach involving government policies, industry partnerships, and workforce upskilling initiatives.

Vishal Pandey, Product Lead (Business Application) - Alphabet Supply Chain, Google: In my view, the biggest challenges and roadblocks for the digital transformation in India are legacy systems and mindset, resistance to change, lack of awareness, etc. Once we overcome these initial blockers, then the secondary barriers like integration challenge, lack of skills and cost would also need to be addressed.

Gaurav Middha: Indian food manufacturers, particularly large corporations, encounter significant challenges in their digital transformation efforts. One major obstacle is technology integration, as many still operate on outdated systems that require extensive modernization. Seamless data integration is also critical to ensuring consistency and reliability across operations. Additionally, these companies must strike a balance between automation and traditional processes while navigating stringent regulatory requirements and mounting

cybersecurity risks.

The struggle to attract skilled professionals further complicates the transition, as does managing the cultural shift among employees. Operational and market challenges add layers of complexity—supply chain transparency and optimization demand substantial investment in advanced technologies. Scaling digital initiatives while maintaining product quality amid shifting customer demands and the rising need for speed and customization requires continuous innovation. Sustainability is another pressing concern, with companies striving to implement ecofriendly practices without sacrificing efficiency.

Despite these hurdles, many manufacturers are already harnessing data analytics, AI, and automation to enhance supply chain efficiency, make data-driven decisions, and improve customer satisfaction. However, the road to full digital transformation remains a formidable journey.

How can Indian manufacturers stand out and become the top choice over other global manufacturing hubs?

Nilanjan Das: Over the last few decades, the manufacturing industry has gradually shifted from developed countries to developing ones, particularly the BRICS nations. The days when the US and Europe were the primary manufacturing hubs are long gone. Today, much of the production has moved to Asia and parts of South and Central America. To understand why this shift has occurred, we need to look at the key drivers behind it.

The primary factor is cost.

The supply chain is only as strong as its weakest link, and those links extend far beyond the primary supplier. With today’s complex supply chains, even the best technology in your factories won’t help if there are delays or inefficiencies at the tier II, III, or IV levels. To prevent this, it’s essential to not only have advanced systems within your own operations but also to understand and align with your suppliers’ capabilities, especially their IT infrastructure. Building resilience and efficiency requires digitizing the entire supply chain. If suppliers don’t have the right tools for forecasting, inventory management, or communication, smooth operations become nearly impossible. Supporting SMEs to improve their infrastructure is equally important, as they play a crucial role in the supply chain.

Manufacturing in developed countries has become too expensive due to high labor, material, and energy costs. One of India’s key advantages on the global stage is cost competitiveness. When positioning ourselves internationally, we need to focus on being a Cost Leader. India has many advantages over other countries in this area. A significant one is the competitive cost of raw materials. Every product begins with a raw material—be it iron ore, rubber, or bauxite—and India is rich in these resources, which are available at competitive prices.

In addition, India has efficient manufacturing facilities for many commodities like steel, rubber, and aluminium, which are crucial in producing machines and equipment. Being a cost leader in manufacturing is a crucial strategy for success.

Another significant advantage is India’s human capital. With a large, young, educated, and productive population, India has a distinct edge compared to many developed nations. For example, Japan is facing an aging workforce and struggles to attract younger generations to manufacturing jobs. In contrast, India boasts a large workforce, eager to work, skilled, and highly educated. This human capital advantage further strengthens India’s position.

However, India also faces several challenges. One major hurdle is the perception of low-quality manufacturing. Even Chinese companies sometimes view Indian products as inferior, which can be an unpleasant surprise. Overcoming this perception requires us to focus on improving quality and skill. We need to pursue tech transfers, form joint ventures with global companies, and

build stronger supply chains to elevate our manufacturing standards.

Finally, India faces a challenge in terms of market volume. The domestic market for certain products may not be large enough to achieve the economies of scale required for manufacturing. The solution lies in focusing on global exports. By producing for both the Indian and global markets, India can achieve the scale needed to compete effectively on cost in the global marketplace.

In summary, while India faces some significant challenges, it has a combination of cost advantages, a strong workforce, and abundant resources that can help it rise as a major global manufacturing player, provided it addresses its quality and volume challenges strategically.

How can India fit into the China plus one strategy and what all are the advantages we can focus on to succeed into that?

Nilanjan Das: Over the past several decades, manufacturing has gradually shifted from developed nations to emerging economies, with China emerging as a dominant force in the global production landscape. Despite ongoing geopolitical tensions, such as the strained relationship between the US and China, the US remains one of China’s largest importers, illustrating the significant dependence on China as a global manufacturing hub. However, recent geopolitical shifts and increasing political tensions have sparked a change in sentiment, especially regarding China. This is where India has a timely opportunity to step in, as the concept of ‘China Plus One’ has become a key strategy for many companies. Businesses across the US, Europe, and other regions

are considering alternative sourcing strategies, with even Japanese companies adopting this approach.

Over the past 10-20 years, many companies from the US and Europe have set up subsidiaries and relocated their manufacturing to China to capitalize on lower costs and economies of scale. These companies also shifted their supply chains to China to take advantage of the country’s competitive pricing. But now, with rising concerns about China’s political climate, trade restrictions, and shifting risk perceptions, many businesses are rethinking their dependence on China. This is India’s chance to capitalize on this change in sentiment, before the situation potentially stabilizes or reverses.

To seize this opportunity, India must focus on its competitive advantages— cost leadership, skilled human capital, and productivity. While China remains a stronger competitor in terms of sheer cost and workforce size, India can differentiate itself by focusing on the “Trust Factor.” Many global businesses view China with some degree of mistrust, even though not all Chinese companies share this reputation. India’s reputation as a trustworthy and stable partner could give it a significant edge in attracting global manufacturing.

When it comes to cost, China still leads the world in several key industries, such as steel production. Chinese steel is the least expensive globally, but Indian steel is the second most affordable. While the gap has traditionally been wide, it’s shrinking. Additionally, China’s steel industry has long been subsidized by the government, which has pressured banks to support Chinese manufacturers in

Upskilling the

order to secure global market share. However, with a growing reluctance from Chinese banks to continue these subsidies, prices for Chinese steel are beginning to rise, creating an opportunity for India to further close the cost gap. With strong government support, India’s steel prices could become even more competitive, and this dynamic extends to other commodities as well.

For India to truly take advantage of the global manufacturing shift, it must ensure that costs are aligned with, or even better than, China’s. As businesses increasingly consider relocating their production from China to other regions like India, Vietnam, Thailand, and Indonesia, this moment represents a high-potential opportunity. India must act now to capture this demand and position itself as the preferred global manufacturing hub.

How can we upskill the workforce for digital transformation?

Hanuman Swami: Upskilling the workforce is paramount for a successful digital transformation. The process begins with identifying skill gaps and designing targeted training programs that focus on emerging technologies like AI, IoT, and robotics. Collaboration between industry and academia can bridge the knowledge gap by integrating practical modules into educational curricula.

Government initiatives like Skill India and partnerships with global technology providers can further enhance these efforts. Companies must also foster a culture of continuous learning, where employees are encouraged to adapt and innovate. E-learning platforms and

workforce

is

hands-on workshops are effective in imparting practical skills.

Leadership plays a crucial role in guiding this transition. By clearly communicating the benefits of digital transformation and aligning it with individual career growth, leaders can mitigate resistance to change. Ultimately, upskilling the workforce ensures not just organizational growth but also creates a robust talent pool for the nation.

Vishal Pandey: Upskilling the workforce for digital transformation in Indian manufacturing is crucial. Here’s how it can be done:

Identify Skill Gaps:

Assess current skills: Use surveys, interviews, and skills assessments to understand the existing capabilities of the workforce.

Analyze future needs: Determine the skills required to operate new technologies and processes related to Industry 4.0, like AI, IoT, data analytics, and cybersecurity.

Prioritize key areas: Focus on upskilling in areas with the largest gaps and the greatest impact on the business.

Implement Targeted Training Programs:

Develop customized programs: Tailor training to address specific skill gaps and the needs of different roles within the organization.

Utilize diverse learning methods:

paramount for a successful digital transformation. The process begins with identifying skill gaps and designing targeted training programs that focus on emerging technologies like AI, IoT, and robotics. Collaboration between industry and academia can bridge the knowledge gap by integrating practical modules into educational curricula. Government initiatives like Skill India and partnerships with global technology providers can further enhance these efforts.

To make the ‘Make in India’ initiative a success, one has to deliver capabilities, in terms of producing goods of equivalent quality / durability and at lower cost. While cost advantage may naturally come to Indian manufacturers due to advantages in lower cost of labour, power, commodities, etc., they have to really scale up in terms of reliable and consistent quality in comparison to global best standards. To do this, Indian manufacturers have to adopt cutting edge automation to improve productivity and avoid human errors. It also helps shorten the learning curve. Hence, we see growing use of Cobots, articulated robots, AGVs, apart from advanced IT systems in manufacturing like Industry 4.0 and others. Poke yoke and failsafe methods of manufacturing are also moving on to automated systems. Hence to shorten the journey on the road to reliable manufacturing, one has to rely on increased level of automation.

Offer a mix of online courses, workshops, on-the-job training, simulations, and mentoring programs for holistic learning experience.

Leverage government initiatives: Take advantage of governmentsponsored programs like SAMARTH and NMCP that offer training and resources for Industry 4.0 adoption.

Partner with educational institutions: Collaborate with universities and technical institutes to develop specialized training programs and curricula.

Foster a Culture of Continuous Learning:

Encourage lifelong learning: Promote a mindset of continuous improvement and provide opportunities for employees to stay updated with the latest technologies.

Create a learning environment: Establish platforms for knowledge sharing, peer learning, and mentorship within the organization.

Reward learning and development: Recognize and reward employees who actively participate in upskilling initiatives.

Leverage Technology for Training:

Online learning platforms: Utilize online courses and resources to provide flexible and accessible training options.

Virtual and augmented reality: Use VR and AR simulations to provide immersive and engaging training experiences for complex tasks.

AI-powered personalized learning: Implement AI-driven platforms that adapt to individual learning styles and pace.

Address Challenges:

Time constraints: Offer flexible training schedules and microlearning modules to accommodate busy work schedules.

Financial constraints: Explore government grants, subsidies, and partnerships to reduce the cost of training.

Resistance to change: Communicate the benefits of upskilling and address concerns about job displacement through transparent communication and change management strategies. By investing in upskilling their workforce, Indian manufacturers can ensure they have the talent and expertise to thrive in the era of Industry 4.0. This will not only enhance their competitiveness but also contribute to the overall growth and development of the Indian manufacturing sector.

What support do manufacturers need from the government since we have fairly stable government in order to boost local manufacturing?

Nilanjan Das: To boost manufacturing, global exports, and the Make in India initiative, the government must focus on one critical element – the Ease of Doing Business. During recent panel discussions, I interacted with Industry Ministers from states like Karnataka, Tamil Nadu, and Andhra Pradesh, and it’s clear that states are fiercely competing for a larger share. This includes aspects like land acquisition, the efficiency and support in obtaining clearances, and how well they manage labor and political challenges. In India, the ease of doing business remains a significant challenge for business growth.

Another important aspect is ensuring that government incentives continue. The Production Linked Incentive (PLI) scheme is a prime example, but there are other incentives as well, such as the capital goods scheme. For those who don’t qualify for PLI, the capital goods scheme offers benefits for setting up and expanding factories. Additionally, there are export incentives, duty drawbacks, and other business-friendly policies that continue to encourage growth.

Finally, one recurring request I have made is for the government to address the rising cost of key commodities, which I believe could be a game changer. Having access to affordable oil, rubber, steel, and aluminium would provide a significant advantage. The government must work to control commodity prices and address the needs of industries like steel and oil, which face unique challenges and require specific safeguards. It’s essential to strike a balance between protecting these industries and ensuring we remain

competitive globally. Once commodity prices are stabilized, industries must focus on turning these raw materials into cost-effective finished products. The government is already making strides in this area, and there is potential for even greater impact with further action.

Vishal Pandey: The government has been taking a lot of initiatives on the technology front. I was amazed to know that many of the manufacturers, especially the smaller players, are not even aware of the initiatives. For instance, the government has launched some of the very fantastic initiatives such as SAMARTH (Smart Advanced Manufacturing and Rapid Transmission Hub). Similarly, there is the National Manufacturing Competitiveness Programme (NMCP). I firmly believe that awareness on the other side is equally important while we wait for the government initiatives to come up.

What role does sustainability play in Indian manufacturing, and how can technology help?

Hanuman Swami: Sustainability is a key driver for long-term success in Indian manufacturing. With rising environmental concerns and stricter regulatory norms, manufacturers are increasingly focusing on sustainable practices. Technology acts as an enabler by providing tools to minimize waste, optimize resource usage, and reduce carbon footprints. For instance, IoT-based sensors monitor energy consumption and identify inefficiencies, while AI algorithms optimize supply

chains to reduce emissions. Circular manufacturing models, supported by digital twins and blockchain, facilitate recycling and repurposing of materials, ensuring minimal waste.

Adopting green technologies like renewable energy and sustainable materials not only benefits the environment but also enhances brand reputation and profitability. Indian manufacturers embracing sustainability will not only comply with global standards but also gain a competitive edge in international markets.

Gaurav Middha: Sustainability isn’t just a passing trend—it’s a crucial necessity in today’s business world. By combining eco-friendly practices with cutting-edge digital technologies, we can create a balance that promotes both business growth and environmental responsibility. For many procurement managers, sustainability was once a topic they avoided. Over time, however, as our careers have evolved, we’ve come to realize that sustainability, while initially perceived as an additional cost, is now an essential and valuable part of the equation—much like a relationship that grows stronger with time, starting from a challenging beginning.

The driving forces behind this shift are rooted in several guiding principles and organizational commitments. The BRSR (Business Responsibility and Sustainability Reporting) framework is a perfect example of how companies in India are embracing sustainable practices. This framework covers critical aspects such as product development

and supply chain management (Scope 1, 2, 3), reflecting the changing preferences of consumers. Studies have shown that consumers are increasingly drawn to products that are fresh and sustainable, which is why businesses must evolve their product development strategies to meet these new expectations.

Furthermore, sustainability is now a mandate in many organizations, particularly around recyclability and the circular economy. Yet, there are still overlooked areas, like merchandising and point-of-sale materials, which could be shifted from plastic to sustainable alternatives, such as using cardboard instead of plastic for shelf strips.

At ITC, sustainability is a cornerstone of our business strategy. We prioritize sustainability through our strict adherence to our Code of Conduct, which includes ethical labor practices, human rights, and environmental protection. A notable project is in our agriculture division, where we focus on sourcing agricultural commodities in a sustainable way. Through our ITC Mars tool, we connect with farmers directly to guide them on best practices. This includes reducing waste, carbon emissions, and promoting sustainable farming practices right from the sowing phase. The goal is to make sustainability a part of the agricultural process from the ground up.

One recent initiative is our “farmto-fork” model, which ensures complete transparency and traceability in the supply chain. For instance, when we source potatoes for our Bingo chips, we track the journey of each potato from the field all the way to the consumer.

The Make in India initiative has been instrumental in accelerating technology adoption in Indian manufacturing by emphasizing innovation, quality, and productivity. Additionally, government-led initiatives like the Production-Linked Incentive (PLI) schemes have made manufacturing sectors more competitive, aligning them with global standards. By fostering an environment conducive to innovation, Make in India enhances India’s positioning as a global manufacturing hub. The focus on infrastructure development, skill enhancement, and regulatory ease ensures that both domestic and foreign investors view India as a viable production destination. With an increasing emphasis on Industry 4.0 technologies, the initiative supports India’s goal of integrating into global supply chains, reducing import dependencies, and bolstering exports.

At ITC, sustainability is a cornerstone of our business strategy. We prioritize sustainability through our strict adherence to our Code of Conduct, which includes ethical labor practices, human rights, and environmental protection. One recent initiative is our “farm-to-fork” model, which ensures complete transparency and traceability in the supply chain. For instance, when we source potatoes for our Bingo chips, we track the journey of each potato from the field all the way to the consumer. This digital traceability, supported by IoT and SCADA technologies, helps monitor the entire process—from farm to cold storage to processing units. The goal is to reduce food waste and enhance sustainability across the entire supply chain.

This digital traceability, supported by IoT and SCADA technologies, helps monitor the entire process—from farm to cold storage to processing units. The goal is to reduce food waste and enhance sustainability across the entire supply chain.

What strategies or technologies can help Indian manufacturers create more resilient supply chains amid global disruptions?

Pratibha Nath: The supply chain is only as strong as its weakest link, and those links extend far beyond the primary supplier. With today’s complex supply chains, even the best technology in your factories won’t help if there are delays or inefficiencies at the tier II, III, or IV levels. To prevent this, it’s essential to not only have advanced systems within your own operations but also to understand and align with your suppliers’ capabilities, especially their IT infrastructure.

Building resilience and efficiency requires digitizing the entire supply chain. If suppliers don’t have the right tools for forecasting, inventory management, or communication, smooth operations become nearly impossible. Supporting SMEs to improve their infrastructure is equally important, as they play a crucial role in the supply chain. Government initiatives to help them grow and connect with larger businesses can strengthen the overall ecosystem. It’s clear that optimizing your own operations isn’t enough—you need to ensure the entire supply chain is ready to scale alongside you.

Hanuman Swami: To build resilient supply chains, Indian manufacturers must adopt a multi-pronged approach.

Leveraging AI and machine learning for demand forecasting and inventory management can help mitigate disruptions caused by fluctuating demand. IoT-enabled systems provide real-time visibility into supply chain operations, ensuring timely identification of bottlenecks.

Diversifying supplier bases and fostering regional collaborations can reduce dependency on single sources. Blockchain ensures transparency and trust, particularly in multi-tier supply chains. Digital twins, which create virtual replicas of supply chains, allow manufacturers to simulate scenarios and devise contingency plans.

Additionally, fostering a collaborative ecosystem where manufacturers, suppliers, and logistics providers share data securely can improve agility and decision-making. With these strategies, Indian manufacturers can not only withstand disruptions but also thrive in an increasingly volatile global environment.

Vishal Pandey: There are no tailor-made technologies specifically for the Indian manufacturers. I believe the technology adoption criteria remain the same across the globe. One critical aspect I would like to address is that while manufacturers might be adopting the latest technology tools, but if their partners – the extended workforce including the suppliers, manufacturers, or the 3PLs aren’t onboarded, then that’s a big roadblock for end-to-end tech deployment. It’s high time that manufacturers convince and encourage the supporting partners in their ecosystem to start adopting those technologies and that’s when we would be able to realize the impact of such big

bang transformation. You need to codevelop the tech infrastructure with your partners to not just share best practices but ensure that your partners also grow with you.

Coming to technologies, there are no limitations and extent to which technological adoption can happen and this is an iterative and every evolving process to stay relevant. However, for starters, Indian manufacturers need to embrace several key technologies to maintain global competitiveness:

Automation and Robotics:

Increased Efficiency and Productivity: Automating tasks leads to faster production, reduced errors, and improved output.

Enhanced Quality: Robots can perform tasks with precision and consistency, leading to higher quality products.

Cost Reduction: Automation can lower labor costs and reduce material waste, making manufacturing more affordable

Artificial Intelligence (AI) and Machine Learning (ML):

Predictive Maintenance: AI and ML can analyze data from machines to predict potential failures, allowing for proactive maintenance and minimizing downtime.

Quality Control: AI-powered vision systems can detect defects in realtime, ensuring only high-quality products leave the factory.

Supply Chain Optimization: AI can optimize inventory management, logistics, and demand forecasting, improving efficiency and responsiveness.

Internet of Things (IoT):

Real-time Data Collection: IoT sensors can collect data on various parameters like temperature, pressure, and vibration, providing valuable insights into the manufacturing process.

Remote Monitoring and Control: IoT enables remote monitoring of equipment and processes, allowing for quick response to issues and improved overall efficiency.

Improved Traceability: IoT can track products throughout the supply chain, providing greater transparency and accountability.

Cloud Computing:

Scalability and Flexibility: Cloud computing allows manufacturers to scale their IT infrastructure up or down based on their needs, providing flexibility and cost-effectiveness.

Data Storage and Analysis: Cloud platforms offer vast storage capacity and powerful analytics tools, enabling manufacturers to gain insights from their data.

Collaboration and Communication: Cloud-based tools facilitate collaboration and communication between teams and partners, improving efficiency and responsiveness.

Gaurav Middha: I believe that digital transformation can play a crucial role in achieving our goals, particularly when it comes to risk management. We’ve made significant progress in diversifying our vendor base, especially in scenarios where we’ve had a single vendor. This has involved classifying these vendors and assessing their risks, categorizing them as low, medium, or high. From there, we’ve been able to develop contingency plans based on the specific risks identified. Additionally, we have tools

in place to track vendor inventories. We place great emphasis on building longterm relationships with our suppliers and fostering collaborative approaches to generate innovative ideas and improve cost management practices.

Which emerging blockchain or AI would have the biggest impact on Indian manufacturing over the next decade?

Pratibha Nath: We are entering the era of smart factories, where technologies like AI, machine learning, and cloud computing play a crucial role. However, to fully leverage these advancements, we must establish the necessary infrastructure within our systems. This ensures high-quality operations, minimizes machine downtime, and enables predictive maintenance. The integration of these technologies in smart factories will be a key driver of success moving forward.

Similarly, blockchain is transforming the logistics industry by enhancing transparency, efficiency, and security in supply chain operations. By providing all stakeholders with access to validated, immutable records, blockchain reduces errors and increases accountability. Secure digital documentation significantly cuts lead times but requires strong collaboration among freight forwarders, government customs organizations, and other key players.

This capability not only improves delivery accuracy but also optimizes overall supply chain efficiency through real-time updates and secure transaction records. While challenges remain—such as scalability, integration with existing systems, data privacy, regulations, and implementation costs, I am confident that we will overcome these hurdles. By embracing cutting-edge technology, we can shape the future of logistics and drive innovation across industries.

Hanuman Swami: Blockchain and AI hold transformative potential for Indian manufacturing. Blockchain, with its secure and transparent recordkeeping, can revolutionize supply chain management. It ensures traceability of raw materials and finished goods, minimizes fraud, and builds trust among stakeholders. This is especially

critical for sectors like pharmaceuticals and food processing, where compliance and quality assurance are paramount. On the other hand, AI-driven solutions are unlocking new levels of efficiency. Predictive maintenance, powered by AI, can significantly reduce downtime by forecasting equipment failures. AI also optimizes production schedules and enhances quality control through realtime monitoring and defect detection.

Over the next decade, the integration of AI and blockchain will enable Indian manufacturers to streamline operations, meet global standards, and strengthen their position in the international market. Collaborative ecosystems will emerge, driven by these technologies, to foster innovation and agility.

Gaurav Middha: Emerging technologies like blockchain and AI have the potential to revolutionize the food manufacturing industry in India over the next decade. Blockchain technology is poised to significantly impact large Indian food manufacturers by enhancing supply chain transparency and efficiency. It can provide a tamper-proof ledger for tracking the journey of food products from farm to fork, reducing fraud, and ensuring food safety. Blockchain can also help streamline processes like procurement, inventory management, and compliance with regulatory standards, ultimately lowering costs and increasing trust among consumers and partners.

On the other hand, AI can drive innovation and improve operational efficiency for large food manufacturers. AI-powered predictive maintenance can help identify and address equipment issues before they lead to costly downtime, ensuring smooth production processes. Moreover, AI can optimize production lines by monitoring and controlling factors such as temperature, humidity, and machinery performance. AI-driven analytics can also help manufacturers understand consumer preferences and forecast demand, allowing for more personalized and efficient production. In essence, both blockchain and AI will play crucial roles in making India’s food manufacturing sector more robust, transparent, and responsive to market needs, contributing to the country’s goal of becoming a global manufacturing hub.

“In India, the transportation sector is responsible for around 14% of the country’s total GHG emissions, with freight transportation accounting for nearly 40% of CO2 emissions within this sector. Without intervention or cleaner technologies, transportation emissions are projected to increase by 4-fold between 2016 & 2050, potentially reaching 1.17 billion tons of CO2 by 2050 and would increase the share of transport in total emissions to 19%. To achieve sustainable supply chain management, companies need to work closely with suppliers, customers, and other stakeholders. By working together, companies can create a more sustainable future for all,” emphasizes Dr. Aditya Gupta, COO, Supply Chain Management Centre, Indian Institute of Management, Bangalore (IIM-B), during this exclusive interaction…

Prior to his academic pursuits, Dr. Aditya Gupta gained extensive experience as a supply chain practitioner in the corporate sector, holding various positions of responsibility at organizations such as Tata Group, TVS Group, Jindal Group, Virgin Mobile, and Moser Baer, for a period of 23 years. He completed his PhD in 2019 and subsequently transitioned from a career in corporate to academia. Dr. Gupta is deeply passionate about sustainability and has developed tools like the Transportation Emission Measurement Tool and Carbon Accounting Tool to measure emissions.

How is sustainability going to impact supply chains and how can companies derive value from making the supply chains more sustainable?

Industry 4.0 or digitalization and sustainability are the two key megatrends which are impacting supply chains of today and tomorrow. There are several ways in which sustainability is reshaping supply chains of tomorrow. I would like to share four ways in which sustainability is impacting the supply chain. The first is decarbonization of supply chain. If we go by the recent news updates, most of the large corporates have declared to go Net Zero by 2040-50. This target just doesn’t include Scope 1 & 2 emissions, they go beyond and in fact focus more on Scope 3 emissions. Under Scope 3 emissions, the supply chain has a major role to play. There’s no escaping the fact that any company that envisions achieving Net Zero target, has to work on its supply chain emissions.

Another big trend that we are witnessing in this space is Circular Economy. We are witnessing shifting sands of change from Linear to Circular economy. In Linear, we talk about Take, Make, Use and Dispose. While in circular, we lay emphasis on closed loop system. There is an increasing pressure on supply chain or procurement officer not to procure virgin material and replace the entire virgin material with either recycled, modular, biodegradable or compostable materials.

The third big impact that we will see is with regards to regulations. There is a greater thrust by the government machinery on environment sustainability and that’s why we are witnessing formation of new policies and rules that mandate sustainability as part of business strategy. I would like to talk about one regulation which I believe will have a significant impact on supply chain – The Corporate Sustainability Due Diligence Directive (CSDDD). On 25 July 2024, the Directive on corporate sustainability due diligence entered into force in Europe. The aim of this Directive is to foster sustainable and responsible corporate behavior in companies’ operations and across their global value chains. The new rules will ensure that companies in scope identify and address adverse human rights and environmental impacts of

TCI-IIMB Supply Chain Sustainability (TCI-IIMB SCSL) Lab’s primary focus areas include the measurement, mitigation, and management of supply chain emissions. The crucial first step in this journey is measuring emissions, and we are developing tools for this purpose. For example, the Transportation Emissions Measurement Tool (TEMT) is already live and measures emissions from freight transportation across all modes. We have also developed a carbon accounting tool to measure scope 1, 2, and 3 emissions for the MSME sector. The next step involves mitigation, where we focus on solutions such as energy efficiency, decarbonization of transportation, the circular economy, green packaging, design for the environment, sustainable procurement, and more to mitigate emissions from supply chains. Lastly, we are concentrating on building and sustaining sustainability programs within organizations, providing training, and fostering a culture of sustainability.

their actions inside and outside Europe. It will become a law by 2026 in several European countries. This law is also called as Supply Chain Law. It mandates all the large corporates in Europe to perform due diligence of all their supply chain / value chain partners up to Nth level. Such a law is going to have a significant outcome on global supply chains.

The fourth major impact will be the physical risks arising from climate change. The frequency and intensity of extreme weather events are increasing, leading to significant supply chain disruptions. For instance, a supplier may fail to deliver due to a cyclone in their region, a company might struggle to fulfill orders because of warehouse flooding, or manufacturing could grind to a halt due to water scarcity caused by drought near a factory. These scenarios highlight the tangible risks businesses may face in the future as a result of climate change. To sum up, the impact of sustainability on Supply chains will be profound and pervasive.

How can we make transportation as a service sustainable without a lot of impact on cost?

When we talk about decarbonization of supply chain, decarbonization of transportation is the most important element. I hear a lot of supply chain managers discussing the lack of EVs available in the country for freight movement, and this being one of the major reasons for not being able to decarbonize. EV is one part of the solution. There are several other aspects that need to be dealt with when it comes to decarbonization of transportation. When you outsource this service to a transportation company, there are certain things which can be made efficient but are beyond your control. For instance, driver behavior can have a significant impact on fuel efficiency, but you can’t control that aspect. Hiring efficient vehicles can reduce emissions but not under your control. Route planning can again have an impact on fuel efficiency but still doesn’t fall under your control

purview because you have outsourced that service. Use of alternative fuels such as green hydrogen or LNG, also doesn’t come under your control.

There are six key logistics drivers that can be used to influence the environmental impact of logistics: Distance to be travelled, Mode of shipment, Transport Equipment being used, Fuel to power, Load Planning and Operation Execution.

By considering these drivers, it is possible to design greener logistics systems. Following are some of strategies which the companies may use to make their logistics greener:

Modal Shift: The first thing I would like to draw all the supply chain planners’ attention is towards modal shift. As a practice, we must switch to a more sustainable route of transport from air to road, from road to rail and from rail to water, wherever it is feasible.

Load Consolidation: The second important aspect is in terms of load consolidation. For instance, if you are sending two 10-ton trucks, instead of that, if you move a one 20-ton truck, then you are reducing your emissions by almost 30-40% upfront. By consolidating

cargo and shifting to higher payload vehicles, it is possible to significantly reduce emissions.

Vehicle Space Utilization: Maximizing the cube of the vehicle and utilizing every single inch of the vehicle for transportation is also one of the efficient ways to reduce emissions.

Network Redesigning: Another aspect that the supply chain professionals need to work towards is network redesign. The redesign of the distribution network to place distribution centers where demand is highest can help reduce the total weight-distance travelled, without compromising customer service.

As logistics professionals, we can influence the secondary packaging also. Minimizing the use of secondary packaging materials, light weighting them, using eco-friendly materials, and promoting the reuse and recycling of packaging materials.

Choosing Right LSP partners: As we do not directly influence the route, vehicle type and the driver behavior, it is essential to choose right transportation

partners who are making efforts to reduce their emissions.

EV in the last mile: EV options may not be easily available for the mid mile, but there are three and four-wheeler EV options available for last mile delivery. Companies must explore them to deliver to retail outlets or directly to customers.

Measurement: The first step in any improvement exercise is the Measurement. Companies must start measuring their emissions even if they are not able to reduce them to begin with.

Green Warehousing: Implementing energy-efficient lighting, insulation, and heating systems, using renewable energy sources, and reducing waste and water consumption.

If you don’t know that root cause of emissions, you can’t take the right measures to solve them. To achieve sustainable supply chain management, companies need to work closely with suppliers, customers, and other stakeholders. By working together, companies can create a more sustainable future for all.

Rather than focusing solely on the upfront cost of acquisition, companies should evaluate the total lifecycle cost of a product. This includes operating costs, maintenance costs, and end-of-life costs. For example, compare a diesel forklift with an electric forklift or a standard motor with a Variable Frequency Drive (VFD) motor. When lifecycle costs—including carbon costs— are considered, the sustainable option often provides better long-term value.

Are there any tools available to measure & report emissions?

In India, the transportation sector is responsible for around 14% of the country's total GHG emissions, with freight transportation accounting for nearly 40% of CO₂ emissions within this sector. Without intervention or cleaner technologies, transportation emissions are projected to increase by 4-fold between 2016 & 2050, potentially reaching 1.17 billion tons of CO₂ by 2050 and would increase the share of transport in total emissions to 19%.

Another important aspect is that the transportation emissions factors that are available in India are incomplete, dated, and limited. Accurate measurement is the critical first step toward mitigating these emissions. Organizations need robust tools to measure their emissions before they can take meaningful action to reduce them.

In response to the escalating call for decarbonization of value chains and the imperative to manage scope three emissions, IIM Bangalore has established the TCI-IIMB Supply Chain Sustainability (TCI-IIMB SCSL) Lab. This dedicated lab is designed to assist organizations in their journey towards achieving net-zero goals. The TCI-IIMB SCSL Lab represents a significant initiative aimed at propelling sustainability in logistics and supply chain management to the forefront.

We take pride in stating that the TCIIIMB Supply Chain Sustainability Lab has become the first organization in India to achieve ISO 14083 certification for its groundbreaking digital platform, the Transportation Emissions Measurement Tool (TEMT). ISO 14083, developed by the International Organization for Standardization (ISO), provides a global standard for quantifying GHG emissions from transport operations.

Applicable to road, rail, air, maritime, and inland waterway transport, it covers fuel combustion and electricity consumption. The standard outlines calculation methods, data requirements, and reporting guidelines, offering a standardized framework for tracking emissions and enabling organizations to make informed decisions on emissionreduction strategies.

The certification underscores the platform’s ability to accurately quantify and report greenhouse gas (GHG) emissions from freight transportation activities, helping organizations to measure, manage, and ultimately reduce their transportation-related emissions in line with regulatory requirements and sustainability goals. The emission factors API is now available on ULIP platform.

TEMT is a comprehensive online platform designed to measure emissions across all modes of transportation. TEMT, with its certified emissions factors across multiple transport modes, empowers organizations to quantify and report emissions accurately, setting the stage for effective emission-reduction strategies.

It integrates India-specific emission factors, validated through ISO 14083 certification, ensuring data accuracy and relevance. The tool allows users to calculate emissions for both past and future shipments and compare emissions between different transport modes for a given origin-destination pair. It also offers users the flexibility to build customized transportation chains, with all past entries securely stored in the cloud for easy monthly tracking and yearover-year comparison. The platform is commodity-agnostic, meaning it applies to all types of shipments, and outputs are available in PDF and CSV formats for ease of reporting and analysis.

How does the lab compare to global standards in terms of research, innovation, and implementation of sustainable supply chain practices?

The lab is still in its nascent stage and has just embarked on its journey. Since it was established at IIM Bangalore, our goal is to make it truly world-class. However, the lab’s focus is on the Indian perspective. We aim to make supply chains in India more sustainable. We have already developed tools with a wide reach and national impact. We are conducting research in collaboration with various government institutions. Our stakeholders include multiple government and private agencies, NGOs, educational institutions, and more. We are creating white papers and case studies to disseminate sustainable supply chain knowledge to the global community. While our standards align with global practices, our primary focus is on the national context.