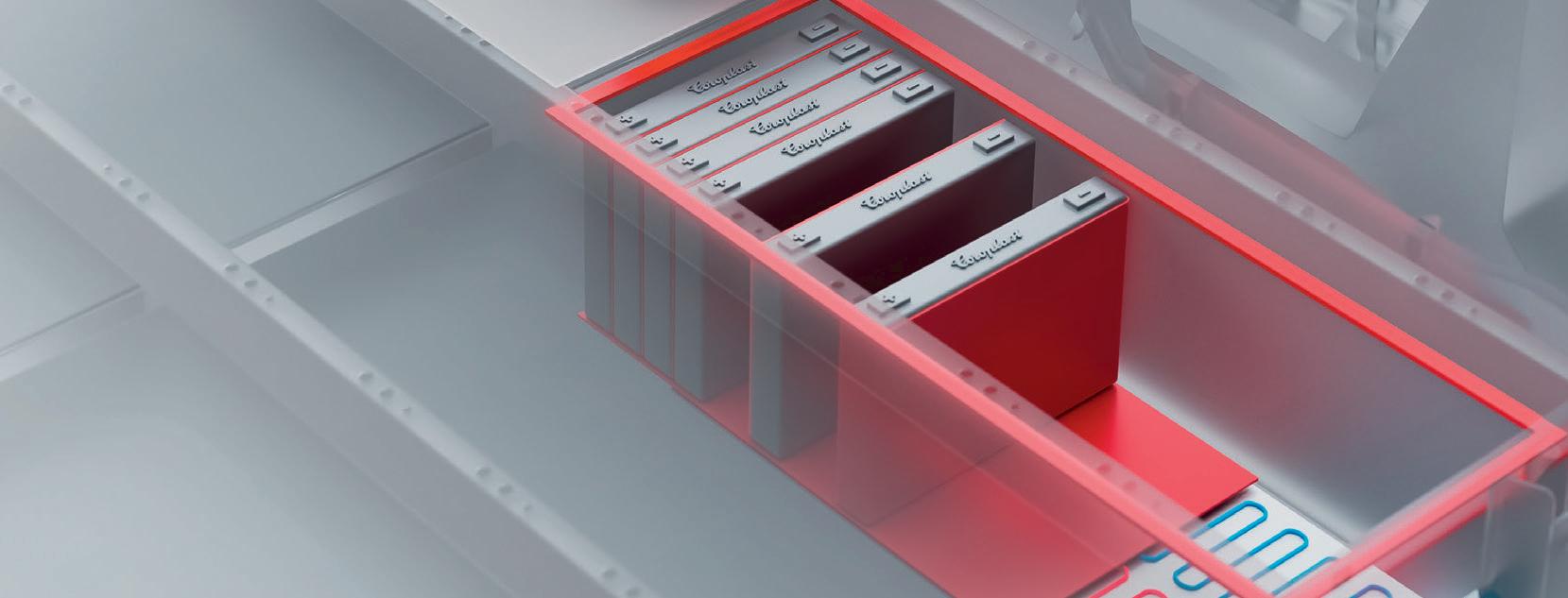

Battery cell, module and pack level charge/discharge cycle testing solutions designed to provide high accuracy measurement with advanced features. Regenerative systems recycle energy sourced by the battery back to the channels in the system or to the grid.

Battery simulation for testing battery connected devices in all applications to confirm if the device under test in performing as intended. Battery state is simulated which eliminates waiting for the charge/discharge of an actual battery. Real time test results include voltage, current, power, SOC%, charge/discharge state and capacity.

To learn more about our Battery Test Solutions visit chromausa.com

DOE allocates $50 million to help suppliers adapt factories for the EV supply chain

Modine introduces EVantage electric compressors and valves for commercial EVs

Cyclic Materials and SYNETIQ partner to recycle rare earth elements from motors

TDK extends inductor range for automotive and industrial uses

NGen invests $29.7 million in five new Canadian EV manufacturing projects

Able Electropolishing enhances its analytic and testing capabilities

ZF Aftermarket introduces electric axle drive repair kits

Paraclete Energy achieves cost-effective silicon anode materials

Hönle and bdtronic develop process for curing sealants for battery controllers

Wright Electric receives $3.34-million grant for ultra-lightweight aircraft batteries

NOVONIX and CBMM sign joint agreement focused on nickel-based cathodes

Arcadium Lithium buys Li-Metal IP and assets

Freudenberg Sealing Technologies launches new product lines for prismatic cells

Logistics firm DSV orders 300 electric semi-trucks from Volvo

Stellantis partner Leapmotor ships its first batch of EVs from China to Europe

Peterbilt 579EV trucks join Universal Logistics fleet

Saudia to buy up to 100 eVTOL jets from Lilium

CASE debuts new 580EV electric backhoe loader

Monarch Tractor raises $133 million in Series C funding for electric tractor

Two Greek cities order 89 electric waste-collection trucks from FUSO Europe

One way to reduce parking costs for property owners—give residents a free EV

Tesla scores a $5-million order from Baltimore for a fleet of EVs

Ford Pro provides free EV chargers to California businesses

South Pasadena, California completely electrifies its police fleet

GM BrightDrop division to be merged into Chevrolet

Munich Airport to deploy 14 Goldhofer electric aircraft tractors

Are Chinese electric buses exempt from European EV tariffs?

Indian firm Exicom to acquire charger manufacturer Tritium

SparkCharge to integrate Pioneer Power’s e-Boost mobile off-grid EV charger

US government awards $521 million in EV charging grants

Los Angeles expands streetlight EV charging program

California incubator launches repair training center for EV chargers

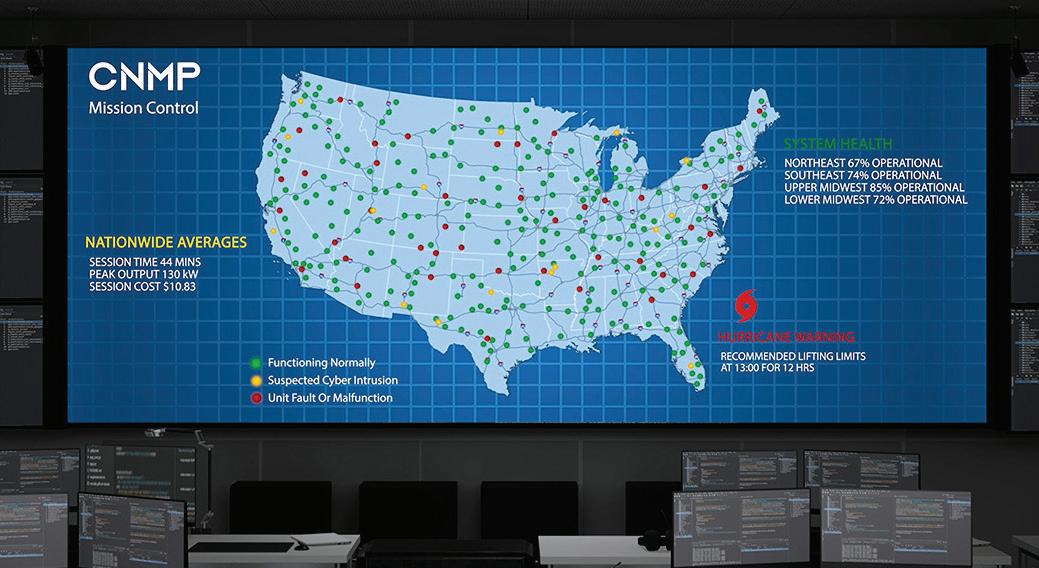

Terbine introduces new digital twin for EV charging networks

Generac makes $35-million investment in Wallbox Chargers

New study finds fleet owners more satisfied with EVs than legacy ICE vehicles

3V Infrastructure launches to offer EV charging at long-dwell properties

SAE International publishes new standard for wireless light-duty EV charging

EVgo pursues several initiatives to improve public EV charging reliability

ENROUTE data sharing to improve efficiency of heavy-duty EV charging

Beam Global acquires power electronics manufacturer Telcom

Uber hires former Tesla Head of Charging Rebecca Tinucci

Publisher Senior Editor

Technology Editor

Segment Leaders

Christian Ruoff

Charles Morris

Jeffrey Jenkins

Joel Franke

Mark Rogers

Greg Schulz

Graphic Designers

Tomislav Vrdoljak

Contributing Writers

Jeffrey Jenkins

Charles Morris

Christian Ruoff

Jonathan Spira

John Voelcker

Cover Image Courtesy of

Special Thanks to

For Letters to the Editor, Article Submissions, & Advertising Inquiries Contact: Info@ChargedEVs.com

American Honda Motor Co., Inc

Kelly Ruoff

Sebastien Bourgeois

ETHICS STATEMENT AND COVERAGE POLICY AS THE LEADING EV INDUSTRY PUBLICATION, CHARGED ELECTRIC VEHICLES MAGAZINE OFTEN COVERS, AND ACCEPTS CONTRIBUTIONS FROM, COMPANIES THAT ADVERTISE IN OUR MEDIA PORTFOLIO. HOWEVER, THE CONTENT WE CHOOSE TO PUBLISH PASSES ONLY TWO TESTS: (1) TO THE BEST OF OUR KNOWLEDGE THE INFORMATION IS ACCURATE, AND (2) IT MEETS THE INTERESTS OF OUR READERSHIP. WE DO NOT ACCEPT PAYMENT FOR EDITORIAL CONTENT, AND THE OPINIONS EXPRESSED BY OUR EDITORS AND WRITERS ARE IN NO WAY AFFECTED BY A COMPANY’S PAST, CURRENT, OR POTENTIAL ADVERTISEMENTS. FURTHERMORE, WE OFTEN ACCEPT ARTICLES AUTHORED BY “INDUSTRY INSIDERS,” IN WHICH CASE THE AUTHOR’S CURRENT EMPLOYMENT, OR RELATIONSHIP TO THE EV INDUSTRY, IS CLEARLY CITED. IF YOU DISAGREE WITH ANY OPINION EXPRESSED IN THE CHARGED MEDIA PORTFOLIO AND/OR WISH TO WRITE ABOUT YOUR PARTICULAR VIEW OF THE INDUSTRY, PLEASE CONTACT US AT CONTENT@CHARGEDEVS.COM. REPRINTING IN WHOLE OR PART IS FORBIDDEN EXPECT BY PERMISSION OF CHARGED ELECTRIC VEHICLES MAGAZINE.

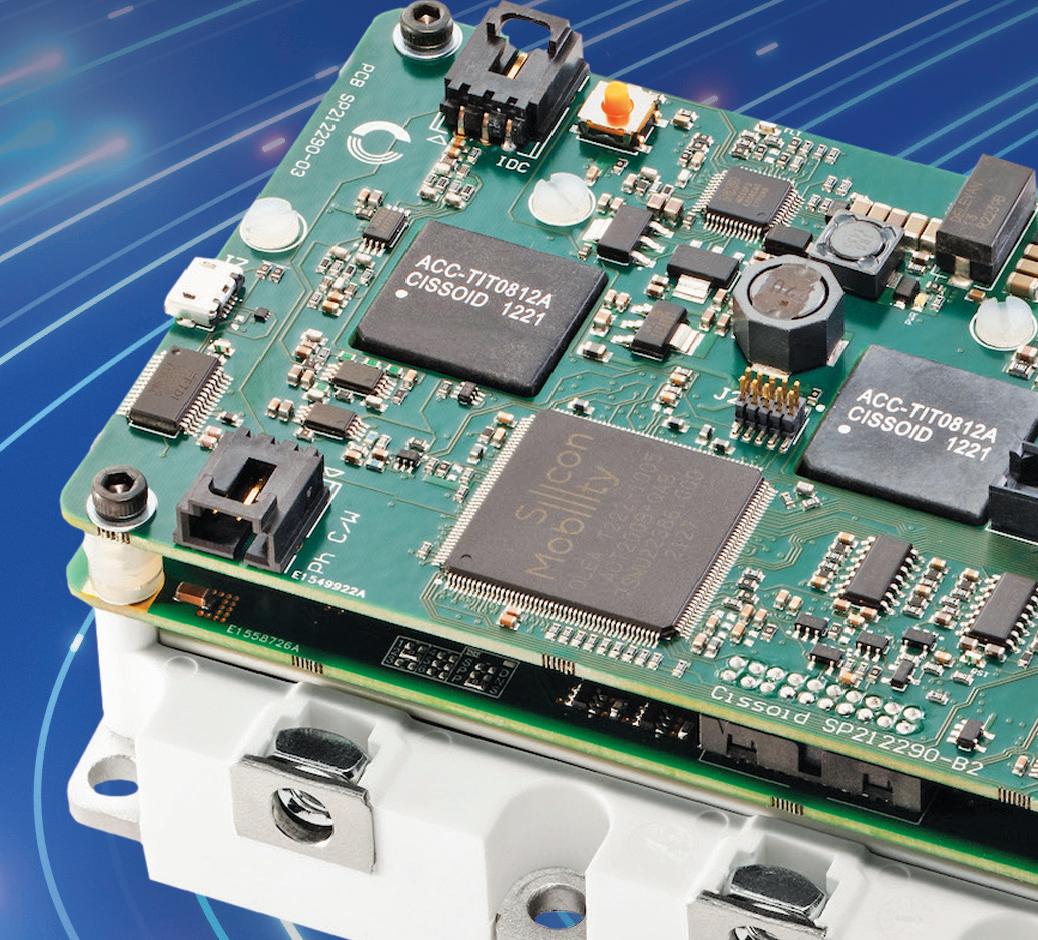

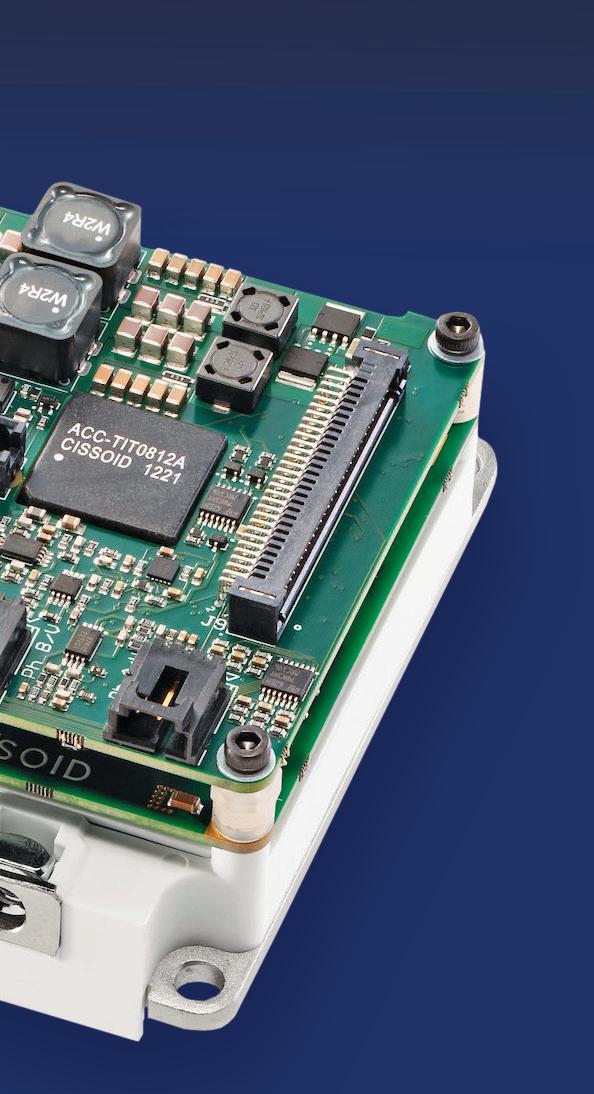

The new CXT-ICM3SA series of Inverter Control Modules forms the heart of CISSOID’s modular inverter platform, leveraging the ultra-fast OLEA® T222 Field Programmable Control Unit by Silicon Mobility.

Based on CISSOID’s CXT-PLA3S series of Intelligent Power Modules and HADES2 gate driver chipset, they are supporting the OLEA® APP - T222 INVERTER software for fast development of electric motor drive trains. OLEA OLEA

3-phase 1200V 340-550A SiC power module

Integrated gate driver board

Dual ARM® Cortex-R5F in lockstep

Advanced Motor Event Control (AMEC®) unit

Real-time actuator & sensor control and processing

T222 processor & software ISO26262 ASIL-D and AUTOSAR 4.3 certified

Less complaining, more educating

A year ago, the media was reporting that the EV dream had gone poof—sales were slowing (belated correction: the rate of growth had slowed). In our last issue, I wrote that the global auto industry is about to be radically reshaped—and possibly not to the advantage of “Western” legacy automakers. Now these trends are starting to converge—spooked by slower sales growth, some automakers are adjusting their plans in ways that bode ill for their future competitiveness.

Sales projections are a big deal because building cars requires coordinating every link in an extremely complex supply chain. Automakers need to predict future demand as precisely as they can, and adjust production accordingly— producing too many or too few of a particular model or component can translate to millions in losses (a sin that Wall Street will promptly punish).

Are Ford and GM (and more recently, Volvo) mistaken to roll back their EV timelines every time they see a dip in sales (and especially, to trumpet such moves in the media)? VW also announced it was considering closing some auto plants in Germany for the rst time in the company’s history, citing di culties in the electric transition as a cause.

Yes, it’s bad to have an oversupply of EVs, but there’s a critical marketing aspect to this—consumers want to buy what others are buying, and corporate kvetching about slow sales can quickly become a self-ful lling prophecy.

Legacy automakers are caught in e Innovator’s Dilemma—with the advantage of a huge brand and customer base but high expectations of yearly sales. Unless they nail the execution, transitioning to all-in on EVs could mean short-term revenue (and job) losses. But there are a couple of things governments and companies could do to boost EV sales, and save our auto industries before the Chinese come in and buy up the remnants at the bankruptcy sale.

First, it’s proven that government support and smart policies will drive sales. EVs are still more expensive to buy upfront than legacy vehicles, and skeptical consumers need a push. Germany abruptly ended its EV purchase subsidies at the end of 2023, and EV sales dropped by 16% in the rst half of 2024. (As we went to press, the German government—spooked by VW’s threat of plant closures—had just agreed to a new set of EV tax breaks.)

Second, the relentless anti-EV campaigns are hitting their marks. Recent surveys have found that substantial numbers of non-EV drivers believe the endlessly-repeated myths. And the anecdotal evidence is overwhelming— everyday acquaintances forward me anti-EV talking points li ed straight from the sewers of social media. e single most valuable thing automakers could do to boost EV sales (assuming they want to) would be to mount a massive public education campaign, not only for potential customers, but for their dealers too. Sales slowdowns, real or feared, may be a topic in Detroit and Wolfsburg, but the outlook from the engineers with their boots on the ground designing the next generation of EVs is overwhelmingly optimistic. Our inboxes over ow with pitches to report on innovations that promise to drastically optimize EV systems to improve quality and performance while reducing costs. For examples, see our articles on e-fuses (page 22) and dry electrode coating technology (page 28). On the infrastructure front, some stubborn logjams are being cleared. Paired Power (page 64) and itselectric (page 72) are addressing very di erent markets, but both aim to bring EV charging to places and segments where it wasn’t practical before, while cutting the delays in setting up new utility service.

And, while we may be hard on the world’s giant automakers, they are moving forward. Honda has introduced an exciting new EV to the US market, and John Voelcker gives you an in-depth look at it on page 46.

Christian Ruoff | Publisher EVs are here. Try to keep up.

e DOE’s O ce of Manufacturing and Energy Supply Chains (MESC) has announced $50 million in grants for six states with signi cant automotive workforces to help small- and medium-sized suppliers adapt their manufacturing facilities to serve the EV supply chain.

e announcement on state allocations follows an April 2024 Request for Information, seeking input on state/federal partnerships that could enable federal funding to reach automotive suppliers embarking on the transition to serve electri ed vehicle supply chains. Eligible states must have a workforce at least 0.5% of which is in the automotive sector. Under these criteria, six states are eligible: Michigan, Ohio, Indiana, Kentucky, Tennessee and Illinois.

DOE has also announced $1.5 million in selections across three teams of technical assistance providers under the Industrial Training and Assessment Center (ITAC) program. e teams from Purdue University, the University of Michigan and the University of Illinois will help create a Small Supplier EV Transition Playbook, to help ICE suppliers navigate the transition to EVs.

“Under President Biden and Vice President Harris’s leadership, America’s auto communities and the workforces they support nally have the tools they need to compete and thrive in the 21st-century clean energy economy,” said Secretary of Energy Jennifer M. Granholm. “By helping states and manufacturers navigate the emerging EV manufacturing industry, today’s announcements will help ensure that the workforces that de ned America’s auto sector for the last 100 years will have the opportunity to shape the next 100 years.”

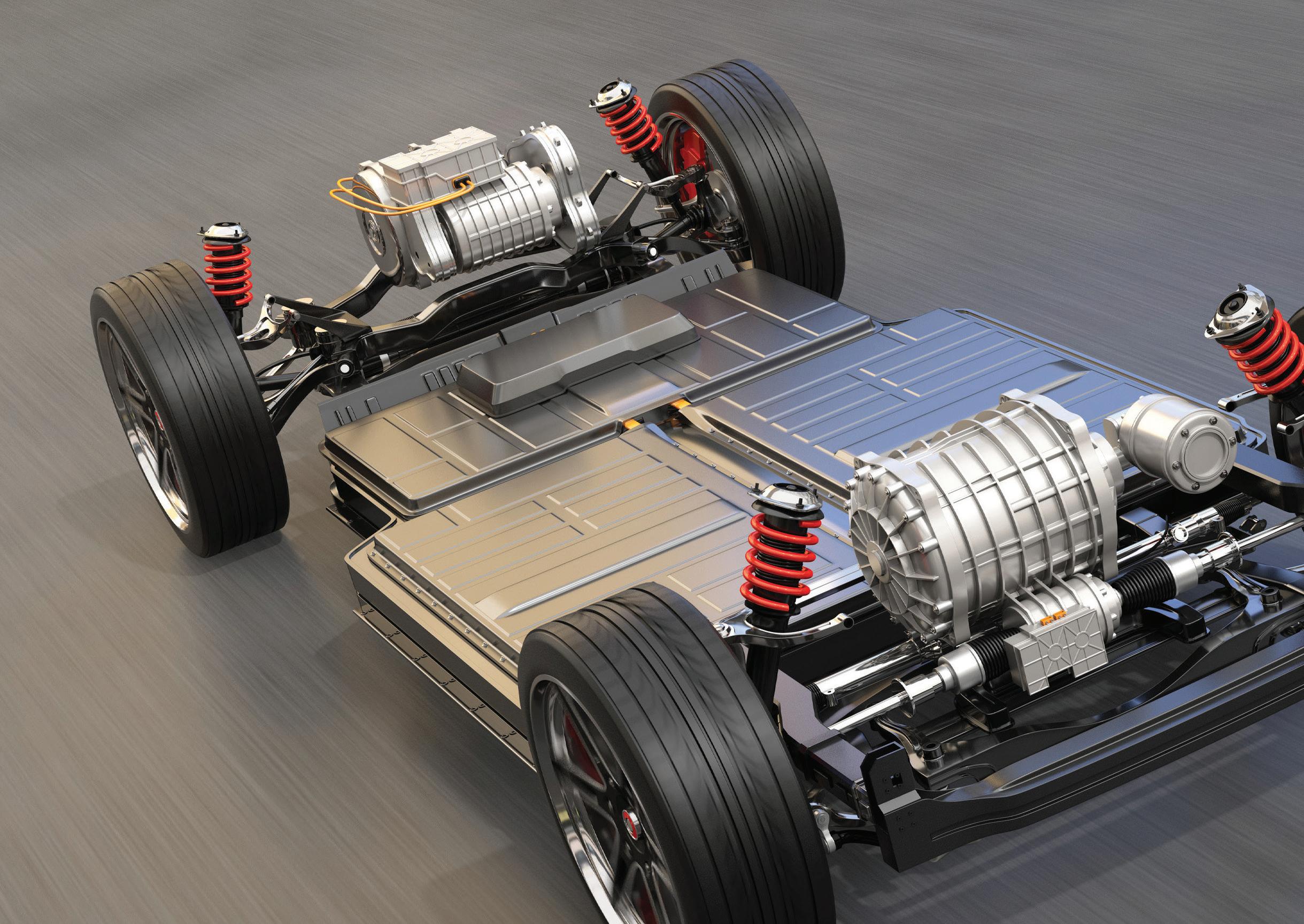

US thermal-management technology company Modine has announced the availability of its EVantage electric compressor and valve product lines designed for the cooling of battery and power electronics and air conditioning of passenger cabins in heavy-duty commercial EVs.

e EVantage High Voltage Electric Compressor, engineered to adapt to 12 V and 24 V systems, conditions the coolant owing to the battery pack or the air for the cabin HVAC system. EVantage 3-Way Coolant Valves, also suitable for 12 V and 24 V systems, feature three 28 mm ports to channel coolant to battery packs, power electronics, motors and other vehicle subsystems. Both components are IP67-rated.

“Our goal was to design a suite of products to keep commercial EVs on the road through long days and extreme conditions,” said Gina Maria Bonini, VP and General Manager of Advanced ermal Systems at Modine. “ e Modine EVantage electric components are proven to withstand the most unforgiving conditions through rigorous testing.”

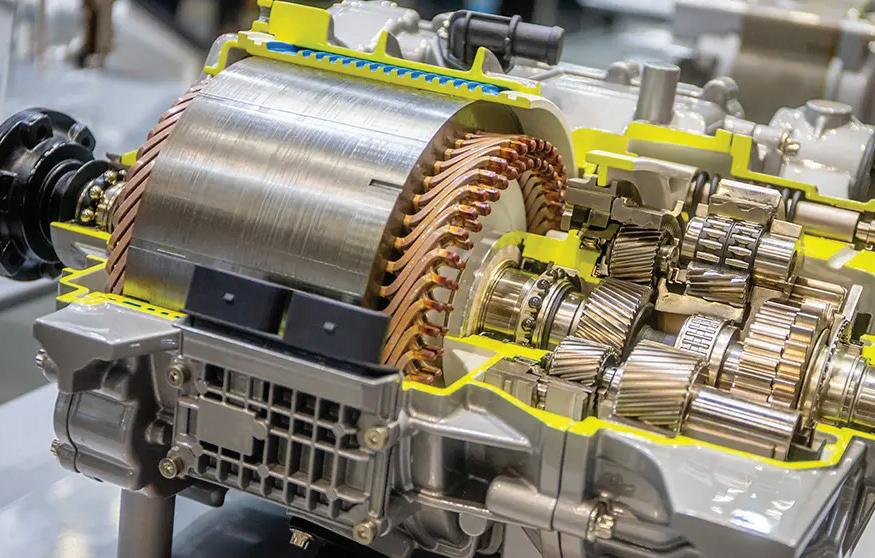

Canada-headquartered metals recycler Cyclic Materials has signed a collaboration agreement with SYNETIQ, a UK-headquartered vehicle salvage and recycling company, for the recycling of end-of-life electric motors containing rare earth elements.

e motors to be supplied by SYNETIQ include hybrid and EV drive motors, as well as auxiliary motors found in all vehicles.

To help meet North American demand for domestic sources of mixed rare earth oxide, Cyclic Materials recently opened its Hub100 commercial demonstration plant in Kingston, Ontario, which employs the company’s proprietary hydrometallurgical technology, REEPure.

Cyclic’s Mag-Cycle and REEPure technologies separate magnets from products such as electric motors and then convert them into mixed rare earth oxides, cobalt-nickel hydroxides and other raw materials. Cyclic will process feedstock from SYNETIQ with Mag-Cycle and send it to the Hub100 plant for processing using REEPure technology.

“ is agreement represents a notable step forward in our mission to advance sustainable solutions for rare earth recycling to drive the circular economy forward across the globe,” said Patrick Nee, Senior VP of Strategic Partnerships and co-founder of Cyclic Materials.

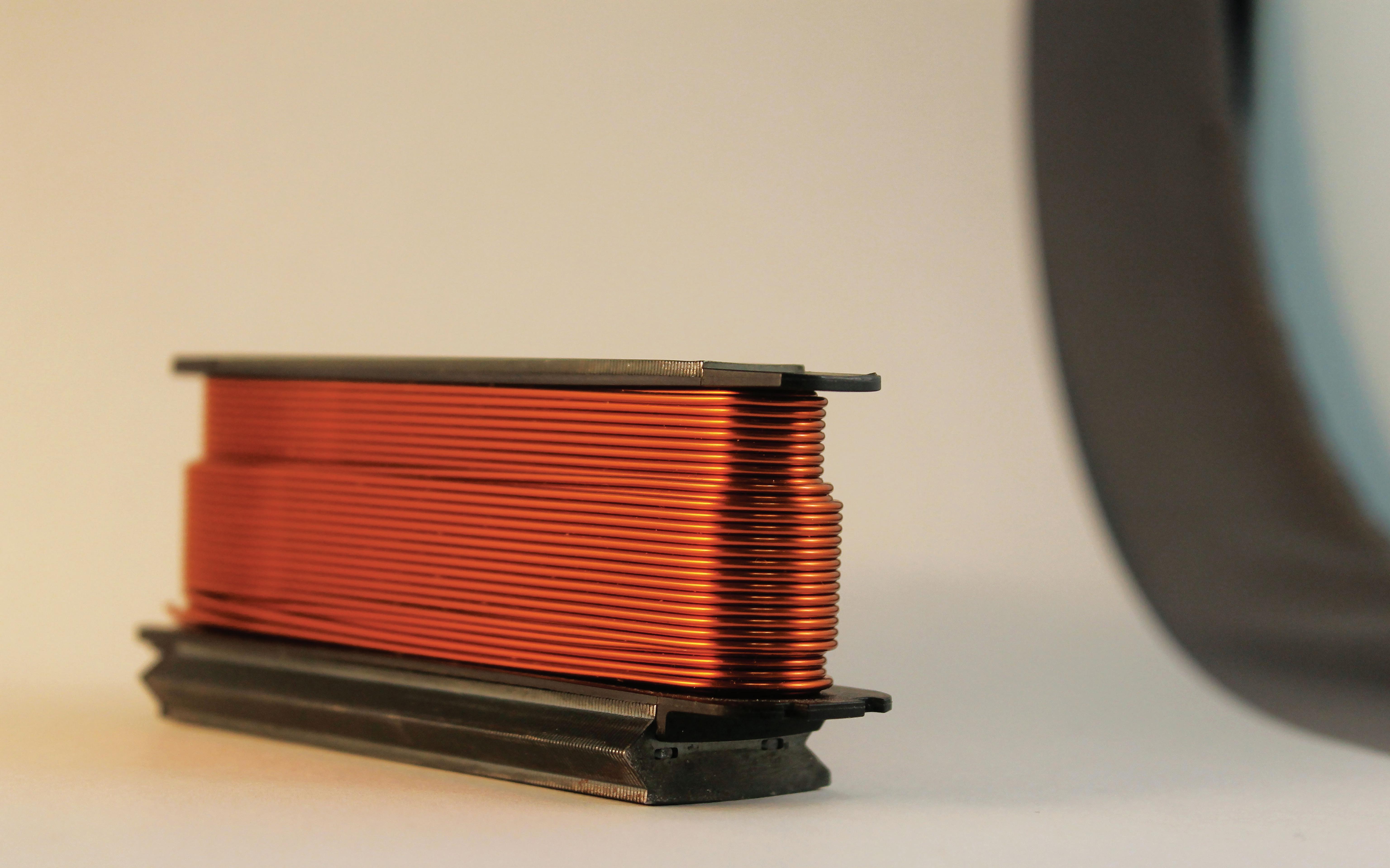

Japanese electronics company TDK Electronics has extended its ERU27M series of SMD high current at wire inductors comprising an isolated alloy powder core and at wire helical winding.

e series of four variants is designed to meet the demand for higher power densities and currents in automotive and industrial applications, by using an alloy powder core material that exhibits a so er saturation characteristic than the core material used previously.

Designed for rated currents from 36 A to 48 A, these surface-mountable components cover a range of inductance values from 2.3 µH to 8.5 µH. DC resistances are as low as 0.68 mΩ to 1.66 mΩ. e at wire winding enables the components to have compact dimensions of 27.1 mm x 25.55 mm. e height ranges from 14.1 mm to 16.4 mm. e inductors are designed for operating temperatures from -40° C to 150° C.

e four new AEC-Q200-quali ed energy storage chokes provide magnetic shielding and robust construction incorporating a third pin that is not electrically connected. ey can be used in DC-DC converters, voltage regulator modules and point-of-load (POL) converters in the automotive sector, as well as in solar converters.

TDK Electronics can change certain production parameters to help customers optimize space and cost or provide fully customized designs.

VISIT BOOTH 3600!

SCHULER NORTH AMERICA 7145 Commerce Blvd. Canton, MI | 48187, USA

Phone +1 734-207-7200 www.schulergroup.com

CONTACT US: marketing.information@schulergroup.com

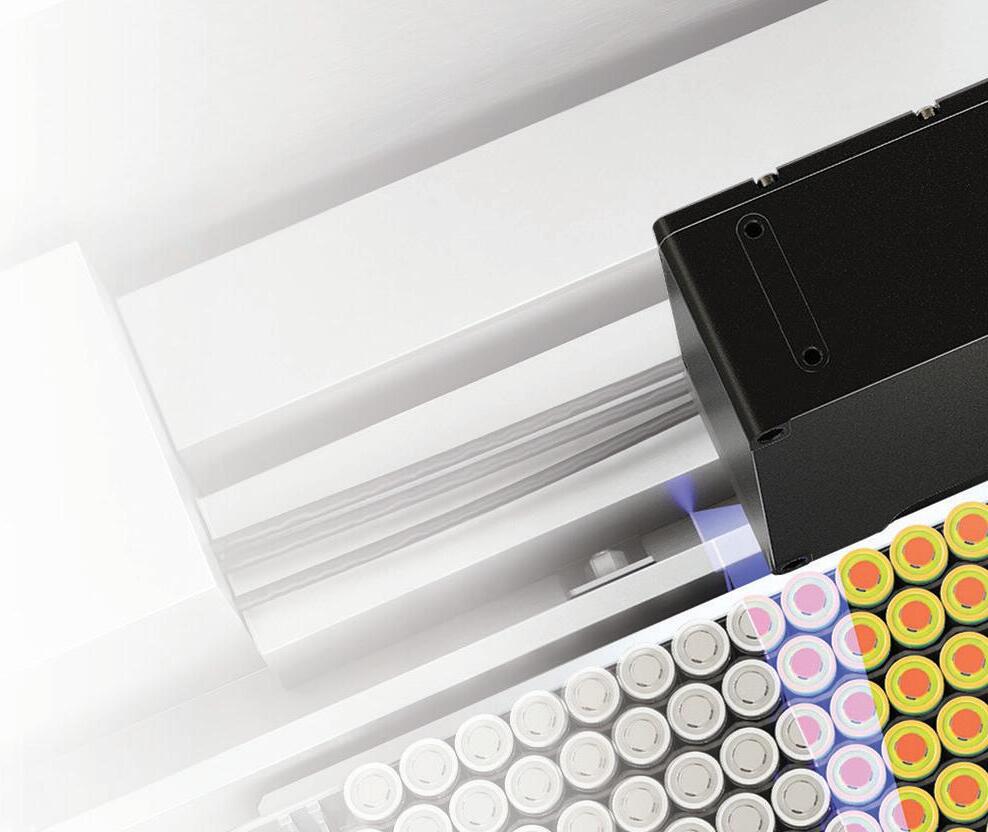

· Latest battery cell production technology for laboratories, pilot plants, and gigafactories.

· Equipment for central processes: battery cell assembly, formation, and testing of cells, modules, and packs.

· System solutions for the production of prismatic and cylindrical battery cell housings.

· NEW calender developed for the upstream electrode production process step.

Manufacturing innovation cluster Next Generation

Manufacturing Canada (NGen) is investing C$40 million ($29.7 million) in ve new advanced manufacturing projects involving 10 companies under its Electric Vehicle Manufacturing Value Chain Program.

Two of the bene ciaries are battery materials developer Nano One Materials and professional services company Worley Chemetics, which together will receive C$2.8 million.

Nano One is developing the process to produce more streamlined, less expensive and less energy-intensive cathode active materials (CAM) for lithium-ion batteries.

Nano One and Worley plan to use the NGen funding to advance their existing strategic alliance to develop, market and sell CAM facility packages. e two companies plan to produce equipment—tanks, reactors, furnaces and kilns—for Nano One’s One-Pot cathode technology process at Worley’s alloy fabrication shop in Pickering, Ontario.

e process engineering design package will include intellectual property rights, ow sheets, detailed engineering, operational know-how, and proprietary equipment including reactors and kiln components, which will be supported by NGen.

Chemetics will support Nano One in identifying the best materials and fabrication methods for the equipment required, as well as engineering and delivering the technology.

“NGen backing Worley Chemetics’ collaboration with Nano One will accelerate the commercial trajectory of the One-Pot process,” said Laura Leonard, Worley’s Group President of Technology Solutions. “ e fastest path to net zero is to standardize or, as we are doing with Nano One, design one, build many.”

Able Electropolishing has acquired new in-house laboratory equipment that brings signi cantly enhanced analytic and testing capabilities.

Electropolishing removes surface imperfections that can compromise mission-critical metal parts used in the automotive, semiconductor and many other industries. Able’s new equipment is designed to further improve the precision and e ectiveness of electropolishing for improving the nish, t and function of critical metal parts made from metal alloys, including stainless steel, aluminum and titanium.

“ e Keyence VK-X3000 3D Surface Pro ler and Keyence VHX-X1 Digital Microscope enable a level of metal surface nish inspection and analysis that provides a high-tech look into electropolishing’s ability to eliminate microcracks, burrs and other surface defects that are invisible to the naked eye,” says the company.

e Keyence VK-X3000 3D Surface Pro ler uses a triple-scan approach, including laser confocal scanning, focus variation and white light interferometry, to perform high-accuracy measurements and analyses, with a resolution of 0.01 nm.

e Keyence VHX-X1 Digital Microscope delivers high-resolution imaging and measurement functions. It features lighting and imaging modes that enhance surface details for a wide range of imaging and analysis capabilities, including metallurgical analysis.

Able Electropolishing is ISO 9001- and ISO 13485-certi ed, and complies with the electropolishing standards ASTM B912, ASTM F86 and ISO 15730.

Automotive a ermarket provider ZF A ermarket, a division of German automotive systems manufacturer ZF Friedrichshafen, has introduced to the US and Canadian markets 25 new kits for performing 25 di erent repair tasks on electric axle drives.

Among 45 new products that the company has recently released in North America, the kits, which contain all needed spare parts and fastening elements, allow independent repair shops to perform such tasks as replacing leaking coolant connections, repairing defective parking locks, changing speed or temperature sensors, and replacing drive sha s, all without removing the electric axle drive.

“Repair shops are seeing more electric cars, and need spare parts to service them. As one of the leading producers of electric drives worldwide, ZF is now making its products available to the independent a ermarket in our region,” said Mark Cali, Head of Independent A ermarket, USC, for ZF A ermarket.

Paraclete Energy, a producer of silicon-based anode materials for the EV and battery markets, has reached a cost of $35/kWh for its SILO Silicon anode materials—below the typical cost of $53/kWh for lithium iron phosphate (LFP) batteries using graphite anodes.

Paraclete Energy’s silicon anode materials o er speci c energy of over 520 Wh/kg, exceeding that of traditional graphite anodes, according to the company. is allows batteries to deliver more energy for longer periods of time.

Paraclete Energy’s distributed manufacturing model enables the production of anode materials near or at customers’ sites, increasing production e ciency and reducing costs.

“ e recent decline in LFP battery prices underscores the industry’s commitment to a ordability and sustainability,” said Je Norris, CEO of Paraclete Energy. “Our SILO Silicon anode technology serves as a proxy for cost-e ective and high-performance energy storage for the rapid adoption of electric vehicles and renewable energy solutions.”

German mechanical engineering company bdtronic and German UV specialist Hönle have created an inline, vestep process for dispensing and curing liquid sealants known as Cured-In-Place-Gaskets (CIPGs) for battery cell module controllers.

In the rst step of the process, the component contours are pretreated with atmospheric pressure plasma to improve the adhesion of the sealant. In the second and third steps, the highly-viscous CIPG is applied in contours. In the fourth step, the sealants are cured using a Hönle UV curing system. Finally, the nished part is inspected for quality and consistency.

e process was developed for a customer that required a production volume of 6,000 battery sensors every 24 hours, requiring one part to be produced every 13 seconds. Hönle’s testing showed that the sealing compound polymerized in the broadband spectrum of UVA and UVC, and required an unusually high UV dose.

Hönle identi ed its UVAPRINT curing module as the optimal curing system for this material, as its Cold-Mirror technology prevents the temperature on the substrate from rising too high despite the high intensity. e components pass through three UVAPRINT modules to receive a full cure before the sensors move to step ve for optical inspection.

“To achieve the best possible process, it is essential to work closely with the customer and all involved technology providers from the very beginning. We need to understand the requirements and collaboratively develop their technical implementation,” explains Fabian Tremmel, Head of Engineering Dispensing at bdtronic.

Wright Electric, a US developer of ultra-lightweight motors, generators and batteries for the aerospace and military sectors, along with its partners, which include NASA, DOE and DOD, has been awarded a $3.34-million grant from the FAA’s Fueling Aviation’s Sustainable Transition (FAST) program.

e funding will be used to develop a new class of batteries for large electric aircra accommodating 100+ passengers—the segment of the aerospace industry that accounts for more than 90% of its carbon emissions. e R&D program’s objective is to make such aircra a possibility by developing lithium-sulfur batteries that hold roughly three times more energy per pound than lithium-ion batteries.

“When Wright Electric was founded in 2016 the idea of a battery that would allow aircra to y regional routes with reserves seemed like a fantasy to most people. Now, we are one of several companies with a viable path toward a technology that will enable regional aircra ights entirely on battery power,” said Wright CEO Je Engler.

COMSOL Multiphysics®

Multiphysics simulation helps in the development of innovative battery technology by providing insight into mechanisms that impact battery operation, safety, and durability. The ability to run virtual experiments based on multiphysics models, from the detailed cell structure to battery pack scale, helps you make accurate predictions of real-world battery performance.

» comsol.com/feature/battery-design-innovation

Battery materials and technology company NOVONIX and niobium specialist CBMM have signed a joint development agreement focused on nickel-based cathode materials.

Under the agreement, NOVONIX will use its patented all-dry, zero-waste synthesis process to synthesize, test and analyze cathode active materials (CAM), which will incorporate CBMM’s suite of niobium products.

NOVONIX will use its cathode pilot line to characterize the materials’ physical and electrochemical performance, including building full-scale pouch cells for benchmark evaluation. CBMM will provide various materials, which will be used to demonstrate optimal performance with NOVONIX’s cathode powders.

NOVONIX was recently granted a patent for its alldry, zero-waste cathode synthesis technology in Japan.

e company continues to produce various grades of mid- and high-nickel cathode material to speci cations of potential commercialization partners, and has begun sampling these pilot-scale materials.

“CBMM’s experience with niobium products allows us to explore the use of important additives to improve the stability and durability of our materials,” said Dr. Chris Burns, CEO of NOVONIX. “Our agreement with CBMM advances NOVONIX’s strategy to form strong partnerships to demonstrate and commercialize our all-dry, zero-waste cathode synthesis technology.”

CBMM has invested $80 million to establish its rst industrial-scale niobium oxide re ning facility, with the intent of providing battery makers with niobium. e use of niobium oxide has been shown to improve the cycle life of NMC cathode materials, and CBMM expects it to be a key material in CAM production. Before the end of 2024, CBMM aims to begin production at the new facility, which has a capacity of the 3,000 metric tons per year.

Arcadium Lithium has acquired the lithium metal business of Li-Metal in an $11-million all-cash deal that includes the company’s intellectual property and physical assets related to lithium metal production, including a pilot production facility in Ontario, Canada.

e acquisition is expected to provide a safer, lower cost and more sustainable process for lithium metal production using various grades of lithium carbonate feedstock, which Arcadium produces in Argentina. ese new capabilities will complement the company’s process technologies for producing lithium metal at its Bessemer City site in North Carolina, using concentrated lithium chloride from its Güemes facility in Salta, Argentina.

Arcadium uses lithium metal to manufacture lithium specialty products, including high-purity lithium metal (HPM) and LIOVIX, a printable lithium metal formulation for primary battery applications and next-generation batteries. Arcadium also processes lithium metal into butyllithium, which is used to manufacture lightweight tires, among other applications.

“ e ability to produce lithium metal from lithium carbonate will give us additional exibility to utilize our vertically integrated network of assets while reducing the need for third-party lithium metal,” said Paul Graves, CEO of Arcadium Lithium. “ is will further enhance the competitiveness of our butyllithium and lithium specialty chemicals business and help us create the scale needed to meet the growing demand for next-generation battery materials developed from lithium metal.”

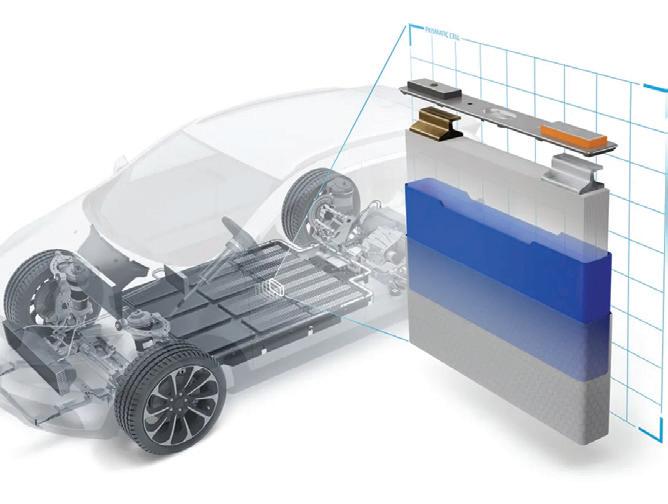

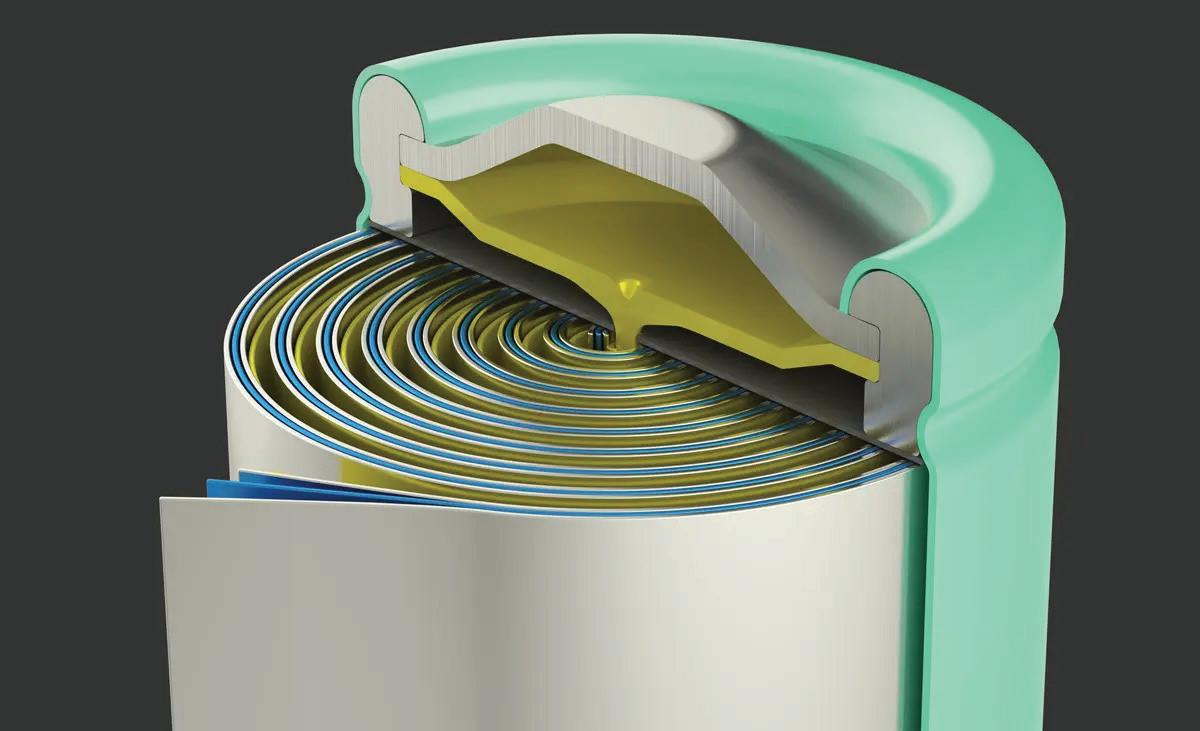

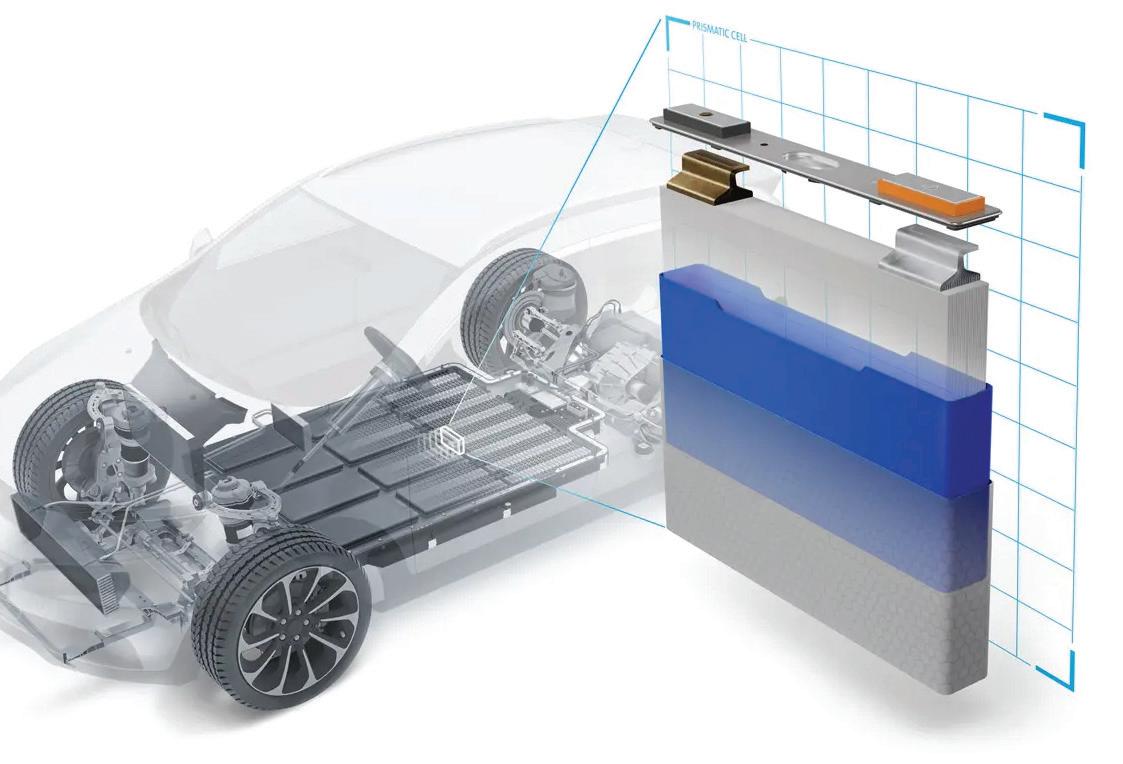

Germany-headquartered Freudenberg Sealing Technologies has introduced cell caps and nonwoven cell stack envelopes for prismatic battery cells.

e battery cell envelopes use nonwoven materials that wrap the cell stack and, like conventional lms, protect it during assembly and provide electrical insulation. Nonwoven envelopes consist of a ber network forming an ultra-homogeneous pore structure. e bers are surface-treated for permanent electrolyte wettability to reduce the risk of entrapping gas bubbles as the cell is lled, and to help to keep the cell stack wetted over its lifetime.

Nonwoven materials lled with electrolyte also o er improved heat management within the cell compared to conventional foils, owing to the resulting higher thermal conductivity, according to the company.

e custom-designed cell caps, developed in collaboration with cell manufacturers, are tested to be gas-tight and to maintain this capacity throughout the battery’s cycle life. is optimizes performance in a range of operating conditions, minimizes the risk of gas leakage and increases safety. e cell caps also have strong mechanical resistance to peak loads and fatigue. ey are compatible with various electrolytes, coolants and gases, enabling integration into di erent EV systems.

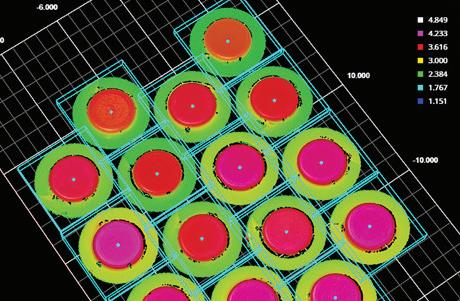

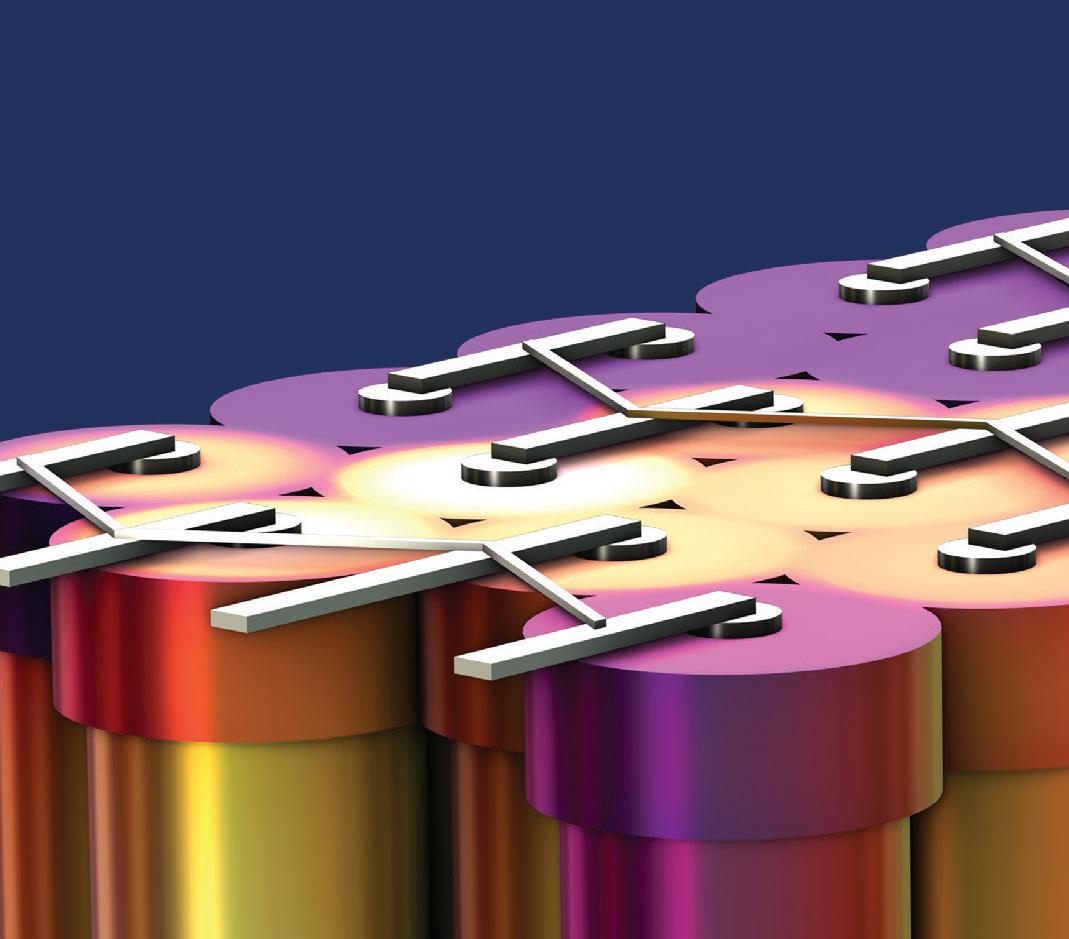

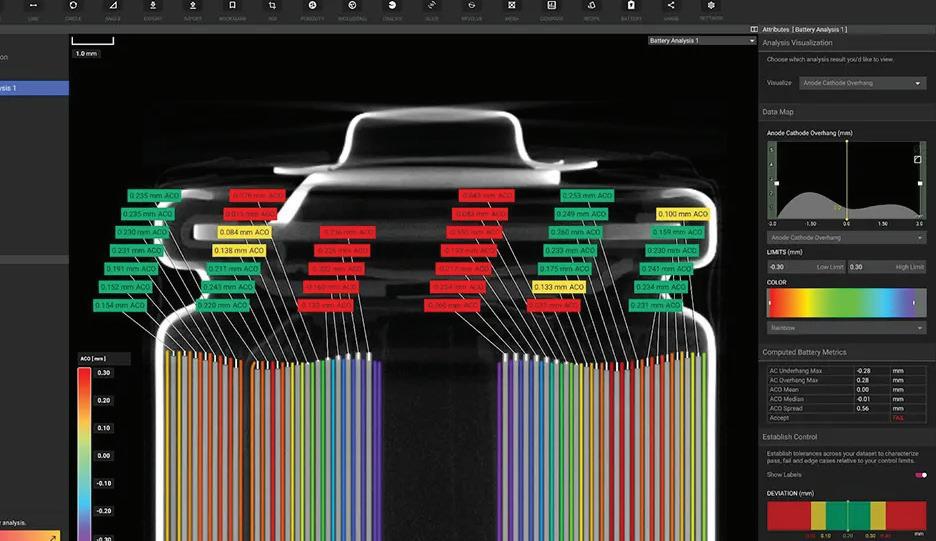

Luma eld’s new Battery Analysis Module is designed to enhance the safety and quality of batteries by providing automated tools for identifying and characterizing common manufacturing defects in batteries.

e module provides automated tools for measuring anode overhang distance, detecting debris and contaminants, assessing can integrity, and identifying common defects such as layer delamination. It also tracks these attributes over time, giving manufacturing managers real-time insights into quality issues as they develop.

Luma eld’s Battery Analysis Module is the latest addition to Voyager, the company’s cloud-based so ware for analyzing industrial X-ray Computed Tomography (CT) scans. Voyager is seamlessly integrated with Luma eld’s CT scanners—the o ce-friendly Neptune scanner and the automated, line-ready Triton inspection solution. e Battery Analysis Module may also be used with legacy CT systems through Uplink, which allows CT data from any scanner to be visualized, analyzed and shared in Voyager.

“Batteries need to be nearly awless to avoid catastrophic failures, and traditional quality control tools can’t look deeply enough to nd every defect. Industrial CT is the best all-purpose inspection tool for batteries, and our Battery Analysis Module gives engineers the tools they need not only to catch aws in real time, but also to track quality trends and ne-tune their processes,” said Eduardo Torrealba, co-founder and CEO of Lumaeld.

e Battery Analysis Module will be available to select partners this fall, and to all customers in early 2025.

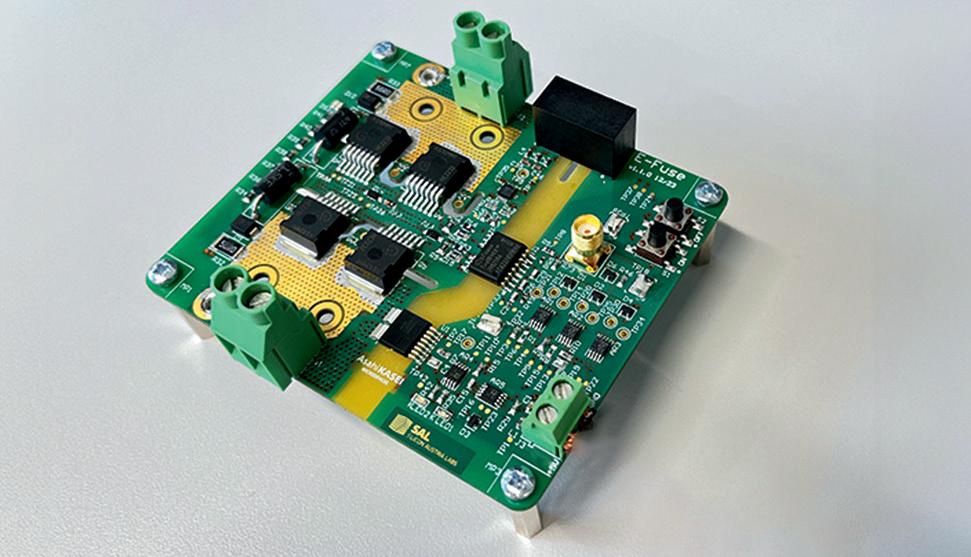

By Jeffrey Jenkins

An old saw often uttered by an electrical engineer (or their hapless techs) when an electronic device releases its magic smoke goes something like this: “The transistor bravely sacrificed itself to protect the fuse.”

is is a succinct way of saying that conventional fuses (and most types of circuit breakers) shouldn’t be counted on to protect a downstream load from complete destruction in the event of a fault, but only to (hopefully!) prevent a re from overheated wiring, sparking, etc.

is regrettable shortcoming is mostly due to physics and economics: a conventional fuse or thermal circuit breaker will take about 1,000 to 10,000 times too long to protect most semiconductor devices from overcurrent even when the latter are grossly over-sized (i.e. cost way more than is economically justi able). Specialized circuit breakers that combine a fast-acting magnetic trip along with the conventional thermal one can allow for less over-sizing of the downstream semiconductors, but they themselves are much more expensive devices, so once again this seems economically questionable. To truly protect the downstream semiconductor devices from short-circuit faults without su ering from nuisance tripping during normal operating conditions requires an overcurrent protective device that responds to severe overcurrents in 1 to 10 microseconds while still maintaining a more conventional fuse response

Microchip’s Silicon Carbide E-Fuse demonstrator is available in six variants for 400–800 V battery systems.

to moderate overcurrents, which is precisely what an electronic fuse can do—and potentially at a competitive cost to the specialized magnetic-thermal circuit breaker, especially if it allows the use of more rationally-rated semiconductors.

To better understand the pros and cons of electronic fuses, a review of conventional fuse and circuit breaker technology is in order. All fuses essentially rely on the melting of a fusible element to break the circuit during overcurrent conditions. e amount of time required is inversely proportional to the degree of overcurrent. Since the heating of the fusible element is the result of I2R losses, a doubling of current should result in a quartering of the time to blow (that is, following a square law). Indeed, fuses are most o en characterized by I2t curves as a shorthand way of expressing the energy required to rupture the fusible element by leaving out the resistance, R, in the energy equation of I2R over a given time, t Various tricks can be used to modify this current vs time behavior—particularly in lengthening the time that moderate overcurrents can be tolerated without unduly compromising the response to shorts—but at higher overcurrents the amount of time required for a fuse to

open tends to an asymptotic minimum (due to the need for the molten metal to actually fall far enough away to break the circuit). Furthermore, if the fuse must break a DC circuit above 50 V or so, an arc will be developed as the fusible link melts, prolonging the amount of time that current will be allowed through it (albeit with a voltage drop across said arc). is arcing problem becomes increasingly di cult to manage with open-circuit DC voltage (it’s less of an issue for AC, because of the periodic returning to 0 V), to the point that some form of forced arc quenching is required above 300 VDC or so (by surrounding the fusible element with quartz sand, or spring loading it, etc).

ermal circuit breakers also rely on I2R heating to trip, but this occurs via the heating of a bimetallic strip that causes it to bend. Inexpensive thermal circuit breakers that aren’t expected to trip more than a few times in their operational life will utilize the bimetallic strip directly to move the current-carrying contacts apart (via self-heating of the strip from load current), but more robust designs—and especially at higher currents—will use a separate heater coil around the strip which will itself actuate a toggling mechanism so that there is a

snap-action response upon reaching the critical trip temperature, rather than a more gradual movement which would encourage arcing. e toggle mechanism allows for either a bistable action, meaning it is stable in either the closed or open (tripped) positions, or a monostable action, meaning it will automatically return to the closed position a er the bimetallic strip has cooled down. Regardless of the speci c design of a thermal circuit breaker, it will su er from some downsides that don’t a ict the simpler fuse (or not to the same degree, anyway). For one thing, it will take far longer to respond to a severe overload or short-circuit than a fuse of the same nominal current rating. For another, the trip current (or the time delay before tripping occurs) will be more sensitive to the ambient temperature, because the temperature rise needed to operate the bimetallic strip must necessarily be limited so as not to create the very re hazard it is supposed to prevent.

ermal-magnetic circuit breakers address the excessive delay in responding to severe overloads that is characteristic of purely thermal circuit breakers by passing the load current through a solenoid—that is, a linear coil of wire around a moving ferromagnetic plunger—which can independently operate the toggling mechanism. e magnetic force developed by a solenoid is proportional to the current owing through it, so the higher the load current, the more forcefully (and therefore faster) its plunger will move. e magnetic-hydraulic circuit breaker addresses the sensitivity of trip current to ambient temperature by replacing the bimetallic strip with a viscous uid that the solenoid plunger must operate against. is preserves the relatively slow response to moderate overloads typical of the thermal circuit breaker with the faster response to short-circuits achieved by the magnetically-actuated mechanism.

e aforementioned shortcomings of conventional fuse and circuit breaker designs can be addressed by going with an electronic solution—that is, by using a semiconductor switch to interrupt the circuit in the event of a fault condition—giving rise to what is popularly called an electronic fuse, or e-fuse for short (though it would be more accurate to describe it as an electronic circuit breaker). E-fuses can not only respond far faster to an overcurrent fault, they can also implement current vs time behaviors that would be impractical (or impossible) with conventional technologies, as well as protect against additional hazards such as overvoltage, over- and

E-fuses can not only respond far faster to an overcurrent fault, they can also implement current vs time behaviors that would be impractical (or impossible) with conventional technologies.

under-temperature, etc, at little to no extra cost (i.e. with a few more components or additional lines of code). Furthermore, e-fuses may cost less than conventional electromechanical circuit breakers of similar current interrupt rating (though, admittedly, they compare less favorably to conventional fuses in this regard).

e simplest implementation of an e-fuse is a current-measuring circuit feeding a comparator that controls a semiconductor switch. At operating voltages up to about 50 V and maximum currents up to about 20 A, the current measuring circuit will typically be a resistive shunt that is wired in series with the negative line (aka the low side), whose voltage drop is multiplied by an opamp-based di erential ampli er with a modest amount of gain (2x to 10x is typical here) so as not to incur too high of a power loss in the shunt. At higher voltages and/ or currents, a current measuring circuit based on a Hall e ect current sensor (or a competing technology, such as giant magnetoresistance) will be more attractive, because there is no I2R loss as incurred by a shunt, and galvanic isolation is automatically provided. Either way, the output of the current-measuring circuit will be compared to a reference voltage by a comparator, which itself can be implemented with an analog IC (such as the venerable LM331 from Texas Instruments), though it’s probably more common to use a microcontroller IC these days, especially if other protective functions are to be implemented. A key requirement for the comparator function is that it have hysteresis, or slightly di erent turn-on and turn-o thresholds, to prevent oscillation when the load current is near the overcurrent trip point.

e output of the comparator will likely be unable to directly drive the semiconductor switch, so some form of gate driver circuit or IC will be required, but this could merely be a complementary pair of bipolar transistors wired in the classic push-pull con guration. e semiconductor switch is most commonly either a

Lightweight construction with long-fiber reinforced polyamides

Tailor-made products for cooling systems

Flame-protected polyamides

High-performance polyamides from EMS-GRIVORY are not only predestined in cars with classic combustion engines, they are also excellently suited for electromobility applications.

This applies to both classic lightweight design applications and structural parts as well as thermal management or components for high-voltage onboard power systems.

single low-side MOSFET (for blocking current ow in one direction—i.e. only discharge, from the perspective of a battery), or two MOSFETs wired source-to-source (for bidirectional blocking). is latter con guration is commonly used in the BMS for Li-ion batteries (which, a er all, incorporates all of the functions of an e-fuse, in addition to its cell monitoring and balancing duties).

At higher voltages, it is more usual to put the switch in the high side (i.e. the positive line) and use either an isolated or level-shi ing gate driver to control it, especially when the negative line must be earth grounded for safety reasons. One key requirement for the semiconductor switch is that it must be able to withstand a higher peak current (or, more correctly, have a higher fusing energy I2t again) than the device it is protecting; a less obvious requirement is that the impedance of the upstream power source not be so low as to make it impossible for the e-fuse’s switch to survive a hard short downstream. Note that this latter requirement also applies to conventional circuit breakers and fuses, but is far easier to meet with devices that don’t rely on active semiconductors. is implies that the switch(es) in the e-fuse will be bee er, and therefore more expensive, than the semiconductor devices it is supposed to protect, which would be economically questionable if not for the e-fuse’s extended protection capabilities and much faster response speed.

Finally, e-fuses obviously require power to operate, and if the voltage of the upstream energy source isn’t directly usable by the e-fuse circuitry (in the range of 3 V to 30 V, say) then some type of DC-DC converter will also be needed, adding to the overall cost while decreasing reliability. is also means that an e-fuse can’t directly replace an existing conventional fuse or circuit breaker, as it needs another wire back to the power source to complete its supply circuit (though this is typically easy to retro t).

It is important to note that there are some power circuit topologies in which no external fuse will be able to protect its semiconductor devices from failure, regardless of fuse technology or how fast it can open. e most common example of such are the switches in a 3-phase inverter, as they are immediately preceded by a capacitor wired directly across the supply rails. is capacitor essentially presents a very low-impedance voltage source to the switches, which means it will deliver a very high peak current to them in the event of

A less obvious requirement for the semiconductor switch is that the impedance of the upstream power source not be so low as to make it impossible for the e-fuse’s switch to survive a hard short downstream.

An e-fuse proof of concept for high voltage 800 V automotive applications developed by Asahi Kasei Microdevices Corporation and Silicon Austria Labs GmbH.

a fault such as overlapping conduction of both switches in a bridge leg or a turn-to-turn short in the windings of the motor. e only good solution for protecting the switches which are directly fed by a voltage source is active current-limiting at the individual switch level (aka pulse-by-pulse current limiting). Another situation in which an e-fuse might fare poorly—especially in comparison to its conventional counterparts—is when subjected to a severe voltage spike, such as from a nearby indirect lightning strike. is is mainly because passive electrical (fuses) or electromechanical (circuit breakers) devices tend to be far more rugged than their electronic counterparts (e-fuses). In conclusion, e-fuses aren’t a panacea, and they won’t save you from bad design decisions and component choices in the power circuits they are supposed to protect, but they could reduce overall warranty and technical support costs, while possibly costing less up front, so they’re de nitely worth considering.

The dry electrode coating process has the potential to enable the production of better, greener, more cost-effective batteries. It relies on advanced fl uoropolymer binders with Tefl on™

By Charles Morris

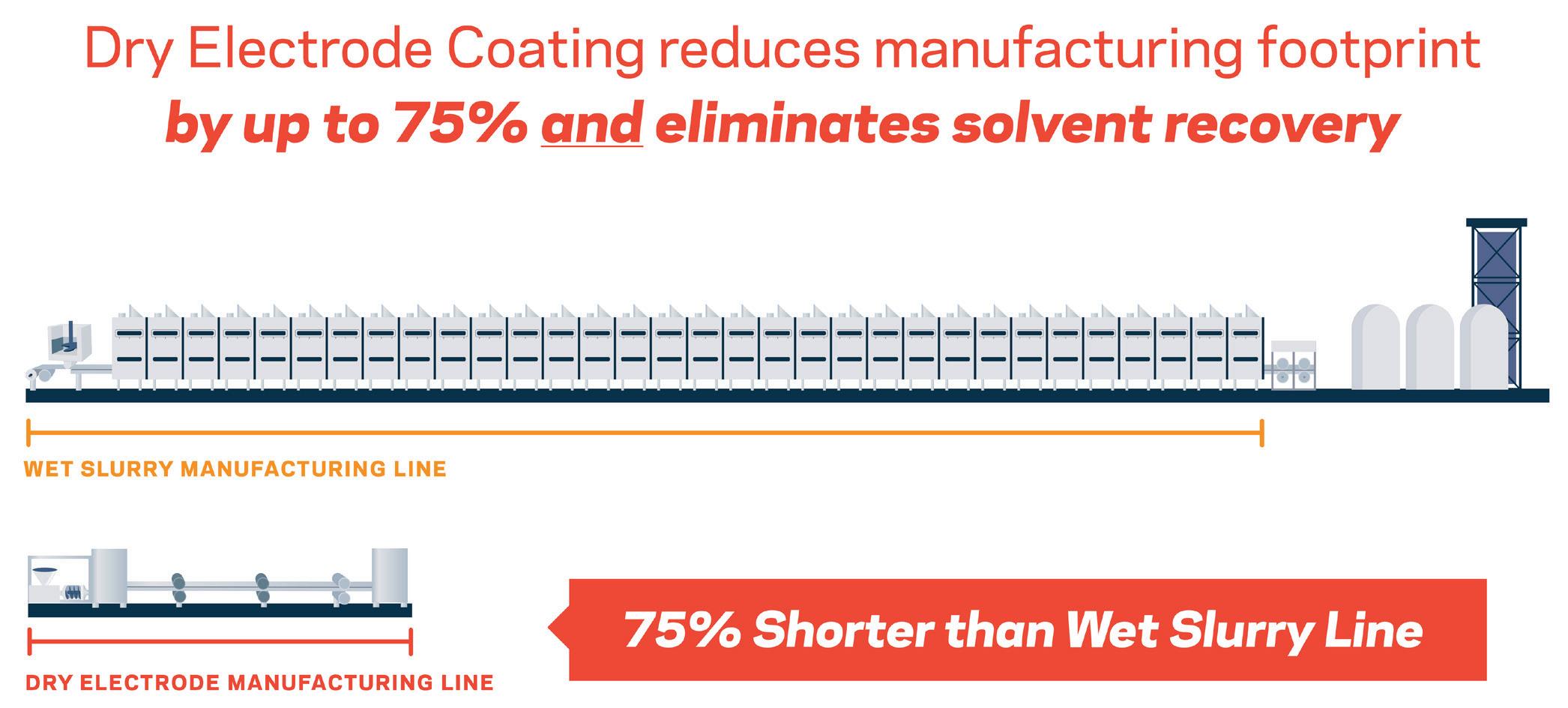

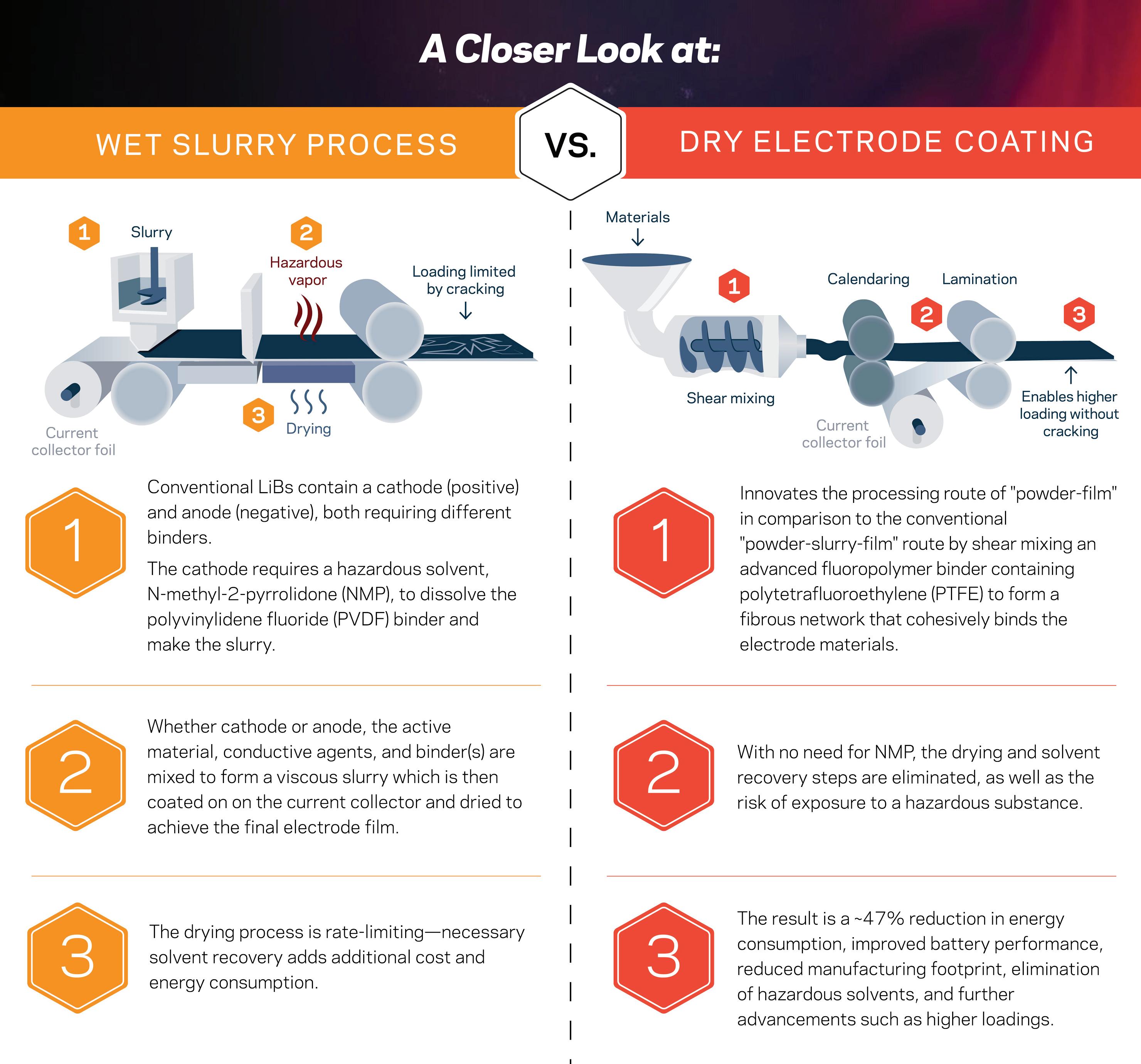

For a few years now, Charged has been reporting on how dry electrode coating processes have the potential to revolutionize battery production by eliminating the use of hazardous, environmentally harmful solvents. Taking the solvents out of the process can translate to big savings in cost and oor space in the factory—and the dry coating process can also enable designers to improve battery performance.

e dry electrode coating process relies on the use of special binders that can form an electrode coating without being dissolved in a solvent, such as uoropolymer binders with Te on™ from specialty chemical company Chemours.

To learn about the advantages of the dry coating process, and how companies are meeting the challenges involved in scaling the technology up from pilot to production scale, Charged spoke with Tejas Upasani, Global EV Technology Manager at Chemours.

A Tejas Upasani: We like to call Chemours “a startup company with 200 years of history.” We spun out of DuPont in 2015, and we have leading brands in various industries, including semiconductors and automotive. Under our Advanced Performance Materials business, we have brands you might recognize, such as Te on™, Na on™ and Viton™.

Now we are experiencing growth in our products in a brand-new eld—the dry electrode coating process—and I’m really excited to see how Chemours can support the scale-up of this new application.

Q Charged: Can you walk us through the basic advantages of the dry electrode coating process versus the traditional wet slurry-based process?

A Tejas Upasani: e dry coating process is a novel way of manufacturing cathode and anode electrodes in lithium batteries.

In the traditional wet slurry process, we have the active ingredients, we have the conductive additives, and we use a particular binder which needs to be dissolved in a solvent. Once all these ingredients are mixed together, we create what is called a slurry. at slurry has to be coated onto a current collector. At that point, the func-

In the dry process, many of the ingredients remain the same—similar active materials, similar conductive additives. What really changes is the binder.

tion of the solvent is done, so we dry o the solvent and we get a nice coating on the current collector.

In the dry process, many of the ingredients remain the same—similar active materials, similar conductive additives. What really changes is the binder. In this case, we’ll be using advanced uoropolymer binders with Te on™ which, because of its unique properties, doesn’t need to be dissolved in any solvent. It can form the coating as it goes through the processing steps through a process called brillation, which basically forms the entire coating on the current collector.

Why is the dry process advantageous over the wet slurry process? We can look at this from three di erent angles. One is that it is much more environmentally friendly. e wet slurry process uses NMP [N-Methylpyrrolidone], which is a hazardous solvent. In order to get rid of

the solvent in the wet slurry process, it has to go through a series of ovens. If there is no need for the solvent, then the hazards associated with the solvent are removed.

e second part is production costs. If you look at how much space is required for the wet slurry process, by some estimates, it’s 10 times the space compared to the dry process, so there’s a tremendous amount of savings of oor space that can be achieved with the dry process.

e third aspect is that it enables better performance of the batteries. With the dry process, we can make

thicker electrodes, which can help with improving power density.

Advanced uoropolymer binders from Chemours are really at the heart and center of that process.

Q Charged: Is this something that could help to reduce charging times?

A Tejas Upasani: It potentially could. ere’s a lot of testing that is being done right now, comparing the wet

But as it stands right now, we are seeing the entire spectrum—lab, pilot, pre-production, production—of adoption of the dry electrode process.

slurry process and the dry process. If you are able to go to a higher loading with the dry electrode process—say, all the way to 8 or 9 milliamp-hours per square centimeter—we can see competitive or higher charging rates compared to a normal loading of the wet slurry process, which is about 3 to 4 milliamp-hours per square centimeter now. Much of this work is done at lab scale or pilot scale, but as the technology matures and we start seeing better process technologies, these can be realized in real-life scenarios as well.

Q Charged: Is dry electrode coating currently in production?

A Tejas Upasani: We are in the early stages of the development process. Some industry players are at production scale. For example, on Battery Day in 2020, Tesla announced that they wanted to produce their 4680 cells in a dry electrode process. And on Investor Day in 2023, the company announced that they had successfully implemented commercial production of the dry electrode process. PowerCo, a subsidiary of Volkswagen, has announced that they will deploy and commercialize the dry electrode process at many di erent locations. LG Energy Solutions has announced similar plans.

We think that cell manufacturers and OEMs in the next two to ve years are going to be in di erent stages. Some are going to be at pilot scale. Others are going to advance into production scale. But as it stands right now, we are seeing the entire spectrum—lab, pilot, pre-production, production—of adoption of the dry electrode process.

Q Charged: Are there any major technical hurdles that we still need to get past before this can be widely adopted?

A Tejas Upasani: Certainly there are hurdles. Everybody’s trying to develop the process, and they’re trying to make sure that the correct mixing and calendaring can be done in order to create a uniform structure. Some of the technical hurdles have to do with binders and the dry electrode processes enabled through understanding the bril network of PTFE [polytetra uoroethylene]. e use of PTFE and the resultant bril network has been understood for decades, and we, as inventors of PTFE, have invested a lot of science behind understanding the bril network, but it generally has been applied to industries where PTFE is the dominant component in the application. As an example, if you look at your standard plumber’s

On the cathode side, generally PTFE is oxidatively very stable...it’s a very promising application. On the anode side there might be reductive stability challenges associated with traditional PTFE, and so using traditional PTFEs might not be the optimum solution.

tape (Te on™ tape), it utilizes exactly the same principle of brillation. at’s why you can pull it in one direction easily, but in the transverse direction, you can just break it apart.

It’s the same in this application—we’re trying to control the brillation through the mixing process and through the calendaring process. Chemours has invested heavily in developing various types of advanced uoropolymer binders with PTFE. ese have a range of di erent molecular weights and di erent polymer architectures, and all of these are intended to enable the proper brillation characteristics within the electrode process.

Traditional PTFE may have challenges on the anode side. On the cathode side, generally PTFE is oxidatively very stable. One of the advantages is that you can go to higher voltages and it still is stable at higher-voltage applications. So, on the cathode side, it’s a very promising application.

On the anode side there might be reductive stability challenges associated with traditional PTFE, and so using traditional PTFEs might not be the optimum solution. at’s one of the reasons why we are developing a lot of di erent products and trying to understand the mechanism of why traditional PTFE is not stable on the anode side. And once we understand that mechanism, how do we solve that? ere’s a tremendous amount of work going on internally and with our external partners as well to try and understand and solve these hurdles.

Q Charged: One of the challenges is adhesion. e dry material has to bond to the electrode surface, but the at surface and lack of texture can make that di cult.

A Tejas Upasani: e industry right now is using what we call carbon-coated current collectors. ey have certain coatings on the current collectors, and when the dry process lms are made, those get laminated onto that carbon-coated current collector.

at’s the solution that the industry has at this point, and it’s working fairly well in both anode and cathode processes. Now, if we wanted to directly laminate the lm onto the current collector without any carbon coating, then that’s a little bit of a problem, and we are working on it right now.

We are looking at ways that we can alter the chemistry of the polymers themselves in order to get better adhesion to the current collectors. If we were able to directly laminate onto the current collector, why have this carbon coating? Eliminating the coating reduces the cost. I think that might come, but right now the focus is on scaling up the technology with coated current collectors.

Q Charged: e process needs to reduce the amount of binder and other inactive material to a similar level as that of wet coating, but this can be expensive and hard to scale up.

A Tejas Upasani: Yeah. Certain cell chemistries require increasing the amount of inactive material, especially on the cathode side, whereas there are some cell chemistries where we are looking at binder loadings of less than 2%, and in some cases even less than 1%.

So, it’s already being worked on, trying to reduce the amount of inactive materials. It does require a lot of process optimization because, as you can imagine, the small amount of binder is holding up the entire powder chemistry. So, a lot of process technology, along with the

We are looking at ways that we can alter the chemistry of the polymers themselves in order to get better adhesion to the current collectors. If we were able to directly laminate onto the current collector, why have this carbon coating?

material enhancements that we are doing in developing new materials and coming up with di erent polymer chemistries, is going to enable even further reductions of the amount of inactive materials.

Q Charged: Another challenge is uniformity—the dry coating mixture needs to be uniform across large areas of the battery electrodes.

A Tejas Upasani: I don’t think uniformity challenges are necessarily restricted to the dry coating process. ere are methods that have been developed in the wet slurry process to understand that the viscosity is right or the solids content is right, and that will help us to understand that the uniformity of the slurry is also good. In the dry process, it’s similar, except that we are dealing with all the powders. ere are analytical methods and tools that are being developed in order to verify that these powders are mixed correctly—the active materials, carbon black and binders, they need to be mixed really homogeneously. Once the mixing is done homogeneously, the beauty of the dry electrode process is that, once it is laminated onto the current collector, the coating process is done. You don’t have any movement or settling of the ingredients. In a wet slurry process, if you were to make a thick electrode, as the solvent is drying o , these ingredients may start to settle during the drying process.

Q Charged: So, your company would partner with the manufacturer to determine the ideal mix.

A Tejas Upasani: Yes. And throughout our history, we have looked at application development. is is what we have done at Chemours for decades. We don’t want to just say to the customers, “Here’s a material, use it.” We don’t want to say that we are just a supplier. We don’t want to stop there. We want to make sure that we contribute to the success of our customers as well. ere are methods available to understand the mixing homogeneity, which are very R&D-based, and we are doing some of that work, but if someone is doing this on a production basis at a manufacturing site, they are not going to have time to take a sample, go into the R&D lab and wait for days in order to get the results. So, when we

Once the mixing is done homogeneously, the beauty of the dry electrode process is that, once it is laminated onto the current collector, the coating process is done. You don’t have any movement or settling of the ingredients.

are developing these methods internally, we are trying to develop a method which is going to be in line with production characterization and analysis.

Q Charged: Can you tell us about your advanced uoropolymer binders with Te on PTFE?

A Tejas Upasani: Understanding the brillation characteristics is really the key in enabling the dry electrode process. We have a spectrum of di erent products, which are available to be applied in a batch mixing process, or in a continuous mixing process. Not all of our customers are going to use the exact same way of manufacturing it, so trying to tailor our products to their needs is the key.

And given that we have tried all di erent sorts of chemistries for our advanced uoropolymer binder products, it’s easier for us to understand what exactly is going to a ect the brillation characteristics, and consequently the mechanical properties of these materials.

Also, Chemours is the only uoropolymer manufacturer who has manufacturing sites in all three major regions—the US, Europe and Asia/Paci c. When we think about a scenario where the manufacturing is going to be scaled up to a production scale, we have the exibility of having the products being made at di erent locations and supporting our customers with the same quality, the same safety standards and same standards applied to responsible manufacturing.

Q Charged: We’ve heard about some proposed regulations in Europe around PFAS that could impact PTFE. What impact would this have on dry electrode coating?

A Tejas Upasani: I’m glad that you asked the question, because sometimes it is the elephant in the room when we are talking with our industry partners.

We at Chemours firmly believe that our fluoropolymers can be manufactured responsibly, and we are in favor of industry-wide national regulations and testing requirements, which are based on science and facts—data-driven regulations and testing methods, we are completely in favor of that.

We spend a lot of time, money and resources in identifying the sources of emissions from manufacturing uoropolymers, and installing abatement systems in order to control those emissions. We are also engaging heavily in trying to develop alternate manufacturing technologies. All of these are steps that we are taking in order to meet the needs of potential regulation.

If we look at the EU regulations, particularly, it’s not necessarily con ned to PTFE. PVDF, which is a uoropolymer used in the wet slurry process, could also be potentially impacted by the same regulations.

Fluoropolymers in general are essential to lithium-ion batteries, and they’re essential for us to transition to a clean energy environment. So, we want to be partners in the regulation to make sure that the regulations address the concerns, and that these products are manufactured in a responsible way, and we are committed to doing both things.

Global logistics rm DSV has ordered 300 electric semi-trucks from Volvo Trucks. e deal represents one of Volvo’s largest orders to date for heavy-duty electric trucks, but it’s just a toe in the water for DSV, which operates a eet of 20,000 trucks. ( e company’s order from Volvo also includes 500 legacy fossil fuel-powered trucks.)

DSV plans to take delivery of the trucks between Q4 of 2024 and the end of 2025, and will deploy them throughout its European operations. e company aims to eld 2,000 electric trucks by 2030.

“I’m very proud to deepen the partnership we have with DSV,” said Volvo Trucks President Roger Alm. “ is order is proof of their trust in our company, and shows that zero-exhaust emissions transport is a viable solution here and now.”

“As a global leader in logistics, we must try to stay at the forefront of the green transition, and this agreement is a fantastic example of how new technologies can be brought to market at scale to make them more accessible for our customers,” said Søren Schmidt, CEO of DSV Road.

DSV’s order will bring Volvo Trucks’ global sales of electric Class 8 trucks to around 4,000 units. e company boasts a 50% market share of electric trucks in Europe, and a 44% share of electric trucks in the US.

In response to the advent of cheap Chinese EVs, the US and EU have instituted various measures to favor domestically manufactured vehicles—including, most recently, steep new tari s. It remains to be seen what the longterm results of these policies will be, but the westward seepage of Chinese-made vehicles continues.

Leapmotor International, a 51/49 joint venture between Stellantis and Chinese automaker Leapmotor, shipped its rst batch of Leapmotor vehicles—C10 SUVs and T03 cars—from Shanghai to European ports this month.

e Leapmotor T03 is “a small ve-door, A-segment urban commuter car” that features 265 km of range (WLTP). e C10 is a ve-seat SUV that comes in both battery-electric vehicle and plug-in hybrid versions.

“ e shipment of Leapmotor C10 and T03 vehicles to Europe this month is a landmark moment in the partnership between Stellantis and Leapmotor,” said Stellantis CEO Carlos Tavares. “Relying on Stellantis’s strong business assets in Europe and the hard work of our companies’ teams on guaranteeing product innovation and quality, I strongly believe that Leapmotor’s electric vehicles will be widely accepted by European customers.”

“China is the biggest and most competitive EV market in the world, and our products have proved their value by being acclaimed by the local customers,” said Leapmotor founder and CEO Zhu Jiangming. “ e C10 and T03 models are designed to meet the high standards of global customers, and we are con dent that the collaboration between Stellantis and Leapmotor will drive signi cant growth for both companies.”

e Leapmotor International JV had 200 retail outlets in Europe at the end of 2024, and plans to increase that number to 500 by 2026. e company also plans to expand its reach to the Middle East, Africa, Asia/Paci c and South American regions in late 2024.

Universal Logistics, an intercontinental transportation and logistics rm that operates in the US, Mexico, Canada and Colombia, has added the Peterbilt Model 579EV truck to its eet in southern California, where it will be used for intermodal logistics.

Designed for regional-haul applications, the Peterbilt Model 579EV features a battery-electric system that the company says provides e cient operation and lower overall maintenance compared to legacy diesel trucks.

e 85-year-old company states that the 579EV “is ideal for regional haul and drayage applications, in part because the frequent starts and stops engage the regenerative braking.”

e Model 579EV’s day-cab con guration features a drive system that uses the energy stored in large packs of

lithium iron phosphate batteries. It went into production in 2021 along with two other all-electric motor lines, the Class 8 520EV low-cab COE and the Class 7 220EV COE (cab over engine).

In 2021, Peterbilt announced that the Model 579EV had become the rst electric Class 8 truck to reach the summit of Pikes Peak.

bdtronic is expert in dispensing 1K and 2K materials, plasma pre-treatment, the unique joining method heat staking as well as impregnation and powder coating processes for electric motors.

Saudi Arabian airline operator Saudia Group has signed a binding sales agreement to purchase 50 Lilium Jets from German electric aircra manufacturer Lilium, and has an option to purchase 50 more.

e sales agreement follows a memorandum of understanding the two companies signed in October 2022. e agreement includes a schedule of deposit and pre-delivery payments, a timeline of future deliveries, guarantees on aircra performance, and provisions on spare parts, maintenance and repairs. e companies also intend to sign a Lilium POWER ON agreement for aircra eet maintenance and support services.

e jets will provide rst- and last-leg connections into Saudia’s regional hubs and new point-to-point city connections, such as Jeddah to Makkah, which could reduce regional travel times by up to 90%. Saudia expects to receive the rst jets in 2026. ey will feature large, premium cabins with capacity for up to six passengers plus luggage.

Saudia will support Lilium in its certi cation process with the General Authority of Civil Aviation (GACA), Saudi Arabia’s aviation regulatory agency.

Lilium has a pipeline of 106 rm orders and reservations, 76 options, and roughly 600 aircra under MOU.

“ e Middle East is a priority for Lilium, and Saudi Arabia will be a very large and exciting market for electric, high-speed regional air mobility. Our partnership will combine Saudia Group’s signi cant market knowledge with our unique eVTOL technology to transform premium air travel in the GCC region,” said Klaus Roewe, CEO of Lilium.

CASE Construction Equipment has developed a production version of the 580EV electric backhoe loader. CASE’s next-generation EV o ers a zero-emission, lownoise solution suitable for work in urban centers or other environments where noise and emissions are an issue, while delivering other EV advantages such as instant torque, lower fuel costs and less maintenance.

e new CASE 580EV electric backhoe loader o ers the same dimensional loading and digging speci cations and delivers the same breakout forces as the company’s 4WD, 97 hp CASE 580SN diesel model. It also o ers new features, including an 8-inch color display, air conditioning, and adjustable four-corner, multicolored LED strobe lights.

Powered by a 400-volt, 71 kWh battery pack that’s charged with a standard Level 2 J1772 connector, the new electric backhoe loader is designed to deliver up to eight hours of operational run time on a single charge, depending on the application. e battery platform uses a thermal management system with system-speci c cooling circuits to help maintain performance in hot or cold conditions.

e four-wheel-drive 580EV uses two independent electric motors for the PowerDrive transmission and hydraulic pumps feeding the loader, backhoe and steering systems to minimize energy consumption and improve performance in loading applications.

CASE’s electric backhoe loader will soon be followed by the commercial availability of two additional EVs: the CX25EV 2.5-metric ton mini-excavator and the CL36EV 3.6-metric ton compact wheel loader. e new models will expand CASE’s EV lineup to ve models, including the previously launched CX15EV electric mini excavator and the SL22EV small articulated loader.

Monarch Tractor, creator of the MK-V electric tractor, has raised $133 million in a Series C funding round co-led by Astanor and the HH-CTBC Partnership, with additional support from At One Ventures, PMV and e Welvaartsfonds.

Monarch will use the new funds to further develop its AI product o ering and expand its operational footprint domestically and globally, while enabling its path to pro tability.

To date, Monarch has raised over $220 million, and has expanded into various agricultural markets such as vineyards, dairy, berries, orchards and land management across 12 states and 3 countries.

In 2022, Monarch released a fully electric, driver-optional smart tractor, the MK-V. Since then, customers have deployed over 400 MK-V tractors.

e cities of Athens and essaloniki in Greece have ordered 89 FUSO eCanter trucks from Portugal-headquartered truck maker FUSO, which is owned by Daimler Truck, for waste collection in their metropolitan areas.

Forty of the trucks are expected to be deployed in November, and the rest will be delivered over the course of 2025.

e trucks are con gured with bodies and rotating drum compaction technology from Greek refuse-collection equipment manufacturer Kaoussis. e li system is compatible with two-wheeled waste bins of 80- to 390-liter capacity, and features integrated diagnostic monitoring from specialized vehicle equipment manufacturer Terberg, which is based in the Netherlands. e 8.55-tonne vehicles have a battery capacity of 82.6 kWh and a range of up to 140 km.

“ anks to its compact dimensions and high chassis load-bearing capacity, the electric eCanter is ideally suited for waste disposal companies that operate in narrow streets,” said Florian Schulz, Head of Sales, Marketing and Customer Services at FUSO Europe.

In our car-obsessed society, providing parking is a major expense for business and property owners. e Delmanor Aurora retirement home near Toronto has found an innovative way to reduce the number of parking spaces it provides to residents, while still allowing them to drive as much as they need to.

In collaboration with EV rideshare technology company Kite Mobility, Delmanor Aurora, which is owned by condominium developer Tridel, provides EVs for the use of residents who volunteer to give up their personal vehicles (and the parking spaces they require).

Participating residents at Aurora have access to an electric Volvo XC40, free of charge, whenever they need to run an errand, or simply feel like taking a ride.

“Real estate developers are struggling with costs, and one of the largest CapEx items that they encounter is parking infrastructure—digging several layers down in the middle of a city or building new surface parking lots,” Kite Mobility CEO Scott MacWilliam told Forbes. “ e idea here is that Kite gives them the ability to reduce or remove parking infrastructure, so some of the CapEx savings there goes to fund these programs.”

At an estimated cost to developers of $100,000 per parking space in a structure, by eliminating an entire oor containing 300 to 400 spaces, a developer could save as much as $30 million to $40 million, according to MacWilliam. “ at would fund the Kite mobility hub and enough EVs (30 to 40) for those without cars, or that don’t want parking spaces.”

Ford’s commercial division, Ford Pro, is supplying its Smart Charging Bundle to businesses in California—one of the largest commercial eet markets in the US—under a new initiative to help make it easier for companies to add EVs to their eets.

e bundle o ers a complimentary Ford Pro Level 2 48 A charger or a Level 2 80 A charger for depot and workplace charging to businesses subscribed to Ford Pro Charging so ware.

e o ering is designed to help businesses improve their operations and reduce upfront and ongoing EV charging costs. e new automated demand-to-grid response function in Ford Pro’s Charging So ware reacts to grid events in California such as high local demand by automatically pausing charging, alerting the customer, and resuming charging when the event is over. is can help reduce the load on the power grid, reducing the risk of brownouts and blackouts.

Ford Pro will manage the enrollment process for customers in grid demand-response programs that manage grid capacity, energy programs, and emergency load programs as well as the Low Carbon Fuel Standard (LCFS) carbon credits program.

“California is an EV pioneer, and new regulations aim to accelerate businesses’ electric transition,” said Ted Cannis, Ford Pro CEO. “We’re here to do the heavy li ing and help companies navigate the complexities of electri cation, helping them be more productive and e cient as they add EVs to their eet.”

e South Pasadena Police Department has completely replaced its gasoline-powered vehicles with EVs. e city’s eet of 20 new Teslas will rely on a bank of 34 new EV chargers installed at South Pasadena City Hall. As part of the project, the City Hall, Police Station and Fire Station buildings will be backed up by a solar PV system with battery storage, adding power resilience in the event of an outage.

e transition is expected to save about $4,000 per year per vehicle on energy costs, and to provide additional savings on maintenance. Overall, the city expects the operational cost of EVs to be around half the per-mile cost of legacy vehicles.

Replacing gas-burning police and other public safety vehicles with EVs can deliver more emissions reductions than replacing other vehicles, a city spokesperson said. Police vehicles typically idle more than others when ocers make tra c stops or respond to emergency calls.

Enterprise Fleet Management assisted the city in acquiring 10 Tesla Model Ys for patrol vehicles and 10 Tesla Model 3s for detective and administrative duties.

e cars were up- tted for police use through Unplugged Performance’s UP.FIT division.

“We’ve had the pleasure of developing best-in-class next-generation police vehicles alongside the great team at South Pasadena Police Department,” said Unplugged Performance CEO Ben Sha er. “As a result, 20 turnkey UP.FIT Tesla Model Y Pursuit and UP.FIT Tesla Model

3 Administrative vehicles have been produced to replace the full eet of aging ICE vehicles.”

General Motors is merging its BrightDrop division, which designs and manufactures light electric commercial vehicles, into Chevrolet, in order to leverage the latter’s sales and service network.

BrightDrop was founded by GM in 2021. Chevrolet was founded 112 years ago in 1911.

e move is intended to provide commercial customers with greater convenience when it comes to eet maintenance and acquisition, by making the Chevrolet BrightDrop vehicles available through select Chevrolet dealerships.

e Chevrolet BrightDrop, formerly known as the BrightDrop Zevo, is an electric delivery van that was unveiled at the 2021 Consumer Electronics Show. e van is available in two models, namely the larger BrightDrop 600 (originally the Zevo 600) and the smaller BrightDrop 400 (formerly the Zevo 400).

“With the addition of BrightDrop to the Chevrolet lineup, we are combining advanced EV technology with the dependability and widespread accessibility that only Chevrolet can o er,” said Scott Bell, Vice President of the Chevrolet division. “ is move strengthens our EV o erings and rea rms our role as a leading commercial brand that enables businesses large and small to get work done.”

BrightDrop EVs o er a GM-estimated 272 miles (438 km) of city and highway driving and incorporate a variety of driver-assistance features including pedestrian detection, automatic emergency braking and a rearview camera. e vehicle features has parking assistance and may be locked, unlocked or started remotely.

An unusual feature built into every BrightDrop van is that the steering wheel and seat are equipped with haptic technology, which can alert the driver of potential hazards through vibration.

While the Zevo name will disappear, the BrightDrop name will continue under Chevrolet’s stewardship. GM builds BrightDrop EVs at a plant in Ingersoll, Ontario that’s capable of turning out 50,000 vehicles per year.

Airport ground support equipment (GSE) presents a perfect use case for EVs. e specialty vehicles that service aircra on the ground travel short distances, and can conveniently charge right on the airport apron.

Goldhofer, a German-headquartered global provider of specialty vehicles, unveiled an electric version of its AST-2 towbarless aircra tow tractor (aka Phoenix E) in 2019. Now EFM, which provides ground support at Munich Airport, has ordered 14 of Goldhofer’s Phoenix E battery-electric tow tractors.

is EV is a beast—it can wrestle aircra of up to 352 tons into position at towing speeds of up to 32 km/h. e Phoenix E boasts the same tractive power, maneuverability and reliability as the legacy diesel version, and o ers lower operating costs and longer maintenance cycles.

e Phoenix E features a 220 kW direct-drive motor and a modular 700 V lithium-ion battery system. Each module has a capacity of 40 kWh, and a vehicle can be equipped with up to six modules for a total capacity of 240 kWh. e Phoenix E supports CCS Type 1, CCS Type 2 and GB/T charging at rates of up to 22 kW AC or up to 150 kW DC.

EFM’s 14 Phoenix E tractors are expected to be delivered and in operation by 2028.

“ is latest investment in Goldhofer equipment is a further milestone for future-proof ground handling by EFM at Munich Airport,” says EFM Managing Director Jörg Abel. “As a pioneer in the eld of zero-emission ground support, our goal is to make ground support t for a sustainable future.”

e EU has joined the US in imposing substantial new tari s on EVs built in China. In June, the EU announced import tari s on Chinese EVs ranging from 17.4% to 38.1%. e rationale behind the new tari s is that the Chinese government has unfairly subsidized its auto industry, enabling Chinese automakers to sell EVs at prices European brands can’t match.

However, one important category of EVs—electric buses—appears to be exempt from the new tari s. As Mika Takahashi, Technology Analyst at IDTechEx, explained in a recent article, the European Commission, in a statement setting out the aims of the anti-subsidy investigation, de nes the product subject to the tari s as a battery-electric vehicle designed for the transport of 9 or fewer passengers. In other words, the EU will only investigate anti-subsidy claims for vehicles that carry 9 people or less.

Ironically, the market share of Chinese electric buses in Europe is far higher than that of Chinese electric cars. e European Commission estimates that Chinese electric cars made up 8% of the market in 2023. According to IDTechEx’s research, Chinese manufacturers accounted for 28% of the European electric bus market in 2023.

As Charged readers know, electric buses are on a roll. IDTechEx tells us that 2023 was the strongest year yet for e-buses in Europe—over 5,000 were sold in the EU and the UK. (However, this is a small fraction of the number sold in China).

Some European bus OEMs are selling their own EVs, but others are behind the curve. According to IDTechEx, some major OEMs did not bring electric buses into production until 2019. Considering the growing market, the comparative lack of domestic competition, and overcapacity at Chinese factories, Europe is a land of opportunity for Chinese electric bus brands.

Meanwhile, Chinese companies are gearing up to produce buses in Europe. BYD has established a factory in Hungary. Battery supplier CATL is also building a plant in Hungary, from which bus-maker Yutong plans to procure modules.

# L E V S 2 4

As it did in previous decades, Honda has used another maker’s car to enter a new US segment.

By John Voelcker

Honda is o en known as the world’s largest maker of internal combustion engines—more than 14 million of them a year. It sells those engines in a variety of containers, from home generators and lawn mowers to ATVs and automobiles. Over the years, the company has pioneered a number of advanced powertrain technologies, including both natural gas and hydrogen fuel cell vehicles.