28 minute read

banks threatened as digital banks enter the fray Banks’ asset quality battered by COVID-19 and protests

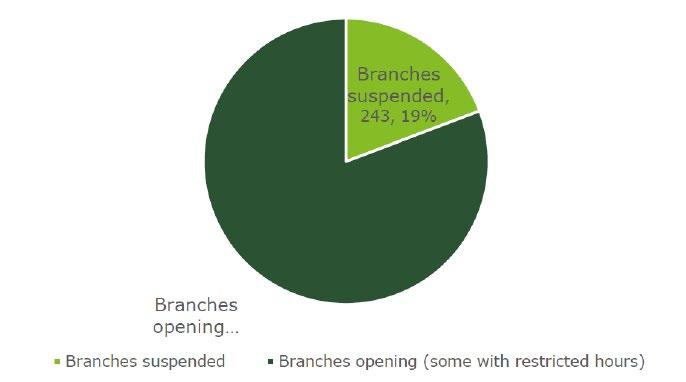

How far bank branches in Hong Kong have been affected Banks’ asset quality battered by COVID -19 and protests

Hong Kong’s banking industry face an exodus of corporate clients, rising mortgage risks, and deteriorating credit and debit card use in 2020. F or Hong Kong, the COVID-19 outbreak couldn’t have come at a worse time. Industry performance and consumer sentiment are already at record lows over the past half year, hampered by the social protests that took the city by storm, and earlier waned by the onslaught of trade tensions and mainland China’s slowing economy. A combination of these factors drove the economy to contract 1.5%—its first annual decline since 2009. Now officials and enterprises are bracing for an extended period of decline as airlines suspend flights and overseas markets tighten their borders.

This spells trouble for local banks, who may see their bad debts rise as large corporates and small and medium enterprises (SMEs) struggle to pay back their loans.

“Hong Kong is an international city and thrives on people coming and going to do business in Hong Kong. To prevent itself from importing coronavirus means shutting its borders to visitors from high risk locations. How well and how long the economy may endure such drastic measures has yet to be tested,” Brian Chan, partner, banking & capital markets for Hong Kong at Deloitte, told Hong Kong Business in an exclusive interview.

As of end-September 2019, loans related to travel and tourism, hospitality, and entertainment accounted for about 5% of systemwide loans, wholesale and retail trade comprised about 4%, credit cards and other personal

How well and how long the economy may endure such drastic measures has yet to be tested.

loans about 8%, and propertyrelated loans including mortgages about 30%.

The lower economic activity will also dent banks’ revenue for the year. “We would expect revenue and profit estimates to be revised downward given the current situation. In particular revenue will be under pressure: we can expect loan growth to be impacted due to lower economic activity and less demand for lending,” noted Paul McSheaffrey, partner, head of banking & capital markets for Hong Kong at KPMG.

McSheaffrey added that the potential impact on global growth from COVID-19 will also make any rise in interest rates unlikely.

Disrupted operations

Already, banks have closed down stores in an effort to mitigate the spread of the virus. Bank of East Asia temporarily closed 20 physical branches starting 1 February, including those in Causeway Bay and Wanchai Convention Plaza. UOB also shuttered its commercial banking centre in Kwun Tong soon after the outbreak first took hold.

A total of 243 bank branches have suspended their services since Chinese New Year, representing 19% of the 1,200 branches operating in the city, according to Deloitte. Some outlets that remained open also restricted their operating hours.

The full impact of these closures remains to be seen since most bank-related transactions are Bank of China Tower and Cheung Kong Center Source: Deloitte

HSBC Headquarters

done electronically, noted Deloitte’s Chan.

“[Although] retail branches serve as one of many touch points that banks service their customers [they] are not the major channel for banking business any more. A typical retail bank handles 80-90% of its transactions through electronic means instead of through a bank teller,” he explained.

Instead, the exodus of corporate clients, mortgage risks, and dropping credit card use poses the biggest threat on banks’ revenues.

With corporates’ profitability and liquidity challenged, banks exposed to retail, restaurants, tourism, education and transportation sectors—the most impacted industries by the outbreak—will see credit deterioration. Of these, SMEs may not weather the economic shock and may go into bankruptcy should the outbreak persist, warned Chan.

Meanwhile, although the average loan-to-value (LTV) ratio provides ample cushion for banks, a drastic fall in property prices increases collateral risk.

Apart from prices, homebuyer demand will likely be dampened further by the outbreak, which was already strained by the protests, S&P Global Ratings’ stated in a report. The firm warned that transaction volumes during the SARS epidemic hit an all-time low, and history could repeat itself.

The length of the outbreak also weighs on workers’ wages and salaries, and any cuts would also

Brian Chan

Paul McSheaffrey

Clement Chan

slash credit card usage and push credit quality to deteriorate, Deloitte’s Chan added.

Similarly, S&P warned of a negative impact on banks’ credit card receivables should the unemployment rate rise. During the 2003 SARS crisis, Hong Kong’s unemployment rate rose to an all-time high of about 8.5%. The jobless rate was 3.3% at end-2019, according to data from the Labour and Welfare Department.

Meanwhile, KPMG’s McSheaffrey sees a rise in bad debts the longer the outbreak persists. “This would probably be most likely to occur in the unsecured personal lending and SME sector as these are the sectors most impacted. We may also see some increase in bad debts for larger corporates, including potentially those with operations in China, although this will depend on the impact of government measures to support business.”

But McSheaffrey noted that, in general, the level of bad debts in Hong Kong’s banking sector has been low. “The banking sector is well capitalised and so should be able to absorb the increase in bad debts,” he added.

Fitch Ratings also said that Hong Kong banks are still wellpositioned as of now, as less than 1% of mortgage loans were in negative equity compared with the 30% in June 2003 during the SARS crisis. Further, the LTV ratio for new mortgages was only 53% in December 2019 compared with 65% in June 2003.

A short-term outbreak would likely have little effect on their operations, added Fitch, given banks’ sufficient capital and liquidity buffers.

But the odds of a short-term outbreak are shrinking every day. By the end of March, close to 800 cases had been recorded in Hong Kong, with the figures continuing to grow, albeit not as fast as those in other markets. Precautionary measures are becoming stricter, and this is likely to have an impact on banks and the wider economy.

Analysts agreed that the endresult will depend on how long the government’s measures will continue to take place.

Despite the branch closures, KPMG’s McSheaffrey has not seen any significant impact—at least, not yet. “We are not seeing any significant disruption to banking operations within Hong Kong. Banks have implemented their Business Continuity Plans. Teams who operate critical functions, such as remittances and payments, are generally working at alternate BCP sites and/or under split team arrangements to ensure these critical functions can still operate.”

Both Deloitte and Fitch agreed that there is still room to recover if the outbreak is contained fast.

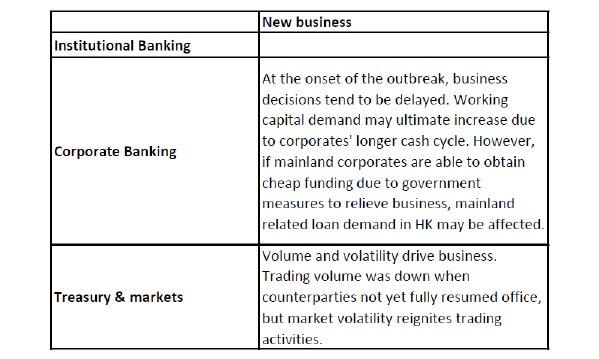

“In general, if the outbreak is contained within months, certain banking business[es] might be delayed but may catch up later in

COVID-19’s impact on institutional banking

Bank of China Headquarters

the year,” said Deloitte’s Chan.

“However, if the outbreak sustains, banks may need to adjust itself to any structural changes in the economy to achieve their growth targets,” he concluded.

Prices of financial assets are also headed towards declines if disruptions from the outbreak persists, according to Moody’s Investors Service. “This will result in declines in the values of mark-to-market securities held by banks and falls in revenue from financial markets,” they concluded.

Protests’ impact lingers

The coronavirus upsurge came at the heels of the social protests that crippled Hong Kong’s economy in the second half of 2019 and riveted the rest of the world. This has created a dent in profitability due to increased costs, as banks’ revisited their operating procedures and risk measures.

“The recent social unrest greatly affected banks’ operations in two aspects. Most of the banks will review and revisit their Business Continuation Plan (BCP) just in case if their HQ is being compromised by the social unrest. The other major impact is to review and reinforce security measures to protect the branch operation particularly those with Chinese background and affiliation,” noted accounting firm BDO’s managing director of assurance Clement Chan.

“The overall results of the social

If the outbreak sustains, banks may need to adjust itself to any structural changes in the economy to achieve their growth targets.

unrest have created a dent on the profitability because of increased costs incurred for the above-mentioned reaction and the forced closure due to sudden outbreak of movement and demonstration.”

BDO’s Chan said that they had noted cases where banks have to incur extra cost to purchase PCs and install appropriate alternative structure for BCP.

“We have seen access to branches at the regularly affected area are heavily guarded around the sensitive hours to minimise the chance of being sabotaged,” he added.

Any growth that banks’ expected to happen in the second half of the year was stopped and in some cases was turnaround to red, BDO’s Chan further noted.

HSBC, for example, increased its provision for expected credit losses by $3.1b (US$400m) in Q3, with which the protests were cited as the driving force for the higher provisions. Despite this, HSBC reported a 7% growth in profits for its Hong Kong operations for the full year of 2019, and its local banking operations recorded growth.

In a similar vein, Citibank Hong Kong said in an exclusive correspondence that their business had not been materially impacted in Q4 2019, but noted that client sentiment remained cautious.

Citi Hong Kong’s franchise grew for the 12th consecutive quarter in Q3 2019. Revenues also rose 8% YoY, driven by solid growth in our balance sheet with average deposits up 10% and loans up 6%. “There is a strong pipeline of business not only for Citi but across the market and this will support and underpin Hong Kong’s role as a major financial centre,” said James Griffiths, spokesperson of Citi Hong Kong. “Key Hong Kong corporates remain active and we continue to see good deal flow. Our treasury clients continue to use Hong Kong as a key treasury hub.”

M&A volumes in Hong Kong also reportedly remained healthy during the year, with inbound volumes up 50% to $34.12b (US$4.4b) as of November YTD and outbound running at $317.9b (US$41b) over the same period, he added.

BDO’s Chan added that banks who are less reliant on retail banking were likely not much affected by the protests. “In general, banks that are less reliant on retail banking business will find the social unrest less disruptive. However, the extent of negative sentiment created by the social movement will drag down the economy through its effect on the retail and property market which ultimately will affect all banks,” he said.

He left one piece of advice for banks: “Adopt a conservative strategy to sail through this storm.”

COVID-19’s impact on retail banking

GrabPay

Crunch time for Malaysia’s

e-wallets as firms set fees

The biggest e-wallets are charging 0.5% from merchants who use their services as their subscriptions soar. T he year 2020 dawns a new era for cardless transactions in Malaysia, with big players confident enough about their customer footholds. These firms have begun charging a 0.5% commission to the merchants who make use of their services, industry sources say. At the same time, Bank Negara Malaysia will give US$7.25 (RM30) in credit to those who sign up for any of the country’s three biggest players: Touch N’ Go, Grab and Boost.

Already, the number of contactless payments via debit cards rose at an annual rate of 288% from 12.8 million in 2017 to 49.7 million in 2018, data analytics and consulting firm GlobalData reported. They noted that the number of contactless point-ofsales terminals in the country rose by 90.3% in 2018 to reach 207,562.

Tok Kim Wah, CEO of Mobiedge, an e-wallet aggregator for banks, said that there are as many as half a million POS terminals out there for both credit cards and QR codes.

Mobiedge alone has installed over 10,000 terminals across Malaysia for Alipay, which is only usually used for big transactions. “People can use Alipay to purchase a $50,000 watch. But nobody will use it to buy a cup of coffee. So for big items they tend to use Alipay but for an everyday food stall, for example, they will use Touch N’ Go and Boost.,” he shared.

This aligns with GlobalData’s report, which says that debit cards are more used for low-value payment transactions.

He also confirmed that the average size of a transaction using an e-wallet is around ten dollars. “People actually don’t want more than that because in case you lose your phone, somebody can use the wallet.”

The expanding network of POS transactions, coupled with the central bank’s efforts to encourage cashless adoption, is forecast to push the share of debit cards in total card payments from only 25.8% in 2019 to 41.8% in 2023, said GlobalData.

The share of debit cards in total payments is expected to increase from only 25.8% in 2019 to 41.8% in 2023.

Mom-and-pop troubles

It wasn’t all smooth sailing for the e-wallets, however. Whilst big retailers are quick to adapt to the technology, smaller businesses remain reluctant to join the trend.

“There is a lack of knowledge and some do not care much for it. But the trend is picking up. The customers are asking the store to accept e-payments and they have been forced to sign wallets up,” Tok said.

Mom-and-pop shops are the most resistant to the change. “The smaller ones, the mom and pop shops, find it very hard to understand [the system] and for most of them, if they don’t have a smartphone, they find it hard to understand how it works.” This suggests the need to better educate SMEs on emerging technologies.

In a bid to boost e-wallet adoption, the central bank has set aside US$108.75m (RM450m) for new e-wallet users under the e-Tunai Rakyat Initiative. New users who sign up for an e-wallet get US$7.25 (RM30).

“It is a big hit—everyone is setting up, everyone is using the money [given by the central bank],” shared Tok.

The initiative, launched in January, is offered under Boost, Touch N Go, and Grab, which according to Tok were likely chosen because they are “the most likely to make it.” Between these three players, more than 5 million Malaysians were using e-wallets, even before the launch.

“There are about 46 licensees issued—wallet licenses—issued over the years, but only these three guys are active and gradually increasing their users everyday,” he added.

It has proven to be a massive success. As of 19 January, the central bank has received 2.9 million e-Tunai Rakyat applications. Of these, 2.2 million have been approved, according to Finance Minister Lim Guan Eng. By 5 February, the number had ballooned to 6 million, with more or less US$43.5m (RM180m) already given out. By Frances Gagua

Banks will need to embrace change to avoid dire straits in the near future.

Asian banks face consolidation as fintech, neobanks usurp market space

Banks’ hopes for survival lie in the US$100b of new revenue opportunties, reports McKinsey & Co.

Asia’s emerging markets have become a major engine of growth in global banking. More than 40 of the world’s 100 largest banks by assets are Asian and account for approximately 50% of the market capitalization of the top 100 banks globally. Asia has been the world’s largest regional banking market for a decade, generating pre-tax

Asia has been the largest regional banking market for more than ten years

profits in excess of US$700b and accounting for 37% of global banking profit pools in 2018.

McKinsey estimates that as incomes continue to rise and the middle class grows to include two-thirds of Asian households, personal financial assets in the region will total US$69t by 2025, representing approximately three-quarters of the global total. Not only have Asian banks caught up and begun to surpass their Western peers in scale, but consumers’ tech-savviness has created opportunities for banks to deliver new innovations and leap ahead. Asia’s best-known financial technology (fintech) innovators, including Alipay and WeChat Pay, lead the world in scaling digital payments. According to McKinsey’s Global Payments Map, digital payments in China account for approximately 99% of the country’s non-cash transaction volume and 45% of digital payments worldwide.

Across Asia, incumbent banks are partnering with fintech startups to promote digital payments. In Thailand, Kasikornbank and Grab have teamed up to launch GrabPay by KBank, a mobile wallet. BRI (Bank Rakyat Indonesia) has partnered with Alipay to expand point-of-sale acceptance of mobile payments for Chinese tourists visiting Indonesia.

Asia has also proven to be fertile ground for the development of digital banking, with numerous companies making the transition from technology platform to digital bank. In China, Tencent’s WeChat offers loans through WeBank; in South Korea, Kakao Talk launched a bank—Kakao

Bank—in 2017; and the Japanese e-commerce group Rakuten has expanded into credit cards, digital banking, investments, and insurance. Not to be outdone by fintech disruptors, traditional banks have launched stand-alone digital banks, (e.g., The State Bank of India’s YONO, BTPN’s Jenius in Indonesia, and DBS digibank in India and Indonesia) as a way to reach new markets and to acquire new customers at lower cost.

The rise of ecosystems as a new way of organizing economic activity is another area where Asia is leading. For example, a diversified ecosystem for trade, including banking and payments, has emerged from Alibaba’s platforms for B2B and B2C commerce. Ping An, one of China’s largest financial conglomerates, has reinvented itself as a “tech + fin” ecosystem company, providing loans and investments, as well as insurance, across platforms for healthcare, housing, and more.

Banks in diverse markets are also building digital platforms as a way to integrate financial services into the everyday activities of consumers and small and medium-size enterprises (SMEs), e.g., HDFC Bank has broadened services for small farmers in India; DBS Marketplace enables consumers to search for cars, auto loans, and more in Singapore.

Asian banking braces for consolidation

For most of the past decade, Asia banking has been the darling of the world, but this is no longer the case.

Banking industry revenue growth in Asia has slowed from double digits in the early years of the decade to 5% per annum for the period from 2014-2018. And whilst Asia today accounts for more than a third of global banking profit pools, this has shrunk from nearly half in 2010, as banks in developed markets have recovered from the Global Financial Crisis.

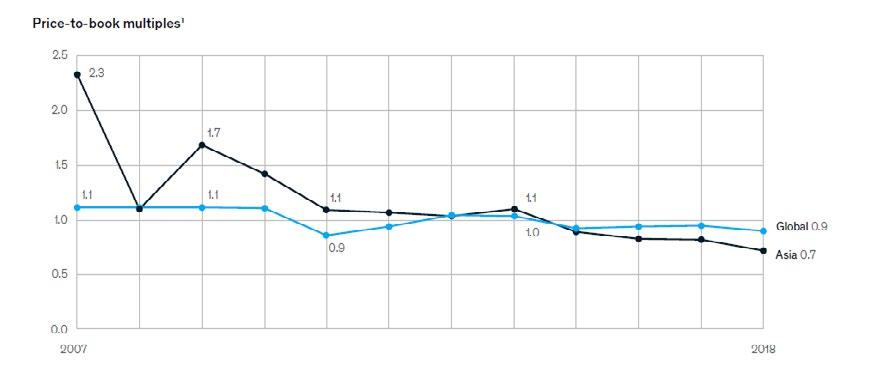

Margins are also thinning, as banks in both emerging and developed markets contend with fierce competition from digital attackers and peer banks. Average banking ROE for Asia decreased from 12.4% in 2010 to 10.1% in 2018. In emerging markets, rising capital costs and declining asset quality have also taken their bite out of returns, pushing the average ROE down from 19.5 in 2010 to 11.4% in 2018, converging with the global average. Investors have shown strong support for the region’s fintech and big tech disruptors, but their outlook for Asia’s traditional banks is, on balance, pessimistic, pushing P/B ratios for Asia banking down from 1.4 in 2010 to 0.7 in 2018—trailing the global average of 0.9.

If, as forecasts suggest, GDP growth continues to lose steam across emerging Asia, banks will be challenged to find new avenues of growth and will likely have to deal with deteriorating asset quality and rising risk cost.

Already in 2018, risk cost provisions for Asia rose to approximately 0.3%, the highest level of loan losses for the region since 2002. Slower GDP growth in China—compounded by ongoing trade friction with the US and the rapid increase in real estate prices relative to household income—could weigh heavily on the country’s trading partners, as the effect of a correction could potentially destabilize banks in neighboring markets.

In addition to these headwinds, open banking is taking hold, with diverse markets moving toward broader participation in the banking system. India, for example, allows non-bank service providers direct access to the United Payments Interface; Hong Kong and Singapore have recently introduced new procedures for licensing digitalonly banks. Australia and Singapore—among others—have adopted open banking rules requiring banks to allow qualified third-party service providers to link to banking systems to access account information and

Across Asia, incumbent banks are partnering with fintech startups to promote digital payments.

initiate transactions on behalf of customers. McKinsey expects that as regulators consider ways to promote lower costs and better products for consumers, as well as improved system efficiencies and controls, open banking will likely become the norm in most Asian markets.

Most banks, however, will be challenged to increase their returns adequately to win investors over and execute the transformation required to remain competitive. Well-capitalized institutions generating market-leading returns will likely seek to cement their advantage by acquiring smaller (less-well-capitalized) organizations to increase scale inorganically. Weighing these dynamics, Asia’s banks are bracing for consolidation.

Reinventing the Future

Just as iron sharpens iron, we believe that the region’s banking industry will emerge stronger and leaner than ever. But to remain relevant each bank must reinvent and must balance short-term goals—in particular strengthening the core and capturing pockets of growth—with priorities for the long term. The latter includes articulating anew the bank’s purpose for the digital age, redefining its value proposition, and rebuilding the operating model, amongst others.

Increasingly, banks will both acquire new customers and interact with ongoing customers through digital ecosystems, requiring new approaches to branding and relationship management as well as changes

Bank’s price-to-book multiples have declined, reflecting investors’ negative expectations

Source: Global Banking Pools, from Panorama by McKinsey in business model and technology architecture. Organizations that generate returns below the average cost of capital—approximately twothirds of Asian banks—will face an existential choice: Either reinvent to stay relevant or lag behind and eventually disappear.

Asia’s banking leaders have already taken decisive steps to strengthen the core, focusing on productivity, risk, and capital optimization. Many have reduced operating costs by 30-40 % across sales and service, support functions, and back-office operations through extensive digitization. The full potential of this opportunity lies in adopting zero-based budgeting to transform mindsets and redesign processes to achieve radical gains in productivity. For risk management, banks are finding that they can reduce loan losses whilst allowing a broader population to qualify for loans by developing machine learning algorithms to analyze a combination of traditional underwriting data and unstructured data from internal and external sources. Capital allocation is another area where banks can leverage new strengths in data analytics to reduce waste. For example, some banks are able to allocate capital consumption to the level of products and individual accounts, which in turn leads to highly accurate risk weightings at the portfolio level. As a result, these banks have been able to free up between 10 and 20% of capital.

To achieve such radical improvements in performance, banks must leverage all the new tools, technologies, and capabilities available today, including digitization, advanced data analytics, robotics, and AI. Banks can deploy these same capabilities in pursuit of strategic growth, focusing on four fast-growing businesses: wealth management, consumer and SME lending, and transaction banking. Together, these businesses hold the potential for US$100b in new revenue for Asia’s banks each year.

In wealth management, the key is to strike the right balance between self-guided digital tools and high-touch consultation. Within high- and ultra-high-net-worth segments, this means delivering portfolio offerings tailored to individual client needs. Use of voice recognition and AI can support a high degree of personalization at scale for the mass affluent segment. Consumer and SME lending are also poised for strong growth.

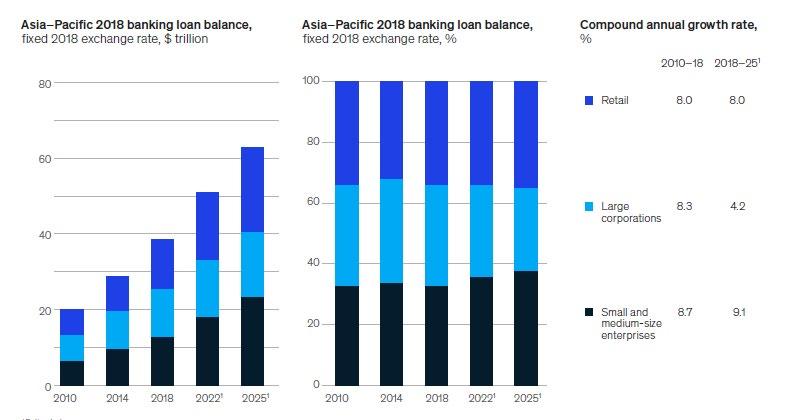

Retail lending in Asia, which totaled US$12.8t in 2018, is on track to reach US$21.2t in 2025. The loan book for SMEs—already bigger than retail and corporate lending—is expected to grow 9% each year, totaling US$23t in 2025. Banks can use this strong growth as a foundation for developing new value propositions and multiplying revenue streams.

In the consumer lending market, regulators in several countries are wary of mounting consumer debt levels, and banks should use sophisticated risk models to identify the most qualified

Asia’s banks can leverage strong growth in retail and in small and medium-size enterprise lending

DBS Hong Kong branch

Margins are also thinning, as banks in both emerging and developed markets contend with fierce competition from digital attackers and peer banks.

customers within segments where product penetration is low relative to GDP. Similarly, by combining traditional and non-traditional data, leading banks and fintech attackers have built risk-scoring engines to speed up loan approvals for SME customers, even those with limited or no credit history. One example is HDFC’s “Milk-toMoney” program in India, which tracks regular ATM deposits to establish a credit profile for dairy farmers, many of whom have only recently opened bank accounts.

Finally, transaction banking, which already accounts for approximately a third of all banking revenues in Asia and captures more than half of transaction banking revenues globally, holds significant potential for further growth. Banks can potentially increase transaction banking revenue by 10-20% across four main business lines: cash management, trade services, securities, and cross-border flows. Competition is fierce and margins are thin, making it crucial for banks to combine scale with sophisticated analytics capabilities to eliminate waste, create new products, and deepen relationships. In response, leading banks are using APIs to integrate banking functions more deeply within corporate systems, enabling them to provide a dashboard view, for example, of intraday cash position across multiple currencies, investments, working capital, and payables. What is

more, advanced data analytical models are helping banks enhance their liquidity management services, optimize netting arrangements for on-us transactions, and implement dynamic pricing.

Flexible technology architecture

To compete with big tech companies on speed, productivity, and customer experience requires modular platforms, which allow developers continuous integration and interoperability with core systems. Whilst core systems may be transformed gradually, the modular applications or microservices supporting specific use cases can be updated frequently as the market changes and new innovations become available. Beyond architectural and system changes, banks should also learn to adopt new ways of working. This requires not only flexibility in acquiring, upskilling, and integrating new talent profiles, but also shifting to a new operating model and culture in which business and technology competencies are more closely intertwined.

Advanced data analytics

Advanced data analytics form the cornerstone of superior customer experience, and many banks now focus on data as a core enterprise asset. This entails the articulation of an enterprise-wide data strategy and investment roadmap so that dataand-analytics projects can be tightly linked to value creation. Banks should focus first on advanced analytics use cases with the greatest impact on customer experience and value to the bank. Commonwealth Bank of Australia (CBA), for example, has built a customer engagement engine that analyzes more than 30 billion data points to generate upwards of 40 million offers each month. Developing a top-notch data-and-analytics program requires vision and commitment, and to earn a good return on the investment, it is crucial to give employees the tools and skills they need to formulate their own data queries for strategic planning and day-today management of strategic goals. This requires a combination of strong governance and autonomy to enable individuals across the entire organization—from sales and service to risk management and digital innovation—to excel in a data-driven environment.

Talent management

With automation expected to disrupt up to 40% of all banking activity and affecting half of banking jobs by 2030, banks are today evaluating how to combine recruiting, reskilling, and redeployment to build the workforce of the future. Malaysia’s Maybank has launched a learning program to help employees acquire relevant skills for the next phase of their careers, with sessions on coding, algorithm programming, artificial intelligence, and machine learning.

Aiming to enhance their appeal to millennials with superior digital skills, many banks are building a reputation for leadership in technological innovation, forging ties with fintech and academic communities, and developing a culture where talented and ambitious employees know they can make a difference. It is critical to understand the shifts required in the bank’s composite talent profile, and to succeed in this transition, top leaders must commit not only to recruiting new talent but also to helping existing employees acquire the skills needed to thrive in the new culture.

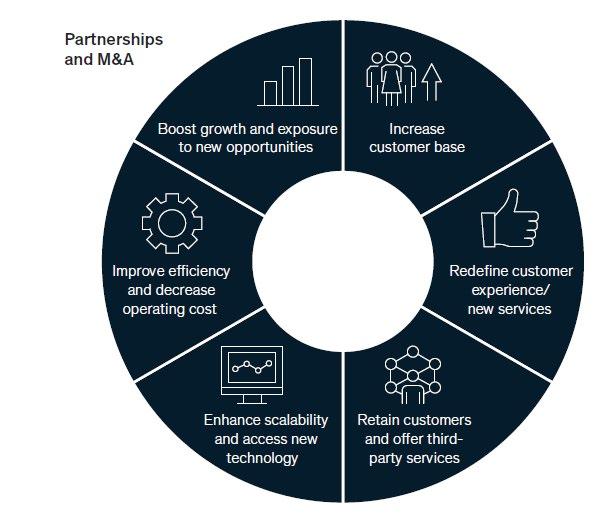

Partnerships and M&As

In this age of open banking and digital ecosystems, many banks are finding that partnerships are critical to success in extending their footprint, delivering superior products, and gaining access both to new customers and to new types of data. As an example, three of Australia’s big four banks—ANZ, NAB, and Westpac—have invested in Data Republic, a data hub through which organizations can store, exchange, and collaborate on aggregated data projects in a secure environment. In Thailand,

Two-thirds of Asian banks will face an existential choice: Either reinvent to stay relevant or lag behind and eventually disappear.

Siam Commercial Bank and Julius Baer have partnered to deliver global investment opportunities to customers. In Indonesia, Bank Central Asia (BCA) has linked with leading e-commerce sites, enabling the bank to expand its lending business whilst keeping risk costs low. And in Singapore, OCBC offers home mortgages through the personal finance portal MoneySmart.

Mergers and acquisitions (M&A) are another way to acquire crucial capabilities and extend market reach. DBS, for example, has acquired ANZ operations in five countries. Kotak Bank has extended its footprint into southern India by acquiring ING Vysya and entered the lower end of the market with its acquisition of BSS Microfinance. Given the importance of scale in achieving higher returns carefully executed mergers and acquisitions offer an attractive option for increasing market share and consolidating scale, capabilities, and talent. Now is the time for banks to establish a dedicated group responsible for planning and managing M&A, as well as partnerships. Banks should remember that 90% of the value of a merger is realized within the first two years and establish early on a plan for post-merger integration to ensure that synergies are realized promptly. From McKinsey & Co. 2020 report “Future of Asia: Banking”

Partnerships and M&A are effective

ING’s global headquarters, Cedar

What can Asian banks learn

from ING ’s new office?

The bank’s CEO and board members no longer have their own offices, but instead work together in one large space. I n January, ING finally unveiled its brand new headquarters,

Cedar. Located at Cumulus Park at the southeast section of Amsterdam, the 39,000 sqm development features a modern, all-glass facade with wide, open areas to reflect the bank’s focus on transparency and sustainability.

Previously, ING called the Amsterdamse Poort building their home. It was the direct opposite of Cedar with its traditional albeit sustainable build: brown stone walls, low ceilings, narrow stairs, and average-sized rooms and halls. Although a unique and sustainable office, with its glass roofs that let in natural light as well as a plethora of plant life, the old building had become incongruous with the changes that ING has undergone in recent years.

“The time had come to change to something different because [the building] didn’t suit our new way of working anymore,” Christophe Linke, ING group investor relations leader, told Asian Banking and Finance. “We have changed to agile working, and [this] requires that teams can join easily together and work together on projects. The old building didn’t offer that.”

In fact, the executive board no longer has personal offices, but instead share a large hall where they can work together. Linke adds that the CEO does not even have his own room.

This is in line with how ING wants to present itself as a global financial company: communitydriven and transparent.

“This building [shows] how we would like to cooperate [with the

Christophe Linke

Cedar’s interior

community],” said Linke. “We would like to present ourselves as open, and transparent. To give you an example, our executive board doesn’t have any more offices. They have a large table where they work together.”

Cedar’s architecture also fosters a healthy lifestyle amongst its 2,900 workers. Unlike the narrow staircases of the Amsterdamse Poort building, ING’s new HQ has wide stairs conveniently located at the heart of the two buildings that make up Cedar. Elevators are located at the corners of the building.

“The goal is to make people walk and take the stairs, which is much healthier, and by that way, they get to meet new people and they get to see what other people are working on,” said Linke.

“So when you walk around the building, you always have the impression that you are part of a larger organization that’s working on a lot of stuff. And you don’t walk in aisles with offices or closed corners on the left and on the right.”

Keeping sustainability in mind, ING used concrete and rubble from a demolished office and tried to minimise utilising new materials in building Cedar. The building also uses solar energy to power its electrical needs, with about 3,000 sqft of solar panels in the roof of the development.

ING has banned the use of disposable plastic in Cedar’s restaurants and coffee shops. Further, various measures have also been put into place to save as much as 12 million litres of water every year, compared to other offices of the same size. By Frances Gagua