FOLLOWING DOESN’T GET YOU THERE FIRST. ERLING HAALAND WEARS THE NAVITIMER.

FOLLOWING DOESN’T GET YOU THERE FIRST. ERLING HAALAND WEARS THE NAVITIMER.

The Limited Edition Bremont Longitude is a groundbreaking timepiece that not only looks back at our country’s legacy but also forward to an exciting future of British watchmaking. The watch’s case back incorporates brass from the original “Flamsteed Line,” in Greenwich, the very spot where the first Astronomer Royal made his celestial observations in pursuit of an aid to navigation.

It has long been the goal of Bremont to bring watch manufacturing back to Britain. The Longitude represents a milestone in that journey, a homecoming of sorts, and proof that, to get where you’re going, you need to know where you came from.

China is the world's second-largest economy, and for decades it has been a driver of global prosperity.

That contribution to the world economy, outshone only by the US, has brought millions out of poverty, changing the dynamics of worldwide trade and production. In recent years, though, China's once apparently unstoppable economic engine has begun to stutter.

And that’s prompting concerns about long-term ramifications. In Early April 2024, Fitch Ratings downgraded the country's outlook to negative, after debt levels hit a worrying $442bn.

The real estate crisis in China is a big one. For years, the sector has been a consistent driver of expansion, creating wealth and increased urbanisation. But a government crackdown on excessive borrowing by developers, and a shift in demographics, have caused a significant slowdown.

The most obvious example of this problem is the case of Evergrande, one of China's biggest property developers. It has been taken to the verge of bankruptcy by mountainous debt — and that has sent shockwaves through the industry. Developers are faltering, incomplete housing projects have stagnated — and homebuyers are losing faith. Property sales, and prices, are falling.

The consequences extend far beyond the property market. Local governments have come to rely on land sales for revenue, and construction is directly related to a range of sectors. The effects are being felt across the country, with an overall slowdown — and diminishing confidence in the property sector.

Low consumer spending is another thorn in China’s economic flank. While there is still a sizable middle class, rising living costs and concern about job security are limiting household budgets. The enduring consequences of the country's draconian “zero-Covid” policies have dented consumer morale, with uncertainty discouraging spending and long-term commitment.

This slowdown in spending impacts businesses — across industries, from retail to hospitality. The lack of demand has exacerbated the economic downturn — and will hamper jobs creation. The negative feedback loop between low spending and economic stagnation is further stifling growth.

China is facing a major unemployment issue, especially for young people. The jobless rate for those aged 16-24 has hovered around 20 percent in recent months, way above the normal national average. This is of concern — for its economic impact, and its effect on society.

A goodly portion of China's young, urban workforce has historically relied on the gig economy and/or the tech sector. Recent regulatory crackdowns on internet companies, and general uncertainty about employment

in the digital sphere, have made the future seem especially bleak for recent graduates.

A generation of unemployed, or underemployed, youth is a decisive factor in the stifling of long-term economic growth. A lack of possibilities can lead to disillusion — and even social unrest. This is an emerging challenge to the Chinese government's traditional tactics for social control.

These economic woes are not limited to Chinese borders and boundaries. The nation is a major trading partner for many countries, and a critical link in the global supply network.

With its massive internal market, China is also a major consumer of goods and services. A deteriorating Chinese economy hits import demand, with knock-on effects felt around the world. This is of particular concern for nations relying on exports.

China's manufacturing capabilities are inextricably linked to global supply systems. Problems in manufacturing, whether induced by a general slowdown or the lingering effects of pandemic lockdowns, can result in shortages and delays — whose effects could be almost unlimited. This increases inflationary pressures and makes it difficult for domestic firms to meet client demand.

All this could cause volatility in global financial markets. Investors may move to safer havens, boosting the US dollar and putting added pressure on developing currencies. This raises additional challenges for nations struggling to manage debt or control import costs.

China's economic slowdown may reduce demand for commodities such as iron ore, copper, and oil. This results in decreased price points for these resources, which will in turn hit exporting countries such as Brazil and Australia, as well as some African nations.

The Chinese government is aware of these issues. To boost the property sector, regulators have relaxed some lending limits for developers, and encouraged banks to provide additional financing. To bolster consumer spending, the government has implemented targeted tax cuts to rebuild confidence following the pandemic lockdowns.

The efficacy of these interventions remains to be seen. The property market may be too top-heavy and indebted for any sort of rapid revival. Consumers are likely to remain cautious as long as there is uncertainty about employment. Finding solutions to fundamental structural issues is time-consuming, intensive, and could involve some uncomfortable adjustments.

China's economic state illustrates the fine balance between supporting growth and managing risk. It also highlights the country's bumpy transition from an investment-driven economy to one orientated towards consumption.

Elon Musk's acquisition of Twitter, now X, has resulted in some major changes. While some (such as Jason Ogilvy, whose letter appeared in your Winter edition) may criticise these disruptions, it is important to evaluate the possible benefits.

Musk wants to make X an "everything app" with more features than most social media offerings. This might provide users with a means to communicate, make payments, and access “approved” news stories. New audio/video call functions indicate evolution.

Musk emphasises free expression. While there are concerns about potential exploitation, this may result in a platform for varied standpoints. X's recent candour regarding the dismantling of electoral interference teams might be interpreted as a step towards more authentic public discourse, in which users make informed decisions based on unfiltered information.

Musk's emphasis on innovation could result in a more robust platform. Upgrading infrastructure and optimising processes, if initially chaotic, may result in a more dependable platform.

Of course, obstacles persist. Addressing misinformation and online harassment necessitate a balanced approach.

Let’s give X an opportunity to prove itself. Time will tell whether Musk’s vision is a valid one. GRACE WITHERSPOON (Hastings, New Zealand)

The UK Post Office scandal is a disgrace to British justice, and I appreciate you covering it in an earlier issue of CFI.co.

Sub-postmasters were unfairly accused, financially ruined, and even imprisoned because of flaws in the Horizon accounting system – flaws which the Post Office was aware of, but concealed.

Lives were ruined, and families split apart. Trust in the institution has been lost. Although recent developments have brought some justice, apologies and compensation schemes will not undo the damage.

Cosmetic reform and fresh leadership are also insufficient. The deep-seated cultural issues that led to this disaster must be addressed from the heart of the organisation.

I propose a complete rebranding for the Post Office. A new name, a new identity, and a fresh commitment to transparency and responsibility. This is about more than public image; it’s about expressing a genuine break with the past and a commitment to building a trustworthy business.

This could be hazardous, and will most likely be opposed. But if the Post Office is serious about restoring its integrity, it must confront the extent of its malfeasance. Only after such a significant makeover can we again begin to believe that the Post Office represents something worthy and exceptional.

ALAN MONTCLIFFE (Newcastle, UK)

The fear that AI will result in widespread job displacement is understandable, but misguided.

“While it is likely to change certain organisations, history demonstrates that technological innovation usually creates more opportunities than it destroys.

As the industrial revolution shifted employment from farms to factories, AI will generate new professions. Developers, data ethicists, and human-AI interface designers are all emerging professions, and there will be more.

AI thrives on repetitive, data-driven tasks, freeing humans to focus on creativity, problem-solving, and empathy – things the bots can’t do. AI will boost efficiency across industries. This does not mean fewer jobs, but more output – and more potential for economic growth.

In the most effective applications, AI will complement human capabilities. Doctors use it for diagnoses, and designers use it for pattern generation. These examples show the potential of human-machine collaboration.

Of course, investments in education and reskilling programmes are needed. But totally disregarding AI means missing out on its promise for a better future. AI can, and should, be embraced as a tool for innovation, resulting in a more competent, prosperous, and joyful workplace.

SUSAN BELLO (Lagos, Nigeria)

“The World Economic Forum’s annual Davos conference was once regarded as an important event for global leaders and thinkers. Now, its relevance is questionable. There is a growing sense of elitism in the world, and the WEF's emphasis on high-level businesspeople and elite officials heightens that sense of distance. This engenders mistrust at a time when societal divisions are stark enough.

The WEF is frequently chastised for making lofty pronouncements without taking follow-up action. High-minded conversations about inequality and climate change rarely result in actual legislation with real-world impact.

The proliferation of alternative venues, and the ease of global communication, have devalued the WEF's exclusive nature. Issues of global significance are now debated on a variety of fora, by people from all social strata.

The WEF may still have a role to play, but only if it becomes a true force for advancing vital issues in an increasingly complex world.

ADRIAN BROMLEY (Pretoria, South Africa)

Chairman

Lord JD Waverley

Editorial Team

Sarah Worthington

George Kingsley

Tony Lennox

Brendan Filipovski

John Marinus

Ellen Langford

Helen Lynn Stone

Naomi Snelling

Columnists

Otaviano Canuto

Lord Waverley

Production Director

Jackie Chapman

Distribution Manager

William Adam

Subscriptions

Maggie Arts

Commercial Director

John Mann

Director, Operations

Marten Mark

Publisher

Anthony Michael

UNCDF

Strategic Reimagining Around Blended Finance (14 – 15)

Paolo is the global research leader in Banking and Financial Markets at IBM, Institute of Business Value. IBV is the thought leadership centre of IBM.

IBM

AI — A Catalyst for Economic Transformation (18 – 19)

Capital Finance International

Meridien House

69 - 71 Clarendon Road

Watford WD17 1DS

United Kingdom

T: +44 203 137 3679

F: +44 203 137 5872

E: info@cfi.co

W: www.cfi.co

Coverimage:IanMunro/TheWestAustralian

Cover Story Green Awakening (24 – 29)

Accenture

Embracing Cloud Based Operating Models (94 – 95)

EY Argentina

Congress to ‘Incentivise FDI’ (100 – 101)

Kellogg Insight New Tech - Who Wins & Who Loses? (114 – 115)

Transforming Food Systems (122)

UNCDF Pradeep Kurukulasuriya Otaviano Canuto

Paolo Sironi IBM Nouriel Roubini

Mohamed A El-Erian Rio Tinto Jakob Stausholm

Anthony Michael Anya Schiffrin Dylan W Groves

Joseph

Stiglitz

FLI Group

Pedro Coelho Square Asset Management

Alessandro Hatami Pacemakers Professor Fabrizio Ferraro

EY

Aloha Browser

Sergio Caveggia Andrew Frost Moroz

Vector Casa de Bolsa Edgardo Cantú Kellogg Insight

Susie Allen Leonid Kogan Dimitris Papanikolaou

Lawrence Schmidt Bryan Seegmiller

Strategic Focus will center on deploying UNCDF’s capability to strengthen UN’s Development Offer by crowding in private sector finance to scale development impact in countries at greatest risk of being left behind.

The United Nations Capital Development Fund (UNCDF)—the UN’s catalytic finance entity for developing countries—announced last week that Pradeep Kurukulasuriya (Sri Lanka) will commence his tenure as Executive Secretary for the organisation.

In assuming the position, Kurukulasuriya as Executive Secretary will focus on strengthening the organisation’s unique capability to crowdin finance to scale development impact where the needs are greatest—a capability rooted in UNCDF’s unique investment mandate to blend and deploy grants, loans and guarantees as well as related advisory services, especially in Least Developed Countries (LDCs).

“The UN Capital Development Fund is an integral part of the UN Development System’s offer to developing countries. It brings a unique capacity to operate in high-risk market conditions, without the constraints of credit ratings, and where it is most needed to address last mile challenges in deploying finance,” said UNDP Administrator Achim Steiner, who also serves as Managing Director for UNCDF. “It is a perfect instrument to break through a glass ceiling that exists in financial markets and in financial engineering. UNDP is proud to welcome Kurukulasuriya in this new capacity to strengthen UNCDF’s capabilities to crowd in private capital for where it matters most.”

“It is time to get to work immediately. Time is fast running out to meet the Sustainable Development targets set for 2030. Developing countries, especially the least developed ones, are furthest behind, resulting in an inequitable context that is untenable for long-term prosperity. UNCDF, with its unique mandate of deploying blended finance solutions, must double down on its efforts to support the rest of the UN to collectively advance on the SDG agenda,” said Kurukulasuriya. “I am excited, along with my colleagues at UNCDF, to put our collective shoulder to the wheel and help play our part in propelling the UN-led effort forward”.

Kurukulasuriya’s strategic focus as Executive Secretary will involve overseeing a business

model for UNCDF that maximises the value of the organisation’s investment mandate to deploy grants, loans and guarantees in the form of blended finance. This unique investment mandate in the UN System dates to the inception of UNCDF by the UN General Assembly in 1966, which stated that “The purpose of the Capital Development Fund shall be to assist developing countries in the development of their economies by supplementing existing sources of capital assistance by means of grants and loans(.)” Another key priority will be to strengthen UNCDF’s internal risk management, oversight practices and operational business model so that the organisation can play a scaled up role in LDCs.

By optimising UNCDF’s investment mandate to crowd-in development finance for developping countries and LDCs, Kurukulasuriya will look to position UNCDF as an accelerating partner in service to governments to achieve their domestic development agenda, donors to achieve their international development priorities, and UN agencies as well as UN Country Teams to accelerate achievement of the Global Goals (or the Sustainable Development Goals) and the Doha Programme of Action for Least Developed Countries.

As part of the effort to support UN Partner Agencies, UNCDF will explore ways to enhance

its long-standing partnership with UNDP and other UN Organisations, as per UN General Assembly directions. Building on his 18year career at UNDP—where he spearheaded partnerships with other UN organisations such as WHO, UNEP, and FAO; with multi-lateral development banks like Asian Development Bank, Asian Infrastructure and Investment Bank, African Development Bank, European Investment Bank, European Bank for Reconstruction and Development; and with asset management firms such as Pegasus— Kurukulasuriya will identify opportunities that combine the UN’s global reach and development prowess with UNCDF’s unique ability to deploy financial instruments to mobilise and crowdin finance. This will include exploring ways to strengthen support to UNDP country offices and other UN organisations, as well as with the private sector, development finance institutions and multi-lateral development banks.

Overall, Kurukulasuriya will continue UNCDF’s commitment and practice to work in countries traditionally overlooked in the capital markets; namely, to provide UNCDF’s investment tools and capabilities primarily for the 45 least developed countries. In the process, UNCDF will commit to working with partner governments as co-investors in financing national development

plans while accelerating SDG achievement to ensure that we leave no one behind.

“It is only the power of the collective— governments, private sector, NGOs, the UN and most importantly, all of us—that will help address the challenges at hand in a materially impactful manner,” said Kurukulasuriya. “I am excited about the prospects of continuing to work alongside my colleagues in UNDP, UNEP, FAO and UNICEF among many others who I have worked with for a number of years on nature, climate and energy related issues. Additionally, I am eager to now broaden such support to other development priorities, such as infrastructure, water and sanitation, education and the like, by utilising the financial instruments of UNCDF, a unique capability in the entire UN system to support development.”

Kurukulasuriya is a Sri Lankan economist with a Ph.D. from Yale University. He previously held the position of UNDP Executive Coordinator for Environmental Finance where he oversaw a US$ 5 billion nature, climate and energy finance portfolio across 140 countries. In this role, Kurukulasuriya provided strategic leadership of partnerships with multilateral environment and climate funds as well as with the private sector, development banks, and private

equity funds related to climate finance. His experience included overseeing blended finance programming, results-based management and compliance with financial rules and regulations.

From 2019-2023, Kurukulasuriya led UNDP’s Nature, Climate, and Energy Practice, leading over 300+ personnel across headquarters and five regional hubs. Previously, he led the development and oversight of UNDP’s Climate Change Adaptation portfolio. Additionally, as a senior technical lead in the Global Environmental Finance team from 2010-2018, he played a key role in trebling UNDP's resource mobilisation efforts for nature, climate and energy. Prior to joining UNDP in 2006, he worked with the World Bank and an NGO in Sri Lanka. i

The United Nations Capital Development Fund (UNCDF) is the United Nations' flagship catalytic financing entity for the world’s 45 least developed countries (LDCs). With its unique capital mandate and focus on the LDCs, UNCDF works to invest and catalyse capital to support these countries in achieving the sustainable growth and inclusiveness envisioned by the 2030 Agenda for Sustainable Development and the Doha Programme of Action for the least developed countries, 2022–2031.

Artificial intelligence (AI) is the name given to the broad spectrum of technologies by which machines can perceive, interpret, learn, and act by imitating human cognitive abilities.

Automation was created to better fulfill repetitive tasks, increasing productivity. AI, with its impressive rate of evolution, can produce new content: texts, images, new computational codes, possibly medical diagnoses, interpretations of data, and so on. It is no coincidence that an AI-based technological revolution is predicted.

I like the way Jesús Fernández-Villaverde of the University of Pennsylvania illustrates the differences between automation and AI:

“Artificial intelligence is not designing a robot that will put a screw in a car on a production line when the time comes, but designing a robot that knows how to interpret that the car arrived crooked to the left or that the screw is broken, and that will be able to react sensibly tothisunexpectedsituation.”

AI will have consequences in areas beyond the economy, including national security, politics, and culture. In the economy, it promises to reshape many professional functions, as well as the division of labor, and the relationship between workers and physical capital. While the impact of automation has been on repetitive work, the impact of AI tends to be on tasks performed by skilled labor.

What effect will AI have on productivity and economic growth, and on social inclusion and income distribution? The impact on work processes and the labor market will be a key element in answering these questions.

It can be anticipated that, in segments of the work process where human supervision of AI will continue to be necessary, the trend will be a substantial increase in productivity and demand for work. In other segments, AI could lead to significant displacements or the simple elimination of jobs. As Daron Acemoglu and Simon Johnson put it in an article in the December edition of the International Monetary Fund’s Finance and Development magazine, “to support shared prosperity, AI needs to complementworkers,notreplacethem”

The systematic increase in aggregate productivity could, in principle, reinforce economic growth and, thus, underpin increases in aggregate demand, generating employment

Figure 1. Source:InternationallabourOrganization(ILO)andIMFstaffcalculations.

Note:Shareofemploymentwithineachcountrygroupiscalculatedastheworking-agepopulation-weightedaverage.

opportunities that would compensate for the destruction of jobs. This evolution could also lead to the emergence of new sectors and professional functions, while others disappear, in a dynamic that will go beyond mere intersectoral reallocation.

In addition to the effects on employment and wage-income distribution, income distribution will also depend on the impact of AI on capital income. This will tend to grow in activities that create and leverage AI technologies or have stakes in AI-driven industries. Depending on the implications in terms of the ‘market power’ of firms, there will be effects on the distributions of capital income and between capital and labor.

On January 14, the IMF released the results of exploratory research into the impacts of AI on the future of work . An estimated 60% of

jobs in advanced economies will be affected, with the percentage falling to 40% in emerging economies, and 26% in low-income countries, because of differences in their current employment structures (Figure 1).

The report estimated that half of the jobs impacted will be affected negatively, while the other half may see increases in productivity. The lesser impact on emerging and developing countries will tend to lead to fewer benefits in terms of increased productivity.

The report highlighted how a country’s level of preparedness for AI will be relevant when it comes to maximising the benefits and dealing with the risks of the technology’s negative effects. The report included an index to measure the state of preparation of countries, taking into account digital infrastructure, economic integration and innovation, levels of

Figure 2. Note: The figure shows the contribution of digital infrastructure,innovationandintegration,humancapitalandpolicies, and regulation and ethics to Al preparedness by country. The length of the bar indicates Al preparedness. Highlighted bars denote the country group average. AEs = advanced economies; EMs=emergingmarketeconomies;LICs=low-incomecountries. CountrynamesuseInternationalOrganizationforStandardisation (ISO)countrycodes.

human capital and labor market policies, and regulation and ethics.

In a set of 30 countries evaluated in detail, Singapore, the United States, and Germany appear in the top positions, while middleincome countries appear alongside low-income countries at the bottom (Figure 2). Increasing each country’s level of AI preparedness should clearly be considered a policy priority. i

OriginallypublishedatPolicyCenterfortheNew South.

Otaviano Canuto, based in Washington, D.C, is a former vice president and a former executive director at the World Bank, a former executive director at the International Monetary Fund, and a former vice president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at the University of São Paulo and the University of Campinas, Brazil. Currently, he is a senior fellow at the Policy Center for the New South, a professorial lecturer of international affairs at the Elliott School of International Affairs - George Washington University, a nonresident senior fellow at Brookings Institution, a professor affiliate at UM6P, and principal at Center for Macroeconomics and Development. Otaviano has been a regular columnist for CFI.co for the past 12 years. X: @ocanuto

Paolo is the global research leader in Banking and Financial Markets at IBM, Institute of Business Value. IBV is thought leadership centre of IBM.

Artificial Intelligence (AI) stands as a beacon of promise on the horizon of technological advancement, poised to reshape the landscape of human endeavor in profound ways.

The recent months witnessed an unparalleled surge in enthusiasm for AI, buoyed by remarkable advancements in generative AI—a probabilistic technology capable of producing human-like content based on vast troves of training data. Stocks tethered to AI soared to the pinnacle of market performance, indicative of pervasive investor confidence in AI's transformative potential. Meanwhile, terms like "authentic" and "hallucinate" reigned supreme in linguistic lexicons, epitomising society's infatuation with AI-driven innovation and the risks involved.

The potential applications of AI are as vast as they are varied. Yet, a key question is if AI can drive substantial economic growth and enhance productivity on a global scale, reversing a trend of declining productivity rates that characterised the new century (see figure 1). Barclays Research and IBM Institute for Business Value explored how recent breakthroughs in AI could provide a boost

to labour productivity, similar to past periods of revolutionary technology change. While the debate is on among economists, Barclays’ and IBM’s research shed some light into the future.

Throughout the annals of history, transformative technologies have already proven to fuel productivity rates, measured as output per worker like Gross Domestic Product (GDP). The steam engine, electricity, and personal computers have indeed heralded epochs of unprecedented economic expansion. These innovations not only bestowed wealth upon their creators but also cascaded benefits across generations. Now, in the age of AI, could we witness a similar economic renaissance?

Examining the moving average of GDP growth reveals that the steam engine, invented in 1765, took almost 100 years to impact the productivity rate of nations. Also, the light bulb took decades from its 1879 invention to reach widespread levels of adoption and impact labor productivity. While

the time gap seems to shorten, a similar pattern has been observed after the 1971 invention of the personal computer: the productivity surge occurred only in the 1990s, three decades after. This contrasts with the decline observed as the new century opened, leading to question why rates declined notwithstanding a continuous advancement in computer technology – especially considering the invention of smartphones.

Provocatively, we can ask if smartphones truly enhanced our intelligence, thus our productivity. Unrestrained access to social media and other entertainment apps may have made large impressions on the consumer, but simply might not have generated the kind of productivity improvement associated with, say, the automobile, intercontinental flight, or air conditioning. It is also possible that what we are seeing measurement errors: that the output produced in a digital world is not adequately captured by traditional GDP statistics. Many digital products have zero marginal costs and

are often provided free of charge. Therefore, they might not show up as an increase in output – even though they provide some value to consumers.

In this regard, AI is not a new technology, although public awareness surged very recently due to public accessibility of generative AI. The history of AI can be traced back to the 1950s, when Alan Turing introduced a test to measure “computer intelligence”. And that is when companies like IBM started investing in AI development.

This indicates that AI is not a “new invention” waiting for mass market adoption, but a maturating invention that is being currently adopted massmarket.

AI increased accessibility and versatility, especially in augmenting human capabilities with Large Language Models and their derivatives, seems to indicate that the time gap between invention and impact is now closing.

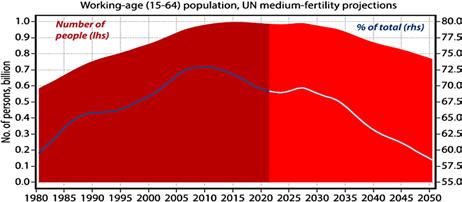

After the 1990s, the world economies suffered the Global Financial Crisis, while the euro-debt crisis swept across Europe. This might have reduced productivity rates. More importantly and on a structural level, an aging workforce became a common challenge in major advanced economies, where a declining workforce contributes to lower productivity and GDP. At the same time, China and other emerging economies started facing structural challenges such as premature de-industrialisation. Rapid automation of Chinese manufacturing power may hinder productivity growth by contracting the workforce. Consequently, to understand dynamics of future productivity rates we must also determine how AI intersects with the longterm challenges of aging workforce and deindustrialisation.

For instance, can AI help augment the workforce pool and mitigate premature industrialisation by shifting towards AI-aided services? According to IBM analysis (see figure

2), there is high consensus among worldwide CEOs that the future of AI is augmentation more than automation, or a balance blend of the two (see figure 2).

However, there are also concerns about the potential negative impact of AI on productivity, such as the automation of simple services leading to decreased cost competitiveness and economic viability for smaller emerging economies which just started their industrialisation journey. Addressing these concerns, and harnessing all potential, requires transparent regulations and equitable distribution of AI resources, particularly considering its concentrated ownership among a few players. And it’s nevertheless essential to recognise that AI may not be necessary for all tasks, highlighting the need for ethical considerations and workforce upskilling to mitigate potential friction.

Amidst these challenges and opportunities, a resounding sense of optimism pervades discussions surrounding AI's transformative potential. By embracing AI's potential with prudence, transparency, and cooperation, we stand to traverse uncharted territories of innovation and affluence. i

To learn more, access the recent Barclays Research’s and IBM Institute for Business Value’s paper AI Revolution: Productivity Boom andBeyond ib.barclays/our-insights/AI-productivity-boom.html

Paolo Sironi is the global research leader in banking at IBM, the Institute for Business Value, and he is author of business literature. His latest Banks and Fintech on Platform Economies has been Amazon bestseller in banking books worldwide. relinks.me/1119756979

Nouriel Roubini:

At this year’s China Development Forum (the highest-level annual meeting between senior Chinese policymakers and top CEOs, current and former policymakers, and academics like me), the discussion focused squarely on the risk of China falling into the dreaded “middle-income trap.” After all, few emerging economies have successfully joined the ranks of high-income countries.

Will China be an exception to this pattern?

Following 30-plus years in which China achieved annual growth rates close to 10%, its economy has slowed sharply this decade. Even last year, with the strong rebound from the “zero-COVID” era, officially measured growth was only 5.2%. Worse, the International Monetary Fund estimates that China’s growth will fall to 3.4% per year by 2028, and, given its current policies, many analysts expect its

potential growth rate to be only 3% by the end of this decade. If that happens, China will indeed find itself in the middle-income trap.

Moreover, China’s problems are structural, rather than cyclical. Among other factors, its slowdown is due to rapid aging, a busted realestate bubble, a massive overhang of private and public debt (now close to 300% of GDP), and a shift from market-oriented reforms

back toward state capitalism. Credit-fueled investment has grown excessive as state-owned banks lend to state-owned enterprises (SOEs) and local governments. At the same time, the government has been bashing the tech sector and other private enterprises, eroding business confidence and private investment.

In this new period of deglobalisation and protectionism, China appears to have hit

the limits to export-led growth. The West’s geopolitically motivated technology sanctions are constraining the growth of its high-tech sectors and reducing inflows of foreign direct investment (FDI); and the combination of a high domestic household savings rate and low consumption rates (owing to weak social insurance and the low share of household income) is further hampering growth.

The old Chinese growth model is broken. Initially, China’s low (and thus internationally competitive) wages meant it could rely on light manufacturing and exports, before pursuing massive investments in infrastructure and real estate. Now, Chinese authorities are advocating high-quality growth based on technologically advanced manufacturing and exports (electric vehicles, solar panels, and other green- and high-tech products) led by financial incentives to already-bloated SOEs. But without a matching increase in domestic demand – especially private consumption –over-investment in these sectors will lead to over-capacity and dumping in global markets.

China’s excess supply (relative to domestic demand) is already producing deflationary pressures, heightening the risk of secular stagnation. When China was smaller and poorer, a sharp increase in its exports was manageable in global markets. But now that it is the world’s second-largest economy, any dumping of its excess capacity will be met by even more draconian tariffs and protectionism targeting Chinese goods.

China therefore needs a new growth model concentrated on domestic services – rather than goods – and private consumption. Services as a share of GDP are too low by global standards, and though Chinese policymakers continue to talk about boosting domestic demand, they seem unwilling to adopt the fiscal and other policies required to boost private consumption and reduce precautionary household savings. The situation demands larger pension benefits, greater health-care provision, unemployment insurance, permanent urban residency for rural migrant workers who currently lack access to public services, higher real (inflation-adjusted) wages, and measures to redistribute SOE profits to households so that they can spend more.

While China obviously needs to boost privatesector confidence and revive growth with a more sustainable economic model, it is not clear that Chinese leaders fully appreciate the challenges they face. While President Xi Jinping has overseen the move back to state

capitalism over the last decade, Premier Li Qiang, a known market-oriented reformer, appears to have been sidelined. Li neither held the customary press conference following the recent National People’s Congress nor met with the full foreign delegation at the latest China Development Forum. Instead, Xi himself hosted a smaller delegation of foreign business leaders.

The most charitable interpretation of these signals is that Xi now realises he needs to engage the private sector and international multinational corporations to restore their confidence and boost FDI, private sector-led growth, and private consumption. Since Li is still around, perhaps he is pushing quietly for “opening-up and reforms,” while keeping a low profile to show deference to Xi.

But many observers have a more pessimistic interpretation. They note that after sidelining market-oriented technocrats such as Li, former Premier Li Keqiang, former People’s Bank of China Governor Yi Gang, advisers like Liu He and Wang Qishan, and a variety of financial regulators, Xi has created new party committees on economic and financial affairs that supersede government bodies. He has surrounded himself with advisers like He Lifeng, the vice premier for the economy, and Zheng Shanjie, the new head of the National Development and Reform Commission, who are sympathetic to the obsolete dogma of state capitalism.

Lofty statements and mantras about reforms and attracting foreign investment mean little. What matters are the actual policies that China pursues over the next year, which will show whether it can circumvent the middle-income trap and return to the path of more robust growth. i

Nouriel Roubini, Professor Emeritus of Economics at New York University’s Stern School of Business, is Chief Economist at Atlas Capital Team, CEO of Roubini Macro Associates, Co-Founder of TheBoomBust.com, and author of the forthcoming MegaThreats: TenDangerousTrendsThatImperilOurFuture, and How to Survive Them (Little, Brown and Company, October 2022). He is a former senior economist for international affairs in the White House’s Council of Economic Advisers during the Clinton Administration and has worked for the International Monetary Fund, the US Federal Reserve, and the World Bank. His website is NourielRoubini.com, and he is the host of NourielToday.com.

nce again, US economic and market forecasters are having a difficult time. Worse, while 2023 surprised on the upside, the deviation from projections in 2024 could be much less favorable.

Recall the start of 2023. Forecasters had overwhelmingly anticipated a difficult year for economic growth, and that this would translate into even more losses for the diversified-portfolio investors who had already suffered one of the

worst years on record in 2022. In a now famous October 2022 headline, Bloomberg warned: “Forecast for US Recession Within Year Hits 100% in Blow to Biden.”

The prediction of a 2023 recession proved correct, but only for Germany and the United Kingdom, not the United States. The contrast was stunning. While the first two countries experienced two quarters of negative growth in the second half of the year, the US economy grew

at an annualized rate of around 4%. Meanwhile, the worrisome investment losses incurred earlier in the year yielded to handsome gains overall, owing to the dramatic turnaround in October for both stocks and bonds.

Chastened by that experience, most forecasters entered 2024 with quite a rosy outlook, anticipating that America’s growth exceptionalism would continue, as would solid investment returns. Yet the growth data for the

first quarter came below the consensus forecast, and inflation has proved stickier than many expected.

The difficulties facing forecasters are complicated by two broader phenomena that could last for years. These can be placed in two categories: transitions and divergences. Many advanced economies have embarked on a transition from a world of deregulation, liberalization, and fiscal prudence to one oriented around industrial

policy, renewed regulation, and sustained budget deficits on a scale that would have been unthinkable previously.

Moreover, these economies’ policies are becoming more differentiated, whereas previously they represented common responses to common shocks. Internationally, globalization is giving way to fragmentation. All this is happening at a time when economies around the world will have different sensitivities to transformational innovations in artificial intelligence, life sciences, sustainable energy, and other fields, as well as to geopolitical conflicts and trends. Moreover, some countries are much more flexible than others when it comes to adjusting factors of production and introducing policy measures to enhance productivity in the face of changing circumstances.

In the absence of common policy commitments and external sources of convergence, the world will be subject to a much wider range of outcomes, on top of potentially more frequent and violent shocks. But this is also a world that, if navigated well, could deliver better long-term productivity-driven growth outcomes that are also more inclusive and respectful of planetary limits.

Three issues are key to deciphering what 202425 will hold for the US economy, which is now the sole major engine of global growth: the Federal Reserve’s reaction function; the resilience of lower-income consumers; and the balance between productivity-boosting innovations and political/social/geopolitical headwinds.

Sticky inflation combined with slower growth will put the Fed between a rock and a hard place. Faced with growth uncertainties and the new global paradigm of insufficiently flexible aggregate supply, the Fed will need to decide whether to stick with its 2% inflation target or allow for a slightly higher one, at least for now.

The future of American growth exceptionalism also will depend to a considerable degree on lower-income consumers. These households’ balance sheets have been deteriorating as pandemic-era savings and stimulus payments have been drawn down, and as credit-card debt has risen. Given high interest rates and some creditors’ loss of enthusiasm, this cohort’s willingness to consume will hinge on whether the labor market remains tight.

The third factor relates to the tensions between exciting innovations and a fragile political and geopolitical landscape, which makes this the most difficult area in which to offer highconfidence forecasts.

While technological advances promise a new favorable supply shock that could unlock higher growth and drive down inflation, geopolitical developments could do the opposite, as well as

limit the scope for macroeconomic policy. Just consider the stagflationary consequences of a geopolitical shock that sends oil above $100 per barrel, or of a further deterioration in ChinaUS relations. It is easy to imagine how today’s “stable disequilibrium” could give way to a more volatile disequilibrium, which would then fuel financial instability.

Sustained US growth is especially important at this juncture because China and Europe have yet to re-establish their own growth momentum, and because “swing countries” like India and Saudi Arabia are not yet in a position to substitute for these alternative global growth engines. (The same goes for Japan, even though its economy and policy mix are in the best place they have been in decades.)

From a sectoral perspective, growth for the next few years will be driven mainly by technological innovations and the economic, social, and political forces they engender. Generative AI, life sciences, and sustainable energy will bring a wide range of reactions at the company level, and sectors such as traditional defense, health care, and cyber security will also be ones to watch.

Despite the many uncertainties, I will stick my neck out and offer some illustrative probabilities: I put the chance of a US soft landing at around 50%; the probability of a (misleadingly named) “no landing” – higher growth with no additional inflationary pressures and genuine financial stability – at around 15%; and the chance of recession and new threats of financial instability at 35%.

Or, for those who prefer images to numbers, picture a bumpy, winding road that could well lead to a desirable destination in the long term. It is being traveled by cars whose engines and drivers vary widely in quality and in their stocks of spare tires; and those drivers must also interact with regulators who are still trying to figure out what the rules of the road should be.

While economic fundamentals, finance, and policymaking obviously will bear on the growth outlook for 2024-25, geopolitics and national politics will have a much bigger impact than in prior years. A world of inherently uncertain transitions and divergences calls for more granular analysis, a proper balance of resilience and agility, and an open mind.. i

Mohamed A El-Erian, President of Queens’ College at the University of Cambridge, is a professor at the Wharton School of the University of Pennsylvania and the author of The Only Game inTown:CentralBanks,Instability,andAvoiding theNextCollapse (Random House, 2016) and a co-author (with Gordon Brown, Michael Spence, and Reid Lidow) of Permacrisis: A Plan to Fix a Fractured World (Simon & Schuster, 2023).

‘Sustainable’and‘mining’don’tusuallygointhesamesentence— butoneenterprisingCEOismakingithappen…

Deep in the Australian Outback, Rio Tinto's massive iron-ore mine is buzzing with activity. But, among the massive trucks and towering stacks of gear, things are changing. The air is cleaner, the land less damaged — and the company's dedication to a sustainable future evident.

This welcome shift is the result of a business strategy confronting environmental concerns. Rio Tinto's leaders have recognised the importance of safeguarding the planet — and are offering a viable future for the industry, the corporation, and its customers.

The cornerstone of this approach was decarbonisation, with aggressive targets for lower emissions and bold investment in renewable energy sources. Massive solar “farms” sprang up alongside the mines, their panels gleaming in the stark desert light. Rio Tinto has also pledged to electrify its vehicle fleet.

And the firm’s ambitions go further than its domestic operations. Thousands of kilometres away from WA, in the Simandou mountains of Guinea, West Africa, it’s working on one of the world's largest reserves of undeveloped iron ore.

This is not “just another mine”; it's a project with sustainability at its core. Rio Tinto has dedicated itself to benefitting local communities,

"This is not 'just another mine'; it's a project with sustainability at its core."

as well as the environment. That means heavy investment in infrastructure, education, and healthcare. The Simandou project demonstrates Rio Tinto's approach to sustainability. It combines a commitment to decarbonisation and environmental stewardship with an understanding of the expanding worldwide demand for responsibly-produced products.

That, of course, goes beyond iron ore. In the drive towards a circular economy, Rio Tinto threw money at recycled aluminium. In the US, a cutting-edge factory processes scrap alloy to reduce the need to mine and refine fresh bauxite. This programme decreased the company's carbon footprint while addressing the global problem of resource depletion and waste.

Rio Tinto is also focusing on the critical role of copper will play in the global energy shift, and is growing this part of the business.

Copper is wildly versatile, necessary for electric vehicles, wind turbines, solar panels, and transmission lines. Rio Tinto's Kennecott mine in Utah, and the Oyu Tolgoi mine in Mongolia,

were already major producers, and the company is investing in new projects such as Resolution Copper in Arizona.

This emphasis is about more than meeting market demand; it’s an active contribution to the fight against climate change. Rio Tinto is playing a central role in the transition to renewable energy and sustainable mobility.

Greenhouse gas emissions from the mining giant are reducing, water consumption is decreasing, and company activities are becoming more efficient. These efforts to produce low-carbon minerals and engage in ethical mining have contributed to the global transition.

It won’t be a quick fix; this is a long-term commitment. The road ahead is still rutted, but Rio Tinto's efforts demonstrate how a huge organisation can embrace sustainability — and generate change along with profits. Environmental stewardship and economic success need not be mutually exclusive.

This demonstrates the power of corporate strategy. It's a narrative about creativity, dedication, and the willingness to take bold steps in an important battle. As the corporation expands into new markets and adopts new technology, it’s soon evident that the behemoth is not simply waking up: it’s maturing. i

Rio Tinto is one of the world's foremost mining and metals firms — which gives it the heft and motivation to decarbonise extraction activities and contribute to a low-carbon future.

This requires a multifaceted approach prioritising renewable energy, electrification, energy efficiency, and innovative technology. Renewable energy is key to cutting the carbon footprint. The company has invested in largescale solar and wind projects to power its mines and processing facilities. The Pilbara region of Western Australia, home to Rio Tinto's sprawling operations, is seeing solar panels popping up all over.

The renewable energy they generate dramatically reduces dependency on fossil fuels. The strategy includes electrifying the mining fleet. The dieselpowered haul trucks so commonly employed in mining operations are, for want of a better word, dirty. The solution, once again, is to go electric. This cuts emissions and increases energy efficiency — with lower operational costs. Rio Tinto's commitment to green transport extends to its light vehicle fleet. Diesel’s being left in the dust.

Energy saving and process optimisation rely heavily on innovative equipment and new tech. By seeking out (and implementing) all possibilities, the Rio Tinto carbon footprint goes down — while operating efficiency rises.

With a combination of data analysis and AI, energy use is monitored in real time, detecting inefficiencies and optimising responsible consumption. Rio Tinto is going further still by researching and developing technology for lowcarbon aluminium smelting — traditionally a polluting, high-energy process. The company is also considering using hydrogen as a clean energy source. The hope is to push the frontiers and limits of sustainability in the sector.

This is more than lip-service, and Rio Tinto is in for the long haul — and ready to take on the attendant challenges. Mining requires a big spend on infrastructure and technology, thanks to the scale and complexity of operations. The availability and affordability of renewable energy can also vary between areas.

Despite any hurdles, Rio Tinto remains dedicated to its targets. It has set lofty goals to cut emissions and reach net-zero by 2050. This reflects a wider industry trend towards sustainability and responsible resource management.

Rio Tinto's efforts are positioning it to lead the way in the modern mining era. i

Rio Tinto chief executive Jakob Stausholm is steering this mining giant as it rolls towards sustainability.

Since taking over as CEO in January 2021, Stausholm has led the company through hills and valleys of transition, aiming always for environmental responsibility, social engagement, and sustainable growth. During his tenure, he has rebuilt trust in the industry, cut carbon emissions, and cultivated a more inclusive and ethical company culture.

Stausholm's appointment came in the aftermath of the Juukan Gorge disaster, in which Rio Tinto destroyed ancient Aboriginal rock dwellings, sparking public outcry and damaging the company's brand. Recognising the gravity of the situation, Stausholm prioritised the reestablishment of confidence with indigenous communities and stakeholders. He launched an open conversation, apologising for the company's blunder and pledging a thorough evaluation of management standards on cultural heritage.

Stausholm has had his work cut out to reestablish Rio Tinto's social licence to operate; he advanced by emphasising cultural sensitivity and community participation. He has managed to foster a collaborative relationship with the affected communities.

Stausholm is an advocate of environmental stewardship, and recognises the importance of addressing the industry's impact. Rio Tinto’s ambitious carbon-reduction targets were established under his leadership, and he is holding onto that goal of reaching net-zero by 2050.

To minimise environmental damage, the corporation is putting its faith in renewable energy, electrifying its vehicle fleet and researching appropriate technologies. This commitment has been consistent with the worldwide call for climate action — and has established Rio Tinto as a leader in the field.

Stausholm prioritises operational excellence along with environmental and social considerations. He has launched a review of the company portfolio, divesting non-core assets and investing in initiatives aligned with longterm strategy.

"Stausholm has kept sharp focus on creating an inclusive and ethical workplace. He promotes open communication, diversity and respect at all levels to keep employees — as well as stakeholders and communities — feeling appreciated and empowered."

The CEO aims to improve financial performance and provide shareholders with long-term value by streamlining operations and focusing on high-value projects. He has also emphasised the importance of investment in R&D.

Stausholm has kept sharp focus on creating an inclusive and ethical workplace. He promotes open communication, diversity and respect at all levels to keep employees — as well as stakeholders and communities — feeling appreciated and empowered. Rio Tinto is becoming a responsible corporate citizen by putting proper value on employee wellbeing and developing an integrity-driven culture.

The firm has made tremendous progress under Stausholm — but still has problems to confront. The sector operates in a tangled web of stakeholders and regulatory regimes. Balancing environmental stewardship with economic prosperity is an ongoing challenge.

The industry's unavoidable and direct effect on the environment demands continual attention. Stausholm sees Rio Tinto as a pioneer, contributing to a low-carbon future while keeping eyes on the prize of long-term value for shareholders and communities. His emphasis on trust, carbon cutting, operational excellence and cultural sensitivity has set the organisation on a new path.

As Rio Tinto navigates the upcoming challenges of the global energy transition, Stausholm's steady hand will be critical to its success, and its contribution to a sustainable future. i

> Now is the Hour:

fter decades of economic underperformance, now is now the time for Guinea to reach its full potential and improve the living standards of millions. CFI.co attended the recent Guinea Investment Forum, GUIF3, in the capital, Conakry.

The country is endowed with resources that go beyond mineral wealth, but that is likely to be the catalyst to spark the infrastructure investment needed to transform the national economy.

Post-Covid economic data shows steady improvement, and Australian mining firm Rio Tinto’s decision to invest $6.2bn in the Simandou mining project — after 27 years of delays — is an impressive vote of confidence. The announcement will assuage concerns about political stability or regulatory risk, and make Guinea an attractive investment destination.

Given the Rio Tinto announcement, GUIF3 could not have come at a more opportune moment. The event bought together representatives of the World Bank, executives, diplomats, and other business luminaries — all of whom can help to drive broad growth.

"Guinea must capitalise on this momentum. The Rio Tinto project represents a significant opportunity for the attraction of FDI. Investors would do well to take a good, hard look at Guinea in 2024."

The APIP Guinée team which organised the forum should be the primary point of contact for potential investors. APIP CEO Diana Kouyaté’s team has vast international experience, and a dynamic approach that impressed all those who attended.

Guinea must capitalise on this momentum. The Rio Tinto project represents a significant opportunity for the attraction of FDI. Investors would do well to take a good, hard look at Guinea in 2024.

There is a window of opportunity which can be kept open by pointing to the success of

established investors. The Rio Tinto case is a national success story: an outstanding deal that can only improve the investment climate. But it’s far from the only country to see potential here.

Immediate promotional efforts are likely to target sectors that are first in line to benefit from mining activities: extraction, production, the provision of services, infrastructure development, and logistics.

Continued efforts to streamline business registration, regulatory processes and the issue of permits will further ease the “business of doing business”. Maintaining transparency and clear communication should address investor concerns and build trust.

Of course, Guinea must continue to address underlying challenges to ensure long-term FDI inflows. There should be a focus on fostering economic diversification that benefits local communities and delivers sustainable growth.

By capitalising on the momentum created by Rio Tinto, and implementing strategic promotion initiatives, Guinea can leverage this opportunity and unlock its full potential. i

Much of the Western perception of Guinea, I realised, soon after landing in the country, is outdated, uninformed — or just plain wrong.

It is thought by some to be a dangerous place, but a recent visit to the capital, Conakry, told me just the opposite. It is, undoubtedly, one of the poorest cities I've ever visited — but there are signs that this, too, is changing.

The people of Guinea are extremely friendly, and — refreshingly, in this day and age — happy to see a foreigner. A balding white man wandering around their city was a welcome distraction; tourism has not yet really taken off here. On the subject of safety, I’ve visited wealthier cities where walking alone can be dangerous. Not so in Conakry, going by my experience. Yes, the locals are watching you, but out of amiable interest, and not in a way that makes you feel like a target.

I traversed the city streets at various times of day, lengthy strolls of up to four hours. I was the sole white person around, but the only approaches made to me were of a friendly nature. Most people simply ignored me, and those who did approach usually just wanted to check if I was okay. On one occasion, when it quickly became apparent that my French language skills were lacking, a little search party went off to find a fluent English speaker. They wanted to ensure that I wasn't lost, and knew how to get to wherever it was that I needed to be.

And when they discovered I was just happily wandering around, they invited me to sit and drink coffee with them. Most visitors from Europe, and much of the expat community, confine themselves to their bubbles: gated complexes, nice hotels, and fancy four-by-fours for transport. And that, unfortunately, is their loss.

If you visit Guinea and roam around the capital, you're likely to be pleasantly surprised.

This amiability is an asset for any country, and the human capital in Guinea is precious — and full of potential. The young population is open to ideas, and wants to see the nation progress. Investors will find a willing workforce, motivated by little more than a fair wage and the desire to see their country develop.

One memorable mental image I brought back from Conakry is that of students, neatly dressed in light brown uniforms, on their way to and from school. Education here, although it requires — and merits — substantial funding, is taken very seriously indeed.

With the right governance, Guinea is capable of turning itself around and realising its potential. Investment will improve infrastructure and enhance the wellbeing of its people.

The next generation, I hope, will see a substantial improvement in the standard of living. This is a country of huge natural wealth: not just the mineral resources, but its people, too.

I see Guinea as a very interesting investment destination. Rio Tinto obviously agrees; its decision to put $6.2bn into a mineral extraction project is a sturdy vote of confidence. Rio Tinto's board considers it safe to invest that impressive sum on behalf of its shareholders, and seems confident of a good return. The mining giant putting its money where its mouth is indicates that opportunity abounds for others. There is a booming energy-production sector, and some of the best hydroelectric resources in the region. Given its generous deposits of iron, there is potential for extraction and steel production — in a low-carbon process which won’t require excessive coal power, thanks to the high quality of the ore.

With the lure of substantial mineral, energy, and agricultural resources, there is an opportunity for

early-stage investors who take the time to properly evaluate Guinea. Rio Tinto’s confidence, and finance, will improve local infrastructure — but a lot of additional work is needed. The potential of the agriculture sector is enormous. Getting produce to market without the current levels of waste will improve food security and boost export opportunities.

Guinea has done some important foundational work to show that this is a country creating a truly business-friendly environment.

The services extended to new investors by APIPGuinée are exemplary, and the country has an efficient civil service. The leadership and citizens want a stable environment, with a good rule-of-law to protect investors and bring in the benefits of FDI. This is not without its challenges, but the core framework is in place — and legislative changes are giving added security to investors. Plans to further improve the business environment are under way, and I, for one, am feeling positive.

The extractive industries have the strongest short-term potential, but with infrastructure improvements and that focus on education, it shouldn’t be long before a whole range of opportunities are on offer in this truly welcoming country.

I think now is the time to take a serious at Guinea. From what I’ve seen, getting in early could make a great deal of sense. i

Anya Schiffrin, Dylan W Groves, & Joseph E

lthough news consumption soared during the COVID-19 pandemic, subscriptions have since fallen, and news outlets around the world have been laying off reporters or even shutting down altogether. That is bad news for all of us.

Our new UNESCO brief highlights recent research that demonstrates just how important high-quality information is to a well-functioning

economy, society, and democracy. New studies in economics and political science use rigorous methods to confirm what journalists already knew: that their work has a positive influence on democratic norms, civic engagement, and governmental and corporate accountability. By building social trust and promoting human rights, serious, credible reporting also supports economic performance and sustainable development.

The 2021 UNESCO Windhoek+30 Declaration –which reaffirmed the importance of information as a public good (one from which everyone benefits, and none are excluded) – was based on numerous studies from Africa, India, Latin America, and the United States. This literature shows that high-quality news and journalism promotes accountability and responsiveness even amid rising tides of misinformation and disinformation. Fact-checking can indeed

"By building social trust and promoting human rights, serious, credible reporting also supports economic performance and sustainable development."

counter the lies and distortions now flooding societies around the world.

Moreover, high-quality journalism remains more effective than social media in disseminating accurate, trustworthy news. While technology can enhance the spread of good information, it is currently doing the opposite. Large digital platforms regularly downrank news, claiming that users are more interested in other categories of content. But Pew Research Center data suggest that news consumption across platforms has remained stable (at least in the US) since 2020. And with more people voting in elections this year than ever before, there has never been a greater need for quality reporting.

Everyone – even those who do not invest in journalism themselves – benefits from the investigation, curation, and dissemination of trustworthy and useful information. But this public good is unlikely to be adequately provided in a free market, even with the help of publicspirited philanthropists, aid organizations, media companies, and governments. In many markets, their support is not enough.

Governments, especially, have a responsibility to ensure the provision of public goods. Enabling high-quality journalism requires legal regimes that protect free expression and the “right to tell.” But that is not enough. For journalists to do their jobs, there also must be laws and enforcement mechanisms in place to ensure the right to access information: the “right to know.” While many countries have passed such laws, they are rarely enforced. When public authorities even bother to respond to information requests, they often do so only after long delays, and with extensive redactions.

Legacy media outlets are a key part of the media ecosystem and require continued support; but so do smaller outlets and those targeting underserved areas. Some promising ideas for supporting journalism include providing special funds or tax breaks (such as payroll tax credits or targeted value-added-tax (VAT) reductions) and issuing news-subscription vouchers. During the pandemic, governments around the world launched variations of these policies, thus producing a wide range of models that can now be emulated.

Another crucial step is to ensure that journalists are appropriately compensated for their work. Big Tech (the proprietors of search engines, social media, and most artificial-intelligence platforms) relies on news media to engage users and improve its products. Since tech firms do not produce news themselves, they have no way to fulfill users’ demand for high-

quality news and search results without the content provided by journalists. However, they have long used content produced by journalists without providing much (if any) compensation, thus depriving media outlets of a major revenue source: advertising. This cycle is destroying the information ecosystem on which they, and our society, depend.

Many countries have helped sustain highquality journalism through investments in independent public broadcasting. Healthy public broadcasting institutions build social trust and generate an important spillover benefit: competition that forces private media companies to hold themselves to a higher standard. The institutional structures that facilitate the development of public broadcasting are well-known; what is required is the political will to establish the necessary frameworks.

A general principle in economics is that without public support, there will be an undersupply of public goods. Unfortunately, quality journalism is fast becoming Exhibit A for this principle, despite rigorous scholarship demonstrating its importance. Journalism’s business model is threatened by the rise of AI and the power of tech monopolies that distribute news without paying a fair price for it, and this is happening just as misinformation, disinformation, and political polarization are magnifying the dangers of journalism’s decline.

Around the world, there is a growing sense that democracy is in decline. An important step toward reversing this is to enhance support for quality journalism, starting immediately. The costs of inaction may be enormous. i

Anya Schiffrin is Director of the Technology, Media, and Communications Specialization at Columbia University’s School of International and Public Affairs.

Dylan W Groves is Assistant Professor of Political Science at Lafayette College.

Joseph E Stiglitz, a Nobel laureate in economics and University Professor at Columbia University, is a former chief economist of the World Bank (1997-2000), chair of the US President’s Council of Economic Advisers, and co-chair of the High-Level Commission on Carbon Prices. He is Co-Chair of the Independent Commission for the Reform of International Corporate Taxation and was lead author of the 1995 IPCC Climate Assessment. He is the author, most recently, of The Road to Freedom: Economics and the Good Society (Norton & Company, 2024).

Economics, like many other fields, has historically been influenced by male viewpoints. But closer look at the 20th Century reveals the seminal work of women whose influence is evident – and ongoing.

These women faced structural impediments, yet their genius and perseverance enabled them to transform economic philosophy, influencing academic debate and policymaking while affecting the lives of millions.

Here we feature six female economists who have had an indelible impact on the economic landscape.

Joan Robinson emerged as a prominent voice within the Post-Keynesian movement. Her insights into how markets function, particularly her understanding of imperfect competition, were revolutionary. Robinson's work on growth theory broadened our understanding of how economies grow and develop.

Elinor Ostrom was awarded the Nobel Prize in Economics for challenging the longheld notion that communal resources are necessarily subject to the "Tragedy of the Commons". Her painstaking efforts proved how communities around the world may effectively and sustainably manage common resources. Ostrom's work transformed the way we think about environmental governance and resource management, paving the way for alternatives to overexploitation.

Janet Yellen smashed glass ceilings by becoming chair of the Fed. She brought

to the post a thorough understanding of labour markets and a nuanced approach to unemployment. Yellen's leadership during periods of economic uncertainty was important in guiding the world's largest economy back to stability and growth.

Esther Duflo, known for her revolutionary approach to poverty reduction, received the Nobel Prize for pioneering how randomised controlled trials, drawn from medical research, might systematically test the effectiveness of development programmes.

Her impact, particularly in some of the world's poorest areas, has been revolutionary.

Labour economist Claudia Goldin shed light on the dynamics that drive the gender wage-gap via historical research of changing roles in the workplace. Her work illuminated systemic difficulties that continue to affect women's economic life, and laid the groundwork for advances towards greater equality.

Anne Kruger, a proponent of free trade, held senior roles at the World Bank and was the International Monetary Fund's first female deputy managing director. Her confidence in the ability of free markets to generate economic progress influenced her policy proposals and sparked global discussions about the path to wealth.

These outstanding women represent several schools of economic thinking, but they were all driven by a desire to challenge conventional wisdom, a commitment to thorough research, and a resolve to make economics relevant to today's concerns.

Their work has more than just historical interest. Many of the topics these women addressed are still at the centre of economic debate, including the origins and effects of inequality, effective poverty-reduction initiatives, environmental resource stewardship, fair labour standards, and the pursuit of long-term economic growth. They tackled topics that had ramifications not only for theory, but also for the wellbeing of millions of people.

This series of features will reveal their particular journeys, including the challenges, successes, and insights that paved their way. Most notably, it will examine their contributions to economics while being marginalised in many ways.

The legacy of these outstanding women is a monument to their intellectual prowess, and poses a challenge to the discipline's future. As the 21st Century economic landscape emerges, their pioneering work serves as a reminder that a plurality of perspectives is required for economics to remain relevant, powerful, and capable of building a more equitable and prosperous global community. i

Esther Duflo’s name is well-known in the field of development economics. Her groundbreaking research and innovative approach to combating global poverty are the reason for her fame.

Born in Paris, France, in 1972, Duflo's intellectual journey was shaped by her upbringing and life experiences. She was catapulted to the forefront of her field, breaking down barriers and gaining global recognition.

Duflo's mother was a paediatrician who worked in humanitarian causes, and her father a maths professor. They instilled in her a strong sense of social responsibility and an appreciation for analytical rigour.

Duflo initially considered a career in history and public affairs, but after a 10-month stint teaching French in Russia, she saw at first-hand the effects of economic upheaval on people's lives. This sparked an interest in economics, and she devoted her working life to understanding the causes of world poverty.

Duflo returned to France and followed her academic goals, earning a Master's degree from the Paris School of Economics before heading to the US for PhD studies at the famed Massachusetts Institute of Technology. There, she crossed paths with economists Abhijit Banerjee and Michael Kremer, who would become long-term working partners (and, in the case of Banerjee, her husband).

Duflo's work stands out for her pioneering use of randomised controlled trials (RCTs) in development economics. Inspired by the rigour of medical research, she advocated using this methodology to evaluate the real-world impact of social and economic reforms.

The underlying premise is straightforward, but effective. By organising research studies with randomly assigned treatment- and control groups, researchers could isolate the unique effects of a certain policy or programme, cutting through the complications that plague observational data.

This novel approach represented a substantial change from standard macro-level analysis in development economics, shifting the emphasis to micro-level actions that could alleviate specific characteristics of poverty. Duflo, Banerjee and Kremer have conducted hundreds of RCTs worldwide as part of their work with the Abdul Latif Jameel Poverty Action Lab (J-PAL), a research institute co-founded by Duflo at MIT in 2003.

Their research provided essential insights into a range of development issues, including education, healthcare, access to finance, and governance.

Duflo's work is distinguished by her emphasis on the intimate relationship between research and policy. Her commitment to evidence-based solutions has resulted in beneficial co-operation with governments and NGOs all around the world.

Duflo's contributions have received widespread recognition. In 2019, she received the Nobel Memorial Prize in Economic Sciences (with Banerjee and Kremer). She was the youngest person, and only the second woman, to earn this economics honour. Her work has other accolades, including the Princess of Asturias Award for Social Sciences and the John Bates Clark Medal.

Duflo's impact can be seen in the way her work has transformed lives. RCTs inspired have guided educational programmes to improve learning

outcomes and the distribution of mosquito nets to combat malaria. They have also influenced the design of microfinance initiatives that promote an escape from poverty.

Duflo is a dedicated educator and mentor. She has taught at MIT and the Collège de France, eager to pass on her knowledge and passion.

Her influence reaches beyond academia, and she has been praised for her ability to explain complicated economic concepts to a broad audience. Her best-selling book, Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty, co-written with Abhijit Banerjee, provides an accessible account of their work, dispelling myths and emphasising the importance of evidence-based approaches in addressing development challenges.

Esther Duflo's legacy is one of unwavering dedication to academic rigour, social effect, and a spirit of innovation in the never-ending fight against poverty.

Claudia Goldin is a champion of economic equalityforbothgenders…

Claudia Goldin's name evokes an unshakable commitment to increasing our understanding of gender equality in the workplace.

This distinguished American economic historian, born in 1946 in the Bronx, New York, dedicated her career to shedding light on the varied historical and current restrictions on women's economic engagement.

Goldin's intellectual journey led her to Cornell University, where she discovered an interest in economics. Following her Bachelor’s degree, she went to the University of Chicago, where she received a Master's and a Doctorate in economics. She developed a strong interest in labour economics – and the changing role of women in the workplace.