Giannis Antetokounmpo

Giannis Antetokounmpo

Giannis Antetokounmpo

Giannis Antetokounmpo

The Limited Edition Bremont Longitude is a groundbreaking timepiece that not only looks back at our country’s legacy but also forward to an exciting future of British watchmaking. The watch’s case back incorporates brass from the original “Flamsteed Line,” in Greenwich, the very spot where the first Astronomer Royal made his celestial observations in pursuit of an aid to navigation.

It has long been the goal of Bremont to bring watch manufacturing back to Britain. The Longitude represents a milestone in that journey, a homecoming of sorts, and proof that, to get where you’re going, you need to know where you came from.

The climate crisis has prompted net-zero posturing from companies across sectors — and any claims they make merit public scrutiny.

The stakes are high.

Net-zero assurances should be checked against select-focus emissions disclosure, misalignment with science-based targets, and ineffective carbon-credit programmes. Regulation and oversight are patchwork at best. Carbon offsets need to be “additional” to make a dent in the crisis — and many aren’t.

The price of credits varies according to the quality of the project and the standards under which it was developed. Market opacity allows companies to buy those credits cheap — and then start touting a reduced-emissions footprint. It’s an easy-out for big polluters seeking business-as-usual.

Researchers have found forest-protection projects for areas that were in no danger of being logged. There is even evidence of the systematic misallocation of credits in the world’s largest offset programme, the Clean Development Mechanism (CDM).

A 2021 report estimates the CDM approved as valid 28 million tonnes of carbon offsets for sub-marginal wind-power projects in India. These windfarms would probably have been built without the CDM subsidy, leading researchers to extrapolate that wasted allocations may have increased global carbon dioxide emissions by 6.1 billion tonnes — equivalent to running 20 one-gigawatt coal powerplants for their entire 50-year lifespans.

Companies wanting to make a difference should explore science-based targets that will verifiably reduce emissions and soften environmental footprints. Otherwise, carbon offsetting is little more than greenwashing, and a distraction.

More transparency and accountability is needed across the movement as a whole.

A 2021 report by the Energy and Climate Intelligence Unit and Oxford Net Zero found that 21 percent of the world’s 2,000 largest public companies had made net-zero commitments —but just over a quarter met the “minimum set of robustness criteria”.

An analysis of climate pledges by 35 companies in the top-10 market capitalisation across the oil and gas, mining, chemicals, utilities, cement, steel, and food-processing industries found most goals were not sciencebased. The fossil fuel and mining companies assessed had minimal target-setting on scope-three emissions — those that occur in the value chain of the reporting company — where over 90 percent of lifecycle emissions occur. Their exclusion in disclosure reports effectively nullifies any net-zero pledge.

Environmental commitments should have short- and medium-term targets, instead of distant ambitions that lack the science-backed steps to achieve them. Corporations should incentivise, and plan at board level for climate action in capital expenditures. At the very least, they shouldn’t be making grand claims that are undermined by shady lobbying tactics.

Greenpeace made waves in June 2021 when it forced lobbyists to admit that ExxonMobil Corporation had publicly endorsed a carbon tax — in the full knowledge that the plan would never gain political support. In 2018, the corporation crowed about the $1m it spent on a two-year carbon-tax advocacy campaign in Congress.

Its annual lobbying budget is $12m.

ExxonMobil claimed to be shocked by the findings, and doubled down on its commitment to find solutions to climate change.

When will big polluters realise that a dead planet supports no business at all?

We are right to protest the difficult (and sometimes dangerous) conditions under which migrant workers sometimes find themselves. Some come to realise that their dreams of a better life will come to nothing when they are thousands of miles from home after signing apparently lucrative employment agreements. Sadly, not a few of these workers would have done much better to stay at home.

Doubtless you are thinking of certain destinations where reports of such behaviour are common. But please don’t think we in the UK are always on the side of the angels.

Some seasonal fruit pickers in Kent who were recruited this year from Nepal are finding themselves in great debt having taken up loans and selling whatever they had to finance their search for fields paved with gold. Expecting to spend half a year in the UK under the government’s seasonal worker scheme, they were let go after less than two months – with no chance of taking on other work because of the type of visa they were holding.

Migrant rights advocates were saying in November that there should be guaranteed hours and the possibility of taking on other jobs if farm work is not available. That sounds about right to me.

The recruitment agencies report that the Nepalis were told of the reducing availability of work before they travelled here. And that may be true. The problem is that when you are chasing a dream there is a tendency to look on the bright side.

I hope we become more welcoming to foreign seasonal workers. ROSEMARY DOWN (Ashford, Kent, UK)

The evening of 9/10 November 1938 has become known as Germany’s Kristallnacht(TheNightofBrokenGlass). Nazi violence to Jewish citizens, shops, other businesses, and synagogues represented a comparative baby step to the unspeakable horrors of the concentration camp and Holocaust.

This year, KFC inadvertently invited German patrons (by app) to celebrate the 84th anniversary of Kristallnacht by sampling its famed “soft cheese and crispy chicken”. Apart from the obvious objection, I was unable to countenance this suggestion because I am a vegan.

Of course, KFC was as alarmed as everyone else when they got the news of this digital screw-up and pulled it immediately. I say “got the news” because most likely, none of their personnel had even the foggiest idea that the invitation had gone out. The company has not explained the problem fully, but it does look as though the message may have been generated by a computer programme that knows about anniversaries but not the significance of each one.

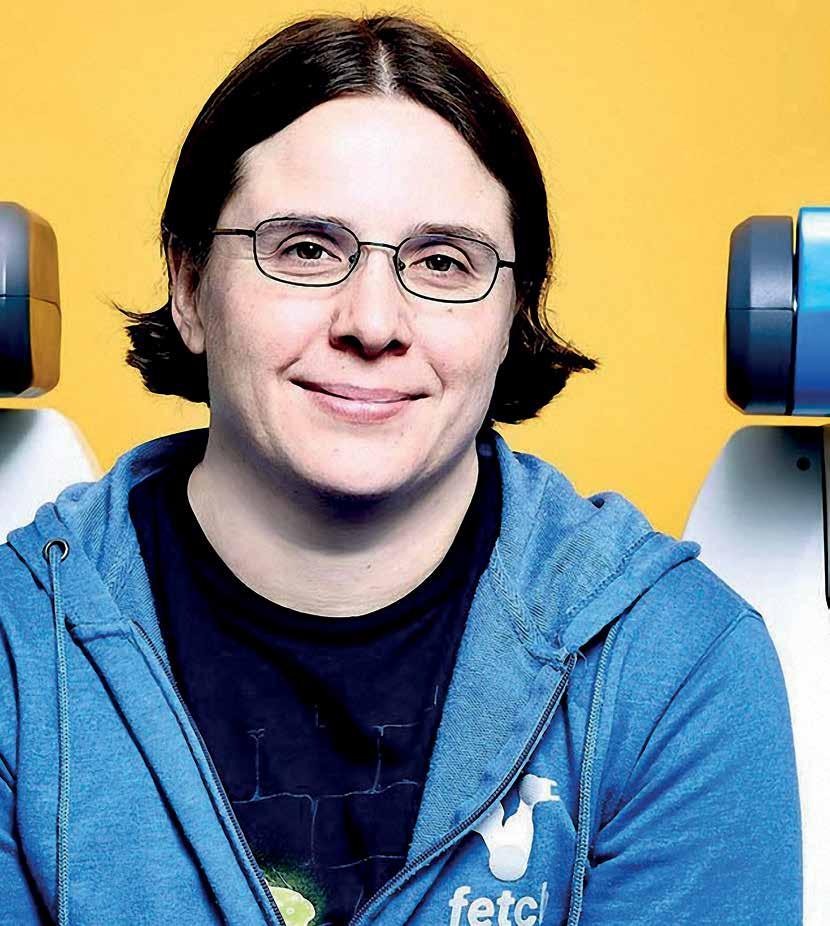

The moral here is that we must ensure that artificial intelligence develops in a way that responds properly to our needs and supports us. KFC was able to correct this error within an hour, but the speed of such a reaction may not always be possible. Some mistakes may go uncorrected and cause us grief. In the meantime, KFC, get one of your warm bodies on the case.

CHARLOTTE WEBER (Berlin, Germany)I came across CFI.co while travelling for business and have tuned into your channels ever since. I appreciate your comprehensive coverage of world markets and the people that move them. I learn something new with each flip through the magazine or scroll down the webpage.

City of London

Your contributors and journalists have sparked plenty of water-cooler conversations with my colleagues, and you’ve introduced me to some of the world’s most innovative entrepreneurs and thought leaders.

There are plenty out there ready to pull us down if we become too successful. And if you’re the richest man in the word, the spotlight is going to be on you.

CFI.co certainly did a fine demolition job on Chief Twit Elon Musk (online post: 7 Nov). Okay, I’ll admit it, the freed bird looks a little unsteady, but don’t write it off yet.

My hunch is that Musk will get things in good shape before long. Your article (and tweet) says, “Dust off your shovels! Elon Musk has bought himself intoa$44bnhole,andyou’reexpectedtodighimout of it….” Yes, he has certainly got a problem on his hands, but I’m confident that he will rescue himself –and take Twitter on to glory.

Don’t forget the extraordinary achievements of the man thus far. He is busy creating a better world for us and has a brain the size of an aviary.

I know, I know. I understand that everyone and their accountant, every business, every shopowner, each gambler and punter and optimist — they all want to be rich. But man, I’m sick of reading about the world’s wealthiest people. The filthy rich: there’s no better term for them.

The worst thing is, it’s always the same handful of misery-bags, more alien than human, it seems to me, who make up the rankings. Musk, Bezos, Arnault, Gates... Aaargh! If the pandemic caused Mr and Mrs Average such woe, financially, spiritually, in terms of lost freedoms, why, oh why, do the rich keep on getting richer and gadding about the planet like it’s their private playground?

Your recent article on the subject (Autumn 2022) — admittedly entertaining, in spite of the content — had me once again writhing in despair and futile anger. I don’t care how many billions they have; what I do care about it that these nincompoops, techies-who-got-lucky, inheritors of vast family fortunes, somehow gain elevated status in society. As if we care, or should care, what they think of world events. Musk is the chief offender here; hopefully he will continue to blunder his way through the Twitter purchase and end up skint. Or skinter, anyway. And then belt up.

World events are the domain of politicians, not ordinary people — not until we have true democracy, anyway — and I promise not to begrudge them their lucre if they’ll just wrap up and go back inside their ivory towers.

PS: If you’re wondering why a Labour voter from East London is even reading your magazine, my almostfilthy-richuncleforgothiscopyinmyfrontroomwhen he came to visit / gloat at my reduced circumstances. I was on my way up myself before Covid hit — on my wayuptopossiblyqualifyingforamortgage,thatis...

TOWER HAMLETS(London)

Lord JD Waverley

Sarah Worthington

George Kingsley

Tony Lennox

Brendan Filipovski

John Marinus

Ellen Langford

Helen Lynn Stone

Naomi Snelling

Wim Romeijn

Lord Waverley

14 – 43

IFC Alfonso García Mora Otaviano Canuto Nouriel Roubini Joschka Fischer Wim Romeijn Lord Waverley Tony Lennox Brendan Filipovski Joseph E Stiglitz Pollen Street Capital 44 – 49

50 – 81

Victor van der Kwast

Byblos Bank Europe

CQ Investment Group

Lindsey McMurray David Casas Alarcón Nordea Finance

Peter Hupfeld Forward You Manfred Dirrheimer Matthieu André Architas Central Bank of Bosnia and Herzegovina Senad Softić Henning Vold Joachim Nahem

Norvestor Christian Andersson Worthwhile Capital Partners

Alberto & Francesco Ferrari First Marine Insurance Kitty Wenham Wilhelm Celeda Kathrein Privatbank 82 – 97

Rewarding Global Excellence 98 – 105

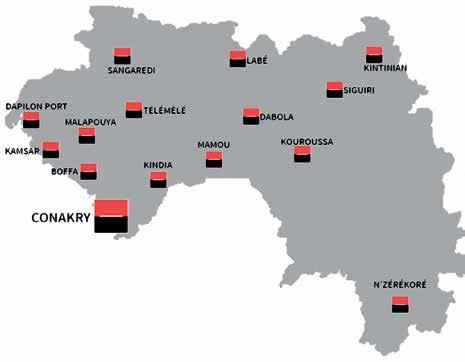

Thierno Ibrahima Diallo Société Générale Guinée Kellogg Insight 106 – 119

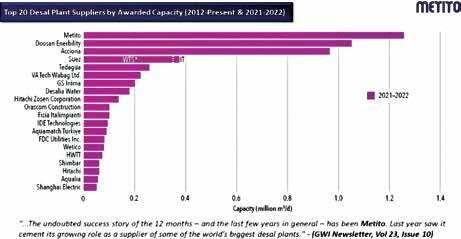

Mohammed Alsheikh Banque Saudi Fransi Metito

Capital Bank of Jordan Salem Khalaf Al-Mannai Qatar Insurance Company’ Bashar Kilani Accenture 120 – 127

Nazca Sergio Caveggia EY Argentina 128 – 147

Mario Choueiri Aidan Garrib PGM Global Inc

John Engel Wesco International Heather Smith OECD 148 – 165

Chris Paton

La Trobe Financial MTR Corporation

Jacob Kam Chak-pui Amal Abeyawardene Wing Bank

Han Peng Kwang Naomi Snelling IDClear

Iding Pardi Thai Life Insurance Chai Chaiyawan Women’s Brain Project UNCDF

By 2030, climate related financing needs to deploy up to $3.5tn – or about four to five times the volume available at present: “The money exists and is mostly in the hands of institutional investors. In fact, they hold about a thousand times more funds than those available to development finance institutions. What we need to do is to create the conditions that make projects bankable.”

Mora is convinced that blended finance is key. Part of the World Bank Group, the International Finance Corporation (IFC) is, arguably, the most successful catalyst of private investment. Its seal of approval usually unlocks private capital to the tune of $11 for each dollar the IFC co-finances. “A few years ago, the role and use of multilateral institutions was being questioned but now the realisation has dawned that we need to coordinate our efforts to get the outcomes desired.”

The IFC provides much more than just financing: “Our environmental, social, and governance [ESG] framework is exceptionally strong. Once our borrowers comply with that framework, they also comply with the ESG framework of any other financial institution. This opens a world of possibilities.”

Mora points out that, in a way, the IFC does the due diligence “free of charge” for other investors. This “additionality” can be leveraged to boost the development of the private sector in nearly any market.

The IFC sees a world of opportunity In Latin America where its strategy rests on three pillars: inclusion, sustainability, and productivity. In Chile, the bank helped finance the largest electric bus programme outside China. It also plans to assist local power utility Engie Chile to decarbonise by changing its energy mix and replacing coal-fired power plants with solar and wind generation. Next, the IFC is exploring ways to encourage the production of green ammonia by exploiting the intermittency of renewables.

Though the IFC doesn’t work with country-based targets, it expects to deliver about $1bn in (blended) financing to Chilean businesses and projects over the course of 2023 – a threefold increase over the 2021 volume: “Chile needs to support inclusive growth and sustainability. Moreover, the macro-economic and fiscal situation of the country is better than that of others in the region which means that Chile has the right fundamentals to deal with what is coming and take the necessary actions.”

Mora would like to see the IFC pick up the pace when it comes to agribusiness: “Our investments in this space have so far been tiny. However, there is an urgent need to improve operational efficiencies and reconfigure wasteful business models particularly as they relate to water use. Water scarcity is real and getting worse with time. Water is going to become a huge issue and may spark conflict.”

The blue economy – defined by the United Nations as the sustainable use of ocean

resources for economic growth, improved livelihoods, and jobs – is another area that merits attention: “In Latin America, already 25 percent of the populations lives on the coast. In some Caribbean island nations that is 100 percent.”

In Ecuador the IFC recently reached an agreement to subscribe up to $40m in blue bonds out of a total of $79m placed by the Banco Internacional. The bonds will help the country’s efforts in climate change mitigation and adaptation. The IFC’s participation paved the way for the first private sector blue bond issue in Latin America.

In Europe, the IFC is determined to underwrite the rebuilding of Ukraine’s battered private sector. “. According to UkraineInvest, 86% of private sector companies completely or partially shut down in March while almost all of them resumed work in September. Our support program will leverage blended finance and will prioritize investments to ensure supply of critical goods and services, such as food and fuel,

To mitigate the harmful effects of climate change requires the mobilisation of trillions of dollars. IFC Regional Vice-President for Europe, Latin America, and the Caribbean Alfonso García Mora is encouraged by the outcome of COP27 where it was decided –after three decades of discussions – to set up a Loss and Damage Fund: “However, the public purse cannot provide the volume of funding needed. Only the private sector can rally the required levels of funding.”Regional Vice-President for Europe, Latin America, and the Caribbean: Alfonso García Mora

support business preservation and reallocation, and address immediate logistics and energy threats. Right now, we are providing working capital to a few companies but most of the attention of multilateral finance institutions has, understandably, gone to the public sector which suffers a fiscal deficit of between three and four billion dollar every month.”

Mora foresees a “huge role” for the IFC and points out that the Marshall Plan was, in essence, a form of blended finance avant-lalettre: “We need something similar for Ukraine whereby multilaterals supply seed financing that mobilises the vast volumes of private capital required to get the Ukrainian economy up and running.”

The IFC is set to launch a financing facility to help Ukraine and neighbouring countries redirect supply chains away from Russia. Another programme involves the setting up of a global food security platform – like the bank’s global health platform – to support commodity traders, farmers, food processors, and fertiliser companies.

In December 2022, García Mora announced that the IFC is to serve as the strategic advisor to the Ukrainian government on the creation of optimal conditions to boost private sector investment in reconstruction.

“The war will have a long-lasting macroeconomic and social impact on Ukraine and its people. The financing needs to rebuild Ukraine’s infrastructure and support its economic recovery are immense and keep rising. As one of Ukraine’s largest private sector investors, the IFC is committed to help leverage much needed private capital for Ukraine’s rebuild. We will start working with the Government of Ukraine on strengthening the enabling environment for private investment in infrastructure, as well prioritising and developing projects. This will help mobilise private investors as soon as Ukraine’s conditions allow to start the full-fledged reconstruction.”

In a policy statement on Ukraine, the IFC pledged to support the country’s existing private sector and provide direct support to Ukrainian suffering from Russia’s invasion, including refugees. The institution is determined to prioritise investments that ensure the supply of critical goods and services such as food and fuel and seek to address immediate logistics and energy threats. i

"In Ecuador the IFC recently reached an agreement to subscribe up to $40m in blue bonds out of a total of $79m placed by the Banco Internacional."

Current global stagflation may evolve to become a soft landing, a sharp downturn, or a deep recession. It will all depend on how fast inflation responds to economic deceleration.

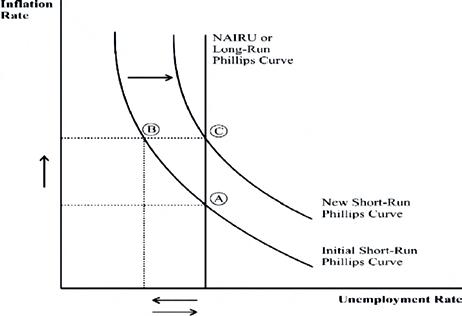

That involves guessing the shift in major economies’ Phillips Curves. The economic model, named after William Phillips, hypothesises a link between reductions in unemployment and increased wage rates.

Some areas of financial intermediation — such as the sudden disappearance of liquidity — have recently developed increased vulnerability. Significant shocks could cause the Phillips Curve to exhibit higher unemployment and under-utilisation of capacity — even as inflation rates decline.

Global inflation has triggered the simultaneous tightening of monetary and fiscal policies. Economic growth projections for 2023 have been revised downward. Inflation rates will come down only gradually, given the price stickiness of their core components. The world faces a situation of stagflation — a combination of significant inflation and low or negative GDP growth.

The evolution of the situation will depend on how fast inflation drops in response to economic deceleration. This can be assessed by the Phillips Curve shifts in major economies, reflecting the cross-border spill-over of countryspecific policy choices. Any abrupt deterioration in financial conditions may cause Phillips Curve movement.

A global recession — global GDP rising more slowly than population growth — is a strong possibility. The combination of economic slowdown and inflation will vary in different countries, but it will be a common feature.

Here we compare the underpinnings of the inflation/unemployment trade-off in the 1970s and ‘80s and the current storm provoked by the pandemic and the war in Ukraine.

Recent challenges arise from the appreciation of the US dollar relative to other currencies,

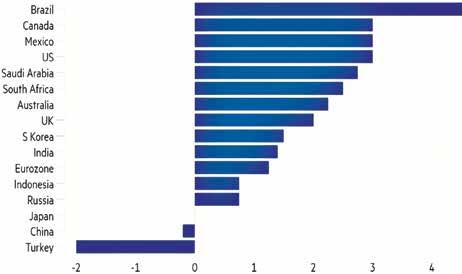

Figure 1 (1/2): Change in central bank policy rates since Dec 31 2021 (G20, except Argentina (+37%pts), % points). Source:Wolf(2022).

particularly those of other major economies. This may reinforce the contractionary pressures on the global economy. In emerging-market and developing countries (EMDEs), although exchange-rate depreciation has not been as intense as in non-US advanced economies, vulnerabilities associated with dollardenominated liabilities could intensify problems.

Recent interest rate rises have been widespread. The left side of Figure 1 depicts basic interest rate hikes since 2021, while its right shows market estimates of rate hikes.

On September 21, 2022, the Fed raised the target for the federal funds rate by 75 basis points, bringing it into the 3-to-3.25 percent range. The Fed maintains that further rate hikes are appropriate. It notes that while national spending and production have declined, the increase in employment has been robust. Individual projections by the members of the Fed’s Open Market Committee (FOMC) have changed from those issued in June. The September median federal-funds interest rate projections pointed to a rate of 4.4 percent by year’s end.

Rates are expected to rise in early 2023, with a projected peak of 4.6 percent. Fed chairman Jerome Powell said rates must remain restrictive

Figure 1 (2/2): Global Monetary Policy Tightening. Note:Bp-basispoints.Source:J.P.MorganGlobalEconomics.

enough to keep the US economy running below its potential to reduce inflation.

This appeared in downward revisions to forecasts for real GDP growth: 0.2 percent year-on-year in Q4 2022, followed by 1.2 percent and 1.7 percent in 2023 and 2024. Growth over the next two years will be below the estimated potential level of 1.8 percent. The Fed believes inflation will not reach its target until 2025.

The Fed has also revised its forecast for the unemployment rate, predicting a rise from 3.7 percent now to 4.4 percent by the end of 2023.

Unemploymentandwageratesaretheoreticallylinked,andmayholdakey toourimmediateeconomicfuture.

Historically, a rise of this magnitude over one year has always been followed by a recession.

Two consecutive quarterly negative GDP numbers are enough to state that the US economy is already in recession (Canuto, 2022a). With a discrepancy between negative GDP and positive gross domestic income (GDI) numbers in the second quarter, the performance of the labour market did not point to strong deceleration.

There is a general rise in interest rates, as seen in Figure 1, with the exception of China, Japan, and Turkey. In the week of the Fed’s September meeting, central banks in Switzerland, Sweden, Norway, Denmark, Hong Kong (China), the UK, Indonesia, the Philippines, and South Africa all hiked rates, as the European Central Bank and the Bank of Canada had done the previous week. In Brazil, there was no increase, as a strong cycle of interest rate hikes had already occurred.

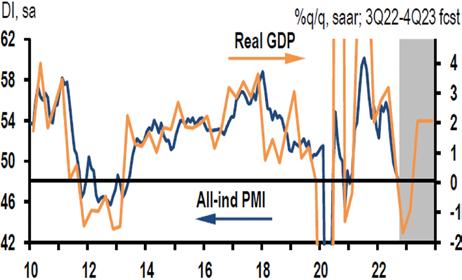

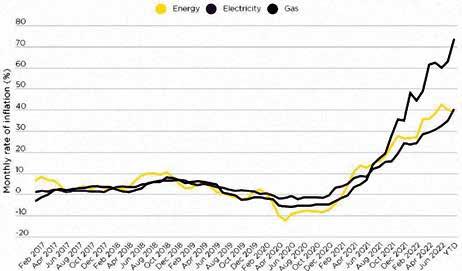

In July 2022, the European Central Bank (ECB) hiked interest rates for the first time in 11 years. In September, it agreed an increase of 75 basis points. After being at zero or in negative territory for more than a decade, the European Union now has a rate of 0.75 percent. The ECB’s interest rate should continue to rise. In the euro area, industrial production dropped in July 2022 (Figure 2), as a result of the energy price shock, while headline inflation projected for September was already close to 10 percent per year.

Higher inflation has prompted central banks around the world to push their restrictive buttons, with exceptions in China, Russia, Japan, and Turkey (Figure 1 (1/2)).

There is an intrinsic challenge to the globalised economy. Each central bank looks to its own country when deciding monetary policies. In such an interdependent economy, the repercussions go beyond borders. The probability of feedback from

restrictive monetary policies is greater when there is response to a common inflationary problem.

The combination of higher energy prices, US dollar appreciation relative to the euro, China’s growth deceleration, and risks of a second eurozone debt crisis as interest rates and risk premium on Italian bonds rise, means a probable recession in Europe. Taking into account the slowdown in America, a global recession is likely.

A September report by the World Bank (Guénette et al, 2022) noted that despite the global slowdown in growth, inflation in many countries has risen to the highest levels in decades. The global economy is experiencing a period of international synchronicity in the tightening of monetary and fiscal policies — like the one that preceded the 1982 global recession.

A key variable is the evolution of the inflation rate as it hovers around multi-decade highs in Europe and the US. With activity weakening, monetary policy commands strong credibility, and inflation expectations remain stable for Europe and the US. One concern is that high inflation itself raises the risk for second-round effects on wages.

It remains to be seen to what extent price feedback and the inflationary spiral will yield to fiscal and monetary tightening. The downward revision of global growth projections for 2022 and 2023 has been remarkable.

The September 2022 OECD Economic Outlook revised downward its GDP growth projections in 2022 and 2023 (Figure 3). Global growth is likely to slow in 2023 to an annual rate of 2.2 percent. with to the OECD forecasts from December 2021, before Russia’s invasion of Ukraine, global GDP is projected to be at least $2.8tn lower in 2023.

Inflationary pressures increase as unemployment declines or the heating of economic activity starts to conflict with its capacity, and vice-versa.

Interest-rate decisions by central banks depend on the level of aggregate demand and the extent to which potential GDP will be under- or over-utilised. The Phillips Curve expresses the inflation-unemployment dilemma.

In principle, there is a level of interest rates at which demand pressures would not be excessive, or would be insufficient in relation to potential GDP. This is called the neutral interest rate: inflation and unemployment would tend to remain stable. There is a certain rate of unemployment at which inflation remains stable — the non-inflation accelerating rate of unemployment (NAIRU).

The relationship between unemployment and inflation does not necessarily remain stable. There are endogenous changes when an economy spends time above or below the neutral level.

In situations of overheating and rising inflation, vicious circles of inflationary feedback can arise. Expectations and behavioural feedback will only be reversed if the economy spends some time below its potential, during which the inertia of inflation will keep it going for some time.

This is illustrated by the shift of the initial short-run Phillips Curve toward a new short-run Phillips curve (Figure 4), after some time spent at point B rather than point A. Stability can then only be reached when the unemployment rate moves back to NAIRU (point C). Any return to point A will demand a period of unemployment rates above NAIRU, coupled with an unwinding of inflation expectations and of wage-price spirals.

Stagflation — significant inflation, high unemployment, and zero or low economic growth — observed in the US in the 1970s and 1980s corresponded to being in a zone to the right of point C. The Phillips Curve had shifted upwards, and inflation only declined after a period of high unemployment.

The following decades saw the period of “great moderation”, the period of low macro-economic volatility from the mid-1980s until the 20072008 financial crisis. The Phillips Curve had shifted down.

After the recession that followed the GFC, the shift seemed to have been confirmed. The US economy took a while to recover but expanded for more than a decade — at rates below historical averages, but corresponding to a period without recessions.

Inflation remained below the Federal Reserve’s two percent target, averaging 1.7 percent throughout the expansion. The looseness of monetary policy — including quantitative easing, or the Fed buying government bonds and mortgages — did not affect inflation (Canuto, 2022d).

Two main factors explain this flattening of the Phillips Curve: the anchoring of inflation expectations at low levels, and the possibilities opened by the globalised economy. Instead of upward pressures on the domestic prices of products that might be in short supply, imports could absorb demand. In the absence of generalised overheating, globalisation could function as a buffer against inflation.

The rise in inflation from pandemic supply shocks and the invasion of Ukraine created the “perfect storm”. Accelerated inflation came to be recognised as something that is not automatically reversible. It reflects the size of fiscal and monetary stimulus in advanced economies, with the channelling of demand for goods creating bottlenecks in supply chains. In addition, the workforce has contracted, reducing employment levels.

The Phillips Curve has shifted again. Gita Gopinath, the IMF’s first deputy managing director, outlined this at the Federal Reserve’s Jackson Hole Economic Symposium in August. Less than a quarter of a percentage point of the rise in inflation can be attributed to unemployment falling below the NAIRU (Gopinah, 2022). In any case, there is now a simultaneous development internationally in the tightening of monetary and fiscal policies, making a global recession likely, as we have discussed.

And now? Where will the Phillips curve go? Will the relationship return to how it was before the pandemic?

According to the Institute of International Finance (Brooks et al, 2022), the effect of the pandemic as a source of shocks on supply chains seems to have ended, given the stage of normalisation of delivery times and the reduction of its upward pressure on inflation. On the supply side, there are still the impacts of the war in Ukraine on global inflation, especially in Europe.

Post-pandemic job supply will remain difficult to predict. There is also the risk that “relative deglobalisation” of value chains undermines the balancing of supply and demand via foreign trade, rather than domestic prices.

On the aggregate demand side, will the longterm low interest rates bring structural changes? Gopinath suggested that while demographics, income inequality, and a preference for safe assets will continue to keep rates low, higher post-pandemic debt and inflationary shocks accompanying the energy transition will work in the opposite direction.

The Philips Curve will keep moving. It is necessary to verify whether monetary adjustment programmes will be effective in keeping inflationary targets as anchors for expectations. This may affect which growth deceleration scenario prevails.

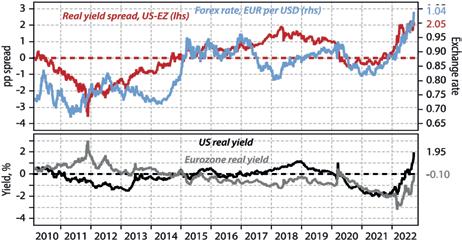

DOLLAR APPRECIATION CONTRACTIONARY? Dollar appreciation may reinforce the

Source:Denyer,W.(2022).TheKeyDriversforCurrencies,GavekalResearch,September28(gavekal.com).

contractionary pressure on the global economy. In emerging market and developing countries (EMDEs), vulnerabilities associated with dollardenominated liabilities may lead to intensified problems.

Take the US Dollar Index (DXY), a measure of the value of the dollar against six other currencies. On September 28, the DXY was at its highest level since May 2002. Compared to the beginning of 2022, the dollar was up 18 percent against the euro, and 26 percent against the Japanese yen and British pound. Figure 5 shows how 20 G20 currencies have so far in 2022 evolved.

A key additional driver of dollar appreciation has been the higher yield in real terms of US assets relative to others. Figure 6 shows the differential in real yields between America and the euro area, as measured by yields on five-year inflationindexed government bonds paired with the eurodollar depreciation. It reflects the more rapid interest rate moves in the US, followed by market expectations about the Fed’s anti-inflation drive.

According to W Denyer, a similar picture may be built for the comparison of risk-adjusted rates of return for other fixed-income assets. Further bouts of dollar appreciation might happen if the other central banks continue to lag in setting interest rates and/or the pace of adjustment by the Fed. One-off events, such as an intense depreciation of the British pound caused by a proposal for unfunded tax cuts, were partly reversed.

Some countries have tried direct interventions in exchange rates instead of — or as a complement to — lifting domestic interest rates. Japan has opted to sell US Treasury bond reserves to try to counteract the yen's exchange rate devaluation against the dollar. Switzerland is also said to be considering selling foreign currency to support the Swiss franc, as well as raising interest rates.

After the 2008-2009 global financial crisis there were “currency wars”, when countries accused

each other of exporting their unemployment problems through significant reductions in domestic interest rates and currency devaluation. A reverse currency war may now be emerging. In the absence of some sort of new Plaza Accord, individual countries’ efforts to evade interest rate adjustments via direct interventions in exchange markets will have limited effect if the underlying factors leading to capital flows are not altered.

Besides hurting US multinational companies’ profits from abroad, and emerging markets’ dollar-denominated foreign liabilities, dollar appreciation may lead to inflationary shocks and tighten monetary policies. Feedback loops of restrictive policies may be sparked.

Where Phillips Curves have moved to will matter.

Since the beginning of 2022, a rapid deterioration of growth prospects, rising inflation and tightening financing conditions have ignited a debate about the possibility of a contraction in global per-capita GDP.

Forecasts for global growth have fallen since the beginning of 2022. They don’t point yet to a global recession in 2022–2023, but Guénette and others call attention to earlier recessions.

Every global recession since 1970 was preceded by a weakening of global growth in the previous year. All previous global recessions coincided with sharp slowdowns or recessions in several major economies.

Despite the current slowdown, inflation has risen to multi-decade highs. To curb the risks from persistently high inflation, many countries are withdrawing monetary and fiscal support. The global economy is in one of the most internationally synchronous episodes of monetary and fiscal policy tightening of recent decades.

These policy actions are understood as necessary to contain inflationary pressures. But their

mutually compounding effects could lead to greater impacts in terms of tightening financial conditions and growth slowdown. These policy conditions were not seen in the 1975 global recession, but they were before the one in 1982.

Guénette proposes three scenarios for 20222024. The first baseline scenario follows closely recent consensus forecasts of growth and inflation, as well as market expectations for policy interest rates. This is the soft-landing scenario, in which global growth is forecast to slow from 2.9 percent in 2022 to 2.4 percent in 2023, rising to three percent in 2024. The slowdown in 2023 would lead to growth in percapita terms approaching that of the downturn episodes of 1998 and 2012. Global trade growth would reflect a broad-based weakening of demand in 2023, before accelerating in 2024.

Growth in advanced economies would slow from 2022 to 2023, before recovering somewhat in 2024. Growth in EMDEs would accelerate from 2022 to 2024 as global headwinds fade and post-pandemic recovery continues.

After peaking at 7.7 percent in 2022, global headline CPI inflation in the baseline scenario would remain high relative to the inflation target into 2023, at 4.6 percent. The projection for 2024, at 3.2 percent, is in line with a gradual approach to the target, about 2.5 percent at the global level in GDP-weighted terms (average 2 percent in the US).

Inflation in EMDEs is projected to decline from 9.4 percent in 2022 to 4.5 percent in 2024, above its aggregate target of 3.5 percent. The decline in core CPI inflation, which excludes the volatile energy component, would be more sluggish. Given this inflation outlook and the expected path of policy rates, short-term interest rates would remain negative, or near zero, in real terms throughout most of the projection horizon.

The degree of monetary policy tightening currently expected may not be enough to restore low inflation quickly enough.

The second scenario — sharp downturn — supposes an upward move in inflation, which would lead to additional synchronous monetary policy tightening by central banks.

Central banks in advanced economies and EMDEs could raise their benchmark policy rates by a cumulative 100 basis points above baseline assumptions until the end of 2023, deciding to sustain this differential through 2024. In this scenario, the global economy would still escape a recession in 2023 but would go through a sharp downturn without restoring low inflation by the end of the next year.

While headline inflation would continue its downward trajectory in 2024, it would do it at a slower pace. The decline in core inflation would be broadly unchanged relative to the baseline

The world economy is lurching toward an unprecedented confluence of economic, financial, and debt crises, following the explosion of deficits, borrowing, and leverage in recent decades.

In the private sector, the mountain of debt includes that of households (such as mortgages, credit cards, auto loans, student loans, personal

loans), businesses and corporations (bank loans, bond debt, and private debt), and the financial sector (liabilities of bank and nonbank institutions). In the public sector, it includes central, provincial, and local government bonds and other formal liabilities, as well as implicit debts such as unfunded liabilities from payas-you-go pension schemes and health-care systems – all of which will continue to grow as societies age.

Just looking at explicit debts, the figures are staggering. Globally, total private- and public-sector debt as a share of GDP rose from 200% in 1999 to 350% in 2021. The ratio is now 420% across advanced economies, and 330% in China. In the United States, it is 420%, which is higher than during the Great Depression and after World War II.

Of course, debt can boost economic activity if borrowers invest in new capital (machinery,

homes, public infrastructure) that yields returns higher than the cost of borrowing. But much borrowing goes simply to finance consumption spending above one’s income on a persistent basis – and that is a recipe for bankruptcy. Moreover, investments in “capital” can also be risky, whether the borrower is a household buying a home at an artificially inflated price, a corporation seeking to expand too quickly regardless of returns, or a government that is spending the money on “white elephants” (extravagant but useless infrastructure projects).

Such over-borrowing has been going on for decades, for various reasons. The democratisation of finance has allowed incomestrapped households to finance consumption with debt. Center-right governments have persistently cut taxes without also cutting spending, while center-left governments have spent generously on social programs that aren’t fully funded with sufficient higher taxes. And tax policies that favor debt over equity, abetted by central banks’ ultra-loose monetary and credit policies, has fueled a spike in borrowing in both the private and public sectors.

Years of quantitative easing (QE) and credit easing kept borrowing costs near zero, and in some cases even negative (as in Europe and Japan until recently). By 2020, negative-yielding dollar-equivalent public debt was $17 trillion, and in some Nordic countries, even mortgages had negative nominal interest rates.

The explosion of unsustainable debt ratios implied that many borrowers – households, corporations, banks, shadow banks, governments, and even entire countries – were insolvent “zombies” that were being propped up by low interest rates (which kept their debtservicing costs manageable). During both the 2008 global financial crisis and the COVID-19 crisis, many insolvent agents that would have gone bankrupt were rescued by zero- or negativeinterest-rate policies, QE, and outright fiscal bailouts.

But now, inflation – fed by the same ultraloose fiscal, monetary, and credit policies – has ended this financial Dawn of the Dead. With central banks forced to increase interest rates in an effort to restore price stability, zombies are experiencing sharp increases in their debtservicing costs. For many, this represents a triple whammy, because inflation is also eroding real household income and reducing the value of household assets, such as homes and stocks. The same goes for fragile and overleveraged corporations, financial institutions, and governments: they face sharply rising borrowing costs, falling incomes and revenues, and declining asset values all at the same time.

Worse, these developments are coinciding with the return of stagflation (high inflation alongside

weak growth). The last time advanced economies experienced such conditions was in the 1970s. But at least back then, debt ratios were very low. Today, we are facing the worst aspects of the 1970s (stagflationary shocks) alongside the worst aspects of the global financial crisis. And this time, we cannot simply cut interest rates to stimulate demand.

After all, the global economy is being battered by persistent short- and medium-term negative supply shocks that are reducing growth and increasing prices and production costs. These include the pandemic’s disruptions to the supply of labor and goods; the impact of Russia’s war in Ukraine on commodity prices; China’s increasingly disastrous zero-COVID policy; and a dozen other medium-term shocks – from climate change to geopolitical developments – that will create additional stagflationary pressures.

Unlike in the 2008 financial crisis and the early months of COVID-19, simply bailing out private and public agents with loose macro policies would pour more gasoline on the inflationary fire. That means there will be a hard landing – a deep, protracted recession – on top of a severe financial crisis. As asset bubbles burst, debtservicing ratios spike, and inflation-adjusted incomes fall across households, corporations, and governments, the economic crisis and the financial crash will feed on each other.

To be sure, advanced economies that borrow in their own currency can use a bout of unexpected inflation to reduce the real value of some nominal long-term fixed-rate debt. With governments unwilling to raise taxes or cut spending to reduce their deficits, central-bank deficit monetisation will once again be seen as the path of least resistance. But you cannot fool all of the people all of the time. Once the inflation genie gets out of the bottle – which is what will happen when central banks abandon the fight in the face of the looming economic and financial crash –nominal and real borrowing costs will surge. The mother of all stagflationary debt crises can be postponed, not avoided. i

Nouriel Roubini, Professor Emeritus of Economics at New York University’s Stern School of Business, is Chief Economist at Atlas Capital Team, CEO of Roubini Macro Associates, Co-Founder of TheBoomBust.com, and author of the forthcoming MegaThreats: Ten Dangerous Trends That Imperil Our Future, and How to Survive Them (Little, Brown and Company, October 2022). He is a former senior economist for international affairs in the White House’s Council of Economic Advisers during the Clinton Administration and has worked for the International Monetary Fund, the US Federal Reserve, and the World Bank. His website is NourielRoubini.com, and he is the host of NourielToday.com.

"With governments unwilling to raise taxes or cut spending to reduce their deficits, centralbank deficit monetisation will once again be seen as the path of least resistance."

e are witnessing an unprecedented confluence of major and minor crises. From the COVID-19 pandemic, surging energy prices, and the return of inflation in developed and developing economies, to fractured supply chains, Russia’s criminal war in Ukraine, and climate change, many of these crises are signs

not just of decay but of a new world order being born.

As the remnants of the twentieth century’s bipolar order finally disappear, a new global pentarchy is coming to the fore. The United States and China – this century’s two military, technological, and economic superpowers – will

be the dominant players, but Europe, Japan, and India will exercise meaningful influence over large swaths of the planet.

A big question mark hangs over Russia, because its future status, capacities, and strategic posture will depend on the outcome of its reckless war of aggression. Under President Vladimir Putin,

Russia has clung desperately to the past, seeking to recreate the twentieth or even the late nineteenth century. But with its catastrophically misguided effort to destroy Ukraine, it ultimately is destroying itself.

A Russian military defeat in Ukraine is already a certainty – a matter of when, not if. But it is still far too early to foretell the likely consequences. Will Putin’s regime survive, or will Russia’s defeat usher in another phase of internal decay and disintegration. Until that question is resolved, we cannot yet know whether Russia will try to maintain its old claim to hegemony in Eastern Europe and much of Eurasia.

If the Kremlin is forced to abandon that claim, its role as a world power would probably be over. To be sure, even a decrepit, humiliated Russia, rather than going into geopolitical hibernation, would most likely remain a major source of instability in the new world order, and especially on the European continent. But it is now clear that Russia’s massive nuclear arsenal is no longer sufficient to secure its geopolitical status in the twenty-first century. Its economy is being decisively weakened as the rest of the world moves to phase out fossil fuels – the backbone of the Russian economy.

Whereas Russia poses new risks because of its fragility and decay, China will do so by dint of its increasing wealth and might. Owing to the massive wave of globalisation that began in the early 2000s, China managed to lift itself out of poverty and position itself to achieve highincome status. And with the 2008 financial crisis partly discrediting the West, China has been able to expand its own global leadership role and present itself as a global superpower alongside the US.

Unlike the Soviet Union during the Cold War, however, China has not made the mistake of focusing solely on its military power. On the contrary, its global rise reflects its embrace of integration into US- and Western-dominated world markets by serving as the world’s “extended workbench,” while investing heavily

in competing with the West on the technological and scientific frontiers. The Chinese certainly have not held back on military investment, but they have not allowed spending on defense and security to crowd out everything else. The defining difference between China and Russia today is that, unlike Putin, the Chinese leadership has been living in the twenty-first century for quite some time.

The recent G20 summit in Bali laid bare this fundamental difference of outlook and purpose. Whereas Russia found itself diplomatically isolated, China was central to all the discussions and the shaping of the final communiqué. Though they have not adopted the Western line on the Ukraine crisis, large countries such as China and India used the occasion to distance themselves noticeably from the Kremlin, decrying its war policy and nuclear threats. If the in-person talks between US President Joe Biden and Chinese President Xi Jinping help to deflate Sino-American tensions, the Bali summit will have opened the door to reshaping international relations in the twenty-first century.

The outcome of the US midterm election offers yet another reason for hope, as the widely anticipated Republican “red wave” failed to materialise. The GOP failed to take the Senate and only barely secured a majority in the House of Representatives. As in 2018 and 2020, former President Donald Trump once again held his party back. Most Americans do not want a return to his “America first” isolationist policies.

Together, the US midterms and the Bali summit offer cause for optimism at an otherwise fraught moment. But we will need much more progress toward global cooperation. Ultimately, our two biggest crises – Russia’s retrograde war in Ukraine and climate change – can be overcome only if the world’s key powers find a way to work together. i

Joschka Fischer, Germany’s foreign minister and vice chancellor from 1998 to 2005, was a leader of the German Green Party for almost 20 years.

"Unlike the Soviet Union during the Cold War, however, China has not made the mistake of focusing solely on its military power."

"The United States and China – this century’s two military, technological, and economic superpowers – will be the dominant players, but Europe, Japan, and India will exercise meaningful influence over large swaths of the planet."

Germany and the German people struggle to become comfortable when donning the mantle of leadership that circumstance has thrust upon the country. The nation and its leaders are visibly shocked by the rapid demise of the old-world order and the unfolding “Zeitenwende”: the epochal tectonic shift that began with a global geopolitical rebasing and reached a disconcerting apex with Russia’s war of aggression against Ukra ine.

Whereas Germany traditionally strives to uphold the principles of the UN Charter as broad guidelines for international order and equilibrium, the country now faces the much more restricted and complex task of safeguarding peace in Europe, imposing compromise on quibbling members of the EU, and securing a meaningful role for the continent in a multipolar world. And, of course, its economy must continue to ensure financial stability.

It's a tall order for any chancellor and particularly one expected to fill the shoes of Angela Merkel who kept Germany, Europe, and indeed the world on a fairly even keel during her 16 years in office. The baffling question facing all German

chancellors is how to lead without being seen to do so. Merkel deployed icy looks and faint smiles to signal her mood. When genuinely angry, she usually just refused to comment or engage. That was often enough to chastise unruly interlocutors and bring them back in line.

Chancellor Scholz possesses no such skills and is less subtle in his demeanour. To the surprise of many, he not only condemned Russia’s invasion of its neighbour in the strongest of terms but almost immediately unveiled a €100bn rearmament drive to equip the Bundeswehr for a “new era” of hot war on European soil.

Out the window went decades of carefully choreographed (Neue) Ostpolitik that sought

to ease East-West tensions through active engagement. The hallmark foreign policy of the Social Democratic Party (SPD) was introduced in the early 1970s by then-Chancellor Willy Brandt who, in 1971, received the Nobel Peace Prize for the initiative.

It has not escaped the commentariat that it was another SPD chancellor who ditched the policy overnight and now openly calls for confrontation: “This is not just any war, but one waged by a nuclear-armed great power to eliminate an independent nation.” However, Chancellor Scholz’ volte-face has since met stiff opposition from his coalition partners. Many practicalities also conspire against Germany’s newfound determination to face up to Russia.

The country has been painfully slow to dispatch weaponry to Ukraine, citing its own depleted stock of hardware or the refusal of others –foremost Switzerland – to grant export licenses. Almost daily, Chancellor Scholz is being accused in the press of indecisiveness for his apparent refusal the lend urgency to the delivery of military kit.

Some NATO allies entertain a lingering suspicion that the German government may be playing for time. Berlin’s fence-sitting is at odds with Chancellor Scholz’ initial bravado but could be rooted in the thinking that, post war, some sort of entente must be found that accommodates Russia. After all, that country is not about to vanish and must somehow be inserted in a future concert of nations.

Aside from the geopolitical conundrum facing Germany – is its first line of defence located on the Elbe or the Dnieper? – the Zeitenwende also poses an existential threat to the country’s economy and with that to nearly all of Europe. Without having any ready solutions, Chancellor Scholz is acutely aware of the danger to an economy largely based on and powered by cheap and plentiful energy.

Early in December, BASF CEO Martin Brudermüller said that his company would downsize in Europe “as quickly as possible and also permanently.” In Ludwigshaven, at BASF’s flagship facility, several production lines have already been mothballed. The ammonia plant was shut down whilst the run rate of the

acetylene facility was sharply reduced due to the high price of the natural gas that is used both as feedstock for chemical processes and fuel for the power plants.

Brudermüller’s blunt statement raised fears in Berlin that the company may in time shutter its vast Ludwigshaven complex entirely and shift production to China where BASF is building a €10bn chemical plant in Guangdong.

Economy Minister and Vice-Chancellor Robert Habeck noted that some were taking an “almost sensual pleasure” in predicting Germany’s industrial decline. Habeck went on to state that the Scholz cabinet is determined to, and capable of, preventing that. Almost on cue, Chancellor Scholz announced a €200bn support package

for households and businesses, including large ones, struggling with the high cost of energy.

Large industrial users such as BASF will be able to buy natural gas at a rate of 7 cents per kWh for up to 70% of their consumption until then. Any part of the allotted energy contingent not used may be resold which could net the chemical giant a profit of some €2.6bn. However, Brudermüller may not qualify for the state largesse which is conditional on keeping production and jobs in Germany.

Scholz faces more trouble on the domestic front. According to an opinion poll commissioned by Der Spiegel, just 29 percent of those queried expressed confidence in the coalition’s ability to successfully navigate the multiple crises.

However, up to 45 percent of the respondents awarded the ‘traffic light’ coalition a “very negative” rating. To add to the coalition’s troubles, the powerful Bundesverband der Deutschen Industrie (BDI, Federation of German Industry) criticised the government for the slow pace of the promised fiscal reforms.

The BDI warned that one in every five of its member companies is actively working to shift production out of the country, undermining Germany’s famous Mittelstand – the vast universe of small- and medium-sized businesses that form the backbone of the country’s economy.

BDI-Chairperson Siegfried Russwurm appealed to Chancellor Scholz for more speed and determination in readying Germany for the new realities: “If this coalition wants to be truly progressive, it must make haste with fiscal reform. If not, domestic investment will evaporate, curtailing growth and undermining our prosperity.”

Part of Scholz’s troubles both at home and abroad may be ascribed to his reluctance to lead and, almost by extension, his tendency to dither and wobble when the going gets proverbially tough. A great communicator he is decidedly not, preferring to murmur instead and disappear into the background such as when he hosted the G7 meeting in Bavaria where the chancellor was mysteriously absent from the traditional group photo.

“We have a chancellor who refuses leadership,” says Stefan Meister of the German Council on Foreign Relations, a policy think-tank: “He only acts in the context of our allies but makes no effort to lead those alliances.”

On the other hand, Chancellor Scholz is a stranger to flights of fancy and grandstanding; he tries to de-escalate by looking for compromise instead – an exceptional quality amongst contemporary world leaders.

An example of inept communication came during a speech at a recent convention of German Catholics when Scholz mused if more violence is the answer to violence and if peace can only be established by force. Speaking to an audience of pacifists, many wondered if the chancellor was pandering to those present or questioning their beliefs.

Poor communication, and perhaps a fear of offending his less belligerent coalition partners, also opens the door to unmerited criticism of Germany’s support for Ukraine. In relation to the size of its economy, Germany is doing as much for Ukraine as most EU member states.

The country supplied some 2,500 anti-aircraft missiles, many thousands of anti-tank weapons, over 15m rounds of ammo, and a long list of other gear. Chancellor Scholz has now promised to send the IRIS-T SLM medium-range surfaceto-air defence system which can shield a city as large as Kyiv from missile attacks.

Foreign Affairs Minister Annalena Baerbock pointed out, perhaps superfluously, that Germany has been reluctant to supply weapons to a region where its own forces killed millions during World War II. However, former Polish Foreign and Defence Minister Radoslav Sikorski, admitted that he, and many of his fellow Poles, now fear German power much less than German inactivity: “It may have taken Putin’s invasion of Ukraine for Europe to finally become comfortable with German military power.”

It is quite a change for a country that until last year refused to export military hardware to any country engaged in, or at risk of, conflict. For over 70 years, Germany has been steeped in pacifism. An aversion to national pugilism has thus become part of the nation’s psyche. The woefully ill-equipped Bundeswehr was a source of pride rather than embarrassment.

To reverse course and admit that the axiom from Roman times “si vis pacem, para bellum”

(if you want peace, prepare for war) may hold some truth takes an almost Herculean political effort that also involves much nose holding. Rolf Mützenich, SPD-leader in the Bundestag, admitted that he had to “grit his teeth” when voting to approve the €100bn supplementary armaments budget.

Cautious by nature, but a capable administrator, Chancellor Scholz must deal with a fair degree of scepticism as well – and told-you-so recriminations. Under his predecessor Merkel, Germany lost considerable goodwill in Europe and elsewhere with its intransigence on completing the €11bn Nord Stream 2 pipeline project (now defunct and furtively shot to bits by an unknown power) and on its rejection of warnings against depending too heavily on Russia for its energy needs. When war broke out, and natural gas flows dwindled to a trickle, it suddenly dawned on Berlin that the country possessed not a single terminal to receive LNG imported from overseas.

Eastern EU member states showed both surprise and barely disguised contempt when Chancellor Scholz recently presented a set of interesting proposals to reform the EU’s foreign policy decision-making process, including stripping member states of their veto power. Polish members of the European Parliament questioned the “arrogance” of the initiative by a country that has followed rather than led on Ukraine and other matters of continent-wide importance – and had refused to listen to its partners about Russia and energy.

Chancellor Scholz has repeatedly called for a German diplomacy without naiveté. The coaxing of troublesome partners with Wandel durch Handel (Change through Trade) seems to have been confined to history – or at least for as long as President Vladimir Putin holds sway over the Kremlin.

That naiveté – aka the Merkel Consensus –reached its highpoint during the Merkel years when Germany trusted that Moscow would prove a reliable energy partner. Germany tacitly accepted Russia’s desire for influence over its immediate neighbourhood as reasonable provided Moscow cooperated with Europe in maintaining the peace. This also helps explain Europe’s tolerance of Belorussia with its strongman and Kremlin stooge Aleksandr Lukashenko even after that dictator forced down a Ryanair plane on a flight from Athens to Vilnius to arrest a prominent dissident.

In November, Scholz became the first western leader to visit Chinese president Xi Jinping since the outbreak of the Corona Pandemic. In what was widely considered a reaffirmation of Germany’s foreign policy independence, the German leader signalled a desire to broaden and intensify economic cooperation. To that end, he travelled with an entourage of executives of iconic corporates such as Volkswagen, Bayer, and BASF.

Chancellor Scholz said that he and President Jinping agreed that Russia’s nuclear threats were “irresponsible and highly dangerous” – words left out in the Chinese telling of events. Both leaders also expressed a need to work together in “times of change and turmoil.”

The short trip – it lasted just 11 hours – sparked concern in Europe and elsewhere with some questioning the wisdom of investing heavily in China given the not insignificant risk of the country making a move on Taiwan. French president Emmanuel Macron was disappointed that Scholz failed to coordinate his China trip with others in the EU and warned the chancellor that he risked becoming isolated.

The Paris-Berlin axis, often described as the engine driving the EU, is showing disconcerting

cracks. French concerns centre on the geostrategic consequences of the war in Ukraine which is seen to enhance Germany’s importance and push France to the side-line. Differences on a host of topics – including defence, energy, subsidies, and EU expansion – have caused a rift in cross-Rhine relations.

The surprise announcement that Germany would acquire US-made F35 fighter jets and Patriot air defence batteries has irked Paris as it leaves European defence initiatives such as the Future Air Combat System in limbo. France and other EU member states are also upset by the €200bn in state aid Chancellor Scholz has earmarked to support businesses and households through the energy crisis. France has argued that it’s impossible to compete with such a high volume of subsidies whilst Germans reply that the French are in no position to dispense lessons about the iniquity of subsidies.

If anything, the differences underscore the renewed sense of pragmatism now reigning in Berlin. In an editorial, Le Figaro noted that France is content to talk about sovereignty whilst Germany exercises it. That exercise in sovereignty may be understated, it is nonetheless real.

And that’s the essence of the German Chancellor: taciturn, considerate, low-key yet determined to carefully plot a course through the political and diplomatic minefields that the country faces.

Scholz seems much aware of the inner strength emanating from Western democracies – and of their tendency to react slowly to emerging threats. As US diplomat and historian George Kennan surmised: Democracies are like prehistoric monsters largely indifferent to what happens in their vicinity - “you practically have to whack off their tail to elicit a response. However, when that tail is whacked hard enough, they react with speed, determination, and strength.”

President Putin was apparently less familiar with the notion: a miscalculation that has cost him dearly. Russia’s annexation of the Crimean Peninsula was a mere pinprick that failed to rouse the monster.

Scholz’ Zeitenwende – a pivot of historical significance – is the clearest sign yet that Germany has shifted track – and where Germany goes, Europe follows. It may take some time for Germans to get used to, and comfortable with, the position of leadership thrust upon their nation. Germany has been pulled out of its comfort zone and is slowly preparing to flex its not inconsiderable industrial muscle and build up its military whilst at it.

Chancellor Scholz is not one for hype. But it’s the quiet ones that need to be watched, because they mean business. i

Determining the purposeful role and contribution of government is a necessary start, with government ideally understanding what its principal role should be; and I venture that of being an enabler, creating a conducive environment, but then stepping aside to let professionals run with the ball. I leave the dire questions on tax levels, the levelling-up strategy, the planning approvals environment, housing needs and general social conditions and focus for the moment on international trade and export promotion. Trade is often derided but is an integral component, as is the relentless need to attract inward investment to enable funding of essential infrastructure.

The BREXIT debate rumbles on with the new administration reflecting on the best model for our relationship with the European Union, with the Norwegian or Swiss models being scrutinised. Hardline Brexiters are seemingly holding firm with the possibility of further acrimonious internal political debate being reopened. That is in noone’s interest. There is a sense of exasperation by the business community that politicians are overcomplicating the whole question, and that friendly frictionless bilateral relations are all that counts in the national interest. Pragmatic initiatives are on the horizon. One of the essential ingredients to make progress with the global trading community is to combine innovation, build efficiency and create sustainability and to do so by putting the jigsaw into place, if you will. Currently there are excellent different components that could usefully be harnessed into a unified approach; however, none is dependent on the other.

I point to three initiatives. The first lends itself well as the Commonwealth is fertile ground given the commonality of common law and language, which should be viewed as the bedrock of a Global Britain. It is a free trade agreement template initially targeting Commonwealth member states,

excluding the two that are members of the EU as they are responsible to internal protocols, that can be adjusted by country to address any specific anomalies. I was originally approached some time back by a well-meaning US interest to stitch together a US/Commonwealth agreement, including the UK, of course, that would unlock the UK/US circumstance, given that the bilateral free trade agreement is moribund. This Commonwealth approach would consist of making a template of what is expected to be covered in a trade agreement with language options built in.

The launch of the Institute for Free Trade (IFT) analysis on a model commonwealth free trade agreement (FTA) last month. The “core” deal can be added to or subtracted from in order to meet the individual requirements of each commonwealth nation. The designers have crafted an agreement which can serve the needs of every Commonwealth nation from India to the Solomon Islands.

The “Commonwealth Advantage” reflects cultural and historic ties, complementary geostrategic interests as well as compatible legal and administrative systems. Accepting as equivalent health, sanitary and phytosanitary standards which aim at equivalent levels of evidencebased protection (defined by the UN Codex Alimentarius) will also liberate Commonwealth agricultural products for free global export. The variety and heterogeneity of the nations of the Commonwealth will lower food prices yearround at a time of inflation, as well as offering developing countries the opportunity to compete in profitable developed markets around the world.

This “trade, not aid” approach has arguably been the driving force behind decades of growth in free trading nations such as Taiwan, South Korea, Singapore, and post-war Japan, as well as export-driven success stories China and

Whilst it is undeniable that we are all going through challenging times in the UK, there is recognition in certainquartersthatwecannotcarryoninwaysofold; andthatinnovationandthinkingoutsidetheboxhave become the imperatives. Now is the time to venture forthwithfreshideasandnewconcepts.

Indonesia. Unfortunately, many Commonwealth nations have faced large tariff and non-tariff barriers to trade, denying developing nations the income to improve domestic value-chains and leaving them particularly reliant on foreign aid, and geopolitical rivals such as the PRC, for their development objectives. These areas are the bedrock of modern trade agreements, and serve the growing opportunities in internet, in research and development, as well as financing of infrastructure projects within the Commonwealth.

While these deep trade agreements are to the advantage of smaller commonwealth nations, who would likely have no opportunity to negotiate such a degree of cooperation with larger Commonwealth nations such as the UK until “priority” talks with the US, India and others are completed, there are some important benefits for larger nations, too. Having modern trade agreements with a diverse set of economies, complete with an implementation of electronic trade documents and digital trade provisions, creates an immense dataset vital both to supplychain management, private sector investment as well as governmental industrial strategy.

Flexibility would allow nations to reap the benefits of agreement where they find it, on an opt-in basis, rather than negotiate themselves into a stalemate by withholding agreement until everything is agreed; a moment which may never arrive.

The second is a dedicated, big-data analytics platform be made readily available to encompass advanced data analytics and modelling for foreign trade data relating to supply chains to consolidate multiple datasets already used by the International Trade Council. These datasets, with additional overlays into a single database, could be used for analysis of markets and supply chains, forecasting and predicting market behaviour. This would enable corporates to validate their supply chains, understand market pricing, monitor competitors, forecast the market and would allow governments seeking to assist their exporters to find new markets, identify priority investment FDI targets and model future market demand, growth, customers and suppliers. The good offices of the International Trade Council are making this available resulting from its agreement with 39 countries that will be packaged electronically and presented via newly branded ADAM; Advanced Data analytics & Modelling for Foreign Trade data.

Thirdly, and this brings me to a major piece of legislation that has started its parliamentary passage in the United Kingdom. The magic of the Electronic Trade Documents Bill is that it is all the more beneficial for being an enabler process, free for the world to join up to—just follow the provisions. If the answer to today’s ails is in the timing, this initiative hits the spot with the legal enactment necessary to a more competitive world for the benefit of all.

Allowing businesses to use electronic trade documents when buying and selling internationally, making it easier, cheaper, faster and more secure for them to trade, to remove an obstacle to progress and to pave the way for international trade and trade law to be brought up to date is the objective.

Passing this law would be a victory for global trade and for the United Nations, as the legislative work is led through the UN Model Law on Electronic Transferable Records—MLETR. By allowing electronic documents and physical documents to be used in parallel, the transition to paperless trade can be made an evolutionary process where the adoption of electronic trade documents will take place when different stakeholders in trade and trade finance are ready to take the step to paperless trade.

Radical change in removing paper-based trading documents will make for a faster, lower-cost, more resilient and more liquid world of trading, leading towards transparent digital supply chain management. It will be especially good for small businesses. While not all problems can be solved at once, recognising a practical step-by-step approach to solve one would be an excellent beginning.

This will allow for the use in electronic form of certain trade documents, such as bills of lading and bills of exchange, which currently must be on paper and physically possessed. The Bill is not mandatory: it is a permissive and facilitative piece of legislation and although only small in content, its impact will be huge. It will help to boost the UK’s international trade, already worth more than £1.4 trillion, by providing benefits to UK businesses over the next 10 years of £1.1 billion.

Business-to-business documents such as bills of lading, which are contracts between parties involved in shipping goods, and bills of exchange, which are used to help importers and exporters complete transactions, currently must be paperbased. Digital trade documents will be put on the same legal footing as their paper-based equivalents, giving UK businesses more choice and flexibility in how they trade.

The provisions cannot be overstated. Whether it is lowering transaction costs associated with trade by reducing resourcing and operational costs and increasing productivity; whether it is increasing efficiency and encouraging business growth by facilitating the development of digital products and services; whether it is delivering environmental benefits through a reduction in paper documents and emissions from couriering the paper documents; or, critically, whether it is increasing the security, transparency,

traceability and transactional data of the flows of goods and finance—the Bill has the potential to revolutionise UK businesses’ ability to trade across borders and lay the foundations for the future digitisation of global trade approach and ambitions.

Improving logistical flow that will address the impediment to the speed of payments, and the current need to move paper to discharge goods and receive payments, bringing more opportunities as we align with the MLETR and benefit from digital trade corridors and individual country compliance. This will allow for documents that carry value and promises to be drawn up and signed in digital form, provided that the system or document fulfils the listed requirements.

A number of trade documents with which domestic and cross-border trade would become significantly more efficient and affordable for all are listed, but small and medium-sized entities would benefit the most. This will create significant opportunities for smaller importers and exporters globally, one reason being that the law of England and Wales is often used when parties have difficulties agreeing on the jurisdiction in which to settle disputes.

The following are issues that need to be reconciled: that international digital identities and digital signatory laws are sufficiently harmonised; that international freight tracking systems with a lack of interoperability is a hurdle that needs to be overcome and that legal entity identifiers are accepted universally.

Significant work is being done and progress is being made in these areas by industry organisations, but this needs to be supported by Governments to pave the way for international harmonisation and adoption. It will be a balancing act to create international standards in such a way that creates legal certainty on the one hand without hampering further adoption of new technologies or innovation on the other.

The United Nations Model Law on Electronic Transferable Records is a very well-designed framework, balancing the need for commercial certainty, relying on current and internationally well-harmonised substantive laws, with allowing for electronic trade documents, providing that the provisions in the MLETR are met.

The Bill does not change the function of the instruments listed. All the safety mechanisms these instruments have and cater for remain intact. Allowing them to be in electronic format means that they will become more efficient and significantly safer. I underline, however, that the Bill does not address the quality of signatures or how to establish identities, other than to say

that they need to be “reliable”. The European Union has a list of trusted digital signature sites and for trade it is important that different parties can use simple verification processes to trust the documents coming from another party, but it is up to the contracting parties to define the method to ensure reliability.

What is reliable today, however, will differ tomorrow as new technology evolves. Legislation that is principles-based rather than technically prescriptive is more favourable. The adoption of the EU regulation for eID and other electronic trust services has been slow in cross-border trade, the main reason being that these have not been readily available and easily accessible as technical solutions. The result has been paperbased trade rather than electronic. Although not perfect, in some cases a lower standard is the stepping-stone for adoption, especially in crossborder dealings, provided that the parties have agreed on where to settle disputes.

These are early days, with much to do but no time to lose. All that I have drawn attention to however is the beginning of an exciting journey that ticks the boxes and I commend it accordingly. i

Lord (JD) Waverley House of Lords, UK Parliament Crossbench Member

Co-chair All Party Parliamentary group: Trade & Investment All Party Parliamentary group: Future UK’s Freight & Logistics sector

Founder www.eChamber.global