11 minute read

Health Care

Personalize your health care

Cerner offers three health plan options so you can personalize your coverage to fit your needs. Each plan works differently, so you’ll want to explore the information in this section and check out the health plan decision support tools to help guide your decision making. Here is a summary of the three health plan options:

Advertisement

HRA Plan a consumer-driven health plan that encourages your active involvement in managing your health. The plan comes with a Health Reimbursement Account (HRA) that Cerner funds to help cover outof-pocket expenses.

HSA Plan a high-deductible health plan with a Health Savings Account (HSA) you can contribute to along with Cerner’s funding. The HSA gives you a tax-free way to pay for medical expenses now or to save for the future (even in retirement).

Bind a no-deductible health plan with clear up-front pricing for services that lets members shop for health care in a new way.

See page 37 for benefit premiums/price tags.

Separate deductible and cost-share levels apply for non-emergent services received out-of-network.

Choose with Confidence with Decision Support Tools

Cerner offers two easy-to-use, interactive tools to help you choose the best health plan for you and your family.

First, use the Health Plan Chooser to find video stories about people like you to help you: see how costs will compare among the plans, think through key considerations when deciding among plans and find the plan that may offer the best value for you and your family. Then, use the Health Plan Cost Estimator to do a more in-depth cost comparison, by: estimating future health care costs for you and your covered family members, comparing estimated out-of-pocket expenses at a glance, determining how much to contribute to an HSA and/or FSA—and see what you’ll save on taxes.

Plan Comparison

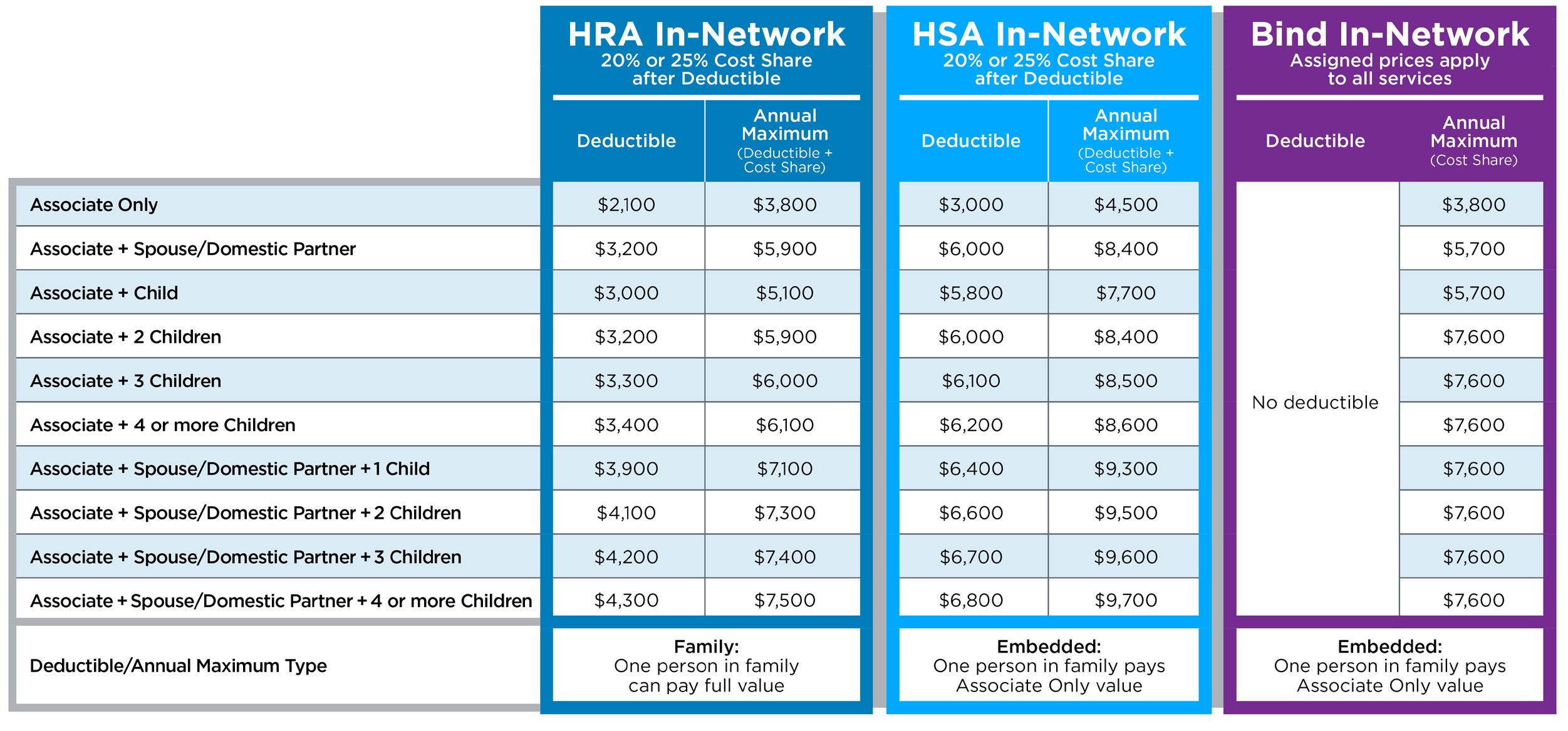

Below is an overview of in-network coverage to help you compare your plan options. 3 Children 4 or more Children Associate + Spouse/Domestic Partner + 1 Child 2 Children 3 Children 4 or more Children

Carrier

Provider network

Coverage levels

You choose whom you want to cover; the number of people you cover will affect your deductible, annual maximum and premium (paycheck deduction)

Deductible

What you pay for services before Cerner’s portion begins

Annual Maximum Preventive care Office visits (diagnostic)

Community Primary

Care Physician

Community Specialist

Anuva/Healthe Clinic – Professional Services

Healthe Clinic Chiropractic

Inpatient/Outpatient

Emergency Room

Prescription drugs HRA Plan HSA Plan

Cerner HealthPlan Services Freedom Network Select (Kansas City) or Cigna (non-Kansas City)

Associate Only

Associate +

Spouse/Domestic Partner

Child 2 Children

Facility services

Bind

Bind UHC Choice Plus

Varies by coverage level you select No deductible

Varies by coverage level you select Plan pays 100% (you pay $0)

You pay after deductible: 20% (in-network)

You pay after deductible: 20% (in-network) Plan pays 100% (you pay $0) You pay after deductible: 20% (in-network) You pay after deductible: 20% (in-network) You pay $35 - $135 You see assigned prices before receiving services

Plan pays 100% (you pay $0)

You pay $25

You pay after deductible: KC: 20% Premier / 25% Standard network Non-KC: 20% (in-network) You pay after in-network deductible: 20%

You pay after in-network deductible: 20% You pay up to $2,550 (inpatient)

$700 You pay $5-$450 Your price depends on the type of medication and length of fill HRA (only for HLwR deposits) FSA

Providers A Cerner Health Benefits member should use the providers in the designated network for your health plan to receive the highest level of benefits. These in-network providers are contracted at a savings for both plan and member. On the HRA and HSA plans, during the cost-share portion of your health plan, the in-network allowable amount paid for services by the health plan are covered at 80% or 75% (if not using a Premier provider in Kansas City). When services are rendered by providers not in the network (out-of-network), the amount paid for covered services is 60% of the allowed amount, after the out-of-network deductible is satisfied, up to their out-of-network annual maximum. The member may also be billed by the out-of-network provider for the difference between the total charge and the allowed amount.

On the Bind plan, coverage outside of the network is limited to emergency services only. It is the Cerner Health Benefits member’s responsibility to confirm they are using an in-network provider prior to their service.

Provider Network Your Cerner Health Benefits provider network is based on what plan you are enrolled in and where you live. The HRA and HSA Plans have a Premier network where you pay a lower cost-share percentage for participating providers compared with the Standard network. With Bind, there’s only one provider network, and out-of-network care is not covered.

HRA and HSA Kansas City-based associates:

• Premier Tier (facility) • Freedom Network Select (FNS)

HRA and HSA non-KC associates: Cigna PPO; Cigna Behavioral Health

Bind members: United HealthCare Choice Plus

Cost-Share Inpatient and outpatient facility- based services All other covered in-network services For HRA and HSA Plans only Premier In-Network Standard In-Network

You pay 20% after deductible You pay 25% after deductible

KC*: AHSM, TMC, KU, WMMC, NKC, CMH Non-KC: All Cigna network facilities

Premier cost-share applies if FNS (KC) or Cigna (non-KC) KC: All other FNS network facilities Non-KC: Not applicable

Not applicable

Plan Administrator To verify eligibility and for help filing claims, you and your provider should always contact the plan administrator:

HRA Plan and HSA Plan: Cerner HealthPlan Services: 877-765-1033

Bind plan: Bind Health Plan: 833-997-1086

Preventive Care The health plans cover preventive care at 100%, which means you and your covered dependents are eligible for important preventive services which can help you avoid illness and improve your health. You will not have to pay towards your deductible and cost-share to receive preventive health services received from an in-network provider such as recommended screenings, vaccinations and counseling. For a list of all covered services please go to https://www.healthcare.gov/what-are-my-preventive-care-benefits/

Prescription Drug Coverage The health plans integrate prescription coverage with medical coverage. This means that your prescriptions and medical expenses both contribute towards your deductible (HRA and HSA Plans) and annual maximum (all plans, including Bind). The nationwide network of pharmacies provides discounted medications to plan members as well as 90 day supplies at preferred providers and mail order prescriptions. Elixir, Cerner’s partner in pharmacy management for the HRA and HSA plans, provides members with important pharmacy information, including your claims and benefits, medication education and prices and mail order services. Navitus provides the same services for Bind plan members. Remember, the Healthe Pharmacies also offer discounted prescriptions at four convenient on-site locations, as well as Anuva Clinics in Malvern and West Chester, PA.

Check out the HealtheAtCerner.com for more information on Pharmacy Advocacy and other tips on managing your health care spend.

Tobacco Cessation Cerner is a health care company; we don’t just talk the talk, we walk the walk! With Cerner Health Benefits, it pays to be tobacco free. During enrollment, Primary Subscribers are asked to verify whether or not they use tobacco. If a tobacco user chooses not to complete Cerner’s tobacco cessation program, they will pay the tobacco-user premium for the plan year.

Savings and Spending Accounts Depending on the health plan you choose, you gain access to special accounts to help you pay for health care expenses and in the case of the HSA, save for future health expenses.

Available with..

Eligible Expenses

Who contributes

Contribution limits

Who owns it

Whose expenses are eligible

Tax advantages

Portability Health Reimbursement Account (HRA) Health Savings Account (HSA) Health Care Flexible Spending Account (FSA) Limited FSA

HRA Plan HRA Plan, Bind and Bind (limited to Healthe Living HSA Plan only those who waive HSA Plan with Rewards dollars) medical coverage Dental Medical, prescription drug, dental and vision expenses & vision expenses Cerner contributes $400 annually, plus any earned Healthe Living with Rewards You contribute on a pre-tax basis dollars, if you’re in the HRA plan. Only earned Healthe Living with Rewards dollars, if you’re in the Bind plan. Cerner matches up to $400 annually, plus any Healthe Living with Rewards dollars You contribute on a pre-tax basis $3,600 (associate-only coverage) and $7,200 (all other coverage levels)

N/A

Cerner owns the account and you are entitled to a 90-day runout period after leaving the plan

You and any dependents covered under the HRA Plan

Reimbursements are taxfree when you use them to pay for eligible expenses

Unused funds roll over from one year to the next as long as you remain enrolled in the HRA Plan or Bind plan (even through COBRA)

Your contribution limit will be adjusted by Cerner’s match and Healthe Living with Rewards earnings If you are age 55 or older (or turn 55 in 2021), you can contribute an additional $1,000 You own the account and balance, even if you leave the plan in the future (but you can only contribute when you are in the HSA plan) You and anyone you claim as a dependent on your tax return, regardless of health plan participation Contributions and reimbursements are tax-free when you use them to pay for eligible expenses; any earnings are also tax-free

Unused funds always roll forward and can be used now or in future (even when you leave the plan) $2,750 ($250 minimum contribution)

Cerner owns the account

You and anyone you claim as a dependent on your tax return, regardless of health plan participation

Contributions and reimbursements are tax-free when you use them to pay for eligible expenses

Unused funds can be used in certain circumstances when on COBRA

How Bind Works With no deductible or cost-sharing percentage, you may be wondering how Bind works.

1.

Shop for health care. Buy health care the way you make other important purchases: check prices in advance and make informed decisions based on cost and quality.

Convenience is key. Use your MyBind mobile app or mybind.com to find providers near you and see prices for the services you need.

In-network only. Bind uses the nationwide UHC Choice Plus network. Out-of-network care is not covered, except in an emergency, and you’ll pay the full cost.

Activate additional coverage if necessary. The vast majority of care you might need is included in the assigned pricing you pay. For certain plannable procedures, such as a tonsillectomy and carpal tunnel surgery, you activate additional coverage in advance and pay for it through an additional paycheck deduction and assigned pricing.

An example to see how the HRA and HSA Plans compare with Bind:

Situation I have a sore throat HRA and HSA Plans Bind

• I call my doctor to get an appointment • I open the MyBind app and • My doctor does a strep test and the instant-read is positive search “sore throat” • My doctor prescribes a Z-pak • I see the care options and • The claim is submitted to Cerner HealthPlan Services to corresponding prices ensure the network discount is applied. I get my Explanation of • I choose a retail visit, the nurse

Benefits (EOB) that shows what I owe and since I am still in practitioner does a strep test my deductible phase: and the instant-read is positive • The nurse prescribes a Z-pak and HRA Plan HSA Plan the app shows me it’s not covered The discounted cost is auto- I use my HSA to pay the dis- but the generic equivalent is matically deducted from my counted amount to the provider • I pay the assigned prices forHRA/FSA to pay the provider and the pharmacy the Rx and the visit and the pharmacy

Electing and activating coverage

Bind has identified a set of plannable treatments and procedures you can elect and activate if needed. These include treatments that have variation in both cost and treatment options. On average, only about 5% of Bind members need to activate coverage. Still, it’s an important Bind feature you’ll want to understand before making your health plan selection. Here’s an example of what activating coverage could look like if you need knee surgery.

Your primary provider thinks you need arthroscopic knee surgery. Typically, this costs $10,000 before insurance. Using the MyBind app, you find a specialist to give a second opinion, and you see that while physical therapy could work, it’s unlikely to provide long-term relief. You use the MyBind app to search arthroscopic knee surgery and find a list of providers and prices. You see a nearby surgery center would charge $1,200, which you pay as a $200 assigned price up-front plus an additional $1,000, paid for through paycheck deductions over time. The amount you pay through paycheck deductions is in addition to your regular paycheck deductions for the health plan.

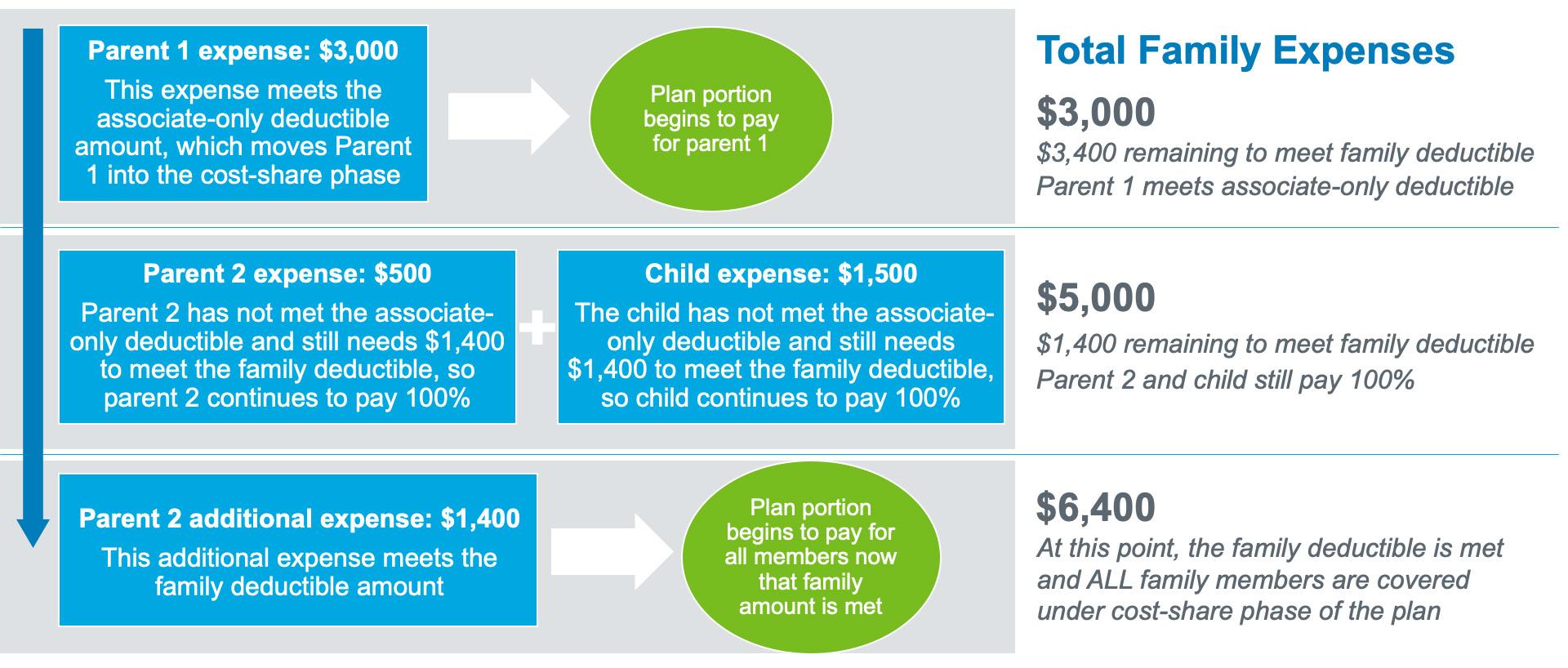

Aggregate Deductible (for a family): HRA Plan Example The HRA Plan has an aggregate deductible. In an aggregate deductible, all family members work towards the family deductible. In this example, we have an associate plus spouse and 1 child on the HRA Plan. The family deductible for this coverage code is $3,900. This same model would also apply to the annual maximum.

Embedded Deductible (for a family): HSA Plan Example In an embedded deductible under the HSA Plan, individuals in a family each work towards the associate-only deductible amount (see page 13). This means, that instead of waiting for the full family deductible to be met, an individual can potentially enter the cost-share phase of the plan much sooner. This helps to ease some of the financial burden on a family. This same model would also apply to the annual maximum.