16 minute read

strengths as finance industry turns digital Mastercard APAC flaunts innovation to stay ahead in the digital era

Mastercard APAC flaunts

innovation to stay

ahead in the digital era

The payments provider has been forging new tech-based products and forging relationships with startups. M astercard is banking on its longstanding innovation and amping up partnerships with digital players to stay ahead of the neo-banks and fintechs that have further tightened the money game in Singapore and Asia.

The entrance of digital firms into the banking space is an important evolutionary step for Singapore, Mastercard Asia Pacific executive vice president for services Matthew Driver said, as the increased competition will bolster innovation in the local banking industry. Contenders for the licenses include consortiums made up of e-commerce, telecommunications, and fintech firms.

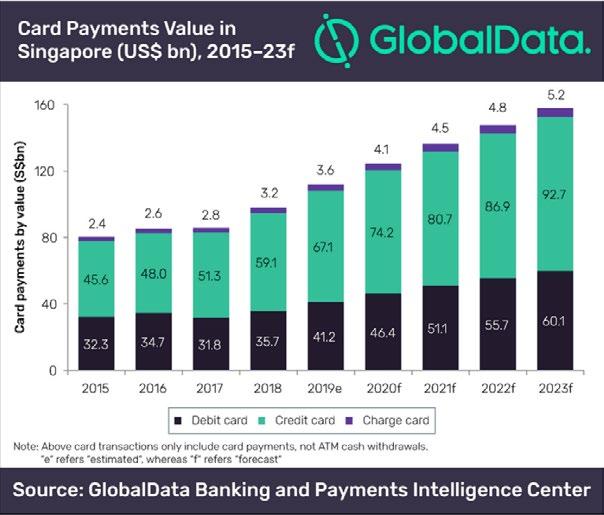

Currently, Mastercard has the upper hand in Singapore. Credit cards continue to make up the lion’s share of the card payments market in the island, at 60% in 2019, reports analytics firm GlobalData. But e-wallets are increasingly closing the gap, with the digital payments segment now making up US$14.27b in 2020 according to data firm Statista. By 2025, this value is expected to rise to $40.38b, a separate report by ResearchAndMarket noted.

In an exclusive interview with Asian Banking & Finance, Driver shares how Mastercard has been preparing for the digital onslaught, and how digitisation will affect the domestic and regional banking industry as a whole.

Digital banks will significantly accelerate and deepen the use of physical and virtual payments solutions across the region.

How does Mastercard APAC plan to position itself in Singapore and in the region with this dawning era of digital banks?

When you think about it, Mastercard itself is one of the original fintech players, which created an international network more than 50 years ago connecting buyers (cardholders) and sellers (merchants), thereby reducing the need for cash. And as a fintech we have continued to innovate throughout our history—it’s part of our DNA.

We started with enabling debit and credit card payments but quickly branched into other payment types as commerce globalized and e-commerce connected consumers to digital marketplaces all over the world. We have grown our payment capabilities extensively to cater for new clients, markets and opportunities, now offering real-time payment solutions and applications, advanced cybersecurity and fraud solutions, and a huge range of data, advisory, loyalty and engagement capabilities.

We are also co-creating new services with partners

Matthew Driver, Executive VP for Services, Mastercard APAC

to help enable commerce and financial inclusion like the Kionect Farmers network whilst advocating for diversity, decency and sustainability. We are the preferred partner of fintechs across the globe because we are global and flexible, we lean into our partnerships to create new solutions and we want to create social impact.

We cultivate relationships with startups, have a globally established fintech accelerator programme called StartPath and, at the Singapore Fintech Festival 2019, we launched our Fintech Express programme as part of our global Mastercard Accelerate initiative designed to simplify the way our global payments work with fintechs around the world.

How will digital banks affect the card and virtual payments in Singapore and in APAC?

Digital banks will significantly accelerate and deepen the use of physical and virtual payments solutions across the region as payments are a great space where they can create relevant and impactful differentiation for their target customers.

Neo-banks and fintech players are fast adopters of prepaid and debit cards, both physical and digital, often because prepaid platforms are very flexible and can be used for everything from travel and gifting to per-diem expenses and, in some cases, closed-loop payments.

Digital banks like Monzo, N26 and Revolut all

Card Payment Values in Singapore, 2018-2023

Source: GlobalData (2020)

started using prepaid propositions, and are now actively marketing debit cards linked to checking accounts. Newer fintech players like 2C2P, YouTrip and Matchmove are also bringing new innovative prepaid solutions to market in partnership with banks across the region.

A number of the bigger platform players have also moved into credit cards, like Lazada in Thailand and Amazon and Rakuten in Japan, and following the success of Apple Card in the US and Nubank’s purple credit card in Latin America, more will surely follow in the region.

Digital banks and fintechs also tend to be immediate users of contactless and QR technology deployed via virtual card form factors securely embedded in mobile banking applications as we have seen with Google Pay in India, AliPay and WeChat Pay in China and LinePay in Thailand and Japan, all of which are transforming the industry.

Digital players are also quick to use open banking standards and so-called faster payment applications. Indeed, any payments service that is digital first and seamless will be better able to meet a customer’s needs. The use of virtual cards in business-to-business payments for procurement and expense management purposes, as well as wholesale and B2B payments, are good examples and have proven to be very successful for digital players like WEX and eNett.

We also expect that digital banks may choose to use virtual cards to solve consumer use cases as well.

Are there opportunities that traditional banks and fintechs can pursue with these digital disruptors?

Fintechs and traditional banks often make excellent partners as they have complementary capabilities. Banks provide the fintechs with access to their distribution network, balance sheet strength and trusted reputation with clients. Fintechs provide banks with more nimble technical infrastructure, helping them deliver and continuously upgrade more compelling and innovative client experiences.

This is not to say that “fintegration” is an easy process. In particular, traditional banks have to strike a careful balance between keeping pace with the

We also believe that a natural outcome of this digitisation will be an accelerated growth in electronic payments as there is still plenty of room for growth.

nimbleness of new technology whilst protecting the customer’s privacy and personal data. We do believe that in this hyper-connected digital world, no one player can really do everything alone anymore, so having the ability to not only agree but successfully execute ecosystem partnerships where all parties mutually benefit (fintech, bank and customer) is an increasingly important aspect of doing business.

These partnerships can range from simply having the bank connect to a fintech application using secure APIs to offer a specific product capability or service—Citi and DBS being great examples of banks leveraging developer zones for this purpose—to the development of a much more elaborate ecosystem model like CBA has done in partnership with Microsoft and KPMG in Australia, or like Chinese players Ping An and Tencent have successfully done.

What is your five-year forecast for Singapore’s financial institutions given the rising digitisation of financial services?

What we do know from other markets is that rising digitisation and increased competition in financial services will only serve to expand the overall market, create greater customer choice, drive innovation, and deliver increased value for consumers, business and corporates. Singapore already has a high level of digitisation thanks to low-cost data, strong local infrastructure, high smartphone penetration and savvy market participants.

We also believe that a natural outcome of this digitisation will be an accelerated growth in electronic payments as there is still plenty of room for growth. Whilst the majority of retail payments in dollar volume terms are electronic, by transaction count they are not, so there is still a huge opportunity for further payments innovation in Singapore. The opportunity is even bigger in the small business and commercial segments, as well as in wealth management where there has been a rapid increase in the number of technology platformenabled wealth management platforms.

As Singapore continues to drive greater connectivity as a “smart city”, even more payment flows can be digitised, releasing value by creating greater transparency, security, and efficiency. Rising digitisation of financial services also creates important opportunities around the management, organisation and control of data: thoughtful data privacy policies have to be implemented to protect customer data in the right way.

Singapore continues to have a market environment that is conducive to innovation and we are confident that, with continued thoughtful regulation, the ever-resourceful Singapore financial sector will embrace this era of open banking and continue to find new and better ways to serve the financial needs of consumers, small business owners, and corporates. By Alyssa Divina

The founders of CredoLab

How CredoLab reduces banks’

credit risks with metadata

The platform generates a credit scorecard in just one second, based on 1.3 million features from opt-in smartphone metadata. W hilst working in the credit and loans departments as well as risk management teams of banks in Europe, Peter Barcak saw firsthand the limitations of the banking industry’s retail loan procedures.

Banks often base their retail lending decisions on an application form that contains only around two dozen data points. Not only does this procedure eat up time—each application takes up to several days to process—the predictive ability of banks in determining which people can pay back their loans is only at around 62%.

Barcak’s search for better loan procedures led him to mobile devices, which offer a plethora of data points that increases the overall predictiveness of a person’s credit behaviour. Armed with insights about the credit risk assessment practices of banks, he founded the digital credit scoring company CredoLab in January 2016.

Over 18 million loan applications and more than 63 lending companies later, the Singapore based startup’s artificial intelligence-based algorithm can now access as much as 1.3 million features to find an individual’s behavioural patterns and produce a credit scorecard. The process takes as fast as only one second to happen, Barcak told Asian Banking & Finance in an exclusive interview.

“Usually a scorecard consists of 20 to 25 features with the highest information value and features with the highest predictive power. But we have built a huge pool of 1.3 million features over the last four years to choose from,” he said.

Lenders in Asia usually use a scorecard system that has a 0.25-0.30 Gini coefficient—where zero means a 50% accuracy of the decision-making model used, whilst one equates to a 100% accuracy. In the context of scorecards, these meant that banks are usually powered by a system that only has a 62.65% accuracy, leaving a lot of uncertainty in the credit decisions they make.

Peter Barcak

In contrast, the startup’s scorecards have a Gini coefficient of 0.40-0.50, giving CredoLabpowered banks and financial firms greater predictive power, with an increase of up to 70% in their Gini compared to the traditional scoring model.

In total, CredoLab said that its customers have seen a 20% increase in new bank customer approval, a 15% reduction in nonperforming loans, and a 22% dip in fraud rate.

CredoLab makes credit risk assessments by looking in clients’ mobile phone behavior: how the client uses their mobile phone, what kind of applications can be found in the phone, the way they receive or send SMS messages. But the company does not read personal messages nor access personal information.

“There is no way we can access data without clients consent or without permissions that the operation system requires. CredoLab collects only metadata: zeroes, ones. So no personal information ever leaves the device. CredoLab doesn’t know the clients name or email address or address or phone number,” assured Barcak.

Financial institutions in the region have already taken notice of CredoLab. In July 2019, CIMB Philippines partnered with the startup for its digital lending business. The partnership reportedly helped increase the overall predictiveness of the bank’s models by up to 40%.

As of January 2020, CredoLab has powered more than $1b in loans issued and has analysed about 1 trillion data points across 25 countries.

The company plans to further expand to Latin America, Africa, and India in the next five years. They are also looking to expand to offer their services to non-bank industries: right hailing companies, airtime credit companies, online travel booking companies, insurance, e-commerce, airline payments or retail companies,” concluded Barcak. By Frances Gagua

Singapore skyline

Sustainability and governance take center stage in ASEAN

corporate banking

Many banks have stopped funding new coal-fired power plants in favor of environment-friendly projects.

When Greta Thunberg told the world’s elites at Davos that they must stop lending to fossil fuel projects to save the planet, US President Donald Trump dismissed her speech and called for people to reject environment-related warnings.

But it seems that sustainability has increasingly come at the forefront of businesses in the past few years, particularly when it comes to getting funding from corporate banks. In a report, Fitch Ratings revealed that global banks have become increasingly sensitive to environment, social, and governance (ESG) factors in their underwriting processes. In 2019, the study found that global banks are outright rejecting dealings with companies suspected of human rights abuses, child labour, or unsafe working conditions.

Mike Ng

Roshel Mahabeer

Following the 2015 Paris climate deal, a clutch of APAC-based banks—mostly in Australia and Singapore—stopped directly financing new thermal coal-mine or coal-fired power station projects. Chief amongst them is Singapore’s OCBC Bank, the first Southeast Asian bank to announce that it will no longer fund new coal-fired power plants.

Before lending out to companies, OCBC said that they study the ESG conformance of the company in a credit and risk evaluation process.

“ESG risks may include biodiversity loss, deforestation, water scarcity and pollution. Companies’ pollution prevention measures, relating to air emissions, water effluents and waste, are expected to be adopted in a manner that is consistent with local laws and regulations, at a minimum, as well as applicable international industry standards. In our risk assessment, we also take into consideration social issues such as child or forced labour, occupational health and safety as well as any resettlement of affected communities,” Mike Ng, OCBC’s head of structured finance and sustainable finance, told Asian Banking & Finance in an exclusive interview.

The bank has set out a US$7.02b (S$10b) target for their sustainable finance portfolio by 2022. In 2019 alone OCBC committed US$3.51b (S$5b) in sustainable financing commitments and participated in more than 20 green loans and sustainability-linked loan transactions.

Other banks in the Southeast Asian region are not to be left behind. Standard Chartered Asia has committed US$75b towards

the sustainable development goals (SDGs), with US$35b specifically allocated for clean technology and renewables whilst the remaining US$40b was for sustainable infrastructure.

Roshel Mahabeer, StanChart’s head of sustainable finance in Asia, noted the growing collaboration and sustainability of ASEAN banks and governments. For example, central banks of Malaysia, Singapore and Thailand have joined the Network for Greening the Financial System (NGFS)—a network of central banks and supervisors seeking to better integrate climate-related risks into financial stability monitoring.

Despite this, APAC and ASEAN banks continue to lag behind their European peers in taking up ESG guidelines, a fact that both Fitch and the World Wildlife Fund (WWF) noted. Of the 35 banks assessed by WWF, only four banks from Singapore and Thailand fulfilled at least half of the 70 criteria and 51% of the banks fulfilled less than a quarter of the criteria.

“However, there is still progress as 74% of the banks have improved since 2018. These are meaningful steps in the right direction, though with only a decade left to 2030—we need to be considering E&S risks and financing SDGs at both pace and scale,” Mahabeer further noted.

“Over the last 3-5 years we have seen a great increase in the number of banks and institutional investors developing E&S strategies either via a prescribed exclusion of investment activities or to more sophisticated ESG scoring models to encourage investment toward companies that have good ESG practices and support the SDGs,” she added.

Economic challenges

Adopting ESG principles remains a challenge for banks in the region, especially in countries that continue to be dependent on fossil fuels, a reality highlighted by Bank of the Philippines Island’s (BPI) Jo Ann Eala, BPI’s head of sustainability development finance.

“Noting the Philippines’ dependence on fossil fuel which provides almost 80% of its energy, these realities of our country’s energy demand and supply capabilities compel the government and the private sector to provide support to diversified sources in the interest of making stable and reliable power available throughout the country,” Eala said.

The bankability of sustainable projects is also still up in the air, said OCBC’s Ng.

“Investments in emerging markets, where many of these infrastructure projects are, entail various forms of risk which are still not being adequately addressed. If a common framework across emerging markets is introduced, that would enhance the bankability of sustainable projects and we would see a rise in sustainable financing,” he said.

Moody’s Investors Service financial institutions group vice president and senior credit officer Alka Anbarasu also noted that ASEAN banks are not completely withdrawing from sectors that pose an ESG risk, but are instead striking a balance between such dealings and sustainable financing.

“For instance, banks are not just withdrawing from lending to industries that pose climate change risks, such as palm oil producers, coal-fired power projects. This is because such industries have a significant impact on the overall economy or livelihood of people. Also, many countries in the region don’t have universal access to electricity, low per capita income and low shock absorption capacities to withstand a drastic change in banks underwriting policies,” she said.

Instead, banks are working with their borrowers to promote sustainability. “At the same time, renewable energy and other green sources of energy are growing in importance. Many countries have pledged to increase green sources in their energy mix. This in itself has led to greater lending to that sector by the banks,” added Anbarasu.

BPI, for example, is providing technical assistance to clients to help them comply with SGD-related laws. One example of this is BPI’s employment of experts to evaluate project proposals, shared Eala. For

Alka Anbarasu

their activities with the agriculture sector, BPI has a dedicated team of agri-specialists to identify potential technical and environment problems.

Seeds of growth

As companies and sovereigns become more environmentally aware in tandem with peoples’ consciousness to climate change, corporate banks are faced with a plethora of opportunities to pursue in the ESG-banking realm.

“Companies and cities are transitioning to low carbon and more sustainable economies, so we expect to see more projects addressing the needs for climate change mitigation and adaptation in coming years. These include renewable energy projects, clean transportation and waste management to name a few,” said OCBC’s Ng.

StanChart’s Mahabeer also noted the large buzz of activities in the sustainability space. “For example, Singapore is fast becoming a hub for green and sustainable loans with over $10b of sustainable finance-related activity between 2018 and 2019, and the Monetary Authority of Singapore (MAS) has announced setting up a $2b green fund.”

BPI’s Eala observed that more and more companies are investing in sustainability to boost their bottomline. “This is evidenced by the increasing number of private sector initiatives around energy efficiency, renewable energy, and climate resilience. Moreover, there are proven live cases of profitable sustainability initiatives, thanks to the quantitative metrics and tools provided by institutions like the IFC-World Bank.” By Frances Gagua