The Limited Edition Bremont Longitude is a groundbreaking timepiece that not only looks back at our country’s legacy but also forward to an exciting future of British watchmaking. The watch’s case back incorporates brass from the original “Flamsteed Line,” in Greenwich, the very spot where the first Astronomer Royal made his celestial observations in pursuit of an aid to navigation.

It has long been the goal of Bremont to bring watch manufacturing back to Britain. The Longitude represents a milestone in that journey, a homecoming of sorts, and proof that, to get where you’re going, you need to know where you came from.

Corporate campaigns in March celebrated the contributions of women worldwide. In April, they showcased (or invented) green credentials to proclaim their support for the planet on Earth Day.

These issues merit more than a day of halfhearted observance.

In South East Asia, the challenges of gender equality and climate change are intersecting in the region’s renewable energies transition. The ASEAN (Association of South East Asia Nations) Centre for Energy has conducted studies on gender, energy, and development finance. One report found that women represent just eight percent of the regional energy workforce.

May Thazin Aung, a climate-change researcher at the UK-based International Institute for Environment and Development think tank, points out that female representation in the sector comprises mostly administrative roles, rather than leadership or technical positions.

Another study revealed that South East Asia received just 6.2 percent of the $11.4bn spent globally on energy and gender programmes from 2010 to 2019. Amira Bilqis, an energy modelling and policy planning associate at ASEAN, believes the region could better secure funds for the energy transition with targeted gender initiatives. Projects with an eye on equality increased visibility among development-fund decision makers.

“I think systematic change is necessary to transition to a future where marginalised people are included,” Aung said. “It is about dismantling the power structures in place that characterise the current fossil fuel economy, and making sure inequalities and inequities are addressed.”

Women make up half of the world’s population, and their perspectives are vital to any transition. Those in rural communities spend hours each day gathering firewood for cooking. Urban entrepreneurs sell food from street stalls or operate modest streetside businesses. It’s important to understand how energy use differs between genders, but there’s a dearth of data. More research is needed to make the most of limited resources — environmental, human, or capital.

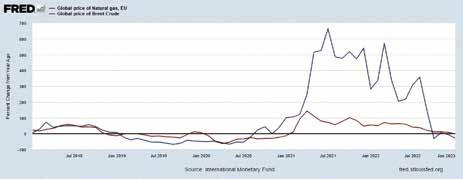

An annual report by non-profit groups showed that — for the first time since 2016 — the world’s biggest banks reduced their funding for fossil fuel companies. The world’s top 60 financial institutions gave $673bn in loans and underwriting in 2022, down from $801bn in 2021.

But that dip could be attributed to record energy profits following the Ukraine invasion, rather than banks honouring climate commitments. Last year, the fossil fuel industry raked in $4tn in profits — a significant jump from the sector’s yearly average of $1.5tn.

Financing for coal power may be on the decline, but many banks have circumvented their climate pledges by merely cutting financing for new projects. Banks in the Asia Pacific region have some of the weakest exclusion policies.

For a world leader in gender balance, green interventions, and smart technologies, look no further than the city-state of Singapore. Women hold 29.5 percent of the national parliament seats and 36.4 percent of the managerial positions. Singapore could serve as a model for countries hoping to engender progress — without jeopardising people or planet.

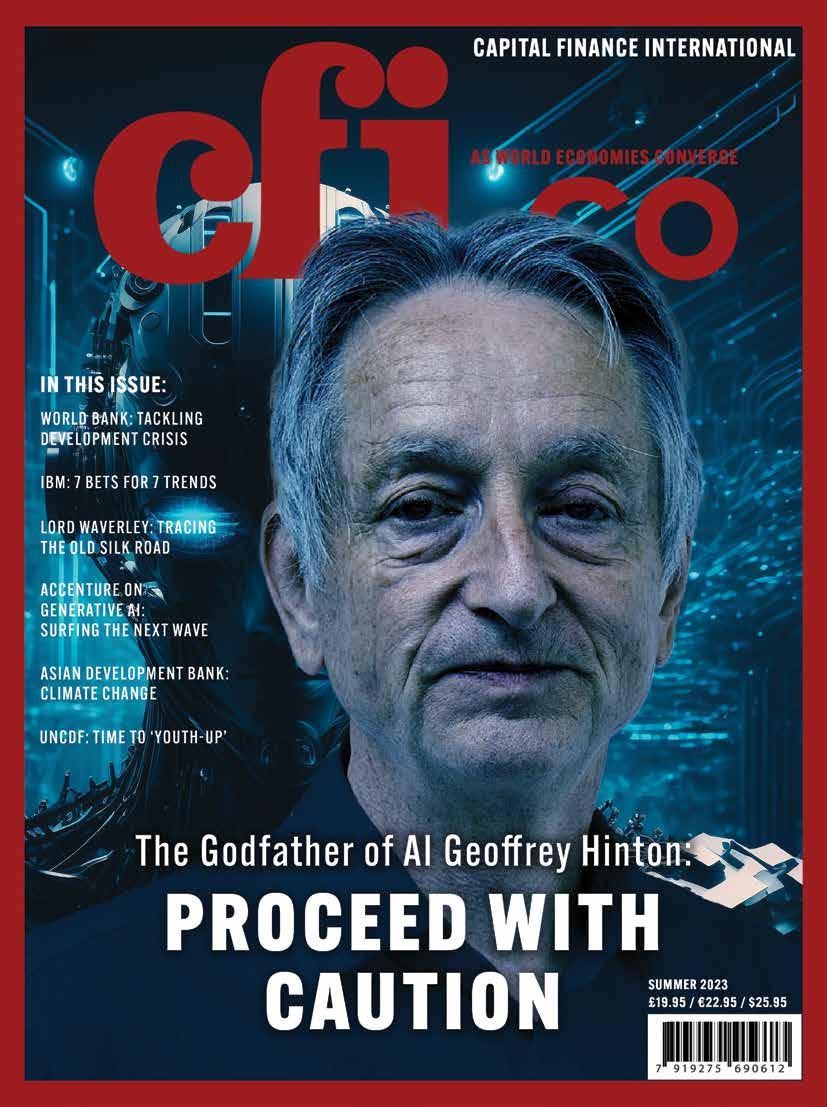

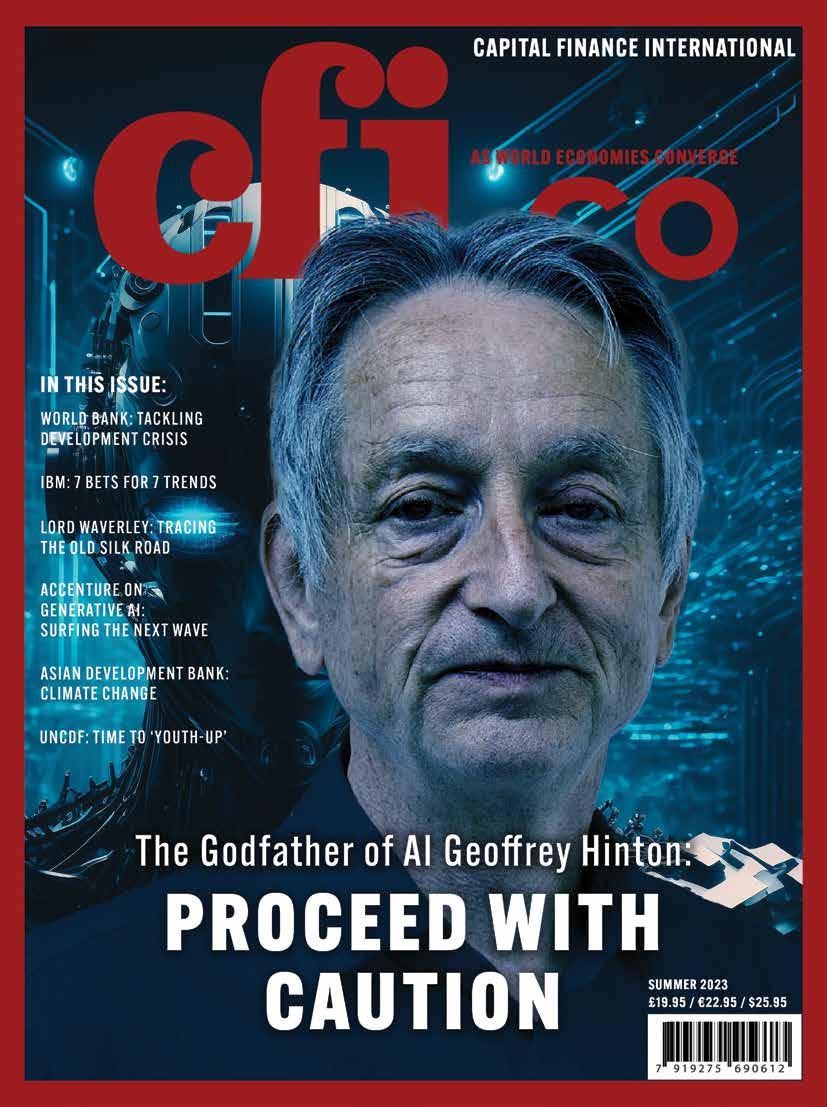

Bard, ChatGPT and all the rest are taking over almost every industry — and they have yours cornered and whimpering. So, pray tell: are you fighting the good Luddite fight, and keeping AI at arm’s length... or are your pages already filling up with machine-generated articles, pumped-out, parsed, and published by digital “staff”?

There is plenty of online advice telling us how to differentiate between people-powered journalism and its digital approximation — but there are just as many posts warning that it is, or soon will be, impossible to tell the difference.

Are we, your readers, already being sung to sleep with capitalist lullabies from robot mouths?

Disclaimer: I only skim-read CFI.co for articles relevant to my sector, and I suppose I don’t really care, one way or the other. I’d just like to know...

JAMES JOHNSON (Durban, RSA)

Editorial Team Reply: Our lullabies are from the people to the people. Sleep well.

After settling in for a proper read of your magazine during lockdown (remember that?) I have come to appreciate the variety you often manage to pack into what is basically a one-subject publication. I mean, it’s all about money, one way or the other — but by spending some time getting to know the regular contributors, I’ve found that I can as happily lose myself in the pages of CFI.co as I can in mags I have bought specifically for entertainment.

If you were wondering, my entrepreneur husband is “the subscriber”; as a (proud, intentional, not-downtrodden, not-a-bleeding-housewife, fulltime but unpaid) parent and home-keeper, I doubt I represent your average reader. So, take it as a feather in your cap that I have occasionally found myself intrigued, amused, and entertained by the more general subjects your writers Naomi Snelling and Tony Lennox tend to tackle.

Keep following the money, by all means, but let’s have some fun along the way, eh?

SARAH GIDDENS (Tonbridge Wells, UK)

To any CFI.co readers who are also expats in Spain, I would highly recommend that you check out the recent article (Spring 2023) on Prime Minister Pedro Sanchez. It’s an easy and informative read about a leader who is “Seldom Down, Never Out”. I’ve noticed that my fellow expats rarely pay attention to the political powers at play here or realise how it could impact their lives. This article should be required reading for Spain’s expats. It gives an overview of the history and current affairs in Spanish politics. It touches on Spain’s troubled past, but also talks about the country’s economic recovery following the Covid pandemic and the benefit of excluding of Russian natural gas from its energy mix.

¡QuévivaEspaña!

BRENDA TRUST (Madrid, Spain)

I’m concerned with the increasing presence of private equity groups in areas affecting basic human rights, particularly housing, healthcare and education. I advocate through my local non-profit for stronger government regulation of private equity in public service sectors. So, it has been refreshing to read some more critical pieces in a magazine that I had believed to be beholden to private equity interests. Please continue to balance the glorification of double-digit returns with the human consequences of short-sighted strategies that prioritise profits at all costs.

LESLIE MILLER (Cambridge, UK)We Brits were happy to have three bank holidays in May, the second in celebration of the crowning (not coronating) of King Charles III. The ceremony itself on the Saturday prior was a little too much to follow in full, but I did watch snippets. The working royals acquitted themselves admirably, and there were a couple of moments that brought joy to my heart. It was good to see the King lingering before making his exit with the representatives of various faiths — which I suppose describes the Church of England on a good day. Charles has always made a virtue of religious and spiritual inclusivity, and hats off to him for that.

Which brings me to the delightful “Feathergate”. Princess Anne’s magnificent red plume — part of her military uniform — exquisitely obscured Prince Harry, sitting directly behind her, from view. It’s said that during Megxit, the placing of a single, massive candle had a similar effect. God save the King.

JAMES CRIGHTON (London, UK)I imagine US politicians from both major parties must be reflecting that they’re “not in Kansas anymore” as it was confirmed that Missouri’s biggest city is, as of May 11, an official LGBTQ+ sanctuary. This decision was made in defiance of state lawmakers who, the day before, opted to ban “gender-affirming care” for minors — and restrict it for some adults. Political polarisation, so common these days, is unhelpful in such instances (and many others). Gender-confused young people need help and advice from those who do not necessarily confine themselves to the view from just one side of the rainbow.

SALLY KENT (St. Louis Mo., US)

SALLY KENT (St. Louis Mo., US)

George Kingsley

Tony Lennox

Brendan Filipovski

John Marinus

Ellen Langford

Helen Lynn Stone

Naomi Snelling

Wim Romeijn

William Adam

Joseph

Global development faces multiple crises: Growing debt burdens, inflation, and the rising cost of finance have made the economic path rockier.

These challenges, together with the escalating climate emergency, have made eradicating extreme poverty and boosting shared prosperity more difficult. Combined, these issues threaten the stability and sustainability of the world.

The World Bank is exploring new ways to channel additional funds into finance development. At its group annual meeting held late last year, shareholders called on multilateral development banks (MDBs) to play a bigger role in scaling-up development financing.

In other initiatives, the International Bank for Reconstruction and Development (IBRD) is considering issuing hybrid instruments to strengthen its capital, leading to increased financing capacity for developing countries, which bear the brunt of the intertwined crises. The IBRD, founded to help rebuild countries after World War II, is an international organisation owned by 189 sovereign members. It offers long-term development loans to creditworthy middle- and lower-income countries. These loans are financed through its equity and from borrowings raised in capital markets.

While hybrid instruments may be new to the MDB community, they are established market tools that occupy a unique space between debt and equity, carrying attributes of both asset classes.

Like debt instruments (bonds), hybrids have principal, coupon, and possibly a maturity. Like equity instruments (stocks), they provide the issuer with loss-absorption capacity through deferred or skipped interest payments.

They are more “junior” than the regular market debt an issuer uses to fund itself — meaning investors are taking on a higher risk. Commercial banks and other financial institutions commonly use hybrid instruments that meet regulatory capital requirements under frameworks such as Basel to strengthen their capital base.

MDBs have not so far done so, but this initiative offers numerous potential benefits

for IBRD — and, in turn, to the World Bank’s client countries. It is a way to increase lending capacity without compromising the bank’s triple-A credit rating. From a capital-adequacy and credit-rating perspective, the instruments are treated like additional risk capital, which can be leveraged for greater lending capacity. This leads to more income and more development impact over time. And it happens not only because of additional lending, but also through income transfers to the International Development Association (IDA) — a World Bank Group institution that offers deep concessional financing to low-income member countries.

Interested shareholders can invest in hybrid capital to show their support for the institution, and rapidly increase IBRD’s financing capacity. Since it can leverage hybrid capital, it can be treated as development resources already provided to IBRD by its shareholders — and be multiplied for greater impact.

Hybrid instruments offer an opportunity to tap private-sector investors who don’t normally purchase IBRD’s senior bond issuance. IBRD has a long history in the capital markets; its bonds, first issued in 1947, are rated triple-A by the major agencies and viewed as high-quality

securities by investors, including commercial banks, asset managers, insurance companies, pension funds, and central banks.

Given the subordination, these investors wouldn’t be interested in hybrid instruments. That means introducing the World Bank to a new set of investors — allowing IBRD to further diversify its funding, strengthen its financial position, and channel new private capital into development projects.

There’s still a lot of work to be done on this initiative, and lessons to be learned along the way. But this is another example of how the World Bank is tackling the challenges of global development with financial innovation. The World Bank and its many stakeholders — most importantly, those who are less well-off — are bound to benefit. i

Introducing the World Elite Mastercard with the contactless feature.

Mastercard credit cards.

For more information, please call our 24 hours Phone Banking on 17531532. Download “Mastercard for you” app on your phone to know the World Elite Mastercard features.

OtavianoCanutodiscussestheongoingroleofthegreenbackininternationalmonetarysystems...

OtavianoCanutodiscussestheongoingroleofthegreenbackininternationalmonetarysystems...

There has been talk of “de-dolarisation” of the global economy, with recent initiatives and policy moves by China and other countries to extend the reach of use of the renminbi in the international monetary system.

The greenback’s share in global reserves has slightly shrunk in relative terms, sparking frequent debate about what all this means in terms of global currency functions, and as means of payment and store of value.

While we point out a relative decline of the dollar’s weight in those functions, there are gravitational factors that tend to uphold its position. The “exorbitant privilege” that the US dollar has provided to its issuer is likely to remain.

The financial sanctions on Russia after the invasion of Ukraine sparked speculation that the weaponization of access to reserves in dollars, euros, pounds, and yen would stimulate a division in the international monetary order. China would tend to strengthen its international payments system and accelerate the establishment of the renminbi as a rival reserve currency to reduce its vulnerability to moves against it. Countries facing geopolitical risks in their relationship with the US and Europe would seize the opportunity to switch out of the dollar system. However, there is a way to go between willing and doing in this case...

In March, Brazil and China agreed to use local currencies in their bilateral trade. China is the destination of more than 30 percent of exports and the origin of more than 20 percent of imports. Given the trend towards surplus flows on the Brazilian side, it is assumed that Brazil will accumulate reserves in renminbi (RMB).

At the Russia-China summit in March, Vladimir Putin said that business transactions between Russia and countries in Asia, Africa, and Latin America would be conducted in RMB. Last December, China, and Saudi Arabia conducted their first yuan transaction, following Saudi statements that they were looking to diversify from the US dollar. Add Iran, another country grappling with US sanctions, and petrodollars might be replaced by "petroyuans".

Also worth noting is French company Total Energies' purchase of liquefied natural gas (LNG), settled in yuan, from Chinese stateowned CNOOC. Since the global financial

crisis, China has sought to extend the use of the renminbi in international trade and as a reserve asset at central banks. It pursued a proliferation of currency swap lines with central banks in other countries — including Brazil.

It is not surprising that the "de-dollarisation" of the global economy, "multipolarity" or "bipolarity" of the international monetary system have become buzzwords. However, it is crucial to gauge the real scope of what is happening.

Consider the difference between using currency to settle transactions — as a means of payment — and its role as a store of value. From the point of view of a central bank that needs to be ready for those payments, using the currency in transactions tends to lead to the constitution of reserves in the corresponding currency.

But it is worth distinguishing between currencies’ uses for payments (flows) and stores of value (stocks, reserves) because transactions may be settled without using a store of value. The recent Brazil-China agreement means that importers will make payments in local currencies, with settlements happening periodically. A similar scheme was used in the past by Brazil and other

Latin American countries to economise on the need to use the greenback on all individual crossborder transactions (reciprocal payments and credit conventions, or CCR in Portuguese and Spanish).

It should be noted in this context that the bulk of foreign exchange transactions corresponds primarily to financial operations, not trade in goods and services. The size of Chinese foreign trade constituted a basis for the potential use of its currency — but not on the financial transaction side.

In 2015, when the RMB was approved to be part of the special basket of currencies that serves as the base for Special Drawing Rights (SDRs, the

accounting currency issued by the IMF). It joined the dollar, euro, yen, and pound because of its weight via China’s foreign trade, not for its use in financial transactions.

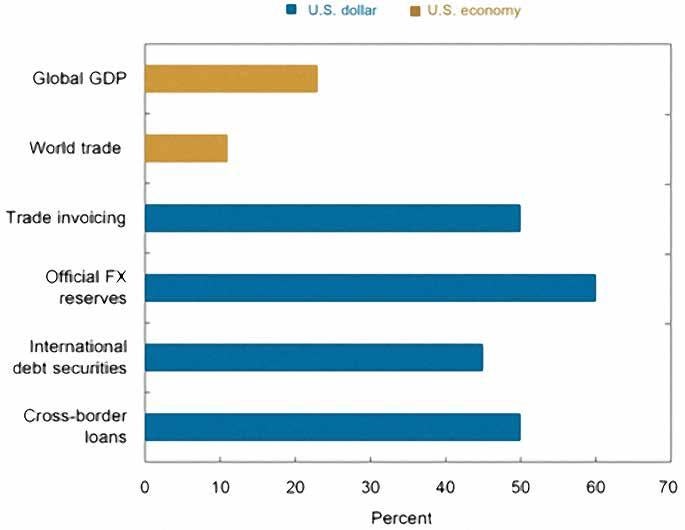

The global use of the dollar in the international monetary system is much higher than the relative size of the US economy (Figure 1). The dollar's shares of foreign trade invoicing, international debt issuance, and cross-border lending are well above the country's shares of international trade, international bond issuance, and cross-border borrowing would suggest.

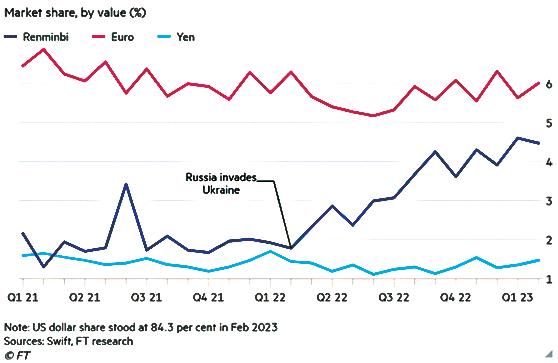

Trade can stimulate trade finance in a currency. Lenders extend credit to facilitate the crossborder movement of goods and services. The renminbi’s share of trade finance has more than doubled since the invasion of Ukraine, as its share by value of the market rose from less than two percent in February 2022 to 4.5 percent a year later (Figure 2). That reflected the use of China’s currency to facilitate trade with Russia and the rising cost of dollar financing since the start of the ongoing Fed’s interest-rate hikes (Locket and Leng, 2023).

While the euro and yen account for six and less than two percent of the total respectively, the dollar’s share was 84.3 percent in February 2023, down from 86.8 percent a year earlier.

The renminbi’s rising share of trade finance reflects China’s drive to accelerate its internationalisation. It constitutes a challenge to the West’s use of sanctions to bar major Russian financial institutions from using the Swift platform of payments. The renminbi’s latest rise among trade finance currencies has not been matched by greater use in international payments made on Swift, which have plateaued at about two percent of the global total.

China had already made an effort to internationalise the renminbi in the years leading up to August 2015, when a devaluation led to severe capital flight. China’s central bank reversed course and imposed draconian capital controls that stalled its progress in promoting the currency. It seems to have shifted back to pushing internationalisation since the beginning of 2022 by searching for greater use of the currency in the settlement of cross-border commodities trades and improving global access to derivatives tied to renminbi assets.

Besides approaching the weight of currencies in their use as the primary conduit to conduct international transactions (flows), either for trade or for finance, one needs to measure their roles as reserve currencies of choice (stocks) by central banks and other cross-border wealth holders.

Trade transactions and reserves from central banks and other global public investors could bolster the renminbi's position as an alternative currency to the dollar, euro, yen, and sterling. However, to

go beyond the settlement of transactions and trade finance, the qualitative leap towards the internationalisation of the renminbi as a reserve currency will only happen when confidence in its convertibility is sufficient to convince private investors to keep reserves of it.

Central banks must have reserves in currencies with which they can operate in the various exchange-transaction areas. It is not by chance that foreign exchange swap lines with China have been little used, while those of countries with the US Federal Reserve have been activated in times of need to stabilise flows. Tight capital controls maintained by China will curb the renminbi from dramatically moving up the ranks of global payments currencies and a stock functioning as a store of value.

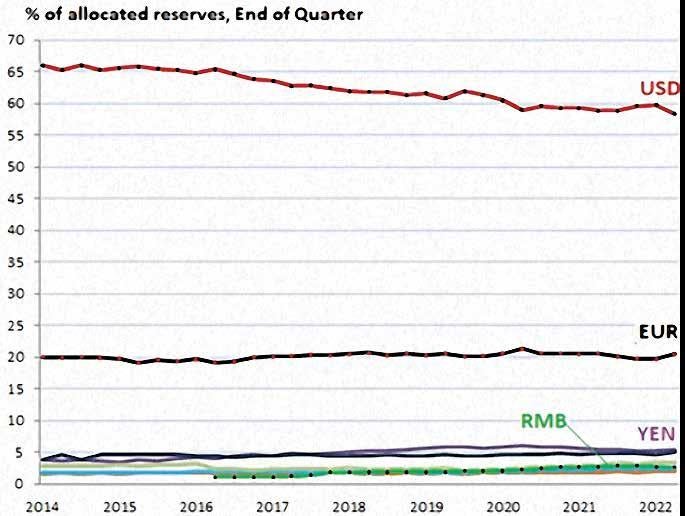

Over recent decades, some two-thirds of the world’s foreign reserves were maintained in US Treasuries and other quasi-sovereign USD assets. A gradual decline in the dollar’s share in total reserves occurred in the 2000s, and it was interpreted as a natural diversification by central banks reflecting trade and financial globalisation. Even the introduction of the euro, despite bets at the time, did not substantially change the dollar’s dominance in foreign reserves.

That dominance remained despite the falling share of US GDP. From the 1970s, it survived the end of gold convertibility and the fixed exchange rate regime inherited from Bretton Woods. Its presence in banking and non-banking transactions grew after the 2007-08 global financial crisis.

The International Monetary Fund (IMF) releases quarterly data on official foreign exchange reserves (COFER). The latest report shows a reduction in the degree of dollar dominance, with its share of central bank reserves falling 12 percentage points from 71 percent in 1999 to 59 percent last year (Figure 3).

That is not in favour of the pound sterling, the yen, or the euro, despite the rise that the latter experienced in its first decade of existence. Instead, it favours what Arslanalp et al call “non-traditional reserve currencies” (Australian and Canadian dollars, Swiss franc and others). The Renminbi reached 2.6 percent of the total (Figure 4).

At the end of Q4 of last year, non-US central banks held $6.47tn in USD-denominated assets, such as US Treasury securities, US corporate bonds, and US mortgage-backed securities. Even as the dollar’s share has dropped since 2014, holdings of dollar-assets rose from $4.4tn in 2014 to $7.1tn in Q3 2021 before falling as the Fed initiated its QT and interest-rate hikes.

These figures must be adjusted to compensate for fluctuations in relative currency prices and

De-dollarisation will remain slow and bounded.

Four gravitational factors favour the continuation of the dollar's central position in international financial markets, in trade invoices and payments,

and in public and private foreign exchange reserves. Call them “network — complementarity and synergy — effects” (Arslanalp). The relative expansion of the other currencies depends on how successfully they manage to offset those factors. First, the more extensive installed base for dollardenominated transactions favours the currency. The increase in liquidity and the reduction in

transaction costs in the “non-traditional” foreign exchange markets — including technological improvements — helped reduce this.

No other monetary system offers an equivalent volume of “investment-grade” government bonds. That volume allows central banks to accumulate reserves and private investors to use them as a haven, something reinforced by the quantitative easing since the global financial crisis.

There was a significant announcement by thenPresident of the European Central Bank, Mário Draghi, in the euro crisis in 2012, that he would do “whatever it takes” as a last-resort provider of liquidity for euro-denominated assets issued in the eurozone. The European Recovery Fund was created last year. The global supply of liquid and safe-haven assets usable as central bank reserves tended to widen in favour of the euro.

Third, it is also worth noting that “non-traditional currencies” were favoured by a partial search for returns in reserve management. Central bank balance sheets — of advanced and emerging economies — have taken on enormous proportions. Some of them separate what would be the appropriate tranche for “liquidity management” (the reason why there are reserves in liquid and low-risk assets, with the purpose of stabilisation), from another “investment tranche” (possible to be allocated in less liquid, but more profitable, assets).

Many countries have created SWFs (sovereign wealth funds) to manage the investment tranche of the public sector’s foreign currency holdings. The search for diversification helped “nontraditional” reserves.

This is illustrated by Figure 5, taken from an April 2 tweet by Brad Setser (from the US CFR, or Council on Foreign Relations) displaying how the foreign acquisition of US treasuries and agencies has decoupled from official dollar reserves. Brad Seter recently compiled data suggesting how the accumulation of dollar assets by official institutions other than central banks has grown in the past decade. He remarks that “the big [current account] surplus countries (China, the GCC, Russia, Singapore) have large state sectors that dominate the balance of payments”, and that “state asset accumulation outside of reserves is, well, quite strong”.

The fourth gravitational in favour of the dollar would be the absence of regulations restricting liquidity and asset availability, including capital controls. Despite the sanctions already applied in Iran, Venezuela and Russia, there is a difficulty here for Chinese bonds compared to those in dollars and the other three major currencies.

Since the global financial crisis, China has sought to extend the use of the Renminbi in international trade and as a reserve asset at other central banks.

This was followed by a proliferation of foreign exchange swap lines with other countries.

While trade transactions and reserves by central banks and other global public investors may reinforce the renminbi's position, the qualitative leap toward the internationalisation of it as a reserve currency will only happen when confidence in its convertibility is sufficient. It is not by chance that the currency swap lines with China have been little used, while those of the countries with the Federal Reserve have been activated in times of need to stabilise flows.

Chinese financial authorities do not appear to be considering relinquishing control. They will probably seek to expand the use of the renminbi without relinquishing controls and without the ambition to build some parallel regime or substitute. The reserve issuer must accept that large amounts of its currency circulate the world and, therefore, that foreign investors have some weight in determining domestic long-term interest and exchange rates.

After Russia invaded Ukraine, portfolio foreign capital movements in and out of China were illustrative of the potential costs for China of rushing out of its existing regime. Data released by the Institute of International Finance (IIF) revealed a large outflow of portfolio (debt and equities) capital from China. Such flows remained stable in other emerging economies.

Although it was later partially reversed, the timing suggests that it had some correlation with the war in Ukraine and sanctions. The same sanctions that stimulated the rise of the renminbi on transactions also sparked capital movements out of China. Given the magnitude of repressed domestic financial wealth in China, one may guess dramatic outflows would follow that capitalaccount liberalisation in search of diversification as it happened in 2015.

One may conclude that the relative dominance of the US dollar appears to be declining, but at a gradual pace. Events have boosted the renminbi as a payment-and-reserve currency, but any declaration of “de-dollarisation” seems to be premature.

In the 1960s, Valéry Giscard d'Estaing, then the French Minister of Finance, coined the term

“exorbitant privilege” to describe the dollar's position as a primary global currency. Such a position allows a country to supply cash or safe assets needed by the rest of the world in exchange for goods and services or long-term assets.

“Countries that issue reserve currencies, especially the United States, tend to benefit from what is called an ‘exorbitant privilege’,” he said. “This broadly refers to the effect of the global demand for safe assets on the reserve currency issuers' funding costs, which tends to tilt consumption towards the present and leads to higher investment.

“Global demand for reserve assets also tends to appreciate the currency of reserve issuers. These effects unambiguously weaken reserve currency issuers’ current accounts … The estimated coefficient suggests that for each 10 percentage points of global reserves held in its currency, a country’s current account balance, is weakened by about 0.3 percent of GDP.”

Country-level mismatches between supply and demand for safe assets appear in the evolution of corresponding net stocks of safe foreign assets. Figure 6 portrays the US and euro area below the line, as safe-asset providers, while China, Japan, oil producers, and emerging Asia ex-China are net purchasers above the line.

To the extent that the world stock of safe assets moves upward, cross-border net purchases of safe assets give carriers of the “exorbitant privilege” a higher amount of goods and services and investment assets from the rest of the world in exchange for those safe assets.

There are those, however, who see that “bonus” as an “onus”. It all hinges on whether the goods and services and investment assets “imported for free”, corresponding to a certain level of currentand/or capital-account deficit that the issuer of safe assets can incur in exchange for the provision of those assets, come in addition to or replacing local production, regardless of whether the “safeasset provider” runs a surplus or deficit in the other balance-of-payment accounts.

The “onerous” view is presented by Pettis, for whom it “allows many of the world’s largest economies to use a portion of American demand to resolve deficient domestic demand and fuel

"Country-level mismatches between supply and demand for safe assets appear in the evolution of corresponding net stocks of safe foreign assets. Figure 6 portrays the US and euro area below the line, as safe-asset providers, while China, Japan, oil producers, and emerging Asia exChina are net purchasers above the line."

domestic growth, for which the US economy must then make up by increasing its household or fiscal debt.

“These economies, in other words, can increase their international competitiveness by lowering the relative share households retain of what they produce. They can then run the large surpluses needed to balance their domestic demand deficiencies while keeping growth high. This is the form of beggar-thy-neighbour trade policy that Keynes most urgently warned against.”

Pettis’ argument, however, is not solely framed against the balance associated with the provision of safe assets, which he blurs into the broader issue of U.S. current-account deficits (Figure 7): “Without the widespread use of the US dollar as the mechanism that allows global imbalances to be absorbed by the US economy, these imbalances cannot exist.”

Excessive or insufficient current-account balances are better approached through the IMF’s methodology of evaluation of current-account imbalances relative to countries’ fundamentals in its annual external sector report (IMF, 2022). The “exorbitant privilege” should not be confounded with countries’ occasional shortcomings in obtaining full employment or efficient allocation of resources.

Despite the drive by China for a higher plurality of main currencies, raising the use of the renminbi, de-dollarisation looks bound to be partial and limited. Higher speed and depth of such a transformation would require a metamorphosis of China’s regulatory and policy regime, which the country most likely will not have the desire to implement right now.

While the euro has remained mostly a regional reserve currency, the US may retain its exorbitant privilege through the provision of dollar-safe assets for longer. i

A previous version was published by the Policy Center for the New South

Otaviano Canuto, based in Washington, D.C, is a senior fellow at the Policy Center for the New South, a nonresident senior fellow at Brookings Institution, a visiting public policy fellow at ILAS-Columbia, and principal of the Center for Macroeconomics and Development. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund and a former vicepresident at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at University of São Paulo and University of Campinas, Brazil. Otaviano has been a regular columnist for CFI.co for the past 11 years.

Follow him on Twitter: @ocanuto

The move was recently proposed as a way to close the technological gap between the UK and other countries. The British Department for Science, Innovation and Technology is legislating on the issue, and a bill on digital IDs has had its first reading in Parliament.

Experts believe this technology will soon be used at passport controls. Air passengers should be able to check-in remotely, with their identities instantly verified via facial recognition software. Digital ID could allow frictionless transition between check-in, bag drop-off, security, passport control and the boarding gate, removing the need for a physical ticket — or a passport.

Business travel is on track to rise by more than 40 percent — the largest increase since the 1980s — and hotel prices are up 54 percent as travel returns to pre-pandemic levels. Industry conferences have made a parallel comeback — with prices also on the rise, and per-capita attendee costs up by as much as 25 percent.

Rising prices will always be a challenge for businesses, but several factors can help. Advance planning is essential to managing expenses, negotiating rates, and making use of reward schemes offered by most airlines, hotels, and car rental companies. Make sure your company is collecting points — and employees are using them.

Scammers are taking advantage of lengthy wait times, increased passport application fees, delays and strikes by offering “fast-tracked” services. These con artists offer rapid passport renewals via email, and those who fall victim could find themselves unwittingly handing over their personal data— and their cash. It’s important to be vigilant and look for warning signs. Always check website URLs, read independent reviews, and pay for trips using a business credit card or PayPal's buyerprotection service.

London authorities are keen to encourage passengers to return to public transport in prepandemic numbers, and have reclassified off-peak travel to include Fridays. The Transport Secretary is said to be investigating how national rail network

ticketing can improve, with return fares set to be eliminated. Cheaper off-peak fares and flexi-season tickets for rail commuters could give business travellers a better deal. Making any travel fare less expensive will always be useful — and companies may start to organise meetings or travel for the end of the week.

Expedia has launched a trip-planning app, powered by ChatGPT; the inclusion of AI could soon be combined with other travel datasets to strengthen results. The quality of the output remains untested, but the pace of adoption is remarkable — and ChatGPT4 does give reasonable itinerary suggestions. Fears have been raised that travel management companies could be rendered redundant, but most commentators believe AI won’t disrupt everything.

AI can only create content from existing information or data; it has no authority or ability to correct itself or identify new concepts. But travel businesses might consider whether such tools can help us to perform better at basic tasks, such as research or presentation planning. i

Some major changes are impacting business travel — and one of the most noteworthy is the new digital ID system.

When US President John F Kennedy gave his famous “Moon speech” in September 1962, against the backdrop of the Cold War, he described “an hour of change and challenge, in a decade of hope and fear, in an age of both knowledge and ignorance”.

Those words could well have been uttered today. JFK acknowledged a pervasive anxiety and uncertainty that had taken hold, straining conventional approaches and systems. But rather than succumbing to this environment, he set out a vision of hope, inspiring progress to meet societal, technological, and business challenges.

Sixty years later, as climate change, economic turmoil and geopolitical conflict converge in the aftermath of a pandemic, businesses need an optimistic vision of progress to rally around — and leaders willing to bet on the future.

Technology is developing faster than ever, sparking debate about potential impact — whether positive or negative. Generative AI represents a significant inflection point, but its abrupt public availability has raised fears, and government eyebrows. ChatGPT has earned global media coverage, and is shaping a regulatory and political debate. It has inspired science fiction art and triggered intense debate about ethics and governance.

And it’s not just AI. Quantum computing has been a holy grail of tech: it would change everything, if it ever moved from the theoretical realm to the practical. Despite billions of dollars spent on research, it has remained an arcane and distant pursuit for academics and theorists. But we are entering a decade when we begin to see business value from it. Quantum computers are getting ready to over-perform their classical cousins in a set of meaningful tasks.

Leaders who fail to understand and adapt will find themselves flailing in a changing world. In coming years, a profound computing revolution could disrupt established business models and redefine entire industries.

It's time to understand the now, the new, and the next of technology disruption — and embrace the opportunities, while protecting against the risks. This is particularly relevant for financial

institutions, which need to manage risk, boost resiliency, and stay continuously compliant in a tumultuous macro-economic environment. But they must evolve by exploring new technologies and sources of revenue as they contend with nontraditional competitors.

This evolution can potentially intensify existing risks and create new ones which could be systemic if not properly managed. The question is how to stay ahead of the curve while being protected from cyber-attack vulnerabilities.

By working with the technology, businesses, scientists, regulators and policymakers should be able to slow global warming, prevent the next pandemic, manage systemic financial risks, and create a more sustainable future. The bets we make today redefine what’s possible tomorrow. Drawing on real-world experience and in-depth research, IBM has identified seven business trends that are expected to shape the world in the next three years — and seven bets worth making to benefit from them.

Forward-looking businesses will focus on AI, sustainability, product engineering mindsets, design thinking for employees and client experiences, combining virtual and physical worlds, partnering to build resilient enterprises across ecosystems, and creating a new work-life continuum.

1

Implement secure, AI-first intelligent workflows to run the enterprise.

For years, we have known that AI would transform business in most industries, but adoption – while accelerating - has been slow and expensive. Foundation models change that: pre-trained AI can be used almost “out of the box” for tasks that can be automated and improved with minimum additional training.

Generative AI expands the scope of automation in administrative, marketing and service

fields. User-friendly interfaces, such as chat or voice, have eased adoption. CEOs and boards of directors must understand how to seize opportunities and also make sure they mitigate risk. Corporate spend on AI ethics doubled between 2018 and 2021, rising from three to six percent of overall AI spend. According to the IBM Institute for Business Value research, organisations expect to increase investment by 40 percent over the next three years, as AI ethics laws are passed and regulatory oversight increases.

2

Avoid false choices between sustainability and profit — deliver both.

Many executives still see sustainability and profitability as conflicting, rather than complementary, but 80 percent of CEOs expect sustainability investments to deliver business results within five years. Many businesses set out aggressive decarbonisation targets before they knew how they would be achieved. Those commitments need to be made operational and economically viable. Integrating sustainability goals into operational metrics is still a limiting factor. Businesses need to to operationalise their goals today, and adopt technology to support automation, transparency, and accountability.

3 4

Invest as much in your software supply chain as your physical supply chain.

Every product becomes digital. Marc Andreessen’s famous prediction has come true: software is eating the world — and AI is eating software. Companies will use AI to compose and reuse software from multiple sources, integrating a bill of materials into their own product development processes. They will use platforms to manage the end-to-end software lifecycle. That’s why savvy executives are building a product engineering mindset. They understand that adoption is critical for success, and employees and customers expect a great digital experience.

Apply design leadership to change every aspect of the enterprise.

Experience matters more than we think.

The best experiences create passionate customers — that might last a minute. A flash of genius isn’t worth much on its own. It’s the painstaking process of implementation that turns it into profit.

Paolo is the global research leader in Banking and Financial Markets at IBM, Institute of Business Value. IBV is thought leadership centre of IBM.

"Generative AI represents a significant inflection point, but its abrupt public availability has raised fears, and government eyebrows."Author: Paolo Sironi

Getting there requires a keen understanding of human behaviour and relentless focus on design thinking. A great client experience starts by helping employees improve productivity and adopt new ways of working.

demonstrates. Executives should be preparing, with skills development front and centre.

future, inviting supply chains to adapt to new geopolitical and economic cycles. In a fast-shifting world, no single company owns innovation, or has all the answers. Success is less about reinventing the enterprise and more about reinventing the ecosystem. In a time of challenge and change, rethinking legacy practices and embracing a new set of priorities will drive competitive advantage.

7

Embrace the new work-life continuum in a tech-enabled workplace.

Few executives have figured out the future of work: how to address the qualified skills shortage, or keep a talent pipeline of engaged, inspired, and inspiring teams. Human workers and AI are changing the nature of work and the skills required, particularly in creative, service, and administrative jobs. The impact will equal that of the Third Industrial Revolution.

At the heart of the new way of working is a social contract that adapts to new priorities and the realities of the post-pandemic workplace. Leaders must adopt talent approaches that make employees feel like strategic business partners, and enable them to cope with, and embrace, productivity-enhancing technologies.

As we enter the Fourth Industrial Revolution, that is a platform revolution, the world goes digital but digital transformations have not been easy for many businesses. Limited success is often a reality before coding even begins. Several reasons rise to the fore. First, C-suites need board engagement, particularly to help them address skills gaps within their workforce. Second, digital transformations require funding, but in ways that differ from traditional growth strategies, which can be challenging. Risk also must be managedbut in a new operational space, firms have limited experience dealing with a host of new vulnerabilities. Facing these decision-making challenges, the Seven Bets can help C-suites systematise their strategic approach and get organised to transform the way their firms do business, the way they add client value with technology inside ethical frameworks, and the way they collaborate across firms and industry borders to create a more sustainable future for the planet and humankind.

It’s time to bet on the future, as our future is coming to us. i

5 6

Simplify, digitalise, and partner for a resilient enterprise.

To learn more, access IBM Seven Bets: ibm.com/thought-leadership/institute-businessvalue/en-us/report/seven-bets

Invest now in augmented reality solutions with clear benefits.

The metaverse will enhance, not replace, the physical world. Hype has obscured momentum for augmented and virtual reality and AI, which can combine to bridge virtual and physical worlds as the latest Apple headset

Social, political, and economic environments are undergoing a radical transformation, impacting trade, talent, and the drivers of success. At the centre of this vortex are disruptive forces that need to be navigated.

The era of stable inflation and geopolitical relationships is gone for the foreseeable

Paolo Sironi is the global research leader in banking at IBM, the Institute for Business Value, and he is author of business literature. His latest Banks and Fintech on Platform Economies has been Amazon bestseller in banking books worldwide.

rnest Hemingway’s maxim that bankruptcy arrives gradually “and then suddenly” applies to banks as well: “The proliferation of social media and the ubiquity of online banking imply that when things are perceived to go wrong, bankers may almost instantly lose control of the narrative. There is no coming back from that,” says KBC Group CEO and Banker of the Year (2016, 2017) Johan Thijs.

Thijs does not attribute the abrupt demise of Silicon Valley Bank (SVB) in early March to a spike in frantic Twitter traffic regarding the bank and its prospects. “Skewed fundamentals and inadequate regulatory oversight are the root causes of the failure. Even without an incendiary flurry of tweets, SVB would have buckled under the weight of a lopsided balance sheet with volatile deposits on the liability side set off against stable but devalued bonds on the asset side.”

The CEO points out that SVB was allowed to operate without sufficient liquid reserves after the administration of former President Donald Trump tweaked the rules for non-systemic US banks considering that any failures would sustain a negligible economic impact which could be absorbed by the public authorities. “What the regulator failed to take into consideration was the psychological fallout of a bank failure; the undermining of public trust in the financial system already thoroughly shaken by the events of 2008.”

FIRM FRAMEWORK

Thijs emphasises that European banks face a much firmer regulatory framework imposed and maintained by both the European Central Bank (ECB) and the national central banks. “Here, banks are required to keep eep a level of liquidity reserves greater or equal to thirty days of stressed cash outflows after which they must still have adequate liquidity. At the time of the SVB collapse, KBC boasted liquidity reserves in such a way that we could easily withstand a multiple of the requested regulatory stressed liquidity outflows.”

Another difference between most European banks and SVB concerns balance sheet management.

“If a bank is flush with volatile corporate deposits, it is unwise to invest those funds in long-term instruments such as government bonds. At KBC we park such deposits overnight with the ECB. We may not get a particularly good return on that parked capital but can access it instantly which, of course, adds to the bank’s liquidity.”

Following the crash of SVB, the contagion seemed to spread to Europe nonetheless with the failure of erstwhile venerable Credit Suisse which quickly sank into ignominy, accumulating unsustainable losses. “Perhaps remarkably, at the time of the SVB crisis, Credit Suisse had sufficient capital and reserves. More than anything, it was the parallels drawn with SVB that sparked trouble. That and a few statements by pundits caused the pressure on Credit Suisse to increase significantly. After stockholders refused to come to the rescue, the Swiss National Bank was forced to intervene and broker the deal with UBS.”

To Thijs this again offered proof that borders have dissipated in the financial world. “As soon as a crisis erupts somewhere, everyone begins wondering if such a thing could happen closer to home as well. Another difference now is the speed at which information is disseminated. Not everything reported on social media is necessarily true but, that said, there is little time, if any, to counter and set the record straight. At the slightest sign of trouble, real or imagined, clients can move their money elsewhere in a matter of seconds. It is good to remember that, today, a bank run is only one click away.”

The good news is that at present few, if any, European banks are in trouble. But Thijs also notes that a banker doesn’t prepare for nonexistent problems but for those that could possibly arise.

Thijs continues: “I am convinced that regulators are looking into the underlying causes of the recent spate of bank failures. It still baffles me that US regulatory agencies apparently bought into the self-regulation myth. They now have their work cut out. European regulators will do likewise even though their system worked quite well. Stricter rules will likely follow, also here in Europe where part of the Basel IV banking supervision framework may be implemented

ahead of time in an anticipatory way. Another expected change could involve different sets of rules for different banks.”

The KBC CEO does see an issue: “Without regulation the market cannot survive. So, we are happy to be regulated. However, too much

"Skewed fundamentals and inadequate regulatory oversight are the root causes of the failure."

regulation may stifle the market and hinder banks in the proper execution of their job which essentially boils down to transforming deposits into credits. This involves a delicate balance that, in turn, requires a stable regulatory system that allows the job to be done profitably but in a normal and orderly fashion.” i

KBC is one of the largest bank-insurance groups headquartered in Belgium and is focused on retail banking and small- and medium-sized businesses in Belgium, Bulgaria, Slovakia, Hungary,andtheCzechRepublic.Itmaintainsa network of over 1,200 branches in Belgium and CentralandEasternEurope.

As the Central Asian region continues to develop and integrate into the global community, the three countries — Kyrgyzstan, Tajikistan, and Turkmenistan — will play an increasingly important role in the region, and beyond.

The countries have their unique historical, political, economic, and cultural backgrounds, each bringing a blend of strengths and challenges, offering their own opportunities for trade, investment, and tourism.

Kyrgyzstan is a mountainous country of seven million people, rich in natural resources and minerals, with high potential for the development of agriculture, hydropower and tourism. The diverse population is highly educated with strong social and civil bonds, and there have been recent improvements in democratic governance. Kyrgyz Republic is a relatively young country making efforts to diversify its economy beyond mining and agriculture. It is home to stunning natural landscapes, such as Lake Issyk-Kul, and cultural landmarks, including the ancient city of Osh.

The people of Kyrgyzstan are among the most ancient races of Asia. The first mention goes back to the 3rd Century BC, when the empire of the Huns dominated the territory. In 201 BC Mode (Maodun) subjugated Gegun (Kyrgyz), then in the Eastern Tien Shan. The reign of Maodun became an important milestone in history, with the term "Kyrgyz" first mentioned in the Chinese chronicles in 201 BC.

Ancient Kyrgyz was characterised by the creation of the Turkic Khaganate (551-744) in the Altai, and the creation of the Great Kyrgyz Khaganate in the 9th Century. At the end of the 18th and beginning of the 19th Centuries, northern Kyrgyz

tribes began to independently establish contact with Russia. After the 1917 Russian October Revolution, the Kara-Kyrgyz Autonomous Region was formed in 1924, and in December 1936 transformed into the Kyrgyz SSR.

In 1991, Kyrgyzstan was one of the first republics to declare independence. The principles of democratic governance began to be introduced, and private forms of ownership were established. In socio-political terms, the republic has acquired all the attributes of statehood and become an equal member of the global community. Kyrgyzstan was the first of the Central Asian countries to introduce a national currency (the Som) in 1993, which allowed the establishment of independent financial and monetary policies. Kyrgyzstan became the first WTO member state among CIS countries in 1998.

The first Constitution of independent Kyrgyzstan was adopted in 1993. Kyrgyzstan became a sovereign, unitary democratic republic built on the principles of a legal secular state. One of the main principles of public administration is the division of state power into legislative, executive, and judicial branches.

Currently, Kyrgyzstan is a presidential republic, where a governance structure has been created with a clear distribution of powers, and an effective reporting system. Sadyr Japarov, who came to power after political unrest in October 2020, was elected president in January 2021 — with the support of 80 percent of voters. The last parliamentary elections were held in November 2021.

LordWaverleycontinueshisjourneythroughCentralAsia, a little-known region nestled in a corner of the world that iscomingintoprominence...

"The countries have their unique historical, political, economic, and cultural backgrounds."

The most difficult test for Kyrgyzstan was the transition to a market economy in the 1990s, when more than half of the population fell below the poverty line and the country's economy halved. Today, the Kyrgyz Republic is at an important stage in its history, when the prerequisites for the long-term development of the country as a politically stable, economically strong, and socially responsible state have been laid.

Notwithstanding the complex and rapidly changing global, and regional economic and geopolitical situation, digital transformation has covered the main areas of public life and necessitated the formation of a new development model. Kyrgyzstan, landlocked and remote, with limited land transport routes, has had to adapt to new conditions of economic development, considering the small size of its economy. The main trade and economic partners of the country are China, Russia, Central Asian countries, Turkey, and the United Kingdom.

The economy showed resilience in 2022, in the face of tensions in Russian-Ukrainian relations. The republic has significant natural mineral deposits. In the first 10 months of 2022, real GDP grew by seven percent. The surge was driven by gold mining, with a settlement of a dispute between the government and Centerra Gold Inc of Canada. The resolution is considered equitable and recognisant of law, trade, and the development of agriculture and transport infrastructure.

The economic policy of the state is focused on employment, stable incomes, and creating productive jobs. Kyrgyzstan is pursuing reforms to create a competitive digital economy through attractive conditions for entrepreneurs, and the use of innovative and environmentally friendly technologies. The widespread introduction of IT is a priority of the national development policy. The salaries of teachers, doctors, workers in science, culture and civil servants were increased by 100 percent.

New laws and regulations have been aimed at minimising corruption, strengthening competition, preventing the emergence of state monopolies, and increasing the transparency and accountability of the public sector. Digitalisation in the field of tax administration and providing access to income and property declarations of public officials to citizens have become important steps.

The recent meeting of the former presidents of the Kyrgyz Republic, at the initiative of President Sadyr Japarov, has strengthened the unity of the Kyrgyz society and led to a significant improvement in the investment climate.

Kyrgyzstan is pursuing a multi-vector foreign policy, establishing the necessary inflow of foreign investment, establishing ties with neighbours and other countries. According to the Foreign Policy Concept, the special role of the Kyrgyz Republic in Central Asia as a bridge between Europe and Asia is emphasised, with the country implementing its foreign policy on the basis of goodwill, mutual understanding, and mutual respect of interests.

Foreign policy priorities include the deepening of integration processes in the region. At the global level, foreign policy is aimed at building confidence in the international community, with the expansion of contacts with countries of the West and the East. It also focuses on the development of interstate co-operation within the framework of international organisations.

This is one of the oldest centres of human civilization. The Kyrgyz, an ethnic group known in Central Asia since the first millennium BC, have brought their identity and culture through the centuries to the present day. The village of Manas, the traditional yurt dwellings, shyrdak and ala kiyiz felt carpets are World Heritagelisted.

The republic is located on the Great Silk Road, along which there are 583 historical and cultural monuments and archaeological sites, some of which (Nevaket, Suyab, Balasagyn, Sulaiman-Too) are of world importance and are also included in the UNESCO World Heritage List.

Kyrgyzstan has a wide range of tourist resources. Some 80 nationalities live in the territory and have preserved their national traditions and customs, handicrafts, and folklore.

The country was the first in Central Asia to abolish visa restrictions for citizens of 60 countries for up to 60 days. It boasts 22 diverse ecosystems, and 160 varieties of mountain and plain landscapes. A full 94 percent of the region is mountainous. Among the famous peaks are Pobeda (7439 m), Lenin (7134 m) and Khan-Tengri (6995 m) — and one of the longest glaciers, Enylchek, is a world landmark. There are 1,923 lakes, the largest of which is Lake Issyk-Kul — one of the deepest alpine lakes in the world. The more than 40,000 rivers are the main source of water. The Kyrgyz Republic is one of 200 priority global ecological regions.

Tajikistan is home to some of the oldest cities in the world, such as Sarazm. The country has faced challenges of political stability and economic development, but has made great strides in improving its infrastructure, particularly in the energy and transportation sectors. Tajikistan is known for its stunning natural beauty, including the Pamir Mountains and the Iskanderkul Lake.

Tajikistan has celebrated 30 years of independence. It has been able to establish the foundations of national statehood, and ensure peace, stability, and unity. There is potential for

everything from energy to tourism, transport to water management.

With strong GDP growth rates (7.5 percent in 2022), political stability, geo-strategic location, business-friendly environment, youthful population (70 percent are under 35) and significant natural resources, Tajikistan is well placed to achieve continued economic expansion with international partners, including those in Western Europe.

Tajikistan's rich and colourful history originate from descendants of Bactria and Sogdiana. In the 6th-4th Centuries BC, the areas of Amudarya and Sirdarya were settled by eastern Iranian tribes, and Bactria and Sogdiana were the most ancient states as part of the Achaemenids Empire. After being conquered by the Alexander the Great, the Greco-Bactrian Empire was established.

About 200 years later, the state of Tokharistan was established in Bactria, which with Sogdiana became part of the larger Kushan Kingdom. The Silk Road crossed Tokharistan, with goods delivered to the Greek and Roman Empires. In the 8th Century, Sogdiana and Tokharistan struggled for liberation after Central Asia was conquered by Arabs. At the end of the 9th Century, the Tajik state of Samanid was formed, independently from the Bagdad Caliphate.

In the period of its most extensive growth, Samanid stretched from the deserts of Central Asia to the Gulf, and from the borders of India to Bagdad. During the Samanids Empire, the Tajik people, language and culture became widespread. The Samanids state lived in peace for more than 100

years, which fostered the growth of cities, craft, development of farming and trade and mining. This was an era of renaissance that produced some of the world's greatest humanitarians, such as the founder of the Persian-Tajik poetry, Rudaki. Internal conflicts and nomadic raids weakened the Samanid state, which in 999 collapsed to Turkic-speaking tribes.

At the beginning of the 13th Century (12191221), Central Asia was invaded by Mongols. In the 15th Century, the leader of Uzbek nomad tribes Muhammad Shaibani khan invaded Central Asia. During his rule the state consisted of independent principalities with the largest being Samarkand, Bukhara, and Balkh.

In the 18th Century, a general government was formed after Central Asia was annexed by Russia and Turkestan. Northern Tajikistan and Badakhshan were part of this new territory, and the central and Southern areas (Eastern Bukhara) were left in the ownership of a vassal of the Russian Tsar, the Emir of Bukhara.

In 1920, the first all-Bukhara national assembly was proclaimed, and the Bukhara People’s Soviet Republic was established. In 1924, a new state emerged: the Uzbek Soviet Socialist Republic, which included the Tajik Autonomous Soviet Socialist Republic. In 1929, the Tajik ASSR was reformed into the independent Tajik Soviet Socialist Republic. With the collapse of the

Soviet Union in September 1991, a new state emerged on the world map: the independent Republic of Tajikistan.

Based on the constitution adopted in 1994, Tajikistan is a sovereign, democratic, legal, secular unitary state with a presidential form of governance. Legislative, executive, and judicial branches were established, providing for a strong legislature. Executive authority is held by the president, who serves as the head of state.

The president is elected directly for a maximum of two seven-year terms; he or she appoints the cabinet and high court justices, subject to approval by the legislature. The prime minister is also appointed by the president and confirmed by the legislature.

The Majlisi-Oli (Parliament) is the supreme representative and legislative body of Tajikistan, and is elected for a five-year period. Two houses — the National Assembly and the Representatives’ Assembly — have the authority to enact and annul bills, interpret the constitution, and confirm presidential appointees. Legislative elections are held every five years under a mixed system. Members of the Assembly of Representatives, the lower chamber, are elected by popular vote to five-year terms; 41 are elected by constituency, and 22 are elected by proportional representation.

Eight of the members of the upper chamber, the National Assembly, are appointed by the president, and 25 are indirectly elected by local deputies to serve five-year terms. One seat is reserved for each former president. The members represent regional constituencies: five from each viloyat (province or region), five from the unincorporated region, and five from the city of Dushanbe. Seven political parties are registered in the country,

The country is divided into three viloyats — Sughd, Khatlon, and Mountainous Badakhshan (also known as Gorno-Badakhshan Autonomous Province) — while a region in the middle of the country remains unincorporated and under the direct governance of the central government. Each region is divided into districts; there are 58 throughout the country.

Despite the ongoing changes in the world economy, the effective implementation of economic reforms, policies, programmes and anti-crisis measures in the past five years were able to maintain average economic growth of 7.3 percent annually. That increased the GDP per capita by 1.5 times. The country joined the World Trade Organisation in 2013. Export commodities include gold, aluminium, raw cotton, zinc ore, electricity, fruit, vegetables and vegetable oil, and textiles.

Tajikistan has been introducing comprehensive reforms in recent years to strengthen protection

for investors, cut red tape, make tax more transparent and support entrepreneurship. The government pays special attention to the development of entrepreneurship and improvement of investment climate. Its goal is to promote a climate for domestic and foreign entrepreneurs.

The economic space is open to investors who create jobs, provide services in the domestic and foreign markets, and comply with national laws. There are economic and administrative benefits for them.

Over the past five years, co-operation with foreign investors and entrepreneurs has attracted more than $bn to the country's economy, including almost $2bn in direct investment. The share of the private sector amounted to 70 percent of GDP, which is 12 percent up on recent years. Thanks to FDI, the export of cement, alabaster, paints, minerals, canned vegetables and fruits, cotton fabrics and carpets has also grown.

Five free economic zones have been created in Tajikistan, and the government welcomes entrepreneurs and investors from all over the world. Tajikistan's export capacity creates opportunities to produce and export goods in domestic and foreign markets. The situation and development of market relations in the country require these reforms to be pursued. An improved investment climate and entrepreneurship have made it possible to keep macro-economic indicators at a sustainable level over the past 10 years; the real sector of the economy grew by seven percent.

Since the first days of independence, Tajikistan has taken a course towards protecting and strengthening state sovereignty, ensuring national security, developing relations of trust, friendship and co-operation with all countries, based on mutual consideration of interests.

Foreign policy is based on a multi-vector approach and an open-door policy. In a recent address, President Emomali Rahmon noted that "the main principle of the open-door policy, which we adhere to and implement in our foreign policy, is aimed at establishing and developing relations of friendship, good neighbourliness, partnership, fruitful co-operation with foreign countries, international and regional organisations, and international financial structures".

Tajikistan is proactive on issues such as water and climate issues, countering terrorism, extremism, drug trafficking and problems in Afghanistan. A pragmatic policy has opened up opportunities for strategic goals, such as ensuring energy-independence, overcoming the communication impasse, food security, and accelerated industrialisation.

Tajikistan has established diplomatic relations with 183 countries and is a member of 57 international organisations, including the UN, OSCE, SCO, CSTO, OIC, and ECO.

Located in the heart of Central Asia, Tajikistan lies on the Silk Road connecting East and West. Its mountains and high peaks symbolise the country's dramatic landscapes.

It may be small, but its tourism offering is exceptionally diverse, from rare animals such as snow leopards and Marco Polo sheep, and there are two UNESCO World Heritage sites, the Tajik National Park Natural Monument and the ancient city of Sarazm.

Tajikistan is committed to long-term sustainable tourism. The opportunities for hiking and mountaineering are superb, as is wildlifewatching at Burgut and Sarsarak. Communitybased tourism projects are key, as they enable tourism to develop in rural areas.

Tourism can also contribute to almost all 17 of the UN’s Sustainable Development Goals (SDGs). The Tajikistan government is particularly focused on SDG 1 (no poverty), SDG 8 (decent work and economic growth), and SDG 10 (deduced inequalities). Tourism can contribute to all these areas, creating jobs and business opportunities. It is paying close attention to SDG 13 (climate action), with projects addressing energy use and waste in the tourism sector.

Investment in infrastructure is key. The government is steadily improving the availability of tourist accommodation, but air and road connectivity need improvement. That comes at a huge cost. The government has begun upgrading the Pamir Highway, and hopes to reinstate the Dushanbe-Khorog flight route soon. Investments in infrastructure, and additional services in human capital and investments in the private sector to promote tourism, are necessary.

Dushanbe, capital of Tajikistan, is located in picturesque and flourishing foothills, and connects all regions of the country through highways, railways and air routes. It has become a venue for high-level international, scientific, cultural and political events, which introduced the city to the world community as a tourism brand.

There are some 40 hotels in Dushanbe, with leisure parks and fountains in the centre of the capital, where I have spent many a happy and relaxing evening. Any visitor to the Tajik capital will enjoy Dushanbe, with its cosy and neatly laid streets, and flower parks erected in a modern and national style.

Tajiks have preserved their traditions and customs and integrated them into the modern lifestyle. History dates back to the 1st Century

BC; one of the most interesting sites is ancient Penjikent. Archaeologists found residential and religious constructions, monumental paintings, and fine sculptures dating back to 7th and 8th Century AD.

Tajiks were known as artisans; in the cities and valleys, men made ceramic dishes on potters’ wheels. In the mountainous areas, women moulded jars by hand, with ancient types of craftsmanship preserved from one generation to the next. Colourful jars, cases, and decorated dishes can be found on display in the art salons of Dushanbe.

Entire neighbourhoods of weavers, potters, coppersmiths, blacksmiths, wood- and alabaster carvers plied their trades, and patterned paper and silks were produced, mainly on simple looms. Primitive foot looms were used for making gowns and trousers. Tajiks carried on ancient traditions

for decorative patterns of embroidery to decorate skullcaps, women’s dresses and housewares.

On the eve of the Arab invasion, the main religious groups were Zoroastrianism, Manicheanism, Buddhism and Hinduism. Islam slowly supplanted these. Mosques were erected, among which the mausoleums of the 11th-12th Centuries perfectly preserved in Sayat, monuments of the Hisar Valley, and there is a mosque in Uroteppa from the 15th Century. It said that the religion of the Tajiks defined their aspiration for understanding the world through science and literature.

Many of Tajikistan's cultural traditions are inscribed on UNESCO's list of Intangible Cultural Heritage, including shashmaqom traditional music; the International Day of Nawruz, which marks the arrival of Spring, the oshi palov, a national dish; and chakan, the art of embroidery. Tajikistan is famous for its hospitality.

Turkmenistan has a rich cultural heritage that dates back millennia, with a particular focus on poetry, literature, and architecture.

The country's foreign policy is grounded in neutrality, and it has worked to foster good relations with its neighbours and the international community. The country's economy is heavily reliant on oil and gas, and it has made efforts to modernise and diversify its economy, particularly in the areas of transport and logistics. Turkmenistan is also home to numerous historical and cultural landmarks, including the ancient city of Merv and the Kunyaurgench complex.

Following the traditions and creative energy of ancestors, the Turkmen people have preserved their national heritage. Historical and cultural values for many centuries have influenced the progress of the peoples of neighbouring and farcountries, while enriching the country itself.

The land is an ancient centre of science and culture, where unique discoveries were made and literary masterpieces were created. Turkmens revere literature, and see books as a treasure for wisdom and spiritual rebirth. There were as many as 10 libraries in Merv during the Middle Ages. Ancient Kunyaurgench became famous for its academy, the first house of sciences in Central Asia.

On the territory of Turkmenistan, one cannot count all the worthy monuments that testify to the contribution that the Turkmen people over the centuries.

Modern Turkmenistan is characterised by the development and improvement of state institutions, with new reforms and undertakings initiated in all spheres of state and public life. The priority directions of Turkmenistan are pursuing global peace, stability and security, consistent implementation of the UN SDGs, and strengthening neighbourly ties in the region and beyond.

Special attention is paid to the younger generation, with a policy of fundamental social transformations aimed at ensuring wellbeing, the financing of health care and education systems, housing and communal services, increasing salaries and pension levels. Within this framework, the economic base of the country is being significantly strengthened, the volume of investments in priority sectors of the national economy is increasing. Comprehensive measures are being gradually implemented aimed at developing industrial, agricultural, and manufacturing with the rationalising of the use of natural resources. Wellbeing and a good standard of living seem assured.

Fuel and energy are key to the national economy. Effective implementation and optimal use of the processing sector will expand the range of competitive products manufactured from

hydrocarbon, as well as diversification of sources supplied to world markets.

At the initiative of Turkmenistan, the United Nations General Assembly adopted a resolution on “Reliable and Stable Transit of Energy and its Role in Ensuring Sustainable Development and International Co-operation”.

The energy strategy is not limited to export of raw materials. Fuel resources allow for the development of the electricity, chemicals, and other industries. The latest scientific and technological progress can be seen in its domestic industry, technical re-equipping of petrochemical enterprises, and the construction of new gas and oil refineries. The industry is gradually being modernised.

Attention is being paid to the transport and communication sectors, developing transport and transit corridors in all directions. There is active participation in the creation of international corridors: Turkmenistan-Azerbaijan-Georgia-Turkey, Uzbekistan-Turkmenistan-Iran-Oman-Qatar, and Transport Corridor Europe-Caucasus-Asia.

Neutrality is a key tenet here. Turkmenistan has followed a peace-orientated foreign policy since the very first days of independent statehood. This was underlined in 2007, when Ashgabat was chosen as the seat of the United Nations Regional Centre for Preventive Diplomacy for Central Asia. The unique structure aims to create a political climate conductive to regional peace and prosperity.

Expansion and diversity of its foreign relations have created favourable conditions for diversification of international economic, trade and investment co-operation.

TOURISM

Development of tourism is a priority area. The increase in the country’s potential is based on the expansion and diversity of tourist routes, together with development of its transport and logistics infrastructure to world standards. Importance is placed on training personnel for the tourism industry.

Cultural and educational tourism have gained popularity among travellers. About 1400 historical and cultural monuments are registered in the country, with several included in the UNESCO World Heritage List. They include

Merv, Kunyaurgench, New and Old Nisa, the sites of Koytendag and Badhyz, Dehistan, the Sumbar valley, and the Karakum desert, the ancient sites, cities and fortresses of the Great Silk Road. i

ABOUT THE AUTHOR

Lord (JD) Waverley

House of Lords, UK Parliament Crossbench Member

Co-chair

All Party Parliamentary group: Trade & Investment

All Party Parliamentary group: Future UK’s Freight & Logistics sector

Founder

www.GoGlobal.trade

Following the May G7 summit in Hiroshima, US President Joe Biden claimed that he expects a “thaw” in relations with China. Yet despite some recent official bilateral meetings – with US Secretary of the Treasury Janet Yellen expressing hopes for a visit to China soon – relations remain icy.

In fact, far from thawing, the new cold war is getting colder, and the G7 summit itself

magnified Chinese concerns about the United States pursuing a strategy of “comprehensive containment, encirclement, and suppression.”