In 1776, moral philosopher Adam Smith, known as the father of economics (which turned out to be a somewhat unruly child) published The Wealth of Nations.

His book didn’t exactly eclipse the US Declaration of Independence – the other blockbuster of that year –but it can perhaps claim greater worldwide impact, and it has certainly been more influential. Smith, the enemy of mercantilism, championed free trade and open markets, believing that unfettered selfinterest, rather than the strict hand of government, would bring stronger economic outcomes.

Mercantilism means maximising exports and protecting against imports through subsidies and high tariffs (and, in the “good old days”, it called for the salting away of much gold and silver). It would seem an odd position to take, given that others are likely to respond in kind – and when they do, things can get nasty. It can be a harbinger of trade wars, and worse.

In 1930, the Smoot-Hawley Act increased 900 import tariffs by an average of almost 50 percent. It set out to relieve the effects of the US Dust Bowl but resulted in a far worse depression, and provided another spark for World War II (as if there were not enough already).

Yet protectionism persists. Britain did not embrace free trade until the 1880s, by which time it was fully confident of its industrial muscle. And, during the past 60 years, pro-business Asian states have created economic miracles on the back of protectionist policies.

But at last year’s UN General Assembly, Chinese president Xi Jinping called for unflagging pursuit of “an open world economy”. He declared: “We should safeguard the multilateral trading system with the

World Trade Organisation as the cornerstone, take a clear stand against unilateralism and protectionism, and keep the global industrial chain and supply chain stable and smooth.”

The US has had the world’s largest trade deficit for the past 45 years. Half-way through Donald Trump’s presidency, he said: “Trade wars are good and easy to win.” Stock markets went into shock, domestic farm bankruptcies soared, other countries retaliated – and many excluded America from new trade agreements. An organisation called Tariffs Hurt The Homeland was formed on the back of claims that the policy was costing Americans $810 – each second. Of course, China was not well-pleased either: former senior trade official Wei Jianguo said: “The essence of the trade war is that the US wants to destroy China.”

Free trade can result in economic miracles, including the one witnessed in Chile in the 1980s. The Chicago Boys, economists who had studied under Milton Friedman, were responsible for a dramatic reorientation. It brought significant material benefits – and led the way to a free society.

Economic globalisation has its critics, and rightly so. It can be blamed for a rise in inequality, and it cannot protect us from financial crises. But if we don’t like the sort of globalisation we have, we should change it. There may be calls for post-pandemic protectionism, but history flags the dangers of taking that road. We need more, rather than less, economic integration and interdependence as we plan for recovery. But that plan must focus on transformative development, and the achievement of the UN’s 17 Sustainable Development Goals by the year 2030.

This will be change enough.

Last year ended on a promising note thanks to DeepMind’s solution to the “proteinfolding problem” (First Thoughts, Winter). This development is likely to accelerate our understanding of diseases, including the one that defined 2020 and continues to haunt us. It is a comfort that Demis Hassabis and his team at DeepMind can bring their formidable intellects to real world problems. This company is at the vanguard of AI research after a string of significant year-by-year achievements, and it clearly has the best of intentions. However, I would like to urge the AI world to be cautious when assuming that art produced in this way can convincingly imitate the work of the great artists. Hassabis includes a slide in his presentations that shows how deep neural networks can produce pastiches of Van Gogh’s work. Big deal: that’s easily done and not very satisfying. DeepMind is not delving into the mind of a creative genius when producing a sketch of the bicycle outside your Aunt Mabel’s Weymouth cottage in the style of The Starry Night. Something is wrong here.

SALLY JONES (Oxford, UK)

I applaud the positive views expressed by Lord Waverley in your Winter issue regarding Britain’s future role in support of international trade relations. It is true that the country can now act as a bridge between developed and developing markets. It is indeed important that we “do trade differently” now. Trade must contribute responsibly to a more inclusive, sustainable and greener economy. To ensure this, we must push hard to achieve the UN’s Sustainable Development Goals by 2030. As a member of the G7, Britain is well placed to influence the international scene for the better, and I hope this is never forgotten. We worked hard in 2020 to conclude satisfactory trade arrangements with our friends in the EU and elsewhere. We should not take our eyes off the ball now.

GEFFREY WALKER (Ludlow, UK)

I thoroughly enjoyed the Winter issue of your magazine. As an observer –from afar – of the US election and its oftenunsavoury aftermath, it was a pleasure to study your predications for change during the Biden presidency. I have framed the cover, which correctly refers to the new president as uniterin-chief, and it now has pride-of-place in my study. This is not my president, but I welcome the opportunity to join with so many of my US friends in celebrating Biden’s success.

AMI BOATENG (Accra, Ghana)

“Your recent article, Prepare for the Impacts of Climate Change (Winter 2020) is the sort of responsibility-dodging, hand-washing disclaimer that is driving us all to distraction, and possibly destruction. Without even considering Covid, social protection, personal identification and digital payment systems, climate change can be fought on far more logical and effective grounds. It is not inevitable, it is a conscious choice – one taken by the world’s corporations, governments, billionaire entrepreneurs, and ministers, to cut costs. Follow the money: it’s the only enduring refrain. You want solutions? Make it a mandatory obligation for those (individual or corporate) seeking planning permission for a new building, be it home, office or luxury hotel. Every project embarked upon in suitable climates (perhaps not The Netherlands, I admit) should have solar panels included in the spec. Without that single, vital commitment, no development should go ahead. Grey-water systems, composting toilets, circular economies, concerted effort on the part of local and national authorities: all these things can be introduced to good effect. Changing the things we are able to, would cut greenhouse emissions, take a load off the national grid, and improve the West’s generally disgusting, chemically driven sewerage systems. The problem is not one of finding solutions; it’s about applying the solutions which are already to-hand – but dismissed for cost reasons. For filthy lucre, put another way. CFI.co and organs like it, that make it seem as if euros and dollars and pounds sterling were the lifeblood of the planet, are partly to blame for the cost-conscious, greedy mindset that pervades modern society. Pursue some issues that really matter, please.

HILDA VAN VUUREN (Amsterdam, NL)

“In response to your article Steeled by Brexit,EuropeanUnionStandsUptoRuleBreakers, I hardly think that in the average British household the end of the transition period will have barely registered. But Brexit turned Kent into a Danteesque tailback of lorries filled with rotting goods and increasingly desperate, and hungry, drivers. The county formerly known as the Garden of England has also managed to come up with a novel strain of Covid-19. As things stand, it could be our major export of 2021.

BEATRICE FAULKS (Gravesend, UK)

“

I read with great interest your article on UniCredit’s social impact banking policies. Having had some recent dealings with the company in this ambit, I can confirm the admirable steps it has taken to improve inclusivity and diversity – not just in-house, but also in its investment policies and outreach initiatives. It is reassuring in these times of increasing disparity of income to find programmes such as these from enlightened organisations which understand that their businesses will ultimately benefit from including more people in the active economy. Congratulations to Ms Penna and her team on the positive impact they are undoubtedly making.

MASSIMO VISCIDO (Brescia, Italy)

Editorial Team

Sarah Worthington

George Kingsley

Jackie Chapman

Tony Lennox

Kate Stanton

Brendan Filipovski

John Marinus

Ellen Langford

Helen Lynn Stone

Naomi Snelling

Columnists

Otaviano Canuto

Evan Harvey

Tor Svensson

Lord Waverley

Distribution Manager

William Adam

Subscriptions

Maggie Arts

Commercial Director

John Mann

Director, Operations

Marten Mark

Publisher

Anthony Michael

World Bank COVID-19 Response (14 – 15)

IBM

Thought Leadership (22 – 25)

Blending Public and Private Finance (24 – 25)

Cover Story

WTO Director-General Ngozi Okonjo-Iweala (32 – 35)

UNCDF

Inclusive Digital Economies (38 – 39)

Capital Finance International

Meridien House

69 - 71 Clarendon Road

Watford WD17 1DS

United Kingdom

T: +44 203 137 3679

F: +44 203 137 5872

E: info@cfi.co

W: www.cfi.co

Deloitte

Alternative Investment Fund Market (72 – 73)

Asian Development Bank

Restoring the World’s Oceans (180 – 181)

Axel van Trotsenburg World Bank

Otaviano Canuto

Nouriel Roubini

Michael Spence Nicholas Stern

Joseph E Stiglitz Kruskaia Sierra-Escalante IFC

Paul Horrocks OECD

Tony Lennox

Anna Bjerde Ahmed Dermish Tor Svensson

UNCDF IBM

Lord Waverley

Paolo Sironi

Lindsey McMurray Pollen Street Capital

SegurCaixa Adeslas

ORBIAN Whitecroft Capital Ventum Dynamics

Korosh Farazad Farazad Investments

Scottish Friendly

BBVA Asset Management Deloitte Gorgi Krlev

Adrian Fuchs Heidelberg University SPORTFIVE

The Access Bank UK Carey AVL

Helmut List Stifel Europe ICICI Bank UK

Narodowy Bank Polski

QNB

Mohamed El Dib Kellogg Insight

Investment House Yousef Abdullah Al Subeai

Bernard Haykel

Abbas Basrai KPMG ICBC Middle East

Linklease TANQIA APICORP

Ahmed Attiga

Santiago Free Zone Corporation Naomi Snelling Maximo Lima

David Ariaz Hemisfério Sul Investimentos (HSI)

Mohamed A El-Erian Otaviano Canuto

Shahnaz Radjy Dr Maria Teresa Ferretti Ingrid van Wees

Said Rustamov Asian Development Bank

By Axel van Trotsenburg World Bank Managing Director of Operations

COVID-19 has imposed a deeper, more widespread shock than the global community has faced in many decades. The pandemic is causing illness and death, disrupting livelihoods, and potentially pushing an estimated 150 million more people into extreme poverty by the end of 2021. And while the rapid development of vaccines offers all of us some hope, the pandemic continues to dominate our lives.

For developing countries, COVID is also compounding the risks posed by climate change, along with other long-term challenges. In many places, fragility and conflict were eroding development gains long before the pandemic. Far too many countries were also coping with unsustainable debt levels. And every country was facing challenges to create more jobs in a global economy marked by accelerating technological change.

Taken together, these factors mean that most developing economies were highly vulnerable when COVID struck. And they are now the ones suffering the greatest damage from its impacts. Given the pressing nature of these challenges— notably climate change—countries don’t have the luxury of putting off action on other crises and risks until the pandemic subsides.

This means that the financing needs in low- and middle-income countries are at a historic high. While industrialised countries have spent up to 15–20% of their GDPs on stimulus packages, emerging markets have spent around 6% and the poorest countries have spent less than 2%. To help developing countries at the scale they need will require substantial new resources, from the World Bank Group and other multilaterals, from the donor community, and from the private sector. Sustained, robust financial support for the poorest countries is critical to boosting their capacity to beat the pandemic, build more resilient economies, and restore momentum on the 2030 agenda.

The World Bank Group is committed to helping close this financing gap. Our COVID crisis response over the past year has been fast and decisive in bringing massive support to developing countries, particularly the poorest and most vulnerable. Across the World Bank, IFC, and MIGA, we have stepped up to this challenge since the onset of the pandemic. World Bank programs, normally in the range of

"In addition to increasing the provision of large concessional resources to the poorest countries, as IDA is doing, debt relief has been a key part of the support package."

$42 billion per year, grew last calendar year to $71 billion to meet intensified client demand. About 60 percent of our operations are currently COVID-related.

We are also starting a year early on the negotiations for the next replenishment of the International Development Association (IDA), our fund for the poorest. IDA has been a steadfast and increasingly important source of support for the poorest countries through various crises, and it has stepped up even more during the pandemic. This is especially evident in our support for health, education, and social protection.

In addition to increasing the provision of large concessional resources to the poorest countries, as IDA is doing, debt relief has been a key part of the support package. The G20 Debt Service Suspension Initiative (DSSI) has helped free up resources for governments, which they have been able to direct to priority areas for combatting the pandemic. But there are still challenges, particularly with private creditors, who have not been participating actively in this important initiative. And while the DSSI has provided essential short-term relief, many of the poorer countries also face longer-term concerns on debt sustainability. The G20 Common Framework, about to begin, should help address these problems on a case-by-case basis.

While debt relief and concessional resources from multilateral organisations and donors are critically important, more needs to be done. Tackling this global crisis effectively can happen only with more international solidarity and more international action. With the pandemic affecting every country simultaneously, there’s a risk that wealthier countries will focus mainly on their own recovery. While this is perhaps understandable, as every government is accountable to its own people, it runs the risk of leaving poorer countries behind. This ultimately jeopardises the wellbeing of all.

The COVID vaccines illustrate this risk very clearly. We are working closely with many other organisations to get the vaccines to the people of developing countries. The World Bank is providing up to $12 billion to governments and the IFC a further $4 billion to manufacturers of vaccines and related equipment in developing countries. Efforts include using COVAX, a mechanism that the international community has set up to ensure global, equitable access to vaccines for major infectious diseases. But at this early stage, the industrialised countries have bought up most of the supply of the COVID vaccines, leaving developing countries with insufficient coverage. Therefore, it is very important to ensure fast and equitable distribution of vaccines worldwide.

But beyond these immediate concerns, the pandemic has wider impacts that could affect developing countries for the long term. Continued, sustained financing will be critical to ensure a lasting recovery but rebuilding better will also mean embracing key shifts that are transforming the global economy. COVID-19 has already spurred changes in how people work and live, and in how economies are organised. The crisis is underscoring the value of robust health, education, and social protection systems. It is making clearer than ever that digital access and innovation can support every sector of the economy. And it highlights the need for effective government and community leadership.

This is why we need to start focusing our support, both financial and technical, on the green, resilient, and inclusive transformations that will help economies withstand a range of potential shocks in the future. While the emergency phase is far from over, we must partner with countries now, not just to anticipate health risks, but also to help them brace against climate change, natural disasters, conflict, and economic disruption.

The World Bank Group believes that countries can chart a new, sustainable route to higher living standards by pursuing their climate and environmental goals. Their recovery from the pandemic is a chance to accelerate this progress and rebuild better. Hence, we are preparing to support developing countries on a much larger scale as they invest in green infrastructure, develop environmentally sustainable technologies, and phase out harmful fuel subsidies. The goals of long-term growth and job creation are inextricable from countries’ efforts to reduce carbon emissions and to mitigate and adapt to climate change.

As they plan for the road ahead, developing countries will also need policies and reforms that expand economic participation, that leverage technology for more robust and inclusive delivery of key services, and that make it easier for the public and private sectors to work together toward development goals.

By focusing on key climate investments, countries can not only unlock short-term gains in growth but also deliver long-term benefits: lower carbon emissions, greater resilience to climate

change, and more good jobs in emerging, greener sectors.

The international community stands at a critical moment, with COVID-19 and climate change imposing dual crises of global proportions. Both require a massive global response, and they must be tackled simultaneously. Meeting investment objectives will call for significant financial resources at a time when countries are facing fiscal constraints and debt overhang, and there is a need to augment all sources of finance – including from the private sector, domestic resources, and development financing – and use it effectively.

Developing countries have been the most vulnerable in this pandemic, just as they are to climate impacts. And they face the steepest path back. The World Bank Group is working hard to help them secure the financial resources and sustained international support needed. We are all in this together, and I remain optimistic that we will see real improvement in many countries during 2021. i

Axel van Trotsenburg is the World Bank Managing Director of Operations.

In this role, which he assumed on October 1, 2019, van Trotsenburg oversees the Bank’s operational program and ensures that the Bank’s delivery model continues to meet the needs of client countries. He also builds support and mobilises financial resources across the international community for efforts to assist low and middle-income countries.

Van Trotsenburg brings deep experience in regional operations and finance, drawing on his experience as currently the longest serving Vice President at the Bank, with two tenures in the Finance Complex and two in Operations. A Dutch and Austrian national, he was Acting World Bank CEO from September 2 – 30, 2019 and served as World Bank Vice President for Latin America and the Caribbean from February 2019. In this latter position, he led relations with 31 countries in the region and oversaw a portfolio of ongoing projects, technical assistance and grants worth more than US$30 billion.

From 2016 to January 2019, van Trotsenburg served as World Bank Vice President of Development Finance (DFi). Here, he oversaw strategic mobilisation of resources, and was responsible for the replenishment and stewardship of the International Development Association (IDA), the largest source of concessional financing for the world's poorest countries. He has led the policy negotiations and process for two IDA replenishments, which together mobilised a record $125 billion—$50 billion in 2010 for IDA16 and $75 billion in 2016 for IDA18. Under his leadership, for the first time, IDA leveraged its equity by blending donor contributions with internal resources and funds raised through debt markets.

In his DFi role, van Trotsenburg also oversaw the International Bank for Reconstruction and Development (IBRD) corporate finances. He co-led the World Bank Group's efforts to obtain a capital increase which resulted in shareholders endorsing a transformative package in April 2018, including an increase of the IBRD capital by $60 billion. He also cochaired the replenishment negotiations for the Global Environment Facility (GEF) that were successfully concluded in April 2018 and was responsible of a multi-billion-dollar trust fund portfolio.

Prior to joining the World Bank, van Trotsenburg worked at the OECD in Paris. He holds a master’s and a doctorate degree in economics and a master’s degree in international affairs. He is married and has two children.

The World Bank, one of the largest sources of funding and knowledge for developing countries, is taking broad, fast action to help developing countries respond to the health, social and economic impacts of COVID-19. This includes $12 billion to help low- and middle-income countries purchase and distribute COVID-19 vaccines, tests, and treatments, and strengthen vaccination systems. The financing builds on the broader World Bank Group COVID-19 response, which is helping more than 100 countries strengthen health systems, support the poorest households, and create supportive conditions to maintain livelihoods and jobs for those hit hardest.

The US economy’s K-shaped recovery is underway. Those with stable fulltime jobs, benefits, and a financial cushion are faring well as stock markets climb to new highs. Those who are unemployed or partially employed in low-valueadded blue-collar and service jobs – the new “precariat” – are saddled with debt, have little financial wealth, and face diminishing economic prospects.

These trends indicate a growing disconnect between Wall Street and Main Street. The new stock-market highs mean nothing to most people. The bottom 50% of the wealth distribution holds just 0.7% of total equity-market assets, whereas the top 10% commands 87.2%, and the top 1% holds 51.8%. The 50 richest people have as much wealth as the 165 million people at the bottom.

Rising inequality has followed the ascent of Big Tech. As many as three retail jobs are lost for every job that Amazon creates, and similar dynamics hold true in other sectors dominated by tech giants. But today’s social and economic stresses are not new. For decades, strapped workers have not been able to keep up with the Joneses, owing to the stagnation of real (inflationadjusted) median income alongside rising costs of living and spending expectations.

For decades, the “solution” to this problem was to “democratise” finance so that poor and struggling households could borrow more to buy homes they couldn’t afford, and then use those homes as ATM machines. This expansion of consumer credit –mortgages and other debt – resulted in a bubble that ended with the 2008 financial crisis, when millions lost their jobs, homes, and savings.

Now, the same millennials who were shafted over a decade ago are being duped again. Workers who rely on gig, part-time, or freelance “employment” are being offered a new rope with which to hang themselves in the name of “financial democratisation.” Millions have opened accounts on Robinhood and other investment apps, where they can leverage their scant savings and incomes several times over to speculate on worthless stocks.

The recent GameStop narrative, featuring a united front of heroic small day traders fighting evil short-selling hedge funds, masks the ugly reality that a cohort of hopeless, jobless, skill-less, debt-burdened individuals is being exploited once again. Many have been convinced that financial success lies not in good jobs, hard work, and patient saving and investment, but in get-rich-quick-schemes and wagers on inherently worthless assets like cryptocurrencies (or “shitcoins,” as I prefer to call them).

Make no mistake: The populist meme in which an army of millennial Davids takes down a Wall Street Goliath is merely serving another scheme to fleece clueless amateur investors. As in 2008, the inevitable result will be another asset bubble. The difference is that this time, recklessly populist members of Congress have taken to inveighing against financial intermediaries for not permitting the vulnerable to leverage themselves even more.

Making matters worse, markets are starting to worry about the massive experiment in budgetdeficit monetisation being carried out by the US Federal Reserve and Department of the Treasury through quantitative easing (a form of Modern Monetary Theory or “helicopter money”). A growing chorus of critics warns that this approach could overheat the economy, forcing the Fed to hike interest rates sooner than expected. Nominal and real bond yields are already rising, and this has shaken risky assets like equities. Owing to these concerns about a Fed-led taper tantrum, a recovery that was supposed to be good for markets is now giving way to a market correction.

Meanwhile, congressional Democrats are moving ahead with a $1.9 trillion rescue package that will include additional direct support to households. But with millions already in arrears on rent and utilities payments or in moratoria on their mortgages, credit cards, and other loans, a significant share of these disbursements will go toward debt repayment and saving, with only around one-third of the stimulus likely to be translated into actual spending.

This implies that the package’s effects on growth, inflation, and bond yields will be smaller than expected. And because the additional

savings will end up being funneled back into purchases of government bonds, what was meant to be a bailout for strapped households will in effect become a bailout for banks and other lenders.

To be sure, inflation may eventually still emerge if the effects of monetised fiscal deficits combine with negative supply shocks to produce stagflation. The risk of such shocks has risen as a result of the new Sino-American cold war, which threatens to trigger a process of deglobalisation and economic balkanisation as countries pursue renewed protectionism and the re-shoring of investments and manufacturing operations. But this is a story for the medium term, not for 2021.

When it comes to this year, growth may yet fall short of expectations. New strains of the coronavirus continue to emerge, raising concerns that existing vaccines may no longer be sufficient to end the pandemic. Repeated stopgo cycles undermine confidence, and political pressure to reopen the economy before the virus is contained will continue to build. Many smalland medium-size enterprises are still at risk of going bust, and far too many people are facing the prospects of long-term unemployment. The list of pathologies afflicting the economy is long and includes rising inequality, deleveraging by debt-burdened firms and workers, and political and geopolitical risks.

Asset markets remain frothy – if not outright bubbly – because they are being fed by superaccommodative monetary policies. But today’s price/earnings ratios are as high they were in the bubbles preceding the busts of 1929 and 2000. Between ever-rising leverage and the potential for bubbles in special-purpose acquisition companies, tech stocks, and cryptocurrencies, today’s market mania offers plenty of cause for concern.

Under these conditions, the Fed is probably worried that markets will instantly crash if it takes away the punch bowl. And with the increase in public and private debt preventing the eventual monetary normalisation, the likelihood of stagflation in the medium term – and a hard landing for asset markets and economies – continues to increase. i

Nouriel Roubini, Professor of Economics at New York University's Stern School of Business and Chairman of Roubini Macro Associates, was Senior Economist for International Affairs in the White House’s Council of Economic Advisers during the Clinton Administration. He has worked for the International Monetary Fund, the US Federal Reserve, and the World Bank. His website is NourielRoubini.com, and he is the host of NourielToday.com.

While the economic recovery around the world remains uneven, fragile, and unbalanced across sectors, financial markets are generally doing very well, thanks! In the United States, only half of the unemployment caused by the pandemic last year has been reversed, while stock markets continued to boom. Of course, this largely reflected the extraordinary support given by monetary authorities since March last year.

As in the period after the 2007-08 global financial crisis, voices have been raised talking about monetary policy and central banks as drivers of income and wealth inequality. The unconventional policies of “quantitative easing” protect the holders of financial assets and value their properties, while workers cross a rough patch on the real side of the economy. As we have already discussed here, financial markets have disconnected from hardships in the street of commons, with the help of the policies of monetary authorities.

Does it make sense to assign an impact of concentration of income and wealth to central bankers' policies? It's complicated...

The argument about central banks’ unconventional monetary policies worsening inequality typically begins with the remark that monetary easing acts in part by raising asset prices, like stock prices. As the rich own more assets than the poor and middle class, “quantitative easing (QE)” policies would increase already high disparities of wealth in countries where they have been applied.

However, first consider that volatility and below-potential macroeconomic performance particularly affect the bottom of the income and wealth pyramids. Adequate fulfillment of the stabilising function attributed to central banks is good for those who have less capacity to defend themselves against unemployment and inflation.

To those who always ask me about rescuing or supporting financial institutions in crisis situations, I always ask back about what the alternative scenario would be. The design of such support can always minimise the rewards in terms of wealth of owners, but the truth is that macroeconomic scenarios in cases where the financial system collapses cannot be out of sight, as economic recovery gets harder under such circumstances.

Mary Daily, president of the Federal Reserve Bank of San Francisco, recently observed how the long expansion of the United States economy after the global financial crisis could only

happen because of the stabilisation measures that followed, with interest rates decided on the basis of a return of inflation to the 2% per year target. Unemployment rates fell to levels close to historical lows. The country's average GDP growth rate in the period fell short of previous decades, but this was not due to monetary policy. She notes:

“This created real opportunities for a large number of sidelined Americans, many of whom were thought to be permanently out of the labor force or lacking the right skills to work in an evolving job market. (…) By early 2019, employers were hiring African American and Hispanicworkersatratesequaltoorhigherthan those of white workers. (…) This reduced longstandingunemploymentgaps,narrowingthemto historic lows.”

In addition, according to a recent Federal Reserve Bank bulletin, the prolonged macroeconomic expansion particularly valued the assets held by those at the bottom of the wealth pyramid (Bhutta et al, 2020). Figure 1 shows how the U.S. median family net worth kept climbing from 2013 to 2019, while the mean family net worth exhibited a lower performance. Median measures divide the population in two halves and are lower than means because of the degrees of wealth concentration at the top. A rising median relative to the mean therefore means that the net worth of families at the lower part of the pyramid grew more.

There are those economists who do not recognise the need for macroeconomic stabilisation through proactive central banks and argue that loose monetary policies favor the top of the pyramid. This would be the case if expansionist policies favored profits more than wages, in addition to the extraordinary gains of the financial intermediaries used to implement the policies (Weiss, 2019). Empirical evidence, however, points to the predominance of distributional effects on income from expansionary monetary policies (Colbion et al, 2014). Across business cycles, monetary policy effects do not tend to make much of a net effect on overall inequality (Bernanke, 2015).

If, on the one hand, it does not seem appropriate to say that stabilisation policies by central banks increase inequality, on the other it is increasingly recognised how inequality in income and wealth affects the effectiveness of their policies. As Luiz Awazu Pereira da Silva, Deputy General Manager of the Bank for International Settlements recently noted (BIS, 2021):

“…inequality reduces the effectiveness of monetarypolicytransmission.(…).Highincome concentration can indeed affect the transmission of monetary policy through the different effects easy monetary conditions have across heterogeneoushouseholds.Wealthierhouseholds have a much lower propensity to consume; hence their consumption may be less reactive to monetary stimulus. In turn, poorer households may not benefit from easier credit conditions because they lack collateral or adequate credit scores and are hence unable to borrow.”

The heterogeneity of monetary policy effects on heterogeneous household conditions is illustrated in Figure 2, taken from a speech by Philip R. Lane, member of the Executive Board of the ECB. It displays how the overall effect on consumer spending through various transmission channels of a 100-basis point cut in eurozone interest rates varies according to household wealth. As Lane (2019) explains:

“First, the standard, intertemporal substitution channel is present only for financially-

Figure 2: Effects of a 100-basis point cut in interest rates on consumption in the euro area, depending on household wealth. Notes:Thefigureshowsadecompositionoftheeffectsofa100-basispointcut ininterestratesonconsumption.Thetotalconsistsoffourparts.Thestandardintertemporalsubstitutioneffect(IES),thecash-floweffect,theincomeeffect,andthehousingwealtheffect.Thesizeofthese effectsvariesdependingonhouseholds’wealth.EuroareainthischartreferstoFrance,Germany,Italy,andSpain.Source:Lane(2019).

unconstrainedhouseholdswhichareabletosave. Itmakesuponlyaboutathirdofthetotalimpact onaggregateconsumption.Second,thecash-flow channel is particularly strong for homeowners with limited financial assets, who tend to have large mortgages, often with adjustable rates. Third,spendingissubstantiallystimulatedviathe income channel. This channel is heavily skewed towards lower-income households, who also tend tobenefitdisproportionatelyfromastrongerlabor market. Fourth, the strongest asset price effect occurs through the increases in house prices. This effect turns out to be quite large for highly leveraged homeowners, since their consumption ismoresensitivetohouseprices.”

Consumption spending of the lower-income cohort and the cohort of homeowners with only limited financial assets rises more intensively as a result of a 100-basis point cut in interest rates, moving up by almost 1.0 percent and 1.6 percent respectively, while consumption of the financially unconstrained group increases only by 0.4 percent. The bottom-line is that the effects of monetary policy decisions depend on the profile of income and wealth distributions.

The rise in income and wealth inequality in recent history in many countries has fundamental,

structural reasons, such as technological changes and the impacts of globalisation, in addition to the absence of effective social protection networks and national traits regarding race bias, ethnicity, gender, and social classes in access to education, jobs and sources of income. Tax and public spending policies can do a lot about it. Financial regulators can also help through actions and regulations that democratise access and availability of financial resources at low cost, minimising market concentration.

In principle, it would be up to monetary policy to avoid unemployment and inflation, as in inflation targeting regimes adopted by independent central banks. It should be noted, on the other hand, that recent developments in central bank policies, going beyond controlling shortterm interest rates and avoiding the illiquidity of longer-term assets, tend to blur the borders between monetary and fiscal policies, due to the selectivity over what assets to favor.

In this context, there are even proposals for coordination between fiscal and monetary policies to define fiscal programs to be supported via monetisation by the central bank (Bartsch et alii, 2019). There is also the proposal by Christine Lagarde, president of the European

Central Bank, to grant special treatment to “green bonds” in their asset acquisition programs, making “quantitative easing (QE, in English)” a “quantitative greening”. Like the climate agenda, fiscal programs dealing with inequality may well end up falling into the central bank arena! i

First appeared at the Policy Center for the New South. References and links available online.

Otaviano Canuto, based in Washington, D.C, is a senior fellow at the Policy Center for the New South, a nonresident senior fellow at Brookings Institution, a visiting public policy fellow at ILAS-Columbia, and principal of the Center for Macroeconomics and Development. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund and a former vicepresident at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at University of São Paulo and University of Campinas, Brazil. Otaviano has been a regular columnist for CFI.co for the past eight years.

Follow him on Twitter: @ocanuto

OVID-19 vaccination programs are gaining momentum as production capacity ramps up, and as disorganised and tentative distribution and administration procedures are replaced by more robust systems. A task of this size will surely encounter additional bumps along the road. But it is now reasonable to expect that vaccines will have been made available to most

people in North America by this summer, and to most Europeans by early fall.

As of March 15, Israel has administered more than 100 doses per 100 people, compared to 38 in the United Kingdom, 36 in Chile, 32 in the United States, and 11 in the European Union – and those numbers are rising fast. The rates are relatively lower in Asia and the Pacific, but

these countries already largely contained the virus without mass vaccination programs, and their economies have since experienced a rapid recovery.

Meanwhile, lower-income countries on several continents are falling behind, pointing to the need for a more ambitious international effort to provide them with vaccines. As many have noted

"The sectors that were partly or completely shut down will revive."

recently, in our interconnected world, no one is safe until everyone is safe.

Assuming that vaccination continues to pick up globally, the most likely scenario for the economy is a rapid recovery in the second half of this year and into 2022. We should see a partial but sharp reversal of the K-shaped growth patterns that have emerged in pandemic-hit economies.

Specifically, growth in highflying digital and digitally enabled sectors will subside, but not dramatically, because the forced adoption of their services will be tempered by the resumption of in-person activities. At the same time, the sectors that were partly or completely shut down will revive. Major service sectors like retail, hospitality, entertainment, sports, and travel will reopen for an eager public. Industries such as cruise lines will probably institute their own version of a vaccination certificate, with sales rebounding once customers are confident about safety.

All told, this return to previously closed consumption patterns, turbocharged by pentup demand, will produce a burst of growth in depressed sectors, leading to improved economic performance overall. Unemployment will almost certainly fall, even if permanent changes in living and work patterns reduce employment in some areas. (For example, hybrid work models that lock in pandemic-era remote workplaces may reduce demand for restaurants in city centers.)

To be sure, while massive government programs have buffered the economic shock of the pandemic, hard-hit sectors have nonetheless faced significant losses. Between these transitory reductions on the supply side and the predictable surge in demand, a temporary bout of inflation is possible and perhaps likely. But that is no cause for great concern.

Financial markets are already anticipating these trends. After struggling before the pandemic and being hammered in the early stages of the contraction, many value stocks are staging a comeback. Growth stocks in the digital sector, meanwhile, have experienced a small correction. But this, too, should be temporary. While value stocks will continue to hover above their previous doldrums, digital growth stocks will benefit from the powerful long-term trend toward incremental value creation via intangible assets.

One matter of considerable importance is international travel. Businesses can function on digital platforms for a while, but eventually inperson contact will become essential. Moreover, many economies are heavily dependent on travel and especially tourism, which accounts for 1011% of GDP in Spain and Italy and as much as 18% of GDP in Greece (and probably more if one counts multipliers).

Compared to many other sectors, travel faces additional headwinds, because it is non-local.

The rapid recovery pattern that local service industries can expect once the virus is under control does not strictly apply to travel, especially at the international level. To allow for more travel between countries, both – origin and destination – will need to have made progress in vaccinating their populations and containing the virus. Those who are vaccinated and willing to travel will have to be acceptable to the destination country, perhaps by presenting some kind of certification or vaccine passport.

Complicating matters further, international travel is subject to multi-jurisdictional and somewhat uncoordinated regulation. This, together with imperfect cross-border knowledge about external conditions, will make adjusting to new realities on the ground more difficult.

The current trajectory of vaccination indicates that the global rollout will take considerably longer than the programs in advanced economies. The hope is that once these first movers are done, their leaders will turn their attention to bolstering international cooperation and accelerating vaccine production and deployment in developing countries and some emerging markets.

By that point, the advanced economies will be experiencing a brisk recovery, like China and the other Asian economies that contained the virus early on. The return of high-employment service sectors will fuel a broad-based comeback, producing market shifts in relative value across sectors. Schools will resume full in-person learning, armed with complementary digital tools that may enhance the curriculum and provide resilience for the next shock.

In the second half of 2021 and into 2022, the K-shaped dynamic of the pandemic economy will give way to a multi-speed recovery, with the traditional high-contact sectors taking the lead. The two lingering areas of uncertainty for health and economic outcomes are the pace of the vaccine rollout in the developing world and international cooperation to accelerate the restoration of cross-border travel. But with forward-looking leadership, both issues should be fully manageable. i

Michael Spence, a Nobel laureate in economics, is Professor of Economics Emeritus and a former dean of the Graduate School of Business at Stanford University. He is Senior Fellow at the Hoover Institution, serves on the Academic Committee at Luohan Academy, and co-chairs the Advisory Board of the Asia Global Institute. He was chairman of the independent Commission on Growth and Development, an international body that from 2006-10 analysed opportunities for global economic growth, and is the author of The Next Convergence: The Future of Economic Growth in a Multispeed World.

by Paolo Sironi

Paolo is the global research leader in Banking and Financial Markets at IBM, Institute of Business Value. IBV is the thought leadership centre of IBM.

Financial markets and economic systems are still exposed to periodic collapses, notwithstanding unprecedented institutional search for stability at all costs. Unorthodox central bank intervention and increasing regulatory action do not seem sufficient to save the macro-framework without a change in perspective. Kristalina Georgieva, chairperson of the IMF, reminded in a late 2019 CNN interview that “uncertaintyisthe new normal”. In 2020, the ECON Committee of the European Parliament identified that one of the top three challenges that central banks will be confronted with in the coming years is our lack of understanding of what a new “economic normal” looks like. As they observed in the turnkey paper “Challenges ahead for the ECB: navigating in the dark?”, some characterise this lack of knowledge of the new steady state, and therefore the lack of understanding of what the new equilibrium will be, as fundamental uncertainty. How can central banks decide on their policy response if they do not know where they are heading? It is in the nature of fundamental uncertainty that it is not measurable.

The Global Financial Crisis already revealed the weaknesses of the equilibrium assumptions, and that something was fundamentally broken in the main mechanisms that regulate or attempt to self-regulate financial services. During a public hearing in front of US Congress (after the default of Lehman Brothers) former FED Chairman Alan Greenspan declared that “I made a mistake in presumingthattheself-interestoforganisations, specifically banks, is such that they were best capable of protecting shareholders and equity in the firms ... I discovered a flaw in the model that I perceived is the critical functioning structure that defines how the world works”. Greenspan’s radical candour might exonerate him from responsibility, but accountability cannot be reduced forever by normatively removing the theoretical problem. Instead, a positive theory is required, as identified in the theory and principles of Financial Market Transparency (FMT) published in 2019.

The rude awakening of 2008 forced the financial services industry to face a two-fold reaction, both inconclusive.

On the one hand, behavioural finance gained new academic thrust in the search for a response to the behavioural problem of intermediaries and investors, qualified as irrational. Notwithstanding the relevant insights, the approach has dealt only partially with the central issue that is essentially biological, having focused on the idea that apparent investor’s irrationality could be resumed to a rational state once cognitive biases had been exposed. From a neurological perspective, it would be like attempting to halve human brain in order to suppress its supposedly “emotional” side. Simple, right? Instead, FMT explains why humans tend to underestimate long tail probabilities as a reaction to uncertaintybased survival needs. Uncertainty is typically considered exogenous to investment decision-

Author: Paolo Sironi

making: forgetting the Black Swan facilitates a more “reassuring” risk-taking appraisal. Same happens to most mathematical models, which are largely based on the assumption that available data is sufficient to calibrate the algorithms. Therefore, the FMT provides needed reasoning to keep financial models and algorithms open, instead of closing the reference framework towards another collapse, as the GFC demonstrated.

On the other hand, regulators had to confront with industry failure of self-regulating capacity. Signs of stress had already emerged in the ’90s, with a repetition of crises increasingly more systemic until the epilogue of the sub-prime mortgage bubble. The strengthening of regulatory safeguards generated an intense debate because of skyrocketing costs of compliance. Instead, the deep anchoring in the causality of the crisis to reference theory might not have been fully discussed and understood. The FMT makes that step, recognizing that we are indeed operating

in an environment of fundamental uncertainty, which is the norm in finance. FMT is a positive and practical theory that investigates the evolution of bank business models facing digital disruption on regulated platform economies. It allows to make uncertainty endogenous to investment decision making, thus generate economic antifragility at micro and macro level.

How does it to that? FMT uses an Occams razor to identify scientifically new biological microfoundations for economic action, and discloses the gap between homo sapiens and homo economicus. It provides a new starting point and a more reasonable understanding of financial markets functioning based on elements that make homo sapiens conscious. In doing so, it opens economic theory to redefine the meaning of money, investing, value, and performance by recognising the endogeneity of fundamental uncertainty on which they lay. Our relationship with money is largely emotional because homo sapiens biology faces fundamental uncertainty

in all decision-making processes, over the irreversible time. Consequently, emotion cannot be excluded - also on digital - in a false claim of homo economicus’ rationality that can be true only ex-post.

A theoretical change paired by regulatory action is a needed step to de-anchor industry mindset from efficiently inefficient outputfocused economies, thus allow for sustainable digital transformation towards outcomeoriented economies, which only win on digital. The FMT institutionalist approach is required to avoid the pitfalls of mainstream financial theory and anchor the current process of digital transformation of business models to investors’ biology, from which that of markets can be derived (responding to the adaptive market hypothesis of Professor Andrew Lo of the MIT Sloan School of Management). Therefore, FMT allows to understand how to remunerate shareholders by generating sustainable value for clients in a transparent regime. It is regulatory transparency – as in the European MiFID II – that is fostering deeper and holistic understanding of the biological micro-foundations of financial markets, letting a “more reasonable” and positive theory emerge that guides business model transformation on a disrupted social, economic, and digital landscape.

To generate value for clients and survive, the banking industry already had to face a bifurcation of strategies which led either towards a fast race-to-zero-price competition, or to the complex search for transparencydriven competitive advantages. On one side, some institutions entrenched in a last-ditch defence of prevailing relationship models, still centred on the assumption of rational agents’ behaviour, fully efficient information, and instantaneous price dynamics that are supposed independent. Instead, the latter are often

influenced by herding and self-referential (i.e., opaque) generation of information. Therefore, the advent of full regulatory transparency (e.g., the reduction of opacity in the European MiFID II) and the impact of digital technology applied on distribution channels of products and their marketing to clients - still designed to conform with mainstream reference theory - has only accelerated the compression of business margins. This led to the search for an efficient scaling on low-cost volumes only (e.g., passive investing). On a larger scale, this trend can produce more endogenous instability because intermediaries become more concentrated in increasing complexity. On the other side, opening financial markets to a business vision that leverages on content (i.e., transparent information and communication) allows clients - real drivers of business value - to reclaim centre stage of any relationships based on trusted and “conscious banking” engagement. In fact, regulatory transparency reveals the fundamental uncertainty of the system stability, behind any attempts of arbitrage. Only dynamic management of financial relationships on a decision-making space mediated by time (irreversible element of human behaviour) allows making sense of investment goals and purpose. This is the target of new financial services platforms, cantered on the financial planning of clients’ lifestyles (e.g., Goal Based Investing). Only making platform participants aware of the generated value makes them also willing to pay for access, transforming the economic relationships of international banking asked to operate on platform economies.

The FMT understanding of how regulatory transparency can turn investment relationships into a competitive advantage, based on real value-generation for participants, re-sets the economic foundations of financial services on more sustainable revenue streams. These can

be finally centred on human goals and purpose, improving ecosystem antifragility and benefitting the whole economy, revising the perspective on what the contribution of exponential technologies should be, such as fintech innovation and artificial intelligence, to unlock added value. Embracing transparency and forging a new theory of value for financial services can truly help to create positive economic impact that is aligned with the UN Development Goals.

Democracy is a platform, society is a platform, economies are platforms, and financial services are platforms. On platform economies, transparency is the core governance principle that generates trust. In a world facing growing uncertainty (deep environmental issues, strong digital shifts and concerning geopolitical tensions) transparency only can help humanity to unlock inclusive economic value, and turn change into progress. Ultimately, transparency is the new invisible hand made visible again. i

Paolo is the Global Research Leader in Banking and Financial Markets at IBM, Institute for Business Value. He is senior advisor for selected global accounts, assisting service teams in C-level conversations to leverage IBM portfolio of exponential technologies. He is one of the most respected Fintech voices worldwide and co-hosts the European edition of Breaking Banks podcast. Paolo founded the German startup Capitects, then acquired by IBM, and directed the quantitative risk management department of Banca Intesa Sanpaolo. He is celebrated book author on digital transformation, quantitative finance and economics.

Paolo’s website: thePSironi.com

FMT link to Amazon: amazon.com/FinancialMarket-Transparency-Theory-Principles/ dp/6202086777/ref=asap_bc?ie=UTF8

US President Joe Biden deserves congratulations for committing the United States to rejoin global efforts to combat climate change. But America and the world must respond to the challenge efficiently. Here, Biden’s January 20 executive order establishing an Interagency Working Group on the Social Cost of Greenhouse Gases is an especially important step.

The group’s task is to devise a better estimate for the dollar cost to society (and the planet) of

each ton of carbon dioxide or other greenhouse gases emitted into the atmosphere. The number, referred to as the social cost of carbon (SCC), gives policymakers and government agencies a basis for evaluating the benefits of public projects and regulations designed to curb CO2 emissions – or of any project or regulation that might indirectly affect emissions.

If the working group settles on a low number, many emission-curbing projects and regulations won’t go ahead, because their price tags will

exceed the estimated climate benefits. So, it is vital to get the number right – and by right, we mean higher than it has been in the past.

Broadly speaking, there are two ways to figure out this cost. One method, employed by President Barack Obama’s administration, is to attempt to estimate directly the future damage from emitting an extra unit of carbon.

Unfortunately, implementing this technique well is extraordinarily difficult. The way the Obama

administration did it was deeply flawed, which led to an estimated SCC that was too low, at $50 per ton by 2030 (in 2007 dollars). Even before Donald Trump became president, therefore, the world – and the US in particular – was on track to do too little about climate change.

The problem was the Obama administration’s use of integrated assessment models, which, as the name suggests, integrate economics and environmental sciences to calculate the course of the economy and climate over the

next century or more. Integrating economics and the environment makes eminent sense, but the devil is in the details. These models have shown themselves to be unreliable, generating widely varying ranges of estimates that are highly sensitive to particular assumptions.

For example, a prominent result from one popular version of these models is that we should accept global warming of 3.5 degrees Celsius relative to pre-industrial levels. This is far higher than the 1.5-2°C limit that the international community adopted in the 2015 Paris agreement. In fact, the Intergovernmental Panel on Climate Change has emphasized that the risks associated with global warming of 2°C are much greater than at 1.5°C, so the risks at 3.5°C obviously are far greater.

The 3.5°C temperature increase results from the assumptions made in the model, including the dangerous failure to take seriously the extreme risks that unmanaged climate change poses to our environment, lives, and economy. Moreover, integrated assessment models don’t adequately recognize the potential role of innovation and increasing returns to scale in climate action.

Another problem with the Obama methodology is that it disadvantaged future generations. Much of the benefit of curbing emissions now lies in avoiding the risk of dangerous climate change decades in the future. That means we have to ask how much we care about our children and grandchildren. If the answer is “not a lot,” then we need not do too much. But if we do care about them, that has to be reflected appropriately in our calculations.

Formally, the Obama-era methodology addressed this issue by making assumptions about discounting, showing how much less a dollar will be worth next year (and the year after) compared to today. The Obama administration used an annual discount rate of 3%, implying that to save $1 in 50 years, we would be willing to spend only 22 cents today; to save $1 in 100 years, we would be willing to spend less than five cents.

There is no ethical justification for giving so little weight to future generations’ welfare. But there is not even an economic rationale once we take risk into account.

After all, we pay insurance premiums today to avoid losses tomorrow – in other words, to mitigate risk. We typically pay, say, $1.20 to get back $1 next year on average, because the insurance company delivers the money when we need it – like after a car accident or a house fire. With spending that lowers future risks, the appropriate discount rate is low or can be negative, as in this example, when the potential effects could involve immense destruction.

Spending money today on climate action is like buying an insurance policy, because it reduces the risk of future climate disasters. So, risk translates into a lower discount rate and a higher carbon price.

Now that the Biden administration has committed itself to the international goal of limiting global warming to 1.5-2°C, it should embrace a second, more reliable way to calculate the SCC. It is simply the price at which we will be able to reduce emissions enough to prevent the world from heating up dangerously

This is the price that will encourage the lowcarbon investments and innovations we need, and help to make our cities less congested and polluted. Many other complementary policies will be necessary, including government investments and regulations. As the international carbon-pricing commission that we co-chaired emphasized in its 2017 report, the more successful these policies are in curbing CO2 emissions, the lower the carbon price could be in the future. But the likely SCC would be closer to $100 per ton by 2030 than the $50 per ton estimated by the Obama administration (with a 3% discount rate). An SCC at the upper end of the $50-100 range we suggested in 2017 is entirely appropriate, given that the Paris agreement’s targets have rightly become more ambitious – a 1.5°C limit on warming and netzero emissions by 2050.

These may seem like technical matters best left to the experts. But too many experts have not sufficiently accounted for the scale of climate risks, the well-being of future generations, and the opportunities for climate action given the right incentives.

The Biden administration must put a high enough price on carbon pollution to encourage the scale and urgency of action needed to meet the commitments it has made to Americans and the rest of the world. The future of our planet depends on it. i

Nicholas Stern, a former chief economist of the World Bank (2000-03) and co-chair of the international High-Level Commission on Carbon Prices, is Professor of Economics and Government and Chair of the Grantham Research Institute on Climate Change and the Environment at the London School of Economics.

Joseph E Stiglitz, a Nobel laureate in economics and University Professor at Columbia University, is a former chief economist of the World Bank (1997-2000) and chair of the US President’s Council of Economic Advisers, was lead author of the 1995 IPCC Climate Assessment, and cochaired the international High-Level Commission on Carbon Prices.

By Kruskaia Sierra-Escalante Acting Director/Senior Manager in IFC’s

What can be done to encourage more private investment in developing countries, especially the poorest and most fragile? This question lies at the heart of the development challenge today.

overnments and development institutions alike recognise that the private sector is essential for ending extreme poverty. But getting investors to enter those markets has never been easy, despite continued progress in improving countries’ overall investment environments. The COVID-19 crisis has only increased the real and perceived risks of doing business in developing countries. But it is more important than ever to sustain and grow a vibrant private sector that preserves and creates jobs and delivers essential goods and services.

One approach has emerged that could help make a difference: the blending of concessional funds from development partners with commercial investment funds from private sources. Blended concessional finance is proving to be effective at encouraging private investment in challenging markets, helping create and sustain markets, introduce new technologies, and accelerate economic development.

Blended concessional finance can help buffer contextual risks that would otherwise make it impossible or unaffordable to invest, even when the underlying business proposition is sound. Or to target funding at projects with positive spillovers, for instance first movers in a market that is costly to develop but makes it easier for future investors. Or to nudge investors into overcoming misperceptions or outdated behaviors that have held back, for instance, financing for women entrepreneurs.

IFC has deployed and refined this tool for nearly two decades, with a total of $1.6 billion in concessional funds used to support 266 highimpact projects during 2010-20, mostly in the poorest countries. Growth has been substantial, with commitments reaching nearly $500 million in fiscal year 2020. The results have been promising—donor funds have leveraged $6.1 billion in IFC financing and more than $7.1 billion in investment from private sources.

Blended concessional finance has been successfully deployed across sectors and regions. For example, through IFC’s Small Loan

Gurantee Program, IFC and the IDA Private Sector Window (PSW) are investing in a Togobased mortgage refinancing company to increase access to housing finance and strengthen local capital markets. In Afghanistan, IFC and the IDA PSW are supporting a power-generation project that will help the country meet its vast energy needs. In Malawi, the Global Agriculture and Food Security Program (GAFSP) Private Sector Window and IFC are helping farmers tap into the global demand for macadamia nuts. In Pakistan, the Women Enterpreneurs Finance Initiative (We-Fi) is supporting IFC’s investment in Sarmayacar, a fund that provides early stage funding and training to start-ups in Pakistan –with a focus on high-impact women-led startups. In Uzbekistan, the Canada-IFC Blended Climate Finance Program is helping bring an additional 100 megawatts of solar power to the grid.

With many lower-income markets remaining below investment grade, blended concessional finance is one of the tools that is helping address the 2030 Sustainable Development Goals— particularly those related to employment, growth, and poverty reduction. Blended finance is also

being used to provide rapid liquidity support and helping preserve jobs for firms struggling because of the COVID-19 crisis. Several such programs were launched by development finance institutions in response to the pandemic, especially in the most high-risk markets.

However, the effective use of blended concessional finance requires knowledge and experience that is relatively new to governments and development practitioners, in part because of the complexity of combining public and commercial funds. When wrongly targeted, it can be wasteful at best and distort or destroy markets at worst.

A clear diagnostic and rationale is critical to ensure that the only activities supported are those that deliver significant developmental benefits and would not occur without the use of blended concessional finance. Furthermore, these investments must show a well-mapped path to sustainable commercial financing without subsidies. Good governance is also paramount: there must be transparency regarding the use of public funds, processes that address potential

conflicts of interest, and the separation of operational decisions and decision-makers from those on blended concessional finance.

Together with other Development Finance Institutions (DFIs), IFC has been at the forefront of developing and upholding high standards for blended concessional finance. In 2017 an IFCled working group developed a set of Enhanced Principles for Using Concessional Finance in Private Sector Investment Operations.

Recognising that transparency is essential, IFC informs development partners, its Board and the public about the key parameters of concessional transactions. Public documents disclose the proposed use of blended concessional finance on a transaction-by-transaction basis, the

instruments to be employed, the estimated amount of financing, the rationale for deploying concessional finance, the expected development impact, and the estimated subsidy as a percentage of total project costs (for projects mandated after October 1, 2019). A revamped IFC project website provides easy access to this information for all IFC blended finance transactions. The website shares this information for all IFC blended concessional finance transactions (please see below to learn how to access these projects).

To avoid a race to the bottom, where concessional resources are being used not to de-risk highly developmental projects that wouldn’t otherwise happen, but solely to benefit the investor, we need to continue to strive for improved

governance, coordination, transparency, and the use of minimum concessionality.

IFC recently released a report as a practitioner’s guide that summarizes its experience in blended concessional finance. It highlights best practices for articulating the rationale for using blended concessional finance; examines approaches for robust transparency, access, and governance; explains how to extend the reach of private sector projects into lower-income countries; and discusses recent financing innovations such as returnable capital contributions. The report, Using Blended Concessional Finance to Invest in Challenging Markets—Economic Considerations, Transparency, Governance, and Lessons of Experience, covers these topics indepth and provides a practical primer about the key elements of this tool. i

IFC’s Blended Finance Unit blends funds from donor partners alongside IFC’s own in order to catalyze investments that would not otherwise happen because of market barriers. These funds can be used to undertake high-risk, high-reward projects that have strong potential to improve lives and reduce poverty. From fiscal year 2010 to 2020, IFC has deployed $1.6 billion of concessional donor funds to support 266 highimpact projects in over 50 countries, leveraging $5.8 billion in IFC financing and more than $6.8 billion from third parties.

Kruskaia Sierra-Escalante is an Acting Director/ Senior Manager in IFC’s Blended Finance Department and in charge of managing a pool of contributor funds of over $5 billion focused on accelerating IFC’s engagement in the most developmentally impactful areas: IDA and FCS countries, climate, infrastructure, gender, SME and agriculture. Since 2013, Kruskaia has managed IFC’s blended finance facilities for climate with more than $1 billion in bilateral and multilateral donor-contributions for climatesmart co-investments in IFC projects. During this period, IFC’s blended climate finance portfolio doubled in volume and helped IFC enter riskier markets. She also manages the IDA Private Sector Window, created in 2017 to support private sector development, growth, and job creation in some of the world’s least developed countries. Prior to her current position, she headed the Blended Finance unit, a governance unit performing credit review, quality assurance and knowledgesharing functions and served as IFC’s Global Lead Counsel for Climate and Blended Finance at IFC.

Kruskaia holds a master’s degree in Public Affairs, with a concentration in Economics and Public Policy, from Princeton University’s Woodrow Wilson School, and a J.D. from the New York University School of Law. Before joining IFC in 2003, Kruskaia was at Chadbourne & Parke, LLP, working primarily in project finance in the power sector.

By Paul Horrocks Head of Private Finance for Sustainable Development Unit at

COVID-19 has had a dramatic impact on developing countries and undone years of progress on sustainable development, pushing back into poverty large sections of the population. World Bank analysis projects growth in SubSaharan Africa to decline to -3.3% in 2020, giving the region the first recession in 25 years. In this respect, COVID-19 is and will have a negative influence on economies in many developing countries and further widen inequality, pushing back as many as 150 Million into extreme poverty by 20211.

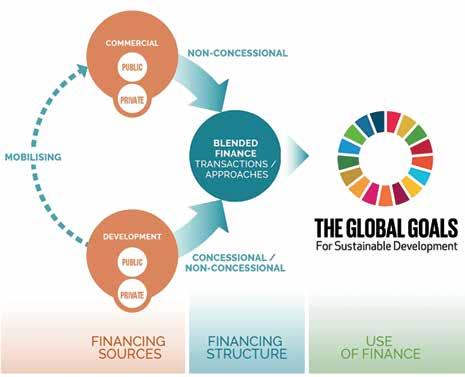

As developing countries are already facing considerable fiscal pressures and in some instances debt burdens, mobilising the private sector in support of the SDGs will become increasingly important. Blended Finance is recognised as one of the tools available to development actors that can be used to bring the much needed private sector support to address the SDG financing gap. The OECD Development Assistance Committee (DAC) defines blended finance as the strategic use of development finance (concessional and non-concessional) for the mobilisation of additional (commercial) finance towards sustainable development in developingcountries.

Filling the financing gap and directing the private sector to key sectors that can stimulate economic recovery, or attracting commercial finance that would not have otherwise invested in development are the key roles of blended finance. Blended finance should not be seen as a substitute of Official Development Assistance (ODA). ODA will always be primordial, particular in social sectors and least developed countries (LDCs). Currently ODA is likely to remain flat, yet the SDG gap due to COVID-19 will grow even bigger.

Directing and de-risking projects and markets is also an important objective of blended finance, particularly in sectors such as climate. Development actors, due to the concessional and non-concessional nature of blended finance, are willing to take risks and expose themselves to greater financial, political, foreign exchange and technological risks. However, whenever blended finance is being used, the fundamental goal is to work alongside the private sector partner in a program or transaction.

Blended finance has gained considerable traction since the launch of the Addis Abba Action Agenda and the SDGs. That is not to say that the instruments that underpin blended finance have not been used before; e.g. guarantees are a stable instrument of development actors. The difference now is that blended finance has become more mainstream and role of the private sector more evident. On the demand side, the development gaps are significant, while on the supply side substantial amounts of capital are invested in low or negative returning assets, yet could be funding projects and portfolios that contribute to the SDGs.

For blended finance to be effective the institutional architecture of the development landscape needs to be fully mobilised, otherwise the necessary scale will be out of reach. The OECD DAC blended finance definition has a wide approach, which financially means concessional and non-concessional funds mobilising the private sector. The goal being to ensure that institutions act as mobilisers of the private sector while not only using blended concessional finance but also in certain instances non-concessional finance but always the institutional capacity. Institutions bring not only finance to a transaction but credibility and

assurances, through the undertaking of due diligence and development skills. The private sector when going in to high-risk transactions focus on the precedent and DFIs and MDBs have a lot of the necessary experience. This approach is captured in the OECD DAC Blended Finance Principles, which were agreed by the High Level Meeting of the DAC in 2017. The Principles have subsequently been referenced by several G7 and G20 Presidencies thereby forming a part of the international development architecture2

At the Blended Finance and Impact week, the release of the OECD DAC Blended Finance Guidance provided further insights on how to mobilise the private sector using all the institutional capacity possible, particularly MDBs and DFIs. Progress has been achieved, with Blended Finance increasing private sector mobilisation by 28% to USD 48.4 Billion in 2018. More still needs to be done and all the capacities of the development system should be mobilised. As highlighted in the Blended Finance Guidance, mobilisation is not only financial: the DFIs’ institutional role is critical given their understanding of the market, involvement in projects and due diligence capabilities. This institutional capacity is a key catalytic factor in mobilising private actors.

As new actors enter the blended finance space, the OECD DAC Blended Finance Guidance provides a tool for donor governments, development cooperation agencies, philanthropies and other

stakeholders to design and implement effective and transparent blended finance programmes. The expectation is that as new DFIs are established or donors deepen their capabilities to work with the private sector, the Guidance will be the essential roadmap. Each of the five Principles and sub principles and their respective detailed guidance notes provide insights and knowledge that has been co-created over several years with development actors – from both developed and partner countries –, CSOs, the private sector and donors, amongst others.

Policy work on mobilising the private sector has been considerable and the mobilisation figures are starting to bear proof of this collective effort. However, blended finance is yet to show its full potential in terms of development impact. Work still remains to be done on assessing the outcomes of the institutions, instruments, and activities.

SDGs. The Standards were developed as part of a community of practice that counts over 300 members from government’s agencies, DFIs, private asset managers and CSOs. Following approval by the DAC, the Standards will be made freely available for subscription, with Detailed Guidance as a support to implementation.

A lot of work still needs to be done but the policy pieces are coming together thereby allowing development actors and the private sector to respond to the SGD challenges according to the direction given but COVID-19 means we now need to redouble our efforts. i

1https://www.worldbank.org/en/news/press-release/2020/10/07/ covid-19-to-add-as-many-as-150-million-extreme-poor-by-2021