Battery cell, module and pack level charge/discharge cycle testing solutions designed to provide high accuracy measurement with advanced features. Regenerative systems recycle energy sourced by the battery back to the channels in the system or to the grid.

Battery simulation for testing battery connected devices in all applications to confirm if the device under test in performing as intended. Battery state is simulated which eliminates waiting for the charge/discharge of an actual battery. Real time test results include voltage, current, power, SOC%, charge/discharge state and capacity.

To learn more about our Battery Test Solutions visit chromausa.com

CEO Mark Gresser on America’s booming battery manufacturing industry

Vector Group acquires vehicle measurement tech manufacturer CSM

Webasto boosts energy capacity of its battery system for commercial EVs

Nexperia to invest $200 million at its semiconductor factory in Germany

Cooper Standard’s new eCoFlow Switch Pump simplifies EV thermal management

ABB launches energy-efficient motor and inverter package for electric buses

Eaton introduces 48 V DC-DC converter for off-highway EVs

Microchip offers new on-board charger package of automotive-qualified devices

Asahi Kasei Microdevices completes proof of concept for eFuse in 800 V EVs

Tecman announces new anti-thermal propagation battery technology

Donaldson’s new Dual-Stage Jet battery vent provides higher degassing rates

Sakuu and SK On to industrialize dry-process battery manufacturing

ZF introduces TraXon 2 Hybrid transmission

EMS acquires micro-component specialist Thin Metal Parts

Evonik’s new fire-resistant coatings for EV battery housings

Silicon Mobility introduces single-chip solution for integrated powertrain

HUBER+SUHNER’s new modular cable assemblies speed up production

Harbinger announces $400 million in electric truck pre-orders

First Student receives $200 million in funding for electric school buses

Yanmar debuts fully electric trio: excavator, wheel loader and tracked carrier

Komatsu debuts battery-electric small-class bolter and jumbo drill

Kramer-Werke’s new 5065e electric wheel loader

APM Terminals to pilot electric terminal tractors at New Jersey port

South Pasadena, California completely electrifies its police fleet

Rio Tinto and BHP to test battery-electric haul trucks in Australia

American Airlines signs agreement for 100 hydrogen-powered engines

Einride orders 150 Peterbilt 579EV electric semi tractors for its US fleet

Blue Bird debuts electric step van

Mullen introduces BEV version of PowerUP mobile EV charging truck

Volvo’s electric trucks have driven 80 million km in 5 years

Mercedes-Benz USA expands 2025 eSprinter options

Singapore concrete company unveils electric-powered concrete mixer truck

Amazon adds Volvo electric drayage trucks to its EV fleet

Belgian transit agency awards agreement for 100 electric buses to Irizar

FedEx orders 150 Shyft Blue Arc electric trucks

Volvo, ZF, Cummins win $441 million to accelerate heavy-duty EV production

Q&A

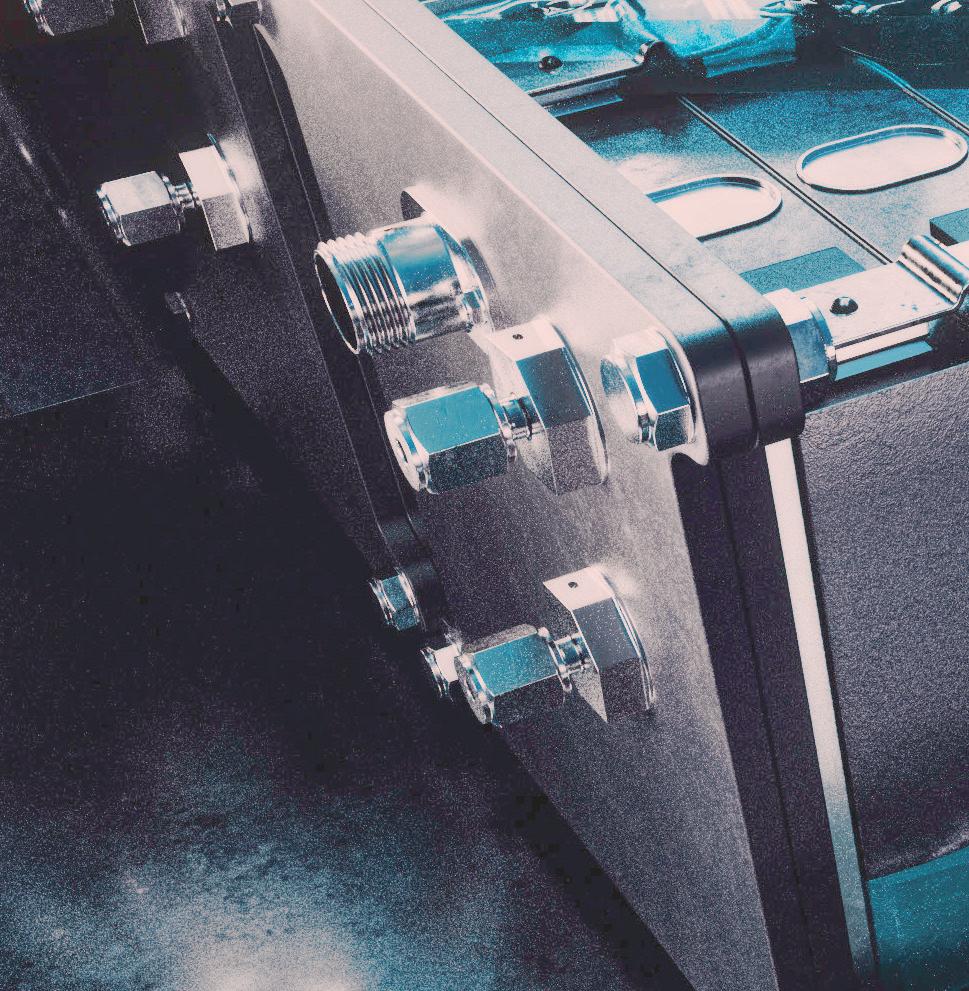

Irdeto’s cryptographic keys and certificates help keep charging communications secure.

CharIN unveils OPNC protocol to enable supplier-agnostic Plug & Charge

IoTecha wins $27-million grant for grid-friendly EV charging in California

Toyota joins US public EV charging network IONNA

Shell opens megawatt charger for electric trucks and boats in Amsterdam

FLO secures $136 million for North American charging network expansion

Daimler Buses and ESWE Verkehr open electric bus depot with 120 chargers

Wallbox debuts small-footprint Supernova 220 wall charger

ChargePoint has secured 125 NEVI awards to fund EV fast charging sites

ABB E-mobility’s new A400 All-in-One charger is designed for reliability

Volvo launches off-grid chargers for fast charging large equipment onsite

Kempower opens production facility in North Carolina

ChargeTronix launches 480 kW charger for electric truck fleets

Paired Power launches microgrid solar charger and battery storage solution

Sixt rental car uses Guided Energy to streamline charging operations

Sunrun launches V2H pilot using Ford F-150 Lightning electric trucks

Emobi and Autocrypt collaborate to make Plug & Charge more secure

Electric vehicles (EVs) are the way of the future but manufacturing them to scale requires next-gen materials that can meet their complex electrical, chemical, and thermal requirements. Chemours™ advanced materials improve EV performance throughout multiple applications:

Fluoropolymers: The

High performance in extreme temperatures

Resistant to chemicals

Superior dielectric properties

Low friction

chemours.com/EV7

Thermal stability

Non-permeability

Sustainable and nonhazardous

Durability extends component life

Publisher Senior Editor

Technology Editor

Segment Leaders

Christian Ruoff

Charles Morris

Jeffrey Jenkins

Joel Franke

Mark Rogers

Greg Schulz

Graphic Designers

Tomislav Vrdoljak

Contributing Writers

Jeffrey Jenkins

Charles Morris

Christian Ruoff

John Voelcker

Cover Image Courtesy of

Chevrolet

For Letters to the Editor, Article Submissions, & Advertising Inquiries Contact: Info@ChargedEVs.com

Special Thanks to

Kelly Ruoff

Sebastien Bourgeois

ETHICS STATEMENT AND COVERAGE POLICY

AS THE LEADING EV INDUSTRY PUBLICATION, CHARGED ELECTRIC VEHICLES MAGAZINE OFTEN COVERS, AND ACCEPTS CONTRIBUTIONS FROM, COMPANIES THAT ADVERTISE IN OUR MEDIA PORTFOLIO. HOWEVER, THE CONTENT WE CHOOSE TO PUBLISH PASSES ONLY TWO TESTS: (1) TO THE BEST OF OUR KNOWLEDGE THE INFORMATION IS ACCURATE, AND (2) IT MEETS THE INTERESTS OF OUR READERSHIP. WE DO NOT ACCEPT PAYMENT FOR EDITORIAL CONTENT, AND THE OPINIONS EXPRESSED BY OUR EDITORS AND WRITERS ARE IN NO WAY AFFECTED BY A COMPANY’S PAST, CURRENT, OR POTENTIAL ADVERTISEMENTS. FURTHERMORE, WE OFTEN ACCEPT ARTICLES AUTHORED BY “INDUSTRY INSIDERS,” IN WHICH CASE THE AUTHOR’S CURRENT EMPLOYMENT, OR RELATIONSHIP TO THE EV INDUSTRY, IS CLEARLY CITED. IF YOU DISAGREE WITH ANY OPINION EXPRESSED IN THE CHARGED MEDIA PORTFOLIO AND/OR WISH TO WRITE ABOUT YOUR PARTICULAR VIEW OF THE INDUSTRY, PLEASE CONTACT US AT CONTENT@CHARGEDEVS.COM. REPRINTING IN WHOLE OR PART IS FORBIDDEN EXPECT BY PERMISSION OF CHARGED ELECTRIC VEHICLES MAGAZINE.

Hall9–Booth622 Nuremberg|11-13June2024

The new CXT-ICM3SA series of Inverter Control Modules forms the heart of CISSOID’s modular inverter platform, leveraging the ultra-fast OLEA® T222 Field Programmable Control Unit by Silicon Mobility.

Based on CISSOID’s CXT-PLA3S series of Intelligent Power Modules and HADES2 gate driver chipset, they are supporting the OLEA® APP - T222 INVERTER software for fast development of electric motor drive trains.

• 3-phase 1200V 340-550A SiC power module

Integrated gate driver board

Dual ARM® Cortex-R5F in lockstep

Advanced Motor Event Control (AMEC®) unit

Real-time actuator & sensor control and processing T222 processor & software ISO26262 ASIL-D and AUTOSAR 4.3 certified

2024 is shaping up to be a momentous year for the EV industry. ere’s so much going on, it’s hard to keep up. I know, we say this every year, but make no mistake—the global EV market is going to look very di erent in 2025 than it did at the dawn of 2024. As EVs begin to move from the early adopter phase into the mass market, the balance of power among automakers, and among automaking countries, is shi ing—and quickly.

Chinese automakers are now exporting EVs that are just as good as Western models, at prices none of our companies can hope to match. Will the sti new tari s announced by the US and Europe buy domestic automakers time to raise their electric games, or will the additional protection from competition simply allow them to continue hitting the snooze button? We shall see. Meanwhile, Chinese EVs are pouring into secondary markets ( ailand, Mexico, South America et al), threatening a reckoning for Toyota, which has long dominated many of these markets, but now has few EVs to o er.

It’s rare for a company that leads one wave of technological innovation to remain in a leading position in the next wave. e company that almost singlehandedly created the modern EV market, Tesla, is seeing its market share erode, and its innovation engine seems to have stalled. Legacy truck companies (Daimler, Volvo) have beaten it to the commercial market, and instead of focusing on the aching need for budget-priced consumer EVs, its leadership seems to be shi ing its focus to non-automotive pursuits (robots, AI, political distractions).

Ford and GM, obsessed with quarterly pro ts, seem to roll back EV production plans every time there’s a slight dip in sales, and their constant trumpeting that their EVs aren’t pro table is unproductive, at best. Meanwhile, Hyundai, whose Ioniqs are winning impressive awards, safety ratings and sales, seems fully committed (and pro table). Kia’s a ordable, long-range EV models are delighting buyers—US sales doubled in the rst half of the year. Which company would you rather buy your next EV from?

On the other hand, GM has its new Ultium platform back on track, and is ramping up production of several new models, including a moderately-priced (below $40k) electric SUV that could be just what the US market has been waiting for. Read John Voelcker’s review of the Equinox EV in this issue, page 48.

On the commercial side, big things are brewing. Drayage eets in California are plugging in, as WattEV and others are building out massive charging hubs.

e new Megawatt Charging Standard is entering the commercial phase—as MCS implementation spreads, so will electric trucking.

And that’s far from the only development on the infrastructure front. Widespread adoption of SAE J3400 (formerly NACS) and the new Plug & Charge feature are making public charging more convenient—and also raising new standardization and security challenges (see our feature articles on charging consortium CharIN, page 66, and cybersecurity specialist Irdeto, page 74).

Curbside charging is now widespread in European cities, and it’s coming to the US. is will make EV adoption practical for millions more city dwellers (see Charles Morris’s Charging Forward column, page 82).

Away from the headlines, o -road vehicles and equipment in the mining, construction and agricultural sectors are rapidly going electric. You’ll be seeing a lot more coverage of this market segment in Charged.

Christian Ruoff | Publisher EVs are here. Try to keep up.

CSM Computer-Systeme-Messtechnik, a manufacturer of networked measurement technology and data loggers for vehicles and test benches, has been acquired by soware specialist Vector Informatik.

Since 1983, CSM has been developing solutions for acquiring a wide range of analog values. e company has more than 100 employees at its headquarters in Filderstadt, near Stuttgart, and at international branches, including an independent team in Auburn Hills, Michigan.

Vector employs over 4,500 people at its headquarters in Stuttgart, and at branches in Brazil, the US, the UK, Japan, India, China and South Korea, among others. e two companies have been working together since 2015 to deliver hardware and so ware solutions for measurement technology applications. CSM will continue its business activities independently.

“ e many years of successful cooperation have shown that Vector and CSM can combine their respective expertise to provide our customers with robust and future-proof measurement technology,” said Dr. Stefan Krauß, CSM’s new Managing Director. “We want to meet future challenges, especially in e-mobility, with further tailor-made developments.”

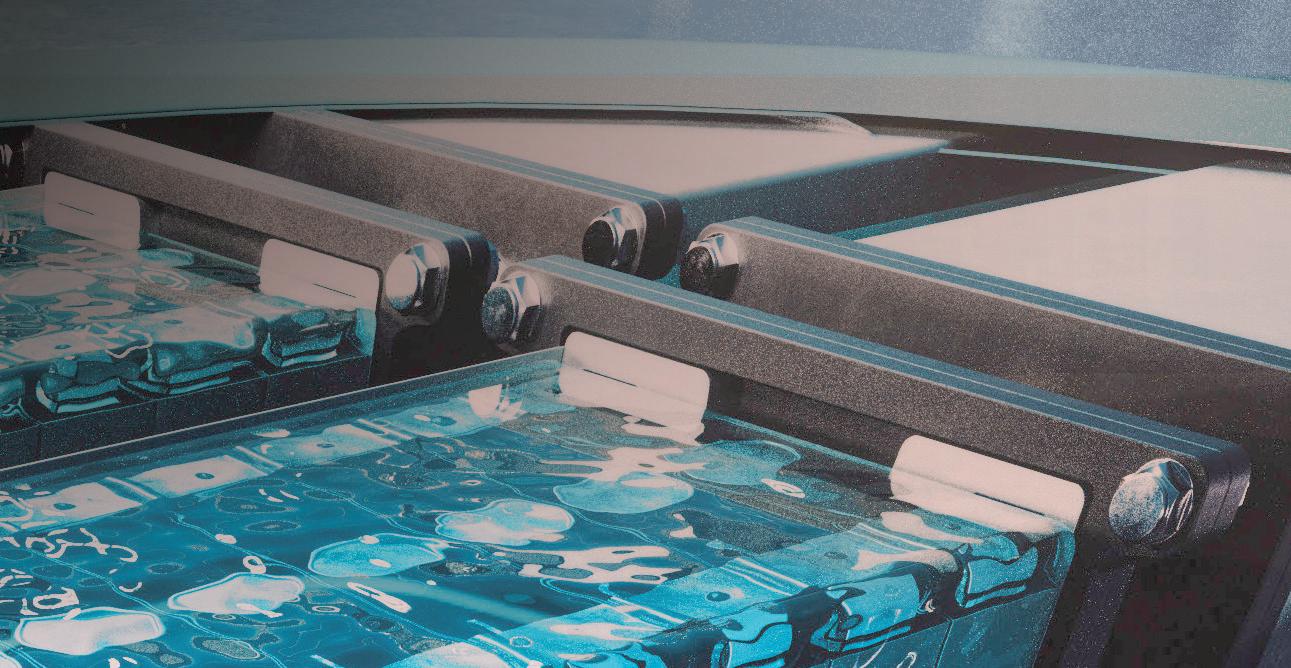

As part of a product update, German automotive supplier Webasto has increased the energy capacity of its traction batteries from 35 to 40 kWh. e new Standard Battery Pro 40 is the same size as its predecessor (960 x 687 x 302 mm), allowing it to t seamlessly into installation spaces that already use the previous Webasto standard battery system.

e Standard Battery Pro 40 is protected by a robust aluminum housing, and can be integrated vertically or horizontally into vehicles to o er manufacturers maximum freedom during installation. e high-voltage battery works with the Webasto eBTM thermal management solution, which keeps traction batteries within the ideal temperature range regardless of the outside temperature. A series of sensors continuously monitor the battery temperature, and fuses and other protective mechanisms take immediate e ect in the event of a malfunction.

e new Standard Battery Pro 40 meets the requirements of ECE R100 and R10, the CE speci cations for selected mobile machinery, and a range of safety standards, including ISO 6469, ISO 19014 and ISO 26262 (ASIL level C). It is protected against the ingress of dust and water in accordance with IP67.

Webasto develops and produces both the control electronics and the battery at its German sites in Schaidt, Schierling and Stockdorf.

Dutch semiconductor manufacturer Nexperia plans to invest $200 million to develop the next generation of wide bandgap (WBG) silicon carbide (SiC) and gallium nitride (GaN) semiconductors, and to build production infrastructure at its facility in Hamburg, Germany. Wafer fab capacity for silicon (Si) diodes and transistors will also be increased.

SiC and GaN semiconductors enable energy-intensive applications like data centers to operate e ciently, and are key components for applications in renewable energy and electromobility, says Nexperia. To meet the growing long-term demand, production of high-voltage GaN D-Mode transistors and SiC diodes started in June 2024, and plans call for new production lines for SiC MOSFETs and GaN HEMTs. Automation of the existing

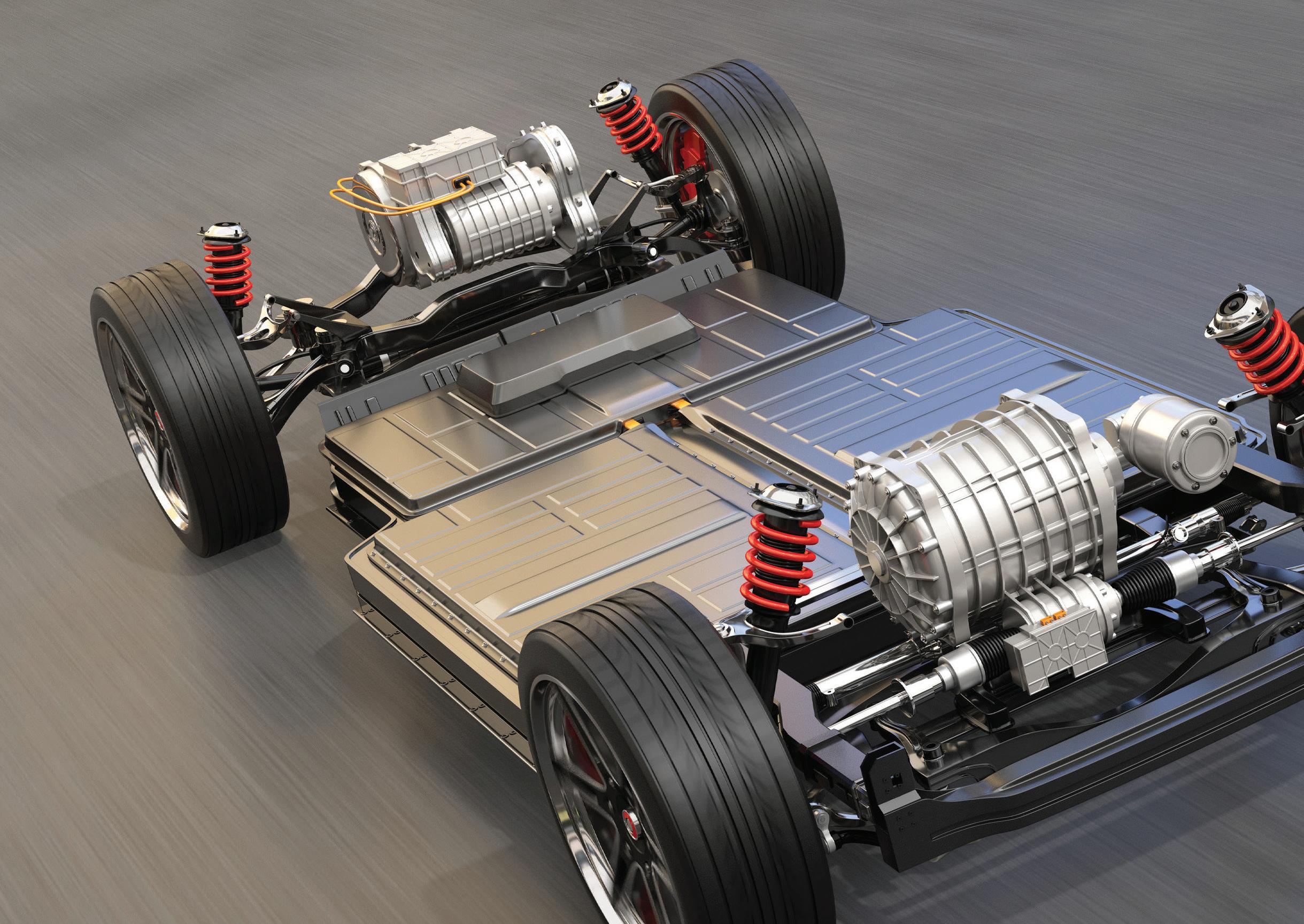

With the rise of hybrid and electric vehicles, the automotive industry is undergoing an unprecedented shift marked by significant engineering and design changes.

At Shell, we are supporting this transformation by working in close technical partnership with equipment manufacturers to develop a range of fluids specifically for high-tech hybrid and EV powertrains.

infrastructure and increased silicon production capacity by converting to 200 mm wafers will be followed by expansion of the clean room areas and construction of R&D labs.

“SiC and GaN are by no means new territory for Nexperia,” said Stefan Tilger, CFO and Managing Director at Nexperia Germany. “GaN FETs have been part of our portfolio since 2019, and in 2023 we expanded our range of products to include SiC diodes and SiC MOSFETs, the latter in collaboration with Mitsubishi Electric.”

Michigan-headquartered Cooper Standard, a global supplier of sealing and uid handling systems and components, recently debuted the rst member of its new eCoFlow product line.

e eCoFlow Switch Pump, created in partnership with the Saleri Group, o ers features of both an electric water pump and electrically driven valve in a single integrated coolant control module. is scalable uid control technology enables uid ow switching, splitting and regulating—features that are needed to address the complex glycol thermal management needs of electric and hybrid vehicles. e combination of water pump and valve functions o ers automakers e ciency improvements, part consolidation, electrical wire harness reduction and reduced packaging space, Cooper says.

As Cooper explains, by reducing complexity, the eCoFlow system enhances the thermal management system’s e ciency by eliminating the pressure drop and waste encountered from traditional pumps and valves. e eCoFlow system also provides smoother transitions in ow to help avoid pressure pulsations and spikes that can lead to system noise. A single electrical connection manages the system’s pumping and uid control functions, eliminating the need for additional connectors, wire harnesses and vehicle input/output channels. According to the company, the eCoFlow system requires approximately half the space of the traditional components it replaces.

“Our eCoFlow Switch Pump enables customers to reduce the complexity of the thermal management system within their vehicles while improving overall system e ciency,” said Chris Couch, President, Fluid Handling Systems and Chief Technology O cer.

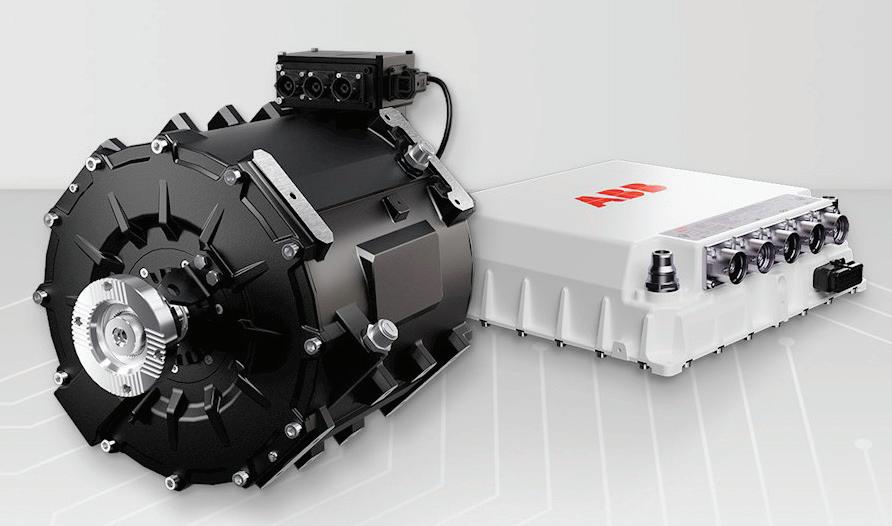

Swedish-Swiss electrical equipment maker ABB has launched a motor and inverter package tailored to electric buses.

e AMXE250 motor and HES580 three-level inverter were developed together to maximize e ciency, o ering up to 12% less motor losses on typical drive cycles compared to previous two-level inverters, according to the company. Unlike two-level inverters, which switch between DC+ and DC- voltage levels, the HES580 introduces a third, neutral voltage step. is e ectively halves the voltage step during each switching operation, resulting in reduced current ripple and subsequently lower harmonic losses.

e inverter extends the lifespan and enhances the reliability of the AMXE250 motor by mitigating harmonic e ects and minimizing stress on motor windings. e AMXE250 is a compact, permanent magnet synchronous motor designed for high-e ciency propulsion. It o ers high torque density for improved dynamic performance, as well as quieter operation for increased passenger comfort.

e HES580 and AMXE250 have been designed to o er exibility, so they can be placed further away from each other to provide operators with the possibility to further optimize space.

“ e motor-inverter package has been designed to work in perfect harmony, and will bring signi cant energy e ciency gains for operators and OEMs alike,” said David Segbers, Global Product Manager at ABB’s Traction Division.

Power management company Eaton has introduced a higher-capacity version of its 48 V DC-DC converter. e new converter has up to 40 A of output current capacity, and is intended for installation in on- and o -highway vehicles. It is hardened for use in harsh environments, features an air-cooled design utilizing natural convection, and can operate at ambient temperatures up to 185° F (85° C).

“ ese are environmental extremes with adverse conditions, shock and vibration that require robust protection features,” noted Ben Karrer, Head of Engineering for

See our solutions in action at the Battery Show Europe 2024

June 18-20, 2024

Messe Stuttgart, Stuttgart, Germany

Low Voltage and Power Conversion at Eaton’s Mobility Group.

e new equipment will reduce weight and save space, according to the company.

e converters step down power from a 48 V system to 12 V to provide power to accessory equipment. ey support the Controller Area Network (CAN) bus speci cation, which allows the converters to communicate with other electronic vehicle controls.

“Microchip established an e-mobility megatrend team with dedicated resources to support this growing market, so in addition to providing the control, gate drive and power stage for an OBC, we can also provide customers with connectivity, timing, sensors, memory and security solutions,” said Joe omsen, VP of Microchip’s digital signal controller business unit.

Microchip Technology is o ering an on-board charger (OBC) package designed to help developers speed their time to market by using key technologies from one supplier, including the control, gate drive and power stage.

e package uses a selection of Microchip’s automotive-quali ed digital, analog, connectivity and power devices, including the dsPIC33C Digital Signal Controller (DSC), the MCP14C1 isolated SiC gate driver and mSiC MOSFETs, in an industry-standard D2PAK-7L XL package.

To accelerate system development and testing, Microchip o ers a exible programmable solution with readyto-use so ware modules for Power Factor Correction (PFC), DC-DC conversion, communication and diagnostic algorithms. e so ware modules in the dsPIC33 DSC are designed to optimize performance, e ciency and reliability, while o ering exibility for customization and adaptation to speci c OEM requirements.

“Microchip established an e-mobility megatrend team with dedicated resources to support this growing market, so in addition to providing the control, gate drive and power stage for an OBC, we can also provide customers with connectivity, timing, sensors, memory and security solutions,” said Joe omsen, VP of Microchip’s digital signal controller business unit.

Japan-based Asahi Kasei Microdevices (AKM) and Silicon Austria Labs (SAL), a European research center for electronics and soware-based systems research, have completed a joint proof of concept of AKM’s eFuse technology in high-voltage applications using silicon carbide-based power devices.

e growing use of power devices based on silicon carbide (SiC) and gallium nitride (GaN) in EVs and other high-voltage applications makes it necessary to replace mechanical fuses—which have been used with conventional silicon-based power converters—to immediately shut down the system when detecting an overcurrent to protect devices and avoid costly maintenance.

e eFuse system provides the overcurrent and short-circuit protection required for next-generation high-voltage EV systems with SiC- and GaN-based power devices, such as on-board chargers. AKM is producing the CZ39, a coreless current sensor with a response time of 100 ns. Its fast-response capability and high accuracy allow for precise detection of overcurrent and quick system shutdown. e sensor can also e ciently regulate the current in connected subsystems, reducing the overall part count.

“We expect that the eFuse technology will contribute to smaller and lighter EV onboard chargers,” said Toshinori Takatsuka, General Manager of AKM’s current sensor business.

“By utilizing the latest AKM current sensing technologies, we can improve the reaction time of eFuses and the protection of wide-bandgap power converters,” said omas Langbauer, Team Lead within the Power Electronics Division at SAL.

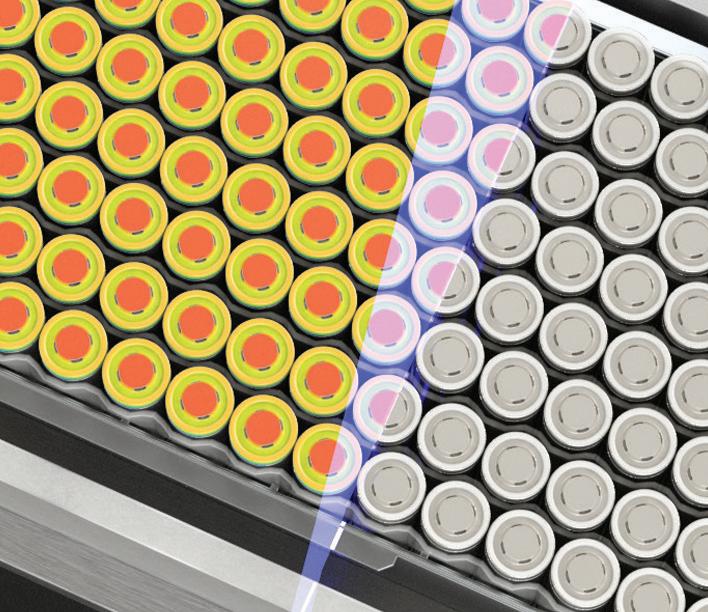

Tecman Advanced Material Engineers, a unit of the Tecman Group, has signed new distribution arrangements for its anti-thermal propagation (ATP) technology.

e technology is designed to enhance cell life and optimize cell performance while simultaneously increasing the thermal propagation delay to over 20 minutes.

As the EV market continues to grow, “the time is now right to expand our European presence even further and build more direct relationships both in Germany and the wider EU,” said Kevin Porter, the company’s Managing Director.

e company is now making its framed and encapsulated ATP pads available directly to European companies that integrate the pads into their EV battery packs.

“Framed ATP pads are an advanced thermal cell barrier that incorporates a physical built-in spacer surrounding the thermal insulation pad, providing

optimum space between cells and enabling the mechanical properties of the insulation material to absorb cell expansion,” the company said. While framed pads are most suitable for prismatic battery cells, encapsulated ATP pads are designed for pouch and solid-state battery cells.

Donaldson’s new Dual-Stage Jet is a battery vent designed to provide enhanced pressure equalization and ingress protection under normal operating conditions to allow gases to escape at rates of approximately 100 liters/second at 100 mbar when necessary. According to Donaldson, the new system is so e cient, it can reduce the number of vents required on a battery pack by up to 90%.

“Customers were telling us that they needed even higher degassing rates than what was available on the market, so the Donaldson Vehicle Electri cation Development engineering team came up with a unique, creative design that allows poppet and cap can be jettisoned to instantly produce a much larger opening for gas to escape and help mitigate thermal runaway,” explains Shane Campbell, Product Manager for Vehicle Electri cation at Donaldson. “ e pressure then rapidly decreases inside the pack, greatly reducing the risk of damage to additional cells and giving occupants extra time to escape from the vehicle.”

e Dual-Stage Jet is available in two distinct con gurations—screw-in/bolt-on or with quarter-turn bayonet ttings. Agricultural and other heavy-duty vehicle manufacturers are likely to choose the former, which can o er more exibility for use in bulkier battery packs, whereas the lighter bayonet ttings are suitable for the automotive sector, and provide clear haptic feedback of proper installation.

“ e option of multiple attachment methods is important to our customers, who want something that integrates really easily with their existing pack, and with application engineers all over the globe, we’re located near the OEM wherever they may be,” says Matt Goode, Engineering Manager for Vehicle Electri cation Development at Donaldson.

Sakuu, a provider of commercial-scale equipment and technologies to the battery manufacturing industry, has announced a joint development agreement (JDA) with EV battery manufacturer SK On. Central to the agreement is the industrialization of Sakuu’s dry-process Kavian platform.

Sakuu says its dry-process manufacturing, together with its electrode printing technology, eliminates the use of solvents and enables the use of new processes in battery manufacturing that will enable cost-e ective, higher performance batteries that are also environmentally friendly.

SK On currently operates two EV battery plants in Commerce, Georgia, and is constructing additional EV battery plants in the US through joint ventures with Ford and Hyundai.

“We are pleased to announce this strategic partnership with Sakuu,” said Dr. Rhee Jang-weon, Chief Technology O cer of SK On. “We look forward to working closely with Sakuu to accelerate innovations in the manufacturing processes for EV battery electrodes.”

“Together, SK On and Sakuu are ushering in a new era in battery manufacturing technology, advancing safety, sustainability and innovation in battery technology,” said Robert Bagheri, founder and CEO of Sakuu. “With Sakuu’s pioneering technology and SK On’s best-in-class EV battery manufacturing expertise, we’re addressing the core issues facing battery makers today.”

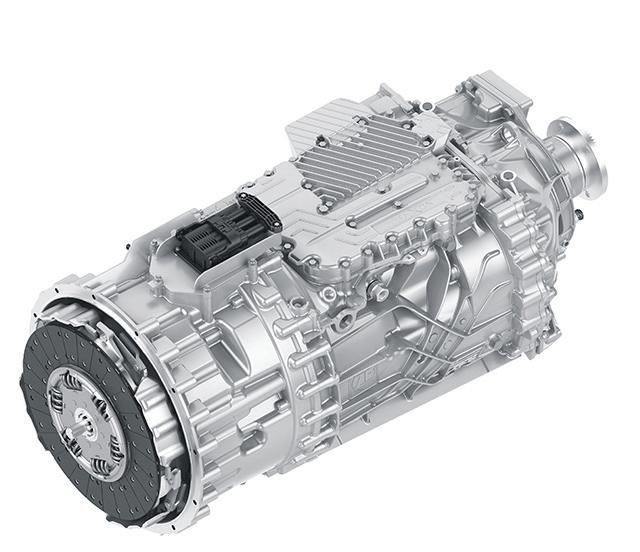

e Commercial Vehicles Solutions division of global automotive and technology company ZF has developed a new hybrid transmission, the TraXon 2 Hybrid, designed for use in commercial vehicles.

“In developing the TraXon 2 Hybrid, we demonstrate how synergies across our divisions enable us to address customer needs swi ly and exibly to create viable technologies to decarbonize commercial vehicles e ciently,” said Professor Dr. Peter Laier, member of the ZF Board of Management responsible for the Commercial Vehicle Solutions Division.

At the ZF Global Technology Day in June, the company also presented its new Braking and e-Drive Synergy Program, a system that optimizes the connection between the electric drive and the EBS brake control.

Engineered Materials Solutions (EMS), a Wickeder Group company that produces functional clad metals for the Li-ion battery, electrical distribution, thermal control, consumer electronics and automotive markets, has acquired Colorado-based in Metal Parts, a provider of micro-components to the defense, aerospace, medical and audio industries.

TMP uses its photochemical etching, electroforming and laser cutting technologies, combined with rapid prototyping services, to supply high-precision parts to its customers.

“ in Metal Parts has been a leader in the manufacturing of high-precision micro-components for over 20 years,” said President Stephen Trahey. “By joining forces with EMS and becoming part of the Wickeder Group of companies, we will be able to tap into a deep pool of resources, positioning us to better meet our customers’ evolving needs.”

Paul Du y, CEO of Engineered Materials Solutions, noted that the Wickeder Group’s portfolio already includes three companies in Europe that produce micro-components. TMP complements that portfolio perfectly, and the acquisition should expand market opportunities in the North American market. “ is acquisition expands the breadth of products and markets served by EMS and aligns with the Wickeder Group’s capabilities in the micro-components industry,” said he.

German chemical company Evonik is expanding its TEGO erm product range to provide heat protection and re-resistant coatings for EV battery housings and covers to prevent thermal runaway.

e range includes TEGO erm HPG 4000 granules, which have a microporous silica core for low thermal conductivity, high hydrophobicity, and reduced ammability. TEGO erm HPG 6806, a ner silica-based granule, is designed to strengthen mechanical performance and ensure smooth, even surfaces of insulation coatings.

e TEGO erm L 300 waterborne polysiloxane hybrid binder further enhances the thermal stability and re resistance of protective coatings.

Coatings based on the range meet UL 94 V-0 re safety standards. Spray application on complex three-dimensional substrates ensures complete and e cient re resistance of the entire battery housing and helps to save space.

When subjected to a propylene ame at more than 1,000° C in testing, TEGO erm-based coatings protected the substrate e ectively as the temperature on the back remained moderate, even with a thin dry lm thickness.

“ e synergy between TEGO erm binder and granules is at the core of our solution. It minimizes heat transfer and e ectively inhibits the spread of res, o ering crucial additional time for emergency response,” said Niko Haberkorn, Global Head of Business Development for the Industrial & Transportation Coatings market segment at Evonik Coating Additives.

Silicon Mobility, an Intel company that provides automotive semiconductor and so ware control solutions, has announced the OLEA U310 Field Programmable Control Unit (FPCU) as part of its next-generation OLEA FPCU series. e new OLEA U310 consolidates the functionalities of multiple traditional microcontrollers into a single system on chip (SoC).

e OLEA U310 is speci cally engineered to match the need for powertrain domain control in electrical architectures with distributed so ware. Up to 6 standard microcontrollers can be replaced by a single OLEA U310 in a system combination where the FPCU is controlling in parallel an inverter, a motor, a gearbox, a DC-DC converter and an on-board-charger. is is designed to enable OEMs to run multiple time-based applications while simultaneously executing multiple event-based control functions.

OEMs and Tier 1 suppliers can design several variants of system integration with the OLEA U310, including a combination of the following functions: traction inverter and electric motor control with gearbox; DC-DC converter control; power factor converter control; on-board charger; air compressor for fuel cell; battery management system; thermal management system with high-voltage e-compressor control; and more.

e OLEA U310 is equipped with a complete so ware suite from Silicon Mobility, including OLEA COMPOSER, a design framework that integrates with development tools throughout the V-Model design cycle to accelerate the development process for OLEA FPCUs, and OLEA LIB, a so ware library that provides engineers with a modular set of pre-built, pre-tested functional blocks tailored to common powertrain control tasks.

Cable and connector specialist HUBER+SUHNER has launched a new purpose-built high-voltage modular cable assembly (mCAY) designed to be simpler to assemble and to save development e orts and time for manufacturers of commercial EVs such as trucks, buses and specialty vehicles. End-of-line testing is included within the assembly process, so once the mCAY solution has been assembled and tested together, the customer can install it immediately in commercial EVs.

“Many vehicle manufacturers focus on the direct costs of their solutions, without paying enough attention to indirect production costs such as assembly, test and production equipment,” says the company. “ ese costs can be signi cantly reduced by considering requirements from production, and through the application of a modular approach, rather than a product-by-product approach.”

HUBER+SUHNER is also launching a product con gurator that allows customers to tailor products to their exact speci cations. e WEB enables users to mix and match cables, connectors and glands in just a few clicks. Options for numerous cable sizes and types (single-core, multi-core or ex) are included, so an mCAY can be customized through the con guration so ware.

HUBER+SUHNER’s modular cable assemblies are designed to be fully compatible with other products in the company’s high-voltage portfolio, including RADOX cables, the modular High-Voltage Distribution Unit (mHVDU) and the RADOX EV-C connection system.

“Our partnerships with major connector manufacturers ensure our engineers remain up to date with the latest solutions. We then use our team’s experience with these technologies to deliver ready-to-use assemblies perfect for our customers’ requirements,” said Senior Product Manager Robert Weirauch.

By Jeffrey Jenkins

In the previous article on o -grid EV charging, the focus was on the energy storage battery and the DC-AC inverter that supplies the EV charger (and all of the other AC loads). is time the focus will be on the renewable energy sources themselves. For reasons of practicality (and availability) the emphasis will be on solar, but wind and hydro will be brie y discussed as well for the rare cases in which they make sense.

That last statement is bound to be controversial, so we might as well get it out of the way first. The main issue with hydroelectric generation is that it will only be an option for those lucky few who either have (legal) access to a fast-moving stream/river or a decent size pond/lake at a much higher elevation on their property (and some way to dispose of the water that will be drained from said body to generate electricity). Since this is necessarily a short article, I have to do triage here and eliminate the less-practical and/or less-available options from consideration, and hydro definitely falls into the latter category, though it is otherwise an excellent option.

e main issue with wind is that it is rarely economically justi able, and the o -cited justi cation that wind can produce power when solar can’t (at night, during a storm, etc) makes this a di cult argument to make, but I’ll give it a shot anyway. Firstly, wind speed goes up with height and all types of wind turbine—whether employing drag, like the Savonius, or li , like the classic horizontal propeller type—work best when the wind ow is non-turbulent (aka laminar)—so the turbine needs to be placed as far away from (and above) any obstructions, including trees, buildings, etc, as possible. e cost of even a bare-minimum 10 m (~33 ) high tower will be the same as 6 or more solar panels on a ground mount, while the cleared area needed for the wind generator could just as easily support more panels—hence you’re better o getting the panels. Secondly, most residential-scale wind generators (i.e. in the range of 200 W to 2 kW nominal rating) are spec’ed to deliver rated power at a wind speed of 8 m/s, or 18 mph (which is quite breezy!), and power output is a cubic function of wind speed, so if your average wind speed is just 4 m/s, as it is in most of Florida, then prepare to be disappointed by an 8-fold reduction in output (you can check your average wind conditions

Photovoltaic solar is arguably the most practical choice among renewable energy sources. It is relatively easy to trade off between effi ciency, area required, complexity of the mounting system, etc, to achieve a certain amount of power output and average daily energy production.

here: https://www.climate.gov/maps-data/dataset/average-wind-speeds-map-viewer). irdly, high wind conditions are potentially even more of a problem, for both mechanical and electrical reasons. Turbine RPM is directly proportional to wind speed (if braking torque—that is, amperage draw—is constant) but it generally takes a really strong (and sustained) wind to cause mechanical failure. Of more potential concern is that the generated voltage is also proportional to RPM, and it is quite possible that it could rise to dangerous levels during a run-of-the-mill storm. ere are purely mechanical solutions to protect against overspeed, such as governors and automatic yawing (to turn the blades away from the wind above a certain RPM), but these are generally too costly to be economical on small-scale wind turbines, so the usual solution is just to make the charge controller more tolerant of high input voltages (which itself incurs a penalty in higher electrical losses) and/or to switch on an additional load resistor to apply more braking torque. Even so, a distressing number of wind turbines fail every year from excessive speed, as a cursory search of videos will show.

Destruction from overproduction isn’t possible with photovoltaic (PV) solar, however, and as most of the planet receives a decent amount of sunlight per day (aka insolation ), it is arguably the most practical choice among renewable energy sources. It is also relatively easy to trade off between efficiency, area required, complexity of the mounting system, etc, to

achieve a certain amount of power output and average daily energy production with PV solar, and it is far easier to increase the power output of an existing PV system compared to wind or hydro.

Generally speaking, the ideal location for a PV panel array has an unobstructed view to the south (in the northern hemisphere) over as much of the day as possible (but at least during the peak generating hours of 10 am to 6 pm), and the most energy will be generated if the panels track the sun over the course of the day, while the tilt angle is varied over the course of each season. That said, these mechanically-complex sun tracking schemes provide a relatively modest increase in total energy production (10-20% is typical) compared to their costs, so mounting the panels at a fixed tilt angle (approximately the same as the latitude) pointed directly south is usually the most economical option.

The two main mounting options are on the ground or on a roof. Ground mounting is the most flexible with regards to the above considerations of tilt angle and orientation, but any obstructions that could shade the panels need to be farther away and/ or shorter. Roof mounting systems tend to be a lot cheaper, and the gain in height relaxes the shading issues, but I would only consider such if the roof has a lifetime exceeding 25 years, and, of course, the roof has a slope roughly the same as the latitude and is facing south. If the bulk of the roof faces east and west then it is possible to split the panels up into two banks feeding separate charge controllers on the premise that the east-facing array will provide energy over more hours in the morning while the west-facing array will do the same in the afternoon, but the overall cost will still be higher than for a south-facing array.

Before you get too set on where to mount the panels—particularly if on a roof—you’ll need to figure out how many of them will be required to meet your average daily energy demand, and that will depend on the insolation value, which is the average number of hours per day that PV panels will produce close to their rated power (another useful search term here is peak sun hours ). A good resource for such data (in tabular as well as map form) is available from the National Renewable Energy Laboratory’s website (https://www.nrel.gov/gis/solar-resource-maps.html).

The typical solar panel available these days will deliver 36-44V open circuit and 8-11 A short circuit, while virtually all charge controllers (whether internal to the inverter or standalone) require the voltage from the PV array to be higher than the battery voltage, so any practical off-grid array will consist of panels wired in series.

For a quick and dirty ballpark estimate, divide your average daily energy use by the insolation hours to get the bare minimum of panel power required (noting that this does not account for panel aging, exceptional uses, extended periods of cloudiness, etc). For example, to supply 20 kWh per day on average at a location that receives 4 sun hours of insolation you would need a minimum of 5 kW PV power capacity, which could be from 16 panels rated for 313 W each, or 12 panels rated for 417 W each, etc. You can install more panels than that, of course, but there are diminishing returns beyond about 3 times the above-calculated number unless you have the storage battery capacity to absorb the excess energy and need to handle extended periods of cloudiness without resorting to a backup generator.

The typical solar panel available these days will deliver 36-44 V open circuit and 8-11 A short circuit, while virtually all charge controllers (whether internal to the inverter or standalone) require the voltage from the PV array to be higher than the battery voltage, so any practical off-grid array will consist of panels wired in series. Maximizing string voltage will minimize conduction (I 2R) losses, and given that pretty much all PV panels made today have internal bypass diodes, the issue of the cells—or entire panel— being forced into reverse conduction when shaded is eliminated. Wiring panels in parallel trades the big swings in voltage that result from shading of one

Finally, there are numerous ancillary items that will be required for a PV energy system, including DC-rated fuses and/or circuit breakers, combiners and/ or Y-cables, surge arrestors, conduit and wire, and a whole bunch of PV connectors.

or more panels in the string for a reduction in total string current. However, the bypass diodes are typically axial-leaded Schottky types without any heatsinking besides said leads, so they can’t really handle more than about 10 A or so, especially when baking in the hot sun. Consequently, two—or maybe three— panels in parallel are the practical upper limit. If you need more power than you can get from about 300 VDC open circuit and 20 A short circuit, then simply break up the PV array into multiple strings that each feed their own charge controller (that can all feed a common storage battery). Most of the higher-power AIO inverters have two PV array inputs, anyway, so that gives a practical power handling capacity of 12 kW right there.

The charge controller that goes in between the PV array and the battery is the final key piece of equipment to consider. As discussed in the previous article, hybrid solar/all-in-one inverters have a PV-input charge controller built into them (and likely even two), and while that is certainly convenient, it might not be the most flexible solution, and it also might not do the best job of MPPT, or Maximum Power Point Tracking. There is also a compelling argument that a separate inverter, AC-input battery charger and PV-input charge controller will be less expensive to maintain if (or when) something fails. The other concern—that it might not do a good job of MPPT— is harder to quantify in the real world unless you have two identical PV strings, with one feeding the charge controller in the AIO and the other feeding a standalone charge controller. I did just that, and while a dataset of one is hardly authoritative, I did notice

that the standalone charge controller consistently extracted about 10% more power from its string compared to the AIO, and it also responded more quickly to intermittent shading from passing clouds. That last observation points to a better/faster MPPT algorithm, which basically hunts for the best combination of loaded voltage and output current from the panels to deliver the most power, as above a certain current (which is less than the short-circuit current) the output power starts to decline, and this current is proportional to the light intensity striking the panels, hence the need to hunt for it on a frequent basis. Finally, there are numerous ancillary items that will be required for a PV energy system, including DC-rated fuses and/or circuit breakers, combiners (to parallel panels at the string level) and/or Y-cables (to parallel panels at the panel level—but make sure they have inline fuses on each branch of the Y), surge arrestors, conduit and wire, and a whole bunch of PV connectors (usually—but not always!—the MC4 type). Off-the-shelf PV combiner boxes feature a two-pole circuit breaker for each string in the array with a two-pole surge protection device on the output side (i.e. from each side of the array to the usual two or more ground rods pounded into the earth) along with knockouts along the perimeter of the box for half-inch or three-quarter-inch conduit, making them a convenient way to wire everything up. The wire that joins the panels together and leads back to the combiner needs to be specified for PV use (e.g. UL 4703 rating) but the wire that goes from the combiner to the charge controller can be of any type if the conduit is continuous and buried at least 24 inches deep, as long as it is of an appropriate gauge for the current (#12 is typically used for 10-15 A and runs of 100 feet or less; #10 is recommended for longer runs and/or if bumping up against the 20 A practical limit for a single array). However, given the price of PVC conduit these days, it might very well be more economical to go with cable rated for direct burial (such as type UF-B or mobile home feeder) so that only short stubs of conduit (that extend 18 inches below grade) are needed at either end of the run. When the cost of everything involved in an offgrid energy system is tallied up, the economics might seem questionable, but that will almost certainly fade into insignificance the first time you recharge your EV with it.

Form hairpins, I-pins & stator connector pins with ease using WAFIOS' new

at WAFIOS' Midwest Tech Center For:

Validating technical feasibility

Sample production for prototyping

Complete support from the first sample to a mass production solution

monitoring for quality control

By Charles Morris

battery technology is advancing rapidly—it seems like every few days we read about a scienti c breakthrough that will enable safer, cheaper, smaller and more energy-dense batteries. However, the road from the lab to the auto dealership is a long one—it typically takes several years of testing and development before a new battery technology is ready to be incorporated into production vehicles.

Wildcat Discovery Technologies, which has been developing battery materials since 2006, specializes in accelerating this process. The company uses proprietary high-throughput synthesis and testing platforms to rapidly evaluate thousands of materials and chemistries, and it partners with customers to develop customized battery cells for specific applications.

Recently, Wildcat has shi ed its strategy—the company will become a producer of cathode materials, while continuing its research and engineering activities. Last December, Wildcat announced plans to build a US plant to produce a portfolio of nickel-free and cobalt-free cathode materials.

Charged spoke with Wildcat President and CEO Mark Gresser about his company’s plans, and the multiple advantages of its new cathode designs.

Q Charged: When we spoke back in 2021, you were working on an EV Supercell that featured a new type of cathode, a solid electrolyte and a lithium metal anode. What’s been happening at Wildcat since then?

It turns out the process and equipment we use to make DRX is shared with other cathode materials like lithium iron phosphate. So, if we’re going to build a plant in the US to make the DRX material, we could manufacture LFP in the same facility.

A Mark Gresser: Over the last few years, cell makers in North America have been looking for accessible, long-term alternatives to China-based cathode active material production. at’s why we’re shi ing our strategy. Our new mission is to produce high-performance US-made cathode materials to enable widespread adoption of clean energy.

e cathode material you and I discussed in 2021 has been advancing very rapidly. We looked at what the industry needed and where we had opportunity, and realized that our DRX cathode was really the star of the show.

e DRX cathode, as we call it, stands for disordered rock salt. It is a high-energy, no-nickel, no-cobalt product that is going to compete really well with all the high-nickel materials that are in the industry now. We’re not quite ready to launch it today, but we’re getting close enough that we want to scale, and we’re seriously thinking about how and where we’re going to manufacture it right here in the United States.

It turns out the process and equipment we use to make DRX is shared with other cathode materials like lithium iron phosphate. So, if we’re going to build a plant in the US to make the DRX material, we could manufacture LFP in the same facility.

LFP is becoming the fastest-growing cathode material in the world, and it’s made almost exclusively in China today. Given the current climate and the desire of our customers to have a more localized supply chain, we’ve decided to expand our strategy. In the near term, we will

produce LFP and be one of the rst US producers of a really fast-growing cathode material. en we can use the same suite of equipment and the same process steps to produce both LFP and our new DRX material.

en in between those two materials is a manganese-rich version of LFP called LMFP. We’re getting lots of customer inquiries about LMFP, so we are developing recipes for that product as well. e overall plan for Wildcat is to produce a family of products that covers the whole spectrum of EV and stationary storage needs, here in the US.

Q Charged : Can you dig a little deeper into how the development of the DRX cathode happened, and the advantages of it?

A Mark Gresser: We started investigating disordered rock salt around 2015. We put a small team on it, as we’re apt to do here at Wildcat, using our high-throughput technology. Our scientists found some interesting compositions that looked really promising, so we started ling

We see DRX as a breakthrough for the battery industry. From a performance standpoint, it’s made from mostly abundant and available low-cost materials. No nickel, no cobalt.

some patents. We’ve got some great patent coverage on that technology, and that’s our foundational IP.

One of our partners in this work is CBMM. ey’re a big mining concern in South America, and they can supply some of the metals we use in the product. BMW has shown interest in this technology, and we announced a joint development agreement with them a couple of years ago. ey’re providing technical support, they’re doing testing, they’re actively involved in bringing DRX to commercial readiness.

Here at Wildcat, we’ve been continually increasing the resourcing on this project. ere are 50 of our people now working on this project exclusively, and we’ve got a partnership with McGill University, with a really sharp team led by Professor Jinhyuk Lee.

We see DRX as a breakthrough for the battery industry. From a performance standpoint, it’s made from mostly abundant and available low-cost materials. No nickel, no cobalt. e material has the potential to be about 20% more energy-dense than the high-nickel materials that are nding their way into the market now.

We also see the potential for a big safety advantage. e material performs very well in our early safety testing. We have more to do on the testing, but it looks like this is going be a clean, safe, higher-energy, low-cost material for the high end of the EV market.

Q Charged: Of those bullet points of advantages, would you say the low cost of the materials is the top one?

A Mark Gresser: It’s certainly one of the top three—of

LMFP is a manganese-rich version of LFP. Manganese is very cheap, and it operates at a higher voltage. The theory is you’re not really adding costs, but you’re adding energy.

course, depending on who we speak with. For some, the higher energy is pretty compelling, and then safety, as you know, is critical. We’re not quite ready to market it today because we’re still developing the material. We think it needs another two years before we’re ready to start shipping samples to customers, but certainly low cost on a $/kWh basis will be critical.

Q Charged: Can you break down the di erence between LFP and LMFP?

A Mark Gresser: Lithium iron phosphate has been around a long time. It’s one of the oldest of the cathode materials, but it was deemed to be not energy-dense enough for EVs.

However, about three years ago something changed. Some clever engineering from Chinese manufacturers took advantage of the safety of the material and designed packs that were much lighter.

When you factor in the lower cost of LFP packs, there is a growing market. Many have taken notice and LFP is now

About three years ago something changed. Some clever engineering from Chinese manufacturers took advantage of the safety of LFP material and designed packs that were much lighter.

the fastest-growing cathode material out there. LMFP is a manganese-rich version of LFP. You’re substituting a lot of manganese into the mix to replace some of the iron. A typical ratio of manganese to iron in that product is around 60:40. ese products perform similarly, but manganese is very cheap, and it operates at a higher voltage. Because of that higher voltage, you can get about a 15% boost in energy density. e theory is that you’re not really adding costs, but you’re adding energy.

For a globally produced product like LFP, the IRA is critical. Otherwise, it would be diffi cult to set up a plant and compete directly with Chinese manufacturers.

e reality though, is that it’s not widely used yet. ere are a number of companies saying they have LMFP ready to go, but much of the LMFP we’ve tested exhibits some shortcomings. We’ve found that most LMFP we test still doesn’t cycle like LFP. And there are a few other small de ciencies.

We think there’s an opportunity to create a better version of LMFP, and so we’re working on this. We have a basic 60:40 manganese version in testing now that some key customers are evaluating. Based on their feedback, we’re pushing that LMFP to higher levels of manganese and better performance.

And then our DRX product is a great t for anything needing a boost in energy—especially premium EVs. So, across our portfolio of three cathodes, we have a low-tech to high-tech spectrum, and a very large cross-section of applications.

Q Charged: Numerous EV industry execs have told Charged the “Buy American” provisions of the 2022 In ation Reduction Act (IRA) are driving massive investments in domestic EV battery materials. How important is the IRA to your plan to manufacture materials in the US?

A Mark Gresser: It is a big driver for our plan to go into manufacturing. We want to scale and produce DRX material because the value proposition for that is great. It’s patent-protected, it o ers higher energy, lower cost, better safety. It checks all the boxes. However, the product isn’t ready to commercialize today. So when the IRA came around, we realized that we could get to scale more quickly by manufacturing multiple cathodes via the same process, which led us to the LFP/LMFP strategy.

For a globally produced product like LFP, the IRA is critical. Otherwise, it would be di cult to set up a plant

and compete directly with Chinese manufacturers. Right now, there’s signi cant overcapacity in China, and when there’s overcapacity, they drop pricing quickly. e IRA tax incentives coupled with tari s protect US manufacturers and o er an important opportunity to invest in manufacturing.

We designed our US plant to keep costs very low. It’s a very automated plant, and a well-engineered process, so we can compete apples-to-apples with anybody.

Q Charged: When you say a hundred percent IRA compliant, that means all your base materials are coming from approved countries. Are those supply chains already in place or are they being built at the same time as you’re ramping up?

A Mark Gresser: Supply chains don’t really fully exist in the US or in compliant countries yet—they’re being built. We’re at one place in the supply chain—we’re making cathode powder and selling to cell makers. But then further upstream from us, you’ve got people making the precursor materials that we use to make our cathode material. We’ve got a lot of MOUs in place with lithium providers, so we don’t think that’ll be a problem.

When you look at building a US-based supply chain for EVs, you have to look at the whole supply chain. You have to go all the way back to the mined materials and make sure that the US is also supporting the development of critical mineral supplies here in North America, and I think our Department of Energy is doing this well.

Q Charged : Do you have any concern about the IRA being rolled back?

A Mark Gresser: We talk a lot with the politicians, the DOE, and other stakeholders about this issue. e sense we get is that the EV supply chain in the US has become a fairly bipartisan issue.

US-made batteries mean energy independence. It’s a key technology for the future, and it isn’t just the passenger vehicle market. It’s trucks, shipping, military applications. Having the ability to produce high-tech batteries in the US and do the R&D for those batteries in the US, we think that puts Wildcat in a pretty good spot. If you combine that with cathode production here in the US, that’s a situation that is not reliant on any kind of foreign partnership, and serves the US well.

Q Charged: If the IRA sticks around, I think it might be one of the most impactful pieces of legislation ever in terms of US manufacturing. e amount of activity that I see every day is insane.

A Mark Gresser: I was just putting together a slide for a presentation—it was about the number of gigafactory announcements in the US pre- and post-IRA. ere’s something like 43 gigafactories that have been announced, and the IRA is a major driver. We’re literally creating a new auto industry and it’s all US-based, which is terri c.

Q Charged: What’s up with the legacy Wildcat business? Are you guys still doing that in parallel with this?

A Mark Gresser: Yes. We’ve got this incredible high-throughput R&D capability, and over the past couple of years, we’ve continued to take that to the next step, from basic R&D to starting to scale. We’ve put in all types of equipment that allows us to make small and large pouch cells right here at Wildcat. We’ve got two dry rooms. We’ve got coaters to produce anodes and cathodes. We’ve got a huge slot dye coater for our big cells. We’ve got all the equipment we’re going to use in production at a pilot scale here in San Diego.

When you think about customer evaluations, the typical process for cathode makers is to ship a powder to a cell maker or an automaker, and then wait for months, sometimes even a year, to get feedback. You’re waiting for them to turn that material into a slurry, make a lm, build a battery and then cycle the battery. You’re asking your customers to provide all that work, and that’s a lot of time and money for them.

So, imagine how much we can accelerate the adoption cycle for our products because we don’t have to ask our customers to do all the work of evaluating a new material. And we take it one step further—if they decide they’re going to use our LFP or our LMFP, we can execute a benchmark project like those we o er to our legacy customers, where we start with the Wildcat cathode, evaluate dozens of anodes, and then tailor multiple di erent electrolyte formulations to work best with that anode/cathode pair. And we can present all that to our customer and say, “If you’re going to buy the Wildcat cathode material, we’ll help you design the whole cell and optimize its performance.”

There’s something like 43 gigafactories that have been announced, and the IRA is a major driver. We’re literally creating a new auto industry and it’s all US-based, which is terrifi c.

Q Charged : You’re aiming to produce LFP material in 2026.

A Mark Gresser: We plan to have the plant stood up in Q4 2026.Of course, selling product will happen later in 2027. Our plan is to produce cathode powder. We’ll be shipping that to cell makers. And it goes beyond EVs—LFP is the material of choice for stationary storage, which is becoming another big market, and we’re already sampling with customers in this space.

Q Charged: How’s the progress on the new plant? Have you announced the location?

A Mark Gresser: We’re making large quantities of material for customer sampling, but that’s from our San Diego demonstration line. In fact, we recently produced one metric ton of LFP cathode material, which demonstrated our capacity for large-scale production. We’re sharing it with customers for sampling, and feedback has been very positive.

For the new plant, we’ve got an engineering rm on board, and they are in the nal phase of designing the

plant. We hired top experts to lead our manufacturing team. We’re actively raising capital now, and looking for key strategic partners to go to the plant scale. We’re telling folks that the plant will be in the battery belt in the Southeast of the US, but we haven’t made a formal location announcement yet. We’re going to keep the R&D headquarters in San Diego—there’s a couple of reasons for that, and one is access to talent. California is a great place to access scienti c talent—the value of the labor pool here outweighs any cost disadvantages. But when it comes to large-scale manufacturing, we have to be cognizant of utility prices in California vs other states, and for us, utility cost is one of the main drivers for our decision on location.

We are excited about Wildcat’s future. Our vision is to be the rst choice for battery materials development, integration, and supply—and we have the strategy, expertise, innovation, and best team in the industry to make it happen.

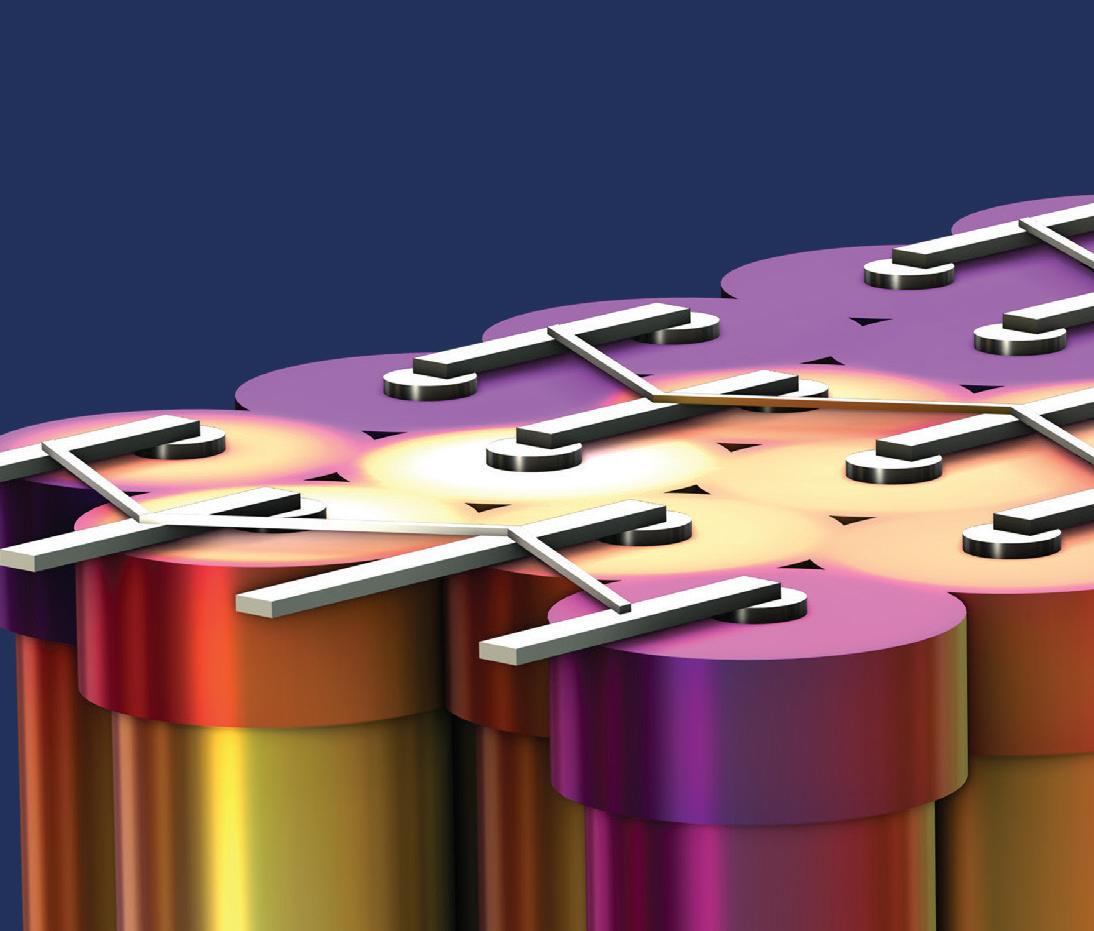

Multiphysics simulation helps in the development of innovative battery technology by providing insight into mechanisms that impact battery operation, safety, and durability. The ability to run virtual experiments based on multiphysics models, from the detailed cell structure to battery pack scale, helps you make accurate predictions of real-world battery performance.

» comsol.com/feature/battery-design-innovation

Southern California-based medium-duty electric truck manufacturer Harbinger has received 4,000 binding pre-orders from customers that include Bimbo Bakeries USA, RV manufacturer THOR Industries, postal service operator Mail Management Services and several North American commercial vehicle dealers.

ese include Doggett Equipment Services Group (500 units), Campbell Supply (125 units), GATR Truck Center (500 units), ETHERO Truck + Energy (200 units) and Electric Commercial Vehicles (50 units). Harbinger says its growing North American network of dealers is positioned to serve 78% of the population.

e company also announced the closing of an additional $13 million in Series A funds in the fourth quarter of 2023 from investors that include Coca-Cola’s System Sustainability Fund. is brings the new Series A total to $73 million, which Harbinger plans to use to expand manufacturing capacity and launch commercial production in the fourth quarter of 2024.

“We are focused on the medium-duty vehicle segment, where there is a huge variety of vehicles built on chassis like ours,” said Harbinger CEO John Harris. “Today, most manufacturers are adapting gasoline or diesel vehicles to electri cation, rather than building a groundup electric platform. is compromised approach leads to concerns with vehicle safety and durability as well as higher production costs, which is why we chose to start fresh with a clean sheet design.”

US-based school transportation provider First Student has received $200 million in rebates from the third round of funding of the EPA’s Clean School Bus Program.

e new funding brings First Student’s total program awards to $401 million across the three funding rounds. is round will enable the company to deploy up to an additional 670 electric school buses in 45 school districts across the US, bringing the total from all three EPA rounds to over 1,200 buses.

e Clean School Bus Program allocates funds for school districts to help cover the cost of replacing fossil fuel school buses with zero-emission vehicles and associated charging infrastructure. First Student works directly with school districts on electrifying their bus eets, collaborating with them on the applications to the EPA and then deploying and maintaining the vehicles once they are in service.

e company has deployed over 350 electric buses across North America, and has also been awarded approximately $65 million through other federal, state and utility programs in the US and Canada to electrify school bus eets.

“First Student electric school buses funded by this program are already creating safer and cleaner rides to and from school, and these investments mean expanding that bene t to even more districts,” said First Student Head of Electri cation Kevin Matthews. “School districts can put these awards to use right away, turning these rebates into much-needed eet upgrades.”

Yanmar Compact Equipment, a Japanese engine and heavy machinery manufacturer, has announced a new trio of electric-powered machines as part of its Unplugged range: a wheel loader, mini-excavator and tracked carrier. All three new electric models match the output of Yanmar’s legacy ICE equivalents.

e SV17e Mini-Excavator is powered by an 18.3 kWh battery pack. It musters digging forces of 9.9 kN and 8.9 kN from its short and long arms, respectively, as well as 16 kN bucket force. It’s designed for compact spaces, and its nearly silent operation makes it suitable for working indoors, as well as in noise-restricted areas. An optional fast charger can replenish the battery (20-80% SOC) in about 2 hours.

e V8e Wheel Loader boasts four working modes (Bucket, Fork, Eco, Power), a bucket volume between 0.8 and 1.2 cubic meters, and a payload on forks of 1,890 kg. Two battery pack options are available: 39.9 kWh and 53.2 kWh. e latter provides up to 4.2 hours of continuous operation in Bucket mode. e loader’s synchronous motor o ers 22 kW rated and 30 kW peak power. Charging power is 11 kW standard, upgradeable to 22 kW.

Yanmar’s C08e Tracked Carrier has a 5.5 kW (rated), 6.5 kW (peak) electric motor and a hydrostatic transmission to ensure smooth handling and operation on inclines up to 20 degrees. Its haul body can carry between 0.34 to 0.42 cubic meters. e 10.4 kWh battery pack has three selectable working modes—battery life is up to three hours in the most demanding mode.

Komatsu, a Japanese manufacturer of construction, forestry, mining, military and industrial equipment, has announced that the second generation of its smallclass drill and bolting equipment will include battery-electric models.

e ZB21 small-class bolter and the ZJ21 jumbo drill will each feature an 83 kWh battery pack, which the company said would meet the challenges of hard-rock mining. Both will be fully compatible with existing Komatsu mine infrastructure.

e two are “the smallest size-class drills and bolters to o er a BEV option,” the company said.

In March, Komatsu opened a new o ce in Longview, Texas. e 56,000-square-foot facility consolidates multiple locations and functions into one building on the company’s manufacturing campus.

Kramer-Werke, a manufacturer of compact construction machines (and a unit of Munich-based Wacker Neuson Group), proclaiming that it is “time for clean air,” showed o its new 5065e electric wheel loader at the recent IFAT trade show in Munich.

e 5065e features a 96-volt lithium-ion battery. It was created for inner city work and is designed to o er very quiet operation. It is also suitable for use indoors and at locations such as parks and zoos.

e battery-electric wheel loader can operate for four hours on a single charge, and has four charging plug options.

APM Terminals Elizabeth, a division of shipping giant

A.P. Moller-Maersk, is dipping its corporate toe into electri cation. e company will invest $5 million in its Electri cation Pilot Project, including a $1.4 million Diesel Emissions Reduction Act (DERA) grant from the EPA.

e DERA grant has facilitated the replacement of seven diesel terminal tractors with new Ma T 230e Electric-Terminal-Tractors (eTTs), which support both plug-in and wireless charging.

e terminal has installed nine Heliox 60-180 kW DC fast charging stations, as well as an InductEV wireless 150 kW DC fast charging station. e eTTs can operate for 16-20 hours a er just two hours of charging time. e power used to charge the electric tractors is sourced from renewable energy through a power purchase agreement.

e pilot program, conducted in collaboration with the Leonardo Academy, will study key performance and operational aspects of using the electric trucks to test technology maturity and ensure operational readiness for the terminal.

“ e project wouldn’t have been possible without the funding assistance and support from the EPA,” said Henrik Kristensen, Managing Director of APM Terminals Elizabeth. “APM Terminals has set a goal to reach net zero in 2040 [and one of the tools is] the use of electric container handling equipment.”

e South Pasadena Police Department has completely replaced its gasoline-powered vehicles with EVs. e city’s eet of 20 new Teslas will rely on a bank of 34 new EV chargers installed at South Pasadena City Hall. As part of the project, the City Hall, Police Station and Fire Station buildings will be backed up by a solar PV system with battery storage, adding power resilience in the event of an outage.

e transition is expected to save about $4,000 per year per vehicle on energy costs, and to provide additional savings on maintenance. Overall, the city expects the operational cost of EVs to be around half the permile cost of legacy vehicles.

Replacing gas-burning police and other public safety vehicles with EVs can deliver more emissions reductions than replacing other vehicles, a city spokesperson said. Police vehicles typically idle more than other vehicles when o cers make tra c stops or respond to emergency calls.

Enterprise Fleet Management assisted the city in acquiring 10 Tesla Model Ys for patrol vehicles and 10 Tesla Model 3s for detective and administrative duties.

e cars were up- tted for police use through Unplugged Performance’s UP.FIT division.

“We’ve had the pleasure of developing best-in-class next-generation police vehicles alongside the great team at South Pasadena Police Department,” said Unplugged Performance CEO Ben Sha er. “As a result, 20 turnkey UP.FIT Tesla Model Y Pursuit and UP.FIT Tesla Model 3 Administrative vehicles have been produced to replace the full eet of aging ICE vehicles.”

Metals and mining giants BHP and Rio Tinto have announced plans to test large battery-electric haul truck technology in Australia’s Outback.

e two companies will collaborate with both Caterpillar and Komatsu to test the latter two’s battery-electric haul trucks in the rugged weather and terrain of the Pilbara, which has an arid and tropical climate where temperatures of 113° F (45° C) are not uncommon during the summer, making it an ideal test site for the battery-electric haul trucks.

e tests will assess the performance of batteries as well as static and dynamic charging systems in the harsh Pilbara environment.

e schedule calls for testing of two Cat 793 haul trucks in the second half of 2024 and two Komatsu 930 haul trucks starting in 2026, both at mine sites in the Pilbara.

ZeroAvia is developing hydrogen-fueled engines for commercial aircra , and has successfully completed ight tests of electric aircra in the US and in the UK.

Now the company has secured a conditional agreement from American Airlines to purchase 100 hydrogen-electric engines intended to power regional jet aircra . e two companies announced a memorandum of understanding in 2022.

American has also increased its investment in ZeroAvia—the airline made its rst investment in ZeroAvia in 2022, and has now participated in the company’s Series C nancing round.

ZeroAvia’s hydrogen-electric engines use hydrogen in fuel cells to generate electricity, which is then used to power electric motors to turn the aircra ’s propellers. According to the company, the only in ight emission is low-temperature water vapor, and the lower-intensity electrical systems have the potential to o er signi cant cost savings.

ZeroAvia is currently ight-testing a prototype for a 20-seat plane, and designing an engine for larger aircra such as the Bombardier CRJ700, which American operates on certain regional routes.

“Advancing the transition of commercial aviation to a low-carbon future requires investments in promising technologies, including alternate forms of propulsion,” said American CEO Robert Isom. “ is announcement will help accelerate the development of technologies needed to power our industry.”

American truck brand Peterbilt has announced its biggest electric semi sale to date: 150 of the company’s 579EV battery-electric trucks to Swedish transport company Einride. is eet of new EVs will service Einride’s North American customers.

Einride’s Freight Capacity as a Service o erings are designed to make it easy for eets to go electric by delivering a turnkey package that includes electric and autonomous vehicles, charging depot infrastructure, and the company’s proprietary digital freight platform, Einride Saga.

Peterbilt’s 579EV Class 8 semi has an 82,000 lb GVWR and a 670 peak hp (536 continuous) electric motor. Its 400 kWh battery pack delivers about 150 miles of range.

“We are proud to announce this partnership with Peterbilt and Rush Peterbilt Truck Centers as we combine our technology platform with their premium hardware to provide a market-leading o ering as we collaborate on the future of electric freight,” said Niklas Reinedahl, General Manager North America at Einride. “Bringing new technology to market is imperative to enabling the switch to electric freight operations.”

“Peterbilt o ers the industry’s most complete lineup of electric vehicles. Our focus on creating reliable zero-emission solutions enables Einride to electrify end-user eets and reduce tailpipe emissions,” said Peterbilt General Manager and PACCAR VP Jason Skoog. “ e Model 579EV is an example of that focus, and is the agship of the Peterbilt electric vehicle lineup.”

US school bus manufacturer Blue Bird has unveiled an operating prototype of an electric step van and underlying stripped chassis.

is prototype of the last-mile delivery commercial vehicle was built in collaboration with US electric truck manufacturer and eet services provider Xos for the powertrain and US work truck body manufacturer Morgan Olson for the body.

e prototype is built on a 178-inch wheelbase for vans with a gross vehicle weight rating of up to 23,000 lbs. It is equipped with a 140 kWh battery that is mounted inside the frame rails for protection and supports a range of up to 130 miles. Other features include “hill hold” to prevent rolling when the vehicle is stationary on a hill, “electric creep,” which simulates the slow forward motion of an ICE vehicle in gear when pressure is removed from the brake pedal, and 55-degree wheel cut for improved maneuverability. Blue Bird expects the electric stripped chassis to be commercially available in late 2024.“For nearly a century, Blue Bird has perfected its core capabilities of designing, engineering and manufacturing school buses from the ground up,” said Blue Bird President Britton Smith. “Now we are one step closer to applying our vehicle manufacturing expertise and expanding our electric-powered product range to the commercial vehicle market.”

US-based commercial EV manufacturer

Mullen Automotive has developed a new battery-powered version of its mobile EV charging truck, based on its Class 3 electric cab chassis truck.

e previous version of PowerUP announced in July 2023 used a gasoline Class 5 cab chassis platform and a propane and natural gas power generation unit. Unlike traditional fossil fuel-powered generators, the new version operates with minimal noise pollution, making it suitable for use in noise-sensitive environments.

PowerUP is designed to provide on-demand mobile DC fast charging in situations such as roadside assistance and emergency response where immediate power is required for recharging an EV or for emergency power backup.

e mobile charger is intended to be a scalable battery platform that can be con gured to meet various market needs, ranging from 10 kW to 1 MW, and can use new or repurposed battery cells. It features two DC fast chargers, each with 60 kW of output. Additional features include 12 V jumper terminals, 20 kW-160 kW AC output, and (optional) solar/wind o -grid power generation and a bidirectional 480 V grid connection.

Mullen is developing PowerUP at its High Energy Facility in Fullerton, California, as part of its plans to build a comprehensive EV ecosystem in the US. e company’s acquisition of battery pack production assets from Romeo Power is helping to accelerate the development of the battery-based PowerUP version.

“ e feedback on the initial PowerUP concept was overwhelmingly positive, but the market is clearly looking for a zero-emission solution,” said David Michery, CEO and Chairman of Mullen Automotive.

Volvo Trucks has announced that its electric models, rst introduced in 2019, have driven a total of more than 80 million kilometers in commercial tra c, equivalent to 2,000 laps around the earth.

e company says it has sold more than 3,500 electric trucks in 45 countries over the past ve years. Its global deliveries of electric trucks increased by 256% to 1,977 trucks in 2023. In the rst quarter of 2024, its share of the electric truck segment was 56% in Europe and 44% in the US.